Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INTERMUNE INC | d462967d8k.htm |

J.P. Morgan 31st Annual

Healthcare Conference

January 7-10, 2013

Exhibit 99.1 |

2

Forward-looking Statements

This

presentation

contains

forward-looking

statements

made

pursuant

to

the

"safe

harbor"

provisions

of

the

Private

Securities

Litigation Reform Act of 1995. Investors are cautioned that, without limitation,

statements in this presentation regarding InterMune's plans and

expectations; anticipated availability of top-line results from the ASCEND trial; the estimated patient

populations

suffering

from

IPF

and

market

potential

for

Esbriet;

anticipated

timing

of

pricing

and

reimbursement

discussions

and/or initiating commercial launches for Esbriet; intellectual property protection

for Esbriet; and expectations regarding the ASCEND trial and prospects for

success thereof are forward-looking statements. All forward-looking statements included in

this presentation are based on information available to InterMune as of the date

hereof, and InterMune assumes no obligation to update any such

forward-looking statements. Actual results could differ materially from those described in the forward-

looking statements. Factors that could cause or contribute to such differences

include, but are not limited to, those discussed in

detail

under

the

heading

“Risk

Factors”

in

InterMune’s

periodic

reports

filed

with

the

SEC,

including

but

not

limited

to

the

following: (i) the risks related to the uncertain, lengthy and expensive clinical

development process for the company’s product candidates; (ii) risks

related to the regulatory process for Esbriet, including that the results of the ASCEND trial may not be

satisfactory to the FDA to receive regulatory approval; (iii) risks related to

unexpected regulatory actions or delays or government regulation generally;

(iv) risks related to the company’s manufacturing strategy; (v) government, industry and

general public pricing pressures; (vi) risks related to the company’s ability

to successfully launch and commercialize Esbriet; and (vii) the

company’s ability to maintain intellectual property protection. The risks and other factors discussed above should

be considered only in connection with the risks and other factors discussed in

detail in InterMune’s Form 10-K, Form 10-Q and its other

periodic reports filed with the SEC, which are also available at www.intermune.com. |

3

Our Vision is that in 2015

InterMune is:

•

A biotech company focused on serving patients with

unmet medical needs in specialty pulmonary and

orphan

fibrotic diseases

•

The recognized world-wide leader in IPF

•

Among the Top 20 U.S. small to mid-sized

biopharmaceutical companies in terms of revenue and

market capitalization

•

Successfully marketing Esbriet

®

(pirfenidone) in the EU,

U.S., Canada and other markets of interest, where it is

–

the standard of care and

–

the backbone of combination regimens for treating

IPF patients

•

Advancing an attractive and balanced R&D pipeline

–

Built first

on the Esbriet platform

VISION

2015 |

4

2012 –

Strong Progress Toward Realizing our Vision

COMMERCIAL

CLINICAL

•

Esbriet launched in 9 EU countries including the two largest:

–

Germany (Sept 2011) and France (November 2012)

–

Esbriet launch in Germany among Top 5 best-ever for orphans

•

Attractive pricing and reimbursement (P&R) of Esbriet

–

Priced in 9 of the Top 15 European countries: $33K-$47K/yr.

–

Strong P&R progress in remaining 6 EU countries

•

Esbriet approved in Canada –

the world’s 9th largest market

•

Closing in on lucrative U.S. IPF market

–

Completion of enrollment in pivotal Phase 3 study –

“ASCEND”

–

Top-Line results in Q2 2014

•

Opportunities in Esbriet LCM and Research programs in fibrosis

|

Commercial Launch

of Esbriet

®

(pirfenidone) |

Idiopathic Pulmonary Fibrosis (IPF) –

A Large, Lethal Orphan Disease

•

Progressive scarring of the lungs

with no known cause

–

Median survival: 2-5 years

1

•

Large market in NA/EU15

–

118,000-158,000

prevalence

–

28,000-37,000 incidence

•

No EMA-

or Canada-approved

medicines

prior

to

Esbriet

®

•

None approved in U.S.

6

1.Bjoraker JA, Am J Respir Crit Care Med. 1998 Jan; 157(1):199-203.

% Patients Surviving at 5 Years

100%

80

60

40

20

Lung

Cancer

IPF

Ovarian

Cancer

PAH

Colo-

rectal

Cancer

Breast

Cancer |

7

Esbriet: The One and Only Approved Medicine for IPF |

8

Entry Strategy: Focus on Top 5+ (80-85% of market)

Focus first on

Top 5 countries:

Germany, France, Italy,

Spain, UK

Population of 314 million

~ 70-75% of EU market

value

Invest in 10 Mid-Sized

Countries & Regions:

Austria, Nordics (4),

Netherlands, Belgium

Ireland, Iceland and

Luxembourg

~ 10% of EU market

value |

9

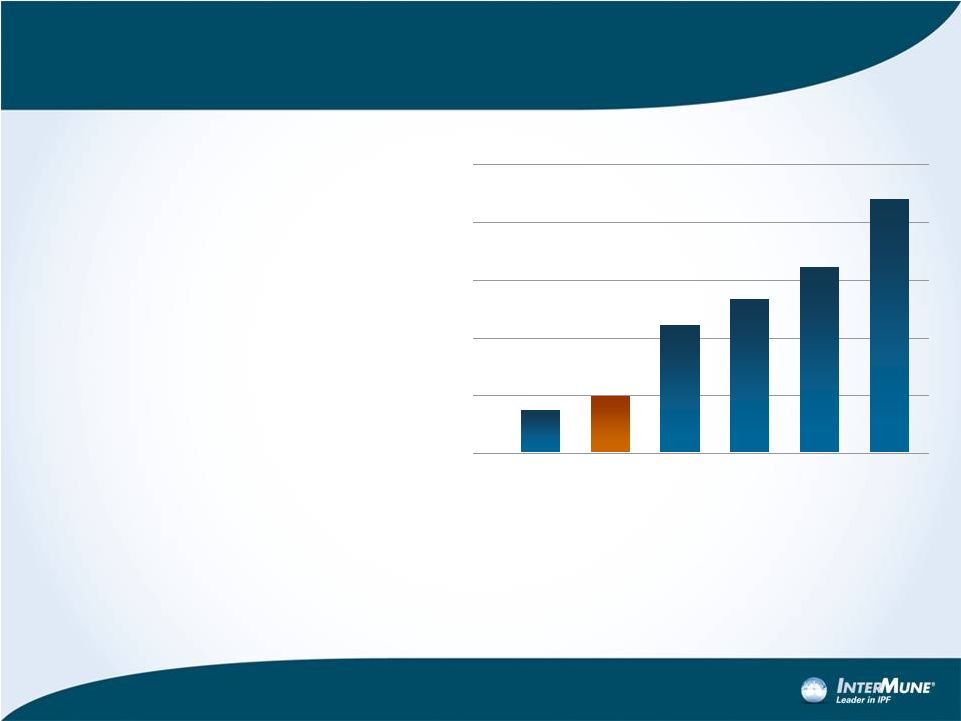

2012 Esbriet Net Revenue –

Consistent Quarterly Growth Since Launch

* Includes $0.5 million in favorable adjustments to revenue primarily

related to foreign currency exchange procedures ** Includes effect of the

expected 11% price reduction in Germany (effective September 15, 2012) (unaudited)

Net Esbriet Revenue by Quarter ($ in millions)

4.9

5.5

2.7

7.5*

Q3’12

Q2’12

Q1’12

Q4’11

0

2.5

5

7.5

10

8.2**

Q4’12 |

Esbriet Among the Best Orphan Drug Launches in Germany*

15 Full Months from Launch

10

Net Sales ($) months 2-16 Germany

(Euro=$1.30)

Patients (POD) end of 16th month Germany

(80% compliance+15% IMS increase)

Millions

*Analysis of 30 products in diseases with prevalence > 30K pts. in Europe

among all 66 orphan registrations in Europe through 6/10.

5.3

11.3

14.7

19.4

25.8

29.7

50.8

63.0

86.8

0

20

40

60

80

100

Adcirca

Tracleer

Tasigna

Sprycel

Esbriet

Exjade

Nexavar

Glivec

Revlimid

374

585

868

920

950-1,000

1,367

1,656

2,096

2,820

0

1000

2000

3000

Tasigna

Tracleer

Sprycel

Revlimid

Esbriet

Nexavar

Certican

Exjade

Glivec |

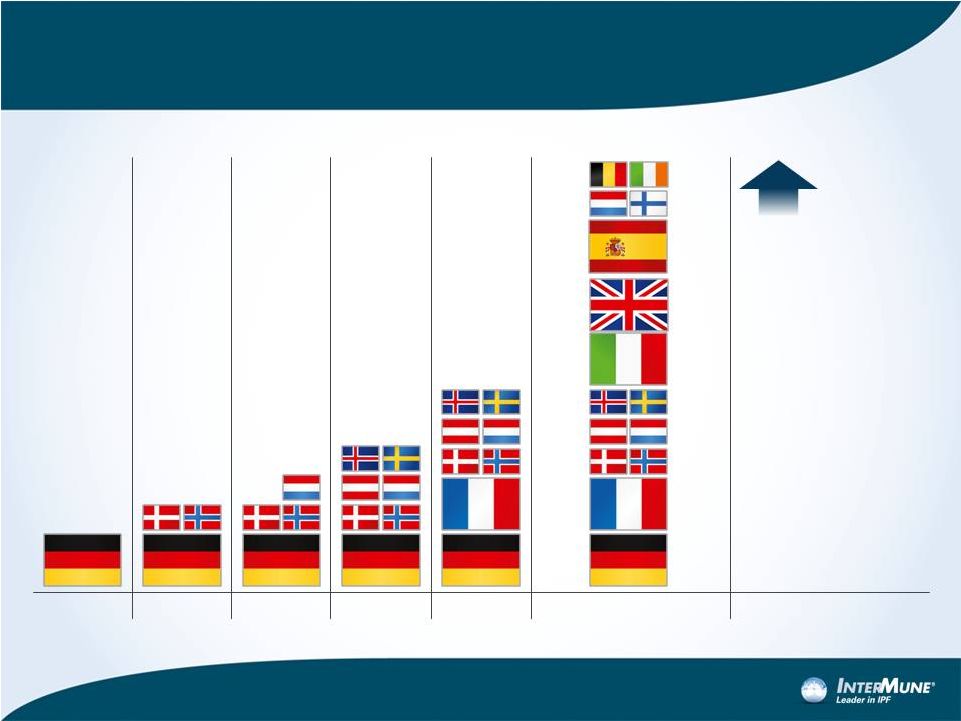

EU

Pricing, Reimbursement and Launch Sequence: Expect launch in up to 15 targeted

markets by mid-2013 11

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Geographic

expansion

2H 2013, 2014

1H 2013

2H 2013 + |

12

Esbriet Launched in Canada –

January 2, 2013

•

Health Canada completed Priority Review on October 1, 2012

–

First approved treatment for mild to moderate IPF patients in Canada

–

Expect reimbursement from private insurance plans during H1’13 and

from all public (provincial) plans ~12 to 18 months from marketing approval

•

Canada is an important pharma market

–

3,500 to 5,000 mild to moderate IPF patients

–

Introductory launch price of $35,000 to $42,000 CAD

–

Final price to be based on median public price in five EU reference

countries

•

Germany, France, Sweden, Italy and the UK |

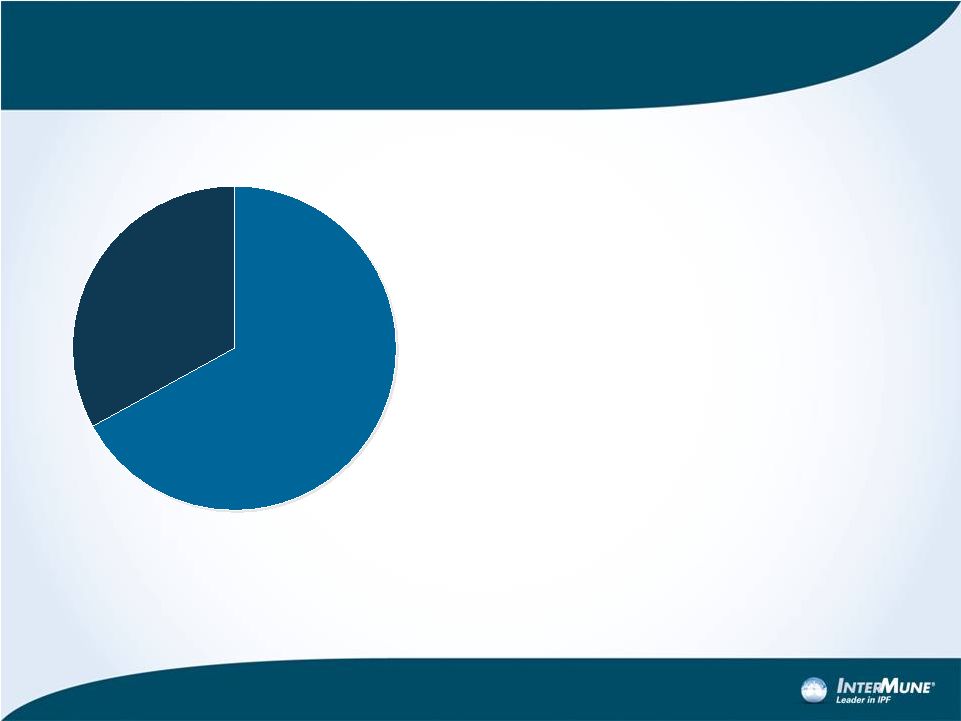

The U.S. Market &

ASCEND Phase 3

Study Rationale |

The

U.S. IPF Market is Very Attractive •

High Prevalence and Incidence:

–

31,000 to 48,000 mild to moderate

IPF patients

–

Incidence: 14,000 to 19,000/year

•

Strong Annual Pricing:

–

EU Esbriet pricing: $33K-$47K/yr.

–

U.S. PAH drugs: $70K-$75K/yr.

•

Small Target Prescribing Audience:

–

~3,000 M.D.s

•

Strong Operating Margins

14

U.S. IPF Prevalence

Mild to Moderate

(31,000-48,000)

Severe

(~20,500) |

Esbriet Has Demonstrated a Consistent Benefit in Multiple

IPF Trials Conducted to Date

15

Standardized treatment effect

Week 48/52

Standardized treatment effect

PIPF-004

PIPF-006

SP3

SP2

Meta Analysis

0.0

0.2

0.4

0.6

0.8

Standardized treatment effect

Week 24/28

Week 36/40

Standardized treatment effect

Week 72

0.0

0.2

0.4

0.6

0.8

0.0

0.2

0.4

0.6

0.8

0.0

0.2

0.4

0.6

0.8

Highly consistent results on FVC/VC

change at one year of treatment |

Phase

3 “ASCEND” Design

Eligibility Criteria

ASCEND Trial

CAPACITY Trials

Primary endpoint

FVC Change

FVC Change

Key Secondary Endpoints

6MWT distance, PFS

6MWT distance, PFS

Duration

52 Weeks*

72 Weeks

Patients

~500

779

% Predicted FVC

50% -

90%

>50%

% DLco

30%

-

90%

>35%

FEV1 / FVC Ratio

>0.80

>0.70

•

Randomized, double-blind, placebo-controlled trial

•

Pirfenidone 2403 mg/d vs. placebo with 1:1 randomization

*Red denotes change from Phase 3 CAPACITY program

16 |

17

Summary of Observations Supporting

ASCEND Eligibility Criteria

•

ASCEND Study enriched for IPF patient more likely to experience

FVC decline and disease progression

–

Eligibility criteria derived from CAPACITY (studies 004 and 006)

and corroborated with other independent data sets, including

INSPIRE Study

•

Analyses of CAPACITY patients meeting “ASCEND Eligibility Criteria”

also show enhanced magnitude of pirfenidone treatment effect

–

FVC and secondary endpoints

–

Independent studies 004 and 006, and pooled CAPACITY

•

Consistent augmentation of disease progression AND pirfenidone

treatment effect across independent endpoints and studies strongly

suggest these observations are at least directionally accurate

|

18

FVC Change -

ITT Group of CAPACITY vs.

“ASCEND Criteria”

Subgroup

0

-5

-10

12

24

36

48

60

72

Weeks

CAPACITY ITT

Week 48

Week 72

Absolute

3.3%

2.5%

Relative

41.6%

22.8%

P-value

<0.001

0.005

CAPACITY ITT (Pooled Studies 004 and 006)

Pirfenidone

Placebo

-10

60

72

36

48

24

12

-5

0

Weeks

“ASCEND Criteria”

subgroup

“ASCEND”

Week 48

Week 72

Absolute

6.1%

7.9%

Relative

63.3%

57.0%

P-value

<0.001

<0.001 |

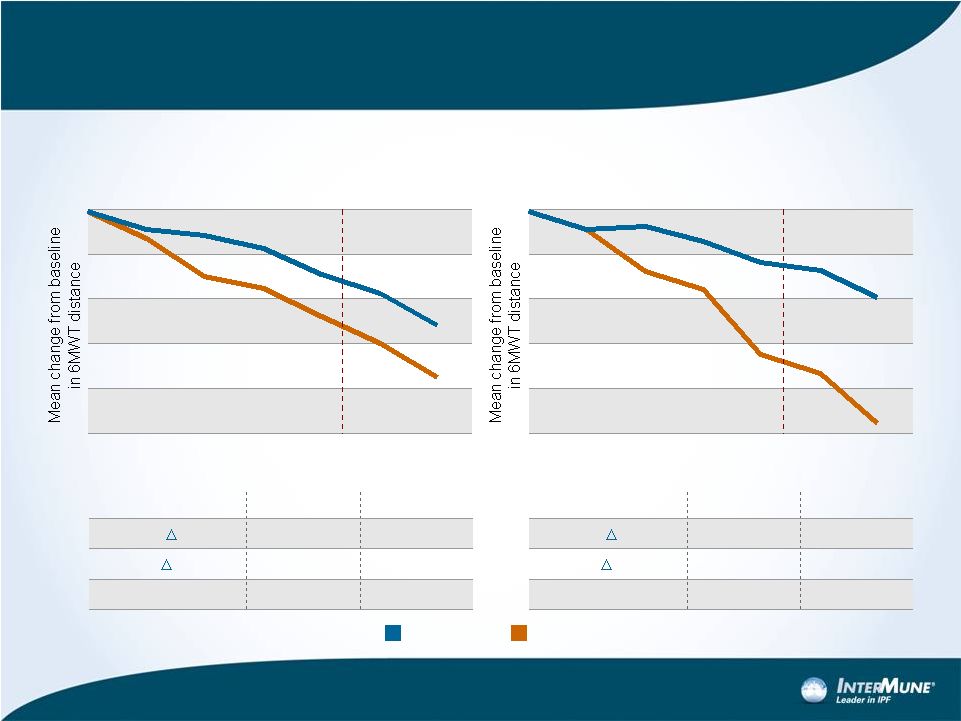

-40

-60

-80

-20

0

“ASCEND Criteria”

Weeks

60

72

36

48

24

12

19

6MWD Change -

ITT Group of CAPACITY vs.

“ASCEND Criteria”

Subgroup

0

-20

-40

-60

-80

12

24

36

48

60

72

CAPACITY ITT (Pooled Studies 004 and 006)

Pirfenidone

Placebo

Weeks

CAPACITY ITT

Week 48

Week 72

Absolute

19.8 m

24.0 m

Relative

40.5%

31.3%

P-value

0.004

<0.001

“ASCEND”

Week 48

Week 72

Absolute

42.4 m

58.7 m

Relative

64.2%

59.5%

P-value

<0.001

<0.001 |

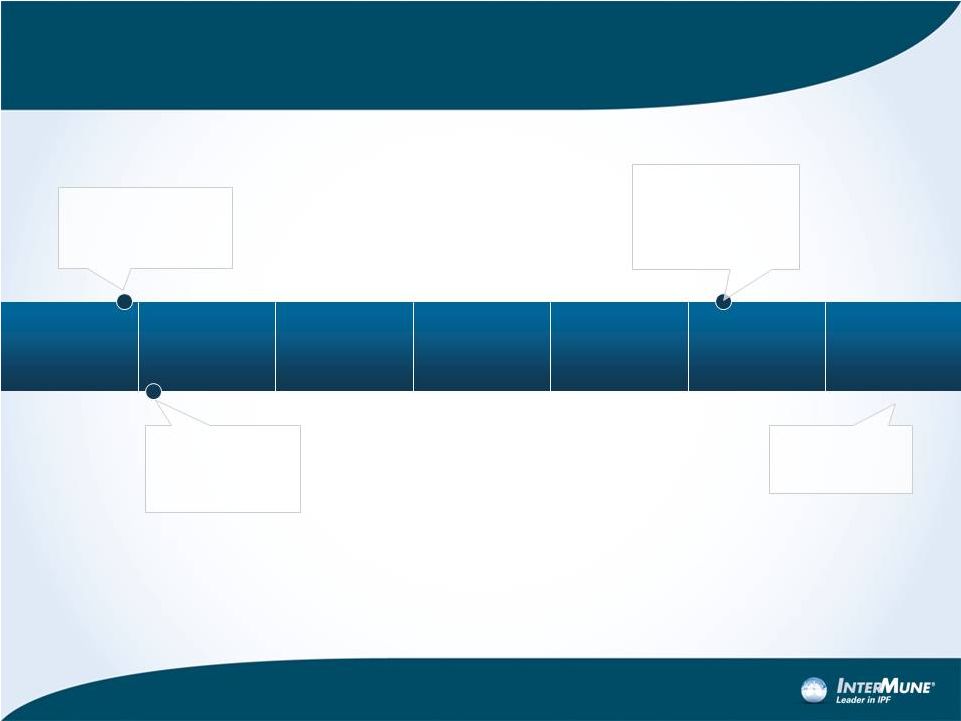

20

ASCEND

Phase

3

Trial

–

Timelines

December 2012:

500

th

patient

randomized

January 9, 2013:

Last patient

randomized

2Q 2014:

Top-line Results

February 2014:

Last patient

completes ~35-day

safety follow-up

4Q

2012

1Q

2013

2Q

2013

3Q

2013

4Q

2013

1Q

2014

2Q

2014 |

2013 Outlook |

22

What to Expect from InterMune in 2013 –

Further Progress Toward Our 2015 Vision

•

Consistent,

steady

growth

of

Esbriet

®

in

Europe

–

Growth of Esbriet in the 9 countries already launched

–

Launch of Esbriet in our 6 remaining EU countries by mid-year 2013

•

Three “Top 5”

countries –

Italy, UK and Spain

•

Launch of Esbriet in our first North American market, Canada (January)

•

Pre-launch preparation for Esbriet in the U.S.

–

CME, KOL engagement, publications, HQ staffing etc.

•

Investment in our pipeline

–

Esbriet Life Cycle Management and formulation opportunities

–

Advancing anti-fibrotic research programs |

Esbriet Roll-Out: Summary of Current Expectations for

Major Markets Where Esbriet is Not Yet Launched *

23

** England and Wales; SMC (HTA for Scotland) in parallel

P&R

L

* Assumes P&R is granted in each country

L

Pricing and Reimbursement concluded

Launch

Spain

Canada

Italy

UK**

P&R

P&R

1H 2013

2H 2013

1H 2014

P&R

PRIVATE INSURANCE PROCEDURES

PROVINCIAL REIMBURSEMENT PROCEDURES

REGIONAL PROCEDURES

REGIONAL PROCEDURES

L

L |

Projected Esbriet Revenue in 2013

24

Countries

2012

Revenue*

(in millions)

2013

Projected

Revenue

Range

(in millions)

Launched Countries

(Germany, France, Canada and

7

Mid-Sized EU countries)

$26

$40 -

$55

Not Yet Launched Countries

(Italy,

UK,

Spain

and

3

Mid-Sized

EU Countries)

$0

$0 -

$15

Total: Top 15 European Countries

and Canada

$26

$40 -

$70

* Unaudited |

Financial Overview

•

Convertible debt:

–

$85M due 2015: 5.00% coupon, $18.88 conversion price

–

$155M due 2018: 2.50% coupon, $31.80 conversion price

25

Full-Year 2012

Guidance

(1/3/13)

Full-Year 2013

Guidance

Revenue

$26.1M (unaudited)

$40 -

$70M

R&D

$100 -

$105M

$100 -

$120M

SG&A

$105 -

$110M

$145 -

$165M

Total (R&D and

SG&A)

$205 -

$215M

$245 -

$285M |

26

Summary

•

IPF is a large orphan market with attractive commercial potential

•

Attractive pricing, focused marketing

high operating margins

•

Esbriet has first-mover advantage in this market

•

Esbriet launch in Germany ranks among the best-ever orphan launches

•

Solid execution in 2012 on Esbriet Pricing and Reimbursement in Europe

during one of the most challenging economic periods

•

2013

is

the

“EU

Launch

Year”

–

expect

to

be

in

market

in

all

Top

15

•

North America the next major territory

•

Approval

of

Esbriet

in

Canada

–

Launched

January

2

•

Phase 3 ASCEND study is now fully enrolled and designed to deliver a

positive result and access to the very attractive U.S. market

|

|