Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DANA INC | d466597d8k.htm |

Honesty & Integrity

Good Corporate Citizen

Open Communication

Continuous Improvement

©

2013 Dana Limited. This presentation contains copyrighted and confidential

information of Dana Holding Corporation and/or its subsidiaries. Those having access to this work

may not copy it, use it, or disclose the information contained within it without

written authorization of Dana Holding Corporation. Unauthorized use may result in prosecution.

Honesty & Integrity

Good Corporate Citizen

Open Communication

Continuous Improvement

Deutsche Bank

2013 Global Auto Industry Conference

January 15, 2013

©

2013 Dana Limited. This presentation contains copyrighted and confidential

information of Dana Holding Corporation and/or its subsidiaries. Those having access to this work

may not copy it, use it, or disclose the information contained within it without

written authorization of Dana Holding Corporation. Unauthorized use may result in prosecution.

Exhibit 99.1 |

©

Dana 2013

Safe Harbor Statement

Certain statements and projections contained in this presentation are, by their nature,

forward-looking within the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based on our current expectations,

estimates and projections about our industry and business, management’s beliefs,

and certain assumptions made by us, all of which are subject to change. Forward-

looking statements can often be identified by words such as “anticipates,”

“expects,” “intends,” “plans,” “predicts,”

“believes,” “seeks,” “estimates,” “may,” “will,” “should,”

“would,” “could,” “potential,” “continue,”

“ongoing,” similar expressions, and variations or negatives of these words.

These forward-looking statements are not guarantees of future results and are subject to

risks, uncertainties and assumptions that could cause our actual results to differ materially

and adversely from those expressed in any forward-looking statement. Dana’s

Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current

Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important

risk factors that could affect our business, results of operations and financial

condition. The forward-looking statements in this presentation speak only as of this

date. Dana does not undertake any obligation to revise or update publicly any

forward-looking statement for any reason.

|

The

Dana Snapshot Founded in 1904

Facilities in 27 countries

Serving customers in 125 countries

2012 preliminary sales ~$7.2 billion

Adjusted EBITDA margin ~10.8%

Dana

is

the

global

technology

leader

in

efficient

power

conveyance

and

energy

management

solutions

that

enable

our

customers

to

achieve

their

sustainability

objectives

3 |

©

Dana 2013

Applying Dana’s Expertise

4

Driveline

Sealing

Thermal Management

Light Vehicle

Driveline

Commercial Vehicle

Driveline

Off-Highway

Power

Technologies

Dana’s

End Markets

Dana’s

Business

Segments

Dana’s

Competencies

&

Technologies |

©

Dana 2013

Sales by Market and Region

45%

Light

Vehicles

35%

Heavy

Vehicles**

2012 Sales by Market*

2012 Sales by Region*

20%

Off-Highway

Markets

* 2012 Preliminary

** Includes 100% of DDAC preliminary 2012 sales of ~$700M

5

20%

Asia Pacific**

43%

North America

12%

South

America

25%

Europe |

©

Dana 2013

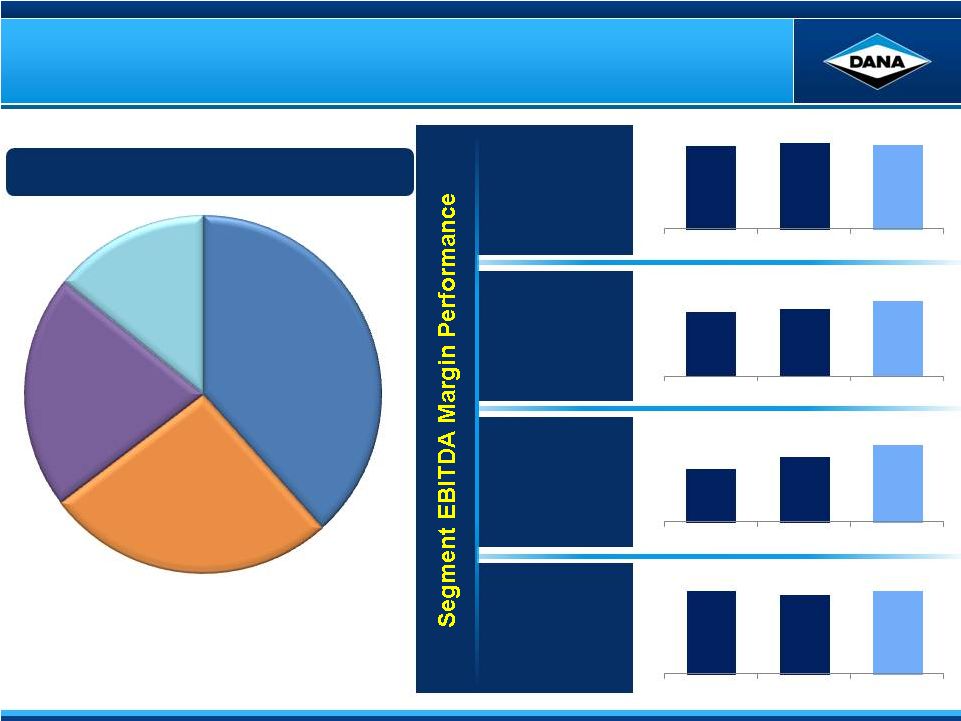

Segment Sales and Performance

6

21%

Off-Highway

38%

Light Vehicle

14%

Power

Technologies

27%

Commercial Vehicle

* 2012 Preliminary

Total Sales -

$7.2 Billion*

See appendix for comments regarding the presentation of non-GAAP

measures Light Vehicle

Driveline

Commercial

Vehicle

Driveline

Off Highway

Power

Technologies

2012 Sales by Business Segment*

9.5%

9.7%

9.6%*

2010

2011

2012P

9.5%

9.7%

10.1%*

2010

2011

2012P

8.7%

10.6%

12.6%*

2010

2011

2012P

13.5%

13.3%

13.5%*

2010

2011

2012P |

©

Dana 2013

Product Innovation

7

Software

Integration

Regionalization

Fuel

Efficiency

Electric

Hybrids

Systems

Integration

Cost of

Ownership

Emissions

Control

Technology / Product Innovation Addressing

Market-Based Value Drivers

Recent Product Introductions

©

Dana 2013 |

2012

Summary 8

Furthered

technology

/

innovation

strategy

–

new

product

introductions and strategic technology alliance

Continued

operating

model

integration

–

driving

profitability and

investment return throughout the organization

Profitability actions

North America Commercial Vehicle initiatives

Final wind-down of Structures business

Divestiture of Leisure Products

Exit of certain legacy programs

Continued margin expansion and cash flow generation despite

volatile / lower end-market demand

Capital

structure

/

shareholder

return

actions

–

pension funding,

common dividend, and share repurchase plan

©

Dana 2013 |

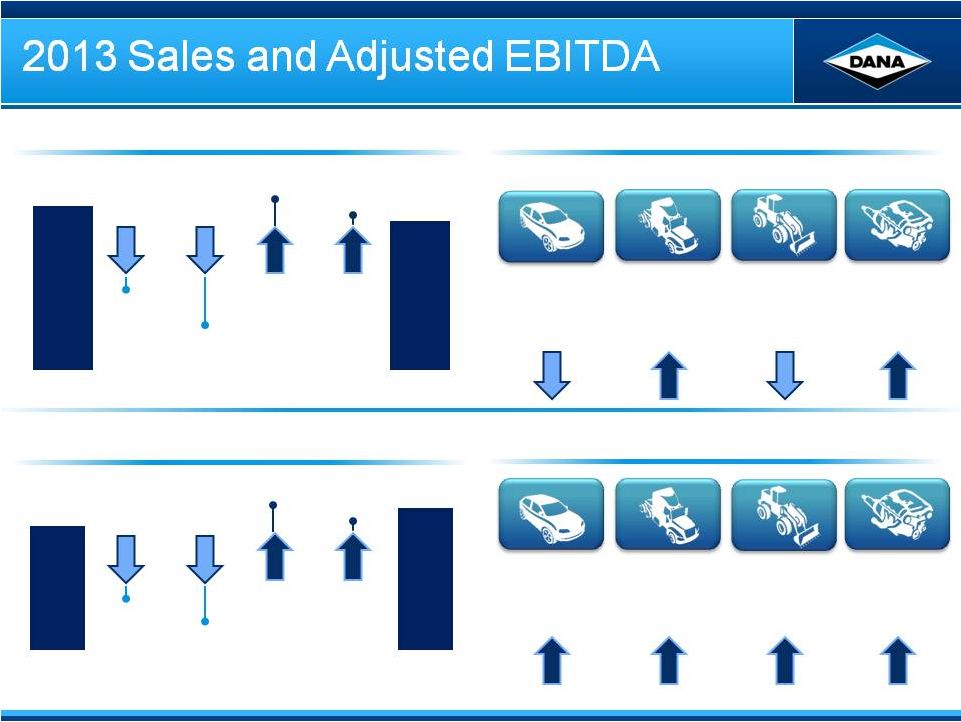

Looking Forward –

2013 Markets

Light Vehicle

Commercial Vehicle

Off-Highway

Market

Conditions

Impact on

Dana Sales

South America

Light Vehicle

Commercial Vehicle

Off-Highway

Market

Conditions

Impact on

Dana Sales

Europe

Market Recovery

Market Recovery

Market Recovery

Comment

Light Vehicle

Commercial Vehicle

Off-Highway

Market

Conditions

Impact on

Dana Sales

North America

Program Roll-offs

Class 8 stable

Insourcing /

Mfg Shift to AP

Comment

Construction Weak

Comment

Light Vehicle

Commercial Vehicle

Off-Highway

Market

Conditions

Impact on

Dana Sales

Asia Pacific

Program Ramp-up

New Business

Mfg Shift from NA

Comment

New Business

Change in mix

9

©

Dana 2013 |

©

Dana 2013

Dana’s Advantage

New technology based on

market value drivers

Cross-selling across

customer base,

regions and markets

Synergies in technology

applications

Systems solutions

Continued execution of lean

operating model

10 |

©

Dana 2013

2012 Preliminary Financial Results

See appendix for comments regarding the presentation of non-GAAP measures

* Excluding

voluntary

pension

contribution

of

$150

million

in

Q1

2012

** Includes marketable securities

2012 Guidance

Preliminary

Results

Compared to 2011

Sales

$7.2 –

$7.3 B

$7.2B

Currency and lower CV

end-market demand

Adjusted EBITDA

$780 –

$800 M

$780M

~ $15M improvement –

pricing and cost actions

Margin

~11.0%

~10.8%

~ 70 bps improvement

Capital Spend

$160 –

$170 M

$160M

Investment discipline

Free Cash Flow*

$240 –

$260 M

$320M

~ $145M improvement

Cash**

$1.1B

~ $140M increase

11 |

©

Dana 2013

Global Vehicle Production

Dana Forecasts (Units in 000s)

SOURCE: IHS Global Insight, ACT, PSR, Dana Estimates

2012

Prelim.

2013

Outlook

North America

Light Vehicle Total

15,300

15,900 –

16,100

Light Truck (Full Frame)

3,400

3,200 –

3,400

Medium Truck

180

180 –

190

Heavy Truck (Class 8)

274

265 –

275

Agricultural Equipment

69

65 –

75

Construction Equipment

156

160 –

170

Europe

(Incl. Eastern Europe)

Light Vehicle

18,900

18,000 –

19,000

Medium/Heavy Truck

400

390 –

410

Agricultural Equipment

255

245 –

255

Construction Equipment

322

285 –

295

South America

Light Vehicle

4,300

4,400 –

4,600

Medium/Heavy Truck

167

180 –

190

Agricultural Equipment

48

50 –

55

Construction Equipment

19

15 –

20

Asia Pacific

Light Vehicle

41,000

41,000 –

42,000

Medium/Heavy Truck

1,500

1,600 –

1,700

Agricultural Equipment

750

780 –

790

Construction Equipment

614

650 –

660

12%

North America

Overall light vehicle strong

Full frame trucks in line with last year

Class 8 truck production flat

Europe

Light vehicle continued softness

Construction equipment weakens

South America

Heavy and medium truck rebounding

Asia Pacific

Heavy truck strengthening

Ag & Construction improving

Summary

12 |

©

Dana 2013

2013 Expectations

13

Production volumes largely

flat to 2012 preliminary results

Currency, divestitures and

program roll-offs lower 2013

sales expectation

Dana Margin Levers

Optimize Performance Within Controllable Levers

Continued focus and

execution on controllable

levers to further margin

expansion

Maintain cost and investment

discipline

Remain flexible as markets

expected to remain volatile

during the course of 2013

Summary

-

+

-

+

-

+

-

+

-

+

Current

Future

Market

Product / Process Complexity

Technology Margin Profile

Macro Environment

Production Demand

Materials / Pricing Leverage

Conversion / Structural Costs |

2013 Financial Targets

*Assumes

24%

effective

tax

rate

&

excludes

impact

of

the

share

repurchase

program

Key

Fx

rate

assumptions

for

2013:

EUR

$1.27,

GBP

$1.60,

BRL

$0.53,

MXN

$

0.68

See

appendix

for

comments

regarding

the

presentation

of

non-GAAP

measures

Key Financial Metrics

2013 Plan

Sales

~$7.1B

Adjusted EBITDA

$800 –

$820 M

Margin

~11.4%

Diluted Adjusted EPS*

$1.88 –

$1.95

Capital Spend

$180 –

$200 M

Free Cash Flow

$240 –

$260 M

14

Other / Selected Cash Flow Items

Depreciation / Amortization

~$275M

Cash Taxes

$125 –

$135 M

Net Interest

~$70M

Pension Funding, Net

~$60M

Restructuring

$45 –

$55 M

©

Dana 2013 |

~$2.7B

~$2.0B

~$1.4B

~$1.0B

LV

CV

OH

PT

15

Sales by Business Segment

Sales Progression

Adjusted EBITDA Progression

~10%

~11%

~13%

~14%

LV

CV

OH

PT

2012

Prelim.

~$7.2B

Currency

~$(40)M

Divestitures &

Program Roll-Offs

~$(240)M

Volume / Mix

~$105M

Pricing /

Recoveries

~$75M

2013

Plan

~$800 -

$820M

Currency

~$(5)M -

Flat

Divestitures &

Program Roll-Offs

~$(20) -

(15)M

Volume / Mix

~$10 -

15M

Performance

~$35 -

40M

2012

Prelim.

~$780M

Margin by Business Segment

See appendix for comments regarding the presentation of non-GAAP

measures 2013

Plan

~$7.1B

©

Dana 2013 |

Honesty & Integrity

Good Corporate Citizen

Open Communication

Continuous Improvement

©

2013 Dana Limited. This presentation contains copyrighted and confidential

information of Dana Holding Corporation and/or its subsidiaries. Those having access to this work

may not copy it, use it, or disclose the information contained within it without

written authorization of Dana Holding Corporation. Unauthorized use may result in prosecution.

Honesty & Integrity

Good Corporate Citizen

Open Communication

Continuous Improvement |

©

Dana 2013

Appendix

Non-GAAP Financial Information

The preceding slides refer to Adjusted EBITDA, which we’ve defined to be earnings from continuing

and discontinued operations before interest, taxes, depreciation, amortization, non-cash

equity grant expense, restructuring expense and other nonrecurring items (gain/loss on debt

extinguishment or divestitures, impairment, etc.). The most significant impact on

Dana’s ongoing results of operations as a result of applying fresh start accounting following our emergence from

bankruptcy was higher depreciation and amortization. By using adjusted EBITDA, a performance

measure which excludes depreciation and amortization, the comparability of results is

enhanced. Management also believes that adjusted EBITDA is an important measure since the

financial covenants in our debt agreements are based, in part, on adjusted EBITDA.

Adjusted EBITDA should not be considered a substitute for income (loss) before income taxes, net

income (loss) or other results reported in accordance with GAAP. Adjusted EBITDA may not

be comparable to similarly titled measures reported by other companies. Diluted adjusted EPS is a

non-GAAP financial measure which we have defined as adjusted net income divided by adjusted

diluted shares. We define adjusted net income as net income (loss) attributable to the parent company

excluding restructuring expense, amortization expense and nonrecurring items (as used in adjusted

EBITDA), net of any associated income tax effects. We define adjusted diluted shares as

diluted shares as determined in accordance with GAAP based on adjusted net income. This

measure is considered useful for purposes of providing investors, analysts and other interested

parties with an indicator of ongoing financial performance that provides enhanced comparability to

EPS reported by other companies. Diluted adjusted EPS is neither intended to represent nor be an

alternative measure to diluted EPS reported under GAAP. Free cash flow is a non-GAAP

financial measure which we have defined as cash provided by (used in) operating activities

excluding any bankruptcy claim-related payments, less purchases of property, plant and

equipment. We believe this measure is useful to investors in evaluating the operational

cash flow of the company inclusive of the spending required to maintain the operations.

Free cash flow is neither intended to represent nor be an alternative to the measure of net cash

provided by (used in) operating activities reported under GAAP. Free cash flow may not be

comparable to similarly titled measures reported by other companies. Please reference the

“Non-GAAP financial information” accompanying our quarterly earnings conference call

presentations on our website at www.dana.com/investors for our GAAP results and the

reconciliations of these measures, where used, to the comparable GAAP measures. |