Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Griffin Capital Essential Asset REIT, Inc. | d467491d8k.htm |

Exhibit 99.1

|

|

January 17, 2013

Dear Financial Professional:

Due to the challenges of engaging with our selling group members during the holiday season, we have decided to extend the Price Announcement Date (date which we will announce the new offering price for Griffin Capital Net Lease REIT), from Friday February 1st to Friday February 15th. Accordingly, we have also determined to adjust the date of effectiveness of the follow-on public offering for Griffin Capital Net Lease REIT from March 1 to April 1, 2013.

This letter provides important details regarding both of these changes, including important deadlines regarding the submission of subscription documents for both qualified and non-qualified monies. While the process and procedures have not changed from those we previously communicated to you, certain important dates have, so please discard previous correspondence and use this letter as your guide.

Please also note that this letter has embedded links to important documents, including an Information Summary Sheet (complete with an ‘at a glance’ timeline of key dates) and a link to our Investor Letter, being sent to all current shareholders of Griffin Capital Net Lease REIT. Armed with this letter, Advisors with clients invested in our REIT are prepared should clients reach out to you with questions.

Should you have any questions concerning any aspect of this correspondence and process, please contact your wholesaler, or our Griffin Capital Securities Sales Desk at (866) 606-5901.

I. CHANGE IN SHARE OFFERING PRICE ANNOUNCEMENT DATE

Griffin Capital Net Lease REIT anticipates disclosing and declaring a new offering price for the shares being sold in our initial public offering on February 15, 2013 (the “Price Announcement Date”).

We will continue to offer shares at the current price of $10.00 per share through the day immediately prior to the Price Announcement Date, and all issuance of shares pursuant to our distribution reinvestment plan (“DRIP”) on or prior to the Price Announcement Date will continue to reflect a price of $9.50 per share. Effective on the Price Announcement Date, we will begin offering shares at our new offering price, which may be different than our current $10.00 per share price. Following the Price Announcement Date, issuance of shares of our common stock pursuant to our DRIP will reflect a price equal to 95 percent of the new primary offering price.

II. CHANGE IN EFFECTIVE DATE OF FOLLOW-ON PUBLIC OFFERING

The above-referenced potential change in offering price is being made in connection with our REIT’s pending follow-on public offering. As you may know, on August 29, 2012 we filed a registration statement on Form S-11 announcing our intent to execute a follow-on public offering. Our broker-dealer partners have made clear, and we agree, that establishing a new offering price in connection with a follow-on offering should be considered best practices for our industry. For those of you doing business with our sister company, Griffin-American Healthcare REIT II, you will recognize that the

process described herein is similar to the one they employed—not a coincidence as our management believes that this process is an appropriate way to handle a price change.

The important change we are announcing is that the anticipated effective date of the Net Lease REIT’s follow-on public offering is April 1, 2013.

III. INSTRUCTIONS REGARDING SUBSCRIPTION AGREEMENT SUBMISSION AND PROCESSING RELATED TO PRICE ANNOUNCEMENT DATE

Subscription Agreement Form

Since our current subscription agreement does not include a share price, there is no need to revise this agreement for the share re-pricing event—this is one less issue for broker-dealers, financial advisors and investors to deal with at this time.

Subscription Processing

Deadlines and Processes for Non-Custodial (Non-Qualified) Subscriptions:

We will continue to accept subscriptions for our primary offering at $10.00 per share through the day immediately prior to the Price Announcement Date. All subscriptions that are in good order and signed and postmarked to DST Systems, Inc., our transfer agent, prior to the Price Announcement Date (i.e., February 14 or earlier, assuming that the Price Announcement Date is February 15) will be processed at $10.00 per share for the primary offering.

Deadlines and Processes for Custodial (Qualified) Subscriptions:

Notwithstanding this hard cut-over to the new offering price effective as of the Price Announcement Date, we will make an accommodation for primary offering subscriptions that require funds to be transferred from an individual retirement account custodian. For custodial accounts (qualified subscriptions) only, in order for us to accept a primary offering subscription at $10.00 per share, the following conditions must be met:

| • | the investor must sign the subscription agreement prior to the Price Announcement Date; |

| • | a copy of the subscription agreement and transfer request must be submitted in good order (subject only to the receipt of funds and custodial signature) and postmarked or faxed to (855) 886-9862 to DST Systems, Inc., our transfer agent, prior to the Price Announcement Date; and |

| • | our transfer agent must receive the final subscription agreement executed by the custodian and proceeds by March 18, 2013. |

For custodial accounts (qualified account subscriptions), please take particular note of the requirement to send a copy of the subscription agreement and transfer request to our transfer agent, dated and faxed to (855) 886-9862 or postmarked prior to the Price Announcement Date (as this may differ from your traditional practice). The original subscription agreement should be sent to the account custodian to process in the ordinary course of standard business processing, but a duplicate copy must also be sent to our transfer agent by the February 14th deadline.

Any subscriptions dated prior to the Price Announcement Date, but postmarked on or after the Price Announcement Date, will be held for confirmation with the advisor whether the transaction is authorized to proceed at the new offering price only.

Any subscriptions dated on or after the Price Announcement Date will be processed at our new offering price.

We appreciate your ongoing support for Griffin Capital Net Lease REIT. Again, should you have any questions, please do not hesitate to contact our Sales Desk at (866) 606-5901.

Sincerely,

|

| |

| Kevin A. Shields | David C. Rupert | |

| Chairman and CEO | President | |

| Griffin Capital Net Lease REIT, Inc. | Griffin Capital Net Lease REIT, Inc. |

Links:

Information Summary Sheet (including link to Timeline)

Investor Letter

| Griffin Capital Net Lease REIT, Inc. | Griffin Capital Securities, Inc., member FINRA/SIPC | |

| 2121 Rosecrans Avenue, Suite 3321 | 4000 MacArthur Blvd., West Tower, Suite 220 | |

| El Segundo, California 90245 | (310) 469-6100 | Newport Beach, California 92660 | (949) 270-9300 |

|

|

Securities offered through Griffin Capital Securities, Inc. Member FINRA/SIPC |

NEW OFFERING PRICE INFORMATION SUMMARY SHEET

(updated as of January 17, 2013)

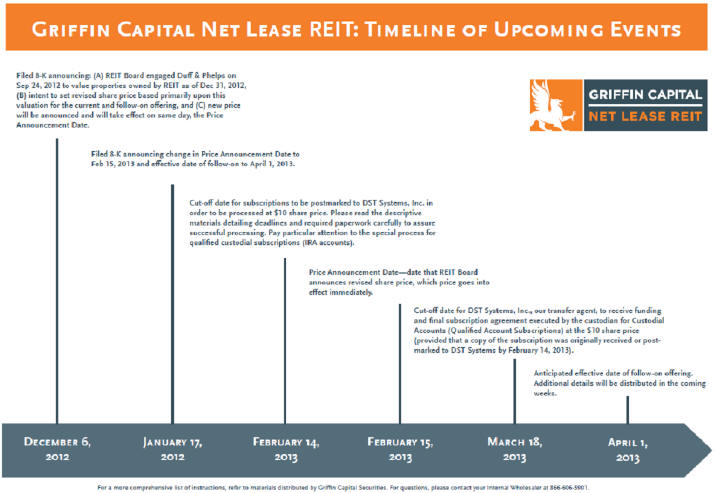

On January 17, 2013 Griffin Capital Net Lease REIT announced two important changes in dates regarding the REIT: (I) the declaration date of a new offering price for the shares of its common stock (the “Price Announcement Date”) has been changed to February 15 from February 1, 2013, and (II) the effective date of the REIT’s pending follow-on public offering has been changed to April 1 from March 1, 2013.

While the process and procedures regarding the submission of Subscription Documents relative to the Price Announcement Date have not changed from those we previously communicated to you, certain important deadlines have changed as a result of this announcement, so please discard previous correspondence and use this Summary Sheet as your guide.

| • | The REIT will continue to offer shares of its common stock in the primary offering at the current price of $10.00 per share through the day immediately prior to the Price Announcement Date, and all issuance of shares pursuant to its distribution reinvestment plan (“DRIP”) on or prior to the Price Announcement Date will continue to reflect a price of $9.50 per share. Effective on the Price Announcement Date, the REIT will begin offering shares at its new offering price. Following the Price Announcement Date, issuance of shares pursuant to the DRIP will reflect a price equal to 95 percent of the new offering price. |

| • | The current subscription agreement for the offering will not change as a result of this share re-pricing event (because the current subscription agreement does not include a specific share price). |

Deadlines and Processes for Non-Custodial (Non-Qualified) Subscriptions:

We will continue to accept subscriptions for our primary offering at $10.00 per share through the day immediately prior to the Price Announcement Date. All subscriptions that are in good order and signed and postmarked to DST Systems, Inc., our transfer agent, prior to the Price Announcement Date (i.e., February 14 or earlier, assuming that the Price Announcement Date is February 15) will be processed at $10.00 per share for the primary offering.

|

|

Securities offered through Griffin Capital Securities, Inc. Member FINRA/SIPC |

Deadlines and Processes for Custodial (Qualified) Subscriptions: Notwithstanding this hard cut–over to the new offering price as of the Price Announcement Date, we will make an accommodation for primary offering subscriptions that require funds due to be transferred from an individual retirement account custodian. For custodial accounts (qualified subscriptions) only, in order for us to accept a primary offering subscription at $10.00 per share, the following conditions must be met:

| • | the investor must sign the subscription agreement prior to the Price Announcement Date; |

| • | a copy of the subscription agreement and transfer request must be submitted in good order (subject only to the receipt of funds and custodial signature) and faxed to (855) 886-9862 or postmarked to DST Systems, Inc., our transfer agent, prior to the Price Announcement Date; and |

| • | our transfer agent must receive the final subscription agreement executed by the custodian, and proceeds by March 18, 2013. |

For custodial accounts (qualified account subscriptions), please take particular note of the requirement to send a copy of the subscription agreement and transfer request to our transfer agent, dated and faxed to (855) 886-9862 or postmarked prior to the Price Announcement Date (as this may differ from your traditional practice). The original subscription agreement should be sent to the account custodian to process in the ordinary course of standard business processing, but a duplicate copy must also be sent to our transfer agent by the February 14th deadline.

Any subscriptions dated prior to the Price Announcement Date, but postmarked on or after the Price Announcement Date, will be held for confirmation with the advisor whether the transaction is authorized to proceed at the new offering price only.

Any subscriptions dated on or after the Price Announcement Date will be processed at our new offering price.

|

|

Securities offered through Griffin Capital Securities, Inc. Member FINRA/SIPC |

Click here for a full-page, print-ready PDF timeline.