Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - ABRAXAS PETROLEUM CORP | axas8ka.htm |

January 2013

Exhibit 99.1

2

Forward-Looking Statements

The information presented herein may contain predictions, estimates and other

forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although

the Company believes that its expectations are based on reasonable

assumptions, it can give no assurance that its goals will be achieved.

forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although

the Company believes that its expectations are based on reasonable

assumptions, it can give no assurance that its goals will be achieved.

Important factors that could cause actual results to differ materially from those

included in the forward-looking statements include the timing and extent of

changes in commodity prices for oil and gas, the need to develop and replace

reserves, environmental risks, competition, government regulation and the

ability of the Company to meet its stated business goals.

included in the forward-looking statements include the timing and extent of

changes in commodity prices for oil and gas, the need to develop and replace

reserves, environmental risks, competition, government regulation and the

ability of the Company to meet its stated business goals.

3

Corporate Profile

Shares outstanding(1)……........ 93.3mm

Institutional(2)…………….. ~54%

Insider(2)…………………….. ~13%

Market cap(3) ……………………... $204mm

Bank debt net of cash(1)………. $131mm

PV-10(4)……………………………….. 271mm

EV/BOE(1,3,4)………………………….

$11.85

$11.85

(1) As of 9/30/12; production inclusive of Blue Eagle interest

(2) Per Thomson Reuters

(3) As of 12/31/12

(4) As of 6/30/12 inclusive of Blue Eagle interest and CANAXAS. Excludes Nordheim disposition. Uses 6/29/12 NYMEX flat pricing

(5) Based on mid year reserves excluding Nordheim and 3Q12 production annualized; inclusive of Blue Eagle

Proved Reserves(4).…………..... 29.3mmboe

% Oil/Liquids……………… ~56%

% Proved developed….. ~50%

% Operated PV-10……… ~94%

Production(1).……………………… ~4,177boepd

R/P Ratio(5)…………………………. 19.2x

2013E CAPEX………………………. $70mm

NASDAQ: AXAS

4

Investment Thesis

Ø Exposure to “core” acreage in top U.S. oil resource plays

Ø Significant exposure to emerging NAM oil resource plays

Premier

Acreage

Acreage

Value +

Growth

Growth

Ø Low decline legacy production

Ø “Manufacturing” model in repeatable resource plays leads to visible growth

Proven

Operator

Operator

Ø Company owned rig in Bakken = pad drilling = efficiency gains

Ø Deep technical and G&G staff

Oil

Weighted

Weighted

Ø 53% crude oil and liquids weighted(1)

Ø Percentage likely to grow meaningfully given capital focus

(1) As of 06/30/12; production inclusive of Blue Eagle interest; excludes Nordheim

5

Business Plan - 2013

§ FOCUS + DELEVER + GROW

§ ReFOCUS Portfolio and CAPEX on Highest Returning Basins

§ Currently: Williston, Eagle Ford, PRB, Permian

§ DELEVER: Actively Pursue Divestitures

§ Properties trading above internal assessment of fair value

§ Lack of scale/high margin production

§ Exemplified by recent transactions for ~$22mm

§ Reduce leverage and maintain that profile

§ Target Debt/EBITDA < 2.0x by YE13 (1)

§ GROW: The Outcome of Sound Investment Decisions

§ Bakken/TFS:

§ Accelerate with company owned drilling rig

§ Eagle Ford:

§ Continuous drilling program

(1) Excluding building mortgage and rig loan which are secured by the building and rig, respectively. EBITDA definition per bank loan agreement (excludes Rig EBITDA)

6

Low Risk Development

Focus On Four Core Positions in Premier Oil Resource Plays Predominately HBP

§ Williston: 23,000+ net acres; Bakken, Three Forks

§ Eagle Ford: 7,300+ net acres: Eagle Ford, Buda

§ PRB: 17,000+ net acres; stacked potential

§ Permian: 40,000+ net acres: conventional & stacked pay opportunities

Premier Positions in Emerging Oil Resource Plays

§ Permian: 40,000+ net acres; exposure to numerous emerging plays

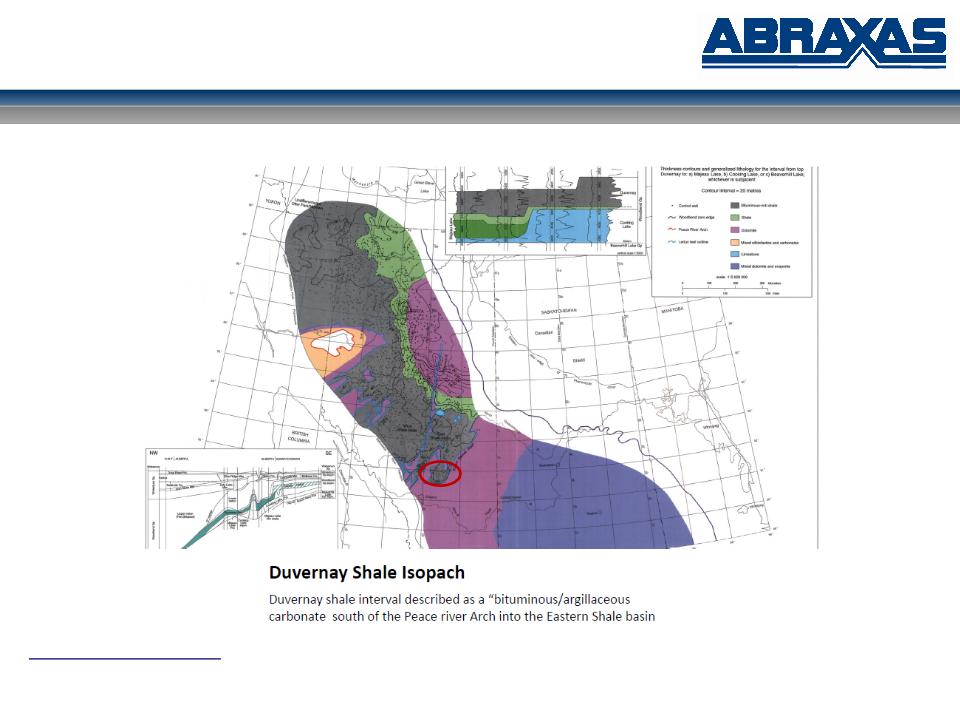

§ Canada: 45,000+ net acres Duvernay/Pekisko

Low Risk Conventional Development

§ Williston Basin: Red River/Duperow

§ Permian Basin: Spires Ranch - hz Strawn

§ Permian Basin: Delaware Basin - dry gas

7

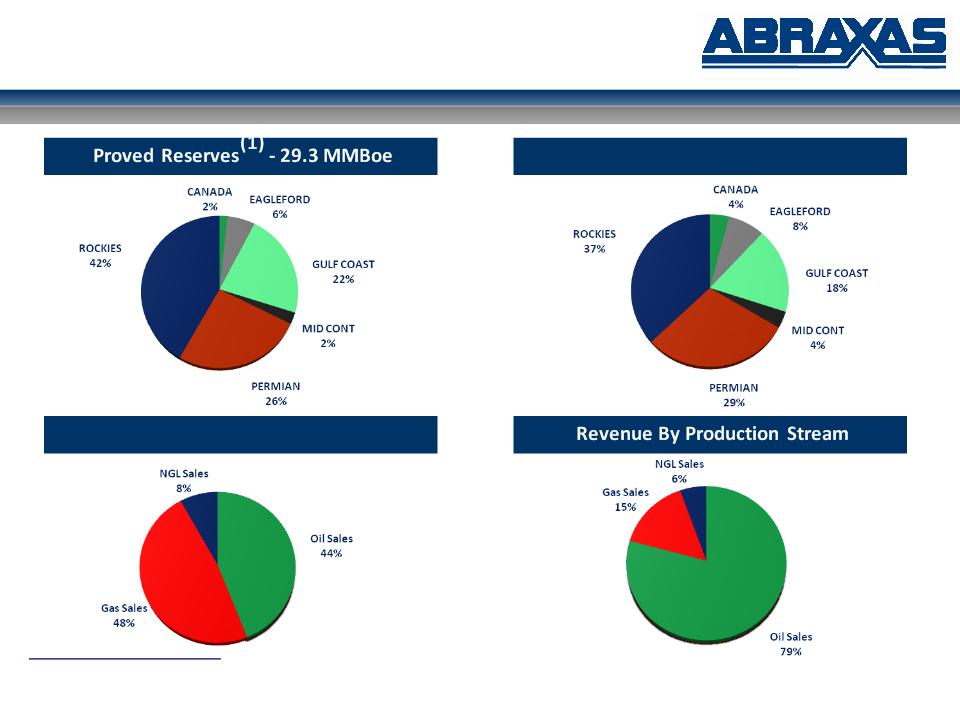

Proved Reserves (MMBoe)(1): 29.3

• Proved Developed: 50%

• Liquids: 56%

• Operated (by PV10): 94%

Abraxas Petroleum Corporation

High Quality Assets

Alberta, Canada

(1) Net proved reserves as of June 30, 2012, including AXAS’ share of Blue Eagle’s proved reserves, Canada; exclusive of Nordheim

Williston:

Bakken / Three Forks

PRB:

Niobrara, Turner

Midland/Eastern Shelf:

Emerging Cline, Wolfcamp

Eagle Ford Shale

CBP: Conventional

Delaware Basin:

Emerging Bone Spring, Wolfcamp

Rocky Mountain

Permian Basin

Gulf Coast

Canada

Pekisko

Eastern Shale

Basin: Duvernay

Basin: Duvernay

8

Reserve / Production Summary

Production(2) - 4,177 Boepd

(1) Net proved reserves as of June 30, 2012, including AXAS’ share of Blue Eagle’s proved reserves per the September 2012 dissolution and exclusive of Nordheim

(2) Daily net production for the quarter ended September 30, 2012, including AXAS’ share of Blue Eagle’s production

Production Mix

9

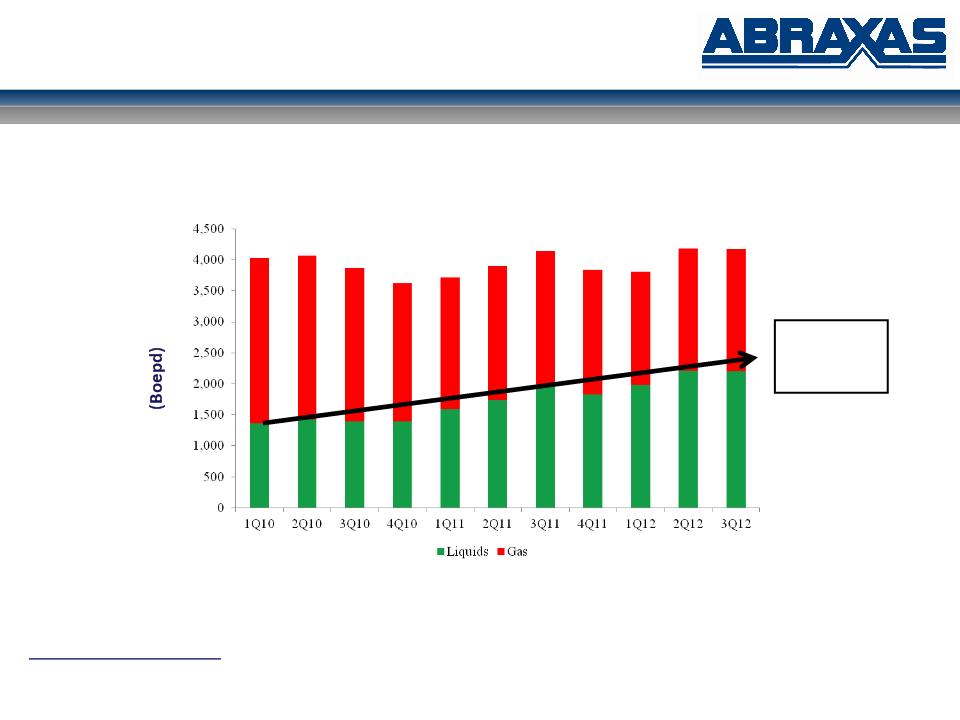

AXAS Production

(1) Includes AXAS’ share of Blue Eagle’s production (50% in Q1 and Q2 2011, 41% in Q3 2011 and 35% in Q4 2011, Q1 2012 and Q2 2012)

Oil/NGL % 34% 35% 36% 39% 43% 44% 48% 48% 52% 53% 53%

Production Net to AXAS(1)

61% Liquids

Growth

Since 1Q10

Growth

Since 1Q10

10

(1) Proved, Probable PV-10 net of Nordheim divestiture. Proved, Probable, Possible PV-10 based off mid year internal reserves and 6/29/12 flat pricing

(2) Building, Rig & Other PP&E (workover rigs, misc equipment, etc) based off net book value

(3) Tax assessment of AXAS surface ownership in 162 acres Coke, TX; 613 acres Scurry, TX. Purchase price of AXAS 1,769 acres in San Patricio, TX; 12,178 acres Pecos, TX; 582 acres McKenzie, ND & Condos; 50 acres DeWitt, TX.

(4) Bank debt as of 9/30 less assumed $22mm in proceeds from Alberta Basin and Nordheim divestitures. WC Deficit as of 9/30 - excludes derivative assets and liabilities

Base NAV

11

2013 Capital Budget/Guidance

|

Project Area

|

|

Net Acres

|

|

2013 Drilling

Program |

|

2013 Net Capital

($MM) |

|

|

|

|

|

|

Gross

|

Net

|

|

|

|

Bakken / Three Forks

|

|

23,320

|

|

12.3

|

6.5

|

|

$47.7

|

|

Eagle Ford Shale

|

|

7,306

|

|

11.0

|

2.6

|

|

$21.6

|

|

PRB

|

|

17,800

|

|

0.0

|

0.0

|

|

$0.0

|

|

Permian Basin

|

|

41,131

|

|

2.0

|

1.9

|

|

$.7

|

|

Other

|

|

50,000+

|

|

0.0

|

0.0

|

|

$0.0

|

|

Total:

|

|

130,000+

|

|

25.3

|

11.0

|

|

$70.0

|

2013 Production Estimate: 4,900-5,200 BOEPD (21-28% growth)

•Variance due to timing of completions

•Does not take into effect the impact of any potential asset sales

12

AXAS Hedges

|

|

2013

|

2014

|

2015

|

2016

|

|

OIL - weighted average price

|

$86.70

|

$94.05

|

$85.00

|

$84.00

|

|

% of 3Q Oil Production

|

~71%

|

~59%

|

~50%

|

~47%

|

|

$MM Revenue Protected

|

$42mm

|

$37mm

|

$29mm

|

$27mm

|

|

|

|

|

|

|

NYMEX-based fixed price swaps:

13

Bakken / Three Forks

|

County

|

McKenzie

|

Richland

|

Burke

|

Sheridan

|

Billings

|

Divide

|

Roosevelt

|

Williams

|

Stark

|

Dunn

|

|

Net Acres

|

5,535

|

5,551

|

3,255

|

2,261

|

1,879

|

1,442

|

1,367

|

1,239

|

563

|

123

|

|

Percent Operated

|

55%

|

30%

|

79%

|

0%

|

0%

|

0%

|

47%

|

0%

|

0%

|

0%

|

|

Net Bakken Locations (1)

|

17

|

17

|

10

|

7

|

6

|

5

|

4

|

4

|

0

|

1

|

|

Net TFS Locations(1)

|

17

|

17

|

10

|

7

|

6

|

5

|

4

|

4

|

2

|

1

|

(1) Unrisked locations based on eight wells (four Bakken and four Three Forks) per 1,280 acre units;

§ 109,658 Gross / 23,320 Net Acres

§ ~100% held by production

§ Drilling Inventory:

§ D&M Risked/Identified:

§ 409 Gross / 64 Net

§ $34.0 MM budget

§ Operated

§ Pad-drilling

§ Company owned rig

§ 2013 to date:

§ Drilling: 4 Gross (1.49 Net)

§ Completing: 2 Gross (.98 Net)

§ Non-operated wells

§ 2013 to date:

§ 4 Gross (.13 Net)

14

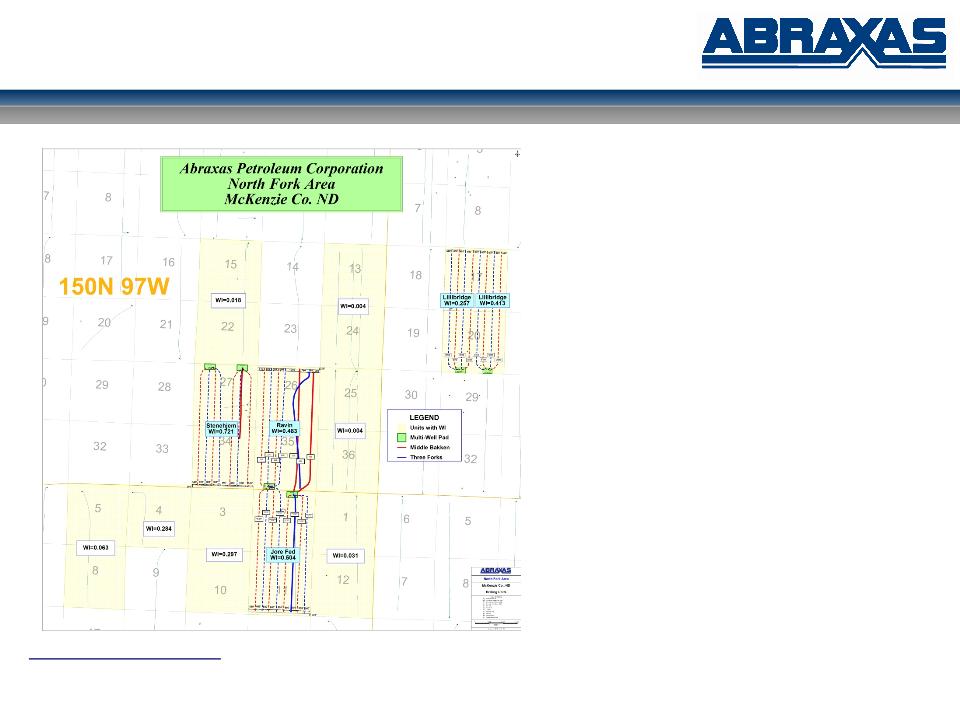

Operated Bakken - North Fork

North Fork

§ 3,314 Net Acres

§ D&M Risked Operated Locations:

§ Drilled: 3 Gross / 2.1 Net

§ Completing: 2 Gross / 1 Net

§ Remaining: 26 Gross / 12 Net

Recent Operated Activity:

§ Ravin 26-35 1H:

§ Cum. production (25 mos): 130.6 Mboe

§Stenehjem 27-34 1H:

§ Cum. production (18 mos): 129.6 MBoe

§Jore Federal 2-11 3H:

§ Cum. production (2 mos): 24.3 MBoe

§Ravin 26-35 2H:

§ Completing

§Ravin 26-35 3H:

§ Completing

§Lillibridge 1H, 2H, 3H & 4H:

§ Drilling

15

Operated Bakken - Harding

Harding

§ 2,886 Net Acres

§ Richland, MT and McKenzie, ND Counties

§ D&M Risked Operated Locations:

§ Middle Bakken: 27 Gross / 8.2 Net

§ Three Forks: TBD

Recent

Slawson

Activity

Slawson

Activity

Current Non -

Op Available

for Swap

Op Available

for Swap

16

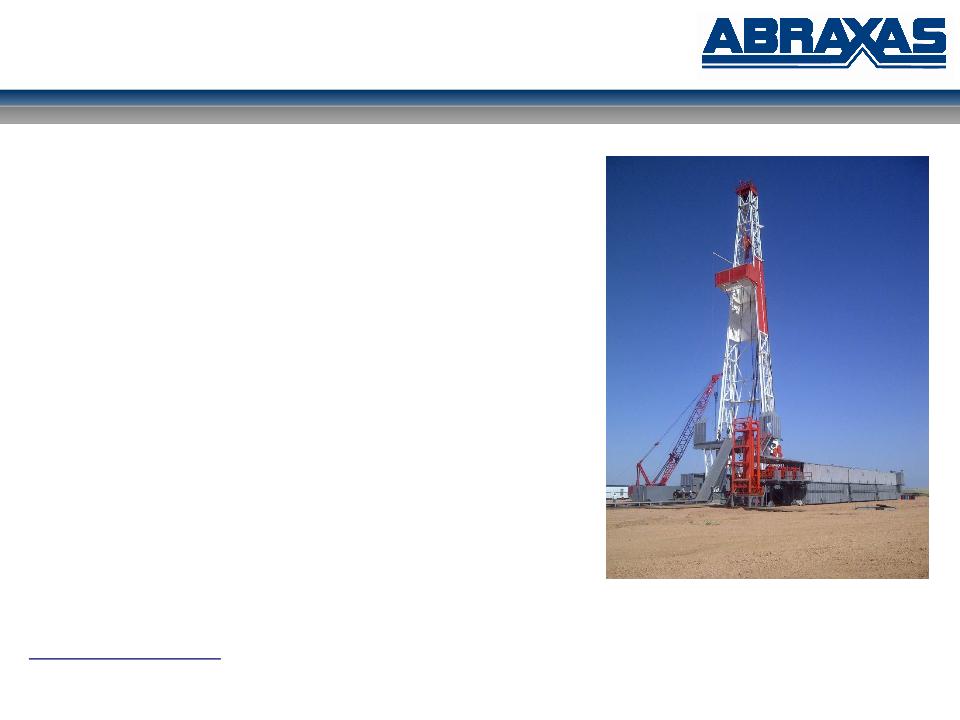

Bakken / Three Forks

Significant Long Term Investments:

§Raven Drilling:

§ 2000 HP walking rig

§ Dedicated AXAS crew

§ Company owned man camp

§ Allows for significant efficiency gains

§North Fork Water System

§ Will service all North Fork wells

§ Enables AXAS to achieve cost savings via

centrally located frac pond & disposal well

centrally located frac pond & disposal well

17

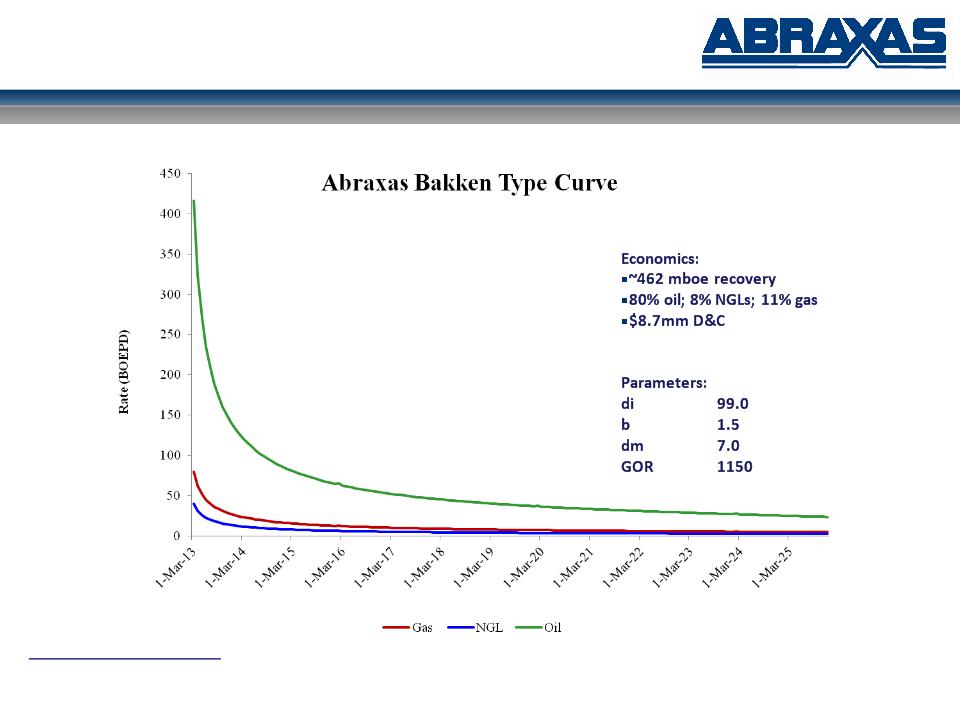

Bakken / Three Forks

18

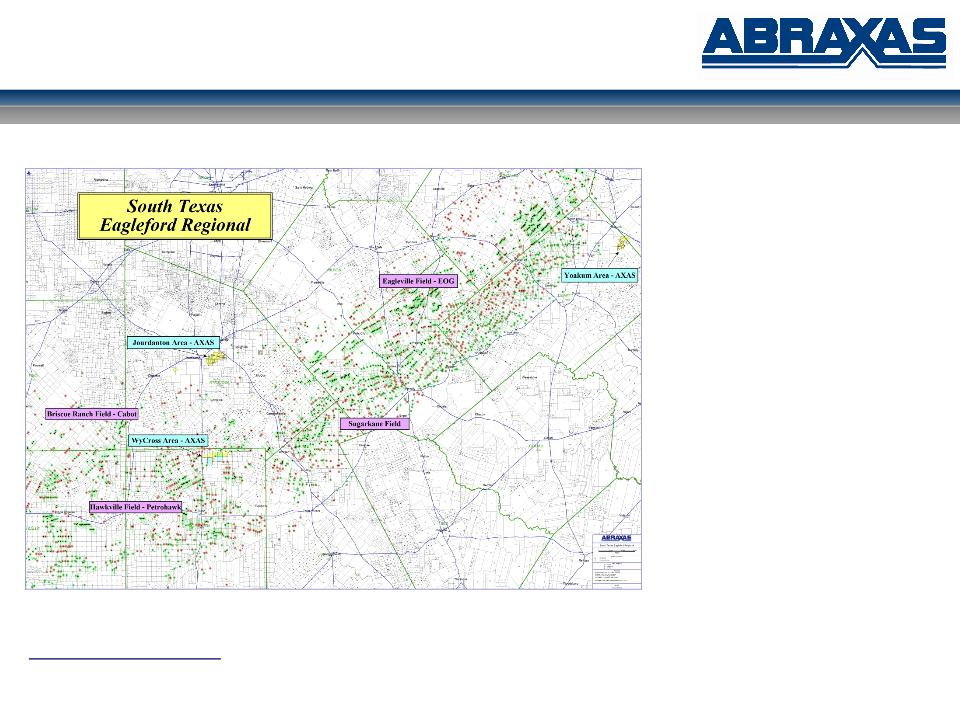

Eagle Ford Shale

§ WyCross McMullen County:

§ ~25% working interest

§ 6,139 Gross / 1,035 Net

§ Eagle Ford: Volatile Oil

§ Jourdantan: Atascosa County

§ 100% working interest

§ ~4,467 Gross / 4,399 Net

§ Eagle Ford/Buda: Oil

§ Yoakum: DeWitt county

§ 100% working interest

§ 2,097 Gross / 1,908 Net

§ Eagle Ford: Dry Gas

§ Planned Activity:

§ Continuous drilling program

§ Economics (WyCross):

§ EUR 575mmboe

§ $8.0mm D&C

19

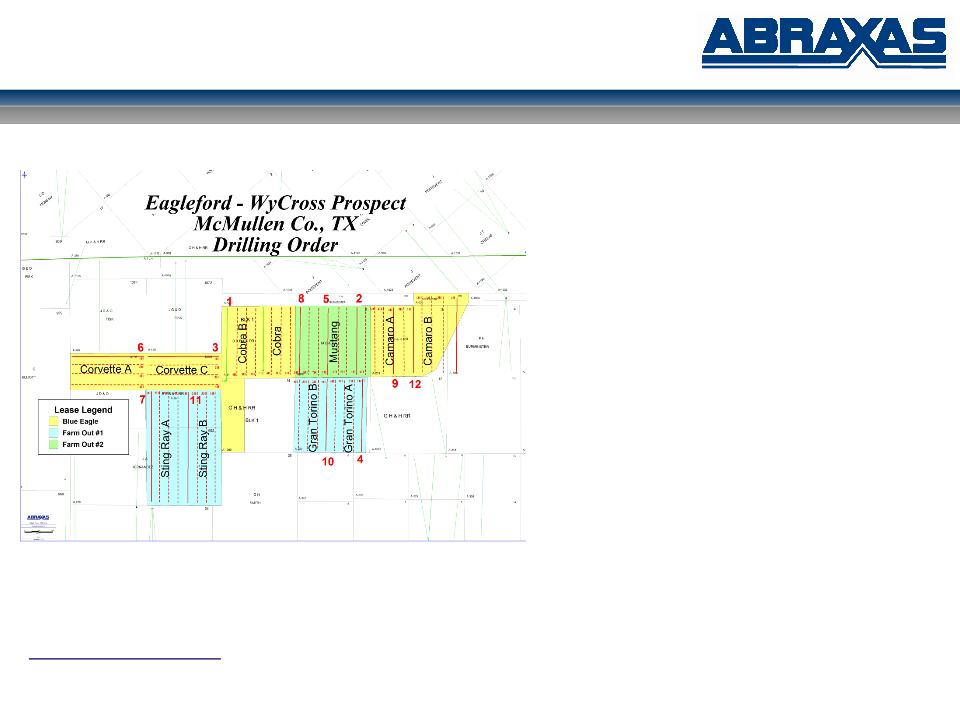

Eagle Ford Shale - Core Area

WyCross

§Core of the volatile oil window

§6,389 Gross / 1,035 Net

§Locations (assuming 80s)

§ 80 Gross / 20 Net

Recent Operated Activity

§Cobra 1H

§ Cum. production (10 mos): 136.8 MBoe

§ 92% Oil / NGLs

§Cobra B 1H

§ Cum. production (1 mos): 17.7 MBoe

§ 96% Oil / NGLs

§Mustang 1H

§ On production

§Corvette C 1H

§ Completing

§Gran Torino A 1H

§ Drilling

20

Eagle Ford - WyCross

21

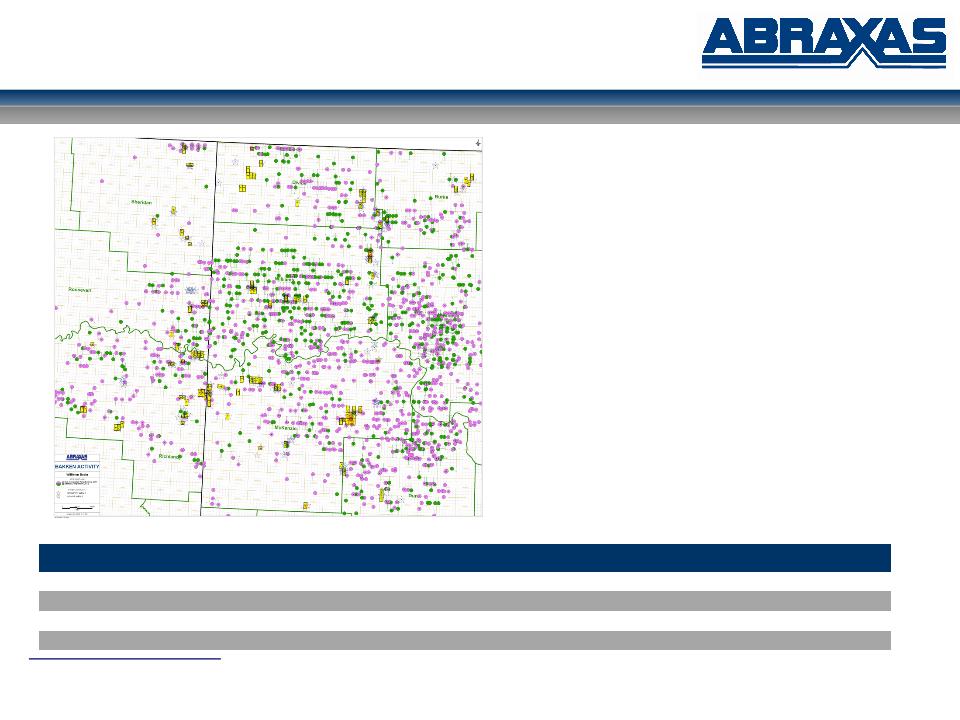

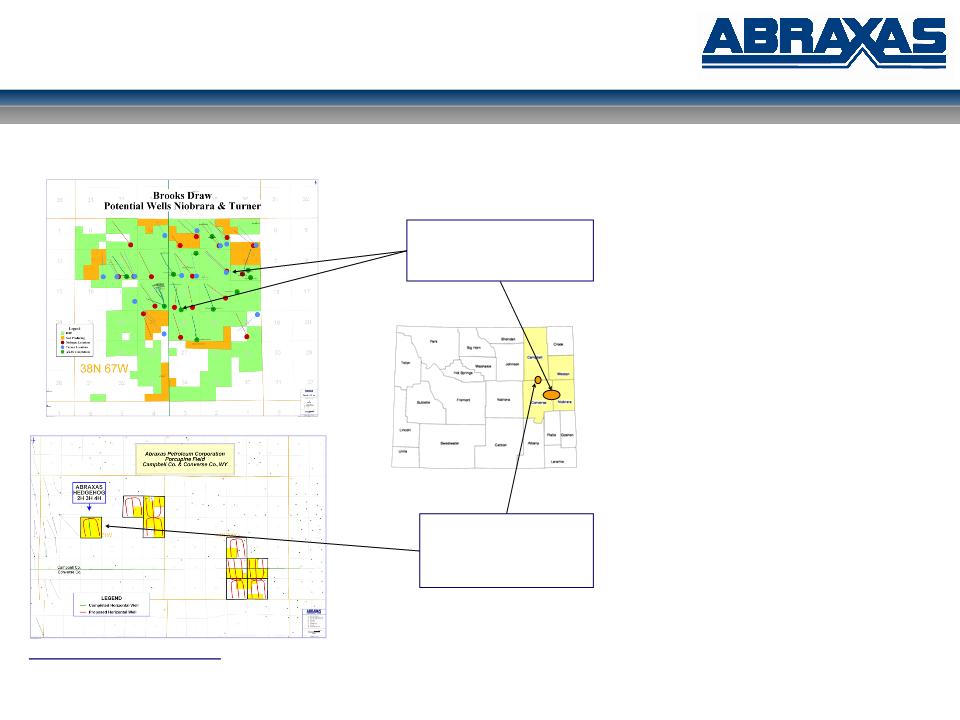

PRB - Stacked Pay Opportunities

Converse / Niobrara Counties, Wyoming

§ Gross / Net Acres:

§ 20,720 / 17,800

§ Primarily in Converse and Niobrara

Counties

Counties

§ ~2,100 net acres in Campbell County

§ ~90% held by production

§ Historical Activity:

§ 13 wells (2000 - 2011)

(8 horizontal / 5 vertical)

§ Recent Activity:

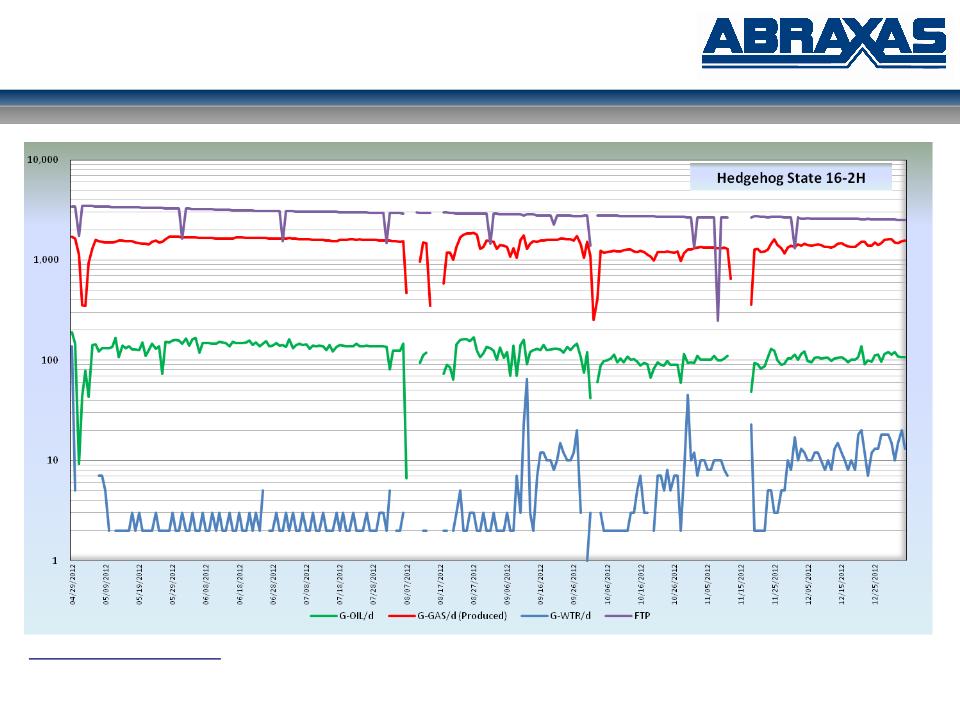

§ Hedgehog State 16-2H (Crossbow)

§ Cum (9 months): 96.2 MBoe

§ 49% Oil / NGLs

Brooks Draw:

Sage Grouse 3H:

(Cum Oil 25 MBbl / 50 MBbl EUR)

Prairie Falcon 3H (Niobrara)

Recent Industry Activity:

74 Permits

8 Completions

Porcupine Field:

Hedgehog State 16-2H (Turner)

22

PRB - Hedgehog State 16 - 2H

23

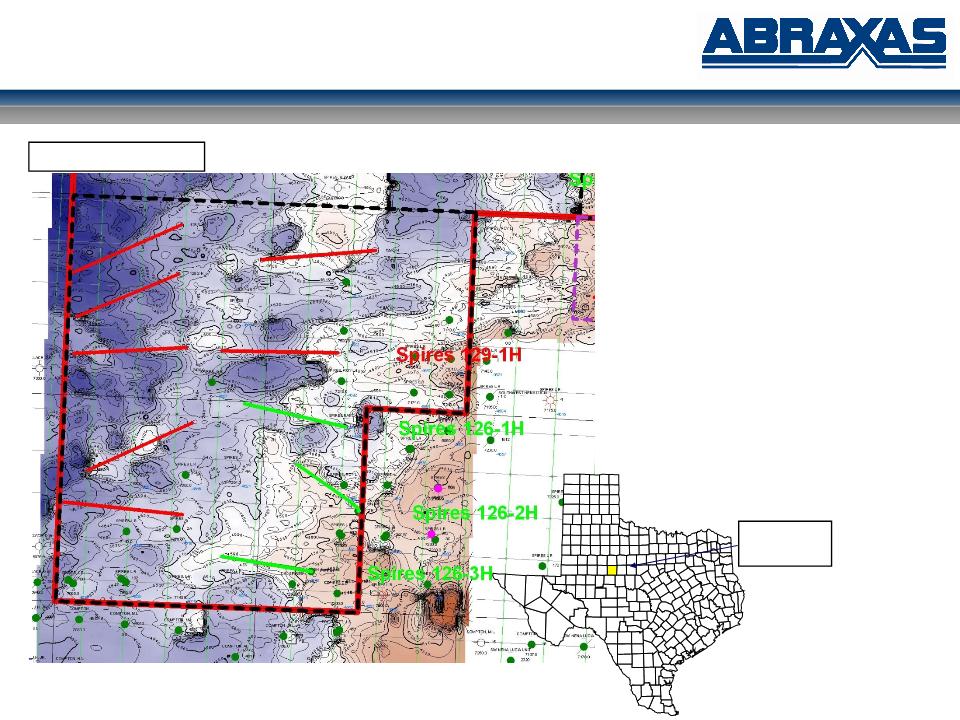

Permian Basin - Spires Ranch

§ 5,600 Gross / Net Acres

§ Recent Activity:

§ Spires 89-1H

§ Cum. Prod (3 mos): 10.9 mboe

§ 88% oil; 7% NGLs

§ Economics:

§ D&C Cost: $1.8 MM

§ EUR: 145 MBoe

§ 54% Oil / NGLs

AXAS owns 100% working interest in Spires Ranch leasehold

5,600 net acres

Nolan

County

County

Spires 89-1H

24

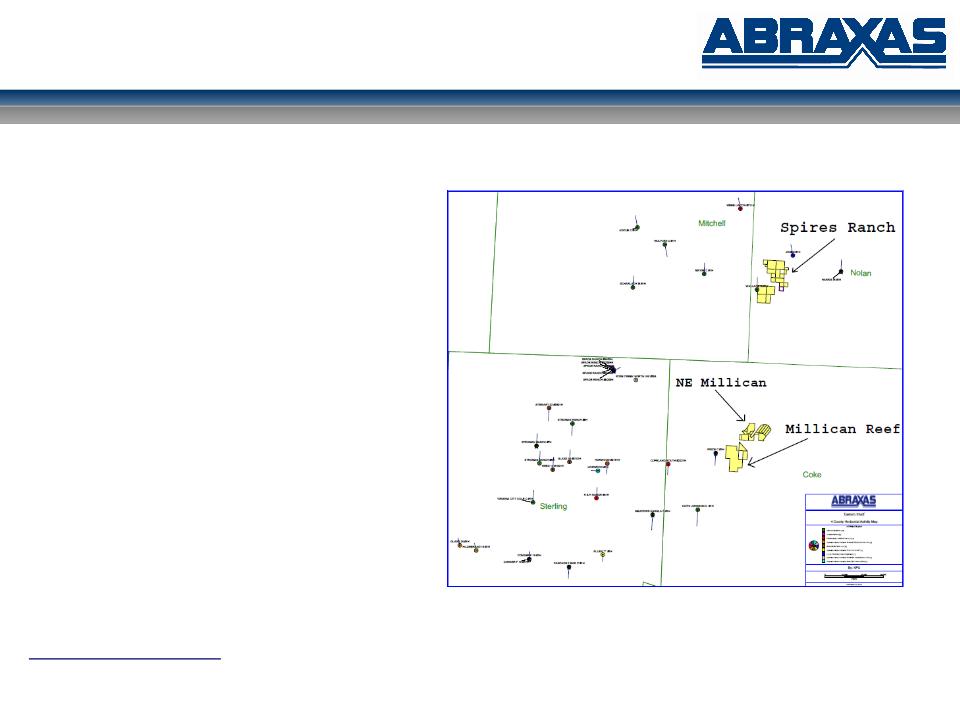

Permian Basin - Emerging Hz

Spires Ranch (Nolan County)

§Monitoring industry activity

§Geologic evaluation

§Logged shales through Spires 89 1H

Millican Reef (Coke County)

§Monitoring industry activity

§Geologic evaluation

25

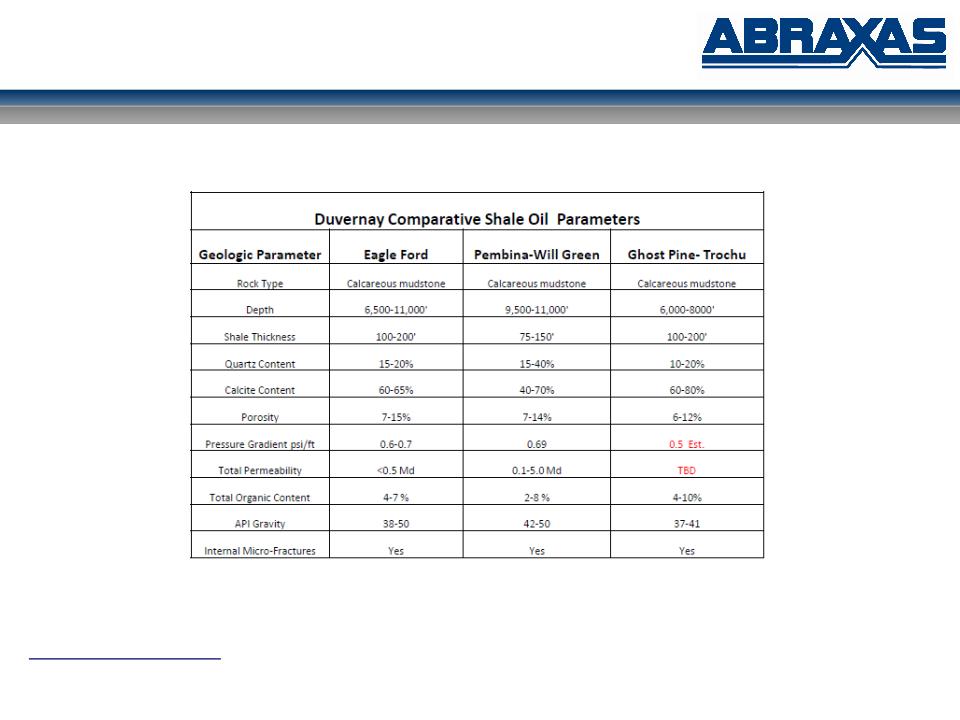

Canada - Duvernay

Duvernay :

§ Net Acres: 42,880 (100% WI)

§ Crown: 32 Sections; five year leases

§ Farm-out/option: 35 Sections; three year term

§ Represents a continuous, self sourced resource contained in a

shaley organic rich low permeability reservoir

shaley organic rich low permeability reservoir

§ Shale assessment and productivity expectations developed

based on a review of analogues (i.e. Eagle Ford, Kaybob,

Pembina/ Willesden Green)

based on a review of analogues (i.e. Eagle Ford, Kaybob,

Pembina/ Willesden Green)

§ All critical shale parameters point to the Duvernay being an

excellent source and reservoir rock

excellent source and reservoir rock

§ Available rock and completion data point to Canaxas lands

containing volatile oil hydrocarbons in place

containing volatile oil hydrocarbons in place

Planned Activity:

§ Drill vertical pressure test

§ Actively marketing for JV/sale with Pekisko (~120 boepd) as a

commingled package

commingled package

Alberta, Canada: Eastern Shale Basin

Recently Drilled

Neighboring Well

Neighboring Well

26

Canada - Duvernay

27

Canada - Duvernay

28

Near-Term Drilling Catalysts

|

|

|

|

|

|

|

|

|

|

Scheduled IP Month

|

Formation

|

Basin/Field/Well

|

AXAS WI

|

30 Day IP

|

Mos Production

|

Cum Prod

|

Notes

|

|

|

|

|

|

|

|

|

|

|

Williston Basin

|

|

|

|

|

|

|

|

|

April 2013

|

Bakken/TFS

|

Lillibridge 1H-4H

|

37%

|

NA

|

NA

|

NA

|

PAD Development Drilling

|

|

January 2013

|

Bakken

|

Ravin 26-35 2H

|

49%

|

NA

|

NA

|

NA

|

Completing

|

|

February 2013

|

Bakken

|

Ravin 26-35 3H

|

49%

|

NA

|

NA

|

NA

|

Completing

|

|

October 2012

|

TFS

|

Jore Fed 02-11 3H

|

76%

|

510

|

2

|

24.3

|

|

|

|

|

|

|

|

|

|

|

|

PRB

|

|

|

|

|

|

|

|

|

April 2012

|

Turner

|

Hedgehog State 16.2H

|

100%

|

442

|

9

|

96.2

|

|

|

|

|

|

|

|

|

|

|

|

Eagle Ford

|

|

|

|

|

|

|

|

|

February 2013

|

Eagleford

|

Gran Torino A 1H

|

19%

|

NA

|

NA

|

NA

|

Drilling

|

|

January 2013

|

Eagleford

|

Corvette C 1H

|

25%

|

NA

|

NA

|

NA

|

Completing

|

|

December 2012

|

Eagleford

|

Mustang 1H

|

19%

|

NA

|

NA

|

NA

|

On Production

|

|

November 2012

|

Eagleford

|

Cobra B 1H

|

25%

|

592

|

1

|

17.7

|

|

|

March 2012

|

Eagleford

|

Cobra 1H

|

25%

|

957

|

10

|

136.8

|

|

|

|

|

|

|

|

|

|

|

|

Permian Basin

|

|

|

|

|

|

|

|

|

September 2012

|

Strawn

|

Spires Ranch 89 1H

|

100%

|

195

|

3

|

10.9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scheduled IP Month

|

Formation

|

Basin/Field/Well

|

Gross/Net

|

30 Day IP

|

Mos Production

|

Cum Prod

|

Notes

|

|

Williston Basin

|

|

|

|

|

|

|

|

|

2013

|

Bakken/TFS

|

Various

|

0/0

|

NA

|

NA

|

NA

|

Various operators; online to date

|

|

2013

|

Bakken/TFS

|

Various

|

2/.05

|

NA

|

NA

|

NA

|

Various operators; w/o completion

|

|

2013

|

Bakken/TFS

|

Various

|

2/.08

|

NA

|

NA

|

NA

|

Various operators; w/o drilling rig

|

29

NASDAQ: AXAS