Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - UV FLU TECHNOLOGIES INC | v330955_ex32.htm |

| EX-31.2 - EXHIBIT 31.2 - UV FLU TECHNOLOGIES INC | v330955_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - UV FLU TECHNOLOGIES INC | v330955_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - UV FLU TECHNOLOGIES INC | Financial_Report.xls |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2012

Commission File Number: 333-140322

| UV FLU TECHNOLOGIES, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 98-0496885 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification Number) | |

| 1694 Falmouth Road, Suite 125 Centerville, Massachusetts 02632-2933 | ||

| (Address of principal executive offices) (Zip Code) | ||

| (508) 362-5455 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| None | None | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K, is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer* ¨ | Smaller reporting company x |

| *(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ¨ Yes x No.

The aggregate market value of the common stock held by non-affiliates as of September 30, 2012 (the last trading day of the fourth quarter) was $3,280,148 based on the last sale price of common stock sold.

As of December 19, 2012, the last practicable date, 52,361,763 shares of the registrant’s Common Stock were outstanding at a par value of $0.001.

DOCUMENTS INCORPORATED BY REFERENCE: Exhibits incorporated by reference are referred to under Part IV.

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. Business | 4 | |

| Item 1A. Risk Factors | 12 | |

| Item 1B. Unresolved Staff Comments | 18 | |

| Item 2. Properties | 18 | |

| Item 3. Legal Proceedings | 19 | |

| Item 4. Reserved | 19 | |

| PART II | ||

| Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases of Equity Securities | 20 | |

| Item 6. Selected Financial Data | 20 | |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 | |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 26 | |

| Item 8. Financial Statements and Supplementary Data | 26 | |

| Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 26 | |

| Item 9A. Controls and Procedures | 27 | |

| Item 9B. Other Information | 27 | |

| PART III | ||

| Item 10. Directors, Executive Officers and Corporate Governance | 27 | |

| Item 11. Executive Compensation | 30 | |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 32 | |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | 33 | |

| Item 14. Principal Accounting Fees and Services | 35 | |

| PART IV | ||

| Item 15. Exhibits, Financial Statement Schedules | 35 | |

| Index to Financial Statements | F-1 to F-15 | |

| Signatures | ||

| Exhibits |

| 2 |

Statement Regarding Forward-Looking Statements

The statements contained in this report on Form 10-K that are not purely historical are forward-looking statements within the meaning of applicable securities laws. Forward-looking statements include statements regarding our “expectations,” “anticipation,” “intentions,” “beliefs,” or “strategies” regarding the future, whether or not those words are used. Forward-looking statements also include statements regarding revenue, margins, expenses, and earnings analysis for fiscal 2012, and thereafter; anticipated levels of future revenues and earnings from the operations of UV Flu Technologies, Inc. (the “Company,” “we,” “us,” or “our”); and projected costs and expenses related to our operations, liquidity, capital resources, availability of future equity capital on commercially reasonable terms. All forward-looking statements included in this report are based on information available to us as of the filing date of this report, and we assume no obligation to update any such forward-looking statements. Our actual results could differ materially from the forward-looking statements. Among the factors that could cause actual results to differ materially are the factors discussed in Item 1A. Risk Factors.

| 3 |

PART I

| ITEM 1. | BUSINESS |

Background

UV Flu Technologies, Inc. (“we”, “us”, “our,” or the “Company”) was organized under the laws of the State of Nevada on April 4, 2006 under the name “Northwest Chariots, Inc.” We were engaged in the business of renting and selling electrically powered human transporters, like electric bicycles, chariots, and quads. Following our fiscal year ended September 30, 2009, we decided to change our product mix to air purification products and to focus on the research, development, manufacturing, and sales of air purification systems and products.

In furtherance of our business objectives, on November 12, 2009, we effected a 32-for-1 forward stock split of all our issued and outstanding shares of common stock, and we merged with our wholly-owned subsidiary, UV Flu Technologies, Inc., for the purposes of effecting a name change to “UV Flu Technologies, Inc.”

Effective November 15, 2009, we acquired AmAirpure Inc.’s air purification technology, product, inventory, and certain equipment pursuant to an Asset Purchase Agreement with AmAirpure, Inc. We issued 15,000,000 shares of our common stock to shareholders of AmAirpure in connection with the asset acquisition. Additionally, on November 25, 2009, we entered into a Distribution Agreement with Puravair Distributors LLC (“Puravair”) where we appointed Puravair as our exclusive master distributor for our Viratech UV-400 product and our other products for the professional, medical, and commercial markets in the U.S. and Canada. On September 30, 2010, we terminated our Distribution Agreement with Puravair and began adding new distributors, which totaled five as of year- end, 2010. Today the Company has a total of 10 Distributors, including Grainger Industrial Supply, with almost 2000 reps throughout the United States, and Ormed Systems, one of the most renowned medical distributors in India.

The latest production runs of our Viratech UV-400 product incorporate our patented UV bacteria killing technology, which has been cleared by the FDA for use as a medical device. In June 2010, we expanded our market reach by introducing the latest generation of our Viratech UV-400 product into the residential and hospitality markets.

On October 28, 2010, we entered into a binding letter of intent with The Red Oak Trust (“Red Oak”) (the “LOI”) in connection with our proposed acquisition of one hundred percent (100%) of the issued and outstanding units of RxAir Industries, LLC, a Nevada limited liability company (“RxAir”), which is wholly owned by Red Oak (the “Acquisition”). At the closing of the Acquisition, Rx Air became a wholly-owned subsidiary of the Company. The acquisition closed January 24, 2011.

The Company’s sales, although above 2011 levels, are expected to begin increasing significantly in the calendar year 2013, when retail, international, and medical distributors have established their distribution channels, and our factory capacity has been expanded.

Our Solution

Around the world, there is a growing awareness of the increasingly poor air quality, particularly with the recent outbreak of H1N1 swine flu and other respiratory pathogens. The public has long been aware of the dangers associated with outdoor air pollution, but never before has there been such growing public concern about the quality of indoor air as well. Today’s lifestyles, coupled with modern building construction practices have created significant challenges in maintaining healthy indoor air. Poor indoor air quality has been proven scientifically to cause increased asthma and allergy related symptoms, as well as contribute to the spread of disease. These factors have created a large and growing need for products which will improve indoor air quality in the workplace and at home.

We fill the need for improved air purification systems in the workplace and at home with proprietary technology utilizing high-energy ultraviolet radiation (UV) inside a “killing chamber” which destroys airborne bacteria, deactivates allergens, and mold. The product also reduces odors, and the concentrations of Volatile Organic Compounds (VOC’S). We plan to develop and market products, which will improve indoor air quality effectively, efficiently, economically and do so in an environmentally friendly way.

Our product safely kills over 99% of airborne bacteria. Extensive independent laboratory testing confirms that this unique technology kills other airborne contaminants as well.

| 4 |

Market Overview

The market for air purification equipment has been gaining momentum as a result of rising concerns over indoor air quality and increasing health consciousness among consumers. Products within this group that until recently had been viewed as a luxury are now found in an increasing number of homes and commercial workspaces. As a result, the North American air purification equipment market is expected to expand significantly.

The U.S. indoor air quality market generated $7.7 billion in 2008, with the equipment segment accounting for $3.6 billion. Continuing media attention given to the health effects of toxic mold, the outbreak of infectious diseases such as swine flu, and the increase in chronic respiratory diseases such as asthma have resulted in new interest in, and attention to, indoor air quality. Building owners and operators are expected to purchase growing quantities of indoor air quality-related equipment in the hope of reducing or eliminating these contaminants from their buildings.

Employers have incentive to keep workers healthy. In 2008, 425 million sick days were taken by employees, costing an estimated $60 billion in lost productivity. “Presenteeism,” a new term coined for employees working while unhealthy, is even worse for employers and the healthcare system, costing approximately $160 billion annually in lost productivity. (Kalorama Information, “The Market for Wellness Programs”, September 2009).

Increased media attention and growing public concern over pandemics, antibiotic resistant superbugs, asthma, allergies, tuberculosis, Sick Building Syndrome, and toxic mold are spurring governments, employers, and homeowners to take action to safeguard their health. Demand for products that combat the spread of airborne illness is rising exponentially, as starkly highlighted by public reaction to the outbreak of H1N1. The Wall Street Journal reported the pandemic will create a $7 billion windfall for manufacturers of swine flu vaccine this year.Between July and September of 2009, shipments of hand sanitizer rose a remarkable 129%.

This heightened awareness has spread to the growing $7.7 billion indoor air quality market, increasing demand for products that improve air quality and remove airborne pathogens in commercial buildings, hospitals, schools and homes. Poor indoor air quality is scientifically proven to cause the spread of infectious disease and increase asthma and allergy symptoms. The Environmental Protection Agency reports the air inside structures, where people now spend approximately 90% of their time, can have contaminated air levels 10 to 100 times worse than EPA guidelines. Studies have shown that indoor air pollution can have direct health links to respiratory issues, pneumonia, sleep disorders, allergies, asthma, diabetes, and even cardiovascular issues.

The air cleaner market is very large with multiple levels. It encompasses an extremely wide range of products, designed to improve the quality of indoor air. In order to deal with the increasingly complex issue of indoor air quality, commercial enterprises must often purchase and use multiple solutions in their effort to provide a safe indoor environment. Including the products designed to freshen the air, surface sprays, portable air cleaners, filters for HVAC systems, other “specialty” solutions for the removal of smoke and airborne microorganisms, the total market for air cleaning products tops an estimated $6 billion per year.

As summarized below, the commercial market (estimated over $5 billion) for air purification products can be broken into three different target segments: (1) Medical; (2) Hospitality; and (3) Office. A listing of selected market opportunities within each segment can be found below. As awareness of poor indoor air quality and its impact on worker productivity grows, demand for products, which go beyond masking and filtration will continue to grow.

Commercial Market

| Medical | Hospitality | Office | ||

| Hospitals | Hotels | Commercial | ||

| Nursing Homes | Motels | Small Office | ||

| Medical Offices | Inns | Home Office | ||

| Dentists | Restaurants | Day Care | ||

| Clinics |

According to IMR Research, the consumer market is estimated to be in the millions of units and over $1 billion in sales. This market has been growing at an annual rate of 17% since 1992. Products utilizing HEPA or HEPA-type filters dominate the market, representing over two-thirds of unit sales.

| 5 |

About 80% of the unit volume sells at prices below $200. These products are typically sold through major mass merchants including home center outlets, specialty catalogs and on the Internet.

While representing slightly less than 35% of the unit sales, products retailing over $200 represent more than 50% of the dollar volume. This includes high-end HEPA air cleaners, electrostatic devices, and, previously, ozone generators. In addition to traditional retail outlets handling upper end products, they can also be found in specialty catalogs and sold on a direct-to-consumer basis. With the recent disappearance of a company that held a large market share in this sector of the market, a significant and growing market exists for premium price air cleaners.

Consumer and Sleep Market

Products utilizing filters (standard and HEPA) dominate the consumer market. Electrostatic products are starting to appear in a portable form. There are currently only two major brands in this market sector, so there is also a growing opportunity and demand for us to develop consumer targeted indoor air quality products.

Recent Clinical studies have shown that the biggest environmental factor affecting sleep related problems is Indoor Air Pollution. The Viratech UV-400 treats all forms of Indoor Air Pollution, and customers have raved about the device’s ability to significantly improve their quality of sleep. As further studies have shown that sleep disorders may be the “Smoking Gun” of health problems, significantly raising the risk of cancer, stroke, diabetes depression and obesity, our units ability to improve the quality and duration of sleep should give the Company distinct marketing advantages in gaining market share in the $25 billion market for sleep-related products. To this end, the Company has already begun distributing the Viratech UV-400 to 20 furniture stores, and recently signed an additional furniture coalition of an additional 400 stores.

Scientific Overview

We develop highly innovative germicidal air purification technology that disinfects indoor air by deactivating allergens and killing airborne pathogens including bacteria, viruses, and mold. Our flagship product, the ViraTech UV-400, utilizes high-intensity germicidal ultraviolet radiation (UV-C) inside a killing chamber that goes beyond filtering to trap and destroy harmful microbes. Extensive independent testing by EPA and FDA certified laboratories confirms the proprietary system captures and kills airborne bacteria, including Bacillus subtilis, Pseudomonas aeruginosa, and Staphylococcus aureus, at rates exceeding 99.2% on a first-pass basis. We recently concluded independent EPA/FDA certified laboratory tests, showing the rates of inactivation of a MS-2 virus surrogate were almost identical to our results on the inactivation of bacteria.

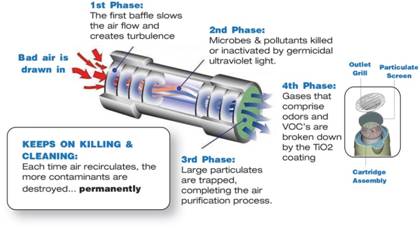

We combine our air purification technology (see diagram below), a sophisticated electronic ballast system with an electronic control module in a product which is totally effective yet user-friendly. The technology uses Ultraviolet C (UVC) in a proprietary, replaceable cartridge which provides 12 months of continuous operation, 24 hours a day, seven days a week. Inside the cartridge, pathogens and bacteria and, in fact, anything with a DNA is killed or neutralized. A gross particulate screen removes the remaining debris from the air stream. This sealed cartridge can be discarded in the regular trash at the end of its useful life.

During the actual purification process, air enters through the base of the purifier. A quiet fan, mounted at the unit’s lower end, pushes incoming contaminated air into the bottom of the replaceable cartridge. Inside, the air flows through the first of two inline baffle sets. The chamber, created by these baffles, slows the airflow and provides turbulence necessary for proper elimination of impurities. Next, the air stream enters the main chamber. Here, impurities in the air are bombarded with germicidal UVC, killing the bacteria and neutralizing the impurities. The interior of the kill chamber is coated with TiO2, which then reduces the concentrations of odors and Volatile Organic Compounds (VOC’s), by reacting with the gases that make contact with the interior surface of the chamber, thus breaking them down to the molecular level. After purification in the main chamber, the air stream passes through a second set of inline baffles, which refocuses the flow. It then exits the unit through a gross particulate screen. This screen removes neutralized pathogens and other particles left in the air stream. The final air stream contains only purified air.

| 6 |

Electronic controls insure that our product is completely effective during the life of the cartridge, allows performance monitoring of all major electrical components, simplifies operation and endows the units with appropriate safety features. An indicator light provides information regarding the state of the cartridge and indicates when a replacement is necessary.

Product

The ViraTech UV-400

The ViraTech UV-400 will be the lead product we produce and distribute. The ViraTech UV-400 portable model is 32 inches tall and uses a 6 inch diameter cartridge. The second product currently being designed is approximately 1/3 smaller and will use a 4.5 inch diameter cartridge (see rendering below). For the U.S. market, all portable models operate on 110/120 volt current and do not require any special wiring. In each product family, there is a design provision for 220/240 volt operation, which allows for adaptation to international standards or use in heavy-duty commercial applications. Each unit is designed to run continuously and will have a minimum active life of 5 years. Cartridge replacement is signaled when as the 9000 lamp hour mark approaches a green light on the front of the unit turns red, and when the useful life is hit, the unit shuts down until the cartridge is replaced. This ensures that the unit maintains adequate germicidal UV strength. Recommended replacement frequency assumes 24 hour per day, seven days a week usage. Because the units run with less resistance than traditional HEPA air filters, the fan is smaller, which results in a quieter product. Depending on room size, each unit will recycle air in a room at the rate of 5 to 10 times per hour.

Large and Small Portable Units

The Company has designed a revolutionary smaller unit, specifically for the residential marketplace. The unit will be approximately 27” high, and will combine the Company’s patented UV killing chamber technology with state of the art HEPA filter technology. Thus, the unit will “Kill and Trap.” The unit will be designed to be sold at a lower price point and will have independent EPA/FDA certified lab results to support every claim. The unit includes a molded handle and an aesthetically pleasing design, which will make it desirable for homes, hotel rooms, and offices. The Company has already been in contact with noted Allergy Specialists that are interested to get prototypes. The product will be sold on infomercials and through the Company’s other distribution channels. The product will be sold at a similar price point to the Sharper Image ‘Ion Breeze,” which sold almost 3 million units.

| 7 |

RX Air Product Line

On January 24, 2011, UV Flu Technology bought all of the inventory, assets, patents and trademarks of Rx Air, a 15 year old company based in Dallas, Texas, which manufactures a line of some of the world’s best HEPA based air purifiers. The Company’s product lines include:

RX-3000: The Rx-3000 is a hospital-grade HEPA air filter, which is used in almost 500 hospitals worldwide. It employs a patented 5-stage HEPA filtration design, germicidal UV irradiation system, with easy portability. It was co-designed with Bio-engineers from the Baylor Medical System, and is FDA cleared as a Class II Medical Device. It can cover spaces up to 1500 sq. ft, and can capture 99.999% of all airborne contaminants. The Company makes all its HEPA filters, which are among the finest in the world, and has Negative-Pressure attachments for hospitals that require Negative-Pressure.

CR-3000: Construction Grade version of the RX-3000

RX-4000 Prototype, metal cabinet wall-mounted commercial version of the RX-3000

RX-4500: Large commercial version of the RX-3000, which can cover hospital and casino spaces up to 10,000 sq. ft.

RX-6500: Bio-terrorism version of the above unit.

RX Air Plus: Unique system which combines 2 FDA cleared medical devices, the RX-3000, and two Viratech UV-400’s, to form the world’s most cost-effective air filtration system. Covers spaces up to 2,000 sq. ft. and removes 99.999% of all airborne contaminants, while killing 99.3% of all organic airborne contaminants, such as bacteria.

Customers

We currently have units in operation in a large number of hotels around the United States. Our units are also in numerous hair and nail salons, pet kennels, test labs, and over 500 hospitals worldwide, including the Baylor Healthcare System, Kaiser Permanente, the George Washington University Hospital, Providence Medical Center, and the University Medical Center. The Company’s products are in a number of restaurants, casinos, and military installations, as well.

Competition

Awareness of the effects of poor indoor air quality continues to grow and will push customers to look for more efficacious products. We believe that companies currently supplying air purification products to commercial accounts will be looking for additional products to sell and new sources of on-going revenue. We believe our ViraTech UV-400 product represents a significant opportunity to distributors for first sales as well as the on-going replacement cartridge sales volume into a growing installed user base.

| 8 |

Our products compete broadly with other current companies offering air purification products, including companies that offer UV air purification products. Honeywell was one of the best-known brand names in the commercial segment of the market. 3M Corporation purchased the commercial air treatment division of Honeywell and now markets their product line. In the consumer market segment, we compete with Honeywell, IQ Air, Duracraft, and Enviracaire brands, all of which compete at the middle and upper-middle price points with HEPA-based products and are offered by Kaz, Incorporated. Kaz purchased Honeywell’s consumer products division and continues to market product under the existing brand names along with a wide variety of other brands. Recently, Alpine Industries left the consumer segment of the market, leaving an opening for new and existing companies to assume Alpine’s market share. Hunter and Blue Air also make competing products.

These products are in direct competition with our products for market share. We have made comparisons of competitive air masking and filtration products to determine the extent to which these competitive products achieve their advertising claims. We believe we are one of the few companies that publish laboratory reports of our products performance capabilities. Based upon these comparisons, we do not believe there is any existing product which can provide safe, effective operation and still deliver high levels of purification against four forms of airborne contaminants (molds, spores, viruses, and bacteria). At one end of the product spectrum, the market includes the replaceable air freshening devices found in restrooms that are intended to mask lavatory and other odors. While masking odors, these products are not capable of attacking the source of the odor. The products also require frequent and costly replacement.

The predominant middle market air cleansing product forms are HEPA type air cleaners and filtration devices built into HVAC systems. Filtration products have some effectiveness against airborne particulates, but they do little to combat odors or pollutants like smoke, bacteria and viruses. Many of these filtering systems are out-of-date. They all require regular filter replacement and maintenance, which ultimately impacts their level of effectiveness. Changing the filter requires wearing protective clothing and a breathing device. Filters connected to central HVAC systems represent significant sales potential and costs to customers because of the sizable installed base of such systems.

At the high end of the spectrum are custom-designed air purification devices, which include large freestanding germicidal UV or ozone generating machines. These machines, which represent a very small portion of the market, are expensive (from $1,000 to $10,000 per unit). Since design and technology of custom units exposes the environment to the UV radiation or ozone, to be effective either (1) they require evacuation of a room or house to run safely at high concentrations of ozone or risk of eye damage to the UV lamp or (2) their performance against airborne contaminants is relatively poor.

Research and Development

Our research and development activities are focused principally on the development of new products that serve the air purification market and on significant upgrades to our existing products. We have completed the design of our second product, a smaller, lower cost version of the ViraTech UV-400. We expect to begin shipping the new model into commercial accounts before year-end 2013. We have also developed a metal, wall mounted commercial version of the RX-3000, called the RX-4000, for International and Commercial markets, where floor space is at a premium.

| 9 |

Manufacturing

Our manufacturing strategy is to utilize high quality, low cost contract manufacturers to provide the routine production of our products. We will outsource the manufacture of the majority of our products. We are currently looking at options for expanding our current production capacity.

Quality Control

Our quality strategy emphasizes rigorous internal and independent laboratory testing to maintain the highest levels of quality control for our products. To insure that the proper style and feature set were identified, a number of potential design combinations were developed. These initial designs were presented to consumers in special triad focus group session and played a major role in selection of the final design. These groups also helped to identify the message, which will be used when we begin our public relations and consumer advertising programs.

In order to eliminate any potential product liability issues, extensive testing has been done with existing prototypes. This testing confirms that all products meet worldwide electrical and safety standards. Separately, each electrical component to be used will be certified by its manufacturer as meeting ETL and/or UL standards.

Our quality system has been created to be harmonized with national and international standards and is focused to ensure it is appropriate for the specific devices we manufacture. Our corporate quality policies govern the methods used in, and the facilities and controls used for, the design, manufacture, packaging, labeling, storage, installation, and servicing of all finished devices intended for human use. These requirements are intended to ensure that finished devices will be safe and effective and otherwise in compliance with the Federal Food, Drug, and Cosmetic Act and other governmental agencies.

In order to validate the efficacy of our technology, we conducted numerous tests at independent, FDA certified laboratories between 1996 and 2007. We will continue to conduct similar tests in the future.

Independent EPA and FDA certified laboratory testing (results below) confirms the system captures and kills airborne bacteria, including Bacillus subtilis, Pseudomonas aeruginosa, and Staphylococcus aureus. The Company recently announced that additional testing was performed at the same certified test facility showing rates of inactivation for a MS-2 virus surrogate comparable to the results shown with bacteria.

NorthEast Laboratories Test Results on the ViraTech UV-400 Unit

| Microbe |

Population Before |

Population After |

Inactivation % |

Average % |

k cm2/μW -s |

Effective Dose μW- s/cm2 | ||||||

| Bacillus subtilis | 420 | <1 | 99.76 | 99.71 | 0.001686 | 3583 | ||||||

| 300 | <1 | 99.67 | 3383 | |||||||||

| Pseudomonas | 8370 | 29 | 99.65 | 99.72 | 0.002375 | 2385 | ||||||

| Aeruginosa | 140,000 | 300 | 99.79 | 2588 | ||||||||

| Klebsiella pneumoniae | 19,000 | 79 | 99.58 | 99.10 | 0.000548 | 10005 | ||||||

| 20,360 | 280 | 98.62 | 7822 | |||||||||

| Staphylococcus aureus | 600 | 7 | 98.83 | 99.30 | 0.003475 | 1281 | ||||||

| 16,000 | 36 | 99.78 | 1754 | |||||||||

| Effective Mean UV Dose | 4100 | |||||||||||

| UVGI Rating Value (URV) | 15 |

Note: Results for Bacillus represent a minimum.

Source: Northeast Laboratories, Inc. 129 Mill Street Berlin, CT 06037

| 10 |

Regulation

Our products are subject to regulation by numerous government agencies, including the FDA and comparable foreign agencies. To varying degrees, each of these agencies requires us to comply with laws and regulations governing the development, testing, manufacturing, labeling, marketing, distribution, installation and servicing of our research, investigational, and commercially-distributed medical devices. These international, national, state, and local agencies set the legal requirements for ensuring our products are safe and effective. Virtually every activity associated with the manufacture and sale of our products are scrutinized on a defined basis and failure to implement and maintain a quality management system could subject us to civil and criminal penalties.

Our ViraTech UV-400 product was issued by the FDA as a Class II medical device in November 2008. FDA clearance to sell our product as a Class II medical device provides invaluable credibility in the marketplace. By granting a listing, the FDA indicates it has reviewed all aspects of a product, including efficacy of the technology, independent test results and product safety to insure that the product complies with our claims. Few air purification products are listed by the FDA, and it is extremely important that we expend the resources necessary to maintain this listing as a Class II medical device with the FDA. The Company has recently concluded independent lab tests, which show the rates of inactivation on a MS-2 virus surrogate were comparable to the results shown with bacteria. Although the Company makes no claims for the inactivation of viruses, it plans on submitting the results for further FDA evaluation.

Because Class II devices have a lower potential safety risk to the patient, user, or caregiver, a full premarket analysis are not required for a Class II device. A premarket notification, known as a 510(k) submission, is required to demonstrate that the device is as safe and effective as a substantially equivalent medical device that has been legally marketed in the U.S. prior to May 29, 1976. Once the FDA has notified us that the product file has been cleared, the medical device may be marketed and distributed in the U.S. Some products that have minimal risk to the intended user are deemed by the FDA as exempt from the FDA approval or clearance process.

Failure to comply with applicable FDA requirements can result in fines, injunctions, civil penalties, recall, or seizure of products, total or partial suspension of production, or loss of distribution rights. It may also include the refusal of the FDA to grant approval of a PMA or clearance of a 510(k). Actions by the FDA may also include withdrawal of marketing clearances and possibly criminal prosecution. Such actions, if taken by the FDA, could have a material adverse effect on our business, financial condition, and results of operation.

Internationally, we will be required to comply with a multitude of other regulatory requirements similar to those of the FDA before we are legally able to market and sell our products in such international markets.

Environmental Laws

We do not manufacture the products that we sell and are therefore not subject to environmental laws that regulate the manufacture of products. The plants that manufacture our products may be subject to environmental regulations and will have to comply with such regulations in order to deliver marketable products to us. We may be required to comply with national and international environmental regulations related to shipping, storage and disposal of our products, and our quality management system will ensure that we are in compliance with all relevant environmental laws.

Patents and Proprietary Rights

We own the rights to U.S. Patent No. 6939397 with 43 claims covering innovative removable cartridge, housing, UV chamber, UV radiation source, and baffle technology. We also, through our RX Air subsidiary, own the rights to U.S. Patent No. 3837700, which covers air cleaning units containing an air filter, UV lights, and a photocatalytic filter. We also own a number of trademarks.

While a patent has been issued, we realize that (a) we will benefit from patents issued only if we are able to market our products in sufficient quantities of which there is no assurance; (b) substitutes for these patented items, if not already in existence, may be developed; (c) the granting of a patent is not a determination of the validity of a patent, such validity can be attacked in litigation or we or owner of the patent may be forced to institute legal proceedings to enforce validity; and (d) the costs of such litigation, if any, could be substantial and could adversely affect us.

| 11 |

Backlog

We currently have no backlog of orders.

Employees

As of September 30, 2012, we had three, full-time employees, and 2 part-time employees, although we engage contractors as needed, and each of our officers and directors devotes a portion of his and her time to the affairs of our Company.

Where you can find more information

We are required to file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other information with the Securities and Exchange Commission (the “SEC”). The public can obtain copies of these materials by visiting the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549, by calling the SEC at 1-800-732-0330, or by accessing the SEC’s website at http://www.sec.gov. In addition, as soon as reasonably practicable after these materials are filed with or furnished to the SEC, we will make copies available to the public free of charge through our website, http://www.uvflutech.com. The information on our website is not incorporated into, and is not part of, this annual report.

ITEM 1A. RISK FACTORS

With the exception of historical facts stated herein, the matters discussed in this report on Form 10-K are “forward looking” statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. Such “forward looking” statements include, but are not necessarily limited to statements regarding anticipated levels of future revenues and earnings from the operations of the Company, projected costs and expenses related to our operations, liquidity, capital resources, and availability of future equity capital on commercially reasonable terms. Factors that could cause actual results to differ materially are discussed below. We disclaim any intent or obligation to publicly update these “forward looking” statements, whether as a result of new information, future events, or otherwise.

An investment in our common stock is subject to risks inherent to our business. The material risks and uncertainties that management believes affect us are described below. Before making an investment decision, you should carefully consider the risks and uncertainties described below together with all of the other information included or incorporated by reference in this report. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that management is not aware of or focused on or that management currently deems immaterial may also impair our business operations. This report is qualified in its entirety by these risk factors.

If any of the following risks actually occur, our financial condition and results of operations could be materially and adversely affected. If this were to happen, the value of our common stock could decline significantly, and you could lose all or part of your investment.

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We have a limited operating history. As such, our historical operating results may not provide a meaningful basis for evaluating our business, financial performance and prospects. Accordingly, you should not rely on our results of operations for any prior periods as an indication of our future performance. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

We cannot accurately predict future revenues or profitability in the emerging market for air purifiers.

The market for ultra violet indoor air purifiers is rapidly evolving. As is typical for a rapidly evolving industry, demand and market acceptance for recently introduced products are subject to a high level of uncertainty. Moreover, since the market for our products is evolving, it is difficult to predict the future growth rate, if any, and size of this market.

| 12 |

Because of our lack of an operating history and the emerging nature of the markets in which we compete, we are is unable to accurately forecast our revenues or our profitability. The market for our products and the long-term acceptance of our products are uncertain, and our ability to attract and retain qualified personnel with industry expertise, particularly sales and marketing personnel, is uncertain. To the extent we are unsuccessful in increasing revenues, we may be required to appropriately adjust spending to compensate for any unexpected revenue shortfall, or to reduce our operating expenses, causing us to forego potential revenue generating activities, either of which could have a material adverse effect on our business, results of operations and financial condition.

We have incurred losses in prior periods and may incur losses in the future.

We incurred net losses of $821,681 for our fiscal year ended September 30, 2012. As of September 30, 2012, we had an accumulated deficit of $2,365,766. We have not achieved profitability in any period, and we expect to continue to incur net losses for the foreseeable future. Should we continue to incur net losses in future periods, we may not be able to increase the number of employees or our investment in capital equipment, sales and marketing programs and research and development in accordance with present plans. Continuation of net losses may also require us to secure additional financing sooner than expected. Such financing may not be available in sufficient amounts, or on terms acceptable to us and may dilute existing shareholders.

We will require additional capital in the future in order to maintain and expand our operations. Failure to obtain required capital would adversely affect our business.

Until such time as we become profitable, we will be required to obtain additional financing or capital investments in order to maintain and expand our operations and take advantage of future business opportunities. Obtaining additional financing will be subject to, among other factors, market conditions, industry trends, investor sentiment and investor acceptance of our business plan and management. These factors may make the timing, amount, terms and conditions of additional financing unattractive or unavailable to us. There are no assurances that we will be able to raise cash from equity or debt financing efforts or that, even if raised, such cash would be sufficient to satisfy our anticipated capital requirements. Further, there is no assurance concerning the terms on which such capital might be available. Failure to obtain financing sufficient to meet our anticipated capital requirements could have a material adverse effect on our business, operating results and financial condition.

If our products do not achieve greater market acceptance, or if alternative brands are developed and gain market traction, our business would be adversely affected.

Our success is dependent upon the successful development and marketing of our products. Our future success depends on increased market acceptance of our air purifier product lines. The air purification community may not embrace our product line. Acceptance of our products will depend on several factors, including cost, product effectiveness, convenience, strategic partnerships and reliability. We also cannot be sure that our business model will gain wide acceptance among retailers or the air purifier community. If the market fails to continue to develop, or develops more slowly than we expect, our business, results of operations and financial condition will be adversely affected. Moreover, if new air purifier brands are developed, our prospective products and current technologies could become less competitive or obsolete. Any of these factors could have a material and adverse impact on our growth and profitability.

The markets in which we operate are very competitive, and many of our competitors and potential competitors are larger, more established and better capitalized than we are.

Although air purification technology is a rapidly emerging technology, the market for these products is highly competitive and we expect that competition will continue to intensify. Our products compete broadly with other current companies offering air purification technology, including companies that offer UV air purification technology, such as 3M Corporation and Sears. These products compete directly with the products offered by us.

Many competitors have longer operating histories, larger customer bases, and greater financial, research and development, technical, marketing and sales, and personnel resources than we have. Given their capital resources, the larger companies with whom we compete or may compete in the future, are in a better position to substantially increase their manufacturing capacity, research and development efforts or to withstand any significant reduction in orders by customers in our markets. Such larger companies typically have broader and more diverse product lines and market focus and thus are not as susceptible to downturns in a particular market. In addition, some of our competitors have been in operation much longer than we have been and therefore may have more longstanding and established relationships with current and potential customers.

| 13 |

Because we are small and do not have much capital, we must limit our activities. Our relative lack of capital and resources will adversely affect our ability to compete with large entities that market air purifier products. We compete against other air purifier manufacturers and retailers, some of which sell their products globally, and some of these providers have considerably greater resources and abilities than we have. These competitors may have greater marketing and sales capacity, established sales and distribution networks, significant goodwill and global name recognition. Furthermore, it may become necessary for us to reduce our prices in response to competition. A reduction in prices of our products could adversely affect our revenues and profitability.

In addition, other entities not currently offering products similar to us may enter the market. Any delays in the general market acceptance of our products may harm our competitive position. Any such delay would allow our competitors additional time to improve their service or product offerings, and provide time for new competitors to develop. Increased competition may result in pricing pressures, reduced operating margins and loss of market share, which could have an adverse effect on our business, operating results and financial condition.

Inability of our officers and directors to manage the growth of the business may limit our success.

We expect to grow as we execute or business strategy. Rapid growth would place a significant strain on our management and operational resources. In addition, we expect the demands on our infrastructure and technical support resources to grow along with our customer base, and if we are successful in implementing our marketing strategy, it could experience difficulties responding to demand for our products and technical support in a timely manner and in accordance with market expectations. These demands may require the addition of new management personnel or the development of additional expertise by existing management personnel. There can be no assurance that our networks, procedures or controls will be adequate to support our operations or that management will be able to keep pace with such growth. Failure to manage growth effectively could have a material adverse effect on our business, operating results and financial condition.

As we expand, management will be faced with new challenges due to increases in operating expenses and risks related to expansion.

As our business grows and expands, we will spend substantial financial and other resources on developing and introducing new products and expanding our sales and marketing organization, strategic relationships and operating infrastructure. If our business and revenues grow, we expect that our cost of revenues, sales and marketing expenses, general and administrative expenses, operations and customer support expenses will increase.

If we fail to integrate our recent acquisitions with our operations, our business could suffer.

We recently acquired air purification technology and products from AmAirpure, Inc., and in the future we may acquire more air purification technologies, businesses or assets. The integration of acquired businesses, technologies or assets requires significant effort and entails risks. We may find it difficult to integrate operations of acquired businesses as personnel may leave and licensees, distributors or suppliers may terminate their arrangements or demand amended terms to these arrangements. Additionally, our management may have their attention diverted while trying to integrate businesses or assets that may be acquired. If we are not able to successfully integrate any businesses or assets that we acquire, we may not realize the anticipated benefits of these acquisitions.

Our success depends on our ability to capitalize on our strategic relationships and partnerships with suppliers, distributors, purchasers and users of our products.

We will rely on strategic relationships with third parties to expand our distribution channels and to undertake joint product development and marketing efforts. Our ability to increase sales depends on marketing our products through new and existing strategic relationships. We intend to partner with established existing suppliers and distributors in order to reach target markets such as the medical, healthcare, hospitality, food service and lodging markets. The termination of one or more of our strategic relationships may have a material adverse effect on our business, operating results and financial condition.

| 14 |

Our intellectual property may not protect our products, and/or our products may infringe on the intellectual property rights of third parties.

We regard our trademarks, trade secrets and similar intellectual property as critical to our success and attempt to protect such property with registered and common law trademarks and copyrights, restrictions on disclosure and other actions to forestall infringement. Despite precautions implemented by us, unauthorized third parties may copy certain portions of our products or reverse engineer or obtain and use information regarded by us as proprietary. We have secured one patent in the United States, have filed an application for an additional patent, and may seek additional patents in the future. We do not know if a patent will issue on the patent application or whether any future patent applications will be issued with the scope of the claims sought by us, or whether any patents received by us will be challenged or invalidated. In addition, many other organizations are engaged in research and product development efforts that may overlap with our products. Such organizations may currently have, or may obtain in the future, legally blocking proprietary rights, including patent rights, in one or more products or methods under development or consideration by us. These rights may prevent us from commercializing products, or may require us to obtain a license from the organizations to use the technology. We may not be able to obtain any such licenses that may be required on reasonable financial terms, if at all, and cannot be sure that the patents underlying any such licenses will be valid or enforceable. The laws of some foreign countries do not protect proprietary rights to the same extent as the laws of the United States. Our means of protecting our proprietary rights in the United States or abroad may not be adequate and competitors may independently develop similar technology and products. Third parties may infringe or misappropriate our copyright, trademarks and similar proprietary rights. In addition, other parties may assert infringement claims against us. We cannot be certain that our products do not infringe issued patents that may relate to our products. We may be subject to legal proceedings and claims from time to time in the ordinary course of business, including claims of alleged infringement of the trademarks and other intellectual property rights of third parties. Intellectual property litigation is expensive and time consuming and may divert management’s attention away from running our business which may have a material adverse effect on our business, operating results and financial condition.

The value of our technology may be vulnerable to the discovery of unknown technological defects.

Our products depend on complex technology. Complex technology often contains defects, particularly when first introduced or when new versions are released. Although we conduct extensive testing, there is a possibility that technology defects may not be detected until after the product has been released. Although we have not experienced any material technology defects to date, it is possible that despite testing, defects may occur in the products. The defects may result in damage to our reputation or increase costs, cause us to lose revenue or delay market acceptance or divert our development resources, any of which may have a material adverse effect on our business, operating results and financial condition.

Government and private insurance plans may not adequately reimburse patients for our products, which could result in reductions in sales or selling prices for our products.

Our ability to sell our products will depend in some part on the extent to which reimbursement for the cost of our products will be available from government health administration authorities, private health insurers and other organizations. In November 2008, the U.S. Food and Drug Administration (“FDA”) cleared our ViraTech UV-400 product as a Class II medical device, and we believe that certain purchasers of our product may generally qualify for reimbursement of some of the costs of purchasing our product, subject to the terms and conditions of their insurance plan or Medicare or Medicaid. Third party payers such as insurance companies are increasingly challenging the prices charged for medical products and can, without notice, deny coverage for treatments that may include the use of our products. Therefore, even if a product is cleared for marketing, we cannot be assured that reimbursement will be allowed for the product, that the reimbursement amount will be adequate or, that the reimbursement amount, even if initially adequate, will not subsequently be reduced. Additionally, future legislation or regulations concerning the healthcare industry or third party or governmental coverage and reimbursement, particularly legislation or regulation limiting consumers’ reimbursement rights, may harm our business.

As we develop new products, those products will generally not qualify for reimbursement, if at all, until they are cleared for marketing and until they are approved for reimbursement under policies of insurance, Medicare and Medicaid. We do not file claims and bill governmental programs or other third party payers directly for reimbursement for our products. However, we are still subject to laws and regulations relating to governmental reimbursement programs, particularly Medicaid and Medicare.

Failure to comply with anti-kickback and fraud regulations could result in substantial penalties and changes in our business operations.

The federal Anti-Kickback Law prohibits persons from knowingly and willfully soliciting, receiving, offering or providing remuneration, directly or indirectly, to induce either the referral of an individual, or the furnishing, recommending or arranging for a good or service, for which payment may be made under a federal healthcare program such as the Medicare and Medicaid programs. The U.S. government has interpreted this law broadly to apply to the marketing and sales activities of manufacturers and distributors like us. Many states and other governments have adopted laws similar to the federal Anti-Kickback Law. We are also subject to other federal and state fraud laws applicable to payment from any third party payer. These laws prohibit persons from knowingly and willfully filing false claims or executing a scheme to defraud any healthcare benefit program, including private third party payers. These laws may apply to manufacturers and distributors who provide information on coverage, coding, and reimbursement of their products to persons who do bill third party payers. Any violation of these laws and regulations could result in civil and criminal penalties (including fines), increased legal expenses and exclusions from governmental reimbursement programs, all of which could have a material adverse effect upon our business, financial conditions and results of operations.

| 15 |

Complying with Food and Drug Administration, or FDA, and other regulations is an expensive and time-consuming process, and any failure to comply could have a materially adverse effect on our business, financial condition, or results of operations.

Based on the intended use of some of our products, our products can be subject to significant federal government regulation. Those regulations could restrict the sale and/or marketing of some of our products. The manufacture, packaging, labeling, advertising, promotion, distribution, and sale of our anti-microbial products are subject to regulation by federal and state governmental agencies in the United States and other countries, including the FDA and the U.S. Federal Trade Commission (“FTC”). We note that failure to comply with FDA regulations can result in adverse governmental enforcement action including civil and criminal action, injunctions, recalls, seizures and fines. Any action of this type by the FDA may materially adversely affect our ability to market our products.

Likewise, failure to comply with FTC rules and standards could result in significant fines, injunctions, cease and desist orders, advertising limitations, and a variety of other enforcement sanctions available to the FTC. FTC would take action if it deemed advertising to be false or misleading. In particular, representations made about our products must be backed by ”competent and reliable scientific evidence” sufficient to support the claims made for the product. FTC would deem the failure of such an advertisement or labeling to be backed by that kind of evidence false FTC and the dissemination of it to be deemed an unfair or deceptive practice. Any enforcement action by the FTC could materially adversely affect our ability to market our products.

We cannot predict the nature of any future laws, regulations, interpretations, or applications, nor can we determine what effect additional governmental regulations or administrative orders, when and if promulgated, would have on our business. They could include, however, requirements for the redesign of our products, the recall or discontinuance of certain products, additional record keeping and reporting, expanded documentation of the scientific support or performance of certain products, and/or changes in labels and advertising. Any of these requirements could have a material adverse effect on the company.

Product sales, introductions or modifications may be delayed or canceled as a result of FDA regulations or similar foreign regulations, which could cause our sales and profits to decline.

Before we can market or sell a new medical device in the United States, we must obtain FDA clearance, which can be a lengthy and time-consuming process and thus very costly. We will have to receive clearance from the FDA to market our products in the United States under Section 510(k) of the Federal Food, Drug, and Cosmetic Act or our products must be found to be exempt from the Section 510(k) clearance process.

Any new product introduction or existing product modification could be subjected to a lengthier, more rigorous FDA examination process. For example, in certain cases we may need to conduct clinical trials of a new product before submitting a 510(k) notice. Additionally, we may be required to obtain premarket approvals for our products. The requirements of these more rigorous processes could delay product introductions and increase the costs associated with FDA compliance. Marketing and sale of our products outside the United States are also subject to regulatory clearances and approvals, and if we fail to obtain these regulatory approvals, our sales could suffer.

We cannot assure you that any new products we develop will receive required regulatory approvals from U.S. or foreign regulatory agencies.

We are subject to substantial regulation related to quality standards applicable to our manufacturing and quality processes. Our failure to comply with these standards could have an adverse effect on our business, financial condition, or results of operations.

The FDA regulates the approval, manufacturing, and sales and marketing of our products in the U.S. Although we outsource the manufacture of our products and do not currently manufacture any products currently, our manufacturers may be required to register with the FDA and may be subject to periodic inspection by the FDA for compliance with the FDA’s Quality System Regulation (“QSR”) requirements, which require manufacturers of medical devices to adhere to certain regulations, including testing, quality control and documentation procedures. In addition, the federal Medical Device Reporting regulations require our manufacturers to provide information to the FDA whenever there is evidence that reasonably suggests that a device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute to a death or serious injury. Compliance with applicable regulatory requirements is subject to continual review and is rigorously monitored through periodic inspections by the FDA. Failure to comply with current governmental regulations and quality assurance guidelines could lead to temporary manufacturing shutdowns, product recalls or related field actions, product shortages or delays in product manufacturing. Efficacy or safety concerns, an increase in trends of adverse events in the marketplace, and/or manufacturing quality issues with respect to our products could lead to product recalls or related field actions, withdrawals, and/or declining sales.

| 16 |

Our profitability and success is subject to risks associated with potential general economic downturn.

Recently, the general health of the U.S. economy has been relatively weakened substantially, a consequence of which has been declining spending by individuals and companies. To the extent the general economic health of the U.S. continues to decline, or to the extent individuals or companies fear such a decline will continue, such individuals and companies may continue to reduce expenditures such as those for the products offered by us because such products may be considered dispensable items in a recession. A continued decline could delay decisions among certain of our customers to purchase our products or could delay decisions by prospective customers to make initial evaluations of our products. Such delays may have a material adverse effect on our business, operating results and financial condition.

A limited public trading market exists for our common stock, which makes it more difficult for our stockholders to sell their common stock in the public markets.

Although our common stock is quoted on the OTC Bulletin Board, or OTCBB, under the symbol “UVFT,” there is currently no active public trading market for our common stock. No assurance can be given that an active market will develop or that a stockholder will ever be able to liquidate our shares of common stock without considerable delay, if at all. Many brokerage firms may not be willing to effect transactions in our securities. Furthermore, our future stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, lack of available credit, interest rates or international currency fluctuations may adversely affect the future market price and liquidity of our common stock.

Our common stock may be subject to the penny stock rules which may make it more difficult to sell our common stock.

Because our common stock is not listed on any national securities exchange, trading in our common stock is also subject to the regulations regarding trading in “penny stocks,” which are those securities trading for less than $5.00 per share. The following is a list of the general restrictions on the sale of penny stocks:

| · | Before the sale of penny stock by a broker-dealer to a new purchaser, the broker-dealer must determine whether the purchaser is suitable to invest in penny stocks. To make that determination, a broker-dealer must obtain, from a prospective investor, information regarding the purchaser’s financial condition and investment experience and objectives. Subsequently, the broker-dealer must deliver to the purchaser a written statement setting forth the basis of the suitability finding and obtain the purchaser’s signature on such statement. |

| · | A broker-dealer must obtain from the purchaser an agreement to purchase the securities. This agreement must be obtained for every purchase until the purchaser becomes an “established customer.” A broker-dealer may not affect a purchase of a penny stock less than two business days after a broker-dealer sends such agreement to the purchaser. |

| · | The Securities Exchange Act of 1934, or the Exchange Act, requires that before effecting any transaction in any penny stock, a broker-dealer must provide the purchaser with a “risk disclosure document” that contains, among other things, a description of the penny stock market and how it functions and the risks associated with such investment. These disclosure rules are applicable to both purchases and sales by investors. |

| · | A dealer that sells penny stock must send to the purchaser, within ten days after the end of each calendar month, a written account statement including prescribed information relating to the security. |

These requirements can severely limit the liquidity of securities in the secondary market because few brokers or dealers are likely to be willing to undertake these compliance activities. As a result of our common stock not being listed on a national securities exchange and the rules and restrictions regarding penny stock transactions, an investor’s ability to sell to a third party and our ability to raise additional capital may be limited. We make no guarantee that our market-makers will continue to make a market in our common stock, or that any market for our common stock will continue.

| 17 |

We cannot guarantee that investors will be paid any dividends.

We have never declared or paid dividends on our common stock. We intend to retain earnings, if any, to support the development of our business and therefore do not anticipate paying cash dividends for the foreseeable future. Payment of future dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including current financial condition, operating results and current and anticipated cash needs.

Nevada law and our articles of incorporation authorize us to issue shares of stock, which shares may cause substantial dilution to our existing shareholders and/or have rights and preferences greater than our common stock.

Pursuant to our Articles of Incorporation, we have, as of the date of this Report, 75,000,000 shares of common stock authorized. As of the date of this Report, we have 52,361,763 shares of common stock issued and outstanding. As a result, our Board of Directors has the ability to issue a large number of additional shares of common stock without shareholder approval, which if issued could cause substantial dilution to our then shareholders.

We are subject to new corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business .

We face corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as new rules and regulations subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules and regulations continue to evolve and may become increasingly stringent in the future. We are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules and regulations is expected to remain substantial. We cannot assure you that we will be able to fully comply with these laws, rules and regulations that address corporate governance, internal control reporting and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition and the value of our securities.

If we are unable to successfully recruit qualified and experienced employees and personnel, we may not be able to execute our business plan.

Our ability to increase revenues will depend in large part on our ability to successfully recruit, train and retain sales marketing personnel. There can be no assurance that we will be able to find, attract and retain existing employees or that we will be able to find, attract and retain qualified personnel on acceptable terms. Competition for additional qualified personnel is intense and we may not be able to hire or retain personnel with relevant experience. Any delays or difficulties encountered by us in hiring or retaining qualified personnel may adversely affect our business, operating results and financial condition.

We are dependent on our key employees.

Our success depends to a significant extent upon the continued service of our senior management and key executives, including John J. Lennon, President, CEO and Chief Financial Officer. Our success depends on the skills, experience and performance of senior management and other key personnel, many of whom have also worked together for only a short period of time. We do not have long-term employment agreements with any member of senior management or other key personnel. Our success also depends on our ability to recruit, train or retain qualified personnel. The loss of the services of any of the key members of senior management, other key personnel, or our inability to recruit, train or retain senior management or key personnel may have a material adverse effect on our business, operating results and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

We currently maintain our registered offices at 1694 Falmouth Road #125, Centerville, MA 02632-2933, and we have 2 other facilities. Our corporate office is located at 411 Main Street, Bldg. #5, Yarmouth Port, Ma, 02675, and our RX Air Manufacturing facility is located at 3323 Garden Brook Dive, Farmers Branch, TX 75234.

| 18 |

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. RESERVED.

Not applicable.

| 19 |

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information

Since inception, there has been a limited trading market for our common stock. Our common stock is listed on the OTC Bulletin Board (“OTCBB”) exchange under the symbol UVFT.OB. Our common stock has been listed on the OTCBB since November 12, 2009. Prior to that time, there was no public market for our common stock. The table below lists the high and low closing prices per share of our common stock since our stock was first traded , as quoted on OTCBB.

| Fiscal 2012 | High | Low | ||||||

| First Quarter | $ | .19 | $ | .03 | ||||

| Second Quarter | $ | .15 | $ | .08 | ||||

| Third Quarter | $ | .15 | $ | .08 | ||||

| Fourth Quarter | $ | .10 | $ | .04 | ||||

Trading in our common stock has been sporadic and the quotations set forth above are not necessarily indicative of actual market conditions. All prices reflect inter-dealer prices without retail mark-up, mark-down, or commission and may not necessarily reflect actual transactions.

Stockholders

As of December 19, 2012, we had 52,361,763 shares of common stock outstanding held by 1189 shareholders.

Dividends

We have not paid dividends to date and do not anticipate paying any dividends in the foreseeable future. Our Board of Directors intends to follow a policy of retaining earnings, if any, to finance our growth. The declaration and payment of dividends in the future will be determined by our Board of Directors in light of conditions then existing, including our earnings, financial condition, capital requirements and other factors.

Securities Authorized For Issuance under Equity Compensation Plans

There are no securities authorized for issuance under any equity compensation plans during the fiscal year ended September 30, 2012.

Purchases of Equity Securities by the Issuer and Affiliated Purchases

There were no issuer purchases of our equity securities during the fiscal year ended September 30, 2012.

| ITEM 6. | SELECTED FINANCIAL DATA |

As a smaller reporting company, as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information required by this item.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included elsewhere in this Report. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward-looking statements are based upon estimates, forecasts, and assumptions that are inherently subject to significant business, economic, and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by us, or on our behalf. We disclaim any obligation to update forward-looking statements.

| 20 |

The discussion and financial statements contained herein are for our fiscal year ended September 30, 2012 and September 30, 2011. The following discussion regarding our financial statements should be read in conjunction with our financial statements included herewith.

Financial Condition as of September 30, 2012

We reported total current assets of $326,200 at September 30, 2012, consisting of accounts receivable, inventory and prepaids. Total current liabilities reported of $151,064 consisted of $54,857 in accounts payable and accrued liabilities and $96,207 in notes payable. We had a working capital $175,136 at September 30, 2012.

Net Loss decreased from $849,073 for the year ended September 30, 2011 to $821,681 for the year ended September 30, 2012.

We are currently a company focused in the air purification industry, and evaluating opportunities for expansion within that industry through acquisition or other strategic relationships.

Plan of Operation

Background

We were organized under the laws of the State of Nevada on April 4, 2006 under the name “Northwest Chariots, Inc.” and were engaged in the business of renting and selling electrically powered human transporters, like electric bicycles, chariots and quads. Subsequent to our fiscal year ended September 30, 2009, we decided to change our product mix to air purification products and to focus on the research, development, manufacturing and sales of air purification systems and products.

In furtherance of our business objectives, on November 12, 2009, we effected a 32-for-1 forward stock split of all our issued and outstanding shares of common stock, and we merged with our wholly-owned subsidiary, UV Flu Technologies, Inc., for the purposes of effecting a name change to “UV Flu Technologies, Inc.”