Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Swisher Hygiene Inc. | d469016d8k.htm |

| EX-99.2 - EX-99.2 - Swisher Hygiene Inc. | d469016dex992.htm |

SWISHER HYGIENE

15

Annual

ICR

XCHANGE

WEDNESDAY | JANUARY 16, 2013

Exhibit 99.1

th |

2

FORWARD LOOKING INFORMATION

This

presentation

includes

financial

forecasts,

projections

and

other

forward-

looking

statements

regarding

Swisher

Hygiene

Inc.,

its

business

and

prospects.

This

forward-looking

information

is

based

on

management

assumptions

and

expectations

which,

while

considered

reasonable

by

Swisher

Hygiene

and

its

management

as

of

the

date

of

this

presentation,

are

subject

to

risks,

uncertainties,

and

other

factors

that

may

cause

actual

results

and

performance

to

materially

differ

from

results

or

performance

expressed

or

implied

by

the

forward-

looking

statements.

A

description

of

these

factors

can

be

found

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2010,

filed

with

the

Securities

and

Exchange

Commission

("SEC")

on

March

31,

2011,

and

in

our

other

filings

with

the

SEC,

which

are

available

at

www.sec.gov.

Swisher

Hygiene

undertakes

no

obligation

to

publicly

revise

the

forward-looking

statements

presented,

except

as

required

by

law. |

3

»

Tom

Byrne

.

.

.

.

.

.

.

.

.

.

.

.

.

Interim

President

and

Chief

Executive

Officer

»

Bill

Nanovsky

.

.

.

.

.

.

.

.

.

Interim

SVP

and

Chief

Financial

Officer

»

Tom

LaMartina

.

.

.

.

.

.

.

SVP,

Sales

and

Service

»

Blake

Thompson

..

.

.

.

SVP,

Manufacturing

and

Supply

Chain

»

Amy

Simpson

.

.

.

.

..

.

.

.

VP,

Investor

Relations

SWISHER ATTENDEES |

4

A leading provider of essential hygiene and

sanitation solutions including cleaning and

sanitizing chemicals, restroom hygiene

programs, linens and a full range of related

products and services.

WHO WE ARE |

5

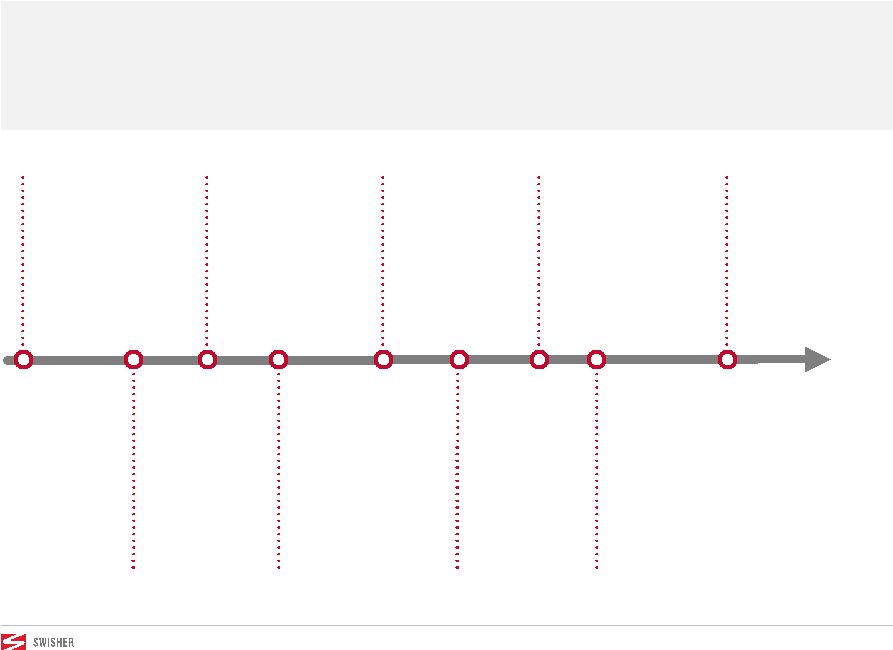

HOW WE GOT HERE

2004

Acquired

by Steve

Berrard

and Wayne

Huizenga

2011

Began

trading on

NASDAQ;

Acquired 63

businesses

2012 (Q4)

Sold waste

operations

2010

Merged with

CoolBrands

and began

trading on

TSX

2013

Now…

2006

Expanded

chemical

service

offering after

successful test

2012 (Q1)

Announced

plans to

restate 2011

results

1986

Founded as

franchised

restroom

hygiene

provider

2005

Began franchise

acquisitions

(completed all

but two through

2011) |

6

WHAT WE SAW IN THE MARKET

And Why We Think The Opportunity is Bigger Today

»

Large industry with attractive

business characteristics

»

Recurring revenue, scalable, well

understood, attractive margins

»

Demand for an alternative

provider

»

Ability to build second largest

chemical service provider

»

Opportunity to differentiate

»

Customers seeking

complementary services

ADDRESSABLE MARKET

$92.8 Billion

Source: Kline Consulting, Textile Rental Services Association and various other

industry publications and public competitor filings. |

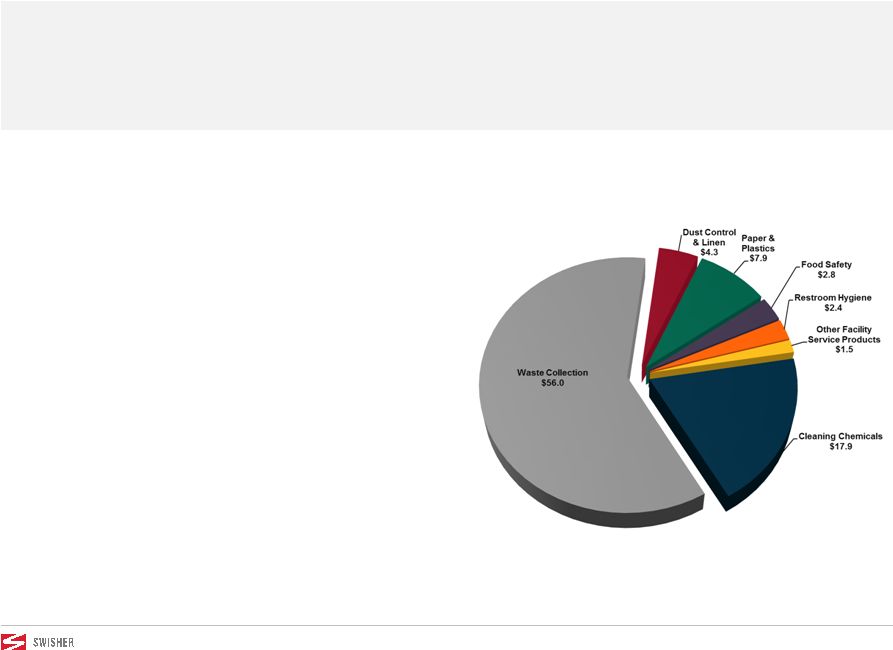

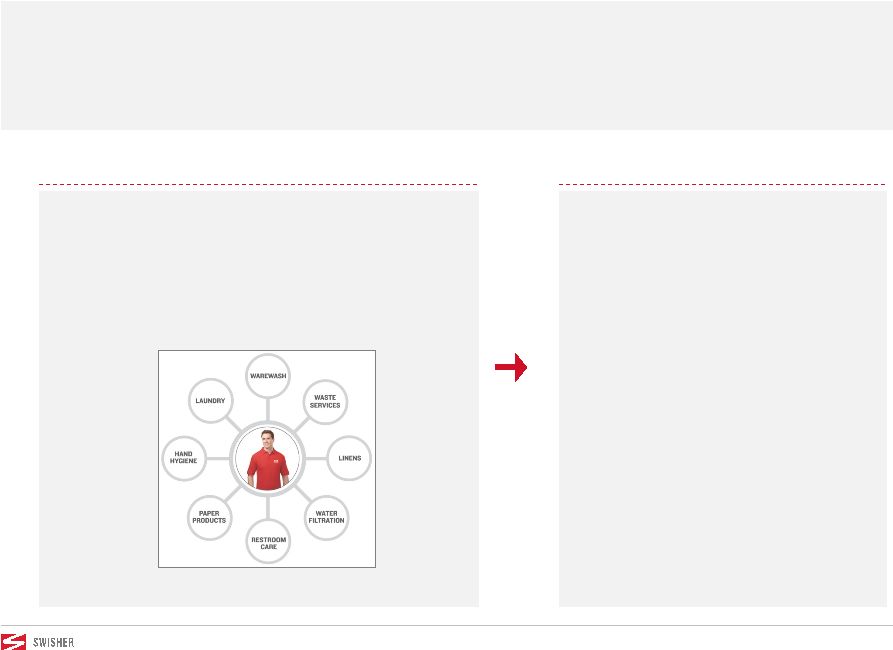

7

CORE SOLUTIONS

We Deliver Clean

CHEMICAL

»

General Cleaning

»

Warewashing

»

Laundry

»

Specialty

HYGIENE

»

Restroom Care

»

Hand Hygiene

»

Paper Products

»

Air Care

LINENS

»

Foodservice Linen

»

Hospitality Linen

»

Bar Towels and

»

Floor Mats

OTHER

»

Brokered

»

Food Safety

»

Water Filtration

Waste Service

Aprons |

8

WASTE SERVICES

Move to Asset-light Model

»

Acquired Choice Environmental in March 2011

»

Completed

two

follow-on

acquisitions

in

the

2

nd

quarter

of

2011

»

Successfully cross-sold waste services into existing Swisher

accounts

»

Announced at 2012 ICR XChange that future growth would be

focused on managed waste services

»

Completed sale of waste division in November 2012

»

Plan to continue offering customers managed waste services

through local providers |

9

STRENGTHENING BUSINESS MODEL

FINANCIAL PROCESS IMPROVEMENT

Adding processes and controls to enhance

financial analysis and reporting.

Building a strong foundation for growth and exceptional service levels by

simplifying and standardizing the way we do business while leveraging new

technology. BRAND & PRODUCT ENHANCEMENT

Driving revenue growth through brand

awareness and product innovation.

OPERATIONAL SIMPLIFICATION

Consistent and scalable operations

built around the customer.

SUPPLY CHAIN RATIONALIZATION

Manufacturing quality products and

providing them to our customers in the

most efficient manner.

Focus on Simplification, Differentiation and Profitability

|

10

OPERATIONAL SIMPLIFICATION

Building a Strong Platform for Future Growth

»

Implementation of handhelds

»

Standardizing all operations around

account manager ensures single

point of customer contact

»

Separation of service and logistics

»

Eliminated 1.2 million

paper transactions and

significant redundant

costs in 2012

»

Account manager drives

customer satisfaction and

cross-selling

»

Greater focus on sales

and service

Initiatives

Impact |

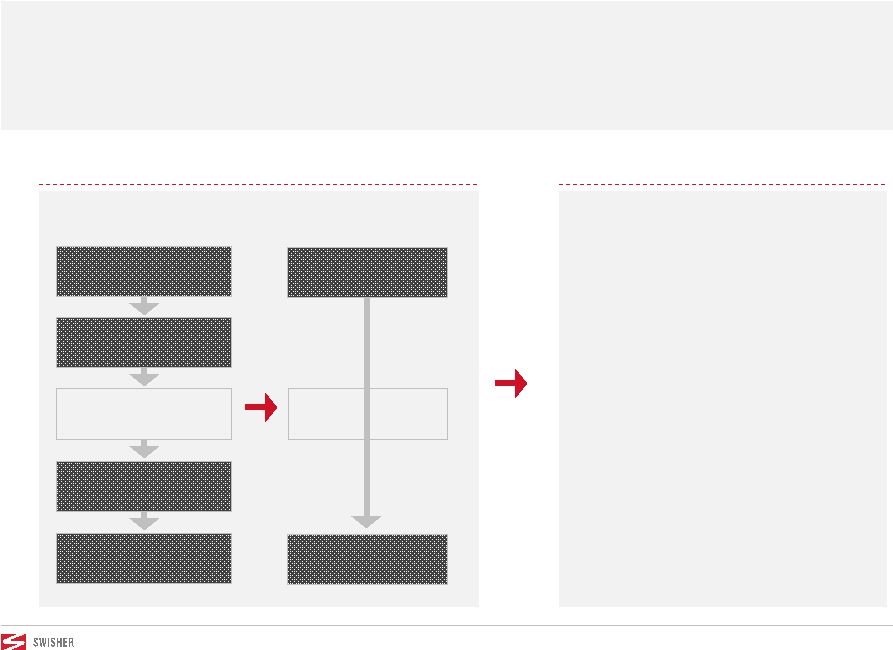

11

SUPPLY CHAIN RATIONALIZATION

Providing Products to Customers in the Most Efficient Manner

»

Restructure product supply model

»

Over 80% of chemicals

now manufactured at

Swisher plants

»

Reduction in product cost

»

Reduction in freight and

route costs

»

Consolidation of inventory

and support functions

3rd

PARTY

MANUFACTURER

REDISTRIBUTOR

BRANCH

ROUTE

CUSTOMER

SWISHER MFG.

PLANT

CUSTOMER

ROUTE / 3rd

PARTY

LOGISTICS

Initiatives

Impact |

12

»

Formula consolidation and

advancement

»

Develop new and enhanced

products through formula,

packaging and system innovation

»

Reposition brand around clean

»

Transition from over 50 acquired

brands to two primary brands

BRAND AND PRODUCT ENHANCEMENT

Leveraging the Importance of Clean

»

Reduced SKUs by 30%

thus far

»

Added differentiation and

improved margins

»

Creating a sustainable

competitive advantage

»

Increasing brand

awareness through brand

integration and strategic

marketing tactics

Initiatives

Impact |

13

FINANCIAL PROCESS IMPROVEMENT

Focus on Simplicity and Efficiency

»

Consolidation of 93 separate

reporting databases

»

New financial leadership

»

Simplification of core processes

across the organization

»

Integration of 50 acquisitions

»

SOX compliant in 2013

»

Implementation of new fixed asset,

HR and other systems

»

Eliminated one million

intercompany

transactions

»

Return to timely financial

reporting in 2013

»

Allows greater focus on

planning and analysis

»

Greater employee

accountability

Initiatives

Impact |

14

WHERE WE STAND TODAY

Accomplishing Initial Goals

»

Transitioned from an acquisition-focused company to an operations-

focused company

»

Continue implementing operating model centered around the customer

»

Completed implementation of over $10 million of cost reductions

»

Additional

$10

million

of

efficiencies

planned

for

2013

»

Greater focus on customer interaction

»

Second largest chemical service provider in the institutional market

»

Strong national platform to add more products and services

»

Programs with 800 distributors and leading GPOs |

15

IMPACT OF RESTATEMENT

Significant Effect on 2012 Results

»

Uncertainty impacted corporate account and distributor program

growth

»

These programs had been a significant source of organic growth in 2011

»

Key buying decisions delayed

»

Customer losses confined to a few large accounts

»

Significant accounting, legal and consulting costs

»

Focus on proper technical guidance using abundance of care

»

Substantial distraction to management team

»

Difficulty in attracting some key hires

»

Team more convinced now than ever about the size of the opportunity

and ability to capitalize on it |

16

STRATEGY AND TACTICS

What to Expect From Us Moving Forward

»

Continue to focus on core chemical and hygiene operations

»

Emphasis on customer retention and growth

»

Capitalize on differentiation including national coverage, distributor and

GPO relationships, product offering and service

»

Expand cross-sale capabilities

»

Linen capabilities in top-20 markets

»

Measured waste brokerage expansion

»

Partner with leading providers to offer complementary services

»

Goal is to ensure customers have a clean and healthy environment

»

If we can’t be a leading provider then we will partner with one

»

Limited small acquisitions and no equity financings planned

|

17

FINANCIAL OVERVIEW

Current Position

»

$225 million of run rate revenue(1) after waste

division sale »

Over 65% from core chemical operations

»

$75 million reduction from asset dispositions (primarily waste division)

»

$20 million reduction primarily from two lost accounts related to

restatement and integration of smaller acquisitions

»

Over $70 million in cash at year-end 2012

»

$13 million in Seller Notes

»

$12.5 million holdback on Choice sale

»

Believe we will achieve positive operating cash flow by 3

rd

quarter

2013

(1) Based on annualized

Q3’12 revenue |

18

FILING UPDATE

Timing of Upcoming Filing

»

Estimated restatement amount within previously announced $4.6

million guidance

»

Key NASDAQ dates

»

February 19

2011 Form 10-K and restated Form 10-Qs for Q1 2011, Q2 2011 and Q3

2011 »

February 28

Form

10-Qs

for

Q1

2012,

Q2

2012

and

Q3

2012

»

April

2012 Form 10-K

»

June

Annual Meeting for 2011 and 2012

»

Additional details in upcoming filings |

19

CONCLUSION

The Opportunity is Bigger Today

»

Large industry with attractive business characteristics

»

Demand still exists for an alternative provider

»

National presence

»

Opportunity to differentiate

»

Customers seeking complementary services

»

Profitability is not dependent on future acquisitions or contribution

from waste division

»

Optimistic about prospects in 2013

»

Will provide additional details along with public filings

|

20

CONTACT INFORMATION:

SWISHER INVESTOR SERVICES

(704) 602-7116

INVESTORRELATIONS@SWISHERHYGIENE.COM |