Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Pacific Green Technologies Inc. | Financial_Report.xls |

| EX-23.2 - CONSENT LETTER - Pacific Green Technologies Inc. | fs12013ex23i_pacificgreen.htm |

| EX-5.1 - LEGAL OPINION OF MACDONALD TUSKEY - Pacific Green Technologies Inc. | fs12013ex5i_pacificgreen.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Registration Statement under the Securities Act of 1933

|

PACIFIC GREEN TECHNOLOGIES INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

8900

|

n/a

|

||||||||

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

||||||||

|

5205 Prospect Road, Suite 135-226,

San Jose, CA 95129

(408) 538-3373

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

|

Copy of communication to:

Macdonald Tuskey

Attention: William Macdonald

570 Granville Street, Suite 400,

Vancouver, BC, V6C 3P1

Phone: 604-689-1022

Fax: 604-681-4760

|

||||||||||

|

Incorporating Services Ltd.,

3500 South DuPont Highway, DE 19901

302-531-0855

|

||||||||||

|

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

As soon as practicable after this Registration Statement is declared effective.

|

||||||||||

|

Approximate Date of Commencement of Proposed Sale to the Public:

|

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. R

|

||||||||||

|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Prospectus number of the earlier effective registration statement for the same offering. £

|

||||||||||

|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

|

||||||||||

|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

|

||||||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

||||||||||

|

Large accelerated filer

|

|

Accelerated filer

|

|

|||||||

|

Non-accelerated filer

|

|

Smaller reporting company

|

R

|

|||||||

|

Title of Each Class of Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Offering Price per Securit(1)

($)

|

Proposed Maximum Aggregate Offering Price(1)

($)

|

Amount of

Registration Fee

($)

|

||||||||||||

|

Shares of Common Stock, par value $0.001

|

1,950,000 | 1.00 | 1,950,000 | $ | 265.98 | |||||||||||

|

(1)

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price of the shares that were sold to our shareholders in a private placement. The price of $1.00 is a fixed price at which the selling stockholders may sell their shares until our common stock is quoted on the OTCBB at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

PROSPECTUS

PACIFIC GREEN TECHNOLOGIES INC.

1,950,000 Shares of Common Stock

The date of this Prospectus is January 22, 2013.

Pacific Green Technologies Inc. (”Pacific Green”, “we”, “us”, “our”) is registering 1,950,000 shares of common stock held by 5 selling security holders, including 500,000 shares of our common stock held by Pacific Green Group Limited, 500,000 shares by Rhumline Limited and 600,000 shares by Chris and Natasha Cuffe, who are affiliates of our company by virtue of their shareholdings.

The selling security holders will sell at an initial price of $1.00 per share until our common stock is quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. However, there can be no assurance that our common stock will become quoted on the OTC Bulletin Board. We will not receive any proceeds from the sale of shares of our common stock by the selling security holders, who will receive aggregate net proceeds of $1,950,000 if all of the shares being registered are sold. We will incur all costs associated with this Prospectus.

Our common stock is presently not traded on any national securities exchange or the NASDAQ stock market. We do not intend to apply for listing on any national securities exchange or the NASDAQ stock market. The purchasers in this offering may be receiving an illiquid security.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups (JOBS) Act.

An investment in our securities is speculative. See the section entitled "Risk Factors" beginning on Page 7 of this Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

The information in this Prospectus is not complete and may be changed. The selling security holders may not sell these securities until the registration statement that includes this Registration Statement is declared effective by the Securities and Exchange Commission. This Prospectus shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall the selling security holders sell any of these securities in any state where such an offer or solicitation would be unlawful before registration or qualification under such state's securities laws.

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with information different from that contained in this Prospectus. The selling shareholders are offering to sell, and seeking offers to buy, their common shares, only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this prospectus or of any sale of our common shares.

Table of Contents

|

Prospectus Summary

|

1

|

|

Risk Factors

|

4

|

|

Use of Proceeds

|

11

|

|

Determination of Offering Price

|

11

|

|

Dilution

|

11

|

|

Selling Security Holders

|

12

|

|

Plan of Distribution

|

13

|

|

Description of Securities to be Registered

|

17

|

|

Legal Matters

|

18

|

|

Interests of Named Experts and Counsel

|

18

|

|

Description of Business

|

18

|

|

Description of Property

|

28

|

|

Legal Proceedings

|

29

|

|

Market for Common Equity and Related Stockholder Matters

|

29

|

|

Financial Statements

|

F-1

|

|

Management's Discussion and Analysis of Financial Position and Results of Operations

|

30

|

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

36

|

|

Directors and Executive Officers

|

36

|

|

Executive Compensation

|

39

|

|

Security Ownership of Certain Beneficial Owners and Management

|

40

|

|

Certain Relationships and Related Transactions

|

42

|

|

Disclosure of Commission Position on Indemnification of Securities Act Liabilities

|

42

|

Prospectus Summary

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section beginning on page 4 of this Prospectus and the “Management's Discussion and Analysis of Financial Position and Results of Operations” section elsewhere in this Prospectus.

Our Business

Pacific Green Technologies Inc. (formerly known as ECash, Inc.) was incorporated in Delaware on March 10, 1994, under the name of Beta Acquisition Corp. In September 1995, we changed our name to In-Sports International, Inc. In August 2002, we changed our name from In-Sports International, Inc. to ECash, Inc. In 2007, due to limited financial resources, we discontinued our operations. Over the course of the last five years, we have sought new business opportunities.

Our management, assisted by Sichel Limited, a consultant, has identified an opportunity to build a business focused on marketing, developing and acquiring technologies designed to improve the environment by reducing pollution. To this end we entered into and closed an agreement with Pacific Green Group Limited (“PGG”) for the assignment of a representation agreement and the acquisition of a company involved in the environmental technology industry (the “Assignment and Share Transfer Agreement”).

The Assignment and Share Transfer Agreement provides for the acquisition of 100% of the issued and outstanding shares of Pacific Green Technologies Limited, PGG’s subsidiary in the United Kingdom. Additionally, PGG has assigned to the Company a ten year exclusive worldwide representation agreement with Envirotechnologies Inc., formerly EnviroResolutions, Inc. (“Enviro”) to market and sell Enviro’s current and future environmental technologies (the “Representation Agreement”). The Representation Agreement entitles the holder to a commission of 20% of all sales (net of taxes) generated by Enviro. Pursuant to the terms of the Assignment and Share Transfer Agreement, all rights and obligations under the Representation Agreement have been transferred to our company. We currently anticipate that sales under the Representation Agreement will be our sole source of revenue for the foreseeable future. We currently intend to complete an acquisition of Enviro, as this is a logical step in our development. However, we do not currently have any arrangements, agreements or understandings in this regard.

We have only recently begun operations, have no sales or revenues, and therefore rely upon the sale of our securities to fund our operations. We have a going concern uncertainty as of the date of our most recent financial statements.

We are not a “shell company” as described under Rule 405 of Regulation C under the Securities Act of 1933, as amended. Rule 405 of Regulation C defines a “shell company” as a registrant that has: (1) no or nominal operations; and (2) either (i) no or nominal assets; assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets.

We are not a blank check company. Rule 419 of Regulation C under the Securities Act of 1933 defines a “blank check company” as a (i) development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person, and (ii) is issuing a penny stock. Accordingly, we do not believe that our Company may be classified as a “blank check company” because we intend to engage in a specific business plan and do not intend to engage in any merger or acquisition with an unidentified company or other entity.

-1-

Emerging Growth Company

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups (JOBS) Act.

We shall continue to be deemed an emerging growth company until the earliest of:

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.’

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have elected not to opt out of the extended transition period for complying with any new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

-2-

The Offering

The 1,950,000 shares of our common stock being registered by this Prospectus represent approximately 34% of our issued and outstanding common stock as of January 22, 2013.

|

Securities Offered:

|

1,950,000 shares of common stock offered by 4 selling security holders, including 500,000 shares of our common stock held by Pacific Green Group Limited, 500,000 shares by Rhumline Limited and 600,000 shares by Chris and Natasha Cuffe, who are affiliates of our company by virtue of their shareholdings.

|

|

Initial Offering Price:

|

The $1.00 per share initial offering price of our common stock was determined by our Board of Directors based on several factors, including our capital structure and the most recent placement price of 600,000 shares of our common stock in a private placement for $1.00 per share on September 14, 2012. The selling security holders will sell at an initial price of $1.00 per share until our common stock is quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. However, there can be no assurance that our common stock will ever become quoted on the OTC Bulletin Board.

|

|

Minimum Number of

Securities to be Sold in this Offering:

|

None

|

|

Securities Issued and to be Issued:

|

As of January 22, 2013 we had 5,727,404 issued and outstanding shares of our common stock, and no issued and outstanding convertible securities.

All of the common stock to be registered under this Prospectus will be registered by existing stockholders. There is no established market for the common stock being registered. We intend to engage a market maker to apply to have our common stock quoted on the OTC Bulletin Board. This process usually takes at least 60 days and the application must be made on our behalf by a market maker. We have not yet engaged a market maker to file our application. If our common stock becomes quoted and a market for the stock develops, the actual price of the shares will be determined by prevailing market prices at the time of the sale. The trading of securities on the OTC Bulletin Board is often sporadic and investors may have difficulty buying and selling or obtaining market quotations, which may have a depressive effect on the market price for our common stock.

|

|

Proceeds:

|

We will not receive any proceeds from the sale of our common stock by the selling security holders.

|

-3-

Financial Summary Information

All references to currency in this Prospectus are to U.S. Dollars, unless otherwise noted.

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the "Management’s Discussion and Analysis of Financial Position and Results of Operations" section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

Consolidated Statements of Operations and Comprehensive Loss

|

Three Months Ended September 30, 2012

(unaudited)

($)

|

Six Months Ended September 30, 2012

(unaudited)

($)

|

From April 5, 2011 (inception) to

March 31, 2012

($)

|

||||||||||

|

Revenues

|

- | - | - | |||||||||

|

Expenses

|

406,177 | 504,098 | 159,387 | |||||||||

|

Net Loss

|

419,677 | 512,914 | 159,387 | |||||||||

|

Net Loss per share

|

0.08 | 0.10 | - | |||||||||

Consolidated Balance Sheet Data

|

March 31, 2012

($)

|

September 30, 2012

(unaudited)

($)

|

|||||||

|

Working Capital (Deficiency)

|

(158,213 | ) | (1,466,971 | ) | ||||

|

Total Assets

|

16,247 | 558,069 | ||||||

|

Total Liabilities

|

174,460 | 5,275,892 | ||||||

Risk Factors

Please consider the following risk factors before deciding to invest in our common stock.

Any investment in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, and all other information contained in this prospectus, before you decide whether to purchase our common stock. The occurrence of any of the following risks could harm our business. You may lose part or all of your investment due to any of these risks or uncertainties.

This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this Prospectus.

-4-

Risks Related to our Business

We Have A Limited Operating History With Significant Losses And Expect Losses To Continue For The Foreseeable Future.

We have yet to establish any history of profitable operations. We incurred a net loss of $159,387 for the period from April 5, 2011 (inception) to March 31, 2012. At September 30, 2012, we had an accumulated deficit of $5,313,446, and a net loss of $512,914 for the six month period ended September 30, 2012. We have not generated any revenues since our inception and do not anticipate that we will generate revenues which will be sufficient to sustain our operations. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will depend on our ability to successfully market and sell the ENVI-Clean™ system and there can be no assurance that we will be able to do so.

There Is Doubt About Our Ability To Continue As A Going Concern Due To Recurring Losses From Operations, Accumulated Deficit And Insufficient Cash Resources To Meet Our Business Objectives, All Of Which Means That We May Not Be Able To Continue Operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended March 31, 2012 and 2011, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 2 to our financial statements for the year ended March 31, 2012, we have incurred operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises doubt about our ability to continue as a going concern.

We May Not Be Able To Secure Additional Financing To Meet Our Future Capital Needs Due To Changes In General Economic Conditions.

We anticipate needing significant capital to develop our sales force and effective market the ENVI-Clean™ system. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

-5-

We are a development stage company and we may not be successful in marketing the ENVI-Clean™ system and the value of your investment could decline.

We are a development stage company with no substantial tangible assets in a highly competitive industry. We have little operating history, no customers, and no revenues. This makes it difficult to evaluate our future performance and prospects. Our prospects must be considered in light of the risks, expenses, delays and difficulties frequently encountered in establishing a new business in an emerging and evolving industry, including the following factors:

|

●

|

our business model and strategy are still evolving and are continually being reviewed and revised;

|

|

●

|

we may not be able to raise the capital required to develop our initial client base and reputation; and

|

|

●

|

we may not be able to successfully develop our planned products and services.

|

We cannot be sure that we will be successful in meeting these challenges and addressing these risks and uncertainties. If we are unable to do so, our business will not be successful and the value of your investment in us will decline.

Our business is subject to environmental and consumer protection legislation and any changes in such legislation could prevent us from becoming profitable.

The energy production and technology industries are subject to many laws and regulations which govern the protection of the environment, quality control standards, health and safety requirements, and the management, transportation and disposal of hazardous substances and other waste. Environmental laws and regulations may require removal or remediation of pollutants and may impose civil and criminal penalties for violations. Some environmental laws and regulations authorize the recovery of natural resource damages by the government, injunctive relief and the imposition of stop, control, remediation and abandonment orders. Similarly, consumer protection laws impose quality control standards on products marketed to the public and prohibit the distribution and marketing of products not meeting those standards.

The costs arising from compliance with environmental and consumer protection laws and regulations may increase operating costs for both us and our potential customers. Any regulatory changes that impose additional environmental restrictions or quality control requirements on us or on our potential customers could adversely affect us through increased operating costs and potential decreased demand for our services, which could prevent us from becoming profitable.

The development and expansion of our business through acquisitions, joint ventures, and other strategic transactions may create risks that may reduce the benefits we anticipate from these strategic alliances and may prevent us from achieving or sustaining profitability.

We intend to enter into technology acquisition and licensing agreements and strategic alliances such as joint ventures or partnerships in order to develop and commercialize our proposed technologies and services, and to increase our competitiveness. We currently do not have any commitments or agreements regarding acquisitions, joint ventures or other strategic alliances. Our management is unable to predict whether or when we will secure any such commitments or agreements, or whether such commitments or agreements will be secured on favorable terms and conditions.

-6-

Our ability to continue or expand our operations through acquisitions, joint ventures or other strategic alliances depends on many factors, including our ability to identify acquisitions, joint ventures, or partnerships, or access capital markets on acceptable terms. Even if we are able to identify strategic alliance targets, we may be unable to obtain the necessary financing to complete these transactions and could financially overextend ourselves.

Acquisitions, joint ventures or other strategic transactions may present financial, managerial and operational challenges, including diversion of management attention from existing business and difficulties in integrating operations and personnel. Acquisitions or other strategic alliances also pose the risk that we may be exposed to successor liability relating to prior actions involving a predecessor company, or contingent liabilities incurred before a strategic transaction. Due diligence conducted in connection with an acquisition, and any contractual guarantees or indemnities that we receive from sellers of acquired companies, may not be sufficient to protect us from, or compensate us for, actual liabilities. Liabilities associated with an acquisition or a strategic transaction could adversely affect our business and financial performance and reduce the benefits of the acquisition or strategic transaction. Any failure to integrate new businesses or manage any new alliances successfully could adversely affect our business and financial performance and prevent us from achieving profitability.

Our sole officer will only spend a modest portion of his available time managing our company. As a result, our success depends on the continuing efforts of other members of our senior management team and employees and the loss of the services of such key personnel could result in a disruption of operations which could result in reduced revenues.

We are dependent upon our officer for execution of our business plan. However, our sole officer, Jordan Starkman, will only spend a modest amount of his time in managing our company. As a result, our future success depends heavily upon the continuing services of the other members of our senior management team. If one or more of such other of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all, and our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Competition for senior management and key personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or key personnel, or attract and retain high-quality senior executives or key personnel in the future. We do not currently maintain key man insurance on our senior managers. The loss of the services of our senior management team and employees could result in a disruption of operations which could result in reduced revenues.

We assumed debt as a result of the Assignment that we may not be able to repay, resulting in possible default and/or substantial dilution to our shareholders.

The Assignment was partly funded through a Promissory Note of $5 million as set out in this document. There is a risk that we may not be able to repay the Promissory Note when it is due on maturity. In addition, any failure by us to repay the Promissory Note may result in PGG converting the amount outstanding into new shares of the Company’s common stock which would have the effect of diluting existing shareholders.

We are at risk that the ENVI-Clean™ system will not perform to expectations.

As at the date of this document, the ENVI-Clean™ system has been tested to satisfactory requirements but there is no guarantee that the ENVI-Clean™ system will continue to perform satisfactorily in the future which would damage our prospects following the Assignment.

-7-

The market for alternative energy products, technologies or services is emerging and rapidly evolving and its future success is uncertain. Insufficient demand for the ENVI-Clean™ system would prevent us from achieving or sustaining profitability.

It is possible that we may spend large sums of money to bring the ENVI-Clean™ system to the market, but demand may not develop or may develop more slowly than we anticipate.

Our future success is dependent on Enviro and its technologies in regards to:

(a) its ability to quickly react to technological innovations;

(b) the cost-effectiveness of its technologies;

(c) the performance and reliability of alternative energy products and services that it develops;

(d) its ability to formalize marketing relationships or secure commitments for our technologies, products and services;

(e) realization of sufficient funding to support our and Enviro's marketing and business development plans; and

(f) availability of government incentives for the development or use of any products and services that we or Enviro develop.

We may be unable to develop widespread commercial markets or obtain sufficient demand or broad acceptance for the Enviro alternative energy products or technologies or services. We may be unable to achieve or sustain profitability.

Competition within the environment sustainability industry may prevent us from becoming profitable.

The alternative energies industry is competitive and fragmented and includes numerous small companies capable of competing effectively in the market we target as well as several large companies that possess substantially greater financial and other resources than we do. Larger competitors' greater resources could allow those competitors to compete more effectively than we can with the Enviro technology. A number of competitors have developed more mature businesses than Enviro has and have successfully built their names in the international alternative energy markets. These various competitors may be able to offer products, sustainability technologies or services more competitively priced and more widely available than Enviro's and also may have greater resources to create or develop new technologies and products than Enviro. Failure to compete either in the alternative energy industry may prevent us from becoming profitable, and thus you may lose your entire investment.

We are at risk of Enviro not being able to manufacture the ENVI-Clean™ system in accordance with contractual terms.

All contracts which we secure for the sale of ENVI-Clean™ system between Enviro and a third party will require that Enviro supplies a functioning emission control system. There is a risk that Enviro is unable to manufacture and supply such a system in accordance with the terms of the contract. Any failure by Enviro to perform its obligations under any such contract may have a detrimental impact on our financial standing and reputation.

-8-

Risks Related to our Stockholders and Shares of Common Stock

The continued sale of our equity securities will dilute the ownership percentage of our existing stockholders and may decrease the market price for our common stock.

Given our lack of revenues and the doubtful prospect that we will earn significant revenues in the next several years, we will require additional financing of at least $660,000 for the next 12 months, which will require us to issue additional equity securities as we only had $558,008 on hand as of September 30, 2012. We expect to continue our efforts to acquire financing to fund our planned development and expansion activities, which will result in dilution to our existing stockholders. In short, our continued need to sell equity will result in reduced percentage ownership interests for all of our investors, which may decrease the market price for our common stock.

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934 (the “Exchange Act”) which imposes additional sales practice requirements on brokers-dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial Industry Regulatory Authority (FINRA) sales practice requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

-9-

Our compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls will be time-consuming, difficult, and costly.

Under Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we will be required to furnish a report by our management on our internal control over financial reporting beginning with our Annual Report on Form 10-K for our fiscal year ending March 31, 2013. We will soon begin the process of documenting and testing our internal control procedures in order to satisfy these requirements, which is likely to result in increased general and administrative expenses and may shift management’s time and attention from revenue-generating activities to compliance activities. While we expect to expend significant resources to complete this important project, we may not be able to achieve our objective on a timely basis. It will be time-consuming, difficult and costly for us to develop and implement the internal controls, processes and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional personnel to do so, and if we are unable to comply with the requirements of the legislation we may not be able to assess our internal controls over financial reporting to be effective in compliance with the Sarbanes-Oxley Act.

As noted above, we will be required to provide an assessment of the effectiveness of internal controls over financial reporting, which will require management to perform appropriate due diligence to test the design and operating effectiveness of key internal controls over financial reporting. However, we do not currently have management or employees with sufficient experience in maintaining books and records and preparing financial statements in accordance with GAAP, which will constitute a material weakness in our internal controls over financial reporting unless rectified.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any May 30.

Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our reporting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

-10-

Use of Proceeds

We will not receive any proceeds from the resale of the securities offered through this Prospectus by the selling security holders. The selling security holders will receive all proceeds from this offering and if all of the shares being offered by this Prospectus are sold at $1.00 per shares, those proceeds would be approximately $1,950,000.

Determination of Offering Price

The selling security holders will offer their shares at an initial offering price of $1.00 per share until our common stock is quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. However, there can be no assurance that our common stock will become quoted on the OTC Bulletin Board. The initial offering price was determined by our Board of Directors, who considered several factors in arriving at the $1.00 per share figure, including the following:

|

·

|

our most recent private placements of 600,000 shares of our common stock at a price of $1.00 per share on September 14, 2012;

|

|

·

|

our lack of operating history;

|

|

·

|

our capital structure; and

|

|

·

|

the background of our management.

|

As a result, the $1.00 per share initial price of our common stock does not necessarily bear any relationship to established valuation criteria and may not be indicative of prices that may prevail at any time. The price is not based on past earnings, nor is it indicative of the current market value of our assets. No valuation or appraisal has been prepared for our business. You cannot be sure that a public market for any of our securities will develop.

If our common stock becomes quoted on the OTC Bulletin Board and a market for the stock develops, the actual price of the shares sold by the selling security holders named in this Prospectus will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling security holders. The number of shares that may actually be sold by a selling security holder will be determined by each selling security holder. The selling security holders are neither obligated to sell all or any portion of the shares offered under this Prospectus, nor are they obligated to sell such shares immediately hereunder. If our common stock becomes quoted on the OTC Bulletin Board and a market for our common stock develops, security holders may sell their shares at a price different than the $1.00 per share offering price depending on privately negotiated factors such as the security holder's own cash requirements or objective criteria of value such as the market value of our assets.

Dilution

All of the 1,950,000 shares of our common stock to be sold by the selling security holders are currently issued and outstanding, and will therefore not cause dilution to any of our existing stockholders.

-11-

Selling Security Holders

The 5 selling security holders are offering for sale 1,950,000 shares of our issued and outstanding common stock which they obtained as follows:

|

·

|

5,000,000 shares of our common stock were issued to Pacific Green Group Limited as part of the closing of our Assignment and Share Transfer Agreement on June 14, 2012. Subsequently, on November 21, 2012 Pacific Green Group Limited transferred a total of 1,375,000 of these shares to three non-US shareholders in a private transaction;

|

|

·

|

We issued 600,000 shares of our common stock to one non-US investor at $1.00 per share for aggregate proceeds of $600,000 on September 14, 2012; and

|

|

·

|

We issued 100,000 shares of our common stock to one US investor as compensation for consulting services.

|

All of these shares were issued in reliance upon an exemption from registration pursuant to Regulation S, under the Securities Act of 1933 (the “Securities Act”). Our reliance upon Rule 903 of Regulation S was based on the fact that the sales of the securities were completed in an "offshore transaction", as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities.

The selling security holders have the option to sell their shares at an initial offering price of $1.00 per share until a market for our common stock develops on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. However, there can be no assurance that our common stock will become quoted on the OTC Bulletin Board.

The following table provides information as of January 22, 2013 regarding the beneficial ownership of our common stock by each of the selling security holders, including:

|

·

|

the number of shares owned by each prior to this offering;

|

|

·

|

the number of shares being offered by each;

|

|

·

|

the number of shares that will be owned by each upon completion of the offering, assuming that all the shares being offered are sold;

|

|

·

|

the percentage of shares owned by each; and

|

|

·

|

the identity of the beneficial holder of any entity that owns the shares being offered.

|

|

Name of Selling Security Holder

|

Shares Owned Prior to this Offering(1)

|

Percent

%(2)

|

Maximum Numbers of Shares Being Offered

|

Beneficial Ownership After Offering

|

Percentage Owned upon Completion of the Offering(2)

|

|||||||||||||||

|

Chris and Natasha Cuffe

|

600,000 | 10.5 | 600,000 | - | - | |||||||||||||||

|

Denali Equity Group LLC (3)

|

100,000 | 1.7 | 100,000 | - | - | |||||||||||||||

|

Diodati Investments Limited (4)

|

250,000 | 4.4 | 250,000 | - | - | |||||||||||||||

|

Pacific Green Group Limited (5)

|

3,625,000 | 63.3 | 500,000 | 3,125,000 | 54.6 | |||||||||||||||

|

Rhumline Limited (6)

|

1,000,000 | 17.4 | 500,000 | 500,000 | 8.9 | |||||||||||||||

|

Total

|

5,575,000 | 97.3 | 1,950,000 | |||||||||||||||||

-12-

|

1)

|

The number and percentage of shares beneficially owned is determined to the best of our knowledge in accordance with the Rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the selling security holder has sole or shared voting or investment power and also any shares which the selling security holder has the right to acquire within 60 days of the date of this Prospectus.

|

|

2)

|

The percentages are based on 5,727,404 shares of our common stock issued and outstanding and as at January 22, 2013.

|

|

3)

|

Justin Ederle has voting and dispositive control over shares owned by Denali Equity Group LLC.

|

|

4)

|

Michael Twist has voting and dispositive control over shares owned by Diodati Investments Limited.

|

|

5)

|

Scott Poulter has voting and dispositive control over shares owned by Pacific Green Group Limited.

|

|

6)

|

Paul Marshall has voting and dispositive control over shares owned by Rhumline Limited.

|

Except as otherwise noted in the above list, the named party beneficially owns and has sole voting and investment power over all the shares or rights to the shares. The numbers in this table assume that none of the selling security holders will sell shares not being offered in this Prospectus or will purchase additional shares, and assumes that all the shares being registered will be sold.

Other than as described above, none of the selling security holders or their beneficial owners has had a material relationship with us other than as a security holder at any time within the past three years, or has ever been one of our officers or directors or an officer or director of our predecessors or affiliates.

None of the selling security holders are broker-dealers or affiliates of a broker-dealer.

Plan of Distribution

We are registering 1,950,000 shares of our common stock on behalf of the selling security holders. The selling security holders have the option to sell the 1,950,000 shares of our common stock at an initial offering price of $1.00 per share until a market for our common stock develops, and thereafter at prevailing market prices or privately negotiated prices.

We intend to engage a market maker to apply to have our common stock quoted on the OTC Bulletin Board. In order for our common stock to be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf to make a market for our common stock. This process takes at least 60 days and can take longer than a year. We have not yet engaged a market maker to make an application on our behalf. If we are unable to obtain a market maker for our securities, we will be unable to develop a trading market for our common stock.

Trading in stocks quoted on the OTC Bulletin Board is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little to do with a company's operations or business prospects. The OTC Bulletin Board should not be confused with the NASDAQ market. OTC Bulletin Board companies are subject to far fewer restrictions and regulations than companies whose securities are traded on the NASDAQ market. Moreover, the OTC Bulletin Board is not a stock exchange, and the trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like the NASDAQ Small Cap or a stock exchange. In the absence of an active trading market investors may have difficulty buying and selling or obtaining market quotations for our common stock and its market visibility may be limited, which may have a negative effect on the market price of our common stock.

-13-

There is no assurance that our common stock will be quoted on the OTC Bulletin Board. We do not currently meet the existing requirements to be quoted on the OTC Bulletin Board, and we cannot assure you that we will ever meet these requirements.

The selling security holders may sell some or all of their shares of our common stock in one or more transactions, including block transactions:

|

·

|

on such public markets as the securities may be trading;

|

|

·

|

in privately negotiated transactions; or

|

|

·

|

in any combination of these methods of distribution.

|

The selling security holders may offer our common stock to the public:

|

·

|

at an initial price of $1.00 per share until a market develops;

|

|

·

|

at the market price prevailing at the time of sale if our common stock becomes quoted on the OTC Bulletin Board and a market for the stock develops;

|

|

·

|

at a price related to such prevailing market price if our common stock becomes quoted on the OTC Bulletin Board and a market for the stock develops; or

|

|

·

|

at such other price as the selling security holders determine if our common stock becomes quoted on the OTC Bulletin Board and a market for the stock develops.

|

We are bearing all costs relating to the registration of our common stock. The selling security holders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the shares of our common stock.

The selling security holders must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of our common stock. In particular, during such times as the selling security holders may be deemed to be engaged in a distribution of any securities, and therefore be considered to be an underwriter, they must comply with applicable laws and may, among other things:

|

·

|

furnish each broker or dealer through which our common stock may be offered such copies of this Prospectus, as amended from time to time, as may be required by such broker or dealer;

|

|

·

|

not engage in any stabilization activities in connection with our securities; and

|

|

·

|

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act.

|

The selling security holders and any underwriters, dealers or agents that participate in the distribution of our common stock may be deemed to be underwriters, and any commissions or concessions received by any such underwriters, dealers or agents may be deemed to be underwriting discounts and commissions under the Securities Act. Our common stock may be sold from time to time by the selling security holders in one or more transactions at a fixed offering price, which may be changed, at varying prices determined at the time of sale or at negotiated prices if our common stock becomes quoted on the OTC Bulletin Board and a market for the stock develops. We may indemnify any underwriter against specific civil liabilities, including liabilities under the Securities Act.

-14-

The selling security holders and any broker-dealers acting in connection with the sale of the common stock offered under this Prospectus may be deemed to be underwriters within the meaning of section 2(11) of the Securities Act, and any commissions received by them and any profit realized by them on the resale of shares as principals may be deemed underwriting compensation under the Securities Act. Neither we nor the selling security holders can presently estimate the amount of such compensation. We know of no existing arrangements between the selling security holders and any other security holder, broker, dealer, underwriter or agent relating to the sale or distribution of our common stock. Because the selling security holders may be deemed to be “underwriters” within the meaning of section 2(11) of the Securities Act, the selling security holders will be subject to the prospectus delivery requirements of the Securities Act. Each selling security holder has advised us that they have not yet entered into any agreements, understandings, or arrangements with any underwriters or broker-dealers regarding the sale of their shares. We may indemnify any underwriter against specific civil liabilities, including liabilities under the Securities Act.

Regulation M

During such time as the selling security holders may be engaged in a distribution of any of the securities being registered by this Prospectus, the selling security holders are required to comply with Regulation M under the Exchange Act. In general, Regulation M precludes any selling security holder, any affiliated purchaser and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security that is the subject of the distribution until the entire distribution is complete.

Regulation M defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant” as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. We have informed the selling security holders that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this Prospectus, and we have also advised the selling security holders of the requirements for delivery of this Prospectus in connection with any sales of the shares offered by this Prospectus.

With regard to short sales, the selling security holders cannot cover their short sales with securities from this offering. In addition, if a short sale is deemed to be a stabilizing activity, then the selling security holders will not be permitted to engage in such an activity. All of these limitations may affect the marketability of our common stock.

Penny Stock Rules

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

-15-

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC which:

|

·

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

·

|

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to violations of such duties or other requirements of federal securities laws;

|

|

·

|

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask prices;

|

|

·

|

contains the toll-free telephone number for inquiries on disciplinary actions;

|

|

·

|

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and

|

|

·

|

contains such other information, and is in such form (including language, type size, and format) as the SEC shall require by rule or regulation.

|

Prior to effecting any transaction in a penny stock, a broker-dealer must also provide a customer with:

|

·

|

the bid and ask prices for the penny stock;

|

|

·

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock;

|

|

·

|

the amount and a description of any compensation that the broker-dealer and its associated salesperson will receive in connection with the transaction; and

|

|

·

|

a monthly account statement indicating the market value of each penny stock held in the customer's account.

|

In addition, the penny stock rules require that prior to effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser's written acknowledgment of the receipt of a risk disclosure statement, (ii) a written agreement to transactions involving penny stocks, and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our securities, and therefore our stockholders may have difficulty selling their shares.

Blue Sky Restrictions on Resale

When a selling security holder wants to sell shares of our common stock under this Prospectus in the United States, the selling security holder will need to comply with state securities laws, also known as “blue sky laws,” with regard to secondary sales. All states offer a variety of exemptions from registration of secondary sales. Many states, for example, have an exemption for secondary trading of securities registered under section 12(g) of the Exchange Act or for securities of issuers that publish continuous disclosure of financial and non-financial information in a recognized securities manual, such as Standard & Poor’s. The broker for a selling security holder will be able to advise the stockholder as to which states have an exemption for secondary sales of our common stock.

Any person who purchases shares of our common stock from a selling security holder pursuant to this Prospectus, and who subsequently wants to resell such shares will also have to comply with blue sky laws regarding secondary sales.

When this Registration Statement becomes effective, and a selling security holder indicates in which state(s) he desires to sell his shares, we will be able to identify whether he will need to register or may rely on an exemption from registration.

-16-

Description of Securities to be Registered

General

Our authorized capital stock consists of 500,000,000 shares of common stock at a par value of $0.001 per share.

Common Stock

As at the date of this Prospectus, there were 5,727,404 shares of our common stock issued and outstanding that is held by 198 stockholders of record.

Holders of our common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of our common stock representing a majority of the voting power of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our articles of incorporation.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Voting Rights

Each holder of our common stock is entitled to one vote per share on all matters on which such stockholders are entitled to vote. Since the shares of our common stock do not have cumulative voting rights, the holders of more than 50% of the shares voting for the election of directors can elect all the directors if they choose to do so and, in such event, the holders of the remaining shares will not be able to elect any person to our Board of Directors.

Dividend Policy

Holders of our common stock are entitled to dividends if declared by the Board of Directors out of funds legally available for payment of dividends. From our inception to January 22, 2013, we did not declare any dividends.

We do not intend to issue any cash dividends in the future. We intend to retain earnings, if any, to finance the development and expansion of our business. However, it is possible that our management may decide to declare a cash or stock dividend in the future. Our future dividend policy will be subject to the discretion of our Board of Directors and will be contingent upon future earnings, if any, our financial condition, our capital requirements, general business conditions and other factors.

-17-

Preferred Stock

We are authorized to issue 10,000,000 shares of preferred stock with a par value of $0.001. As of January 22, 2013, there were no preferred shares issued and outstanding. Under our Bylaws, the Board of Directors has the power, without further action by the holders of the common stock, to determine the relative rights, preferences, privileges and restrictions of the preferred stock, and to issue the preferred stock in one or more series as determined by the Board of Directors. The designation of rights, preferences, privileges and restrictions could include preferences as to liquidation, redemption and conversion rights, voting rights, dividends or other preferences, any of which may be dilutive of the interest of the holders of the common stock.

Legal Matters

Macdonald Tuskey, of Suite 400, 570 Granville Street, Vancouver, BC, V6C 3P1 has provided an opinion on the validity of the shares of our common stock being offered pursuant to this prospectus.

Interests of Named Experts and Counsel

No expert or counsel named in this Prospectus as having prepared or certified any part thereof or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of our common stock was employed on a contingency basis or had or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in us. Additionally, no such expert or counsel was connected with us as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Experts

Our audited financial statements for the period from April 5, 2011 (inception) to March 31, 2012 have been included in this Prospectus in reliance upon MNP LLP, Chartered Accountants, an independent registered public accounting firm, as experts in accounting and auditing.

Description of Business

Forward-Looking Statements

This Prospectus contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “will”, “may”, “anticipates”, “believes”, “should”, “intends”, “estimates” and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our intellectual property; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified personnel; and other risks detailed from time to time in our filings with the SEC, or otherwise.

-18-

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for the purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications outlined above and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements.

Historical business overview

Pacific Green Technologies Inc. (formerly known as ECash, Inc.) was incorporated in Delaware on March 10, 1994, under the name of Beta Acquisition Corp. In September 1995, we changed our name to In-Sports International, Inc. In August 2002, we changed our name from In-Sports International, Inc. to ECash, Inc. In 2007, due to limited financial resources, we discontinued our operations. Over the course of the last five years, we have sought new business opportunities.

On May 1, 2010 we entered into a consulting agreement with Sichel Limited (“Sichel”). Sichel has investigated new opportunities for us and has subscribed for new shares of the Company’s common stock, as set out in this document. The consulting agreement entitles Sichel to US$20,000 per calendar month. As at our year ended March 31, 2012, we owed Sichel US$460,000 under the terms of this agreement. In addition, pursuant to the terms of the consulting agreement, if we are unable to pay the monthly consulting fee, Sichel may elect to be paid in shares of stock, and if we are unable to make payments for more than six months in any 12 month period, Sichel has the right to appoint an officer or director to the board, which right has not been exercised at this time.

On June 13, 2012 we changed our name to Pacific Green Technologies Inc., and effected a reverse split of our common stock following which we had 27,404 shares of common stock outstanding with $0.001 par value. On June 14, 2012 we issued a further 5,000,000 new shares of our common stock in satisfaction of an assignment and share transfer agreement, as set out in this document. As at the date of this Registration Statement, the Company has 5,727,404 shares of common stock outstanding with $0.001 par value.

New strategy

Our management, assisted by Sichel, has identified an opportunity to build a business focused on marketing, developing and acquiring technologies designed to improve the environment by reducing pollution. To this end we have entered into and closed an agreement with Pacific Green Group Limited (“PGG”) for the assignment of a representation agreement and the acquisition of a company involved in the environmental technology industry (the “Assignment and Share Transfer Agreement”).

The Assignment and Share Transfer Agreement provides for the acquisition of 100% of the issued and outstanding shares of Pacific Green Technologies Limited, PGG’s subsidiary in the United Kingdom. Additionally, PGG has assigned to the Company a ten year exclusive worldwide representation agreement with Envirotechnologies Inc., formerly EnviroResolutions, Inc. (“Enviro”) to market and sell Enviro’s current and future environmental technologies (the “Representation Agreement”). The Representation Agreement entitles the holder to a commission of 20% of all sales (net of taxes) generated by Enviro. Pursuant to the terms of the Assignment and Share Transfer Agreement, all rights and obligations under the Representation Agreement have been transferred to our company. We currently anticipate that sales under the Representation Agreement will be our sole source of revenue for the foreseeable future. We currently intend to complete an acquisition of Enviro, as this is a logical step in our development. However, we do not currently have any arrangements, agreements or understandings in this regard.

-19-

Both Sichel Limited and Pacific Green Group Limited are wholly owned subsidiaries of the Hookipia Trust. Pacific Green Group Limited’s wholly owned subsidiary was Pacific Green Technologies Limited. As a result, we acquired Pacific Green Technologies Limited as described herein from Pacific Green Group Limited. Sichel is a significant shareholder of our company, and also provides us with consulting services pursuant to a consulting agreement as noted above, all as described in additional detail herein. The sole director of Sichel is also the sole director of Pacific Green Group Limited. Further, Sichel is a significant shareholder of Enviro and provides management services to Enviro under a management services contract.

The Assignment and Share Transfer Agreement closed on June 14, 2012 via the issuance of 5,000,000 shares of our common stock as well as a $5,000,000 promissory note to PGG. We have consequently undertaken the operations of Pacific Green Technologies Limited and PGG’s obligations under the Representation Agreement.

Full consideration contemplated by the Assignment and Share Transfer Agreement was US$25 million satisfied through the issue of 5,000,000 new shares of our common stock at a price of $4 per share with the balance of US$5 million structured as a promissory note (the “Promissory Note”) over the next five years as follows:

|

●

|

31 March 2013 $1,000,000

|

|

●

|

31 March 2014 $1,000,000

|

|

●

|

31 March 2015 $1,000,000

|

|

●

|

31 March 2016 $1,000,000

|

|

●

|

31 March 2017 $1,000,000

|

Under the terms of the Promissory Note, the loan repayments specified above shall not exceed the amount we earn under the terms of the Representation Agreement. If we are unable to meet the repayment schedule set out above, PGG will have the option to either roll over any unpaid portion to the following payment date or to convert the outstanding amount into new shares of our common stock. However, the entire amount of the Promissory Note is due upon the maturity date on the fifth anniversary. The Promissory Note is unsecured.

The total consideration of US$25 million was a purchase price not determined under U.S. GAAP, and both the US$25 million total price and the deemed price of $4 per share does not represent the fair value of the stock issued or a value used in accounting for the acquisition. The number of shares issued and the terms of the Promissory Note were negotiated between the parties and are intended to represent full consideration for the acquisition of Pacific Green Technologies Limited and the Representation Agreement.

Information on Enviro

Enviro, a company incorporated in Delaware, has protected intellectual property rights throughout most of the world for its ENVI-Clean™ Emissions System (“ENVI-Clean™”). The ENVI-Clean™ system removes most of the sulphur dioxide, particulate matter, greenhouse gases and other hazardous air pollutants from the flue gases produced by the combustion of coal, biomass, municipal solid waste, diesel and other fuels.

-20-

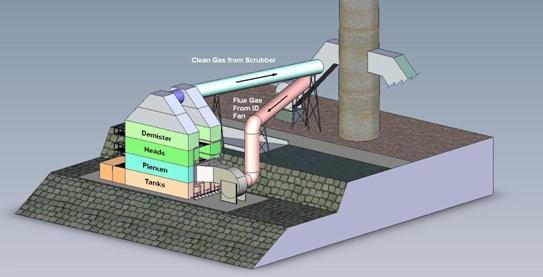

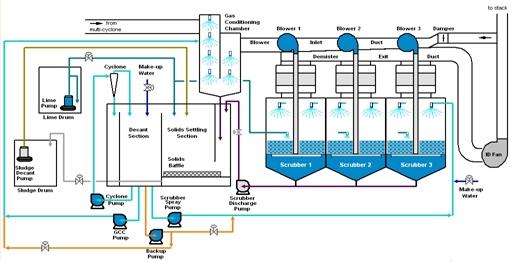

The ENVI-Clean™ system is comprised of five components:

|

●

|

an induced draft fan (“ID fan”);

|

|

●

|

a gas conditioning chamber;

|

|

●

|

the ENVI-Clean™ unit;

|

|

●

|

a demister; and

|

|

●

|

settling tanks.

|