Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGENERON PHARMACEUTICALS, INC. | d463788d8k.htm |

J.P.

Morgan Healthcare Conference January 2013

Exhibit 99.1 |

2

SAFE

HARBOR

STATEMENT

Except for historical information, the matters contained in this presentation may constitute

forward-looking statements that involve risks and uncertainties, including risks

and uncertainties related to product development and clinical trials, unforeseen safety

issues resulting from the administration of products and product candidates in patients,

uncertainties related to the need for regulatory and other government approvals,

government regulations, risks related to third party patents and proprietary technology,

litigation, the need for additional capital, uncertainty of market acceptance of Regeneron’s

products and product candidates, the ability of the Company to meet any of its sales or

other financial projections, the receipt of future payments, the continuation of business

partnerships, and additional risks detailed from time to time in Regeneron’s filings with

the Securities and Exchange Commission (SEC). Please refer to Regeneron’s Form 10-K

for the year ended December 31, 2011 and its Form 10-Q for the quarter ended September

30, 2012 for additional information on these risks and uncertainties and for other

information related to our business.

Because forward-looking statements involve risks and uncertainties, actual results may

differ materially from current results expected by Regeneron. Regeneron is providing this

information as of the original date of this presentation and expressly disclaims any duty to

update any information contained in these materials, including without limitation any sales

forecasts and any other forward-looking statements.

|

|

4

REGENERON TRANSFORMED

One of the top 5 biopharmaceutical launches of all time

EYLEA

®

LAUNCH HAS EXCEEDED EXPECTATIONS

EYLEA US, EU, Japan, Australia, and other countries; ZALTRAP US

MULTIPLE REGULATORY APPROVALS

GAAP & Non-GAAP FOUR FULL

QUARTERS OF PROFITABILITY Year end cash and receivables of ~$1.2B

STRONG FINANCIAL POSITION

Science

magazine

annual

poll;

“Biotechnology

Company

of

the

Year”

by

Scrip

Intelligence

WORLD’S #1 BIOPHARMACEUTICAL EMPLOYER |

5

REGENERON LOOKING FORWARD

RESEARCH & DEVELOPMENT

Expanding late stage pipeline with REGN727 (PCSK9), Sarilumab (IL6R), & REGN668

(IL4R) Continuing to invest in early stage pipeline and innovative

technologies EYLEA

Increasing market share, expanding

geographies and indications, securing future

ZALTRAP

Global launch; Novel combinations

FINANCIAL

Continuing growth in sales and profits |

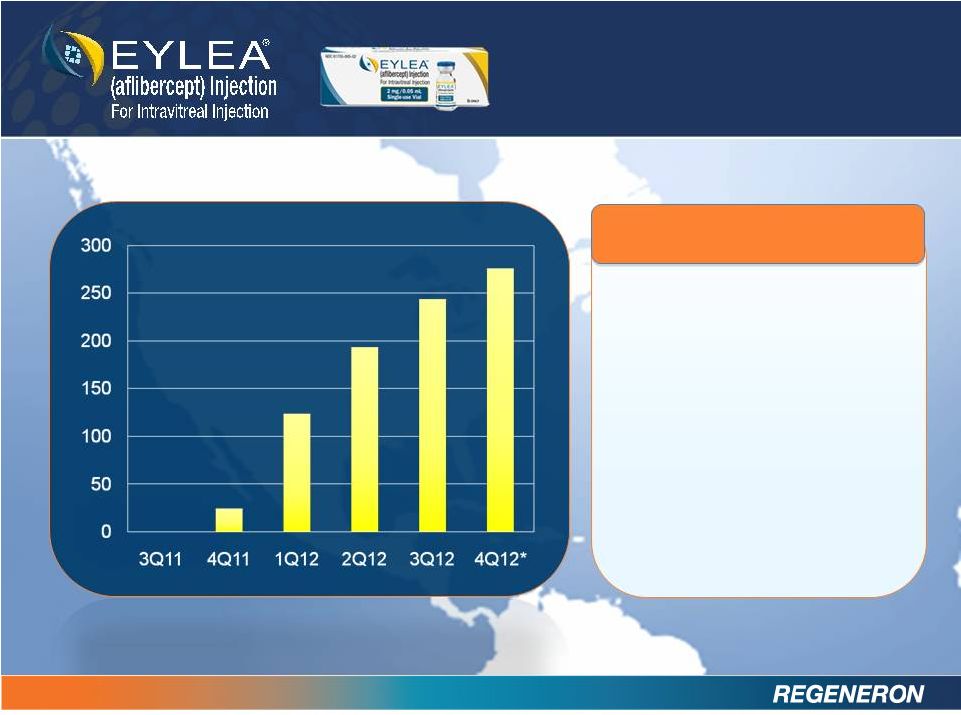

6

EYLEA

net product

sales of $276 million

in 4Q12*

$838 million in full year

2012*

2013 EYLEA U.S. net sales

guidance: ~50% growth

(i.e. ~$1.2B to $1.3B)

U.S. LAUNCH

* 4Q12 Sales Estimate

EXCEEDING

EXPECTATIONS |

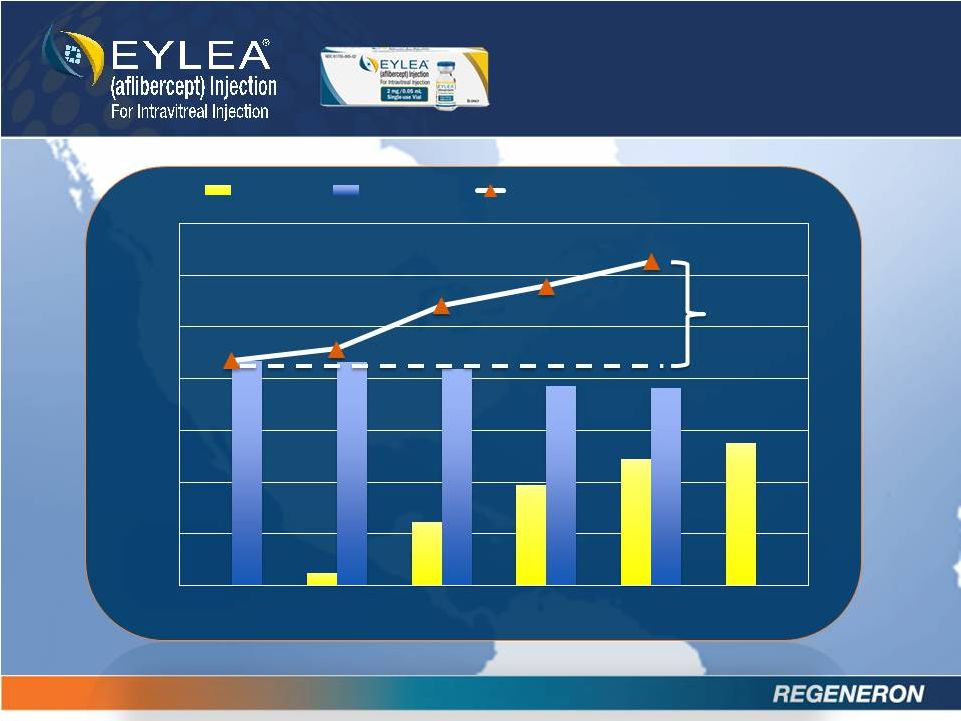

7

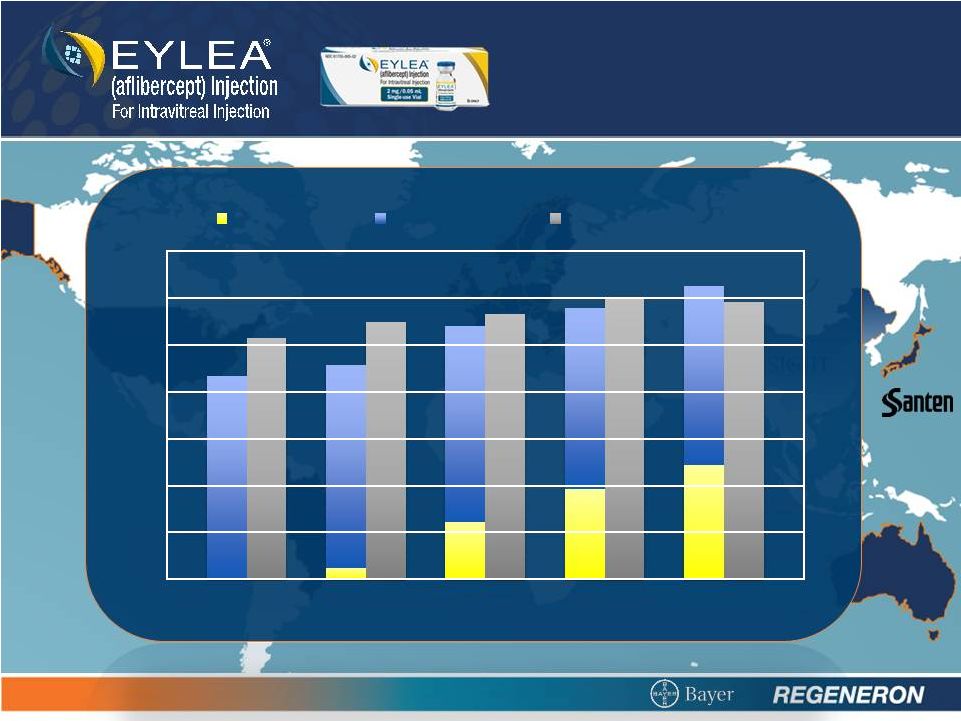

* 4Q12 Sales Estimate

EXPANDING

BRANDED MARKET

0

100

200

300

400

500

600

700

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

EYLEA

Lucentis

EYLEA & Lucentis Total

+47

% |

8

EXPANDING

GEOGRAPHY

3Q11

4Q11

1Q12

2Q12

3Q12

0

100

200

300

400

500

600

700

US: EYLEA

US: Lucentis

exUS: Lucentis |

9

Trials fully enrolled

Diabetic Macular Edema (DME)

BROADENING

INDICATIONS

Myopic CNV

Trial fully enrolled in Asia

Trial enrolling

Branch Retinal Vein Occlusion (BRVO)

Approved in U.S.; Filings globally

Central Retinal Vein Occlusion (CRVO) |

10

SECURING

THE FUTURE

High affinity, fully-human

antibody to PDGFR

Goal to enter clinic with

co-formulated product in 2H13

PDGFR

High affinity, fully human

antibody to ang2

Goal to enter into ophthalmology

clinical development in 2013

ANG2

Novel formulation and delivery of EYLEA as

well as evaluation of new technologies

Novel Targets in Development for Retinal Disease |

11

OPPORTUNITIES

IN CANCER

Approved and launched in U.S.

Discovered by Regeneron and

co-developed with Sanofi

Regeneron has worldwide

co-commercialization rights

Approved in the US

Positive recommendation for

approval by European CHMP

EU approval expected 1Q13

Regeneron has worldwide

co-commercialization rights

Pending Approval in the EU

ZALTRAP is the only agent that has demonstrated a statistically significant

improvement in overall survival in combination with FOLFIRI versus FOLFIRI

alone in patients who progressed on a prior oxaliplatin-containing

regimen. |

12

EXPANDING LATE

STAGE PIPELINE

IL6R antibody for

rheumatoid arthritis

Sarilumab

PCSK9 antibody for

elevated cholesterol

REGN727

IL4R antibody for Asthma

and Atopic Dermatitis

REGN668 |

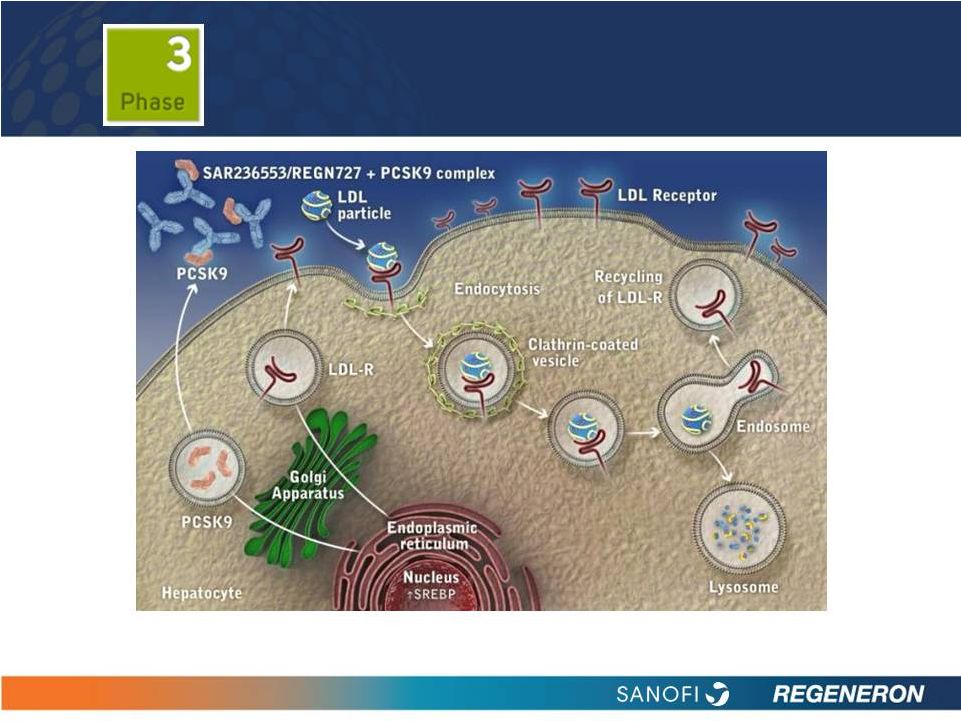

13

(1) Tibolla G et al. Nutr Metab Cardiovasc Dis 2011;21:835-43. (2) Akram ON et

al. Arterioscler Thromb Vasc Biol 2010;30:1279-81. (3) Duff CJ et al.

Expert Opin Ther Targets 2011;15:157-68. (4) Horton JD et al. J Lipid Res 2009;50 Suppl:S172-7. (5) Cariou B et al.

Atherosclerosis 2011;216:258-65.

PCSK9: BLOCKING PCSK9 CAN

POTENTIALLY

LOWER

LDL-C

LEVELS

1-5 |

14

Phase 2 data published in The

Lancet, Journal of the American

College of Cardiology, and NEJM

Significantly reduced mean LDL-C

by 40% to 72% over 8 to 12 weeks

in patients on stable dose of statins

Most common adverse event

was injection site reaction

Mean percentage change in calculated LDL-C from baseline to weeks 2, 4, 6, 8,

10, and 12 in the modified intent-to-treat (mITT) population, by

treatment group. Week 12 estimation using LOCF method. *Data from Phase 2 ,

dose-ranging study. Patients were on background atorvastatin therapy of 10, 20, or 40 mg.

Decrease in LDL-C shown is at week 12.

REGN727:

LDL CHOLESTEROL REDUCTION

Change in Calculated LDL-C at Bi-Weekly Intervals from Baseline to Week 12 in

Patients With Primary Hypercholesterolemia. |

15

FH I

HIGH FH

FH II

OPTIONS I

OPTIONS II

MONO

ALTERNATIVE

LONG TERM

COMBO I

COMBO II

N=105

18 months

N=471

18 months

N=250

18 months

N=2,100

18 months

N=306

12 months

N=660

24 months

N=250

6 months

N=300

6 months

N=100

6 months

N=350

6 months

N=18,000

(Event

Driven)

REGN727:

LDL CHOLESTEROL REDUCTION

OUTCOMES

Heterozygous Familial

Hypercholesterolemia

High Cholesterol at High

Cardiovascular Risk

Additional

populations/studies |

SARILUMAB:

RHEUMATOID ARTHRITIS

Sarilumab is a fully human, high

affinity, interleukin-6 receptor (IL-6R)

antibody

Positive Phase 2 study in rheumatoid

arthritis

Types and incidence of adverse

events consistent with those previously

reported with IL-6 inhibition

Phase 3 MOBILITY trial fully enrolled

Phase 3 TARGET trial enrolling

16

*p<0.01 versus placebo (only unadjusted p-values

<0.01 are considered statistically significant)

Significant improvements in signs and symptoms of moderate-to-severe RA in

patients receiving sarilumab in combination with methotrexate in Phase 2

study. ACR20

ACR50

ACR70

46.2

66.7

65.4

15.4

35.3

40.4

1.9

11.8

17.3

0

10

20

30

40

50

60

70

80

Placebo

150 mg q2w

200mg q2w |

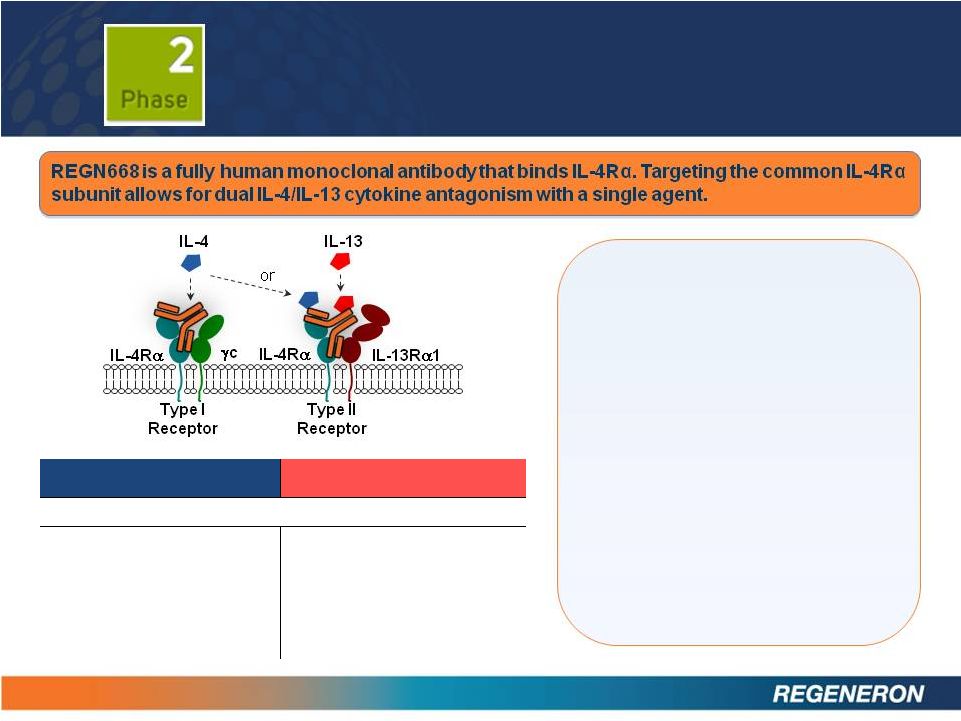

REGN668:

ASTHMA AND ATOPIC DERMATITIS

17

Positive proof of concept data

for atopic dermatitis to be

submitted for presentation at

a medical conference in 2013

Positive proof of concept data

for asthma to be submitted for

presentation at a medical

conference in 2013

Phase 2b initiation in both

indications expected mid-year

IL-4

IL-13

Dominant (some overlapping) functions in :

•

Initiation

and

drive

of

T

H

2

differentiation

•

Activation and growth of B

cells

•

Class switching to IgE and

IgG1a

•

Recruitment of eosinophils

•

Airway hyper responsiveness

(AHR)

•

Goblet cell hyperplasia

•

Tissue remodeling

•

Fibrosis

•

Regulation of gastrointestinal

parasite expulsion |

BROAD ANTIBODY PIPELINE

18

Inflammation

Therapeutic Focus Legend:

Metabolism

Oncology

Ophthalmology

Pain

REGN421 (DII4 Antibody)

Advanced malignancies

REGN910 (ANG2 Antibody)

Advanced malignancies

REGN1033 (GDF8 Antibody)

Metabolic disorders

REGN1400 (ERBB3 Antibody)

Advanced malignancies

REGN846

(undisclosed target)

Atopic dermatitis

REGN1154

(undisclosed target)

REGN1500

(undisclosed target)

Phase 1

REGN668 (IL-4R Antibody)

Eosinophilic asthma

REGN668 (IL-4R Antibody)

Atopic dermatitis

REGN475* (NGF Antibody)

Osteoarthritis

Phase 2

REGN727 (PCSK9 Antibody)

LDL cholesterol reduction

Sarilumab (IL-6R Antibody)

Rheumatoid arthritis

EYLEA

Diabetic macular edema

EYLEA

Branch Retinal Vein Occlusion

Phase 3

Novel Antibody Technologies in Preclincal

Development

Bispecific Antibodies

Long Acting Technologies

Antibody Drug Conjugates

*Remains on clinical hold by the FDA |

SANOFI ANTIBODY COLLABORATION

19

*100% development funding by Sanofi for all opted-in antibodies except 80% of

an antibody’s Phase 3 costs incurred after receipt of the first

positive results in a Phase 3 trial for that antibody.

**Regeneron repays Sanofi for 50% of development costs out of profits.

Repayment capped in any year at 10% of Regeneron share of total antibody

profits Discovery

Discovery

Development

Development

Commercialization

Commercialization

$160 million of annual

funding through 2017

(plus possible

tail period through 2020)

Sanofi funds

approximately 100% of

clinical development cost*

Current antibodies

include:

•

REGN727 (Phase 3)

•

Sarilumab (Phase 3)

•

REGN668 (Phase 2)

•

3 additional in Phase 1

Regeneron retains

50% of profits in US**

Regeneron retains 35%

to 45% of profits ex-US**

Co-promotion rights

in US and other major

market countries |

FINANCIALS

20

Year-end 2012

Year-end 2012

cash and

cash and

securities

securities

Year-end 2012

Year-end 2012

trade

receivables

receivables

Non-GAAP Net Income

* Unaudited Estimate

$0

$50

$100

$150

$200

$250

1Q12

2Q12

3Q12 |

THE YEAR AHEAD

21

•

EYLEA US sales guidance of ~50% growth (i.e. $1.2B to $1.3B)

•

EYLEA ex-US launch in multiple additional countries

COMMERCIAL MILESTONES

•

EYLEA approval in CRVO outside the U.S.

•

ZALTRAP approval in metastatic colorectal cancer outside the U.S.

EXPECTED REGULATORY MILESTONES

•

Top-line 1-year Phase 3 EYLEA results in DME by year end

•

REGN668

Phase

1b

data

in

Atopic

Dermatitis

to

be

presented

at

a

medical

conference

•

REGN668 Phase 2a data in Asthma to be presented at a medical conference

•

Sarilumab additional Phase 3 trials in RA to start

•

Enrollment updates for REGN727 in hypercholesterolemia

EXPECTED CLINICAL MILESTONES |