Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ERBA Diagnostics, Inc. | v331464_8k.htm |

1 Erba Diagnostics, Inc. January 7, 2013

2 This presentation includes statements that constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , and Erba Diagnostics, Inc . (“ Erba ”) claims the protection of the safe - harbor for forward - looking statements contained in such act . The forward - looking statements in this presentation are also “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . All opinions, forecasts, projections, future plans or other statements, other than statements of historical fact, are forward - looking statements . Forward - looking statements are based on current expectations that involve a number of risks and uncertainties . Although Erba believes that the expectations contained in the forward - looking statements are based on reasonable assumptions, there is no assurance that expectations will be attained . Actual results could differ materially from those contemplated in the forward - looking statements as a result of a variety of risks and uncertainties, many of which are outside of the control of management . These risks and uncertainties include, but are not limited to, those relating to : Erba’s relationship with Transasia Bio - medicals Ltd . (“Transasia”), including, without limitation, that such relationship will not result in the expansion of Erba’s customer or geographic markets, create the expected synergies for the companies or otherwise result in Erba achieving improved financial performance or operating results and that Transasia, indirectly through its wholly owned subsidiary, may not exercise any or all of the outstanding warrants to purchase shares of Erba’s common stock or otherwise provide funds to Erba in the future ; the in - vitro diagnostics market and the trends related thereto, including, without limitation, that the in - vitro diagnostics market and consumer demand for in - vitro diagnostics products may not grow at the rates or in the regions anticipated or at all, or they may decrease, and other expectations relating to industry, market and customer segment trends may not be accurate ; Erba’s suite of instrumentation and in - vitro diagnostic kits as well as Erba’s sale strategy with respect to such products, including, without limitation, that Erba may not be successful in marketing its products and that the products may not perform as expected or otherwise be a factor in Erba’s growth ; and Erba’s growth strategy, including, without limitation, that Erba may not be successful in expanding its placement of systems in the United States or internationally, or otherwise achieve organic growth, that Erba’s recent acquisition of Drew Scientific Inc . , (Drew) the subsidiary through which Escalon Medical Corp . conducted its clinical diagnostics business, may not result in the benefits expected by Erba or otherwise have a positive impact on Erba’s operating results and financial condition, in each case whether as a result of Erba’s ability to successfully enter into and conduct operations within the diabetes, hematology, and clinical chemistry markets or otherwise, and that Erba may not successfully integrate the aquired businesses and products of Drew or in the future be successful in identifying or consummating acquisitions of, or integrating any acquired, businesses or products . Erba also cautions that past performance is not indicative of future results . In addition to the risks and factors identified above, reference is also made to other risks and uncertainties detailed in Erba’s filings with the Securities and Exchange Commission, including, without limitation, those discussed in the “Risk Factors” sections of such filings . Erba does not undertake, and specifically disclaims any obligation, to update or supplement any forward - looking statements, including, without limitation, to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements . Disclaimer

3 • In - Vitro diagnostics business – Natural autoimmune antigens, raw material for the test kits – Instrumentation, including third - party instrumentation – Test kits, focus on autoimmune and infectious disease • Erba is comprised of 5 wholly - owned operating subsidiaries – ImmunoVision, Inc., antigen business based in Springdale, Arkansas – Delta Biologicals S.r.l ., instrumentation business based in Rome, Italy – Diamedix Corporation, test kit business based in Miami , Florida – Drew and its subsidiary Jas, c linical chemistry, Hematology and Hb1ac instrumentation and reagents based in Miami, Florida • Diverse product portfolio – 250 FDA cleared products and 470 CE marked products, including OEM products • Markets to hospitals, reference labs and physician owned labs • Transasia, a leading diagnostics company in I ndia, currently owns approximately 82.4% of Erba – Relationship expected to expand Erba’s customer and geographic markets Company Overview

4 Erba and Transasia Synergies • Transasia is a leading diagnostics company in India – Business segments include clinical chemistry, biochemistry, ESR, hematology, critical care, urine analysis, immunology, molecular diagnostics, electrophoresis, coagulation, and diabetes management – Customers include hospitals, reference labs and clinics – Geographic markets include India, Eastern Europe, the Middle East and South America • Transasia’s financial commitment to Erba – Paid $21 million @ $0.75 per share for 72% of Erba during 2010 – $30 million additional capital commitment during 2011 • $15 million of common stock @ $0.75 per share, of which $11.5 million has been purchased • $15 million of warrants with an exercise price of $0.75 per share, of which $450,000 has been exercised • Capital may be used for general purposes, including acquisitions ($6.5 million of proceeds was used to fund the acquisition of Drew/Jas during October 2012) • Acquisitions targeting products or businesses with products to be marketed to combined customer base • Expected synergies – Transasia’s customer base expected to have access to Erba’s suite of products, including its immunology platform • Erba’s geographic markets expected to expand into I ndia, Eastern Europe, the Middle East, and South America • Transasia did not have an immunology platform prior to its investment in Erba – Transasia expected to introduce its products into Erba’s sales channel (subject to approvals) • Clinical chemistry, hematology, urine analysis, biochemistry, and microbiology

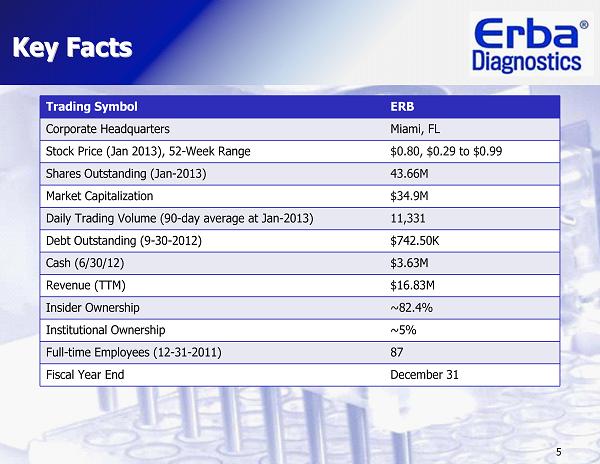

5 Trading Symbol ERB Corporate Headquarters Miami, FL Stock Price (Jan 2013), 52-Week Range $0.80, $0.29 to $0.99 Shares Outstanding (Jan-2013) 43.66M Market Capitalization $34.9M Daily Trading Volume (90-day average at Jan-2013) 11,331 Debt Outstanding (9-30-2012) $742.50K Cash (6/30/12) $3.63M Revenue (TTM) $16.83M Insider Ownership ~82.4% Institutional Ownership ~5% Full-time Employees (12-31-2011) 87 Fiscal Year End December 31 Key Facts Key Facts

6 Suresh Vazirani Executive Chairman Suresh Vazirani was appointed to Erba’s Board of Directors and named Executive Chairman of the Board of Directors on September 1, 2010. Since 1985, Mr. Vazirani has been the Chairman and Managing Director of Transasia Bio - Medicals Ltd., a diversified research and development based, export oriented in vitro diagnostics company headquartered in India. Additionally, Mr. Vazirani has served as the Chief Executive Officer of Erba Diagnostics Mannheim GmbH , an in - vitro diagnostics company headquartered in Germany and wholly owned subsidiary of Transasia , since 2002. Kevin D. Clark CEO Kevin D. Clark was named Erba’s President and Chief Executive Officer on September 3, 2010. He has served as Erba’s Chief Operating Officer since September 2007 and as Chief Operating Officer of ImmunoVision since 1987. Mr. Clark served as Erba’s acting Chief Executive Officer from January 2008 to September 2008. He also served as President of ImmunoVision from 1987 through 1995. Mr. Clark was a founding member of the Arkansas Biotech Association and, from 1995 through 2004, served as its Executive Vice President, and in 2002, served as its President. Since 2003, Mr. Clark has served as a member of the Executive Committee of the University of Arkansas Technology Development Foundation, a non - profit foundation for the commercialization of technology developed at the University of Arkansas in Fayetteville. From 2000 to 2003, Mr. Clark was a member of the Advisory Board of Arkansas BioVentures, a state and federally funded incubator program for biotechnology. Management Team

7 • $41.95 billion worldwide market for in - vitro diagnostics products ‒ U.S. makes up approximately 44% of the worldwide in - vitro diagnostics market ‒ Includes all laboratory, hospital - based, and over - the - counter IVD product sales • Estimated to grow to $56.3 billion in 2012 ‒ Asia projected to be the largest growth market for in - vitro diagnostics • Demand for medical testing has increased rapidly in emerging markets ‒ Aging worldwide population has increased the need for near - patient, home, and physician office testing ‒ Top 16 in - vitro diagnostic companies account for 78% of the global market ‒ Major growth in the in - vitro diagnostics industry expected to come from niche players in histology, molecular assays, diabetes, and rapid tests for infectious diseases • Autoimmune market remains a niche market with no single company currently posing a dominant market position Market Overview and Trends

8 Immunoassay Clinical Analyzer Estimated US Market Size Macro Market Trends • Stable but not growing market for in - vitro diagnostics testing • ELISA / EIA and IFA / DFA are still significant portions of the immunoassay market Customer Segment Trends • Automate as much of the immunoassay process as possible • Instrument and assay consolidation • Hospitals pursuing programs to increase revenues and to reduce costs Automated Immunoassay (Integrated Systems) $205M ELISA / EIA $131M Immunoassay $433M IFA / DFA $76M Multiplexing IA $21M

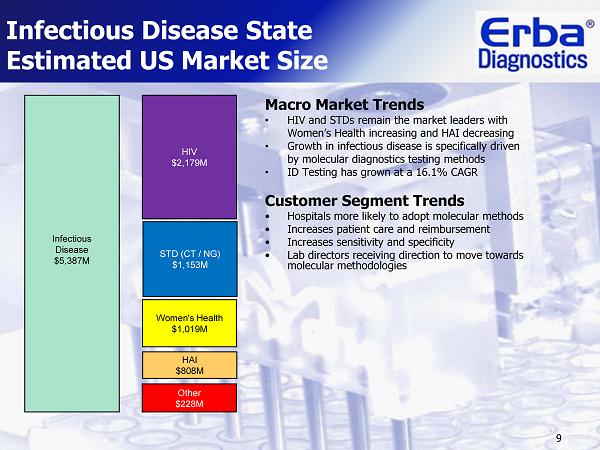

9 Infectious Disease State Estimated US Market Size Macro Market Trends • HIV and STDs remain the market leaders with Women’s Health increasing and HAI decreasing • Growth in infectious disease is specifically driven by molecular diagnostics testing methods • ID Testing has grown at a 16.1% CAGR Customer Segment Trends • Hospitals more likely to adopt molecular methods • Increases patient care and reimbursement • Increases sensitivity and specificity • Lab directors receiving direction to move towards molecular methodologies STD (CT / NG) $1,153M Women's Health $1,019 M Infectious Disease $5,387 M HAI $808 M Other $228 M HIV $2,179M

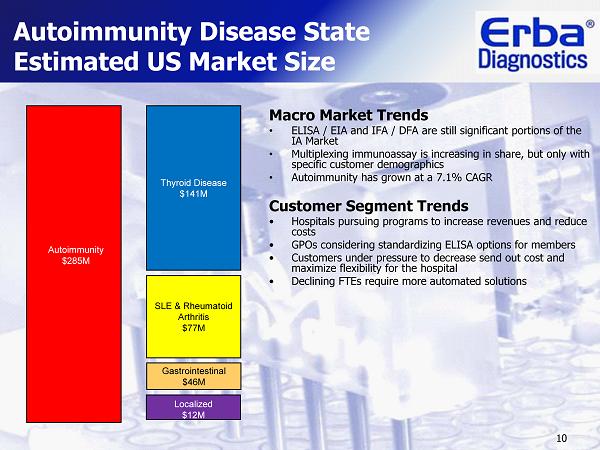

10 Autoimmunity Disease State Estimated US Market Size Macro Market Trends • ELISA / EIA and IFA / DFA are still significant portions of the IA Market • Multiplexing immunoassay is increasing in share, but only with specific customer demographics • Autoimmunity has grown at a 7.1% CAGR Customer Segment Trends • Hospitals pursuing programs to increase revenues and reduce costs • GPOs considering standardizing ELISA options for members • Customers u nder pressure to decrease send out cost and maximize flexibility for the hospital • Declining FTEs require more automated solutions Thyroid Disease $141 M SLE & Rheumatoid Arthritis $77 M Autoimmunity $285 M Gastrointestinal $46 M Localized $12 M

11 • Diagnostic raw materials, antibodies and antigens – Autoimmune (Systemic L upus, Rheumatoid Factor, etc.) – Infectious (Measles, Mumps, Rubella, Hepatitis, etc.) • Automated instrumentation systems – Proprietary Mago ® Automated ELISA and IFA processor – Supply Agreement with Dynex Technologies to provide DSX™ and DS2™ ELISA – D3 3part hematology – XL 2280 5 part hematology – Ds5 Hb1Ac analyzer – Ds360 Hb1Ac analyzer • In - vitro diagnostics kits – Autoimmune disease – Infectious disease – Allergy products – Hematology – Clinical chemistry – Diabetes Product Overview

12 • Diagnostic raw materials – Autoimmune • Native • Recombinant • Antibodies – Infectious • Viral • Recombinant • Antibodies – BioMarkers • Targeting diagnostic companies developing immunoassays • A ntigens • Antibodies Diagnostic Raw Materials

13 Automated Instrumentation • Mago ® Instrumentation Systems – Complete line of fully automated, integrated ELISA and IFA processing systems – Large global installed base of over 600 systems • Dynex DSX ™ and DS2™ instrumentation – Supply agreement with Dynex Technologies • Dynex only manufactures equipment – Proprietary reagent racks have been developed for use with the Dynex instruments – DS2 ™ and DSX™ instruments provide disposable pipette tips and sample identification capability for accounts that require these features, especially for hepatitis and HIV testing • D3 3 part Hematology • XL 2280 5 part Hematology • Ds5 Hb1Ac analyzer • Ds360 HPLC Hb1ac analyzer • Instrumentation primarily installed in hospitals, reference labs and POLs

14 • ELISA Autoimmune Disease Products – 20 FDA approved test kits • A ssays for screening antinuclear antibodies and specific tests to measure antibodies to dsDNA, SSA, SSB, Sm, Sm/RNP, Scl 70, Jo - 1, Rheumatoid Factor, MPO, PR - 3, TPO, TG, and others • Products are used for the diagnosis and monitoring of autoimmune diseases, including Systemic Lupus Erythematosus, or SLE, Rheumatoid Arthritis, Mixed Connective Tissue Disease, Sjogren’s Syndrome, Scleroderma, and Dermatopolymyositis • ELISA Infectious Disease Products – 19 FDA approved test kits; distribute approximately 200 additional FDA approved kits manufactured by third party companies • Toxoplasma IgG, Toxoplasma IgM, Rubella IgG, Rubella IgM, Cytomegalovirus, or CMV, IgG, CMV IgM, Herpes Simplex Virus, or HSV, IgG, HSV IgM, Measles, Varicella Zoster Virus, or VZV, Lyme Disease , H. pylori, Mumps, six different Epstein - Barr Virus kits and others • OEM agreements for more than 400 other products • Provide complete FDA cleared system for equipment and kits – Validation and correlations already completed for customer In Vitro Diagnostic Kits

15 Sales Strategy • U.S. Sales – Direct sales force – Channel partners • Labsco • Fisher Scientific • Medline • International Sales – Direct sales force in Italy and independent sales agents in Western Europe – Network of independent distributors outside Italy – Autoimmune and infectious disease kit menu is supplemented with additional products that are obtained from third party companies – Complete line of allergy products is marketed in Italy – Hepatitis products for international markets – Clinical chemistry , hematology , Hb1Ac instrumentation and reagents • Transasia – Transasia’s customer base expected to have access to Erba’s immunology platform • Prior to its investment in Erba, Transasia did not have an immunology platform • Expected to increase Erba’s presence in India, Eastern Europe, the Middle East , and South America

16 Capitalization Table Equity (100,000,000 authorized) Non - Diluted Shares Avg Price Fully Diluted Common Stock 43,658,221 48,324,887 Stock Options Outstanding $1.29 1,120,870 Warrants, Expire June 2016 $0.75 19,400,000 Total 62,735,403 Debt Principle Balance City National Bank, Secured Revolving Line of Credit $975,000 Total $975,000

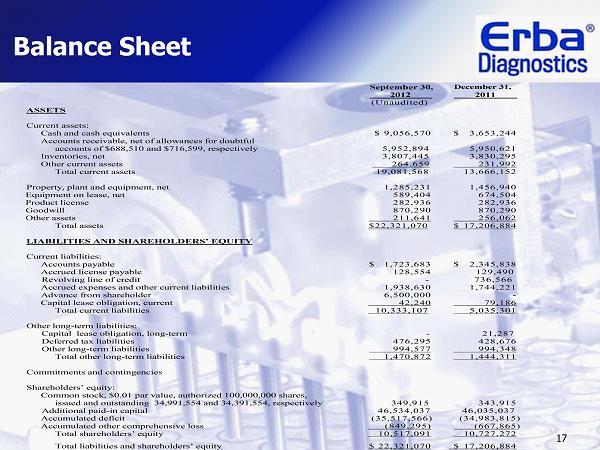

17 Balance Sheet September 30, December 31, 2012 2011 (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 9,056,570 $ 3,653,244 Accounts receivable, net of allowances for doubtful accounts of $688,510 and $716,599, respectively 5,952,894 5,950,621 Inventories, net 3,807,445 3,830,295 Other current assets 264,659 231,992 Total current assets 19,081,568 13,666,152 Property, plant and equipment, net 1,285,231 1,456,940 Equipment on lease, net 589,404 674,504 Product license 282,936 282,936 Goodwill 870,290 870,290 Other assets 211,641 256,062 Total assets $22,321,070 $ 17,206,884 LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities: Accounts payable $ 1,723,683 $ 2,345,838 Accrued license payable 128,554 129,490 Revolving line of credit - 736,566 Accrued expenses and other current liabilities 1,938,630 1,744,221 Advance from shareholder 6,500,000 - Capital lease obligation, current 42,240 79,186 Total current liabilities 10,333,107 5,035,301 Other long-term liabilities: Capital lease obligation, long-term - 21,287 Deferred tax liabilities 476,295 428,676 Other long-term liabilities 994,577 994,348 Total other long-term liabilities 1,470,872 1,444,311 Commitments and contingencies Shareholders’ equity: Common stock, $0.01 par value, authorized 100,000,000 shares, issued and outstanding 34,991,554 and 34,391,554, respectively 349,915 343,915 Additional paid-in capital 46,534,037 46,035,037 Accumulated deficit (35,517,566 ) (34,983,815) Accumulated other comprehensive loss (849,295) (667,865) Total shareholders’ equity 10,517,091 10,727,272 Total liabilities and shareholders’ equity $ 22,321,070 $ 17,206,884

18 Income Statement Period Ended September 30, Three months Nine months 2012 2011 2012 2011 Net revenues $3,788,821 $4,059,598 $12,372,980 $12,568,953 Cost of sales 1,726,815 1,973,863 5,984,181 6,008,085 Gross profit 2,062,006 2,085,735 6,388,799 6,560,868 Operating expenses: Selling and marketing 1,042,469 1,320,244 3,022,096 4,054,260 General and administrative 866,284 1,350,734 3,031,027 4,274,806 Research and development 195,493 412,231 633,340 1,397,333 Total operating expenses 2,104,246 3,083,209 6,686,463 9,726,399 Loss from operations (42,240) (997,474) (297,664) (3,165,531) Other income (expense): Interest income (expense) (8,702) (1,892) (30,698) (9,112) Gain (loss) on foreign currency transactions 65,072 (5,286) (38,122) (3,449) Acquisition expenses (84,699) - (84,699) - Other income (expense), net (6,539) (200,413) (7,956) (163,313) Total other income (expense), net (34,868) (207,591) (161,475) (175,874) Loss before income taxes (77,108) (1,205,065) (459,139) (3,341,405) (Provision) benefit for income taxes (19,508) (28,614) (74,612) 320,224 Net (loss) (96,616) (1,233,679) (533,751) (3,021,181) Other comprehensive income (loss) foreign currency translation adjustments (147,808) (163,889) (181,430) 91,879 Comprehensive loss $(244,424) $(1,397,568) $(715,181) $(2,929,302) Net (loss) per share-basic and diluted ($0.01) ($0.04) ($0.02) ($0.10) WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: Basic 34,991,554 34,391,554 34,759,437 29,943,392 Diluted 34,991,554 34,391,554 34,759,437 29,943,392

19 Growth Strategy • Continue efforts to expand placement of systems in the USA − Currently 250 systems placed in the USA under a Reagent Rental Agreement • Reagent Rental Agreement places equipment with no up - front cost to customers who agree to purchase test kits from Erba − 12% system expansion target per year in the USA • Systems currently generate an average of $30K in test kit revenue per year • Acquisitions − Acquisition of Drew/Jas during October 2012 − Targets that could speed introduction of Transasia’s products into the USA − Complimentary product lines • Sales of Erba’s products in Transasia’s sales channel − Commenced during Q3 2012 − Transasia’s customer base is roughly 5 times greater than Erba’s • Targeting 25% Gross Margins on sales in Transasia’s sales channel

20 • Erba acquired Drew Scientific which conducted the c linical d iagnostics b usiness unit of Escalon Medical during October, 2012. • This acquisition marks the entry of Erba in the fields of – HbA1c Analysis for long term glycemic control in Diabetes – Hematology for blood cell analysis – Clinical chemistry targeted at the physician’s office market Growth through Acquisitions

21 • Erba intends to make foray in the vast Physician’s office segment which comprises of nearly 10000 potential customers with not a great choice of solutions. • Erba aspires to provide solutions in the segment of Moderate Complexity Analyzers for – HbA1c – Clinical Chemistry – Hematology – Immunology Strategic Acquisition

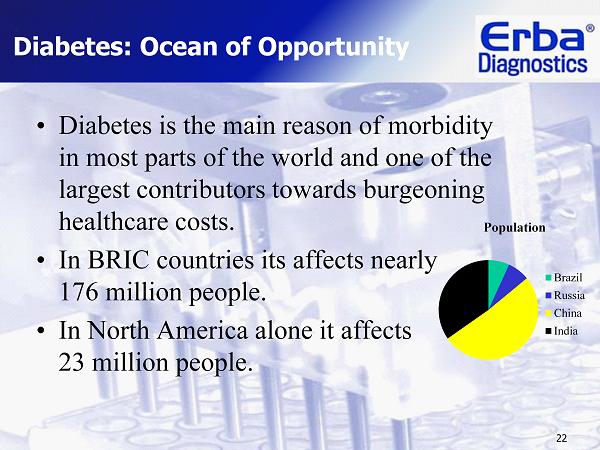

22 • Diabetes is the main reason of morbidity in most parts of the world and one of the largest contributors towards burgeoning healthcare costs. • In BRIC countries its affects nearly 176 million people. • In North America alone it affects 23 million people. Diabetes: Ocean of Opportunity Population Brazil Russia China India

23 • HbA1c has been accepted as the marker of choice for Long term glycemic control in Diabetics. • Drew Scientific manufactures analyzers based on HPLC technique for HbA1c analysis. • HPLC is the method of choice applied in DCCT studies for HbA1c and other hemoglobin variants. Diabetes: Ocean of Opportunity

24 • Hematology is one of the primary testing ordered on patients. • Drew/Jas manufactures FDA approved D3 and XL - 2280 range of hematology analyzers. • The Physician’s office segment has relatively little competition and Drew products fill this gap nicely. Hematology

25 • Clinical Chemistry is the mainstay of any laboratory. • An obvious strategy is to marry the expertise of the Erba Diagnostics Mannheim’s capability in Chemistry Analyzers with the Jas Diagnostics capability in reagents. • XL - 200 range of analyzers would be the product of choice for Physician’s office segment. Clinical Chemistry

26 • In - Vitro diagnostics business with a h igh degree of vertical integration – ImmunoVision manufactures natural autoimmune antigens – Delta Biologicals designs and develops proprietary instrumentation and software – Diamedix develops and manufactures ELISA test kits – Drew/Jas develops and sales clinical chemistry, hematology, and Hb1Ac instruments and reagents. • Erba has a diverse product portfolio of more than 400 products – Geographically diverse customer base with expanding product offerings – Includes third party and OEM products • Continue towards goal to be a leader in the diagnostics industry – Working capital – Synergistic acquisitions – Transasia’s sales channel Summary