Attached files

| file | filename |

|---|---|

| EX-99.4 - CONSENT OF RAYMOND J. KILMER TO BE NAMED AS A DIRECTOR - ExOne Co | d461168dex994.htm |

| EX-23.1 - CONSENT OF PARENTEBEARD LLC - ExOne Co | d461168dex231.htm |

| EX-10.07.02 - FORM OF AWARD AGREEMENTS UNDER 2013 EQUITY INCENTIVE PLAN - ExOne Co | d461168dex100702.htm |

| EX-10.07.01 - 2013 EQUITY INCENTIVE PLAN - ExOne Co | d461168dex100701.htm |

| EX-10.01.02 - FIRST AMENDMENT TO THE AMENDED AND RESTATED EXCLUSIVE PATENT LICENSE AGREEMENT - ExOne Co | d461168dex100102.htm |

| EX-10.01.01 - AMENDED AND RESTATED EXCLUSIVE PATENT LICENSE AGREEMENT - ExOne Co | d461168dex100101.htm |

| EX-10.16 - LEASING CONTRACT, AGREEMENT CONCERNING MACHINE USE, SALE & LEASEBACK AGREEMENT - ExOne Co | d461168dex1016.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 24, 2013

Registration No. 333-185933

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

The ExOne Company

(Exact name of registrant as specified in its charter)

| Delaware | 3599 | 46-1684608 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

127 Industry Boulevard

North Huntingdon, Pennsylvania 15642

(724) 863-9663

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

S. Kent Rockwell

Chairman & CEO

The ExOne Company

127 Industry Boulevard

North Huntingdon, Pennsylvania 15642

(724) 863-9663

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Warren J. Archer Morella & Associates, A Professional Corporation 706 Rochester Road Pittsburgh, Pennsylvania 15237 (412) 369-9696 |

Jonathan H. Talcott Nelson Mullins Riley & Scarborough LLP 101 Constitution Avenue, NW, Suite 900 Washington, DC 20001 (202) 712-2806 | |||||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

|

| ||||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.01 per share |

$92,000,000 | $12,549 | ||||

|

| ||||||

|

| ||||||

| (1) | Includes shares of common stock subject to an over-allotment option granted to the underwriters. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act. |

| (3) | The registrant previously paid $10,230. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On January 1, 2013, The Ex One Company, LLC, a Delaware limited liability company, merged with and into a Delaware corporation, which survived and changed its name to The ExOne Company (the “Reorganization”). As a result of the Reorganization, The Ex One Company, LLC became the registrant, a Delaware corporation, the common and preferred interest holders of The Ex One Company, LLC became holders of common stock and preferred stock, respectively, of the registrant and the subsidiaries of The Ex One Company, LLC became the subsidiaries of the registrant. The preferred stock of the registrant will convert into common stock immediately prior to the consummation of this offering. Except as disclosed in the accompanying prospectus, the consolidated financial statements and selected historical consolidated financial data and other financial information included in this registration statement are those of The Ex One Company, LLC and its subsidiaries and variable interest entities and do not give effect to the Reorganization.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we and the selling stockholder are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JANUARY , 2013 |

Shares

The ExOne Company

Common Stock

We are offering shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholder.

This is our initial public offering, and prior to this offering, there has been no public market for our common stock. We anticipate that the initial public offering price of our common stock will be between $ and $ per share. We will apply to list our common stock on the Nasdaq Global Market under the symbol “XONE.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. Please read “Risk Factors ” beginning on page 14 of this prospectus to read about the risks you should consider before investing.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds before expenses to us |

$ | $ | ||||||

| Proceeds before expenses to the selling stockholder |

$ | $ | ||||||

We and the selling stockholder have granted the underwriters an option, exercisable within 30 days of the date of this prospectus, to purchase a maximum of additional shares of our common stock from us and the selling stockholder at the initial public offering price, less the underwriting discount, to cover over-allotments of shares, if any.

The underwriters will reserve up to shares from this offering for sale, directly or indirectly, to certain of our employees, directors and officers, and certain other investors related to us, at the public offering price without payment of an underwriting discount or commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock to purchasers against payment on or about , 2013.

FBR

The date of this prospectus is , 2013.

Table of Contents

Table of Contents

| 1 | ||||

| 14 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 33 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

36 | |||

| 64 | ||||

| 87 | ||||

| 94 | ||||

| 95 | ||||

| 97 | ||||

| 98 | ||||

| 100 | ||||

| 103 | ||||

| 105 | ||||

| 110 | ||||

| 113 | ||||

| 113 | ||||

| 113 | ||||

| F-1 |

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that is important to you or that you should consider before investing in our common stock. You should carefully read the entire prospectus, including the risk factors, financial data, and financial statements included herein, before making a decision about whether to invest in our common stock. All financial information included in this prospectus includes our variable interest entities, Troy Metal Fabricating, LLC (“TMF”) and Lone Star Metal Fabrication, LLC (“Lone Star”). Unless the context requires otherwise or we specifically indicate otherwise, the information in this prospectus assumes that the underwriters do not exercise their over-allotment option. As used in this prospectus, unless the context otherwise requires or indicates, the terms “ExOne,” “our company,” “we,” “our,” “ours,” and “us” refer to The ExOne Company and its subsidiaries.

Our Company

We are a global provider of three-dimensional (“3D”) printing machines and printed products to industrial customers. Our business primarily consists of manufacturing and selling 3D printing machines and printing products to specification for our customers using our in-house 3D printing machines. We offer pre-production collaboration and print products for customers through our Production Service Centers (“PSCs”), which are located in the United States, Germany and Japan. We build 3D printing machines at our facilities in the United States and Germany. We also supply the associated products, including consumables and replacement parts, and services, including training and technical support, necessary for purchasers of our machines to print products. We believe that our ability to print in a variety of industrial materials, as well as our industry-leading printing capacity (as measured by build box size and printhead speed), uniquely position us to serve the needs of industrial customers.

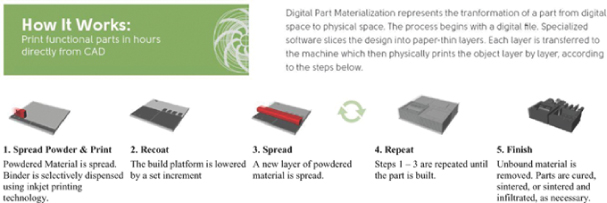

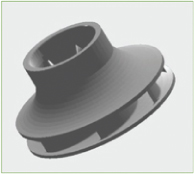

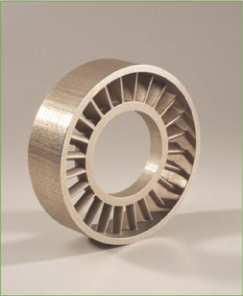

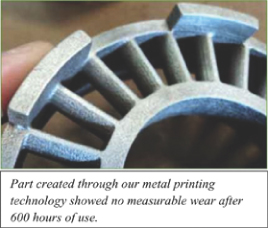

Our 3D printing machines use our technology, powdered materials, chemical binding agents and integrated software to print 3D products directly from computer models by repeatedly depositing very thin layers of powdered materials and selectively placing chemical binding agents to form the finished product. One of our key industry advantages is that our machines are able to print products in materials that are desired by industrial customers. Currently, our 3D printing machines are able to manufacture casting molds and cores from specialty silica sand and ceramics, which are the traditional materials for these casting products. We are capable of printing in silica sand, ceramics, stainless steel, bronze and glass, and we are in varying stages of qualifying additional industrial materials for printing, such as titanium, tungsten carbide, aluminum and magnesium.

We believe that we are a leader in providing 3D printing machines, 3D printed products and related services to industrial customers in the aerospace, automotive, heavy equipment, energy/oil/gas and other industries. Each of the following customers are among our top ten customers (based upon machine revenue in 2010, 2011 and 2012 through September 30, 2012 and non-machine revenue in 2011 through September 30, 2012) in the indicated industry; however, these customers do not necessarily account for ten percent or more of our revenue during that period. As an industrial 3D printing and emerging growth company, we believe that continued introduction and acceptance through use of our products and machines without regard to revenue volume, by leaders in various industries is critical to us obtaining more general acceptance of our technology by industrial companies. The following customers are a sample of companies that are using our industrial products and machines in the industries that we serve. Our customers in the aerospace industry include Magellan Aerospace Corporation, Boeing and Mitchell Aerospace Inc. Our customers in the automotive industry include Ford Motor Company, Bavarian Motor Works (“BMW”) and Tesla Motors, Inc. Our customers in the heavy equipment industry include Caterpillar, Inc., Deere & Company and Bosch Rexroth and our customers in the energy/oil/gas industry include ITT Corp. and the KSB Group.

Our business began as the advanced manufacturing business of Extrude Hone Corp., which manufactured its first 3D printing machine in 2003 using licensed technology developed by researchers at the Massachusetts

1

Table of Contents

Institute of Technology (“MIT”). In 2007, we were acquired by S. Kent Rockwell through his wholly-owned company Rockwell Forest Products, Inc. (“RFP”). Since 2007, when he purchased our company for approximately $7.2 million, Mr. Rockwell (through RFP and affiliated entities) and our other owners have funded our company and related entities, through January 23, 2013, with $41.7 million in either equity or debt. The primary goals of these investments were to: increase the scale, speed and efficiency of our 3D printing machines; expand the range of qualified materials in which our machines can print; and position us to compete in the rapidly evolving 3D printing market. As a result, we have significantly reduced our unit cost of production over time, thereby expanding the potential market for our machines and products.

Our revenues for the year ended December 31, 2011 were $15.3 million, as compared to $13.4 million for the prior year period, and for the first nine months of 2012 were $15.9 million, as compared to $12.6 million for the same period in 2011. Our EBITDA was ($8.9) million for the first nine months of 2012, as compared to ($2.3) million for the same period in 2011. Our EBITDA for the nine months ended September 30, 2012 includes a non-cash equity based compensation expense of $7.7 million. See note 7 to the table set forth in “— Summary Consolidated Financial Data” for a reconciliation of EBITDA to net loss.

| Twelve Months Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2010 | 2011 | 2011 | 2012 | |||||||||||||

| (unaudited) | ||||||||||||||||

| Machine Units Sold(A) |

||||||||||||||||

| S 15 |

2 | 2 | 2 | 1 | ||||||||||||

| S Max |

2 | 1 | 1 | 4 | ||||||||||||

| S Print |

— | 1 | 1 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

4 | 4 | 4 | 5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (A) | See “Business — Our Machines and Machine Platforms” for a description of the machines. |

During the nine months ended September 30, 2011 and 2012 and the twelve months ended December 31, 2010 and 2011, we conducted a significant portion of our business with a limited number of customers. Our top five customers represented approximately 46% and 42% of total revenue for the nine months ended September 30, 2011 and 2012, respectively, and approximately 43% and 47% of total revenue in 2010 and 2011, respectively. These customers primarily purchased 3D printing machines. Sales of 3D printed parts and consumables tend to be from repeat customers that may utilize the capability of our PSCs for three months or longer. Sales of 3D printing machines are low volume and generate significant revenue but the same customers do not necessarily buy machines in each period. Timing of customer purchases is dependent on the customer’s capital budgeting cycle, which may vary from period to period. The nature of the revenue from 3D printing machines, as described above, does not leave us dependent upon a single or a limited number of customers. Rather, the timing of the sales can have a material effect on period to period financial results.

We incurred a net loss of approximately $5.2 million and $7.6 million for the years ended December 31, 2010 and 2011, respectively, and had an accumulated deficit of approximately $15.6 million as of December 31, 2011. As shown in the accompanying unaudited condensed consolidated financial statements, we incurred a net loss of approximately $10.7 million for the nine months ended September 30, 2012, and had a working capital deficit of approximately $7.3 million. These conditions raise substantial doubt as to our ability to continue as a going concern. We believe that we will be able to raise additional equity or debt financing sufficient to support our ongoing operations either in connection with this offering or otherwise. However, we can give no assurance that profitable operations or sufficient cash flows will occur in the future.

Recent Developments

Machine Unit Shipments and Backlog

During the three month period ended December 31, 2012, we shipped eight machine units to end customers globally. We had no machine unit shipments to end customers during the three months ended December 31,

2

Table of Contents

2011. We believe the significant increase in machine unit shipments for the three month period ended December 31, 2012 is a strong indicator of the increased acceptance of our 3D printing technology in the marketplace and is significant to an investor’s understanding of our business.

The following is a summary of machine unit shipments by type for each of the respective periods:

| For the Three Months Ended December 31, |

Period-over- period change |

|||||||||||

| 2011 | 2012 | |||||||||||

| Machine unit shipments(A) |

||||||||||||

| S Max |

— | 4 | 4 | |||||||||

| S Print |

— | 3 | 3 | |||||||||

| Orion |

— | 1 | 1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

— | 8 | 8 | |||||||||

|

|

|

|

|

|

|

|||||||

| (A) | See “Business — Our Machines and Machine Platforms” for a description of the machines. |

We had six ordered and undelivered machine units at both December 31, 2012 and December 31, 2011 (five S Max units and one S Print unit at December 31, 2012 and four S Max units, one S Print unit and one Orion unit at December 31, 2011).

In connection with our financial statement close for the three month period ending December 31, 2012, we are presently evaluating each of the machine unit shipments cited above in order to determine the appropriate accounting period for revenue recognition under accounting principles generally accepted in the United States (“GAAP”). We are currently unable to provide financial data for the period ending December 31, 2012, based on the timing of our financial statement close and this offering.

MIT License Amendment

Effective January 22, 2013, we amended our license agreement with MIT related to the MIT Patents. See “Business—Intellectual Property.” The amendment provides, among other things, that we will pay MIT an annual fee of $100,000 for each of 2011, 2012, 2013, 2014, 2015 and 2016, in satisfaction of a license maintenance fee for such periods. In addition, we will make a one-time payment to MIT of $200,000 in satisfaction of all remaining royalty payments for licensed products, processes or consumables sold either before or after such amendment.

Global, Director of Finance

On January 2, 2013, we hired Douglas D. Zemba as Director of Finance, with responsibility for global accounting and financial reporting. From 2003 through 2012, Mr. Zemba was with PricewaterhouseCoopers LLP, a global accounting and auditing firm, for which he most recently served as a Senior Manager in the assurance practice. Mr. Zemba is a certified public accountant (CPA) in the state of Pennsylvania and has extensive experience in working with both public and private companies related to financial accounting matters and internal control over financial reporting. Mr. Zemba’s retention by us is one of several steps in our process of enhancing our internal control over financial reporting.

Our Industry and Recent Trends

3D printing is the most common type of an emerging manufacturing technology broadly referred to as additive manufacturing (“AM”). In general, AM is a term used to describe a manufacturing process that produces 3D objects directly from digital or computer models through the repeated deposit of very thin layers of material. 3D printing is

3

Table of Contents

the process of joining materials from a digital 3D model, usually layer by layer, to make objects using a printhead, nozzle or other printing technology. The terms “AM” and “3D printing” are increasingly used interchangeably as the media and marketplace have popularized the term 3D printing rather than AM, the industry term. AM represents a transformational shift from traditional forms of manufacturing (e.g., machining or tooling), sometimes referred to as “subtractive” manufacturing.

Our 3D printing process differs from other forms of 3D printing processes in that we use a chemical binding agent and focus on industrial products and materials. We believe that our industry advantage lies in the materials that our machines are able to print. We are capable of printing in silica sand, ceramics, stainless steel, bronze and glass, and we are in varying stages of qualifying additional industrial materials for printing, such as titanium, tungsten carbide, aluminum and magnesium. In contrast, the majority of the AM industry generally utilizes polymer materials.

According to estimates contained in the 2012 report of Wohlers Associates, Inc., “Additive Manufacturing and 3D Printing State of the Industry” (the “Wohlers Report”), the market for AM, including 3D printing, will achieve a compound annual growth rate (CAGR) in excess of 18% over the coming eight years and exceed $6.5 billion in revenue annually by 2019, up from $1.7 billion in 2011. The Wohlers Report defines the market for AM as (1) products, including “AM systems, system upgrades, materials, and aftermarket products” and (2) services, specifically including “revenues generated from parts produced on AM systems by service providers, system maintenance contracts, training, seminars, conferences, expositions, advertising, publications, contract research, and consulting.”

We believe that our market opportunity is much larger than the Wohlers Report estimates. In addition to the market described by the Wohlers Report, we believe that our potential market includes (1) the replacement of a substantial part of traditional manufacturing technology equipment sold globally, (2) the end market production of many industrial products and (3) tooling, parts made from tooling, and castings for industrial end markets.

Our 3D printing process provides several benefits over traditional design methods and manufacturing processes, the most critical of which are:

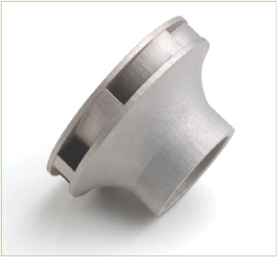

| • | Design Freedom. 3D printing allows designers and engineers the freedom to manufacture a product that very closely matches their optimal design and expands design possibilities. Traditionally, designers of products have had to make design compromises based on the limitations of how products are created through subtractive manufacturing (i.e., the removal of material from a solid object). 3D printing, on the other hand, permits the manufacture of intricate and complex products which would not be possible or economically feasible to design and produce using subtractive manufacturing. |

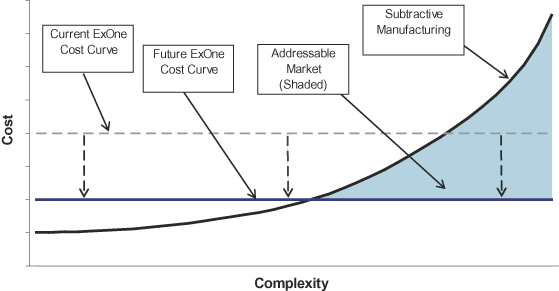

| • | Reduced Cost of Complexity. 3D printing technology makes complex products in the same way, and at essentially the same cost, as simple ones. The 3D printing process of building parts by layering very small amounts of material can just as easily make a simple solid product as a highly complex and intricate product. Because a complex product can require less material than a simple solid product, the complex product may be even less expensive to make using 3D printing technology than a simple product. |

| • | Mass Customization. 3D printing allows products to be customized with little or no incremental cost because their manufacture is directed by computer-aided design (“CAD”) without the need for substantial retooling between prints. Each product printed using 3D printing can be identical to, or radically different from, other products that are printed concurrently. Conventional manufacturing, by contrast, does not provide this flexibility. For example, 3D printing permits us to manufacture products that are identical except each part can have a unique quick response code inscribed on the part to support product tracking. |

4

Table of Contents

| • | Co-Located/Just-in-Time Manufacturing. 3D printing facilities are able to be located in close geographic proximity to customers because, unlike traditional manufacturing methods, 3D printing is not labor intensive and has low tooling and set-up costs. When establishing a manufacturing facility for subtractive manufacturing, labor is often the most important cost variable. As a result, manufacturing operations are often located offshore or in geographically remote locations where labor is cheaper. The proximity of 3D printing facilities to customers’ operations improves integration and collaboration with product engineers and designers and reduces shipping costs. This proximity also provides customers with an important supply chain management tool by supporting just-in-time availability of products without large inventory buildup. |

| • | Reduced Time Between Design and Production. 3D printing reduces the time required between product conception and production. 3D printing designs may be altered quickly, remotely and inexpensively without costly extensive retooling as the design is refined. We believe that increasing the speed at which products can be designed, prototyped and integrated into full-scale production is a priority for our industrial customers. |

Our Competitive Strengths

We believe that our competitive strengths include:

| • | Volumetric Output Rate. We believe that our 3D printing machines provide us the highest rate of volume output per hour among competing AM technologies. Because of our early entrance into the industrial market for AM and our investment in our core 3D printing technology, we have been able to improve the printhead speed and build box size of our machines. As a result, we have made strides in improving the output efficiency of our machines as measured by volume output per unit of time. These efficiency gains and associated cost reductions have enabled us to shift our costs down and compete with traditional subtractive manufacturing technologies, effectively expanding our addressable market. |

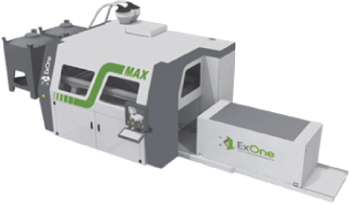

| • | Printing Platform Size. The size of the build box area and the platform upon which we construct a product is important to industrial customers, who may want to either make a higher number of products per job run or make an industrial product that has large dimensions and is heavy in final form. Our 1,260-liter platform for our “S Max” machine is one of the largest commercially available 3D printing build platforms. We believe that our technology and experience give us the potential to develop even larger build platforms to meet the production demands of current and potential industrial customers. In addition, we have created machine platforms in four size ranges in order to cater to the varying demands of our customers. |

| • | Industrial Material. Currently, our 3D printing machines are able to manufacture casting molds and cores from specialty silica sand and ceramics, which are the traditional materials for these casting products. We are capable of printing in silica sand, ceramics, stainless steel, bronze, and glass, and we are in varying stages of qualifying additional industrial materials for printing, such as titanium, tungsten carbide, aluminum, and magnesium. There is significant demand for products made in these materials. Most AM companies, however, cannot print industrial products in these materials and focus instead on polymer applications. |

| • | Chemical Binding. We use liquid chemical binding agents during the printing process. We believe that our unique chemical binding agent technology can more readily achieve efficiency gains over time than other AM technologies such as laser-fusing technologies. For instance, in order to increase the print speed of laser-based technologies, another expensive industrial laser must be added to the manufacturing process, raising the unit cost of production. |

| • | International Presence. Since our inception, we have structured our business to cater to major international markets. We have established one or more PSCs in each of North America, Europe and |

5

Table of Contents

| Asia. Because many of our current or potential customers are global industrial companies, it is important that we have a presence in or near the areas where these companies have manufacturing facilities. |

| • | Co-location of High Value Production. Over the last few years, many U.S. industrial manufacturers have out-sourced parts supply or otherwise created long, relatively inflexible supply chains for their high-complexity, high-value parts. We believe that over the next few years, many of these companies will need to build these industrial parts in the United States, near their main manufacturing facilities, in order to be competitive nationally and internationally. We believe we are well positioned to help these manufacturers co-locate the production of parts so as to optimize customers’ supply chains. |

Our Business Strategies

The principal elements of our growth strategy include:

| • | Expand the Network of Production Service Centers. Our PSCs are centers for customer collaboration and provide customers with a direct contact point to learn about our 3D printing technology, buy products printed by us, and purchase our machines. By the end of 2015, we plan to expand our PSC network from the current five locations to fifteen locations. Like our current PSCs, we plan to locate the additional PSCs in major industrial centers near existing and potential customers. While we may adjust the final locations based upon market considerations, our initial plan includes opening a new PSC in South America and on the west coast of the United States by the third quarter of 2013, and opening two additional locations in Asia and Western Europe by the second quarter of 2014. |

| • | Qualify New Industrial Materials Printable In Our Systems. Currently, our 3D printing machines are capable of printing in silica sand, ceramics, stainless steel, bronze, and glass, and we are in varying stages of qualifying additional industrial materials for printing, such as titanium, tungsten carbide, aluminum, and magnesium. By expanding into these other materials, we believe we can expand our market share and better serve our industrial customer base. We established ExOne Materials Application Laboratory (“EXMAL”), which focuses on materials testing. We believe EXMAL will assist us in increasing the rate at which we are able to qualify new materials. |

| • | Increase the Efficiency of Our Machines to Expand the Addressable Market. We intend to invest in further developing our machine technology so as to increase the volume output per unit time that our machines can produce. We recently began selling a new second generation mid-sized platform, the S Print machine. In addition, we are marketing our new M Flex machine and expect to accept orders for it beginning in the fourth quarter of 2012. In both cases, the new machines are designed to increase the volume output per hour over the machines that they will replace through advances in printhead speed and build box size. Achieving improved production speed and efficiency will expand our potential market for our machines and for products made in our PSCs. |

| • | Focus Upon Customer Training and Education to Promote Awareness. We will continue to educate the marketplace about the advantages of 3D printing. We will use our regional PSCs to educate our potential customers. In addition, we have supplied 3D printing equipment to more than 20 universities and research institutions, in hopes of expanding the base of future adopters of our technology. We established the ExOne Training and Education Center (“EXTEC”) in our North Huntingdon headquarters. At EXTEC, technicians guide our current and prospective customers in the optimal use of 3D printing and customers gain digital access to our 3D printing knowledge database as it continues to evolve. We will make EXTEC accessible to universities, individual customers, employees/trainees, designers, engineers and others interested in 3D printing. |

| • | Achieve Revenue Balance and Geographic Diversification. Over the long-term, our goal is to balance revenue between machine sales and PSC production, service contracts, and consumables. |

6

Table of Contents

| Machine sales tend to be seasonal, less predictable and generally more heavily impacted by the macroeconomic cycle, as compared to PSC production, service contracts and consumables. We will focus on machine sales during up-swings in the economy and on the sales of other products and services during periods of declines in industrial capital investment. In addition, as we sell more machines, the machine sales portion of our business will be supplemented by related sales of service, replacement parts and consumables. To avoid being overly dependent on economic conditions in one part of the world, we intend to develop our customer base so that our revenues are balanced across the Americas, Europe and Asia. As overall revenues increase, maintaining that balance will largely be achieved by targeting specific customers and industries for machine sales and by establishing PSCs in each key region. |

The Reorganization

On January 1, 2013, we merged our predecessor company, The Ex One Company, LLC, a Delaware limited liability company (sometimes referred to as the “LLC”), with and into a Delaware corporation (sometimes referred to herein as the “Corporation”), which changed its name to The ExOne Company (the “Reorganization”). To the extent that the LLC had undistributed earnings on January 1, 2013, such earnings will be included in the Company’s financial statements at December 31, 2012 as additional paid-in capital. This assumes a constructive distribution to the owners followed by a contribution to the capital of the corporation.

Historically, the LLC had not been taxed at the company level. Following the Reorganization, we will be taxed as a corporation for federal income tax purposes. As a result, for periods following the Reorganization, we will determine if a tax provision on our income, which will include U.S. federal income taxes and each state, local and foreign jurisdiction, will be required. The highest statutory rates in the United States (including state and local), Germany and Japan are currently 44%, 31% and 40%, respectively. In addition, we will recognize deferred taxes equal to the tax effect of the difference between the book and tax basis of our assets and liabilities as of January 1, 2013. The amount of additional deferred tax assets if the Reorganization had been completed as of September 30, 2012 would have been approximately $0.6 million, assuming a 40% tax rate. However, due to a history of operating losses, a valuation allowance of 100% of the deferred tax asset would be established.

For additional information about the Reorganization, please read “Certain Relationships and Related Party Transactions — Reorganization” and “Use of Proceeds.”

Transactions Prior to the Offering — Class A Preferred Stock

As of January 1, 2013, we had outstanding 18,983,602 shares of Class A preferred stock. See “Description of Capital Stock” for the rights and preferences of the Class A preferred stock. The Class A preferred stock accrues a cumulative dividend at the annual rate of eight percent (8%) per share, payable annually in arrears on the next business day following December 31st. The preferred stock dividend accrued through December 31, 2012 was settled on January 23, 2012. As of the consummation of this offering, we will owe a cumulative dividend from the period beginning as of January 1, 2013, through the date of this offering to the holders of the Class A preferred stock. Immediately prior to the consummation of this offering, the Class A preferred stock will convert into common stock on a 9.5 to 1 basis, or 1,998,272 shares of common stock (the “Conversion”). See “Related Relationships and Related Party Transactions — Rockwell Related Entities — Share Ownership.” While each holder of Class A preferred stock has the right to elect not to convert such preferred stock, they have waived their right to do so.

7

Table of Contents

Selling Stockholder and Majority Member

Our selling stockholder is Rockwell Holdings, Inc. (“RHI”). S. Kent Rockwell, our Chairman and Chief Executive Officer, is deemed to have beneficial ownership of our common or preferred units owned by RHI. (See “Certain Relationships and Related Party Transactions — Rockwell Related Entities — Share Ownership.”)

As used in this prospectus, references to the majority member refer to affiliates of S. Kent Rockwell, our Chairman and Chief Executive Officer, who is the indirect, sole shareholder of RHI and Rockwell Forest Products, Inc. (“RFP”). Each of RHI and RFP have provided funding to us. See “Certain Relationships and Related Party Transactions.”

Risks Affecting Us

We are subject to numerous risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. Please read the section entitled “Risk Factors” beginning on page 12 for a discussion of some of the factors you should carefully consider before deciding to invest in our common stock.

Corporate Information

Our principal executive offices are located at 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642, and our telephone number is (724) 863-9663. Our corporate website address is www.exone.com. The information contained on, or accessible from, our corporate website is not part of this prospectus and you should not consider information contained on our website to be a part of this prospectus or in deciding whether to purchase our common stock.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we may present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations; |

| • | we are exempt from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

| • | we are permitted to provide less extensive disclosure about our executive compensation arrangements; |

| • | we are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | we have elected to use an extended transition period for complying with new or revised accounting standards. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens.

8

Table of Contents

The Offering

| Common stock offered by us | shares ( shares if the underwriters exercise the over-allotment option in full). | |

| Common stock offered by the selling stockholder | shares ( shares if the underwriters exercise the over-allotment option in full). | |

| Common stock to be outstanding after the offering | shares ( shares if the underwriters exercise the over-allotment option in full)(1) | |

| Common stock beneficially owned by the selling stockholder after the offering | 1,366,694 shares by the selling stockholder ( shares if the underwriters exercise the over-allotment option in full). | |

| Use of proceeds | We estimate that the net proceeds to us from this offering, after deducting underwriters’ discounts and commissions and our estimated offering expenses, will be approximately $ . We intend to use the net proceeds from this offering to invest in further improving the efficiency and capacity of our machines and expanding the number of materials from which we can make products, to increase the number of locations of our PSCs and for working capital and other general corporate purposes. We will also use approximately $9.8 million of the net proceeds to repay a revolving line of credit that we have with RFP, an entity controlled by our CEO, and approximately $3.0 million to purchase the business of TMF and Lone Star, our variable interest entities. We will not receive any proceeds from the sale of common stock by the selling stockholder. | |

| Over-allotment option | We have granted the underwriters a 30-day option to purchase a maximum of additional shares of our common stock from us and the selling stockholder at the initial public offering price to cover over-allotments. | |

| Risk factors | You should consider carefully all of the information set forth in this prospectus and, in particular, the specific factors set forth under “Risk Factors” on page 14, before deciding whether to invest in our common stock. | |

9

Table of Contents

| Dividend policy | We have not historically paid dividends and we do not intend to declare or pay regular dividends on our common stock in the foreseeable future. | |

| Proposed Nasdaq Global Market symbol for our common stock | XONE

| |

Unless otherwise indicated, all information in this prospectus excludes:

(i) 500,000 shares of common stock reserved for issuance under our 2013 Equity Incentive Plan (the “Plan”). The Plan also provides for automatic annual increases in the number of shares reserved thereunder, as more fully described in “Executive Compensation — 2013 Equity Incentive Plan.” The maximum number of shares authorized pursuant to the Plan will not exceed , (15% of the total number of shares outstanding immediately after the offering) subject to certain adjustments.

(ii) We have granted options to certain employees to purchase an aggregate of 180,000 of such reserved shares and restricted stock to our non-employee directors in an aggregate of 10,000 of such reserved shares, each effective upon and subject to the completion of this offering, at an exercise price equal to the public offering price per share indicated on the cover of this prospectus. References to the number of shares of common stock to be outstanding after the offering in this prospectus does not take these awards into account.

10

Table of Contents

Summary Consolidated Financial Data

The following table sets forth certain of our summary consolidated financial information for the periods represented. The financial data as of and for the years ended December 31, 2010 and 2011 have been derived from our audited consolidated financial statements and notes thereto. The financial data as of and for the nine months ended September 30, 2011 and 2012 have been derived from our unaudited condensed consolidated financial statements and notes thereto. We have prepared the unaudited consolidated financial information set forth below on the same basis as our audited consolidated financial statements and have included all adjustments, consisting of only normal recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for such periods. The interim results set forth below are not necessarily indicative of expected results for the year ending December 31, 2012 or for any other future period.

The data presented below should be read in conjunction with, and are qualified in their entirety by reference to, “Capitalization,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| Twelve Months Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2010 | 2011 | 2011 | 2012 | |||||||||||||

| (unaudited) | ||||||||||||||||

| $ in thousands, except per common unit data |

||||||||||||||||

| Income Data: |

||||||||||||||||

| Revenue |

$ | 13,440 | $ | 15,290 | $ | 12,571 | $ | 15,913 | ||||||||

| Cost of sales |

10,374 | 11,647 | 9,327 | 10,018 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

3,066 | 3,643 | 3,244 | 5,895 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

1,153 | 1,531 | 1,146 | 1,179 | ||||||||||||

| Selling, general and administrative (includes non-cash equity based compensation expense of $7.7 million for the nine months ended September 30, 2012) |

5,978 | 7,286 | 5,196 | 14,826 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 7,131 | 8,817 | 6,342 | 16,005 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(4,065 | ) | (5,174 | ) | (3,098 | ) | (10,110 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Interest income |

(1 | ) | (3 | ) | (2 | ) | (2 | ) | ||||||||

| Interest expense |

1,115 | 1,569 | 1,188 | 542 | ||||||||||||

| Other (income) expense, net |

(197 | ) | (154 | ) | 34 | (71 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 917 | 1,412 | 1,220 | 469 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(4,982 | ) | (6,586 | ) | (4,318 | ) | (10,579 | ) | ||||||||

| Provision for income taxes |

198 | 1,031 | 709 | 171 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to the controlling and the noncontrolling interests |

(5,180 | ) | (7,617 | ) | (5,027 | ) | (10,750 | ) | ||||||||

| Less: Net income of noncontrolling interest |

328 | 420 | 244 | 320 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to the controlling interest(A) |

$ | (5,508 | ) | $ | (8,037 | ) | $ | (5,271 | ) | $ | (11,070 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per common unit(B): |

||||||||||||||||

| Basic |

$ | (0.55 | ) | $ | (0.80 | ) | $ | (0.53 | ) | $ | (1.21 | ) | ||||

| Diluted |

(0.55 | ) | (0.80 | ) | (0.53 | ) | (1.21 | ) | ||||||||

| Cash Flow Data: |

||||||||||||||||

| Net cash used for operating activities |

$ | (5,912 | ) | $ | (2,435 | ) | $ | (3,333 | ) | $ | (9,084 | ) | ||||

| Capital expenditures |

(1,795 | ) | (1,080 | ) | (232 | ) | (1,973 | ) | ||||||||

| Net cash provided by financing activities |

7,811 | 5,931 | 3,795 | 9,050 | ||||||||||||

| Other Data (unaudited): |

||||||||||||||||

| EBITDA (A)(D) |

$ | (2,993 | ) | $ | (4,005 | ) | $ | (2,267 | ) | $ | (8,852 | ) | ||||

| Machine Units Sold(C) |

||||||||||||||||

| S 15 |

2 | 2 | 2 | 1 | ||||||||||||

| S Max |

2 | 1 | 1 | 4 | ||||||||||||

| S Print |

— | 1 | 1 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

4 | 4 | 4 | 5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (A) | Net loss attributable to the controlling interest and EBITDA include a non-cash equity based compensation expense of $7.7 million for the nine months ended September 30, 2012. |

| (B) | The loss per unit for the nine months ended September 30, 2012 reflects the effect of the dividend declared on the Class A preferred units of $1.0 million, or $0.10 per common unit. |

| (C) | See “Business—Our Machines and Machine Platforms” for a description of the machines. |

11

Table of Contents

| (D) | We define EBITDA (earnings before interest, taxes, depreciation and amortization) as net loss attributable to the controlling interest (as calculated under GAAP) plus income of the noncontrolling interest, taxes, interest, net, depreciation, and other (income) expense, net. Disclosure in this prospectus of EBITDA, which is a “non-GAAP financial measure,” as defined under the rules of the Securities and Exchange Commission (“SEC”), is intended as a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. EBITDA should not be considered as an alternative to net income, income from continuing operations or any other performance measure derived in accordance with GAAP. |

We believe EBITDA is meaningful to our investors to enhance their understanding of our financial performance. Although EBITDA is not necessarily a measure of our ability to fund our cash needs, we understand that it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance and to compare our performance with the performance of other companies that report EBITDA. Our calculation of EBITDA may not be comparable to similarly titled measures reported by other companies.

The following table reconciles net loss attributable to the controlling interest to EBITDA for the periods presented in this table and elsewhere in this prospectus.

| Twelve Months Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2010 | 2011 | 2011 | 2012 | |||||||||||||

| (unaudited) | ||||||||||||||||

| $ in thousands |

||||||||||||||||

| Net loss attributable to the controlling interest |

$ | (5,508 | ) | $ | (8,037 | ) | $ | (5,271 | ) | $ | (11,070 | ) | ||||

| Net income of noncontrolling interest |

328 | 420 | 244 | 320 | ||||||||||||

| Taxes |

198 | 1,031 | 709 | 171 | ||||||||||||

| Interest, net |

1,114 | 1,565 | 1,186 | 540 | ||||||||||||

| Depreciation |

1,072 | 1,170 | 831 | 1,258 | ||||||||||||

| Other (income) expense, net |

(197 | ) | (154 | ) | 34 | (71 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA(A)(D) |

$ | (2,993 | ) | $ | (4,005 | ) | $ | (2,267 | ) | $ | (8,852 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

12

Table of Contents

| December 31, | September 30,

2012 (unaudited) |

|||||||||||||||||

| 2010 | 2011 | Actual | Pro Forma Conversion and Offering(4)(5) |

Pro

Forma As Adjusted(4)(5) |

||||||||||||||

| $ in thousands | ||||||||||||||||||

| Financial Position Data: |

||||||||||||||||||

| Operating working capital (6) |

$ | 4,998 | $ | 5,297 | $ | 9,335 | $ | |||||||||||

| Cash and cash equivalents |

1,021 | 3,496 | 1,431 | |||||||||||||||

| Deferred revenue and customer deposits |

(1,098 | ) | (4,938 | ) | (2,994 | ) | ||||||||||||

| Accrued expenses and other current liabilities |

(2,345 | ) | (2,669 | ) | (3,954 | ) | ||||||||||||

| Dividends payable |

— | — | |

(1,031 |

)(9) |

|||||||||||||

| Line of credit |

— | — | (900 | )(8) | ||||||||||||||

| Current portion of long-term debt and capital lease obligations |

(808 | ) | (1,294 | ) | (2,464 | ) | ||||||||||||

| Demand note payable to member(1) |

(15,045 | ) | — | (1) | (7,266 | )(7) | ||||||||||||

| All other, net |

24 | (1,224 | ) | 499 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

| Working capital |

$ | (13,253 | ) | $ | (1,332 | ) | $ | (7,344 | ) | $ | ||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

| Property and equipment |

$ | 7,990 | $ | 7,919 | $ | 12,708 | $ | |||||||||||

| Total assets |

$ | 15,233 | $ | 18,968 | $ | 27,436 | $ | |||||||||||

| Long-term debt and capital lease obligations – net of current portion |

$ | 3,031 | $ | 4,135 | $ | 6,541 | $ | |||||||||||

| Redeemable Class A preferred units |

$ | — | $ | 18,984 | (1) | $ | — | (3) | $ | |||||||||

| Class A preferred units |

$ | — | $ | — | $ | 18,984 | (3) | $ | ||||||||||

| Total members’ deficit |

$ | (8,277 | ) | $ | (15,599 | )(2) | $ | (713 | ) | $ | ||||||||

| Total stockholders’ equity |

$ | — | $ | — | $ | — | $ | |||||||||||

| (1) | Demand note payable to member was converted into Redeemable Class A preferred units on December 31, 2011. |

| (2) | Excludes Redeemable Class A preferred units which are classified as a liability at December 31, 2011. |

| (3) | Redeemable Class A preferred units were converted into Class A preferred units in February 2012 which are classified as equity at September 30, 2012. |

| (4) | Reflects (a) the completion of the Reorganization as of January 1, 2013, including the issuance of 5,800,000 shares of our common stock and 18,983,602 shares of our preferred stock to the holders of limited liability company interests of The Ex One Company, LLC and (b) the Conversion of 18,983,602 shares of Class A preferred stock into 1,998,272 shares of common stock on a 9.5 to 1 basis, immediately prior to the consummation of this offering. |

| (5) | These amounts reflect balance sheet data as of September 30, 2012, as adjusted for the sale of shares of our common stock (excluding the additional shares offered by the selling stockholder) in this offering (based on an assumed offering price of $ per share and assuming the underwriters do not exercise their over-allotment option), underwriting discounts and commissions, estimated offering expenses payable by us and the application of the net proceeds received by us from this offering as described under “Use of Proceeds.” |

| (6) | Operating working capital is a subset of total working capital and represents accounts receivable plus related party receivables plus inventories less accounts payable. |

| (7) | Borrowings from majority member since January 1, 2012. Balance is $9.8 million as of January 23, 2013. |

| (8) | We notified the bank in December 2012 that we are not in compliance with an equity-to-asset ratio covenant related to this facility. According to the terms of the agreement, the bank at its discretion may request additional security to maintain the facility. |

| (9) | The balance on January 23, 2013 of $1.4 million was settled on January 23, 2013. |

13

Table of Contents

An investment in our common stock involves risks. You should carefully consider each of the following risks and all of the information set forth in this prospectus before deciding to invest in our common stock. The risks and uncertainties described below are not the only ones we face. If any of the following risks and uncertainties develops into actual events, our business, financial condition, results of operations and cash flows could be materially adversely affected. In that case, the price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We may not be able to significantly increase the number of materials in which we can print products fast enough to meet our business plan.

Our business plan is heavily dependent upon our ability to steadily increase the number of qualified materials in which our machines can print products, since this will increase our addressable market, both as to customers and products for customers. However, qualifying new materials is a complicated engineering task, and there is no way to predict whether, or when, any given material will be qualified. If we cannot hire sufficient skilled people to work on qualifying new materials for printing or if we lack the resources necessary to create a steady flow of new materials, we will not be able to meet our business plan goals and a competitor may emerge that is better at qualifying new materials, either of which would have an adverse effect on our business results.

Our future success in qualifying new materials for printing may attract more competitors into our markets, some which may be much larger than we are.

If we succeed in qualifying a growing number of materials for use in our 3D printing machines, that will increase our addressable market. However, as we create a larger addressable market, our market may become more attractive to other 3D printing companies or large companies that are not 3D printing companies but which may see an economic opportunity in the markets we have created. Because we are a supplier of 3D printed products to industrial companies, an increase in the number of competitors for our addressable market is likely to adversely affect our business and financial results.

We may not be able to adequately increase demand for our products.

Our business plan is built around a steady increase in the demand for our products. However, only a relatively small number of our potential customers know of the existence of AM and are familiar with its capabilities, and even fewer understand the potential benefits of using AM to manufacture products. If we do not develop effective strategies to raise awareness among potential customers of the benefits of AM, we may be unable to achieve our planned rate of growth, which could adversely affect our results of operations.

We may not be able to hire the number of skilled employees that we need to achieve our business plan.

For our business to grow in accordance with our business plan, we will need to hire and retain additional employees with the technical competence and engineering skills to operate our machines, improve our technology and processes and expand our technological capability to print using an increasing variety of materials. People with these skills are in short supply and may not be available in sufficient numbers to allow us to meet the goals of our business plan. If we cannot obtain the services of sufficient technically skilled employees, we may not be able to achieve our planned rate of growth, which could adversely affect our results of operations.

Our revenues and operating results may fluctuate.

Our revenues and operating results may fluctuate from quarter-to-quarter and year-to-year and are likely to continue to vary due to a number of factors, many of which are not within our control. A significant portion of

14

Table of Contents

our machine orders are typically received during the third or fourth quarter of the fiscal year as a result of the timing of capital expenditures of our customers. Our machines typically are shipped within the quarter or the next quarter after orders are received. Thus, revenues and operating results for any future period are not predictable with any significant degree of certainty. We also typically experience weaker demand for our machines in the first and second quarters. For these reasons, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our past results as an indication of our future performance.

Fluctuations in our operating results and financial condition may occur due to a number of factors, including, but not limited to, those listed below and those identified throughout this “Risk Factors” section:

| • | the degree of market acceptance of our products; |

| • | the mix of products that we sell during any period; |

| • | our long sales cycle; |

| • | generally weaker demand for machines in the first and second quarters; |

| • | development of competitive systems by others; |

| • | our response to price competition; |

| • | delays between our expenditures to develop and market new or enhanced machines and products and the generation of sales from those products; |

| • | changes in the amount we spend to promote our products and services; |

| • | the geographic distribution of our sales; |

| • | changes in the cost of satisfying our warranty obligations and servicing our installed base of products; |

| • | our level of research and development activities and their associated costs and rates of success; |

| • | general economic and industry conditions that affect end-user demand and end-user levels of product design and manufacturing, including the adverse effects of the current economic crisis affecting Europe; |

| • | changes in accounting rules and tax laws; and |

| • | changes in interest rates that affect returns on our cash balances and short-term investments. |

Due to the foregoing factors, you should not rely on quarter-to-quarter or year-to-year comparisons of our operating results as an indicator of future performance.

We may not be able to generate operating profits.

Since our inception, we have not generated operating profits. In the event that we are unable to execute on our business plan, we may be unable to generate profits in the future.

We may not be able to introduce new machines and related industrial materials acceptable to the market or to improve the technology and industrial materials used in our current machines.

Our revenues are derived from the sale of machines for, and products manufactured using, AM. Our market is subject to innovation and technological change. A variety of technologies have the capacity to compete against one another in our market, which is, in part, driven by technological advances and end-user requirements and preferences, as well as the emergence of new standards and practices. Our ability to compete in the industrial AM market depends, in large part, on our success in enhancing and developing new machines, our success in enhancing our current machines, our success in enhancing and adding to our technology, and our success in developing and qualifying new industrial materials in which we can print. We believe that to remain competitive

15

Table of Contents

we must continuously enhance and expand the functionality and features of our products and technologies. However, we may not be able to:

| • | Enhance our existing products and technologies; |

| • | Continue to leverage advances in industrial printhead technology; |

| • | Develop new products and technologies that address the increasingly sophisticated and varied needs of prospective end-users, particularly with respect to the physical properties of industrial materials and other consumables; |

| • | Respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis; |

| • | Develop products that are cost effective or that otherwise gain market acceptance; and |

| • | Adequately protect our intellectual property as we develop new products and technologies. |

If the market does not develop as we expect, our revenues may stagnate or decline.

The marketplace for industrial manufacturing is dominated by conventional manufacturing methods that do not involve AM technology. If AM technology does not gain market acceptance as an alternative for industrial manufacturing, or if the marketplace adopts AM based on a technology other than our technology, we may not be able to increase or sustain the level of sales of our products and machines and our results of operations would be adversely affected as a result.

Loss of key management or sales or customer service personnel could adversely affect our results of operations.

Our future success depends to a significant extent on the skills, experience and efforts of our management and other key personnel. We must continue to develop and retain a core group of management individuals if we are to realize our goal of continued expansion and growth. While we have not previously experienced significant problems attracting and retaining members of our management team and other key personnel, there can be no assurance that we will be able to continue to retain these individuals, and the loss of any or all of these individuals could materially and adversely affect our business. We do not carry key-man insurance on any member of management.

Our international operations pose currency risks, which may adversely affect our operating results and net income.

Our operating results may be affected by volatility in currency exchange rates and our ability to effectively manage our currency transaction and translation risks. In general, we conduct our business, earn revenue and incur costs in the local currency of the countries in which we operate. As a result, our international operations present risks from currency exchange rate fluctuations. The financial condition and results of operations of each of our foreign operating subsidiaries are reported in the relevant local currency and then translated to U.S. dollars at the applicable currency exchange rate for inclusion in our combined consolidated financial statements. We do not manage our foreign currency exposure in a manner that would eliminate the effects of changes in foreign exchange rates. Therefore, changes in exchange rates between these foreign currencies and the U.S. dollar will affect the recorded levels of our foreign assets and liabilities, as well as our revenues, cost of goods sold, and operating margins, and could result in exchange losses in any given reporting period.

In the future, we may not benefit from favorable exchange rate translation effects, and unfavorable exchange rate translation effects may harm our operating results. In addition to currency translation risks, we incur currency transaction risks whenever we enter into either a purchase or a sale transaction using a different

16

Table of Contents

currency from the currency in which we receive revenues. In such cases we may suffer an exchange loss because we do not currently engage in currency swaps or other currency hedging strategies to address this risk.

Given the volatility of exchange rates, we can give no assurance that we will be able to effectively manage our currency transaction and/or translation risks or that any volatility in currency exchange rates will not have an adverse affect on our results of operations.

One of our principal stockholders will be able to exert substantial influence.

S. Kent Rockwell, our Chairman and Chief Executive Officer, will beneficially own approximately % of our outstanding shares of common stock following this offering ( % if the underwriters exercise their overallotment in full) and may have effective control over the election of our Board of Directors and the direction of our affairs. As a result, he could exert considerable influence over the outcome of any corporate matter submitted to our stockholders for approval, including the election of directors and any transaction that might cause a change in control, such as a merger or acquisition. Any stockholders in favor of a matter that is opposed by Mr. Rockwell would have to obtain a significant number of votes to overrule the votes of Mr. Rockwell. See “Principal Stockholders.”

We may need to raise additional capital from time to time if we are going to meet our growth strategy and may be unable to do so on attractive terms.

Expanding our business to meet the growth strategy may require additional investments of capital from time to time, and our existing sources of cash and any funds generated from operations may not provide us with sufficient capital. For various reasons, including any current noncompliance with existing or future lending arrangements, additional financing may not be available when needed, or may not be available on terms favorable to us. If we fail to obtain adequate capital on a timely basis or if capital cannot be obtained at reasonable costs, we will not be able to achieve our planned rate of growth, which will adversely affect our results of operations.

We are highly dependent upon sales to certain industries.

For 2012, revenues of machines and products have been concentrated to companies in the aerospace (17%), automotive (34%), heavy equipment (21%) and energy/oil/gas (7%) industries and those industries’ respective suppliers. To the extent any of these industries experience a downturn, our results of operations may be adversely affected. Additionally, if any of these industries or their respective suppliers or other providers of manufacturing services develop new technologies or alternatives to manufacture the products that are currently manufactured using our machines, it may adversely affect our results of operations.

We are dependent on a single supplier of printheads.

We currently rely on a single source to supply the printheads used by our machines. While we believe that there are other suppliers of printheads upon which we could rely, we could experience delays and interruptions if our supply is interrupted that might temporarily impact the financial performance of our business.

All of the equipment at our Troy, Michigan and Houston, Texas PSCs is subject to a lien which secures certain loans.

All of the equipment at our Troy, Michigan and Houston, Texas PSCs is owned by our variable interest entities (“VIEs”) TMF and Lone Star, respectively, and leased to us. Each of these companies borrowed money from one or more lending institutions to fund the purchase of the equipment which is leased to us. Each of these loans is secured by a lien on the equipment leased to us. If any of those loans goes into default, the lender could repossess the equipment which is security for that loan, which would adversely affect our business at the affected PSC until the equipment could be replaced.

17

Table of Contents

We may not be able to manage the expansion of our operations effectively in order to achieve our projected levels of growth.

We have expanded our operations significantly in recent periods, and our business plan calls for further expansion over the next several years. We anticipate that further development of our infrastructure and an increase in the number of our employees will be required to achieve our planned broadening of our product offerings and client base, improvements in our machines and materials used in our machines, and our planned international growth. In particular, we must increase our marketing and services staff to support new marketing and service activities and to meet the needs of both new and existing customers. Our future success will depend in part upon the ability of our management to manage our growth effectively. If our management is unsuccessful in meeting these challenges, we may not be able to achieve our anticipated level of growth which would adversely affect our results of operations.

Our planned expansion of our international sales is subject to various risks, and failure to manage these risks could adversely affect our results of operations.

Our business is subject to certain risks associated with doing business globally. Our sales outside of the Americas were 70.7% and 70.0% of our total sales in 2010 and 2011, respectively, and were 63.0% for the nine months ended September 30, 2012. One of our growth strategies is to pursue opportunities for our business in several areas of the world outside of the United States, any or all of which could be adversely affected by the risks set forth below. Our operations outside of the United States are subject to risks associated with the political, regulatory and economic conditions of the countries in which we operate, such as:

| • | fluctuations in foreign currency exchange rates; |

| • | potentially longer sales and payment cycles; |

| • | potentially greater difficulties in collecting accounts receivable; |

| • | potentially adverse tax consequences; |

| • | reduced protection of intellectual property rights in certain countries; |

| • | difficulties in staffing and managing foreign operations; |

| • | laws and business practices favoring local competition; |

| • | costs and difficulties of customizing products for foreign countries; |

| • | compliance with a wide variety of complex foreign laws, treaties and regulations; |

| • | tariffs, trade barriers and other regulatory or contractual limitations on our ability to sell or develop our products in certain foreign markets; and |

| • | becoming subject to the laws, regulations and court systems of many jurisdictions. |

Any of these factors could materially adversely affect sales of our products to global customers or harm our reputation, which could adversely affect our results of operations.

Global economic, political and social conditions have adversely impacted our sales and may continue to do so.

The uncertain direction and relative strength of the global economy, difficulties in the financial services sector and credit markets, continuing geopolitical uncertainties and other macroeconomic factors all affect spending behavior of potential end-users of our products. The prospects for economic growth in the United States and other countries remain uncertain and may cause end-users to further delay or reduce technology purchases. In particular, a substantial portion of our sales are made to customers in countries in Europe, which is experiencing a significant economic crisis. If global economic conditions remain volatile for a prolonged period or if European economies experience further disruptions, our results of operations could be adversely affected. The global financial crisis affecting the banking system and financial markets has resulted in a tightening of credit markets,

18

Table of Contents

lower levels of liquidity in many financial markets and extreme volatility in fixed income, credit, currency and equity markets. These conditions may make it more difficult for our end-users to obtain financing.

Due to our plan to increase our global business activities, we may be adversely affected by violations of the FCPA, similar anti-bribery laws in other jurisdictions in which we currently or may in the future operate, or various international trade and export laws.