Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRSTMERIT CORP /OH/ | d472036d8k.htm |

January 2013

Fixed Income Investor

Presentation

Exhibit 99.1 |

1

Forward-looking Statement Disclosure

This presentation contains forward-looking statements relating to present or future

trends or factors affecting the banking industry, and specifically the financial condition and

results of operations, including without limitation, statements relating to the earnings outlook of the Corporation, as well

as its operations, markets and products. Actual results could differ materially from those indicated.

Among the important factors that could cause results to differ materially are interest rate

changes, continued softening in the economy, which could materially impact credit quality trends and

the ability to generate loans, changes in the mix of the Corporation's business, competitive

pressures, changes in accounting, tax or regulatory practices or requirements and those risk

factors detailed in the Corporation's periodic reports and registration statements filed with the Securities

and Exchange Commission. The Corporation undertakes no obligation to release revisions to these

forward-looking statements or reflect events or circumstances after the date of this

release. Additional Information and Where to Find It

In connection with the proposed merger between FirstMerit Corporation ("FirstMerit") and

Citizens Republic Bancorp., Inc. ("Citizens"), FirstMerit has filed with the U.S.

Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that includes a preliminary joint proxy

statement of FirstMerit and Citizens that also constitutes a prospectus of FirstMerit. FirstMerit and

Citizens will deliver the definitive joint proxy statement/prospectus to their respective

shareholders. FirstMerit and Citizens urge investors and shareholders to read the joint proxy

statement/prospectus regarding the proposed merger and the definitive joint proxy statement/prospectus

(when it becomes available), as well as other documents filed with the SEC, because they will

contain important information. You may obtain copies of all documents filed with the SEC

regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also

obtain these documents, free of charge, from FirstMerit’s website (www.firstmerit.com)

under the heading “Investors” and then under the heading “Publications and Filings.” You may also

obtain these documents, free of charge, from Citizens’ website (www.citizensbanking.com) under

the tab “Investors” and then under the heading “Financial Documents” and

then under the heading “SEC Filings.” Participants in the Merger Solicitation

FirstMerit, Citizens, and their respective directors, executive officers and certain other members of

management and employees may be soliciting proxies from FirstMerit and Citizens shareholders in

favor of the merger and related matters. Information regarding the persons who may, under the

rules of the SEC, be deemed participants in the solicitation of FirstMerit and Citizens shareholders in connection with the proposed merger are

set forth in the preliminary joint proxy statement/prospectus. You can find information about

FirstMerit’s executive officers and directors in its definitive proxy statement filed with

the SEC on March 8, 2012. You can find information about Citizens’ executive officers and directors in its

definitive proxy statement filed with the SEC on March 12, 2012. Additional information about

FirstMerit’s executive officers and directors and Citizens’ executive officers and

directors can be found in the above-referenced Registration Statement on Form S-4. You can obtain free copies of

these documents from FirstMerit and Citizens using the contact information above.

|

FirstMerit Overview

(1)

•

Headquarters: Akron, Ohio

•

Employees (FTE): 2,724

•

Founded: 1845

•

Assets: $14.9 Billion

4th largest Ohio bank

41

st

largest US bank

•

Market Capitalization: $1.7 Billion

•

S&P

/

Moody’s

Hold

Co.

Ratings:

BBB+

/

A2

•

Ticker: FMER (NASDAQ)

2

Source: SNL Financial.

(1) Total assets at 12/31/12 and market capitalization as of 1/18/13.

|

The

First Merit Opportunity Highly regarded

and experienced

management team

•

Senior management team with an average of over 25 years of banking industry

experience principally with larger institutions

•

Dedicated focus on risk management, credit, and controls

Stable earnings

base

•

55 consecutive quarters of profitability

•

Stable NIM historically and throughout the cycle

Experienced

integrator

•

Successfully integrated 3 bank M&A transactions in 2010

•

Robust planning, identified risks and detailed integration plan

Citizens Republic

–

strategically

compelling and

financially

attractive

•

Creates a premier Midwest banking franchise with over $23bn in assets

•

EPS accretive, IRR of 18%+, with short TBV earnback period

3

•

Robust pro forma capital and capital generation capacity

•

Outstanding asset quality, exceptional liquidity profile, and strong core deposit

base Robust credit,

capital, and

liquidity |

Highly Regarded and

Experienced Management Team 4

Name

Title

Industry

Experience

Bio

Paul G. Greig

Chairman &

CEO

35

Terrence E. Bichsel

Executive VP &

CFO

39

William P. Richgels

Executive VP &

CCO

31

Mr. Richgels joined FirstMerit as Executive Vice President, Chief Credit Officer on May 1, 2007. He

joined FirstMerit from JP Morgan Chase, Chicago, where he held the position of Senior Vice

President and Senior Credit Executive since 2004. Mr. Richgel’s experiences and successes

in lending include asset-based, commercial and industrial, commercial real estate, floor

plan, private banking, distressed debt and mezzanine.

Mark N. DuHamel

Executive VP

and Treasurer

30

Thomas P. O’Malley

Senior VP, Dir.

of Investor

Relations and

Corporate

Communications

17

Mr. O’Malley

is

Senior

Vice

President,

Director

of

Investor

Relations

and

Corporate

Communications.

He

joined FirstMerit in 2004 from National City Corporation, Cleveland, where he was a buy-side

equity research analyst

covering

financial

service

companies.

Prior

to

that,

he

was

a

sell-side

equity

research

analyst

covering banks for McDonald & Company/KeyCorp., Cleveland.

Mr. Greig has served as Chairman, President and CEO of FirstMerit since 2006 and is a member of the

Company’s Executive Committee. Mr. Greig is also the Chairman, President and CEO of

FirstMerit Bank, N.A. Prior to joining FirstMerit, Mr. Greig served as President and CEO of

Charter One Bank, Illinois from 2005-2006 and President and CEO of Chase, Wisconsin from

1999-2005.

Mr. Bichsel is the Executive Vice President and Chief Financial Officer of FirstMerit Corporation. He

joined FirstMerit in September 1999 from Banc One Corporation where he was the Vice President

of Finance and Performance Management. He previously held high level finance positions in Bank

One Services Corporation, Bank One Wisconsin Corp, and Bank One, Dayton. He has more than 30

years of experience in financial management, systems, budgeting, risk management, investments,

cost accounting and financial forecast modeling. Mark N. DuHamel is Executive Vice President of Treasury for FirstMerit Corporation. He also serves as

Executive Vice President and Treasurer of FirstMerit Bank, NA.. He directs investment

portfolio strategy and execution, manages wholesale funding activities and oversees the bank's

asset liability management function. He manages the corporation's investor relations function

and he is the corporate development officer overseeing merger and acquisition activity. |

Highly Regarded and Experienced Management Team (cont.)

5

Name

Title

Industry

Experience

Bio

David G. Goodall

Executive VP,

Corporate

Banking

15

Mr. Goodall serves as Executive Vice President, Commercial Banking and has held

this position since November 2009. He joined FirstMerit in March 2009 as

Executive Vice President and Head of Specialized Banking from National City Business

Credit, Inc., a subsidiary of National City Bank, where he was President and

CEO. N. James

Brocklehurst

Executive VP,

Retail Banking

23

Mr. Brocklehurst was appointed Executive Vice President, Retail Banking in July

2010. He joined FirstMerit as Senior Vice President, Retail Sales Manager

in July 2006, from JPMorgan Chase where he served as Senior Vice President, Retail

Market Manager since 2003. Mr. Brocklehurst began his banking career in 1989 in

Branch Management in Indianapolis, IN. Mike G. Robinson

Executive VP,

Wealth

Management

Services

27

Mark D. Quinlan

Executive VP &

Chief

Information

Officer

25

Mr. Quinlan is Executive Vice President and Chief Information Officer. Prior to

joining FirstMerit in 2013, he was Executive Vice President, Chief

Information and Operations Officer at Associated Bancorp in Green Bay, Wis. Prior to that, he held

significant positions at such organizations as Charter One, Union Center Insurance

and Investments, US Bancorp and Citibank.

Christopher J.

Maurer

Executive VP,

Human

Resources

41

Judith A. Steiner

Executive VP,

Risk

Management

25

Ms. Steiner joined FirstMerit in 1990. She is Executive Vice President, General

Counsel, Corporate Secretary and Chief Risk Officer of FirstMerit

Corporation. Prior to her current position, Ms. Steiner was manager of the Legal and Compliance

Departments and was AML/BSA Officer of the Corporation. Her responsibilities

include oversight of the Legal, Compliance, AM/BSA, CRA, Security,

Insurance and Enterprise Risk Management functions. Prior to joining FirstMerit, she was an

Associate with Brouse McDowell law firm, Akron, Ohio.

Julie C. Tutkovics

Senior VP &

Chief Marketing

Officer

20

Mr. Robinson is Executive Vice President, Wealth Management Services. Prior to joining FirstMerit, he

spent 27 years at JPMorgan Chase where he held a number of leadership roles within the

company’s wealth management business. As a managing director and co-head of the JP

Morgan Private Bank in Michigan, Mr. Robinson managed a team of specialists in wealth

advisory, investment management, estate and trust administration and banking Mr. Maurer is Executive Vice President, Human Resources of FirstMerit Corporation. He joined First

National Bank of Ohio (now part of FirstMerit) in June 1992 as Senior Vice President and

Director of Human Resources. In November 1993, Mr. Maurer was named Senior Vice President and

Director of Human Resources of FirstMerit Corporation. Prior to his joining First

National, he was employed by Diebold Incorporated where he spent 21 years holding various management positions in

Human Resources.

Mrs. Tutkovics was appointed Senior Vice President, Chief Marketing Officer, in November 2010. She is

responsible for corporate Line of Business marketing across the country, driving

FirstMerit’s branding initiatives, overseeing product development, heading up marketing

research and working closely with line of business heads to develop marketing and advertising

strategies. Prior to joining FirstMerit, Mrs. Tutkovics served as First Vice President, Director of Product

Development at New York Community Bancorp, Inc. (formerly AmTrust Bank). Before that, she served in

a variety of marketing roles at Citizens Financial Group/Charter One Bank, Citizens

Bank, Fidelity Investments and KeyCorp. |

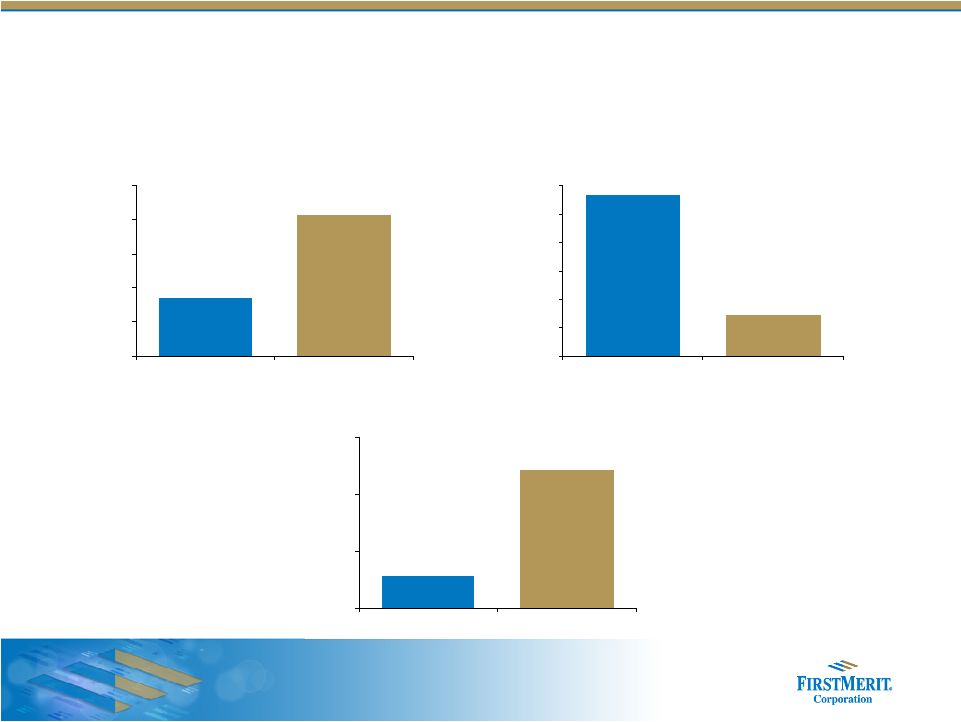

6

•

Solid asset quality results

(1)

NCO

ratio

consistently

below

peers

(0.53%

for

2012

vs.

0.81%

for

peers)

NPA ratio at 0.57% vs. peers at 2.43%

(2)

•

Robust capital

Tangible common equity ratio of 8.16% as of 12/31/12

Pro forma acquisition of 7.15% as of 9/30/12

Ratios well in excess of fully phased-in Basel III NPR requirements

•

Strong liquidity

Strong core deposit funding base anchored by noninterest-bearing demand

deposits

Core deposits are 88% of deposit base at 12/31/12

Robust Credit, Capital and Liquidity

Note: Financial metrics for FMER as of 12/31/2012. Financial metrics for peers as of

9/30/2012 YTD. Peer Group includes Huntington, Associated, Fulton Financial,

TCF Financial, Citizens Banking, Park National, First

Commonwealth

Financial,

Old

National,

MB

Financial

and

FNB

as

of

most

recent

quarter

available.

(1)

Includes $10.6 million of accruing consumer post chapter 7 bankruptcy loans

reclassified to non performing based on guidance from the Office of the Comptroller of the Currency in Q3’12.

(2)

Excludes restructured loans. |

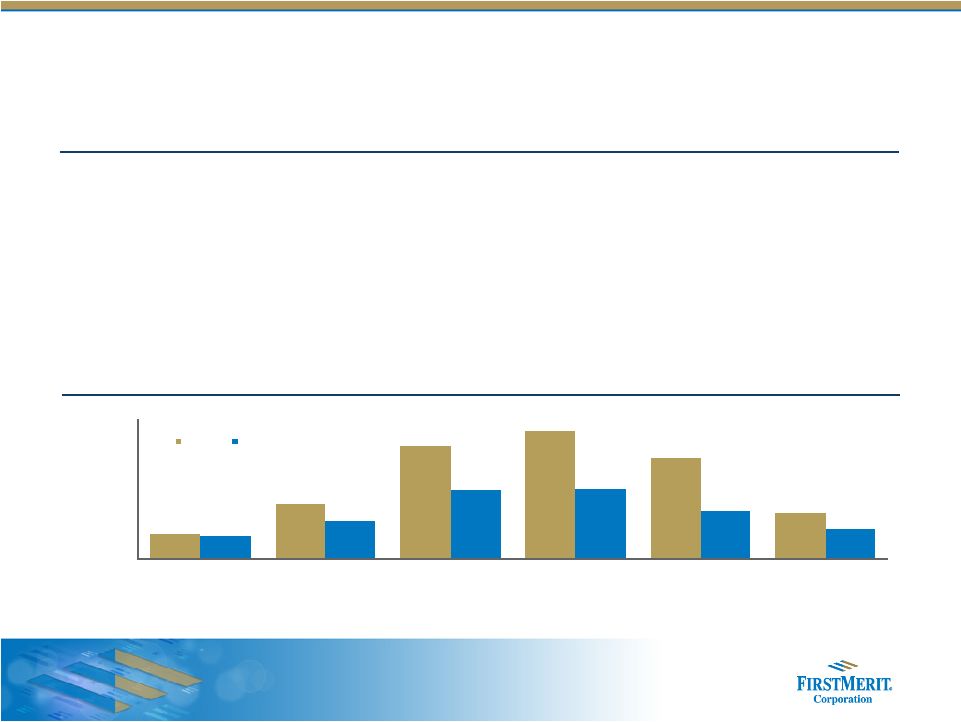

Stable Earnings Base

Source: SNL Financial. FMER 2012YTD as of 12/31/2012. Peer 2012YTD as of

9/30/2012. Peer Group includes Huntington, Associated, Fulton Financial, TCF

Financial, Citizens Banking, Park National, First Commonwealth

Financial, Old National, MB Financial and FNB 7

55 Consecutive Quarters of Profitability

ROAA

ROAE

1.19%

1.13%

0.76%

0.76%

0.82%

0.92%

0.96%

0.06%

(0.85%)

0.23%

0.68%

1.10%

(1.00%)

(0.50%)

0.00%

0.50%

1.00%

1.50%

2007

2008

2009

2010

2011

2012 YTD

FMER

Peers

14.1%

12.8%

8.1%

7.8%

7.7%

8.3%

10.4%

1.5%

(7.1%)

2.3%

6.0%

8.9%

(10.0%)

(5.0%)

0.0%

5.0%

10.0%

15.0%

2007

2008

2009

2010

2011

2012 YTD

FMER

Peers |

Assets: $415 million

Branches: 24

February 2010

Assets: $420 million

Branches: 4

February 2010

Assets: $3.0 billion

Branches: 26

May 2010

•

Successful integration in a new market

–

Seamless conversions of three franchises in 2010, within very compressed,

overlapping timelines –

Smooth transition from announcement to conversion

–

Experienced project management team executing integration process

•

Chicago commercial lending initiative began in February 2010 with a commercial staff

of 5, which has significantly exceeded expectations

–

FirstMerit’s commercial team today has grown to over 40 relationship managers

–

Commercial calling effort has developed $780 million in loans outstanding with

total commitments of $1.4 billion in just 2 ½

years

•

Total Chicago loan portfolio in excess of $2 billion of outstanding loans

–

Balanced

portfolio

–

approximately

$1

billion

of

new

production

and

$1

billion

of

acquired

loans

Experienced Integrator

8 |

Citizens Republic –

Strategically Compelling and Financially Attractive

Strategically

compelling

combination

•

Traditional community banking franchises in the Midwest

•

Creates a franchise with size and scale to compete effectively

•

Leverages FMER’s core middle market commercial lending expertise

•

Robust planning, identified risks and detailed game plan

•

Following a proven model from previous, recent acquisitions

•

Assistance from well-recognized third parties

Exhaustive due

diligence and

mitigated credit

risks

•

Estimated loan portfolio fair value mark of $377.6 million (6.8%) at transaction

closing, and NCOs

of

12.3%

(for

a

total

of

19.1%),

mitigates

credit

exposure

going

forward

•

Conservative risk profile

•

44% of pro forma portfolio will be marked at fair value

•

More than 120 people (110 FirstMerit employees), three months, multiple external

third parties

Very strong

liquidity, capital

levels

•

All stock transaction

•

Strong pro forma capital and capital generation capacity

•

Capital raise for TARP repayment equal to TARP outstanding

•

Exceptional liquidity profile

9

•

EPS accretive in first full year following close

•

18%+ IRR, well in excess of cost of capital

•

Increased earnings capacity and lower total payout ratio

Financially

Attractive

Proven

integration

strategy |

Summary of Key Deal Terms

Consideration

•

Fixed Exchange Ratio:

1.37 shares of FirstMerit for each share of Citizens

Republic

•

Implied Value

(1)

:

$22.50 per common share, or $912 million

•

Consideration Mix:

100% stock

•

Dividend:

TARP Repayment

•

Intend to repay in full at closing, subject to regulatory authorization and

Treasury approval •

Intend to fund repayment with a combination of FirstMerit preferred stock and

debt Balance Sheet Restructuring

•

Balance sheet deleveraging at close of approximately $750 million focused on

higher cost FHLB borrowings and Repos

Cost Savings

•

22% ($59 million) of 6/30/12 CRBC YTD annualized noninterest expense

Merger-Related Charges

•

$88 million pre-tax

Name

•

Rebranded to FirstMerit Bank

Board Representation

•

FirstMerit

will

appoint

2

Citizens

Republic

Board

members

to

its

Board

Required Approvals

•

Approval of Citizens Republic and FirstMerit shareholders

•

Customary

regulatory

approvals,

including

approval

to

repay

Citizens’

TARP

Anticipated Closing

•

Early 2Q 2013

(1) Based

on

FirstMerit’s

10

day

average

closing

share

price

prior

to

signing

the

definitive

merger

agreement

(8/29/12

–

9/12/12).

10

Current quarterly dividend of $0.16

|

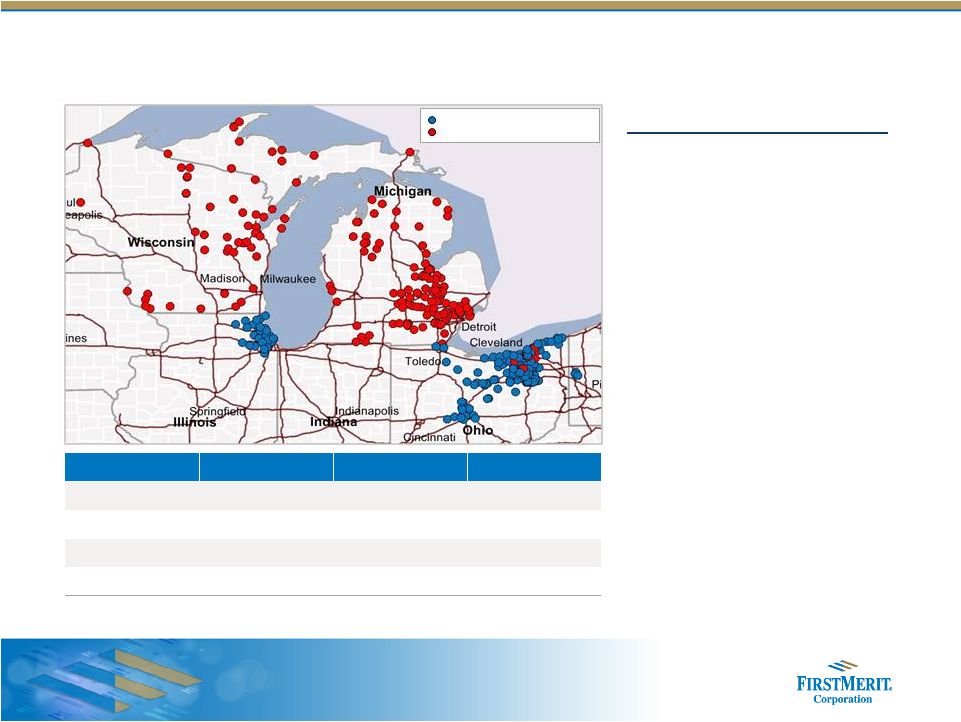

Creating a Premier Midwest Banking Franchise

Source: Balance sheet items as of 12/31/12, other items of 9/30/12. Figures are pro

forma for purchase accounting. Loans by state are not adjusted for purchase

accounting mark. (1) Includes

4

FirstMerit

branches

in

Western

Pennsylvania

($0.2

billion

of

deposits).

•

$24.5 billion in Assets

•

$14.9 billion in Loans

•

$18.9 billion in Deposits

•

10.59% Tier 1 Ratio

•

9.50% Tier 1 Common Ratio

•

415 branches

•

452

ATMs

•

Over 5,000 employees

State

Deposits ($bn)

Loans ($bn)

Branches

Ohio

(1)

$9.2

$7.9

162

Michigan

$5.9

$4.3

158

Illinois

$2.7

$2.1

44

Wisconsin

$1.0

$0.4

47

FirstMerit (196 branches)

Citizens Republic (219 branches)

Green Bay

Chicago

Akron

Pro Forma Franchise

11 |

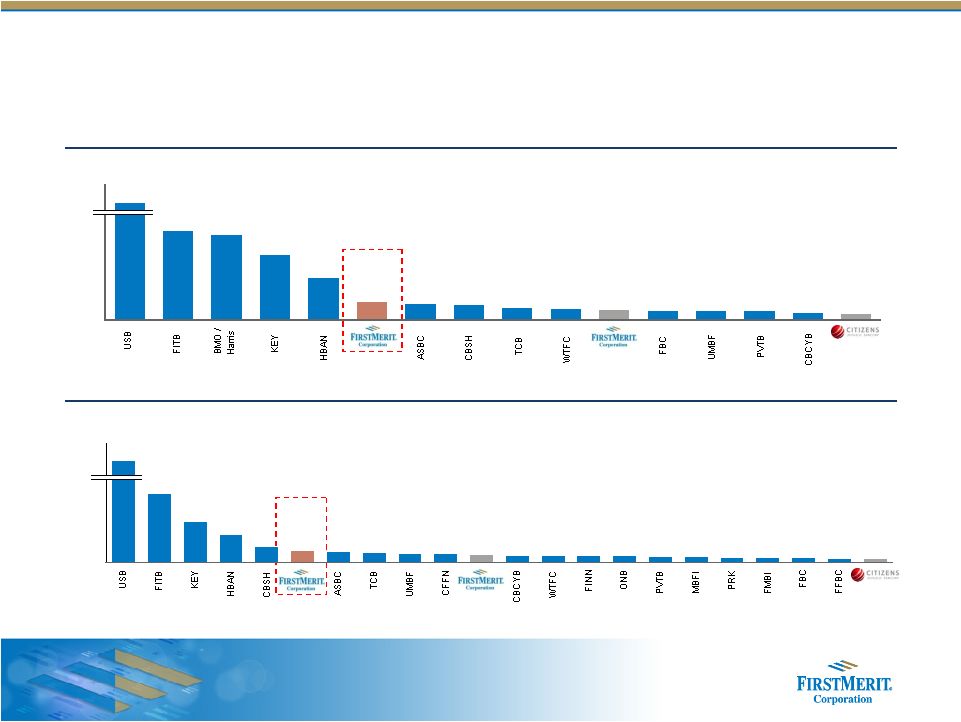

12

A Stronger Regional Presence

Top

Banks

Headquartered

in

the

Midwest

by

Assets

(1)

Source:

SNL Financial as of 1/18/13.

(1) Excludes mutual holding companies and NTRS.

($ in billions)

Top

Banks

Headquartered

in

the

Midwest

by

Market

Capitalization

(1)

($ in billions)

$60.0

$65.0

$61.4

$353

$350

$375

$118

$112

$87

$57

$25

$22

$21

$18

$17

$15

$14

$13

$13

$10

$10

$0

$25

$50

$75

$100

$125

$14.4

$8.7

$5.9

$3.4

$2.5

$2.3

$2.1

$1.9

$1.8

$1.7

$1.4

$1.4

$1.4

$1.3

$1.3

$1.2

$1.0

$1.0

$1.0

$0.9

$0.8

$0.0

$5.0

$10.0

$15.0 |

13

Compelling Financial Rationale

Attractive Pricing

Superior Returns

•

First

full-year

EPS

accretion

of

7.5%

(3)

•

18%+ IRR

(3)

•

TBV dilution of 6.9%, inclusive of balance sheet restructuring charge

•

Earn-back

of

TBV

dilution

of

under

2.5

years

(3)

Conservative

Synergies

•

22%

($59

million)

cost

savings

net

of

investments

(3)

•

Future synergies accruing to combined shareholders

•

Further opportunity to leverage FirstMerit’s efficiency discipline

Mitigated Credit

Risk

•

Extensive credit review involving both FirstMerit’s credit team and third

party valuation consultants

•

6.8% loan mark ($378 million) and implied 19.1% credit cycle losses

FMER

–

CRBC

(1)

Recent

Transactions

–

Median

(2)

Price / Book Value:

0.87x

1.49x

Price / Tangible Book Value:

1.26x

1.75x

Core Deposit Premium:

2.8%

10.4%

(1)

At announcement.

(2) Based

on

the

following

transactions

(Buyer

/

Target):

Union

Bank

/

Pacific

Capital,

Prosperity

/

American

State,

Susquehanna

/

Tower, Valley National / State, Brookline / Bancorp Rhode Island, Susquehanna /

Abington, People’s United / Danvers, Comerica / Sterling, Hancock /

Whitney, BMO / Marshall & Ilsley, M&T / Wilmington, and First Niagara / New Alliance.

(3) Estimated. |

14

FMER

12/31/12

FMER

Pro Forma

Well-Capitalized

Minimums

TCE / TA

8.16%

7.15%

N/A

Leverage Ratio

8.43%

7.30%

5.00%

Tier 1 Common Ratio

11.25%

9.50%

N/A

Tier 1 Ratio

11.25%

10.59%

6.00%

Total Risk-Based Capital

12.50%

13.06%

10.00%

Strong Balance Sheet…

•

Preliminary

estimates

based

on

Basel

III

NPR

show

capital

ratios

in

excess

of

fully

phased

in

requirements

•

Planned capital actions

–

Raise $250 million of Tier 2 debt and $100 million of Tier 1 preferred

•

Expect to quickly accumulate capital

–

Recover TCE / TA in under 2 years

•

Excellent prospects to reinvest in business

Capital Ratios |

Minimized Liquidity Risk

FirstMerit Bank

Citizens Bank

Pro Forma

FirstMerit Bank

As of 6/30/12

Loans / Deposits

79.2%

75.4%

75.6%

Wholesale / Total Funding

1.4%

9.3%

0.9%

As of 12/31/12

Holding Company Cash

$141mm

--

--

As of 8/31/12

As a % of Total Deposits

3.6%

5.9%

4.5%

Asset-based Liquidity / Total Assets

13.3%

28.2%

16.3%

(1)

15

•

•

•

Both companies use cash flow liquidity practices in measuring liquidity risk

Both companies perform extensive cash flow liquidity stress tests using severely

adverse conditions Post restructuring, limited reliance on wholesale

funding (1)

Pro forma wholesale / total funding includes repayment of $658mm of FHLB borrowings and $103.4mm of

repos and $44.0mm write-up of deposits. |

16

Conservative Credit Evaluation

Gross Loan Mark

Type

Mark ($mm)

Mark (%)

C&I

$62.4

3.6%

CRE

$103.6

7.3%

Indirect

Consumer

–

RV

/

Marine

$23.7

2.4%

Mortgage

$29.8

4.5%

HELOC

$158.2

21.4%

Total Loan Mark

$377.6

6.8%

Citizens’

NCOs since 1/1/08 as a % of 12/31/07 gross loan balance:

12.3%

Total Loan Mark and NCOs since 1/1/08:

19.1%

Note: Estimated based on most recently available information.

|

17

Similar Customer-Focused Cultures Ensure Smooth Integration

•

History of both companies is based on Midwest ethos embraced by customers and

employees •

Independent third party brand awareness study on both companies revealed strikingly

similar themes –

FirstMerit

and

Citizens

are

both

recognized

in

their

markets

for

same

characteristics

–

Big bank capabilities and product offerings with local delivery

–

Strong presence in marketplace

–

Customers know their banker

–

FirstMerit

and

Citizens

customer

base

cited

same

attributes

when

asked

to

describe

their

bank

–

Approachable

–

Resourceful

–

Committed

–

Conservative

•

Remarkable level of similarity also found in independent third party customer

satisfaction study on both companies

–

FirstMerit and Citizens customers report comparable levels of high satisfaction

with their bank –

86% (FirstMerit)

–

89% (Citizens)

–

Both bank customer bases also show strikingly similar tendency to act as advocate

of their bank to others –

86% (FirstMerit and Citizens)

•

Similar corporate values and excellence in customer service will

ensure smooth integration

–

Limiting customer disruption and ensuring employee retention

|

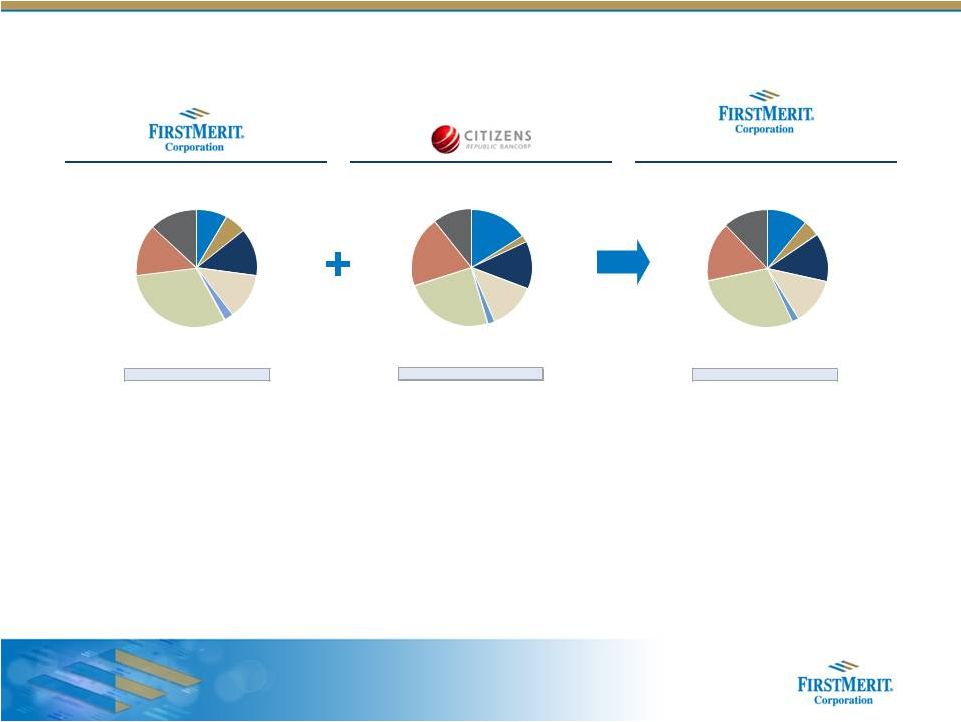

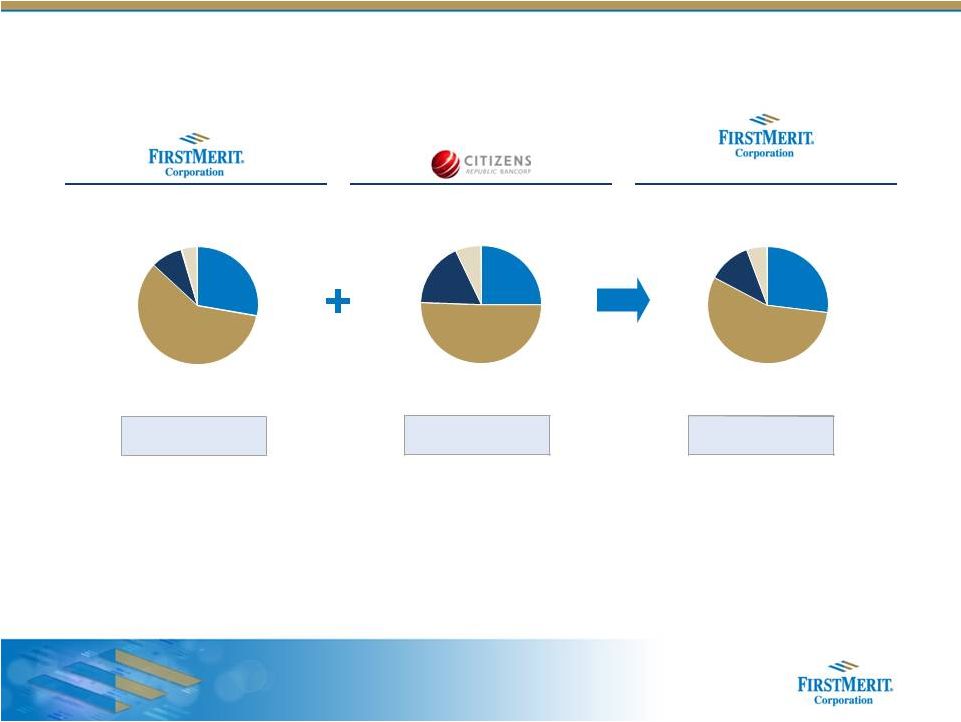

Lending Presence and Product Offerings

Source: SNL Financial based on regulatory data as of 9/30/12.

Note: CRBC and FMER loan compositions do not reflect estimated loan mark.

•

Leverage FirstMerit’s lending expertise across the Citizens Republic

footprint –

Commercial banking: middle market, business banking and asset-based

lending –

Indirect auto and dealer services

–

Mortgage banking and credit card

•

Expand Citizens Republic’s specialized indirect consumer lending

experience –

Extensive experience in indirect consumer lending with over 750 dealer

relationships across the Midwest –

Superior

credit

–

NPLs

were

~35bps

of

total

loans

throughout

the

cycle

($ in millions)

Pro Forma

18

Gross Loans: $9,377.0

C&I

32%

Other

13%

Consumer

14%

Multifamily

2%

NonOwner-Occ

CRE

12%

Owner-Occ

CRE

13%

C&D

6%

1-4 Family

8%

Gross Loans: $5,461.0

C&I

23%

1-4 Family

16%

NonOwner-Occ

CRE

13%

Multifamily

2%

Consumer

20%

Other

11%

C&D

2%

Owner-Occ

CRE

13%

Gross Loans: $14,838.0

C&I

29%

Other

12%

Consumer

16%

Multifamily

2%

NonOwner-Occ

CRE

13%

Owner-Occ

CRE

13%

C&D

4%

1-4 Family

11% |

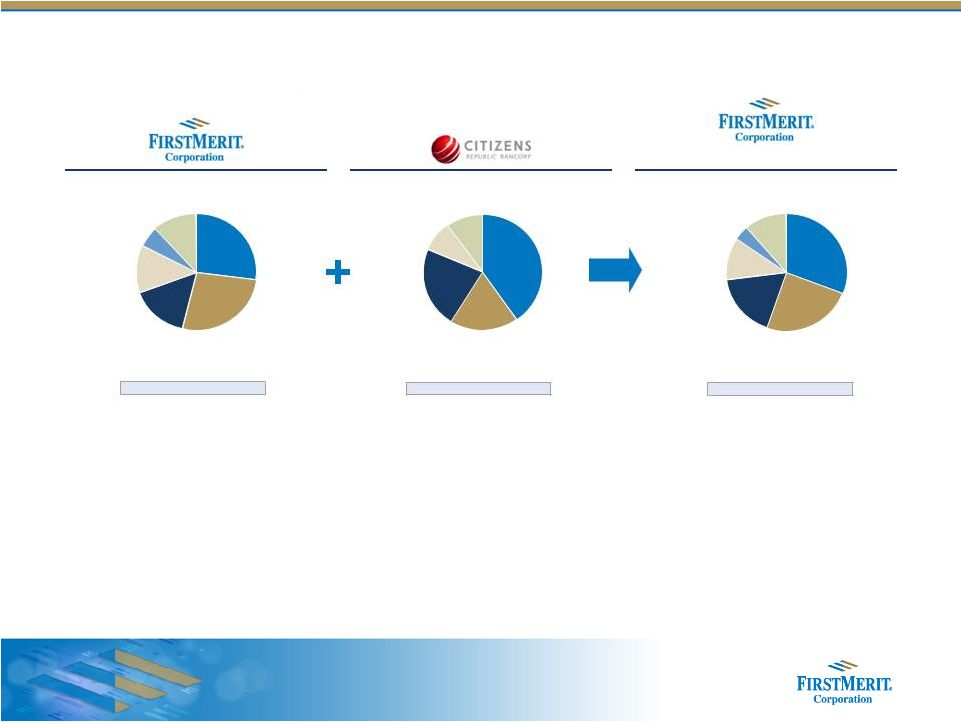

Strong Core Deposit Funding

Source: SNL Financial based on GAAP data as of 9/30/12.

(1) Core deposits include all deposits less certificates of deposit.

•

Deposit product offering very similar to FirstMerit’s

•

Strong core deposit funding base anchored by noninterest-bearing demand

deposits •

Opportunity

for

additional

core

deposit

growth

driven

by

growing

middle

market

commercial

relationships

($ in millions)

Pro Forma

19

Deposits: $11,532.4

MRQ Cost: 0.28%

Core Deposits: 87%

(1)

MMDA, Savings

& Other

59%

Retail CDs

8%

Jumbo CDs

5%

Non-Interest

Bearing

28%

MMDA, Savings

& Other

51%

Retail CDs

17%

Jumbo CDs

7%

Non-Interest

Bearing

25%

Deposits: $18,835.4

Cost: 0.36%

Core Deposits: 82%

(1)

MMDA, Savings

& Other

55%

Retail CDs

12%

Jumbo CDs

6%

Non-Interest

Bearing

27%

Deposits: $7,303.0

MRQ Cost: 0.48%

Core Deposits: 76%

(1) |

Opportunities to Expand Fee Income

Source: SNL Financial based on GAAP data as of 9/30/12.

Note:

Core

fee

income

shown

(excludes

gains

/

losses

on

sales

of

securities

and

loans

held

for

sale).

•

Citizens

Republic

currently

outsources

mortgage

banking

–

conversion

to

FirstMerit's

business

model

will

enhance

fee income

•

Expansion

of

middle-market

commercial

solutions

–

treasury

management,

interest

rate

derivatives,

international,

and merchant card services

•

Leverage FirstMerit's success in wealth management

–

Greater scale and enhanced product suite

–

Focused cross-sell initiatives with commercial / consumer banking

($ in millions)

20

Other

12%

BOLI Income

6%

Loan Sales &

Other Loan Income

13%

Wealth

Management

15%

Credit Card & ATM

Service Charges

27%

MRQ Annualized: $217.5

Fees

27%

MRQ Annualized: $95.6

Credit Card & ATM

19%

Wealth

23%

Other

Loan Sales &

8%

Service

42%

Fees

Management

10%

Other Loan Income

Charges

MRQ Annualized: $313.1

Other

BOLI Income

Wealth

18%

Credit Card & ATM

24%

Loan Sales &

12%

Service Charges

11%

4%

Management

Fees

Other Loan Income

31%

Pro Forma |

Significant Cost Savings

Annualized Net Expense Reductions

Category

Amount

($MM)

Personnel

$24.8

Technology

$18.3

Regulatory

$5.9

Professional

$5.6

Other

$5.6

Occupancy

$1.7

Marketing

($2.8)

Total

$59.1

(1) Excludes value of restructuring charge.

(2) Assumes a 35% tax rate.

•

31% of costs saves will be achieved in 2013

•

FMER does not include any revenue synergy assumptions in its projections

21 |

22

Disciplined Execution Strategy

•

FirstMerit will leverage its extensive, best-practice integration experience from

its recent Chicago expansion

–

FDIC deals were significantly more complex

–

Limited involvement from target institutions

•

Disciplined FirstMerit project management approach to integration has begun

–

Every line of business and functional area is participating and communicating

daily –

Third party experts utilized as necessary, especially in IT area

•

Similar product sets and product features across all business lines facilitate a

smooth integration and transition for customers and staff

–

Core operating systems both provided by Fidelity Information Services (FIS)

•

Hiring of Sandra Pierce establishes strong, local leadership in that market

–

Enhancing customer and employee experience during transition

|

The

First Merit Opportunity Highly regarded

and experienced

management team

•

Senior management team with an average of over 25 years of banking industry

experience principally with larger institutions

•

Dedicated focus on risk management, credit, and controls

Stable earnings

base

•

55 consecutive quarters of profitability

•

Stable NIM historically and throughout the cycle

Experienced

integrator

•

Successfully integrated 3 bank M&A transactions in 2010

•

Robust planning, identified risks and detailed integration plan

Citizens Republic

–

strategically

compelling and

financially

attractive

•

Creates a premier Midwest banking franchise with over $23bn in assets

•

EPS accretive, IRR of 18%+, with short TBV earnback period

23

•

Robust pro forma capital and capital generation capacity

•

Outstanding asset quality, exceptional liquidity profile, and strong core deposit

base Robust credit,

capital, and

liquidity |

24

Appendix –

FirstMerit Financial Performance |

0.44%

0.98%

2.01%

2.29%

1.82%

0.81%

0.40%

0.68%

1.22%

1.23%

0.85%

0.53%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

2007

2008

2009

2010

2011

2012

N

e

t

C

h

a

r

g

e

-

o

f

f

s

Peers

FMER

25

•

Primary focus of entire management team and organization

•

Aligned incentives

•

Hired Chief Credit Officer and added other key personnel

•

Active internal focus on credit quality

•

Ongoing comprehensive internal and external review of portfolio

•

Implementing initiatives for ongoing credit improvement

Actions to Sustain Improved Performance

Source: SNL Financial.

Note: FMER data as of 12/31/2012. Peer data as of 9/30/2012.

National, MB Financial and FNB. Figures shown are simple averages.

Credit Quality Initiatives

Leads to Superior Credit Quality

Peer Group includes Huntington, Associated, Fulton Financial, TCF Financial, Citizens Banking, Park

National, First Commonwealth Financial, Old |

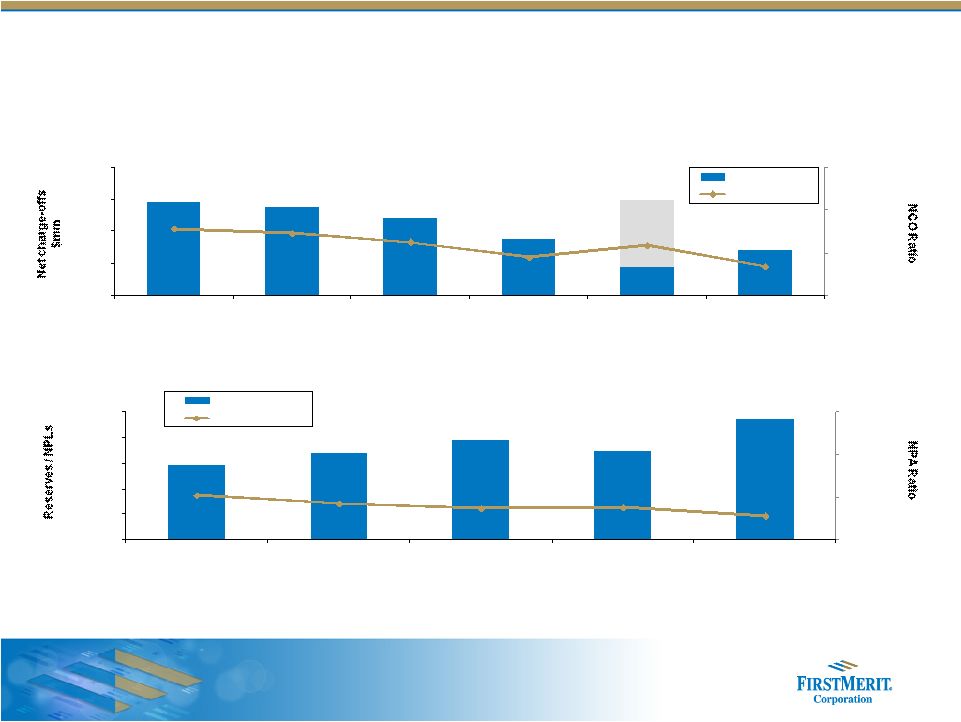

$14.6

$13.8

$12.0

$8.8

$14.9

$7.1

0.79%

0.73%

0.63%

0.45%

0.59%

0.34%

0.00%

0.50%

1.00%

1.50%

$0.0

$5.0

$10.0

$15.0

$20.0

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Net charge-offs

NCO ratio

26

Credit

Results-Excluding

Covered

Loans

(1)

(1)

Gray bar represents $10.6 million of accruing consumer post chapter 7 bankruptcy

loans reclassified to non performing based on guidance

from

the

Office

of

the

Comptroller

of

the

Currency.

NCO

ratio

excludes

reclassification

impact.

176.5%

205.0%

234.3%

208.1%

284.5%

1.06%

0.87%

0.75%

0.77%

0.57%

0.00%

1.00%

2.00%

3.00%

0.0%

60.0%

120.0%

180.0%

240.0%

300.0%

4Q11

1Q12

2Q12

3Q12

4Q12

Reserves/NPLs

NPA Ratio

(1) |

Credit

Results

(continued)

Source: SNL Financial

Note: FMER metrics as of 12/31/2012. Peer metrics as of 9/30/2012.

Note: Peer Group Includes Huntington, Associated, Fulton Financial, TCF Financial,

Citizens Banking, Park National, First Commonwealth Financial, Old

National, MB Financial and FNB 27

0.34%

0.83%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

FMER

Peers

285%

73%

0%

50%

100%

150%

200%

250%

300%

FMER

Peers

0.57%

2.43%

0.00%

1.00%

2.00%

3.00%

FMER

Peers

Net-Charge offs / Average Loans

NPAs / Loans and OREO

Allowance for Credit Losses /

Nonperforming Loans |

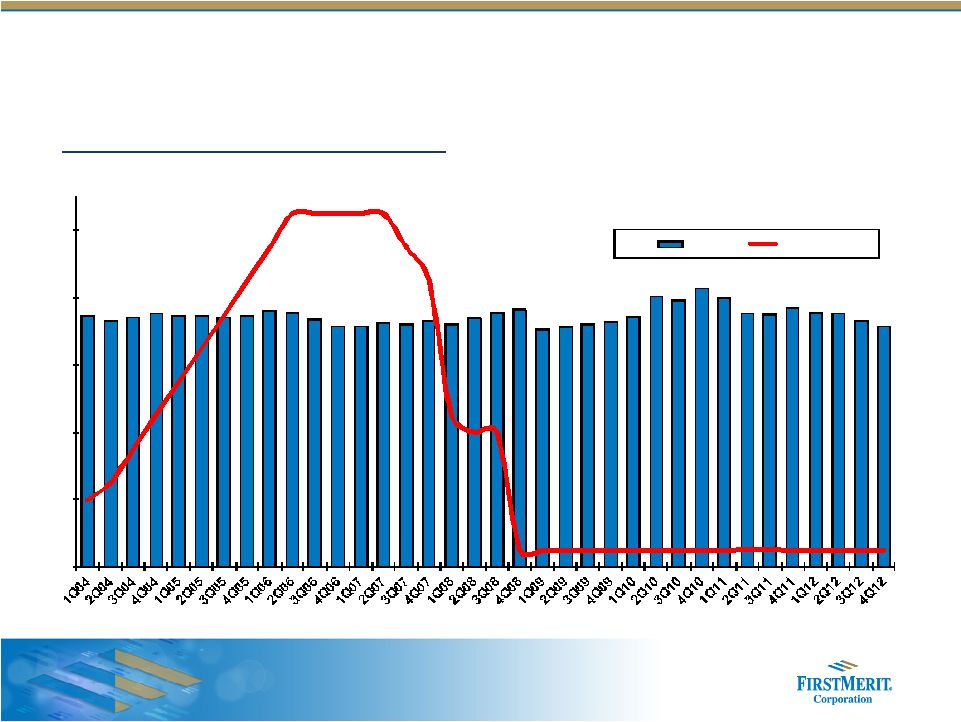

Margin Stability

Source: Bloomberg

28

Margin Historical Performance

•

Net interest margin stability throughout volatile

interest rate cycle

3.74%

3.66%

3.71%

3.76%

3.73%

3.74%

3.70%

3.73%

3.80%

3.78%

3.68%

3.58%

3.58%

3.62%

3.61%

3.66%

3.60%

3.69%

3.78%

3.82%

3.53%

3.56%

3.61%

3.64%

3.72%

4.02%

3.96%

4.14%

4.00%

3.77%

3.75%

3.85%

3.78%

3.77%

3.66%

3.58%

0%

1%

2%

3%

4%

5%

NIM

Fed Funds* |

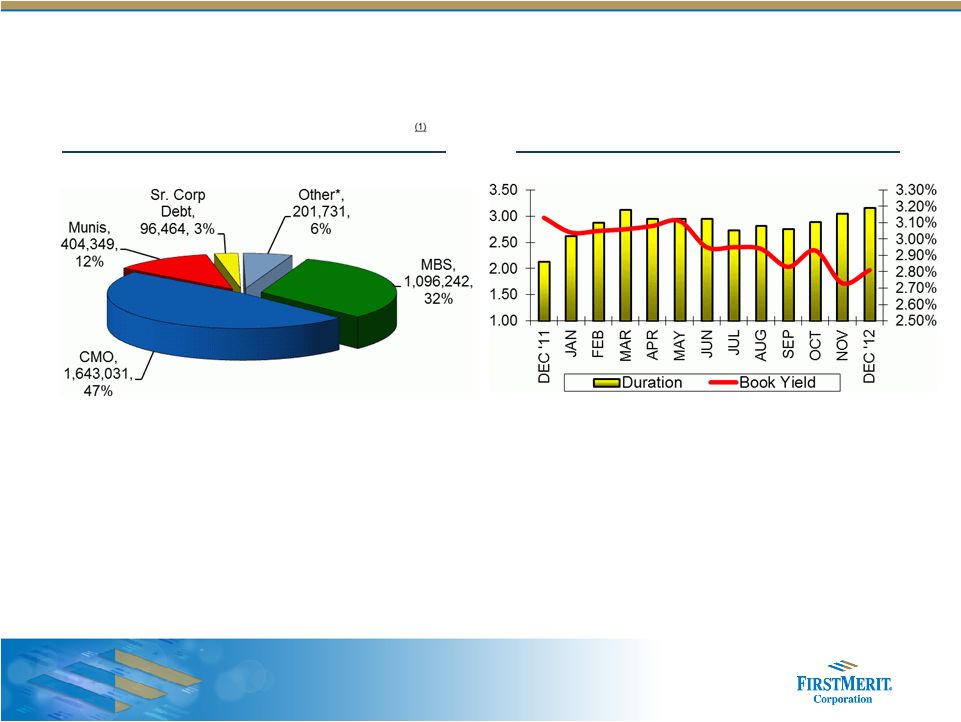

29

Investment Portfolio Summary

Investment Portfolio Composition

Book Yield and Duration

*Other: FHLB/FRB stock and Trups

(1) as of 12/31/12 |