Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20130108.htm |

EXHIBIT 99.1

Occidental Petroleum Corporation

Goldman Sachs Global Energy Conference 2013

Goldman Sachs Global Energy Conference 2013

Stephen I. Chazen

President and Chief Executive Officer

President and Chief Executive Officer

January 8 - 9, 2013

1

2

Christopher G. Stavros

Vice President and Treasurer

212-603-8184 | chris_stavros@oxy.com

Christopher M. Degner

Senior Director - Investor Relations

212-603-8185 | christopher_degner@oxy.com

Vice President and Treasurer

212-603-8184 | chris_stavros@oxy.com

Christopher M. Degner

Senior Director - Investor Relations

212-603-8185 | christopher_degner@oxy.com

Anthony J. Cottone

Manager - Investor Relations

212-603-8188 | anthony_cottone@oxy.com

Manager - Investor Relations

212-603-8188 | anthony_cottone@oxy.com

3

Oil & Gas - Improved Capital Efficiency &

Operating Cost Reduction Program

Operating Cost Reduction Program

Oil & Gas - Improved Capital Efficiency &

Operating Cost Reduction Program

Operating Cost Reduction Program

4

Oil & Gas - Improved Capital Efficiency &

Operating Cost Reduction Program

Operating Cost Reduction Program

Oil & Gas - Improved Capital Efficiency &

Operating Cost Reduction Program

Operating Cost Reduction Program

5

This page left intentionally blank.

6

7

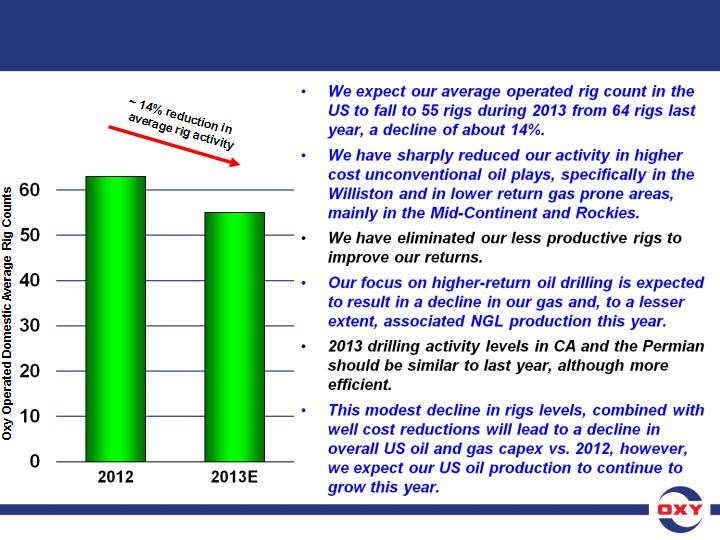

64

Oxy’s US Operated Rig Activity

55

7

8

First Nine Months 2012 Results - Summary

First Nine Months 2012 Results - Summary

|

|

YTD 2012

|

YTD 2011

|

|

• Income from continuing operations

|

$4,271

|

$4,999

|

|

• EPS (diluted) from continuing operations

|

$5.26

|

$6.14

|

|

|

|

|

|

• Net Income

|

$4,262

|

$5,137

|

|

• Reported EPS (diluted)

|

$5.25

|

$6.31

|

|

|

|

|

|

• Worldwide oil and gas production volumes

(mboe/d) +5% |

762

|

728

|

|

• US oil and gas production volumes

(mboe/d) +10% |

462

|

420

|

|

|

|

|

|

• Capital Spending

|

$7,716

|

$4,969

|

|

• Cash Flow from Operations

|

$8,500

|

$8,600

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, except EPS data)

8

9

Overriding Goal is to Maximize Total Shareholder Return

• We believe this can be achieved through a combination of:

• Growing our oil and gas production by 5% to 8% per year on

average over the long term;

average over the long term;

• Allocating and deploying capital with a focus on achieving

well above cost-of-capital returns (ROE and ROCE);

well above cost-of-capital returns (ROE and ROCE);

– Return Targets*

• Domestic - 15+%

• International - 20+%

• Consistent dividend growth, that is superior to that of our

peers.

peers.

*Assumes Moderate Product Prices

What Is Our Philosophy & Strategy?

What Is Our Philosophy & Strategy?

9

This page left intentionally blank.

10

11

1. Base/Maintenance Capital

2. Dividends

3. Growth Capital

4. Acquisitions

5. Share Repurchase

Cash Flow Priorities

11

12

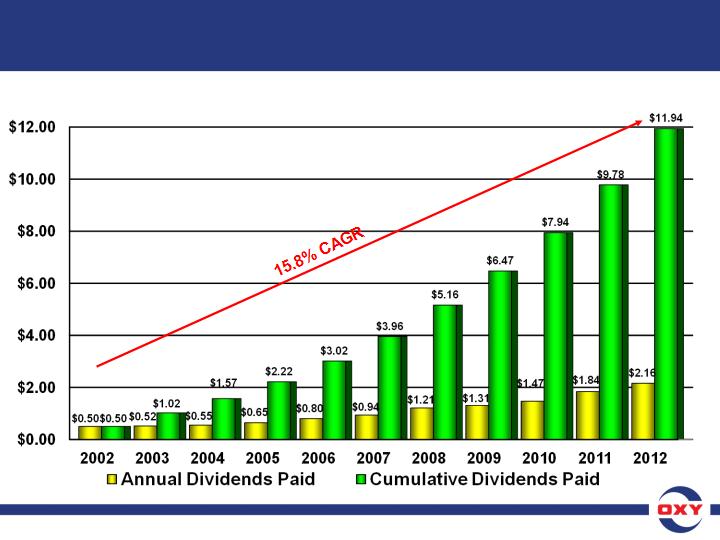

• Our ability to pay dividends is indicated by our free cash

flow generation.

flow generation.

• In February 2012 the Board of Directors increased the

company’s dividend by 17% to an annualized rate of $2.16

per share, compared to the previous annual rate of $1.84.

company’s dividend by 17% to an annualized rate of $2.16

per share, compared to the previous annual rate of $1.84.

• We have now increased our dividend every year for 10

consecutive years, and a total of 11 times during that

period.

consecutive years, and a total of 11 times during that

period.

• This increase brings the company’s compound annual

dividend growth rate over the last 10 years to 15.8%.

dividend growth rate over the last 10 years to 15.8%.

• We expect to increase our dividends again this year and

in the future at a rate that would maximize returns to our

stockholders.

in the future at a rate that would maximize returns to our

stockholders.

Consistent Dividend Growth

12

13

Consistent Dividend Growth

Note: Dividends paid as per the Record Date

($/share)

13

14

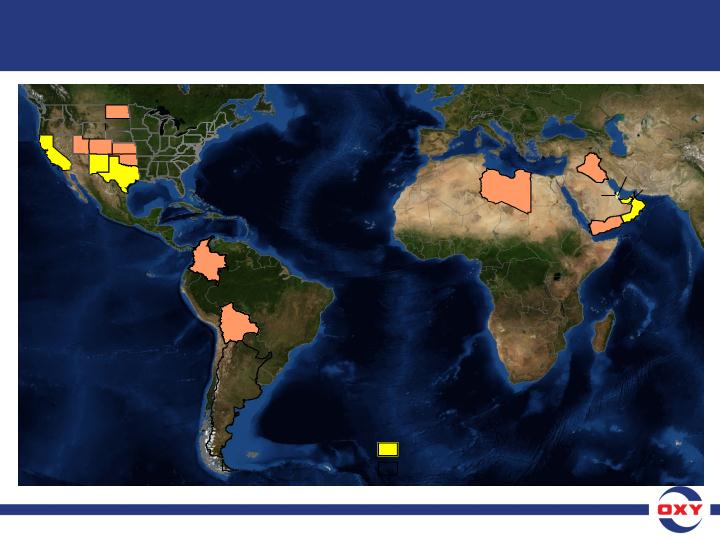

Worldwide Oil & Gas Producing Areas

Colombia

Colombia

Libya

Libya

Oman

Oman

UAE

UAE

Yemen

Yemen

Bolivia

Bolivia

Qatar

Qatar

Iraq

Iraq

Bahrain

Bahrain

Focus Areas

United States

United States

Permian

Permian

Basin

Basin

California

California

14

15

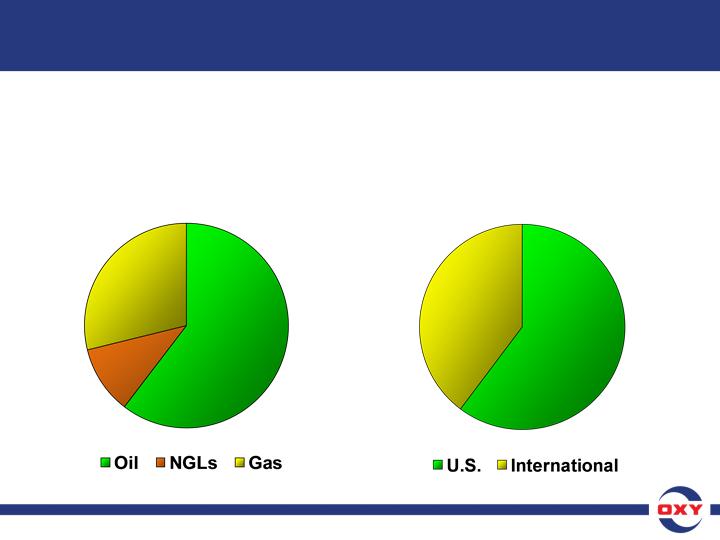

Oil & Gas Production

9 months - 2012

(Million barrels of oil equivalent)

9 months - 2012

(Million barrels of oil equivalent)

126

61%

82

39%

127

60%

59

29%

22

11%

Oxy Is Primarily a Domestic Oil Producer

Oxy Is Primarily a Domestic Oil Producer

15

16

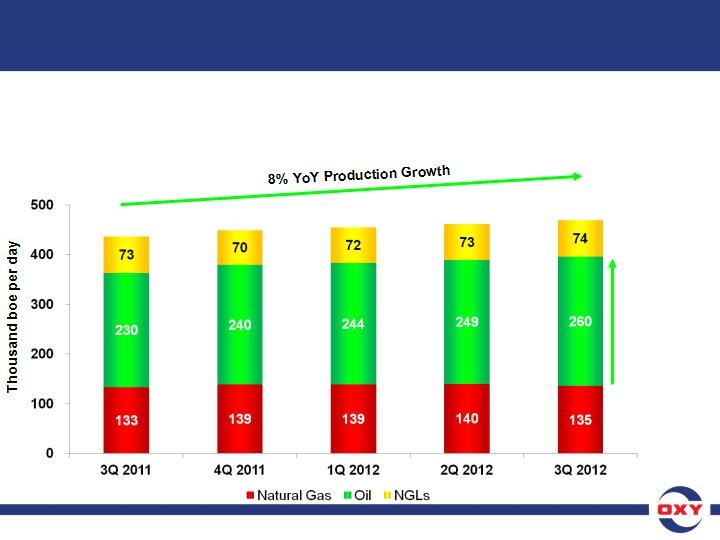

436

449

455

462

469

• Total U.S. production in 3Q12 was 469 mboe/d, up 7 mboe/d from 2Q12 the

8th consecutive quarterly domestic volume record for Oxy. Year-over-year,

production grew by 8%, or 33 mboe/d, of which 30 mb/d was oil growth.

8th consecutive quarterly domestic volume record for Oxy. Year-over-year,

production grew by 8%, or 33 mboe/d, of which 30 mb/d was oil growth.

+30 mb/d oil

production

growth

production

growth

Key Performance Metrics - Production Growth

Key Performance Metrics - Production Growth

16

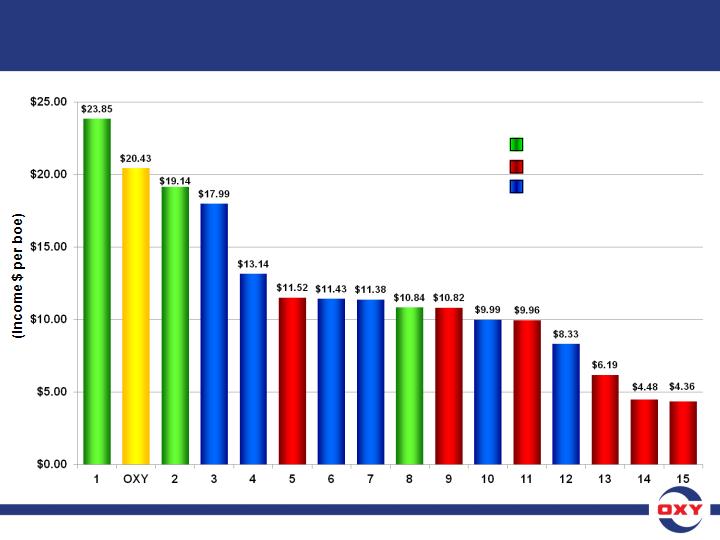

Peer Company -

Income per Boe of Production

Income per Boe of Production

17

(Nine Months ended 9/30/12)

Integrated O&G

Large Cap Independent E&P

S/Mid Cap Oil Focused E&P

17

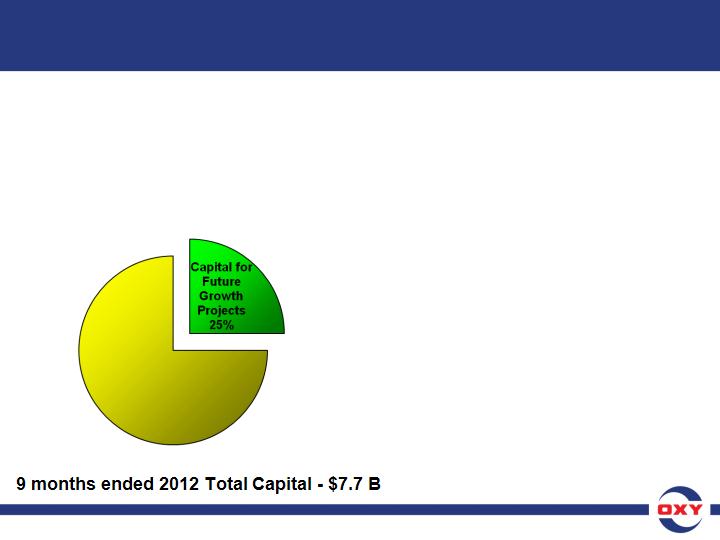

• These expenditures include

capital for:

capital for:

– the Al Hosn Shah gas project

which is expected to start

production in late 2014;

which is expected to start

production in late 2014;

– gas and CO2 processing

plants and pipelines to

maintain or expand the

capacity of these facilities to

handle future production

increases;

plants and pipelines to

maintain or expand the

capacity of these facilities to

handle future production

increases;

– the chemical segment, and

other items.

other items.

18

Capital Spending

Capital Spending

• In 2012, we expected to spend

~25% of our total capital

expenditures on future growth

projects that will contribute to

our operations over the next

several years.

~25% of our total capital

expenditures on future growth

projects that will contribute to

our operations over the next

several years.

18

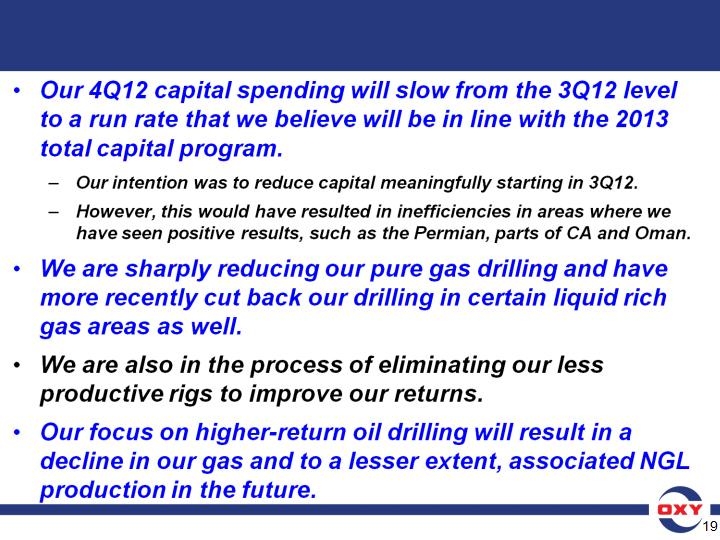

4Q12 Outlook - Capital Program

4Q12 Outlook - Capital Program

19

This page left intentionally blank.

20

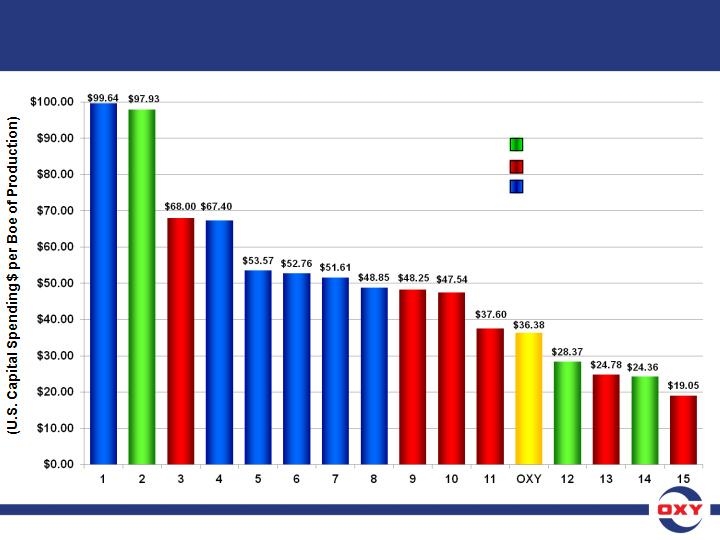

Peer Company -

U.S. Capital Spending per Boe of Production

U.S. Capital Spending per Boe of Production

21

(Nine Months ended 9/30/12)

Integrated O&G

Large Cap Independent E&P

S/Mid Cap Oil Focused E&P

21

22

• Over the past year, we have achieved our goal of

increasing domestic production by 6 to 8 mboe/d

quarter-over-quarter.

increasing domestic production by 6 to 8 mboe/d

quarter-over-quarter.

– We expect our 4Q12 oil production to grow by about this much.

– However, the expected decline in gas production resulting from

the change in our capital program focus may offset some of the

increased oil production on an equivalent basis.

the change in our capital program focus may offset some of the

increased oil production on an equivalent basis.

• Internationally, at current prices we expect production

to be approximately flat with 3Q12, while sales volumes

increase slightly.

to be approximately flat with 3Q12, while sales volumes

increase slightly.

4Q12 Outlook - Oil and Gas Production

22

23

• Base 5 - 8% Compounded Average Annual Growth

– Current California risked prospects

– Non-CO2 & CO2 in the Permian

– Oman

• Upside from Existing Holdings

– New California conventional and unconventional prospects

– Permian exploration

– Williston Basin & Rockies

– Oman exploration

– Bahrain and Iraq

• Additional opportunities from balance sheet and cash

generation

generation

– Domestic property acquisitions

– New Middle East projects

Oil & Gas Volume Growth Drivers

23

24

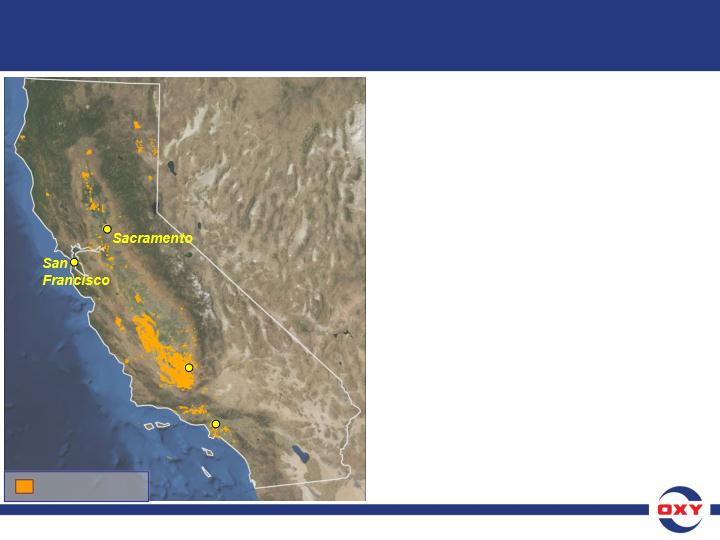

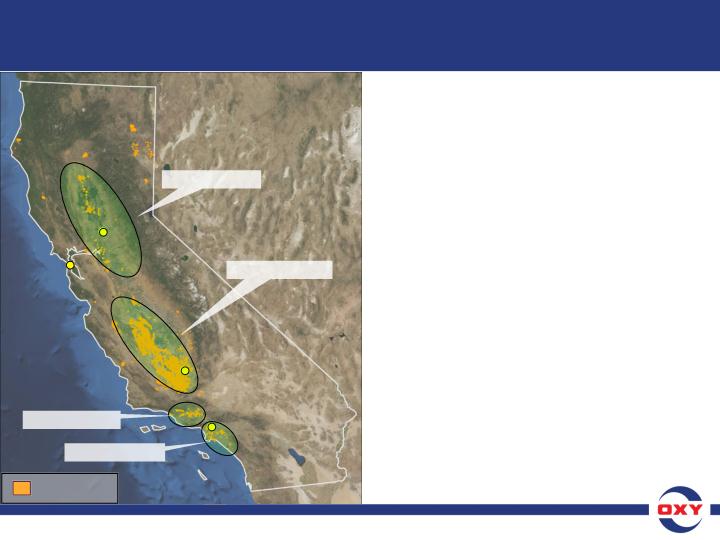

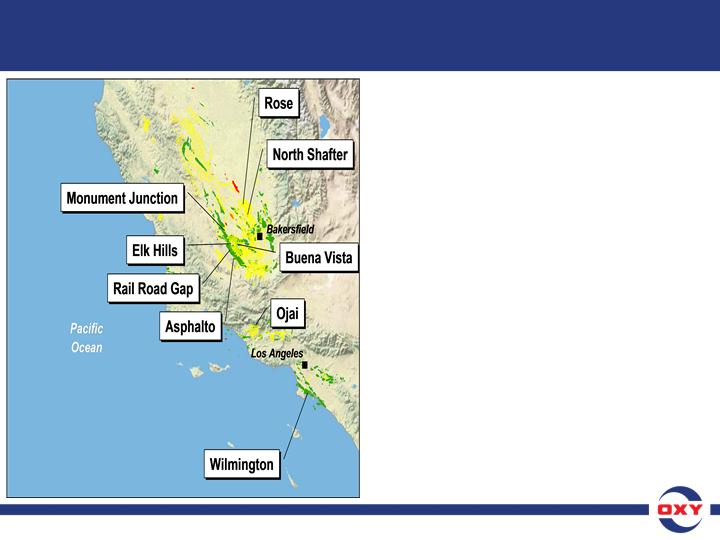

California Overview

California Overview

Los Angeles

Los Angeles

Bakersfield

Bakersfield

Oxy Acreage

• Largest acreage holder in CA

with ~1.7 mm acres, majority of

which are net mineral interests

with ~1.7 mm acres, majority of

which are net mineral interests

• 3Q12 production of 147 mboe/d

• Diverse geologic

characteristics and numerous

reservoir targets

characteristics and numerous

reservoir targets

• Development opportunities

range from conventional to

steam floods, water floods and

shales

range from conventional to

steam floods, water floods and

shales

• Drilling costs and expected

ultimate recoveries (EURs) vary

for each opportunity

ultimate recoveries (EURs) vary

for each opportunity

• 78% interest in the Elk Hills

Field — the largest producer of

gas and NGLs in CA

Field — the largest producer of

gas and NGLs in CA

24

25

California Conventional Exploration

• World Class Province

– 35+ Billion BOE discovered

– 5 of top 12 U.S. oil fields

• Significant Remaining Potential

– Large undiscovered resources

– Multiple play and trap types

• Underexplored

• Oxy

– Major producer

– Largest acreage holder

– Successful explorer

– Multi-year prospect inventory

Sources:

California Division of Oil, Gas & Geothermal Resources

Gibson Consulting

Oxy Fee/Lease

2 Billion BOE

20 Billion BOE

3 Billion BOE

10 Billion BOE

Major Producing

Basins

Sacramento

Sacramento

San

Francisco

Francisco

San

Francisco

Francisco

Los Angeles

Los Angeles

Bakersfield

Bakersfield

25

26

• Multi-year inventory of drill sites in

CA, many of which are both outside

of Elk Hills proper & the Kern County

Discovery Area

CA, many of which are both outside

of Elk Hills proper & the Kern County

Discovery Area

• 30-day initial production rate for

these wells is between 300 and 400

BOE per day

these wells is between 300 and 400

BOE per day

• For the shale wells outside Elk Hills,

~80% of the BOE production is a

combination of black oil and high-

value condensate

~80% of the BOE production is a

combination of black oil and high-

value condensate

• We expect the cost of drilling and

completing unconventional wells to

decline significantly over the medium

-term

completing unconventional wells to

decline significantly over the medium

-term

California Unconventional “Shale” Program

26

27

• Total CA production growth on a BOE basis is slower than we

thought it would be, in part due to the Elk Hills decline, permitting

issues and more recently low gas prices.

thought it would be, in part due to the Elk Hills decline, permitting

issues and more recently low gas prices.

• On a positive note, overall performance of the new resources has

been consistent with expectations, including our unconventional

opportunities for which well performance is similar to the type curves

we disclosed a couple of years ago.

been consistent with expectations, including our unconventional

opportunities for which well performance is similar to the type curves

we disclosed a couple of years ago.

• We will continue our focus on higher return, low cost opportunities in

CA, and this is a very diverse opportunity set.

CA, and this is a very diverse opportunity set.

• For example, Lost Hills - a major steam flood project

– We expect to achieve significant production growth to about 15 mb/d in several

years from the current 4 mb/d;

years from the current 4 mb/d;

– Total oil in place in Lost Hills is estimated to be about 500 million barrels;

– Using reasonable assumptions, we expect to recover over 50 million barrels

net to Oxy;

net to Oxy;

– Our drilling costs in this area average in the low $200,000's per well

and we expect to bring this average cost down over time.

and we expect to bring this average cost down over time.

California Update

California Update

27

28

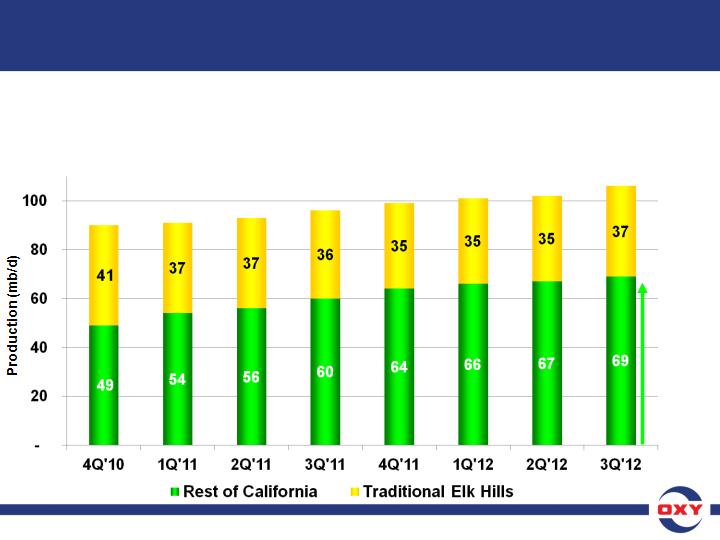

• In mid-2010, we shifted our development program to conventional and

unconventional opportunities outside of the traditional and more mature

Elk Hills areas.

unconventional opportunities outside of the traditional and more mature

Elk Hills areas.

90

91

93

96

99

101

102

106

Liquids Production Volumes

California Liquids Production

+20 mb/d

production

growth

production

growth

28

29

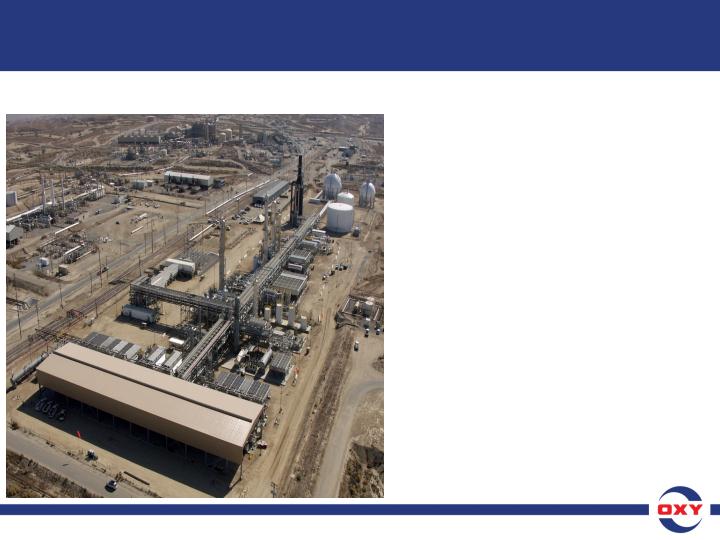

• Over the last several years we

have spent $370 mm on the

new Elk Hills gas plant.

have spent $370 mm on the

new Elk Hills gas plant.

• The plant went into operation in

early July and, notwithstanding

initial startup issues, is

positively affecting our

operational efficiency and

production including higher

liquids yields.

early July and, notwithstanding

initial startup issues, is

positively affecting our

operational efficiency and

production including higher

liquids yields.

• The plant operated optimally

for about one month in 3Q12

and has been operating as

expected since.

for about one month in 3Q12

and has been operating as

expected since.

California Gas Processing Plant

California Gas Processing Plant

Elk Hills Cryogenic Gas Processing Plant

29

This page left intentionally blank.

30

31

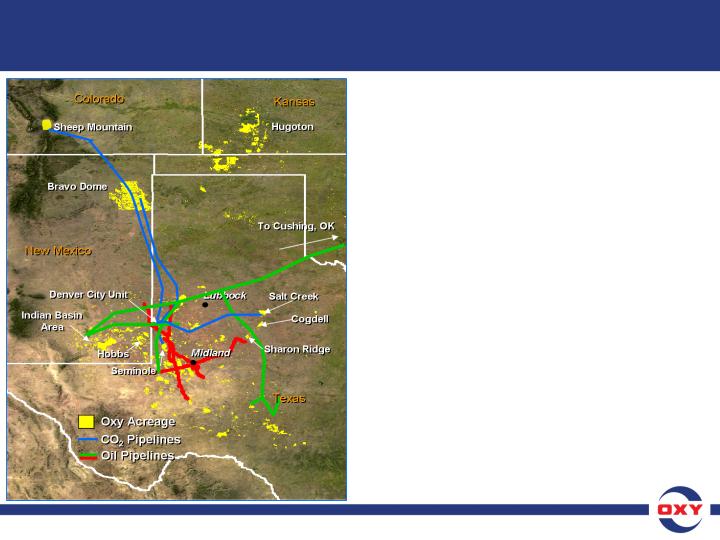

Permian Basin Overview

• 3Q12 production of 209 mboe/d

• Largest oil producer in Permian

(~15% net share of total)

(~15% net share of total)

• Largest operator in Permian

(of 1,500+ operators)

(of 1,500+ operators)

• ~64% of Oxy’s Permian oil

production is from CO2 related

EOR projects - Oxy’s most

profitable business

production is from CO2 related

EOR projects - Oxy’s most

profitable business

• Drilled ~409 wells on operated

properties in 2011

properties in 2011

• Have another 2.5 BBOE of likely

recoverable resource

recoverable resource

• 1.7 bcf/d (0.5 tcf/year) of CO2

• Ample supply of CO2 accelerates

project implementations

project implementations

31

32

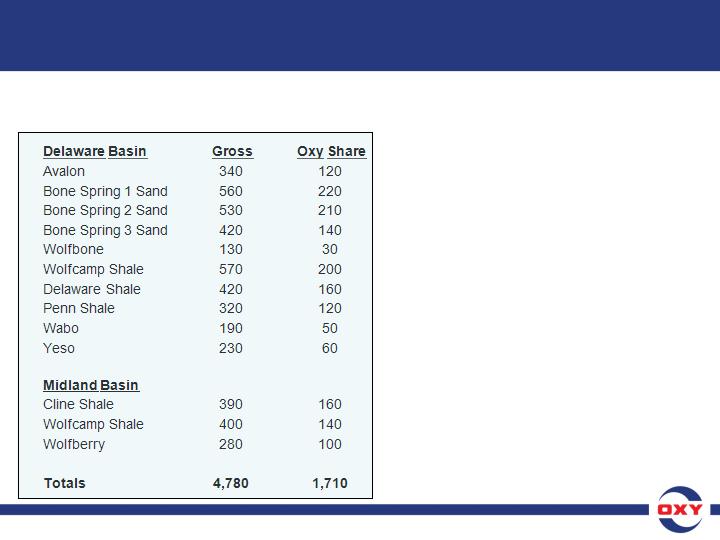

Acreage in Select Permian Plays

(Thousands of Acres)

• Permian non-CO2 business is one

of Oxy’s fastest growing assets;

of Oxy’s fastest growing assets;

• Since beginning delineation and

development efforts in 2010, we

have grown production by +25%;

development efforts in 2010, we

have grown production by +25%;

• As a result of the significant

activity by us and our partners,

our Permian acreage where we

believe resource development is

likely, has grown from our

estimate of about 3 mm gross

acres earlier in the year to about

4.8 mm acres in October;

activity by us and our partners,

our Permian acreage where we

believe resource development is

likely, has grown from our

estimate of about 3 mm gross

acres earlier in the year to about

4.8 mm acres in October;

• Oxy's net share of this acreage

grew from about 1 mm acres to

about 1.7 mm acres during the

same period.

grew from about 1 mm acres to

about 1.7 mm acres during the

same period.

Permian non-CO2 Business

32

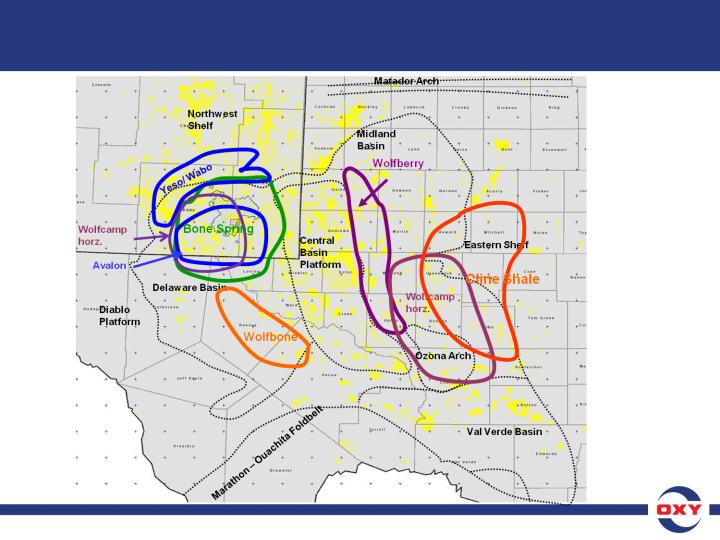

33

Map of Select Permian Basin Plays

33

34

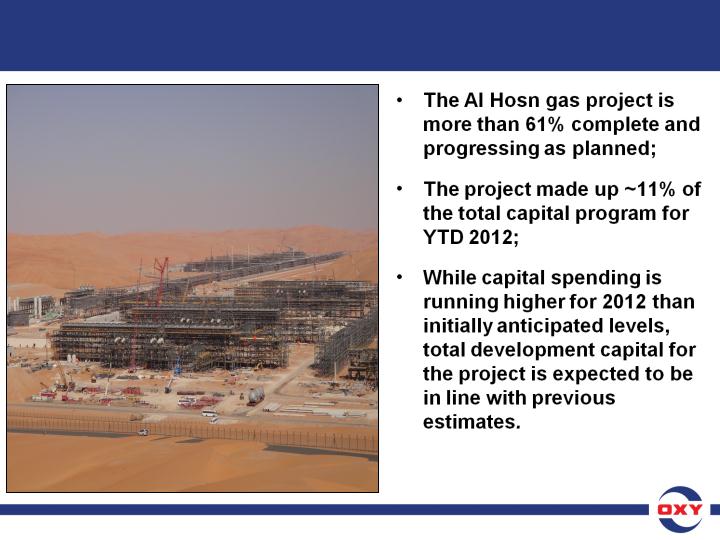

Abu Dhabi - Al Hosn Gas Project (Shah Field)

• Shah Gas Field one of the largest

in the Middle East;

in the Middle East;

• Oxy holds a 40% participating

interest under a 30-year contract;

interest under a 30-year contract;

• The project involves development

of high-sulfur content reservoirs

within the Shah field, located

onshore ~180 km so. west of Abu

Dhabi;

of high-sulfur content reservoirs

within the Shah field, located

onshore ~180 km so. west of Abu

Dhabi;

• Production start-up is scheduled

in late 2014;

in late 2014;

• Anticipated to produce ~500

mmcf/d of sales gas and 50 mboe/d

of NGLs and condensate -

providing net to Oxy ~200 mmcf/d

of gas and ~20 mboed of NGLs and

condensate.

mmcf/d of sales gas and 50 mboe/d

of NGLs and condensate -

providing net to Oxy ~200 mmcf/d

of gas and ~20 mboed of NGLs and

condensate.

34

35

Abu Dhabi - Al Hosn Gas Project (Shah Field)

35

This page left intentionally blank.

36

Abu Dhabi - Al Hosn Gas Project (Shah Field)

37

This page left intentionally blank.

38

39

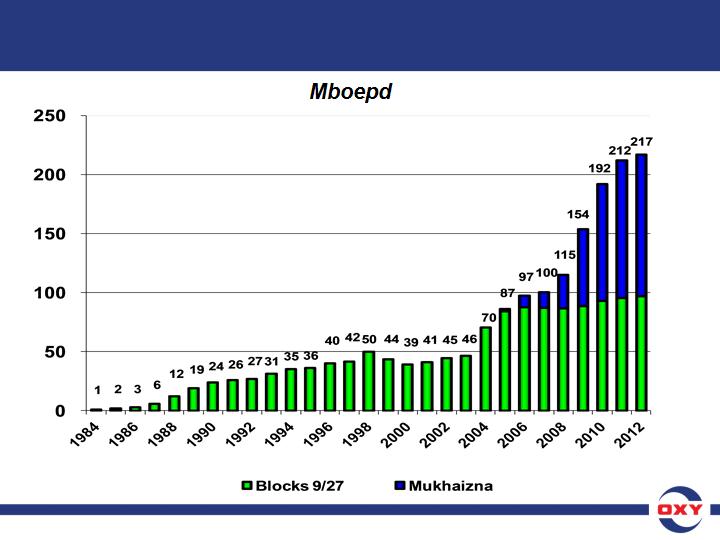

Oxy Oman Gross Production Growth

39

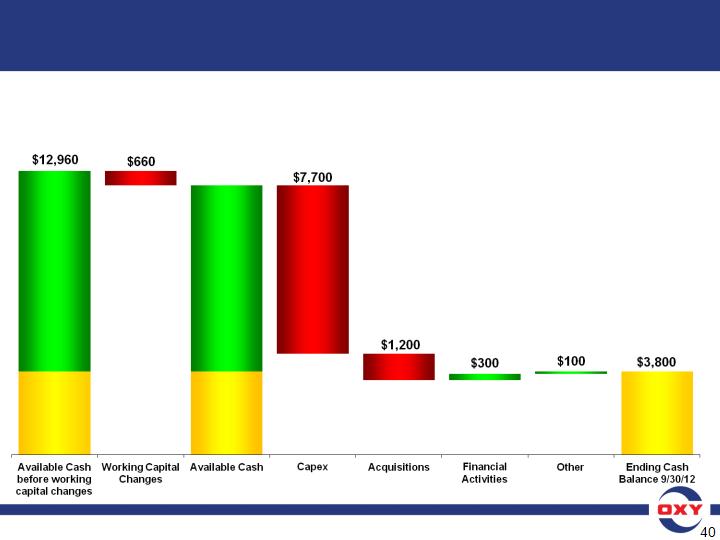

– Working capital reduced our nine-month cash flow from operations of $9.2 billion by ~$660 mm to $8.5 billion.

~$510 mm of working capital use occurred in 3Q12. Capex was $7.7 billion for the first nine months, of which

$2.6 billion was spent in 3Q12; YTD capex was 82% in oil and gas, 14% in midstream and remainder in chemicals.

Financial activities, which included dividends paid, stock buybacks and a $1.74 billion borrowing earlier this year,

provided a net $300 mm of cash flow.

~$510 mm of working capital use occurred in 3Q12. Capex was $7.7 billion for the first nine months, of which

$2.6 billion was spent in 3Q12; YTD capex was 82% in oil and gas, 14% in midstream and remainder in chemicals.

Financial activities, which included dividends paid, stock buybacks and a $1.74 billion borrowing earlier this year,

provided a net $300 mm of cash flow.

($ in millions)

Cash Flow

From

Operations

before

Working

Capital

changes

From

Operations

before

Working

Capital

changes

$9,160

Beginning

Cash

$3,800

12/31/11

Cash

$3,800

12/31/11

Beginning

Cash

$3,800

12/31/11

Cash

$3,800

12/31/11

Cash Flow

From

Operations

$8,500

From

Operations

$8,500

$12,300

Summary of YTD 2012 Cash Flow

40

41

Gross Cash Flow Uses

Gross Cash Flow Uses

Dividends

Debt Reduction &

Cash

Cash

Share Repurchase

Acquisitions

Capital

100

9

20

14

16

41

2007

100

9

16

2

29

44

2011

Percentage of Total

100

9

3

21

26

41

2006

100

8

-

13

40

39

2008

100

16

3

-

27

54

2009

100

10

15

-

42

33

2010

Sub-Total

57

73

66

79

81

75

31

42

5-yr avg.

73

41

This page left intentionally blank.

42

43

• Company’s core business is acquiring assets that can provide

future growth through improved recovery.

future growth through improved recovery.

– Foreign contracts

– Domestic add-ons

– Small incremental additions to production in short term

• Generate returns of at least 15% in the US and 20% overseas.

• Overall average finding & development costs of less than 25%

of selling price.

of selling price.

• Our program continues to generate a significant amount of free

cash flow after capital.

cash flow after capital.

• Acquisitions are measured against reinvesting in the existing

business with the goal of enhancing company value.

business with the goal of enhancing company value.

• Large number of opportunities over 5-year period.

• Deep inventory of high-return opportunities eliminates the need

to pursue capital intensive acquisitions.

to pursue capital intensive acquisitions.

Acquisition Strategy

43

44

• 5 - 8% base annual production growth over the long term

• Opportunity for additional volume growth

• Returns on invested capital significantly in excess of the

Company’s cost of capital

Company’s cost of capital

• Consistent, annual increases in dividends

• Significant financial flexibility for opportunities in distressed

periods

periods

• Conservative financial statements

• Committed to generating stock market value which is greater

than earnings retained

than earnings retained

• We believe this will generate top quartile returns for our

shareholders

shareholders

Oxy - Investment Attributes

44

Cautionary Statement

45

Portions of this presentation contain forward-looking statements and involve risks and uncertainties that could materially affect

expected results of operations, liquidity, cash flows and business prospects. Factors that could cause results to differ

materially include, but are not limited to: higher-than-expected costs; global commodity pricing fluctuations; supply and demand

considerations for Occidental’s products; general domestic political and regulatory approval conditions; political events; not

successfully completing, or any material delay of, any development of new fields, expansion projects, capital expenditures,

efficiency-improvement projects, acquisitions or dispositions; potential failure to achieve expected production from existing and

future oil and gas development projects; exploration risks such as drilling unsuccessful wells; any general economic recession

or slowdown domestically or internationally; potential liability for remedial actions under existing or future environmental

regulations and litigation; potential liability resulting from pending or future litigation; general domestic and international political

conditions; potential disruption or interruption of Occidental’s production or manufacturing or damage to facilities due to

accidents, chemical releases, labor unrest, weather, natural disasters or insurgent activity; failure of risk management; changes

in law or regulations; or changes in tax rates. The United States Securities and Exchange Commission (SEC) permits oil and

natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically producible, as of a given

date, by application of development projects to known accumulations. We use certain terms in this presentation, such as net-in

-place, net risked reserves, de-risked, EUR (expected ultimate recovery), discovered barrels, likely recoverable resources, net

remaining and oil in place, that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These terms represent

our internal estimates of volumes of oil and gas that are not proved reserves but are potentially recoverable through exploratory

drilling or additional drilling or recovery techniques and are not intended to correspond to probable or possible reserves as

defined by SEC regulations. By their nature these estimates are more speculative than proved, probable or possible reserves

and subject to greater risk they will not be realized. You should not place undue reliance on these forward-looking statements,

which speak only as of the date of this presentation. Unless legally required, Occidental does not undertake any obligation to

update any forward-looking statements, as a result of new information, future events or otherwise. U.S. investors are urged to

consider carefully the disclosures in our 2011 Form 10-K, available through the following toll-free number 1-888-OXYPETE (1-

888-699-7383) or on the internet at http://www.oxy.com. You also can obtain a copy form the SEC by calling 1-800-SEC-0330.

We post or provide links to important information on our website including investor and analyst presentations, certain board

committee charters and information that SEC requires companies and certain of its officers and directors to file or furnish.

Such information may be found in the “Investor Relations” and “Social Responsibility” portions of the website.

expected results of operations, liquidity, cash flows and business prospects. Factors that could cause results to differ

materially include, but are not limited to: higher-than-expected costs; global commodity pricing fluctuations; supply and demand

considerations for Occidental’s products; general domestic political and regulatory approval conditions; political events; not

successfully completing, or any material delay of, any development of new fields, expansion projects, capital expenditures,

efficiency-improvement projects, acquisitions or dispositions; potential failure to achieve expected production from existing and

future oil and gas development projects; exploration risks such as drilling unsuccessful wells; any general economic recession

or slowdown domestically or internationally; potential liability for remedial actions under existing or future environmental

regulations and litigation; potential liability resulting from pending or future litigation; general domestic and international political

conditions; potential disruption or interruption of Occidental’s production or manufacturing or damage to facilities due to

accidents, chemical releases, labor unrest, weather, natural disasters or insurgent activity; failure of risk management; changes

in law or regulations; or changes in tax rates. The United States Securities and Exchange Commission (SEC) permits oil and

natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically producible, as of a given

date, by application of development projects to known accumulations. We use certain terms in this presentation, such as net-in

-place, net risked reserves, de-risked, EUR (expected ultimate recovery), discovered barrels, likely recoverable resources, net

remaining and oil in place, that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These terms represent

our internal estimates of volumes of oil and gas that are not proved reserves but are potentially recoverable through exploratory

drilling or additional drilling or recovery techniques and are not intended to correspond to probable or possible reserves as

defined by SEC regulations. By their nature these estimates are more speculative than proved, probable or possible reserves

and subject to greater risk they will not be realized. You should not place undue reliance on these forward-looking statements,

which speak only as of the date of this presentation. Unless legally required, Occidental does not undertake any obligation to

update any forward-looking statements, as a result of new information, future events or otherwise. U.S. investors are urged to

consider carefully the disclosures in our 2011 Form 10-K, available through the following toll-free number 1-888-OXYPETE (1-

888-699-7383) or on the internet at http://www.oxy.com. You also can obtain a copy form the SEC by calling 1-800-SEC-0330.

We post or provide links to important information on our website including investor and analyst presentations, certain board

committee charters and information that SEC requires companies and certain of its officers and directors to file or furnish.

Such information may be found in the “Investor Relations” and “Social Responsibility” portions of the website.

45

Occidental Petroleum Corporation

46

46