Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ADA-ES INC | d466896d8k.htm |

| EX-99.2 - PRESS RELEASE, ADA-ES, INC. TO PRESENT AT 15TH ANNUAL NEEDHAM GROWTH CONFERENCE - ADA-ES INC | d466896dex992.htm |

Investor Presentation

January 2013

Exhibit 99.1 |

Safe

Harbor ©

2013 ADA-ES, Inc.

This presentation includes forward-looking statements within the meaning of Section

21E of the Securities Exchange Act of 1934, which provides a "safe

harbor" for such statements in certain circumstances. The

forward-looking statements include statements or expectations regarding future

contracts, projects, demonstrations and technologies; amount and timing of

production of RC, revenues, earnings, cash flows and other financial measures;

future operations; our ability to capitalize on and expand our business to meet

opportunities in our target markets and profit from our proprietary technologies;

scope, timing and impact of current and anticipated regulations, legislation and

IRS guidance; future supply and demand; the ability of our technologies to assist

our customers in complying with government regulations and related matters. These

statements are based on current expectations, estimates, projections, beliefs and

assumptions of our management. Such statements involve significant risks and

uncertainties. Actual events or results could differ materially from those

discussed in the forward-looking statements as a result of various factors, including but

not limited to, changes in laws, regulations and IRS interpretations or guidance,

government funding, accounting rules, prices, economic conditions and market

demand; timing of laws, regulations and any legal challenges to or repeal of

them; failure of the RC facilities to produce coal that qualifies for tax credits;

termination of or amendments to the contracts for RC facilities; decreases in the

production of RC; failure to lease or sell the remaining RC facilities on a

timely basis; failure of the new expected RC investor to close on its debt

restructuring or obtain the PLR from the IRS; our inability to ramp up operations to effectively

address expected growth in our target markets; inability to commercialize our

technologies on favorable terms; impact of competition; availability, cost of

and demand for alternative tax credit vehicles and other technologies;

technical, start-up and operational difficulties; availability of raw materials and equipment; loss

of key personnel; intellectual property infringement claims from third parties;

seasonality and other factors discussed in greater detail in our filings with

the Securities and Exchange Commission (SEC). You are cautioned not to place

undue reliance on such statements and to consult our SEC filings for additional risks

and uncertainties that may apply to our business and the ownership of our securities.

Our forward-looking statements are presented as of the date made, and we

disclaim any duty to update such statements unless required by law to do so. |

A

leader in providing emission control solutions serving the power generation

industry for more than 30 years Offers customers a portfolio of proprietary, low

CAPEX technologies to meet pollution control mandates

ADA-ES, Inc. (“ADA”) currently has 16 patents issued or

applications allowed

Clients include leading electric power utilities

Expect significant revenue, earnings and cashflow growth as

utilities respond to new regulations

Investment Highlights

-2-

©

2013 ADA-ES, Inc. |

28

Refined Coal facilities that qualify for Section 45 Tax Credits of $6.47 /

ton (2012 rate) of coal burned for 9 years, ending December 31, 2021

Currently operating 8 facilities, 4 of which are leased to RC investors

and operating at plants that have historically burned more than 11

MT/year in total. ADA receives between $1.50-$2.00/ton of pre-tax

income after payments to JV partners.

In final stages of contracts with two RC investors for three facilities

operating at plants that have historically burned 10 MT/year in

total. Finalization of the contracts will also trigger more than

$20M

in prepayments.

New M-45-PC

™

technology significantly expands addressable market

for remaining 12 facilities.

Investment Highlights

-3-

©

2013 ADA-ES, Inc. |

Emissions Control driven by Federal Mercury and Air Toxics

Standard (MATS) regulation (April 2012) creates an

addressable market of $1 billion in the next three years.

Won fleet wide contract for Activated Carbon Injection (ACI) systems

from a major US utility.

Acquired the assets of Bulk Conveyor Systems in August 2012 to enhance

Dry Sorbent Injection (DSI) capabilities. Won DSI/ACI contract in

November 2012 valued at up to $15M.

Enhanced Coal offering helps reduce mercury-

long-term revenue

potential through royalty and user fees.

CO

2

Capture technology development business partnering

with U.S. DOE, Electric Power Research Institute (EPRI) and

Southern Company.

Investment Highlights

-4-

©

2013 ADA-ES, Inc. |

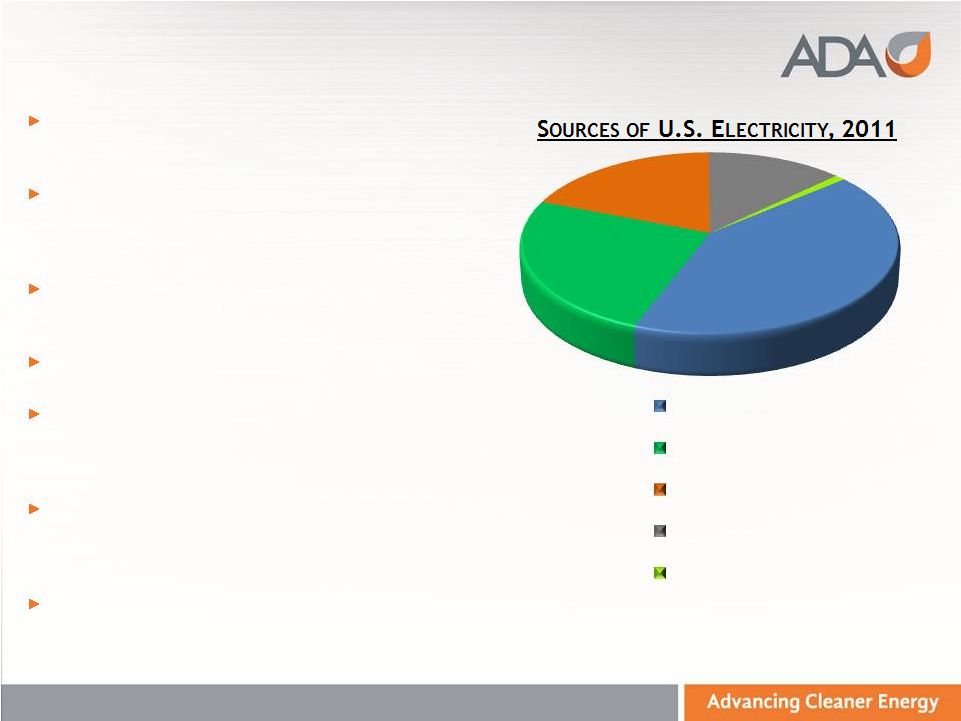

Source:

U.S. EIA, March 2012 Coal expected to provide ~ 40% of

America’s electricity in 2035 according

to Department of Energy

1,200 existing coal-fired power plants

in the US generate the majority of the

nation’s electricity, and consume

~ 900M to 1B tons of coal each year

EPRI estimates that the coal-fired

power industry will invest $275 billion

in retrofits through 2035

Lower coal prices benefit our

customers

11 new coal-fired power projects

currently have permits and are

expected to begin construction in the

next year

The energy in America’s recoverable

coal reserves is equivalent to 1 trillion

barrels of oil –

about equal 2/3rds of

the world’s known reserves

In order to maintain its leadership

position, coal must burn cleaner

Coal Energy

-5-

©

2013 ADA-ES, Inc.

19%

42%

13%

25%

Coal

Natural Gas

Nuclear

Renewables

Petroleum

1% |

Wet

Scrubber $100M+

ADA’s ACI = $1.0M

ADA’s DSI = $3.0M

Refined Coal

$0 cost to utility

Enhanced Coal

No capital equipment

$1.0 -

$4.0M / year in

higher producer fuel cost

Benefits of $1.0 -

$4.0 / ton

of Western Coal burned

-6-

©

2013 ADA-ES, Inc.

Emissions Control

Equipment

(NO

x

, SO2, Particulate)

ACI System for

mercury

Trades variable operating expenses for fixed capital costs

ADA’s offerings do not require 10-20 years of extended plant life to justify

purchase VALUE PROPOSITION: Allows continued operation of plants that may otherwise be considered for closure LOW CAPEX EMISSIONS SOLUTIONS FOR EXISTING FLEET |

-7-

©

2013 ADA-ES, Inc.

Enhanced Coal

Refined Coal

Flue Gas

Conditioning

Dry Sorbent

Injection (DSI)

Activated Carbon

Injection (ACI)

Filter

or ESP

SCR

DeNOx

Air

Preheater

Boiler

Flue Gas Desulfurization

(FGD) Scrubber

Coal

Bunker

PORTFOLIO OF MISSIONS CONTROL SOLUTIONS E

Scrubber

Additive |

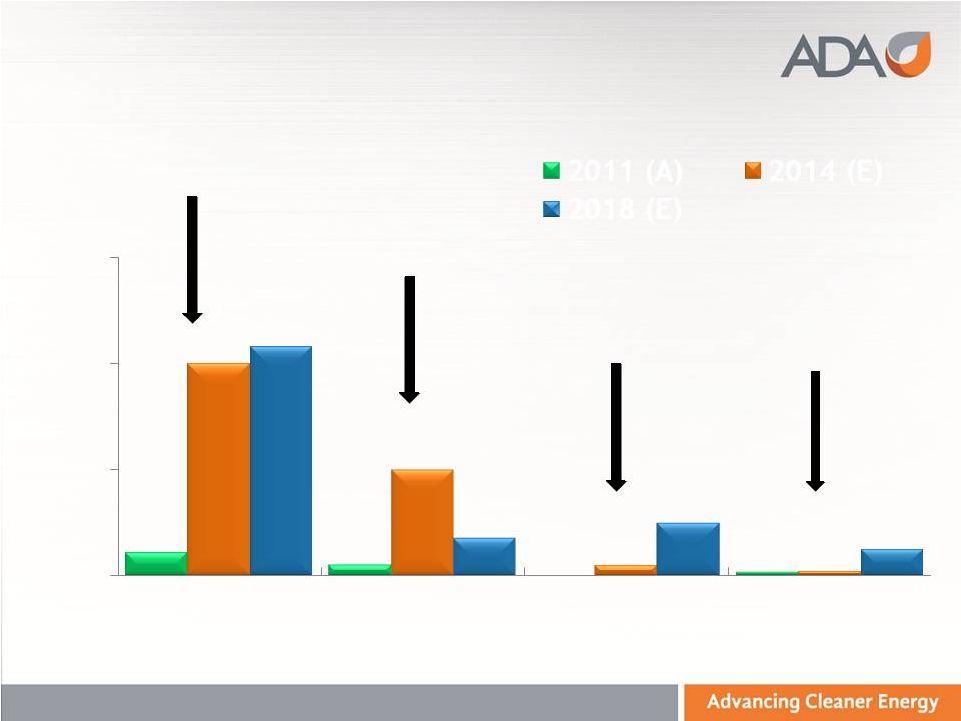

Up to 28

RC facilities operational / monetized

by 2014

MATS response by

utilities

ADA maintaining 35%

market share

DOE Contracts

CO

2

Capture Pilot Plant

MATS and License with

Arch Coal

ACI/DSI

1)

RC amounts exclude

RC coal sales revenues

(1)

-8-

©

2013 ADA-ES, Inc.

CO

2

Capture

Enhanced Coal

Emissions Control

Equipment

Refined Coal

$300

$200

$100

$0

2011 (A)

2018 (E)

2014 (E)

(ANNUAL REVENUE

$

IN

M)

SEGMENT REVENUES (2011)

+ OUTLOOK |

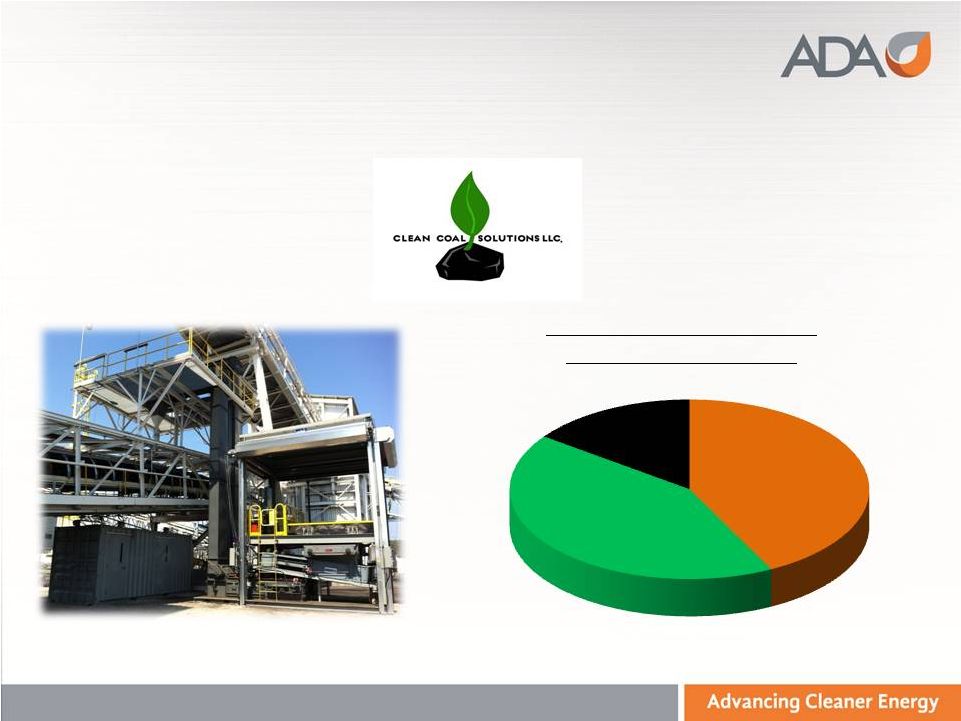

CLEAN COAL

SOLUTIONS, LLC (CCS)

NEXGEN

42.5%

ADA

42.5%

GOLDMAN

SACHS

15%

-9-

©

2013 ADA-ES, Inc.

CLEAN

COAL

SOLUTIONS

JV

OWNERSHIP

STRUCTURE

REFINED COAL

|

The

American Jobs Creation Act of 2004, Section 45 of the IRC: contains

provisions

to

incentivize

the

production

of

pollution

mitigating

Refined

Coal

(RC)

via escalating tax credits per ton of coal burned. RC reduces mercury by 40%+

and NOx emissions by 20%+ when that coal is burned.

Clean Coal Solutions (“CCS”) JV offers three technologies that produce

Section 45 Refined Coal

-

The CyClean

TM

, M-45

TM

and M-45-PC

TM

technologies provide on-site, proprietary pre-

treatment to Powder River Basin (PRB) and Lignite coals for use in cyclone boilers,

circulating fluid bed boilers and pulverized coal

boilers. Key Dates

June

2010:

Clean

Coal

Solutions

commences

operations

at

first

two

RC

facilities

December

2010:

Congress

extends

“placed-in-service”

deadline

for

new

RC

facilities

to 12/31/11

January

-

December

2011:

CCS

fabricates,

installs

and

“places-in-service”

26

additional RC units able to qualify for Section 45 tax credits

June

2011:

an affiliate

of

Goldman

Sachs

purchases

a

15%

stake

in

the

JV

for

$60M

2012

-

2014:

CCS

focused

on

capturing

the

value

of

Section

45

tax

credits

Refined Coal: Introduction & Overview

-10-

©

2013 ADA-ES, Inc. |

REFINED COAL: MONETIZATION DYNAMICS

Requirements to

commence operations:

Operating permits obtained

from each relevant state

Approval from Public

Utilities Commissions (PUC)

in regulated states

Approval from coal and

transportation companies

Approval from plant owners

Contracts negotiated and

signed among CCS, RC

investor and power

companies

3 RC investors currently

engaged

Working with additional

RC investors for

remaining RC facilities

Utility

Receives:

value

of

$1.00 -

$4.00 / ton for

emissions reduction

Payment of ~$1/ton from

RC investor

RC Investor

Receives:

(a)$6.47 tax credit

through RC production, and

(b) tax deductions for rental,

utility and operating expenses

Pays:

~$1/ton to utility, ~$2/ton for

operating expenses and

~$3+/ton to CCS

CCS Receives:

~$3+/ton in consolidated

payments, net $1.50-$2/ton to

ADA of pre-tax income after

payments to ADA’s JV partners

Each RC facility can be monetized

(leased or sold) to generate revenue, or

operated by CCS for tax credit benefit to

offset future tax obligations

-11-

©

2013 ADA-ES, Inc. |

Goal

2014 Proportion of Refined Coal Produced that is

Monetized

2012

2014

-12-

©

2013 ADA-ES, Inc.

20

21

60

8

28

0

20

40

60

2014

Operating by 2014

Annual Run Rate

MT/yr of RC Produced

28 Total

RC Facilities

Operating YE 2012

YE 2012

Retained

Monetized 70%

30%

20%

80%

REFINED COAL:

STATUS UPDATE

|

FINANCIAL RESULTS

OF

RETAINING

TONS

AND

TAX

CREDITS

CCS will often operate an RC facility, retaining the tax credits, prior to

monetizing that facility with a third party

$7.50 /Ton

$40 /Ton

($3/Ton)

Value of Tax

Credits and

Benefits

Operating

Cost

Current Period

Future Period

Raw Coal

Cost

RC Sales

-13-

©

2013 ADA-ES, Inc.

-$50

-$40

-$30

-$20

-$10

$0

$10

$20

$30

$40

$50

($40/Ton)

REFINED COAL: |

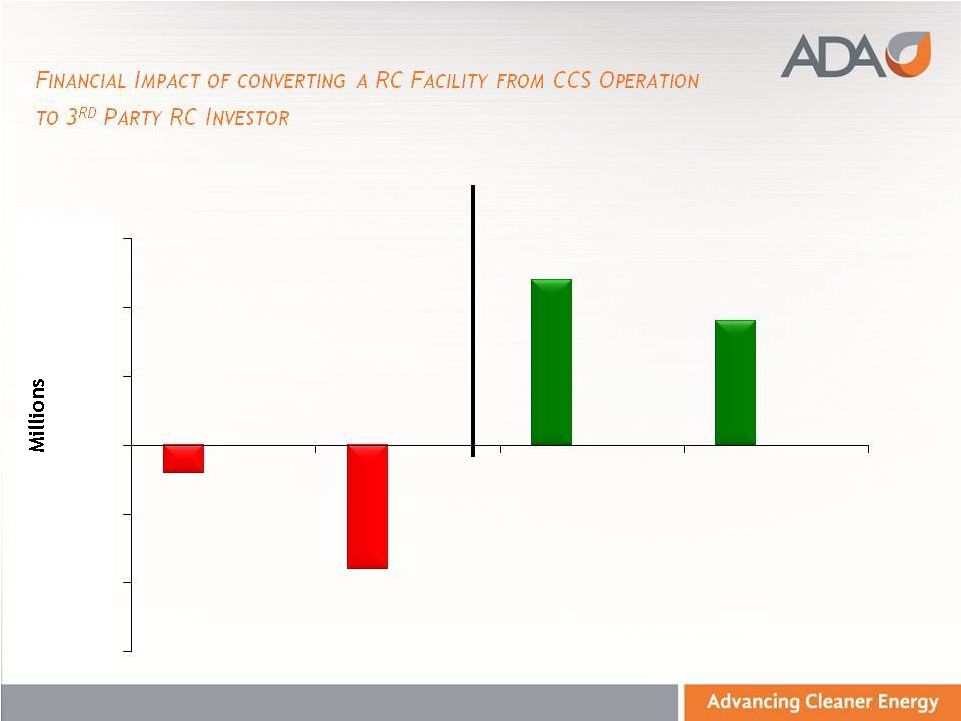

Payment

from RC investor

CCS Self Monetization

3

Party RC Investor

CCS Consolidated financial example for a 3 MT/yr facility

Operating

Expense

CAPEX

Cash at Closing

(Pre-Paid Rent)

-14-

©

2013 ADA-ES, Inc.

$(15)

$(10)

$(5)

$

-

$5

$10

$15

($2M)

($9M/yr)

$12M/yr

~$9M

In final stages of contracts with two RC

investors for three facilities at plants that

historically burn more than 10MT/year. Two

of these facilities are currently being

operated by CCS

rd

REFINED COAL:

|

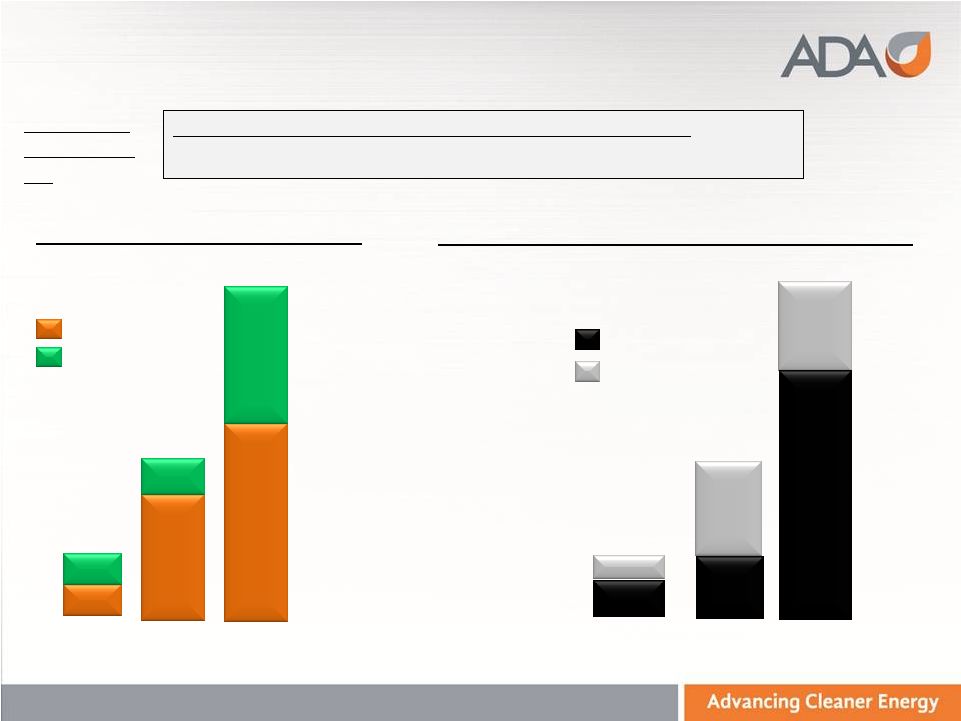

R

($

IN

M)

$20.1

$20.2

$150

$40

$300

$200

$7.0

$1.5

$16

$6

$30

$70

2011

2014-2021

(E)

2012

(E)

$500

$8.5

$40.3

$190

$22

$100

2011

2014-2021

(E)

2012

(E)

Coal Sales

Rental Revenue

Segment Income

Tax Credits

Equivalent

Annualized

MT

2011

2012

2014-2021

CCS revenues (consolidated)

ADA (excluding non-controlling interests)

-15-

©

2013 ADA-ES, Inc.

EFINED

OAL

ROGRESS

C

P

7

60

21 |

8

Facilities producing Refined Coal 4 monetized with RC investors treating more

than 11 MT/year 2 facilities permanently operating for CCS producing

approximately 2MT/yr 2 facilities in final stages of contracts at plants that

historically have burned approximately 8 MT/year. These facilities are

currently generating tax credits for CCS

8 Facilities committed to sites

Status ranges from initial contracts and permitting to final stages of

contracts

12

Facilities

pursuing

options

to

use

new

M-45-PC

TM

technology

M-45-PC

TM

technology

achieves

Section

45

qualifying

emissions

for

pulverized

coal boilers

Significantly expands the addressable market to include many larger boilers

that use more than 5 MT of coal per year

Initial

facilities

using

M-45-PC

TM

technology

could

be

operating

as

early

as

the second or third quarter of 2013

Update on Refined Coal Activities

-16-

©

2013 ADA-ES, Inc. |

>20

GW

SOLD

FOR

MERCURY

CONTROL

Installed/installing ACI systems on 55 boilers at coal-fired power plants

Over 35% market share of 159 boilers served for mercury control from power plants

Reduces mercury emissions by up to 90%

Work in progress at September 30, 2012 of $3.9MM; expect to recognize as revenue in 2012

and 2013. This does not include recent fleet order valued at up to $20M

MATS is expected to generate new market of $500-600M 2012-2015

-17-

©

2013 ADA-ES, Inc.

COMMERCIAL ACI

SYSTEMS |

New

environmental regulations creating demand for control of acid

gases such as HCI, SO

2 ,

and

SO

3

ADA provides DSI systems as a low-

cost option to wet scrubbers

Equipment costs $2-3M for average

size plants

EPA predicts over 200 systems will

be needed by 2015

Acquired the assets of Bulk

Conveyor Systems in August 2012 to

enhance DSI capabilities

Awarded 9 DSI systems in 2012

-18-

©

2013 ADA-ES, Inc.

CONTROL OF ACID GASES

HCI, SO

2

, SO

3 |

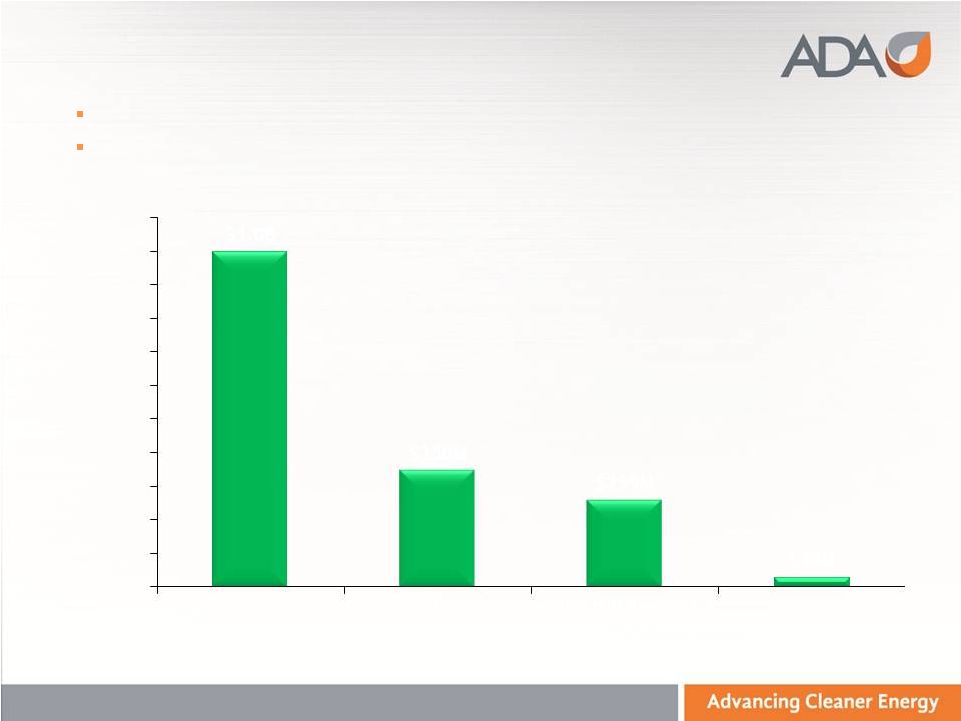

MATS is

projected to create $500+ M market for both ACI & DSI Procurement activities have

commenced and ADA is responding to several fleet bids 1) Total Expected Revenue

from Estimated Equipment Sales 2012-2015 -19-

©

2013 ADA-ES, Inc.

$1.0B

$350M

$259M

$30M

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

Estimated Market Size

(2012-2015)

Expected Revenue

(1)

(~35% Market Share)

Bids Outstanding

Wins

E

MISSIONS

C

ONTROL

:

ACI & DSI EQUIPMENT MARKET |

Patented technology designed to enable Western

coals to burn with lower mercury emissions

–

U.S. burns up to 600 MT of Western Coal per year

$1.00-4.00/ton in benefits to customer

Technology has been licensed to Arch Coal to apply

to their PRB coals at the mine

–

Royalty agreement: payments to ADA of up to $1.00/ton

based on a portion of the premium paid on Enhanced Coal

sales

ADA retained rights to apply technology at power

plants

Initial market: states with mercury regulations

already in place

MATS expected to expand market by 2015

Continued demonstration of technology to

customers

-20-

©

2013 ADA-ES, Inc.

MERCURY CONTROL: ENHANCED COAL |

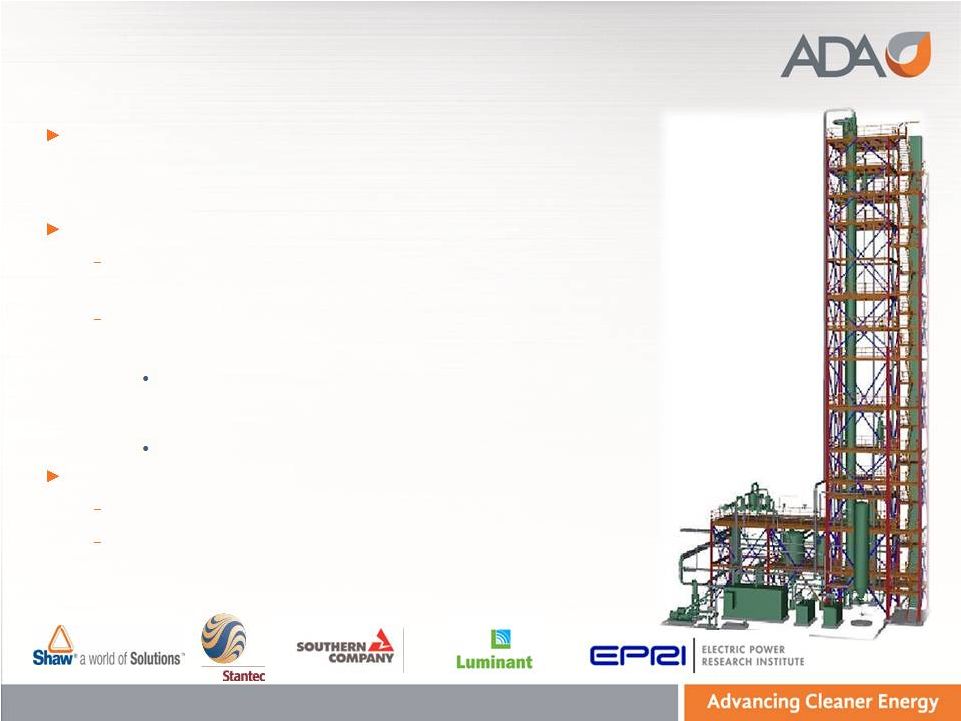

Developing proprietary solid sorbent capture

technology to capture CO2 from flue gas in

conventional coal-fired boilers

DOE and industry funding:

Phase I -

$3.8 M R&D at 1 KW pilot plant completed

in 2011

Phase II -

$20.5 M, 51-month contract to scale-up

technology to 1 MW

Entered Fabrication and Construction phase of 1 MW

plant in June 2012, estimated completion in October

2013

Testing in 2014

Advantages over competing technologies:

For customer: lower cost and less parasitic energy

For ADA: continuous revenues from sale of

proprietary chemical sorbents

-21-

©

2013 ADA-ES, Inc.

CO

2

CAPTURE

:

OVERVIEW |

-22-

©

2013 ADA-ES, Inc.

FINANCIAL

RESULTS

OVERVIEW |

Self

monetization has a dominating impact on GAAP Income Statement ~$59 million of Q3

revenues are due to coal sales relating to retained RC facilities, which drive

revenue growth ~$8 million of Q3 operating expenses are due to ~2.5

million retained tons Financial benefit of tax credits generated will not been

seen until future quarters

$ in Ms

Nine Months

2012

Nine Months

2011

FY 2011

Revenues

$145.1

$28.7

$53.3

Gross Profit / Margin, Including Coal Sales

$15.4 / 11%

$19.7 / 69%

$24.4 /

46%

Gross Profit / Margin, Excluding Coal Sales

and Retained Tonnage Operating Expense

$30.8 / 80%

$23.4 / 90%

$38.9 /

73%

Operating (Loss) Income

($3.0)

$3.1

$3.0

-23-

©

2013 ADA-ES, Inc.

FINANCIAL SUMMARY:

FIRST NINE MONTHS

2012 |

As of

9/30/12 As of 12/31/11

Cash & Cash Equivalents

$17.5

$40.9

Working Capital, net of

deposits and deferred

revenues

$5.0

$20.1

Long-term Debt

$2.4

$ 3.6

Shares Outstanding

10.0

10.0

In Ms

-24-

©

2013 ADA-ES, Inc.

BALANCE SHEET HIGHLIGHTS

REDUCTION IN CASH REFLECTS BUILD OUT OF RC FACILITIES

|

RC

opportunities expected to provide substantial growth in revenues, profits and

cashflows in 2013, and consistent revenue streams through 2021

MATS compliance requirements are driving expected >$300

million total equipment revenues for ADA in next 3-4 years

Enhanced Coal technology and royalty opportunity expected

to produce additional growth in 2013 to 2015 and beyond

Developing solid sorbent capture technology to capture CO

2

from flue gas in conventional coal-fired boilers

Available cash on balance sheet and expected cash flows

from RC provides the resources to execute on future

opportunities

Key Takeaways

-25-

©

2013 ADA-ES, Inc. |

Michael D. Durham, Ph.D., MBA

President & CEO

Mark H. McKinnies

CFO

(303) 734-1727

www.adaes.com

Graham Mattison

VP of Investor Relations

(646)-319-1417

graham.mattison@adaes.com

Devin Sullivan

Senior Vice President

(212) 836-9608

dsullivan@equityny.com

-26-

©

2013 ADA-ES, Inc.

CONTACTS

|