Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - AtriCure, Inc. | d462665dex991.htm |

| 8-K - CURRENT REPORT - AtriCure, Inc. | d462665d8k.htm |

Investor

Presentation January 2013

Exhibit 99.2 |

1

Forward Looking Statements

Non-GAAP Measures

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform Act of 1995. Forward-looking statements include statements that address activities,

events or developments

that

AtriCure

expects,

believes

or

anticipates

will

or

may

occur

in

the

future,

such

as

earnings

estimates, other predictions of financial performance, launches by AtriCure of new products and

market acceptance of AtriCure’s products. Forward-looking statements are based

on AtriCure’s experience and perception of current conditions, trends, expected

future developments and other factors it believes are appropriate under the circumstances

and are subject to numerous risks and uncertainties, many of which are beyond

AtriCure’s control. These risks and uncertainties include the rate and degree of market acceptance of

AtriCure’s products in the United States, AtriCure’s ability to develop and market new

and enhanced products, the timing of and ability to obtain and maintain regulatory

clearances and approvals for its products and the impact of failure to obtain such

clearances and approvals on its ability to promote its products and train doctors in the use

of its products, the timing of and ability to obtain reimbursement of procedures utilizing

AtriCure’s products and the potential impact of current healthcare reform

initiatives thereon, competition from existing and new products and procedures or

AtriCure’s ability to effectively react to other risks and uncertainties described from time to

time

in

AtriCure’s

SEC

filings,

such

as

fluctuation

of

quarterly

financial

results,

reliance

on

third

party

manufacturers and suppliers, litigation or other proceedings (including by the FDA), government

regulation, negative publicity, current worldwide economic conditions and stock price

volatility. AtriCure does not guarantee any forward-looking statements, and actual

results may differ materially from those projected. Unless required by

law,

AtriCure

undertakes

no

obligation

to

publicly

update

any

forward-looking

statement,

whether

as

a

result

of new information, future events or otherwise. A list and description of risks, uncertainties

and other matters can be found in AtriCure’s Annual Report on Form 10-K for 2010

and in AtriCure’s reports on Forms 10-Q and 8-K. This presentation includes

the use of non-GAAP measures, which are noted with a *. Reference AtriCure’s 8-K’s

filings which include the furnishing of our earnings releases for a reconciliation to the

related GAAP measure. |

2

AtriCure Highlights

New leadership November 2012

–

Focus on accelerating growth, commercial execution, R&D innovation

Large underpenetrated market with few sustainable treatment options

Undisputed market leader in all types of surgical ablation

–

Broad and deep product portfolio

–

Strong IP in the field of AF

–

Strongest brand –

recognized for high-quality and innovative products

–

Leading KOL support and enthusiasm

Accelerating

revenue

growth

see

path

to

15%+

growth

–

Open

only

AF

label

for

surgical

ablation

–

Minimally

Invasive

Solutions

(MIS)

Largest

long-term

market

–

Left

Atrial

Appendage

(LAA)

Management

Solution

Danger

Zone….Opportunities

–

International Expansion

Improve share and enter new markets

Opportunity

for

expanding

gross

margins

see

path

to

75%+ |

3

AtriCure at a Glance –

Strong Track Record

Surgical ablation leader for the treatment of atrial fibrillation (AF)

–

Over 100,000 Open procedures in >700 medical centers

–

Over 10,000 MIS procedures in ~130 medical centers

Leader in implants designed to exclude left atrial appendage (LAA)

–

Over 14,000 safely and effectively implanted

100+ peer-reviewed publications highlighting product results

Significant key opinion leader (KOL) support

Global innovator with comprehensive product line

–

AtriCure

Synergy

Ablation

System

–

bipolar

ablation

clamp

system

–

Cryoablation –

reusable and disposable cryoablation devices

–

AtriClip –

designed to safely and effectively exclude the LAA

Experienced Sales Force

–

Over 40 US territories led by eight managers

Preliminary

2012

Revenue

-

$70.2

million

–

Expected Growth of ~9% y/y |

4

AF Population: Large, Growing & Undertreated

(1)Miyasaka Y, et al. Circulation. 2006;114(2):119-125.

(2)Lloyd-Jones D, et al. [published online ahead of print December 17, 2009].

Circulation. doi:10.1161/CIRCULATIONAHA.109.192667.

(3)Lloyd-Jones DM, et al. Circulation. 2004;110(9):1042-1046.

(4) Fuster V, et al. J Am Coll Cardiol. 2001;38(4):1231-12665

(5)

Benjamin EJ, et al. Circulation. 1998;98(10):946-952.

(6)

Kim M, et al. Circ Cardiovasc Qual Outcomes. 2011;

4:313-320

AF affects over 5

million in the U.S.

(1)

Significant costs to

healthcare system

•

U.S. prevalence projected to grow to 12-15 million by 2050

•

International prevalence is comparable to the U.S.

•

Most

common

sustained

cardiac

arrhythmia

(2)

•

Lifetime

risk

of

AF:

~1

in

4

for

adults

40

years

of

age

(3)

AF increases 5-fold

the

risk

of

stroke

(4,5)

•

AF

is

leading

cause

of

stroke

–

over

15%

in

US

linked

to

AF

(5)

•

AF

results

in

early

mortality

and

cause

of

stroke

in

elderly

(4)

•

AF-related strokes are more severe

(5)

Issues with non-

surgical treatment

of AF

•

Warfarin drug therapy has complications

•

Anti-arrhythmic drugs often not well-tolerated and ineffective

•

< 3% of AF patients are treated with catheter or surgical

ablation

•

Direct

medical

costs

are

~73%

higher

in

AF

patients

(6)

•

Net

incremental

cost

of

$8,705

per

patient

per

annum

(6)

•

U.S.

annual

incremental

cost

of

AF

is

~$26.0

billion

(6) |

5

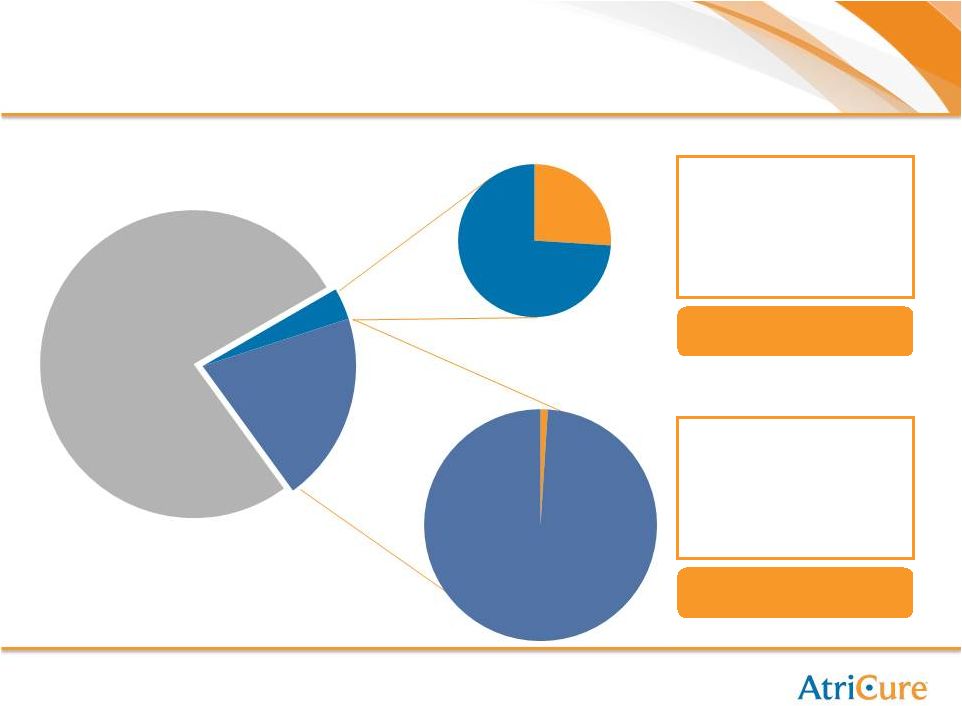

Atrial Fibrillation U.S. Market Opportunity

•

Labeling advantage in US

•

Best products

•

High gross margins

•

Education key

•

Competition is large device

•

High reimbursement

•

High gross margins

•

Growing internationally

•

Development needed

•

Competition is start-ups

AtriCure is the only

on-label product

Developing Market

Market

Opportunity,

$370M

Current

Market,

$130M

Market

Opportunity,

$3.9 billion

Current

Market,

$40M

Open

Surgical

Patient

Opportunity,

100,000

Untreated

or

Managed

with

Drugs,

2.3

Million

MIS/Stand-

Alone

Patient

Opportunity,

600,000

MIS Market

Open Surgical Market

3-5 Million Patients in U.S. with AF |

Left Atrial

Appendage U.S. Market Opportunity •

Mechanical, Electrical,

Atraumatic; Solution

•

Competition includes Tiger

Paw, staple, suture,

ligature (endloop) –

NO

Complete Solution

•

Attractive sole therapy

reimbursement

•

Competition includes

implants and EP closure

(w/o FDA approval)

AtriCure has more

implants than

competition (14K+)

~1M U.S, LAA Patients

LAA (Concomitant)

LAA

(Concomitant)

100,000

patients

LAA

(Sole Therapy)

~750,000

patients

Market

Opportunity,

$100M

Current

Market,

$10M

Current

Market,

$32M

Market

Opportunity,

$1.5B

LAA ( Sole Therapy)

6 |

7

AtriCure Business Overview

Focus Areas

2012

Growth

Market

Size ($M)

Keys to Success

Current

Trials

Open AF

(Concomitant)

+13%

$500M

Education; referral dev.; Reimbursement;

awareness; conversions; add-on sales

PAS

MIS AF Sole

Therapy

-11%

$4,000M

Referral development; new products; hybrid;

surgeon proctoring; development of less invasive

approach (products and procedures)

Staged DEEP

Open Clip

(Concomitant)

$100M

Market awareness; open growth; overcoming

cost argument; stroke RCT

Papers

Clip Sole

Therapy

New ’13

$1,500M

Market awareness; international; eliminating

complications; supporting early adopters; referral

development; prominent KOLs; stroke RCT

Papers

International

+14%

Same as US

Market development; reimbursement; coverage;

marketing; customer service

Involvement

Above

Overall

+9%

$12,000M

Investments in marketing, international, R&D

pipeline

+26% |

8

Growth Strategy: Overview

Expand Open-Heart Sales

Penetrate LAA Opportunity

Build MIS Platform

International Expansion

•

Leverage recent AF indication

•

Increased training and education

•

Capitalize on sales force realignment

and AF Strategic Marketing Team

•

Capitalize on cross-sale opportunities

resulting from AF labeling

•

Capitalize on increased investments in

direct sales team

•

Geographic expansion and new products

•

Increase support for distributors

•

Penetrate open-heart ablation centers

•

Featured in our training and education

for open-heart

•

FDA approved for use in DEEP AF trial

•

Longer-term: commercialization of sole-

therapy platform

•

Support existing MIS surgeons

•

Support staged DEEP AF trial

AtriCure

is

the

only

company

with

FDA

approval

to

treat

the

AF

disease

state

and

is a leader in the emerging market of LAA exclusion |

9

Growth Strategy: Expand Open-Heart Sales

•

FDA approved the AtriCure Synergy

Ablation System for treatment of non-

paroxysmal Atrial Fibrillation in

patients undergoing other structural

heart procedures (December 2011)

•

Only surgical ablation system that

has received FDA indication

•

AtriCure can partner with surgical AF

leaders to provide comprehensive

training and support

•

Support “on-label”

surgeon training

and education

–

Improves safety and efficacy

–

Increases surgeon confidence

–

Reduces operative time

•

Actively increase market awareness

•

Competitive account conversions

FDA Approval

Leveraging FDA Approval |

10

Growth Strategy: Expand Open-Heart Sales

•

Significant

progress

in

both

surgeon

and

site

certification

–

all

achieved

in

a

9

month

period (18 month program)

•

Expectation that revenue for all accounts trained will be consistent with these results

•

Significant competitor conversions during 2012

Surgeons Certified

Sites Certified

609

1,000

359

500

-

200

400

600

800

1,000

9 Month Progress

18 Month Goal

9 Month Progress

18 Month Goal |

11

Growth Strategy: Build MIS Platform

•

Leverage HRS consensus statement

•

AF Centers of Excellence

•

AtriCure Maze IV surgeon post training

marketing programs

•

AF Awareness Campaign focused on

surgical options

•

Sole therapy clinical trials spur interest

in surgical AF

•

Product launches

–

Coolrail

re-launch

–

October

2012

–

AtriClip

Pro

launch

–

October

2012

•

DEEP AF / Staged DEEP AF IDE

Feasibility Trial

•

Randomized CA vs. MIS PCORI Study

Submission (Ellenbogen)

•

Support academic papers

Build Clinical Evidence

Strategic Initiatives |

12

Growth Strategy: Penetrate LAA Opportunity

•

14,000+ AtriClips implanted:

–

No reported erosions

–

No clip migration

–

No leakage

•

Mechanical closure reduces nidus for AF-

related emboli

•

Electrically isolates the appendage,

reduces source for ectopic firing

•

AtriCure has first 510(k) device clearance

for LAA specific exclusion device

EXCLUDE 510(k) trial demonstrated 98% of patients with complete closure at three

month endpoint and zero device-related serious adverse effects

Efficacy

Safety

Safety & Efficacy of Open and MIS AtriClip products is Well-Established

|

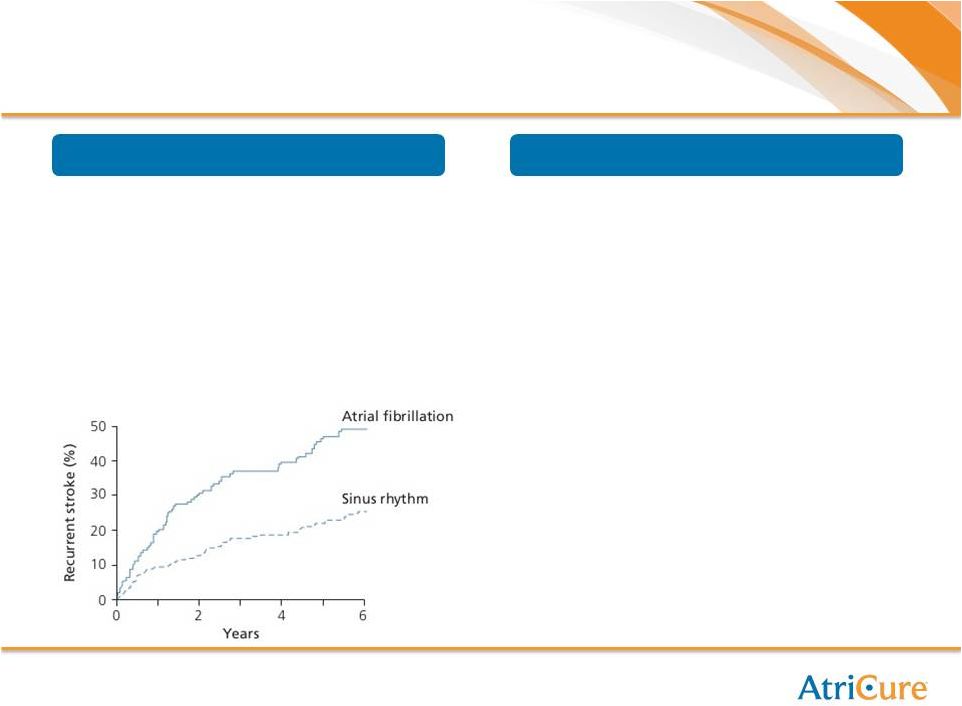

13

Growth Strategy: Penetrate LAA Opportunity

•

Most prevalent and life-threatening

complication of AF is stroke

•

LAA is the site of more than 90% of

detected thrombi in AF patients

(1)

•

Atritech Watchman PROTECT AF clinical

trial results confirms LAA exclusion

reduces AF related stroke

•

The 2006 AHA/ACC/ESC guidelines:

–

“The LAA should be removed from

circulation when possible during

cardiac surgery in patients at risk of

developing postoperative AF”

•

Conventional surgical techniques for

exclusion are suboptimal

(3)

–

60% of closures were unsuccessful

–

41% with unsuccessful LAA exclusion

had thrombus in LAA

–

15% with unsuccessful closure had

evidence of stroke or TIA

•

Growing patient awareness created by Big

Pharma

•

Reimbursement code established for sole

therapy LAA exclusion

(1)

Blackshear

(2)

Am J Med, vol. 114, Penado et al. 2003

(3)

(1) Kanderian, MD, Anne S., A. Marc Gillinov, MD, Gosta B. Pettersson, MD, PHD, Eugene

Blackstone, MD, and Allan L. Klein, MD, FACC. "Success of Surgical Left Atrial

Appendage Closure." JACC. 52.11 (2008): 924-9. Print.

Cumulative

Stroke

Recurrence

Rate

(2)

LAA Exclusion Market Drivers

Significant Risks Associated with LAA |

14

Growth Strategy: International Expansion

•

EMEA office based in Amsterdam with infrastructure to support commercial activities

•

Direct sales in Germany, Switzerland

(1)

, Austria, Benelux and the UK in 2013

•

Exclusive country distributors in other regions

(1)

Sales agent

Amsterdam

Cincinnati

South America

Distributor

relationships:

Canada

Asia Pacific

Distributor relationships:

Europe

China

Hong Kong

Japan

Korea

Thailand

Malaysia

Singapore

India

Australia /

New Zealand

Taiwan

Brazil

Colombia

Chile

Mexico

Argentina

Costa Rica

Distributor relationships:

Italy

Spain

Denmark

Poland

Portugal

Sweden

Turkey

Czech

Republic

Greece

Norway

Russia

South Africa

Middle East

Distributor

relationships:

Pakistan

Saudi Arabia |

15

Growth Strategy: International Expansion

$6.4

$8.3

$10.5

$11.5

$15.5

$17.6

International

Revenue

By

Region

(2007

–

2012)

$3.4

$4.5

$5.4

$6.6

$8.7

$10.3

$2.7

$3.4

$4.6

$4.5

$6.3

$6.7

$0.4

$0.4

$0.5

$0.4

$0.5

$0.6

-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

2007

2008

2009

2010

2011

2012

EMEA

Asia

ROW

$

Benelux,

20%

Germany,

15%

UK, 9%

Other

EMEA,

14%

Japan,

22%

China,

13%

Other

Asia, 4%

ROW, 3%

International sales growing rapidly – 25% of total revenue |

16

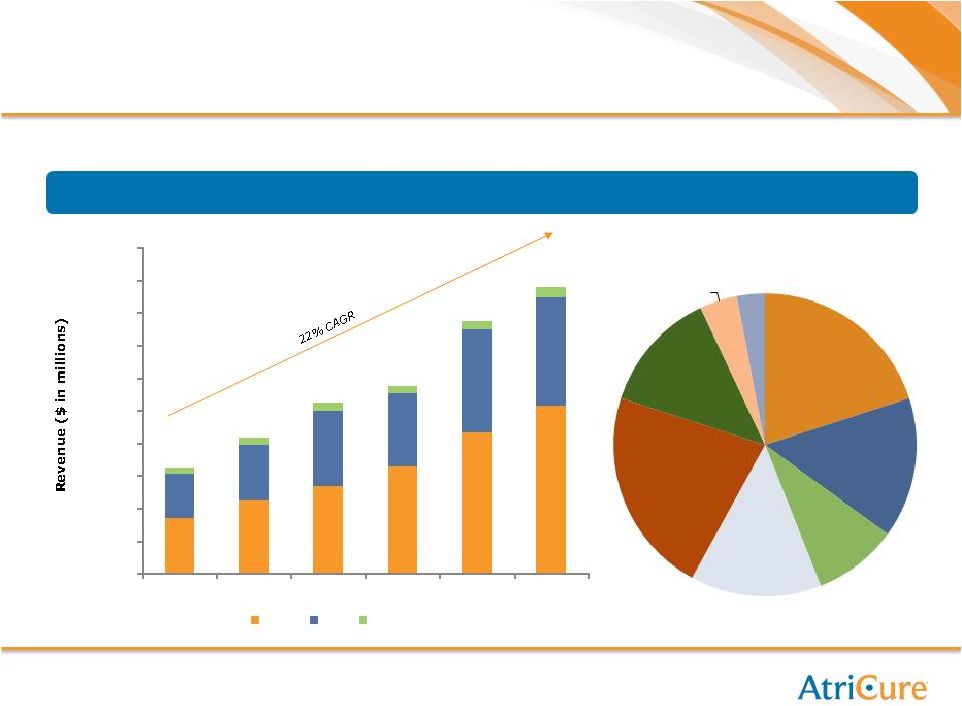

Key Financial Highlights

Opportunity for…

Accelerating revenue growth to 15%+ (8% 5yr. CAGR today)

Expanding Gross Margins to over 75% (71% today) |

17

AtriCure Highlights

New leadership since November 2012

–

Focus on accelerating growth, commercial execution, R&D innovation

Large underpenetrated market with few sustainable treatment options

Undisputed market leader in all types of surgical ablation

–

Broad and deep product portfolio

–

Strong IP in the field of AF

–

Strongest brand –

recognized for high-quality and innovative products

–

Leading KOL support and enthusiasm

Accelerating

revenue

growth

see

path

to

15%+

growth

–

Open

only

AF

label

for

surgical

ablation

–

Minimally

Invasive

Solutions

(MIS)

Largest

long-term

market

–

Left

Atrial

Appendage

(LAA)

Management

Solution

Danger

Zone….Opportunities

–

International

Expansion

Improve

share

and

enter

new

markets

Opportunity

for

Expanding

Gross

Margins

see

path

to

75%+ |

Appendix

|

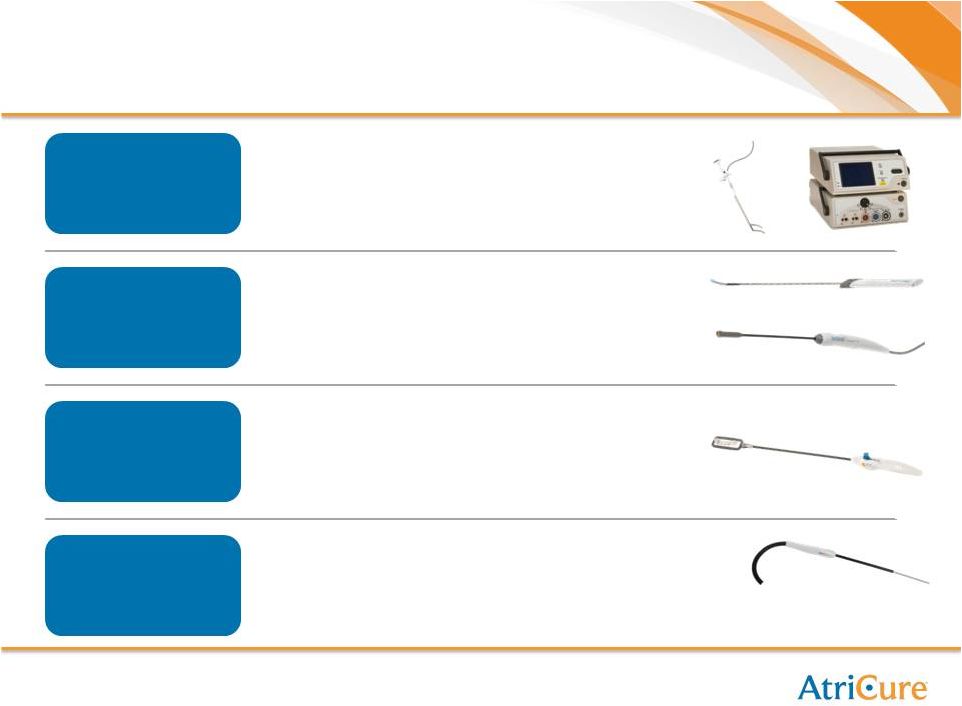

19

Broadest Product Portfolio

Probes/Pens

Synergy

Cryoablation

AtriClip

•

Workhorse ablation system

•

Completely automated

•

Rapid: 10-30 second ablations

•

Used in Open and MIS

•

Deepest unidirectional lesion formation

•

Totally thoracoscopic design

•

Simple user interface

•

Clip

easily

be

repositioned

–

MIS

and

Open

•

Fabric prevents slippage, promotes in-growth

•

Appendage atrophies away

•

Used for LAA

•

Faster and More consistent to achieve lethal

probe temperature

•

Only probe with Defrost feature

•

Greatest work capacity in cryo probe market |

20

Robust Product Pipeline

AtriClip

RF Ablation

Cryoablation

Long Linear Ablation

•

One-sided approach to perform

Pulmonary Vein Isolation

•

Improved safety and efficacy

over competitive devices

Next

Generation

AtriClip

-

BOA2

•

Tailored to most difficult and

challenging access

•

Launched 3Q 2012

Reusable Clip Deployment

•

Reusable Platform

•

Lower cost clip option

Next Generation AtriClip and

AtriClip –

ACH2

•

Improved access via malleable

shaft and in-line design

•

Open-ended clip design

Cryo Console Adapter Box-AAM

Next Generation Cryo-

CRYO2A

•

Increased Malleability

Next Generation RF & Cryo

Generators

•

Improved usability and branding

•

Increased capabilities to support

future platforms

•

Ability to use re-usable cryo

platform with automated

cryo module (ACM)

Current status:

94 active product versions and 153 active product codes |

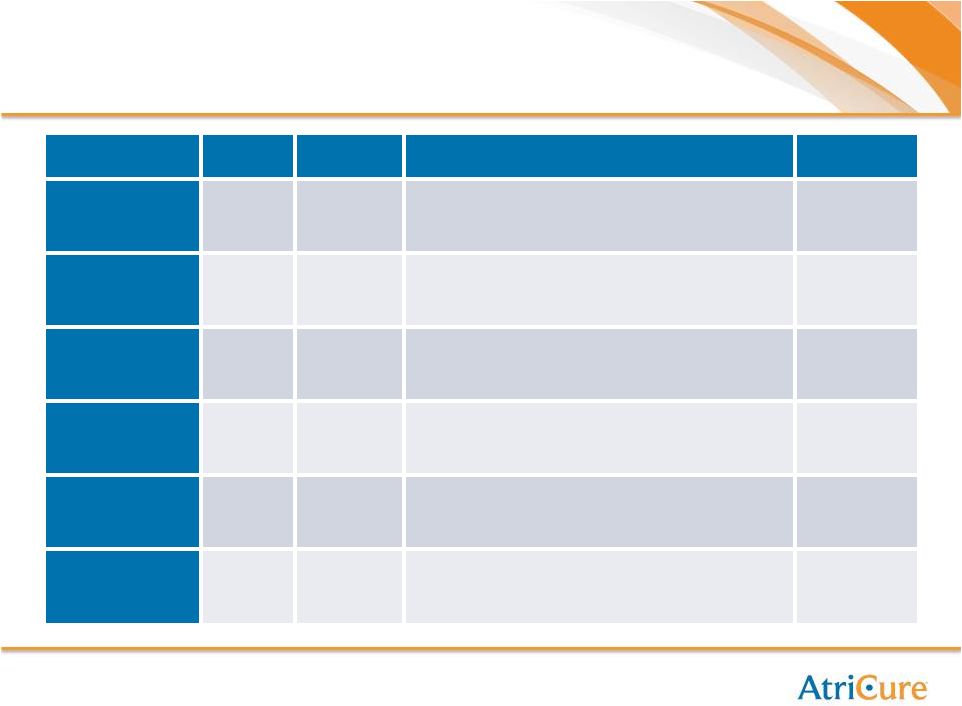

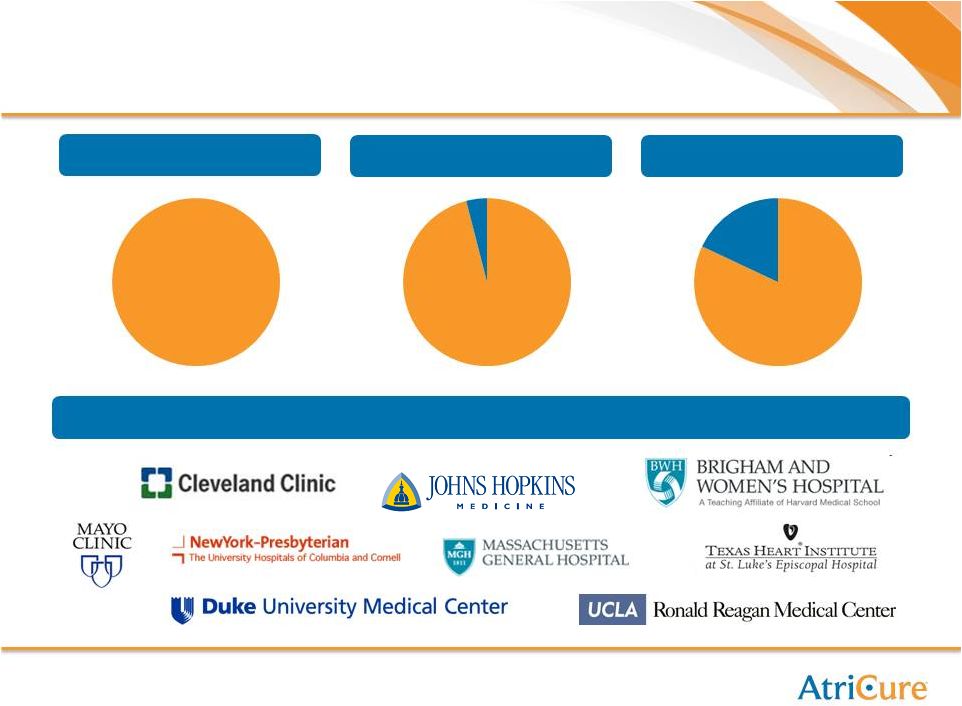

21

Blue Chip Customer Base

Top 10 “Heart Hospitals”

U.S. News & World Report

Top 25 “Heart Hospitals”

U.S. News & World Report

Top 50 “Heart Hospitals”

U.S. News & World Report

Representative Blue Chip Customers

AtriCure

Hospitals,

100%

Non-

AtriCure

Hospitals,

4%

AtriCure

Hospitals,

96%

Non-

AtriCure

Hospitals,

18%

AtriCure

Hospitals,

82% |