Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SAExploration Holdings, Inc. | v332367_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - SAExploration Holdings, Inc. | v332367_ex99-2.htm |

Merger Partner Trio Merger Corp. NASDAQ: TRIO / OTCBB: TRIOW SAE LTM (September) Revenue $268.7 MM Unaudited 2012 Nine - Month Revenue $209.3 MM Unaudited 2012 Nine - Month EBITDA $26.9 MM Total Backlog and Bids Outstanding at November 30, 2012 $248.3 MM / $315.7 MM SAExploration Holdings, Inc . (“SAE”) is one of the largest international seismic data acquisition and processing companies in the world . SAE provides a full range of 2 D, 3 D and 4 D seismic data services to its clients, including surveying, program design, logistical support, data acquisition, processing, camp services, catering, environmental assessment and community relations . With an operational focus concentrated in North America, South America and Asia Pacific, SAE is operating in most of the prolific oil producing regions in the world . SAE services its multinational client base from offices in Canada, Alaska, Peru, Colombia, Bolivia, Papua New Guinea, New Zealand and Brazil . SAE operates 10 - 12 crews globally with approximately 300 full - time employees and up to 7 , 000 seasonal employees . SAE and Its Markets Operating as a sub - sector of the $ 600 billion (est . ) global energy exploration & production industry, the seismic industry represents a $ 16 to $ 19 billion worldwide annual revenue opportunity ( 1 ) . The land acquisition services segment of the seismic market represents a $ 4 . 4 - $ 5 . 3 billion annual market ( 1 ) . Seismic data acquisition involves applying an energy source at a surface location, analyzing the reflected energy, and then creating high resolution images of complex underground structures . These images are used primarily by oil and gas companies to identify geologic structures favorable to the accumulation of hydrocarbons, to reduce risk associated with oil and gas exploration, to optimize well completion techniques, and to monitor changes in hydrocarbon reservoirs . SAE specializes in logistically complex and challenging environments (e . g . Alaska, Peru, Papua New Guinea), while maintaining a strong Quality, Health, Safety and Environmental (“QHSE”) performance record . 100 % of SAE’s revenue is earned on a contracted basis with customers, as opposed to shooting unfunded or partially funded speculative libraries, which have significantly more risk and uncertainty . Revenue and EBITDA Profile ($ in MM; unaudited) Growth Rate: 26.8% 39.5% $140.5 $178.2 $150 $209.3 100 120 140 160 180 200 220 2010 2011 9M 2011 9M 2012 Revenue $14.5 $14.5 $17.8 $26.9 $48 $54 10 15 20 25 30 35 40 45 50 55 60 2010 2011 9M11 9M12 2013 2014 EBITDA (1) 1) 2013 and 2014 EBITDA based on mid - points of EBITDA targets CAGR of 38.9% $ $ (1) Source : Ion Geophysical Corporation 4 th Annual Johnson Rice & Company Energy Conference October 3, 2012 Presentation

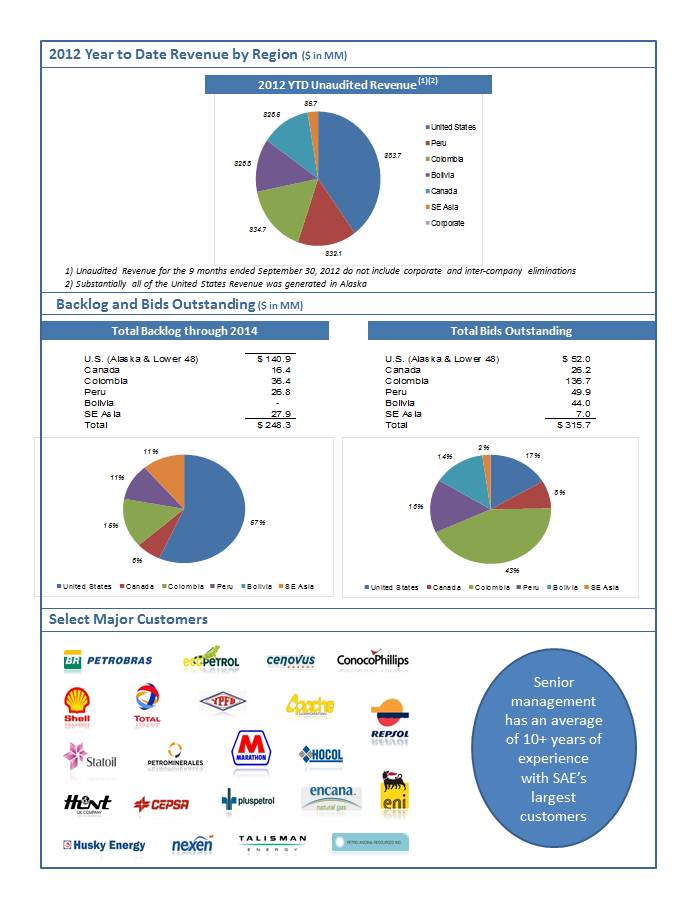

Total Bids Outstanding Total Backlog through 2014 U.S. (Alaska & Lower 48) $ 140.9 Canada 16.4 Colombia 36.4 Peru 26.8 Bolivia - SE Asia 27.9 Total $ 248.3 U.S. (Alaska & Lower 48) $ 52.0 Canada 26.2 Colombia 136.7 Peru 49.9 Bolivia 44.0 SE Asia 7.0 Total $ 315.7 57% 6% 15% 11% 11% United States Canada Colombia Peru Bolivia SE Asia 17% 8% 43% 16% 14% 2% United States Canada Colombia Peru Bolivia SE Asia Backlog and Bids Outstanding ($ in MM) Select Major Customers 2012 Year to Date Revenue by Region ($ in MM) Senior management has an average of 10+ years of experience with SAE’s largest customers $83.7 $32.1 $34.7 $26.8 $26.5 $5.7 United States Peru Colombia Bolivia Canada SE Asia Corporate 2012 YTD Unaudited Revenue (1)(2) 1) Unaudited Revenue for the 9 months ended September 30, 2012 do not include corporate and inter - company eliminations 2) Substantially all of the United States Revenue was generated in Alaska

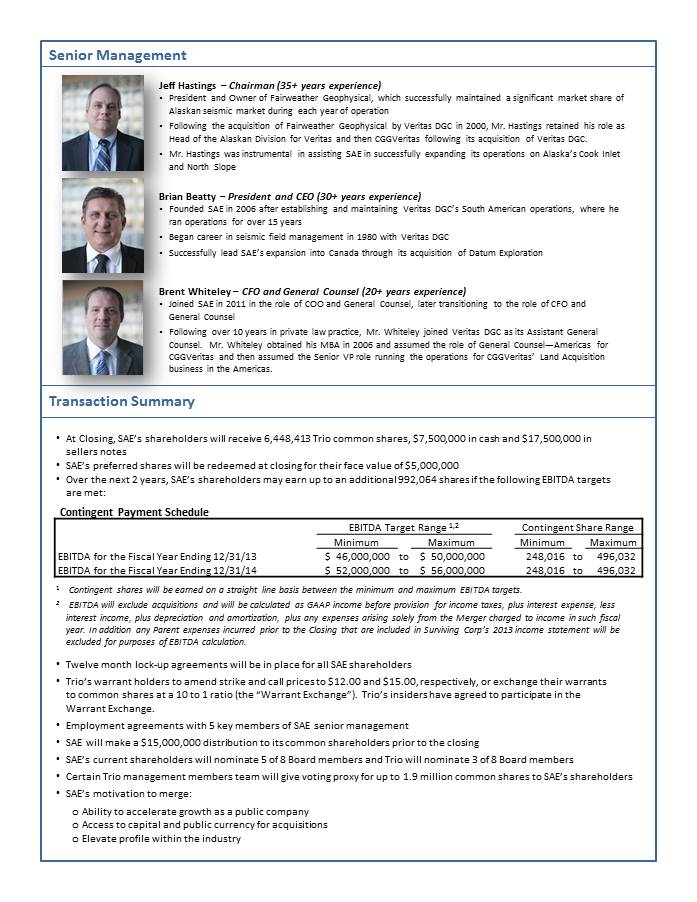

Senior Management Transaction Summary Jeff Hastings – Chairman (35+ years experience) • President and Owner of Fairweather Geophysical, which successfully maintained a significant market share of Alaskan seismic market during each year of operation • Following the acquisition of Fairweather Geophysical by Veritas DGC in 2000, Mr. Hastings retained his role as Head of the Alaskan Division for Veritas and then CGGVeritas following its acquisition of Veritas DGC. • Mr. Hastings was instrumental in assisting SAE in successfully expanding its operations on Alaska’s Cook Inlet and North Slope Brian Beatty – President and CEO (30+ years experience) • Founded SAE in 2006 after establishing and maintaining Veritas DGC’s South American operations, where he ran operations for over 15 years • Began career in seismic field management in 1980 with Veritas DGC • Successfully lead SAE’s expansion into Canada through its acquisition of Datum Exploration Brent Whiteley – CFO and General Counsel (20+ years experience) • Joined SAE in 2011 in the role of COO and General Counsel, later transitioning to the role of CFO and General Counsel • Following over 10 years in private law practice, Mr. Whiteley joined Veritas DGC as its Assistant General Counsel. Mr. Whiteley obtained his MBA in 2006 and assumed the role of General Counsel — Americas for CGGVeritas and then assumed the Senior VP role running the operations for CGGVeritas ’ Land Acquisition business in the Americas. • At Closing, SAE’s shareholders will receive 6,448,413 Trio common shares, $7,500,000 in cash and $17,500,000 in sellers notes • SAE’s preferred shares will be redeemed at closing for their face value of $5,000,000 • Over the next 2 years, SAE’s shareholders may earn up to an additional 992,064 shares if the following EBITDA targets are met: Contingent Payment Schedule EBITDA Target Range 1,2 Contingent Share Range Minimum Maximum Minimum Maximum EBITDA for the Fiscal Year Ending 12/31/13 $ 46,000,000 to $ 50,000,000 248,016 to 496,032 EBITDA for the Fiscal Year Ending 12/31/14 $ 52,000,000 to $ 56,000,000 248,016 to 496,032 1 Contingent shares will be earned on a straight line basis between the minimum and maximum EBITDA targets. 2 EBITDA will exclude acquisitions and will be calculated as GAAP income before provision for income taxes, plus interest expe nse, less interest income, plus depreciation and amortization, plus any expenses arising solely from the Merger charged to income in su ch fiscal year. In addition any Parent expenses incurred prior to the Closing that are included in Surviving Corp’s 2013 income stateme nt will be excluded for purposes of EBITDA calculation. • Twelve month lock - up agreements will be in place for all SAE shareholders • Trio’s warrant holders to amend strike and call prices to $12.00 and $15.00, respectively, or exchange their warrants to common shares at a 10 to 1 ratio (the “Warrant Exchange”). Trio’s insiders have agreed to participate in the Warrant Exchange. • Employment agreements with 5 key members of SAE senior management • SAE will make a $15,000,000 distribution to its common shareholders prior to the closing • SAE’s current shareholders will nominate 5 of 8 Board members and Trio will nominate 3 of 8 Board members • Certain Trio management members team will give voting proxy for up to 1.9 million common shares to SAE’s shareholders • SAE’s motivation to merge: o Ability to accelerate growth as a public company o Access to capital and public currency for acquisitions o Elevate profile within the industry

About Trio Merger Corp. Trio was incorporated in Delaware on February 2 , 2011 as a blank check company whose objective is to effect a merger, capital stock exchange, asset acquisition or other similar business combination with an operating business . Trio’s initial public offering was declared effective June 20 , 2011 and was consummated on June 24 , 2011 , receiving net proceeds of $ 57 . 43 million through the sale of 6 . 0 million units at $ 10 . 00 per unit and $ 3 . 55 million from the sale of private placement warrants to the initial stockholders and the underwriters . On June 24 , 2011 , the underwriters exercised their over - allotment option and on June 27 , 2011 , the Company received net proceeds of $ 8 . 69 million from the sale of 900 , 000 units . Each unit was comprised of one share of Trio common stock and one warrant with an exercise price of $ 7 . 50 . Pursuant to a share repurchase plan, the Company repurchased a total of 0 . 78 million shares of common stock at an aggregate purchase price of $ 7 . 54 million . As of September 30 , 2012 , Trio held $ 61 . 69 million in a trust account maintained by an independent trustee, which will be released upon the consummation of the business combination . The closing of the acquisition is subject to approval by the stockholders of Trio, and holders of 496 , 032 or more of the shares of Trio common stock issued in Trio’s initial public offering of securities not exercising their rights to convert their shares into a pro rata share of the Trust Fund in accordance with Trio’s charter documents . EarlyBirdCapital , Inc . , the managing underwriter in Trio's initial public offering consummated in June 2011 , is acting as Trio's investment banker in connection with the proposed merger with SAE, for which it will receive a fee of $ 2 , 415 , 000 . Trio and its directors and executive officers and EarlyBirdCapital , Inc . may be deemed to be participants in the solicitation of proxies for the special meeting of Trio stockholders to be held to approve the merger . Stockholders are advised to read, when available, Trio’s preliminary proxy statement/information statement and definitive proxy statement/information statement in connection with the solicitation of proxies for the special meeting because these statements will contain important information . The definitive proxy statement/information statement will be mailed to stockholders as of a record date to be established for voting on the merger . Stockholders will also be able to obtain a copy of the proxy statement/information statement, without charge, by directing a request to : Trio Merger Corp . , 777 Third Avenue, 37 th Floor, New York, NY 10017 . The preliminary proxy statement/information statement and definitive proxy statement/information statement, once available, can also be obtained, without charge, at the Securities and Exchange Commission's internet site ( http : //www . sec . gov ) . This presentation may contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , about Trio, SAE and their combined business after completion of the proposed merger . Forward looking statements are statements that are not historical facts . Such forward - looking statements, based upon the current beliefs and expectations of Trio’s and SAE’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward looking statements . The following factors, among others, could cause actual results to differ from those set forth in the forward - looking statements : business conditions ; weather and natural disasters ; changing interpretations of generally accepted accounting principles ; outcomes of government reviews ; inquiries and investigations and related litigation ; continued compliance with government regulations ; legislation or regulatory environments ; requirements or changes adversely affecting the businesses in which SAE is engaged ; fluctuations in customer demand ; management of rapid growth ; intensity of competition from other providers of seismic services ; general economic conditions ; community relations ; permitting issues ; geopolitical events and regulatory changes ; as well as other relevant risks detailed in Trio’s filings with the Securities and Exchange Commission . The information set forth herein should be read in light of such risks . Additionally, SAE’s financial information is unaudited and does not conform to SEC Regulation S - X . Furthermore, it includes certain financial information (EBITDA) not derived in accordance with generally accepted accounting principles (“GAAP”) . Accordingly, such information may be materially different when presented in Trio’s Proxy Statement to solicit stockholder approval of the merger . Trio believes that the presentation of this non - GAAP measure provides information that is useful to investors as it indicates more clearly the ability of SAE to meet capital expenditures and working capital requirements and otherwise meet its obligations as they become due . SAE’s EBITDA was derived by taking earnings before interest, taxes, depreciation and amortization as adjusted for certain one - time non - recurring items and exclusions . Neither Trio nor SAE assumes any obligation to update the information contained in this presentation . For Additional Information The Equity Group Inc. Devin Sullivan Senior Vice President Dsullivan@equityny.com 212 - 836 - 9608 Thomas Mei Account Executive Tmei@equityny.com 212 - 836 - 9614 Trio Merger Corp. Chairman and CEO Eric Rosenfeld 212 - 319 - 7676 Chief Financial Officer David Sgro 212 - 319 - 7676