Attached files

| file | filename |

|---|---|

| 8-K - Midway Gold Corp | midway8k_01072013.htm |

EXHIBIT 99.1

Midway Drills 106.7 Meters of 1.23 gpt Gold at the Gold Rock Project, Nevada

January 7, 2013

Denver, Colorado – Midway Gold Corp. ("Midway" or the "Company") (MDW:TSX-V; MDW:NYSE-MKT) is pleased to announce drill results from its Gold Rock project, White Pine County, Nevada, which have identified several new zones of mineralization. Drilling highlights include:

| ● | GR12-01c |

83.3 meters of 0.89 grams per tonne (gpt)

including1.2 meters of 3.53 gpt and 1.5 meters of 5.10 gpt |

|

| ● | GR12-02c | 9.1 meters of 3.26 gpt | |

| ● | GR12-03c | 114.0 meters of 0.58 gpt | |

| ● | GR12-17 |

106.7 meters of 1.23 gpt including

1.5 meters of 4.90 gpt

1.5 meters of 7.44 gpt and

3.0 meters of 3.77 gpt

|

“Drilling at Gold Rock continues to confirm historic drill results. Additionally, step-out holes have been successful in identifying new extensions to the current gold mineralization with the goal of expanding the resource ahead of developing the mine plan at Gold Rock and beginning the formal permitting process. Our geologists have also identified a large number of nearby targets that warrant further drilling to test for additional upside potential,” commented Ken Brunk, President & CEO of Midway. “The Company anticipates that Gold Rock will be the next project in our portfolio to go into production, following the construction and start-up of the Pan project.”

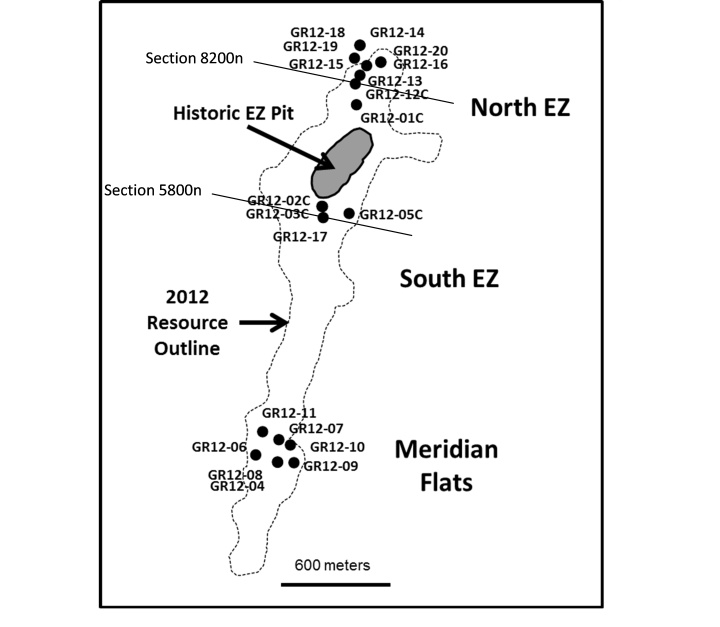

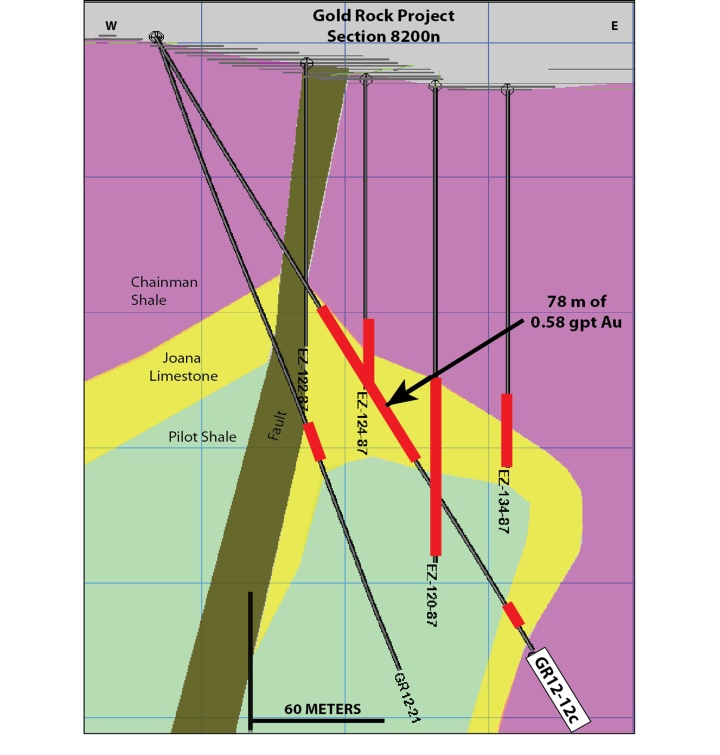

Midway currently has one RC rig operating on the Gold Rock property. Table 1 lists previously unreleased drill results completed at Gold Rock. The Company has completed 11,872 meters of RC drilling and 1,634 meters of core drilling thus far in 2012. An additional 6,084 meters of RC is planned and drilling may extend into the beginning of 2013. Figure 1 shows the locations of drill holes listed in Table 1 in relation to the current Gold Rock resource estimate, while Figures 2-3 demonstrate representative intercepts in cross-section.

Table 1. Drill intercepts, Gold Rock Project, White Pine County, Nevada

|

Hole ID

|

From (m)

|

Interval (m)

|

Gold grade (gpt)

|

Estimated True

Thickness (m)

|

|

GR12-01C

|

46.3

|

5.8

|

0.24

|

unknown

|

|

60.4

|

9.4

|

0.27

|

unknown

|

|

|

135.3

|

83.3

|

0.89

|

27.4

|

|

|

Including

|

1.2

|

3.53

|

||

|

Including

|

1.5

|

5.10

|

|

Hole ID

|

From (m)

|

Interval (m)

|

Gold grade (gpt)

|

Estimated True T

hickness (m)

|

|

GR12-02C

|

19.8

|

9.1

|

3.26

|

unknown

|

|

Including

|

3.0

|

9.12

|

||

|

41.1

|

24.4

|

0.24

|

||

|

GR12-03C

|

3.0

|

4.6

|

0.14

|

unknown

|

|

21.3

|

19.8

|

0.41

|

16.8

|

|

|

51.8

|

114.0

|

0.58

|

16.8

|

|

|

GR12-04

|

86.9

|

10.7

|

1.03

|

10.7

|

|

GR12-05C

|

Assays Pending

|

|||

|

GR12-06

|

105.2

|

15.2

|

0.48

|

15.2

|

|

GR12-07

|

103.6

|

10.7

|

0.48

|

10.7

|

|

137.2

|

25.9

|

0.69

|

unknown

|

|

|

192.0

|

7.6

|

0.21

|

10.7

|

|

|

G12-08

|

108.2

|

15.2

|

0.93

|

15.2

|

|

129.5

|

4.6

|

0.14

|

unknown

|

|

|

169.2

|

12.2

|

0.45

|

10.7

|

|

|

GR12-09

|

No Significant Intercepts

|

|||

|

GR12-10

|

No Significant Intercepts

|

|||

|

GR12-11

|

187.5

|

18.3

|

0.45

|

unknown

|

|

GR12-12C

|

106.7

|

4.6

|

0.14

|

unknown

|

|

141.4

|

78.3

|

0.58

|

36.6

|

|

|

298.4

|

11.3

|

0.38

|

10.7

|

|

|

GR12-13

|

175.3

|

32.0

|

0.93

|

18.3

|

|

Including

|

1.5

|

4.46

|

||

|

GR12-14

|

178.3

|

29.0

|

0.24

|

29.0

|

|

GR12-15

|

246.9

|

12.2

|

0.45

|

18.3

|

|

GR12-16

|

No Significant Intercepts

|

|||

|

GR12-17

|

76.2

|

106.7

|

1.23

|

18.3

|

|

Including

|

1.5

|

4.90

|

||

|

Including

|

1.5

|

7.44

|

||

|

Including

|

3.0

|

3.77

|

||

|

187.5

|

19.8

|

0.55

|

18.3

|

|

|

GR12-18

|

No Significant Intercepts

|

|||

|

GR12-19

|

No Significant Intercepts

|

|||

|

GR12-20

|

185.9

|

24.4

|

0.65

|

21.3

|

|

GR12-21

|

187.5

|

16.8

|

0.75

|

15.2

|

|

GR12-22C

|

Assays Pending

|

|||

|

GR12-23C

|

Assays Pending

|

|||

|

GR12-24

|

Assays Pending

|

|||

|

GR12-25C

|

Assays Pending

|

|||

|

GR12-26

|

Assays Pending

|

|||

2

|

Hole ID

|

From (m)

|

Interval (m)

|

Gold grade (gpt)

|

Estimated True Thickness (m)

|

|

GR12-27

|

Assays Pending

|

|||

Reverse circulation drilling was conducted by National EWP of Elko, Nevada. Core drilling was conducted by KB Drilling of Carson City, Nevada. Drill hole numbers ending with a "C" indicate core holes. Samples were assayed by ALS-Chemex Labs, in Sparks, Nevada using 30 gram fire assay methods. Results reported represent thickness along the trace of the drill hole except where true thickness estimates are reported in the table. Intervals may not match to the nearest tenth due to arithmetic rounding.

Figure 1. Gold Rock Drill Hole Locations for Results in Table 1.

3

Figure 2. Gold Rock Section 5800N

4

Figure 3. Gold Rock Section 8200N

About the Gold Rock Project

Gold Rock is 8 km southeast of Midway's Pan Project and appears to contain similar host rocks and styles of gold mineralization. The Gold Rock project is a Carlin-style gold deposit with a current Indicated resource estimate of 310,000 oz of gold (12,968,000 tonnes at a grade of 0.74 gpt gold), plus an Inferred resource estimate of 331,000 oz gold (17,894,000 tonnes at a grade of 0.58 gpt gold) using a 0.27 gpt

5

gold cutoff grade (see NI 43-101 Technical Report, February 2012). The resource includes results from 466 verified historic drill holes and 31 Midway verification holes that were drilled in 2011. An updated Technical Report dated November 29, 2012 clarified some of the language contained within the report, but did not change the resource estimates.

This release has been reviewed and approved for Midway by Mr. William S. Neal (M.Sc. and CPG), Midway’s Vice President of Geological Services and a "qualified person" as that term is defined in NI 43-101.

ON BEHALF OF THE BOARD

"Kenneth A. Brunk"

Kenneth A. Brunk, Chairman, President and CEO

About Midway Gold Corp.

Midway Gold Corp. is a precious metals company with a vision to explore, design, build and operate gold mines in a manner accountable to all stakeholders while assuring return on shareholder investments. For more information about Midway, please visit our website at www.midwaygold.com or contact Jaime Wells, Investor Relations Analyst, at (877) 475-3642 (toll-free).

Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) nor the NYSE MKT accepts responsibility for the adequacy or accuracy of this release.

This press release contains forward-looking statements about the Company and its business. Forward looking statements are statements that are not historical facts and include, but are not limited to, reserve and resource estimates, estimated NPV of the projects, anticipated IRR, estimated strip ratio, anticipated mining methods at the projects, the estimated economics of the projects, anticipated gold recoveries and annual production, estimated capital costs, operating cash costs and total production costs, planned development drilling and anticipated expansion of the resource, and the outcome of the permitting process. The forward-looking statements in this press release are subject to various risks, uncertainties and other factors that could cause the Company's actual results or achievements to differ materially from those expressed in or implied by forward looking statements. These risks, uncertainties and other factors include, without limitation risks related to fluctuations in gold prices; uncertainties related to raising sufficient financing to fund the planned work in a timely manner and on acceptable terms; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the interpretation of drilling results and other tests and the estimation of gold reserved and resources; the possibility that required permits may not be obtained on a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; risks related to projected project economics, recovery rates, and estimated NPV and anticipated IRR and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, should change.

Cautionary note to U.S. investors concerning estimates of reserves and resources: This press release and the documents referenced in this press release use the terms “reserve" and "mineral resource“, which are terms defined under Canadian National Instrument 43-101 and the Canadian Institute of Mining and Metallurgy Classification system. Such definitions differ from the definitions in U.S. Securities and Exchange Commission ("SEC") Industry Guide 7. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Mineral resources are not mineral reserves and do not have demonstrated economic viability. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. The references to a “resource” in this press release and the documents referenced in this press release are not normally permitted under the rules of the SEC. It cannot be assumed that all or any part of mineral deposits in any of the above categories will ever be upgraded to Guide 7 compliant reserves. Accordingly, disclosure in this press release and in the technical reports referenced in this press release may not be comparable to information from U.S. companies subject to the reporting and disclosure requirements of the SEC.

6