Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - LIPOSCIENCE INC | d339769dex231.htm |

| EX-10.37 - EXHIBIT 10.37 - LIPOSCIENCE INC | d339769dex1037.htm |

| EX-10.9.2 - EXHIBIT 10.9.2 - LIPOSCIENCE INC | d339769dex1092.htm |

| EX-10.16.1 - EXHIBIT 10.16.1 - LIPOSCIENCE INC | d339769dex10161.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 24, 2013

Registration No. 333-175102

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 8

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIPOSCIENCE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8071 | 56-1879288 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) | ||

2500 Sumner Boulevard

Raleigh, NC 27616

(919) 212-1999

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Richard O. Brajer

President and Chief Executive Officer

LipoScience, Inc.

2500 Sumner Boulevard

Raleigh, NC 27616

(919) 212-1999

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Brent B. Siler, Esq. Darren K. DeStefano, Esq. Brian F. Leaf, Esq. Cooley LLP 11951 Freedom Drive Reston, VA 20190-5656 (703) 456-8000 |

Glenn R. Pollner, Esq. Gibson, Dunn & Crutcher LLP 200 Park Avenue New York, NY 10166-0193 (212) 351-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 under the Securities Exchange Act of 1934. (Check one):

| Large Accelerated Filer ¨ |

Accelerated Filer ¨ | Non-accelerated Filer x | Smaller Reporting Company ¨ |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated January 24, 2013

PROSPECTUS

5,000,000 Shares

Common stock

This is the initial public offering of the common stock of LipoScience, Inc. We are offering 5,000,000 shares of our common stock. No public market currently exists for our common stock.

Our common stock has been approved for listing on The NASDAQ Global Market under the symbol “LPDX.”

We anticipate that the initial public offering price will be between $13.00 and $15.00 per share.

We are an “emerging growth company” as defined under the federal securities laws and, as such, we may elect to comply with certain reduced public company reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12 of this prospectus.

| Per share |

Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds to us (before expenses) |

$ | $ | ||||||

We have granted the underwriters the option to purchase 750,000 additional shares of common stock on the same terms and conditions set forth above if the underwriters sell more than 5,000,000 shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2013.

| Barclays | UBS Investment Bank | Piper Jaffray |

Prospectus dated , 2013

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| 37 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

47 | |||

| 90 | ||||

| 113 | ||||

| 125 | ||||

| 143 | ||||

| 145 | ||||

| 148 | ||||

| 154 | ||||

| 157 | ||||

| 161 | ||||

| 168 | ||||

| 168 | ||||

| 168 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus and any related free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither this prospectus nor any related free writing prospectus is an offer to sell, nor are they seeking an offer to buy, these securities in any state where the offer or solicitation is not permitted. The information contained in this prospectus is complete and accurate as of the date on the front cover of this prospectus, but information may have changed since that date.

Table of Contents

The items in the following summary are described in more detail later in this prospectus. This summary does not contain all of the information you should consider. Before investing in our common stock, you should read the entire prospectus carefully, including the “Risk Factors” beginning on page 12 and the financial statements and related notes beginning on page F-1. Unless the context indicates otherwise, as used in this prospectus, the terms “LipoScience,” “our company,” “we,” “us” and “our” refer to LipoScience, Inc.

Overview

We are an in vitro diagnostic company pioneering a new field of personalized diagnostics based on nuclear magnetic resonance, or NMR, technology. Our first diagnostic test, the NMR LipoProfile test, directly measures the number of low density lipoprotein, or LDL, particles in a blood sample and provides physicians and their patients with actionable information to personalize management of risk for heart disease. To date, over 8 million NMR LipoProfile tests have been ordered. Our automated clinical analyzer, the Vantera system, has recently been cleared by the FDA. The Vantera system requires no previous knowledge of NMR technology to operate and has been designed to significantly simplify complex technology through ease of use and walk-away automation. We plan to selectively place the Vantera system on-site with national and regional clinical laboratories as well as leading medical centers and hospital outreach laboratories. We are driving toward becoming a clinical standard of care by decentralizing our technology and expanding our menu of personalized diagnostic tests to address a broad range of cardiovascular, metabolic and other diseases.

Approximately 50% of people who suffer a heart attack have normal cholesterol levels. We believe that direct quantification of the number of LDL and other lipoprotein particles using our NMR-based technology platform addresses the deficiencies of traditional cholesterol testing and allows clinicians to more effectively manage their patients’ risk of developing cardiovascular disease. We believe that the inherent analytical and clinical advantages of NMR-based technology, which can simultaneously analyze lipoproteins as well as hundreds of small molecule metabolites from blood serum, plasma and several other bodily fluids without time-consuming sample preparation, will also allow us to expand our diagnostic test menu. The scientific community is actively investigating our NMR-based technology for use in the prediction of diabetes, insulin resistance and other metabolic disorders, and we believe that our technology provides an attractive platform for potential expansion of the diagnostic tests we plan to offer into these areas.

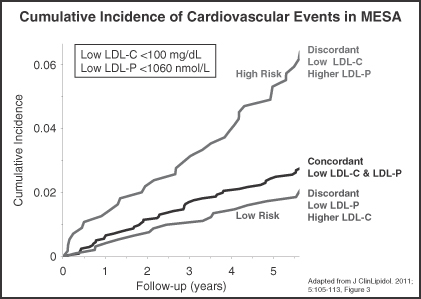

Our strategy is to continue to advance patient care by converting clinicians, and the clinical diagnostic laboratories they use, from traditional cholesterol testing to our NMR LipoProfile test for the management of patients at risk for cardiovascular disease, with the goal of ultimately becoming a clinical standard of care. An increasing number of large clinical outcome studies, including the Multi-Ethnic Study of Atherosclerosis, or MESA, and the Framingham Offspring Study, indicate that a patient’s number of LDL particles is more strongly associated with the risk of developing cardiovascular disease than is his or her level of LDL cholesterol when one of the measures suggests a higher risk and the other suggests a lower risk. LDL cholesterol, or LDL-C, is a measure of the amount of cholesterol contained in LDL particles and is used to estimate the patient’s LDL level. In the MESA and Framingham studies, participants’ blood samples were evaluated to measure LDL particles using our NMR LipoProfile test, while their LDL-C levels were measured using a traditional cholesterol test.

Because the NMR LipoProfile test provides direct quantification of the number of LDL particles, as well as additional measurements related to a patient’s risk for developing cardiovascular disease, we believe that it has the potential to become a new paradigm by which clinicians evaluate key cardiovascular risk factors to provide better treatment recommendations and improve outcomes, even for patients considered to have normal levels of cholesterol. A 2008 joint consensus statement by the American Diabetes Association, or ADA, and the American College of Cardiology, or ACC, recognized that direct LDL particle measurement by NMR may be a more accurate way to capture the risk posed by LDL than is traditional LDL-C measurement. Additionally, in October 2011, the National Lipid Association, or NLA, convened an expert panel to evaluate the use of a number of

1

Table of Contents

biomarkers other than LDL-C, including LDL particle number, for initial clinical risk assessment of cardiovascular disease and ongoing management of cardiovascular disease risk in patients. The recommendations of this panel included:

| • | for initial clinical risk assessment, the use of LDL particle number, as well as a number of the other non-LDL-C biomarkers, is reasonable for many patients considered to be at intermediate risk of coronary heart disease, patients with a family history of coronary heart disease and patients with recurrent cardiac events, and it should be considered for selected patients known to have coronary heart disease; and |

| • | for ongoing management of risk, the use of LDL particle number, as well as some of the other biomarkers, is reasonable for many patients at intermediate risk, patients with known coronary heart disease and patients with recurrent cardiac events, and it should be considered for selected patients with a family history of coronary heart disease. |

During 2011, the NMR LipoProfile test was ordered more than 1.5 million times. The number of NMR LipoProfile tests ordered increased at a compound annual growth rate of approximately 30% from 2006 to 2011. We generated revenues of $45.8 million for the year ended December 31, 2011 and $41.2 million for the nine months ended September 30, 2012. Our NMR LipoProfile test has its own dedicated current procedural terminology, or CPT, code, and is reimbursed by a number of governmental and private payors, which we believe collectively represent approximately 150 million covered lives. These payors include Medicare, TRICARE, WellPoint, United Healthcare and several Blue Cross Blue Shield affiliates.

We estimate that more than 75 million traditional cholesterol tests, or lipid panels, are performed by independent clinical laboratories and hospital outreach laboratories for patient management purposes each year in the United States. Accordingly, we estimate that the 1.5 million NMR LipoProfile tests we performed in the year ended December 31, 2011 represented 2% of our potential market. In a number of states where we have targeted our sales and marketing efforts, we estimate that we have achieved market penetration rates of up to 11%. For example, in North Carolina, Alabama and West Virginia, we estimate that the number of NMR LipoProfile tests performed represented approximately 11%, 7% and 7%, respectively, of the total cholesterol tests performed in those states for patient management purposes, and 6% in Georgia. We plan to significantly increase our geographic presence across the United States to expand market awareness and penetration of the NMR LipoProfile test, with the goal of ultimately becoming a clinical standard of care.

Our clinical laboratory, which is certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, allows us to fulfill current demand for our test and we believe serves as a strategic asset that will facilitate our ability to launch new personalized diagnostic tests we plan to develop. To accelerate clinician and clinical diagnostic laboratory adoption of the NMR LipoProfile test and future clinical diagnostic tests, we plan to decentralize access to our technology platform through the launch of our new Vantera system, our highly automated next-generation version of our NMR-based clinical analyzer technology platform that is designed to be placed directly in clinical diagnostic laboratories. In August 2012, we received FDA clearance to market our Vantera system. The Vantera system became commercially available in December 2012, and we expect to begin placing the Vantera system in third-party clinical diagnostic laboratory facilities in the first quarter of 2013, which we believe will facilitate their ability to offer our NMR LipoProfile test and other diagnostic tests that we may develop.

Our Market

Coronary Heart Disease and Atherosclerosis

Coronary heart disease, or CHD, is the second most prevalent form of cardiovascular disease in the United States after hypertension. According to the American Heart Association, CHD accounted for over one-half of all cardiovascular disease deaths in 2006, and the direct medical costs of CHD in the United States are expected to increase from $36 billion in 2010 to $106 billion in 2030. CHD usually results from atherosclerosis, a hardening

2

Table of Contents

and narrowing of the arteries caused by a buildup of fatty plaque composed of cholesterol and other lipids, such as triglycerides, in the arterial wall. Atherosclerosis is a leading cause of heart attacks and strokes.

Since the 1960s, the scientific community has recognized that LDL particles are a key causal factor for atherosclerosis. However, for many years the only practical way to estimate the amount of LDL and high density lipoproteins, or HDL, was to measure the level of cholesterol contained in these LDL and HDL particles.

Limitations of Traditional Cholesterol Testing

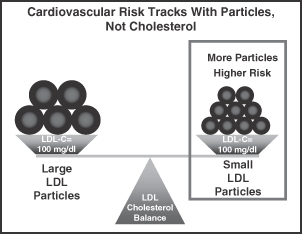

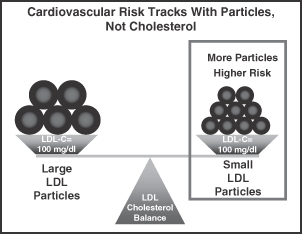

While LDL and HDL testing is a generally well-accepted means to determine a patient’s need for LDL-lowering or HDL-raising therapy and monitoring treatment response, there is increasing awareness that traditional cholesterol measures of these key lipoprotein risk factors are deficient because they can overestimate or underestimate the actual levels of these lipoproteins in many patients and the CHD risk they confer. This is because many patients have disparities between their level of cholesterol and the number of lipoprotein particles in their blood, a state known as discordance. Research data have shown that the number of LDL particles, or LDL-P, is more strongly correlated with CHD risk than is the level of LDL-C in discordant patients, and that the number of HDL particles, or HDL-P, and LDL-P are more predictive of future CHD events than HDL-C and LDL-C levels. As a result, we believe that reliance on the traditional cholesterol measures of LDL and HDL contributes to the under-treatment or over-treatment of millions of patients.

The following graphic illustrates that two patients with the same level of LDL-C can have different numbers of LDL-P, leading to different CHD risk profiles.

Our Solution

Our NMR LipoProfile test has been cleared by the FDA for use in our clinical laboratory and directly measures LDL-P for use in managing cardiovascular disease risk. We believe that our test provides clinicians with more clinically relevant information about LDL and other classes and subclasses of lipoproteins than does the traditional cholesterol test for managing their patients’ CHD risk.

The current NMR LipoProfile test report consists of two pages. The first page includes test results for the following measurements, which have received FDA clearance:

| • | LDL-P, along with reference ranges to guide patient management decisions; |

| • | HDL-C; and |

| • | triglycerides. |

3

Table of Contents

The second page of the NMR LipoProfile report includes test results for a number of additional lipoprotein measures that have been validated by us but which have not been cleared by the FDA. These include:

| • | measures related to cardiovascular risk, including HDL-P, the total number of small LDL particles, and LDL particle size; and |

| • | measures associated with insulin resistance and diabetes risk, including numbers of large HDL particles, small LDL particles and very large LDL, or VLDL, particles, as well as HDL, LDL and VLDL particle size. |

When the Vantera system is placed in third-party laboratories, they will process the blood sample and produce the FDA-cleared results on the first page of the test report. At the option of the third-party laboratories, we will generate these second-page test results in our clinical laboratory, and make the second-page test results available to them at no additional charge for dissemination along with the first-page results.

Clinical Validation of Lipoprotein Particle Quantification Using NMR

The clinical utility of lipoprotein particle quantification has been supported by a number of scientific papers published in peer-reviewed journals, including Journal of the American Medical Association, New England Journal of Medicine, Circulation, American Journal of Cardiology, Atherosclerosis and Journal of Clinical Lipidology. To date, eleven cardiovascular disease outcome studies have specifically evaluated the link between LDL-P and CHD risk. In each case, LDL-P was associated significantly with atherosclerotic outcomes and, in ten of the studies, the strength of association was greater than for LDL-C. In addition, studies have shown greater clinical relevance of HDL-P as compared to HDL-C. In these scientific studies, LDL-P was measured using our test, while LDL-C was measured using traditional cholesterol testing. In each of these studies, our Chief Scientific Officer, Dr. James Otvos, participated as a scientific collaborator with the studies’ academic investigators, none of whom are affiliated with our company. We did not provide any funding for any of these studies.

Our Strategy

Our strategy is to convert clinicians, and the clinical diagnostic laboratories they use, from traditional cholesterol testing to our NMR LipoProfile test for the management of patients at risk for CHD, with the goal of ultimately becoming a clinical standard of care. The key elements of our strategy to achieve this goal include:

| • | Expand our sales force nationally; |

| • | Increase market awareness and educate clinicians about the clinical benefits of our test; |

| • | Expand relationships with clinical diagnostic laboratories; |

| • | Decentralize access to our technology platform with the Vantera system; |

| • | Broaden medical policy coverage; |

| • | Pursue inclusion in treatment guidelines; |

| • | Develop and expand relationships with leading academic medical centers; and |

| • | Develop new personalized diagnostic tests using our NMR-based technology platform. |

Our Technology Platform

Our technology platform combines proprietary signal processing algorithms and NMR spectroscopic detection into a clinical analyzer to identify and quantify concentrations of lipoproteins and, potentially, small molecule metabolites. NMR detectors, or spectrometers, analyze a blood plasma or serum sample by subjecting it to a short pulse of radio frequency energy within a strong magnetic field. Each lipoprotein particle within a given diameter range simultaneously emits a distinctive radio frequency signal, similar to distinctive ringing sounds for

4

Table of Contents

bells of different sizes. The amplitude, or “volume,” of the NMR signal is directly proportional to the concentration of the particular subclass of lipoprotein particles emitting the signal. Our proprietary software then collects, records and analyzes the composite signals emitted by all of the particles in the sample in real time and separates the signals into distinct subclasses. Within minutes, we are able to quantify multiple subclasses of lipoprotein particles.

Our technology platform based on NMR offers the following advantages over conventional methods of quantifying lipoproteins and small molecule metabolites:

| • | Information-rich detection. NMR can analyze lipoproteins as well as potentially hundreds of small molecule metabolites; |

| • | Processing efficiency. Our technology does not require physical separation of the lipoprotein particles and does not require chemical reagents in order to evaluate a sample; |

| • | Sample indifference. Our technology may be used to analyze multiple sample types, including plasma, serum, urine, cerebrospinal fluid and other biological fluids; and |

| • | Throughput. Simultaneous lipoprotein and metabolite quantification from a rapid NMR measurement makes the platform extremely efficient with high throughput. |

The Vantera System

The Vantera system is our next-generation automated clinical analyzer. In August 2012, we received FDA clearance to market the Vantera system commercially to laboratories. We intend to decentralize access to our technology through the Vantera system in order to drive both geographic expansion and the technology adoption necessary for successful execution of our market conversion strategy. We intend to place the Vantera system in select high-volume national and regional clinical diagnostic laboratories, as well as at leading medical centers and hospital outreach laboratories.

We have entered into agreements with some of our current clinical diagnostic laboratory customers to place the Vantera system in their laboratories. We are also in discussions with additional laboratory customers who have indicated a similar interest in the placement of the Vantera system. We currently expect these placements to begin in the first quarter of 2013.

As with our existing clinical analyzers, the Vantera system uses NMR spectroscopy and proprietary signal processing algorithms to identify and quantify lipoproteins and metabolites from a single spectrum, or scan. We believe that the Vantera system provides the following strategic and technological benefits:

| • | direct access to our technology on site, rather than relying on a “send-out” test; |

| • | processing of samples at a rate that is approximately twice as fast as our current-generation analyzers; |

| • | a reagent-less platform requiring no sample preparation for analysis; |

| • | multiple NMR-test processing capabilities; and |

| • | limited operator intervention, with no specialized NMR training required for operation. |

Risks Related to Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, among others:

| • | Our ability to successfully execute our business strategy is dependent on our achieving greater market acceptance of the NMR LipoProfile test. |

| • | A small number of clinical diagnostic laboratory customers account for most of our revenues from sales of our NMR LipoProfile test. |

5

Table of Contents

| • | We had an accumulated deficit of $48.2 million as of September 30, 2012, we incurred a net loss of $0.5 million for the year ended December 31, 2011 and, while we generated net income of $1.1 million during the nine months ended September 30, 2012, we expect to incur losses for the next several years as we increase our expenses in an effort to increase market share for our NMR LipoProfile test and to develop new diagnostic tests. In addition, we have $16.0 million in term loans with two banks that require us to make monthly installment payments through July 2016 and a revolving line of credit with one of these banks that matures in December 2013. |

| • | Even though our next-generation Vantera clinical analyzer has received FDA clearance, if clinical diagnostic laboratories are not receptive to placement of the Vantera system in their facilities, or are not satisfied with such system after placement in their facilities, a key element of our business strategy may not be successful. |

| • | Health insurers, accountable care organizations and other third-party payors may decide not to cover, or may discontinue reimbursing, our NMR LipoProfile test or any other diagnostic tests we may develop in the future, or may provide inadequate reimbursement. |

| • | We rely on a limited number of key suppliers for the components used in the Vantera system and other necessary supplies to perform our NMR LipoProfile test. |

| • | Our ability to meet increased demand for our NMR LipoProfile test will be harmed if we are unable to place the Vantera system in third-party diagnostic laboratories. |

| • | If we do not successfully develop or acquire and introduce new personalized diagnostic tests or other applications of our NMR-based technology, we may not be able to generate additional revenue opportunities. |

| • | We have limited patent protection for the NMR LipoProfile test and may have limited patent protection for future tests that we may develop. As a result, our intellectual property position may not adequately protect us from competitors for sales of our NMR LipoProfile test or any future diagnostic tests we may develop. |

| • | The NMR LipoProfile test is, and any other test for which we obtain marketing approval will be, subject to extensive ongoing regulatory requirements, and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our products. |

Corporate Information

We were incorporated under the laws of North Carolina in June 1994 under the name LipoMed, Inc. and reincorporated under the laws of Delaware in June 2000. In January 2002, we changed our corporate name to LipoScience, Inc. Our principal executive office is located at 2500 Sumner Boulevard, Raleigh, North Carolina. Our telephone number is (919) 212-1999. Our website address is www.liposcience.com. Information contained in, or accessible through, our website does not constitute a part of, and is not incorporated into, this prospectus.

LIPOSCIENCE®, NMR LIPOPROFILE® and VANTERA® are our registered United States trademarks. All other trademarks, trade names or service marks referred to in this prospectus are the property of their respective owners.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

6

Table of Contents

The Offering

| Common stock offered by us |

5,000,000 shares |

Common stock to be outstanding after

| this offering |

13,888,795 shares |

| Over-allotment option |

750,000 shares |

| Use of proceeds |

We estimate that the net proceeds from our sale of shares of our common stock in this offering will be approximately $61.6 million, or approximately $71.4 million if the underwriters exercise their over-allotment option in full, based upon an assumed initial public offering price of $14.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently expect to use the net proceeds from this offering as follows: |

| • | $5.2 million upon the closing of this offering to pay dividends on the outstanding shares of Series F redeemable convertible preferred stock that will convert into common stock; |

| • | approximately $22.6 million to hire additional sales and marketing personnel and to support costs associated with increased sales and marketing activities; |

| • | approximately $18.0 million for capital expenditures, including components of the Vantera system and other improvements to our laboratory infrastructure; |

| • | approximately $4.8 million to fund our research and development programs, including the expansion of our diagnostic test menu based on the Vantera system; and |

| • | the balance for other general corporate purposes, including general and administrative expenses, working capital and the potential repayment of indebtedness. |

| These estimates are subject to change. See “Use of Proceeds.” |

| Risk factors |

See the section titled “Risk Factors” beginning on page 12 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed NASDAQ Global Market symbol |

LPDX |

Some of our existing stockholders and their affiliated entities, including holders of more than 5% of our common stock, have indicated an interest in purchasing up to an aggregate of $3.4 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these existing stockholders and any of these existing stockholders could determine to purchase more, less or no shares in this offering. Any shares purchased by these stockholders will be subject to the lock-up agreements described in the “Underwriting” section of this prospectus.

7

Table of Contents

The number of shares of our common stock that will be outstanding immediately after this offering is based on 8,888,795 shares of common stock outstanding as of December 31, 2012, and excludes:

| • | 2,056,848 shares of our common stock issuable upon the exercise of stock options outstanding under our 1997 stock option plan and 2007 stock incentive plan as of December 31, 2012, at a weighted average exercise price of $5.56 per share; |

| • | 85,430 shares of our common stock issuable upon the exercise of outstanding warrants as of December 31, 2012, at an exercise price of $8.97 per share; and |

| • | 1,212,500 shares of our common stock to be reserved for future issuance under our equity incentive plans following this offering. |

Except as otherwise indicated herein, all information in this prospectus, including the number of shares that will be outstanding after this offering, assumes or gives effect to:

| • | a 0.485- for -1 reverse stock split of our common stock effected on January 10, 2013; |

| • | the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 6,994,518 shares of our common stock, which will occur automatically upon the closing of this offering; and |

| • | no exercise of the underwriters’ over-allotment option. |

8

Table of Contents

Summary Financial Data

The following tables summarize our financial data. We have derived the following summary of our statement of operations data for the years ended December 31, 2009, 2010 and 2011 from our audited financial statements appearing later in this prospectus. We have derived the following summary of our statement of operations data for the nine months ended September 30, 2011 and 2012 and balance sheet data as of September 30, 2012 from our unaudited financial statements appearing later in this prospectus.

The unaudited financial data include, in the opinion of our management, all adjustments, consisting only of normal recurring adjustments, that are necessary for a fair presentation of our financial position and results of operations for these periods. Our historical results are not necessarily indicative of the results that may be expected in the future and our results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year. You should read the summary of our financial data set forth below together with our financial statements and the related notes to those statements, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing later in this prospectus.

Pro forma basic and diluted net (loss) income per common share have been calculated assuming the conversion of all outstanding shares of convertible preferred stock into shares of common stock. See Note 1 to our financial statements for an explanation of the method used to determine the number of shares used in computing historical and pro forma basic and diluted net (loss) income per common share.

We have presented the summary balance sheet data:

| • | on an actual basis as of September 30, 2012; |

| • | on a pro forma basis to give effect to: |

| • | the conversion of all then outstanding shares of our convertible preferred stock into an aggregate of 6,985,817 shares of our common stock, which will occur automatically upon the closing of this offering; |

| • | the payment of $5.2 million of accrued dividends on the outstanding shares of Series F redeemable convertible preferred stock that will convert into common stock upon the closing of this offering; and |

| • | the reclassification of the preferred stock warrant liability to additional paid-in-capital upon conversion of the convertible preferred stock issuable upon exercise of such warrants into common stock; and |

| • | on a pro forma as adjusted basis to give further effect to our sale of 5,000,000 shares of common stock in this offering at an assumed initial public offering price of $14.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us after September 30, 2012. |

The pro forma as adjusted information presented in the summary balance sheet data is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. Each $1.00 increase or decrease in the assumed initial public offering price of $14.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus, would increase or decrease each of cash and cash equivalents, total assets and total stockholders’ equity on a pro forma as adjusted basis by approximately $4.7 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same. We may also increase or decrease the number of shares we are offering. An increase or decrease of 1,000,000 in the number of shares we are offering would increase or decrease each of cash and cash equivalents, total assets and total stockholders’ equity on a pro forma as adjusted basis by approximately $13.0 million, assuming the assumed initial public offering price per share, which is the midpoint of the range set forth on the cover page of this prospectus, remains the same.

9

Table of Contents

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except share and per share data) |

||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Revenues |

$ | 34,713 | $ | 39,368 | $ | 45,807 | $ | 33,328 | $ | 41,241 | ||||||||||

| Cost of revenues |

7,792 | 8,139 | 8,529 | 6,367 | 7,622 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

26,921 | 31,229 | 37,278 | 26,961 | 33,619 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

6,156 | 7,276 | 7,808 | 5,698 | 7,418 | |||||||||||||||

| Sales and marketing |

12,990 | 15,246 | 21,305 | 15,453 | 16,746 | |||||||||||||||

| General and administrative |

7,020 | 7,331 | 8,550 | 6,248 | 7,764 | |||||||||||||||

| Gain on extinguishment of other long-term liabilities |

— | (2,700 | ) | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

26,166 | 27,153 | 37,663 | 27,399 | 31,928 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations |

755 | 4,076 | (385 | ) | (438 | ) | 1,691 | |||||||||||||

| Total other (expense) income |

(495 | ) | 220 | (163 | ) | (130 | ) | (634 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before taxes |

260 | 4,296 | (548 | ) | (568 | ) | 1,057 | |||||||||||||

| Income tax expense (benefit) |

2 | (16 | ) | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

258 | 4,312 | (548 | ) | (568 | ) | 1,057 | |||||||||||||

| Accrual of dividends on redeemable convertible preferred stock |

(1,040 | ) | (1,040 | ) | (613 | ) | (612 | ) | — | |||||||||||

| Undistributed earnings allocated to preferred stockholders |

— | (2,655 | ) | — | — | (850 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to common stockholders – basic |

(782 | ) | 617 | (1,161 | ) | (1,180 | ) | 207 | ||||||||||||

| Undistributed earnings re-allocated to common stockholders |

— | 303 | — | — | 109 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to common stockholders – diluted |

$ | (782 | ) | $ | 920 | $ | (1,161 | ) | $ | (1,180 | ) | $ | 316 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to common stockholders per share – basic |

$ | (0.49 | ) | $ | 0.38 | $ | (0.69 | ) | $ | (0.71 | ) | $ | 0.12 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to common stockholders per share – diluted |

$ | (0.49 | ) | $ | 0.34 | $ | (0.69 | ) | $ | (0.71 | ) | $ | 0.11 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares of common stock outstanding used in computing net (loss) income per share – basic |

1,596,920 | 1,611,843 | 1,674,018 | 1,666,820 | 1,704,736 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares income of common stock outstanding used in computing net (loss) income per share – diluted |

1,596,920 | 2,713,770 | 1,674,018 | 1,666,820 | 2,984,817 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net (loss) income per share of common stock – basic |

$ | (0.09 | ) | $ | 0.07 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Pro forma net (loss) income per share of common stock – diluted |

$ | (0.09 | ) | $ | 0.06 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted average shares of common stock outstanding used in computing pro forma net (loss) income per share – basic |

9,031,264 | 8,986,474 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted average shares of common stock outstanding used in computing pro forma net (loss) income per share – diluted |

9,031,264 | 10,266,555 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

10

Table of Contents

| As of September 30, 2012 | ||||||||||||

| Actual | Pro forma | Pro

forma as adjusted(1) |

||||||||||

| (in thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 10,279 | $ | 5,079 | $ | 69,335 | ||||||

| Accounts receivable, net |

8,057 | 8,057 | 8,057 | |||||||||

| Total assets |

33,549 | 28,349 | 89,803 | |||||||||

| Revolving line of credit(2) |

3,500 | 3,500 | 3,500 | |||||||||

| Current maturities of long-term debt(2) |

2,400 | 2,400 | 2,400 | |||||||||

| Long-term debt, less current maturities(2) |

1,800 | 1,800 | 1,800 | |||||||||

| Preferred stock warrant liability |

462 | — | — | |||||||||

| Total liabilities |

15,480 | 15,018 | 14,872 | |||||||||

| Redeemable convertible preferred stock and convertible preferred stock |

57,165 | — | — | |||||||||

| Additional paid-in capital |

9,089 | 61,508 | 123,103 | |||||||||

| Accumulated deficit |

(48,186 | ) | (48,186 | ) | (48,186 | ) | ||||||

| Total stockholders’ (deficit) equity |

(39,094 | ) | 13,331 | 74,931 | ||||||||

| (1) | As of September 30, 2012, we had paid approximately $2.7 million of expenses incurred in connection with this offering. |

| (2) | Subsequent to September 30, 2012, we refinanced our indebtedness. As of December 31, 2012, our indebtedness consisted of $16.0 million in term loans, all of which was classified as long-term on our balance sheet, and $5.0 million borrowed under our revolving line of credit, all of which was classified as current liabilities on our balance sheet. |

11

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information included in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks actually occurs, they may harm our business, prospects, financial condition and operating results. As a result, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Strategy

Our ability to successfully execute our strategy is dependent on our achieving greater market acceptance of the NMR LipoProfile test.

Our ability to generate revenue depends on our successful marketing of the NMR LipoProfile test. The NMR LipoProfile test accounted for 85% of our revenues for the year ended December 31, 2009, 87% of our revenues for the year ended December 31, 2010, 93% of our revenues for the year ended December 31, 2011 and 94% of our revenues for the nine months ended September 30, 2012. We expect that our revenues and profitability will depend on sales of the NMR LipoProfile test for the foreseeable future.

There is not currently widespread awareness of the NMR LipoProfile test among clinicians, even though the test has been available since 1999. In order to achieve greater market acceptance of the NMR LipoProfile test, we must continue to demonstrate to clinicians, other healthcare professionals, clinical diagnostic laboratories, healthcare thought leaders and third-party payors that the test is a clinically useful and cost-effective diagnostic test and disease management tool for cardiovascular disease risk providing improved or additional benefits over traditional cholesterol testing, which has been widely accepted as effective for managing cardiovascular risk for many years.

When seeking testing and management recommendations for coronary heart disease, many physicians and other clinicians look to clinical guidelines published by influential organizations. Such organizations include the National Cholesterol Education Program, or NCEP, an authority on cholesterol management overseen by the National Heart, Lung and Blood Institute, or NHLBI, part of the National Institutes of Health, and the American Heart Association. The NMR LipoProfile test is not currently included in guidelines published by NCEP or the American Heart Association. If we are not successful in our strategy of gaining inclusion in the guidelines published by these or other organizations, it could ultimately limit market adoption of the NMR LipoProfile test.

A study published in May 2012 in Circulation, a peer-reviewed scientific journal published by the American Heart Association, evaluated frozen archived blood samples collected between 1994 and 1997 from approximately 20,000 United Kingdom subjects, and concluded that LDL-P and traditional cholesterol testing have similar predictive value for the incidence of CHD. Although this paper did not include data analyses addressing the utility of these measurements for patient management in discordant subjects, and therefore in our view does not diminish the weight of scientific evidence supporting the utility of LDL-P testing in discordant patients, it is possible that readers may misunderstand this paper, which could make it more difficult to persuade clinicians and publishers of clinical guidelines of the benefits of our NMR LipoProfile test over traditional cholesterol testing.

A small number of clinical diagnostic laboratory customers account for most of the sales of our NMR LipoProfile test. If any of these laboratories orders fewer tests from us for any reason, our revenues could decline.

For the year ended December 31, 2011 and the nine months ended September 30, 2012, we generated 76% and 88% of our revenues, respectively, from clinical diagnostic laboratory customers. Sales to one of these laboratories, Laboratory Corporation of America Holdings, or LabCorp, accounted for 33% of our revenues for the year ended December 31, 2010, 33% of our revenues for the year ended December 31, 2011 and 29% of our

12

Table of Contents

revenues for the nine months ended September 30, 2012. Sales to a second laboratory customer, Health Diagnostics Laboratory, Inc., accounted for 21% of our revenues for the year ended December 31, 2011 and 32% of our revenues for the nine months ended September 30, 2012.

Our current agreements with our laboratory customers do not require them to purchase any minimum quantities of the NMR LipoProfile test. In addition, these customers generally have the right to terminate their respective agreements with us at any time. If any major customer were to terminate its relationship with us, or to substantially diminish its purchases of the NMR LipoProfile test, our revenues could significantly decline or it could adversely impact our revenue growth.

We expect to incur losses for the next several years as we increase expenses in our effort to increase market share for the NMR LipoProfile test, place the Vantera system in third-party clinical diagnostic laboratories, and develop new personalized diagnostic tests.

Although we generated net income for the nine months ended September 30, 2012, we incurred a net loss of $0.5 million for the year ended December 31, 2011 and have incurred significant losses since our inception. As of September 30, 2012, we had an accumulated deficit of $48.2 million. We anticipate experiencing losses for the next several years as we increase expenses in pursuit of our growth strategy and our efforts to increase market share for the NMR LipoProfile test, place the Vantera system in third-party clinical diagnostic laboratories, and develop new personalized diagnostic tests.

Historically, our losses have resulted principally from research and development programs, our sales and marketing efforts, and our general and administrative expenses. We expect to continue to incur significant operating expenses and anticipate that our expenses and losses will increase due to costs relating to, among other things:

| • | expansion of our direct sales force and increasing our marketing capabilities to promote market awareness and acceptance of our NMR LipoProfile test; |

| • | placement of the Vantera system in third-party clinical diagnostic laboratories; |

| • | development of and, as necessary, pursuit of regulatory approvals for, new diagnostic tests; |

| • | expansion of our operating capabilities; |

| • | maintenance, expansion and protection of our intellectual property portfolio and trade secrets; |

| • | employment of additional clinical, quality control, scientific and management personnel; and |

| • | employment of operational, financial, accounting and information systems personnel, consistent with expanding our operations and our status as a newly public company. |

To become and remain profitable, we must succeed in increasing sales of our NMR LipoProfile test or develop and commercialize new tests with significant market potential, and place the Vantera system in third-party clinical diagnostic laboratories. We may never succeed in these activities and may never generate revenues that are sufficient to achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain consistently profitable would likely depress the market price of our common stock and could significantly impair our ability to raise capital, expand our business or continue to pursue our growth strategy.

If we do not establish relationships with additional clinical diagnostic laboratories, we may not be able to increase the number of NMR LipoProfile tests we sell.

A significant element of our strategy is to leverage relationships with clinical diagnostic laboratories to increase market acceptance of the NMR LipoProfile test and gain market share. Most clinicians who request traditional cholesterol tests, our NMR LipoProfile test and other diagnostic tests to evaluate cardiovascular disease risk order these tests through clinical diagnostic laboratories.

13

Table of Contents

If we are unable to establish relationships with additional clinical diagnostic laboratories, clinicians who order tests through these laboratories may be unwilling or unable to order our NMR LipoProfile test. In addition, we would not have the benefit of leveraging the sales, marketing and distribution capabilities of these laboratories, which we believe is important to our ability to increase awareness of and expand utilization of the NMR LipoProfile test. As a result, if we are unable to establish additional clinical laboratory relationships, our ability to increase sales of our NMR LipoProfile test and to successfully execute our strategy could be compromised.

We will need to expand our marketing and sales capabilities in order to increase demand for our NMR LipoProfile test, to expand geographically and to successfully commercialize any other personalized diagnostic tests we may develop.

We believe our current sales and marketing operations are not sufficient to achieve the level of market awareness and sales required for us to attain significant commercial success for our NMR LipoProfile test, to expand our geographic presence and to successfully commercialize any other diagnostic tests we may develop. In order to increase sales of our NMR LipoProfile test, we will need to:

| • | expand our direct sales force in the United States by recruiting additional sales representatives in selected markets; |

| • | educate clinicians, other healthcare professionals, clinical diagnostic laboratories, healthcare thought leaders and third-party payors regarding the clinical benefits and cost-effectiveness of our NMR LipoProfile test; |

| • | expand our number of clinical diagnostic laboratory and hospital outreach laboratory customers; and |

| • | establish, expand and manage sales and reimbursement arrangements with third parties, such as clinical diagnostic laboratories and insurance companies. |

We have limited experience in selling and marketing the NMR LipoProfile test nationally, and we have no experience in placing and servicing the Vantera system in third-party clinical diagnostic laboratories for commercial purposes. We intend to hire a significant number of additional sales and marketing personnel with experience in the diagnostic, medical device or pharmaceutical industries. We may face competition from other companies in these industries, some of whom are much larger than us and who can pay significantly greater compensation and benefits than we can, in seeking to attract and retain qualified sales and marketing employees. If we are unable to hire and retain qualified sales and marketing personnel, our business will suffer.

Furthermore, in order to successfully commercialize diagnostic tests that we may develop in the future, we may need to conduct lengthy, expensive clinical trials and develop dedicated sales and marketing operations to achieve market awareness and demand. If we are not able to successfully implement our marketing, sales and commercialization strategies, we may not be able to expand geographically, increase sales of our NMR LipoProfile test or successfully commercialize any future diagnostic tests that we may develop.

The diagnostic industry is subject to rapidly changing technology which could make our current test and the tests we are developing obsolete unless we continue to develop and manufacture new and improved tests and pursue new market opportunities.

Our industry is characterized by rapid technological changes, frequent new product introductions and enhancements and evolving industry standards. Our future success will depend on our ability to keep pace with the evolving needs of our customers on a timely and cost-effective basis and to pursue new market opportunities that develop as a result of technological and scientific advances. These new market opportunities may be outside the scope of our expertise or in areas which have unproven market demand, and the utility and value of new tests that we develop may not be accepted in the market. Our inability to gain market acceptance of new tests could harm our future operating results. Further, if new research or clinical evidence or economic comparative evidence arises that supports a different marker for coronary heart disease risk, demand for our test could decline.

14

Table of Contents

Our NMR LipoProfile test competes with other diagnostic testing methods that may be more widely accepted than our test.

The clinical diagnostics market is highly competitive, and we must be able to compete effectively against existing and future competitors in order to be successful. In selling our NMR LipoProfile test, we compete primarily with existing diagnostic, detection and monitoring technologies, particularly the conventional lipid panel test, which is relatively inexpensive, widely reimbursed and broadly accepted as an effective test for managing the risk of developing cardiovascular disease. We also compete against companies that offer other methods for directly or indirectly measuring cholesterol concentrations, lipoproteins or lipoprotein particles. For example, measuring apolipoprotein B, or apoB, is an indirect way to approximate LDL-P. ApoB tests are offered by many clinical diagnostic laboratories and are generally less expensive than our tests. It is possible that apoB, or other competing tests, could be perceived by clinicians as more cost-effective than our test in providing information useful in managing CHD risk. In addition, some competitors offering these competing technologies may have longer operating histories, better name recognition and greater financial, technical, sales, marketing, distribution and public relations resources than we have. They may also have more experience in research and development, regulatory matters, manufacturing and marketing than we do, and may have established broad third-party reimbursement for their tests. If we do not compete successfully, we will not be able to increase our market share and our business will be seriously harmed.

Even though the Vantera system has received regulatory clearance in the United States, if laboratories are not receptive to placement of the Vantera system at their facilities, or if we do not receive regulatory clearance of the Vantera system in other jurisdictions, our growth strategy may not be successful.

A key element of our strategy is to place the Vantera system, our next-generation automated clinical NMR analyzer, on site with selected clinical diagnostic laboratory customers to broaden access to our technology and increase demand for our NMR LipoProfile test and any future diagnostic tests that we may develop. Although we received clearance from the FDA to perform the FDA-cleared measurements of the NMR LipoProfile test using the Vantera system in August 2012, we have not applied for clearance from comparable regulatory agencies in other countries for the Vantera system, and we may not receive regulatory clearance for the commercial use of the Vantera system in other countries on a timely basis, or at all. Even though the Vantera system is cleared by the FDA, it may not gain significant acceptance by clinical diagnostic laboratories, or these laboratories may not be satisfied with the Vantera system after it is placed in their facilities. If clinical diagnostic laboratories do not accept the placement of the Vantera system in their facilities, our ability to grow our business by deploying the Vantera system could be compromised.

We currently do not generate significant revenue from sales of the NMR LipoProfile test to laboratory customers in the State of California. Among other things, California law restricts a clinical diagnostic laboratory from charging its customers a mark-up on the price of diagnostic tests performed by a third-party laboratory. We believe that the FDA clearance for the Vantera system will facilitate our ability to drive conversion in the California market by allowing our clinical diagnostic laboratory customers to perform the NMR LipoProfile test themselves using the Vantera system. If clinical laboratories do not accept the placement of the Vantera system in their facilities, we may need to pursue other strategies in order to increase the amount of our business from clinical laboratory customers who serve the California market.

We rely on two key suppliers for the components used in the Vantera system. If we were to lose either of these suppliers, our ability to broadly place the Vantera system could be compromised.

We currently rely on a single supplier, Agilent Technologies, Inc., for the magnet, probe and console incorporated in the Vantera system. These are the key components of the analyzers necessary to perform our NMR LipoProfile test. We are party to a supply agreement with Agilent pursuant to which we have agreed to exclusively purchase all of our NMR-related components from them. We are also party to a production agreement with KMC Systems, Inc. under which KMC is our exclusive manufacturer of the sample handler and shell for the Vantera system.

15

Table of Contents

We are currently aware of one other primary supplier of NMR spectrometers, Bruker BioSpin, part of Bruker Corporation. We have in the past acquired NMR spectrometers from Bruker BioSpin, and we use them in our current generation of NMR clinical analyzers, but we do not currently have an agreement or relationship with Bruker BioSpin. In the event it is necessary or desirable to acquire NMR spectrometers from Bruker BioSpin, we might not be able to obtain them on commercially reasonable terms, if at all. It could also require significant time and expense to redesign our current analyzers or the Vantera system to work with the spectrometers provided by another company.

If we are unable to obtain the NMR components we need at a reasonable price or on a timely basis, we may be unable to maintain the analyzers we use in our facility to perform our NMR LipoProfile test, which could compromise our ability to meet our customers’ orders for the test. Likewise, if the components or any other part of the Vantera system are not available when needed, we may not be able to place the Vantera system broadly, which could impair our ability to pursue our growth strategy.

Our ability to meet increased demand for our NMR LipoProfile test will be harmed if we are unable to place the Vantera system in third-party diagnostic laboratories.

We have recently experienced rapid growth in orders of our NMR LipoProfile test. We perform our NMR LipoProfile test using our current generation NMR analyzers, as well as our Vantera system analyzers, located in our laboratory facility in Raleigh, North Carolina. If demand for our test grows to the point at which it exceeds our existing capacity, we will be required to add capacity in order to meet this demand. We do not expect to be able to expand capacity through the addition of more of our existing NMR clinical analyzers, because those analyzers use NMR spectrometers from Bruker BioSpin, a supplier with whom we no longer have an agreement or relationship. Instead, we intend to meet additional demand for our test by using a decentralization strategy of placing our Vantera system in the facilities of clinical diagnostic laboratories, as well as utilizing additional Vantera system analyzers at our laboratory facility in Raleigh, North Carolina.

If we are unsuccessful in broadly placing the Vantera system in third-party diagnostic laboratories for any reason, we may be unable to meet demand that exceeds our current capacity. In that case, we would need to meet increased demand by performing our NMR LipoProfile test on Vantera system analyzers located in our own laboratory and we might not be successful in doing so.

We rely on a single supplier for our branded blood collection tubes, called LipoTubes, which are used to collect a majority of our blood samples for testing.

We use an exclusive supplier for LipoTubes, which are produced according to our specifications. An alternate supplier might not be easily located, and if we are unable to obtain these tubes from this vendor for any reason, our ability to perform our test and maintain effective relationships with our current clinical customers would be impaired.

If we do not successfully develop or acquire and introduce new personalized diagnostic tests or other applications of our technology, we may not generate new sources of revenue and may not be able to successfully implement our growth strategy.

Our business strategy includes the acquisition, development and introduction of new clinical diagnostic applications of our NMR-based technology in addition to our NMR LipoProfile test. Additionally, we believe that for our Vantera system to be attractive to laboratories to place in their facilities, it may be necessary for us to offer additional tests for use on the Vantera system. All of our diagnostic tests under development will require significant additional research and development, a commitment of significant additional resources and possibly costly and time-consuming clinical testing prior to their commercialization. Our technology is complex, and we cannot be sure that any tests under development will be developed successfully, be proven to be effective, offer diagnostic or other improvements over currently available tests, meet applicable regulatory standards, be produced in commercial quantities at acceptable costs or be successfully marketed.

16

Table of Contents

We may also in the future seek to acquire complementary products or technologies from third parties. Integrating any product or technology we acquire could be expensive and time-consuming, disrupt our ongoing business and distract our management. If we are unable to integrate any tests or technologies effectively, we may not be able to implement our business model. If we do not successfully develop new clinical diagnostic applications of our NMR-based technology or acquire complementary diagnostic products, we could lose interest from academic medical centers and could also lose revenue opportunities with existing or future clinical laboratory customers.

If we are not able to retain and recruit qualified management, sales and marketing, regulatory and research and development personnel, we may be unable to successfully execute our business strategy.

Our future success depends to a significant extent on the skills, experience and efforts of our senior management team, including Richard O. Brajer, our President and Chief Executive Officer; Lucy G. Martindale, our Chief Financial Officer; James D. Otvos, our Chief Scientific Officer and founder; Timothy J. Fischer, our Chief Operating Officer; and Thomas S. Clement, our Vice President of Regulatory and Quality Affairs. The loss of any or all of these individuals, or other management personnel, could harm our business and might significantly delay or prevent the achievement of our business objectives. We have entered into an employment agreement or offer letters with each of these individuals and with our other executives. The existence of an employment agreement or offer letter does not, however, guarantee retention of these employees, and we may not be able to retain those individuals for the duration of or beyond the end of their respective terms. We do not maintain key person life insurance on any of our management personnel.

Recruiting and retaining qualified sales and marketing, regulatory, scientific and laboratory personnel will also be critical to our success. We may not be able to attract and retain these personnel on acceptable terms, given the competition among numerous diagnostic, medical device, pharmaceutical and biotechnology companies for similarly skilled personnel.

If we are unable to successfully manage our growth, our business will be harmed.

During the past several years, we have significantly expanded our operations. We expect this expansion to continue to an even greater degree following completion of this offering as we seek to expand nationally and explore potential expansion into international markets. Our growth has placed and will continue to place a significant strain on our management, operating and financial systems and our sales, marketing and administrative resources. As a result of our growth, our operating costs may escalate even faster than planned, and some of our internal systems may need to be enhanced or replaced. If we cannot effectively manage our expanding operations and our costs, we may not be able to continue to grow or we may grow at a slower pace and our business could be adversely affected.

We currently perform our tests exclusively in one laboratory facility. If this or any future facility or our equipment were damaged or destroyed, or if we experience a significant disruption in our operations for any reason, our ability to continue to operate our business could be materially harmed.

We currently perform our NMR LipoProfile tests exclusively in a single laboratory facility in Raleigh, North Carolina. If this or any future facility were to be damaged, destroyed or otherwise unable to operate, whether due to fire, floods, hurricanes, storms, tornadoes, other natural disasters, employee malfeasance, terrorist acts, power outages, or otherwise, or if performance of our analyzers is disrupted for any other reason, we may not be able to perform our tests or generate test reports as promptly as our customers expect, or possibly not at all. If we are unable to perform our tests or generate test reports within a timeframe that meets our customers’ expectations, our business, financial results and reputation could be materially harmed.

Currently, we maintain insurance coverage totaling $12 million against damage to our property and equipment and an additional $10 million to cover business interruption and research and development restoration expenses, subject to deductibles and other limitations. If we have underestimated our insurance needs with respect to an interruption, or if an interruption is not subject to coverage under our insurance policies, we may not be able to cover our losses.

17

Table of Contents

Failure in our information technology, storage systems or our analyzers could significantly disrupt our operations and our research and development efforts, which could adversely impact our revenues, as well as our research, development and commercialization efforts.

Our ability to execute our business strategy depends, in part, on the continued and uninterrupted performance of our information technology, or IT, systems, which support our operations and our research and development efforts, as well as our storage systems and our clinical analyzers, including the Vantera system analyzers. Due to the sophisticated nature of the NMR technology we use in our testing, we are substantially dependent on our IT systems. IT systems are vulnerable to damage from a variety of sources, including telecommunications or network failures, malicious human acts and natural disasters. Moreover, despite network security and back-up measures, some of our servers are potentially vulnerable to physical or electronic break-ins, computer viruses and similar disruptive problems. Despite the precautionary measures we have taken to prevent unanticipated problems that could affect our IT systems, sustained or repeated system failures that interrupt our ability to generate and maintain data, and in particular to operate our NMR analyzers, including any Vantera system analyzers placed in third-party clinical diagnostic laboratories, could adversely affect our ability to operate our business. Any interruption in the operation of our NMR analyzers, due to IT system failures, part failures or potential disruptions in the event we are required to relocate our analyzers within our facility or to another facility, or failures of the Vantera system analyzers within the facilities of third-party clinical diagnostic laboratories, could have an adverse effect on our operations.

We rely on courier delivery services to transport samples to our facility for analysis. If these delivery services are disrupted, our business and customer satisfaction could be negatively impacted.

Clinicians and clinical laboratories ship samples to us by air and ground express courier delivery service for analysis in our Raleigh, North Carolina facility. Disruptions in delivery service, whether due to bad weather, natural disaster, terrorist acts or threats, or for other reasons, can adversely affect specimen quality and our ability to provide our services on a timely basis to customers.

Our business involves the use of hazardous materials that could expose us to environmental and other liabilities.

Our laboratory facility is subject to various local, state and federal laws and regulations relating to safe working conditions, laboratory and manufacturing practices and the use and disposal of hazardous or potentially hazardous substances, including chemicals, biological materials and various compounds used in connection with our research and development activities. In the United States, these laws include the Occupational Safety and Health Act, the Toxic Test Substances Control Act and the Resource Conservation and Recovery Act. We cannot assure you that accidental contamination or injury to our employees and third parties from hazardous materials will not occur. We do not have insurance to cover claims arising from our use and disposal of these hazardous substances other than limited clean-up expense coverage for environmental contamination due to an otherwise insured peril, such as fire.

If product liability lawsuits are successfully brought against us, we may incur substantial liabilities that could have a significant negative effect on our financial condition or reputation.

Diagnostic testing entails the risk of product liability, and we may be exposed to liability claims arising from the use of our tests. We maintain product liability insurance that is subject to deductibles and coverage limitations and is in an amount that we believe to be reasonable. We cannot be certain, however, that our product liability insurance will be sufficient to protect us against losses due to liability. As a result, we may be required to pay all or a portion of any successfully asserted product liability claim out of our cash reserves. Furthermore, we cannot be certain that product liability insurance will continue to be available to us on commercially reasonable terms or in sufficient amounts. We can provide no assurance that we will be able to avoid significant product liability claims, which could hurt our reputation and our financial condition.

18

Table of Contents

If we expand sales of our products or place the Vantera system outside of the United States, our business will be susceptible to costs and risks associated with international operations.

As part of our longer-term growth strategy, we may decide to target select international markets to grow our presence outside of the United States. Conducting international operations would subject us to new risks that, generally, we have not faced in the United States, including:

| • | fluctuations in currency exchange rates; |

| • | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| • | uncertain regulatory registration and approval processes for seeking clearance of the Vantera system and our diagnostic tests; |

| • | competition from companies located in the countries in which we offer our products, which may be a competitive disadvantage; |

| • | difficulties in managing and staffing international operations and assuring compliance with foreign corrupt practices laws; |

| • | the possibility of management distraction; |

| • | potentially adverse tax consequences, including the complexities of foreign value added tax systems, tax inefficiencies related to our corporate structure and restrictions on the repatriation of earnings; |

| • | increased financial accounting and reporting burdens and complexities; |

| • | political, social and economic instability abroad, terrorist attacks and security concerns in general; and |

| • | reduced or varied protection for intellectual property rights in some countries. |

The occurrence of any one of these risks could harm our business or results of operations. Additionally, operating internationally requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required in establishing operations in other countries will produce desired levels of revenues or profitability.

We may use third-party collaborators to help us develop, validate or commercialize any new diagnostic tests, and our ability to commercialize such tests could be impaired or delayed if these collaborations are unsuccessful.