Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE ISSUED JANUARY 7, 2013 - Wright Medical Group N.V. | d462429dex991.htm |

| 8-K - FORM 8-K - Wright Medical Group N.V. | d462429d8k.htm |

January 7, 2012

David Mowry,

Interim President and CEO

Specialists SERVING

Specialists

Exhibit 99.2

[ 1 ] |

Forward-Looking Statements

[ 2 ]

Statements contained in this presentation that relate to future, not past, events are

forward-looking statements under the Private Securities Litigation Reform Act of 1995.

Forward-looking

statements are based on current expectations of future events and often can be identified by

words such as “expect,” “anticipate,” “project,” “intend,”

“will,” “may,” “believe,” “should,” “could,”

“continue,” “estimate,” “outlook,” “plan,” “guidance,” other words of similar meaning

or the use of future dates. Forward-looking statements by their nature address matters that are,

to different degrees, uncertain. Uncertainties and risks may cause Tornier’s actual

results to be materially different than those expressed in or implied by Tornier’s

forward-looking statements. For Tornier, such uncertainties and risks include, among

others, Tornier’s future operating results and financial performance, fluctuations in

foreign currency exchange rates, the effect of global economic conditions, the timing of

regulatory approvals and introduction of new products, physician acceptance, endorsement, and

use of new products; the effect of regulatory actions, changes in and adoption of reimbursement

rates, potential product recalls, competitor activities and the costs and effects of litigation

and changes in tax and other legislation. More detailed information on these and other factors

that could affect Tornier’s actual results are described in Tornier’s filings with

the U.S. Securities and Exchange Commission, including its most recent quarterly report

on Form 10-Q. Tornier undertakes no obligation to update its forward-looking

statements.

|

Non-GAAP Financial Measures

[ 3 ]

Tornier uses certain non-GAAP financial measures in this presentation, such as

constant

currency. Tornier uses non-GAAP financial measures as supplemental measures

of

performance and believes these measures provide useful information to investors in

evaluating Tornier’s operations, period over period. However,

non-GAAP financial measures have

limitations as analytical tools, and should not be considered in isolation or as a substitute

for Tornier’s financial results prepared in

accordance with GAAP. In addition, investors should

note that any non-GAAP financial measure Tornier uses may not be the same

non-GAAP financial

measure, and may not be calculated in the same manner, as that of other companies.

A reconciliation of the non-GAAP financial measures used in the presentation to the

most directly comparable GAAP

financial measures can be found on Tornier’s website

www.tornier.com under the “Non-GAAP Measure Reconciliation Tables” section of

the

“Investor Relations” page.

|

Specialists SERVING

Specialists

Global Medical Device Company,

Focusing on Surgeons Treating

Extremities Injuries and Disorders

EXTREMITIES

[ 4 ] |

The

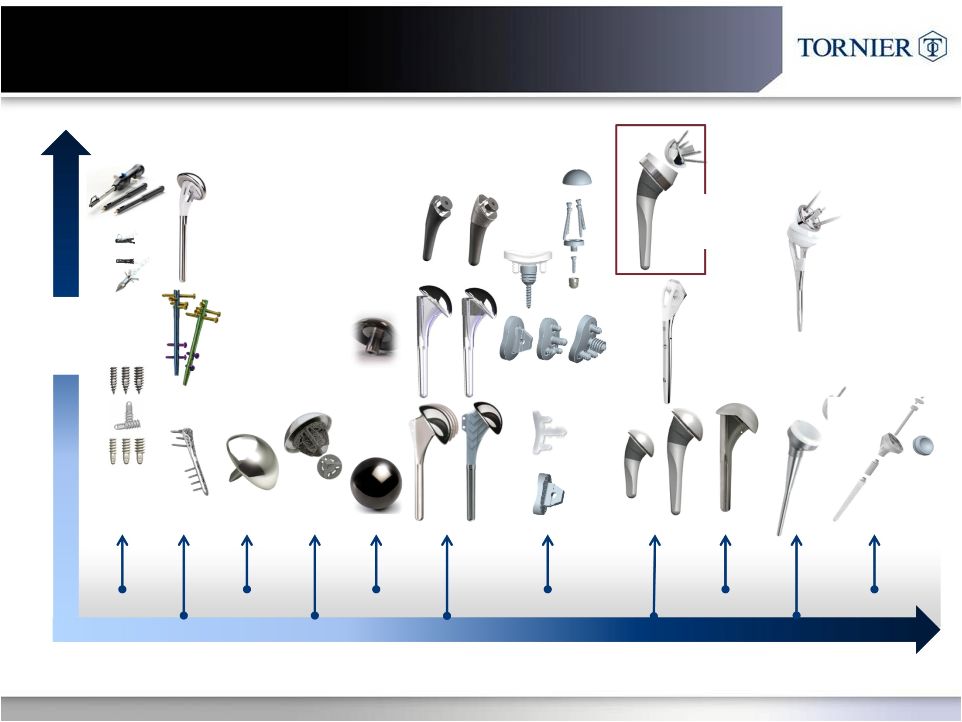

Tornier Story: Positioning for Future Growth BROADEST

PRODUCT PORTFOLIO

Upper

Extremities

Lower

Extremities

Biologics/

Sports

Medicine

Leader in Innovation,

Science & Education

HIGH

GROWTH MARKET

Robust Drivers

Assure Growth

$6.5B

7-9%

CAGR

(’12 –

’17)

SCALE FOR

EFFICIENT SALES

Target High-Volume

Extremities Specialists

Upper

Extremities

Lower

Extremities

[ 5 ]

Extremities

EXECUTION FOCUS FOR 2013 |

Attractive Market for Extremities

BROADEST

PRODUCT PORTFOLIO

Upper

Extremities

Lower

Extremities

Biologics/

Sports

Medicine

Leader in Innovation,

Science Education

SCALE FOR

EFFICIENT SALES

Target High-Volume

Extremities Specialists

EXECUTION FOCUS FOR 2013

HIGH

GROWTH MARKET

Robust Drivers

Assure Growth

Extremities

$6.5B

7-9%

CAGR

(’12 –

’17)

Upper

Extremities

Lower

Extremities

[ 6 ] |

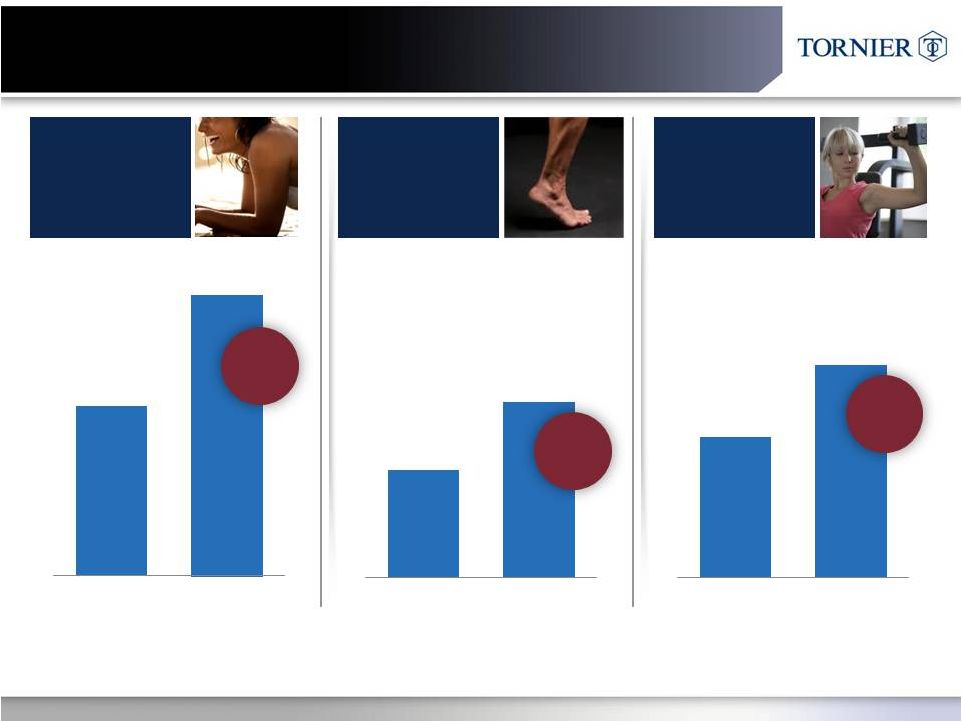

Large

and Growing Global Extremities Market $2.7B

~ $4.0B

8-9%

CAGR

UPPER

EXTREMITES

$2.1B

~ $3.0B

7-8%

CAGR

SPORTS

MEDICINE &

BIOLOGICS

$1.7B

~ $2.5B

7-8%

CAGR

LOWER

EXTREMITIES

Total

Extremities

Market

Is

$6.5B

with

7-9%

CAGR

[ 7 ]

2012

2017

2012

2017

2012

2017 |

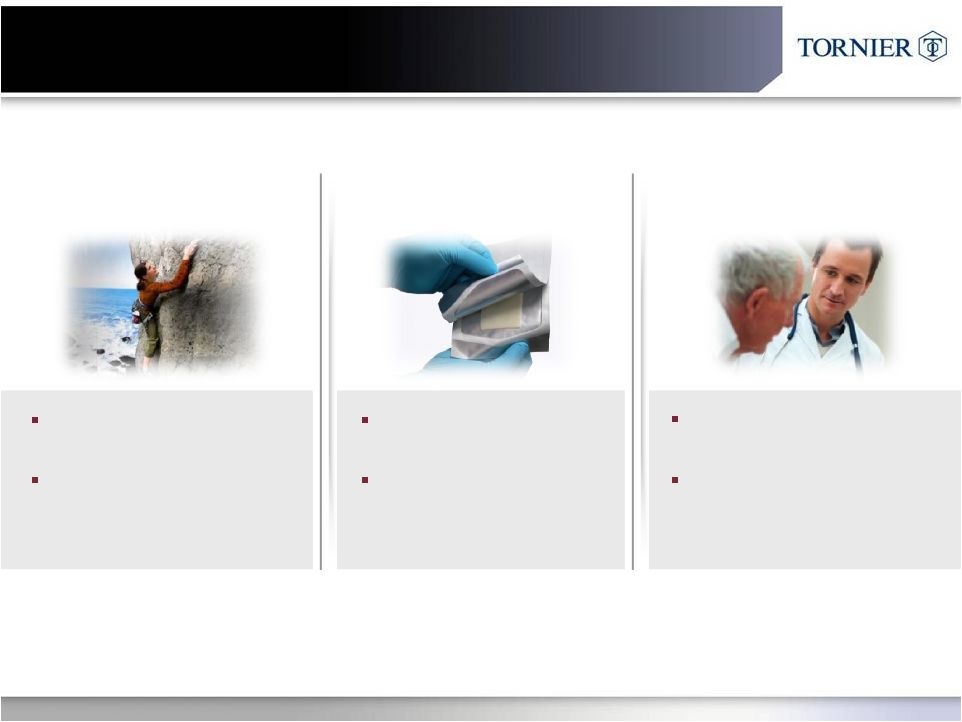

Robust

Extremities Market Drivers Provide Opportunity for Future Growth and

Differentiation Active, Younger

Patient Population

Expanding Knowledge

of Treatment Options

Early Stages of

Device Innovation

Opportunity for

Material and Design

Improvements

TECHNOLOGY

PATIENTS

OUTCOMES

Upside for Continued

Clinical Improvements

Economic Environment

Driving Clinical Data

Requirements

[ 8 ] |

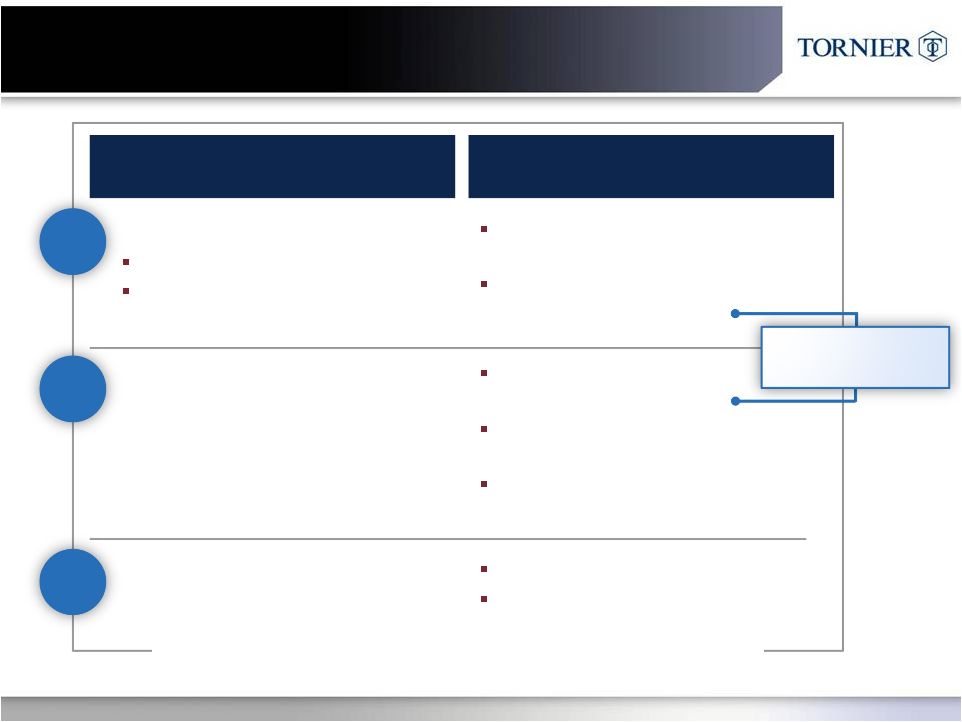

2012

Actions Focused on Capturing Opportunities ACTIONS

ACTIONS

OPPORTUNITY

OPPORTUNITY

Specific Press-fit Shoulder

Broaden Lower Extremities

Offering

US SALES CHANNEL

EXECUTION

OVERHEAD / EXPENSE

REDUCTION

1

2

3

Access to Foot & Ankle

Sales Channel

New Sales Management

Organization

Developed 2013 Playbook

for Upper & Lower Focus

COGS Reduction / Insourcing

Facilities Consolidation

Introduced 14 New Products

including the Ascend Flex

Acquired Foot & Ankle Bone

Fixation Portfolio

OrthoHelix

Acquisition

* Nine months ended September 30, 2012 constant currency growth of 8.9% over nine

months ended October 2, 2011 [ 9 ]

BROADEN PORTFOLIO

9%* Y-O-Y Extremities Revenue Growth |

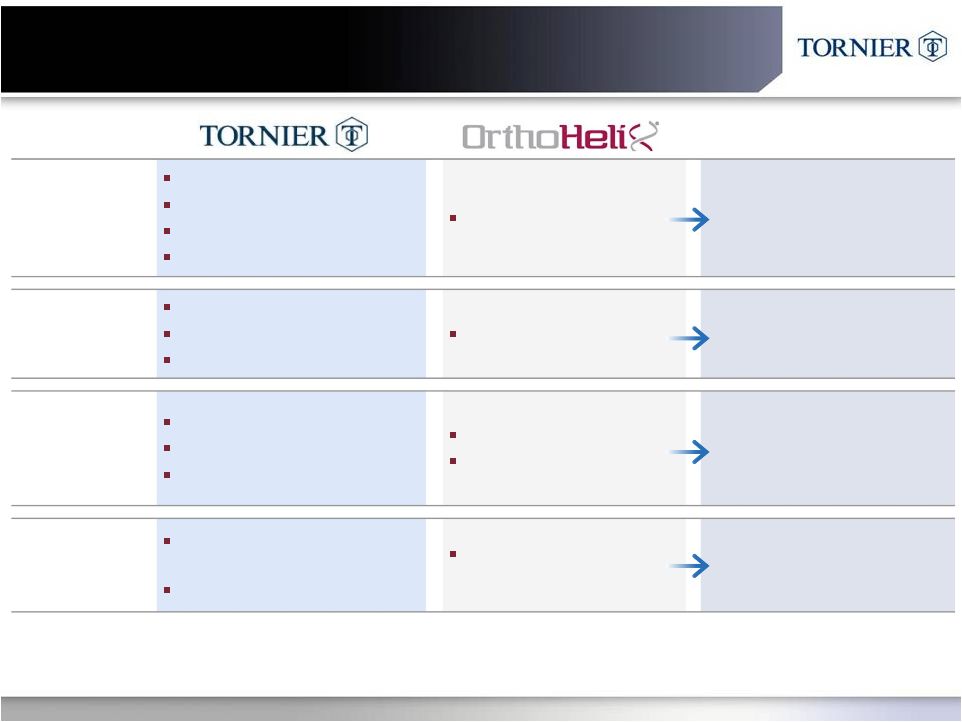

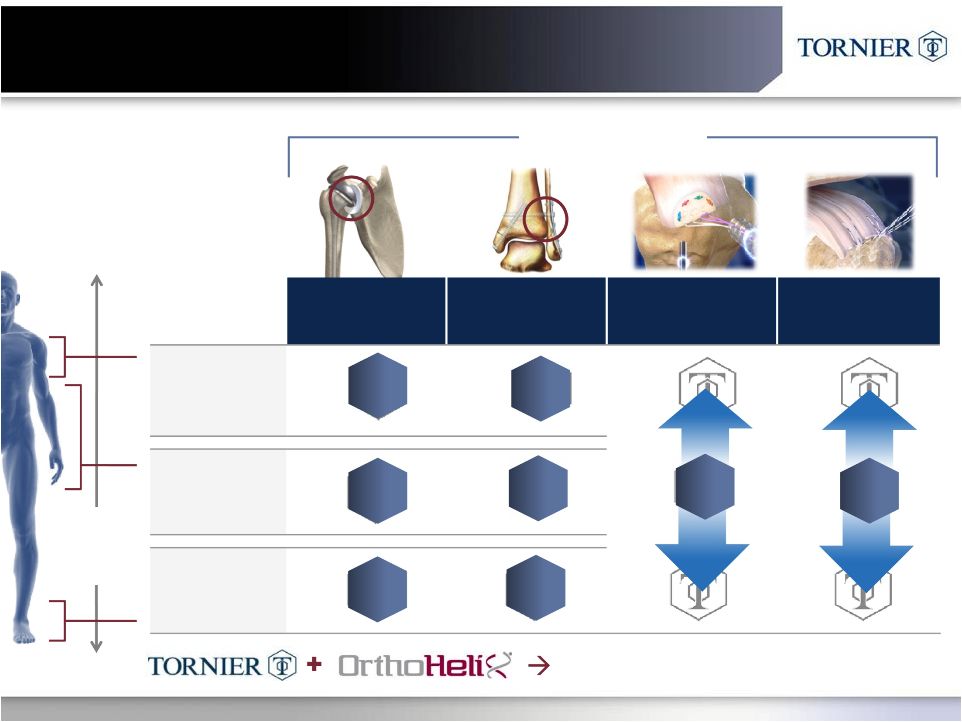

OrthoHelix Acquisition:

Complementary Capabilities

PRODUCTS

Broad Shoulder Portfolio

Elbow Arthroplasty

Strong Ankle Arthroplasty

Sports Medicine & Biologics

Foot & Ankle Fixation

Comprehensive Upper &

Lower Extremities Portfolio

with Minimal Overlap

GEOGRAPHY

US

Europe

Emerging Markets

US Only Channel

US Cross Selling &

Geographic Expansion

US SALES

CHANNEL

18 Distributors

3 Direct Territories

Upper Extremities Focus

50+ Metro Distributors

Sole Focus on Lower

Scale and Flexibility

Focused Upper & Lower

Extremity Sales Forces

R&D

EXPERTISE

Arthroplasty / Replacement

(Motion)

Materials / Biologics

Plate Design / Repair

(Fixation)

Broad R&D Talent to Be

Leveraged into Each

Market Segment

THE PAYOFF

[ 10 ]

and

Accelerated Financial Performance

Global Extremities Leadership |

Filling Out Our Extremities Product Portfolio

SCALE FOR

EFFICIENT SALES

Target High-Volume

Extremities Specialists

HIGH

GROWTH MARKET

Robust Drivers

Assure Growth

Extremities

$6.5B

EXECUTION FOCUS FOR 2013

BROADEST

BROADEST

PRODUCT PORTFOLIO

PRODUCT PORTFOLIO

Upper

Extremities

Lower

Extremities

Biologics/

Sports

Medicine

Leader in Innovation,

Science & Education

Upper

Extremities

Lower

Extremities

7-9%

CAGR

(2012 –

2017)

[ 11 ] |

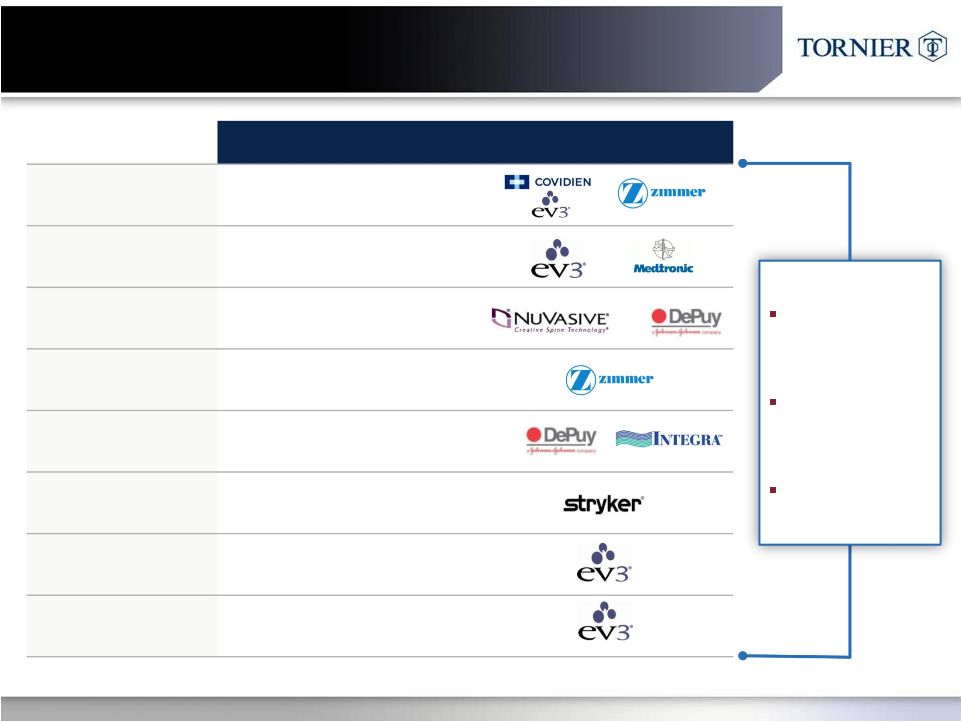

Portfolio Strategy Leverages

Strong Arthroplasty Position

$1.2B

$6.5B

CALL

POINT

FOCUS

[ 12 ]

#2

Top

5

#1

JOINT

JOINT

REPLACEMENTS

REPLACEMENTS

BONE REPAIR

BONE REPAIR

BIOLOGICS

BIOLOGICS

SPORTS

SPORTS

MEDICINE

MEDICINE

SHOULDER

HAND,

WRIST AND

ELBOW

FOOT AND

ANKLE

PROCEDURES

LEVERAGE

Strength of Products / Innovation

R&D Skills and Talent

Key Physician Relationships

Common Call Points |

13

12

10

2

3

35

9

CALL

POINT

FOCUS

Most Comprehensive Extremities Product Portfolio

88 Distinct Extremities Products

[ 13 ]

4

JOINT

JOINT

REPLACEMENTS

REPLACEMENTS

BONE REPAIR

BONE REPAIR

BIOLOGICS

BIOLOGICS

SPORTS

SPORTS

MEDICINE

MEDICINE

SHOULDER

HAND,

WRIST AND

ELBOW

FOOT AND

ANKLE

PROCEDURES |

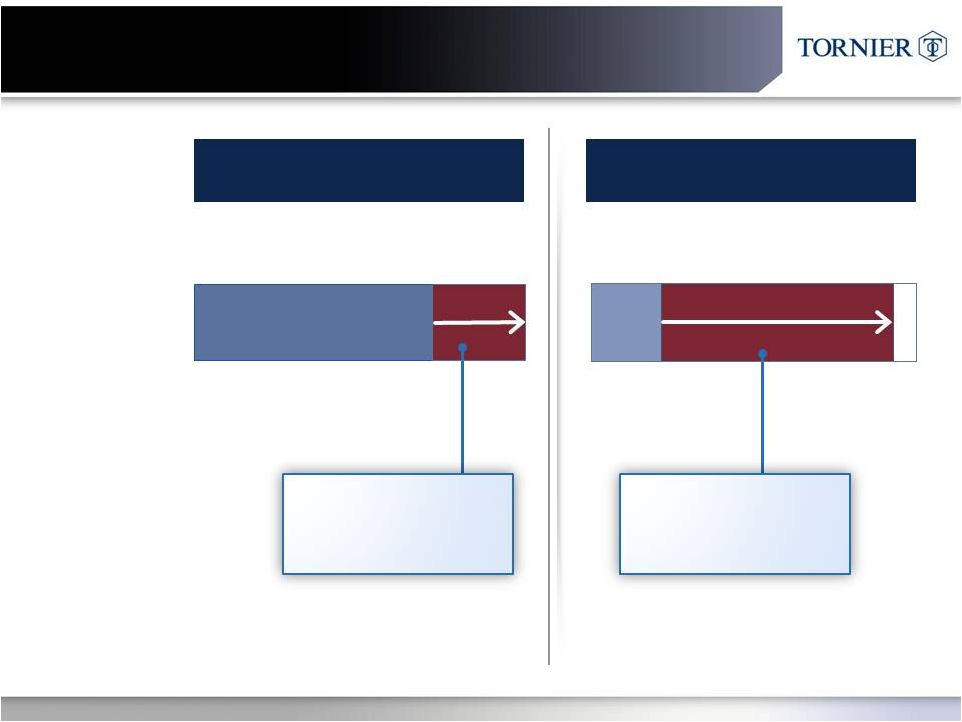

January

‘13 Filling Out Portfolio with High-Impact New Products

UPPER EXTREMITIES

UPPER EXTREMITIES

Shoulder Arthroplasty

% of Addressed Procedures

ADDED

Ascend Flex Press-Fit

Reverse Shoulder

(Revision Friendly)

LOWER EXTREMITIES

LOWER EXTREMITIES

Foot and Ankle Procedures

% of Addressable Procedures

OrthoHelix Foot

and Ankle Portfolio

[ 14 ] |

Varying

Treatment

Anchors

Fracture

Resurfacing

Stemless

Anatomic

Reverse

Revision

Convertible

CTA

Glenoid

Conservative to More Aggressive Treatments

PyC

Tornier Shoulder Portfolio:

Building a Continuum of Care

Ascend

Flex

[ 15 ]

Options |

The

“Go-To” Company for the Specialist

[ 16 ]

CLINICAL DATA DRIVEN STRATEGY

Aequalis Shoulder Registry

Simpliciti Shoulder US IDE Study

Salto-Talaris Total Ankle Data Set

Pyrolytic Carbon Material & Application

Biologic Augmentation

Synthetic Growth Factors

Significant Investment in Training & Education

Unique Shoulder and Foot & Ankle Master Courses

Tornier Fellows Courses

ACTIVE FUNDAMENTAL RESEARCH

COMMITMENT TO CLINICAL EDUCATION

RESPECTED FOR

RESPECTED FOR

SCIENTIFIC RIGOR

SCIENTIFIC RIGOR |

Efficient, Targeted Sales Distribution

BROADEST

PRODUCT PORTFOLIO

Upper

Extremities

Lower

Extremities

Biologics/

Sports

Medicine

Leader in Innovation,

Science Education

HIGH

GROWTH MARKET

Robust Drivers

Assure Growth

Extremities

$6.5B

7-9%

CAGR

(’202 –

2017)

EXECUTION FOCUS FOR 2013

SCALE FOR

SCALE FOR

EFFICIENT SALES

EFFICIENT SALES

Target High-Volume

Extremities Specialists

Upper

Extremities

Lower

Extremities

[ 17 ] |

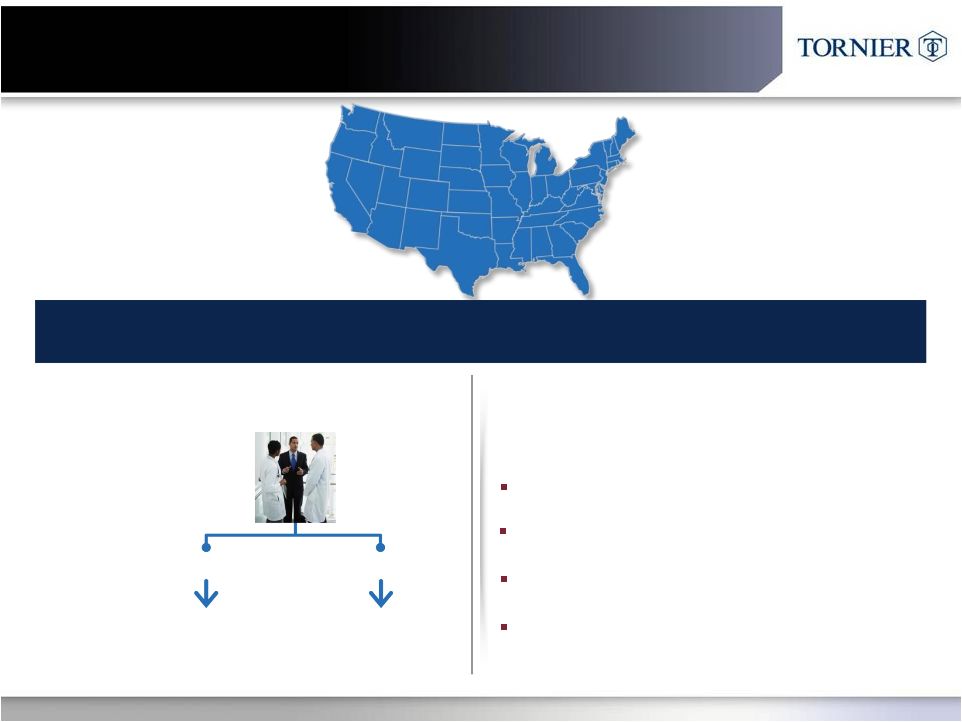

US: Planning for Focused

Upper and Lower Sales Distribution

CHANNEL FOCUS MIRRORS

CUSTOMER SPECIALIZATION

Upper Extremities

Lower Extremities

Sales

Force:

Surgeon

Specialists:

Shoulder, Elbow,

Wrist & Hand

Foot and

Ankle

[ 18 ]

Complete Offering / Procedure Coverage

Product Pull-through / Cross-Selling

Access to New Surgeons & Accounts

Entry

into

“OPEN

OrthoHelix

Territories

INCREASED SELLING

OPPORTUNITIES

Scale Drives Flexibility

” |

International: Addressing Mature and

Underpenetrated Markets

OUS Launch of OrthoHelix Products in 2H ‘13

MATURE MARKETS

–

Focused Extremities Channels

–

Japan Converted to Direct 2Q12

–

Belgium Converted to Direct in 3Q12

–

Canada Conversion Planned for 1H13

UNDER PENETRATED MARKETS

–

Underpenetrated in So America & Asia

–

4 New Countries Added in 2012

•

–

Additional Registration and Approvals

–

Introduction of Complementary

Products

Direct in Key EU and PACRIM Markets

Ongoing Channel Conversions

Untapped Geographies

Leverage Existing Geographies

[ 19 ] |

The

Outlook for 2013 BROADEST

PRODUCT PORTFOLIO

Upper

Extremities

Lower

Extremities

Biologics/

Sports

Medicine

Leader in Innovation,

Science Education

SCALE FOR

EFFICIENT SALES

Target High-Volume

Extremities Specialists

Upper

Extremities

Lower

Extremities

HIGH

GROWTH MARKET

Robust Drivers

Assure Growth

Extremities

Extremities

$6.5B

7-9%

CAGR

(2012 –

2017)

EXECUTION FOCUS FOR 2013

[ 20 ] |

POSITION

POSITION

EXPERIENCE

EXPERIENCE

Dave Mowry

Interim President & CEO

Shawn McCormick

CFO

Terry Rich

SVP US Commercial Ops

David Andersen

VP Global Marketing

Robert Ball

VP Global R & D

Stéphan Epinette

VP International Commercial Ops

Kevin Klemz

VP, Chief Legal Officer

Greg Morrison

VP Global HR

Energized, Execution-Focused Leadership Team

EXPERTISE

EXECUTION

FOCUS

Medical Device

Orthopedics

Drive Revenues

& Profitability

Do Fewer Things,

Better

[ 21 ] |

Positioning the Company for Future Growth

Continue to Innovate Across Portfolio

10 –

12 New Products Per Year

Increase the Focus of Our Sales Channels

Balanced Global Extremities Growth

Direct in Mature Markets; Expand in Emerging Markets

Expanding OUS Channels

Leverage OrthoHelix to

Achieve Foot and Ankle Leadership

[ 22 ]

TECHNOLOGY

TECHNOLOGY

LEADER

LEADER

DRIVE

DRIVE

REVENUE

REVENUE

DRIVE

DRIVE

REVENUE

REVENUE

INCREASE

INCREASE

GROWTH RATE

GROWTH RATE |

2013

– We Will Focus on a Vital Few Initiatives

US Sales Channel Alignment

1

OrthoHelix Integration

2

New Product Launches

3

[ 23 ] |

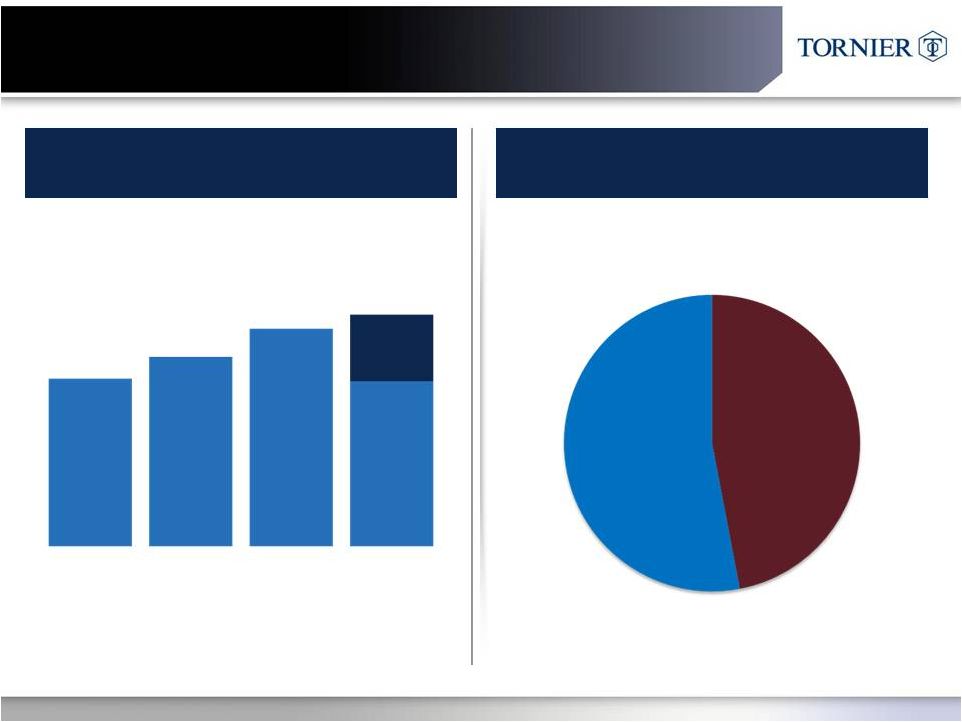

Positioned for Growth:

Revenue *

Expected

2012

revenue

as

reiterated

in

press

release

on

January

7,

2013

[ 24 ]

HISTORY

HISTORY

GEOGRAPHY

GEOGRAPHY

$201M

$227M

$261M

$274 -

277M*

2009

2010

2011

Expected

2012

$75.8-78.8M*

$274 -

$277M

Expected 2012*

US

~56%

OUS

~44% |

Summary

BROADEST

BROADEST

PRODUCT PORTFOLIO

PRODUCT PORTFOLIO

Upper

Extremities

Lower

Extremities

Biologics/

Sports

Medicine

Leader in Innovation,

Science & Education

HIGH

HIGH

GROWTH MARKET

GROWTH MARKET

Robust Drivers

Assure Growth

Extremities

$6.5B

7-9%

CAGR

(’12 –

’17)

EXECUTION FOCUS FOR 2013

SCALE FOR

SCALE FOR

EFFICIENT SALES

EFFICIENT SALES

Target High-Volume

Extremities Specialists

Upper

Extremities

Lower

Extremities

[ 25 ] |

Specialists SERVING Specialists

[ 26 ] |