Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - AutoGenomics, Inc. | d402968dex51.htm |

| EX-1.1 - EXHIBIT 1.1 - AutoGenomics, Inc. | d402968dex11.htm |

| EX-3.5 - EXHIBIT 3.5 - AutoGenomics, Inc. | d402968dex35.htm |

| EX-23.1 - EXHIBIT 23.1 - AutoGenomics, Inc. | d402968dex231.htm |

| EX-10.24 - EXHIBIT 10.24 - AutoGenomics, Inc. | d402968dex1024.htm |

| EX-10.26 - EXHIBIT 10.26 - AutoGenomics, Inc. | d402968dex1026.htm |

| EX-10.25 - EXHIBIT 10.25 - AutoGenomics, Inc. | d402968dex1025.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 23, 2013

Registration No. 333-184121

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AutoGenomics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3826 | 80-0252299 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2980 Scott Street

Vista, California 92081

(760) 477-2248

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Fareed Kureshy

President and Chief Executive Officer

AutoGenomics, Inc.

2980 Scott Street

Vista, California 92081

(760) 477-2248

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copy to:

| Todd A. Hentges Timothy R. Rupp Bingham McCutchen LLP 600 Anton Boulevard, 18th Floor Costa Mesa, CA 92626-7653 (714) 830-0600 |

Charles S. Kim Sean M. Clayton Cooley LLP 4401 Eastgate Mall San Diego, CA 92121-1909 (858) 550-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) (2) |

Amount of Registration Fee (3) | ||

| Common Stock, $0.01 par value |

$75,900,000 | $8,936 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee, in accordance with Rule 457(o) promulgated under the Securities Act of 1933. |

| (2) | Includes offering price of shares that the underwriters have the option to purchase to cover overallotments, if any. |

| (3) | Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended, based on an estimate of the proposed maximum aggregate offering price. $7,449 of this amount was previously paid. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 22, 2013

Preliminary Prospectus

6,000,000 Shares

Common Stock

We are offering 6,000,000 shares of our common stock. This is our initial public offering, and no public market currently exists for our common stock. We expect the initial public offering price to be between $9.00 and $11.00 per share. We have applied to list our common stock on the NASDAQ Global Market under the symbol “AGMX.”

We are an “emerging growth company,” as defined under federal securities laws, and have elected to comply with certain reduced public company reporting requirements available to such companies.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 20.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

Delivery of the shares of common stock is expected to be made on or about , 2013. We have granted the underwriters an option for a period of 30 days to purchase, on the same terms and conditions set forth above, up to an additional 900,000 shares of our common stock to cover overallotments. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ and the total proceeds to us, before expenses, will be $ .

Leerink Swann

| Stephens Inc. | Mizuho Securities |

Cantor Fitzgerald & Co.

The date of this prospectus is , 2013.

Table of Contents

Not all products have received all necessary domestic or international regulatory approvals or clearances for commercial sale. The vast majority of products sold by AutoGenomics are offered for sale to allow for the collection of research data, and may only be used for clinical purposes by laboratories certified under the Clinical Laboratory Improvements Amendments of 1988 and that have incorporated the products into laboratory-developed tests pursuant to guidelines issued by the College of American Pathologists. The FDA has not adopted these guidelines and AutoGenomics is not permitted to represent these products as in vitro diagnostic products.

Table of Contents

| 1 | ||||

| 20 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

56 | |||

| 87 | ||||

| 122 | ||||

| 128 | ||||

| 144 | ||||

| 146 | ||||

| 150 | ||||

| 154 | ||||

| Material United States Federal Income Tax Consequences to Non-U.S. Holders |

157 | |||

| 161 | ||||

| 167 | ||||

| 167 | ||||

| 167 | ||||

| F-1 |

INFINITI, BioFilmChip, Intellipac and QMatic are our trademarks. All other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

Neither we, nor the underwriters, have authorized anyone to provide you with additional or different information than that contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

Until , 2013 (25 days after the date of this prospectus), all dealers that buy, sell or trade in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Table of Contents

This summary highlights certain information contained in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of the information that you may consider important in making your investment decision, we encourage you to read this entire prospectus. Among the other information in this prospectus, you should carefully consider the information set forth under the heading “Risk Factors” and our financial statements and accompanying notes included elsewhere in this prospectus. Unless the context requires otherwise, the words “we,” “us,” “our,” “Company” and “AutoGenomics” refer to AutoGenomics, Inc.

Our Company

We design, develop, manufacture and market the INFINITI molecular diagnostics system. The system includes an extensive and expanding menu of genetic tests and a family of highly automated analyzers. Our products are sold to reference laboratories, hospital laboratories and specialty clinics that produce genetic test results in a broad range of market segments, including personalized medicine, women’s health, oncology and infectious disease. Genetic tests are performed on our INFINITI analyzer utilizing our high-margin and test-specific consumables, which include our proprietary BioFilmChip microarrays and our proprietary Intellipac Reagent Management Modules. In the United States, we market and sell our genetic tests that have been cleared by the U.S. Food and Drug Administration, or FDA, for use in the indications specified in those clearances. The remainder of our genetic tests are marketed and sold on a research use only, or RUO, basis. Our RUO tests may be used for clinical purposes in the United States only by customers that are certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and that have incorporated our test into the customer’s laboratory-developed tests, or LDTs, pursuant to guidelines issued by the College of American Pathologists. Our INFINITI analyzers are capable of both mid- to high-volume testing and generating many different laboratory results from one patient sample at the same time, which is commonly referred to as multiplexing, while providing a high level of accuracy and reproducibility. Our INFINITI system is easy to use, as it eliminates the need for multiple, specialized instruments and automates many of the discrete processes of traditional genetic testing.

As of December 31, 2012, we offered 53 tests for use on our INFINITI analyzers, and had more than 15 additional tests in development. Our current and in-development tests are focused on the areas of personalized medicine (including pain management, mental health and cardiovascular health assessment), women’s health, oncology, infectious disease, genetic disorders, newborn screening and blood banking, which we believe represent large and growing market opportunities in genetic testing. We believe the depth and breadth of our test menu is a significant competitive advantage that will allow laboratories to utilize laboratory space, labor and capital investment more efficiently to conduct additional molecular diagnostic tests. The proprietary design of our INFINITI system allows us to introduce new and enhanced tests to our genetic test menu without the need to modify our INFINITI analyzers. We intend to increase the number of tests offered in each of our target market segments, which will further increase the utility of our INFINITI system to our customers. Our internal test development efforts are generally driven by our customers’ current and anticipated needs, our analysis and projections for the molecular diagnostics market, and our ability to leverage our core competencies such as automation and multiplexing. We have entered into, and expect to continue to enter into, collaborative relationships with leading research and academic institutions for the development of additional or enhanced tests to further increase the depth and breadth of our genetic test menu. Since the initial launch of our INFINITI system in 2007 we have introduced more than five new or enhanced tests per year.

We have received FDA 510(k) clearance for our INFINITI Analyzer and five of our genetic tests, and we have submitted an additional notification to the FDA for 510(k) clearance of our UGT1A1 test. We are finalizing the protocol for a clinical trial necessary to support a premarket approval application, or PMA, for our HPV-HR tests and intend to commence this clinical trial in 2013. The balance of our tests are currently offered for sale in

1

Table of Contents

the United States under the RUO designation. These RUO tests are labeled “For Research Use Only. Not for use in diagnostic procedures.” as required by FDA regulations. We are not permitted to market these products for in vitro diagnostic use, and must maintain distribution controls to assure that these products are not used for diagnostic purposes. We therefore train our personnel to only market these products to laboratories for research or investigational use in the collection of research data, and to not promote any off-label uses of our products. Internationally, we have obtained a Conformité Européenne, or CE, mark for our INFINITI Analyzer, our INFINITI Plus Analyzer and a total of 22 of our tests. This designation is supported by completed clinical and validation studies that demonstrate the analytical performance of each CE marked test. The CE mark facilitates the marketing and sale of our CE marked analyzers and tests in the European Union and the European Economic Area as well as certain other international markets.

Sales of products for which we have received 510(k) clearance accounted for 13%, 8% and 4% of our net revenue for 2010, 2011 and the first nine months of 2012, respectively. The balance of our product sales for those same periods, representing 87%, 92% and 96% of our net revenue for 2010, 2011 and the first nine months of 2012, respectively, were derived from sales of RUO products. These products are offered for sale to allow for the collection of research data, and may only be used in the United States for clinical purposes by laboratories and other facilities certified under CLIA that have incorporated these products into their LDTs pursuant to guidelines issued by the College of American Pathologists. We believe that nearly all of our RUO product sales are incorporated into LDTs. In order to develop an LDT utilizing our products, these certified laboratories and other facilities must develop and validate a test protocol that includes specimen collection, DNA extraction, PCR amplification, hybridization and detection, and data analysis, interpretation and reporting. Our products provide components that can be used by these certified laboratories and other facilities for the PCR amplification, hybridization and detection portions of these LDTs. We sell each of these components individually, as ordered by the customer in its discretion, and not as a kit or system. The validation process engaged in by these certified laboratories and other facilities can involve validation of the sample collection and extraction process, establishing limits of detection and analytical sensitivity, testing for specificity and cross-reactivity, including interfering substances, validation for assay accuracy, precision and reproducibility, and establishing reportable ranges of test results for the test system and reference values that will be measured against as controls. This validation process also requires verifying the result from the LDT against known standard samples or the results of a high-standard laboratory testing method such as sequencing, and can involve the testing of a large number of patient samples. Depending on the availability of patient samples, this process may take from several weeks to several months or more to complete, and thus requires a significant investment by the customer. This validation process must be completed for each of our RUO genetic test components that a customer wishes to incorporate into one of its LDTs.

We believe that all sales of our RUO products in the United States are to customers that are either certified in the manner described above and have incorporated our products into their LDT’s, or that use such products for research only. The FDA has not adopted these guidelines and we are not permitted to represent our RUO products as in vitro diagnostic products. Our decision to seek FDA approvals or clearances domestically, and CE marking internationally, for our genetic tests is made on a test-by-test basis, and is based on a variety of factors, including:

| • | the regulatory environment for the use of genetic tests, in particular the FDA’s requirements and limitations on marketing RUO tests, which may not be marketed as in vitro diagnostic products; |

| • | the demand by our existing and target customers, as expressed to us, for particular genetic tests that have received regulatory approvals or clearances; |

| • | the competitive environment for the use of genetic tests that have received regulatory approvals or clearances versus similar tests that have not; for example, certain of our competitors provide FDA cleared or approved tests in the area of HPV testing, and to compete with those competitors we intend to obtain FDA clearance or approval for certain of our HPV tests as well; and |

2

Table of Contents

| • | the size of the available market for the particular test, given the relatively significant expense and time required to obtain regulatory approvals or clearances. |

For those of our tests for which we have not obtained FDA regulatory clearance or approval, we experience delays of anywhere from a few weeks to several months or more in obtaining revenue from customers that desire to utilize our RUO test consumables during the period of time that the customer is developing its own LDT that incorporates our RUO test.

We believe that we are in compliance with existing FDA rules and regulations governing our business, including those governing the marketing and sale of RUO tests; however, a significant change in existing laws, or their enforcement, may require us to change our business model or our business practices to maintain compliance with these laws. For instance, in June 2011 the FDA issued a Draft Guidance entitled “Commercially Distributed In Vitro Diagnostic Products Labeled for Research Use Only or Investigational Use Only: Frequently Asked Questions,” which, if enforced, would limit our marketing of RUO tests to general discovery laboratories and would require us to halt sales to clinical laboratories that validate and use our RUO tests as part of their LDTs. The FDA has generally exercised its enforcement discretion to not enforce applicable regulations with respect to LDTs. However, the FDA has indicated, since 2010, that it intends to reconsider its policy regarding enforcement and to begin drafting an oversight framework for such tests. If the FDA imposes significant changes to the regulation or enforcement of LDTs, including our RUO tests that are used as LDTs, it may require us to suspend sales of our RUO tests, which together represented 96% of our net revenues for the nine months ended September 30, 2012, and it would require us to seek FDA clearance or approval for our RUO tests, which would in turn require significant time and capital investments on our part and reduce our revenues or increase our costs and adversely affect our business, prospects, results of operations or financial condition. We have not undertaken any specific efforts to comply with this draft guidance. If we were to voluntarily elect to comply with this draft guidance, we would be required to seek regulatory approval for all of our RUO tests that are sold in the United States, which would require significant time and capital investments on our part, significantly reduce our revenues until we obtain regulatory approvals, and significantly increase our capital costs, which could in turn adversely affect our business, prospects, results of operations or financial condition during the affected fiscal periods. Our management currently believes that finalization or enforcement of this draft guidance in its present form is unlikely given the significant adverse effect it would have on a variety of industry participants, and on the ability of physicians to provide effective healthcare.

We believe that compared to traditional genetic testing methods our INFINITI system can significantly improve laboratory productivity, workflow and throughput while reducing the cost per reportable result. We believe that these and other attributes of our INFINITI system decrease the cost and complexity of genetic testing and reduce the need for specialized laboratory personnel, training, equipment and facilities. Our INFINITI system has been designed to enable our customers to start performing, or to more cost-effectively perform, molecular diagnostic tests, which we believe will facilitate acceptance and adoption of our INFINITI system.

We experienced meaningful revenue growth in the first nine months of 2012, with net revenue of $14.5 million during this period, $13.2 million of which was derived from consumables sales, as compared to net revenue of $7.5 million and $8.0 million for fiscal years 2010 and 2011, respectively, of which $3.9 million and $6.8 million was derived from consumables sales, respectively. We expect to continue to generate the substantial majority of our net revenue through the sale of our genetic test consumables for the foreseeable future. As of December 31, 2012, we had 191 INFINITI analyzers placed with customers.

Market Opportunity

Industry Background

Molecular diagnostic testing is used to measure or detect genetic biomarkers associated with a predisposition to, or the presence of, a particular disease or condition, or other genetic variance such as drug

3

Table of Contents

response. The information provided by molecular diagnostic testing may enable physicians to achieve better patient outcomes and better contain health care costs through, for example, earlier diagnosis of disease, improved monitoring of disease progression and more personalized treatment. According to Kalorama Information, an independent market research firm, the global molecular diagnostics market is expected to grow from an estimated $4.8 billion in 2010 to $8.1 billion in 2015, which represents a compound annual growth rate of approximately 11%, a rate we believe will be greater than the growth of the overall diagnostics market.

Current practices in developing and running molecular diagnostic tests typically involve manual and complex procedures that require significant expertise, time and expense. We believe the resource and time constraints of traditional testing methods have limited the growth of the molecular diagnostics market, and that the recent availability of more automated and integrated testing methods will result in accelerated use of molecular diagnostic testing. The growth of the molecular diagnostics market will also depend on increasing physician education regarding the use of genetic testing and greater coverage of tests by insurance carriers. Growing understanding of the utility of genetic information for the diagnosis and treatment of disease, as well the increase in identification of new biomarkers, may lead to increased growth in the molecular diagnostics market.

Our Target Markets

We believe there are additional factors that will continue to drive growth in the molecular diagnostics market segments we target, including:

| • | Personalized Medicine and Companion Diagnostics. The matching of treatment options to a patient’s specific genetic profile has emerged as an important trend in medicine because the efficacy and side-effect profile of certain treatments can be predicted by the presence or absence of specific genetic markers in a particular patient. Better targeted and more effective pharmacogenomic-based treatments have the potential to improve healthcare outcomes and lower healthcare costs. As of December 31, 2012, we offered 23 genetic tests for use in the area of personalized medicine and companion diagnostics, three of which have received FDA 510(k) clearance. |

| • | Pain Management. Pharmacogenomics is playing an integral role in the administration and management of pain medication, as gene mutations can be key factors in determining whether specific pain medications will be effective, or will otherwise result in adverse side effects. As of December 31, 2012, we offered five RUO genetic tests for use in the area of pain management. |

| • | Mental Health. Mental health represents a major component of overall pharmaceutical sales. According to the Centers for Disease Control and Prevention, or CDC, as much as 11% of the U.S. population is taking antidepressants at a given time, while as many as 23% of women between the age of 40 and 59 are on psychiatric medication. As of December 31, 2012, we offered 11 genetic tests for use in the area of mental health, two of which have received FDA 510(k) clearance. |

| • | Cardiovascular Health Assessment. According to the World Health Organization, or WHO, cardiovascular diseases were responsible for 30% of global deaths in 2008. It is estimated that by 2030, 23.6 million people will die from some form of cardiovascular disease. In addition to the increasing prevalence of cardiovascular diseases, the information generated by molecular diagnostic testing is becoming increasingly important for determining the predisposition and treatment of cardiovascular diseases. As of December 31, 2012, we offered 16 genetic tests for use in the area of cardiovascular health assessment, five of which have received FDA 510(k) clearance. |

| • | Women’s Health. We believe the women’s health diagnostics market will continue to grow and represent a substantial market opportunity. Non-molecular tests are commonly employed in this market, but the use of molecular diagnostics is expanding significantly due to increased applications, |

4

Table of Contents

| better performance and better clinical discriminatory capabilities. As of December 31, 2012, we offered 15 RUO genetic tests for use in the area of women’s health. |

| • | Cancer and Companion Diagnostics. Because of the high cost of many cancer therapeutics, and the varied levels of efficacy and toxicity across different patients, tests to diagnose or direct the treatment of, or to determine the predisposition to, various forms of cancer are becoming increasingly important. As of December 31, 2012, we offered 23 RUO genetic tests for use in the area of cancer and companion diagnostics. |

| • | Infectious Diseases. According to the WHO, infectious diseases caused approximately 20% of all recorded deaths in 2008. Within this group, HIV, tuberculosis, or TB, and respiratory infections were the top three contributors to overall mortality in adults aged 15-59, at 35%, 21% and 10%, respectively. Molecular diagnostic testing offers advantages in identifying infectious disease pathogens compared to traditional testing methods. As of December 31, 2012, we offered 15 RUO genetic tests for use in the area of infectious diseases. |

| • | Genetic Disorders. Genetic and inherited disease testing is a cornerstone of molecular diagnostic testing. Molecular diagnostic tests offer significant advantages over prior, often subjective, forms of diagnosis. As of December 31, 2012, we offered six RUO genetic tests for use in the area of genetic disorders; however, we did not have any material sales or net revenue from sales of genetic tests in the area of genetic disorders during the year ended December 31, 2012. |

| • | Newborn Screening. Many common newborn screening panels require the identification of multiple (often five or more) genetic markers which makes traditional testing impractical. Classic testing algorithms are limited in that they utilize subjective analysis of a newborn’s parental health history with little to no genetic evaluation. Targeted genetic evaluation can inform the clinician if the newborn is at risk for developing the disease in question. As of December 31, 2012, we offered four RUO genetic tests for use in the area of newborn screening; however, we did not have any material sales or net revenue from sales of genetic tests in the area of newborn screening during the year ended December 31, 2012. |

| • | Blood Banking. As genetic testing products have become more prevalent, more accurate and more cost-effective, the use of genetic tests in screening in the blood banking market has grown, and is expected to continue to grow. As of December 31, 2012, we did not offer any tests for use in the area of blood banking, and did not have any sales or net revenue in the blood banking market during the year ended December 31, 2012. |

As is noted in the tables appearing in “Business — Our Current Test Menu”, many of our 53 genetic tests may be utilized in more than one of our target markets, resulting in particular genetic tests being counted multiple times in the information presented above.

The Limitations of Traditional Testing Methods

Traditional testing platforms to detect genetic biomarkers have a number of drawbacks, which we believe have significantly limited their use, including:

| • | High cost per reportable result; |

| • | Impractical for use by smaller reference labs, hospitals and specialty clinics; |

| • | Limited testing menu; |

| • | Inability to multiplex; |

| • | Limited automation and throughput capability; |

| • | Need for specialized labor; and |

5

Table of Contents

| • | Inaccurate results and challenges with reproducibility. |

These limitations have created the need in the molecular diagnostics market for a highly integrated system to perform a large menu of automated, cost-effective and easy to use tests with a high degree of accuracy and reproducibility.

The AutoGenomics Solution

Our INFINITI system has been designed to enable a broad range of reference laboratories, hospital laboratories and specialty clinics to start performing, or to more cost-effectively perform, molecular diagnostic testing, which we believe will drive adoption and use of our INFINITI system as well as expand the potential of the molecular diagnostic testing market.

To use our system, an operator loads the prepared test samples into an INFINITI analyzer, along with the specific BioFilmChip and Intellipac Reagent Management Module, for the desired test. Once the INFINITI analyzer is loaded and the test is initiated, no further action by the operator is required. After the test is completed, the system generates an electronic report that can be transmitted directly to a laboratory information system.

Our INFINITI system has a number of key advantages, including:

| • | Enhanced cost-efficiency. Our system eliminates the need for complex protocols and manual intervention once a test is initiated, which is intended to reduce the laboratory’s cost of testing by simplifying workflow and reducing the need for highly skilled technicians. |

| • | Ability to decentralize molecular diagnostics. We believe that medium-sized reference laboratories, hospital laboratories and specialty clinics are increasingly seeking to add or expand molecular diagnostics capabilities to treat patients more efficiently and provide a more comprehensive offering, lower the cost of providing healthcare, and participate in the value provided by diagnostic testing. We believe that this trend is being facilitated in part by new technologies like ours that are more automated, easier to use, more cost-effective and require less bench space in a laboratory than traditional genetic testing methods. |

| • | Broad menu of tests. As of December 31, 2012, we offered 53 tests as part of our INFINITI system, of which five have received FDA clearance. The balance of our tests are sold on an RUO basis. We believe that this represents one of the broadest available test menus on a single system. We believe that the depth and breadth of our test menu is a strong competitive advantage that will allow our customers to utilize laboratory space, labor and capital investment more efficiently. We also believe that our offering of five FDA cleared tests is comparable to similar testing system offerings of our competitors, which we believe based on publicly available information ranges from zero to seven FDA-cleared tests. As we increase the number of tests available for use on our INFINITI system, laboratories using our system will be able to broaden their molecular diagnostics offerings without significant additional capital investment or operator training. |

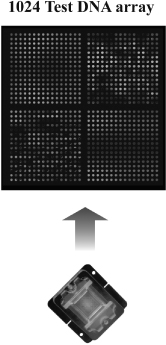

| • | Ability to multiplex. Many diseases and patient responses to therapy are caused by multiple genetic mutations that necessitate testing for multiple biomarkers to diagnose those diseases or to predict and/or monitor therapy response. Our INFINITI system is able to detect up to 1,024 individual features of biochemical sensors within a single microarray, which reduces the amount of sample needed, reduces the time required to run the test, and often reduces the need for multiple tests. |

| • | Multiple patient array technology. Our proprietary multiple patient array, or MPA, technology is designed to test up to eight patient samples on a single microarray. This significantly enhances throughput by up to |

6

Table of Contents

| 300% while reducing cost per sample by up to 75% as compared to our single patient microarrays. Our MPA technology is particularly well suited for addressing high volume test markets such as HPV and TB. |

| • | Better workflow. Our broad offering of INFINITI analyzers combined with the integrated, “load and go” design of the INFINITI system is designed to address our target customers’ varied throughput and workflow requirements. We believe that we can substantially increase a laboratory’s workflow by enabling them to perform their tests on our highly integrated and automated system that has the ability to multiplex and run high volume MPAs. The INFINITI system can run multiple different tests simultaneously which reduces or eliminates the need for laboratories to run tests in batches. |

| • | Increased accuracy of results. Human handling of samples is the most common cause of contamination in existing technologies. By reducing the risk of human error and contamination, we believe that our INFINITI system can provide more accurate and more reproducible test results compared to other, less automated systems. In addition, where certain systems only use target or signal amplification (e.g., polymerase chain reaction, or PCR, amplification), we believe that our combined target and signal amplification technologies can increase the sensitivity and specificity over these widely used stand-alone amplification methods. |

Our Products

Our INFINITI Analyzers

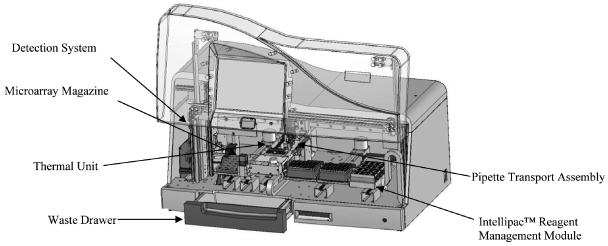

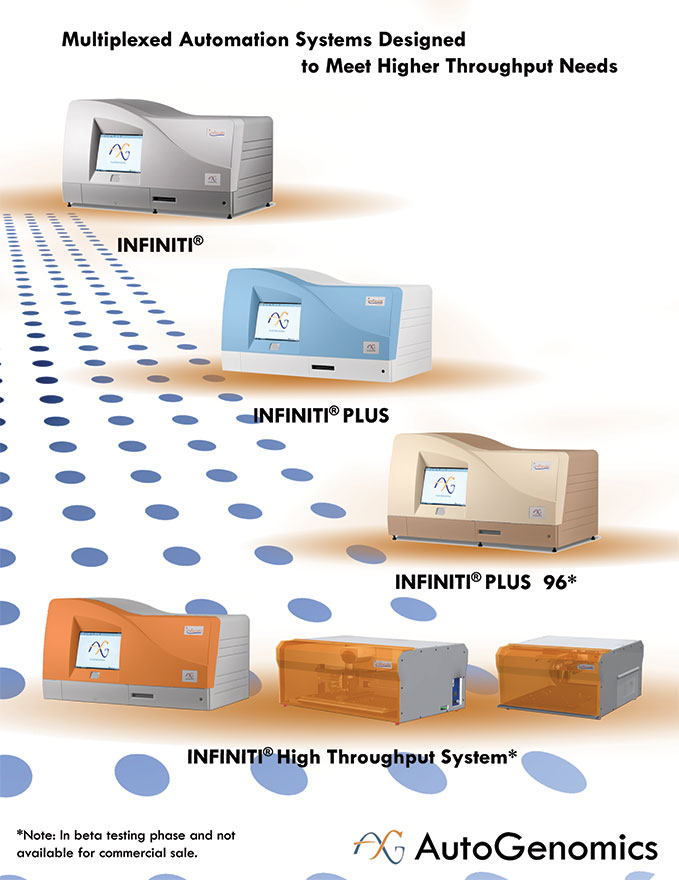

Our INFINITI system includes a family of analyzers, each of which is designed to address customer-specific needs based on the customer’s productivity, workflow and throughput requirements. Our INFINITI analyzers integrate and automate the discrete processes of sample handling, reagent management, hybridization, detection, results analysis and reporting in a self-contained system. They have been designed to operate on a “load and go” basis, which means that to run a genetic test, an operator loads prepared samples into the INFINITI analyzer along with the BioFilmChip microarrays and the Intellipac Reagent Management Modules specific to that test. From the perspective of the operator, the test protocols are substantially identical for all of our genetic tests, which eliminates the need to retrain operators when additional tests are added. After the test is completed, the INFINITI analyzer generates an electronic report that can be transmitted directly to a laboratory information system. Our BioFilmChips and Intellipac Reagent Management Modules are test-specific, but are not analyzer-specific, so all of our INFINITI analyzers use substantially the same consumables.

The following table illustrates the test capabilities of our different INFINITI analyzers:

| Analyzer |

Capacity per run |

Patient results * | ||

| INFINITI |

24 samples | up to 96 per day | ||

| INFINITI PLUS |

48 samples | up to 192 per day | ||

| INFINITI PLUS 96 (in beta testing) |

96 samples | up to 288 per day | ||

| INFINITI HTS (in beta testing) |

384 samples | up to 1,152 per day |

| * | numbers presented are based on average time to complete an HPV-HR Quad test run |

Selected Key Tests

We have a demonstrated track record of successfully developing genetic tests that leverage our core competencies and that address current and anticipated customer needs. We believe that by offering a wide variety of tests for each of our target market segments, we will provide significant value to our customers in these areas

7

Table of Contents

by allowing them to consolidate multiple testing platforms, expand their testing capabilities, increase workflow, reduce costs, and limit additional investment in equipment, personnel and training. Some of our key test offerings in our focus market segments currently include:

| • | HPV. We have developed four HPV tests, which are designed for screening and/or genotyping and each of which addresses a different segment of the HPV testing market. Our tests include our HPV-HR Quad and HPV-HR Hex tests, designed to screen for and genotype 14 high-risk types of HPV simultaneously, our HPV Quad test, designed to screen for 13 high-risk and two low-risk types of HPV and our HPV Genotyping test, designed to identify 26 types of HPV. Our HPV-HR Quad, HPV-HR Hex and HPV Quad tests are designed to allow a laboratory to test samples from four to six different patients simultaneously on a single BioFilmChip. We believe our tests offer several competitive advantages: consolidation of multiple testing steps, better automation, reduction of sample requirements and enhanced accuracy and reproducibility. We plan to seek a PMA for our HPV-HR tests and 510(k) clearance for our HPV Genotyping test. Our HPV-HR Quad, HPV Quad and HPV Genotyping tests have been CE marked. |

| • | Other STDs. We have launched a variety of panels consisting of tests that our customers use to identify numerous organisms associated with sexually transmitted diseases, or STDs. Our panels are designed to screen for multiple STDs in a single sample. |

| • | Breast Cancer. We have developed tests such as our CHEK-2 and the Breast Cancer Panel-AJ tests, which are designed to identify individuals at greater risk for breast cancer, and our CYP450 2D6T test, which is designed to determine if a woman will benefit from tamoxifen, a frequently prescribed drug for the prevention of breast cancer recurrence. |

| • | Colorectal Cancer. We have developed KRAS and KRAS-BRAF tests, which enable laboratories to identify certain genetic mutations associated with poor response to anti-epidermal growth factor receptor, or EGFR, therapies. |

| • | Personalized Medicine. One of our leading personalized medicine offerings is our CYP450 2C19 Panel test, which is designed to enable laboratories to identify certain gene variants that affect the metabolism and efficacy of the anticoagulant drug Plavix (clopidogrel). Our other leading tests in this area currently include our CYP450 2C19 Plus, Warfarin and CYP450 2D6I tests, which are designed to enable laboratories to identify certain gene variants associated with responsiveness to certain medications for psychiatric disorders, the oral anticoagulant Warfarin and certain antidepressants and cancer drugs, respectively. |

| • | Infectious Disease. Our Multidrug Resistance Tuberculosis (MDR-TB) test is a multiplexed test that can identify Mycobacterium tuberculosis infections (as opposed to nontuberculous mycobacterium infections) while simultaneously determining resistance to the three front-line TB treatments: rifampin, isoniazid and pyrazinamide. |

| • | Genetic Disorders. Our Familial Mediterranean Fever (FMF) panel multiplexes multiple markers into a single test that allows simultaneous identification of the five most common FMF variations as well as eight other variations spanning 14 ethnicities. |

| • | Newborn Screening. Our Ashkenazi Jewish Panel is capable of simultaneously detecting 31 genetic variants that account for eight diseases commonly found among those of Ashkenazi Jewish descent. |

| • | Blood Banking. We have several tests for blood typing and infectious disease screening currently in development that are intended to take advantage of our multiplexed automation capabilities. |

8

Table of Contents

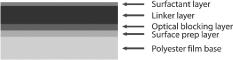

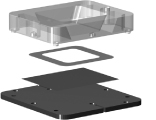

BioFilmChip

Our proprietary BioFilmChip microarrays consist of multiple layers of a hydro-gel matrix coated on polyester film sandwiched between a plastic base and a reaction body to form a microarray. Our microarrays are printed with 36 to 1,024 individual features of biochemical sensors depending on the requirements of the test. These spotted microarrays are then packaged into specifically designed magazines and are used on all of our INFINITI analyzers.

Intellipac Reagent Management Module

Our proprietary Intellipac Reagent Management Modules hold the reagent needed to run our specific genetic tests. Our reagent module is designed to communicate all relevant information about a test to the INFINITI analyzer without any intervention from the operator, saving time and reducing errors. A read-write memory chip embedded in the module saves test-specific information on the module, including reagent identification, expiration dates, lot number, amount of reagent remaining for future tests, specific instructions for test processing, the time last used and the serial number for the instrument.

Our Strategy

Our objective is to become a leading provider of genetic tests to a broad array of customers within our target market segments. We believe our INFINITI system will allow us to achieve this objective by facilitating molecular diagnostic testing by reference laboratories, hospital laboratories and specialty clinics. To achieve our objective, we intend to:

| • | Capitalize on the capabilities of our INFINITI system to increase penetration within our target market segments. We believe that our INFINITI system’s high level of automation, ability to multiplex and broad test menu are attractive to our target customers in our target market segments as our genetic tests provide an easy to use solution with greater breadth of diagnostic information at a lower cost per reported result than many competing systems. |

| • | Develop and launch new and enhanced tests. We believe that developing a broad menu of genetic tests to run on our system will increase the value of our INFINITI system, drive additional placements of our INFINITI analyzers and increase our consumables sales. We believe that the depth and breadth of our test menu is a significant competitive advantage that will allow customers to increase their ability to conduct molecular testing and utilize laboratory space, labor and capital investment more efficiently, as well as generate supplementary revenue. In addition, the depth and breadth of our test menu diversifies our revenue so that we are not dependent on the performance of any single test. The majority of tests that we offer, are developing and intend to develop have established market demand and reimbursement by public and private payors. |

| • | Target molecular diagnostic laboratories with high potential utilization of our INFINITI system. We believe that our INFINITI system’s automation, broad genetic test menu and family of analyzers designed to address various throughput requirements will generate demand from both larger reference laboratories seeking a more flexible and efficient molecular diagnostic platform and from smaller reference laboratories, hospital laboratories and specialty clinics for whom it has not previously been cost-effective to develop their own tests. |

| • | Expand our domestic sales force and international distribution of our products. We are marketing and selling the INFINITI system in the United States through our own sales and marketing organization and believe there is a meaningful opportunity to further penetrate existing markets and customers as well as enter new markets by expanding our U.S. sales force. We also plan to expand our global distribution networks to address increasing international demand in addition to driving increased utilization with our existing distributors. |

9

Table of Contents

| • | Pursue regulatory clearances, approvals and certifications for products and facilities, as necessary. We have received FDA 510(k) clearance for our INFINITI Analyzer and five of our genetic tests, and we have submitted an additional notification to the FDA for 510(k) clearance of our UGT1A1 test. We are finalizing the protocol for a clinical trial necessary to support a PMA application to the FDA for our HPV-HR tests and intend to commence the clinical trial in 2013. We intend to seek regulatory clearance or approval, as necessary, for our tests. |

| • | Align with key opinion leaders at leading institutions and increase scientific awareness of our products. We align with key opinion leaders at leading institutions and clinical research laboratories to help to increase awareness of our system, to demonstrate its benefits relative to existing technologies and to accelerate its adoption in the molecular diagnostics market. We also seek to increase awareness of our products through participation at trade shows, academic conferences, online webinars and hospital-based grand, or teaching, rounds. In addition, our INFINITI system has been discussed in several published peer review articles. |

Risks Affecting Us

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” elsewhere in this prospectus, including the following:

| • | There is limited information available to evaluate our business, as we have a limited operating history and limited current revenue; |

| • | We have a long history of losses and negative cash flows and may not be able to maintain profitability in the current fiscal year or in future fiscal periods; |

| • | The vast majority of our net revenue (96% for the nine month period ended September 30, 2012) is derived from the sale of products designated for research use only; changes in RUO regulations or the FDA’s enforcement discretion with respect to RUO regulations, or violations of these regulations by us, could significantly limit our ability to sell our products to our target customers, or otherwise require us to obtain regulatory approvals for our products at considerable time and expense; |

| • | Some of our existing indebtedness will come due and be payable in the immediate future, and we do not have the resources to satisfy this indebtedness absent the completion of this offering; |

| • | After completing this offering, we may not be able to meet our cash requirements without obtaining additional capital, and if we are unable to do so, we may have to curtail or cease operations; |

| • | Our financial results depend on commercial acceptance of the INFINITI system and its tests and the development of additional tests; |

| • | We currently derive a significant portion of our revenue from a few customers; |

| • | Many of our competitors are large and well capitalized, and we face significant competition; |

| • | The molecular research use and diagnostic market may fail to fully develop, or we may fail to capture a significant share of that market; |

| • | If the medical relevance of the biomarkers targeted by our tests is not demonstrated or is not recognized by others, we may experience reduced demand for our products; |

| • | We have identified material weaknesses and significant deficiencies in our internal controls; and |

| • | Our success will depend in part on our ability to operate without infringing or misappropriating the proprietary rights of others, on our ability to own or license patents that are adequate to reduce competition and on our ability to license intellectual property from third parties for certain tests and manufacturing processes needed for our business. |

10

Table of Contents

Corporate Information

We were incorporated as Neuron Technologies, Incorporated in California in April 1999, and changed our name to AutoGenomics, Incorporated in August 2000. We subsequently changed our name to AutoGenomics, Inc. in October 2002. We reincorporated in Delaware in November 2008. Our principal executive offices are located at 2980 Scott Street, Vista, California, 92081. Our telephone number is (760) 477-2248. Our website address is www.autogenomics.com. Information contained in or that can be accessed through our website is not incorporated by reference into this prospectus and should not be considered to be part of this prospectus.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. As an emerging growth company, we are eligible to comply with less stringent disclosure requirements than those applicable to larger, more established companies. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,” and references herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

Recent Financial Results

We are finalizing our financial results as of and for the year ended December 31, 2012. Complete financial information and operating data as of and for such period are not available, and we believe that this data will not be available prior to the completion of this offering; however, based on the preliminary information and data available, our management estimates that for the three months ended December 31, 2012, our net revenue will range between $4.0 million and $4.2 million, as compared to net revenue of $2.8 million for the three months ended December 31, 2011, and as compared to net revenue of $5.8 million for the three months ended September 30, 2012; and our loss from operations will range between $1.3 million and $1.6 million, as compared to a loss from operations of $0.8 million for the three months ended December 31, 2011, and as compared to income from operations of $1.5 million for the three months ended September 30, 2012. Taken together with the statement of operations financial data for the nine months ended September 30, 2012 included elsewhere in this prospectus, these estimates would result in income from operations for the year ended December 31, 2012 to range between $1.7 million and $2.0 million, as compared to losses from operations of $6.8 million and $16.5 million for the years ended December 31, 2011 and 2010, respectively.

Net revenue during the three months ended December 31, 2012 was impacted positively as compared to the three months ended December 31, 2011 primarily due to increases in INFINITI analyzer and consumables sales, and was impacted negatively as compared to the three months ended September 30, 2012 by decreased sales of consumables to a key customer, partially offset by increased sales of INFINITI analyzers. We believe the decrease in sales of consumables to this key customer was the result of this customer having increased its purchases of equivalent products from one of our competitors in October and November 2012. We have taken steps to recapture purchases by this key customer and we believe that the recent volume decrease was temporary, as consumables sales to this customer began to increase in December 2012; however, we can provide no assurance that either sales volume or net revenue from this key customer will return to levels we observed in the third quarter of 2012, or that either or both will not decrease further, in future quarters.

Income/(loss) from operations during the three months ended December 31, 2012 was impacted positively as compared to the three months ended December 31, 2011 primarily due to increases in INFINITI analyzer and consumables sales and higher gross margins resulting from a shift in product sales mix that reflected increased

11

Table of Contents

sales of consumables as compared to sales of INFINITI analyzers, and was impacted negatively as compared to the three months ended September 30, 2012 primarily as a result of significantly lower gross profit from decreased consumable sales to a key customer, a significant increase in operating expenses associated with the estimated accounts receivable reserve described below, and lower gross margins resulting from a shift in product sales mix that reflected increased sales of INFINITI analyzers as compared to sales of consumables.

We are unable to estimate with reasonable specificity our net income/(loss) and net income/(loss) per share attributable to common stockholders (basic and diluted) for the three months, and for the year, ended December 31, 2012, primarily due to the impact on such financial measures of certain non-cash charges that we expect to take during these periods, the determination of which have not yet been made. These determinations include the impact on our financial results for the three months, and for the year, ended December 31, 2012 of:

| • | Our exchange in November 2012 of subordinated promissory notes for 4,287,074 shares of Series NC convertible preferred stock, which we anticipate will be treated as an exchange of debt for what we currently estimate to be equity of equal value based on the fair value of the debt and equity on the exchange date. If we were to determine in connection with finalizing our financial results for the three months, and for the year, ended December 31, 2012, that the Series NC convertible preferred stock was not issued at fair value on the issue date, but rather at a discount, then we would be required to recognize a non-cash charge for the three months, and for the year, ended December 31, 2012 in an amount equal to the amount of that discount, which would increase our net loss for that period. For example, if we were to determine that the fair value of the Series NC convertible preferred stock at the date of issue was $2.00 per share (rather than the $1.75 per share that we currently estimate), then the discount on the date of issue would be $0.25 per share ($1.1 million in the aggregate), and if we were to determine that the fair value of the Series NC convertible preferred stock at the date of issue was $2.50 per share (rather than the $1.75 per share that we currently estimate), then the discount on the date of issue would be $0.75 per share ($3.2 million in the aggregate). This discount would then increase our net loss for the three months, and for the year, ended December 31, 2012. |

| • | The issuance in November 2012 of common stock warrants in connection with the exchange of debt for Series NC convertible preferred stock, the fair value of which we anticipate will be recognized as a charge against the proceeds of the Series NC convertible preferred stock, with an offsetting charge against additional paid in capital, and which will not affect our income statement. The fair value of these issued common stock warrants will be determined using the Black-Scholes valuation model. We estimate that this charge against proceeds and against additional paid in capital will range between $1.7 million and $2.2 million. |

| • | Our exchange in November 2012 of subordinated promissory notes and warrants to purchase common stock for new subordinated promissory notes with extended maturity dates and warrants to purchase common stock, which we anticipate will be recorded in our financial statements for the three months, and the year, ended December 31, 2012 as an extinguishment of debt in accordance with FASB ASC 470-50, and which we anticipate will be recorded at fair value on the exchange date as calculated using future discounted cash flows, and the issuance in November 2012 of common stock warrants in connection with the exchange of debt for new debt with extended maturity dates, the fair value of which we anticipate will be recorded as a discount to the new debt and will be amortized over the three year term of the new debt using the effective interest method. The fair value of these issued common stock warrants will be determined using the Black-Scholes valuation model. We estimate that the result of this exchange and accounting treatment will result in a non-cash charge in a range between $0.2 and $0.5 million for the three months, and for the year, ended December 31, 2012. This non-cash charge, once determined, will be recognized in each of our fiscal quarters going forward for the entire three-year term of the new debt. If the offering referred to in this prospectus is consummated and our outstanding promissory note indebtedness is paid in full from the proceeds of this offering, as is |

12

Table of Contents

| expected, then the remaining unamortized portion of this non-cash charge will be recognized in the same fiscal quarter that our outstanding promissory note indebtedness is paid in full. |

In addition, we expect to recognize the deferred costs we incurred in connection with our November 2012 debt-to-equity exchange transaction, which we estimate were approximately $0.3 million, as a non-cash charge for the three months, and for the year, ended December 31, 2012, and we expect to recognize the deferred costs we incurred in connection with our November 2012 debt-for-debt exchange transaction, which we estimate were approximately $0.7 million, as a non-cash charge over the three year term of the new debt, which we estimate will result in a non-cash charge of $0.1 million for the three months, and for the year, ended December 31, 2012. If the offering referred to in this prospectus is consummated and our outstanding promissory note indebtedness is paid in full from the proceeds of this offering, as is expected, then the remaining unamortized portion of these deferred costs will be recognized as a non-cash charge in the same fiscal quarter that our outstanding promissory note indebtedness is paid in full.

Each of these above non-cash items, when determined, will impact our net income/(loss) and net income/(loss) per share attributable to common stockholders (basic and diluted) for the three months, and for the year, ended December 31, 2012. If we were to determine that each of the above non-cash items were to be at the low end of the estimated ranges and examples presented above, based on the preliminary information and data available, and using our estimated range of loss from operations for the same period described above, our management estimates that for the three months ended December 31, 2012, our net loss would range between $1.9 million and $2.2 million, as compared to a net loss of $1.9 million for the three months ended December 31, 2011, and as compared to net income of $0.7 million for the three months ended September 30, 2012. Taken together with the statement of operations financial data for the nine months ended September 30, 2012 included elsewhere in this prospectus, these estimates would result in net income for the year ended December 31, 2012 to range between $1.1 million and $1.4 million, as compared to net losses of $10.0 million and $19.7 million for the years ended December 31, 2011 and 2010, respectively. If we were to determine that each of the above non-cash items were to be at the top end of the estimated ranges and examples presented above, based on the preliminary information and data available, and using our estimated range of loss from operations for the same period described above, our management estimates that for the three months ended December 31, 2012, our net loss would range between $5.4 million and $5.7 million, as compared to a net loss of $1.9 million for the three months ended December 31, 2011, and as compared to net income of $0.7 million for the three months ended September 30, 2012. Taken together with the statement of operations financial data for the nine months ended September 30, 2012 included elsewhere in this prospectus, these estimates would result in a net loss for the year ended December 31, 2012 to range between $2.4 million and $2.7 million, as compared to net losses of $10.0 million and $19.7 million for the years ended December 31, 2011 and 2010, respectively.

As of December 31, 2012, approximately $1.1 million in accounts receivable from a key customer were past due 90 days or more. We have not finalized our assessment of the collectability of these receivables; however, for the purposes of the estimates provided above, we have reserved this entire past due amount. If we determine that we are able to reduce this reserved amount, it would have a positive impact on our income/(loss) from operations, as well as our net income/(loss) and our net income/(loss) per share attributable to common stockholders (basic and diluted), for the three months, and the year, ended December 31, 2012.

The preliminary financial data and accounting treatment information above has been prepared by, and is the responsibility of, our management. Our independent registered public accounting firm has not audited, reviewed, compiled, or performed any procedures with respect to this preliminary financial data and accounting treatment information and does not express an opinion or any other form of assurance with respect thereto. Because the three months ended December 31, 2012 has recently ended, the unaudited net revenue, income/(loss) from operations and net income/(loss) information presented above for the three months and year ended December 31, 2012 has not yet been subject to our normal quarterly financial closing processes, reflects estimates based only

13

Table of Contents

upon preliminary information available to us as of the date of this prospectus, and is not a comprehensive statement of our financial results for the three months, or for the year, ended December 31, 2012. We believe that our financial statements and operating data as of and for the three months and the year ended December 31, 2012 will not be available until after this offering is completed and may differ from the unaudited net revenue, income/(loss) from operations and net income/(loss) information we have provided. Such differences may be material. Accordingly, the net revenue, income/(loss) from operations and net income/(loss) information and accounting treatment information presented should not be viewed as a substitute for full interim financial statements prepared in accordance with GAAP, and undue reliance should not be placed on these preliminary estimates. These preliminary estimates are not necessarily indicative of any future period and should be read together with “Risk Factors,” “Special Note Regarding Forward-looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Selected Financial Data” and our financial statements and related notes included elsewhere in this prospectus.

14

Table of Contents

The Offering

| Common stock to be offered by us |

6,000,000 shares |

| Common shares to be outstanding immediately after this offering |

16,746,791 shares |

| Overallotment option |

We have granted the underwriters an option for 30 days from the date of this prospectus to purchase up to 900,000 additional shares of our common stock at the initial public offering price to cover overallotments. |

| Use of proceeds |

We anticipate that we will use the net proceeds from this offering to (i) repay the principal and interest under our outstanding promissory notes, (ii) fund the expansion of our sales force, enhance our international distributor network, and increase our marketing and promotional activity and business development efforts, (iii) support a PMA for our HPV-HR tests and 510(k) and CE mark studies and submissions for several tests associated with women’s health and personalized medicine, (iv) fund research and development activities to add new or enhanced tests to our menu, (v) fund the expansion of our manufacturing capacity and efficiency, including purchasing automation equipment, (vi) satisfy outstanding accounts payable to advisors and service providers incurred in connection with certain of our prior capital raising activities conducted from 2008 through 2010, and (vii) make payment of past due amounts owed to our landlord. We anticipate that we will use the remainder of the net proceeds from this offering for additional working capital and general corporate purposes. See “Use of Proceeds.” |

| NASDAQ Global Market listing |

We have applied to list our common stock on the NASDAQ Global Market under the symbol “AGMX.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common stock. |

The number of shares of common stock outstanding after this offering is based on the following as of December 31, 2012: 2,855,771 shares of common stock, and 1,579,227 shares of Series A Convertible Preferred Stock, 4,468,369 shares of Series B Convertible Preferred Stock, 6,417,680 shares of Series C Convertible Preferred Stock, 3,423,258 shares of Series D Convertible Preferred Stock, 732,555 shares of Series E Convertible Preferred Stock and 4,287,074 shares of Series NC Convertible Preferred Stock which will convert into an aggregate of 7,891,020 shares of common stock in connection with the completion of this offering, and excludes as of that date:

| • | 1,549,720 shares of common stock issuable upon exercise of options outstanding at a weighted average exercise price of $5.16 per share; |

| • | 465,328 and 82,500 shares of common stock reserved for future issuance under our 2008 Equity Incentive Plan and 2008 Employee Stock Purchase Plan, respectively; and |

| • | warrants to purchase 3,372,711 shares of common stock at a weighted average exercise price of $6.08 per share and warrants to purchase 371,300 shares of our preferred stock which will become warrants to purchase 133,488 shares of common stock at a weighted average exercise price of $10.78 per share in connection with the completion of this offering. |

15

Table of Contents

Unless otherwise indicated, all information in this prospectus assumes an initial public offering price of $10.00 per share, the midpoint of the range on the cover page of this prospectus, and gives effect to the 1-for-0.33 reverse split of our common stock that we effected in January 2013.

Effective immediately prior to the completion of this offering, each outstanding share of our Series A Convertible Preferred Stock will convert into 0.6600 shares of our common stock, each outstanding share of our Series B, Series C and Series E Convertible Preferred Stock will convert into 0.3595 shares of our common stock, each outstanding share of our Series D Convertible Preferred Stock will convert into 0.3674 shares of our common stock and each outstanding share of our Series NC Convertible Preferred Stock will convert into 0.3300 shares of our common stock. The conversion into common stock of our Series C, Series E and Series NC Convertible Preferred Stock is predicated on the offering referred to in this prospectus resulting in net proceeds to us of $25 million or more. Our outstanding warrants to purchase our convertible preferred stock will automatically become exercisable for shares of our common stock in connection with the completion of this offering.

Except as otherwise indicated, all information in this prospectus assumes:

| • | no issuance of any options under our 2008 Equity Incentive Award Plan after December 31, 2012 and no exercise of any outstanding warrants or options after December 31, 2012; and |

| • | no exercise by the underwriters of their overallotment option. |

As of December 31, 2012, we had outstanding total indebtedness and accrued interest under promissory notes of approximately $17.5 million, of which approximately $2.3 million in principal amount was in payment default. In November 2012, the holders of $7.5 million in aggregate principal amount of and accrued interest on our outstanding subordinated promissory notes with rates of interest ranging from six percent to 12% that were then past due or scheduled to come due in the immediate future surrendered their right to payment of those promissory notes in exchange for an aggregate of 4,287,074 shares of our Series NC Convertible Preferred Stock. In connection with this surrender and issuance, these noteholders surrendered warrants for the purchase of an aggregate of 637,813 shares of our common stock with exercise prices ranging from $5.24 per share to $15.15 per share in exchange for warrants of a like tenor for the purchase of an aggregate of 637,813 shares of our common stock with exercise prices of $4.55 per share that are exercisable through November 2017. Also in November 2012, the holders of $14.4 million in aggregate principal amount of and accrued interest on our outstanding subordinated promissory notes with rates of interest ranging from six percent to 13% that were then past due or scheduled to come due in the immediate future surrendered their right to payment of those promissory notes in exchange for new promissory notes in aggregate principal amount of $14.4 million with eight and one-half percent rates of interest and November 2015 maturity dates. In connection with this surrender and issuance, these noteholders surrendered warrants for the purchase of an aggregate of 1,156,013 shares of our common stock with exercise prices ranging from $5.24 per share to $15.15 per share in exchange for warrants of a like tenor for the purchase of an aggregate of 1,734,020 shares of our common stock with exercise prices of $5.30 per share that are exercisable through November 2017. As of November 27, 2012, after giving effect to these actions, we had outstanding total indebtedness and accrued interest under promissory notes of approximately $17.4 million, of which approximately $2.9 million was past due or scheduled to come due in the immediate future, and outstanding warrants to purchase an aggregate of 3,372,711 shares of our common stock.

On December 28, 2012, Tregale Group Ltd, the holder of approximately $2.2 million in principal amount under our promissory notes that had been in default beginning in the first quarter of 2012, filed a request for judicial intervention and motion for summary judgment in lieu of complaint, demanding payment of the principal and interest outstanding under its promissory notes as well as reimbursement of certain legal and other expenses. See “Business—Legal Proceedings” elsewhere in this prospectus. In January 2013, we issued and sold a

16

Table of Contents

subordinated promissory note in the amount of $2.4 million to one of our existing investors, who is a holder of more than 5% of our capital stock. This promissory note has a maturity date of March 31, 2013, an annual interest rate of 8.5%, and is prepayable at any time without premium or penalty. We used the proceeds of this sale to retire the outstanding principal and interest owed to Tregale Group Ltd under our outstanding promissory notes, and are negotiating with Tregale Group Ltd with respect to the reimbursement of its legal and other expenses, and the dismissal of the lawsuit.

17

Table of Contents

Summary Financial Data

The following tables provide our summary financial data and should be read in conjunction with our audited financial statements, the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. The summary statement of operations data for each of the years ended December 31, 2010 and 2011 were derived from our audited financial statements appearing elsewhere in this prospectus. The summary statement of operations data for the nine months ended September 30, 2011 and September 30, 2012 and the summary balance sheet data as of September 30, 2012 were derived from our unaudited financial statements. The unaudited financial data, in management’s opinion, have been prepared on the same basis as the audited financial statements and related notes included elsewhere in this prospectus, and include all adjustments, consisting only of normal recurring adjustments, that our management considers necessary for a fair presentation of the information for the periods presented. The results of operations for the nine months ended September 30, 2012 are not necessarily indicative of the results that may be expected for the year ended December 31, 2012 or any other period.

| Years ended December 31, | Nine months ended September 30, | |||||||||||||||

| 2010 | 2011 | 2011 | 2012 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Statement of operations data: |

||||||||||||||||

| Net revenue |

$ | 7,504 | $ | 8,005 | $ | 5,166 | $ | 14,473 | ||||||||

| Cost of sales |

7,666 | 6,019 | 4,378 | 5,035 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit/(loss) |

(162 | ) | 1,986 | 788 | 9,438 | |||||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

3,560 | 2,768 | 2,146 | 1,724 | ||||||||||||

| General and administrative |

5,376 | 3,360 | 2,587 | 2,775 | ||||||||||||

| Sales and marketing |

4,717 | 2,672 | 2,023 | 1,655 | ||||||||||||

| Impairment of film coating equipment |

981 | — | — | — | ||||||||||||

| Initial public offering costs - terminated offering |

1,752 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

16,386 | 8,800 | 6,756 | 6,154 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income/(loss) from operations |

(16,548 | ) | (6,814 | ) | (5,968 | ) | 3,284 | |||||||||

| Interest expense, net |

(4,109 | ) | (3,626 | ) | (2,598 | ) | (1,913 | ) | ||||||||

| Other income/(expense), net |

36 | (2 | ) | — | 5 | |||||||||||

| Change in fair value of warrant liabilities |

926 | 445 | 434 | (170 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income/(loss) |

(19,695 | ) | (9,997 | ) | (8,132 | ) | 1,206 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income/(loss) per share attributable to common stockholders |

||||||||||||||||

| Basic |

$ | (7.63 | ) | $ | (3.79 | ) | $ | (3.09 | ) | $ | 0.45 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | 0.13 | ||||||||||||||

|

|

|

|||||||||||||||

| Shares used to compute net income/(loss) per share attributable to common stockholders |

||||||||||||||||

| Basic |

2,581,708 | 2,634,385 | 2,633,929 | 2,651,833 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

9,148,420 | |||||||||||||||

|

|

|

|||||||||||||||

18

Table of Contents

| As of September 30, 2012 | ||||||||||||

| Actual | Pro forma (1) | Pro forma as adjusted (2) |

||||||||||

| (unaudited) | ||||||||||||

| (in thousands) | ||||||||||||

| Balance sheet data: |

||||||||||||

| Cash and cash equivalents |

$ | 294 | $ | 294 | $ | 36,727 | ||||||

| Current assets |

7,104 | 7,104 | 43,537 | |||||||||

| Total assets |

9,826 | 9,826 | 46,259 | |||||||||

| Total debt (3) |

20,784 | 17,057 | — | |||||||||

| Convertible preferred stock (4) |

47,432 | — | — | |||||||||

| Total stockholders’ equity/(deficit) |