Attached files

| file | filename |

|---|---|

| EX-10.1 - ROYALTY AGREEMENT - ARX Gold Corp | arx-ex1001.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 22nd, 2012

Commission File Number: 333-152002

ARX GOLD CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

30-0459858

(IRS Employer Identification Number)

Level 13- 40 Creek

St

Brisbane QLD Australia 4000,

(Address of principal offices)

Tel: 888 408-9402

(Registrant’s telephone number)

www.ARXGOLD.net

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

FORWARD LOOKING STATEMENTS

This current report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future results of operation or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “intends”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” in this current report, which may cause our or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. You should not place undue reliance on these statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that we may issue in the future. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

| 1 |

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, we acquired 100% of Grimsby Investments Ltd, which holds the the ARX Springs Gold Project rights. Accordingly, we are providing the following information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the post Share Exchange Agreement entity, except that information relating to periods prior to the date of the transaction relates to the pre-transaction company, unless otherwise specifically indicated.

The foregoing Items enumerated 1 through 15 are enumerated utilizing the Item number designation of Form 10 and intended to satisfy and relate such information required by Item 2.01 for Form 8-K.

Item 1 – Registrant’s Business

ARX Gold Corporation (Formerly known as Daulton Capital Corp.) “ARX Gold” (“Company,” “we,” “us,” or “our”) was incorporated in Nevada on January 8, 2008 with the intention of pursuing oil and gas exploration opportunities.

On February 15, 2008, the Company filed a Certificate of Amendment to increase our authorized stock into 50,000,000 shares of common stock, $0.001 par value and 5,000,000 shares of preferred stock, $0.001 par value.

On October 17, 2008, the Company filed a Certificate of Change with the Nevada Secretary of State effecting a four-for-one forward stock split of our common stock and increasing the our authorized capitalization to 200,000,000 shares of common stock.

On August 7, 2009, the Company filed a Certificate of Amendment to affect a four-for-one forward split of our common stock.

Operational History

On February 22, 2010, the Company entered into the “Ballarat Option Agreement” to purchase an undivided interest of mining claims of a property described as “Ballarat Property.” In addition, on February 25, 2010, the Company entered into the “Hunker Option Agreement to purchase an undivided interest of mining claims of a property described as “Hunker Project.”

On April 18, 2011, the Company and South Pacific Connection Ltd entered into a Purchase Agreement for the Company to purchase an 80% working interest of a mining claim in Papua New Guinea.

On April 29, 2011, the Company executed a “Termination Agreement” to terminate the Ballarat Option Agreement, and amendments thereto and the Hunker Option Agreement (collectively, the “Option Agreements”). Pursuant to the Termination Agreement, the Option Agreements were terminated.

General Overview of Business

As of April 30, 2011, the Company has abandoned the oil and gas prospects. The Company shifted focus to evaluate mining prospects and participate in mining activities on those prospects, which in the opinion of management were favorable. If, through the Company’s review, a geographical area indicates geological and economic potential, the Company may attempt to acquire leases or other interests in the area. The Company may then attempt to sell portions of its leasehold interests in a prospect to unrelated third parties, thus sharing the risks and rewards of the exploration of the prospect with the joint owners.

However, pursuant to a Termination Agreement of April 29th, 2011, the aforementioned Hunker Option Agreement has been terminated and thus is null and void as of the date of this report. Pursuant to the Termination Agreement Ryan kept a payment of $25,000 and the issuance of 1,000,000 shares of restricted common stock.

On March 26, 2012, agents of Grimsby Investments Ltd (Grimsby”) established ARX Springs Pte, Ltd., (“ARX Pte”), a company incorporated in Singapore, in anticipation of a future restructuring of the Company. At the time of its incorporation, ARX Pte had no operations, assets or stockholders.

On April 12, 2012, the one founding stockholder of ARX Springs Pty. Ltd a (“ARX Springs”), formed on November 11, 2011, and the two founding stockholders of ARX Pacific Resources Pty Ltd. (“ARX Pacific”), formed on May 28, 2010, transferred 100% of their respective ownerships in such companies to ARX Pte.

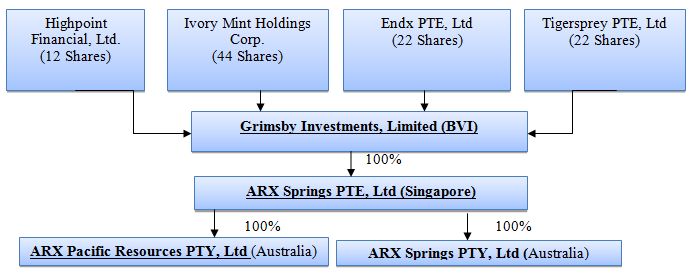

On May 15, 2012, in connection with a reorganization of Grimsby, 100% of the founders’ shares of ARX Pte were issued to Grimsby and Grimsby issued its founders shares to 4 entities.

On May 22, 2012, ARX Gold, Grimsby , a company incorporated under the law of the British Virgin Islands on March 8, 2012, and the stockholders of Grimsby (“Grimsby Shareholders”) entered into a Share Exchange. Upon closing of the transaction contemplated under the Share Exchange, as amended, on May 22, 2012, the Grimsby Shareholders (4 entities) transferred all of the issued and outstanding capital stock of Grimsby to ARX Gold in exchange for an aggregate of 4.148 billion shares of the common stock of ARX Gold and a commitment to pay royalties of $7,500,000 to two original founding stockholders of Grimsby, as amended retroactively in August 2012 for an original $150 million debt to the four stockholders. Such exchange caused Grimsby to become a wholly-owned subsidiary of ARX Gold. ARX Gold and Grimsby with its subsidiaries are collectively referred to as “the Company”.

| 2 |

There was no material relationship between the Company and Grimsby other than the Agreement. A fully executed copy of the Agreement is attached hereto and incorporated by reference herein as Exhibit 99.1 to this Current Report filed on Form 8-K.

ARX Springs holds mining rights to Gold Mining Claims and Gold ore Tailing dumps / Mining rights, permits and concessions located at Coonambula, in the vicinity of Eidsvold, Queensland, Australia. Necessary Permits are current and Extractive operations have already commenced, and are more fully described in the Exhibits hereby submitted as part of this filing.

On May 25, 2012, Daulton Capital Corp. changed its name to Celframe ARX Resources Corp. and on October 16, 2012, Celframe ARX Resources Corp. changed its name to ARX Gold Corporation.

The May 22nd, 2012, Share Exchange was accounted for as a reverse-merger and recapitalization of Grimsby since the stockholders of Grimsby obtain voting and management control of ARX Gold. Grimsby was the acquirer for financial reporting purposes and ARX Gold was the acquired company. Consequently, the assets and liabilities and the operations reflected in the historical financial statements prior to the Exchange Agreement will be those of Grimsby and was recorded at the historical cost basis of Grimsby, and the consolidated financial statements after completion of the Share Exchange included the assets and liabilities of both Grimsby and ARX Gold and the Company’s consolidated operations from the closing date of the Share Exchange.

Subsequently, on August 28th, 2012, ARX Gold and the Shareholders of Grimsby Investments Ltd entered into an Amendment of their above-referenced May 22nd , 2012 Agreement, solely to address two previous conditions between the parties, namely the Company's obligations under that agreement to tender preferred shares and funds payable to the shareholders of Grimsby Investments Ltd. §a of that Agreement called for $75,000,000 of the debt to be converted into preferred shares. This section and obligation was specifically waved and cancelled. §b of that Agreement called for $75,000,000 of the original debt to be held against a Profits. This section and obligation is specifically amended by the waiver and cancellation of obligation to pay $67,500.000 of the debt. The remaining $7,500,000 of the debt was memorialized as a Royalty Agreement in favor of Endx Pte Limited and TigerSprey Pte Limited with a commitment to pay, at the discretion of the Board of Directors, $7,500,000 in royalties based on future operating profits of the ARX Gold Project. All other aspects of the original Share Purchase Agreement are unchanged and this Amendment should have no effect upon any other clause within said Agreement. Said Amendment was filed on form 8K on August 31st, 2012.

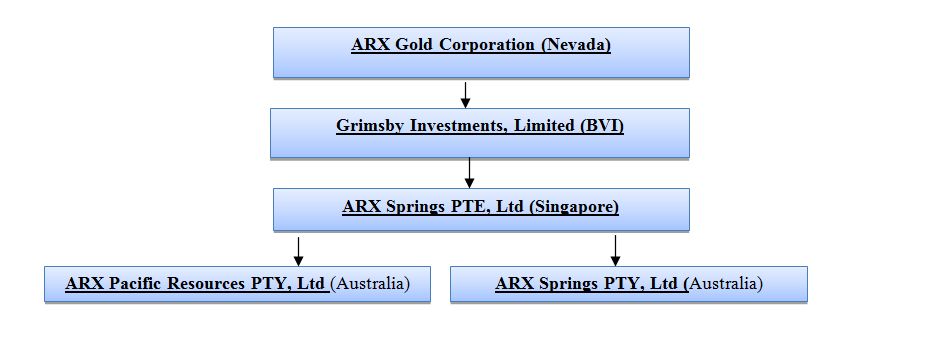

On May 22, 2012, immediately after the Share Exchange, the Company’s organizational structure of the Company is as follows:

Pursuant to certain mining rights agreements (see Footnote 3 of the April 30th 2012 and 2011 Consolidated Financia Statements of Grimsby contained in this form 8-K/A), ARX Pacific and ARX Springs, together referred to as the “ARX Companies”) have the rights to mine and extract gold and other materials from certain properties in Australia as described in footnote 3.

Business Strategy:

We are currently focused on mineral exploration and development activities in the Wide Bay Burnett Region in central Queensland, Australia. Our strategy is to advance this project to the production stage as aggressively as prudent financing will allow and to determine the presence and recovery of gold, silver and other precious mineral reserves. If we are successful in doing so, we believe we can attract the attention of the existing mining companies already operating in the area or new mining companies to either enter into development agreements with us or to acquire the projects from us outright.

Additionally, we are currently exploring additional acquisition opportunities. The Management team comprises of a focused group with experience in both the mining and business development sectors.

| 3 |

Item 1A. RISK FACTORS.

The following important factors among others, could cause our actual operating results to differ materially from those indicated or suggested by forward-looking statements made in this Form 10 or presented elsewhere by management from time to time.

There is a substantial doubt about the Company’s ability to continue as a going concern.

The Report of Independent Registered Public Accounting firm on our consolidated financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing concern. Because obtaining investment capital in not certain, or that our officers and directors may be unable or unwilling to loan or advance any additional capital to the Company, we may not have the funds necessary to continue our operations. See the Audited Financial Statements contained infra.

We have a limited operating history and are still in the development stage.

We have only entered the field of precious metals mining within the past twelve months, making it difficult to judge our prospects. As a development stage company, we face all the risks inherent in a new business, including the expenses, difficulties, complications and delays frequently encountered in connection with commencing new operations, including capital requirements and management’s potential underestimation of initial and ongoing costs. We face the risk that we not be able to effectively implement our business plan. If we are not effective in addressing these risks, we may not develop a viable business or may not operate profitably. As a start-up company, we expect to incur significant operating losses for the near future, and there can be no assurance that we will be able to generate significant revenues or that any revenues generated will be sufficient for us to become profitable or thereafter maintain profitability.

If our strategy is unsuccessful, we will not be profitable and our stockholders could lose their investment.

There is no guarantee that our strategy for obtaining or developing our assets will be successful or that if successfully developed, will result in the Company becoming profitable. If our strategy is unsuccessful, we may fail to meet our objectives and not realize the revenues or profits from the business we pursue that may cause the value of the Company to decrease, thereby potentially causing our stockholders to lose their investment.

We have not paid any cash dividends in the past and have no plans to issue cash dividends in the future, which could cause the value of our common stock to have a lower value than other similar companies which do pay cash dividends.

We have not paid any cash dividends on our common stock to date and do not anticipate any cash dividends being paid to holders of our common stock in the foreseeable future. While our dividend policy will be based on the operating results and capital needs of the business, it is anticipated that any earnings will be retained to finance our future expansion. As we have no plans to issue cash dividends in the future, our common stock could be less desirable to other investors and as a result, the value of our common stock may decline, or fail to reach the valuations of other similarly situated companies who have historically paid cash dividends in the past.

It is more difficult for our shareholders to sell their shares because we are not, and may never be, eligible for NASDAQ or any national stock exchange.

We are not presently, nor is it likely that for the foreseeable future we will be, eligible for inclusion in NASDAQ or for listing on any United States national stock exchange. To be eligible to be included in NASDAQ, a company is required to have not less than $4,000,000 in net tangible assets, a public float with a market value of not less than $5,000,000, and a minimum bid price of $4.00 per share. At the present time, we are unable to state when, if ever, we will meet the NASDAQ application standards. Unless we are able to increase our net worth and market valuation substantially, either through the accumulation of surplus out of earned income or successful capital raising financing activities, we will never be able to meet the eligibility requirements of NASDAQ. As a result, it will more difficult for holders of our common stock to resell their shares to third parties or otherwise, which could have a material adverse effect on the liquidity and market price of our common stock.

Although the our Common Stock is currently traded on the OTC Bulletin Board, there is no assurance any public market for our Common Stock will continue. There is also no assurance as to the depth or liquidity of any such market or the prices at which holders may be able to sell the Shares. An investment in these Shares may be totally illiquid and investors may not be able to liquidate their investment readily or at all when they need or desire to sell.

We will need significant additional capital, which we may be unable to obtain.

The Company’s capital requirements in connection with its development activities and transition to commercial operations have been and will continue to be significant. The funds raised in future Offerings may not be sufficient to develop commercial operations, and we will require additional funds to continue acquisition, development and testing, and to commercialize our physical assets. There can be no assurance that financing will be available in amounts or on terms acceptable to the Company, if at all. Any future financing that may occur could be at a price that significantly dilutes the shareholders of the Company at that time.

Volatility of stock prices

In the event a public market continues for our Common Stock, market prices will be influenced by many factors, and will be subject to significant fluctuation in response to variations in operating results of the Company and other factors such as investor perceptions of the Company, supply and demand, interest rates, general economic conditions and those specific to the industry, developments with regard to the Company's activities, future financial condition and management.

We may not be able to effectively control and manage our growth, which would negatively impact our operations.

If the Company’s business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing and expanding our business and in integrating any acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy increased demands could interrupt or adversely affect our operations and cause administrative inefficiencies.

| 4 |

We may be unable to successfully execute any of our identified business opportunities or other business opportunities that we determine to pursue.

We currently have a limited operational infrastructure. In order to pursue business opportunities, we will need to build our infrastructure and operational capabilities. Our ability to do any of these successfully could be affected by any one or more of the following factors, among others, our ability to:

| · | raise substantial additional capital to fund the implementation of our business plan; |

| · | execute our business strategy; |

| · | manage the expansion of our operations and any acquisitions we may make, which could result in increased costs, high employee turnover or damage to customer relationships; |

| · | attract and retain qualified personnel; |

| · | manage our third-party relationships effectively; and |

| · | Accurately predict and respond to the rapid technological changes in our industry and the evolving demands of the markets we serve. |

The Company’s failure to adequately address any one or more of the above factors could have a significant impact on its ability to implement its business plan and its ability to pursue other opportunities that arise.

Competition

In Australia, there are numerous mining and exploration companies, both big and small. All of these mining companies are seeking properties of merit and funds. We will have to compete against such companies to acquire the funds to develop our mineral claims. The availability of funds for exploration is sometimes limited, and we may find it difficult to compete with larger and more well-known companies for capital. Even though we have the right to the minerals on our claims, there is no guarantee we will be able to raise sufficient funds in the future to maintain our mineral claims in good standing. Therefore, if the Company does not have sufficient funds for exploration, its claims might lapse and be staked by other mining interests. We might be forced to seek a joint venture partner to assist in the exploration of our mineral claims. In this case, there is the possibility that we might not be able to pay our proportionate share of the exploration costs and might be diluted to an insignificant carried interest. Even when a commercial viable ore body is discovered, there is no guarantee competition in refining the ore will not exist. Other companies may have long-term contracts with refining companies, thereby inhibiting our ability to process our ore and eventually market it. The exploration business is highly competitive and highly fragmented, dominated by both large and small mining companies. Success will largely depend on the Company’s ability to attract talent from the mining field and its ability to fund its operations. There is no assurance that our mineral expansion plans will be realized.

Limited liability of Directors and Officers.

The Company has adopted provisions to its Articles of Incorporation and Bylaws which limit the liability of its Officers and Directors, and provide for indemnification by the Company of its Officers and Directors to the full extent permitted by Nevada corporate law, which generally provides that its officers and directors shall have no personal liability to the Company or its stockholders for monetary damages for breaches of their fiduciary duties as directors, except for breaches of their duties of loyalty, acts or omissions not in good faith or which involve intentional misconduct or knowing violation of law, acts involving unlawful payment of dividends or unlawful stock purchases or redemptions, or any transaction from which a director derives an improper personal benefit. Such provisions substantially limit the shareholder's ability to hold officers and directors liable for breaches of fiduciary duty, and may require the Company to indemnify its officers and directors.

Our operations are subject to various government regulations.

The research, development, distribution, marketing and selling of our mineral products is subject to regulation by governmental regulatory authorities. Failure to comply with regulatory requirements could subject the Company to regulatory or judicial enforcement actions, including, but not limited to, seizures, injunctions, civil penalties, criminal prosecution, refusals to approve new exploration and development and suspensions and withdrawals of existing approvals.

We must comply with various government and environmental regulations. We also must comply with assurances guarding endangered, threatened or candidate fish, wildlife, plants or habitat. Should we be unable to effectively comply with these regulations, the results of the Company’s operations could be adversely affected.

Government Regulations

We are committed to complying with, and, to our knowledge, are in compliance, with all governmental and environmental regulations. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. We cannot predict the extent to which future legislation and regulation could cause additional expense, capital expenditures, restrictions, and delays in the exploration of our properties.

Our activities are not only subject to extensive federal, state, and local regulations controlling the mining of, and exploration for, mineral properties, but also the possible effects of such activities upon the environment. Future legislation and regulations could cause additional expense, capital expenditures, restrictions, and delays in the exploration of our properties, the extent of which cannot be predicted. Permits may also be required from a variety of regulatory authorities for many aspects of mine operation and reclamation. In the context of environmental permitting, including the approval of reclamation plans, we must comply with known standards, existing laws, and regulations that may entail greater or lesser costs and delays depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. We are not presently aware of any specific material environmental constraint affecting its properties that would preclude the economic development or operation of any specific property. It is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of our proposed exploration operations; costs associated with minimizing surface impact; water treatment and protection; reclamation activities, including rehabilitation of various sites; on-going efforts at alleviating the mining impact on wildlife; and permits or bonds as may be required to ensure the Company’s compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide not to proceed with exploration on any of its mineral properties. We are prepared to engage professionals, if necessary, to ensure regulatory compliance, but in the near term we expect the activities to require minimal regulatory oversight.

| 5 |

The Company operates internationally, there are risks which could adversely affect operating results.

We are a company involved in international operations. Doing business in foreign countries does subject the Company to additional risks, any of which may adversely impact future operating results, including:

| · | international political, economic and legal conditions; |

| · | our ability to comply with foreign regulations and/or laws affecting operations and projects; |

| · | difficulties in attracting and retaining staff and business partners to operate internationally; |

| · | language and cultural barriers; |

| · | seasonal reductions in business activities and operations in the countries where our international projects are located; |

| · | integration of foreign operations; |

| · | potential adverse tax consequences; and |

Factors beyond the control of the Company.

Projects for the acquisition and development of the Company’s products are subject to many factors, which are outside our control. These factors include general economic conditions in Australia, North America and worldwide (such as recession, inflation, unemployment, and interest rates), proximities to utilities and transportation, shortages of labor and materials and skilled craftsmen and price of materials and competitive products and the regulation by federal and state governmental authorities.

Lack of diversification

Because of the limited financial resources that the Company has, we do not currently intend to diversify our operations. Our inability to diversify our activities into more than one area will subject the Company to economic fluctuations and therefore increase the risks associated with the Company’s operations.

If we borrow money using the Company’s assets as collateral, our shareholders could lose all of their investment, if the collateral was to be foreclosed.

We may borrow money secured by the Company’s assets as collateral. The terms of the loan and the payments required to be made under the loan documents may reduce the return that the Company may otherwise generate. Should we fail to satisfy the terms of any loan, the Company assets pledged to secure such loan may be at risk to foreclosure or other similar process to satisfy the amount borrowed for the loan.

Future changes in financial accounting standards and other applicable regulations by various governmental regulatory agencies may cause lower than expected operating results and affect our reported results of operations.

Changes in accounting standards and their application may have a significant effect on our reported results on a going forward basis and may also affect the recording and disclosure of previously reported transactions. New standards have occurred and will continue to occur in the future.

The Sarbanes-Oxley Act of 2002 and various new rules subsequently implemented by the Securities and Exchange Commission (“SEC”) and the NASDAQ National Market have imposed additional reporting and corporate governance practices on public companies.

In addition, if we do not adequately continue to comply with the requirements of Section 404 of the Sarbanes-Oxley Act in the future, we may not be able to accurately report our financial results or prevent error or fraud, which may result in sanctions or investigation by regulatory authorities, such as the SEC. Any such action could harm our business, financial results or investors’ confidence in our company, and could cause our stock price to fall.

| 6 |

ITEM 2. FINANCIAL INFORMATION –

This discussion should be read in conjunction with the Company’s consolidated financial statements, including the Notes thereto, for the years ended April 30, 2012 and 2011, beginning on Page F-1.

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following plan of operation provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto. This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Plan of Operations

We have commenced limited operations and we will require outside capital to implement our business model.

We were incorporated under the laws of the State of Nevada July 8, 2008 as formerly Daulton Capital Corp. On May 25, 2012, Daulton Capital Corp. changed its name to Celframe ARX Resources Corp. and on October 16, 2012, Celframe ARX Resources Corp. changes its name to ARX Gold Corporation (“ARX Gold”).

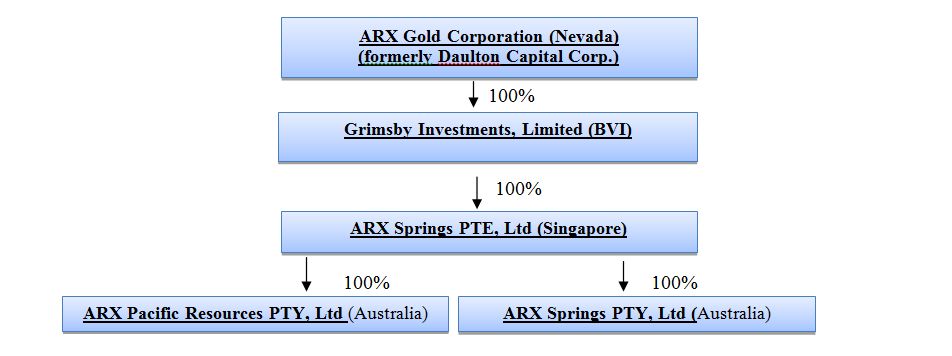

On May 22, 2012, ARX Gold, Grimsby Investments Limited (“Grimsby”), a company incorporated under the law of the British Virgin Islands on March 8, 2012, and the stockholders of Grimsby (“Grimsby Shareholders”) entered into a Share Exchange. Upon closing of the transaction contemplated under the Share Exchange, as amended, on May 22, 2012, the Grimsby Shareholders (4 entities) transferred all of the issued and outstanding capital stock of Grimsby to ARC Gold in exchange for an aggregate of 4.148 billon shares of the common stock of ARX Gold and a commitment to pay royalties of $7,500,000 to two original founding stockholders of Grimsby, as amended retroactively in August 2012 for an original $150 million debt to the four original founding stockholders of Grimsby. Such exchange caused Grimsby to become a wholly-owned subsidiary of ARX Gold. ARX Gold and Grimsby with its subsidiaries are collectively referred to as “the Company”.

The Share Exchange was accounted for as a reverse-merger and recapitalization since the stockholders of Grimsby obtained voting and management control of ARX Gold. Grimsby was the acquirer for financial reporting purposes and ARC Gold was the acquired company. Consequently, the assets and liabilities and the operations reflected in the historical financial statements prior to the Exchange Agreement will be those of Grimsby and was recorded at the historical cost basis of Grimsby, and the consolidated financial statements after completion of the Share Exchange included the assets and liabilities of both Grimsby and ARX Gold and the Company’s consolidated operations from the closing date of the Share Exchange.

On March 26, 2012, agents of Grimsby established ARX Springs Pte, Ltd., (“ARX Pte”), a company incorporated in Singapore, in anticipation of a future restructuring of the Company. At the time of its incorporation, ARX Pte had no operations, assets or stockholders.

On April 12, 2012, the one founding stockholder of ARX Springs Pty. Ltd a (“ARX Springs”), formed on November 11, 2011, and the two founding stockholders of ARX Pacific Resources Pty Ltd. (“ARX Pacific”), formed on May 28, 2010, transferred 100% of their respective ownerships in such companies to ARX Pte.

On May 15, 2012, in connection with a reorganization of Grimsby, 100% of the founders’ shares of ARX Pte were issued to Grimsby and Grimsby issued its founders shares to 4 entities.

On May 22, 2012, immediately after the Share Exchange, our organizational structure is as follows:

Pursuant to certain mining rights agreements, ARX Pacific and ARX Springs, together referred to as the “ARX Companies”) have the rights to mine and extract gold and other materials from certain properties in Australia.

| 7 |

ARX Springs Project

On March 6, 2012 and as amended on March 31, 2012, our subsidiaries, ARX Springs and ARX Pacific entered into Stage Tribute Agreements (the “Stage Tribute Agreements”) with Riverstone Resources Pty Ltd. (“Riverstone”). The Stage Tribute Agreements were made pursuant to the terms of an agreement dated February 27, 2012 between Riverstone and BRI Microfine Pty Ltd., a related party (the “Riverstone Master Agreement”). The Stage Tribute Agreements grant the exclusive right to the ARX Companies to explore, mine and extract gold and other extracted products on the ARX Springs Project properties located in the Wide Bay Burnett Region in central Queensland, Australia. The ARX Springs Project overall covers approximately 16 km² of surface area and the mining project is part of a larger area for which Riverstone owns and operates an extractive industries business.

The two ARX Companies will jointly operate at the ARX Springs site, and Phase 1 of the mining processing at ARX Springs under the respective Stage Tribute Agreements will mine a surface area of 600 ha. Under the terms of the Riverstone Master Agreement between BRI, a related party and Riverstone, phase 2 of the mining process at the ARX Springs Project may commence at any time and does not require work on phase 1 to be completed. ARX Companies must pay to Riverstone production royalty of 19% of the value of production extracted and processed from the first 100 ha surface area of the ARX Springs Project treated and 15% of the value of production extracted and processed from the surface area of the project which exceeds 100ha.

Limited Operating History

We have generated a limited financial history and have not previously demonstrated that we will be able to expand our business. Our business is subject to risks inherent in growing an enterprise, including limited capital resources and possible rejection of our business model and/or sales methods.

Critical Accounting Policies and Estimates

While our significant accounting policies are more fully described in Note 2 to our consolidated financial statements for the years ended April 30, 2012 and 2011, we believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this management discussion and analysis.

Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We continually evaluate our estimates, including those related to the accounting for and recovery of long-lived assets including mining rights, income taxes, and the valuation of equity transactions. We base our estimates on historical experience and on various other assumptions that we believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Any future changes to these estimates and assumptions could cause a material change to our reported amounts of revenues, expenses, assets and liabilities. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of the financial statements.

Mining property acquisition and exploration costs

We follow ASC 930 “Extraction Activities – Mining” in accounting for mining costs. Costs of lease, acquisition, exploration, carrying and retaining unproven mineral lease properties are expensed as incurred. We have chosen to expense all mineral acquisition and exploration costs as incurred given that it is still in the development stage. Once we have identified proven and probable reserves in our investigation of our properties and upon development of a plan for operating a mine, we will capitalize future costs until production is established. When a property reaches the production stage, the related capitalized costs will be depleted, using the units-of-production method over the estimated life of the probable-proven reserves. When we have capitalized mineral properties, these properties will be periodically assessed for impairment of value and any diminution in value. To date, we have not established the commercial feasibility of any exploration prospects; therefore, all costs are being expensed.

Environmental Matters

Our operations are subject to evolving government environmental laws and regulations related to the discharge of materials into the environment. Our process is not expected to produce harmful levels of emissions or waste by-products. However, these laws and regulations would require us to remove or mitigate the environmental effects of the disposal or release of substances at our site should they occur. Compliance with such laws and regulations can be costly. Additionally, governmental authorities may enforce the laws and regulations with a variety of civil and criminal enforcement measures, including monetary penalties and remediation requirements. We are not aware of any area of non-compliance with governmental environmental laws and regulations as of the date of this report.

Asset retirement obligations

We follow the provisions of ASC 410, Asset Retirement and Environmental Obligations, which establishes standards for the initial measurement and subsequent accounting for obligations associated with the sale, abandonment or other disposal of long-lived tangible assets arising from the acquisition, construction or development and for normal operations of such assets.

Impairment of long-lived assets

In accordance with ASC Topic 360, we review long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable, or at least annually. We recognize an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value.

| 8 |

Foreign currency translation

The accompanying consolidated financial statements are presented in U.S. dollars (“USD”). The reporting currency of the Company is the USD. The functional currency of the ARX Companies is the Australian dollar and the functional currency of ARX Pte is the Singapore dollar. Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the spot exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income.

Assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Stock-based compensation

We account for stock-based instruments issued to employees in accordance with ASC Topic 718. ASC Topic 718 requires companies to recognize in the statement of operations the grant-date fair value of stock options and other equity based compensation issued to employees. We account for non-employee share-based awards in accordance with ASC Topic 505-50.

Recent accounting pronouncements

Accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the financial statements upon adoption.

Results of Operations

For the Years Ended April 30, 2012 and 2011

Revenues

Since inception, we had $0 in revenue.

Operating Expenses

For the years ended April 30, 2012 and 2011, operating expenses consisted of the following:

| Year Ended April 30, | ||||||||

| 2012 | 2011 | |||||||

| Compensation | $ | 62,826 | $ | – | ||||

| General and administrative | 155 | 96 | ||||||

| $ | 62,981 | $ | 96 | |||||

| * | For the years ended April 30, 2012, compensation expense was $62,826 and related to stock-based compensation expense from the issuance of shares to the Company’s founders. We did not incur compensation expense during the year ended April 30, 2011. |

| * | For the year ended April 30, 2012 and 2011, general and administrative expenses, which included bank service charges and other office related expenses, amounted to $155 and $96, respectively. We expect general and administrative expenses to increase as we increase our operations. |

Net Loss

As a result of the factors described above, our net loss for the year ended April 30, 2012 and 2011 was $62,981 and $96.

| 9 |

Liquidity and Capital Resources

Liquidity is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise operate on an ongoing basis. To date, we have funded our operations through the sale of our common stock. Our primary uses of cash have been for compensation, and professional fees. All funds received have been expended in the furtherance of growing the business and establishing brand portfolios. The following trends are reasonably likely to result in a material decrease in our liquidity over the near to long term:

| · | An substantial increase in working capital requirements to finance our mining operations, |

| · | Addition of administrative and professional personnel as the business grows, |

| · | The cost of being a public company, and |

| · | Capital expenditures on excavation, mining and other equipment |

| · | Payment of royalties upon commencement of production. |

At April 30, 2012, we had no cash balance. Since inception we have funded our operations as follows:

| · | During the six months ended October 31, 2012, we borrowed funds from a shareholder amounting to $73,600 to fund our operating expenses, pay our obligations, and for working capital purposes. |

| · | In September 2012, we issued 5,000,000 shares of common stock for proceeds of $225,000. |

We currently have no material commitments for capital expenditures, however, in order to commence operations, we must raise funds through an equity or debt financing. We will need to raise additional funds, particularly if we are unable to generate positive cash flow as a result of our operations. We estimate that based on current plans and assumptions, that our available cash will not be sufficient to satisfy our cash requirements under our present operating expectations, without further financing, for up to 12 months. Other than working capital and funds received from a shareholder and related parties, we presently have no other alternative source of working capital. We will use these funds to fund our operating expenses, pay our obligations, grow our company, and to begin or exploration and mining operation on the ARX Springs Project. We may not have sufficient working capital to fund the expansion of our operations and to provide working capital necessary for our ongoing operations and obligations and we will need to raise significant additional capital. We do not anticipate we will be profitable in fiscal 2013. Therefore our future operations may be dependent on our ability to secure additional financing. Financing transactions may include the issuance of equity or debt securities, obtaining credit facilities, or other financing mechanisms. However, the trading price of our common stock and a downturn in the U.S. equity and debt markets could make it more difficult to obtain financing through the issuance of equity or debt securities. Even if we are able to raise the funds required, it is possible that we could incur unexpected costs and expenses, fail to collect amounts owed to us, or experience unexpected cash requirements that would force us to seek alternative financing. Furthermore, if we issue additional equity or debt securities, stockholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of existing holders of our common stock. The inability to obtain additional capital may restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will be required to further curtail our marketing and development plans and possibly cease our operations.

We anticipate that depending on market conditions and our plan of operations, we may incur operating losses in the foreseeable future. Therefore, our Independent Registered Public Accounting Firm has raised substantial doubt about our ability to continue as a going concern in their audit opinion for the years ended April 30, 2012, and the period from May 28, 2010 (inception) to April 30, 2011.

Our liquidity may be negatively impacted by the significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly.

Operating activities

For the year ended April 30, 2012 and 2011, net cash flows used in operating activities amounted to $531 and $471, respectively. We expect cash used in operations to increase in future periods as we implement our business plan.

Financing activities

For the year ended April 30, 2012 and 2011, net cash flows provided by financing activities was $515 and $420, respectively, and related to proceeds from shareholder contributions.

Contractual Obligations

We have certain fixed contractual obligations and commitments that include future estimated payments. Changes in our business needs, cancellation provisions, changing interest rates, and other factors may result in actual payments differing from the estimates. We cannot provide certainty regarding the timing and amounts of payments. We have presented below a summary of the most significant assumptions used in our determination of amounts presented in the tables, in order to assist in the review of this information within the context of our financial position, results of operations, and cash flows.

The following tables summarize our contractual obligations as of October 31, 2012 and the effect these obligations are expected to have on our liquidity and cash flows in future periods.

| Payments due by period | ||||||||||||||||||||

| Contractual obligations | Total | Less than 1 year | 1-3 Years | 3-5 Years | 5+ Years | |||||||||||||||

| Royalties payable – related parties | $ | 7,500,000 | $ | – | $ | – | $ | – | $ | 7,500,000 | ||||||||||

| Loans payable | 73,600 | 73,600 | – | – | – | |||||||||||||||

| Total contractual obligations | $ | 7,573,600 | $ | 73,600 | $ | – | $ | – | $ | 7,500,000 | ||||||||||

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

| 10 |

ITEM 3. PROPERTIES –

Mineral Properties

ARX Springs Project

On March 6, 2012 and as amended on March 31, 2012, our subsidiaries, ARX Springs and ARX Pacific entered into Stage Tribute Agreements (the “Stage Tribute Agreements”) with Riverstone Resources Pty Ltd. (“Riverstone”). The Stage Tribute Agreements were made under an agreement dated February 27, 2012 between Riverstone and BRI Microfine Pty Ltd., a related party (See Note 4) (the “Riverstone Master Agreement”). The Stage Tribute Agreements grant the exclusive right to the ARX Companies to explore, mine and extract gold and other extracted products on the ARX Springs Project properties located in the Wide Bay Burnett Region in central Queensland, Australia. The ARX Springs Project overall covers approximately 16 km² of surface area and the mining project is part of a larger area for which Riverstone owns and operates an extractive industries business.

The two ARX Companies will jointly operate at the ARX Springs site and Phase 1 of the mining processing at ARX Springs under the respective Stage Tribute Agreements will mine a surface area of 600 ha. Under the terms a Riverstone Master Agreement between BRI, a related party and Riverstone, phase 2 of the mining process at the ARX Springs Project may commence at any time and does not require work on phase 1 to be completed. ARX Companies must pay to Riverstone production royalty of 19% of the value of production extracted and processed from the first 100 ha surface area of the ARX Springs Project treated and 15% of the value of production extracted and processed from the surface area of the project which exceeds 100ha.

During the term of the Stage Tribute Agreements, Riverstone solely or jointly with one or both of the ARX Companies (and either of the ARX Companies solely or jointly with Riverstone) may apply for extensions and additional mining licenses from the Queensland Mines and Resources Department. During all terms of the mining license and any additional mining licenses the holders of all ARX Springs mining license and additional mining licenses shall be obliged to comply with the regulations applicable and to meet the obligations imposed by the Mineral Resource Act of 1989 (Queensland). If the mining license or additional mining licenses at any time are cancelled, the ARX Companies may lose the right to mine and process at the ARX Springs Project. Riverstone may terminate the Stage Tribute Agreements on prior notice to the ARX Companies if ARX Companies are in breach of the agreements but termination cannot be affected without the ARX Companies being first permitted to remedy any alleged breach and any disputes between Riverstone and the ARX Companies will be subject to mediation and if mediation is unsuccessful will be submitted to arbitration. Riverstone may terminate the Stage Tribute Agreements by giving three month’s notice by March 5, 2037, with provision to extend dates if required, or after the resources have been fully mined and processed, whichever occurs first. The initial ten hectare surface area of the ARX Springs Project must be mined and processed by March 5, 2025. The ARX Companies are obliged to take out business liability and employee insurances which shall be effected when mining processing commences.

Prior to undertaking any ground disturbing work on the ARX Springs Project, the ARX Companies must, in the ordinary course of the mining business obtain the approval of the Queensland Department of Mines on a proposed work plan. The agreements with Riverstone require consultation with Riverstone on the form of any proposed work plan to ensure it is not likely to interfere with the activities of Riverstone. The ARX companies solely or jointly with Riverstone may proceed to obtain all necessary regulatory approvals for any proposed work plan according to standard industry mining practice in the State of Queensland as governed by the Mineral Resource Act 1989.

The ARX Companies will be responsible for all rehabilitation works on the properties, as required by the Queensland Mines and Resources Department, and any other governmental or other authorities in relation to exploration or mining activities carried out by the ARX Companies. Prior to the commencement of work the Queensland Mines and Resources Department will assess a value of a rehabilitation bond and the value of the rehabilitation bond will have to be paid by the ARX companies. There is no reason known to Riverstone or ARX Companies why the bond will not be assessed according to current Queensland Mines and Resources Department guidelines but the actual amount of the rehabilitation bond is not yet known.

During the term of the Stage Tribute Agreements, Riverstone shall take all action necessary to keep the ARX Project in good standing. Riverstone will be obliged to protect the land areas and the Mining License and Riverstone shall make any required payments to the Department of Mines and Resources or such other department of the government of Queensland Australia responsible for the administration of the Mineral Resource Act of 1989 (Queensland) in order to maintain its rights to explore and, if warranted, to develop its property. If Riverstone fails to meet these obligations, the Company may lose the right to explore for gold and other extracted products on the property. In general terms the Arx Companies are entitled under their agreements to act on their own behalf to protect the land and site and the mining leases and to pay royalties to Queensland Mines Department if they decide to do so by potential threats or risks to the project or rights.

| 11 |

Item 4. Security Ownership of Certain Beneficial Owners and Management.

The following table sets forth, as of January 18, 2013, the number of shares of our Common Stock owned of record and beneficially by all directors, executive officers and persons who beneficially own more than 5% of the outstanding shares of Common Stock of the Company:

| Name and Address | Amount and Nature of Beneficial Ownership |

Percentage of Class(1) |

| Directors and Executive Officers: | ||

|

Brian Smith (2) |

912,560,000 | 20.65% |

| Tom Verdon | 0 | 0% |

| 0 | 0% | |

|

All Directors and Executive Officers as a group (2 persons) (3) |

912,560,000 | 20.65% |

|

IVORY MINT HOLDINGS (3) SUITE 363 |

1,600,000,000 | 36.21% |

|

ENDX PTE LTD (4) 151 Chin Swee Road #07-12 Manhattan House Singapore |

912,560,000 | 20.65% |

(1) Percentages are calculated on the basis of 4,418,240,003 shares of Common Stock outstanding as of January 18, 2013.

(2) Mr. Brian Smith, our Director, is the sole Director and stockholder of TIGERSPREY PTE LTD.

(3) Mr. Irving Aaronson is the sole Director and shareholder of Ivory Mint Holdings.

(4) Mr. Shane Aldred is the sole Director and shareholder of Endx Pte Ltd.

ITEM 5. DIRECTORS & EXECUTIVE OFFICERS –

Our directors and executive officers and additional information concerning them are as follows:

| Name | Age | Position |

| Brian Smith | 55 | Chair, Chief Executive Officer, Chief Financial Officer, Director |

| Tom Verdon | 48 | Director |

BRIAN SMITH - CEO

Brian Smith is Director and CEO of the company, as well as Director of BRI Microfine Pty Ltd. He has a strong history within the precious mining industry, particularly in Australia. His expertise is focused on development implementation, funding, improvement and expansion of the mining technology in order to maximize the commercialization of BRI Microfine gold recovery technology and production

TOM VERDON - DIRECTOR

From 2004 to 2010, Mr. Verdon was Head of Bespoke Investment Solutions for Dexia Private Bank Jersey, in charge of private equity business. In 2010, Mr. Verdon joined Deutsche Bank, as a Director of the Bank's African private wealth management business. He provided advisory insight on private equity financing and was the lead advisor to the Central Bank of Lesotho in relation to the fixed income portion of their reserves portfolio. Mr. Verdon holds a law degree from the University of Wales, is a member of the Society of United Kingdom Investment Professionals and holds an Advanced Diploma in Financial Planning.

ITEM 6. EXECUTIVE COMPENSATION

Compensation of Directors & Officers

The persons who serve as members of our board of directors, including executive officers did not receive any compensation for services as Director or officers from the May 22nd, 2012 transaction to date. There are no plans for any compensation until such time as the company is deemed profitable.

Retirement, Resignation or Termination Plans

We sponsor no plan, whether written or verbal, that would provide compensation or benefits of any type to an executive upon retirement, or any plan that would provide payment for retirement, resignation, or termination as a result of a change in control of our Company or as a result of a change in the responsibilities of an executive following a change in control of our Company.

| 12 |

ITEM 7. CERTAIN RELATIONSHIPS & RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE –

Technology Sub-license Agreement

On November 24, 2011, our subsidiary, ARX Springs, entered into a Technology Sub-license Agreements (the “Technology Agreement”) with BRI Microfine Pty Ltd. (“BRI”), a company incorporated in Australia and owned by the Company’s CEO and by a principal stockholder/founder of the Company. Pursuant to the Technology Agreement, BRI granted to ARX Springs an exclusive non-assignable, non-transferrable sub license to use the BRI’s technology with the ARX Spring Project for the term of the project. BRI’s technology is a chemical leaching process which has been shown to concentrate gold, particularly in a microfine (finer than 5 microns) state, from concentrates, ores, tailings, solutions and other friable or pulverized materials. As consideration of the Sub-license agreement, the Company shall pay a royalty to BRI calculated as a percentage of the gross value of extracted product on a sliding scale based on tonnes processed ranging from 15% down to 10%. BRI in its discretion may at any time allow a rebate to AR Springs of any royalty payable.

BRI, at the cost of the Company, and in accordance with the requirements of the Company, will construct at the ARX Springs Project site alluvial material processing production plants. Additionally, BRI will arrange for the application of software systems for operations and metallurgical reporting and information systems to be installed in all alluvial material processing production plants for the ARX Spring project. We shall pay BRI invoices for the provision of software systems and metallurgical reporting and information systems and construction of alluvial material processing production plants.

Royalty commitment

In August 2012, in connection with an amendment to the Share Exchange dated May 22, 2012, we entered into a royalty agreement (the “Royalty Agreement”) with two original founding stockholders of Grimsby (one whom which is TIGERSPREY PTE LTD, a company owned by Brian Smith, an officer and director of the Company), who received shares in the Share Exchange. Pursuant to the Royalty Agreement, we agreed, at the discretion of our board of directors, to pay these parties up to $7,500,000 in royalties from gross profits derived from the sales of all minerals and other products recovered from the ARX Spring Project.

Except as noted above, none of our Directors has any direct or indirect material interest in any transaction to which we were or are a party since the beginning of our last fiscal year, or in any proposed transaction to which we propose to be a party:

| (A) | any of our directors or executive officers; | |

| (B) | any nominee for election as one of our directors; | |

| (C) | any person who is known by us to beneficially own, directly or indirectly, shares carrying more than 5% of the voting rights attached to our common stock; or | |

| (D) | any member of the immediate family (including spouse, parents, children, siblings and in-laws) of any of the foregoing persons named in paragraph (A), (B) or (C) above |

We anticipate reviewing all related party transactions as they are presented to us, and we would not anticipate that such review procedures would be in writing until such time as our Board of Directors felt it was necessary.

ITEM 8 LEGAL PROCEEDINGS

We are not presently a party to any litigation or threatened litigation.

ITEM 9 MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS –

Market Information

Our common stock is currently quoted on the OTC Bulletin Board. Our common stock has been quoted on the OTC Bulletin Board since June 27th, 2008 & is currently under the symbol “DUCP.OB.” Because we are quoted on the OTC Bulletin Board, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

Our authorized capital stock consists of 5,000,000,000 shares of common stock, par value $0.001 per share. The holders of our common stock:

| * | have equal ratable rights to dividends from funds legally available if and when declared by our board of directors; | |

| * | are entitled to share pro rata in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; | |

| * | do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and | |

| * |

are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

We refer you to our Articles of Incorporation, Bylaws and the applicable statutes of the State of Nevada for a more complete description of the rights and liabilities of holders of our securities.

| 13 |

Non-cumulative Voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors.

The following table sets forth the high and low bid quotations for our common stock as reported on the OTC Bulletin Board for the periods indicated.

| 2012, First Quarter | High | .04 | Low | .02 | ||||

| Second Quarter | High | .03.8 | Low | .02 | ||||

| Third Quarter | High | .23 | Low | 11.5 | ||||

| Fourth Quarter | High | 15 | Low | .02 |

Information for the periods referenced above has been furnished by the OTC Bulletin Board. The quotations furnished by the OTC Bulletin Board reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not reflect actual transactions.

We have never declared or paid any cash dividends on our common stock nor do we intend to do so in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, operating results, capital requirements, any applicable contractual restrictions and such other factors as our board of directors deems relevant.

Trading Information

The Company’s common stock is currently approved for quotation on the OTCBB under the symbol “DUCP.OB,” but there is currently no liquid trading market for the Company’s common stock. The information for our transfer agent is as follows:

Transhare Corporation

4626 S. Broadway

Englewood, CO 80113

(303) 662-1112

Holders

As of January 15th, 2013, there are 79 shareholders holding 4,413,240,003 shares of the Company.

Section 15(g) of the Securities Exchange Act of 1934

Our company’s shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the NASD’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

ITEM 10 RECENT SALES OF UNREGISTERED SECURITIES

None -

ITEM 11. DESCRIPTION OF REGISTRANTS SECURITIES TO BE REGISTERED

None -

| 14 |

ITEM 12. INDEMNIFICATION OF OFFICERS & DIRECTORS

Nevada Corporation Law allows for the indemnification of officers, directors, and any corporate agents in terms sufficiently broad to indemnify such persons under certain circumstances for liabilities, including reimbursement for expenses, incurred arising under the 1933 Act. The Bylaws of the Company provide that the Company will indemnify its directors and officers to the fullest extent authorized or permitted by law and such right to indemnification will continue as to a person who has ceased to be a director or officer of the Company and will inure to the benefit of his or her heirs, executors and Consultants; provided, however, that, except for proceedings to enforce rights to indemnification, the Company will not be obligated to indemnify any director or officer in connection with a proceeding (or part thereof) initiated by such person unless such proceeding (or part thereof) was authorized by the Board of Directors. The right to indemnification conferred will include the right to be paid by the Company the expenses (including attorney’s fees) incurred in defending any such proceeding in advance of its final disposition.

The Company may, to the extent authorized from time to time by the Board of Directors, provide rights to indemnification and to the advancement of expenses to employees and agents of the Company similar to those conferred to directors and officers of the Company. The rights to indemnification and to the advancement of expenses are subject to the requirements of the 1940 Act to the extent applicable.

Furthermore, the Company may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Company or another company against any expense, liability or loss, whether or not the Company would have the power to indemnify such person against such expense, liability or loss under the Nevada General Corporation Law.

ITEM 13. FINANCIAL STATEMENTS & SUPPLEMENTARY DATA

Attached hereto as an Exhibit, please find the Report of the Independent Registered Public Accounting Firm and Accompanying Consolidated Financial Statements of Grimsby Investments Limited at April 30, 2012 and 2011 and for the year ended April 30th, 2012, the period from May 28, 2010 (inception) to April 30, 2011 and the period from May 28, 2010 (inception) to April 30, 2012.

ITEM 14. CHANGES IN & DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING & FINANCIAL DISCLOSURES.

There are not and have not been any disagreements between the Company and its accountants on any matter of accounting principles, practices or financial statement disclosure.

ITEM 15. FINANCIAL STATEMENTS & EXHIBITS

(a) Financial Statements.

The financial statements included in this Form 8-K commence on the following page

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| ARX GOLD CORPORATION | ||

| Date: January 22, 2013 | By: | /s/ Brian Smith |

|

Brian Smith, Chief Executive Officer (Principal Executive Officer) | ||

| 15 |

GRIMSBY INVESTMENTS LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

consolidated Financial statements

For the Year Ended April 30, 2012, for the Period from May 28, 2010 (Inception) to April 30, 2011, and

for the Period from May 28, 2010 (Inception) to April 30, 2012

GRIMSBY INVESTMENTS LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

For the Year Ended April 30, 2012, for the Period from May 28, 2010 (Inception) to April 30, 2011

and for the Period from May 28, 2010 (Inception)

to April 30, 2012

CONTENTS

| Report of Independent Registered Public Accounting Firm | F-2 |

|

Consolidated Financial Statements: |

|

| Consolidated Balance Sheets | F-3 |

| Consolidated Statements of Operations and Comprehensive Income (Loss) | F-4 |

| Consolidated Statements of Changes in Stockholders’ Equity | F-5 |

| Consolidated Statements of Cash Flows | F-6 |

| Notes to Consolidated Financial Statements | F-7 to F-18 |

| F-1 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of:

Grimsby Investments Limited and Subsidiaries

We have audited the accompanying consolidated balance sheets of Grimsby Investments Limited and Subsidiaries (a development stage company) as of April 30, 2012 and 2011 and the related statements of operations and comprehensive income (loss), changes in stockholders' equity, and cash flows for the year ended April 30, 2012, for period from May 28, 2010 (inception) to April 30, 2011, and for period from May 28, 2010 (inception) to April 30, 2012. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Grimsby Investments Limited and Subsidiaries (a development stage company) as of April 30, 2012 and 2011, and the results of their operations and their cash flows for the year ended April 30, 2012, for period from May 28, 2010 (inception) to April 30, 2011, and for period from May 28, 2010 (inception) to April 30, 2012, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company reported a net loss and cash used in operations of $62,981 and $531 in 2012 and as of April 30, 2012, has a deficit accumulated during the development stage of $63,077 and is in the development stage with no revenues. These matters raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans as to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Salberg & Company, P.A.

SALBERG & COMPANY, P.A.

Boca Raton, Florida

January 22, 2013

| F-2 |

GRIMSBY INVESTMENTS LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED BALANCE SHEETS

| April 30, | ||||||||

| 2012 | 2011 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | – | $ | 11 | ||||

| Due from related party | 850 | 426 | ||||||

| Total Current Assets | 850 | 437 | ||||||

| Total Assets | $ | 850 | $ | 437 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accrued expenses | $ | 64 | $ | – | ||||

| Total Current Liabilities | 64 | – | ||||||

| Total Liabilities | 64 | – | ||||||

| COMMITMENTS AND CONTINGENCIES (NOTE 8) | ||||||||

| Stockholders' Equity: | ||||||||

| Common stock $1.00 par value; 50,000 shares authorized; 100 and 100 issued and outstanding at April 30, 2012 and 2011, respectively | 100 | 100 | ||||||

| Additional Paid-in capital | 63,661 | 320 | ||||||

| Deficit accumulated during development stage | (63,077 | ) | (96 | ) | ||||

| Accumulated other comprehensive income | 102 | 113 | ||||||

| Total Stockholders' Equity | 786 | 437 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 850 | $ | 437 | ||||

See accompanying notes to the consolidated financial statements.

| F-3 |

GRIMSBY INVESTMENTS LIMITED AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

| For the Year Ended April 30, | For the Period from May 28, 2010 (Inception) to April 30, | For the Period from May 28, 2010 (Inception) to April 30, | ||||||||||

| 2012 | 2011 | 2012 | ||||||||||

| REVENUES | $ | – | $ | – | $ | – | ||||||

| OPERATING EXPENSES: | ||||||||||||

| Compensation | 62,826 | – | 62,826 | |||||||||

| General and administrative | 155 | 96 | 251 | |||||||||

| Total Operating Expenses | 62,981 | 96 | 63,077 | |||||||||

| LOSS FROM OPERATIONS | (62,981 | ) | (96 | ) | (63,077 | ) | ||||||

| NET LOSS | $ | (62,981 | ) | $ | (96 | ) | $ | (63,077 | ) | |||

| COMPREHENSIVE LOSS | ||||||||||||

| NET LOSS | $ | (62,981 | ) | $ | (96 | ) | $ | (63,077 | ) | |||

| OTHER COMPREHENSIVE INCOME (LOSS): | ||||||||||||

| Unrealized foreign currency translation Income (loss) | (11 | ) | 113 | 102 | ||||||||

| COMPREHENSIVE INCOME (LOSS) | $ | (62,992 | ) | $ | 17 | $ | (62,975 | ) | ||||

| Net Loss per Common Share (Basic and Diluted) | $ | (629.81 | ) | $ | (0.96 | ) | ||||||

| Weighted Average Shares Outstanding:- Basic and Diluted | 100 | 100 | ||||||||||

See accompanying notes to the consolidated financial statements.

| F-4 |

GRIMSBY INVESTMENTS LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(A DEVELOPMENT STAGE COMPANY)

For the Period from May 28, 2010 (Inception) to April 30, 2011 and

For the Year Ended April 30, 2012

| Common Stock | Additional Paid-in |

Deficit | Accumulated Other Comprehensive Income | Total Stockholders' | ||||||||||||||||||||

| Shares | Amount | Capital | Stage | (Loss) | Equity | |||||||||||||||||||

| Balance, May 28, 2010 (Inception) | – | $ | – | $ | – | $ | – | $ | – | $ | – | |||||||||||||