Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Simulations Plus, Inc. | simulations_8k-011513.htm |

Exhibit 99.1

Simulations Plus, Inc. (NASDAQ:SLP) First Quarter Fiscal Year 2013 Conference Call and Webinar January 15, 2013

With the exception of historical information, the matters discussed in this presentation are forward looking statements that involve a number of risks and uncertainties. The actual results of the Company could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity. Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission. Safe Harbor Statement

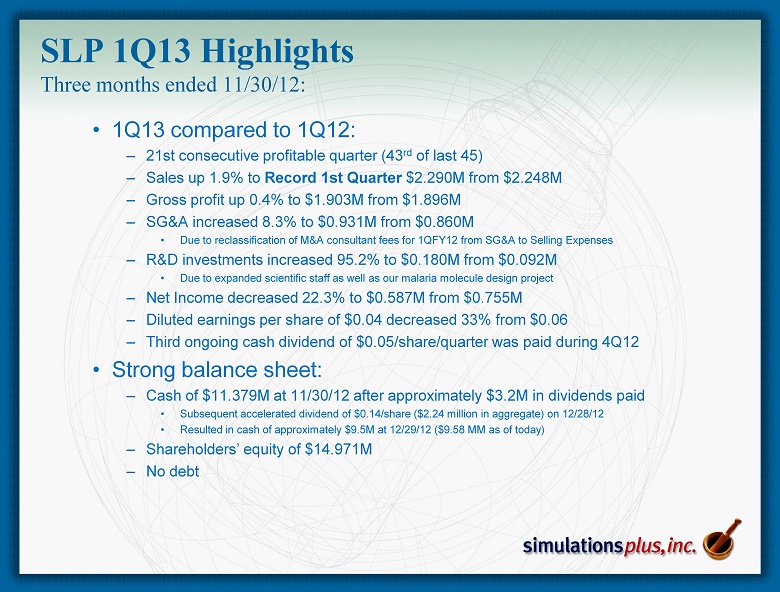

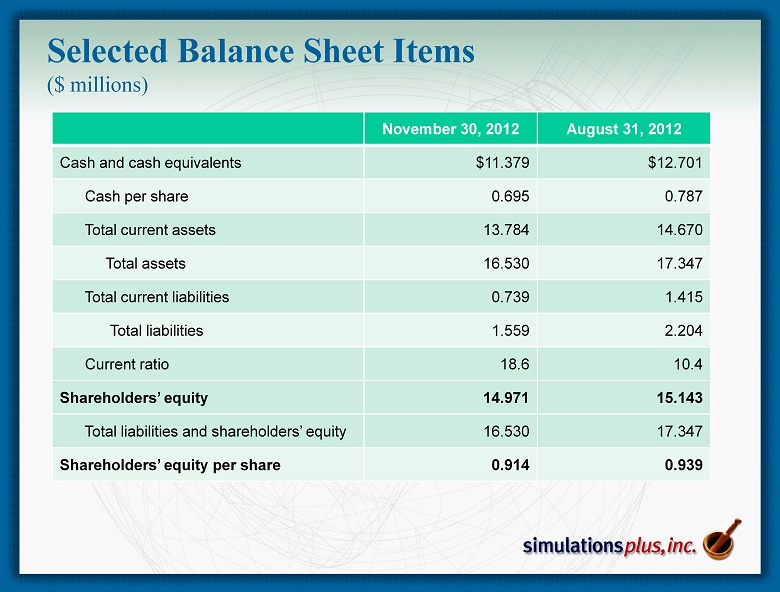

• 1Q13 compared to 1Q12: – 21st consecutive profitable quarter (43 rd of last 45) – Sales up 1.9% to Record 1st Quarter $2.290M from $2.248M – Gross profit up 0.4% to $1.903M from $1.896M – SG&A increased 8.3% to $0.931M from $0.860M • Due to reclassification of M&A consultant fees for 1QFY12 from SG&A to Selling Expenses – R&D investments increased 95.2% to $0.180M from $0.092M • Due to expanded scientific staff as well as our malaria molecule design project – Net Income decreased 22.3% to $0.587M from $0.755M – Diluted earnings per share of $0.04 decreased 33% from $0.06 – Third ongoing cash dividend of $0.05/share/quarter was paid during 4Q12 • Strong balance sheet: – Cash of $11.379M at 11/30/12 after approximately $3.2M in dividends paid • Subsequent accelerated dividend of $0.14/share ($2.24 million in aggregate) on 12/28/12 • Resulted in cash of approximately $9.5M at 12/29/12 ($9.58 MM as of today) – Shareholders’ equity of $14.971M – No debt SLP 1Q13 Highlights Three months ended 11/30/12:

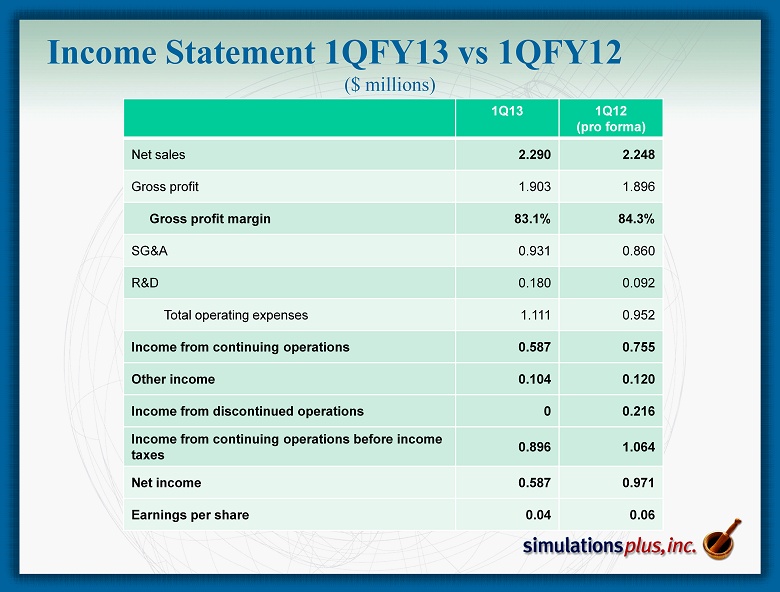

Income Statement 1QFY13 vs 1QFY12 ($ millions) 1Q13 1Q12 (pro forma) Net sales 2.290 2.248 Gross profit 1.903 1.896 Gross profit margin 83.1% 84.3% SG&A 0.931 0.860 R&D 0.180 0.092 Total operating expenses 1.111 0.952 Income from continuing operations 0.587 0.755 Other income 0.104 0.120 Income from discontinued operations 0 0.216 Income from continuing operations before income taxes 0.896 1.064 Net income 0.587 0.971 Earnings per share 0.04 0.06

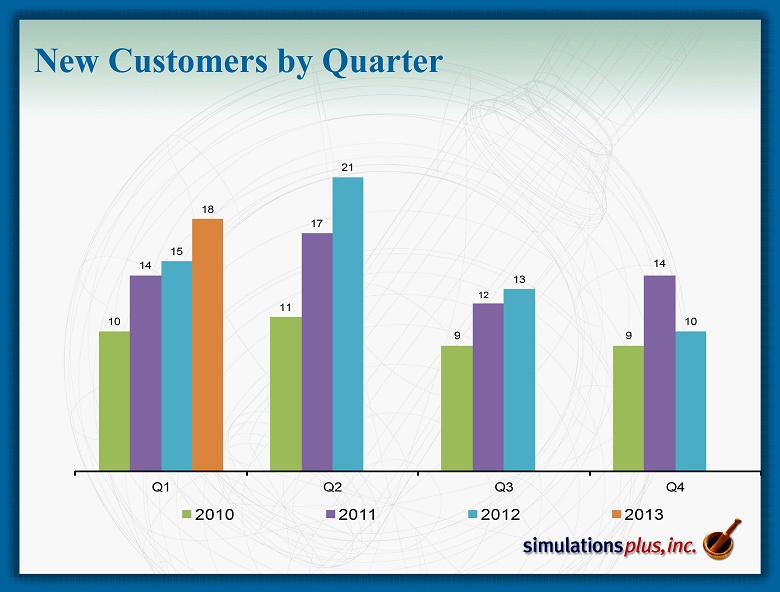

New Customers by Quarter 10 11 9 9 14 17 12 14 15 21 13 10 18 Q1 Q2 Q3 Q4 2010 2011 2012 2013

Revenues by Quarter (pro forma prior to 2012) $1.4 $1.8 $2.0 $1.1 $1.7 $2.2 $2.3 $1.3 $2.1 $2.6 $2.6 $1.4 $2.2 $2.8 $2.8 $1.6 $2.3 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

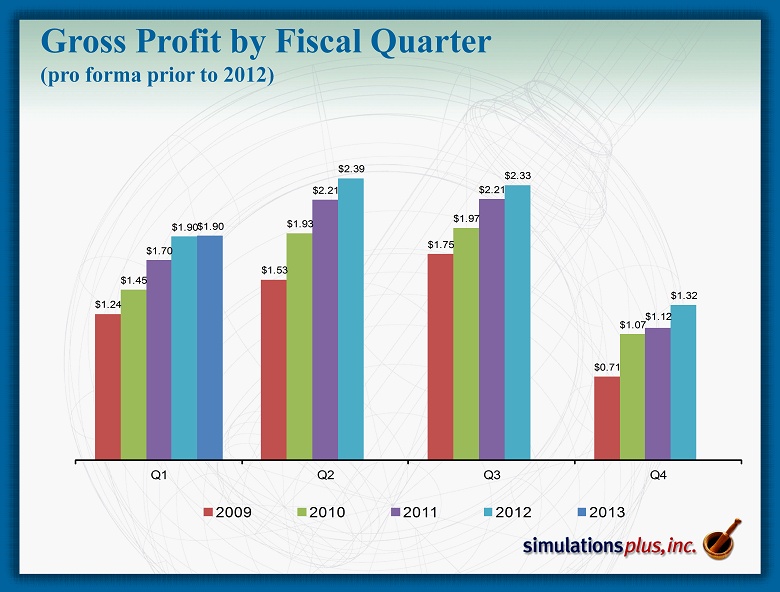

Gross Profit by Fiscal Quarter (pro forma prior to 2012) $1.24 $1.53 $1.75 $0.71 $1.45 $1.93 $1.97 $1.07 $1.70 $2.21 $2.21 $1.12 $1.90 $2.39 $2.33 $1.32 $1.90 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

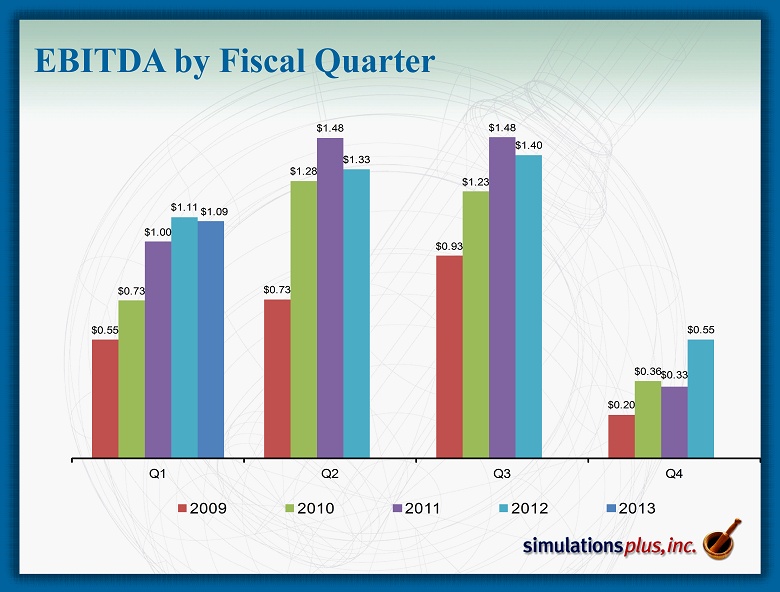

EBITDA by Fiscal Quarter $0.55 $0.73 $0.93 $0.20 $0.73 $1.28 $1.23 $0.36 $1.00 $1.48 $1.48 $0.33 $1.11 $1.33 $1.40 $0.55 $1.09 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

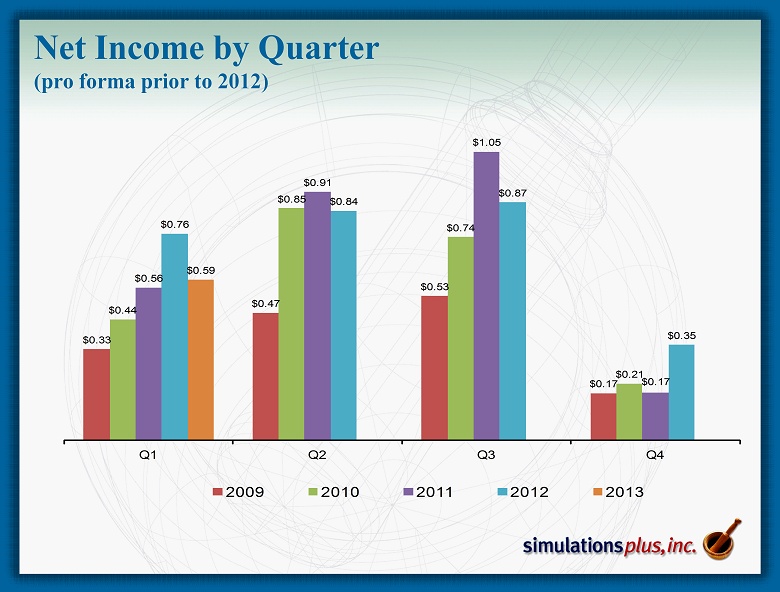

Net Income by Quarter (pro forma prior to 2012) $0.33 $0.47 $0.53 $0.17 $0.44 $0.85 $0.74 $0.21 $0.56 $0.91 $1.05 $0.17 $0.76 $0.84 $0.87 $0.35 $0.59 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013

Selected Balance Sheet Items ($ millions) November 30, 2012 August 31, 2012 Cash and cash equivalents $11.379 $12.701 Cash per share 0.695 0.787 Total current assets 13.784 14.670 Total assets 16.530 17.347 Total current liabilities 0.739 1.415 Total liabilities 1.559 2.204 Current ratio 18.6 10.4 Shareholders’ equity 14.971 15.143 Total liabilities and shareholders’ equity 16.530 17.347 Shareholders’ equity per share 0.914 0.939

Returning Cash to Shareholders

N H O OH O CH 3 CH 3 CH 3 Discovery Preclinical Clinical MedChem Studio™ MedChem Designer™ GastroPlus™ DDDPlus™ ADMET Predictor™ Simulations Plus Products & Services Consulting Services & Collaborations MembranePlus™

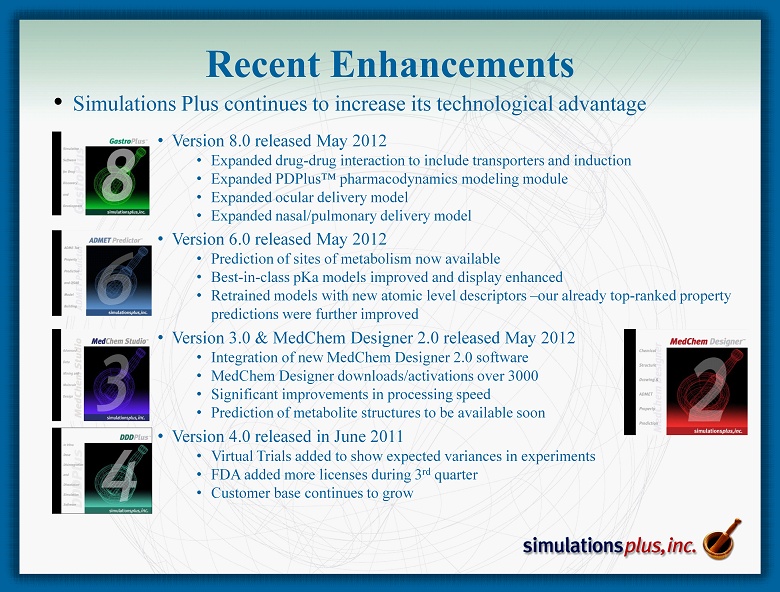

• Simulations Plus continues to increase its technological advantage Recent Enhancements • Version 8.0 released May 2012 • Expanded drug - drug interaction to include transporters and induction • Expanded PDPlus™ pharmacodynamics modeling module • Expanded ocular delivery model • Expanded nasal/pulmonary delivery model • Version 6.0 released May 2012 • Prediction of sites of metabolism now available • Best - in - class pKa models improved and display enhanced • Retrained models with new atomic level descriptors – our already top - ranked property predictions were further improved • Version 3.0 & MedChem Designer 2.0 released May 2012 • Integration of new MedChem Designer 2.0 software • MedChem Designer downloads/activations over 3000 • Significant improvements in processing speed • Prediction of metabolite structures to be available soon • Version 4.0 released in June 2011 • Virtual Trials added to show expected variances in experiments • FDA added more licenses during 3 rd quarter • Customer base continues to grow

Marketing and Sales Program • Added Cheminformatics salesperson July 2012 to increase sales of ADMET Design Suite™ (MedChem Studio™, MedChem Designer™, and ADMET Predictor™) • Conferences/Scientific Meetings continue to be primary source of leads • During Q1 we did 10 meetings in the U.S., Europe, and Asia • Total of 12 posters/presentations • Training Workshops – Basic GastroPlus and Cheminformatics training workshops added to our Advanced GastroPlus™ training workshops • New Cheminformatics training workshop to be held in March • Strategic Digital Marketing Initiatives • Collaborations/Consulting/Grants – Progressing on our 5 - year collaboration with the FDA Center for Food Safety and Applied Nutrition to build many toxicity models with ADMET Predictor/Modeler™ for food additives and contaminants – Consulting studies continue – provides exposure of software to new groups – New funded collaboration announced for enhancement of the GastroPlus oral cavity dosing model – New funded collaboration announced for enhancement of the GastroPlus pulmonary dosing model • We believe fundamental industry shift continues – Software tools are constantly gaining wider acceptance and applications are growing – 18 new customers during 1QFY13 (includes new companies as well as new departments within existing large customers)

FDA Food Safety Research Collaboration • Completed the first year of a 5 - year renewable Research Collaboration Agreement (RCA) with Center for Food Safety and Applied Nutrition (CFSAN) to provide model - building capabilities for a large number (>70,000) of substances that can be in foods as additives or contaminants, only a small fraction of which have been testes for various toxicities. • Models will then be used to predict the likely toxicity of the molecules that were not tested to identify likely problems • Requested code modifications from the FDA became a part of ADMET Predictor 6.0, which was released in May. • The first new toxicity model for ADMET Predictor coming from this collaboration was released with Version 6.0. This is a model for predicting rodent carcinogenicity. Others are in progress.

NCE (New Chemical Entity) Project • Using a public database courtesy of GlaxoSmithKline, and applying MedChem Studio/MedChem Designer/ADMET Predictor, we designed a number of lead candidates to inhibit the malaria parasite and qualified them for acceptable properties using only ADMET Predictor predictions. • Seven molecules were received from synthesis and were tested against the malaria parasite. All seven showed inhibition of the growth of the parasite, with two active at a nanomolar level against both wild - type and drug - resistant strains of the parasite . • Note that last week according to Reuters, GlaxoSmithKline Plc reported disappointing results for their malaria vaccine for infants in Africa’s largest ever clinical trial of over 6,500 babies aged 6 - 12 weeks. It was effective for about 30% of babies. Reuter noted further that GSK plans to push ahead with vaccine development. Note that our molecules are not intended as vaccines, but as therapeutic drugs. • We have initiated communications with outside organizations that are known to fund developments for malaria and other diseases to determine whether there is interest in funding further work by Simulations Plus using the methods we have demonstrated.

Summary • For 1QFY13: - Financial performance continues our 5 - year profitable trend - Sale of Words+ has simplified and focused the business - margins increased, reporting and auditing much simpler • Continuing to Expand our Life Sciences team: - Two new Ph.D.s started in August, interviews continuing - Promoting development of new products and services (e.g., MembranePlus) - Strengthens and supports our marketing and sales efforts • Expanding Sales Team and Activities - New field sales manager for cheminformatics products and services started in July - Greater staff time spent on marketing and sales activities - New training workshop for chemistry tools to be held in Boston in March • Simulations Plus is globally recognized as a leader - Outstanding reputation for scientific expertise and innovation - Strong customer support • Strong cash position and no debt - Four quarterly cash dividends of $0.05/share/quarter have now been paid for a total of just under $3.2 million, yet cash grew by over $2.5 million during FY2012 .

Q&A