Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DELCATH SYSTEMS, INC. | d463116d8k.htm |

Investor Presentation

(NASDAQ: DCTH)

January 2013

Exhibit 99.1 |

2

DELCATH SYSTEMS, INC

Forward-looking Statements

Private Securities Litigation Reform Act of 1995 provides a safe

harbor for forward-looking statements made by the

Company or on its behalf. This presentation contains forward-looking

statements, which are subject to certain risks and uncertainties that can

cause actual results to differ materially from those described. Factors that

may cause such differences include, but are not limited to, uncertainties

relating to: timing of completion of the FDA’s review of our NDA, the

extent to which the FDA may request additional information or data and our ability to provide the same in a timely

manner, acceptability of the Phase 1, 2 and 3 clinical trial data by the FDA, FDA

approval of the Company's NDA for the treatment of metastatic ocular

melanoma to the liver, adoption, use and resulting sales, if any, for the chemosaturation

system in the United States, adoption, use and resulting sales, if any, for the

Hepatic CHEMOSAT delivery system in the EEA, our ability to successfully

commercialize the chemosaturation system in various markets and the potential of the

chemosaturation system as a treatment for patients with cancers in the liver, the

timing and our ability to successfully enter into strategic partnership and

distribution arrangements in foreign markets including Australia and key Asian markets

and resulting sales, if any, from the same, patient outcomes using the Generation 2

system, approval of the current or future chemosaturation system for other

indications and/or for use with various chemotherapeutic agents, actions by the

FDA or other foreign regulatory agencies, our ability to obtain reimbursement for

the CHEMOSAT system in various markets, submission and

publication of the Phase II and III clinical trial data, the timing and results of

research and development projects, the timing and results of future clinical

trials including the initiation of clinical trials in key Asian markets with

the Hepatic CHEMOSAT Delivery System device for intra-hepatic arterial delivery and extracorporeal

filtration of doxorubicin, approval of the Hepatic CHEMOSAT Delivery System to

delver and filter doxorubicin in key Asian

markets and adoption, sales, if any, and patient outcomes using the same, the

timing, price and use, if any, of the committee equity financing facility

with Terrapin, the timing and use, if any, of the line of credit from SVB and our ability to

access this facility and uncertainties regarding our ability to obtain financial

and other resources for any research, development and commercialization

activities. These factors, and others, are discussed from time to time in

our filings with the Securities and Exchange Commission. You should not

place undue reliance on these forward-looking statements, which speak

only as of the date they are made. We undertake no obligation to publicly update or revise these forward-

looking statements to reflect events or circumstances after the date they are

made. |

3

DELCATH SYSTEMS, INC

Investment Considerations

Concentrating the Power of Chemotherapy

•

Commercial stage company focused on oncology

•

Proprietary CHEMOSAT delivery systems allow unique whole organ

therapy for the liver

•

CHEMOSAT system has demonstrated extension of progression free

survival

•

Addressing large unmet market need for cancer patients who usually die

of liver failure

•

2013 estimated addressable market opportunity of $2.3 billion

•

Expanding clinical data expected to broaden clinical use and indication

•

On the cusp of realizing the potential:

o

EU commercial launch underway

o

Reimbursement in additional key EU markets expected in Q1

o

U.S.

NDA

under

review

–

PDUFA

date

June

15,

2013

•

Attractive financial model, $80 million in available resources and

experienced management team to execute plan |

4

DELCATH SYSTEMS, INC

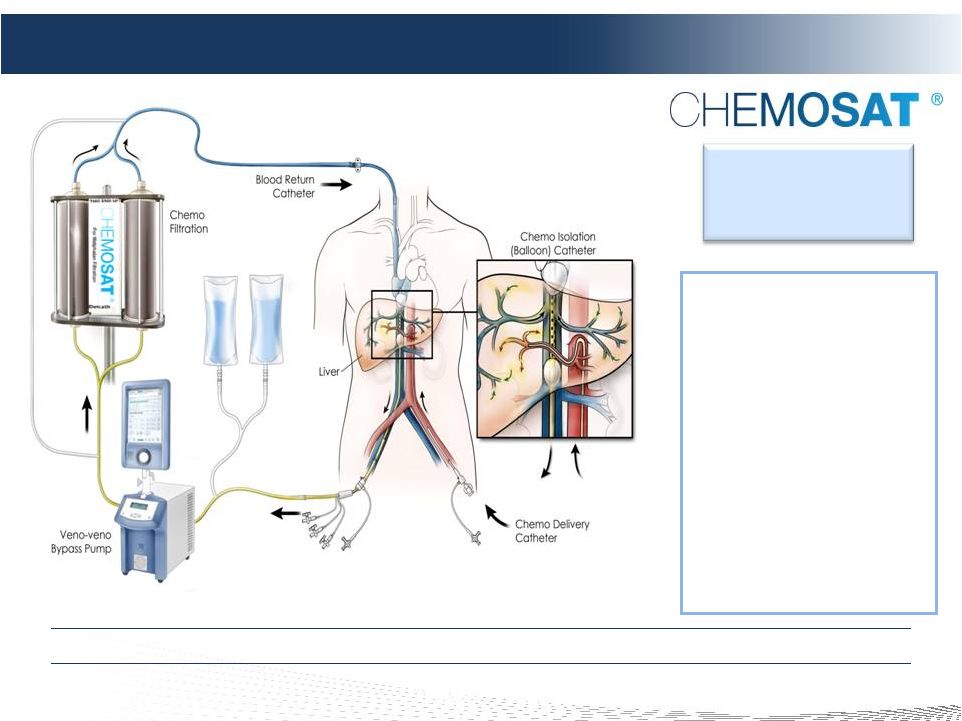

The Delcath CHEMOSAT System

Minimally Invasive, Repeatable Liver Procedure That Could Complement Systemic

Therapy 1.

ISOLATE

2.

SATURATE

3.

FILTRATE

•

Improves disease

control in the liver

•

Treats entire liver

(macro and micro)

•

Controls systemic

toxicities

•

Allows for over 100x

effective dose

escalation at tumor

site

Chemosaturation |

5

DELCATH SYSTEMS, INC

Melanoma Liver Metastases

A Great Demonstration of CHEMOSAT’s Potential

•

A challenging histology

•

Notoriously insensitive to

systemic chemotherapy and

focal interventions

•

CHEMOSAT has

demonstrated ability to extend

progression free survival

Our Opportunity

•

Ability to achieve ultra-high concentrations of chemotherapy that

are effective on a wide variety of cancers in the

liver •

Physicians are recognizing the broad applicability of CHEMOSAT, based

on early EU experience |

6

DELCATH SYSTEMS, INC

Clinically Differentiated Results

•

Phase 1, 2 and 3 trials produced positive results in multiple histologies

•

Melanoma Liver Mets

o

Positive Phase 3 results in hepatic metastatic melanoma

o

n=93 (90% ocular melanoma, 10% cutaneous melanoma)

•

Neuroendocrine Tumor (NET) Liver Mets

o

mNET cohort in Phase 2 trial showed encouraging 42% objective response rate

(ORR) vs ~10% for approved targeted therapy

o

median overall survival of ~32 months on ITT basis

•

Hepatocellular Carcinoma (HCC)

o

Positive signal with high-dose melphalan in HCC cohort of Phase 2 trial (5/8

patients) is encouraging when approved systemic therapies have modest

efficacy and challenges with tolerability

•

Colorectal Cancer (CRC) Liver Mets

o

Data from surgical Isolated Hepatic Perfusion (IHP) with melphalan indicates

strong potential in well-defined patient population with earlier stage

CRC yielding ~50-60% median response rate and median OS of

17.4-24.8 mos •

Safety profiles consistent with pivotal US Phase 3 melanoma trial

|

7

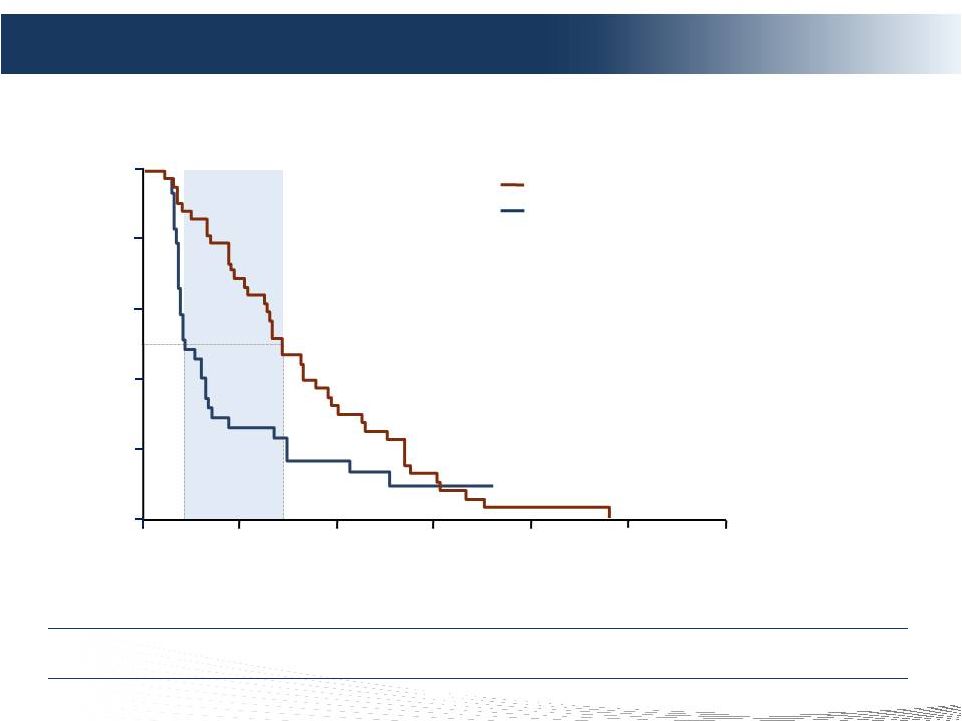

DELCATH SYSTEMS, INC

INDEPENDENT

REVIEW

COMMITTEE

(IRC)

ASSESSMENT

-

UPDATED

ANALYSIS

(4

June

2012)

Hepatic progression-free survival (IRC)

Hazard ratio = 0.50

(95%

CI

0.31

–

0.80)

P=0.0029

0

5

10 15

20

25

30

Months

7.0

1.7

1.0

0.8

0.6

0.4

0.2

Proportion of patients surviving

5.3 mo

Intent-to-treat population

Chemosaturation (CS-PHP)

Best alternative care (BAC)

Positive Phase 3 Results –

Primary Endpoint hPFS

CS-PHP Demonstrated 4x or 5.3 months Improvement in Primary Endpoint of

hPFS 0.0 |

8

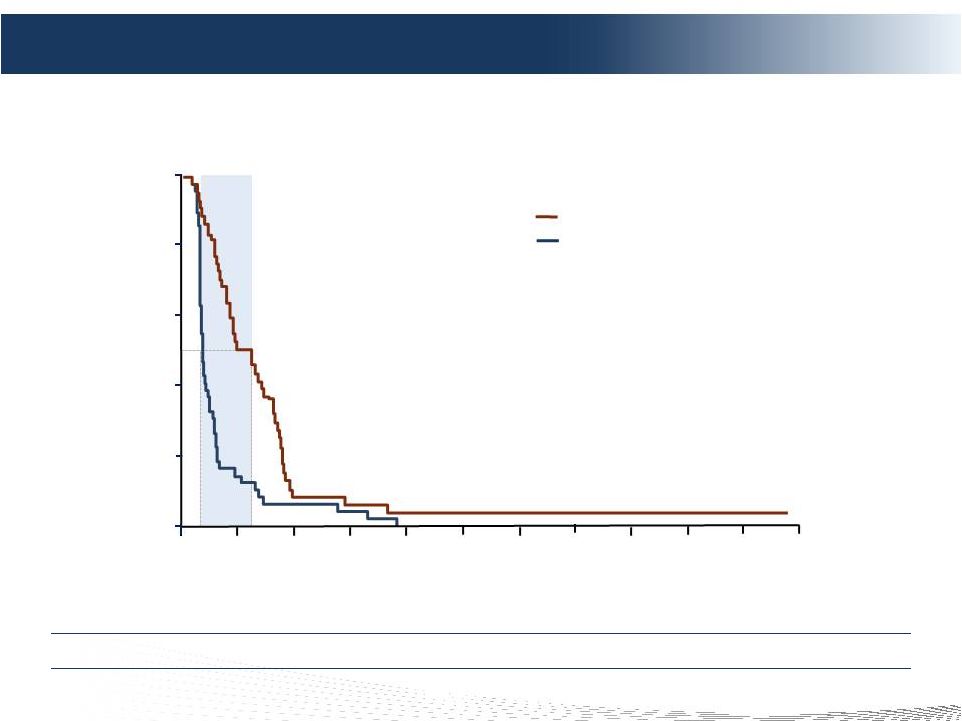

DELCATH SYSTEMS, INC

INVESTIGATOR

ASSESSMENT

-

UPDATED

ANALYSIS

(4

June

2012)

Overall progression-free survival (investigator)

Months

5.4

1.6

Proportion of patients surviving

Hazard ratio = 0.42

(95%

CI

0.27–

0.64)

P<0.0001

3.8 mo

Intent-to-treat population

Chemosaturation (CS-PHP)

Best alternative care (BAC)

Positive Phase 3 Results –

Overall PFS

CS-PHP also Demonstrated a Highly Statistically Significant Improvement in

Overall PFS 1.0

0.8

0.6

0.4

0.2

0.0

0

5 10 15

20

25

30 35 40

45

50 55 |

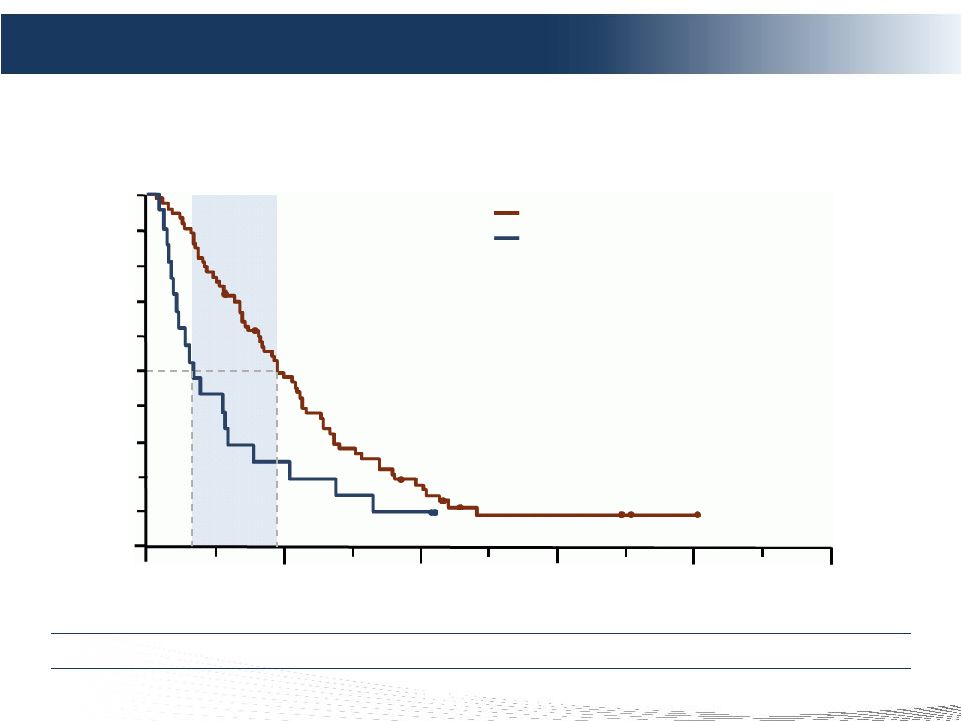

9

DELCATH SYSTEMS, INC

TOTOL CS-PHP vs BAC ONLY

Proportion of subjects surviving

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

12

36

0

24

48

60

11.4

Total

CS-PHP

incl.

crossover

BAC only

Months

4.1

Intent-to-treat population

7.3 mo

Overall Survival –

Exploratory Subset Analysis

Overall

Survival

Tail

For

CS-PHP

Treated

Patients |

10

DELCATH SYSTEMS, INC

Phase

2

Multi-Histology

NCI

Trial

–

Summary

•

Strong efficacy signals in mNET

o

42% objective Response Rate (ORR) vs ~10%

for approved targeted therapy

o

66% patients had hepatic tumor shrinkage and

durable disease stabilization

•

Positive Signal in primary hepatic malignancies

(HCC and Cholangiocarcinoma) in 5 of 8 patients

•

Similar safety profiles across tumor types |

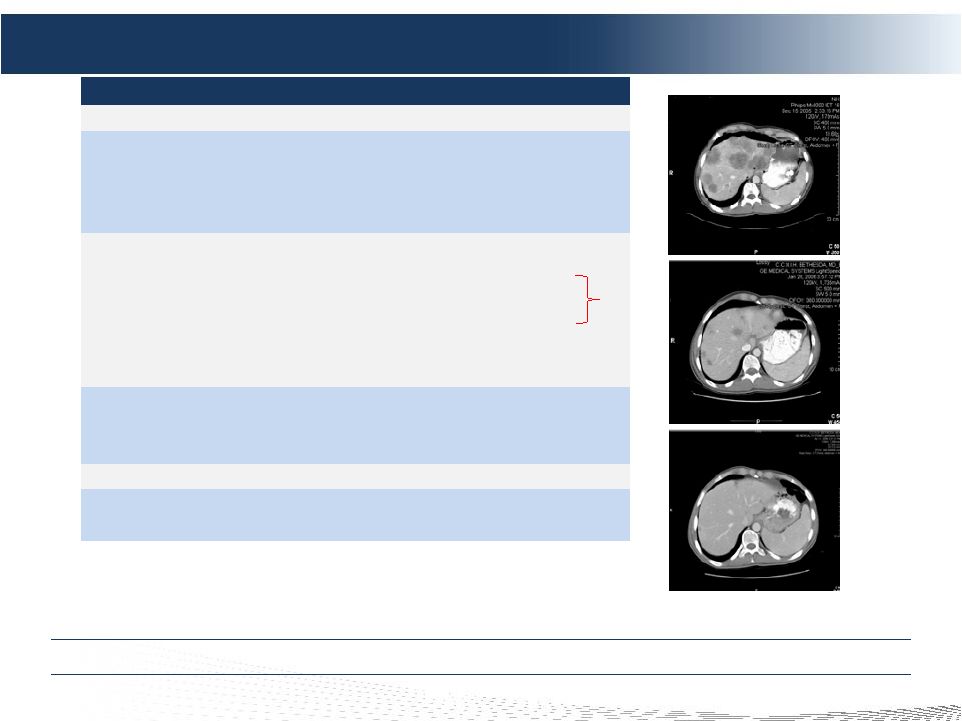

11

DELCATH SYSTEMS, INC

Phase 2 NCI Trial –

Metastatic Neuroendocrine Cohort

Pre-CS

(Baseline)

Post-CS #2

(+4 Months)

Post-CS #1

(+6 Weeks)

Compelling Clinical Data in Attractive mNET Market

Phase 2 mNET Tumor Cohort (n=24)*

Number (n)

Tumor Types

Pancreatic NET

13

Carcinoid tumor

3

Other NET

8

Response

Partial Response (PR)

10

Stable disease (SD)

6

Progressive disease

3

Not assessed or evaluable

5

Objective Response Rate

42%

Median Duration of Hepatic Response

Partial Response (n-10)

23.5 months

Partial Response/Stable Disease (n=16)

16.8 months

Hepatic Progression Free Survival (IIT n=24)

Median Hepatic PFS

16.8

Min/Max

2.1, 64.1

Overall Survival After CS

Median

31.9 months

Min/Max

2.4, 81.1

66%

disease

control |

12

DELCATH SYSTEMS, INC

Phase 2 NCI Trial –

Hepatobilliary Carcinoma Cohort

•

Best hepatic tumor response by modified RECIST assessed by investigators

o

Partial response (PR)

1 patient

o

Stable disease (SD)

4 patients

o

Progressive disease

1 patient

o

Not assessed or evaluable

2 patients

•

Median duration of response

o

hPR (N=1)

6.42 months

o

hPR/SD (N=5)

8.12 months

•

Hepatic progression free survival (ITT N=8)

o

Median

5.60 months

o

Minimum, Maximum

2.7, 12.2 months

•

Overall survival (ITT N=8)

o

Median

9.12 months

o

Minimum, Maximum

3.4, 20.5 months

•

HCC is the most common primary cancer of the liver, with approximately 750,000* new

cases diagnosed worldwide annually

•

Intend

to

initiate

new

HCC

trials

with

CHEMOSAT

Encouraging Positive Signal for Primary Liver Cancer

*Source: GLOBOCAN |

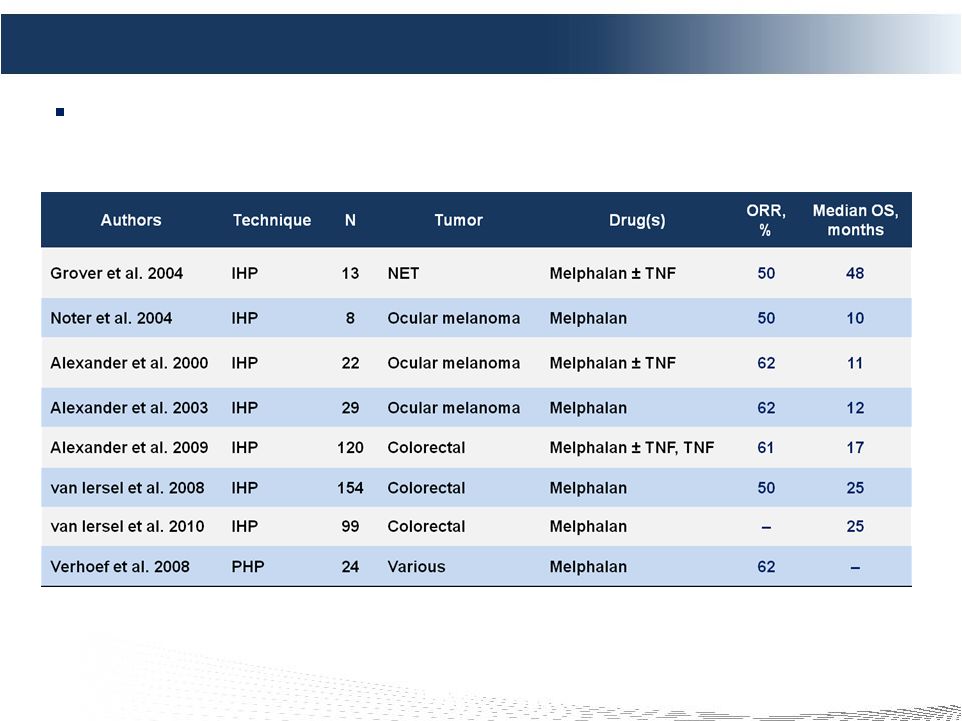

13

DELCATH SYSTEMS, INC

•

Substantial clinical evidence of benefit of using ultra-high dose

melphalan to treat mCRC via isolated hepatic perfusion (IHP)

procedure

o

Over 800 patients treated in 15 studies since 1998

o

Patients treated only once

o

Median response rate of ~50-60% and median OS of 17.4 –

24.8 mos1,2

•

Delcath

Phase

2

NCI

Chemosaturation

Trial

–

mCRC

Cohort

o

Challenges enrolling at NCI due to competing FOLFOX & FOLFIRI trials

o

17

patients treated since 2004

o

Safety profile –

expected and consistent with pivotal FDA Phase III

melanoma trial

•

Intend to invest in new mCRC trials with CHEMOSAT Melphalan

Strong Rationale for Using CHEMOSAT with Melphalan to Treat mCRC

1)

van Iersel LB, Gelderblom H, et al. Ann Oncol. 2008;19:1127-34

2)

Alexander, HR, Barlett DL, et al. Ann Surg Oncol, 16:1852-9, 2009

Phase 2 NCI Trial –

mCRC Cohort |

14

DELCATH SYSTEMS, INC

Additional Clinical Data Generation

•

Goals:

Expand US (CS-PHP: MEL) label indications beyond the

initial indication we are seeking

Generate robust clinical data to support commercialization

•

FDA has accepted IND Amendment to include Gen 2 device in

Expanded Access Program (EAP), compassionate use (CU),

and all future clinical trials

•

On track to initiate EAP to treat first patient

•

Activate EU Registry to systematically collect data from

commercial experience

Establish CHEMOSAT as the Standard of Care (SOC) for Disease Control in the

Liver |

15

DELCATH SYSTEMS, INC

2013 Clinical Development Plan

•

Planned 2013 studies, pending discussion with the FDA:

Hepatocellular carcinoma (HCC)

o

Global Phase 3 Randomized CHEMOSAT Melphalan vs. BSC for

Sorafenib Failure

Advanced colorectal cancer (CRC) with liver dominant metastasis

o

Global Phase 3 Randomized CHEMOSAT Melphalan vs.

Available Alternatives

Neuroendocrine tumor (NET) with liver dominant disease

o

Global Phase 3 Randomized CHEMOSAT Melphalan vs.

Available Alternatives

•

Phase 2 studies in multiple indications: HCC, NET, CRC, melanoma

•

Global

Investigator-initiated

trials

(IITs)

–

opportunity-driven

Establish CHEMOSAT as the Standard of Care (SOC) for Disease Control in the

Liver |

16

DELCATH SYSTEMS, INC

CHEMOSAT -

Potential Multi-Billion Dollar Global Market

8,708

6,563

4,085

8,212

7,202

33,966

19,861

33,953

52,143

5,585

7,671

99,749

0

25,000

50,000

75,000

100,000

125,000

150,000

175,000

200,000

USA

EU

APAC

$2.3 Billion Market Opportunity in 2013 with Pharmaceutical-Like Gross

Margins Sources: LEK Consulting, GLOBOCAN, Company estimates.

EU: Initial target countries of Germany, UK, Italy, France, Spain, Netherlands,

Ireland. APAC: Initial target countries of China, Japan, S. Korea, Taiwan,

Australia. Assumes 2.5 treatments per patient.

Assumes EU ASP of $15K; US ASP of $25K; APAC ASP of $5K.

55,389

$2.2 B

42,367

$2.6 B

189,943

$2.2 B

HCC

CRC

Melanoma

NET

$2.3B Initial Opportunity

•

$100M Initial on-label

opportunity in Ocular

Melanoma in US*

•

$2.2B multi-histology

opportunity in EU |

17

DELCATH SYSTEMS, INC

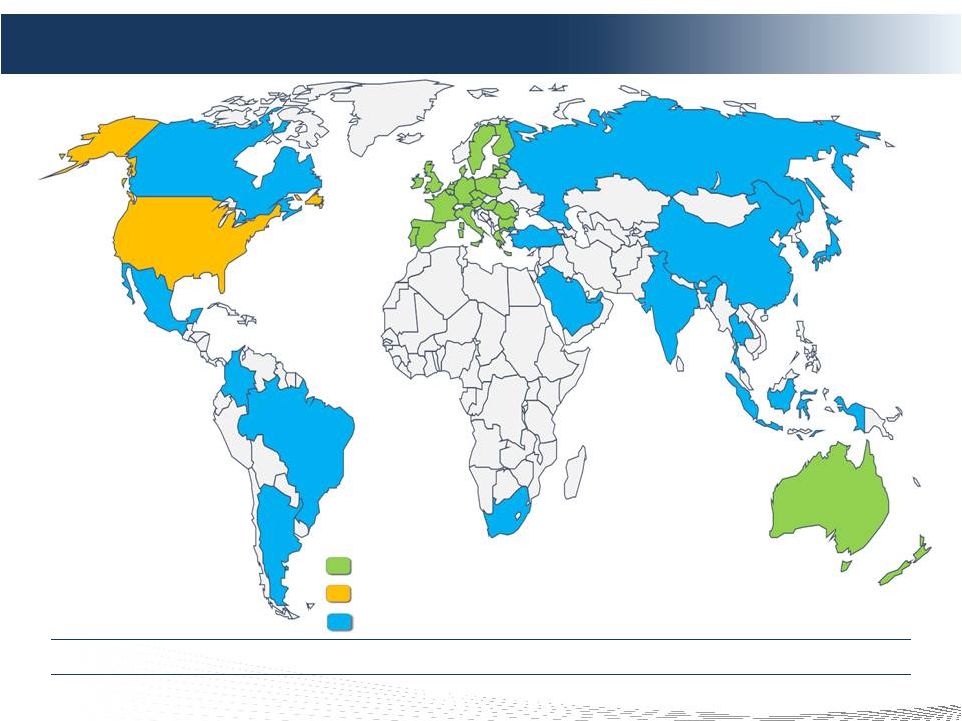

Approved (CE Mark Device)

NDA Filing Accepted by the FDA with PDUFA goal date of June 15, 2013

Application Submitted/ Planned –

Mutual Recognition of European CE Mark

Global Commercialization Status

Addressing A Multi-Billion Dollar Global Market |

18

DELCATH SYSTEMS, INC

CHEMOSAT: EU Launch Underway

•

Marketing in target EU countries -

Italy, Germany, France,

UK, Ireland, NL, Spain

•

Training completed in key centers

o

Eight EU Clinical Sites activated in 2012

•

EU clinicians using CHEMOSAT for a broad range of liver

metastases

o

Use includes: cutaneous melanoma, ocular melanoma, colorectal

cancer (CRC), gastric cancer, breast cancer, neuroendocrine tumor

(NET), hepatocellular carcinoma (HCC) and Cholangiocarcinoma

•

EU reimbursement gaining momentum

o

Italy

–

Reimbursement

pathway

established

o

Germany,

UK

–

Reimbursement

anticipated

Q1

2013

Rapid

expansion

of

EU

Clinical

and

Commercial

footprint

expected

for

2013 |

19

DELCATH SYSTEMS, INC

U.S. NDA Under Review

•

PDUFA date: June 15, 2013

•

Initial indication: unresectable metastatic ocular melanoma

in the liver

o

Provides lowest risk pathway to FDA approval and fastest access

•

NDA filing included:

o

Comprehensive set of additional data in a new FDA compliant

CDISC database

o

Gen 2 filter as part of the Chemistry, Manufacturing and Control

(CMC) module

•

Oncology Drug Advisory Committee (ODAC) panel

expected May 2013

•

Three meetings scheduled with FDA to discuss clinical

programs for planned label expansions in each of NET,

HCC,CRC |

20

DELCATH SYSTEMS, INC

U.S. Commercialization Strategy

•

Launch in Q4 2013 assuming approval on PDUFA date of June

15, 2013

•

Initial commercial focus on centers that are active in the EAP or

participated in the Phase 3 clinical trial

•

Utilize active EAP hospitals as Centers of Excellence for training

and support of new centers

•

Intend to seek chemosaturation specific CPT reimbursement

code, based upon value proposition relative to other cancer

therapies

•

Educate Medical Oncologists via Medical Science Liaison (MSL)

•

Direct strategy to sell to hospital based Interventional

Radiologists and Surgeons

Participating EAP Centers Provide Immediate Commercial Footprint

|

21

DELCATH SYSTEMS, INC

Barriers to Entry

•

Patent Protection

o

6 U.S. patents in force and 6 U.S. patent applications pending

o

9 foreign patents in force (with patent validity in 25 countries) and 14 foreign

patent applications pending

o

Primary US device patent set to expire August 2016

o

Up to 5 years of patent extension post FDA approval

•

Trade Secret Protection

o

Developed improved filter media via proprietary manufacturing processes

•

FDA Protection

o

Orphan Drug Designation granted for melphalan in the treatment of ocular

melanoma, cutaneous melanoma and metastatic neuroendocrine tumors, as well as

for doxorubicin in the treatment of HCC

Provides 7 years of marketing exclusivity post FDA approval

o

Additional Orphan Drug applications to be filed for other drugs and indications,

including melphalan for HCC and CRC

Multiple Levels of Protection |

22

DELCATH SYSTEMS, INC

Financial Summary

Cash & Cash Equivalents:

$28.3 million at September 30, 2012

ATM Program

$21.5 million remaining as of November 2012

Committed Equity Financing

Facility (CEFF)

Up to $35 million as of December 5, 2012

Working Capital Line of Credit:

$20.0 million credit facility

Debt:

None

Cash Spend:

$14.6 million in 3Q2012

Projected Q4 < $12 million

Shares Outstanding:

75.1

million

(85.5

million

fully

diluted

¹

)

as

of

November 2012

1) Fully diluted includes an additional 4.8 million options and 5.6 million

warrants $80 Million in Available Resources to Execute Plan

|

23

DELCATH SYSTEMS, INC

Management: A Track Record of Success

Executive

Title

Prior Affiliation(s)

Years of

Experience

Eamonn Hobbs

President and CEO

AngioDynamics, E-Z-EM

32

Graham Miao, Ph.D.

EVP & CFO

D&B, Pagoda Pharma, Schering-Plough,

Pharmacia, JP Morgan

23

Krishna Kandarpa, M.D.,

Ph.D.

CSO and EVP, R&D

Harvard, MIT(HST), Cornell, UMass

33

Agustin Gago

EVP, Global Sales

AngioDynamics, E-Z-EM

31

Jennifer Simpson, Ph.D.

EVP, Global Marketing

Eli Lilly (ImClone), Johnson & Johnson

(Ortho Biotech)

23

Peter Graham, J.D.

EVP, General Counsel &

Global Human Resources

Bracco, E-Z-EM

18

David McDonald

EVP, Business Development

AngioDynamics, RBC Capital Markets

30

John Purpura

EVP, Regulatory Affairs & Quality

Assurance

E-Z-EM, Sanofi-Aventis

29

Harold Mapes

EVP, Global Operations

AngioDynamics, Mallinckrodt

27

Gloria Lee, M.D., PH.D.

EVP, Clinical & Medical Affairs

Hoffmann-La Roche, Syndax

Pharmaceuticals, Inc.

21

Bill Appling

SVP Medical Device R&D

AngioDynamics

27

Dan Johnston, Ph.D.

VP, Pharmaceutical R&D

Pfizer, Wyeth

12 |

24

DELCATH SYSTEMS, INC

2012 Accomplishments

•

First patients treated with CHEMOSAT Melphalan in

Europe in January

•

Obtained CE Mark for Gen 2 CHEMOSAT Melphalan filter

in April

•

Executed contract for MSL services in EU in 1Q 2012

(Quintiles was selected to support EU launch of

CHEMOSAT)

•

Secured agreements with 14 leading cancer centers in EU

•

8 EU Clinical Sites Activated for commercial use

•

US NDA submitted in August 2012

•

US NDA accepted with PDUFA date of June 15, 2013

•

Obtained CE Mark for CHEMOSAT Doxorubicin in October

•

Interim reimbursement established in Italy in December

|

25

DELCATH SYSTEMS, INC

2013 Anticipated

Milestones

•

First

patient

enrolled

in

EAP

-

Q1

2013

•

Secure

interim

reimbursement

in

Germany

and

UK

-

Q1

2013

•

Submission for publications of Phase 3 data and mNET arm of Phase 2 data in

Q1 2013

•

Initiate EU Registry -

Q1 2013

•

First commercial sale in APLA –

Q2 2013

•

ODAC Panel Meeting May 2013

•

Receive NDA approval of Delcath’s chemosaturation system by PDUFA date of

June 15, 2013

•

Commence Company’s first investigator initiated trial (IIT) –

Q2 2013

•

First patient enrolled in Company sponsored trial (CST) to expand indications

– Q4 2013

•

US commercial launch of Delcath’s chemosaturation system –

Q4 2013

•

First patient enrolled in Taiwan HCC pivotal trial –

Q4 2013

•

Execute strategic partnership for China |

26

DELCATH SYSTEMS, INC

A Compelling Investment Opportunity

•

Commercial stage company focused on oncology

•

CHEMOSAT provides a unique whole organ therapy for the liver

•

CHEMOSAT system has demonstrated extension of progression

free survival (PFS)

•

Addressing large unmet market need for cancer patients who

usually die of liver failure

•

EU commercial launch underway

•

2013 estimated addressable market opportunity of $2.3 billion

•

Reimbursement in additional key EU markets expected in Q1

•

U.S. NDA under review

•

Expanding clinical data expected to broaden clinical use and US

labeling

•

Attractive financial model, $80 million in available resources

and experienced management team to execute plan

. |

©

2011 DELCATH SYSTEMS, INC. ALL RIGHTS RESERVED |

28

DELCATH SYSTEMS, INC

Appendices |

29

DELCATH SYSTEMS, INC

LIVER CANCER TREATMENT

OPTIONS

Appendix 1 |

30

DELCATH SYSTEMS, INC

Existing Liver Cancer Treatments Have Significant Limitations

The Problem

•

Metastatic disease to the liver, brain or lungs is often the life-

limiting location of solid tumors

o

Often life-limiting or leads to withdrawal of systemic treatments in

favor of palliative care

•

Effective treatment for patients with liver-limited or dominant

cancers remains a clinical challenge

o

Can be diffuse

o

Often not responsive to chemotherapy and radiation therapy

•

Whole organ therapy creates a new option for patients in the

management of liver dominant disease |

31

DELCATH SYSTEMS, INC

Existing Liver Cancer Treatments Have Limitations

Unmet Medical Need Exists for More Effective Liver Cancer Treatments

Treatment

Advantages

Disadvantages

Systemic

–

Non-invasive

–

Repeatable

–

Systemic toxicities

–

Limited efficacy in liver

Regional

(e.g., Isolated Hepatic Perfusion)

–

Therapeutic effect

–

Targeted

–

Invasive/limited repeatability

–

Multiple treatments are

required but not possible

Focal

(e.g. surgery, radioembolization,

chemoembolization, radio

frequency ablation)

–

Partial removal or

treatment of tumors

–

Only 10% to 20% resectable

–

Invasive and/or limited

repeatability

–

Treatment is limited by tumor

size, number of lesions and

location

–

Tumor revascularization

–

Cannot treat diffuse disease |

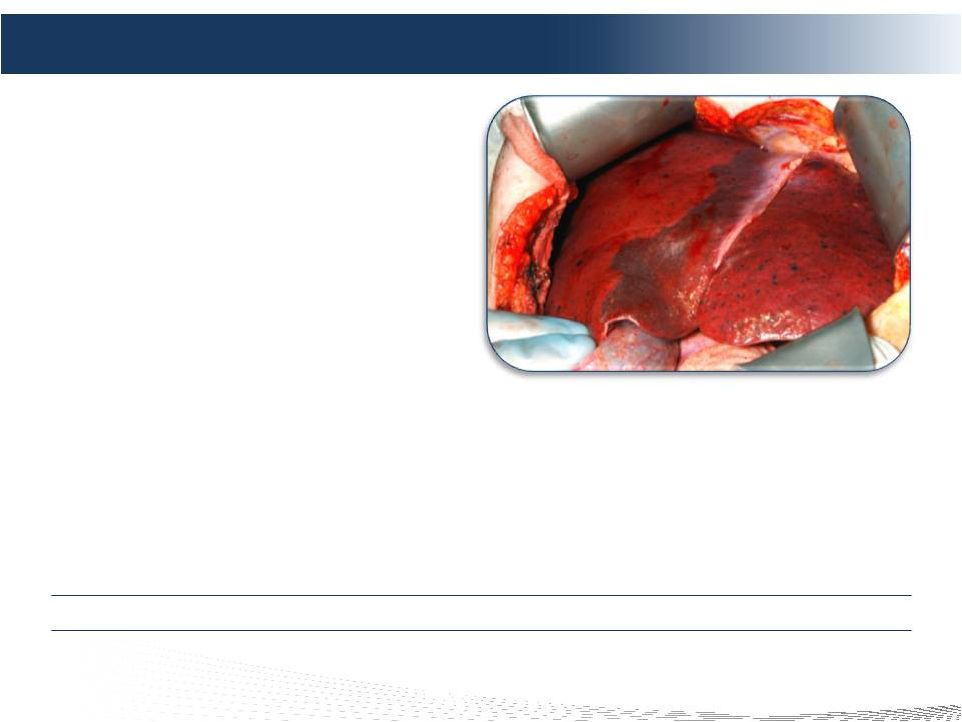

32

DELCATH SYSTEMS, INC

Diffuse Hepatic Metastases from Melanoma

•

Diffuse disease in the liver is prevalent

•

Effective treatment for patients with liver-limited or dominant cancers

remains a clinical challenge

•

Whole organ therapy creates a new option for patients in the management

of liver dominant disease |

33

DELCATH SYSTEMS, INC

Concentrating the Power of Chemotherapy for Disease Control in the Liver

Our Solution –

Whole Organ-Focus Disease Control

•

Our proprietary CHEMOSAT system isolates the liver

circulation, delivers an ultra-high concentration of

chemotherapy (melphalan) to the liver and filters most of the

chemotherapy out of the blood prior to returning it to the patient

•

The procedure typically takes approximately two hours to

complete and involves a team including the interventional

radiologist and perfusionist

•

CHEMOSAT (Gen 2) has demonstrated minimal systemic

toxicities and impact to blood components in initial commercial

use and may complement systemic therapy

•

CHEMOSAT has been used on approximately 200

patients to

date through clinical development and early commercial launch

|

34

DELCATH SYSTEMS, INC

CHEMOSAT MARKET OPPORTUNITY

BY DISEASE & TARGET COUNTRIES

Appendix 2 |

35

DELCATH SYSTEMS, INC

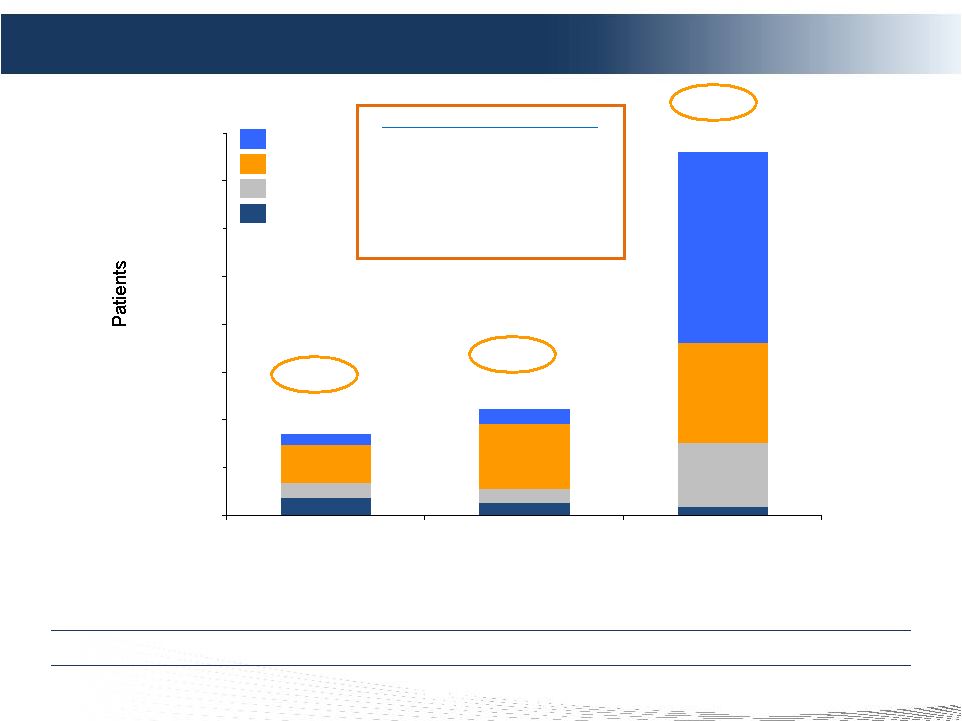

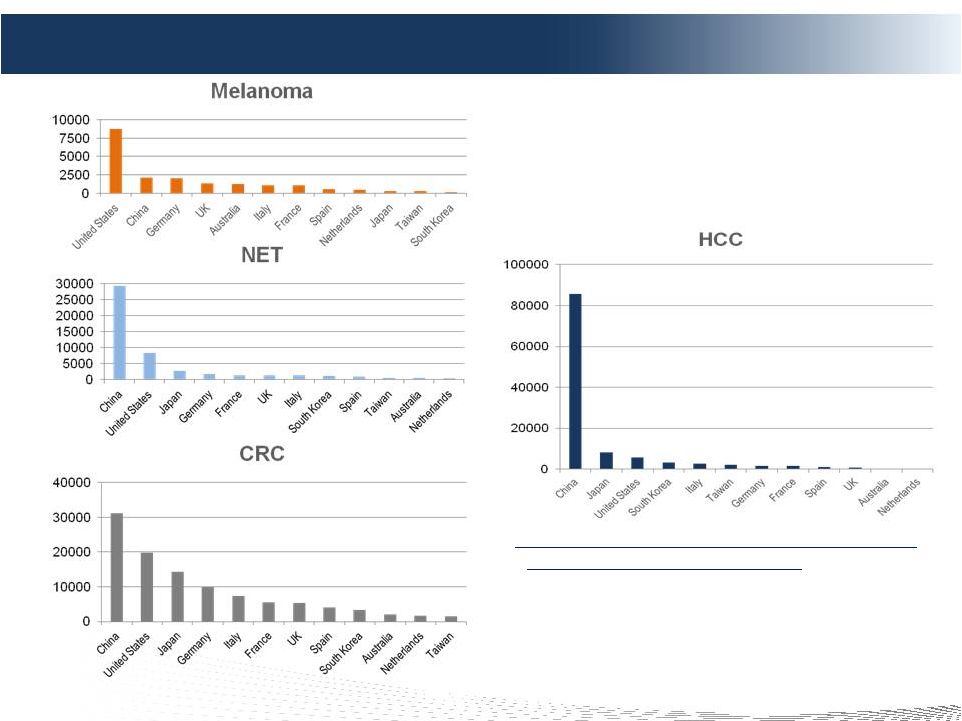

•

Europe –

Largest near-term opportunity

•

CRC –

Largest opportunity worldwide

•

Melanoma –

Largest opportunity is in the US

•

China –

Largest opportunity for HCC

Market Opportunity by Disease (patients)

Market Opportunity defined as Total Potential

Market

(TPM)

for

CHEMOSAT

®

1.Primary cancer incidence

2.Adjusted for predominant disease in the liver (primary

or metastatic cancer)

3.Adjusted

for

addressable

patients

via

Delcath

CHEMOSAT

® |

36

DELCATH SYSTEMS, INC

Europe Market by Disease –

Device Only

Germany

(Direct)

UK

(Direct)

France

(Indirect)

Italy

(Indirect)

Spain

(Indirect)

Netherlands

(Direct)

Ireland

(Direct)

Total

Potential

(patients)

Potential

Market

($ MM)

1,2,3

Total Potential Market #Patients

Ocular

Melanoma

404

297

295

285

197

79

19

1,576

$ 62

Cutaneous

Melanoma

1,625

994

753

801

360

379

73

4,987

$ 206

CRC

9,902

5,300

5,475

7,281

4,016

1,644

335

33,953

$1,339

HCC

(Primary)

1,637

720

1,514

2,597

1,087

82

35

7,671

$277

NET

1,783

1,336

1,353

1,299

974

360

98

7,202

$ 281

TOTAL

15,351

8,647

9,389

12,263

6,634

2,545

560

55,389

$ 2,166

Europe Presents Significant Potential Market Opportunity

Sources: LEK Consulting, GLOBOCAN, Company estimates.

1) Assumes 2.5 treatments per patient.

2) Assumes ASP of ~$15K USD.

3) Assumes mix of direct sales and distributors. |

37

DELCATH SYSTEMS, INC

US Market by Disease –

Device and Drug Combination

Sources: LEK Consulting, GLOBOCAN, Company estimates.

1) Assume 2.5 treatments per patient.

2) Estimated ASP of $25K.

Liver Metastasis

Potential Market

# Patients

Potential Market

# Procedures

Potential Market

($MM)

1,2

Ocular

Melanoma

1,685

4,213

$ 105

Cutaneous

Melanoma

7,023

17,557

$ 439

CRC

19,861

49,653

$ 1,241

HCC (Primary)

5,586

13,964

$ 349

NET

8,212

20,530

$ 513

TOTAL

42,367

105,917

$ 2,648 |

38

DELCATH SYSTEMS, INC

APAC Market by Disease

China

(Device)

S. Korea

(Device)

Japan

(Device)

Taiwan

(Device)

Australia

(Device)

Total

Potential

(patients)

Potential

Market

($MM)

1,2

Total Potential Market #Patients

HCC

(Primary)

85,780

3,258

8,296

2,152

263

99,749

$ 1,156

Other

CRC

31,127

3,245

14,298

1,441

2,031

52,143

$ 642

NET

29,197

1,048

2,759

500

462

33,966

$ 393

Ocular

Melanoma

1,765

66

175

31

96

2,134

$ 25

Cutaneous

Melanoma

382

43

136

246

1,144

1,951

$ 23

OTHER

TOTAL

62,472

4,403

17,368

2,218

3,733

90,194

$ 1,083

TOTAL

148,104

7,661

25,665

4,370

3,996

189,943

$ 2,239

APAC Target Markets Represent Over $2 Billion Potential Market Opportunity

Sources: LEK Consulting, GLOBOCAN, Company estimates.

1) Assume 2.5 treatments per patient.

2) Estimated ASP of ~$5K. |

39

DELCATH SYSTEMS, INC

HIGH-DOSE MELPHALAN

HISTORY AND RATIONALE

Appendix 3 |

40

DELCATH SYSTEMS, INC

The Evidence for Melphalan

Melphalan, an established chemotherapy agent, is proven active at

high doses with broad antitumor activity

8. Verhoef C, et al. Ann Surg Oncol 15:1367-74

7. Van Iersel LB, et al. Ann Oncol 2010;21:1662-7

6. Van Iersel LB, et al. Ann Oncol 2008;19:1127-34

5. Alexander HR Jr, et al. Ann Surg Oncol 2009;16:1852-9

4. Alexander HR Jr, et al. Clin Cancer Res 2003;9:6343-9

3. Alexander HR Jr, et al. Clin Cancer Res 2000;6:3062-70

2. Noter SL, et al. Melanoma Res 2004;14:67-72

1. Grover AC, et al. Surgery 2004;136:1176-82 |

41

DELCATH SYSTEMS, INC

Melphalan Dosing & Background

•

Well understood, dose dependent, tumor preferential, alkylating cytotoxic agent

that demonstrates little to no hepatic toxicity

•

Manageable systemic toxicities associated with Neutropenia and

Thrombocytopenia

•

Drug dosing 12x higher than FDA-approved dose via systemic IV

chemotherapy •

Dose delivered to tumor is over 100x higher than that of systemic IV

chemotherapy

Type

Dosing (mg/kg)

Multiple Myeloma (label)

0.25

Chemoembolization

0.62

Surgical Isolated Hepatic Perfusion (IHP)

1.50

Myeloablation

2.50-3.50

Chemosaturation (PHP)

3.00

An Established Drug for Liver Cancer Therapy |

42

DELCATH SYSTEMS, INC

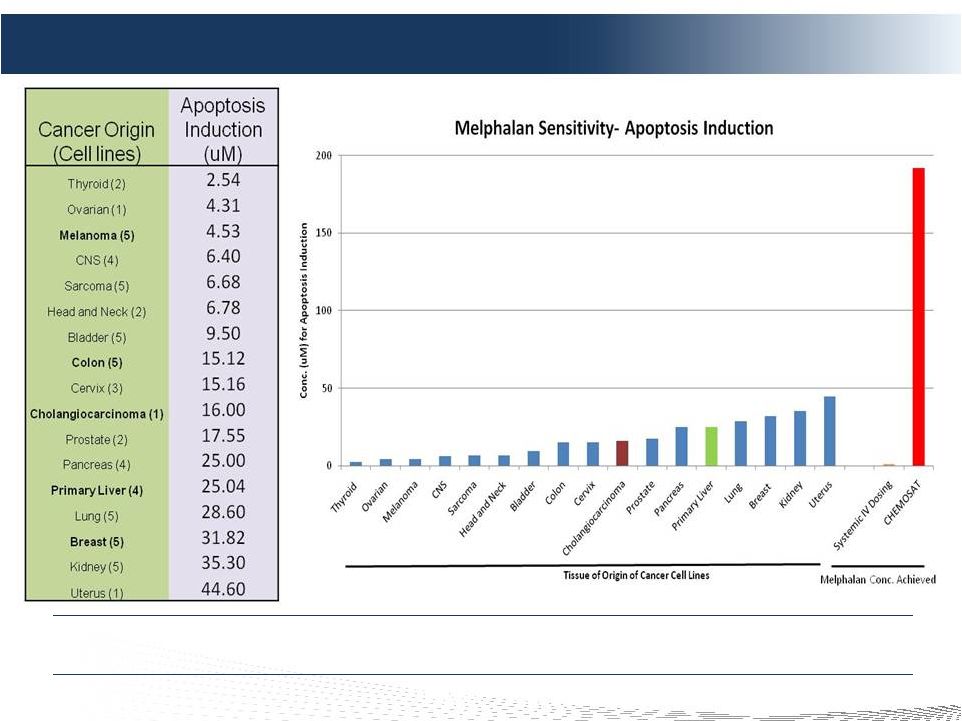

Melphalan Sensitivity: In Vitro Tumor Cell Lines Study

We Believe CHEMOSAT Will Be Effective On a Wide Range of Solid Tumors

192 uM |

43

DELCATH SYSTEMS, INC

PHASE 3 TRIAL

Appendix 4 |

44

DELCATH SYSTEMS, INC

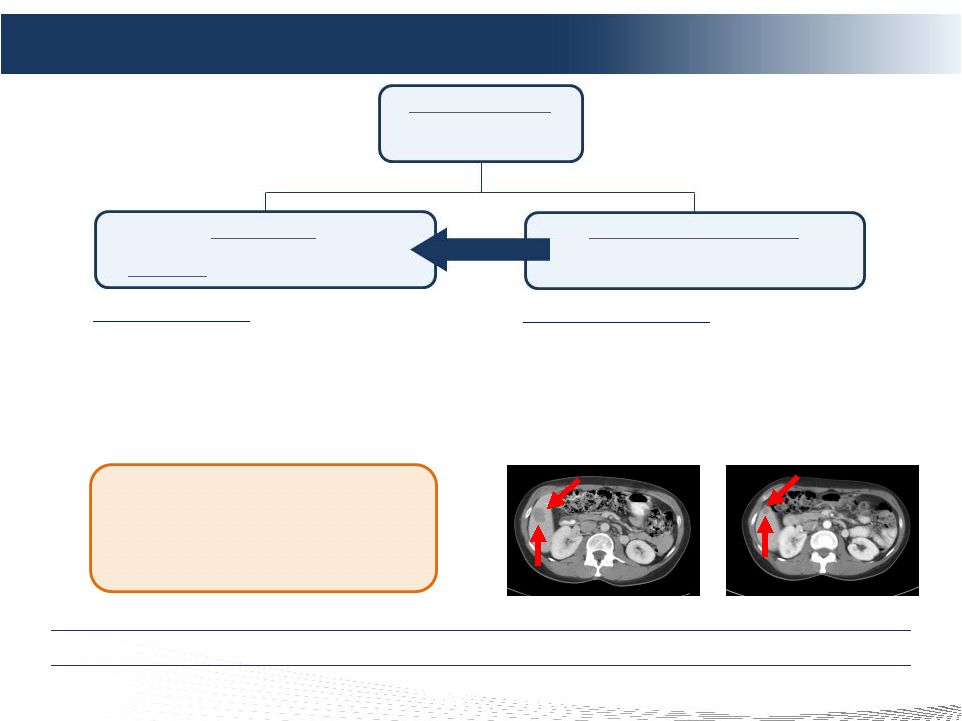

Phase III Clinical Trial Design

Randomized to CS

93 patients: ocular

or cutaneous melanoma

Best Alternative Care (BAC)

Investigator and patient decision

(any and all treatments)

CS/Melphalan

Treat every 4 weeks x 4 rounds

(responders

can receive up to 6 rounds)

Cross-over

Primary Trial Endpoint

•

Statistically significant difference in Hepatic Progression

Free Survival (“hPFS”): p < 0.05

(IRC) •

Over 80% of Oncologic drugs approved by FDA between

2005

–

2007

on

endpoints

other

than

overall

survival

Modeled hPFS for Trial Success:

7.73 months (CS)

vs.

4 months (BAC)

Secondary Trial Endpoints

•

Investigator hPFS

•

Hepatic objective response rate

•

Overall objective response rate

•

Overall

Survival

–

Diluted

by

Cross

Over

•

SAP calls for analysis of various patient subsets

Pre-CS (Baseline)

Post-CS (22+ Months)

Hepatic

Response

–

Metastatic

Melanoma

Fully Powered, 93 Patient, Randomized, Multi-Center NCI Led Study

CS = Chemosaturation (CHEMOSAT) |

45

DELCATH SYSTEMS, INC

Positive Phase 3 Results

•

Primary endpoint (hPFS by IRC) exceeded, p value =

0.0029, hazard ratio of 0.50 as of June,

2012 o

CS/PHP

median

hepatic

progression

free

survival

(hPFS)

was

4-fold

of

control,

or

5.3

months

improvement

o

CS/PHP

achieved

a

median

hPFS

of

7.0

months

vs

1.7

months

for

BAC

control

o

75% overall clinical benefit (CR + PR + SD)

•

Secondary endpoints consistent with primary endpoints

o

CS/PHP achieved a median overall PFS of 5.4 months vs. 1.6 months for BAC

o

OS –

No difference demonstrated due to heavy crossover from BAC to CS/PHP

o

Median OS 10.6 months vs. 10.0 months for CS/PHP and BAC

respectively •

OS exploratory analyses supportive of key observations

o

Median overall survival of 11.4 months for all patients treated with melphalan,

including crossover o

BAC patients did not cross-over to CS/PHP had a median survival of 4.1

months o

7 CS/PHP-treated and 3 BAC-only patients still alive as of 6/2012

•

Gen 1 Safety profile –

consistent with currently approved labeling for melphalan

o

30-day deaths on PHP: 3/44 patients (6.8%)

1 Neutropenic Sepsis (2.3%); 1 Hepatic Failure 2.5% (95% tumor burden); 1 gastric

perforation o

30-day deaths on BAC: 3/49 patients (6.1%)

Trial Outcomes Favorable and Consistent with Special Protocol Assessment

|

46

DELCATH SYSTEMS, INC

PUBLISHED PHASE 1 / 2 STUDIES OF

DOXORUBICIN WITH CS-PHP

Appendix 5 |

47

DELCATH SYSTEMS, INC

Phase 1 & 2 Studies of PHP-Doxorubicin For HCC

Delivered Safely in Multiple Studies with Promising Response Rates

No. of

pts

No. of

PHP/

pt

Disease stage

(tumor diameter)

Treatment

Median survival

(mo)

Response

Rates

Reference

HCC

(n=79)

CHM

(n=23)

1–4

1–2

IV A: n=66

IV B: n=13

All multiple

bilobar

Extrahepatic disease in 52%

Doxorubicin 60

–150 mg/m

Cisplatin

50–150 mg/m

2

Mitomycin C 50–200 mg/m

2

16

13

HCC pts

RR 64.5%

5-year

survival 20.3%

Kobe

1

Phase I/II

HCC

(n=11)

1–3

Mean

9.5 cm

Doxorubicin 60

–120 mg/m

2

6.5

13 (responders)

2 (non-responders)

RR 20%

MDACC

Phase I

HCC

(n=5)

CHM

(n=8)

Other

(n=8)

2–4

Extrahepatic disease in 17%

Doxorubicin 50

–120 mg/m

5-FU 1000–5000 mg/m

2

NR

RR 22%

Yale

Phase I

HCC

(n=7)

Other

(n=11)

1–10

NR

Doxorubicin 90

–120 mg/m

23 (responders)

8 (non-responders)

RR 58%

Yale

4

Phase I

1) Ku Y et al. Chir Gastroenterol 2003;19:370–376.

2) Curley SA et al. Ann Surg Oncol 1994;1:389–99.

3) Ravikumar TS et al. J Clin Oncol 1994;12:2723–36.

4) Hwu WJ et al. Oncol Res 1999;11:529–37.

2

2

2

2

3 |

48

DELCATH SYSTEMS, INC

PRODUCT DEVELOPMENT PIPELINE

Appendix 6 |

49

DELCATH SYSTEMS, INC

Product Development Pipeline

•

Orphan

Drug

-

Ocular

Melanoma liver mets

•

Proprietary drug-melphalan &

CHEMOSAT System

•

All

liver

cancers

–

melphalan

•

Classified as Medical Device

•

3

rd

party melphalan

•

Gen 2 melphalan CE Mark

•

Doxorubicin system CE Mark

•

CHEMOSAT for additional drugs

•

CHEMOSAT for other organs (lung

and brain)

•

mNET, mCRC and HCC

indications

Initial Opportunity

Near Term (< 5 years)

Intermediate Term (> 5 years)

•

mCRC and HCC clinical trials

•

CHEMOSAT for additional drugs

•

CHEMOSAT for other organs (lung

and brain)

•

CHEMOSAT Melphalan in

Taiwan and Japan

•

CHEMOSAT Doxorubicin in

China and South Korea

•

3

rd

party doxorubicin

•

CHEMOSAT for additional drugs

•

CHEMOSAT for other organs (lung

and brain)

•

CHEMOSAT Melphalan in

Australia, New Zealand, and

Hong Kong

•

3

rd

party melphalan

Development Aligned to Address Significant Market Opportunity

|

50

DELCATH SYSTEMS, INC

CHEMOSAT System for Doxorubicin –

CE Mark

•

Satisfied all of the requirements to affix the CE Mark to Hepatic

CHEMOSAT Delivery System device for intra-hepatic arterial delivery

and extracorporeal filtration of doxorubicin in October, 2012

o

Provides a pathway for regulatory approval in China and S. Korea

•

Provides basis for partnership opportunities in China and S. Korea

where doxorubicin has a broad label for multiple tumor types

•

Multiple published Phase I/II studies from MD Anderson Cancer Center

and Yale with percutaneous hepatic perfusion (PHP) and Kobe

University using doxorubicin show promising response rates for HCC*

•

Plan

to

use

CHEMOSAT

Doxorubicin

in

Asia

Phase

III

2L

HCC

trials

Addressing the Large HCC Market Opportunity in China |

51

DELCATH SYSTEMS, INC

NON US/EU

REGULATORY UPDATE

Appendix 7 |

52

DELCATH SYSTEMS, INC

International Strategy beyond EU and US

•

Leverage CE Mark to obtain reciprocal regulatory approvals for CHEMOSAT

System in other international markets

o

Obtained approval for Gen 2 CHEMOSAT System with melphalan in Australia

•

International regulatory submissions status:

Application submitted and expected approvals in

Hong Kong

-

2013

Canada

-

2013

Singapore

-

2013

Argentina

-

2013

Brazil

-

2014

Intend to submit applications

S. Korea

(CHEMOSAT Doxorubicin)

Mexico

China

(CHEMOSAT Doxorubicin)

Taiwan

Russia

India

Japan

Israel

•

Utilize

3

rd

party

melphalan

and

doxorubicin

available

to

physicians

Combination of Strategic Partnerships and Specialty Distributors

|

53

DELCATH SYSTEMS, INC

CHEMOSAT CENTERS

Appendix 8 |

•

Entered training and marketing agreements with leading cancer centers in

Europe o

Milan, Italy –

European Institute of Oncology (IEO)

o

Frankfurt, Germany –

Johann Wolfgang Goethe-Universität (JWG)

o

Kiel, Germany –

Universitätsklinikum Schleswig-Holstein

o

Villejuif, France –

Cancer Institute Gustave Roussy (IGR)

o

Barcelona, Spain –

El Hospital Quiron

o

Naples,

Italy

–

Instituto

Nazionale

Tumori

Fondazione

"G.

Pascale"

o

Amsterdam,

The

Netherlands

–

Netherlands

Cancer

Institute-Antoni

van

Leeuwenhoek

Hospital

o

Erlangen,

Germany

–

University

Hospital

of

Erlangen

o

Pamplona,

Spain

–

Clinica

Universidad

de

Navarra

o

Bordeaux, France –

Hôpital Saint-André

(St Andre)

o

Galway, Ireland –

University Hospital Galway (UHG)

o

Leiden,

The

Netherlands

–

Leiden

University

Medical

Center

o

Southampton, United Kingdom –

Southampton University Hospital (SUH)

o

Göttingen, Germany -

University Medical Center Göttingen (UMG)

o

Varese, Italy –

Varese University Hospital (VUH)

•

Training completed and patients treated at IEO, JWG, IGR, St Andre, UHG, SUH, UMG,

VUH CHEMOSAT Centers in Europe

54

DELCATH SYSTEMS, INC

•

Liver

metastases

from

cutaneous

melanoma,

ocular

melanoma,

gastric

cancer,

breast

cancer,

neuroendocrine tumor (NET), hepatocellular carcinoma (HCC) and

Cholangiocarcinoma |