Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - dELiAs, Inc. | d468299d8k.htm |

Exhibit 99.1 |

This

presentation

contains

forward-looking

statements.

Forward-looking

statements

are

based

on

current

expectations

and

projections

about

future

events

and

are

subject

to

risks,

uncertainties

and

assumptions

about

our

Company,

economic

and

market

sectors

and

the

industry

in

which

we

do

business,

among

other

things.

These

statements

are

not

guarantees

of

future

performance,

and

except

as

required

by

law,

we

undertake

no

obligation

to

publicly

update

any

forward-looking

statements

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Actual

events

and

results

may

differ

from

those

expressed

in

any

forward-looking

statements

due

to

a

number

of

factors.

Factors

that

could

cause

our

actual

performance,

future

results

and

actions

to

differ

materially

from

any

forward-looking

statements

include,

but

are

not

limited

to,

those

discussed

in

risk

factors

within

our

Form

10-K

for

the

fiscal

year

ended

January

28,

2012,

and

our

Form

10-Q

for

the

fiscal

quarter

ended

October

27,

2012,

as

filed

with

the

Securities

and

Exchange

Commission.

Disclaimer

2 |

dELiA*s

Overview |

Company

Overview Multi-channel retail company comprised of two lifestyle brands primarily

marketing to teen girls and young women

Retail Segment accounts for approximately 57% of sales

o

106 mall-based dELiA*s stores in 33 states averaging 3,800 sq. ft.

o

Primarily selling tops, bottoms, dresses and accessories

Direct Segment accounts for approximately 43% of sales

o

Growing Direct to Consumer business consists of dELiA*s and Alloy catalog and

e-commerce

o

dELiA*s:

•

Expanded product offering includes shoes, swimwear, outerwear and extended sizes

•

Growing 12 month buyer file, with significant catalog circulation of 20.0 million in

2012 o

Alloy:

•

Target customer is an older teen to young, contemporary woman

•

Offers branded apparel, dresses, accessories, swimwear, footwear

and outerwear

•

Highly penetrated in denim through extended sizes/inseams offering

•

Catalog circulation of 16.5 million in 2012

4 |

The dELiA*s

Target Customer Young teen, transitioning to “young adult”

o

15/16 year old high school girl is sweet spot

The dELiA*s girl is a girly-girl; she’s playful, positive

and always present

o

Considers herself pretty, not sexy

o

Is in the know about what’s cool now

o

Loves social media and is technology savvy

Primarily suburban from a broad demographic

spectrum

Independent shopping style, but most still using

parents’

credit card

5

She is celebrity influenced with a feminine, casual, on-trend style.

|

The dELiA*s Brand

Concept 6

Serve as her best fashion friend; keep her in the fashion loop

Ignite her imagination with great outfitting ideas

Provide a look to fit every adventure and special occasion

Help her to bring her unique twist to any trend, while taking style cues from

celebrities, magazines, bloggers and friends

Everything we create should inspire her

She’s creative

She’s inspired

She’s ready |

Hybrid, fast

fashion/vertical model o

Provide frequent flow of new, trend-right merchandise

o

Shift mix to fashion merchandise/less emphasis on key

items

Be the destination for all of her outfitting needs

o

Trend –right assortment of tops, fashion bottoms and

accessories

o

Great fitting jeans in the newest washes, colors, prints

and dominant in graphic tees (in touch with what’s

current as evidenced by success of One Direction tees)

o

“Must Have Dress”

for her special event

o

Fashion selection for every holiday

Merchants have a clear brand vision for the dELiA*s

girl that is utilized as the filter for all product

selection

dELiA*s

Merchandising Strategy

7

Deliver girly-girl fashion that captures “the look”

she wants |

In-house

product development team coordinates scheduling, cost negotiation and fabric on key

programs

Flexible vendor model facilitates fast fashion and

test capabilities

Procure product through vendor partners and

domestic importers

Improved

sourcing on key items to reduce costs

Shorter lead times -

currently have the ability to

replenish most merchandise within 60 days, with

some as quickly as two weeks

Sourcing Supports Merchandising Strategy

8

Increased chase supported by sourcing model and web/in-store testing

|

Pricing and

Promotions Target promotional buys around key events in

her life

o

Promotions planned upfront, not reactionary

o

Support with marketing strategy in catalog,

online and in store

Continue to fine tune pricing strategy

o

Ensure non-dELiA*s branded product is priced

right

Opportunity to offer better opening price

points on select items while improving

merchandise margin

9 |

Marketing

Initiatives Continue utilization of dELiA*s catalog to drive traffic to stores and

web o

Circulate catalogs to retail buyers

o

Redirect unprofitable circulation spend to web based marketing initiatives

Enhance email campaigns through customized messaging, and maximize

search & affiliate programs

Use

targeted

social

media

to

reach

out

through

the

channels

that

she

uses

daily to communicate with friends

o

Facebook (680K+ friends, up 150% vs LY): Keep our girl informed

of what’s

going on with our brand, including cute new outfits, promotions,

trends, and

contests

10

Create

results

driven,

integrated

cross

channel

campaigns

fed

by

intelligent,

relevant and captivating content |

dELiA*s

E-Commerce Platform Re-launched e-commerce platform

for delias.com in September with

new look and site features

o

New Customer reviews

o

Greater ability to schedule creative

& promotions (i.e. Flash Sales)

Results have been positive thus far

o

Cart conversion improved by 6%

versus prior trends

o

Flash sale emails were top

performers this holiday season

o

dELiA*s mobile generated 4% of

dELiA*s direct Nov/Dec sales versus

1.5% in 2012

New Alloy e-commerce platform

and mobile site scheduled to launch

in January 2013

11

Establish dELiA*s website as her Home Page |

Financial

Overview |

YTD Results

Through Q3 13

Retail:

o

Three consecutive quarters of positive comparable store

sales and improving gross margins

Direct:

o

Q3 YTD net sales increase of 2.8% YoY

Double digit traffic increase in stores and web

Increased conversion in stores and web

Double-digit increase in the dELiA*s 12-month buyer file

190 bps of leverage in SG&A

Completed transition to outsourced contact center and

upgrade of order management system

Occupancy cost reductions in line with expectations

Note: YTD as of 10/27/12 |

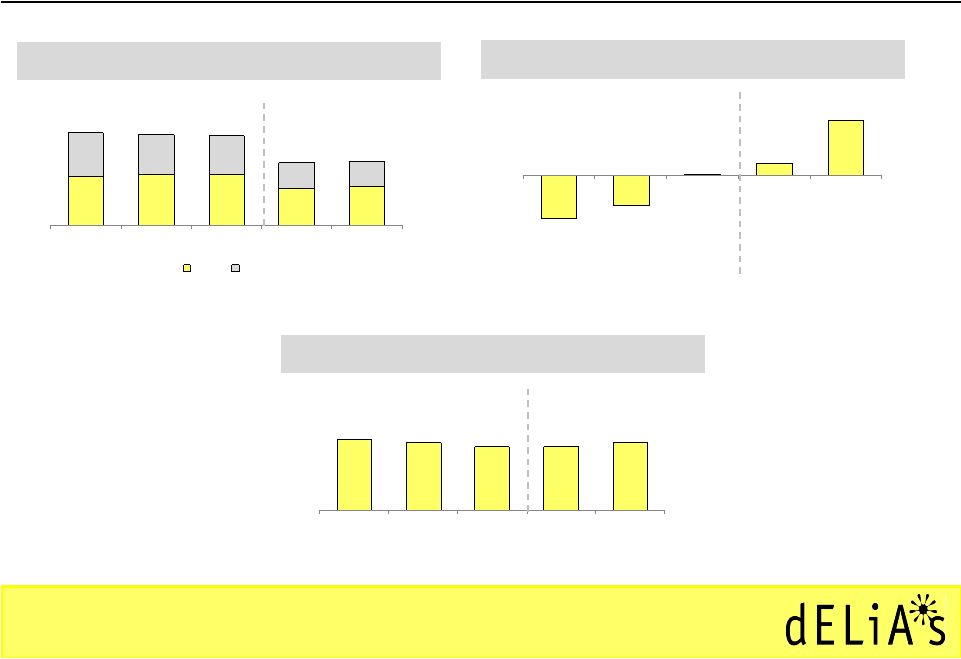

35.0%

33.3%

31.5%

31.1%

33.5%

2009

2010

2011

YTD 2011*

YTD 2012*

$118.5

$122.4

$123.2

$89.6

$92.8

$105.4

$98.3

$93.9

$62.0

$63.7

$223.9

$220.7

$217.2

$151.6

$156.5

2009

2010

2011

YTD 2011*

YTD 2012*

Retail

Direct

Select Historical Performance Metrics

Net Sales –

Channel

Gross Margin

14

($ in millions)

Comparable Store Sales

-5.9%

-4.1%

0.1%

1.6%

7.3%

2009

2010

2011

YTD 2011*

YTD 2012*

*Note: YTD as of the end of the third fiscal quarter |

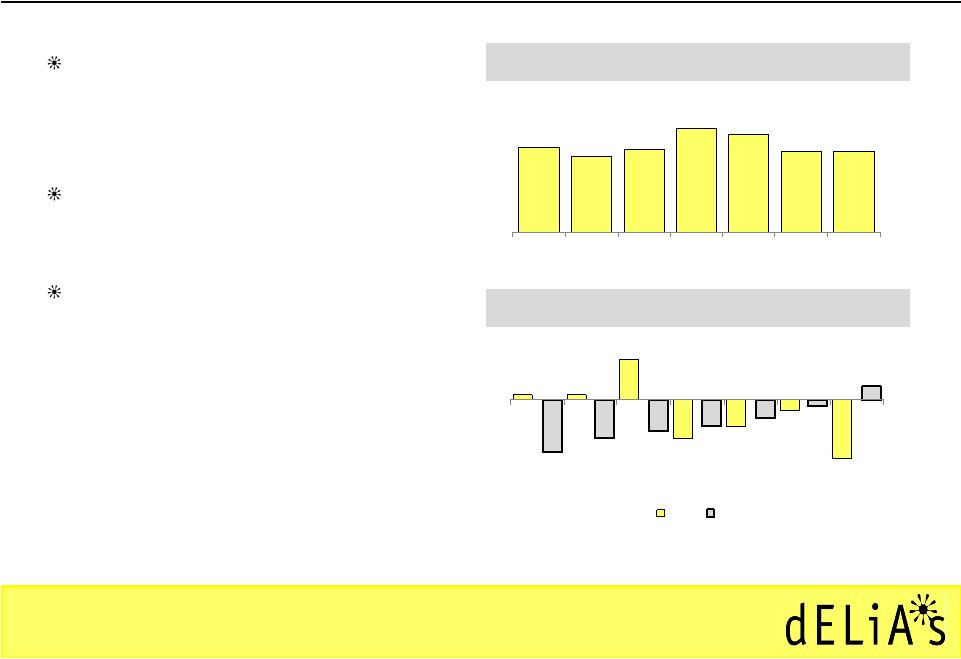

Inventory

Position Inventory Turnover

YoY Inventory Change

Disciplined inventory management

contributing to improved financial

results

3Q12 average inventory per store

down YoY

Expect year-end average inventory

per store to be down mid single

digits and direct segment year-end

average inventory to be down low

single digits vs. LY

4.0x

3.6x

3.9x

4.9x

4.6x

3.8x

3.8x

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

Note: Retail inventory change represents average per store

1.0%

1.0%

7.9%

-7.4%

-5.1%

-2.1%

-11.2%

-10.1%

-7.4%

-5.9%

-5.1%

-3.4%

-1.1%

2.6%

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

Retail

Direct

15 |

Investment

Highlights Well-established multi-channel, multi-brand retailer marketing to

teens and young women

Driving improved store productivity through restructured merchandising and

marketing approach and enhanced selling techniques

Potential for store expansion and improved four-wall store economics

E-commerce growth potential with new website driving increased productivity and

conversion

Turnaround story with significant upside to EBITDA

16 |