Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED JANUARY 7, 2013 - DAKOTA PLAINS HOLDINGS, INC. | dakota130087_8k.htm |

Exhibit 99.1

Investor Presentation

January 2013

www.dakotaplains.com

1/7/2013

1

Forward Looking Statements

Statements made by representatives of Dakota Plains Holdings, Inc. (“Dakota Plains” or the “Company”) during the course of this presentation that are not historical facts, are forward-looking statements. These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to global economics or politics, our ability to obtain additional capital needed to implement our business plan, minimal operating history, loss of key personnel, lack of business diversification, reliance on strategic, third-party relationships, financial performance and results, prices and demand for oil, our ability to make acquisitions on economically acceptable terms, and other important factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Dakota Plains undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information or future events.

1/7/2013

2

Dakota Plains Holdings, Inc. Overview

Dakota Plains Holdings, Inc. (OTCBB:DAKP) is a publicly traded company focused on developing

transloading facilities, marketing and transporting of crude oil and related products from and into

the

Williston Basin oil fields of North Dakota. The Company was founded in 2008 and is based in

Wayzata, MN.

The Company focuses on marketing and transporting oil produced from the Bakken Shale, which

was named the largest on-shore oil deposit in North America by the US Geological Society.

Publicly traded effective March 2012

North Dakota is the 2nd largest oil producing state in the USA.

World Class Relationships

World Fuel Services (NYSE:INT) – $2.7 B market cap, Marketing and Transloading Partner

Prairie Field Services – Trucking Services Partner

Strobel Starostka Transfer – Premier national logistics and transloading operations company

Canadian Pacific – One of two Class 1 rail lines operating in the Williston Basin

Three Business Lines

Transloading Oil Products

Marketing Williston Basin Crude Oil

Trucking

1/7/2013

3

Dakota Plains Midstream Businesss

Marketing

Upstream

(E&P)

Downstream

(Refinery)

Pipeline = WTI Markets

Crude By Rail = Brent Markets

Trucking

We take title to the crude oil at the

well, pay the transportation related

expenses and sell at the refinery.

Transloading

Average Volumes

Truck = 220 barrels

Tank Car = 680 barrels

Average Volumes

Unit Train = 80-120 Cars

Unit Train = 54k – 82k barrels

1/7/2013

4

Business Segments

Transloading

50/50 joint venture with World Fuel Services (NYSE:INT)

Land is owned by Dakota Plains, infrastructure investments shared through 2021

Crude focus started August 2010 with two tracks each capable of 40 tank cars

Doubled facility’s onsite capacity in July 2011 to four 40 car tracks

Approximately 5.6 million barrels of crude oil transloaded in 2011

Approximately 5.5 million barrels of crude oil transloaded through September 2012

Marketing

50/50 joint venture with World Fuel Services (NYSE:INT) through 2021

Initiated marketing of crude oil in July 2011

1,104 tank cars under long term lease, average 7 years remaining

Approximately 1.2 million barrels of crude oil marketed in 2011

Approximately 5.7 million barrels of crude oil marketed through September 2012

Trucking

50/50 joint venture with Prairie Field Services through 2021

Established in September 2012

Immediate focus is hauling crude oil

Extensive expansion opportunities

Phase 1 & Phase 2

1/7/2013

5

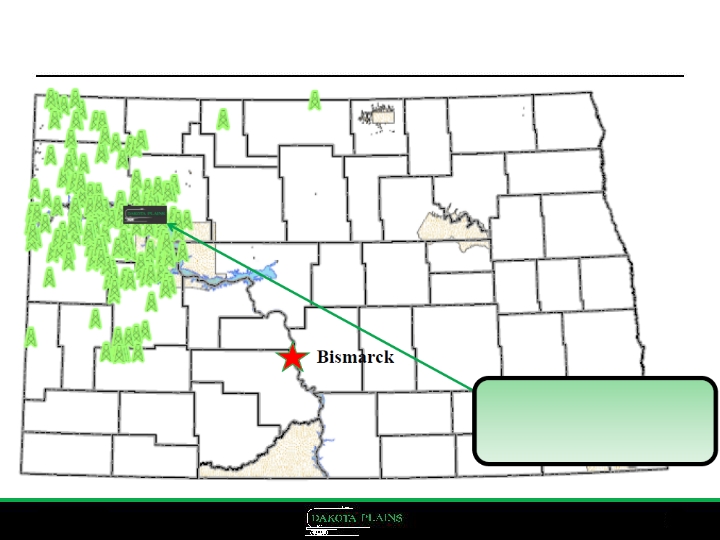

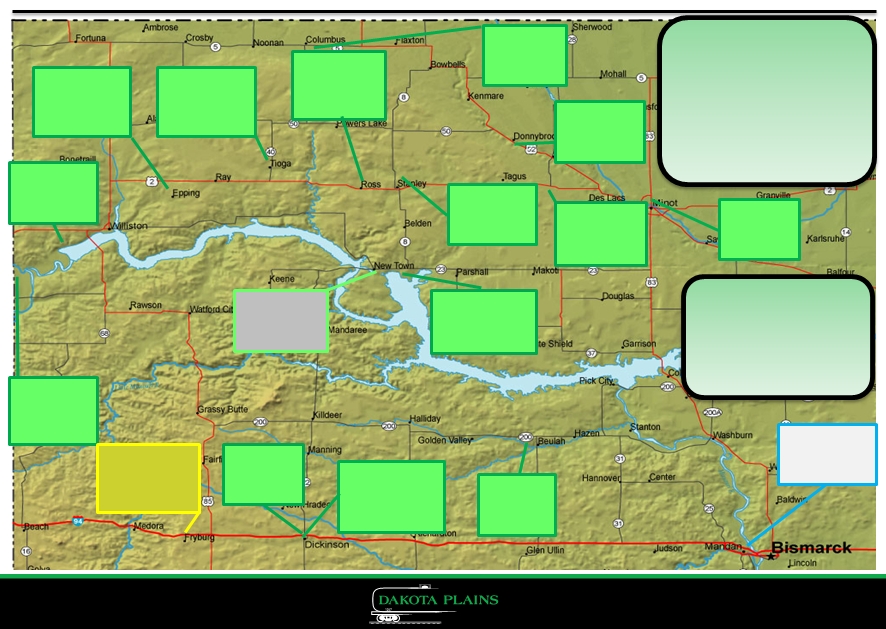

January 2013 – 179 Rigs

Source: North Dakota Industrial Commission – https://www.dmr.nd.gov/OaGIMS/viewer.htm. 01-07-13.

Location, Location, Location:

Dakota Plains’ rail terminal is located

in the heart of the Bakken and Three

Forks play in Mountrail County, ND.

1/7/2013

6

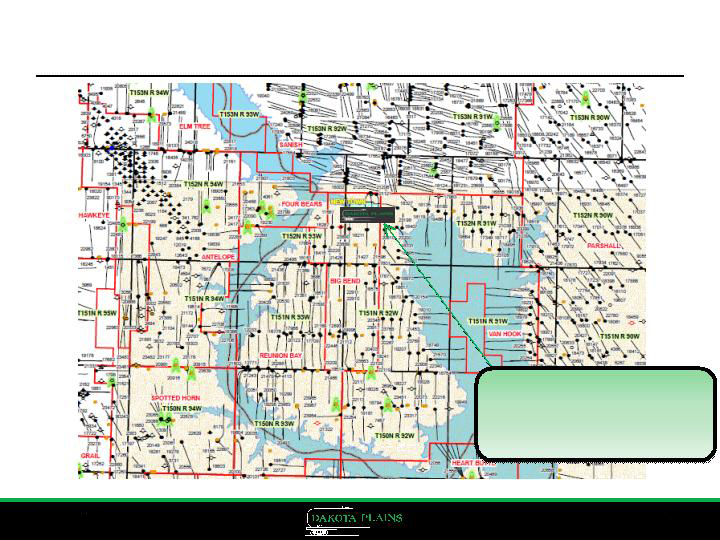

New Town Area Wells – January 2013

Source: North Dakota Industrial Commission – https://www.dmr.nd.gov/OaGIMS/viewer.htm. 01-07-13

Location, Location, Location:

All crude leaving the peninsula is forced

to cross the Dakota Plains Rail Terminal.

Likely 1,300+ wells from 168 current

spacing units in this captive geography.

1/7/2013

7

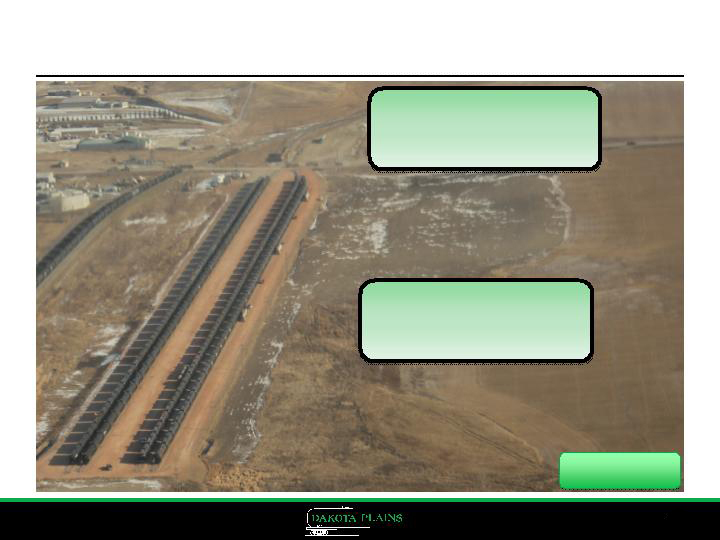

New Town – Site Today

GGC Photo 01-17-12

Top Tier Logistics:

The site is connected to the Canadian

Pacific line and is currently managed

by Strobel Starostka, a national leader

in transloading logistics and operations.

Expansion Opportunity:

Dakota Plains and WFS are planning

the addition of a more efficient, double

loop track on this site, to be constructed

without affecting existing operations.

1/7/2013

8

Williston Basin Crude Production Forecast

Source: North Dakota Pipeline Authority 09-20-12 presentation and December 2012 Monthly Update.

North Dakota

1,000,000 bpd

Q2 2014

2012 North Dakota Results

January = 546,547 bpd

February = 558,558 bpd

March = 577,478 bpd

April = 609,503 bpd

May = 639,277 bpd

June = 660,332 bpd

July = 676,249 bpd

August = 701,409 bpd

September = 729,248 bpd

October = 747,239 bpd

1/7/2013

9

Williston Basin Crude Oil Pipelines

Source: North Dakota Pipeline Authority 09-20-12.

Tesoro 68,000 bbls/day

Enbridge 235,000 bbls/day

Belle Fourche, Bridger, Butte,

Little Missouri & Plains 145,000 bbls/day

TransCanada ? bbls/day

Total Capacity Roughly 448,000 bbls/day

Tesoro Mandan

Refinery

Baker, MT

1/7/2013

10

Williston Basin Oct. 2012 Takeaway

Source: North Dakota Pipeline Authority December 2012

October 2012

July 2011

ND Avg = 425k bpd

E. MT Avg ≈ 65k bpd

Pipe ≈ 328k bpd

Tesoro ≈ 58k bpd

Rail ≈ 83k bpd

ND Avg = 747,239 bpd

E. MT Avg ≈ 68,907 bpd

Pipe ≈ 310,135 bpd

Tesoro ≈ 65,292 bpd

Rail ≈ 424,396 bpd

1/7/2013

11

Dakota Plains

New Town

50k bbls/day

3rd Party OK

Storage = 90k

EOG

Stanley

70k bbls/day

NO 3rd Party

Storage = 240k

Lario Logistics

Bakken Oil Express

Dickinson

100k bbls/day

Belle Fourche Pipe

Storage = 210k + 200K

Global/Basin

Zap

70k bbls/day ?

3rd Party OK

No Storage

Port of ND

Minot

30k bbls/day ?

3rd Party OK

No Storage

Savage

Trenton

90K bbls/day

2-Gathering Lines

Storage = 300k

Rangeland COLT

Epping ≈ $70m

80k bbls/day

Beaver Lodge Pipe

Storage = 600k

Hess

Tioga ≈ $48m

70k bbls/day

Gathering

3rd Party ?

Storage = 180k +

Global/Basin

Stampede

70k bbls/day ?

3rd Party OK

Storage = 100k

Centennial Energy

Donnybrook

10k bbls/day ?

3rd Party ?

No Storage

Tesoro Logistics

Refinery

Mandan

58k bbls/day

Musket Corp.

Dore

70k bbls/day

Banner Pipeline

3rd Party OK

Storage = 90k

Enbridge

Berthold

80k bbls/day

Gathering

Storage = 300k

Musket Corp.

Dickinson

8k bbls/day ?

3rd Party OK

No Storage

Great Northern

Power Development

Fryburg ≈ $45m

BakkenLink Pipeline

70k bbls/day

Storage = 300k

Plains All American

Ross – 350 acres

65k bbls/day

Gathering

Robinson Lake Pipe

Storage = 200K +

USD

Van Hook

65K bbls/day?

3rd Party OK

Storage ≈ 12k + 285K

ND Crude By Rail Sites

Rail has a Bright Future:

Pipeline companies such as

Enbridge and Plains All

American, as well as top

operators like EOG and

Hess have made substantial

investments in Williston

Basin crude

terminals.

Pipeline Capacity will

consistently be unable to

handle current and

anticipated Bakken

production volumes.

1/7/2013

12

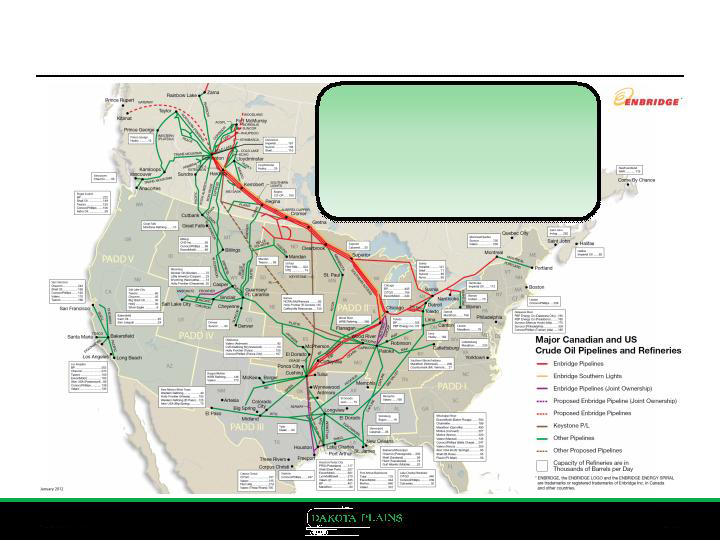

Crude Oil Pipelines & Markets

Are New Pipelines such as Keystone a Threat to

Dakota Plains?

Keystone’s capacity is projected at 700K BOPD.

600K oil sand barrels will already be in the pipe as it

crosses the US border. Other pipeline projects are

many

years out, but once online, Dakota Plains may

transition its marketing efforts to pipeline if needed

and use rail for both outbound crude and inbound

commodities and supplies.

1/7/2013

13

Current Destinations

Galveston, TX

St. John, NB

Irving Oil

Albany, NY

Global

Petroleum

“Philadelphia”

St. James, LA

US Development

and NuStar

Terminals

Shreveport, LA

Calumet

Bakersfield, CA

Kern

Walnut Hill, FL

Genesis Energy

Bakken Pipelines are Limited in their Destination

Crude by rail provides access to markets that

current pipelines cannot access, allowing Dakota

Plains to take advantage of the WTI to Brent/LLS

spread in several markets. Numerous

new

destinations are being constructed and planned.

1/7/2013

14

New Town - Future

Existing Tracks:

After the loop tracks are finished,

the 10,000 feet of existing tracks

will be used for inbound

commodity transloading.

Loop Tracks:

Expansion at New Town in the

form of a new double loop track

will significantly expand takeaway

capacity.

Margin Improvements:

Loop tracks are the most efficient,

and Class 1 railroads traditionally

incentivize the owners investment

via lower cost structures for

shipments.

1/7/2013

15

Business Segments – Phase 2

Transloading

Double loop tracks capable of handling 120 car unit trains

All crude by rail operations transition to loop tracks

Crude by rail volumes increase 50-100%

Inbound commodity transloading launches on Tracks 1-4

Additional revenue stream for storage of sand, pipe, ceramics, etc.

Marketing

No down time during construction of loop tracks

Loop track efficiencies drive better Canadian Pacific freight rates

Easily launch 100+ car unit trains

Onsite storage solutions

Volume allocations secured in pipelines

Trucking

Turnkey solution for hauling inbound commodities out to wells

Continued expansion of crude hauling

Enter the water hauling segment

1/7/2013

16

2013 Operational Targets

EBITDA Range of $25 to $31 Million

10 to 11 Million Barrels Transloaded

11 to 13 Million Barrels Marketed

5 to 5.5 Million Barrels Trucked

Expansion of Offsite Marketed Barrels

Inbound Transloading, Storage & Trucking

Successful Completion of Loop Track

Successful tie-in to localized gathering systems

1/7/2013

17

Financial Overview

Dakota Plains reports its financials using the “Equity Method” which nets out nearly all of Dakota Plains’

true revenues and expenses associated with each of their three JVs to one

line item “Other Income” located

below GAAP Revenue and Income from Operations on the Income Statement. As such, normal GAAP top-

line revenue and GAAP income from operations are not appropriate performance metrics.

Dakota Plains has continued to increase production in both barrels transloaded and marketed. Year to date,

Dakota Plains has seen an increase in barrels marketed by 363.5% over 2011

Totals. Barrels transloaded is

also outpacing 2011 Totals and through three quarters is almost even with 2011 Totals.

Price data as of 01-07-13.

Balance Sheet items as of Q3 2012

Note: Enterprise Value calculation includes Restricted Cash Balance

Source: CapIQ, Company Filings

Growth in Operations

Company Financial Highlights

Symbol

DAKP

Stock Price

$3.40

Market Cap (MM)

$142.2

Shares Outstanding (MM)

41.8

52 Week High

$12.50

52 Week Low

$2.25

Cash (MM)

$5.0

Restricted Cash (MM)

$25.0

Total Debt (MM)

$26.6

Enterprise Value (MM)

$138.6

Total Assets (MM)

$39.0

2012 9 Mos. Adjusted EBITDA (MM)

$10.0

1/7/2013

18

INVESTMENT CASE

Current Market Price approximately 5x 2013 midpoint target EBITDA of $0.67/Share

No Net Debt, Approximately $30 Million in Cash, $26.6 Long Term Debt

Solid and Experienced JV Partners Across all Business Lines

Extensive Expansion Opportunities

Premier Site Offering Competitive Advantage in Marketing & Transloading

Attractive Acquisition Target For Mid-Stream MLP

Bakken Production Expected to More Than Double From Current Level

Dakota Plains Owns all Property and Infrastructure

JV Partners Pay for 50% share of Any Improvements

1/7/2013

19

Questions and Answers

1/7/2013

20