Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPIRIT REALTY CAPITAL, INC. | d470181d8k.htm |

| EX-99.5 - EX-99.5 - SPIRIT REALTY CAPITAL, INC. | d470181dex995.htm |

| EX-99.3 - EX-99.3 - SPIRIT REALTY CAPITAL, INC. | d470181dex993.htm |

| EX-99.2 - EX-99.2 - SPIRIT REALTY CAPITAL, INC. | d470181dex992.htm |

| EX-99.1 - EX-99.1 - SPIRIT REALTY CAPITAL, INC. | d470181dex991.htm |

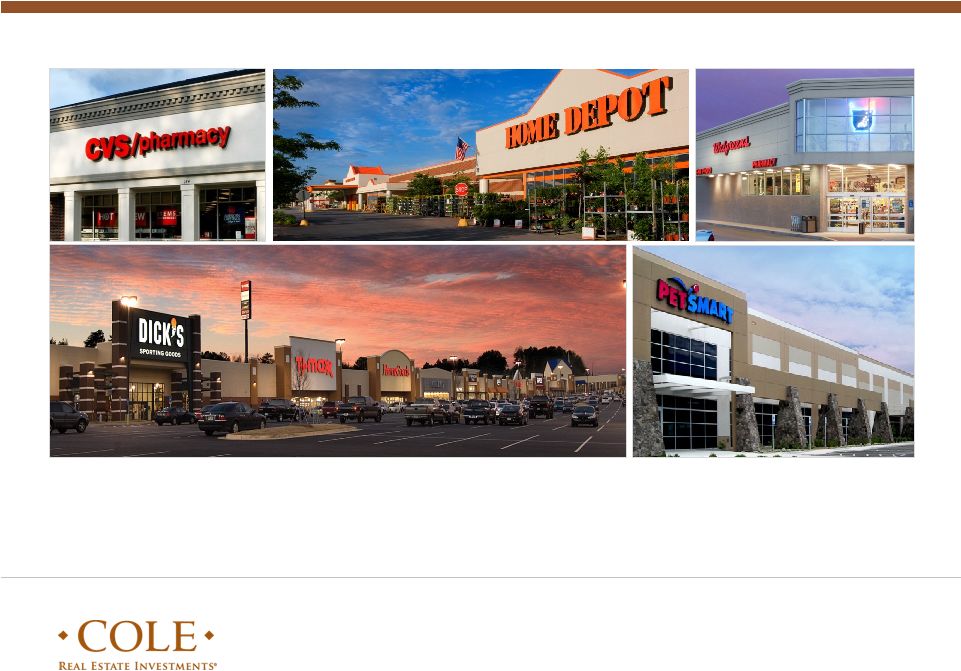

Cole Credit Property

Trust II and Spirit Realty Capital: REALIZING LIQUIDITY AND CREATING OPPORTUNITY AT AN

ATTRACTIVE VALUATION JANUARY 2013 INVESTOR PRESENTATION

Exhibit 99.4 |

©

2013 Cole Capital Advisors. All Rights Reserved.

2

Important Disclosures

Spirit and CCPT II and their respective directors and executive officers and other members of

management and employees may be deemed to be participants in the solicitation of proxies in

respect of the proposed transaction. You can find information about Spirit’s executive officers and directors in Spirit’s final prospectus filed with the SEC on September 21,

2012. You can find information about CCPT II’s executive officers and directors in CCPT II’s

definitive proxy statement filed with the SEC on April 13, 2012. Additional information

regarding the interests of such potential participants will be included in the joint proxy

statement/prospectus and other relevant documents filed with the SEC if and when they become

available. You may obtain free copies of these documents from Spirit or CCPT II using the sources

indicated above. This document shall not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as

amended. www.sec.gov

www.spiritrealty.com

In addition to historical information, this document contains forward-looking statements within

the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of

the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and

projections about the industry and markets in which Spirit, and Cole operate and beliefs of and

assumptions made by Spirit management and CCPT II management, involve risks and uncertainties

that could significantly affect the financial results of Spirit or CCPT II or the combined company. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “projects,” “seeks,”

“estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally

are not historical in nature. Such forward-looking statements include, but are not limited to,

statements about the benefits of the business combination transaction involving Spirit and CCPT

II, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions. All statements that address

operating performance, events or developments that we expect or anticipate will occur in the future

— including statements relating to rent and occupancy growth, changes in sales or

contribution volume of developed properties, general conditions in the geographic areas where we operate and the availability of capital — are forward-looking

statements. These statements are not guarantees of future performance and involve certain risks,

uncertainties and assumptions that are difficult to predict. Although we believe the

expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained

and therefore, actual outcomes and results may differ materially from what is expressed or forecasted

in such forward-looking statements. Some of the factors that may affect outcomes and

results include, but are not limited to: (i) national, international, regional and local economic climates, (ii) changes in financial markets, interest rates, credit

spreads, and foreign currency exchange rates, (iii) changes in the real estate markets, (iv) continued

ability to source new investments, (v) increased or unanticipated competition for our

properties, (vi) risks associated with acquisitions, (vii) maintenance of real estate investment trust status, (viii) availability of financing and capital, (ix)

changes in demand for developed properties, (x) risks associated with achieving expected revenue

synergies or cost savings, (xi) risks associated with the ability to consummate the merger and

the timing of the closing of the merger, and (xii) those additional risks and factors discussed in reports filed with the SEC by Spirit and CCPT II

from time to time. Neither Spirit nor CCPT II undertakes any duty to update any forward-looking

statements appearing in this document.

Cole Credit Property Trust II, Inc. (“CCPT II”) expects to file with the Securities and

Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a

joint proxy statement of CCPT II and Spirit Realty Capital, Inc. (“Spirit”) that also

constitutes a prospectus of Spirit. CCPT II and Spirit also plan to file other relevant

documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME

AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the

joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by Spirit and CCPT II with the SEC at

the SEC’s website

at . Copies of the documents filed by Spirit with the SEC will be available free of charge on Spirit’s

website

at

or by directing a written request to Spirit Realty Capital, Inc., 16767

North Perimeter Drive, Suite 210, Scottsdale, Arizona 85260, Attention: Investor Relations. Copies of the

documents filed by CCPT II with the SEC will be available free of charge by directing a written

request to Cole Credit Property Trust II, Inc., 2325 East Camelback Road, Suite 1100, Phoenix,

Arizona, 85016, Attention: Investor Relations. |

©

2013 Cole Capital Advisors. All Rights Reserved.

3

Compelling Transaction

•

Full liquidity with no lockup provisions for NYSE-listed shares of

second largest publicly-traded net-lease REIT

•

Successful exit for a portfolio that was raised and invested prior to

the financial crisis

•

Based on Spirit’s 1/18/2013 closing price of $17.82, an attractive

valuation with a positive cumulative total return of 20-42%,

including dividends, depending on shareholder holding period

•

No internalization fee or transaction fees paid to Cole

•

Expect continuation, without disruption, of a dividend distribution

•

Enhanced and diversified portfolio profile, including higher

occupancy and longer weighted average lease term

•

Leadership by experienced and highly-regarded management

team with well-established infrastructure

•

Smooth transition expected with support from Cole

•

Significant upside from additional scale and access to capital

Spirit Realty Capital

Company Snapshot

•

Net-lease REIT owns and invests

primarily in single-tenant,

operationally essential real estate

•

Formed in 2003

•

Taken private in 2007

•

Completed IPO in 2012

(NYSE: SRC) |

©

2013 Cole Capital Advisors. All Rights Reserved.

4

Transaction Overview

•

Merger of Spirit Realty Capital, Inc. (“Spirit”) and Cole Credit Property Trust II

(“CCPT II”) •

100%

stock

merger

transaction

resulting

in

$7.1

billion

combined

pro

forma

enterprise

value

•

Fixed exchange ratio with each common share of Spirit converted into 1.9048 shares of CCPT II common

stock (equates to 0.525 Spirit shares for each share of CCPT II)

•

Implied

value

per

CCPT

II

share

of

$9.36

based

on

Spirit

closing

price

of

$17.82

on

January

18,

2013

•

Implied value per CCPT II share of $9.27 based on the volume weighted average of Spirit’s share

price from the date of its inclusion in the Russell 2000 Index through the closing price on

January 18, 2013, which was $17.66. •

Implied value per CCPT II share of $9.17 based on Spirit’s 20 trading day volume weighted

average price of $17.47 as of January 18, 2013

•

Combined entity to listed on the NYSE under Spirit’s ticker SRC

•

Ownership: 44% Spirit / 56% CCPT II

•

Contingent

upon

majority

approval

of

both

companies’

stockholders

•

Spirit’s largest shareholders, Macquarie and TPG-Axon, who together own ~15% of Spirit, have

executed agreements that state their intention to vote in favor of the transaction

TRANSACTION

CONSIDERATION

•

Combined company will be named Spirit Realty Capital

•

Spirit management team to lead merged entity

•

Spirit board to grow to nine members with addition of two directors from CCPT II

CORPORATE

GOVERNANCE

•

Proxy filed Q1 2013

•

Closing Q3 2013

EXPECTED TIMING |

©

2013 Cole Capital Advisors. All Rights Reserved.

5

Pro Forma Combined Portfolio

IMPROVED PORTFOLIO CHARACTERISTICS

Pro Forma

822

2,012

1,190

33.1

47

165

98.4%

11.2

52%

21.2

45

282

99.5%

10.0

41%

54.3

48

300+

98.8%

10.6

37%

1%

45%

19%

$3.4 billion

$3.7 billion

$7.1 billion

Enterprise Value

(1)

Properties

(2)

Square Feet (MM)

Number of States

Number of Tenants

Weighted Average

Occupancy

(3)

Remaining Lease

Term

(4)

Top 10 Tenant

Concentration

(4)

Investment Grade

Rental Revenue

(4)(5)

(6)

Source: Company filings.

Notes:

(1) Based on the January 18, 2013 closing price of Spirit Realty of $17.82 and exchange ratio of

1.9048. (2) 98.5% of Spirit’s total gross investments represent owned properties. Remaining investments

include properties securing mortgage loans. (3) Occupancy based on number of properties.

(4) Based on rental revenue.

(5) Includes single tenant properties only.

(6) Includes 69 mortgage notes receivable. |

©

2013 Cole Capital Advisors. All Rights Reserved.

6

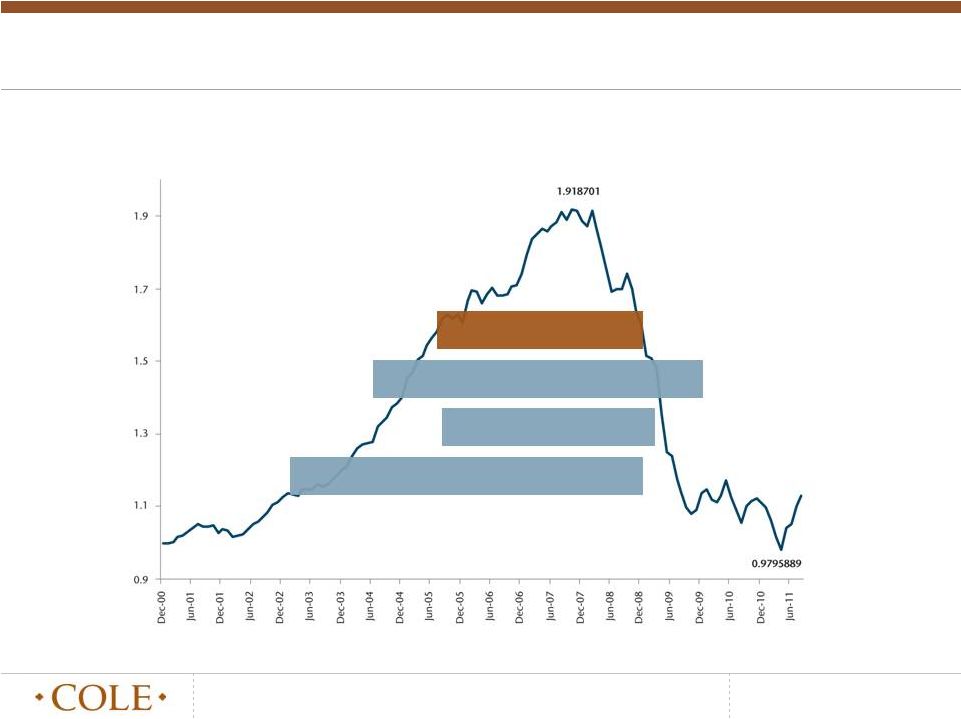

CCPT II Outperformance Amid Headwinds

Source: MIT’s Moody’s CPPI Index

(1) Hines Real Estate Investment Trust, Inc. (“Hines REIT”), Inland American Real Estate

Investment Trust, Inc. (“Inland American REIT”), Behringer Harvard REIT I, Inc. (“Behringer Harvard REIT I”)

MIT’s Moody’s CPPI Index

•

From the peak of the market in October 2007 to the trough in April 2011, the commercial real estate

market declined 49%. A number of products, including CCPT II, raised capital during this

time CCPT II Offering Period

(6/27/2005 –

1/2/2009)

Hines

REIT

Offering

Period

(1)

(6/18/2004 –

12/31/2009)

Inland

American

REIT

Offering

Period

(1)

(8/31/2005 –

4/6/2009)

Behringer

Harvard

REIT

I

Offering

Period

(1)

(2/19/2003 –

12/31/2008) |

©

2013 Cole Capital Advisors. All Rights Reserved.

7

Performance of Legacy Products: Values and Distribution Yields

Source: MTS Advisors, Company Websites, and Public SEC Filings; Representative of non-listed REITS

fundraising and acquiring real estate between 2002-2010 (1) Current Share Value

reflects estimated share value per public filings (2) Current Distribution Rate based on original

offering price (3) Beginning

July

2011

through

Q3

2012,

30%

of

the

Distribution

has

been

designated

as

“Special

Distribution”,

which

is

a

return

of

invested

capital

and

reduces

shareholders’

remaining

investment

in

the

company

Behringer

Harvard REIT I

•

CCPT II performed substantially better than other contemporaneous products

•

Based on Spirit’s 1/18/2013 closing price of $17.82, CCPT II shareholders will have a positive

cumulative total return on their investment, despite the vast majority of the capital being

invested prior to and throughout the financial crisis

Current Share Value

(1)

Current Distribution Rate

(2)

5.00%

(3)

5.00%

6.25%

0.00%

$9.36

$7.78

$7.22

$4.01

$10

$8

$6

$4

$2

$0

7%

6%

5%

4%

3%

2%

1%

0% |

©

2013 Cole Capital Advisors. All Rights Reserved.

8

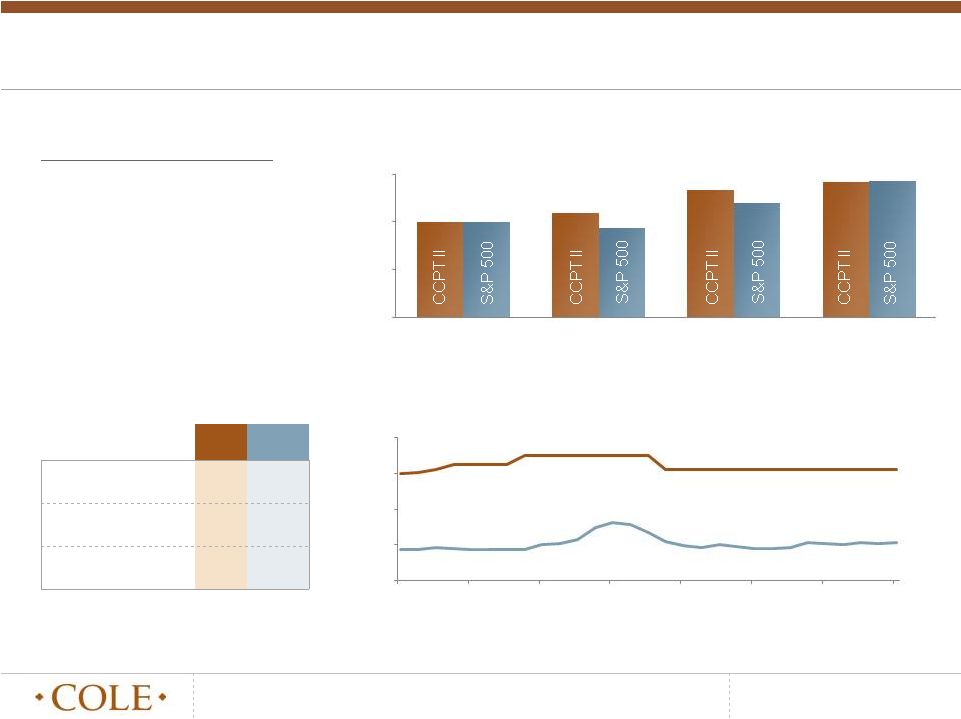

CCPT II and Broader Equity Market Returns

GROWTH OF $100,000

(1)

QUARTERLY DIVIDEND HISTORY

(3)

CCPT II

S&P 500

CCPT

II

relative

to

S&P

500

CCPT II

S&P 500

Total Return

(1)

41.47%

42.78%

Compound Annual Growth

Rate (CAGR)

(2)

4.77%

4.68%

Standard Deviation of

Yearly Returns

(2)

10.86%

22.44%

9/27/2005

CCPT II Share Price:

$10.00

6/22/2010

CCPT II Estimated

Share Value: $8.05

7/27/2011

CCPT II Estimated

Share Value : $9.35

1/18/2013

CCPT II Implied Value

Per

Share:

$9.36

(4)

•

Comparable performance

•

Higher dividend yield

•

Low correlation

$100,000

$109,037

$133,653

$141,616

$100,000

$93,500

$119,711

$142,775

$0

$50,000

$100,000

$150,000

0.00%

2.00%

4.00%

6.00%

8.00%

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Source: Bloomberg, Standard & Poors, Public Filings

(1)

Total Return and Growth of $100,000 time period: 9/27/2005 to12/31/2012, dividends reinvested

(2)

CAGR and Standard Deviation time period: 1/1/2006 to 12/31/2012

(3)

S&P 500 Dividend Yield and CCPT II Distribution Rate

(4)

Implied value per CCPT II share based on SRC’s 1/18/2013 closing price of $17.82; future value

upon listing will be different |

©

2013 Cole Capital Advisors. All Rights Reserved.

9

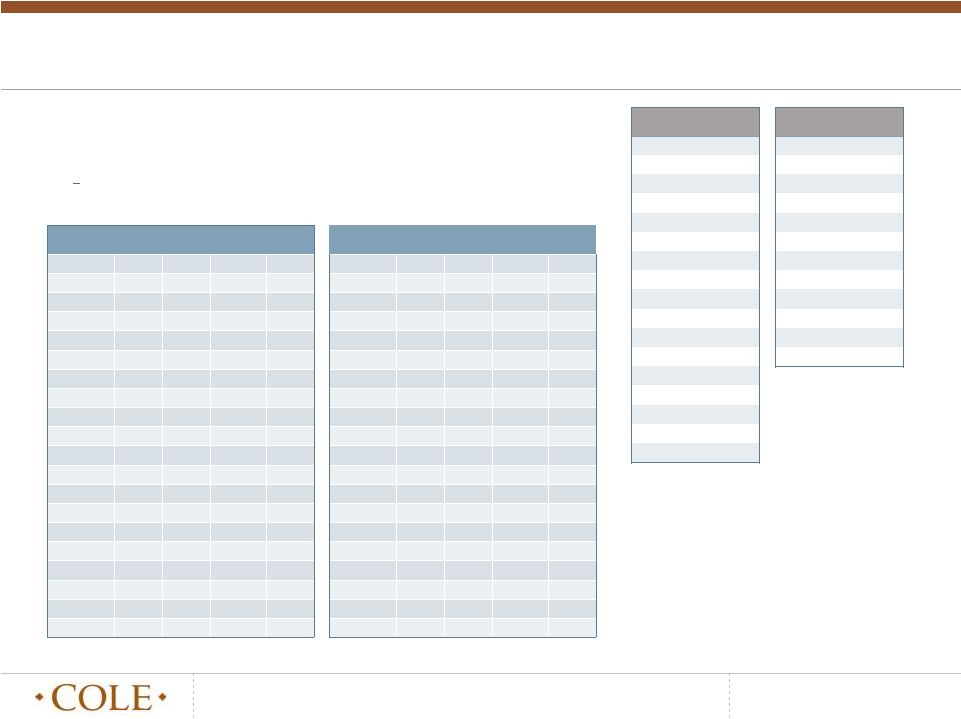

CCPT II Investor Performance

Month & Year

Invested

(1)

CASH

(2)

Return

(3)

DRIP

(2)

Return

(3)

Sep-05

$141,058

41%

$141,616

42%

Oct-05

$140,558

41%

$141,124

41%

Nov-05

$140,058

40%

$140,631

41%

Dec-05

$139,558

40%

$140,138

40%

Jan-06

$139,058

39%

$139,646

40%

Feb-06

$138,551

39%

$139,146

39%

Mar-06

$138,044

38%

$138,647

39%

Apr-06

$137,538

38%

$138,147

38%

May-06

$137,017

37%

$137,634

38%

Jun-06

$136,496

36%

$137,121

37%

Jul-06

$135,975

36%

$136,608

37%

Aug-06

$135,433

35%

$136,074

36%

Sep-06

$134,892

35%

$135,541

36%

Oct-06

$134,350

34%

$135,007

35%

Nov-06

$133,808

34%

$134,473

34%

Dec-06

$133,267

33%

$133,939

34%

Jan-07

$132,725

33%

$133,406

33%

Feb-07

$132,183

32%

$132,872

33%

Mar-07

$131,642

32%

$132,338

32%

Apr-07

$131,100

31%

$131,805

32%

Month & Year

Invested

(1)

CASH

(2)

Return

(3)

DRIP

(2)

Return

(3)

May-07

$130,558

31%

$131,271

31%

Jun-07

$130,017

30%

$130,737

31%

Jul-07

$129,475

29%

$130,204

30%

Aug-07

$128,892

29%

$129,629

30%

Sep-07

$128,308

28%

$129,054

29%

Oct-07

$127,725

28%

$128,479

28%

Nov-07

$127,142

27%

$127,905

28%

Dec-07

$126,558

27%

$127,330

27%

Jan-08

$125,975

26%

$126,755

27%

Feb-08

$125,392

25%

$126,181

26%

Mar-08

$124,808

25%

$125,606

26%

Apr-08

$124,225

24%

$125,031

25%

May-08

$123,642

24%

$124,456

24%

Jun-08

$123,058

23%

$123,882

24%

Jul-08

$122,475

22%

$123,307

23%

Aug-08

$121,892

22%

$122,732

23%

Sep-08

$121,308

21%

$122,157

22%

Oct-08

$120,725

21%

$121,583

22%

Nov-08

$120,142

20%

$121,008

21%

Dec-08

$119,558

20%

$120,433

20%

•

Depending on shareholder holding period and based on Spirit Realty’s

closing price of $17.82 per share on January 18, 2013, CCPT II

shareholders have recognized a positive total return

Initial investors who elected dividend reinvestment have experienced

a 42% cumulative return

Source: Cole Credit Property Trust II, Inc., SEC filings and reports

(1) Assumes beginning period convention, no follow-on subscriptions,

no redemptions and no distributions past December 31, 2012

(2) Ending values based on distributions paid in cash (“CASH”) or

reinvested in shares (“DRIP”), calculated by growing beginning value

by commensurate distribution rates. DRIP reflects reinvestment at

commensurate share price

(3) Return is calculated by taking the difference of stated ending value

and beginning value of $100,000 and then dividing by beginning value;

not time weighted

(4) Historical annualized equivalent dividend distribution rate

(5) Share price history: Offering price $10.00, subsequent share prices

of $8.05 and $9.35, and $9.36 estimated share price based on Spirit

1/18/2013 closing price of $17.82 and 0.525 exchange ratio

Date

Distribution

Rate

Q4 2005

6.00%

Q1 2006

6.08%

Q2 2006

6.25%

Q3 2006

6.50%

Q4 2006

6.50%

Q1 2007

6.50%

Q2 2007

6.50%

Q3 2007

7.00%

Q4 2007

7.00%

Q1 2008

7.00%

Q2 2008

7.00%

Q3 2008

7.00%

Q4 2008

7.00%

Q1 2009

7.00%

Q2 2009

7.00%

Q3 2009

6.25%

Q4 2009

6.25%

Date

Distribution

Rate

Q1 2010

6.25%

Q2 2010

6.25%

Q3 2010

6.25%

Q4 2010

6.25%

Q1 2011

6.25%

Q2 2011

6.25%

Q3 2011

6.25%

Q4 2011

6.25%

Q1 2012

6.25%

Q2 2012

6.25%

Q3 2012

6.25%

Q4 2012

6.25%

(4)

(4) |

©

2013 Cole Capital Advisors. All Rights Reserved.

10

Anticipated Timeline and Next Steps

Shareholder Votes

Close Transaction

List New Entity on NYSE

Announce Transaction

File Proxy

Q1 2013

Anticipated

Q3 2013 |