Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CITIZENS REPUBLIC BANCORP, INC. | d470763d8k.htm |

Investor Presentation

Fourth Quarter 2012

Exhibit 99.1 |

| 2

Safe Harbor Statement

Discussions and statements in this presentation that are not statements of

historical fact (including without limitation statements that include terms such as

“will,”

“may,”

“should,”

“believe,”

“expect,”

“anticipate,”

“estimate,”

“project”,

“intend,”

and “plan”) and statements regarding Citizens’

future financial and

operating results, plans, objectives, expectations and intentions, are

forward- looking statements that involve risks and uncertainties, many

of which are beyond

Citizens’

control or are subject to change. No forward–looking statement is a

guarantee of future performance and actual results could differ

materially. Factors that could cause or contribute to such differences

include, without limitation, risks and uncertainties detailed from time to

time in Citizens’ filings with

the Securities and Exchange Commission.

Other factors not currently anticipated may also materially and adversely affect

Citizens’

results of operations, cash flows, financial position and prospects. There

can be no assurance that future results will meet expectations.

While Citizens

believes that the forward-looking statements in this presentation are

reasonable, you should not place undue reliance on any forward-looking

statement. In addition, these statements speak only as of the date

made. Citizens does not undertake, and expressly disclaims any

obligation to update or alter any statements, whether as a result of new

information, future events or otherwise, except as required by applicable

law. |

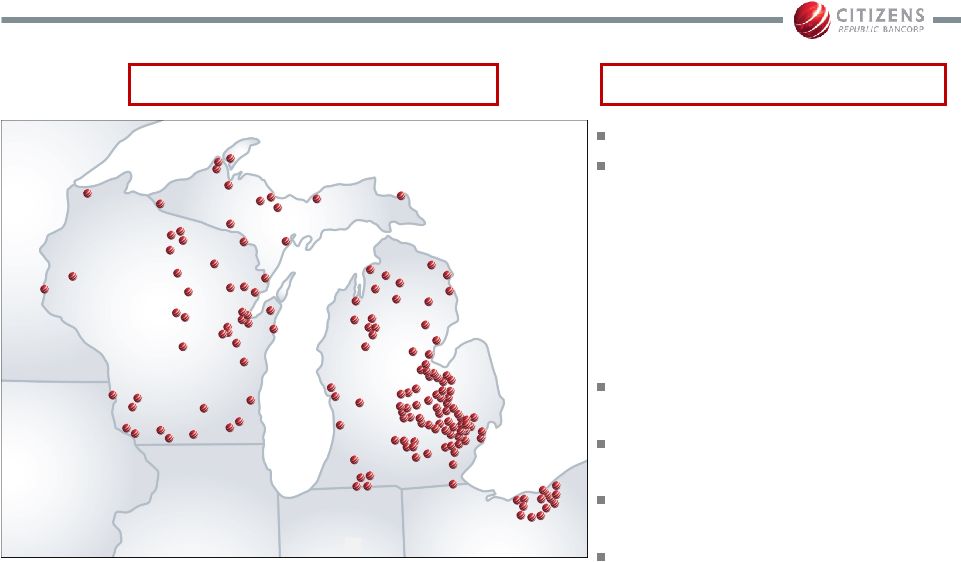

| Who

We Are |

4

Who We Are

Established in 1871

58

largest

bank

holding

company in the U.S. ranked by

assets

–

$9.6 billion assets and $7.2

billion deposits

–

Presence in 3 Upper

Midwest states with 219

branches and 248 ATMs

Increased market share in 49%

of our counties since 2008

Grew number of new clients by

10%

85% of revenue is Michigan

based

Pending merger with FirstMerit,

expect to close 2Q13

Company Overview

219 Branches / 248 ATMs

th |

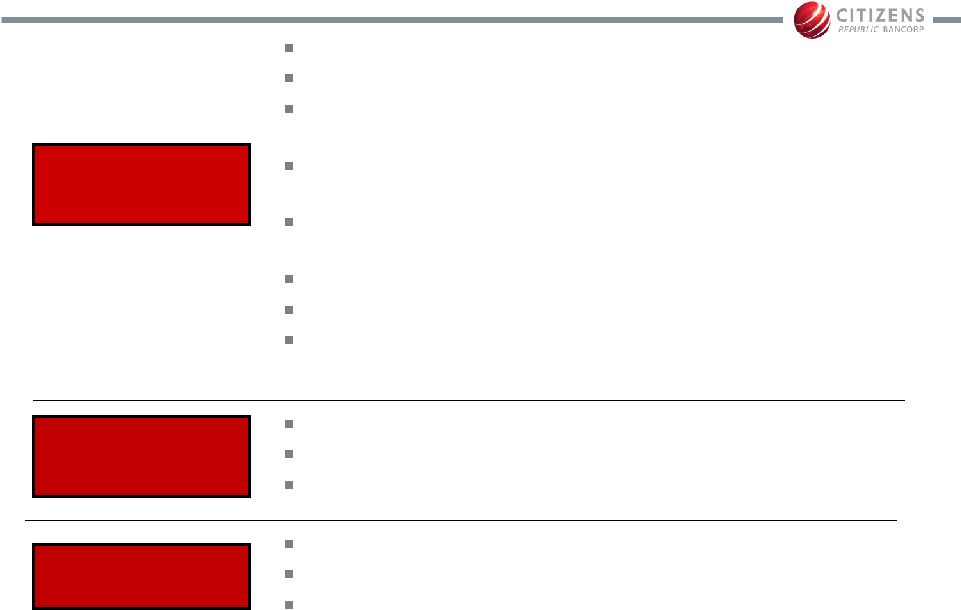

5

How We Deliver Our Service

Core Banking

87% of revenue

Retail consumer

Commercial clients up to $5 million loan size

Treasury Management: 31% of commercial clients use TM

services

Public Funds: focus on generating lasting relationships rather

than temporary deposits

Preferred SBA Lender: dedicated specialists to fast track

process. Expertise in other state and local loan programs.

Mortgage: accommodate and sell

Indirect marine and RV lending

Investment Center: introduce single service CD clients to

financial consultants

Corporate Banking

9% of revenue

Asset Based Lending

Corporate

Specialty healthcare focus in assisted living & skilled nursing

Wealth Management

4% of revenue

Personal Trust

Employee Benefits

Institutional Trust |

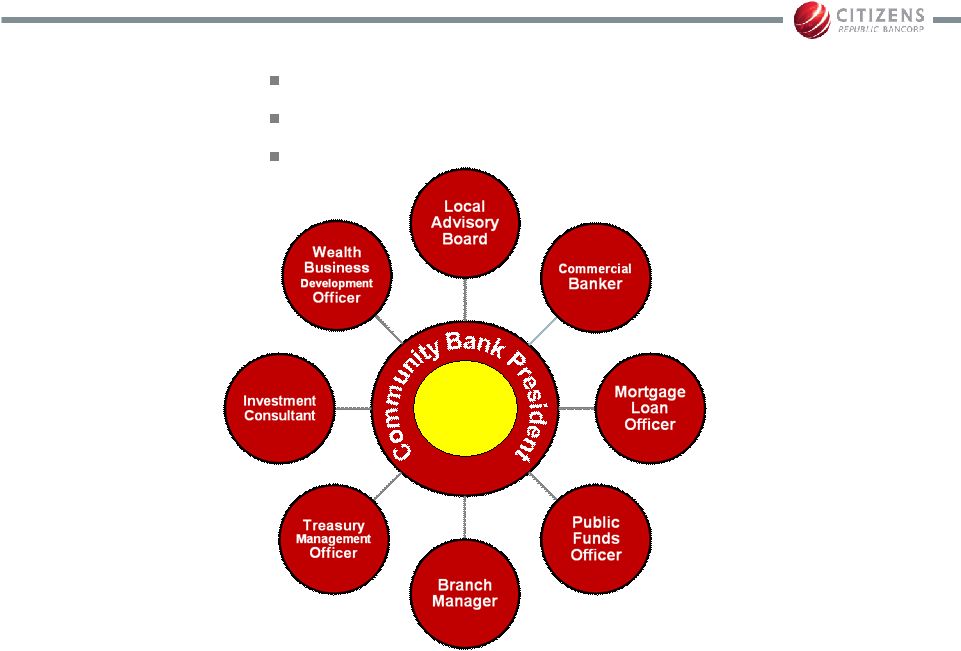

Local

Delivery of Service Local teams focus on delivery of :

Client service

Closing pipeline opportunities

Referring business

6

Client |

| Where We’ve Been |

8

Strategically Managed Through Cycle

Acquired Michigan-based bank with heavy real

estate concentrations in late 2006

Economic downturn and challenging Michigan

economy resulted in elevated credit costs

Employed strategies to reduce balance sheet risk

Enhanced capital

–

suspended dividend (1Q08)

–

$200 million common equity raise (3Q08)

–

$300 million TARP issuance (4Q08)

–

exchanged sub debt & trust preferred for $200

million of common equity (3Q09) |

9

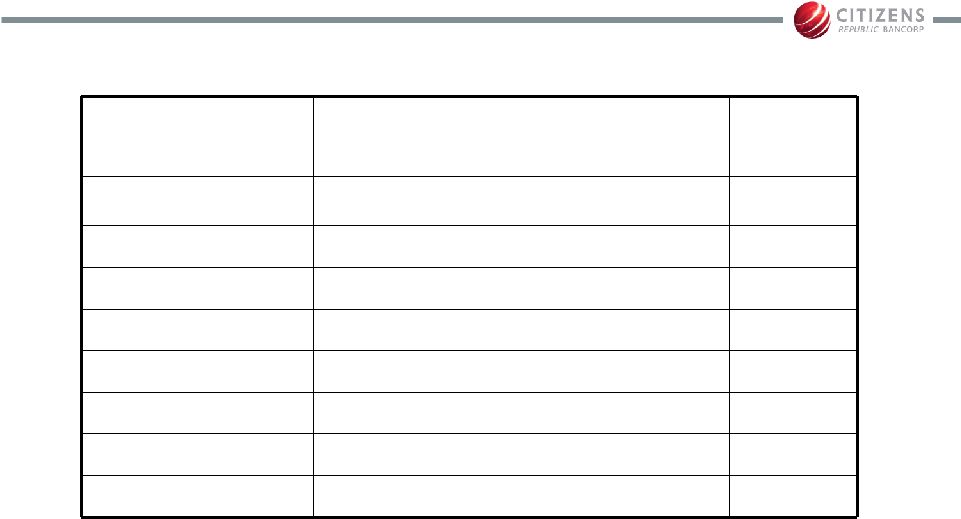

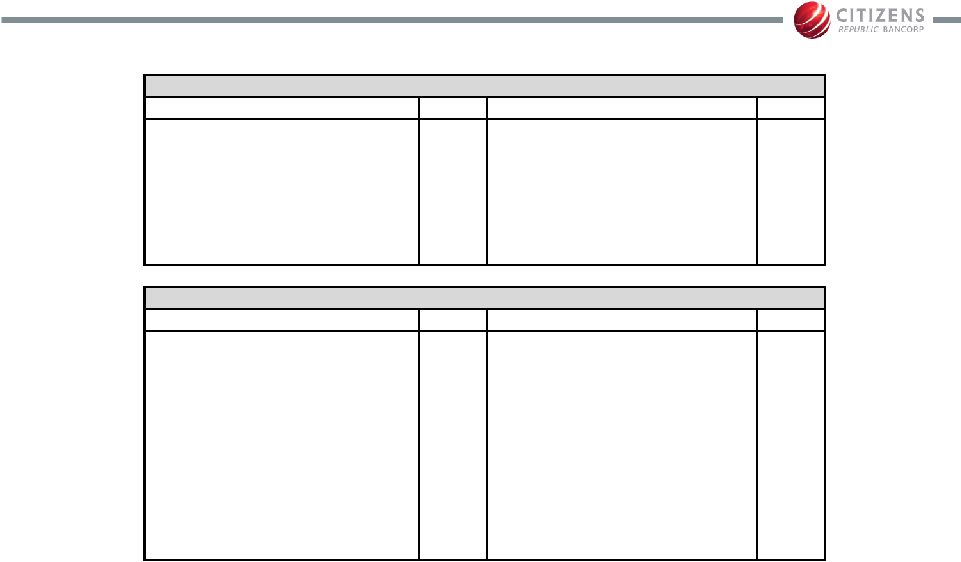

Successful Leaders in Key Roles

Name

Title

Held

Position

Since

Cathy Nash

Chief Executive Officer

Feb. 09

Lisa McNeely

Chief Financial Officer

Aug. 10

Mark Widawski

Chief Credit Officer

Feb. 09

Brian Boike

Treasurer

Oct. 09

Judi Klawinski

Director of Core Banking

Oct. 09

Ray Green

Director of Corporate Banking

May 10

Joe Czopek

Controller

Oct. 09

Ken Duetsch

Director of Wealth Management

Aug. 11 |

Since

2009, focused on clients/revenue while working through credit issues

10

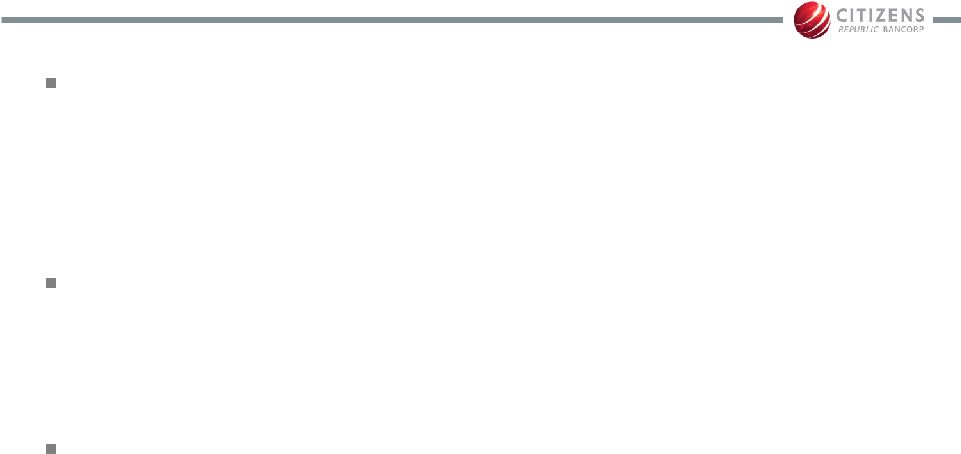

$26.6

$20.6

$29.6

$33.1

$34.7

$34.5

$36.2

$32.1

$30.7

$32.8

$37.8

$36.9

$31.7

$31.7

$33.0

$31.8

$0

$10

$20

$30

$40

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

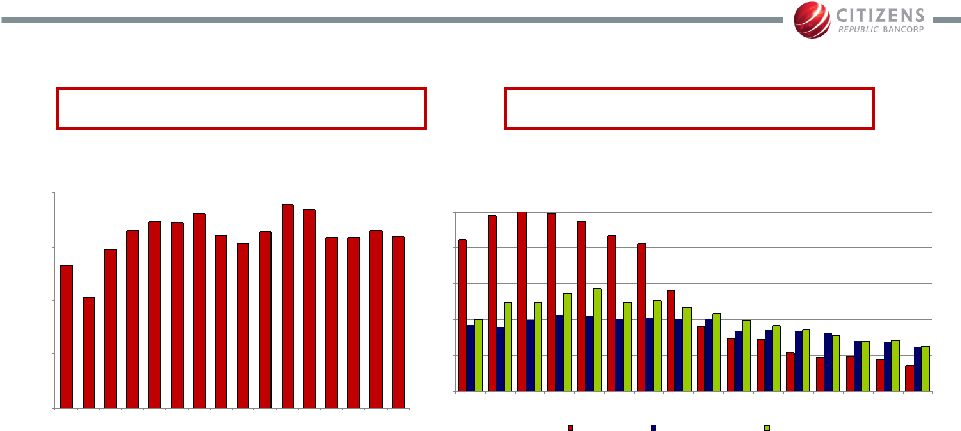

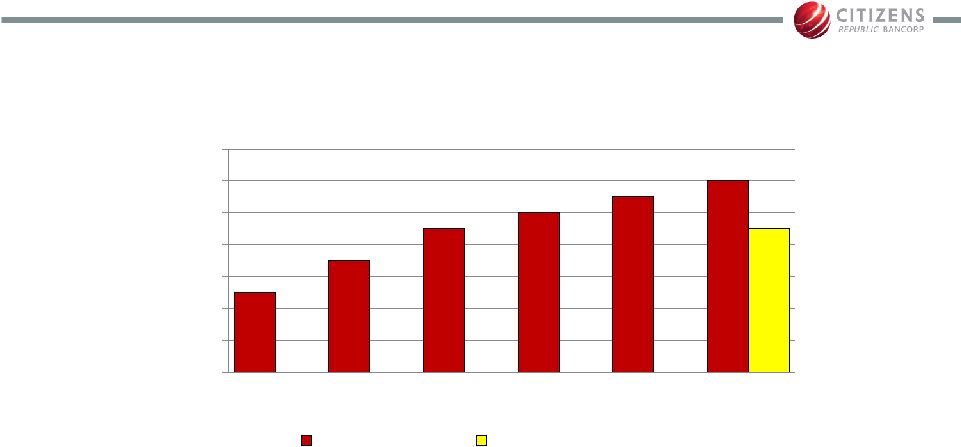

Pre-tax Pre-provision Profit*

Revenue Focus

Problem Asset Resolution Focus

Strengthened franchise

value

Eliminated uncertainty

around credit

0%

1%

2%

3%

4%

5%

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q112

2Q12

3Q12

4Q12

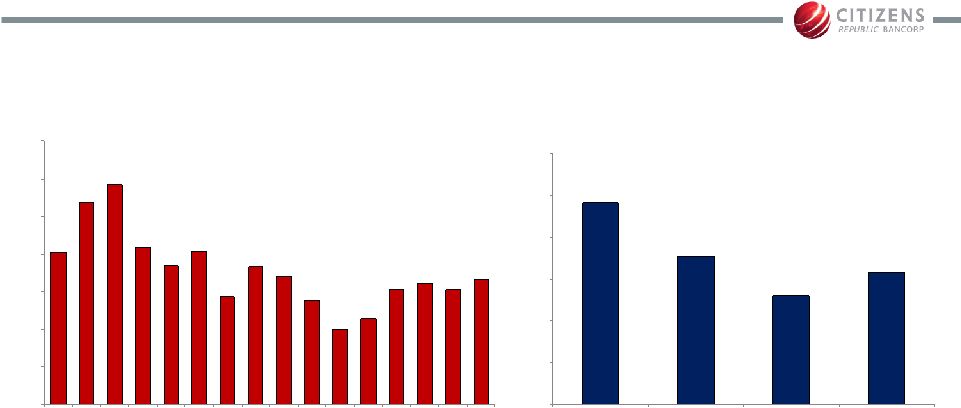

NPAs / Assets %

CRBC

Peer Median**

Regional Peer Median**

(in millions)

*

Non-GAAP

measure,

as

defined

by

management,

represents

net

income

(loss)

excluding

income

tax

provision

(benefit)

provision

for

loan

losses,

securities

(gains)/losses,

and

any

impairment

charges

(including

goodwill,

credit

write

downs

and

fair-value

adjustments)

caused

by

this

economic

cycle.

**

Source:

SNL

Financial

MRQ

data |

Strategy from 2009 –

2010

1.

Preserved capital by managing assets

2.

Grew and maintained reserve levels in recognition of

portfolio risk

11 |

Strategy from 2009 –

2010

3.

Aggressively and actively worked out of problem assets

4.

Carefully managed capital levels to allow execution of

problem asset reduction

12

Dec. 31,

2009

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2012*

Leverage ratio

9.21%

7.71%

8.45%

9.95%

Tier 1 capital ratio

12.52

12.11

13.51

15.67

Total capital ratio

13.93

13.51

14.84

16.93

Tier 1 common

equity (non-GAAP)

8.47

6.62

7.24

9.24

* Estimate |

| Focused on Growth |

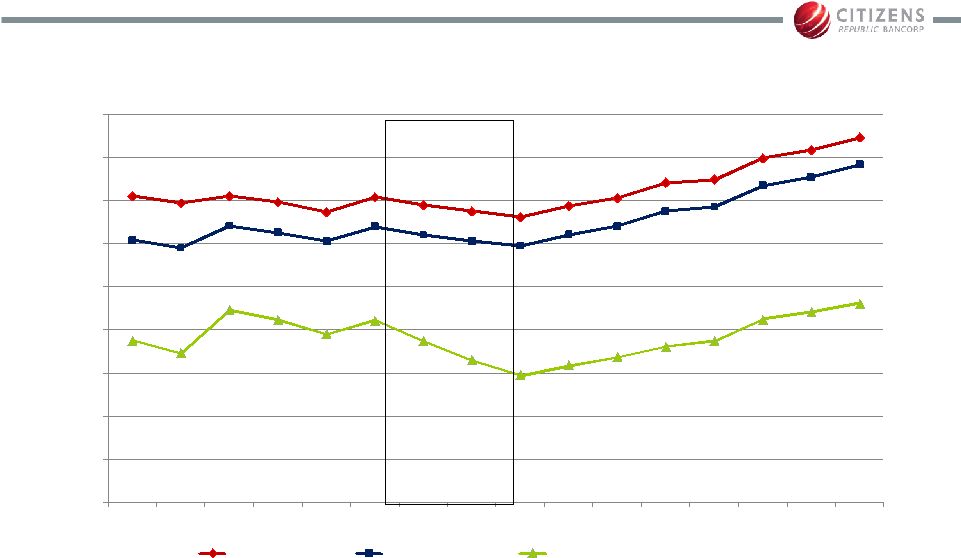

Continue to Provide Top Tier Client Service

14

* Surveys conducted by Prime Performance ™

76

78

80

82

84

86

88

90

Sep 07

Sep 08

Sep 09

Sep 10

Sep 11

Sep 12

Likelihood to Recommend *

Citizens' Score

PPI Industry Average |

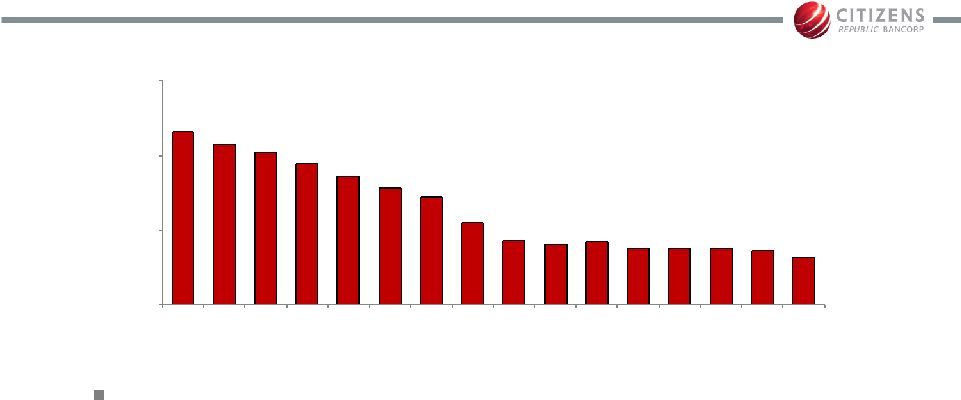

Rebuild Loan Portfolio

Focused on proven competencies

–

Business owner lending

–

Corporate lending –

structured finance, ABL, healthcare

expertise

–

Indirect marine and RV

15

$8,625

$8,302

$8,097

$7,788

$7,439

$7,138

$6,888

$6,217

$5,704

$5,628

$5,672

$5,530

$5,528

$5,522

$5,431

$5,259

$4,000

$6,000

$8,000

$10,000

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Loan Portfolio Balances

(in millions) |

Mitigate Expected Margin Pressure

16

2.74%

2.75%

2.99%

3.13%

3.14%

3.35%

3.32%

3.42%

3.53%

3.56%

3.63%

3.62%

3.56%

3.60%

3.57%

3.50%

2.00%

2.50%

3.00%

3.50%

4.00%

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Net Interest Margin (FTE)

Continue focus on core deposits

Reduce single service CD clients

Manage liquidity levels to reflect

improved credit trends

10,000

12,000

14,000

16,000

18,000

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

Single Service CD Clients

Fed Funds Sold (average)

(in millions) |

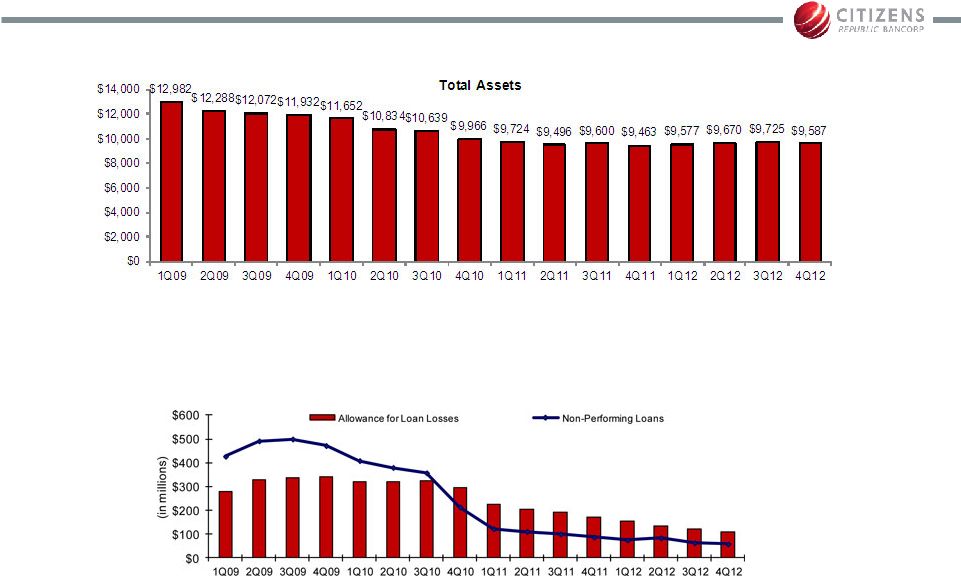

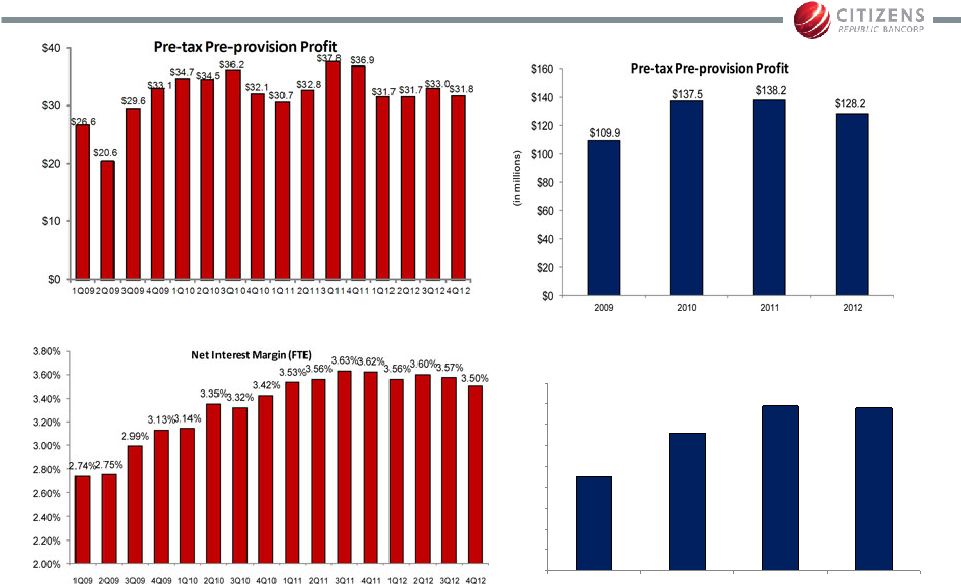

Reserve Reductions Follow Improved Metrics

17

Reserve model is historical looking; future

modeling will continue to reflect significantly

improved credit metrics

Ensure reserves reflect reduced portfolio risk and

support growth initiatives

0%

1%

2%

3%

4%

5%

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Loan Loss Reserves / Loans %

CRBC

Peer Median*

Regional Peer Median*

* Source: SNL Financial MRQ data |

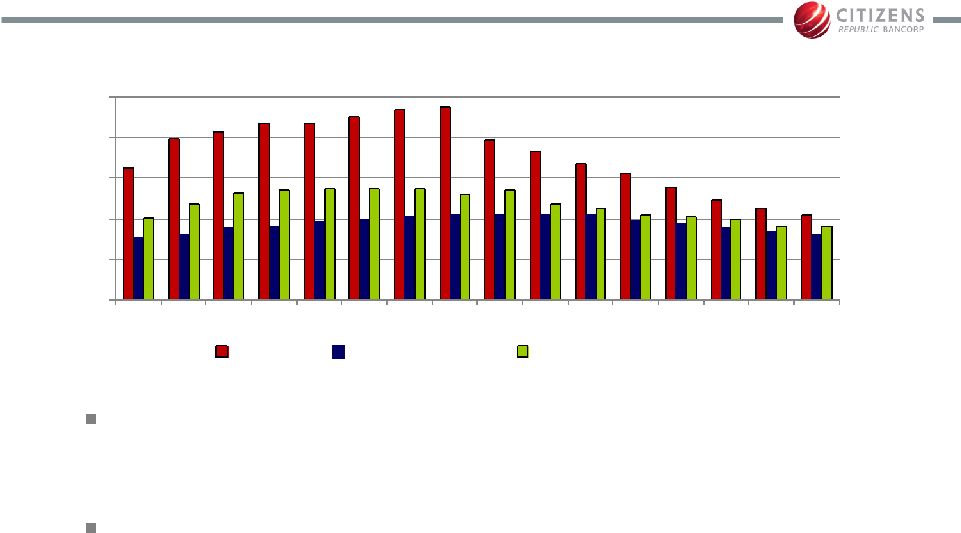

Report Consistent Profits

18

* Excludes discontinued operations

Reprice and add new fee income

streams to replace lost revenue

from regulatory changes

* Non-GAAP measure. See Appendix for reconciliation.

Continue prudent expense

management while adding key

revenue generating positions

Income (Loss) before Tax* |

19

4Q12 Highlights

Reported consistent quarterly profit from banking

operations

–

Consistent net interest margin at 3.50%

–

Fee income from core banking services remained solid

–

Maintained control over operating expenses

Loan growth in focused areas of expertise

–

7% growth in C&I portfolio since last year

–

11% growth in Indirect portfolio since last year

–

Strong origination and pipeline activity in C&I and Indirect

Continued strong credit metrics and core deposit

funding base have created a lower risk profile balance

sheet |

Solid

Core Earnings 20

2.90%

3.31%

3.58%

3.56%

2.00%

2.20%

2.40%

2.60%

2.80%

3.00%

3.20%

3.40%

3.60%

3.80%

2009

2010

2011

2012

Net Interest Margin (FTE) |

Maintained Expense Control

21

70.2%

76.8%

79.2%

70.9%

68.4%

70.4%

64.2%

68.2%

67.1%

63.9%

59.9%

61.4%

65.2%

66.0%

65.2%

66.7%

50%

55%

60%

65%

70%

75%

80%

85%

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Quarterly Efficiency Ratio

74.21%

67.73%

63.05%

65.75%

50%

55%

60%

65%

70%

75%

80%

2009

2010

2011

2012

Annual Efficiency Ratio |

Organically Growing Strong Capital Position

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Total Capital

Tier 1 Capital

Tier 1 Common (non-GAAP)

22

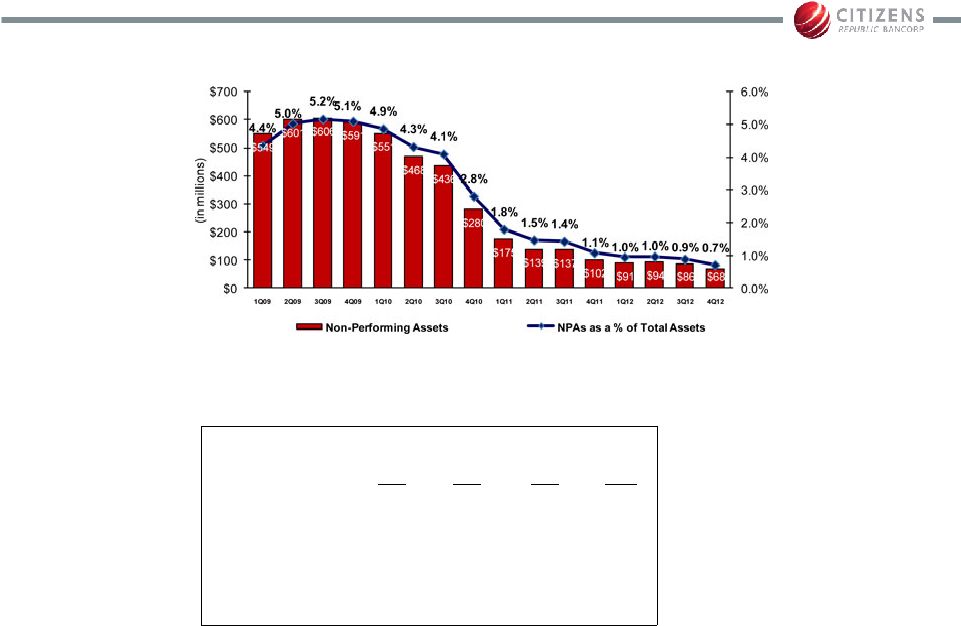

Accelerated

resolution of

over $920

million of

problem

assets |

23

Positioned for Growth

Successfully managed through credit cycle with a

strategic focus on revenue generation and problem

asset resolutions

Strategically focused into 2013 to

–

Continue providing top tier client service

–

Rebuild loan portfolio

–

Mitigate expected margin pressure

–

Evaluate reserve levels

–

Report consistent profitability

Pending merger with FirstMerit Corporation (NASDAQ:

FMER) expected to close 2Q13 |

| 24

Appendix |

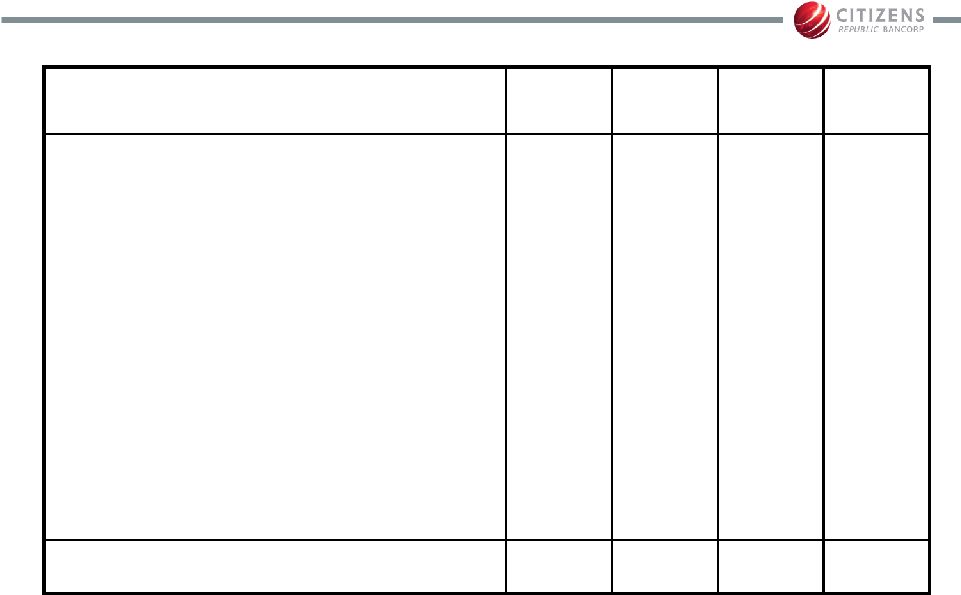

25

Upper Midwest Franchise

MSA

Rank

Number

of

Branches

Total

Deposits

($000)

% of

Franchise

% Market

Share

Michigan:

Flint, MI

1

21

1,413,395

19.2

37.84

Detroit-Warren-Livonia, MI

11

31

1,155,621

15.7

1.19

Saginaw-Saginaw Township North,

1

15

614,662

8.4

30.60

Lansing-East Lansing, MI

3

14

527,318

7.2

10.13

Jackson, MI

2

8

372,527

5.1

23.76

Bay City, MI

3

5

216,496

2.9

20.69

Ann Arbor, MI

12

6

211,446

2.9

3.17

Cadillac, MI

1

7

192,242

2.6

36.30

Owosso, MI

3

6

139,177

1.9

20.48

Sturgis, MI

3

4

101,110

1.4

15.27

Total Michigan

8

156

5,923,119

80.7

3.55

Non-Michigan:

Green Bay, WI

5

10

286,993

3.9

4.85

Cleveland-Elyria-Mentor, OH

18

12

279,794

3.8

0.56

Appleton, WI

12

5

105,395

1.4

2.77

Stevens Point, WI

5

2

88,627

1.2

6.89

Platteville, WI

9

4

70,793

1.0

6.02

Total Non-Michigan

60

1,419,936

19.3

Source: SNL Financial as of 6/30/12 |

26

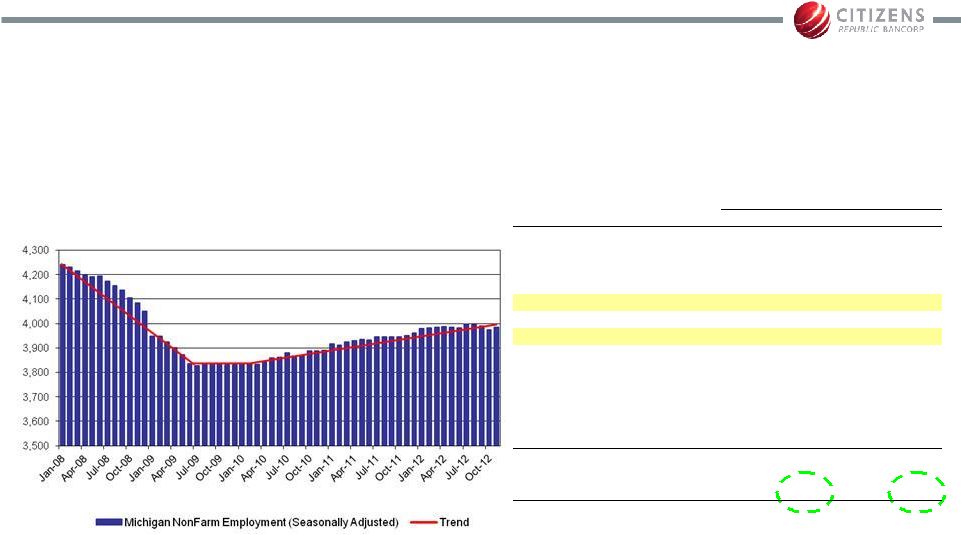

Continued Stabilization and Diversification

in Michigan’s Economy

Source: U.S. Bureau of Labor Statistics

Michigan Nonfarm Employment

Michigan Employment by Industry

Nov. 2012

Nov. 2002

$000s

%

$000s

%

Trade, Transportation, and Utilities

663.5

16.5%

763.3

16.8%

Government

630.3

15.6%

717.9

15.8%

Professional Services

578.1

14.3%

606.7

13.4%

Health Care

554.9

13.8%

477.8

10.5%

Other Manufacturing

391.4

9.7%

479.0

10.6%

Leisure and Hospitality

366.3

9.1%

391.1

8.6%

Motor Vehicle

211.1

5.2%

362.0

8.0%

Financial Activities

198.0

4.9%

213.8

4.7%

Other Services

168.7

4.2%

179.2

3.9%

Construction

124.2

3.1%

201.7

4.4%

Education Services

82.8

2.1%

68.2

1.5%

Information

52.5

1.3%

69.1

1.5%

Mining and Logging

7.3

0.2%

8.8

0.2%

Total Nonfarm

4,029.1

4,538.6

Total Manufacturing

602.5

15.0%

841.0

18.5%

in thousands |

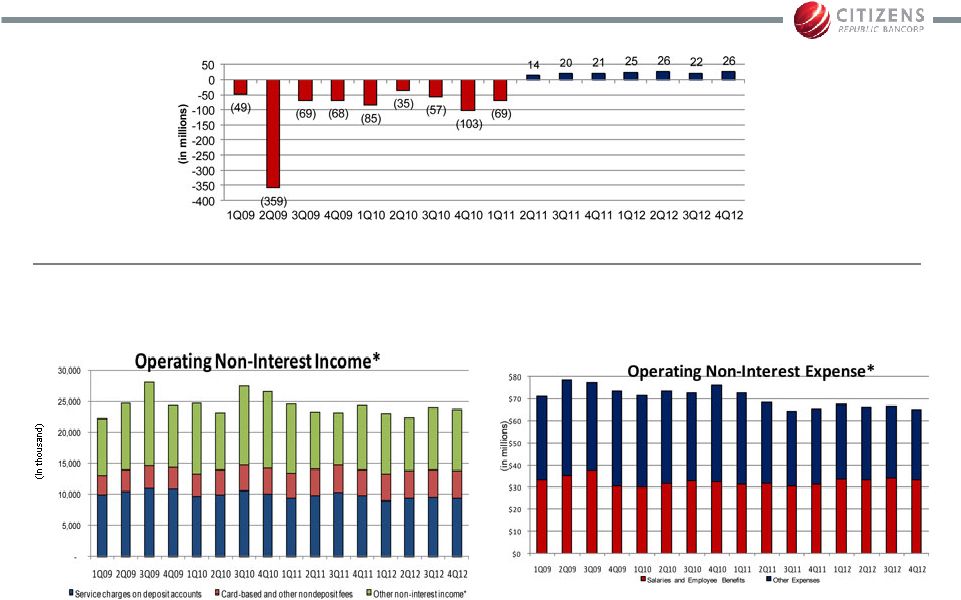

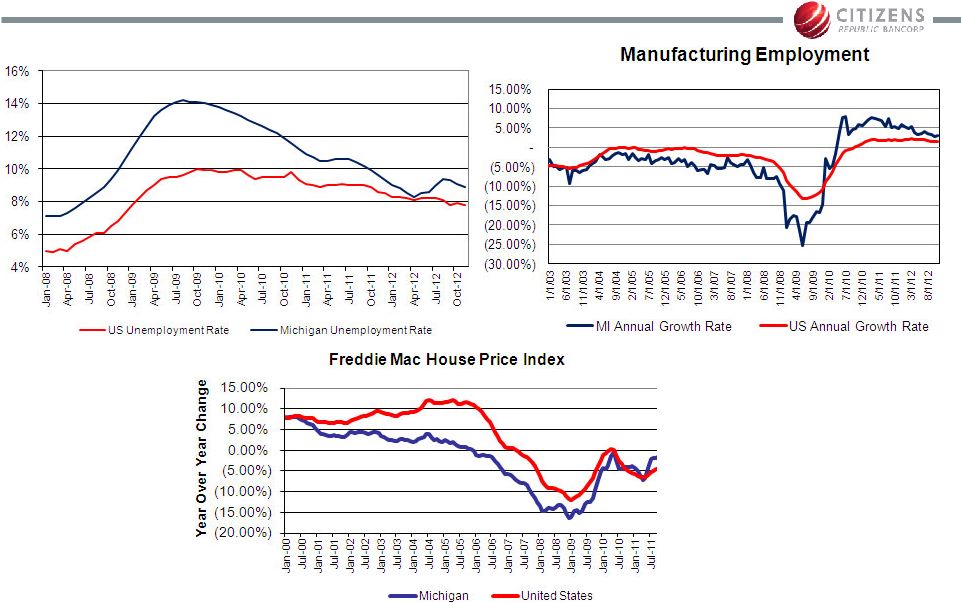

27

Continued Stabilization and Diversification

in Michigan’s Economy

Source: U.S. Bureau of Labor Statistics and Freddie Mac

Unemployment Trends |

28

Core Earnings Strength

(1)

Non-GAAP

measure,

as

defined

by

management,

represents

total

revenue

(total

net

interest

income

and

non-interest

income)

excluding

any

securities

gains/losses,

fair

value

adjustments

on

loans

held

for

sale,

interest

rate

swaps,

and

bank

owned

life

insurance,

less

non-interest

expense

excluding

any

goodwill

impairment

charges,

credit

write

downs,

fair

value

adjustments

and

special

assessments.

Pre-Tax Pre-Provision Profit (non-GAAP)

(in millions)

1Q12

2Q12

3Q12

4Q12

Income(loss) from continuing operations

$24.9

$303.2

$21.0

$23.2

Income tax (benefit) provision

-

(276.8)

1.3

2.5

Provision for loan losses

8.4

5.3

5.2

4.3

Investment securities (gains) losses

-

-

-

-

Net losses (gains) on LHFS

(0.9)

(0.0)

0.2

1.7

(Gains) losses on ORE

(0.4)

(0.2)

0.9

(0.6)

Merger related expenses

-

-

4.4

0.6

Fair-value adjustment on BOLI

(0.2)

0.1

(0.0)

0.0

Fair-value adjustment on swaps

(0.1)

0.1

0.1

(0.1)

Pre-Tax Pre-Provision Profit

(1)

$31.7

$31.7

$33.0

$31.8

Last 12 Months

$128.2 |

29

(in millions)

2009

2010

2011

2012

Income (loss) from continuing operations

($505.7)

($289.1)

$6.7

$372.3

Income tax (benefit) provision

(29.6)

12.9

(20.2)

(273.0)

Provision for loan losses

323.8

392.9

138.8

23.2

Goodwill impairment charge

256.3

-

-

-

Net loss on debt extinguishment

15.9

-

-

-

Investment securities (gains) losses

(0.0)

(13.9)

1.3

-

FDIC special assessment

5.4

-

-

-

Net losses (gains) on LHFS

20.1

20.6

(1.8)

1.0

Losses (gains) on ORE

23.3

13.4

12.8

(0.2)

Merger related expenses

-

-

-

5.0

Fair-value adjustment on BOLI

(0.1)

(0.1)

0.2

(0.1)

Fair-value adjustment on swaps

0.6

0.8

0.4

0.0

Pre-Tax Pre-Provision Profit

(1)

$109.9

$137.5

$138.2

$128.2

Core Earnings Strength

Pre-Tax Pre-Provision Profit (non-GAAP)

(1)

Non-GAAP

measure,

as

defined

by

management,

represents

total

revenue

(total

net

interest

income

and

non-interest

income)

excluding

any

securities

gains/losses,

fair

value

adjustments

on

loans

held

for

sale,

interest

rate

swaps,

and

bank

owned

life

insurance,

less

non-interest

expense

excluding

any

goodwill

impairment

charges,

credit

write

downs,

fair

value

adjustments

and

special

assessments. |

30

Quarterly Non-Interest Income Trends

(in thousands)

4Q 11

1Q12

2Q12

3Q12

4Q12

Service charges on deposit accounts

$9,724

$8,985

$9,355

$9,554

$9,414

Trust fees

3,747

3,602

3,582

3,635

3,782

Mortgage and other loan income

2,705

1,858

1,952

2,028

2,265

Brokerage and investment fees

1,243

1,324

1,331

1,831

1,569

Card-based and other nondeposit fees

4,305

4,265

4,444

4,431

4,367

Net (losses) gains on loans held for sale

(217)

916

6

(184)

(1,723)

Investment securities gains (losses)

38

-

-

-

-

Other income

2,818

3,290

1,675

2,415

2,350

Total Non-Interest Income (GAAP)

$24,363

$24,240

$22,345

$23,710

$22,024

Investment securities gains (losses)

(38)

$

-

$

-

$

-

$

-

$

Net (losses) gains on loans held for sale

217

(916)

(6)

184

1,723

Fair value adjustment on BOLI

(100)

(205)

118

(31)

47

Fair value adjustment on swaps

(46)

(61)

74

83

(85)

Operating Non-interest Income

(Non-GAAP)

$24,396

$23,058

$22,531

$23,946

$23,709 |

31

Annual Non-Interest Income Trends

(in thousands)

2009

2010

2011

2012

Service charges on deposit accounts

$42,116

$40,336

$39,268

$37,308

Trust fees

14,784

15,603

15,103

14,601

Mortgage and other loan income

12,393

10,486

9,620

8,104

Brokerage and investment fees

5,194

4,579

5,072

6,055

Card-based and other nondeposit fees

6,283

7,057

17,167

17,507

Bankcard fees

7,714

8,859

Net (losses) gains on loans held for sale

(20,086)

(20,617)

1,808

(984)

Net loss on debt extinguishment

(15,929)

-

-

-

Investment securities gains (losses)

5

13,896

(1,336)

-

Other income

10,659

14,460

8,555

9,729

Total Non-Interest Income (GAAP)

$63,133

$94,659

$95,257

$92,320

Net loss on debt extinguishment

$15,929

-

$

-

$

-

$

Investment securities gains (losses)

(5)

(13,896)

1,336

-

Net (losses) gains on loans held for sale

20,086

20,617

(1,808)

984

Fair value adjustment on BOLI

(144)

(67)

233

(71)

Fair value adjustment on swaps

606

782

413

11

Operating Non-interest Income

(Non-GAAP)

$99,605

$102,095

$95,431

$93,244 |

32

Quarterly Non-Interest Expense Trends

(in thousands)

4Q 11

1Q12

2Q12

3Q12

4Q12

Salaries and employee benefits

$30,952

$33,298

$32,801

$33,589

$33,163

Occupancy

6,326

6,696

6,140

6,129

6,031

Professional services *

2,311

2,023

2,465

6,806

2,478

Equipment

3,326

3,303

2,904

2,937

2,858

Data processing services

3,709

4,048

3,721

4,427

4,521

Advertising and public relations

1,298

1,335

1,708

1,847

1,014

Postage and delivery

1,165

1,099

1,119

1,157

1,081

Other loan expenses

3,497

3,186

3,266

3,121

3,650

Losses on other real estate (ORE)

1,081

(385)

(173)

941

(596)

ORE expenses

995

450

266

323

220

Intangible asset amortization

688

578

545

513

484

Other expense

11,292

11,470

11,577

10,265

10,224

Total Non-Interest Expense (GAAP)

$66,640

$67,101

$66,339

$72,055

$65,128

Merger related expenses

-

-

-

4,411

597

Losses (gains) on ORE

1,081

(385)

(173)

941

(596)

Operating Non-Interest Expense

(Non-GAAP)

$65,559

$67,486

$66,512

$66,703

$65,127

* Includes merger related expenses |

33

Annual Non-Interest Expense Trends

(in thousands)

2009

2010

2011

2012

Salaries and employee benefits

$135,389

$126,384

$123,514

$132,850

Occupancy

26,723

26,963

26,059

24,997

Professional services

11,877

10,550

9,331

13,772

Equipment

11,714

12,482

12,136

12,001

Data processing services

17,692

18,734

16,131

16,717

Advertising and public relations

7,113

6,530

5,848

5,904

Postage and delivery

5,525

4,571

4,543

4,456

Other loan expenses

24,553

20,311

16,007

13,224

Losses on other real estate (ORE)

23,312

13,438

12,768

(214)

ORE expenses

4,389

4,970

4,322

1,259

Intangible asset amortization

7,036

3,923

3,027

2,120

Goodwill impairment

256,272

-

-

-

Other expense

53,544

58,231

49,464

43,536

Total Non-Interest Expense (GAAP)

$585,139

$307,087

$283,150

$270,622

Goodwill impairment

256,272

$

-

$

-

$

-

$

FDIC Special Assessment

5,351

-

-

-

Merger-related expenses

-

-

-

5,008

Fair-value adjustment on ORE

23,312

13,438

12,768

(214)

Operating Non-Interest Expense

(Non-GAAP)

$300,204

$293,649

$270,382

$265,828 |

34

($ in millions)

Market

% of

Credit Rating

Value

Total

Gov't & Agency

2,711

$

91.0%

AAA

15

0.5%

AA

137

4.6%

A

34

1.2%

BAA1, BAA2 & BAA3

51

1.7%

BA1 & Lower

14

0.5%

Non-rated

18

0.6%

Total

2,980

$

100.0%

•

Over $2.2 billion in unpledged securities

•

No OTTI concerns

•

Over 70% of portfolio are GNMA securities

purchased over the last 2 –

3 years

($ in millions)

Book

Market

TEY*

Duration

Type

Value

Value

(%)

(years)

MBS Agency

893

$

933

$

2.61%

1.46

CMO - Agency

594

601

1.82%

3.54

CMO - Non-agency

60

61

3.43%

2.52

Municipals

97

103

6.21%

2.50

Total Available for Sale

1,644

$

1,698

$

2.57%

2.31

MBS Agency

844

$

883

$

2.99%

2.18

CMO - Agency

283

293

1.96%

1.22

Municipals

99

106

6.00%

3.54

Total Held to Maturity

1,226

$

1,282

$

2.99%

2.07

Total Investment Securities

2,870

$

2,980

$

2.75%

2.21

Investment Portfolio at December 31, 2012

* Taxable equivalent yield, except for Municipal yields which are before tax

effect Effective Management of Securities Portfolio Provides

Source of Liquidity |

35

($ in millions)

12/31/09

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12**

Tier 1 capital

$ 1,067

$ 777

$ 706

$ 727

$ 758

$ 773

$ 795

$ 860

$ 878

$ 892

Qualifying LLR

109

83

76

74

75

73

74

74

73

72

Qualifying capital securities

10

7

3

3

3

3

-

-

-

- Total risk-based capital

$ 1,186

$ 867

$ 785

$ 805

$ 836

$ 850

$ 869

$ 934

$ 951

$ 964

Tier 1 capital

$ 1,067

$ 777

$ 706

$ 727

$ 758

$ 773

$ 795

$ 860

$ 878

$ 892

Qualifying capital securities

(74)

(74)

(74)

(74)

(74)

(74)

(74)

(74)

(74)

(74)

Preferred stock

(272)

(278)

(280)

(282)

(283)

(285)

(287)

(289)

(291)

(292)

Tier 1 common equity

$ 721

$ 425

$ 352

$ 371

$ 401

$ 415

$ 435

$ 497

$ 514

$ 526

Total Capital Ratio

13.93%

13.51%

13.24%

13.77%

14.14%

14.84%

14.97%

15.96%

16.35%

16.93%

Tier 1 Capital Ratio

12.52%

12.11%

11.90%

12.43%

12.81%

13.51%

13.70%

14.70%

15.09%

15.67%

Tier 1 Leverage Ratio

9.21%

7.71%

7.39%

7.83%

8.21%

8.45%

8.71%

9.77%

9.66%

9.95%

Tier 1 Common Ratio *

8.47%

6.62%

5.93%

6.36%

6.77%

7.24%

7.49%

8.50%

8.83%

9.24%

TCE to TA *

6.16%

4.20%

3.59%

4.05%

4.31%

4.47%

4.68%

7.73%

7.91%

8.15%

** Estimate

TA - tangible assets

* Non-GAAP

TCE - tangible common equity

Maintaining Strong Capital Levels |

36

Non-GAAP Common Equity Ratios

($ in thousands)

4Q11

1Q12

2Q12

3Q12

4Q12*

Total assets

$9,463

$9,577

$9,670

$9,725

$9,587

Goodwill

(318)

(318)

(318)

(318)

(318)

Other intangible assets

(7)

(7)

(6)

(6)

(5)

Tangible assets

$9,137

$9,252

$9,346

$9,401

$9,263

Total shareholders' equity

$1,020

$1,045

$1,336

$1,358

$1,371

Goodwill

(318)

(318)

(318)

(318)

(318)

Other intangible assets

(7)

(7)

(6)

(6)

(5)

Tangible equity

$694

$720

$1,011

$1,034

$1,047

Preferred stock

(285)

(287)

(289)

(291)

(292)

Tangible common equity

$409

$433

$723

$744

$755

Total shareholders' equity

$1,020

$1,045

$1,336

$1,358

$1,371

Qualifying capital securities

74

74

74

74

74

Goodwill

(318)

(318)

(318)

(318)

(318)

Disallowed tax assets

-

-

(236)

(235)

(242)

Accumulated other comprehensive income

6

2

10

6

13

Other assets

(7)

(7)

(6)

(6)

(5)

Total Tier 1 capital (regulatory)

$773

$795

$860

$878

$892

Qualifying capital securities

(74)

(74)

(74)

(74)

(74)

Preferred stock

(285)

(287)

(289)

(291)

(292)

Total Tier 1 common equity (non-GAAP)

$415

$435

$497

$514

$526

Net risk-weighted assets (regulatory)

$5,723

$5,804

$5,852

$5,822

$5,695

Tangible common equity to tangible assets ratio

4.47%

4.68%

7.73%

7.91%

8.15%

Tier 1 common equity ratio (non-GAAP)

7.24%

7.49%

8.50%

8.83%

9.24%

(1)

Other assets deducted from Tier 1 capital and risk-weighted assets consist of

intangible assets (excluding goodwill) * Estimate

(¹)

(1) |

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

37

Proactive Credit Management

$0

$50

$100

$150

$200

$250

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

30-89 Day Past Due

Portfolio Balances

Non-Performing Loans

($ in millions)

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Net Charge-Offs

$0

$2,000

$4,000

$6,000

$8,000

$10,000

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12 |

$0

$5

$10

$15

$20

$25

$30

$35

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

$0

$20

$40

$60

$80

$100

$120

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

$0

$10

$20

$30

$40

$50

$60

1Q092Q093Q094Q091Q102Q103Q104Q101Q112Q113Q114Q111Q122Q123Q124Q12

38

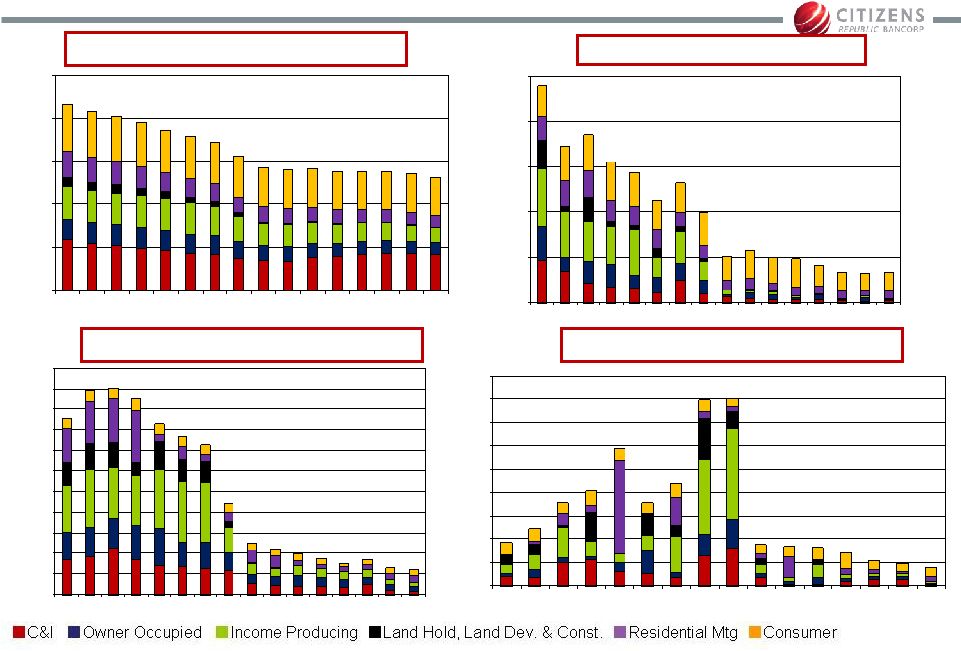

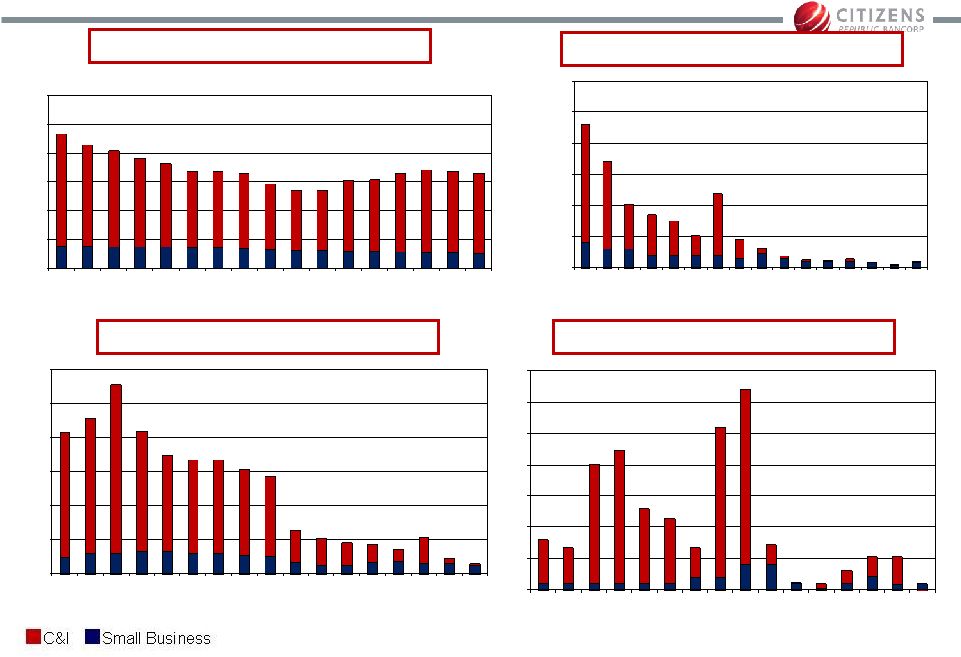

Commercial & Industrial Portfolio

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

30-89 Day Past Due

Portfolio Balances

($ in millions)

Non-Performing Loans

Net Charge-Offs |

39

Commercial Portfolio Size Characteristics

< $5 million

$5 - $10 million

> $10 million

Total

Total Commercial Portfolio

Total (millions)

1,823

$

515

$

561

$

2,899

$

# of loans

6,791

74

37

6,902

Average loan size

$268,000

$6,954,000

$15,162,000

$420,000

Delinquencies

Total (millions)

4

$

-

$

-

$

4

$

# of loans

33

-

-

33

Average loan size

$125,000

-

$

-

$

$125,000

Nonperforming Loans

Total (millions)

27

$

-

$

-

$

27

$

# of loans

162

-

-

162

Average loan size

$164,000

-

$

-

$

$164,000

Loan size category: |

$0

$40

$80

$120

$160

$200

$240

$280

$320

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

$0

$20

$40

$60

$80

$100

$120

$140

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

40

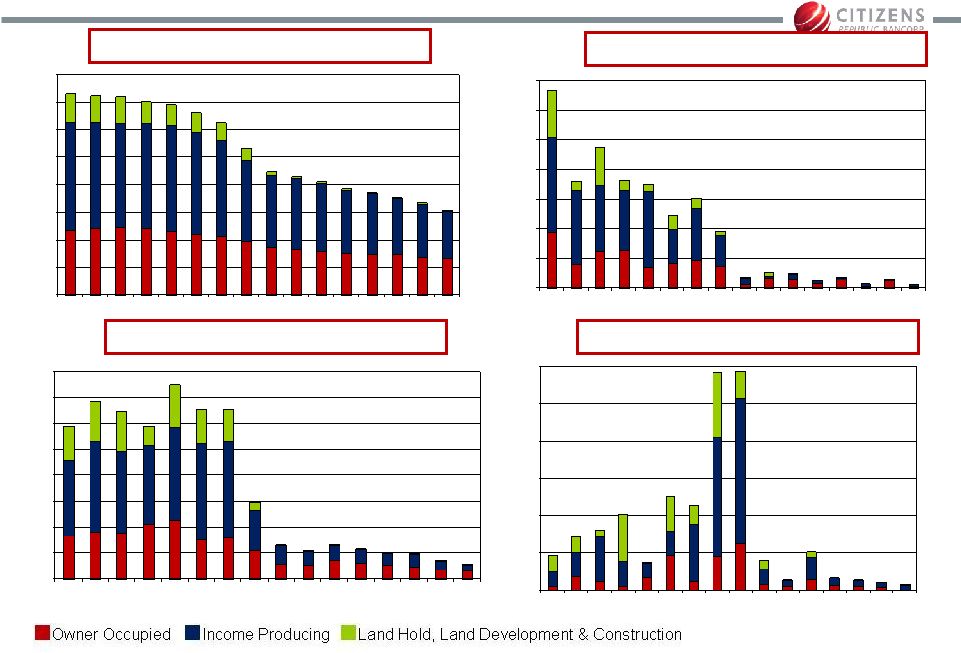

Commercial Real Estate Portfolio

$0

$400

$800

$1,200

$1,600

$2,000

$2,400

$2,800

$3,200

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

30-89 Day Past Due

Portfolio Balances

($ in millions)

Non-Performing Loans

$0

$20

$40

$60

$80

$100

$120

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Net Charge-Offs |

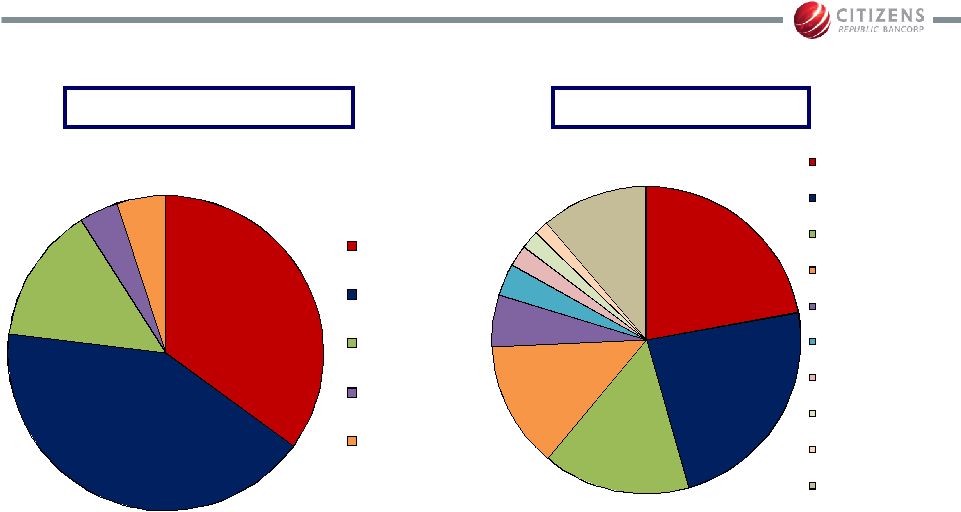

41

Commercial Real Estate Portfolio

35%

42%

14%

4%

5%

Southeast

Michigan

Greater

Michigan

Ohio

Wisconsin

Other

22%

23%

16%

13%

5%

3%

2%

2%

1%

11%

Retail

Medical

Warehouse/

Industrial

Office

Multi-Family

Hotel

Mixed Use

Gas Station/ C.Store

Residential

Other (<1%)

By Collateral

By Region |

$0

$20

$40

$60

$80

$100

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

42

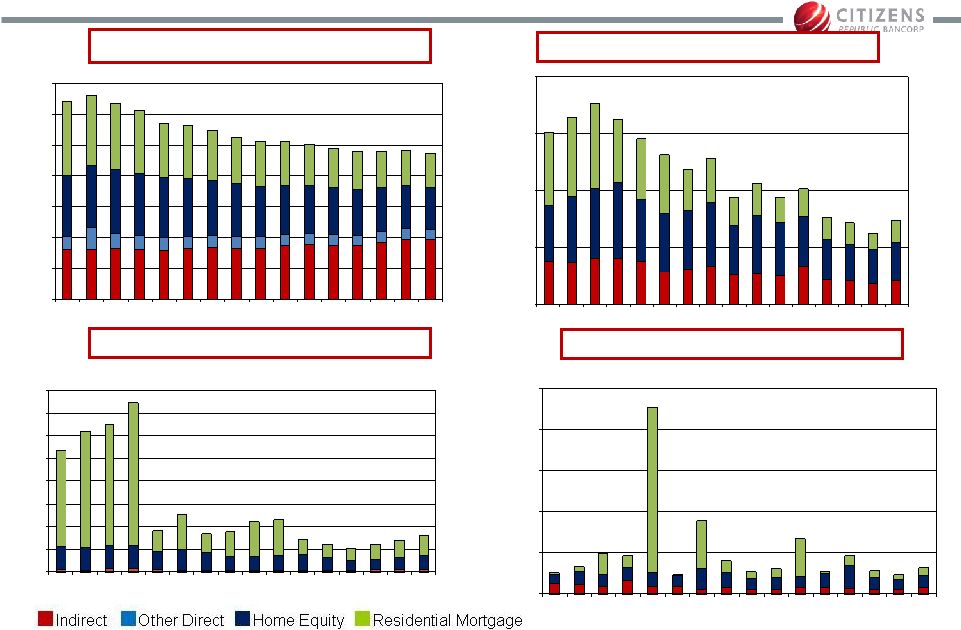

Consumer Portfolio

$0

$20

$40

$60

$80

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

30-89 Day Past Due *

Portfolio Balances

Non-Performing Loans *

Net Charge-Offs *

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

($ in millions)

$0

$20

$40

$60

$80

$100

$120

$140

$160

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

* Other direct included with Home Equity

|

43

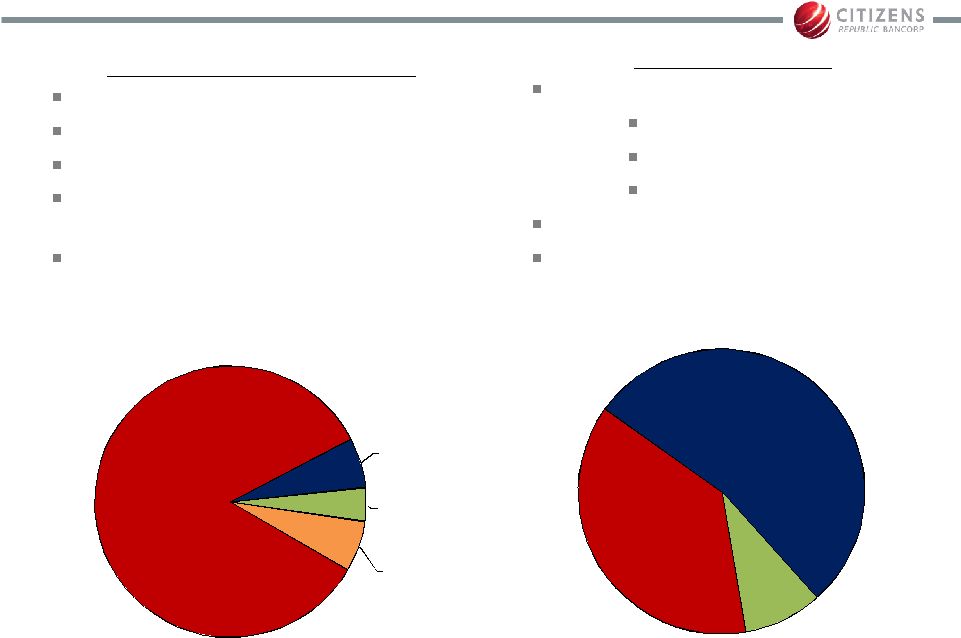

Consumer Portfolio Profiles

Home Equity

$35,900 avg

loan size

Indirect

(1)

$24,300 avg

loan size

(1) Indirect loans are RV and marine only (no auto)

Consumer Portfolio

Strong refreshed FICO scores

741 Home Equity

742 Indirect

728 Other Direct

45% of home equity is first lien position

Indirect NPLs have been less than

$2.6 million, or 0.33% of total,

throughout the cycle

Other

Direct

$19,500 avg

loan size

Residential Mortgage Portfolio

$162,000 average loan size

717 refreshed FICO score

67% average original LTV

Seasoned portfolio –

52% originated

2004 or earlier

Foreclosures are handled by PHH;

Michigan does not follow a judicial

foreclosure process

Michigan

84%

Ohio

6%

Wisconsin

4%

Other

6% |

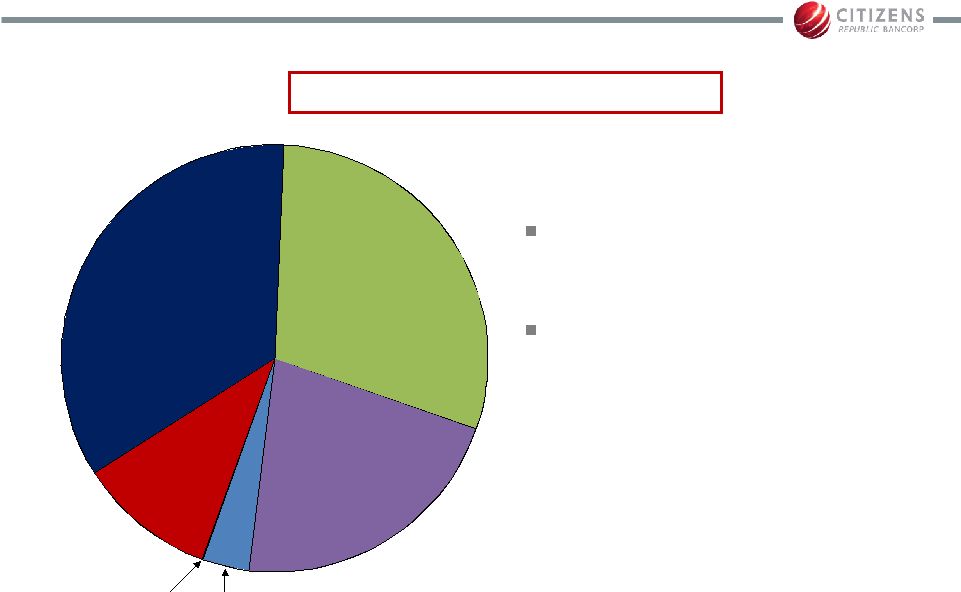

44

Non-Performing Loans

Commercial

Real Estate

$20.5

34.7%

Commercial

$6.2

10.4%

Residential

Mortgage

$17.5

29.7%

($ in millions)

Direct

Consumer

$12.7

21.6%

$59.0 million or 1.12% of portfolio

Indirect

Consumer

$2.1

3.5%

Loans 90+

Accruing

$0.01

Loan loss reserve = $110.4

million

Allowance for loan losses to

NPLs = 187.2% |

45

(in millions)

1Q12

2Q12

3Q12

4Q12

Beginning NPAs

$102.2

$90.6

$94.0

$86.2

Commercial:

Additions

14.0

23.8

4.6

4.8

Payments

(5.1)

(12.0)

(21.0)

(7.9)

Returned to accruing status

(3.9)

(0.5)

(1.3)

-

Charge-Offs/ OREO writedown

(13.1)

(6.0)

(6.2)

(5.8)

Consumer - net change

(3.9)

3.4

3.6

4.1

Held For Sale - net change

0.9

(2.4)

15.8

(13.5)

OREO - net change

(0.6)

(3.0)

(3.1)

0.1

Ending NPAs

$90.6

$94.0

$86.2

$68.0

Aggressive Non-Performing Asset Management

Quarterly Non-Performing Asset Activity

*

* 2Q12 inflows and 3Q12 outflows include a single $14 million relationship

* |

46

Peer Groups

Company Name

Ticker

Company Name

Ticker

Associated Banc-Corp

ASBC

Huntington Bancshares Incorporated

HBAN

Comerica Incorporated

CMA

KeyCorp

KEY

Commerce Bancshares, Inc.

CBSH

MB Financial, Inc.

MBFI

Fifth Third Bancorp

FITB

Old National Bancorp

ONB

First Midwest Bancorp, Inc.

FMBI

PNC Financial Services Group, Inc.

PNC

FirstMerit Corporation

FMER

TCF Financial Corporation

TCB

Flagstar Bancorp, Inc.

FBC

Wintrust Financial Corporation

WTFC

Company Name

Ticker

Company Name

Ticker

Associated Banc-Corp

ASBC

MB Financial, Inc.

MBFI

BancorpSouth, Inc.

BXS

National Penn Bancshares, Inc.

NPBC

Chemical Financial Corporation

CHFC

Old National Bancorp

ONB

Commerce Bancshares, Inc.

CBSH

Park National Corporation

PRK

Cullen/Frost Bankers, Inc.

CFR

Sterling Financial Corporation

STSA

F.N.B. Corporation

FNB

Susquehanna Bancshares, Inc.

SUSQ

First Citizens BancShares, Inc.

FCNCA

TFS Financial Corporation (MHC)

TFSL

First Midwest Bancorp, Inc.

FMBI

Trustmark Corporation

TRMK

FirstMerit Corporation

FMER

UMB Financial Corporation

UMBF

Flagstar Bancorp, Inc.

FBC

Valley National Bancorp

VLY

Fulton Financial Corporation

FULT

Wintrust Financial Corporation

WTFC

Regional Peers

Selected Peers |

www.citizensbanking.com |