Attached files

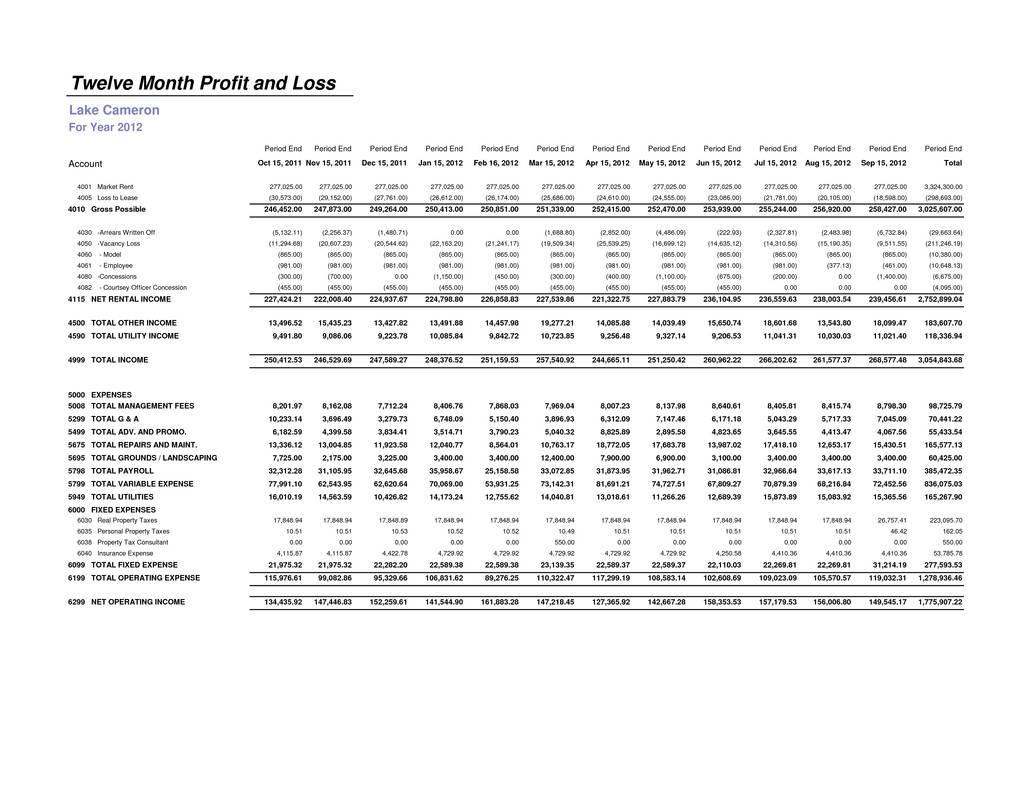

Period End Period End Period End Period End Period End Period End Period End Period End Account Nov 15, 2011 Jan 15, 2012 Mar 15, 2012 Apr 15, 2012 May 15, 2012 Jun 15, 2012 Jul 15, 2012 Aug 15, 2012 277,025.00 277,025.00 277,025.00 277,025.00 277,025.00 277,025.00 277,025.00 277,025.00 (29,152.00) (26,612.00) (25,686.00) (24,610.00) (24,555.00) (23,086.00) (21,781.00) (20,105.00) 247,873.00 250,413.00 251,339.00 252,415.00 252,470.00 253,939.00 255,244.00 256,920.00 (2,256.37) 0.00 (1,688.80) (2,852.00) (4,486.09) (222.93) (2,327.81) (2,483.98) (20,607.23) (22,163.20) (19,509.34) (25,539.25) (16,699.12) (14,635.12) (14,310.56) (15,190.35) (865.00) (865.00) (865.00) (865.00) (865.00) (865.00) (865.00) (865.00) (981.00) (981.00) (981.00) (981.00) (981.00) (981.00) (981.00) (377.13) (700.00) (1,150.00) (300.00) (400.00) (1,100.00) (675.00) (200.00) 0.00 (455.00) (455.00) (455.00) (455.00) (455.00) (455.00) 0.00 0.00 222,008.40 224,798.80 227,539.86 221,322.75 227,883.79 236,104.95 236,559.63 238,003.54 15,435.23 13,491.88 19,277.21 14,085.88 14,039.49 15,650.74 18,601.68 13,543.80 9,086.06 10,085.84 10,723.85 9,256.48 9,327.14 9,206.53 11,041.31 10,030.03 246,529.69 248,376.52 257,540.92 244,665.11 251,250.42 260,962.22 266,202.62 261,577.37 8,162.08 8,406.76 7,969.04 8,007.23 8,137.98 8,640.61 8,405.81 8,415.74 3,696.49 6,748.09 3,896.93 6,312.09 7,147.46 6,171.18 5,043.29 5,717.33 4,399.58 3,514.71 5,040.32 8,825.89 2,895.58 4,823.65 3,645.55 4,413.47 13,004.85 12,040.77 10,763.17 18,772.05 17,683.78 13,987.02 17,418.10 12,653.17 2,175.00 3,400.00 12,400.00 7,900.00 6,900.00 3,100.00 3,400.00 3,400.00 31,105.95 35,958.67 33,072.85 31,873.95 31,962.71 31,086.81 32,966.64 33,617.13 62,543.95 70,069.00 73,142.31 81,691.21 74,727.51 67,809.27 70,879.39 68,216.84 14,563.59 14,173.24 14,040.81 13,018.61 11,266.26 12,689.39 15,873.89 15,083.92 17,848.94 17,848.94 17,848.94 17,848.94 17,848.94 17,848.94 17,848.94 17,848.94 10.51 10.52 10.49 10.51 10.51 10.51 10.51 10.51 0.00 0.00 550.00 0.00 0.00 0.00 0.00 0.00 4,115.87 4,729.92 4,729.92 4,729.92 4,729.92 4,250.58 4,410.36 4,410.36 21,975.32 22,589.38 23,139.35 22,589.37 22,589.37 22,110.03 22,269.81 22,269.81 99,082.86 106,831.62 110,322.47 117,299.19 108,583.14 102,608.69 109,023.09 105,570.57 147,446.83 141,544.90 147,218.45 127,365.92 142,667.28 158,353.53 157,179.53 156,006.80 Twelve Month Profit and Loss Lake Cameron For Year 2012 Period End Period End Period End Period End Period End Oct 15, 2011 Dec 15, 2011 Feb 16, 2012 Sep 15, 2012 Total 4001 Market Rent 277,025.00 277,025.00 277,025.00 277,025.00 3,324,300.00 4005 Loss to Lease (30,573.00) (27,761.00) (26,174.00) (18,598.00) (298,693.00) 4010 Gross Possible 246,452.00 249,264.00 250,851.00 258,427.00 3,025,607.00 4030 -Arrears Written Off (5,132.11) (1,480.71) 0.00 (6,732.84) (29,663.64) 4050 -Vacancy Loss (11,294.68) (20,544.62) (21,241.17) (9,511.55) (211,246.19) 4060 - Model (865.00) (865.00) (865.00) (865.00) (10,380.00) 4061 - Employee (981.00) (981.00) (981.00) (461.00) (10,648.13) 4080 -Concessions (300.00) 0.00 (450.00) (1,400.00) (6,675.00) 2,752,899.04 4082 - Courtsey Officer Concession (455.00) (455.00) (455.00) 0.00 (4,095.00) 4115 NET RENTAL INCOME 227,424.21 224,937.67 226,858.83 239,456.61 4500 TOTAL OTHER INCOME 13,496.52 13,427.82 14,457.98 18,099.47 183,607.70 4590 TOTAL UTILITY INCOME 9,491.80 9,223.78 9,842.72 11,021.40 118,336.94 3,054,843.68 5000 EXPENSES 4999 TOTAL INCOME 250,412.53 247,589.27 251,159.53 268,577.48 5008 TOTAL MANAGEMENT FEES 8,201.97 7,712.24 7,868.03 8,798.30 98,725.79 5299 TOTAL G & A 10,233.14 3,279.73 5,150.40 7,045.09 70,441.22 5499 TOTAL ADV. AND PROMO. 6,182.59 3,834.41 3,790.23 4,067.56 55,433.54 5675 TOTAL REPAIRS AND MAINT. 13,336.12 11,923.58 8,564.01 15,430.51 165,577.13 5695 TOTAL GROUNDS / LANDSCAPING 7,725.00 3,225.00 3,400.00 3,400.00 60,425.00 5798 TOTAL PAYROLL 32,312.28 32,645.68 25,158.58 33,711.10 385,472.35 12,755.62 15,365.56 165,267.90 836,075.03 5799 TOTAL VARIABLE EXPENSE 77,991.10 62,620.64 53,931.25 72,452.56 6000 FIXED EXPENSES 6030 Real Property Taxes 17,848.94 17,848.89 5949 TOTAL UTILITIES 16,010.19 10,426.82 17,848.94 26,757.41 223,095.70 6035 Personal Property Taxes 10.51 10.53 10.52 46.42 162.05 6038 Property Tax Consultant 0.00 0.00 0.00 0.00 550.00 6040 Insurance Expense 4,115.87 4,422.78 4,729.92 4,410.36 53,785.78 1,775,907.22 6199 TOTAL OPERATING EXPENSE 115,976.61 95,329.66 6099 TOTAL FIXED EXPENSE 21,975.32 22,282.20 22,589.38 31,214.19 277,593.53 89,276.25 119,032.31 1,278,936.46 6299 NET OPERATING INCOME 134,435.92 152,259.61 161,883.28 149,545.17