Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CurrencyShares South African Rand Trust | Financial_Report.xls |

| EX-3.2 - EXHIBIT 3.2 - CurrencyShares South African Rand Trust | d449394dex32.htm |

| EX-31.1 - EXHIBIT 31.1 - CurrencyShares South African Rand Trust | d449394dex311.htm |

| EX-32.1 - EXHIBIT 32.1 - CurrencyShares South African Rand Trust | d449394dex321.htm |

| EX-31.2 - EXHIBIT 31.2 - CurrencyShares South African Rand Trust | d449394dex312.htm |

| EX-32.2 - EXHIBIT 32.2 - CurrencyShares South African Rand Trust | d449394dex322.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-34162

CurrencyShares® South African Rand Trust

Sponsored by Guggenheim Specialized Products, LLC,

d/b/a Guggenheim Investments

(Exact name of registrant as specified in its charter)

| New York | No. 30-6164140 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

(301) 296-5100

(Registrant’s telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

During the fiscal period ended October 31, 2012, none of the registrant’s common stock was held by non-affiliates of the registrant.

Table of Contents

CURRENCYSHARES® SOUTH AFRICAN RAND TRUST

INDEX

| Caption |

Page | |||||

| PART I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

3 | |||||

| Item 1B. |

8 | |||||

| Item 2. |

8 | |||||

| Item 3. |

8 | |||||

| Item 4. |

8 | |||||

| PART II | ||||||

| Item 5. |

9 | |||||

| Item 6. |

9 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

9 | ||||

| Item 7A. |

10 | |||||

| Item 8. |

10 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures. |

10 | ||||

| Item 9A. |

10 | |||||

| Item 9B. |

11 | |||||

| PART III | ||||||

| Item 10. |

12 | |||||

| Item 11. |

12 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

12 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

12 | ||||

| Item 14. |

12 | |||||

| PART IV | ||||||

| Item 15. |

13 | |||||

| SIGNATURES | — | |||||

i

Table of Contents

Overview

The CurrencyShares® South African Rand Trust (the “Trust”) is a grantor trust that was formed on August 7, 2008. The Trust issues shares (the “Shares”) in blocks of 50,000 (a “Basket”) in exchange for deposits of South African Rand and distributes South African Rand in connection with the redemption of Baskets.

The investment objective of the Trust is for the Shares to reflect the price in USD of the South African Rand plus accrued interest, less the expenses of the Trust’s operations. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding the South African Rand. The Sponsor intends to apply to NYSE Arca to have the Shares listed and traded on NYSE Arca under the symbol “FXSA.” When admitted to trading, the Shares will be bought and sold on NYSE Arca like any other exchange-listed security. The Shares are backed by the assets of the Trust, which does not hold or use derivative products. Investing in the Shares will not insulate the investor from certain risks, including price volatility. The value of the holdings of the Trust will be reported on the Trust’s website, www.currencyshares.com, each business day.

The Trust

General

The Trust holds South African Rand and is expected from time to time to issue Baskets in exchange for deposits of South African Rand and distribute South African Rand in connection with redemptions of Baskets. The South African Rand held by the Trust will be sold only (1) if needed to pay Trust expenses, (2) in the event the Trust terminates and liquidates its assets or (3) as otherwise required by law or regulation.

The Sponsor

The Sponsor of the Trust generally oversees the performance of the Trustee and the Trust’s principal service providers, but does not exercise day-to-day oversight over the Trustee or the Trust’s service providers. The Sponsor is Guggenheim Specialized Products, LLC, a Delaware limited liability company. The Sponsor changed its name from Rydex Specialized Products LLC as of March 30, 2012.

The Trust’s only ordinary recurring expense is the Sponsor’s fee. The Sponsor is responsible for payment of the following administrative and marketing expenses of the Trust: the Trustee’s monthly fee, typical maintenance and transaction fees of the Depository, NYSE Arca listing fees, printing and mailing costs, audit fees and expenses, up to $100,000 per year in legal fees and expenses, and applicable license fees. The Sponsor also paid the costs of the Trust’s organization, including the applicable SEC registration fees. The Sponsor’s fee will accrue daily at an annual nominal rate of 0.40% of the South African Rand in the Trust (including all unpaid interest but excluding unpaid fees, each as accrued through the immediately preceding day). The Sponsor did not receive a fee during the fiscal period ended October 31, 2012.

The Trustee

The Bank of New York Mellon, a banking corporation with trust powers organized under the laws of the State of New York, serves as the Trustee. The Trustee is responsible for the day-to-day administration of the Trust, including keeping the Trust’s operational records.

Net Asset Value

The Trustee will calculate, and the Sponsor will publish, the Trust’s Net Asset Value (“NAV”) each business day. To calculate the NAV, the Trustee will add to the amount of South African Rand in the Trust at the end of the preceding day accrued but unpaid interest, South African Rand receivable under pending purchase orders and the value of other Trust assets, and subtract the accrued but unpaid Sponsor’s fee, South African Rand payable under pending redemption orders and other Trust expenses and liabilities, if any. The NAV will be expressed in U.S. Dollars (“USD”) based on the “Closing Spot Rate,” which is the USD/ South African Rand exchange rate as

1

Table of Contents

determined by The World Markets Company PLC, a State Street business, as of 4:00 PM (London fixing) on each day that NYSE Arca is open for regular trading. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent Closing Spot Rate will be used to determine the NAV of the Trust unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for the valuation.

The Trustee will also determine the NAV per Share, which equals the NAV of the Trust, divided by the number of outstanding Shares. The NAV of the Trust and NAV per Share will be published by the Sponsor on each day that NYSE Arca is open for regular trading and will be posted on the Trust’s website, www.currencyshares.com.

Depository and Deposit Accounts

JPMorgan Chase Bank, N.A., London Branch is the Depository. The Depository maintains two deposit accounts for the Trust, a primary deposit account which is expected to earn interest and a secondary deposit account which does not earn interest (collectively, the “Deposit Accounts”). Interest on the primary deposit account, if any, accrues daily and is paid monthly. If the Sponsor believes that the interest rate paid by the Depository is not competitive, the Sponsor’s recourse is to remove the Depository by terminating the Deposit Account Agreement and closing the Deposit Accounts. The Depository is not paid a fee for its services to the Trust. The Depository may earn a “spread” or “margin” over the rate of interest it pays to the Trust on the South African Rand deposit balances.

The secondary deposit account is used to account for any interest that may be received and paid on creations and redemptions of Baskets. The secondary deposit account is also used to account for interest earned on the primary deposit account, if any, pay Trust expenses and distribute any excess interest to Shareholders on a monthly basis. In the event that the interest deposited exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, then the Trustee will direct that the excess be converted into USD at a prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro rata basis (in accordance with the number of Shares that they own).

Trust Expenses

In certain exceptional cases the Trust may pay expenses in addition to the Sponsor’s fee. These exceptions include expenses not assumed by the Sponsor, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Trustee or the Sponsor on behalf of the Trust or action taken by the Trustee or the Sponsor to protect the Trust or the interests of Shareholders, indemnification of the Sponsor under the Depositary Trust Agreement, and legal expenses in excess of $100,000 per year.

Termination

The Trust will terminate upon the occurrence of any of the termination events listed in the Depositary Trust Agreement and will otherwise terminate on August 7, 2048.

The Shares

General

Each Share represents a proportional interest, based on the total number of Shares outstanding, in the South African Rand owned by the Trust, plus accrued and unpaid interest less accrued but unpaid expenses (both asset-based and non-asset based) of the Trust. All Shares are of the same class with equal rights and privileges. Each Share is transferable, is fully paid and non-assessable and entitles the holder to vote on the limited matters upon which Shareholders may vote under the Depositary Trust Agreement.

Limited Rights

The Shares are not a traditional investment. They are dissimilar from the shares of a corporation operating a business enterprise, with management and a board of directors. Trust Shareholders do not have rights normally associated with owning shares of a business corporation, including, for example, the right to bring “oppression” or “derivative” actions. Shareholders have only those rights explicitly set forth in the Depositary Trust Agreement. The Shares do not entitle their holders to any conversion or pre-emptive rights or, except as described herein, any redemption or distribution rights.

2

Table of Contents

Voting and Approvals

Shareholders have no voting rights under the Depositary Trust Agreement, except in limited circumstances. If the holders of at least 25% of the Shares outstanding determine that the Trustee is in material breach of its obligations under the Depositary Trust Agreement, they may provide written notice to the Trustee (or require the Sponsor to do so) specifying the default and requiring the Trustee to cure such default. If the Trustee fails to cure such breach within 30 days after receipt of the notice, the Sponsor, acting on behalf of the Shareholders, may remove the Trustee. The holders of at least 66 2/3% of the Shares outstanding may vote to remove the Trustee. The Trustee must terminate the Trust at the request of the holders of at least 75% of the outstanding Shares.

Creation and Redemption of Shares

The creation and redemption of Baskets requires the delivery to the Trust or the distribution by the Trust of the amount of South African Rand represented by the Baskets being created or redeemed. This amount is based on the combined NAV per Share of the number of Shares included in the Baskets being created or redeemed, determined on the day the order to create or redeem Baskets is accepted by the Trustee.

Only Authorized Participants may place orders to create and redeem Baskets. An Authorized Participant is a Depository Trust Company participant that is a registered broker-dealer or other securities market participant, such as a bank or other financial institution that is not required to register as a broker-dealer to engage in securities transactions.

Before initiating a creation or redemption order, an Authorized Participant must have entered into a Participant Agreement with the Sponsor and the Trustee. The Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of South African Rand required for creations and redemptions. The Participant Agreements may be amended by the Trustee and the Sponsor. Authorized Participants pay a transaction fee of $500 to the Trustee for each order that they place to create or redeem one or more Baskets. In addition to the $500 transaction fee paid to the Trustee, Authorized Participants pay a variable fee to the Sponsor for creation orders and redemption orders of two or more Baskets to compensate the Sponsor for costs associated with the registration of Shares. The variable fee paid to the Sponsor by an Authorized Participant will not exceed $2,000 for each creation or redemption order, as set forth in the Participant Agreement. Authorized Participants who make deposits with the Trust in exchange for Baskets receive no fees, commissions or other form of compensation or inducement of any kind from either the Sponsor or the Trust. No Authorized Participant has any obligation or responsibility to the Sponsor or the Trust to effect any sale or resale of Shares.

You should consider carefully the risks described below before making an investment decision. You should also refer to the other information included in this report, including the Trust’s financial statements and the related notes

The value of the Shares relates directly to the value of the South African Rand held by the Trust. Fluctuations in the price of the South African Rand could materially and adversely affect the value of the Shares.

The Shares are designed to reflect the price of the South African Rand, plus accumulated interest, if any, less the Trust’s expenses. Several factors may affect the price of the South African Rand, including:

| • | Sovereign debt levels and trade deficits; |

| • | Domestic and foreign inflation and interest rates and investors’ expectations concerning those rates; |

| • | Currency exchange rates; |

| • | Investment and trading activities of mutual funds, hedge funds and currency funds; and |

| • | Global or regional political, economic or financial events and situations. |

In addition, the South African Rand may not maintain its long-term value in terms of purchasing power in the future. When the price of the South African Rand declines, the Sponsor expects the price of a Share to decline as well.

3

Table of Contents

The USD/South African Rand exchange rate, like foreign exchange rates in general, can be volatile and difficult to predict. This volatility could materially and adversely affect the performance of the Shares.

Foreign exchange rates are influenced by the factors identified immediately above and may also be influenced by: changing supply and demand for a particular currency; monetary policies of governments (including exchange control programs, restrictions on local exchanges or markets and limitations on foreign investment in a country or on investment by residents of a country in other countries); changes in balances of payments and trade; trade restrictions; and currency devaluations and revaluations. Also, governments from time to time intervene in the currency markets, directly and by regulation, in order to influence prices directly. These events and actions are unpredictable. The resulting volatility in the USD/South African Rand exchange rate could materially and adversely affect the performance of the Shares.

If interest earned by the Trust does not exceed the Trust’s expenses, the Trustee will withdraw South African Rand from the Trust to pay these excess expenses, which will reduce the amount of South African Rand represented by each Share on an ongoing basis and may result in adverse tax consequences.

Each outstanding Share will represent a fractional, undivided interest in the South African Rand held by the Trust. Although the Trust is expected to generate interest, it is possible that the amount of interest earned may not exceed expenses, in which case the Trustee will withdraw South African Rand from the Trust to pay these excess expenses. As a result, the amount of South African Rand represented by each Share will gradually decline. This is true even if additional Shares are issued in exchange for additional deposits of South African Rand into the Trust, as the amount of South African Rand required to create Shares will proportionately reflect the amount of South African Rand represented by the Shares outstanding at the time of creation As long as the Trust’s expenses are greater than the amount of interest earned, the Shares will only maintain their original price if the price of the South African Rand increases. There is no guarantee that interest earned by the Trust in the future will exceed the Trust’s expenses.

Investors should be aware that a gradual decline in the amount of South African Rand represented by the Shares may occur regardless of whether the trading price of the Shares rises or falls in response to changes in the price of the South African Rand. The estimated ordinary operating expenses of the Trust, which accrue daily commencing after the first day of trading of the Shares on NYSE Arca, are described in “Business – The Trust – Trust Expenses.”

The payment of expenses by the Trust will result in a taxable event to Shareholders. To the extent Trust expenses exceed interest paid to the Trust, a gain or loss may be recognized by Shareholders depending on the tax basis of the tendered South African Rand.

The interest rate paid by the Depository, if any, may not be the best rate available. If the Sponsor determines that the interest rate is inadequate, then its sole recourse is to remove the Depository and terminate the Deposit Accounts.

The Depository is committed to endeavor to pay a competitive interest rate on the balance of South African Rand in the primary deposit account of the Trust, but there is no guarantee of the amount of interest that will be paid, if any, on this account. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The Depository may change the rate at which interest accrues, including reducing the interest rate to zero, based upon changes in market conditions or the Depository’s liquidity needs. The Depository will notify the Sponsor of the interest rate applied each business day after the close of such business day. The Sponsor will disclose the interest rate on the Trust’s website. If the Sponsor believes that the interest rate paid by the Depository is not adequate, the Sponsor’s sole recourse will be to remove the Depository and terminate the Deposit Accounts. The Depository will not be paid a fee for its services to the Trust; rather, it will generate income or loss based on its ability to earn a “spread” or “margin” over the interest it pays to the Trust by using the Trust’s South African Rand to make loans or in other banking operations. For these reasons, you should not expect that the Trust will be paid the best available interest rate at any time or over time.

If the Trust incurs expenses in USD, the Trust will be required to sell South African Rand to pay these expenses. The sale of the Trust’s South African Rand to pay expenses in USD at a time of low South African Rand prices could adversely affect the value of the Shares.

The Trustee will sell South African Rand held by the Trust to pay any Trust expenses incurred in USD, irrespective of then-current South African Rand prices. The Trust is not actively managed and no attempt will be made to buy or sell South African Rand to protect against or to take advantage of fluctuations in the price of the South African Rand. Consequently, if the Trust incurs expenses in USD, the Trust’s South African Rand may be sold at a time when the South African Rand price is low, resulting in a negative effect on the value of the Shares.

4

Table of Contents

Purchasing activity in the South African Rand market associated with the purchase of Baskets from the Trust may cause a temporary increase in the price of the South African Rand. This increase may adversely affect an investment in the Shares.

Purchasing activity associated with acquiring the South African Rand required for deposit into the Trust in connection with the creation of Baskets may temporarily increase the market price of South African Rand, which will result in higher prices for the Shares. Temporary increases in the market price of the South African Rand may also occur as a result of the purchasing activity of other market participants. Other market participants may attempt to benefit from an increase in the market price of South African Rand that may result from increased purchasing activity of South African Rand connected with the issuance of Baskets. Consequently, the market price of South African Rand may decline immediately after Baskets are created. If the price of South African Rand declines, then it is anticipated that the trading price of the Shares will also decline. In addition, if the Trust experiences a significant increase in its expenses due to an unexpected event, then it is anticipated that the unexpected expenses would reduce the NAV of the Trust, which would cause the trading price of the Shares to decline even if the price of South African Rand did not decline.

The Deposit Accounts are not entitled to payment at any office of JPMorgan Chase Bank, N.A. located in the United States.

The federal laws of the United States prohibit banks located in the United States from paying interest on unrestricted demand deposit accounts. Therefore, payments out of the Deposit Accounts will be payable only at the London branch of JPMorgan Chase Bank, N.A., located in England. The Trustee will not be entitled to demand payment of these accounts at any office of JPMorgan Chase Bank, N.A. that is located in the United States. JPMorgan Chase Bank, N.A. will not be required to repay the deposit if its London branch cannot repay the deposit due to an act of war, insurrection or civil strife or an action by a foreign government or instrumentality (whether de jure or de facto) in England.

Shareholders will not have the protections associated with ownership of a demand deposit account insured in the United States by the Federal Deposit Insurance Corporation nor the full protection provided for bank deposits under English law.

Neither the Shares nor the Deposit Accounts and the South African Rand deposited in them are deposits insured against loss by the FDIC or any other federal agency. Deposits may have only limited protection under the Financial Services Compensation Scheme of England.

If the Depository becomes insolvent, its assets may not be adequate to satisfy a claim by the Trust or any Authorized Participant. In addition, in the event of the insolvency of the Depository or the U.S. bank of which it is a branch, there may be a delay and costs incurred in recovering the South African Rand held in the Deposit Accounts.

South African Rand deposited in the Deposit Accounts by an Authorized Participant will be commingled with South African Rand deposited by other Authorized Participants and will be held by the Depository in either the primary deposit account or the secondary deposit account of the Trust. South African Rand held in the Deposit Accounts will not be segregated from the Depository’s other assets.

The Trust will have no proprietary rights in or to any specific South African Rand held by the Depository and will be an unsecured creditor of the Depository with respect to the South African Rand held in the Deposit Accounts in the event of the insolvency of the Depository or the U.S. bank of which it is a branch. In the event the Depository or the U.S. bank of which it is a branch becomes insolvent, the Depository’s assets might not be adequate to satisfy a claim by the Trust or any Authorized Participant for the amount of South African Rand deposited by the Trust or the Authorized Participant and, in such event, the Trust and any Authorized Participant will generally have no right in or to assets other than those of the Depository.

In the case of insolvency of the Depository or JPMorgan Chase Bank, N.A., the U.S. bank of which the Depository is a branch, a liquidator may seek to freeze access to the South African Rand held in all accounts by the Depository,

5

Table of Contents

including the Deposit Accounts. The Trust and the Authorized Participants could incur expenses and delays in connection with asserting their claims. These problems would be exacerbated by the reality that the Deposit Accounts will not be held in the U.S. but instead will be held at the London branch of a U.S. national bank, where it will be subject to English insolvency law. Further, under U.S. law, in the case of the insolvency of JPMorgan Chase Bank, N.A., the claims of creditors in respect of accounts (such as the Trust’s Deposit Accounts) that are maintained with an overseas branch of JPMorgan Chase Bank, N.A. will be subordinate to claims of creditors in respect of accounts maintained with JPMorgan Chase Bank, N.A. in the U.S., greatly increasing the risk that the Trust and the Trust’s beneficiaries would suffer a loss.

Shareholders will not have the protections associated with ownership of shares in an investment company registered under the Investment Company Act.

The Investment Company Act is designed to protect investors by preventing: insiders from managing investment companies to their benefit and to the detriment of public investors; the issuance of securities having inequitable or discriminatory provisions; the management of investment companies by irresponsible persons; the use of unsound or misleading methods of computing earnings and asset value; changes in the character of investment companies without the consent of investors; and investment companies from engaging in excessive leveraging. To accomplish these ends, the Investment Company Act requires the safekeeping and proper valuation of fund assets, restricts greatly transactions with affiliates, limits leveraging, and imposes governance requirements as a check on fund management.

The Trust is not registered as an investment company under the Investment Company Act and is not required to register under that act. Consequently, Shareholders will not have the regulatory protections afforded to investors in registered investment companies.

Shareholders will not have the rights enjoyed by investors in certain other financial instruments.

As interests in a grantor trust, the Shares will have none of the statutory rights normally associated with the ownership of shares of a business corporation, including, for example, the right to bring “oppression” or “derivative” actions. Apart from the rights afforded to them by federal and state securities laws, Shareholders have only those rights relative to the Trust, the Trust property and the Shares that are set forth in the Depositary Trust Agreement. In this connection, the Shareholders have limited voting and distribution rights. They do not have the right to elect directors. See “Business – The Shares – Limited Rights” for a description of the limited rights of the Shareholders.

The Shares may trade at a price which is at, above, or below the NAV per Share.

The NAV per Share fluctuates with changes in the market value of the Trust’s assets. The market price of Shares can be expected to fluctuate in accordance with changes in the NAV per Share, but also in response to market supply and demand. As a result, the Shares might trade at prices at, above or below the NAV per Share.

The Depository owes no fiduciary duties to the Trust or the Shareholders, is not required to act in their best interest and could resign or be removed by the Sponsor, which would trigger early termination of the Trust.

The Depository is not a trustee for the Trust or the Shareholders. As stated above, the Depository is not obligated to maximize the interest rate paid to the Trust. In addition, the Depository has no duty to continue to act as the depository of the Trust. The Depository could terminate its role as depository for any reason whatsoever upon 90 days’ notice to the Trust. Such a termination might result, for example, if the Sponsor determines that the interest rate paid by the Depository is inadequate. In the event that the Depository was to resign or be removed, the Trust will be terminated.

6

Table of Contents

Shareholders may incur significant fees upon the termination of the Trust.

The occurrence of any one of several events would either require the Trust to terminate or permit the Sponsor to terminate the Trust. For example, if the Depository were to resign or be removed, then the Sponsor would be required to terminate the Trust. Shareholders tendering their Shares within 90 days of the Trust’s termination will receive the amount of South African Rand represented by their Shares. Shareholders may incur significant fees if they choose to convert the South African Rand they receive to USD.

Redemption orders are subject to rejection by the Trustee under certain circumstances.

The Trustee will reject a redemption order if the order is not in proper form as described in the Participant Agreement or if the fulfillment of the order, in the opinion of its counsel, might be unlawful. Any such rejection could adversely affect a redeeming Shareholder. For example, the resulting delay would adversely affect the value of the Shareholder’s redemption distribution if the NAV were to decline during the delay. In the Depositary Trust Agreement, the Sponsor and the Trustee disclaim any liability for any loss or damage that may result from any such rejection.

Substantial sales of South African Rand by the official sector could adversely affect an investment in the Shares.

The official sector consists of central banks, other governmental agencies and multi-lateral institutions that buy, sell and hold South African Rand as part of their reserve assets. The official sector holds a significant amount of South African Rand that can be mobilized in the open market. In the event that future economic, political or social conditions or pressures require members of the official sector to sell their South African Rand simultaneously or in an uncoordinated manner, the demand for South African Rand might not be sufficient to accommodate the sudden increase in the supply of South African Rand to the market. Consequently, the price of the South African Rand could decline, which would adversely affect an investment in the Shares.

Shareholders that are not Authorized Participants may only purchase or sell their Shares in secondary trading markets.

Only Authorized Participants may create or redeem Baskets through the Trust. All other investors that desire to purchase or sell Shares must do so through NYSE Arca or in other markets, if any, in which the Shares may be traded.

The liability of the Sponsor and the Trustee under the Depositary Trust Agreement is limited and, except as set forth in the Depositary Trust Agreement, they are not obligated to prosecute any action, suit or other proceeding in respect of any Trust property.

The Depositary Trust Agreement provides that neither the Sponsor nor the Trustee assumes any obligation or is subject to any liability under the Trust Agreement to any Shareholder, except that they each agree to perform their respective obligations specifically set forth in the Depositary Trust Agreement without negligence or bad faith. Additionally, neither the Sponsor nor the Trustee is obligated to, although each may in its respective discretion, prosecute any action, suit or other proceeding in respect of any Trust property. The Depositary Trust Agreement does not confer upon Shareholders the right to prosecute any such action, suit or other proceeding.

The Depositary Trust Agreement may be amended to the detriment of Shareholders without their consent.

The Sponsor and the Trustee may amend most provisions (other than those addressing core economic rights) of the Depositary Trust Agreement without the consent of any Shareholder. Such an amendment could impose or increase fees or charges borne by the Shareholders. Any amendment that increases fees or charges (other than taxes and other governmental charges, registration fees or other expenses), or that otherwise prejudices any substantial existing rights of Shareholders, will not become effective until 30 days after written notice is given to Shareholders.

The License Agreement with The Bank of New York Mellon may be terminated by The Bank of New York Mellon in the event of a material breach. Termination of the License Agreement might lead to early termination and liquidation of the Trust.

7

Table of Contents

The Bank of New York Mellon and an affiliate of the Sponsor have entered into a License Agreement granting the Sponsor’s affiliate a license to certain patent applications made by The Bank of New York Mellon covering systems and methods for securitizing a commodity. The Sponsor’s affiliate has sublicensed the license to the Sponsor. The license is limited to a non-exclusive grant for the life of The Bank of New York Mellon’s patents and patent applications. The License Agreement provides that each of the parties may provide notice of intent to terminate the License Agreement in the event the other party commits a material breach. If the License Agreement is terminated and one or more of The Bank of New York Mellon’s patent applications issue as patents, then The Bank of New York Mellon may claim that the operation of the Trust violates its patent or patents and seek an injunction forcing the Trust to cease operation and the Shares to cease trading. In that case, the Trust might be forced to terminate and liquidate, which would adversely affect Shareholders.

Item 1B. Unresolved Staff Comments

None.

The principal offices of the Sponsor and the Trust are at 805 King Farm Boulevard, Suite 600, Rockville, Maryland 20850 which is leased by an affiliate of the Sponsor. Neither the Sponsor nor the Trust owns or leases any other property.

None.

Item 4. (Removed and Reserved)

8

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Not applicable.

Item 6. Selected Financial Data

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement Regarding Forward-Looking Information

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate” and other similar words. Forward-looking statements are based upon our current expectations and beliefs concerning future developments and their potential effects on us. Such forward-looking statements are not guarantees of future performance. Various factors may cause our actual results to differ materially from those expressed in our forward-looking statements. These factors include fluctuations in the price of the South African Rand, as the value of the Shares relates directly to the value of the South African Rand held by the Trust and price fluctuations could materially adversely affect an investment in the Shares. Readers are urged to review the “Risk Factors” section in this report for a description of other risks and uncertainties that may affect an investment in the Shares.

Neither Guggenheim Specialized Products, LLC d/b/a Guggenheim Investments (the “Sponsor”) nor any other person assumes responsibility for the accuracy or completeness of forward-looking statements contained in this report. The forward-looking statements are made as of the date of this report, and will not be revised or updated to reflect actual results or changes in the Sponsor’s expectations or predictions.

Movements in the Price of South African Rand

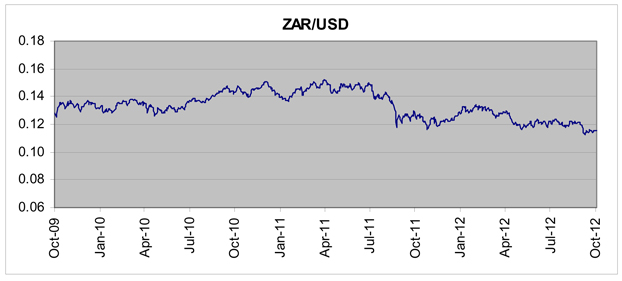

The investment objective of the Trust is for the Shares to reflect the price in USD of the South African Rand plus accrued interest, less the expenses of the Trust’s operations. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding South African Rand. Each outstanding Share represents a proportional interest in the South African Rand held by the Trust. The following chart illustrates recent movements in the price of South African Rand in USD as reported by the Bloomberg Professional service.

9

Table of Contents

Liquidity

The Sponsor is not aware of any trends, demands, conditions or events that are reasonably likely to result in material changes to the Trust’s liquidity needs. The Trust did not have any Authorized Participant creation activity during the year ended October 31, 2012. The balance reflected in the financial statements is seed capital from the Sponsor.

Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Sponsor’s management to make estimates and assumptions that affect the reported amounts of the assets and liabilities and disclosures of contingent liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period covered by this report.

In addition to the description below, please refer to Note 2 to the consolidated financial statements for further discussion of our accounting policies.

The functional currency of the Trust is the South African Rand in accordance with ASC 830, Foreign Currency Translation.

Results of Operations

No additional shares were created or redeemed during the years ended October 31, 2010, October 31, 2011 or October 31, 2012. As of October 31, 2010, the number of South African Rand owned by the Trust was 1,000 resulting in a redeemable capital share value of $144. As of October 31, 2011, the number of South African Rand owned by the Trust was 1,000 resulting in a redeemable capital share value of $127. As of October 31, 2012, the number of Singapore Dollars owned by the Trust was 1,000 resulting in a redeemable capital share value of $115.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Except as described above with respect to the USD/South African Rand exchange rate and the nominal annual interest rate to be paid by the Depository on South African Rand held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.

Item 8. Financial Statements and Supplementary Data

See Index to Financial Statements on page F-1 for a list of the financial statements filed with this report.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

The chief executive officer and chief financial officer of the Sponsor have evaluated the effectiveness of the Trust’s disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of October 31, 2012. Based on that evaluation, the chief executive officer and chief financial officer of the Sponsor have concluded that the disclosure controls and procedures of the Trust were effective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

The Sponsor’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined under Rules 13a-15(f) and 15d-15(f) of the Exchange Act. The Trust’s internal control over financial reporting is based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States. Internal control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Trust’s assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in

10

Table of Contents

accordance with generally accepted accounting principles, and that the Trust’s receipts and expenditures are being made only in accordance with appropriate authorizations; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Trust’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become ineffective because of changes in conditions, or that the degree of compliance with policies or procedures may deteriorate.

The chief executive officer and chief financial officer of the Sponsor have assessed the effectiveness of the Trust’s internal control over financial reporting as of October 31, 2012. Their assessment included an evaluation of the design of the Trust’s internal control over financial reporting and testing of the operation effectiveness of its internal controls over financial reporting. Based on their assessment and those criteria, the chief executive officer and chief financial officer of the Sponsor believe that the Trust maintained effective internal control over financial reporting as of October 31, 2012.

Changes in Internal Control over Financial Reporting

There were no changes in the Trust’s internal control over financial reporting that occurred during the Trust’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Not applicable.

11

Table of Contents

Item 10. Directors, Executive Officers and Corporate Governance

Nikolaos Bonos and Joseph Arruda serve as the Chief Executive Officer and Chief Financial Officer of the Sponsor, respectively. The Sponsor’s Board of Managers is composed of Mr. Arruda, Mr. Bonos and Michael Byrum.

Nikolaos Bonos, 49, has been the Chief Executive Officer of the Sponsor since May 2009. Mr. Bonos has been a Manager of the Sponsor since September 2005. Prior to his appointment as Chief Executive Officer, Mr. Bonos served as the Chief Financial Officer of the Sponsor beginning in September 2005. Mr. Bonos has served as Executive Officer of Rydex Fund Services LLC, an affiliate of the Sponsor, from January 2009 to the present and as Senior Vice President of Rydex Fund Services LLC, from December 2003 to August 2006 and Vice President of Accounting of Rydex Fund Services LLC, from 2001 to December 2003. Mr. Bonos holds a Bachelor of Science in Business Administration with a major in Finance from Suffolk University.

Joseph Arruda, 46, has been the Chief Financial Officer of the Sponsor since May 2009. Mr. Arruda has been a Manager of the Sponsor since July 2009. Prior to his appointment as Chief Financial Officer, Mr. Arruda served as Vice President, Fund Accounting, and Administration, of the Sponsor beginning in 2003. From 1997 to 2003, Mr. Arruda served as Vice President, Fund Accounting at State Street Corporation. He holds a Bachelor of Science with a Finance and Accounting concentration from Bridgewater State College.

Michael Byrum, 42, has served as a Manager of the Sponsor since September 2005. Since August 2006, he has served as the Chief Investment Officer, of Rydex Advisors II, LLC (RAII), and Rydex Advisors, LLC (RA), affiliates of the Sponsor, and each of which were merged into Security Investors, LLC, also an affiliate of the Sponsor, as of January 3, 2011. Mr. Byrum served as the Executive Vice President of RAII from December 2002 to May 2004, and as President of RA from May 2004 until January 2011. He has served as Senior Vice President of Security Investors, LLC, since December 1, 2010. Mr. Byrum is a Chartered Financial Analyst and has a Bachelor of Science in Business Administration with a major in Finance from Miami University of Ohio.

Item 11. Executive Compensation

Not applicable.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

None.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Not applicable.

Item 14. Principal Accountant Fees and Services

The following fees were paid by the Sponsor and were for services performed by Ernst & Young LLP for the fiscal years ended October 31, 2012 and October 31, 2011:

| 2012 | 2011 | |||||||

| Audit Fees |

$ | 9,000 | $ | 9,000 | ||||

| Audit-related fees |

0 | 0 | ||||||

| Tax fees |

0 | 0 | ||||||

| All other Fees |

0 | 0 | ||||||

|

|

|

|

|

|||||

| $ | 9,000 | $ | 9,000 | |||||

|

|

|

|

|

|||||

12

Table of Contents

Item 15. Exhibits and Financial Statement Schedules

Financial Statements

See Index to Financial Statements on Page F-1 for a list of the financial statements being filed as a part of this report. Schedules have been omitted since they are either not required, not applicable or the information has otherwise been included.

Exhibits

| Exhibit No. |

Description | |

| 3.1 |

Certificate of Formation of Guggenheim Specialized Products, LLC dated September 14, 2005, incorporated herein by reference to 3.1 to the Registration Statement on Form S-1 (File No. 333-150685) filed by the Trust on May 7, 2008. | |

| 3.2 |

Amendment to Certificate of Formation of Guggenheim Specialized Products, LLC dated March 27, 2012. | |

| 3.3 |

Limited Liability Company Agreement of Guggenheim Specialized Products, LLC, incorporated herein by reference to 3.2 to the Registration Statement on Form S-1 (File No. 333-150685) filed by the Trust on May 7, 2008. | |

| 4.1 |

Depositary Trust Agreement dated as of August 7, 2008 among Guggenheim Specialized Products, LLC, The Bank of New York Mellon, all registered owners and beneficial owners of South African Rand Shares issued thereunder and all depositors, incorporated herein by reference to Exhibit 4.1 to the Annual Report on Form 10-K/A filed by the Trust on March 10, 2011. | |

| 4.2 |

Global Amendment to Depositary Trust Agreement dated as of March 6, 2012 between Guggenheim Specialized Products, LLC and The Bank of New York Mellon, incorporated herein by reference to Exhibit 4.1 to the Quarterly Report on Form 10-Q filed by the Trust on March 12, 2012. | |

| 4.3 |

Form of Participant Agreement, incorporated herein by reference to Exhibit 4.2 to the Annual Report on Form 10-K filed by the Trust on January 13, 2012. | |

| 10.1 |

Deposit Account Agreement dated as of August 7, 2008 between The Bank of New York Mellon and the London Branch of JPMorgan Chase Bank, N.A. incorporated herein by reference to Exhibit 10.1 to the Annual Report on Form 10-K/A filed by the Trust on March 10, 2011. | |

| 10.2 |

Sublicense Agreement dated as of August 28, 2008 between PADCO Advisors II, Inc. and Guggenheim Specialized Products, LLC, incorporated herein by reference to Exhibit 10.2 to the Annual Report on Form 10-K/A filed by the Trust on March 10, 2011. | |

| 31.1 |

Certification by Principal Executive Officer pursuant to Section 302(a) of the Sarbanes-Oxley Act of 2002. | |

| 31.2 |

Certification by Principal Financial Officer pursuant to Section 302(a) of the Sarbanes-Oxley Act of 2002. | |

| 32.1 |

Certification by Principal Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2 |

Certification by Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 101.INS |

XBRL Instance Document. | |

| 101.SCH |

XBRL Taxonomy Extension Schema Document. | |

| 101.CAL |

XBRL Taxonomy Extension Calculation Linkbase Document. | |

| 101.DEF |

XBRL Taxonomy Extension Definition Linkbase Document. | |

| 101.LAB |

XBRL Taxonomy Extension Label Linkbase Document. | |

| 101.PRE |

XBRL Taxonomy Extension Presentation Linkbase Document. | |

13

Table of Contents

CurrencyShares® South African Rand Trust

Financial Statements as of October 31, 2012

| Page | ||||

| F-2 | ||||

| Statements of Financial Condition at October 31, 2012 and October 31, 2011 |

F-3 | |||

| F-4 | ||||

| F-5 | ||||

| F-6 | ||||

| F-7 | ||||

F-1

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders of CurrencyShares® South African Rand Trust:

We have audited the accompanying statements of financial condition of CurrencyShares® South African Rand Trust (the “Trust”) as of October 31, 2012 and 2011, and the related statements of income and comprehensive income, changes in shareholders’ equity, and cash flows for the three years in the period ended October 31, 2012. These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Trust’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of CurrencyShares® South African Rand Trust at October 31, 2012 and 2011, and the results of its operations and its cash flows for each of the three years in the period ended October 31, 2012, in conformity with U.S. generally accepted accounting principles.

| /s/ Ernst & Young LLP |

McLean, VA

January 14, 2013

F-2

Table of Contents

CurrencyShares® South African Rand Trust

Statements of Financial Condition

| October 31, 2012 | October 31, 2011 | |||||||

| Assets |

||||||||

| Current Assets: |

||||||||

| South African Rand deposits, interest bearing |

$ | — | $ | — | ||||

| South African Rand deposits, non-interest bearing |

115 | 127 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 115 | $ | 127 | ||||

|

|

|

|

|

|||||

| Liabilities, Redeemable Capital Shares and Shareholders’ Equity |

||||||||

| Current Liabilities |

$ | — | $ | — | ||||

| Commitments and Contingent Liabilities (note 8) |

— | — | ||||||

| Redeemable Capital Shares, at redemption value, no par value, 10,150,000 authorized - 1 issued and outstanding |

115 | 127 | ||||||

| Shareholders’ Equity: |

||||||||

| Retained Earnings |

— | — | ||||||

| Cumulative Translation Adjustment |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities, Redeemable Capital Shares and Shareholders’ Equity |

$ | 115 | $ | 127 | ||||

|

|

|

|

|

|||||

See Notes to Financial Statements.

F-3

Table of Contents

CurrencyShares® South African Rand Trust

Statements of Income and Comprehensive Income

| Year ended October 31, 2012 |

Year ended October 31, 2011 |

Year ended October 31, 2010 |

||||||||||

| Income |

||||||||||||

| Total Income |

$ | — | $ | — | $ | — | ||||||

| Expenses |

||||||||||||

|

|

|

|

|

|

|

|||||||

| Total Expenses |

— | — | — | |||||||||

| Net Income |

$ | — | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| Other Comprehensive (Loss)/Income: |

||||||||||||

| Currency translation adjustment |

(12 | ) | (17 | ) | 16 | |||||||

|

|

|

|

|

|

|

|||||||

| Total Comprehensive (Loss)/Income |

$ | (12 | ) | $ | (17 | ) | $ | 16 | ||||

|

|

|

|

|

|

|

|||||||

| Basic and Diluted Earnings per share |

$ | 0 | $ | 0 | $ | 0 | ||||||

| Weighted-average Shares Outstanding |

1 | 1 | 1 | |||||||||

| Cash Dividends per Share |

$ | 0 | $ | 0 | $ | 0 | ||||||

See Notes to Financial Statements.

F-4

Table of Contents

CurrencyShares® South African Rand Trust

Statements of Changes in Shareholders’ Equity

| Year ended October 31, 2012 |

Year ended October 31, 2011 |

Year ended October 31, 2010 |

||||||||||

| Retained Earnings, Beginning of Year |

$ | — | $ | — | $ | — | ||||||

| Net Income |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Retained Earnings, End of Year |

$ | — | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| Cumulative Translation Adjustment, Beginning of Year |

$ | — | $ | — | $ | — | ||||||

| Currency translation adjustment |

(12 | ) | (17 | ) | 16 | |||||||

| Adjustment of redeemable capital shares to redemption value |

12 | 17 | (16 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Cumulative Translation Adjustment, End of Year |

$ | — | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

See Notes to Financial Statements.

F-5

Table of Contents

CurrencyShares® South African Rand Trust

Statements of Cash Flows

| Year ended October 31, 2012 |

Year ended October 31, 2011 |

Year ended October 31, 2010 |

||||||||||

| Cash flows from operating activities |

||||||||||||

|

|

|

|

|

|

|

|||||||

| Net cash provided by operating activities |

$ | — | $ | — | $ | — | ||||||

| Cash flows from financing activities |

||||||||||||

|

|

|

|

|

|

|

|||||||

| Net cash provided by financing activities |

— | — | — | |||||||||

| Adjustment to period cash flows due to currency movement |

(12 | ) | (17 | ) | 16 | |||||||

|

|

|

|

|

|

|

|||||||

| (Decrease)/Increase in cash |

(12 | ) | (17 | ) | 16 | |||||||

| Cash at beginning of year |

127 | 144 | 128 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash at end of year |

$ | 115 | $ | 127 | $ | 144 | ||||||

|

|

|

|

|

|

|

|||||||

See Notes to Financial Statements.

F-6

Table of Contents

CurrencyShares® South African Rand Trust

Notes to Financial Statements

| 1. | Organization and Description of the Trust |

The CurrencyShares® South African Rand Trust (the “Trust”) was formed under the laws of the State of New York on August 7, 2008. On August 8, 2008, Guggenheim Specialized Products, LLC d/b/a “Guggenheim Investments” (the “Sponsor”) deposited 1,000 South African Rand in the Trust’s primary deposit account held by JPMorgan Chase Bank, N.A., London Branch (the “Depository”). The Sponsor is a Delaware limited liability company whose sole member is Security Investors, LLC (also d/b/a “Guggenheim Investments”). The Sponsor is responsible for, among other things, overseeing the performance of The Bank of New York Mellon (the “Trustee”) and the Trust’s principal service providers, including the preparation of financial statements. The Trustee is responsible for the day-to-day administration of the Trust.

The investment objective of the Trust is for the Trust’s shares (the “Shares”) to reflect the price of the South African Rand plus accrued interest less the Trust’s expenses and liabilities. The Shares are intended to provide investors with a simple, cost-effective means of gaining investment benefits similar to those of holding the South African Rand. The Trust’s assets primarily consist of South African Rand on demand deposit in two deposit accounts maintained by the Depository: a primary deposit account which may earn interest and a secondary deposit account which does not earn interest. The secondary deposit account is used to account for any interest that may be received and paid out on creations and redemptions of 50,000 Shares (“Baskets”). The secondary account is also used to account for interest earned, if any, on the primary deposit account, pay Trust expenses and distribute any excess interest to holders of Shares (“Shareholders”) on a monthly basis.

The accompanying audited financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

| 2. | Significant Accounting Policies |

| A. | Use of Estimates |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of the assets, liabilities and disclosures of contingent liabilities at the date of the financial statements, the reported amounts of revenue and expenses during the period and the evaluation of subsequent events through the issuance date of the financial statements. Actual results could differ from those estimates.

| B. | Foreign Currency Translation |

The Trustee will calculate the Trust’s net asset value (“NAV”) each business day, as described in Note 4. For NAV calculation purposes, South African Rand deposits (cash) are translated at the Closing Spot Rate, which is the U.S. Dollar (“USD”)/South African Rand exchange rate as determined by The World Markets Company PLC, a State Street business, at 4:00 PM (London fixing) on each day that NYSE Arca is open for regular trading.

The functional currency of the Trust is the South African Rand in accordance with generally accepted accounting standards. For financial statement reporting purposes, the U.S. Dollar is the reporting currency. As a result, the financial records of the Trust are translated from South African Rand to USD. The Closing Spot Rate on the last day of the period is used for translation in the statements of financial condition. The average Closing Spot Rate for the period is used for translation in the statements of income and comprehensive income and the statements of cash flows. Any currency translation adjustment is included in comprehensive income.

F-7

Table of Contents

| C. | Federal Income Taxes |

The Trust is treated as a “grantor trust” for federal income tax purposes and, therefore, no provision for federal income taxes is required. Interest, gains and losses are passed through to the Shareholders.

Shareholders generally will be treated, for U.S. federal income tax purposes, as if they directly owned a pro-rata share of the assets held in the Trust. Shareholders also will be treated as if they directly received their respective pro-rata portion of the Trust’s income, if any, and as if they directly incurred their respective pro-rata portion of the Trust’s expenses. The acquisition of Shares by a U.S. Shareholder as part of a creation of a Basket will not be a taxable event to the Shareholder.

The Sponsor’s fee accrues daily and is payable monthly. For U.S. federal income tax purposes, an accrual-basis U.S. Shareholder generally will be required to take into account as an expense its allocable portion of the USD-equivalent of the amount of the Sponsor’s fee that is accrued on each day, with such USD-equivalent being determined by the currency exchange rate that is in effect on the respective day. To the extent that the currency exchange rate on the date of payment of the accrued amount of the Sponsor’s fee differs from the currency exchange rate in effect on the day of accrual, the U.S. Shareholder will recognize a currency gain or loss for U.S. federal income tax purposes.

The Trust does not expect to generate taxable income except for interest income (if any) and gain (if any) upon the sale of South African Rand. A non-U.S. Shareholder generally will not be subject to U.S. federal income tax with respect to gain recognized upon the sale or other disposition of Shares, or upon the sale of South African Rand by the Trust, unless: (1) the non-U.S. Shareholder is an individual and is present in the United States for 183 days or more during the taxable year of the sale or other disposition, and the gain is treated as being from United States sources; or (2) the gain is effectively connected with the conduct by the non-U.S. Shareholder of a trade or business in the United States.

A non-U.S. Shareholder’s portion of any interest income earned by the Trust generally will not be subject to U.S. federal income tax unless the Shares owned by such non-U.S. Shareholder are effectively connected with the conduct by the non-U.S. Shareholder of a trade or business in the United States.

| D. | Revenue Recognition |

Interest on the primary deposit account, if any, accrues daily as earned and is received on a monthly basis.

| E. | Dividends |

To the extent that the interest earned by the Trust, if any, exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trust will distribute, as a dividend, the excess interest earned in South African Rand effective on the first business day of the subsequent month. The Trustee will direct that the excess South African Rand be converted into USD at a prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own).

| 3. | South African Rand Deposits |

South African Rand principal deposits are held in a South African Rand-denominated, interest-bearing demand account. For the year ended October 31, 2012, there were no South African Rand principal deposits and no South African Rand principal redemptions resulting in an ending South African Rand balance of 1,000. This equates to 115 USD. For the year ended October 31, 2011, there were no South African Rand principal deposits and no South African Rand principal redemptions resulting in an ending South African Rand balance of 1,000. This equates to 127 USD. For the year ended October 31, 2010, there were no South African Rand principal deposits and no South African Rand principal redemptions resulting in an ending South African Rand balance of 1,000. This equates to 144 USD.

F-8

Table of Contents

| 4. | Redeemable Capital Shares |

Shares are classified as “redeemable” for financial statement purposes, since they are subject to redemption. Shares are issued and redeemed continuously in Baskets in exchange for South African Rand. Individual investors cannot purchase or redeem Shares in direct transactions with the Trust. Only Authorized Participants (as defined below) may place orders to create and redeem Baskets. An Authorized Participant is a participant of the Depository Trust Company (“DTC”) that is a registered broker-dealer or other institution eligible to settle securities transactions through the book-entry facilities of DTC and which has entered into a contractual arrangement with the Trust and the Sponsor governing, among other matters, the creation and redemption process. Authorized Participants may redeem their Shares at any time in Baskets.

Due to expected continuing creations and redemptions of Baskets and the three-day period for settlement of each creation or redemption, the Trust reflects Shares created as a receivable. Shares redeemed are reflected as a liability on the trade date. Outstanding Shares are reflected at a redemption value, which is the NAV per Share at the period end date. Adjustments to redeemable capital Shares at redemption value are recorded against retained earnings or, in the absence of retained earnings, by charges against the cumulative translation adjustment.

Activity in redeemable capital Shares is as follows:

| Year ended October 31, 2012 |

Year ended October 31, 2011 |

Year ended October 31, 2010 |

||||||||||||||||||||||

| Shares | U.S. Dollar Amount |

Shares | U.S. Dollar Amount |

Shares | U.S. Dollar Amount |

|||||||||||||||||||

| Opening balance |

1 | $ | 127 | 1 | $ | 144 | 1 | $ | 128 | |||||||||||||||

| Shares issued |

— | — | — | — | — | — | ||||||||||||||||||

| Shares redeemed |

— | — | — | — | — | — | ||||||||||||||||||

| Adjustment to period Shares due to currency movement and other |

— | (12 | ) | — | (17 | ) | — | 16 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ending balance |

1 | $ | 115 | 1 | $ | 127 | 1 | $ | 144 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The Trustee will calculate the Trust’s NAV each business day. To calculate the NAV, the Trustee will subtract the Sponsor’s accrued fee through the previous day from the South African Rand held by the Trust (including all unpaid interest accrued through the preceding day) and calculate the value of the South African Rand in USD based upon the Closing Spot Rate. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent Closing Spot Rate will be used to determine the NAV of the Trust unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for the valuation. If the Trustee and the Sponsor determine that the most recent Closing Spot Rate is not an appropriate basis for valuation of the Trust’s South African Rand, they will determine an alternative basis for the valuation. The Trustee also determines the NAV per Share, which equals the NAV of the Trust, divided by the number of outstanding Shares. Shares deliverable under a purchase order are considered outstanding for purposes of determining NAV per Share; Shares deliverable under a redemption order are not considered outstanding for this purpose.

| 5. | Sponsor’s Fee |

The Sponsor’s fee will accrue daily at an annual nominal rate of 0.40% of the South African Rand in the Trust (including all unpaid interest but excluding unpaid fees, each as accrued through the immediately preceding day) and will be paid monthly.

The Sponsor assumes and pays the following administrative and marketing expenses incurred by the Trust: the Trustee’s monthly fee, NYSE Arca listing fees, SEC registration fees, typical maintenance and transaction fees of the Depository, printing and mailing costs, audit fees and expenses, up to $100,000 per year in legal fees and expenses, and applicable license fees.

F-9

Table of Contents

In certain exceptional cases the Trust will pay for some expenses in addition to the Sponsor’s fee. These exceptions include expenses not assumed by the Sponsor (i.e., expenses other than those identified in the preceding paragraph), taxes and governmental charges, expenses and costs of any extraordinary services performed by the Trustee or the Sponsor on behalf of the Trust or action taken by the Trustee or the Sponsor to protect the Trust or the interests of Shareholders, indemnification of the Sponsor under the Depositary Trust Agreement, and legal expenses in excess of $100,000 per year.

| 6. | Related Parties |

The Sponsor is a related party of the Trust. The Sponsor oversees the performance of the Trustee and the Trust’s principal service providers, including the preparation of financial statements, but does not exercise day-to-day oversight over the Trustee or the Trust’s service providers.

| 7. | Concentration Risk |

All of the Trust’s assets are South African Rand, which creates a concentration risk associated with fluctuations in the price of the South African Rand. Accordingly, a decline in the South African Rand to USD exchange rate will have an adverse effect on the value of the Shares. Factors that may have the effect of causing a decline in the price of the South African Rand include national debt levels and trade deficits, domestic and foreign inflation rates, domestic and foreign interest rates, investment and trading activities of institutions and global or regional political, economic or financial events and situations. Substantial sales of South African Rand by the official sector (central banks, other governmental agencies and related institutions that buy, sell and hold South African Rand as part of their reserve assets) could adversely affect an investment in the Shares.

All of the Trust’s South African Rand are held by the Depository. Accordingly, a risk associated with the concentration of the Trust’s assets in accounts held by a single financial institution exists and increases the potential for loss by the Trust and the Trust’s beneficiaries in the event that the Depository becomes insolvent.

| 8. | Commitments and Contingencies |

Under the Trust’s organizational documents, the Sponsor is indemnified against any liability or expense it incurs without negligence, bad faith or willful misconduct on its part. The Trust’s maximum exposure under this arrangement is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

F-10

Table of Contents

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Rockville, State of Maryland, on January 14, 2013.

| CURRENCYSHARES® | ||

| SOUTH AFRICAN RAND TRUST | ||

| By | Guggenheim Specialized Products, LLC | |

| Sponsor of the CurrencyShares® | ||

| South African Rand Trust | ||

| By: | /S/ NIKOLAOS BONOS | |

| Nikolaos Bonos Chief Executive Officer | ||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons son behalf of the registrant and in the capacities* and on the dates indicated.

| Signature |

Capacity |

Date | ||

| /S/ NIKOLAOS BONOS Nikolaos Bonos |

Director and Chief Executive Officer (principal executive officer) |

January 14, 2013 | ||

| /S/ JOSEPH ARRUDA Joseph Arruda |

Director and Chief Financial Officer (principal financial officer and principal accounting officer) |

January 14, 2013 | ||

| /S/ MICHAEL BYRUM Michael Byrum |

Director |

January 14, 2013 | ||

| * | The registrant is a trust and the persons are signing in their capacities as officers or directors of Guggenheim Specialized Products, LLC, the Sponsor of the registrant. |