Attached files

| file | filename |

|---|---|

| 8-K - MAXWELL RESOURCES, INC. FORM 8-K FOR DECEMBER 26, 2012 - Maxwell Resources, Inc. | maxwell8k122612.htm |

Exhibit 3.1

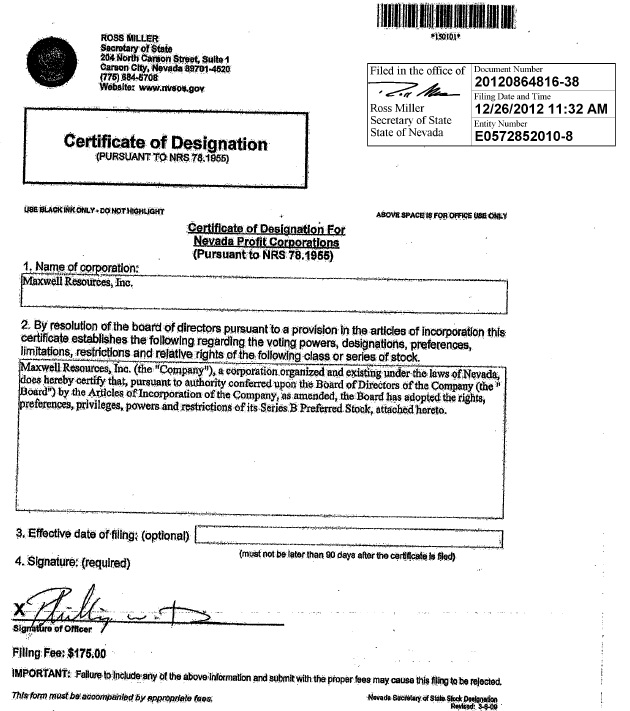

ROSS MILLER Secretary of State 204 NOrth Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 884-5708 website: www.nvsos.gov

CERTIFICATE OF DESIGNATION (PURSUANT TO NRS 78.1955) filed in the office of ROSS MILLER SECRETARY OF STATE STATE OF NAVADA DOCUMENT NUMBER 20120864816-385 FILING DATE AND TIME 12/26/12 11:32 AM ENTITY NUMBER E0572852010-8

Certificate of Designation for Nevada Profit Corporations (pursuant to NRS 78.1955) 1. Name of Corporation: Maxwell Resources, Inc. 2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock. Maxwell Resources, Inc. (the "Company"), a corporation organized and existing u nder the laws of Nevada, does hereby certify that, pursuant to authority conferred upon the Board of Directors of the Company (the "Board") by the Articles of Incorporation of the Company, as amended, the Board has adopted the rights, preferences, privileges, powers and restrictions of its Series B Preferred Stock, attached hereto. 3. EFFECTIVE DATE OF FILING (OPTIONAL) 4. SIGNATURE (REQUIRED) //s/ Phillip W. Dias SIGNATURE OF OFFICER FILING FEE$175.00

CERTIFICATE OF DESIGNATION OF THE RELATIVE RIGHTS

AND

PREFERENCES

OF THE

SERIES B PREFERRED STOCK

OF

MAXWELL RESOURCES, INC.

The undersigned, Chief Executive Officer of Maxwell Resources, Inc., a Nevada corporation (the “Corporation”), DOES HEREBY CERTIFY that pursuant to the authority conferred upon the Board of Directors by the Articles of Incorporation of the Corporation, as amended, the following resolution creating a series of Series B Preferred Stock, was duly adopted by the Board of Directors of the Corporation by unanimous written consent on December 21, 2012:

RESOLVED, that pursuant to the authority expressly granted to and vested in the Board of Directors of the Corporation by provisions of the Amended and Restated Articles of Incorporation of the Corporation, as amended (the “Articles of Incorporation”), there hereby is created out of the shares of Preferred Stock, par value $.001 per share, of the Corporation authorized in Article IV of the Articles of Incorporation (the “Preferred Stock”), a series of Preferred Stock of the Corporation, to be named “Series B Preferred Stock,” consisting of Two Million Four Hundred Thousand (2,400,000) shares, which series shall have the following designations, powers, preferences and relative and other special rights and the following qualifications, limitations and restrictions:

A. Designation and Rank.

(a) Designation. The designation of such series of the Preferred Stock shall be the Series B Preferred Stock, par value $.001 per share (the “Series B Preferred Stock”). The maximum number of shares of Series B Preferred Stock shall be Two Million Four Hundred Thousand (2,400,000) Shares.

(b) Rank. The Series B Preferred Stock shall rank prior to the common stock, par value $.001 per share (the “Common Stock”), and to all other classes and series of equity securities of the Corporation which by its terms does not rank on a parity with or senior to the Series B Preferred Stock (“Junior Stock”).

(c) Stated Value. Each share of Series B Preferred Stock shall have a stated value of $.01 per share (as appropriately adjusted to reflect any stock split, combination or other similar recapitalization with respect to the Series B Preferred Stock, the “Stated Value”).

B. Voting.

Voting Rights. Holders of Series B Preferred Stock (a) have the right to vote on all matters submitted to the holders of the Corporation’s common stock for a vote, or with respect to which the holders of the Corporation’s common stock shall be entitled, by law or otherwise, to vote, (b) shall vote as a single class together with the common stock, and (c) in the aggregate shall be entitled to cast that number of votes equal to the number of shares of Series B Preferred Stock owned by such Holder multiplied by 15.

The record holders of the Series B Preferred Stock shall be entitled to the same notice of any regular or special meeting of the stockholders as may or shall be given to holders of common shares entitled to vote at such meetings. No corporate actions requiring majority stockholder approval or consent may be submitted to a vote of common stockholders which in any way precludes the holders of the Series B Preferred Stock from exercising its voting or consent rights as though it is or was a common stockholder.

All notices required to be delivered hereunder to the holders of the Series B Preferred Stock shall be sent by facsimile transmission (such notice shall be deemed received by the recipient on the first business day following transmission and electronic confirmation of receipt), prepaid overnight courier or first class or registered or certified mail, return receipt requested, with postage prepaid thereon, to the holder at holder’s last address shown on the records of the Corporation for the Series B Preferred Stock.

C. Redemption.

(a) Upon the date eighteen (18) months after the date of issuance of the Series B Preferred Stock, the Corporation shall redeem the outstanding Series B Preferred Stock at a purchase price equal to One Dollar ($1.00) (the “Redemption Price”).

(b) Redemption Notice. The Corporation shall send written notice of the mandatory redemption (the “Redemption Notice”) to each holder of record of Series B Preferred Stock not less than forty (40) days prior to each redemption date (the “Redemption Date”). Each Redemption Notice shall state:

(i) the number of shares of Series B Preferred Stock held by the holder that the Corporation shall redeem on the Redemption Date specified in the Redemption Notice;

(ii) the Redemption Date and the Redemption Price;

(iii) that the holder is to surrender to the Corporation, in the manner and at the place designated, his, her or its certificate or certificates representing the shares of Series B Preferred Stock to be redeemed.

(c) Surrender of Certificates; Payment. On or before the applicable Redemption Date, each holder of shares of Series B Preferred Stock to be redeemed on such Redemption Date, shall surrender the certificate or certificates representing such shares (or, if such registered holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate) to the Corporation, in the manner and at the place designated in the Redemption Notice, and thereupon the Redemption Price for such shares shall be payable to the order of the person whose name appears on such certificate or certificates as the owner thereof.

(d) Rights Subsequent to Redemption. If the Redemption Notice shall have been duly given, and if on the applicable Redemption Date the Redemption Price payable upon redemption of the shares of Series B Preferred Stock to be redeemed on such Redemption Date is paid or tendered for payment or deposited with an independent payment agent so as to be available therefor in a timely manner, then notwithstanding that the certificates evidencing any of the shares of Series B Preferred Stock so called for redemption shall not have been surrendered, and all rights with respect to such shares shall forthwith after the Redemption Date terminate, except only the right of the holders to receive the Redemption Price without interest upon surrender of their certificate or certificates therefor.

D. Lost or Stolen Certificates. Upon receipt by the Corporation of evidence satisfactory to the Corporation of the loss, theft, destruction or mutilation of any Preferred Stock Certificates representing the shares of Series B Preferred Stock, and, in the case of loss, theft or destruction, of any indemnification undertaking by the holder to the Corporation and, in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Corporation shall execute and deliver new preferred stock certificate(s) of like tenor and date.

E. Specific Shall Not Limit General; Construction. No specific provision contained in this Certificate of Designation shall limit or modify any more general provision contained herein. This Certificate of Designation shall be deemed to be jointly drafted by the Corporation and all initial purchasers of the Series B Preferred Stock and shall not be construed against any person as the drafter hereof.

F. Failure or Indulgence Not Waiver. No failure or delay on the part of a holder of Series B Preferred Stock in the exercise of any power, right or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege preclude other or further exercise thereof or of any other right, power or privilege.

IN WITNESS WHEREOF, the undersigned has executed and subscribed this Certificate and does affirm the foregoing as true this 21st day of December, 2012.

|

MAXWELL RESOURCES, INC.

By: /s/ Phillip W. Dias

Name: Phillip Dias

Title: President, CEO and Principal Financial Officer

|

|||