Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Yew Bio-Pharm Group, Inc. | d30139_ex23-1.htm |

| EX-5.1 - EX-5.1 - Yew Bio-Pharm Group, Inc. | fs1a1ex5i_yewbio.htm |

| EX-3.3 - EX-3.3 - Yew Bio-Pharm Group, Inc. | fs1a1ex3iii_yewbio.htm |

As filed with the Securities and Exchange Commission on

January 23, 2013

Registration No. 333-185320

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

THE SECURITIES ACT OF 1933

Yew Bio-Pharm Group, Inc.

(Exact name of registrant as specified in its charter)

Nevada |

0100 |

26-1579105 |

||||||||

(State

or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

||||||||

294 Powerbilt Avenue

Las Vegas, Nevada 89148

(702) 487-6727

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Las Vegas, Nevada 89148

(702) 487-6727

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Zhiguo Wang

294 Powerbilt Avenue

Las Vegas, Nevada 89148

(702) 487-6727

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

294 Powerbilt Avenue

Las Vegas, Nevada 89148

(702) 487-6727

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Lance Jon Kimmel, Esq.

SEC Law Firm

11693 San Vicente Boulevard, Suite 357

Los Angeles, California 90049

Tel: (310) 557-3059

Fax: (310) 388-1320

Lance Jon Kimmel, Esq.

SEC Law Firm

11693 San Vicente Boulevard, Suite 357

Los Angeles, California 90049

Tel: (310) 557-3059

Fax: (310) 388-1320

Approximate date of commencement of proposed sale to

public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [X]

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated

filer o |

Accelerated filer o |

|||||

Non-accelerated

filer o (Do not check if a smaller reporting company) |

Smaller reporting company [X] |

|||||

Calculation of Registration Fee

| Title of Each Class Of Securities to be Registered |

|

Amount to be Registered(1) |

|

Proposed Maximum Offering Price per Share (2) |

|

Proposed Maximum Aggregate Offering Price |

|

Amount of Registration Fee |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Common stock, par value $0.001 per share |

16,500,000 |

$0.25 |

$ | 4,125,000 | $ | 562.65 | ||||||||||||

(1) |

This Registration Statement covers the resale by our selling shareholders of up to 16,500,000 shares of common stock previously issued to such selling shareholders. |

(2) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a), based on the last private sales price for common stock of the registrant, as there is currently no public market price for the registrant’s common stock. The last private sales price here is determined by the price per share sold in a private placement completed in September 2009 of $0.10 per share plus an arbitrary increase in value of $0.15, to account for the potential increased value of our stock as a result of such shares having increased liquidity and being registered with the SEC. The selling shareholders will sell at the fixed price of $0.25 per share until our common stock is quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. |

The Registrant hereby amends this registration statement on

such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that

this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the

registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may

determine.

The information in this prospectus is not

complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in

any state where the offer or sale is not permitted.

PRELIMINARY

PROSPECTUS |

SUBJECT TO COMPLETION ON JANUARY 23, 2013 |

16,500,000 Shares of Common Stock

Yew Bio-Pharm Group, Inc.

This prospectus relates to periodic offers and sales of

16,500,000 shares of our common stock by the selling security holders.

Our common stock is presently not traded on any market or

securities exchange. The 16,500,000 shares of our common stock will be sold by selling security holders at a fixed price of $0.25 per share until our

shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. The offering price of $0.25 per

share for the shares of common stock was determined based on the price of our common stock of $0.10 during our most recently completed private

offering. We arbitrarily added an additional $0.15 over the offering price of our common stock during our most recently completed private offering to

account for the potential increased value of our stock as a result of such shares having increased liquidity and being registered with the SEC and

unrestricted. Such increase in value is purely speculative and not based upon any rigorous analysis.

The offering price bears no relationship to the book value,

assets or earnings of our company or any other recognized criteria of value. There can be no assurance that a market maker will agree to file the

necessary documents with the Financial Industry Regulatory Authority, or FINRA, nor can there be any assurance that such an application for quotation

will be approved. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders. There is no

assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained. In the absence of a trading market or

an active trading market, investors may be unable to liquidate their investment or make any profit from the investment.

We are an emerging growth company as that term is used in the

Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and are subject to reduced public company reporting

requirements.

An investment in our securities is highly speculative,

involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk

Factors” beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to

the contrary is a criminal offense.

The date of this prospectus is _______________,

2012

| 1 | ||||||

| 5 | ||||||

| 25 | ||||||

| 25 | ||||||

| 26 | ||||||

| 26 | ||||||

| 26 | ||||||

| 27 | ||||||

| 53 | ||||||

| 74 | ||||||

| 76 | ||||||

| 78 | ||||||

| 80 | ||||||

| 81 | ||||||

| 82 | ||||||

| 103 | ||||||

| 104 | ||||||

| 104 | ||||||

| 104 | ||||||

| F-1 |

Please read this prospectus carefully. It describes our business,

our financial condition and results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed

investment decision.

You should rely only on information contained in this prospectus.

We have not authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer

to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the

date on the front cover, but the information may have changed since that date.

This summary highlights information

contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities.

You should read the entire prospectus, including “Risk Factors” and the consolidated financial statements and the related notes before making

an investment decision.

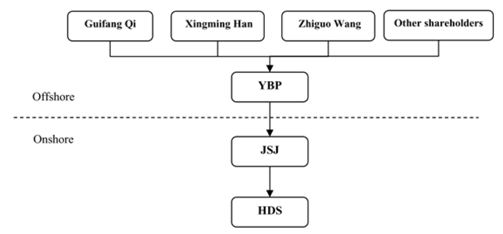

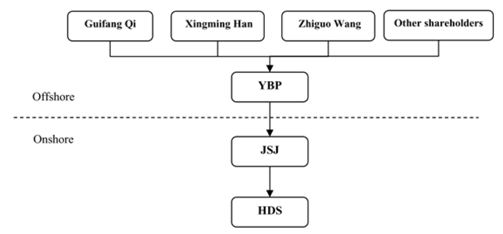

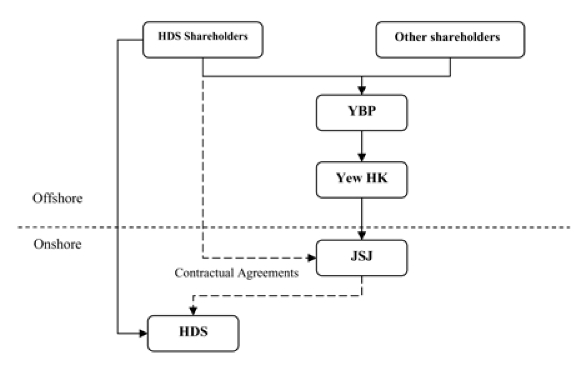

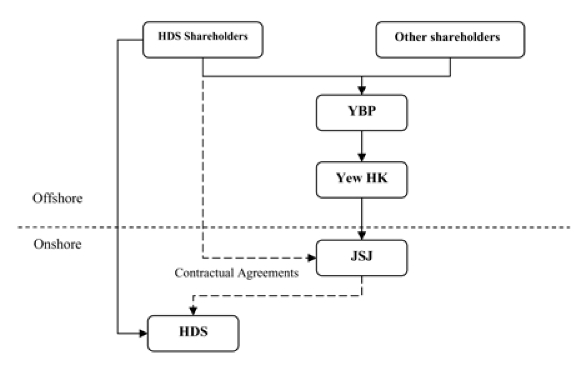

Unless otherwise noted, references in

this registration statement to the “Company,” “we,” “our” or “us” means Yew Bio-Pharm Group, Inc. (or

individually, YBP), a Nevada corporation; its wholly-owned subsidiaries, Yew Bio-Pharm Holdings Limited (or individually, Yew HK), a corporation

organized under the laws of Hong Kong, and Heilongjiang Jinshangjing Bio-Technology Development Co., Limited (or individually, JSJ), a corporation

organized in the People’s Republic of China, referred to as the PRC or China; and a deemed variable interest entity, or VIE, Harbin Yew Science

and Technology Development Co., Ltd. (or individually, HDS), a corporation organized in the PRC; but such references to not include the shareholders of

YBP.

Business Overview

The Company, through YBP; its

wholly-owned subsidiaries Yew HK and JSJ; and its VIE, HDS; is a major grower and seller of yew trees and manufacturer of products made from yew trees

in China. We also sell raw material, including the branches and leaves of yew trees, used in the manufacture of traditional Chinese medicine, or TCM.

The yew raw material contains taxol, and TCM containing yew raw material has been approved in the PRC for use as a secondary treatment of certain

cancers, meaning it must be administered in combination with other pharmaceutical drugs. The yew industry is regulated in the PRC because the yew tree

is considered an endangered species.

We believe that our business is built

upon five unique components:

• |

We have entered into several land use agreements with various parties, which provide the potential for us to grow a large number of yew trees on approximately 1,017,713.5 mu (approximately 169,619 acres) over the next few decades, although we cannot currently estimate the total number of trees we will grow or the total amount of land we will put into production over such period. (Mu is a Chinese measurement of land that is equivalent to approximately 0.167 acres.) |

• |

We employ proprietary, patented accelerated growth technology, “Northeast Yew Asexual Reproduction Method”, or the Asexual Reproduction Method, to bring yew trees to commercialization decades faster than growing yew trees naturally. |

• |

Because of our more productive and faster rate of yew cultivation, we have a sufficient supply of raw material to allow us to use the branches and leaves, rather than the bark, of yew trees, to sell to customers for the purpose of making TCM. The yew industry is highly regulated in the PRC because the yew tree is considered an endangered species. By harvesting only branches and leaves of yew trees we respond to both environmental sensitivities and regulations, because cutting the bark of the yew trees will damage the trees and stop it from growing new branches. |

• |

We have permits from the Heilongjiang provincial government to sell our yew trees and manufacture handicrafts using yew timber. We believe that we are one of only a handful of companies in the PRC with permissions to manufacture handicrafts using yew timber. |

• |

The TCM raw materials and yew tree segments of our business are tax-free in the PRC. |

Using patented accelerated growth

technology developed by our founder and President, Zhiguo Wang, based on principles of asexual propagation and cloning, we can bring yew trees to

maturity and commercialize them in as little as two-to-three years, compared to more than 50 years needed for naturally grown yew trees. Additionally,

we have permits from the Heilongjiang provincial government to sell our yew trees and products made from yew trees. We believe that we are one of only

a few companies in the PRC with such permission.

1

We operate in three business segments:

TCM raw materials, yew trees and handicrafts. We sell raw materials in the form of yew tree branches and leaves to our customers, primarily an

affiliate, to manufacture TCM containing taxol. We began the TCM raw materials segment in 2010.

Our TCM raw materials business became

our largest operating segment in 2011 and is expected to continue to contribute an increasing percentage of net revenue in future

periods.

In December 2009, another company owned

directly and indirectly primarily by Mr. Wang, Heilongjiang Yew Pharmaceutical Co., Ltd., or Yew Pharmaceutical, received approval from the

Heilongjiang Food and Drug Agency, or HFDA, to sell Zi Shan, a TCM to be sold under both prescription and over-the-counter drug categories.

Zi Shan contains taxol, and the TCM is approved in the PRC as a secondary treatment of cancer, meaning it must be administered in combination

with other pharmaceutical drugs. In February 2010, we began selling to Yew Pharmaceutical branches and leaves of yew trees, which is more

environmentally responsible than using the bark of yew trees, to extract taxol.

We also derive a significant amount of

our revenue from the sale of yew seedlings and trees to state-owned enterprises and private businesses for reforestation in Heilongjiang Province and

Jilin Province, in northeastern China, as well as the sale of potted yew trees to retail customers. Additionally, we generate revenue from the sale of

handicrafts, including furniture, made from yew timber. All of our revenue is derived from the Chinese domestic market.

For the nine months ended September 30,

2012, our TCM raw materials revenue represented approximately 59.2% of consolidated revenue (including 12.4% of consolidated revenues to related

parties); sale of yew trees represented approximately 38.3% of consolidated revenue; and the sale of handicrafts represented approximately 2.5% of

consolidated revenue (including 0.1% of consolidated revenues to related parties). For the nine months ended September 30, 2011, our TCM raw materials

revenue represented approximately 60.2% of consolidated revenue (including 26.5% of consolidated revenues to related parties); sale of yew trees

represented approximately 37.7% of consolidated revenue; and the sale of handicrafts represented approximately 2.1% of consolidated revenue. For the

year ended December 31, 2011, our TCM raw materials revenue represented approximately 58.0% of consolidated revenue (including 23.3% of consolidated

revenues to related parties); sale of yew trees represented approximately 40.3% of consolidated revenue; and the sale of handicrafts represented

approximately 1.7% of consolidated revenue. For the year ended December 31, 2010, our TCM raw materials revenue represented approximately 55.5% of

consolidated revenue (including 25.9% of consolidated revenues to related parties); sale of yew trees represented approximately 41.6% of consolidated

revenue; and the sale of handicrafts represented approximately 2.9% of consolidated revenue. We expect that sales from our TCM raw materials segment

will become an increasingly important source of revenue for us.

Under Article 27 of the Law of the PRC

on Enterprises Income Tax and Article 15 of the provisional regulations of the PRC on Value Added Tax, we do not pay any tax, including income tax and

value added tax, or VAT, in our TCM raw materials and yew tree segments. Our current VAT exemption certificate is valid from July 1, 2005 through

December 31, 2016 and our current income tax exemption certificate is valid from January 1, 2008 through December 31, 2058. We pay taxes on handicrafts

made from yew timber.

Zhiguo Wang, the founder of the Company

and our President, does not devote all of his time to the Company’s business. We estimate that Mr. Wang devotes approximately 71% of his time, or

approximately 120 hours per month, to the Company’s business. He devotes about 12% of his time, or approximately 20 hours per month, to the

business of Yew Pharmaceutical and the balance of his time, or approximately 28 hours per month, to the business of other companies in which he is

involved. These allocations are approximate only and are subject to change depending upon the particular projects and changing needs of the individual

businesses in which he is involved.

The executive offices of HDS, our

operating entity, are located in Harbin City, the capital of Heilongjiang Province in the PRC. Our four nurseries used to cultivate yew trees, and our

production facilities to manufacture products made from yew trees, are located in and around Harbin. We also have a facility in Harbin where we

exhibit and warehouse potted yew trees, handicrafts and furniture.

2

YBP was incorporated in Nevada on

November 5, 2007.

Risk Factors

Our ability to successfully operate our

business and achieve our goals and strategies is subject to numerous risks as discussed in the section titled “Risk Factors,” beginning on

page 5.

Corporate Information

YBP’s executive offices are

located at 294 Powerbilt Avenue, Las Vegas, Nevada 89148 and our telephone number is (702) 487-4683. Our website is www.yewchina.com. No part of

our website is incorporated into this registration statement, the prospectus forming a part thereof, or any other report we file with the Securities

and Exchange Commission, or the SEC, from time to time.

Implications of Being an Emerging Growth

Company

We qualify as an emerging growth

company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are

otherwise applicable generally to public companies. These provisions include:

• |

A requirement to have only two years of audited financial statements and only two years of related MD&A; |

• |

Exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002; |

• |

Reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

• |

No non-binding advisory votes on executive compensation or golden parachute arrangements. |

We have already taken advantage of

these reduced reporting burdens in this prospectus, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the

Securities Exchange Act of 1934, as amended, or the Exchange Act.

In addition, Section 107 of the JOBS

Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. We have elected to use the extended transition

period provided above and therefore our financial statements may not be comparable to companies that comply with public company effective

dates.

We could remain an emerging growth

company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion,

(ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market

value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal

quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year

period.

For more details regarding this

exemption, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Critical Accounting

Policies.”

3

The Offering

Shares of common

stock offered by selling shareholders |

16,500,000 |

|||||

Shares of common

stock outstanding before the offering |

50,000,000 |

|||||

Shares of common

stock outstanding after the offering |

50,000,000 |

|||||

Terms of the

offering |

The

selling shareholders will determine when and how they will sell the securities offered in this prospectus. |

|||||

Trading

Market |

There

is currently no trading market for our common stock. We intend to apply soon for quotation on the OTC Bulletin Board. We will require the assistance of

a market-maker to apply for quotation and there is no guarantee that a market-maker will agree to assist us. |

|||||

Use of

proceeds |

We

will not receive proceeds from the resale of shares by the selling shareholders. |

|||||

Risk

Factors |

The

common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire

investment. See “Risk Factors” below. |

|||||

4

An investment in the Company is

highly speculative in nature and involves a high degree of risk. You should carefully consider the risks described below together with all of the other

information included in this prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated

herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ

materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial

condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Related to our Business

Our products may not achieve or maintain widespread market

acceptance.

Success of our products is highly

dependent on market acceptance. We believe that continued market acceptance of our products will depend on many factors, including:

• |

the perceived advantages of our products over competing products and the availability and success of competing products; |

• |

the effectiveness of our sales and marketing efforts; |

• |

our product pricing and cost effectiveness; |

• |

the safety and efficacy of our products and the prevalence and severity of adverse side effects, if any; and |

• |

publicity concerning our products, product candidates or competing products. |

If our products fail to achieve or

maintain market acceptance, or if new products are introduced by others that are more favorably received than our products, are more cost effective or

otherwise render our products obsolete, we may experience a decline in the demand for our products. If we are unable to market and sell our products

successfully, our business, financial condition, results of operation and future growth would be adversely affected.

Our operating results may fluctuate and our future revenues

and profitability are uncertain.

Our operating results have varied in

the past and may fluctuate significantly in the future as a result of a variety of factors, many of which are outside our control. These factors

include the following:

• |

current and changing economic and financial conditions in China; |

• |

market acceptance of our products; |

• |

The effectiveness of distribution channels for our products; |

• |

the impact of price changes in our products and services or our competitors’ products and services; |

• |

the impact of decisions by distributors to offer competing or replacement products or modify or cease their marketing practices; |

• |

the availability of alternatives to our products; |

• |

seasonal fluctuations in business activity; |

• |

changes in marketing expenses related to promoting and distributing our services |

• |

limitations on sales of yew raw materials and yew trees during certain times of the year due to the seasonal growth cycle of yew trees; and |

• |

potential disruptions in commerce due to catastrophic natural events or political conflict. |

5

Our operating expenses may increase. If

an increase in our expenses is not accompanied by a corresponding increase in our revenues, our net profit will decrease and our financial condition

may be adversely affected.

Due to all of the above factors, our

revenues and operating results are difficult to forecast. Therefore, we believe that period-to-period comparisons of our operating results will not

necessarily be meaningful, and you should not rely upon them as an indication of future performance. Also, operating results may fall below our

expectations and the expectations of securities analysts or investors in one or more future periods. If this were to occur, the market price of our

common stock would likely decline.

Our future research and development projects may not be

successful.

The successful development of TCM and

pharmaceutical products can be affected by many factors. Products that appear to be promising at their early phases of research and development may

fail to be commercialized for various reasons, including the failure to obtain the necessary regulatory approvals. In addition, the research and

development cycle for new products for which we may obtain an approval certificate is long.

There is no assurance that our future

research and development projects will be successful or completed within the anticipated time frame or budget or that we will receive the necessary

approvals from relevant authorities for the production of these newly developed products, or that these newly developed products will achieve

commercial success. Even if such products can be successfully commercialized, they may not achieve the level of market acceptance that we

expect.

We have limited insurance coverage and may incur losses

resulting from product liability claims or business interruptions.

The nature of our business exposes us

to the risk of product liability claims that is inherent in the research and development, manufacturing and marketing of pharmaceutical products. These

risks are greater for our products that receive regulatory approval for commercial sale. Even if a product were approved for commercial use by an

appropriate governmental agency, there can be no assurance that users will not claim effects other than those intended resulted from the use of our

products. While to date no material claim for personal injury resulting from allegedly defective products has been brought against us, a substantial

claim or a substantial number of claims, if successful, could have a material adverse impact on our business, financial condition and results of

operations.

We have a high concentration of sales to a small number of

customers, one of which is an affiliate of our founder and President.

For the nine months ended September 30,

2012, Yew Pharmaceutical accounted for approximately 21% of our TCM raw materials revenue and approximately 13% of our consolidated revenue. For the

year ended December 31, 2011, Yew Pharmaceutical accounted for approximately 40% of our TCM raw materials revenue and approximately 23% of our

consolidated revenue. Yew Pharmaceutical is directly and indirectly owned primarily by our founder and President, Zhiguo Wang, and his wife, Guifang

Qi.

The following customers accounted for

10% or more of our consolidated revenue for the nine months ended September 30, 2012:

• |

Anhui Bairun Medication Company, or Anhyui Bairun, accounted for approximately 16% of our consolidated revenue |

• |

Shenzhen City Lianchengfa Keiji Corporation, or Shenzhen Keiji, accounted for approximately 14% of our consolidated revenue |

• |

Changchun Hengtai Medication Corporation, or Changchun Hengtai, accounted for approximately 14% of our consolidated revenue |

• |

Wuchang Hongyi Co., Ltd., or Wuchang Hongyi, accounted for approximately 13% of our consolidated revenue |

6

• |

Yew Pharmaceutical accounted for approximately 12% of our consolidated revenue |

• |

Shenzhen Tianyitang Company, or Shenzhen Tianyitang, accounted for approximately 11% of our consolidated revenue |

For the year ended December 31, 2011,

the following customers accounted for 10% or more of our consolidated revenue:

• |

Yew Pharmaceutical accounted for approximately 23% of our consolidated revenue |

• |

Anhui Bairun accounted for approximately 29% of our consolidated revenue |

• |

Changchun Hengtai accounted for approximately 10% of our consolidated revenue |

• |

Wuchang Hongyi accounted for approximately 13% of our consolidated revenue. |

The loss of any of our largest

customers could have a material adverse effect on our results of operations unless and until we can replace such customers.

The concentration of sales of yew trees

to a small number of large customers could subject us to loss of significant revenues in the event that we were to lose one or more of our larger

customers.

Additionally, many of our customers

purchase trees from us in the spring but are not able to pay their bills until after harvest in the fall. Accordingly, our accounts receivable tend to

increase during the second and third quarters of the year. If we are unable to collect the amounts owed to us by our major customers, there could be a

material adverse effect on our results of operations and liquidity.

We owe amounts to related parties that are unsecured and

payable on demand.

We owe certain amounts to related

parties, including Zishan Technology Co., Ltd., or ZTC, Yew Pharmaceutical, Zhiguo Wang and Guifang Qi, that are payable on demand. As of December 31,

2011, the aggregate amount of these payables was approximately $266,488 and at September 30, 2012, the aggregate amount of these payables was

approximately $56,098. If one or more of the parties demanded payment of the amounts due to them, we would be required to use cash on hand or other

assets to satisfy these obligations. While we believe that we presently have more than adequate resources to satisfy all of these obligations, there is

no assurance that, in the future, the use of resources to satisfy then-current amounts owed to such parties or other related parties would not require

us to modify our operations should such obligations then constitute a significant amount of our then-available resources.

We face substantial competition in connection with the

marketing and sale of our products.

Our products compete with products with

similar medical efficacy in similar market areas. Most of our competitors are well established, have greater financial, marketing, personnel and other

resources, have been in business for longer periods of time than us, and have products that have gained wide customer acceptance in the marketplace.

The TCM and pharmaceutical industries are also characterized by the frequent introduction of new products. We may be unable to compete successfully or

our competitors may develop products which have greater medical efficacy or gain wider market acceptance than ours.

We may not be able to manage our expansion of operations

effectively.

We anticipate significant continued

expansion of our business to address growth in demand for our products, as well as to capture new market opportunities. To manage the potential growth

of our operations, we will be required to improve our operational and financial systems, procedures and controls, increase manufacturing capacity and

output, and expand, train and manage our growing employee base. Furthermore, we need to maintain and expand our relationships with our customers,

suppliers and other third parties. In addition, the success of our growth strategy depends on a number of internal and external factors, such as the

expected growth of the pharmaceutical market in the PRC and the competition from other pharmaceutical companies. If we are unable to manage our growth

effectively, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive

pressures.

7

In addition, our personnel, systems,

procedures and controls may be inadequate to support our future operations. The improvements required to manage our growth will require us to make

significant expenditures, expand, train and manage our employee base and allocate valuable management resources. If we fail to effectively manage our

growth, our operating performance will suffer and we may lose clients, key vendors and key personnel.

We may incur substantial debt which could adversely affect

our financial condition.

It is possible that we may incur

substantial debt in order to expand our business, which could adversely affect our financial condition. Incurring a substantial amount of debt may

require us to use a significant portion of our cash flow to pay principal and interest on such debt, which will reduce the amount available to fund

working capital, capital expenditures and general corporate purposes. Our indebtedness may negatively impact our ability to operate our business and

limit our ability to borrow additional funds by increasing our borrowing costs, and impact the terms, conditions and restrictions contained in possible

future debt agreements, including the addition of more restrictive covenants; impact our flexibility in planning for and reacting to changes in our

business as covenants and restrictions contained in possible future debt arrangements may require that we meet certain financial tests; and place

restrictions on the incurrence of additional indebtedness and place us at a disadvantage compared to similar companies in our industry that have less

debt.

We may not be able to raise additional capital as it is

needed to fund our operations. In such an event, we may have to curtail some of our existing and planned business activities.

While we are profitable and have

adequate financial resources to fund our business for at least the next 12 months, we may need additional capital in the future to expand our existing

operations, including growing yew trees under the Joint Venture Agreement, which could require capital beyond our available resources from operations.

We have no current plans to raise additional capital at this time. No assurance can be given that we will be able to raise any additional capital that

may be needed in any public or private offering of our securities, or secure debt through banks or other lenders.

If adequate additional financing is not

available on reasonable terms, we may not be able to expand our business and we would have to modify our business plans accordingly. There is no

assurance that additional financing will be available to us.

In connection with our growth

strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without

additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive

products by our competition; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including

acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

In recent years, the securities markets

in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have

experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such

companies. For these reasons, our securities can also be expected to be subject to volatility resulting from purely market forces over which we will

have no control. If we need additional funding we will, most likely, seek such funding in the United States, and the market fluctuations affect on our

stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding,

we may be required to: (i) limit our expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions

could materially adversely affect our business and our ability to compete.

Even if we do find a source of

additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are favorable to us. Any future

capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new

equity or convertible debt securities issued by us to obtain financing could have rights, preferences and

8

privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Our results of operations may be affected by fluctuations

in availability and price of raw materials.

The raw materials we use are subject to

price fluctuations due to various factors beyond our control, including, among other pertinent factors:

• |

increasing market demand; |

• |

inflation; |

• |

severe climatic and environmental conditions; |

• |

seasonal factors, and |

• |

changes in governmental regulations and programs. |

We also expect that our raw material

prices will continue to fluctuate and be affected by inflation in the future. Changes to our raw materials prices may result in increases in production

and packaging costs, and we may be unable to raise the prices of our products to offset the increase costs in the short-term or at all. As a result,

our results of operations may be materially and adversely affected.

We purchase yew cuttings from third parties to grow our yew

trees. The cost of yew cuttings has been rising significantly in recent years and is expected to continue.

We purchase yew cuttings from third

parties to grow our yew trees. Because yew cuttings are scarce, the cost of yew cuttings has been rising approximately 20% per year in recent years and

we expect this to continue for at least the next few years. Scarcity in the supply of yew cuttings or significantly increased costs for yew cuttings,

or both, could have a material adverse effect on our ability to do business or our cost of doing business.

Changes in certain current favorable tax treatment we

receive could adversely affect our business.

Under current PRC national laws and

regulations, we do not pay any tax, including income tax, on (i) the raw materials we sell for the manufacture of TCM or (ii) the yew trees we sell for

reforestation or transplanting, or on the cultivate yew trees we sell as potted yew trees. If these laws and regulations change and we become subject

to tax on any of these operations, our costs of doing business would increase, which would decrease our profits and could have a material adverse

effect on our results of operations and financial condition.

Developments by competitors may render our products or

technologies obsolete or non-competitive.

The TCM and pharmaceutical industries

are intensely competitive and subject to rapid and significant technological change. A large number of companies are pursuing the development of

pharmaceuticals that target the same diseases and conditions that our TCM raw materials are targeting. We face competition from TCM and pharmaceutical

companies in the PRC and other countries. In addition, companies pursuing different but related fields represent substantial competition. Many of these

organizations competing with us have substantially greater capital resources, larger research and development staffs and facilities, longer drug

development history in obtaining regulatory approvals and greater manufacturing and marketing capabilities than we do. These organizations also compete

with us to attract qualified personnel and parties for acquisitions, joint ventures or other collaborations.

We rely substantially on our founder and President. We may

be adversely affected if we lose his services or the services of other key personnel or are unable to attract and retain additional

personnel.

Our success is substantially dependent

on the efforts of our senior management, particularly Zhiguo Wang, our founder and President. The loss of the services of Mr. Wang or other members of

our senior management may significantly delay or prevent the achievement of our business objectives. If we lose the

9

services of, or do not successfully recruit, key sales and marketing, technical and corporate personnel, the growth of our business could be substantially impaired. At present, we do not maintain key man insurance for any of our senior management.

Mr. Wang will not devote 100% of his time to the business

affairs of the Company.

Zhiguo Wang, the founder of the Company

and our President, does not devote all of his time to the Company’s business. As a result, he may not provide as much management and attention as

would be the case if he devoted 100% of his time to our business. We estimate that Mr. Wang devotes approximately 71% of his time, or approximately 120

hours per month, to the Company’s business. He devotes about 12% of his time, or approximately 20 hours per month, to the business of Yew

Pharmaceutical and the balance of his time, or approximately 28 hours per month, to the business of other companies in which he is involved. These

allocations are approximate only and are subject to change depending upon the particular projects and changing needs of the individual businesses in

which he is involved.

There may be conflicts of interest between management and

other stockholders of the Company.

Zhiguo Wang, the founder of our

company, our President and a director, is also our principal stockholder. As a result of this conflict of interest, management may have an incentive to

act in a manner that is in its best interest, which could be adverse to the interests of any other stockholders of the Company. In addition, a conflict

of interest may arise between Mr. Wang’s personal pecuniary interest directly, as the lessor of certain premises we rent, or indirectly through

companies he controls and with whom we do business, such as Yew Pharmaceutical, Shanghai Kairun Bio-Pharmaceutical Co., Ltd., or Kairun, and ZTC, and

his fiduciary duty to our stockholders.

We have engaged, and are likely to continue to engage, in

certain transactions with related parties. These transactions are not negotiated on an arms’ length basis.

We have engaged in certain transactions

with our founder and President, Zhiguo Wang, and his wife, Guifang Qi. These include renting office space from Mr. Wang and retail space from Madame

Qi, the aggregate rental expense incurred for which was approximately $4,022 for the nine months ended September 30, 2012 and $4,171 for the year ended

December 31, 2011, respectively; an agreement whereby Yew Pharmaceutical, a company controlled by Mr. Wang, purchases raw materials including yew

branches and leaves of yew trees from us to manufacture TCM and with respect to which we generated approximately $602,000 or 13% of our total revenue

for the nine months ended September 30, 2012 and $1.4 million or 23% of our total revenue for the year ended December 31, 2011, respectively; the

purchase of yew trees from a company majority-controlled by Mr. Wang and Madame Qi, of which the total purchase amount was approximately $3,400 for the

year ended December 31, 2011; and the lease of from a company majority-controlled by Mr. Wang and Madame Qi for the growing of yew trees, the lease of

which was approximately $19,300 for the nine months ended September 30, 2012 and $25,000 for the year ended December 31, 2011, respectively. We are

likely to continue to engage in these arrangements and may enter into new arrangements with Mr. Wang and/or Madame Qi. None of these arrangements has

been negotiated as a result of arms’ length transactions. It is possible that we could have received more favorable terms had these agreements

been entered into with third parties.

We may need to hire additional

employees.

Our future success also depends upon

our continuing ability to attract and retain highly qualified personnel. Expansion of our business and the management and operation will require

additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled

management personnel and other employees. There can be no assurance that we will be able to attract or retain highly qualified personnel. Competition

for skilled personnel in our industries is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified

managers and employees.

10

Reporting requirements under the Exchange Act and

compliance with the Sarbanes-Oxley Act of 2002, including establishing and maintaining acceptable internal controls over financial reporting, are

costly and may increase substantially.

The rules and regulations of the SEC

require a public company to prepare and file periodic reports under the Exchange Act, which will require that the Company engage legal, accounting,

auditing and other professional services. The engagement of such services is costly. Additionally, the Sarbanes-Oxley Act of 2002, or the

Sarbanes-Oxley Act, requires, among other things, that we design, implement and maintain adequate internal controls and procedures over financial

reporting. The costs of complying with the Sarbanes-Oxley Act and the limited technically qualified personnel we have may make it difficult for us to

design, implement and maintain adequate internal controls over financial reporting. In the event that we fail to maintain an effective system of

internal controls or discover material weaknesses in our internal controls, we may not be able to produce reliable financial reports or report fraud,

which may harm our overall financial condition and result in loss of investor confidence and a decline in our share price.

As a public company, we will be subject

to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act of 2010 and other applicable securities rules and

regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless increase our legal and

financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources,

particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things, that we file annual,

quarterly, and current reports with respect to our business and operating results.

We are working with our legal,

independent accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems

to manage our growth and our obligations as a public company. These areas include corporate governance, corporate control, disclosure controls and

procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas. However, we

anticipate that the expenses that will be required in order to adequately prepare for being a public company could be material. We estimate that the

aggregate cost of increased legal services; accounting and audit functions; personnel, such as a chief financial officer familiar with the obligations

of public company reporting; consultants to design and implement internal controls; and financial printing alone will be a few hundred thousand dollars

per year and could be several hundred thousand dollars per year. In addition, if and when we retain independent directors and/or additional members of

senior management, we may incur additional expenses related to director compensation and/or premiums for directors’ and officers’ liability

insurance, the costs of which we cannot estimate at this time. We may also incur additional expenses associated with investor relations and similar

functions, the cost of which we also cannot estimate at this time. However, these additional expenses individually, or in the aggregate, may also be

material.

In addition, being a public company

could make it more difficult or more costly for us to obtain certain types of insurance, including directors’ and officers’ liability

insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar

coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our board of

directors, our board committees or as executive officers.

The increased costs associated with

operating as a public company may decrease our net income or increase our net loss, and may cause us to reduce costs in other areas of our business or

increase the prices of our products or services to offset the effect of such increased costs. Additionally, if these requirements divert our

management’s attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of

operations.

If we are not able to implement the requirements of Section

404 of the Sarbanes-Oxley Act in a timely manner or with adequate compliance, we may be subject to sanctions by regulatory

authorities.

Section 404 of the Sarbanes-Oxley Act

requires that we evaluate and determine the effectiveness of our internal controls over financial reporting and, beginning with our annual report for

fiscal year 2013, provide a management report on the internal control over financial reporting. We are in the preliminary stages of

seeking

11

consultants to assist us with a review of our existing internal controls and the design and implementation of additional internal controls that we may determine are appropriate. If we have a material weakness in our internal control over financial reporting, we may not detect errors on a timely basis and our financial statements may be materially misstated. We will be evaluating our internal controls systems to allow management to report on, and eventually allow our independent auditors to attest to, our internal controls. We will be performing the system and process evaluation and testing (and any necessary remediation) required to comply with the management certification requirements of Section 404 of the Sarbanes-Oxley Act of 2002.

We cannot be certain as to the timing

of completion of our evaluation, testing and remediation actions or the impact of the same on our operations. If we are not able to implement the

requirements of Section 404 in a timely manner or with adequate compliance, we may be subject to sanctions or investigation by regulatory authorities,

such as the SEC or a stock exchange on which our securities may be listed in the future. Any such action could adversely affect our financial results

or investors’ confidence in us and could cause our stock price to fall. Moreover, if we are not able to comply with the requirements of Section

404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our internal controls that are deemed

to be material weaknesses, we could be subject to sanctions or investigations by the SEC, any stock exchange on which our securities may be listed in

the future, or other regulatory authorities, which would entail expenditure of additional financial and management resources and could materially

adversely affect our stock price. Inferior internal controls could also cause us to fail to meet our reporting obligations or cause investors to lose

confidence in our reported financial information, which could have a negative effect on our stock price.

We are an “emerging growth company” under the

recently enacted JOBS Act and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common

stock less attractive to investors.

We qualify as an “emerging growth

company” under the recently enacted JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure

requirements. For so long as we are an emerging growth company, among other things, we will not be required to:

• |

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

• |

submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency”; |

• |

obtain shareholder approval of any golden parachute payments not previously approved; and |

• |

disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS

Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting

standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended

transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting

standards.

We will remain an “emerging growth

company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed

$1 billion; (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934,

which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our

most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the

preceding three-year period.

12

Until such time, however, because the

JOBS Act has only recently been enacted, we cannot predict whether investors will find our stock less attractive because of the more limited disclosure

requirements that we may be entitled to follow and other exemptions on which we are relying while we are an “emerging growth company”. If

some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price

may be more volatile.

Our status as an “emerging growth company” under

the JOBS Act may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various

reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying

with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital

as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial

accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial

condition and results of operations may be materially and adversely affected.

We must comply with the Foreign Corrupt Practices

Act.

We are required to comply with the

United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials

for the purpose of obtaining or retaining business. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from

time-to-time in the PRC. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving

our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put

us at a disadvantage. Although we intend to inform our personnel that such practices are illegal, we cannot assure you that our employees or other

agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such

practices, we could suffer severe penalties.

We may have difficulty establishing adequate management,

legal and financial controls in the PRC.

The PRC historically has been deficient

in Western-style management and financial reporting concepts and practices, as well as in modern banking and other control systems. We may have

difficulty in hiring and retaining a sufficient number of locally-qualified employees to work in the PRC who are capable of satisfying the obligations

of a U.S. public reporting company. As a result of these factors, we may experience difficulty in establishing adequate management, legal and financial

controls (including internal controls over financial reporting), collecting financial data and preparing financial statements, books of account and

corporate records and instituting business practices in the PRC that meet U.S. standards as in effect from time to time.

If the Chinese regulatory bodies determine that the

structure for operating our business in the PRC does not comply with Chinese regulatory restrictions on foreign investment, we could be subject to

severe penalties, which may materially and adversely affect our business.

The Chinese government has broad

discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions

necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by

higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new Chinese laws or regulations on our businesses. We

cannot assure you that our current ownership and operating structure would not be found in violation of any current or future Chinese laws or

regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide

certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial

portion of our business operations, which could materially and adversely affect our business, financial condition and results of

operations.

13

If we are determined to be in violation

of any existing or future Chinese laws, rules or regulations or fail to obtain or maintain any of the required governmental permits or approvals, the

relevant Chinese regulatory authorities would have broad discretion in dealing with such violations, including:

• |

revoking the business and operating licenses of our Chinese entities; |

• |

discontinuing or restricting the operations of our Chinese entities; |

• |

imposing conditions or requirements with which YBP or our Chinese entities may not be able to comply; |

• |

Requiring YBP or our Chinese entities to restructure the relevant ownership structure or operations; |

• |

restricting or prohibiting our use of the proceeds from any offering to finance our business and operations in the PRC; or |

• |

imposing fines. |

The imposition of any of these

penalties would severely disrupt our ability to conduct business and have a material adverse effect on our financial condition, results of operations

and prospects.

Special Risks Relating to Doing Business in the

PRC

Because all of our operations are outside the United

States, we are subject to additional significant risks.

We are subject to risks inherent in

business operations outside the United States. These risks include but are not limited to geopolitical concerns, currency fluctuations, currency

exchange controls, restrictions on repatriating foreign-derived profits to the United States, inflation, local regulatory compliance, punitive tariffs,

unstable local tax policies, trade embargoes, import and export license requirements, trade restrictions, greater difficulty collecting accounts

receivable and longer payment cycles, unfamiliarity with local laws and regulations, differing legal standards in enforcing or defending our rights in

courts or otherwise, less favorable intellectual property protection than is provided in the United States, changes in labor conditions, difficulties

in staffing and managing international operations, difficulties in finding personnel locally who are capable to complying with the requirements of

reporting by a U.S. reporting company, risks related to shipment of raw materials and finished goods across national borders, and cultural and language

differences. Foreign economies may differ favorably or unfavorably from the United States economy in growth of gross domestic product, rate of

inflation, market development, rate of savings, capital investment, resource self-sufficiency and balance of payments positions, and in many other

respects.

The Chinese government exerts substantial influence over

business activities.

We are dependent on relationships with

the local government in the provinces in which we operate in the PRC. The Chinese government has exercised and continues to exercise substantial

control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in the PRC may be harmed by

changes in the PRC’s laws and regulations, including those relating to taxation, environmental regulations, land use rights, real property,

intellectual property and other matters. We intend to continue to conduct our business in material compliance with all applicable legal and regulatory

requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing

regulations that could require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more

centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic

conditions in the PRC generally or particular regions thereof, and could have an adverse impact on our business prospects, results of operations and

financial condition.

14

The production, sale and distribution of TCM are subject to

Chinese regulation.

Economic reforms adopted by the Chinese

government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the

legal systems at any time. This could either benefit or damage our operations and profitability. Some changes that could have this effect are: (i)

level of government involvement in the economy; (ii) control of foreign exchange; (iii) methods of allocating resources; (iv) balance of payment

positions; (v) international trade restrictions; and (vi) international conflict.

We depend upon governmental laws and regulations that may

be changed in ways that will harm our business.

Our business and products are subject

to government regulations mandating the manufacturing of pharmaceuticals in the PRC and other countries. Changes in the laws or regulations in the PRC,

or other countries we may sell into, that govern or apply to our operations could have a materially adverse effect on our business. For example, the

law could change so as to prohibit the use of certain pharmaceuticals. If one of our pharmaceuticals or medical products is prohibited, this change

would reduce our productivity of that product.

The Chinese government exerts substantial influence over

the manner in which we must conduct our business activities.

The PRC only recently has permitted

provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial

control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in the PRC may be harmed by

changes in its laws and regulations, including those relating to taxation, import and export tariffs, pharmaceutical regulations, and other matters. We

believe that our operations in the PRC are in material compliance with all applicable legal and regulatory requirements. However, the central or local

governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional

expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the

future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or

local variations in the implementation of economic policies, could have a significant effect on economic conditions in the PRC or particular regions

thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Our operations and assets in the PRC are subject to

significant political and economic uncertainties.

Our operations may be adversely

affected by the political environment in the PRC. The PRC has operated as a socialist and Communist state since 1949 and is controlled by the Communist

Party of the PRC. In recent years, however, the government has introduced reforms aimed at creating a “socialist market economy” and policies

have been implemented to allow business enterprises greater autonomy in their operations. Changes in the political leadership of the PRC may have a

significant effect on laws and policies related to the current economic reforms program, other policies affecting business and the general political,

economic and social environment in the PRC, including the introduction of measures to control inflation, changes in the rate or method of taxation, the

imposition of additional restrictions on currency conversion and remittances abroad, and foreign investment. These effects could substantially impair

our business, profits or prospects in the PRC. Moreover, economic reforms and growth in the PRC have been more successful in certain provinces than in

others, and the continuation or increases of such disparities could affect the political or social stability of the PRC.

Changes in Chinese laws and

regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply,

devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business,

results of operations and financial condition. Under current leadership, the Chinese government has

15

been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

We derive virtually all of our revenues from the PRC and we

are therefore susceptible to the strength of the Chinese economy.

We derive virtually all of our revenues

from the sale of products within the PRC. Any significant decline in the condition of the Chinese economy could adversely affect consumer demand of our

services, among other things, which in turn would have a material adverse effect on our business and financial condition.

Currency fluctuations and restrictions on currency exchange

may adversely affect our business, including limiting our ability to convert Chinese currency into foreign currencies and, if the Chinese currency were

to decline in value, reducing our revenue in U.S. dollar terms.

Our reporting currency is the U.S.

dollar and our operations use the RMB as our primary functional currency in our operations. We are subject to the effects of exchange rate fluctuations

with respect to either of these currencies. For example, the value of the RMB depends to a large extent on Chinese government policies and the

PRC’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official

exchange rate for the conversion of RMB to the U.S. dollar had generally been stable and the RMB had appreciated slightly against the U.S. dollar.

However, on July 21, 2005, the Chinese government changed its policy of pegging the value of RMB to the U.S. dollar. Under the new policy, RMB may

fluctuate within a narrow and managed band against a basket of certain foreign currencies. It is possible that the Chinese government could adopt a

more flexible currency policy, which could result in more significant fluctuation of RMB against the U.S. dollar. We can offer no assurance that RMB

will be stable against the U.S. dollar or any other foreign currency.

The income statements of our operations

in the PRC will be translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens

against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net

income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign

currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed

to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there

is a change in foreign currency exchange rates, the conversion of financial statements into U.S. dollars will lead to a translation gain or loss which

is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other

than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that

will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may

do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge our

exchange rate risks.

Although Chinese governmental policies

were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for

capital items, such as foreign direct investment, loans or securities, requires the approval of SAFE, which is under the authority of the People’s

Bank of China. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to

obtain all required conversion approvals for our operations or that Chinese regulatory authorities will not impose greater restrictions on the

convertibility of RMB in the future. Because a significant amount of our future revenue may be in the form of RMB, our inability to obtain the

requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in RMB to fund any business

activities outside of the PRC or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on

our financial condition and results of operations.

16

Chinese currency is not freely convertible, which may limit

our ability to obtain financing for expansion on favorable terms, and may limit our ability to pay dividends in the future.

The RMB is not a freely convertible

currency at present and, based solely on our understanding of the news that is widely and publicly available, it does not appear that the RMB will

become a freely convertible currency in the foreseeable future. Some, and perhaps a significant amount, of the revenue generated by our future

operations in the PRC will be paid in RMB, which may need to be converted to other currencies, primarily U.S. dollars, and remitted outside the PRC

from time to time. The Chinese government strictly regulates conversion of RMB into foreign currencies. Over the years, foreign exchange regulations in

the PRC have significantly reduced the government’s control over routine foreign exchange transactions under current accounts.

SAFE regulates the conversion of RMB

into foreign currencies. Effective July 1, 1996, foreign currency “current account” transactions by foreign investment enterprises are no

longer subject to the approval of SAFE, but need only a ministerial review, according to the Administration of the Settlement, Sale and Payment of

Foreign Exchange Provisions promulgated in 1996. “Current account” items include international commercial transactions, which occur on a

regular basis, such as those relating to trade and provision of services. Distributions to joint venture parties also are considered a “current

account” transaction. Other non-current account items, known as “capital account” items, remain subject to SAFE approval. Under current