Attached files

| file | filename |

|---|---|

| 8-K - 8-K - rue21, inc. | d467910d8k.htm |

Exhibit 99.1 |

Certain

statements in this presentation and responses to various questions may be

“forward-looking statements” which reflect the company’s

current expectations or beliefs concerning future events. Actual results of

operations may differ materially from historical results or current expectations.

Any such forward-looking statements are subject to various risks and

uncertainties, including the strength of the economy, changes in the overall level

of consumer spending or preferences in apparel, our ability to

compete with other retailers, the performance of the company’s

products within the prevailing retail environment, our strategy and

expansion plans, reliance on key personnel, trade restrictions,

political or financial instability in countries where the company’s

goods are manufactured, availability of suitable store locations at

appropriate terms and other factors which are set forth in the

company’s SEC filings, which are available on our website. Safe Harbor Statement

|

3

Holiday 2012 Update

Holiday 2012 Update |

•

877 stores in strips, outlets and

malls in 47 states

•

Small and mid-size markets

•

Mix of girls and guys apparel

and accessories

•

Fast sourcing model

•

Experienced management

•

Highly developed infrastructure

= Consistent Growth

4

WHO IS rue21 |

Progress

Report Merchandise:

Real Estate:

Systems & Infrastructure:

Consistency:

November 13, 2012 was rue21’s

3 year IPO Anniversary

5

Grown more diversified across all categories

350 stores opened in the last 3 years, with 2012 stores best

performers to date

DC space doubled, HQ space tripled, new allocation system

implemented, new planning system to go live Q1 2013, eComm platform

established Double digit sales and profit increases every year

Never missed a quarterly earnings guidance estimate

Never missed a quarterly earnings guidance estimate |

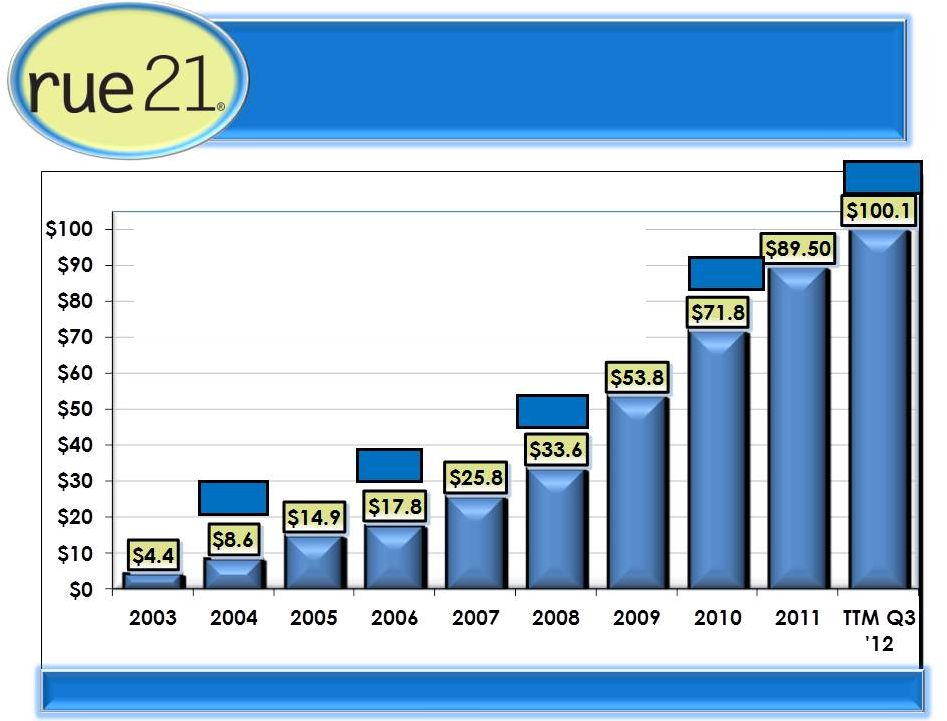

Consistent Sales Growth

Compound Sales Growth of 26% over 8 yrs.

$ in Millions

6

$ in Millions |

Proven

Earnings Growth & Margin Expansion

11.7%

11.3%

8.6%

7.9%

5.9%

Compound EBITDA Growth

Compound EBITDA Growth

of 46% over 8 yrs.

of 46% over 8 yrs.

$ in Millions

$ in Millions

Note: TTM Q-3 ‘12 Adjusted for CA wage & hour class action

7 |

•

Flexibility in Real Estate Options

•

Flexibility in Merchandise Assortment

•

Consistent New Store Productivity

•

Consistent Positive Comp Store Sales

•

Consistent Investments in Growth: Systems and Infrastructure

2013 Projection: $1 BILLION IN SALES AND APPROXIMATELY 1000 STORES

The Secret Sauce:

Consistency and Flexibility

8 |

9

MULTIPLE

GROWTH

DRIVERS |

2012

New Stores Generating Record Results

10

New stores sales per square foot up 9%

New stores 4-wall per square foot up 15%

ROI rates up 10 bps on similar build out costs

Note: Comparison to 2011 fleet of new stores |

Growth

Potential by U.S. Shopping Center Type 11

Ability to

DOUBLE

our Growth!

18%

Current

Stores

Identified

Locations

Share

Strip Centers

451

2,500

18%

Regional Malls

313

1,100

28%

Outlet Centers

113

175

65%

Total

877

3,775

23%

2008

2012

0

300

600

900

1,200

1,500

449

877

1,700

Predictable Growth –

Real Estate

2018E+ |

12

FARMINGTON, MO

#3 VOLUME STORE in NOV/DEC

#3 VOLUME STORE in NOV/DEC |

13

HAZARD, KENTUCKY |

14

BISMARCK, ND |

SIOUX

FALLS, SD |

PREDICTABLE GROWTH --

MERCHANDISE

Color, Color, Color

Dominating the Sector in Dresses

Strengthening of Fashion Knits and Woven Tops

Denim at Better Price Points

Sandals and Casual Footwear

Guys Key Item Knits Including Tanks

16

ABILITY TO CAPITALIZE ON TRENDS: |

17

COLOR, COLOR, COLOR |

18

etc!

Division Improvement |

eComm

Opportunity Update 19

Go

LIVE

on target for early 2014

eComm leader onboard; dedicated internal

resources in place

Growing online presence and viral marketing

initiatives

2

million

emails collected

4 million

predicted to be captured by go-live

•

•

•

• |

Status

Commentary

Headquarters

Systems

Software –

latest releases, ERP, financial, real estate,

HRIS with state of the art hardware

Planning and Allocation Systems

Headquarters expanded to 84,000 sq ft to support 25%

future associate growth

Team

Focus on recruiting and talent management

Expanded field management organization & focus

Distribution Center

DC square footage doubled to support up to 1,600

stores

eCommerce

Leadership retained and eComm strategy being

developed

Vendor selection process initiated with “go-live”

set

for 2014

20

Investments Made to

Support Our Growth |

Identify and capture operations efficiencies and

Increase Comp Sales in 2013

–

Add technology tools/mobile scanners

–

Redesign business processes

–

Improve workforce management

–

Simplify visual merchandising tasks

Project Simplification

21 |

Consistent Long-Term Comp

Sales Gains

$100 Valued by Successive Comp Store % Performance

$ in Millions

22 |

Predictable

Net Income Results First

Second

Third

Fourth

First

Second

Third

Fourth

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Net Sales Growth

40.1%

42.0%

27.9%

20.9%

20.4%

26.9%

33.6%

43.6%

Net Income Growth

249.7%

59.0%

50.9%

22.5%

56.3%

31.2%

55.8%

33.1%

Comp Store Sales

12.7%

8.9%

9.8%

1.8%

-5.2%

0.7%

6.6%

11.2%

First

Second

Third

Fourth

First

Second

Third

Fourth

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Net Sales Growth

40.7%

27.6%

40.7%

30.5%

27.6%

14.3%

19.5%

22.3%

Net Income Growth

257.5%

23.5%

106.9%

67.9%

94.7%

20.0%

19.5%

41.0%

Comp Store Sales

8.3%

0.6%

13.5%

8.6%

7.7%

-1.6%

1.8%

1.5%

First

Second

Third

Fourth

First

Second

Third

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Net Sales Growth

25.5%

21.0%

18.8%

15.7%

18.9%

17.0%

15.6%

Net Income Growth

65.2%

20.0%

22.4%

18.7%

20.6%

18.5%

14.5%

Comp Store Sales

5.2%

-0.3%

0.0%

-2.2%

1.7%

0.5%

0.2%

Fiscal 2009

Fiscal 2010

Fiscal 2011 Fiscal 2012

Fiscal 2007 Fiscal 2008

Ability

to

Expand

Net

Income

by

Double

Digits

in

Low

Comp

Growth

Quarters

23

Note: Q-3 ‘12 Adjusted for CA wage & hour class action

|

Gross

Margin Long-Term Gains

Year Over Year Margin Change

24

-2.0%

-1.5%

-1.0%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

FY08

FY09

FY10

FY11

Q3 FY12 YTD

peers

rue21 |

Gross

Margin History 25

34.1%

35.8%

37.0%

37.7%

38.1%

31.0%

32.0%

33.0%

34.0%

35.0%

36.0%

37.0%

38.0%

39.0%

$0

$50

$100

$150

$200

$250

$300

$350

FY08

FY09

FY10

FY11

TTM Q3 2012

Gross Profit $

GM% |

Years

Ended Jan

2011

Jan

2012

TTM

Q-3

Long Term

GOAL

Gross Margin

37.0%

37.7%

38.1%

38.5 -

39.0%

Selling, General and Administrative

*25.7%

*25.9%

*26.3%

25.0 -

25.5%

Depreciation and Amortization

3.4%

3.5%

3.7%

3.0%

Operating Income Margin

7.9%

8.3%

8.1%

10.5%

Pre-Tax Income Margin

7.8%

8.3%

8.1%

10.5 -

11.0%

Net Income

4.8%

5.1%

5.1%

6.0 -

7.0%

*Stock Comp Margin

.4%

.7%

1.1%

Margin Expansion Opportunity

Note: TTM Q-3 Adjusted for CA wage & hour class action

26 |

METRIC

METRIC

LONG-TERM TARGET

LONG-TERM TARGET

SQUARE FOOTAGE CAGR

square footage growth =

“mid teens”

COMPARABLE STORE

SALES GROWTH

LOW SINGLE DIGITS

GROSS MARGIN

150 BPS IMPROVEMENT

NET INCOME CAGR

17% -

20%

Long-Term Financial Targets

27 |

|