Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nielsen CO B.V. | d456510d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - Nielsen CO B.V. | d456510dex21.htm |

| EX-99.1 - JOINT PRESS RELEASE ISSUED BY ARBITRON INC. AND NIELSEN HOLDINGS N.V. - Nielsen CO B.V. | d456510dex991.htm |

Nielsen Announces Agreement to Acquire Arbitron

December 18, 2012

Measuring More Media Together

Exhibit 99.2 |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 2

Forward Looking Statements and Other Information

This written communication includes information that could constitute forward-looking statements

made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of

1995. These statements may be identified by words such as “will”, “expect”,

“should”, “could”, “shall” and similar expressions. These statements are subject to risks and uncertainties concerning

Nielsen's proposed acquisition of Arbitron, Arbitron's expected financial performance, as well as

Arbitron's strategic and operational plans and actual results and events could differ

materially from what presently is expected. The potential risks and uncertainties include

the possibility that the transaction will not close or that the closing may be delayed; the possibility that Arbitron may be unable

to obtain stockholder approval as required for the transaction or that the other conditions to the

closing of the transaction may not be satisfied; the transaction may involve unexpected costs,

liabilities or delays; the outcome of any legal proceedings related to the transaction; the

occurrence of any event, change or other circumstances that could give rise to the termination of the transaction

agreement; general economic conditions; conditions in the markets Nielsen and Arbitron are engaged in;

behavior of customers, suppliers and competitors (including their reaction to the transaction);

technological developments; as well as legal and regulatory rules affecting Nielsen’s and

Arbitron’s business and specific risk factors discussed in other releases and public filings made by

Nielsen and Arbitron (including the their respective filings with the Securities and Exchange

Commission (the “SEC”)). This list of factors is not intended to be

exhaustive. Such forward-looking statements only speak as of the date of this written communication,

and we assume no obligation to update any written or oral forward-looking statement made by us or

on our behalf as a result of new information, future events, or other factors.

Forward

Looking

Statements:

Additional

Information

and

Where

to

Find

It:

Arbitron and its directors and executive officers and other members of management and employees are

potential participants in the solicitation of proxies from Arbitron’s stockholders in

respect of the proposed transaction. Information regarding Arbitron’s directors and executive officers is available in Arbitron’s

proxy statement for its 2012 annual meeting of stockholders, filed with the SEC on April 12,

2012. Additional information regarding the interests of such potential participants in

the proposed transaction will be included in the proxy statement to be filed with the SEC in

connection with the proposed transaction.

In

connection

with

the

proposed

acquisition

by

Nielsen

of

Arbitron

pursuant

to

the

terms

of

an

Agreement

and

Plan

of

Merger

by

and

among

Arbitron,

Nielsen,

and

a

wholly-owned

subsidiary

of

Nielsen,

Arbitron

will

file

a

proxy

statement

with

the SEC. Investors are urged to read the proxy statement (including all amendments and supplements

to it) because it will contain

important

information.

Investors

may

obtain

free

copies

of

the

proxy

statement

when

it

becomes

available,

as

well

as other

filings containing information about Arbitron, without charge, at the SEC’s Internet site

(www.sec.gov). These documents may also

be

obtained

for

free

from

Arbitron’s

Investor

Relations

web

site

(http://www.Arbitron.com/investors)

or

by

directing

a

request

to

Arbitron

at:

Arbitron,

9705

Patuxent

Woods

Drive,

Columbia,

Maryland

21046. |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 3

Nielsen Strategy

WATCH

BUY

BUY + WATCH

Measure more ways

that consumers spend

time with media

Expand coverage of

consumer purchase

behavior globally

Understand how media

consumption relates to

purchase behavior |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 4

Different markets and distinct capabilities

supporting syndicated measurement

Complementary

Assets and Scale

Provides local clients linkage to retail and

purchasing impact to improve ROI

Addresses unmeasured areas: streaming

audio, out-of-home, multicultural audiences

Advertising

Effectiveness

Digital and

Representative

Measurement

Expands global measurement of consumer

behavior

Broader

Platform

Long-term opportunity to measure listening

audiences in non-U.S. markets

Global

Expansion

Transaction Rationale |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 5

Expanded Measurement of Global Consumers

Broader

Measurement

Platform

TV/Video

Digital/Social

Radio/Music

What

consumers

watch

Retail

E-commerce

What

consumers

buy

(1)

Nielsen

Cross-Platform

Report:

Based

on

Total

US

Population,

Persons

2+

for

TV

and

Online,

(Home

and

Work)

13+

for

Mobile;

2 Qtr

2012;

Arbitron

Radio

Today,

2012

Measuring More Media

Consumption

TV

Radio

Total

Average Time Spent per Person per Day

1

~5 hrs

7 hrs

~2 hrs

nd |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 6

Complementary Businesses with Great Histories

and Future Opportunities

Nielsen

•

Global leader in measurement and analytics

for what consumers buy and watch

•

Founded by Arthur C. Nielsen Sr. in 1923

•

Retail sales and market share in 100+

countries; TV, digital audience and

cross-platform measurement

•

Advertising effectiveness solutions for

TV/video/digital/social

Arbitron

•

Leader in measurement of listening

audiences at home, at work, out of home

•

Founded by Jim Seiler in 1949

•

Local radio ratings, network and national

radio audience measurement plus

consumer information and software services

•

Innovator in measurement technologies |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 7

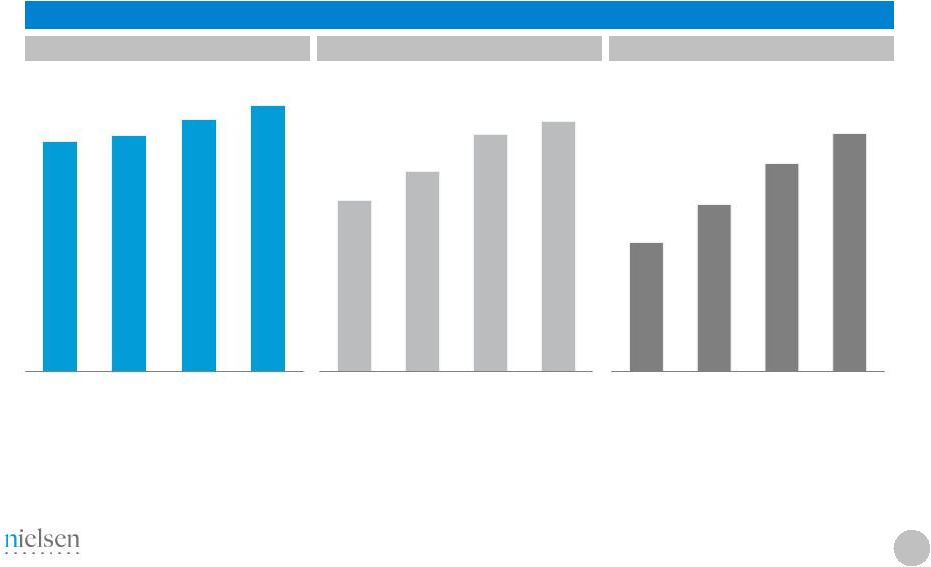

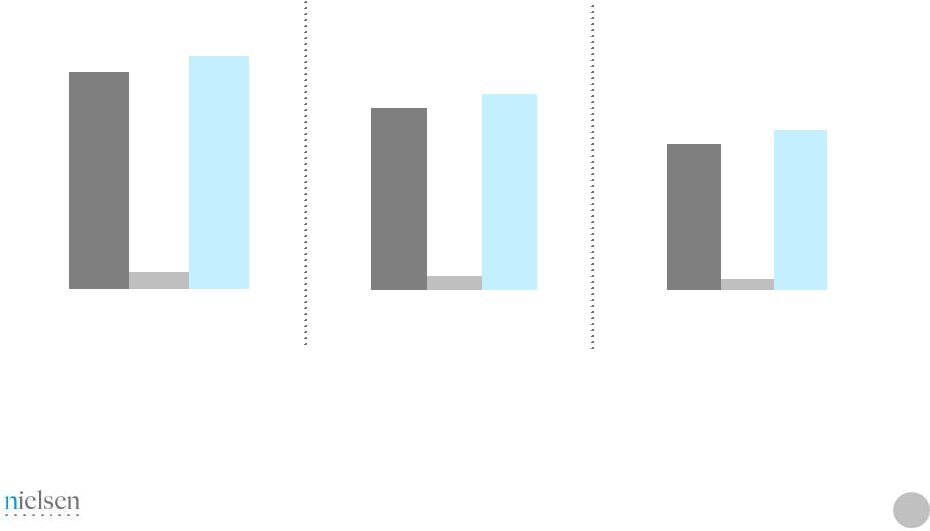

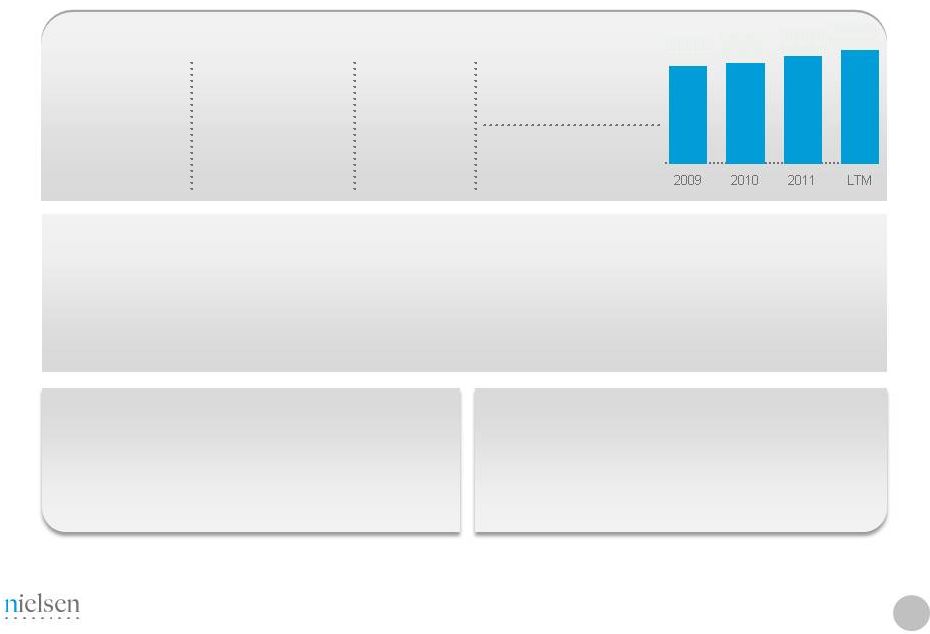

Arbitron Financial Summary

Financial summary ($millions)

Cash Flow

(1)

As reported in Arbitron Inc. public filings

(2)

Defined as EBITDA less Capex

Revenue

Revenue Growth

High Margin

Strong Cash Flow

$385

$395

$422

$445

2009

2010

2011

LTM 9/30/12

$86

$100

$119

$126

2009

2010

2011

LTM 9/30/12

$54

$70

$87

$100

2009

2010

2011

LTM 9/30/12

EBITDA

1

1

2 |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 8

Robust and scalable integrated

technology platform

Strong cash flow enables

investments for growth

Measuring more media

consumption

More ways to understand and

monetize audiences

•

Streaming audio

•

Out-of-home

•

Deeper measurement of

U.S. multicultural audiences

Complementary products,

cultures and market fit

Bridging different markets

Expertise in providing clients with

consumer measurement and insights

Global footprint

Links media consumption to retail

and purchasing impact ROI

Enables broader music industry

insights

Benefits of scale

Improving local

advertising effectiveness

Transaction Benefits Both Radio and TV Clients

and Their Respective Advertisers

Client

Benefits |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 9

Complementary Business Fundamentals

Embedded in daily

client operations

Mission-critical

measurement

and analytics

Enabling

client growth

Unique consumer

information and insights

Industry-strength,

scalable solutions

Syndicated services

Opportunity for

global growth

Global footprint

Nielsen

Arbitron |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 10

Transaction Highlights

Purchase

Price

$48 per share: $1.3 billion equity value

26% premium to 12/17/12 close

Consideration

100% cash consideration with committed financing

Pro Forma

Financials

1

Pro Forma Revenue: $6.0 billion

Pro Forma Adj. EBITDA: $1.7 billion

EPS Impact

2

Expect $0.13 accretive impact to Adj. EPS 12 months after

close, $0.19 accretive impact to Adj. EPS 24 months after close

Synergies

Expected annualized savings of at least $20MM

Transaction

Close

Transaction close subject to customary closing conditions and

regulatory review

(1)

Pro forma is sum of Nielsen and Arbitron financials for last twelve months as of 9/30/12, adjusted

for joint venture consolidation. Pro forma figures exclude transaction costs, estimates for

purchase accounting adjustments and synergy benefits. See Appendix for reconciliation to GAAP financial measures

(2)

Excludes transaction costs and estimates for purchase accounting adjustments

|

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 11

Similar Financial Models

Mid-single digit

compounding growth

Consistent growth

Majority of revenues

under contract

Recurring revenue

Syndicated volume

drives margin expansion

Operating leverage

Scale benefits with

low capital intensity

Strong free cash flow

conversion

Nielsen

Arbitron |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 12

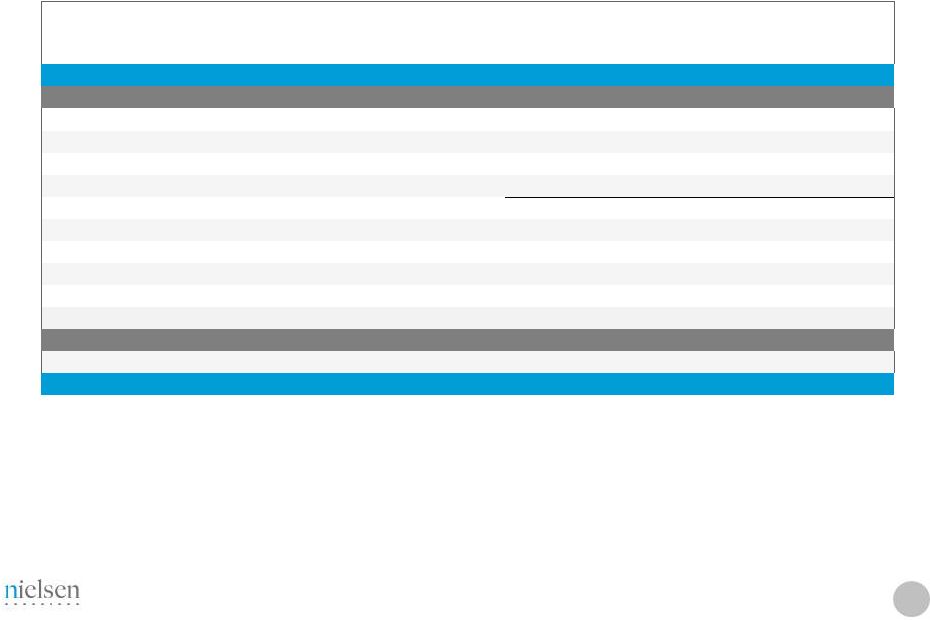

Pro Forma

1

Financials for Last Twelve Months

ended 9/30/12

($ millions)

LTM Revenue

LTM

Adj.

EBITDA

NLSN

ARB

Pro Forma

LTM Cash Flow

(EBITDA –

CAPEX)

Growth

Rate

NLSN

ARB

(1)

Pro forma is sum of Nielsen and Arbitron financials for last twelve months as of

9/30/12, adjusted for pro forma impact of interest, tax and joint venture

consolidation. Pro forma figures exclude transaction costs, estimates for purchase

accounting adjustments and synergy benefits (2)

See Appendix for reconciliation to GAAP financial measures

(3)

Based on constant currency growth

6.7%

4.2%

7.7%

4.5%

6.4%

9.2%

$5,569

$445

$6,043

$1,577

$131

$1,723

Pro Forma

NLSN

ARB

$1,198

$105

$1,318

Pro Forma

2.8%

16.7%

3.9%

2

3 |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 13

Financial Impact for Nielsen

Key Considerations

•

Modest increase to leverage

•

Accretive to Adj. EPS

1

$0.13

to

Adj.

EPS

in

12

months

$0.19

to

Adj.

EPS

in

24

months

•

Financing commitment supports

$1.3B purchase amount

•

Enhances plan for future return

of capital strategy

(1)

Pro forma figures exclude transaction costs and estimates for purchase accounting

adjustments See Appendix for reconciliation to GAAP financial measures

|

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 14

Transaction Advances Our Long-Term Objectives

Robust platforms supporting global solutions

Global scale

Enable greater marketing efficiency

Broader measurement of rapidly changing

consumer behavior

Advertising

ROI

Expanding

coverage |

15

Q&A |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 Appendix |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 17

2011 Financials

1

ADJ. EBITDA

$1,546 MM

ADJ. EPS

$1.61

YTD 9/30/12

revenue growth

2

4.1%

Snapshot of Nielsen’s Business

Value proposition

Providing

independent third-party measurement and market share to consumer packaged

goods and media industries globally

Delivering

critical

media

and

marketing

information,

analytics

and

industry

expertise

about

what

consumers watch and what consumers buy on a global and local basis

Clients

Consumer packaged goods manufacturers and

retailers, media content providers and

distributors, digital players and online publishers,

ad agencies

Key Facts

Clients and operations in 100 countries

~70% of business in long-term contracts

CAGR

2

(‘09-’11) 5.8%

REVENUE

$5,532 MM

$4,808

$5,126

$5,532

$5,569

($ millions)

(1)

See Nielsen reconciliation to GAAP financial

measures (2)

Based on constant currency growth

9/30/12

2009

2010

2011

LTM |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 18

2011 Financials

1

Snapshot of Arbitron’s Business

Clients

Media, mobile, advertising agencies and

advertisers

Key Facts

Primarily U.S.-based business

77% revenues from local ratings services

EBITDA

$119 MM

EPS

$1.93

YTD 9/30/12

revenue growth

7.6%

CAGR

(‘09-’11) 4.7%

Value proposition

Serving

the

media—primarily

radio

Measuring

network

and

local

market

radio

audiences

in

U.S.;

retail,

media

and

product

patterns

of U.S. consumers; mobile audience measurement and analytics; software

services REVENUE

$422 MM

($ millions)

(1)

As reported in Arbitron Inc. public filings

$385

$395

$422

$445

9/30/12 |

| Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 19

Certain Non-GAAP measures

Overview of Non-GAAP Presentations

Nielsen consistently uses the below non-GAAP financial measures to evaluate the

results of our operations. We believe that the presentation of these

non-GAAP measures provides useful information to investors regarding

financial and business trends related to our results of operations and that when

this non-GAAP financial information is viewed with our GAAP financial

information, investors are provided with a more meaningful understanding of our

ongoing operating performance. None of the non-GAAP measures presented should

be considered as an alternative to net income or loss, operating income or

loss, cash flows from operating activities or any other performance measures

of operating performance or liquidity derived in accordance with GAAP. These non-GAAP

measures have important limitations as analytical tools and should not be

considered in isolation or as substitutes for an analysis of our results as

reported under GAAP. Constant Currency Presentation

We

evaluate

our

results

of

operations

on

both

an

as

reported

and

a

constant

currency

basis.

The

constant

currency

presentation, which is a non-GAAP measure, excludes the impact of fluctuations

in foreign currency exchange rates. We believe providing constant currency

information provides valuable supplemental information regarding our results

of operations, consistent with how we evaluate our performance. We calculate constant currency

percentages

by

converting

our

prior-period

local

currency

financial

results

using

the

current

period

exchange

rates

and comparing these adjusted amounts to our current period reported results.

Net Debt and Net Debt Leverage Ratio

The net debt leverage ratio is defined as net debt as of the balance sheet date

divided by Adjusted EBITDA for the twelve months then ended. Net debt and

the net debt leverage ratio are not presentations made in accordance with

GAAP, and our use of these terms may vary from the use of similarly-titled

measures by others in our industry due to the potential inconsistencies in

the method of calculation and differences due to items subject to interpretation. |

| Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 20

Certain Non-GAAP measures (cont’d)

Adjusted EBITDA

We define Adjusted EBITDA as net income or loss from our consolidated statements of

operations before interest income and

expense,

income

taxes,

depreciation

and

amortization,

restructuring

charges,

goodwill

and

intangible

asset

impairment charges, stock compensation expense and other non-operating items

from our consolidated statements of operations as well as certain other

items considered unusual or non-recurring in nature. Adjusted EBITDA is not a

presentation made in accordance with GAAP, and our use of the term Adjusted EBITDA

may vary from the use of similarly-titled measures by others in our

industry due to the potential inconsistencies in the method of calculation and

differences due to items subject to interpretation. We use Adjusted EBITDA to

consistently measure our performance from period to period both at the

consolidated level as well as within our operating segments, to evaluate and fund

incentive compensation programs and to compare our results to those of our

competitors. Adjusted Net Income

We define Adjusted Net Income as net income or loss from our consolidated

statements of operations before income taxes, depreciation and amortization

associated with acquired tangible and intangible assets, restructuring charges,

goodwill and intangible asset impairment charges, other non-operating items

from our consolidated statements of operations and certain other items

considered unusual or non-recurring in nature, reduced by cash paid for income

taxes. Also excluded from Adjusted Net Income is interest expense attributable to

the mandatory convertible subordinated bonds due 2013. We also describe

Adjusted Net Income per share as Adjusted EPS. Last Twelve Months

LTM refers to the last twelve months in the period ended September 30, 2012. For

example, Nielsen LTM ended September 30, 2012 revenue represents $5,532 for

the year ended December 31, 2011, less $4,111 for the nine months ended

September 30, 2011 plus $4,148 for the nine months ended September 30, 2012. All other financial information

presented for the LTM ended September 30, 2012 follows the same approach.

|

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 Pro Forma Reconciliation for LTM 9/30/12

Last Twelve Months ended 9/30/12

NLSN

ARB

Eliminations/

Adjustments

(a)

Total

Revenue

$ 5,569

$ 445

$ 29

$ 6,043

Net income / (loss)

$ 329

$ 58

$ (41)

$ 346

Income from discontinued operations, net

(2)

--

--

(2)

Interest expense, net

424

1

69

494

Provision / (Benefit) for income taxes

187

36

(28)

195

Depreciation and amortization

521

31

--

552

EBITDA

1,459

126

--

1,585

Equity in net (income) / loss of affiliates

(5)

(7)

15

3

Other non-operating (income) / expense, net

(1)

3

--

2

Restructuring charges

85

--

--

85

Stock-based compensation expense

33

9

--

42

Other items

(b)

6

--

--

6

Adjusted EBITDA

$ 1,577

$ 131

$ 15

$ 1,723

Capital Expenditures

(379)

(26)

--

(405)

Cash flow (EBITDA –

Capex)

$ 1,198

$ 105

$ 15

$ 1,318

($ in millions)

(a)

Eliminations

and

adjustments

made

to

reflect

pro

forma

interest,

tax

and

joint

venture

consolidation

impact

(b)

Other items for Nielsen primarily consist of deal related fees.

21 |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 Nielsen Reconciliation to GAAP Financial Measures

(a) (b) (c) See footnotes on next page

Year ended

December 31

(Unaudited)

2011

Net income

$ 86

Income from discontinued operations, net

(1)

Interest expense, net

471

Provision for income taxes

22

Depreciation and amortization

529

EBITDA

1,107

Equity in net income of affiliates

(3)

Other

non-operating

expense,

net

(a)

219

Restructuring charges

84

Stock-based compensation expense

27

Other items

(b)

112

Adjusted EBITDA

$ 1,546

Interest expense, net

(471)

Depreciation and amortization

(529)

Depreciation and amortization of acquisition-related tangible and intangible

assets 182

Cash paid for income taxes

(132)

Stock-based compensation expense

(27)

Interest expense attributable to mandatory convertible bonds

21

Adjusted net income

$ 590

Adjusted

net

income

per

share

of

common

stock,

diluted

(c)

$1.61

($ in millions except per share amounts)

22 |

Copyright ©

2012 Nielsen Holdings N.V.

Nielsen and Arbitron Conference Call

December 18, 2012 Nielsen Reconciliation to GAAP Financial Measures

cont’d

(a)

Non-operating expense for twelve months ended December 31, 2011 reflects debt

extinguishment/pre-payment charges of $231M.

(b)

Other items primarily consist of Sponsor Advisory Fees (including termination

payments of $102 million for the full year ended December 31, 2011), costs

related to our initial public offering and other deal related fees. (c)

Adjusted Net Income per share of common stock presented on a diluted basis

includes potential common shares associated with stock-based

compensation plans that may have been considered anti-dilutive in accordance with

GAAP. The amount also includes the weighted-average amount of shares of common

stock convertible associated with the mandatory convertible bonds based

upon the average price of our common stock during the period.

Weighted-average shares of common stock outstanding as of

year end December 31, 2011, basic

352,469,181

Dilutive shares of common stock from

stock compensation plans

5,032,773

Shares of common stock convertible associated

with the mandatory convertible bonds

9,531,994

Weighted-average shares of common stock outstanding,

diluted

367,033,948

23 |

web

http://ir.nielsen.com

email

ir@nielsen.com

phone

+1.646.654.4602

@NielsenIR |