Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMSURG CORP | d460274d8k.htm |

| EX-10.1 - SIXTH AMENDMENT TO LEASE AGREEMENT - AMSURG CORP | d460274dex101.htm |

Exhibit 10.2

Burton Hills VI

AmSurg Corp.

Schedule to Lease Agreement

The following Schedule comprises an integral part of the Lease Agreement between the Landlord and Tenant hereinafter named, dated as of December 27, 2012 (the “Lease”). Unless the context otherwise requires, the terms described below shall have the meanings ascribed to them and shall be governed and construed in accordance with the terms of the Lease.

| Landlord: | Burton 6, LLC, a Tennessee limited liability company, whose address is c/o Eakin Properties, LLC, 1600 Division Street, Suite 600, Nashville, TN 37203, and FAX number 615-250-1805. | |

| Tenant: | AmSurg Corp., a Tennessee corporation, whose address is Suite 500, 20 Burton Hills Blvd, Nashville, TN 37215, Attn: Chief Financial Officer and Fax Number 615-665-0755. | |

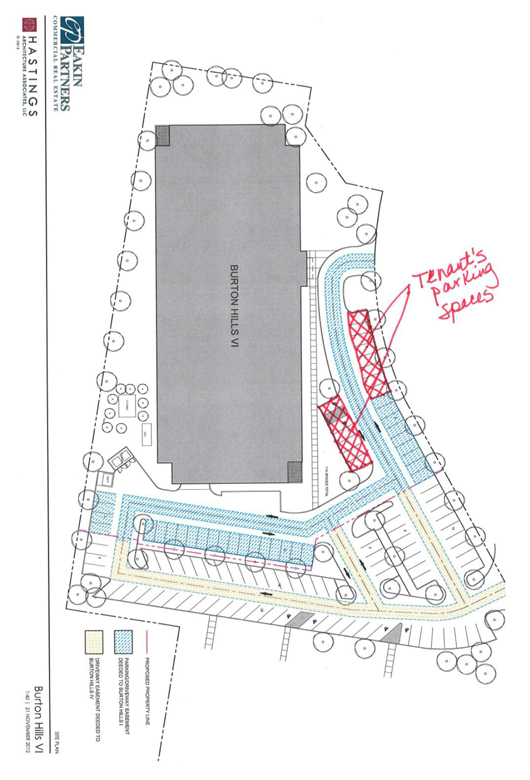

| Project: | That certain property consisting of approximately two and 9/100 (2.09) acres of currently unimproved land located on Burton Hills Boulevard, Nashville, Tennessee, a legal description of which is attached as Exhibit A (the “Land”), together with a three story office building to contain 109,751 rentable square feet designated Burton Hills VI (the “Building”) and related parking areas, driveways and other improvements (the “Site Improvements”) to be constructed thereon by Landlord in accordance with the site plan attached hereto as Exhibit B (the “Site Plan”), the provisions of Sections 4 and 5 below and the provisions of that certain Development Agreement of even date herewith, by and between Landlord and Tenant (the “Development Agreement”) together with all rights, privileges, easements, servitudes, right-of-ways and appurtenances belonging or appurtenant to the Land. The Building shall include an underground parking garage (such portion of the Building being sometimes hereinafter referred to as the “Parking Garage”). The Building (including the Parking Garage), the Land and the Site Improvements are herein collectively referred to as the “Project.” The Building, excluding the Parking Garage, is sometimes hereinafter referred to as the Premises. | |

| Initial Term: | 180 months. | |

1

| Renewal Terms: | Two (2) 5 year renewal options. | |

| Commencement Date: | March 1, 2015, subject to change as provided in Section 1 of this Lease. | |

| Initial Term Expiration Date: | February 28, 2030, subject to change as provided in Section 1 of this Lease. | |

| Base Rental: | $2,277,333.25 ($20.75 per rentable square foot of the Premises) per annum; provided, however, that on the first day of the second Lease Year, and on the first day of each succeeding Lease Year thereafter, such Base Rental shall be increased by 1.9% over the Base Rental payable during the prior Lease Year. Base Rental shall be paid according to the rent schedule attached hereto as Exhibit C. This shall be the rent net of the Operating Costs that are to be paid by Tenant pursuant to Section 6. | |

| Rentable Area: | 109,751 rentable square feet. | |

| Tenant Cost Allowance: | $4,390,040 ($40.00 per rentable square foot of the Premises) to be used and applied in the manner specified in the Development Agreement. The allowance may be used towards physical improvements to the Premises, architectural design costs, engineering fees, construction management services, cabling and telecommunications, supplemental A/C units, Tenant security systems and such other items as may be permitted by the Development Agreement. | |

| Security Deposit: | None. | |

| Permitted Use: | General office purposes that are consistent with a first class office building, subject to the terms, limitations and conditions provided in this Lease. | |

| Parking: | Exclusive use of (i) not less than 330 parking spaces located within the Parking Garage, and (ii) fourteen (14) of the parking spaces located in the parking lot located on the north side of the Building (the “Surface Parking Lot”), as depicted on the Site Plan, at no cost to Tenant, subject to Section 10 hereof. | |

| Broker(s): | Eakin Properties, LLC and Cornerstone Commercial Real Estate Services of Tennessee, LLC. | |

2

Landlord and Tenant hereby agree to the foregoing terms of this Schedule.

| LANDLORD: | TENANT: | |||||||||

| Burton 6, LLC, a Tennessee limited liability company | AmSurg Corp., a Tennessee corporation | |||||||||

| By: | Eakin Properties, LLC, a Tennessee limited liability company, Chief Manager |

By: | /s/ Christopher A. Holden | |||||||

|

Printed Name: |

Christopher A. Holden | |||||||||

| By: | /s/ John W. Eakin |

Title: | President and CEO | |||||||

| John W. Eakin, President | ||||||||||

| Date: December 27, 2012 | Date: December 27, 2012 | |||||||||

3

LEASE AGREEMENT

Landlord leases to Tenant, and Tenant accepts from Landlord, the Premises described in the Schedule, in consideration of the following mutual covenants and conditions:

1. Initial Lease Term: Renewal Terms.

(a) The term of this Lease shall commence upon the Commencement Date specified in the Schedule, and shall expire on the Initial Lease Term Expiration Date specified in the Schedule (the “Initial Lease Term”), unless such term is extended pursuant to Section 1(e) below.

(b) As used herein, “Lease Year” shall mean each twelve (12) month period or portion thereof during the Term, commencing with the Commencement Date (or an anniversary thereof), without regard to calendar years.

(c) Landlord shall deliver possession of the Premises to Tenant on the Substantial Completion Date (as defined in the Development Agreement). In the event the Substantial Completion Date occurs prior to the Commencement Date, then during the period commencing on the Substantial Completion Date and ending on the Commencement Date, Tenant may commence the use and occupancy of the Premises, in which event all terms and provisions of this Lease shall apply, except that no Base Rental, Operating Costs or Additional Rent shall be due with respect to Tenant’s use or occupancy of the Premises during such period. Landlord hereby acknowledges Tenant’s desire to begin occupancy of certain portions of the Premises on a staggered basis, as same are substantially completed in compliance with the Development Agreement. Landlord agrees that in the event a portion of the Premises (but no less than one floor) has reached substantial completion prior to the Substantial Completion Date, Landlord shall notify Tenant of same and Landlord and Tenant shall work in good faith to provide Tenant access to said portion to facilitate Tenant’s occupancy on a staggered basis. In the event Tenant occupies a portion of the Premises in accordance with the foregoing, Tenant agrees not to interfere with the progress of construction within the remaining areas of the Project.

(d) In the event the Substantial Completion Date occurs after the scheduled Commencement Date due to reasons other than Tenant Delay, then the Commencement Date and Initial Term Expiration Date shall be extended by one day for each day that elapses from the scheduled Commencement Date until the Substantial Completion Date. In the event the Substantial Completion Date occurs after the scheduled Commencement Date due to reasons other than Tenant Delay or delay due to Force Majeure, as defined in Section 41 hereof, (provided that no more than thirty (30) days of delay for Force Majeure shall be included for the purposes of this sentence), in excess of thirty (30) days, Landlord shall reimburse Tenant for all holdover costs (i.e. the 100% increase in rent under such leases over the rent in effect as of the last day of the then-expiring term(s)) Tenant is required to pay to its existing landlords under Tenant’s leases for Suite 500, 20 Burton Hills Boulevard, and Suite 200, 40 Burton Hills Blvd. Nashville, TN. The Commencement Date shall not be so extended to the extent the Substantial Completion Date is delayed beyond the scheduled Commencement Date due solely to Tenant Delay. “Tenant Delay” shall mean any measurable delay that Landlord may encounter in the performance of Landlord’s obligations under this Lease solely because of (i) changes requested

4

by Tenant to the Plans and Specifications (as defined in the Development Agreement) after such Plans and Specifications have been approved by Landlord and Tenant pursuant to Sections 2 and 3 of the Development Agreement; (ii) the postponement of any work at Tenant’s request; (iii) delay by Tenant in the submission of information or the giving of authorizations or approvals required under Development Agreement beyond the time periods specified therein; (iv) delays attributable to the failure by Tenant’s architect, space planner or other agent or contractor, to timely prepare plans, pull permits, provide approvals or perform any other act required under Development Agreement beyond the time periods specified therein; (v) delays attributable to Tenant’s failure to pay any amounts required to be paid by Tenant pursuant to Development Agreement beyond the time periods specified therein; (vi) delays caused by specialty items required by Tenant that have extended delivery periods; and (vii) delays caused by Tenant or Tenant’s employees, agents, or contractors due to unreasonable interference with the progress of construction at the construction site; provided, however, that no act or omission shall be deemed to constitute “unreasonable interference with the progress of construction” unless Landlord shall deliver written notice to Tenant that Tenant’s acts or omissions are interfering with the progress of construction within two (2) business days after Landlord’s actual knowledge of such interference. Promptly after Landlord has actual knowledge of a Tenant Delay, Landlord shall deliver written notice thereof to Tenant and shall confirm the number of days that such Tenant Delay existed to the extent then determinable. Upon Tenant’s request from time to time, Landlord shall provide Tenant with Landlord’s calculation as to how many aggregate days of Tenant Delay has occurred at such time. When the Commencement Date has been determined, Landlord and Tenant shall execute that certain Commencement Date Letter attached hereto as Exhibit F.

(e) Provided no Default (as hereinafter defined) exists beyond the expiration of any applicable grace and/or notice and cure periods at the time of exercising each renewal option described below or as of the first day of any resulting renewal term, Landlord hereby grants to Tenant the option to renew this Lease for two (2) additional successive five (5) year periods (each, a “Renewal Term”) upon the same terms and conditions set forth herein, including the continuation of annual 1.9% Base Rental increases, as provided in the Schedule. Tenant agrees to notify Landlord of Tenant’s intent to exercise its option to renew this Lease in writing no later than three hundred sixty-five (365) days, and no more than five hundred forty-five (545) days, prior to the expiration date of the Initial Term or the then preceding the Renewal Term in question. If Tenant fails to give such notice within the foregoing notice period, the remaining renewal options shall be deemed null and void. References herein to “Term” or “Lease Term” or the “Term of this Lease” shall include the “Initial Term” and the “Renewal Term(s)” as to which the foregoing renewal options are timely and properly exercised.

2. Rent. Commencing on the Commencement Date, Tenant shall pay the annual Base Rental specified in the Schedule in equal monthly installments equal to one twelfth (12th) of the annual Base Rental to Landlord at the address set forth on the Schedule or to such other address as Landlord may direct by notice in accordance with this Lease. Such Base Rental shall be due and payable in advance without demand on or before the first day of each calendar month during the Term. In addition, Tenant shall pay to Landlord any sales, use or other tax (excluding, however, the Tax Exclusions (as hereinafter defined)) that may be levied upon or in any way measured by this Lease or the rents payable by Tenant, notwithstanding the fact that a statute, ordinance or enactment imposing the same may endeavor to impose such tax upon

5

Landlord. If the Term commences on other than the first day of a calendar month or terminates on other than the last day of a calendar month, then the Base Rental for such month or months shall be prorated. Tenant shall also pay, as additional rent, all such other sums as shall become due from and payable by Tenant under this Lease (“Additional Rent”). All rent or other payments due hereunder, if not paid within five (5) days of when due, shall bear interest from the date due until paid at the Prime Rate of interest that Citibank, N.A. (or its successor) establishes from time to time as its Prime Rate (the “Prime Rate”), plus two percent (2%), said interest rate to be adjusted on the date the Prime Rate changes, but not to exceed the lesser of (i) ten percent (10%) per annum, or (ii) the maximum lawful rate of interest chargeable under applicable Law (the “Default Rate”). All sums due under this Lease shall be deemed rent and shall be paid without offset or deduction.

3. Site Plan; Title Matters.

a. The Land is a portion of a larger tract of land which shall be subdivided by Landlord into two separate parcels prior to July 22, 2013 pursuant to a subdivision plat approved by Tenant, which approval shall not be unreasonably withheld, conditioned, or delayed; provided that such subdivision plat and any related easements and agreements shall be subject to the provisions of Section 3(f) below and shall not materially and adversely affect Tenant’s rights or obligations under this Lease, its use or occupancy of the Project, or its ingress or egress to the Project; provided further that Tenant shall not be required to expend any funds in connection with such subdivision, easements or agreements except to the extent applicable as Operating Costs. Landlord shall comply with all reasonable requests of Tenant for information relating to such subdivision, at no material cost to Landlord. Notwithstanding the foregoing, in no event shall Landlord grant to third parties any access rights through, or parking rights upon, the Project, except as set forth in any Permitted Encumbrances (as defined below). The Site Plan is subject to modification only with Tenant’s prior written agreement, which shall not be unreasonably withheld, conditioned, or delayed.

b. Landlord represents and warrants that ingress and egress to the Project shall be provided by Burton Hills Boulevard, a public road, substantially as outlined in the Site Plan.

c. Landlord represents and warrants that (i) the Land is currently owned by E.P. Real Estate Fund, L.P., a Tennessee limited partnership (“Ground Lessor”), (ii) Landlord has the full power and authority to execute this Lease, (iii) Landlord shall hold a ground leasehold interest in the Project on or before August 22, 2013 pursuant to a Ground Lease by and between Ground Lessor and Landlord (the “Ground Lease”), and (iv) the estate demised herein is and shall be subject only to the Ground Lease and the liens and encumbrances described on Exhibit D attached hereto, as the same may be modified from time to time in compliance with Section 3(f) below, and any new easements, restrictions or other encumbrances hereafter applicable to the Project executed in compliance with Section 3(f) below (collectively, the “Permitted Encumbrances”). The Ground Lease shall be subject to the approval of Tenant, which approval shall not be withheld so long as the Ground Lease, when considered collectively within the Ground Lessor NDA (as hereinafter defined), does not increase the obligations of Tenant under this Lease in any material respect, decrease or interfere with the rights and entitlements of Tenant under this Lease in any material respect, interfere with Tenant’s use and

6

enjoyment of the Project in any material respect or expose Tenant to any additional material risk. Contemporaneously with the execution of the Ground Lease, Landlord shall also deliver to Tenant (x) a non-disturbance agreement (the “Ground Lessor NDA”) executed by Ground Lessor, which shall be in a form mutually acceptable to Tenant and Ground Lessor, whereby Ground Lessor shall agree to honor and to not disturb or interfere with Tenant’s use and occupancy of the Project or Tenant’s rights and entitlements under this Lease (including rights regarding the application of insurance proceeds and condemnation awards), regardless of any default by Landlord under the Ground Lease or any termination of the Ground Lease, and (y) a non-disturbance agreement (the “Fee Mortgagee NDA”) executed by the holder (“Fee Mortgagee”) of any Mortgage (as hereinafter defined) on Ground Lessor’s fee interest in the Project (“Fee Mortgage”), which shall be in a form mutually acceptable to Tenant and Fee Mortgagee, whereby Fee Mortgagee shall agree to honor and to not disturb or interfere with Tenant’s use and occupancy of the Project or Tenant’s rights and entitlements under this Lease (including rights regarding the application of insurance proceeds and condemnation awards), regardless of any default by Landlord under the Ground Lease, any termination of the Ground Lease or any default by Ground Lessor under the Fee Mortgage. The Ground Lease shall include an obligation of Ground Lessor to convey, and an obligation of Ground Lessee to purchase, Ground Lessor’s fee interest in the Project on or before December 31, 2015. In the event the Ground Lease, the Ground Lessor NDA and the Fee Mortgage NDA are not approved by Tenant and fully executed and delivered by all parties thereto on or before August 22, 2013, then Tenant shall be entitled to terminate this Lease by delivering written notice of such termination to Landlord in addition to Tenant’s other rights and remedies available at law. Upon Landlord’s acquisition of fee title to the Project, pursuant to the Ground Lease or otherwise, the premises leased by Landlord to Tenant under this Lease shall automatically, without the execution of any further documentation, be expanded to include such greater estate then held by Landlord.

d. As long as Tenant is entitled to possession of the Premises, Tenant shall have the non-exclusive right (in common with the occupants of Burton Hills Building I) to use all drives and entrances located within the Project, the exclusive right to use fourteen (14) parking spaces in the Surface Parking Lot (which spaces shall be marked as reserved for Tenant’s use) and three hundred thirty (330) parking spaces in the Parking Garage (as more particularly provided in Section 10), and the right to use all other portions of the Project (except Ground Lessor’s Reserved Parking Spaces, as described in Section 10), including the driveways, sidewalks and other site improvements within the Project as they may exist from time to time, subject to the Permitted Encumbrances. No third parties have the right to use any portion of the Project except as set forth in this Lease or the Permitted Encumbrances. Notwithstanding the foregoing, Landlord hereby reserves the right to establish reasonable rules and regulations for the use thereof, and to close all or any portion thereof as may be deemed necessary by Landlord to prevent a dedication thereof or the accrual of any rights to any person or the public therein.

e. Landlord acknowledges and agrees that, by July 22, 2013, Landlord will deliver to Tenant complete copies of any surveys, title policies (including copies of the Permitted Encumbrances) and environmental reports relating to the Premises in its possession.

f. Landlord and Tenant acknowledge that Tenant, Landlord, Ground Lessor, and the Premises shall be subject to the terms and conditions of that certain declaration to be executed by Landlord and Ground Lessor as amended from time to time in compliance with this

7

Section 3(f), the “Declaration”). Tenant shall have the right to approve the Declaration which approval shall not be unreasonably withheld, conditioned or delayed so long as the Declaration does not increase the obligations of Tenant under this Lease in any material respect, decrease or interfere with the rights and entitlements of Tenant under this Lease in any material respect, interfere with Tenant’s use and enjoyment of the Project in any material respect or expose Tenant to any additional material risk. The Declaration shall provide for mutual ingress/egress easements and certain parking rights for the Ground Lessor’s Reserved Parking Spaces on the Surface Parking Lot and within the Parking Garage. Landlord agrees that in no event shall Landlord agree to any amendment or modification to the Declaration, or consent to any matter under the Declaration, that could adversely affect the rights, or increase the obligations, of Tenant hereunder, including, without limitation, any action that (i) grants any easement that could interfere with the operations of Tenant, or (ii) grants any access easements or other rights of ingress or egress to third parties onto or through the Project, without the prior written consent of Tenant, which shall not be unreasonably withheld, conditioned, or delayed. Landlord agrees to (x) promptly provide Tenant with copies of any notices that Landlord may give or receive pursuant to the Declaration or any of the other Permitted Encumbrances and (y) consult with Tenant regarding how to cast any votes allocated to the Project under the Declaration or any of the other Permitted Encumbrances. Landlord represents and warrants that it has or will receive all necessary approvals required pursuant to the Declaration or any of the other Permitted Encumbrances in order to construct the improvements described herein. Subject to Landlord’s obligation to subdivide the larger parcel of which the Premises is part, Landlord shall not amend, modify or terminate the Permitted Encumbrances, or grant any consent or approval regarding any matter under the Permitted Encumbrances, or allow any new easements, restrictions or encumbrances with respect to the Project to be created, without the prior written consent of Tenant (which shall not be unreasonably withheld, conditioned, or delayed), except for such amendments, modifications, terminations, consents or approvals, or such new easements, restrictions or encumbrances (copies of which shall be promptly provided to Tenant), as shall not increase in any material respect the obligations of Tenant under this Lease, decrease, interfere with or impair in any material respect Tenant’s rights under this Lease or its use and enjoyment of the Project, or expose Tenant to additional material risk.

g. Tenant acknowledges that, except as set forth in this Lease and the Development Agreement, including but not limited to Landlord’s commitment to complete the construction described in the Development Agreement, no promise has been made by or on behalf of Landlord, or relied upon by Tenant, to construct, alter, remodel, improve, repair, decorate or maintain the Project, and that, except as otherwise provided in this Lease and in the Development Agreement, no representation respecting the condition of the Project has been made by or on behalf of Landlord or relied upon by Tenant

4. Landlord’s Work.

(a) Landlord agrees to construct the Base Building (as defined in the Development Agreement) and the Site Improvements (“Landlord’s Work”), at its expense in a good and workmanlike manner and in compliance with all Laws (as defined in Section 12), all Permitted Encumbrances and the terms and provisions of the Development Agreement. All of Landlord’s Work shall be completed at Landlord’s sole cost and expense, without contribution from Tenant, except as otherwise expressly set forth in the Development Agreement.

8

(b) The Rentable Area of the Premises shall be 109,751 rentable square feet.

(c) Prior to August 22, 2013, Landlord shall provide Tenant with (i) reasonable evidence that Landlord has obtained construction financing and equity commitments sufficient to pay all costs of the Project, and (ii) the NDA required by Section 28(b) below. If Landlord fails to provide such items prior to August 22, 2013, and if such failure continues for an additional thirty (30) days after written notice from Tenant, Tenant shall be entitled to terminate this Lease without limiting Tenant’s other rights and remedies with respect to such failure.

(d) In the event (i) Landlord does not commence vertical construction of the Building on or before February 22, 2014, (ii) Landlord abandons construction of the Building or ceases construction activities related to the Project after the commencement of vertical construction for a period longer than ninety (90) days for reasons other than Tenant Delay or Force Majeure (or for more than one hundred twenty (120) days for reasons other than Tenant Delay only), (iii) the Substantial Completion Date does not occur within one hundred eighty (180) days after the scheduled Commencement Date herein for reasons other than Tenant Delay or Force Majeure or (iv) the Substantial Completion Date does not occur within two hundred forty (240) days after the scheduled Commencement Date herein for reasons other than Tenant Delay (regardless of Force Majeure), then, without limiting any other remedies available to Tenant at law or in equity, Tenant may terminate this Lease, which such right to terminate must be exercised at any time after the lapse of time giving rise to such termination right but no later than thirty (30) days after the date Landlord notifies Tenant in writing that Tenant is entitled to exercise such termination right.

5. Tenant Improvements to Premises.

a. Landlord further agrees to construct certain interior improvements to the Building to provide finished and functioning office space for Tenant’s use (the “Tenant Improvements”). The Tenant Improvements shall be more particularly described in, and shall be constructed in accordance with the provisions of, the Development Agreement.

b. Landlord shall pay for all Tenant Improvements up to the Tenant Cost Allowance. If the cost of the Tenant Improvements exceeds the Tenant Cost Allowance, Tenant shall be responsible for paying all excess costs as incurred by Landlord pursuant to, and as more particularly described in, the Development Agreement.

c. Provided that Tenant has obtained the commercial general liability insurance required hereunder, naming Landlord as additional insured, Tenant shall be granted early access to the Premises prior to the Substantial Completion Date for the purpose of installing communication equipment, cabling and similar infrastructure; and its modular furniture systems at the times, and subject to the terms, described in Section 4 of the Development Agreement. Such early access by Tenant shall be deemed to be that of a tenant under all of the terms, covenants, and conditions of this Lease, except that the obligation to pay Base Rental, Operating Costs or Additional Rent shall not be due and payable until the Commencement Date.

9

6. Additional Rent. As Additional Rent, commencing on the Commencement Date, Tenant shall pay Landlord an amount equal to the annual Operating Costs for the Project, which Operating Costs shall be calculated and paid as follows:

a. “Operating Costs” shall mean all commercially reasonable costs and expenses incurred by Landlord in connection with the operation, maintenance, repair and management of the Project, as computed on a cash basis in accordance with generally accepted accounting principles consistently applied, and shall include all commercially reasonable expenses, costs and disbursements of every kind and nature that Landlord shall pay because of or in connection with the ownership and operation of the Project, including but not limited to, the following:

i. Wages, salaries, taxes, insurance and benefits directly attributable to all employees engaged solely in operating, maintaining, managing or providing security for the Project, or to employees partially so engaged, on a proportionate basis.

ii. All supplies and materials used in operation and maintenance of the Project.

iii. Utilities for the Project, including but not limited to water, electric, sewer and gas; provided, however, that at Tenant’s option, Tenant may put all or a part of such utilities serving the Premises in its own name, in which event Tenant shall pay such utilities directly to the appropriate utility provider(s) and that portion of such utilities shall be excluded from Operating Costs.

iv. Maintenance, janitorial, security, and service agreements for the Project.

v. All insurance required to be carried by Landlord with respect to the Project in accordance with Section 26 below (the “Insurance Costs”).

vi. Ad valorem real estate taxes, assessments and governmental charges charged or assessed against the Project (“Taxes”); provided, however, that (x) Landlord’s income, profit, excise and franchise taxes and similar taxes as well as any inheritance, estate, succession, gift or any form of property transfer tax or indebtedness tax which may be assessed or levied against Landlord or any mortgagee of Landlord (collectively, the “Tax Exclusions”) are specifically excluded from Taxes for purposes of this paragraph, (y) in the event any assessments may be paid in installments, only those installments becoming due during the applicable calendar year shall be included in the amount of Taxes for such year, and (z) Tenant shall receive the full benefit of any tax incentives procured with respect to the Project and in connection therewith, in the event that lease of the Land pursuant to the Ground Lease results in the value of the Land being excluded from the benefits of the PILOT Agreement (as defined in Section 46 below) during the term of the Ground Lease, then only fifty percent (50%) of the resulting real estate taxes resulting therefrom shall be included in Operating Expenses during the term of the Ground Lease.

10

vii. Maintenance, repairs and replacements of improvements comprising the Project (except to the extent the same are for the repair, maintenance, or replacement of the roof, structural components, or exterior walls (including windows therein) of the Building) including all capital maintenance, repairs and replacements to the full extent the same may be expensed (and not capitalized) pursuant to GAAP.

viii. Amortization (on a straight line basis over the useful life of the applicable item) of the cost of installation of capital investment items required by, or permitted pursuant to, this Lease or otherwise requested by Tenant, except to the extent same are for the repair, maintenance, or replacement of the roof, structural components, or exterior walls (including windows therein) of the Building.

ix. Management fees for the Project not to exceed three and 62/100 percent (3.62%) of the then-applicable annual Base Rental, which management fee shall be inclusive of all accounting, property management and incidentals such as postage and copies.

x. Legal consultants’, appraisers’ and auditors’ fees incurred in connection with an appeal for reduction of taxes requested by Tenant or for other management purposes directly incurred in the operation of the Project, but excluding any such expenses intended to be included in the management fees as described in clause (ix) above.

xi. Association fees and payments allocated to the Premises pursuant to the Declaration, or other Permitted Encumbrances.

b. Intentionally Deleted.

c. Notwithstanding the foregoing, the following items shall not be included in Operating Costs: (i) any expenses which under generally accepted accounting principles would not be considered a maintenance, repair and/or operating expense for a commercial office facility, other than items expressly included in Operating Expenses as set forth in subsections 6(a)(vii) and (viii) above, (ii) costs associated with the operation of the business of the entity which constitutes the “Landlord”, including, but not limited to, the legal and accounting costs associated with the leasing, selling, syndicating, financing, mortgaging, or hypothecating of any of Landlord’s interest in the Project, (iii) costs of disputes between Landlord and its employees, tenants or contractors, (iv) depreciation and/or amortization of the Project, (v) the cost of repairs or other work incurred by reason of fire, windstorm or other casualty paid under insurance contracts, (vi) Landlord’s gross receipts taxes, personal and corporate taxes, inheritance and estate taxes, franchise, gift or transfer taxes or other Tax Exclusions, (vii) fines, penalties and other government imposed charges inclusive of interest and attorney fees incurred solely

11

as a result of Landlord’s failure to comply with legal or regulatory requirements (except to the extent such fees were incurred as a result of Tenant’s failure to perform Tenant’s obligations hereunder), (viii) costs relating to challenging the assessed valuation of the Project including attorneys’ fees, except for any costs or expenses incurred by Landlord in challenging tax assessments at the request of Tenant; (ix) capital improvements, except for items expressly included in Operating Expenses as set forth in subsections 6(a)(vii) and (viii) above; (x) construction defects or repairs due to the negligent or willful acts or omissions (where there was a duty to act) of Landlord or its agents or others under its control, (xi) advertising or other promotional costs concerning the Project, (xii) ground lease payments, payments on mortgages or other debt obligations, (xiii) any expense which is reimbursed by insurance, warranties or third parties; (xiv) management fees in excess of three and 62/100 percent (3.62%) of the then-applicable annual Base Rental; (xv) wages, salaries, or other compensation paid to any executive above the grade of building manager; (xvi) expenditures for compliance with any federal, state or local law, rule, ordinance or requirement regarding the environment or hazardous waste and materials the violation of which existed at or prior to the Commencement Date hereof for which Tenant is not legally responsible; (xvii) expenses of Landlord in curing defaults or performing work expressly provided in this Lease to be borne at Landlord’s expense; (xviii) Landlord’s general corporate overhead and administrative expenses; (xix) penalties for late payment, including, without limitation, penalties for late payment of taxes, equipment leases, and other amounts owing by Landlord, unless such late payment was due to Tenant’s late payment of Additional Rent; (xx) wages, salaries, benefits and expenses attributable to off-site personnel, except as expressly included in Section 6(a) hereof; (xxi) except for emergencies, rentals and other related expenses, if any, incurred in leasing air conditioning systems, elevators or other equipment ordinarily considered to be of a capital nature except equipment the costs of which would have been included in Operating Costs had Landlord purchased such equipment, but not any amounts in excess of the Operating Costs that Landlord would have incurred had Landlord purchased such equipment; (xxii) initial costs of constructing the Building, the Site Improvements, the Tenant Improvements and the parking lots, driveways, sidewalks, landscaping, courtyard and any other improvements on the Project; (xxiii) the costs of any initial “tap fees” or one time lump sum sewer or water connection fees for the Project; (xxiv) costs or fees relating to the defense of Landlord’s title to or interest in the Project, or any part thereof, or any costs or expenses associated with any sale or finance transaction, or any costs or expenses associated with implementing the Ground Lease beyond what Landlord would have incurred had Landlord owned the Project in fee simple; (xxv) expenses and costs of encapsulation, removal, or abatement of substances located on the Project prior to the Commencement Date required to be encapsulated, removed, or abated pursuant to applicable laws; (xxvi) costs or expenses, including judgments, incurred in connection with tort claims against Landlord (including the cost of investigating, defending, or settling the same), (xxvii) payments to subsidiaries or affiliates of Landlord for goods or services which as a result of a non-competitive selection process materially exceed the cost of such goods or services if obtained by parties unaffiliated with Landlord; and (xxviii) costs for the acquisition of sculpture, paintings or other objects of art unless Tenant expressly consents in writing, (xxix) any charges otherwise payable by Tenant under another provision of this Lease (i.e. no duplicative charges); and (xxx) costs to maintain those parking spaces on the Surface Parking Lot exclusively used by Ground Lessor.

12

d. Landlord may estimate the Operating Costs for any calendar year, (the “Estimated Operating Costs”). The Estimated Operating Costs shall be divided by twelve and paid to Landlord as Additional Rent monthly on the same day the Base Rental is due and payable. The initial Estimated Operating Costs for the first Lease Year shall be $817,645 ($7.45 per rentable square foot of the Premises), assuming no tax abatement is in effect at such time. Tenant agrees to pay this amount monthly with the Base Rental as shown on Exhibit C. Landlord agrees that the total amount of Operating Costs allocated to janitorial services (for cleaning five (5) times per week), landscaping, repairs, maintenance, and management fees shall not exceed $2.39 per rentable square foot for the 2015 calendar year (to be prorated if the Commencement Date occurs after January 1, 2015). Landlord agrees to review the budget for Operating Costs with Tenant prior to the beginning of each calendar year and to consider in good faith Tenant’s input with respect to such budget and the management of Operating Costs.

e. Within one hundred fifty (150) days or as soon thereafter as may be reasonably practicable after the conclusion of each calendar year during the Term, Landlord shall furnish to Tenant a report describing the actual amount of Operating Costs for such calendar year. A lump sum payment shall be made by Landlord to Tenant or by Tenant to Landlord, as appropriate, within thirty (30) days after the delivery of such report equal to the amount of any difference between the actual Operating Costs and the Estimated Operating Costs paid by Tenant for such year (the “Reconciliation Payment”).

f. Landlord shall present Tenant with all tax notices, bills or assessments imposed upon the Project (to the extent reimbursable by Tenant), within fifteen (15) days after Tenant’s request therefor. Tenant shall have the right to require Landlord, at no cost to Landlord, to challenge any such taxes or other impositions, provided Tenant posts any security or pays any Taxes required by law in connection with the challenge. Landlord will then file appropriate appeals as directed by Tenant. Upon request of Tenant, Landlord shall cooperate with Tenant by assigning to Tenant the right to proceed on behalf of or in the name of Landlord with respect to the challenge of any such tax or imposition.

g. Landlord shall maintain reasonably detailed books and records of all Operating Costs paid by Landlord. Tenant shall have the right no more than one (1) time for each calendar year during the Term, after reasonable notice to Landlord, during normal business hours, to inspect, review, or audit the books and records of Landlord relating to the calculation of Operating Costs. If the inspection, review, or audit reveals an overcharge by Landlord, then Landlord shall refund any such overcharge within thirty (30) days after notice from Tenant. In addition, if Tenant’s inspection, review, or audit of the Operating Costs reveals an overcharge of more than five percent (5%), Landlord shall reimburse Tenant for the reasonable cost of the audit within ten (10) days after Landlord’s receipt of an invoice therefor. In the event Tenant does not object to a report of Operating Costs (as discussed in Section 6(e)) within one (1) year after the receipt of same, such report shall be considered final and the Operating Costs covered by same shall no longer be subject to audit as set forth in this Section 6(g).

h. The Operating Costs during any fractional part of a calendar year shall be prorated.

13

7. Services to be Furnished by Landlord. As a part of Operating Costs, Landlord shall furnish the following services:

a. Tenant may have entry at all times to the Parking Garage by card key system or by such other method as is chosen by Tenant. Tenant shall have access to the Premises on a 24-7 basis, subject only to such security procedures as Tenant may elect from time to time.

b. Tenant shall have full use of all elevators in the Building, subject to call.

c. Hot and cold water at those points of supply provided for in the Plans and Specifications; central heat and air conditioning as provided for in the Plans and Specifications, at such temperatures and in such amounts as are desired by Tenant consistent with the capacity of the HVAC facilities described in the Plans and Specifications.

d. Routine maintenance and electric lighting service for all public areas and special service areas of the Project.

e. Janitorial service as requested by Tenant from time to time.

f. Electrical facilities and sufficient power for Tenant’s office equipment consistent with the capacities described in the Plans and Specifications. Any additional equipment, feeders or risers necessary to supply Tenant’s electrical requirements in excess of the amount to be provided by Landlord pursuant to this subsection shall be supplied by Landlord at the expense of Tenant, and only if such installations will not, in Landlord’s judgment, overload the electrical system of the Project or entail excessive or unreasonable alterations to the Project.

g. Replacement of Building standard fluorescent bulbs in all areas and incandescent bulbs in the Building.

Notwithstanding the foregoing, upon reasonable prior notice, Tenant may request modifications, cessation or additions to the services provided by Landlord and/or to the service providers being used, which such additions or modifications shall be included within Operating Costs. Upon any such request, Landlord agrees to use commercially reasonable efforts, at no cost to Landlord, to accommodate such request, provided that, Landlord shall always have the sole and exclusive right to appoint the property manager. Notwithstanding the foregoing, in the event that the property manager is not affiliated with Eakin Partners, LLC or John W. Eakin, Tenant shall have the right to request a change to the property manager at the end of the term of such property manager’s agreement (but in no event later than one (1) year after Tenant’s request), but only if the Project is not being operated in a manner comparable to other first class

14

office buildings in the Nashville, Tennessee market (the “Operating Standard”), and if such failure is not cured within sixty (60) days after written notice to Landlord and the property manager, which notice specifies the ways in which the management of the Project does not meet the Operating Standard.

8. Keys, Locks and Card Keys. Landlord shall furnish Tenant with a reasonable number of keys and/or key cards for all of Tenant’s employees for entry to the Building and the Parking Garage. Additional keys or keycards, or the replacement of lost keys or key cards, will be furnished to Tenant, at Tenant’s cost, on an order signed by Tenant or Tenant’s authorized representative. All such keys shall remain the property of Landlord. No additional locks shall be allowed on any door of the Premises, nor shall Tenant change any locks without Landlord’s prior permission (which shall not be unreasonably withheld) and delivery to Landlord of a key for same. Tenant shall not make, or permit to be made, any duplicate keys. Upon termination of this Lease, Tenant shall surrender to Landlord all keys and card keys for the Premises and the Building, along with all parking cards. Tenant shall supply Landlord with the combination of all locks for safes, safe cabinets and vault doors, if any, installed in the Premises.

9. Signage. Tenant will have full rights to all signage in, on or about the Premises, including interior signage, building signage (which, at Tenant’s option, may include signage on top of the Building) and any exterior signage, all as Tenant may specify and elect from time to time, provided that Tenant shall be limited to one (1) sign on the exterior walls of the Building, all of which may be modified by Tenant from time to time; provided, however, that all such signage must adhere to any applicable municipal codes and meet Landlord’s approval as to design and method of installation, which approval shall not be unreasonably withheld, conditioned or delayed. All Tenant signage costs may, at Tenant’s option, be paid from the Tenant Improvement Allowance. Landlord shall pay for signage required within the parking areas to comply with applicable law. Tenant shall remove any exterior signage at the expiration or earlier termination of this Lease. Tenant shall maintain such signage at Tenant’s sole cost and expense, and shall repair any damage to the Building caused by the maintenance, operation, or removal of such signage.

10. Parking. Tenant shall have the exclusive right to use (a) fourteen (14) parking spaces within the Surface Parking Lot as shown on the Site Plan (which spaces shall be marked for Tenant’s exclusive use) and (b) a minimum of three hundred thirty (330) parking spaces within the Parking Garage for parking of Tenant’s automobiles and those of its employees and visitors. Tenant acknowledges that, pursuant and subject to the Declaration, the Ground Lessor shall have rights to use those spaces in the Surface Parking Lot that are not reserved for Tenant’s exclusive use, and six (6) parking spaces in the Parking Garage on an exclusive basis, which six (6) spaces shall be in the location shown on the Site Plan and shall be marked for Ground Lessor’s use (collectively, the “Ground Lessor’s Reserved Parking Spaces”). Tenant agrees not to use the Ground Lessor’s Reserved Parking Spaces. Landlord reserves the right to adopt reasonable regulations for the use of the Parking Garage and/or Surface Parking, including those rules which may be necessary to curtail unauthorized parking within the Parking Garage and/or the Surface Parking Lot, including the required use of “parking permits” so long as Landlord uses reasonable efforts to enforce the same on a uniform basis. Notwithstanding the foregoing, in the event Landlord fails for any reason to provide at least 330 parking spaces in the Parking Garage for Tenant’s exclusive use in accordance with the terms of this Section 10, then without limiting Tenant’s other rights and remedies for such failure, Tenant shall have the right to seek alternate parking and Landlord shall reimburse Tenant on demand for the costs incurred by Tenant to obtain such parking.

15

11. Permitted Uses. Tenant may use and occupy the Premises for the purpose specified in the Schedule and purposes ancillary thereto and for no other purpose. Tenant shall not commit or allow any waste or damage to be committed on any portion of the Premises. Tenant shall not occupy or use, or permit any portion of the Premises to be occupied or used for (i) any business or purpose that is unlawful or extra-hazardous, (ii) a noxious use, or a use which would be considered a public or private nuisance, (iv) a use which would trigger or require any further or different governmental compliance or improvements (unless the cost thereof is paid for by Tenant) than as proposed as part of the initial construction of the Building. Tenant shall not permit anything to be done that would in any way increase the rate of any insurance coverage on the Project (unless Tenant agrees to pay the increased cost associated therewith), cause the load on any floor of the Building to exceed the load for which the floor was designed, or use electrical energy exceeding the capacity of the then existing feeders or wiring installations (unless Tenant agrees to pay the increased cost to increase such capacity). Further, in the event Tenant subleases space within the Premises hereunder, such sublease shall not materially increase the burden on the then-existing parking areas beyond the burden that would exist on such areas if Tenant’s use of the Building was at full capacity. Tenant shall further conduct its business and control its agents, employees, invitees, and visitors (the “Tenant Parties”) in such manner as not to create any nuisance. Any food, soft drink or other vending machine installed within the Premises shall not be visible from the exterior of the Building. Tenant will have, throughout the Term, access to all portions of the Premises (including the roof, except that any access to the roof by Tenant shall be in compliance with the Permitted Encumbrances) for installation and maintenance of any conduits, cables and other equipment installations necessary for its communications, data processing, and any other requirements necessary for the conduct of the Tenant’s business. Tenant shall cause such installation and maintenance of this equipment to be constructed in such a manner as to not violate the roof or other building systems warranties, the Permitted Encumbrances or applicable law. Tenant shall give Landlord reasonable advance notice of Tenant’s intention to access the roof for any purposes, and Landlord shall have the right to accompany Tenant. Tenant shall indemnify and hold Landlord harmless from any and all losses, claims, or other liabilities resulting from any such installations by Tenant, including reasonable attorneys’ fees.

12. Laws, Regulations, and Rules of Building. Landlord shall deliver the Project in compliance with all applicable federal, state, county and local governmental and municipal laws, statutes, ordinances, rules, regulations, requirements, codes, decrees, orders, and decisions by courts and cases now in force or which may hereafter be in force, when the decisions are considered binding precedent in Tennessee, and all decisions of federal courts applying the law of Tennessee; including but not limited to The Americans With Disabilities Act of 1990 (42 U.S.C. § 12101 et seq.) (the “ADA”), and any regulations and guidelines promulgated thereunder, as all of the same may be amended and supplemented from time to time (the “Laws”) and all Permitted Encumbrances and, if the Project is not in compliance with all Laws and Permitted Encumbrances in effect as of the date of delivery of the Premises to Tenant, Landlord will make such alterations (at Landlord’s cost and not as part of Operating Costs) as may be required in order to cause the Project to comply with such Laws and Permitted Encumbrances. Thereafter, (a) Tenant shall comply with all Laws to the extent applicable to the

16

portions of the Premises required to be maintained by Tenant; provided, however, that in no event shall Tenant have any obligation to make structural alterations to the Premises, except as may be required by Laws enacted after the Commencement Date and imposing the obligation to make such structural repairs only in connection with Tenant’s particular use of the Premises (but not with respect to structural alterations required by law as a result of office space generally), and (b) Landlord shall be obligated to comply with Laws to the extent applicable to portions of the Project required to be maintained by Landlord. Tenant shall comply with the rules and regulations attached hereto as Exhibit E, as such rules and regulations may be reasonably modified by Landlord from time to time for the safety, care and cleanliness of the Project and for preservation of good order therein after receiving notice thereof (the “Rules and Regulations”); provided, however, that in the event of a conflict between the Rules and Regulations and the terms of this Lease, the terms of this Lease shall control.

Landlord makes no representations or warranties with respect to crime in the area, undertakes no duty to protect against criminal acts and shall not be liable for any injury, wrongful death or property damage arising from any criminal acts of third parties; provided, however, Landlord shall, from time to time, upon Tenant’s request, and as a part of Operating Costs, employ or cause to be employed security personnel and equipment for the Project. Landlord’s agreement to employ security as requested by Tenant shall not be deemed an undertaking by Landlord to ensure the safety of the tenants of the Building or any of their agents, employees, contractors, customers or invitees or the property of any such parties. Tenant is urged to provide security for its agents, employees, contractors, customers and invitees or the property of any such parties, as it deems necessary, and to obtain insurance to protect against criminal acts.

13. Financial Statements. In the event Tenant’s financial statements are not publicly available, Tenant shall provide Landlord with accurate financial statements (balance sheet and income statements) on Tenant within thirty (30) days of request by Landlord. As a condition to the delivery of any such financial statements, Landlord agrees to keep such financial statements confidential and to not disclose or deliver such financial statements to any third party, except that Landlord may deliver such financial statements to actual or potential lenders, purchasers or investors as long as such parties agree to keep such financial statements confidential.

14. Repairs.

a. During the Term of this Lease, Landlord shall maintain, repair, and replace the entirety of the Project, including without limitation the Building (including all leasehold improvements and all Building Systems), the Parking Garage, the Surface Parking Lot, all driveways and landscaping and all other portions of the Project as necessary to keep same in good condition and repair, in a manner consistent with first class office buildings located in Nashville, Tennessee. In addition, Landlord shall perform all maintenance, repairs, replacements and improvements to the Project required by any governmental law, ordination, rule or regulation. Notwithstanding the foregoing (i) the cost of repairs, maintenance, or replacement of the roof, structural portions, and exterior walls (including the windows therein) of the Building, including the repair of damage caused by any leaks caused by Landlord’s failure to maintain the roof or exterior walls (including windows therein), shall be paid by Landlord and shall not be a part of Operating Costs, (ii) maintenance, repair, and/or replacement of Permitted Alterations shall always be considered a part of Operating Costs, and (iii) Tenant shall pay on demand

17

Landlord’s costs for any repairs necessitated by the acts or omissions of Tenant or Tenant’s agents, contractors, employees, visitors or invitees to the extent not covered by Landlord’s insurance.

b. If Tenant is not satisfied with the level of service provided by any of Landlord’s vendors (for example, hvac, janitorial, landscape maintenance which are included within Operating Costs), Tenant shall notify Landlord. Landlord will thereafter work with Tenant in good faith to upgrade the level of services by rebidding the unsatisfactory vendor’s contract to another vendor reasonably acceptable to both Landlord and Tenant.

c. As used above, “Building Systems” shall mean any plant, machinery, transformers, duct work, cable, wires, and other equipment and facilities, and any systems designed to supply heat, ventilation, air conditioning and humidity or any other services or utilities, or comprising or serving as any component or portion of the electrical, gas, steam, plumbing, sprinkler, communications, alarm, security, or fire/life safety systems or equipment, any telecommunications system serving the Building and any other mechanical, electrical, electronic, computer or other systems or equipment that serves the Building in whole or in part. Unless otherwise specifically agreed in writing, Landlord shall have no responsibility for the maintenance of Tenant’s telecommunications equipment, including wiring and cabling, nor for any wiring or other infrastructure to which Tenant’s telecommunications equipment may be connected. Tenant agrees that to the extent any such service is interrupted, curtailed or discontinued, Landlord shall have no obligation or liability with respect thereto (unless such interruption or curtailment is a result of Landlord’s gross negligence or intentional misconduct), and it shall be the sole obligation of Tenant at its expense to obtain substitute service.

d. Notwithstanding any provision contained herein to the contrary, if Landlord fails to commence any of its maintenance, repair, or replacement obligations pursuant to this Section 14 for more than thirty (30) days after written notice from Tenant (or does not within said period commence and diligently proceed to cure such default, although notice shall be limited to that which is reasonable under the circumstances if there is an emergency with imminent threat to life or property or if such failure has an imminent material and adverse impact on the operation of Tenant’s business operations), Tenant may perform such maintenance, repairs, and replacements, and Landlord shall pay to Tenant the reasonable cost thereof actually incurred by Tenant within thirty (30) days after receipt of an invoice from Tenant together with supporting documentation reasonably acceptable to Landlord.

e. Tenant shall, at its expense, keep in good order, condition and state of repair all portions of the Premises with the exception of those to be maintained and repaired by Landlord under the preceding subsections. In the event Tenant fails to comply with the requirements of this Section and such failure continues for more than thirty (30) days after written notice of such failure is delivered to Tenant, Landlord may make such maintenance and repair, and Tenant shall pay the cost thereof, plus an administrative fee of five percent (5%), upon demand.

18

15. Alterations.

a. After construction of the Tenant Improvements, except for any Permitted Alterations (hereinafter defined), Tenant shall not make or allow to be made any alterations or physical additions in or to the Premises, without first obtaining the written consent of Landlord which consent shall not be unreasonably withheld, conditioned or delayed; provided, however, Landlord’s consent may be subject to reasonable protections or restrictions designed to preserve the architectural design and structural integrity of the Building and to protect against claims by materialmen and laborers, or contingent upon Tenant’s agreement to remove such alteration at the end of the Term. At Landlord’s election, any alterations or additions made by Tenant (excluding Tenant’s Personal Property) shall become the property of Landlord upon termination of this Lease. Landlord’s interest in the Project shall not be subject to liens for improvements made by Tenant, and Tenant shall have no power or authority to create any lien or permit any lien to attach to the Project as a result of improvements made by Tenant or by reason of any other work done on Tenant’s behalf or any other act or omission of Tenant. Tenant agrees to provide notice to such effect to any such persons doing work or supplying materials to the Premises. Tenant shall indemnify Landlord against any loss or expenses incurred as a result of the assertion of any such lien, and Tenant covenants and agrees to remove such lien or transfer such lien to a bond or such other security, as may be permitted by applicable law, within thirty (30) days after Tenant has actual knowledge of such lien. In the event Tenant fails to have such lien removed as required hereunder, Landlord shall have the right to pay such lien, and Tenant shall reimburse Landlord for such sum, plus an administrative fee of five percent (5%) of same, upon demand.

b. Notwithstanding any provision contained in this Lease to the contrary, Tenant shall have the right to make the following alterations to the Premises without obtaining Landlord’s prior consent (the “Permitted Alterations”): (i) interior, non-structural alterations which do not cost in excess of One Hundred Thousand and No/100 Dollars ($100,000) in any one instance and do not adversely affect the Building or require any work to be done within the walls, above the ceiling, or below the floor; and (ii) cosmetic alterations such as changing carpets, floor coverings, wall coverings and painting. Tenant shall give Landlord advance written notice of all Permitted Alterations to be made by Tenant whenever the cost of such Permitted Alterations exceeds Ten Thousand and No/100 Dollars ($10,000.00).

c. In no event shall Landlord make alterations to the Project without the approval of Tenant except in connection with the discharge of Landlord’s obligations hereunder.

16. Surrender of Premises. At the termination of this Lease, Tenant shall deliver possession of the Premises to Landlord in as good condition as at the Commencement Date (but as altered or improved after such date in compliance with the requirements of this Lease), or as the same may have been improved during the Term, ordinary wear and tear, damage resulting from fire or other casualty or condemnation, and construction, maintenance, repairs and replacements required hereunder to be completed by Landlord excepted. If Tenant installs improvements in the Premises reasonably determined by Landlord to be special or non-standard and advises Tenant at the time such improvements are made that Landlord will require the same to be removed at the end of the Term, Landlord may require Tenant to remove such special or non-standard improvements and repair the Premises at Tenant’s sole cost and expense upon the termination of this Lease. Before surrendering possession of the Premises, Tenant shall, without expense to Landlord, remove all signs, furnishings, equipment, trade fixtures, merchandise and

19

other personal property installed or placed in the Premises by Tenant (the “Tenant’s Personal Property”). Tenant’s Personal Property shall be and shall remain the property of Tenant and may be removed by Tenant at any time during the Term; provided that, if any of Tenant’s Personal Property is removed, Tenant shall promptly repair any damage resulting from such removal. If Tenant fails to remove any of the Tenant’s Personal Property prior to expiration or termination of this Lease and such failure continues for ten (10) days following written notice thereof from Landlord to Tenant, then Landlord may, at its sole option, (a) deem any or all of such items abandoned, and, at Landlord’s option, title to such items shall pass to Landlord under this Lease as by a bill of sale, or (b) remove and dispose of all or any part of Tenant’s Personal Property, in which event Tenant shall pay the reasonable cost of removal and disposal, including, without limitation, repairing any damage caused by such removal.

Notwithstanding the foregoing, the parties to this Lease acknowledge the importance of complying with the National Electric Code, as amended from time to time, and all other applicable electric, fire and safety codes. Tenant shall promptly remove and properly discard any wiring and/or cabling installed for Tenant’s use to the extent required by applicable laws, codes, or regulations, before or as of the time of the surrender of the Premises, unless excused in writing by Landlord. Tenant hereby agrees that any such cabling or wiring installed during the Lease shall meet the requirements of the applicable electric, fire and safety codes. In the event that any wiring and/or cabling remains on the Premises upon surrender by Tenant, such items are deemed to be abandoned and may be removed and disposed of by Landlord as Landlord sees fit. To the extent Tenant is required to remove cabling and wiring pursuant to the provisions of this paragraph, all expenses of such removal and disposal shall be at Tenant’s sole cost and shall be payable on demand.

17. Quiet Enjoyment. Tenant shall have the right to peacefully occupy, use and enjoy the Premises during the Term, subject to the other terms hereof, provided no Default exists hereunder.

18. Landlord’s Right of Entry. Landlord or its agents or representatives may enter the Premises, at reasonable times, and on reasonable prior notice to Tenant (except in the event of an emergency, in which case only such notice as may be reasonable under the circumstances (which may include no notice if merited by the circumstances) shall be required) (a) to inspect the Premises; (b) to show the Premises to any prospective purchaser or lender of the Project, or to others having an interest in the Project or Landlord; (c) during the last six (6) months of the Term, to show the Premises to brokers and prospective tenants; (d) to make inspections, repairs, alterations, additions, or improvements to the Premises or the Building (including, without limitation, checking, calibrating, adjusting, or balancing controls and other parts of the heating, ventilation and air-conditioning system) required or permitted by this Lease and (e) to take all steps as may be necessary or desirable for the safety, protection, maintenance, or preservation of the Premises or the Building or Landlord’s interest therein, or as may be necessary or desirable for the operation or improvement of the Building in order to comply with Laws. Landlord shall use reasonable efforts not to interfere with the operation of Tenant’s business during any such entry. Notwithstanding any of Landlord’s rights to enter the Building pursuant to the terms of this Lease, Landlord shall not cause Tenant to in any way violate any laws, regulations or ordinances intended to protect the rights and privacy of confidential patient and billing information processed in Tenant’s operations, including those relating to any and all patient and billing records and the computers and servers that store such records, which at any time, Tenant shall be able to secure in locked storage units or areas.

20

19. Limitation of Landlord’ Liability. Landlord’s liability to Tenant shall be limited as follows:

a. As between Landlord and Tenant, Tenant hereby assumes all risk of damage or injury to Tenant or Tenant’s employees, invitees, or contractors or the property of Tenant or Tenant’s employees, invitees, or contractors in, on, or about the Project from any cause other than the negligence or tortious act or omission (where there was a duty to act) of Landlord or the breach of this Lease by Landlord. By way of example, but without limitation, Tenant agrees that Landlord will not be liable for any loss, injury, death, or damage to persons, property, or Tenant’s business resulting from (i) theft; (ii) act of God, public enemy, injunction, riot, strike, insurrection, war, terrorism, court order, requisition, order of governmental body or authority, fire, explosion or falling objects; (iii) any accident or occurrence in, on or about the Premises caused by the Premises becoming out of repair or by the obstruction, breakage or defect in or failure of equipment, pipes, sprinklers, wiring, plumbing, heating, ventilation and air-conditioning or lighting fixtures of the Building or by broken glass or by the backing up of drains, or by gas, water, steam, electricity or oil leaking, escaping or flowing into or out of the Premises; (iv) business interruption or loss of use of the Premises; (v) any diminution or shutting off of light, air or view by any structure erected on the Land or any land adjacent to the Premises, even if Landlord is the adjacent land owner; (vi) mold or indoor air quality; (vii) any acts or omissions of any visitor of the Premises; or (viii) any cause beyond Landlord’s control, unless caused by the gross negligence or tortious act or omission (where there was a duty to act) of Landlord or the breach of this Lease by Landlord. In no event shall Landlord be liable for indirect, consequential, or punitive damages or for damages based on lost profits. None of the foregoing shall be considered a constructive eviction of Tenant, nor shall the same entitle Tenant to an abatement of rent; provided, however, if an interruption or failure of utility services caused by or within the control of Landlord or any of its employees or contractors continues for more than five (5) business days, Tenant shall receive an abatement of all Base Rental hereunder from the commencement of such interruption or failure until such time as the services are restored.

b. All separate and personal liability of any member, partner, principal, joint venturer, director, officer, shareholder or beneficial owner of Landlord and of any constituents of the Landlord is hereby expressly waived by Tenant, and by every person now or hereafter claiming by, through, or under Tenant; and Tenant shall look solely to Landlord’s interest in the Project and the proceeds thereof for the payment of any claim against Landlord. Upon any transfer of Landlord’s interest in this Lease or in the Project and the corresponding assumption by the transferee of Landlord’s obligations under this Lease, the transferring Landlord shall have no liability or obligation for matters arising under this Lease after the date of such transfer.

20. Indemnity.

a. Tenant shall hereby indemnify, defend and hold Landlord harmless against and from all liabilities, obligations, suits, damages, penalties, claims, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by law), that may be imposed upon, incurred by, or asserted against Landlord

21

and arising, directly or indirectly, out of or in connection with (i) Tenant’s use, occupancy or maintenance of the Premises, the Building or the Project (but not including the use of the Parking Garage by others or the use of other portions of the Project by others), (ii) any failure on the part of Tenant to perform or comply with any of the covenants, agreements, terms or conditions contained in this Lease; and (iii) any negligent or otherwise tortious act or omission (where there was a duty to act) of Tenant.

b. Landlord shall hereby indemnify, defend and hold Tenant harmless against and from all liabilities, obligations, suits, damages, penalties, claims, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by law), that may be imposed upon, incurred by, or asserted against Tenant and arising, directly or indirectly, out of or in connection with any of the following: (i) any failure on the part of Landlord to perform or comply with any of the covenants, agreements, terms or conditions contained in this Lease; and (ii) any negligent or otherwise tortious act or omission (where there was a duty to act) of Landlord.

21. Defaults. Any of the following shall be deemed a “Default”:

a. If Tenant fails to pay any rent when due and does not cure such failure within five (5) days after written notice from Landlord that such amount is past due. Notwithstanding the preceding sentence, Landlord shall not be obligated to give more than two (2) such written notices during any calendar year. Thereafter, failure by Tenant to pay any monetary sum due under the Lease within five (5) days after the applicable due date shall constitute an Event of Default without the obligation to provide notice therefor.

b. If any material representation or warranty made by Tenant to Landlord is false in any material respect when made.

c. If any voluntary or involuntary petition under any section of any bankruptcy act shall be filed by or against Tenant, or any voluntary or involuntary proceeding in any court or tribunal shall be instituted to declare Tenant insolvent or unable to pay its debts, and in the case of an involuntary petition or proceeding, the petition or proceeding is not dismissed within ninety (90) days from the date it is filed.

d. If the leasehold interest of Tenant be levied upon under execution or be attached by process of law (and the same shall not be released within ninety (90) days after the filing thereof), or if Tenant makes an assignment for the benefit of creditors, or if a receiver be appointed for any property of Tenant and is not discharged within ninety (90) days after such appointment.

e. Failure by Tenant to observe or perform any other covenant, agreement, condition or provision of this Lease, if such failure shall continue for thirty (30) days after written notice thereof from Landlord to Tenant; provided that such thirty (30) day period shall be extended for the time reasonably required to complete such cure, if such failure cannot reasonably be cured within said thirty (30) day period and Tenant commences to cure such failure within said thirty (30) day period and thereafter diligently and continuously proceeds to cure such failure.

22

22. Remedies and Damages.

a. In the event of a Default and for so long as such Default shall be continuing, then in addition to any other rights or remedies Landlord may have at law or in equity, Landlord shall have the right, at Landlord’s option, without further notice or demand of any kind, to do any or all of the following without prejudice to any other remedy that Landlord may have:

i. Terminate this Lease and Tenant’s right to possession of the Premises by giving notice to Tenant. Tenant shall immediately surrender the Premises to Landlord, and if Tenant fails to do so, Landlord may re-enter the Premises and take possession thereof, whereupon Tenant shall have no further claim to the Premises or under this Lease.

ii. Continue this Lease in full force and effect, whether or not Tenant has vacated or abandoned the Premises, and collect any unpaid rent or other charges that have or thereafter become due and payable.

iii. Continue this Lease in effect, but terminate Tenant’s right to possession of the Premises and re-enter the Premises and take possession thereof, whereupon Tenant shall have no further claim to the Premises without the same constituting an acceptance of surrender.

iv. In the event of any re-entry or retaking of possession by Landlord, Landlord shall have the right, but not the obligation, (A) to expel or remove Tenant and any other party who may be occupying the Premises or any part thereof; and (B) to remove all or any part of Tenant’s or any other occupant’s property on the Premises and to place such property in storage at a public warehouse at the expense and risk of Tenant.

v. Landlord may relet the Premises without thereby avoiding or terminating this Lease (if the same has not been previously terminated), and Tenant shall remain liable for any and all rent and other charges and expenses hereunder. For the purpose of reletting, Landlord is authorized to make such repairs or alterations to the Premises as may be reasonably necessary in the sole discretion of Landlord for the purpose of such reletting, and if a sufficient sum is not realized from such reletting (after payment of all costs and expenses of such repairs, alterations and the expense of such reletting (including, without limitation, reasonable attorney and brokerage fees) and the collection of rent accruing therefrom) each month to equal the rent payable under this Lease, then Tenant shall pay such deficiency each month upon demand therefor. Actions to collect such amounts may be brought from time to time, on one or more occasions, without the necessity of Landlord’s waiting until the expiration of the Term.

vi. Without any further notice or demand, Landlord may enter upon the Premises, if necessary, without being liable for prosecution or claim for damages therefor, and do whatever Tenant is obligated to do under the terms of the Lease. Tenant agrees to reimburse Landlord on demand for any reasonable expenses which Landlord may incur in effecting compliance with Tenant’s obligations under the Lease. Tenant further agrees that Landlord shall not be liable for any damages resulting to Tenant from such action, unless caused by the gross negligence or willful misconduct of Landlord (but subject to the other limitations on Landlord’s liability set forth in this Lease). Notwithstanding anything herein to the contrary, Landlord will have no obligation to cure any Default of Tenant.

23

vii. Landlord shall at all times have the right, without prior demand or notice except as required by Law, to seek any declaratory, injunctive or other equitable relief, and specifically enforce this Lease, or restrain or enjoin a violation or breach of any provision hereof, without the necessity of proving the inadequacy of any legal remedy or irreparable harm.

viii. The rights given to Landlord in this Section are cumulative and shall be in addition and supplemental to all other rights or remedies that Landlord may have under this Lease and under applicable Laws or in equity.

b. Should Landlord elect to terminate this Lease or Tenant’s right to possession under the provisions above, Landlord may recover the following damages from Tenant:

i. The worth at the time of the award of any unpaid rent that had been earned at the time of termination; plus

ii. The worth at the time of the award of the unpaid rent that would have been earned after termination, until the time of award; plus

iii. The worth at the time of the award of the amount by which the unpaid rent for the balance of the Term after the time of award exceeds the amount of the rental loss that Tenant proves could have been reasonably avoided, if any; plus