Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VALERO ENERGY CORP/TX | d467558d8k.htm |

Exhibit 99.01

| Refining 101 January 17, 2013 |

| Safe Harbor Statement Statements contained in this presentation that state the Company's or management's expectations or predictions of the future are forward- looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. The words "believe," "expect," "should," "estimates," and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see Valero's annual reports on Form 10^K and quarterly reports on Form 10^Q, filed with the Securities and Exchange Commission, and available on Valero's website at www.valero.com. 2 |

| 3 Lane RiggsSenior Vice PresidentRefining Operations |

| 4 Crude Oil Characteristics Crudes are classified and priced by density and sulfur contentCrude density is commonly measured by API gravityAPI gravity provides a relative measure of crude oil density The higher the API number, the lighter the crudeLight crudes are easier to process Heavy crudes are more difficult to process Crude sulfur content is measured as a percentageLess than 0.7% sulfur content = sweetGreater than 0.7% sulfur content = sourHigh sulfur crudes require additional processing to meet regulatory specsAcid content is measured by Total Acid Number (TAN)Acidic crudes highly corrosive to refinery equipmentHigh acid crudes are those with TAN greater than 0.7Becoming more important, particularly as Brazilian production increases |

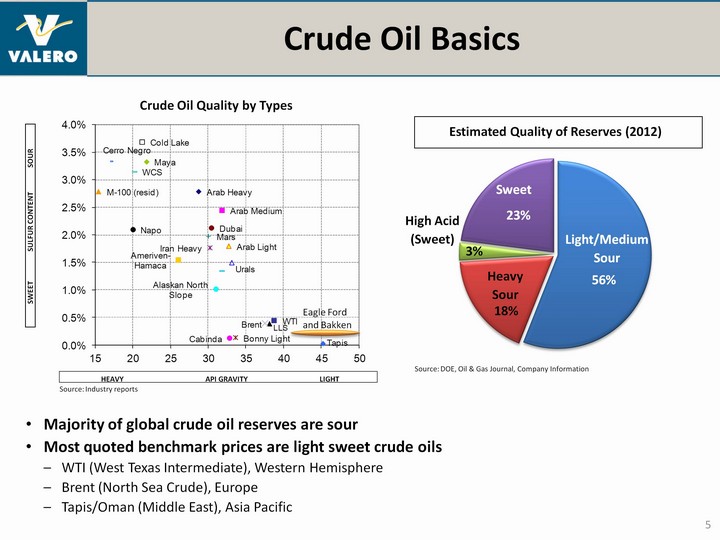

| (CHART) 5 Crude Oil Basics Majority of global crude oil reserves are sourMost quoted benchmark prices are light sweet crude oilsWTI (West Texas Intermediate), Western HemisphereBrent (North Sea Crude), EuropeTapis/Oman (Middle East), Asia Pacific High Acid(Sweet) Source: DOE, Oil & Gas Journal, Company Information Light/MediumSour HeavySour Sweet SWEET SULFUR CONTENT SOUR HEAVY API GRAVITY LIGHT Crude Oil Quality by Types Source: Industry reports Estimated Quality of Reserves (2012) Eagle Ford and Bakken |

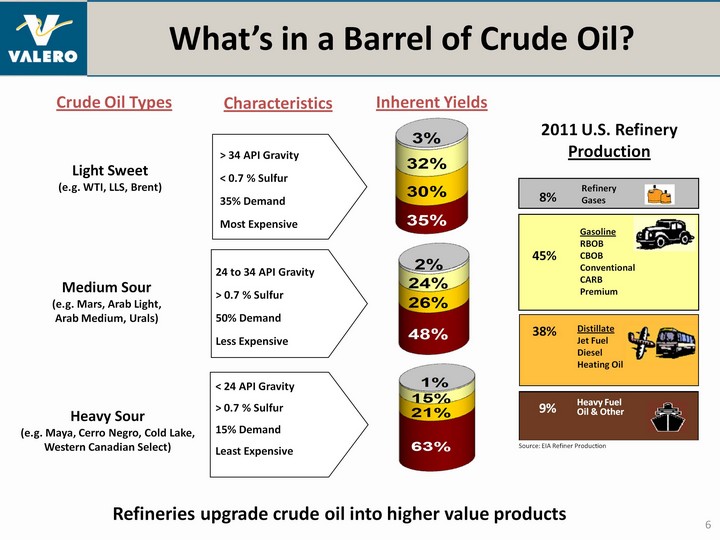

| 6 What's in a Barrel of Crude Oil? > 34 API Gravity < 0.7 % Sulfur35% DemandMost Expensive 24 to 34 API Gravity > 0.7 % Sulfur50% DemandLess Expensive < 24 API Gravity > 0.7 % Sulfur15% DemandLeast Expensive Refineries upgrade crude oil into higher value products 2011 U.S. Refinery Production 8% Propane/Butane 45% GasolineRBOBCBOBConventionalCARBPremium 38% DistillateJet FuelDieselHeating Oil Heavy Fuel Oil & Other 9% Source: EIA Refiner Production Refinery Gases 8% Light Sweet(e.g. WTI, LLS, Brent) Medium Sour(e.g. Mars, Arab Light,Arab Medium, Urals) Heavy Sour(e.g. Maya, Cerro Negro, Cold Lake, Western Canadian Select) Crude Oil Types Characteristics Inherent Yields |

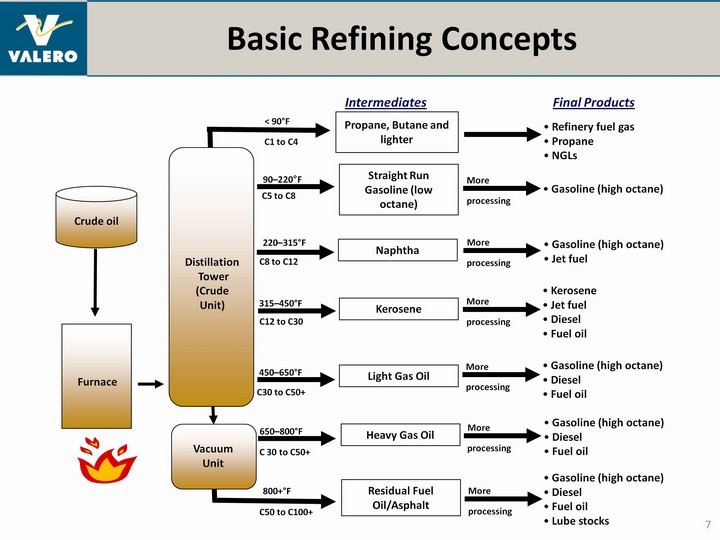

| 7 Basic Refining Concepts Gasoline (high octane) Jet fuel Distillation Tower(CrudeUnit) Propane, Butane and lighter Refinery fuel gas Propane NGLs < 90°F Straight Run Gasoline (low octane) Gasoline (high octane) 90-220°F Naphtha 220-315°F Kerosene Kerosene Jet fuel Diesel Fuel oil 315-450°F Light Gas Oil Gasoline (high octane) Diesel Fuel oil 450-650°F Heavy Gas Oil 650-800°F Residual Fuel Oil/Asphalt 800+°F Furnace VacuumUnit More Gasoline (high octane) Diesel Fuel oil Gasoline (high octane) Diesel Fuel oil Lube stocks Intermediates Final Products processing More processing More processing More processing More processing More processing Crude oil C1 to C4 C5 to C8 C8 to C12 C12 to C30 C30 to C50+ C 30 to C50+ C50 to C100+ |

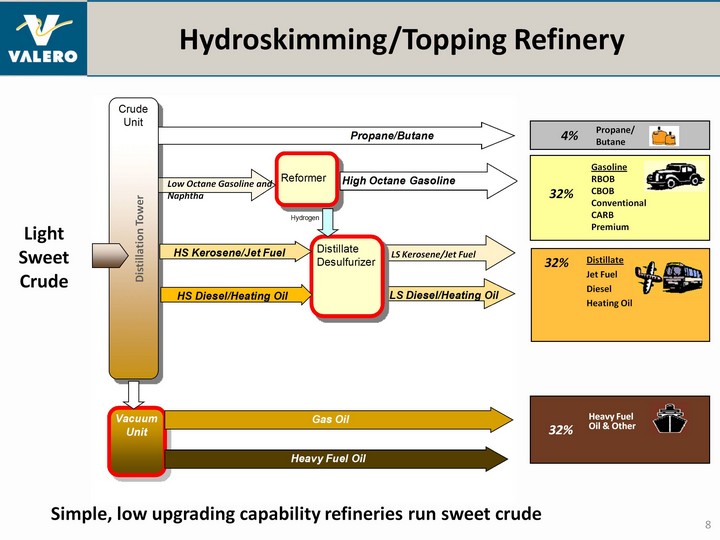

| 8 Hydroskimming/Topping Refinery LightSweetCrude Heavy Fuel Oil & Other 32% GasolineRBOBCBOBConventionalCARBPremium Simple, low upgrading capability refineries run sweet crude Propane/Butane 4% 32% 32% DistillateJet FuelDieselHeating Oil Distillation Tower Low Octane Gasoline and Naphtha LS Kerosene/Jet Fuel |

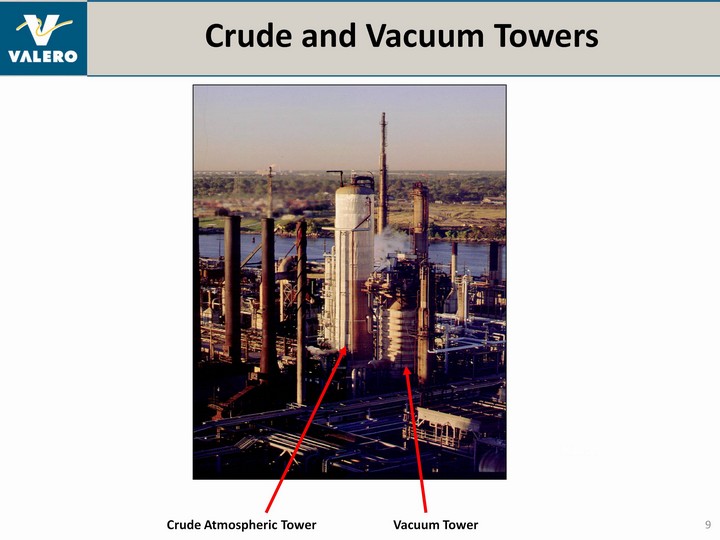

| 9 Crude and Vacuum Towers Crude Atmospheric Tower Vacuum Tower Heater |

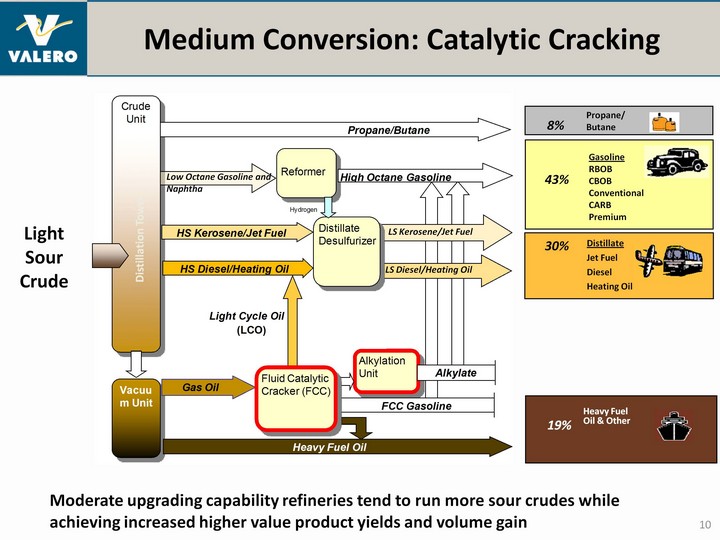

| 10 Medium Conversion: Catalytic Cracking Moderate upgrading capability refineries tend to run more sour crudes while achieving increased higher value product yields and volume gain Heavy Fuel Oil & Other 19% Distillation Tower Propane/Butane 8% 30% DistillateJet FuelDieselHeating Oil 43% GasolineRBOBCBOBConventionalCARBPremium LightSourCrude Low Octane Gasoline and Naphtha LS Kerosene/Jet Fuel LS Diesel/Heating Oil |

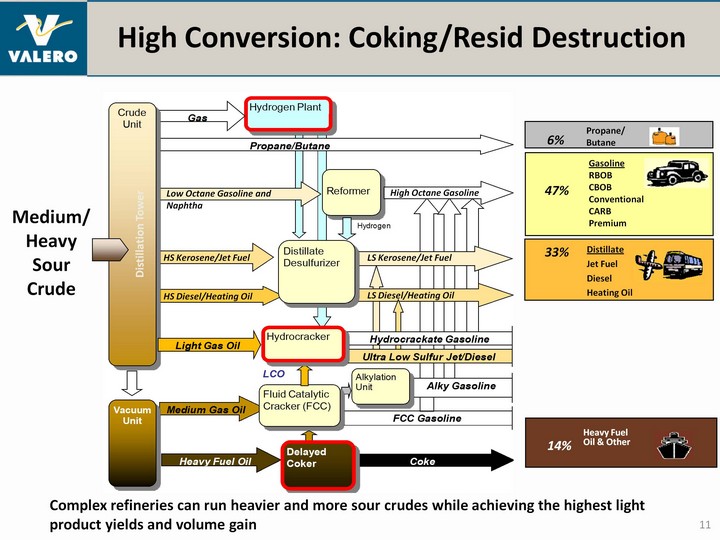

| High Conversion: Coking/Resid Destruction 11 Complex refineries can run heavier and more sour crudes while achieving the highest light product yields and volume gain Heavy Fuel Oil & Other 14% Propane/Butane 6% 33% DistillateJet FuelDieselHeating Oil 47% GasolineRBOBCBOBConventionalCARBPremium Medium/ Heavy Sour Crude Distillation Tower Low Octane Gasoline and Naphtha HS Kerosene/Jet Fuel HS Diesel/Heating Oil LS Kerosene/Jet Fuel LS Diesel/Heating Oil High Octane Gasoline |

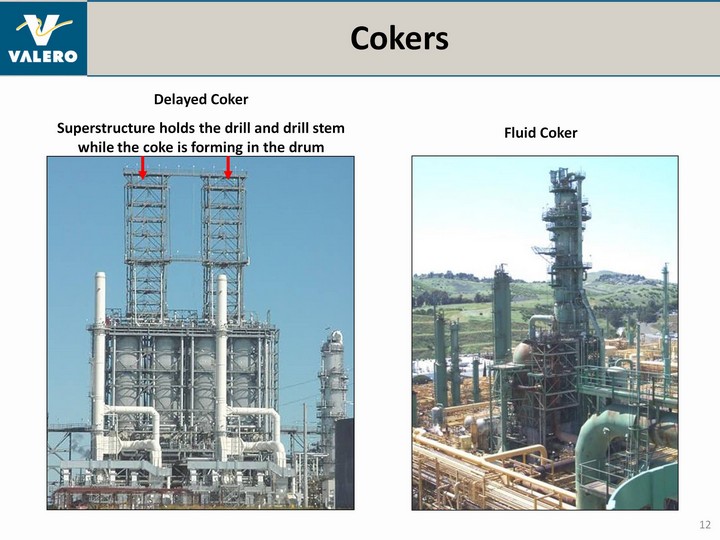

| 12 Cokers Delayed Coker Superstructure holds the drill and drill stem while the coke is forming in the drum Fluid Coker |

| 13 Gary SimmonsVice PresidentCrude, Feedstock Supply & Trading |

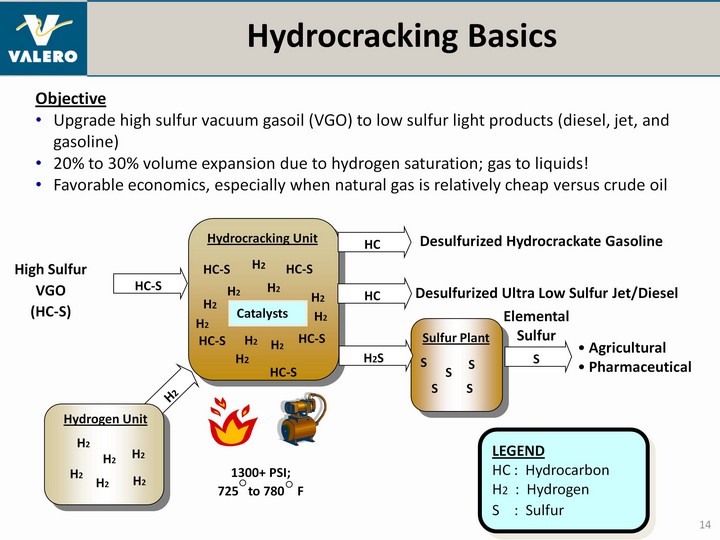

| 14 Hydrocracking Basics LEGENDHC : HydrocarbonH2 : HydrogenS : Sulfur ObjectiveUpgrade high sulfur vacuum gasoil (VGO) to low sulfur light products (diesel, jet, and gasoline)20% to 30% volume expansion due to hydrogen saturation; gas to liquids!Favorable economics, especially when natural gas is relatively cheap versus crude oil High SulfurVGO(HC-S) Hydrocracking Unit HC-S HC-S HC-S Catalysts HC-S HC-S Desulfurized Hydrocrackate Gasoline HC Sulfur Plant Agricultural Pharmaceutical ElementalSulfur S S S S S H2S S HC-S H2 H2 H2 H2 Desulfurized Ultra Low Sulfur Jet/Diesel HC H2 H2 H2 H2 H2 H2 1300+ PSI;725 to 780 F H2 Hydrogen Unit H2 H2 H2 H2 H2 H2 |

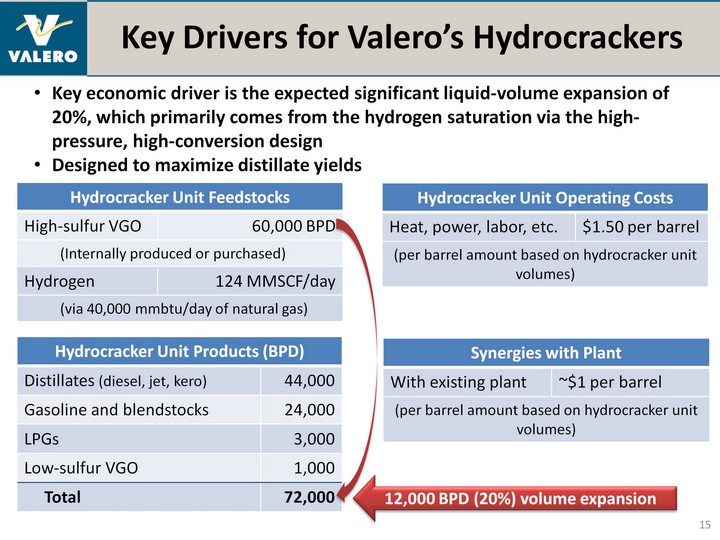

| 12,000 BPD (20%) volume expansion Hydrocracker Unit Operating Costs Hydrocracker Unit Operating Costs Heat, power, labor, etc. $1.50 per barrel (per barrel amount based on hydrocracker unit volumes) (per barrel amount based on hydrocracker unit volumes) Synergies with Plant Synergies with Plant With existing plant ~$1 per barrel (per barrel amount based on hydrocracker unit volumes) (per barrel amount based on hydrocracker unit volumes) Key Drivers for Valero's Hydrocrackers 15 Key economic driver is the expected significant liquid-volume expansion of 20%, which primarily comes from the hydrogen saturation via the high- pressure, high-conversion designDesigned to maximize distillate yields Hydrocracker Unit Products (BPD) Hydrocracker Unit Products (BPD) Distillates (diesel, jet, kero) 44,000 Gasoline and blendstocks 24,000 LPGs 3,000 Low-sulfur VGO 1,000 Total 72,000 Hydrocracker Unit Feedstocks Hydrocracker Unit Feedstocks High-sulfur VGO 60,000 BPD (Internally produced or purchased) (Internally produced or purchased) Hydrogen 124 MMSCF/day (via 40,000 mmbtu/day of natural gas) (via 40,000 mmbtu/day of natural gas) |

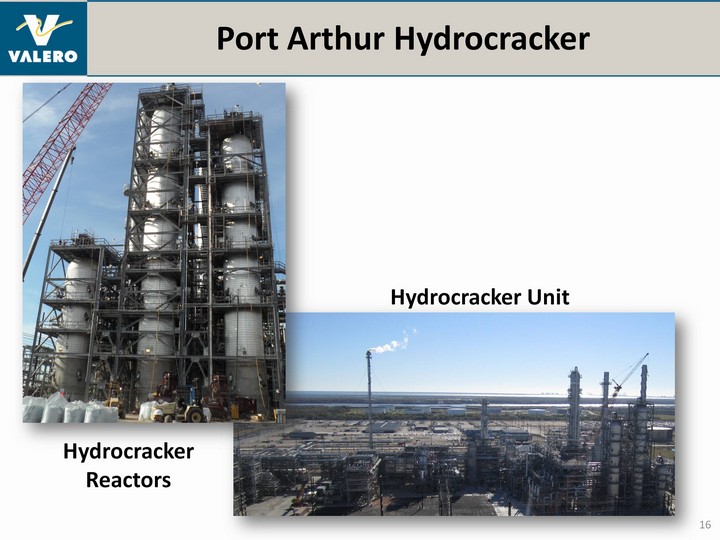

| Port Arthur Hydrocracker 16 Hydrocracker Reactors Hydrocracker Unit |

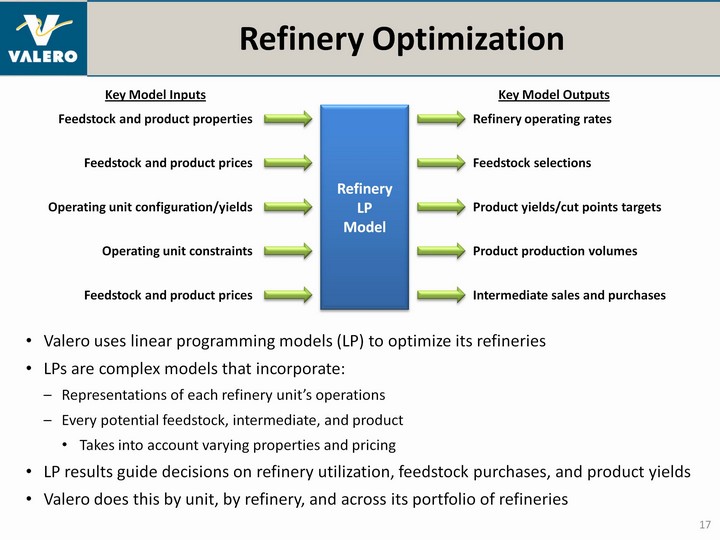

| Key Model Inputs Refinery Optimization Valero uses linear programming models (LP) to optimize its refineriesLPs are complex models that incorporate:Representations of each refinery unit's operationsEvery potential feedstock, intermediate, and productTakes into account varying properties and pricingLP results guide decisions on refinery utilization, feedstock purchases, and product yieldsValero does this by unit, by refinery, and across its portfolio of refineries 17 Refinery LPModel Feedstock and product properties Feedstock and product prices Operating unit configuration/yields Operating unit constraints Feedstock and product prices Refinery operating rates Feedstock selections Product yields/cut points targets Product production volumes Intermediate sales and purchases Key Model Outputs |

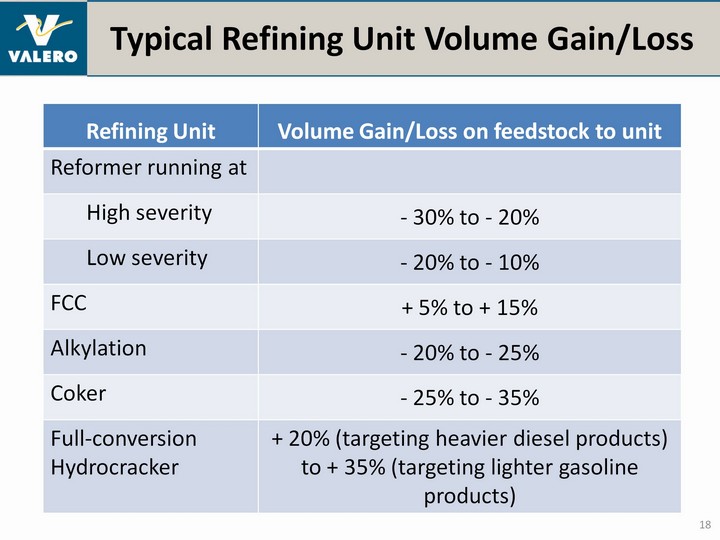

| Typical Refining Unit Volume Gain/Loss 18 Refining Unit Volume Gain/Loss on feedstock to unit Reformer running at High severity - 30% to - 20% Low severity - 20% to - 10% FCC + 5% to + 15% Alkylation - 20% to - 25% Coker - 25% to - 35% Full-conversion Hydrocracker + 20% (targeting heavier diesel products) to + 35% (targeting lighter gasoline products) |

| Gulf Coast Refineries and Growing Availability of Domestic Light Sweet Crude Oil Growing supply of domestic light sweet crude is expected to provide a structural discount for Gulf Coast light sweet crudesHow do you deal with growing supply of cheaper light sweet volumes?Back out imports from existing light sweet capacityFill previously uneconomic light sweet capacityAdditional light sweet crude runs will need to displace heavier crude oil volumesPursue projects that address constraints to using light sweet crudesRefinery configuration plays a large part in determining the suitability of crudes and feedstocks in a given refineryCrude and feedstock selection is based on the relative economics of available choices assisted by analysis using LP models 19 |

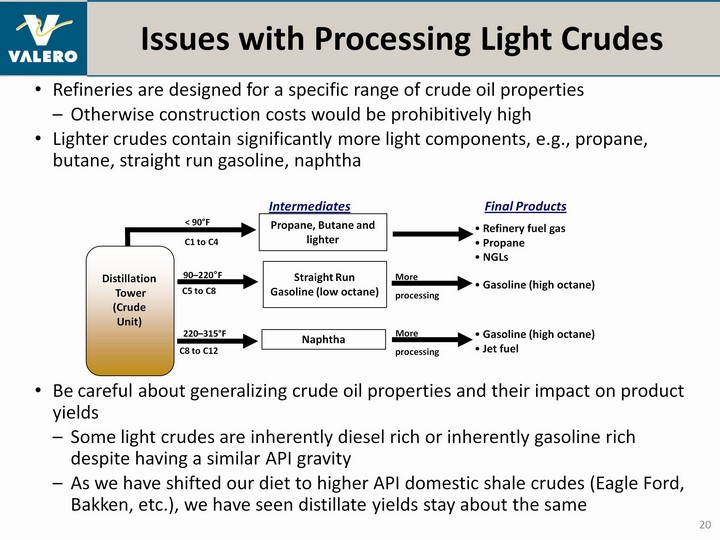

| Issues with Processing Light Crudes 20 Refineries are designed for a specific range of crude oil properties Otherwise construction costs would be prohibitively highLighter crudes contain significantly more light components, e.g., propane, butane, straight run gasoline, naphtha Gasoline (high octane) Distillation Tower(CrudeUnit) Propane, Butane and lighter Refinery fuel gas Propane NGLs < 90°F Straight Run Gasoline (low octane) 90-220°F Naphtha 220-315°F More Intermediates Final Products processing More processing C1 to C4 C5 to C8 C8 to C12 Gasoline (high octane) Jet fuel Be careful about generalizing crude oil properties and their impact on product yieldsSome light crudes are inherently diesel rich or inherently gasoline rich despite having a similar API gravityAs we have shifted our diet to higher API domestic shale crudes (Eagle Ford, Bakken, etc.), we have seen distillate yields stay about the same |

| Key Constraints 21 Many factors can constrain the ability to process light componentsConstraints are very specific to each refinery and individual crude unit within a refineryThey may occur in the crude unit itself, or in the downstream processing of lighter components into finished productsExamples include: Distillation tower has insufficient capacity for light componentsHydraulic capacity of overhead distillation hardwareHeater or heat exchanger design limits ability due to insufficient heater flexibility or limited ability to cool and condense higher volume of light endsSaturated gas plant has insufficient capacity to process additional volumeDownstream processing capacity limits ability to convert intermediates into finished productsDepending on the constraint, solutions can range from $10 million to hundreds of millions |

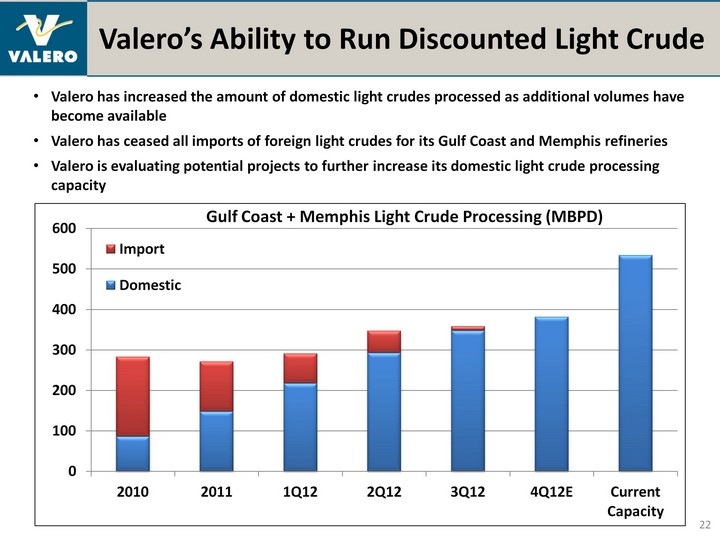

| Valero has increased the amount of domestic light crudes processed as additional volumes have become availableValero has ceased all imports of foreign light crudes for its Gulf Coast and Memphis refineriesValero is evaluating potential projects to further increase its domestic light crude processing capacity Valero's Ability to Run Discounted Light Crude 22 (CHART) |

| 23 Ashley SmithVice PresidentInvestor Relations |

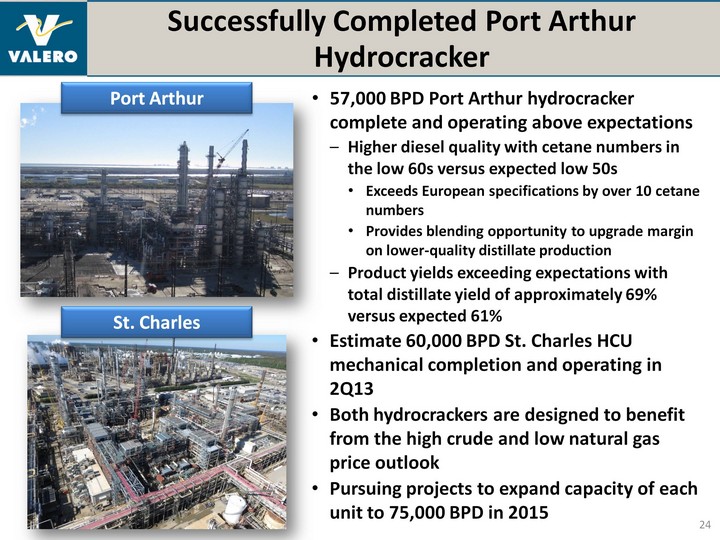

| 57,000 BPD Port Arthur hydrocracker complete and operating above expectationsHigher diesel quality with cetane numbers in the low 60s versus expected low 50sExceeds European specifications by over 10 cetane numbersProvides blending opportunity to upgrade margin on lower-quality distillate production Product yields exceeding expectations with total distillate yield of approximately 69% versus expected 61%Estimate 60,000 BPD St. Charles HCU mechanical completion and operating in 2Q13Both hydrocrackers are designed to benefit from the high crude and low natural gas price outlookPursuing projects to expand capacity of each unit to 75,000 BPD in 2015 Successfully Completed Port Arthur Hydrocracker 24 St. Charles Port Arthur |

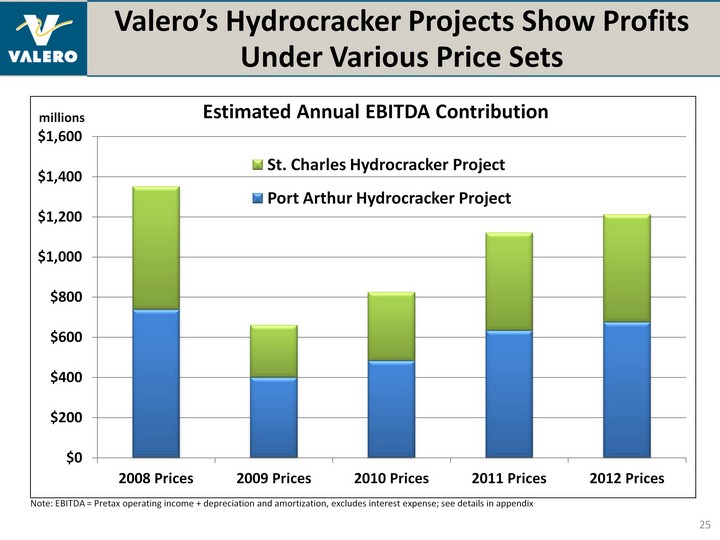

| Valero's Hydrocracker Projects Show Profits Under Various Price Sets Under Various Price Sets Under Various Price Sets 25 Note: EBITDA = Pretax operating income + depreciation and amortization, excludes interest expense; see details in appendix millions |

| 26 Q & A |

| 27 Appendix |

| 28 Major Refining Processes - Crude Processing DefinitionSeparating crude oil into different hydrocarbon groups The most common means is through distillationProcessDesalting - Prior to distillation, crude oil is often desalted to remove corrosive salts as well as metals and other suspended solids.Atmospheric Distillation - Used to separate the desalted crude into specific hydrocarbon groups (straight run gasoline, naphtha, light gas oil, etc.) or fractions. Vacuum Distillation - Heavy crude residue ("bottoms") from the atmospheric column is further separated using a lower-pressure distillation process. Means to lower the boiling points of the fractions and permit separation at lower temperatures, without decomposition and excessive coke formation. |

| 29 Major Refining Processes - Cracking Definition"Cracking" or breaking down large, heavy hydrocarbon molecules into smaller hydrocarbon molecules thru application of heat (thermal) or through the use of catalystsProcessCoking - Thermal non-catalytic cracking process that converts low value oils to higher value gasoline, gas oils and marketable coke. Residual fuel oil from vacuum distillation column is typical feedstock.Visbreaking - Thermal non-catalytic process used to convert large hydrocarbon molecules in heavy feedstocks to lighter products such as fuel gas, gasoline, naphtha and gas oil. Produces sufficient middle distillates to reduce the viscosity of the heavy feed.Catalytic Cracking - A central process in refining where heavy gas oil range feeds are subjected to heat in the presence of catalyst and large molecules crack into smaller molecules in the gasoline and surrounding ranges.Catalytic Hydrocracking - Like cracking, used to produce blending stocks for gasoline and other fuels from heavy feedstocks. Introduction of hydrogen in addition to a catalyst allows the cracking reaction to proceed at lower temperatures than in catalytic cracking, although pressures are much higher. |

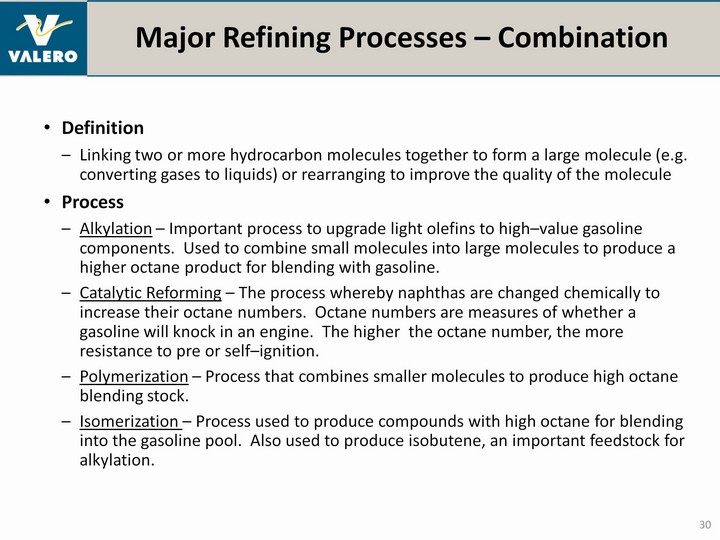

| 30 Major Refining Processes - Combination DefinitionLinking two or more hydrocarbon molecules together to form a large molecule (e.g. converting gases to liquids) or rearranging to improve the quality of the moleculeProcessAlkylation - Important process to upgrade light olefins to high-value gasoline components. Used to combine small molecules into large molecules to produce a higher octane product for blending with gasoline.Catalytic Reforming - The process whereby naphthas are changed chemically to increase their octane numbers. Octane numbers are measures of whether a gasoline will knock in an engine. The higher the octane number, the more resistance to pre or self-ignition.Polymerization - Process that combines smaller molecules to produce high octane blending stock.Isomerization - Process used to produce compounds with high octane for blending into the gasoline pool. Also used to produce isobutene, an important feedstock for alkylation. |

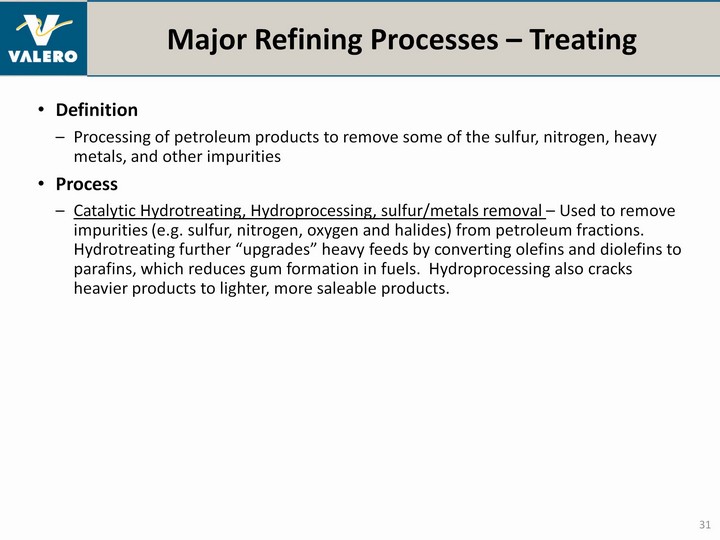

| 31 Major Refining Processes - Treating DefinitionProcessing of petroleum products to remove some of the sulfur, nitrogen, heavy metals, and other impuritiesProcessCatalytic Hydrotreating, Hydroprocessing, sulfur/metals removal - Used to remove impurities (e.g. sulfur, nitrogen, oxygen and halides) from petroleum fractions. Hydrotreating further "upgrades" heavy feeds by converting olefins and diolefins to parafins, which reduces gum formation in fuels. Hydroprocessing also cracks heavier products to lighter, more saleable products. |

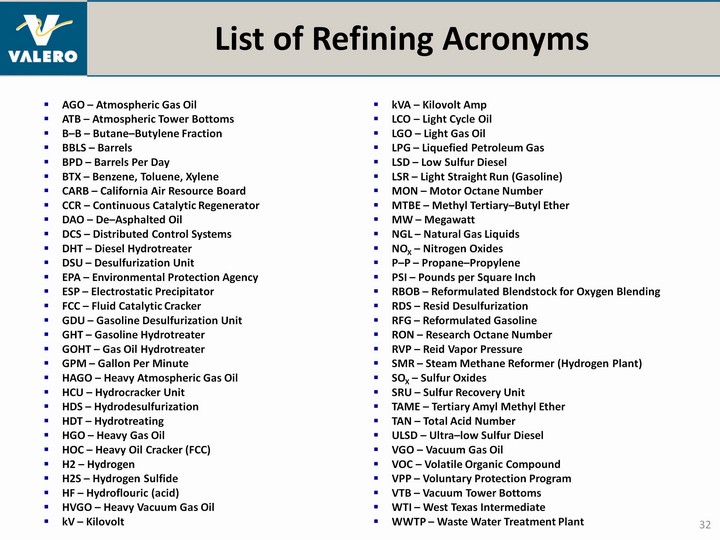

| 32 List of Refining Acronyms AGO - Atmospheric Gas OilATB - Atmospheric Tower BottomsB-B - Butane-Butylene FractionBBLS - BarrelsBPD - Barrels Per DayBTX - Benzene, Toluene, XyleneCARB - California Air Resource BoardCCR - Continuous Catalytic RegeneratorDAO - De-Asphalted OilDCS - Distributed Control SystemsDHT - Diesel HydrotreaterDSU - Desulfurization Unit EPA - Environmental Protection AgencyESP - Electrostatic PrecipitatorFCC - Fluid Catalytic CrackerGDU - Gasoline Desulfurization UnitGHT - Gasoline HydrotreaterGOHT - Gas Oil HydrotreaterGPM - Gallon Per MinuteHAGO - Heavy Atmospheric Gas OilHCU - Hydrocracker UnitHDS - HydrodesulfurizationHDT - HydrotreatingHGO - Heavy Gas OilHOC - Heavy Oil Cracker (FCC)H2 - HydrogenH2S - Hydrogen SulfideHF - Hydroflouric (acid)HVGO - Heavy Vacuum Gas OilkV - Kilovolt kVA - Kilovolt AmpLCO - Light Cycle OilLGO - Light Gas OilLPG - Liquefied Petroleum GasLSD - Low Sulfur DieselLSR - Light Straight Run (Gasoline)MON - Motor Octane NumberMTBE - Methyl Tertiary-Butyl EtherMW - MegawattNGL - Natural Gas LiquidsNOX - Nitrogen OxidesP-P - Propane-PropylenePSI - Pounds per Square InchRBOB - Reformulated Blendstock for Oxygen Blending RDS - Resid DesulfurizationRFG - Reformulated GasolineRON - Research Octane NumberRVP - Reid Vapor PressureSMR - Steam Methane Reformer (Hydrogen Plant)SOX - Sulfur OxidesSRU - Sulfur Recovery UnitTAME - Tertiary Amyl Methyl EtherTAN - Total Acid NumberULSD - Ultra-low Sulfur DieselVGO - Vacuum Gas OilVOC - Volatile Organic CompoundVPP - Voluntary Protection ProgramVTB - Vacuum Tower BottomsWTI - West Texas IntermediateWWTP - Waste Water Treatment Plant |

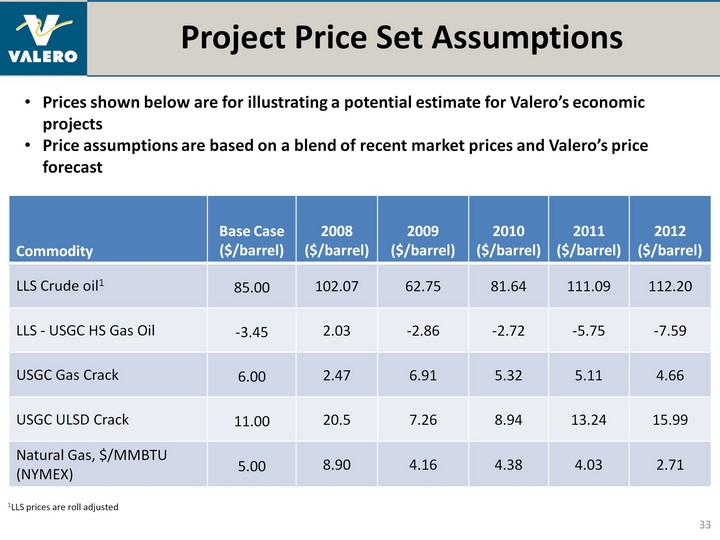

| Project Price Set Assumptions 33 Commodity Base Case ($/barrel) 2008 ($/barrel) 2009 ($/barrel) 2010 ($/barrel) 2011 ($/barrel) 2012 ($/barrel) LLS Crude oil1 85.00 102.07 62.75 81.64 111.09 112.20 LLS - USGC HS Gas Oil -3.45 2.03 -2.86 -2.72 -5.75 -7.59 USGC Gas Crack 6.00 2.47 6.91 5.32 5.11 4.66 USGC ULSD Crack 11.00 20.5 7.26 8.94 13.24 15.99 Natural Gas, $/MMBTU (NYMEX) 5.00 8.90 4.16 4.38 4.03 2.71 Prices shown below are for illustrating a potential estimate for Valero's economic projectsPrice assumptions are based on a blend of recent market prices and Valero's price forecast 1LLS prices are roll adjusted |

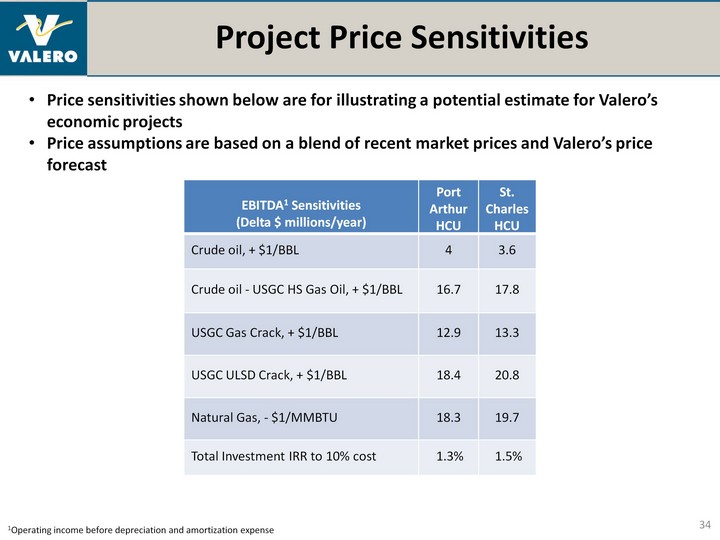

| Project Price Sensitivities 34 EBITDA1 Sensitivities (Delta $ millions/year) Port Arthur HCU St. Charles HCU Crude oil, + $1/BBL 4 3.6 Crude oil - USGC HS Gas Oil, + $1/BBL 16.7 17.8 USGC Gas Crack, + $1/BBL 12.9 13.3 USGC ULSD Crack, + $1/BBL 18.4 20.8 Natural Gas, - $1/MMBTU 18.3 19.7 Total Investment IRR to 10% cost 1.3% 1.5% 1Operating income before depreciation and amortization expense Price sensitivities shown below are for illustrating a potential estimate for Valero's economic projectsPrice assumptions are based on a blend of recent market prices and Valero's price forecast |

| Investor Relations Contacts For more information, please contact:Ashley Smith, CFA, CPAVice President, Investor Relations210.345.2744ashley.smith@valero.comMatthew JacksonInvestor Relations Specialist210.345.2564matthew.jackson@valero.com 35 |