Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Crocs, Inc. | d468510d8k.htm |

Exhibit 99.1 |

Regarding Forward-Looking Statements

2 |

Investment Highlights

•

Global Multi Channel Casual Lifestyle

Footwear Brand

•

Focus on the Consumer

•

Balanced, International Long-Term

Sales Growth

•

Strong Balance Sheet

•

Strong Free Cash Flow

•

Rewarding Investors Through

Reinvestment of Cash

3 |

Fourth

Quarter

Update |

•

Revenue expected to be in line with previous guidance of $220mm

•

Difficult holiday retail sales environment similar to other brands / retailers

•

New products were well accepted in most markets

•

Global opportunities and challenges remain

•

Backlog for

first

half

2013

is estimated to be up

15%

on

a

nominal

basis

from prior year

Key Observations on Q4 2012

5

1.

Guidance last provided on October 24, 2012. Other than with respect to

revenue nothing herein updates or reaffirms such prior guidance.

1 |

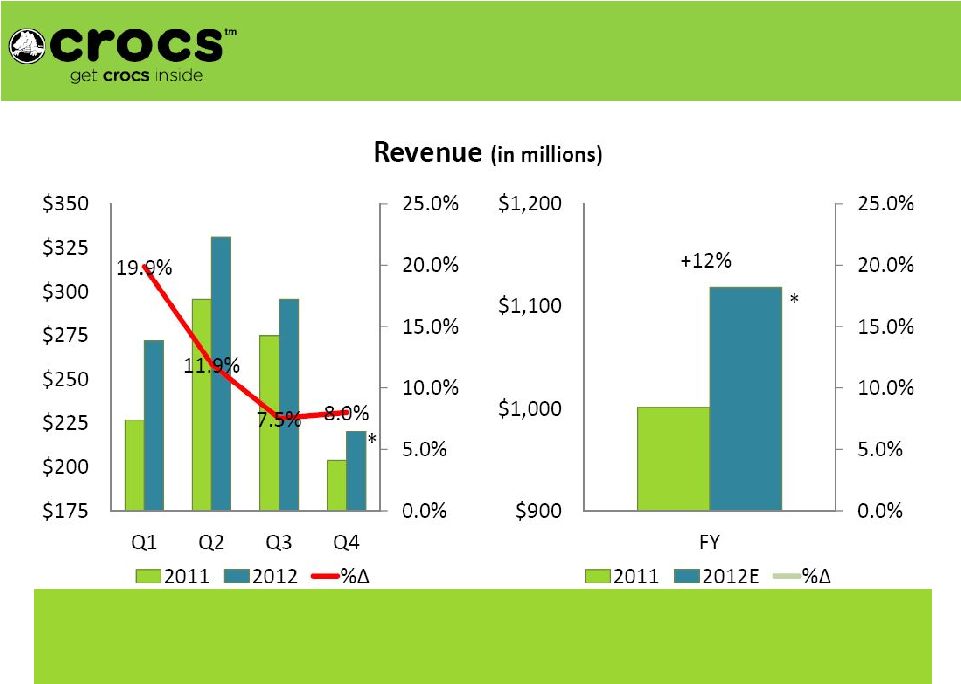

Strong Quarterly and YOY Revenue Growth

6

First Half growth of 16%, Second half growth of 8%

2012 Revenue Growth of Approximately 12%

On a Constant Currency Basis –

Annualized Growth of Approximately 15%

* Based on October 24, 2012 Q412 revenue guidance of $220mm |

|

Long-Term Organic Growth Drivers

•

Product-Driven

•

New Consumers

•

Multi-Channel, Global Business Model

•

Wholesale Channel Expansion

8 |

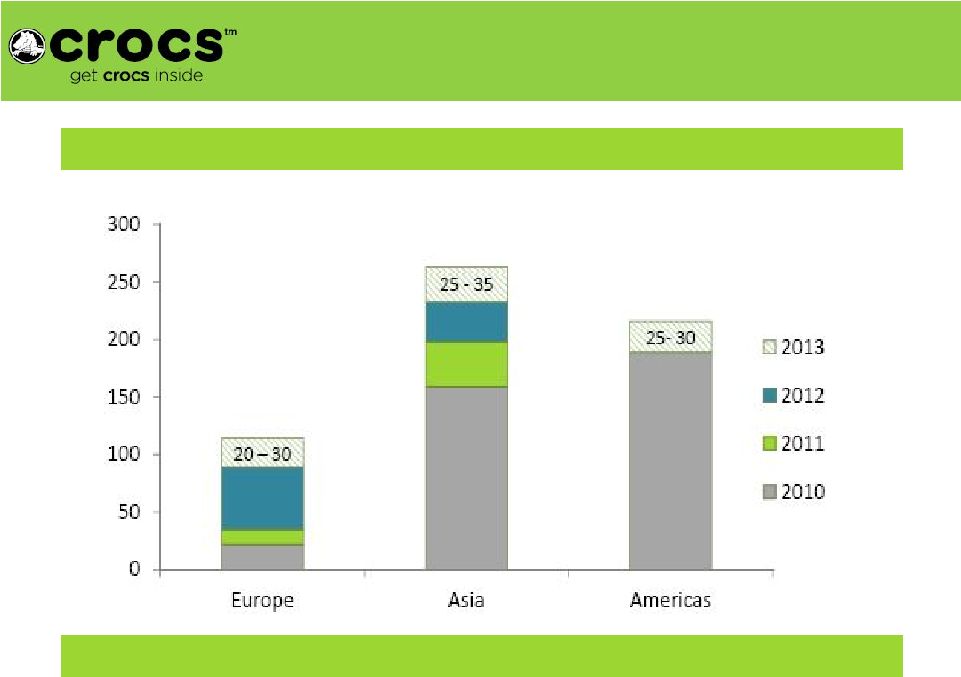

Global Sustained Revenue Growth

9

2010

2011

2012E*

CAGR

Asia

Wholesale

$

200

$

259

$

297

14%

Retail

77

112

143

23

Internet

8

11

16

26

Total

285

382

456

Europe

Wholesale

$

96

$

125

$

110

5%

Retail

15

20

35

33

Internet

17

26

23

11

Total

128

171

168

Americas

Wholesale

$

183

$

214

$

235

9%

Retail

143

175

196

11

Internet

51

59

63

7

Total

377

448

494

Global Long-Term Multi Channel Growth

Asia: 17%

Europe: 9%

Americas: 9%

* Based on October 24, 2012 Q412 revenue guidance of $220mm |

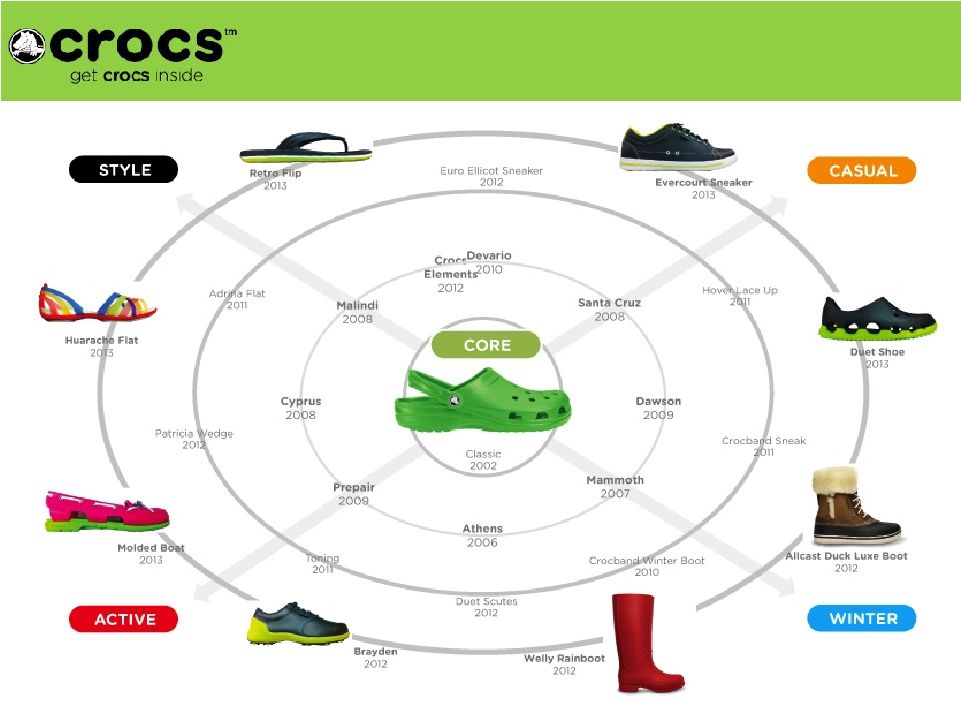

Expanding

Product Line |

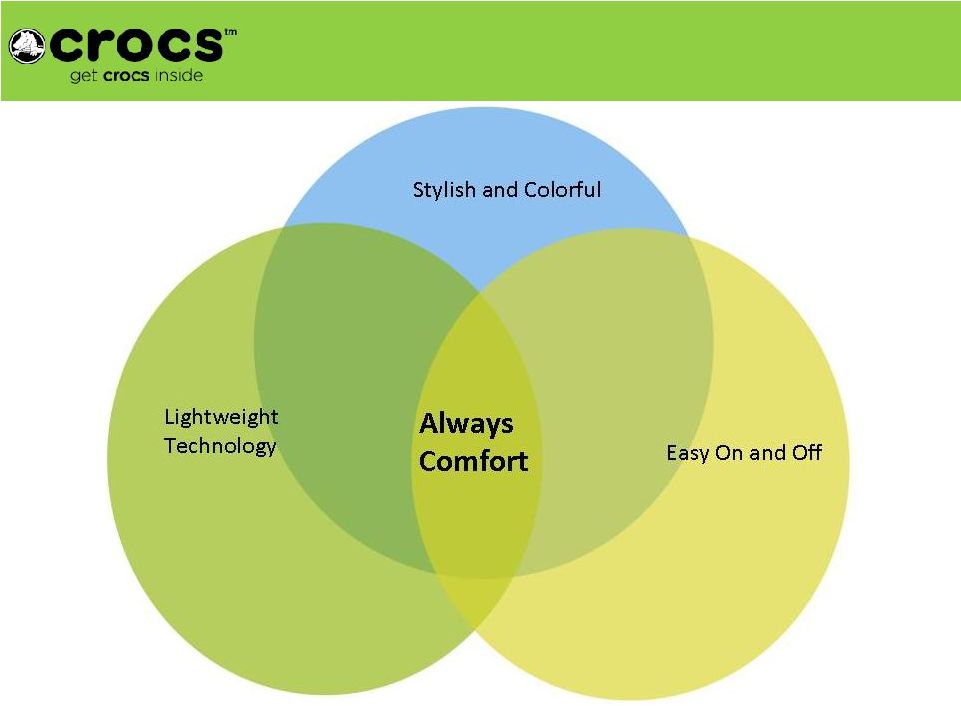

Focus on Comfort

11 |

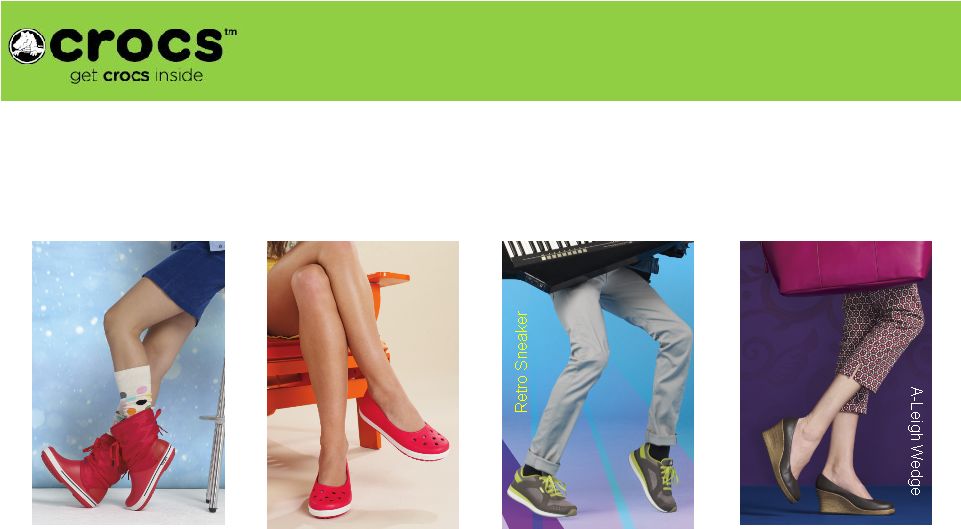

Product Road Map –

All Year Growth

12 |

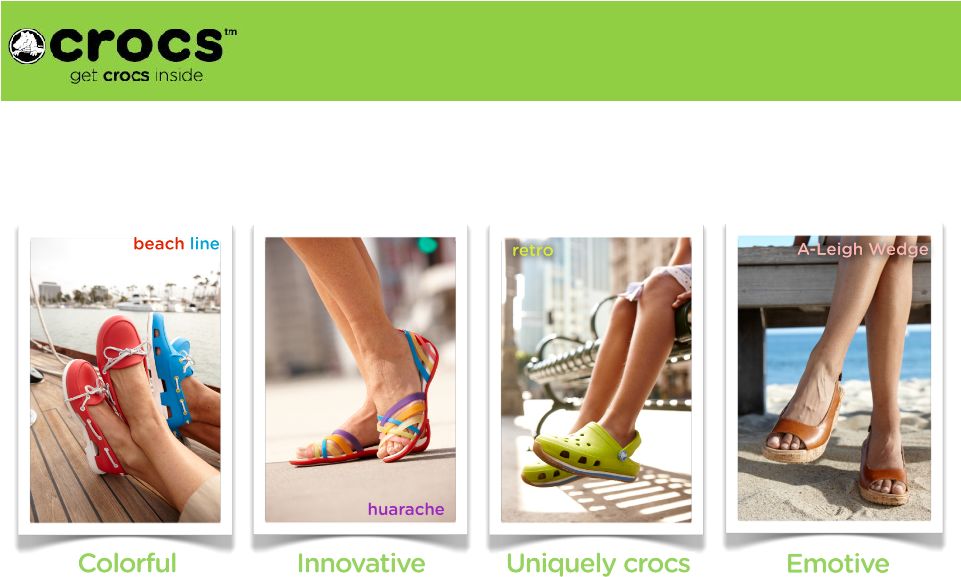

Product Stories –

2013

13

Compelling Line up of All Season Products

Launched Year-Round |

Product Stories –

SS13

14 |

Easy on | off

Lightw

eight

Purpose Built

Stylish

Product Stories –

FH13

15

Crocband

Boot

Airy Flat |

|

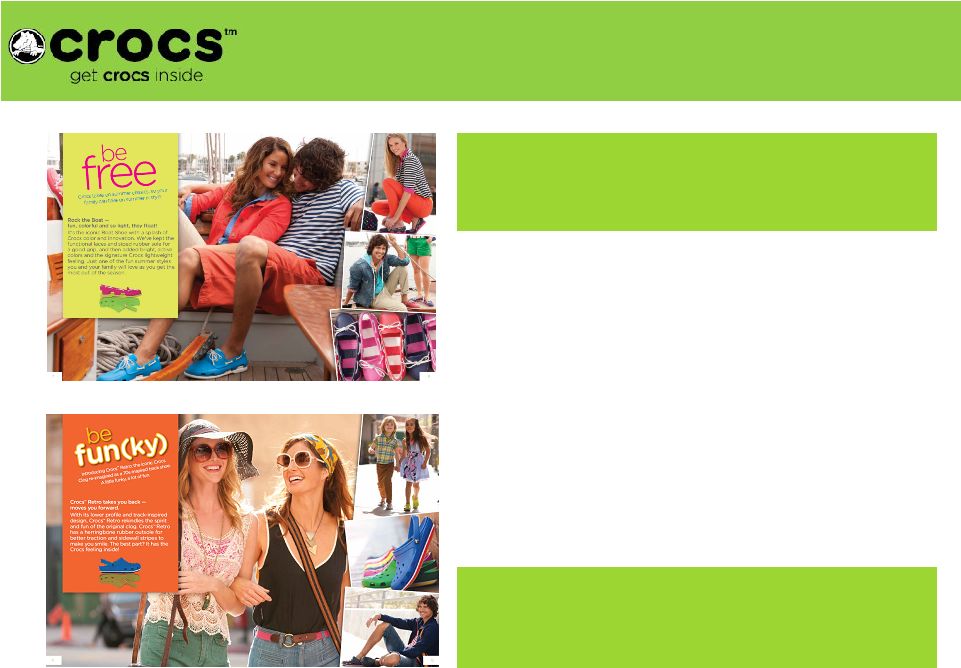

Engaging New Consumers

17

•

Emerging Lifestyle Brand

-

Engage New Consumers

-

Innovative Products

-

Retain Crocs loyalists

•

Multi-Channel Approach of

print /outdoor /social media

Consumer Marketing Investment

will Increase Going Forward

Expanding Consumer Awareness is

Key to Crocs Strategy |

Engaging New Consumers

18

Multi-Channel

Global Message

Around

Lifestyle

Imaging

Fun, Cool,

Colorful,

Casual,

Comfort |

|

•

SAP Implementation through 2013

-

$0.04 per share FY 2013 impact

due to accelerated depreciation

-

$0.04 -

$0.06 per share FY 2013

impact due to increased op ex

•

Expected launch in 1H 2014

2013 SAP Investment

20

* SAP expenses are excluded from normalized operating income results

Total FY 2013 SAP Impact of

$0.08 -

$0.10 per share* |

Credit

Agreement – Key Terms

Capital Allocation –

Credit Agreement

21

•

Renegotiated credit agreement in December 2012

•

Credit line increased to $100mm

•

Up to $50mm per quarter –

$150mm per year -

can now be used towards share

repurchases |

Share

Repurchase *Share repurchase totals are as of market close December 31, 2012

Capital Allocation –

Share Repurchase

22

•

Since

November

2012,

approximately

1.9

million

shares

have

been

repurchased

at

an

average

price

of

$13.25

-

~$25.0mm*

•

Shares

are

being

repurchased

under

the

2007

Share

Repurchase

authorization

which

has

3.4

million

shares

remaining |

2013 Planned Retail Store Growth

23

2013 Global Retail Store Growth of Approximately 70 -

95 Net Stores

Estimated 600 -

625 Retail Locations Globally by YE 2013 |

New Retail Investment Metrics

•

Location, Location, Location

•

Focus on High Traffic, Outlet Locations

Avg Store Size –

US

Avg Store Size -

Asia

1500 –

1800 sqft

650 –

1500 sqft

Avg. Store Cost –

US

Avg. Store Cost –

Asia

$240K

$140K

Avg. Store Sales

Operating Income (OI)

$750K-$800K

>20%

ROI

Payback Period

>35%

1-3 years

(3 year maximum)

24 |

•

Engaging with the Consumer through

Core and New Innovative Products

•

Growing Wholesale with Key Partners

•

Retail and Internet Expansion to

Connect with Core and New Consumers

•

Focus on Retail Excellence

•

Increased Investment in Marketing

•

Creating Leverage

First Half Drivers –

Building on A Solid Base

25 |

•

Benefit from our Global Footprint

•

Growing our Back to School Business in US

Market, Licensing Products, Fall and Winter

Products

•

Increased Marketing of New, Comfortable

Products

•

Expansion into Contraseasonal Markets –

Latin / South America, Middle East, Asia

Pacific

•

Managing Fixed Costs

Back Half Drivers –

A Slow Methodical Journey

26 |

|

Investment Summary

28

•

Global Multi Channel Casual Lifestyle

Footwear Brand

•

Focus on the Consumer

•

Balanced, International Long-Term

Sales Growth

•

Strong Balance Sheet

•

Strong Free Cash Flow

•

Rewarding Investors Through

Reinvestment of Cash |

Thank You |