Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ATHENAHEALTH INC | form8k01-07x2013.htm |

| EX-99.4 - BLOOMBERG ARTICLE - ATHENAHEALTH INC | angrybirds.htm |

| EX-99.2 - CONFERENCE CALL TRANSCRIPT - ATHENAHEALTH INC | calltranscript.htm |

| EX-99.3 - VIDEO TRANSCRIPT - ATHENAHEALTH INC | videotranscript.htm |

Regulation M-A Disclosure In connection with the acquisition of Epocrates, Inc.(“Epocrates”) by athenahealth, Inc.(“athenahealth”) pursuant to an Agreement and Plan of Merger (the “Merger”), Epocrates will file with the U.S. Securities and Exchange Commission (the “SEC”) a proxy statement and other relevant materials in connection with the proposed transaction. Epocrates will also mail the proxy statement to Epocrates stockholders. athenahealth and Epocrates urge investors and security holders to read the proxy statement and the other relevant material when they become available because these materials will contain important information about athenahealth, Epocrates, and the proposed transaction. The proxy statement and other relevant materials (when they become available), and any and all documents filed with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, free copies of the documents filed with the SEC by athenahealth will be available on the “Investors” portion of athenahealth’s website at www.athenahealth.com. Free copies of the documents filed with the SEC by Epocrates will be available on the “Investor Relations” portion of Epocrates’s website at www.epocrates.com. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND THE OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION. athenahealth, Epocrates Merger Sub, Inc. (“MergerSub”), Epocrates, and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from the security holders of Epocrates in connection with the Merger. Information about those executive officers and directors of athenahealth is set forth in athenahealth’s proxy statement for its 2012 annual meeting of stockholders, which was filed with the SEC on April 26, 2012, and is supplemented by other public filings made, and to be made, with the SEC. Information about those executive officers and directors of Epocrates and their ownership of Epocrates common stock is set forth in Epocrate’s proxy statement for its 2012 annual meeting of stockholders, which was filed with the SEC on August 30, 2012, and is supplemented by other public filings made, and to be made, with the SEC. Investors and security holders may obtain additional information regarding the direct and indirect interests of athenahealth, MergerSub, Epocrates, and their respective executive officers and directors in the Merger by reading the proxy statement and the other filings and documents referred to above. This presentation does not constitute an offer of any securities for sale. 2

3 Jonathan Bush President, Chairman & CEO Rob Cosinuke Senior Vice President, Chief Marketing Officer Andy Hurd President, Chairman & CEO

Jonathan Bush Chairman, President, CEO & Co-Founder

We began as an OB practice in 1997 delivering better health care to women 5 Co-founded by Jonathan Bush and Todd Park (Todd is now the U.S. Chief Technology Officer)

That business model led us to the pursuit of a more profound vision 6

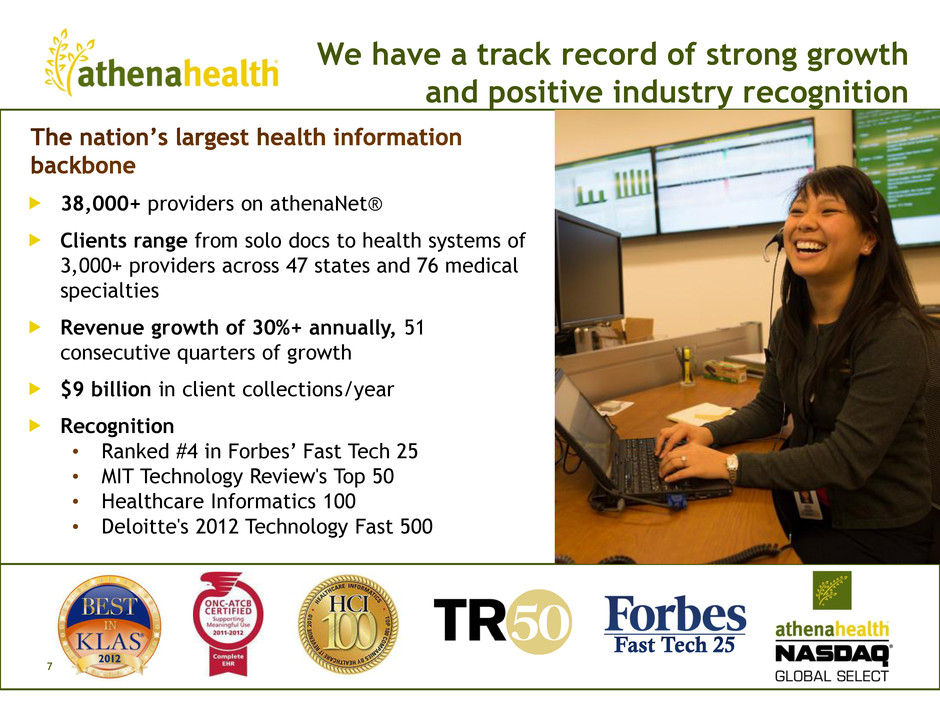

38,000+ providers on athenaNet® Clients range from solo docs to health systems of 3,000+ providers across 47 states and 76 medical specialties Revenue growth of 30%+ annually, 51 consecutive quarters of growth $9 billion in client collections/year Recognition • Ranked #4 in Forbes’ Fast Tech 25 • MIT Technology Review's Top 50 • Healthcare Informatics 100 • Deloitte's 2012 Technology Fast 500 7 We have a track record of strong growth and positive industry recognition

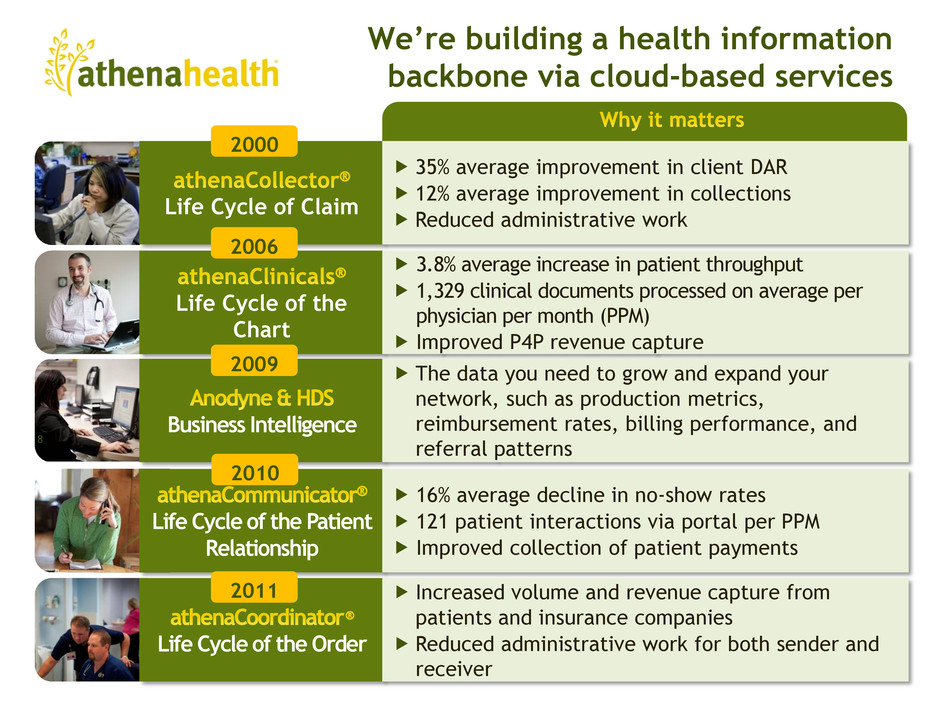

We’re building a health information backbone via cloud-based services 8 Life Cycle of Claim 35% average improvement in client DAR 12% average improvement in collections Reduced administrative work Life Cycle of the Patient Relationship 16% average decline in no-show rates 121 patient interactions via portal per PPM Improved collection of patient payments Life Cycle of the Chart 3.8% average increase in patient throughput 1,329 clinical documents processed on average per physician per month (PPM) Improved P4P revenue capture Life Cycle of the Order Increased volume and revenue capture from patients and insurance companies Reduced administrative work for both sender and receiver Business Intelligence The data you need to grow and expand your network, such as production metrics, reimbursement rates, billing performance, and referral patterns 2000 2006 2011 2009 2010

Rob Cosinuke Senior Vice President, Chief Marketing Officer

10

Epocrates 11

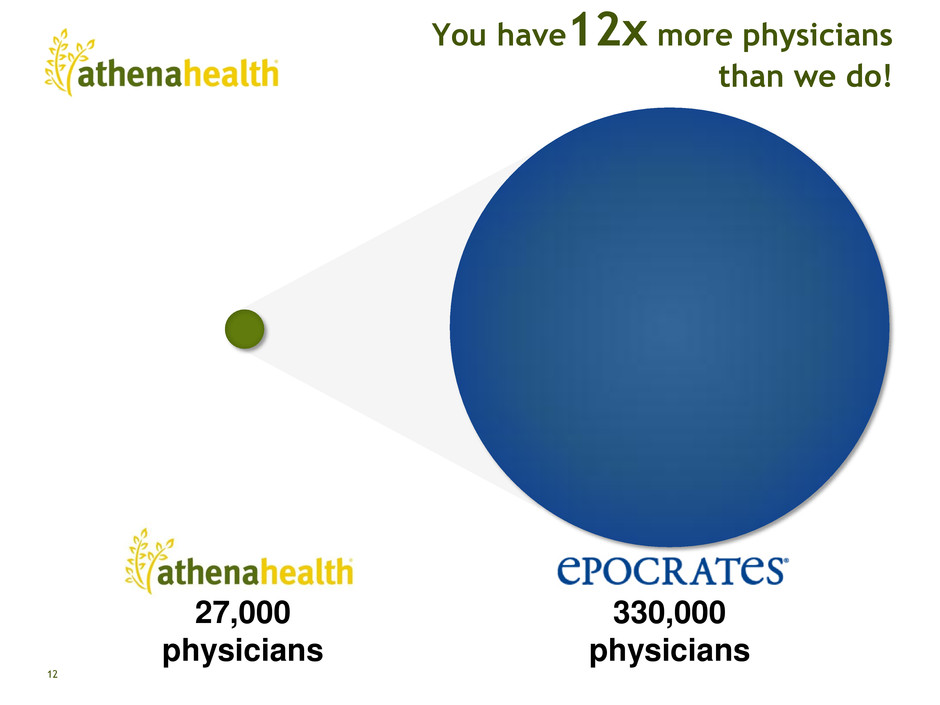

You have12x more physicians than we do! 12 27,000 physicians 330,000 physicians

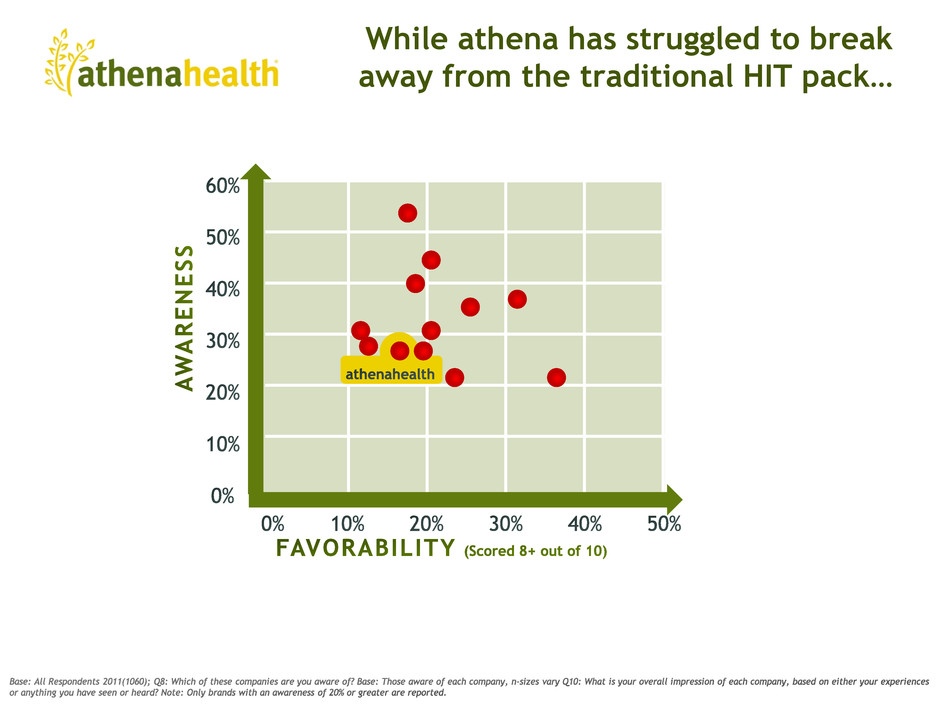

While athena has struggled to break away from the traditional HIT pack…

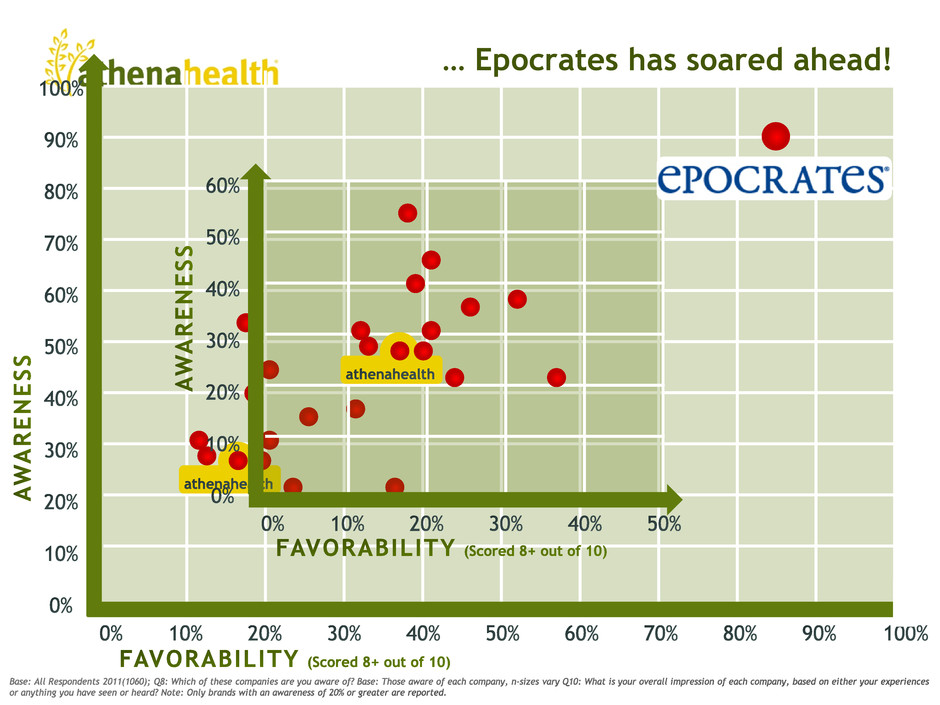

… Epocrates has soared ahead!

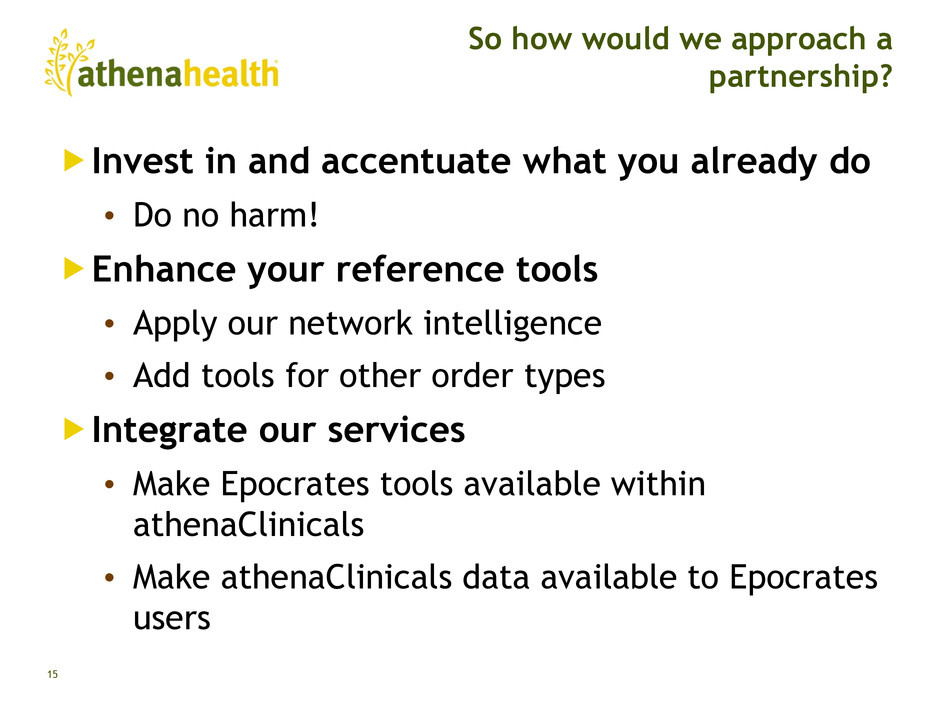

So how would we approach a partnership? Invest in and accentuate what you already do • Do no harm! Enhance your reference tools • Apply our network intelligence • Add tools for other order types Integrate our services • Make Epocrates tools available within athenaClinicals • Make athenaClinicals data available to Epocrates users 15

What can you expect? Over the next ~90 days • Learn more about each other • Explore integration potential and long-term business strategies Deal completion during Q2 2013 LAUNCH! 16

18