Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - HOME LOAN SERVICING SOLUTIONS, LTD. | d423417dex51.htm |

| EX-8.2 - EX-8.2 - HOME LOAN SERVICING SOLUTIONS, LTD. | d423417dex82.htm |

| EX-23.2 - EX-23.2 - HOME LOAN SERVICING SOLUTIONS, LTD. | d423417dex232.htm |

| EX-23.1 - EX-23.1 - HOME LOAN SERVICING SOLUTIONS, LTD. | d423417dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 18, 2012

Registration No. 333-184715

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1/A

(Amendment No. 2)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Home Loan Servicing Solutions, Ltd.

(Exact Name of Registrant As Specified in Its Charter)

| Cayman Islands | 6162 | 98-0683664 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Home Loan Servicing Solutions, Ltd.

c/o Intertrust Corporate Services (Cayman) Limited (formerly Walkers Corporate Services Limited)

190 Elgin Avenue

George Town, Grand Cayman KY1-9005

Cayman Islands

Telephone: +(345) 943-3100

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

C T Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

William C. Erbey

Home Loan Servicing Solutions, Ltd.

2002 Summit Boulevard, Sixth Floor

Atlanta, Georgia 30319

Telephone: (561) 682-7721

| Christopher S. Auguste, Esq. Kramer Levin Naftalis & Frankel LLP 1177 Avenue of the Americas New York, New York 10036 Telephone: (212) 715-9100 |

Danielle Carbone, Esq. Shearman & Sterling LLP 599 Lexington Avenue New York, New York 10022 Telephone: (212) 848-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ¨ |

Accelerated Filer ¨ | Non-Accelerated Filer x | Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2)(3) | ||

| Ordinary shares, par value $0.01 per share |

$480,000,000 | $65,472.00 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of additional shares that the underwriters have the option to purchase. |

| (2) | Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | Includes $47,740.00 previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December 18, 2012

PROSPECTUS

22,000,000 Ordinary Shares

We are offering ordinary shares. The public offering price of our ordinary shares is $ per share.

Our ordinary shares are listed for trading on The NASDAQ Global Select Market under the symbol “HLSS.” The last reported sale price of our ordinary shares on December 17, 2012 was $18.37 per share.

Investing in our ordinary shares involves risks that are described under “Risk Factors” beginning on page 21.

| Per Share | Total | |||

| Price to public |

$ | $ | ||

| Underwriting discounts and commissions |

$ | $ | ||

| Proceeds, before expenses, to us |

$ | $ |

We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional 3,300,000 ordinary shares from us, at the public offering price, less the underwriting discounts and commissions. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ and the total proceeds to us, before expenses, will be $ .

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to purchasers on or about , 2012.

| Wells Fargo Securities | Barclays | BofA Merrill Lynch | Citigroup | |||

| Keefe, Bruyette & Woods | Sterne Agee |

Prospectus dated , 2012.

Table of Contents

| Page | ||||

| 1 | ||||

| 21 | ||||

| 48 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| 55 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

60 | |||

| 98 | ||||

| 125 | ||||

| 132 | ||||

| 137 | ||||

| 138 | ||||

| 142 | ||||

| 142 | ||||

| 149 | ||||

| MATERIAL CAYMAN ISLANDS AND UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS |

150 | |||

| 155 | ||||

| 156 | ||||

| 165 | ||||

| 165 | ||||

| 165 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus and in any related free writing prospectus we prepare or authorize. Neither we nor the underwriters and their affiliates have authorized anyone to give you any other information. We do not, and the underwriters and their affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. We are offering to sell, and seeking offers to buy, our ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, or other earlier date stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our ordinary shares.

For investors outside of the United States: neither we nor any of the underwriters has done anything that would permit this offering outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our ordinary shares and the distribution of this prospectus outside of the United States.

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our ordinary shares, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included elsewhere in this prospectus. You should also consider, among other things, the matters described under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “The Business” appearing elsewhere in this prospectus. Unless otherwise stated, all references to “us,” “our,” “we,” the “Company” and similar designations refer to Home Loan Servicing Solutions, Ltd. and its consolidated subsidiaries.

Our Company

We are a Cayman Islands exempted company that acquires mortgage servicing assets consisting of mortgage servicing rights, rights to mortgage servicing rights, associated servicing advances and other related assets. We launched our operations on March 5, 2012 using the proceeds from our initial public offering and a concurrent private placement with our founder and Chairman of our Board of Directors to acquire mortgage servicing assets relating to a portfolio of subprime and Alt-A mortgage loans with an unpaid principal balance of $15.2 billion from Ocwen Loan Servicing, LLC, or “Ocwen Loan Servicing.” As of March 31, 2012, our total assets and total liabilities were $546 million and $368 million, respectively. As of September 30, 2012, our total assets and total liabilities increased to $1,703 million and $1,285 million, respectively. Since completing our initial acquisition of mortgage servicing assets, we have purchased additional mortgage servicing assets from Ocwen Loan Servicing, and as of September 30, 2012, we had acquired mortgage servicing assets with an unpaid principal balance of approximately $48.0 billion from Ocwen Loan Servicing.

We do not originate or purchase mortgage loans, and as a result we are not subject to the risk of loss related to the origination or ownership of mortgage loans. We have engaged Ocwen Loan Servicing, a high quality residential mortgage loan servicer, to service the mortgage loans underlying our mortgage servicing assets and therefore have not and do not intend to develop our own mortgage servicing platform. While we have only completed two full quarters of operations, we believe that our revenue and expense structure is predictable and will generate a stable income stream and that the quality of our assets is and will continue to be strong. We believe this combination will accomplish our primary objective of delivering attractive and consistent risk-adjusted returns to our shareholders. We intend to distribute at least 90% of our net income over time to our shareholders in the form of a monthly cash dividend. In addition, unlike many income-oriented investment alternatives, we believe that our income stream and the valuation of our assets are not substantially correlated to movements in interest rates.

Our results of operations for the quarter ended September 30, 2012 reflect consistent earnings that were in line with our expectations.

We reported net income of $6.6 million, or $0.37 per ordinary share, for the third quarter of 2012. Our third quarter business performance highlights include the following:

| • | declaration of dividends of $0.10 per share per month totaling $5.9 million for the quarter. |

| • | receipt of net proceeds of $236.0 million in connection with our public offering of 16,387,500 shares at $15.25 per ordinary share that closed on September 12, 2012. The net proceeds from the offering were used to acquire mortgage servicing assets from Ocwen Loan Servicing with an unpaid principal balance of $27.8 billion. |

| • | completion of the acquisition of mortgage servicing assets with an unpaid principal balance of $2.1 billion from Ocwen Loan Servicing on August 1, 2012. |

1

Table of Contents

On September 13, 2012, we amended and restated the servicing advance facility agreements that we originally entered into simultaneously with the closing of our initial public offering and the Initial Ocwen Purchase to (i) add Wells Fargo Securities, LLC as an administrative agent, (ii) create a master trust (the “Trust”) that can issue multiple series of notes with varying maturity dates and credit ratings ranging from AAA to BBB, including 2a-7 money market eligible notes and medium term notes and (iii) allow for deferred servicing fees to be included in the borrowing base as principal and interest advances for pooling and servicing agreements that meet certain conditions. This resulted in a reduced cost of our financing. The servicing advance facility agreements, as amended and restated, are referred to throughout this prospectus as the “Servicing Advance Facility Agreements.”

Our executive management team has extensive experience in the mortgage servicing industry and each of our executive managers was formerly in a senior management role at Ocwen. We believe our executive management team’s extensive experience provides us with the ability to assess the vital characteristics of the mortgage loans underlying the mortgage servicing assets we have acquired and may seek to acquire and evaluate the quality of our current and potential mortgage servicers. We believe this experience further enables us to accurately value mortgage servicing assets and better forecast future asset performance and servicing cash flows. In addition, our management team has demonstrated historical success in arranging cost-effective servicing advance financing through a variety of economic cycles. Under the terms of our professional services agreement with Ocwen, which we refer to as the “Ocwen Professional Services Agreement” throughout this prospectus, the Company and its management team provide Ocwen valuation and analysis services for mortgage servicing rights, advance financing management, treasury management, legal services and other similar services. See “The Business—Description of Ocwen Professional Services Agreement” for a detailed description of the Ocwen Professional Services Agreement. None of our officers or employees holds positions at Ocwen or its affiliates. Nonetheless, because of our management team’s past or current relationships with Ocwen, conflicts of interest could occur with respect to the services performed under the Ocwen Professional Services Agreement or the other agreements the Company has with Ocwen. Matters that could give rise to conflicts include pricing, valuation and quality of assets or services that Ocwen and the Company purchase from one another, including Mortgage Servicing Assets (as defined below) or services under the Ocwen Professional Services Agreement. In addition, William C. Erbey, the Chairman of our Board of Directors, is the Chairman of the Board of Directors of Ocwen. See “Risk Factors—We could have conflicts of interest with Ocwen, and our officers and directors could have conflicts of interest due to their relationships with us and Ocwen, that could be resolved in a manner adverse to us” and “—We are highly dependent upon our senior management team” for a description of the risks associated with the Company providing services to Ocwen, and Ocwen providing services to the Company, under the Ocwen Professional Services Agreement and other agreements. We will seek to mitigate these potential conflicts through oversight by the independent members of our Board of Directors.

Our business strategy is focused on acquiring mortgage servicing rights. In many cases, however, the transfer of legal ownership of mortgage servicing rights requires the prior approval or consent of various third parties, including rating agencies. If the seller from whom we have agreed to purchase mortgage servicing rights has not obtained the necessary approvals and consents to transfer legal ownership of the mortgage servicing rights to us, we will instead seek to acquire the rights to receive the servicing fees that the current servicer is entitled to receive, and the current servicer will continue to service the mortgage loans and receive compensation from us for its servicing activities. We refer to these rights, along with the right to acquire legal ownership of the related mortgage servicing rights automatically upon obtaining the necessary approvals and consents to transfer the mortgage servicing rights, as “Rights to MSRs.” Acquiring Rights to MSRs results in the Company recording assets such as Notes Receivable—Rights to MSRs and match funded advances, and liabilities such as match funded liabilities. It also entitles us to collect the contractual servicing fees related to such Rights to MSRs, which are typically 50 basis points annually of the unpaid principal balance of the related mortgage loans. Servicing fees collected are reduced by the

2

Table of Contents

portion of fees paid to Ocwen, and the retained fees are further reduced by the amortization of the Notes Receivable—Rights to MSRs, to arrive at revenue or Interest Income—Notes Receivable—Rights to MSRs. This source of revenue allows us to pay operating expenses and other expenses such as interest expense on the match funded liability, and the income that remains is expected to compensate our investors for their investment. These balances are expected to grow in the future in periods where we are acquiring additional Mortgage Servicing Assets. In periods when we are not acquiring additional Mortgage Servicing Assets, these balances would likely decrease as the underlying mortgage loans are repaid. See “Management’s Discussion and Analysis—Primary Components of Income” and “The Business—Our Economic Model” for a complete description of our components of income and expenses.

Upon receipt of the necessary third party approvals and consents, the seller is obligated to transfer legal ownership of the mortgage servicing rights to us without any additional payment. Whether we acquire mortgage servicing rights or Rights to MSRs, we also acquire servicing advances and other associated assets. We do not believe that our business strategy or economic performance has been or will be materially affected by whether we directly own mortgage servicing rights or the related Rights to MSRs. All of our acquisitions of mortgage servicing assets to date have been structured as acquisitions of Rights to MSRs and we expect that any additional acquisitions of mortgage servicing assets will be structured in the same manner, at least in the near term.

Throughout this prospectus, when we refer to our “Mortgage Servicing Assets,” we are referring to the Rights to MSRs that we own and the mortgage servicing rights that we may acquire in the future, and when we refer to “Purchased Assets,” we are referring to the Mortgage Servicing Assets, together with the associated servicing advances and any other assets related to such Mortgage Servicing Assets that we have acquired. We refer to the mortgage servicing rights related to the Rights to MSRs that we have acquired and any mortgage servicing rights we may acquire in the future and which are or will be serviced by Ocwen Loan Servicing as the “Ocwen Mortgage Servicing Rights.”

We have not and do not intend to develop our own mortgage servicing platform but instead will rely on high quality third-party residential mortgage loan servicers. All of the Rights to MSRs that we have acquired to date have been acquired from, and are serviced by, Ocwen Loan Servicing. Ocwen Loan Servicing is a leader in the residential subprime and Alt-A mortgage servicing industry based on its historical servicing performance through a variety of real estate and economic cycles. Prior to the transfer of legal ownership of any Ocwen Mortgage Servicing Rights to us, Ocwen Loan Servicing will remain obligated to service the underlying mortgage loans and will remit to us the servicing and other related fees (excluding any ancillary income that Ocwen Loan Servicing will retain) it collects in each month related to the Rights to MSRs. Following the transfer of legal ownership of any Ocwen Mortgage Servicing Rights to us, Ocwen Loan Servicing will service the underlying mortgage loans on our behalf as subservicer, and we will receive the servicing and other related fees (excluding any ancillary income). As compensation for its servicing and subservicing activities, Ocwen Loan Servicing receives from us a monthly base fee initially equal to 12% of such recognized servicing fees collected each month. Ocwen Loan Servicing also earns a monthly performance-based incentive fee that fluctuates based on collections and servicing advance reduction criteria with respect to the underlying mortgage loans. We believe this arrangement aligns the interests of both companies. We will compensate Ocwen Loan Servicing for the services it performs for us prior to the transfer of legal ownership of the Ocwen Mortgage Servicing Rights to us. The method used to calculate the fees that we pay to Ocwen Loan Servicing under the Purchase Agreement with respect to the Rights to MSRs is the same as the method used to calculate the fees that we will pay to Ocwen Loan Servicing under the Subservicing Agreement with respect to any Ocwen Mortgage Servicing Rights that we subsequently acquire. As a result, the compensation to be paid to Ocwen Loan Servicing will not vary based on whether Ocwen Loan Servicing or we hold legal title to the underlying Ocwen Mortgage Servicing Rights.

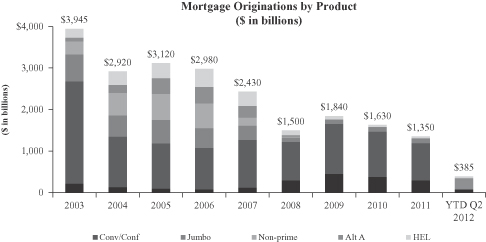

The assets we have purchased from Ocwen to date have pertained solely to subprime and Alt-A loans. This reflects the fact that the majority of the assets Ocwen owns pertain to servicing subprime and Alt-A

3

Table of Contents

loans. Additionally, the prepayment rate on subprime and Alt-A loans has demonstrated little correlation to interest rates in recent years which is a characteristic that we find attractive and which fits within our business strategy.

We intend to continue to acquire assets pertaining to subprime and Alt-A mortgage loans that were originated prior to 2008. Given the low volume of originations of subprime and Alt-A loans since 2007, at some point in the future we may be unable to acquire sufficient similar assets, which would likely cause us to reduce or not be able to pay dividends to our shareholders and we would reevaluate our long-term business strategy at such time. If we are unable to acquire sufficient assets meeting our investing criteria, we may return cash to shareholders in the form of increased dividends, a special dividend or share repurchases, the effect of which may be to reduce future earnings and dividends. See “Risk Factors—A significant increase in prepayment speeds would reduce the unpaid principal balance of the mortgage loans underlying our Mortgage Servicing Assets and could adversely affect our operating results” and “—We may be unable to maintain the unpaid principal balance of the mortgage loans underlying our Mortgage Servicing Assets at an adequate level, which may cause administrative expenses to increase relative to our equity base” for a description of risks associated with the acquisition of subprime and Alt-A mortgage loans.

We anticipate future growth through subsequent acquisitions of Mortgage Servicing Assets. As part of our strategy to acquire additional Mortgage Servicing Assets, we expect to acquire over time substantially all of Ocwen Loan Servicing’s remaining mortgage servicing rights relating to subprime and Alt-A mortgage loans, which had an unpaid principal balance of approximately $63.8 billion as of September 30, 2012. In addition, in connection with Ocwen’s announced acquisition of Homeward Residential Holdings, Inc. and Ocwen Loan Servicing’s announced acquisition of certain assets of Residential Capital, LLC, Ocwen and Ocwen Loan Servicing are anticipated to acquire additional rights to service mortgage loans with approximately $120.0 billion of unpaid principal balance that are similar to those in our current portfolio. We believe that Ocwen perceives that it has benefited from the transfer of Rights to MSRs to us in connection with our previous acquisition transactions. Although we cannot guarantee that future acquisition transactions will occur, we also believe that Ocwen will benefit from such transactions and therefore will continue to sell mortgage servicing assets to us in this manner which will allow us to maintain or grow the unpaid principal balance of our servicing portfolio.

We intend to continue to acquire additional similar mortgage servicing assets from Ocwen in the near term in two ways:

| • | In order to remain fully invested and to offset the impact of prepayments in our servicing portfolio, we expect to continue to utilize cash flow from operations in excess of our dividend to purchase mortgage servicing assets that are similar to our initial portfolio from Ocwen Loan Servicing under substantially similar terms. We refer to such transactions as “flow transactions.” We expect flow transactions to take place at regular intervals. Certain terms of such flow transactions, including the servicing incentive fee and advance ratio targets, will vary over time through these transactions. |

| • | In order to increase the scale of our business we will look for opportunities to issue additional equity in the form of ordinary shares to allow us to execute larger purchases of mortgage servicing assets similar to our initial portfolio from Ocwen under similar terms. We refer to such transactions as “follow on purchases.” These follow on purchases will be subject to equity market conditions and will likely require that additional advance financing capacity be arranged in advance or concurrent with each transaction in order to maintain leverage similar to our current level. |

Although we believe that competitive and regulatory dynamics in the mortgage servicing industry will present us with opportunities to acquire Mortgage Servicing Assets from banks, other financial institutions and independent mortgage servicers and we remain open to purchasing mortgage servicing assets from

4

Table of Contents

third parties other than Ocwen Loan Servicing, given the large amount of mortgage servicing assets remaining at Ocwen Loan Servicing, we do not view initiating purchases from other third parties as a near-term priority. The provisions of our Amended and Restated Memorandum and Articles of Association (“Articles of Association”) restrict our ability to issue and sell additional ordinary shares at a price below our then current net asset value per share without first obtaining the prior approval of holders of at least a majority of the outstanding ordinary shares voted with respect to such approval. Future sales of ordinary shares by us will dilute the ownership percentage of our then-existing shareholders, including shareholders that purchase in this offering.

We were incorporated as an exempted company in the Cayman Islands, which currently does not levy income taxes on individuals or companies. We expect to be treated as a passive foreign investment company (“PFIC”) under U.S. federal income tax laws. We intend to distribute at least 90% of our net income over time to our shareholders in the form of a monthly dividend that will primarily be based on projected annual earnings, although we are not required by law to do so. Payment of a monthly dividend is not a condition of our tax status, and our decision to pay this dividend is not expected to be impacted by any changes in our status for U.S. tax purposes. Except for our subsidiary that is taxed as a corporation for U.S. federal income tax purposes, we do not expect to be treated as engaged in a trade or business in the United States and thus do not expect to be subject to more than a nominal amount of U.S. federal income taxation.

Since the closing of our initial public offering, we paid monthly dividends of $0.10 per ordinary share through September 2012 (except during the month of March in which we paid a pro-rated amount of $0.08 per ordinary share), a dividend of $0.11 for October 2012 and a dividend of $0.12 for November 2012. On November 15, 2012, our Board of Directors increased the previously declared dividend for the months of November and December 2012 by $0.01 to $0.12 per ordinary share.

The following table sets forth the record and payment dates of the dividend that has been declared by our Board of Directors, but is unpaid, for the month of December 2012:

| Record Date |

Payment Date | Amount per Ordinary Share |

||||

| December 31, 2012 | January 10, 2013 | $ | 0.12 | |||

Our Board of Directors has the right to rescind declared, but unpaid dividends at any time prior to the applicable dividend payment date. See “Dividend Policy” and “Description of Share Capital.”

If we do not qualify as a PFIC, or if a shareholder does not make a QEF election if we do qualify as a PFIC, dividends paid out of our current or accumulated earnings and profits (other than excess distributions which are discussed in “Material Cayman Islands and United States Income Tax Considerations”) will be taxable as dividends for U.S. federal income tax purposes. Although our earnings and profits are calculated as of the end of the taxable year, we expect that all of our future dividends will be paid out of our current earnings. If we qualify as a PFIC, and a shareholder makes a QEF election, the shareholder will be taxable for U.S. federal income tax purposes on the shareholder’s pro rata portion of our earnings each year. In that case, the shareholder would not be taxed again when any previously taxed earnings are distributed to the shareholder. The tax basis in a shareholder’s shares will increase by any earnings the shareholder is taxed on, and decreased by any distributions of previously taxed earnings. See “Material Cayman Islands and United States Federal Income Tax Considerations.”

5

Table of Contents

Acquisitions of Mortgage Servicing Assets

The Initial Ocwen Purchase

On March 5, 2012, we consummated our initial acquisition of Mortgage Servicing Assets from Ocwen Loan Servicing (the “Initial Ocwen Purchase”). The Mortgage Servicing Assets that we purchased in connection with the Initial Ocwen Purchase were a portion of the assets acquired by Ocwen Loan Servicing when it acquired the U.S. subprime mortgage servicing business known as “HomEq Servicing” on September 1, 2010. The business acquired by Ocwen Loan Servicing included the mortgage servicing rights and associated servicing advances of HomEq Servicing, as well as the servicing platform based in Sacramento, California and Raleigh, North Carolina. The sellers were Barclays Bank PLC and Barclays Capital Real Estate Inc. (collectively, “Barclays”). The unpaid principal balance of the subprime and Alt-A mortgage loans underlying the mortgage servicing rights acquired in the Initial Ocwen Purchase was approximately $15.2 billion and the amount of associated servicing advances outstanding was approximately $413.4 million, in each case as of March 5, 2012. We funded the Initial Ocwen Purchase with a portion of the net proceeds from our initial public offering.

Pursuant to a master servicing rights purchase agreement between Ocwen Loan Servicing and HLSS Holdings, LLC, or “HLSS Holdings,” which we refer to as the “Purchase Agreement” throughout this prospectus, we purchased the following:

| • | the contractual right to receive the servicing fees (excluding any ancillary income) related to the initial Ocwen Mortgage Servicing Rights; |

| • | the contractual right to receive any investment earnings on the custodial accounts related to the initial Ocwen Mortgage Servicing Rights that Ocwen Loan Servicing receives pursuant to the related pooling and servicing agreements, which are the agreements that govern the packaging of mortgage loans into a pool, the servicing of such mortgage loans and the terms of the mortgage-backed securities issued by the securitization trust; |

| • | the right to automatically obtain legal ownership, without any additional payment to Ocwen Loan Servicing, of each Ocwen Mortgage Servicing Right upon the receipt of the necessary third party approvals and consents (this right, together with rights described in the bullet points above, constitute the “Rights to MSRs” with respect to the initial Ocwen Mortgage Servicing Rights); |

| • | the outstanding servicing advances associated with the related pooling and servicing agreements; and |

| • | other assets related to the foregoing (collectively, the foregoing represent the “Initial Purchased Assets”). |

Pursuant to a servicing advance facility, we also assumed a related match funded servicing advance financing facility from Ocwen Loan Servicing effective upon the closing of the Initial Ocwen Purchase.

At closing on March 5, 2012, we paid cash of $149.8 million to Ocwen for the estimated purchase price of the Initial Purchased Assets (net of assumed liabilities of $359.2 million), subject to certain closing adjustments. The purchase price for the Rights to MSRs was based on the value of such assets at the time we entered into the Purchase Agreement and the estimated outstanding unpaid principal balance of the underlying mortgage loans at closing. The purchase price for the associated servicing advances and other assets was equal to the net consolidated book value, which approximated fair value, as of the purchase date of all assets and liabilities of the special purpose entity (“SPE”) established in connection with the advance financing facility that owns these servicing advances. We acquired servicing advances in connection with the Initial Ocwen Purchase that are held in the SPE pursuant to the Servicing Advance Facility Agreements.

6

Table of Contents

On March 31, 2012, the Company and Ocwen, pursuant to the terms of the Purchase Agreement, agreed to a final purchase price of $138.8 million for the Initial Purchased Assets (net of assumed liabilities of $359.2 million), reflecting post-closing adjustments of $11.0 million that principally resulted from declines in match funded advances. See “The Business—Description of Purchase Agreement” and “—Description of Subservicing Agreement” for more information on the Purchase Agreement and the related Master Subservicing Agreement, respectively.

The Flow Transactions

On May 1, 2012, we completed an acquisition from Ocwen Loan Servicing, which we refer to as the “Flow One Purchase,” of Rights to MSRs and related servicing advances for a servicing portfolio of subprime and Alt-A residential mortgage loans, which we refer to as the “Flow One Purchased Assets.” The Flow One Purchase resulted in the acquisition by us of Rights to MSRs with approximately $2.9 billion in unpaid principal balance as of April 30, 2012. The characteristics of the Rights to MSRs and associated servicing advances acquired in the Flow One Purchase are substantially similar to those rights we acquired in the Initial Ocwen Purchase. The Flow One Purchased Assets were acquired pursuant to a supplement to the Purchase Agreement. The initial purchase price for the Flow One Purchase was $103.8 million. To finance the purchase price, we used $25.9 million in cash generated from our operations and borrowed $77.9 million under the Servicing Advance Facility against the $92.6 million in servicing advances associated with the Rights to MSRs. The final adjusted purchase price was $103.5 million.

On August 1, 2012, we completed an acquisition from Ocwen Loan Servicing, which we refer to as the “Flow Two Purchase,” and together with the Flow One Purchase, the “Flow Purchases” of Rights to MSRs and related servicing advances for a servicing portfolio of subprime and Alt-A residential mortgage loans, which we refer to as the “Flow Two Purchased Assets” and together with the Flow One Purchased Assets, the “Flow Purchased Assets,” and together with the Initial Purchased Assets and the Follow On Offering Assets (as defined below), the “Aggregate Purchased Assets”. The Flow Two Purchase resulted in the acquisition by us of Rights to MSRs with approximately $2.1 billion in unpaid principal balance as of July 31, 2012. The characteristics of the Rights to MSRs and associated servicing advances acquired in the Flow Two Purchase are substantially similar to those rights we acquired in the Initial Ocwen Purchase and the Flow One Purchase. The Flow Two Purchased Assets were acquired pursuant to a supplement to the Purchase Agreement. The initial purchase price for the Flow Two Purchase was $74.7 million. To finance that amount, we used $18.6 million in cash generated from our operations and borrowed $56.1 million under the Servicing Advance Facility against the $66.7 million in servicing advances associated with the Rights to MSRs. The final purchase price was $76.2 million, which reflected a $1.5 million adjustment for updated match funded advances and Notes Receivable—Rights to MSRs balances.

Follow On Offering Purchases

On September 13, 2012, we completed an acquisition from Ocwen Loan Servicing, which we refer to as the “First Follow On Offering Purchase” of Rights to MSRs and related servicing advances for a servicing portfolio of subprime and Alt-A residential mortgage loans, which we refer to as the “First Follow On Offering Assets.” The First Follow On Offering Purchase resulted in the acquisition by us of Rights to MSRs with approximately $21.1 billion in unpaid principal balance as of September 12, 2012. The characteristics of the Rights to MSRs and associated servicing advances acquired in the First Follow On Offering Purchase are substantially similar to those rights we acquired in the Initial Ocwen Purchase and the Flow Purchases. The First Follow On Offering Purchased Assets were acquired pursuant to a supplement to the Purchase Agreement. The initial purchase price for the First Follow On Offering Purchase was $793.0 million. To finance the purchase price, we used $202.5 million in proceeds from our offering of 16,387,500 newly issued ordinary shares at a price to the public of $15.25 per share, in which we received net proceeds of $236.0 million after deducting underwriting discounts and expenses (the “Follow On Offering”) and $590.5

7

Table of Contents

million in cash borrowed under the Servicing Advance Facility against the $707.5 million in servicing advances associated with the Rights to MSRs. The final purchase price was $788.2 million, which reflected a $4.8 million adjustment for revised match funded advance balances.

On September 28, 2012, we completed an acquisition from Ocwen Loan Servicing, which we refer to as the “Second Follow On Offering Purchase” and together with the First Follow On Offering Purchase, the “Follow On Offering Purchases,” of Rights to MSRs and related servicing advances for a servicing portfolio of subprime and Alt-A residential mortgage loans, which we refer to as the “Second Follow On Offering Assets” and together with the First Follow On Offering Assets, the “Follow On Offering Assets.” The Second Follow On Offering Purchase resulted in the acquisition by us of Rights to MSRs with approximately $6.7 billion in unpaid principal balance as of September 27, 2012. The characteristics of the Rights to MSRs and associated servicing advances acquired in the Second Follow On Offering Purchase are substantially similar to those rights we acquired in the Initial Ocwen Purchase, the Flow Purchases and the First Follow On Offering Purchase. The Second Follow On Offering Purchased Assets were acquired pursuant to a supplement to the Purchase Agreement. The initial purchase price for the Second Follow On Offering Purchase was $238.1 million. To finance the purchase price, we used $30.6 million of the remaining net proceeds from the Follow On Offering and borrowed $207.5 million under the Servicing Advance Facility. The final purchase price was $242.4 million, which reflected a $4.3 million adjustment for updated match funded advances and Notes Receivable—Rights to MSRs balances.

Throughout this prospectus, we refer to the Initial Ocwen Purchase, the Flow Purchases and the Follow On Offering Purchases together as the “Ocwen Transactions.” We refer to the mortgage servicing rights associated with the Ocwen Transactions as the “Acquired Mortgage Servicing Rights.”

As of September 30, 2012, the outstanding balance for the Servicing Advance Facility used to finance the Ocwen Transactions was $1,251 million with a weighted average effective interest rate of 5.01% for the quarter ended September 30, 2012. We executed a hedging strategy aimed to mitigate the impact of changes in variable interest rates on the excess of interest rate sensitive liabilities over interest rate sensitive assets. Accordingly, we entered into interest rate swaps to hedge against the effects of a change in 1-Month LIBOR, and as of September 30, 2012, we had interest rate swaps totaling a notional amount of $460 million with banks. None of the swap counterparties is Ocwen, its affiliates or affiliates of HLSS.

The Planned Acquisition

Consistent with our growth strategy, we intend to use the net proceeds of this offering to purchase additional Mortgage Servicing Assets from Ocwen Loan Servicing in a follow on purchase, which we refer to as the “Planned Acquisition.” We are in discussions with Ocwen Loan Servicing regarding the composition of the Planned Acquisition Assets (as defined below), but have not yet finalized the identification of the specific assets we will acquire. We expect the Planned Acquisition Assets will have similar characteristics to those Mortgage Servicing Assets acquired in the Ocwen Transactions, and that the related servicing advances, both current and future, will be eligible for funding under the Servicing Advance Facility Agreements.

We will pursue additional advance financing in connection with the Planned Acquisition, including increasing the borrowing size of the Servicing Advance Facility to allow for additional borrowing or entering into one or more new servicing advance facilities with one or more lenders. We have not entered into definitive agreements for either of these financing options and do not have firm commitments for additional servicing advance financing for the Planned Acquisition.

8

Table of Contents

The Planned Acquisition will be made pursuant to a supplement to the Purchase Agreement under similar terms to those supplements governing the Aggregate Purchased Assets, which provides for, among other things:

| • | the contractual right to receive the servicing fees (excluding any ancillary income) related to any acquired mortgage servicing rights; |

| • | the contractual right to receive any investment earnings on the custodial accounts related to any acquired mortgage servicing rights that Ocwen Loan Servicing receives pursuant to the related pooling and servicing agreements; |

| • | the right to automatically obtain legal ownership, without any additional payment to Ocwen Loan Servicing, of each acquired mortgage servicing right upon the receipt of the necessary third party approvals and consents (this right, together with rights described in the bullet points above, constitute the “Rights to MSRs” with respect to any acquired mortgage servicing rights); |

| • | the outstanding servicing advances associated with the related pooling and servicing agreements; and |

| • | other assets related to the foregoing (collectively, the foregoing represent the “Planned Acquisition Assets”). |

The mortgage loans underlying the Planned Acquisition Assets will be serviced by Ocwen Loan Servicing and, if and when we acquire the related Third Party Consent related to the Planned Acquisition Assets, will be subserviced by Ocwen Loan Servicing pursuant to the Subservicing Agreement under similar terms to those subservicing supplements governing the Aggregate Purchased Assets. We currently expect that the Planned Acquisition will close shortly after this offering, although we cannot assure you that the closing of the Planned Acquisition will not be delayed. The closing of this offering is not conditioned upon the closing of the Planned Acquisition.

Ocwen Loan Servicing has stated that as of September 30, 2012 it has mortgage servicing assets with approximately $63.8 billion of unpaid principal balance that are similar to the assets that HLSS has purchased in the past. In addition, in connection with Ocwen’s announced acquisition of Homeward Residential Holdings, Inc. and Ocwen Loan Servicing’s announced acquisition of certain assets of Residential Capital, LLC, Ocwen and Ocwen Loan Servicing are anticipated to acquire additional rights to service mortgage loans with approximately $120.0 billion of unpaid principal balance that are similar to those in our current portfolio.

Third Party Consents

Ocwen Loan Servicing will remain the named servicer of the Acquired Mortgage Servicing Rights and the mortgage servicing rights associated with the Planned Acquisition until such time as the approvals and consents necessary to transfer legal ownership of such acquired mortgage servicing rights to us are obtained. We expect that the approvals, consents and other documentation from third parties necessary to transfer such legal ownership will include:

| • | statements from the rating agencies that rated the related securitization transactions (which will likely include Moody’s Investors Service, Standard & Poor’s Ratings Service and Fitch Ratings Service) that the transfer of legal ownership of the acquired mortgage servicing rights to us will not cause a downgrade of the related mortgage-backed securities; |

| • | the consent of parties to the related pooling and servicing agreements, which may include the trustees of the related securitization trusts, the sponsors of the securitization transactions, any master servicer for the securitization transactions or any bond insurers or other credit enhancers insuring the mortgage-backed securities issued by the securitization trusts; and |

9

Table of Contents

| • | any amendments to the related pooling and servicing agreements required to effectuate the transfer and sale of the related acquired mortgage servicing rights to us. |

We refer to these requirements collectively as they relate to the Acquired Mortgage Servicing Rights and the mortgage servicing rights associated with the Planned Acquisition or any acquired mortgage servicing rights as the “Required Third Party Consents.”

In connection with the Initial Ocwen Purchase, one of the rating agencies from whom a rating confirmation is required prior to the transfer of legal ownership of the mortgage servicing rights to us in the Initial Ocwen Purchase stated that it would not provide such confirmation primarily because we were a newly formed entity with no demonstrated operating history as a mortgage servicer. Based on our current dialogue with this rating agency and the other consent parties, our near term goal in pursuit of such consents is to establish an operating history that demonstrates a continued capability to perform the servicing requirements, specifically our obligation to fund servicing advances and to make principal and interest remittances in conformity with all requirements of the pooling and servicing agreements. Although no specific time frame was provided by the rating agency, we believe that it will be up to at least one year from the closing of our initial public offering before the rating agency will consider issuing a rating confirmation. As of the date of this prospectus, we have not received an update from the rating agencies with respect to the timing of a rating confirmation or whether that confirmation will be forthcoming. As a result, the Initial Ocwen Purchase, the Flow Purchases and the Follow On Offering Purchases were structured as purchases of Rights to MSRs and the Planned Acquisition is expected to be structured as a purchase of Rights to MSRs. A continued strategic priority for us is to obtain the Required Third Party Consents necessary for us to become the named servicers for the securitizations where we currently own Rights to MSRs and the associated advances. We will automatically obtain legal ownership of any such mortgage servicing rights without any additional payment to Ocwen Loan Servicing if and when we obtain the Required Third Party Consents.

So long as any Required Third Party Consents have not been obtained:

| • | Ocwen Loan Servicing will remain obligated to perform its obligations as servicer under the related pooling and servicing agreement; |

| • | we will be contractually required to purchase any servicing advances that Ocwen Loan Servicing is required to make pursuant to such pooling and servicing agreement as long as such servicing advances made by Ocwen Loan Servicing are made in accordance with its advance and stop advance policies; |

| • | Ocwen Loan Servicing will be prohibited from taking actions inconsistent with our right to acquire legal ownership of the related mortgage servicing right upon receipt of the Required Third Party Consents; and |

| • | we will account for the acquired Rights to MSRs as a financing. Accordingly, we will record the purchase price paid to Ocwen Loan Servicing as a “Notes Receivable—Rights to MSRs.” We will record the servicing fees that we receive with respect to the Rights to MSRs, net of servicing costs related to such Rights to MSRs, as payments on the note and apportion these payments between interest income and principal repayment. |

If and when we obtain the Required Third Party Consents and become the legal owner of any acquired mortgage servicing right:

| • | we will be contractually obligated to service the mortgage loans underlying such acquired mortgage servicing rights in accordance with the related pooling and servicing agreement; |

| • | Ocwen Loan Servicing will be contractually obligated to us pursuant to a subservicing agreement to perform substantially all of the servicing functions it previously performed relating to such acquired |

10

Table of Contents

| mortgage servicing right on our behalf, other than maintaining custodial accounts, remitting amounts from the custodial accounts and funding servicing advances pursuant to the terms of the related pooling and servicing agreement, which will be functions for which we would be responsible; and |

| • | we will account for the remaining balance of the Notes Receivable—Rights to MSRs related to such acquired mortgage servicing right as mortgage servicing rights to the extent we receive any Required Third Party Consents to transfer legal ownership of such mortgage servicing rights to us. |

We cannot be certain of how long it would take to obtain any Required Third Party Consents or if we would be able to obtain them at all. We do not believe, however, that our business strategy or economic performance has been or will be materially affected by whether we own any acquired mortgage servicing rights or the related Rights to MSRs.

The Market Opportunity

We believe that the current dynamics of the subprime and Alt-A mortgage servicing market have created a unique opportunity where the supply of mortgage servicing rights potentially for sale outweighs the number of potential buyers. These dynamics include:

| • | higher borrower delinquencies and defaults experienced over the last few years and increased regulatory oversight has led to substantially higher costs for mortgage servicers and negatively impacted their profitability; |

| • | regulatory changes resulting from the implementation of the new international bank capital adequacy framework (“Basel III”), which will impose increased regulatory capital costs on depository institutions for owning mortgage servicing rights; and |

| • | our belief that subprime and Alt-A mortgage servicing has become less attractive to many mortgage servicers due to increasingly negative publicity and heightened government and regulatory scrutiny. |

We believe that our business model allows us to be highly competitive in the acquisition of Mortgage Servicing Assets due to our cost structure, ability to access advance financing and our relationship with Ocwen Loan Servicing and although we remain open to purchasing assets from third parties other than Ocwen Loan Servicing, given the large amount of servicing assets remaining at Ocwen Loan Servicing, we do not view initiating purchases from other third parties as a near-term priority. We anticipate that our acquisitions of Mortgage Servicing Assets from sellers other than Ocwen Loan Servicing may involve engaging a party other than such seller to service the underlying mortgage loans.

Competitive Strengths

We believe we are well positioned to execute our business strategy based on the following competitive strengths:

Experienced Management Team with Extensive Knowledge of the Mortgage Servicing Industry. We have an executive management team with extensive experience in the mortgage servicing industry. This experience includes evaluating and acquiring mortgage servicing rights, performing asset valuation analysis and financing mortgage servicing businesses through a variety of economic cycles. Key members of our executive management team also have experience in managing a public company in the mortgage servicing industry.

11

Table of Contents

Asset Acquisition and Evaluation Expertise. We believe that our asset acquisition evaluation process, which includes using proprietary historical data to project the performance of mortgage loans, and our executive management team’s experience and judgment in identifying, assessing, valuing and acquiring new Mortgage Servicing Assets enables us to accurately price assets.

Access to Mortgage Servicing Assets. Over time, we expect to acquire substantially all of Ocwen Loan Servicing’s remaining mortgage servicing rights relating to subprime and Alt-A mortgage loans, which had an unpaid principal balance of approximately $63.8 billion as of September 30, 2012, either through flow transactions or follow on purchases depending upon our excess cash flow and access to the capital markets to obtain additional equity financing. In addition, in connection with Ocwen’s announced acquisition of Homeward Residential Holdings, Inc. and Ocwen Loan Servicing’s announced acquisition of certain assets of Residential Capital, LLC, Ocwen and Ocwen Loan Servicing are anticipated to acquire rights to service mortgage loans with approximately $120.0 billion of unpaid principal balance that are similar to those in our current portfolio. As of September 30, 2012, we had acquired Rights to MSRs with an unpaid principal balance of approximately $48.0 billion from Ocwen Loan Servicing. Future acquisitions of Ocwen Loan Servicing’s remaining mortgage servicing rights will depend on various factors, including our ability to access financing and to obtain the required third party approvals and consents, and may not take place.

Relationship with Ocwen. We intend to continue to capitalize on the servicing capabilities of Ocwen Loan Servicing, which we view as superior relative to other servicers in terms of cost, management experience, technology infrastructure and platform scalability. Ocwen Loan Servicing will continue to service the mortgage loans underlying the Aggregate Purchased Assets, as well as service the mortgage loans underlying the Planned Acquisition Assets, during the period of time prior to the transfer of legal ownership to us of the Acquired Mortgage Servicing Rights and the mortgage servicing rights associated with the Planned Acquisition. Thereafter, we will engage Ocwen Loan Servicing to service on our behalf the mortgage loans underlying our Mortgage Servicing Assets and any additional mortgage servicing assets that we may acquire from them in the future, provided that the performance criteria specified in the Subservicing Agreement are met. We may also engage Ocwen Loan Servicing to service mortgage loans underlying any mortgage servicing assets that we acquire from other third parties in the future.

Recent Developments

On November 15, 2012, the Company announced that its Board of Directors increased the dividend for the months of November and December 2012 by $0.01 to $0.12 per ordinary share. The Company increased dividends previously declared due to increased earnings expectations, which resulted from lower than anticipated prepayments through the middle of the fourth quarter. The October prepayment rate was 13.6% despite a rebound in the number of loan modifications. With the prepayment rate likely to remain below 15% for the fourth quarter, the Company revised its earnings guidance to $0.40 to $0.41 per share. At the lower end of our guidance, this dividend increase will bring our dividend payout ratio for the full year within our targeted range of 90-100% of net income over time.

This information was prepared by, and is the responsibility of, our management. Management’s expectations regarding prepayment rates and our anticipated earnings per share for the quarter ending December 31, 2012 are based upon a number of assumptions. While this information is presented with numerical specificity and is considered reasonable, it is inherently subject to significant business, economic and competitive uncertainties. Additional information regarding the risks and uncertainties that affect our business is contained in the “Risk Factors” section beginning on page 21 of this prospectus, and the information provided in the preceding paragraph should be read in conjunction with the section entitled “Forward-Looking Statements” beginning on page 48 of this prospectus.

Management’s expectations regarding prepayment rates and our anticipated earnings per share for the quarter ending December 31, 2012 are necessarily speculative in nature, and actual results could differ

12

Table of Contents

materially, particularly if the actual prepayment rate increases significantly beyond historical levels in December 2012. If one or more of our assumptions prove incorrect, our results will differ, and such differences could be material. Accordingly, prospective purchasers should not place undue reliance on these expectations, as they should not be regarded as a representation that the anticipated results will be achieved.

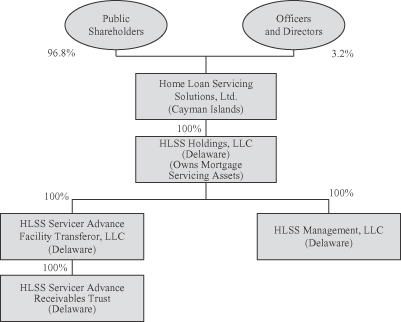

Ownership, Organizational and Operating Structure

On December 1, 2010, we were incorporated as a Cayman Islands exempted company. The following diagram illustrates our corporate structure, the jurisdiction of formation and the ownership interests of our subsidiaries as of September 30, 2012.

Risk Factors

We have a very limited operating history and our business model is new and relatively untested. An investment in our ordinary shares involves significant risks. Below is a summary of some of the key risk factors that you should consider in evaluating an investment in our ordinary shares. This list is not exhaustive and you should carefully read the full discussion of these risks and other risks described under “Risk Factors” beginning on page 21.

| • | We may be unable to continue to implement our business strategy or operate our business as currently expected, including being able to obtain the Required Third Party Consents. |

| • | The assumptions underlying our business model may prove incorrect. |

| • | We will have increased risk related to our relationship with Ocwen Loan Servicing so long as it retains legal ownership of any mortgage servicing rights we may acquire from Ocwen Loan Servicing. |

| • | We may not be able to pay dividends on our ordinary shares, and our Board of Directors has the right to rescind any dividends declared, but unpaid at any time prior to the applicable dividend payment date. |

13

Table of Contents

| • | We rely on Ocwen Loan Servicing to service our entire portfolio of Purchased Assets both before legal ownership is transferred to us and after. |

| • | We will need to acquire additional Mortgage Servicing Assets to maintain and grow our business as planned. |

| • | We may not be able to obtain financing or be able to comply with our obligations under our financing arrangements to fund our servicing advances and future acquisitions of Mortgage Servicing Assets, including the Planned Acquisition. |

| • | Government regulation may adversely affect our business. |

| • | We may become subject to taxation in the United States. |

| • | Many pooling and servicing agreements for subprime and Alt-A mortgage loans contain servicer termination events or events of default based upon the percentage of delinquent loans in the related mortgage loan pool, the loss performance of the related mortgage loans or servicer ratings downgrades. Servicer termination events or events of default based on the number of delinquent mortgage loans, loss performance of the related mortgage loans or servicer ratings downgrades have been triggered in pooling and servicing agreements representing approximately 81% of the unpaid principal balance of the mortgage loans underlying the Ocwen Mortgage Servicing Rights as of June 30, 2012, although the parties to the related securitization transactions have not exercised their right to terminate Ocwen Loan Servicing as servicer. |

Corporate Information

Our principal executive offices are located in the Cayman Islands c/o Intertrust Corporate Services (Cayman) Limited (formerly Walkers Corporate Services Limited), 87 Mary Street, George Town, Grand Cayman KYI-9005, Cayman Islands. We also maintain offices in the United States located at 2002 Summit Boulevard, Sixth Floor, Atlanta, Georgia 30319 and at 1661 Worthington Road, Suite 100, West Palm Beach, Florida 33409. We can be reached by telephone at (561) 682-7561, and our website is www.hlss.com. We do not incorporate information on, or accessible through, our corporate website into this prospectus, and you should not consider it a part of this prospectus.

14

Table of Contents

The Offering

| Issuer |

Home Loan Servicing Solutions, Ltd. |

| Ordinary shares offered in this offering |

22,000,000 ordinary shares. |

| Underwriters’ option to purchase additional ordinary shares |

We have granted the underwriters an option to purchase up to an additional 3,300,000 ordinary shares from us at the public offering price, less the underwriting discounts, for a period of 30 days from the date of this prospectus to cover the option to purchase additional shares, if any. |

| Number of ordinary shares to be outstanding after the offering |

52,584,718 ordinary shares (55,884,718 ordinary shares if the underwriters’ option to purchase additional ordinary shares is exercised in full). |

| Use of proceeds |

The net proceeds to us from this offering, after deducting underwriting discounts and commissions and our estimated offering expenses, will be approximately $388 million (or $447 million if the underwriters exercise their option to purchase up to an additional 3,300,000 ordinary shares) assuming a public offering price of $18.37 per share, which represents the closing price of the ordinary shares on The NASDAQ Global Select Market on December 17, 2012. We intend to use the net proceeds of this offering to acquire the Planned Acquisition Assets from Ocwen Loan Servicing in the Planned Acquisition. We are in discussions with Ocwen Loan Servicing regarding the composition of the Planned Acquisition Assets, but have not yet finalized the identification of the specific assets we will acquire. We expect the Planned Acquisition Assets will have similar characteristics to those Mortgage Servicing Assets acquired in the Ocwen Transactions, and that the related servicing advances, both current and future, will be eligible for funding under the Servicing Advance Facility Agreements. We have not entered into any agreement to acquire the Planned Acquisition Assets. The closing of the Planned Acquisition is not a condition to the closing of this offering. We intend to use the remaining net proceeds, if any, to acquire additional Mortgage Servicing Assets from Ocwen Loan Servicing or for working capital and general corporate purposes. See “Use of Proceeds.” |

| Dividend policy |

We intend to distribute at least 90% of our net income over time to our shareholders in the form of a monthly cash dividend, although we are not required by law to do so. |

| Since the closing of our initial public offering, we paid monthly dividends of $0.10 per ordinary share through September 2012 (except during the month of March in which we paid a pro-rated amount of $0.08 per ordinary share), a dividend of $0.11 for October 2012 and a dividend of $0.12 for November 2012. On |

15

Table of Contents

| November 15, 2012, our Board of Directors increased the previously declared dividend for the months of November and December 2012 by $0.01 to $0.12 per ordinary share. |

| The following table sets forth the record and payment dates of the dividend that has been declared by our Board of Directors, but is unpaid, for the month of December 2012: |

| Record Date |

Payment Date |

Amount per Ordinary Share | ||||||

| December 31, 2012 | January 10, 2013 | $0.12 |

| Our Board of Directors has the right to rescind any declared, but unpaid dividends at any time prior to the applicable dividend payment date. See “Dividend Policy,” “Description of Share Capital” and “Material Cayman Islands and United States Federal Income Tax Considerations.” |

| NASDAQ Global Select Market symbol |

“HLSS.” |

| Tax Considerations |

We expect to be treated as a PFIC for U.S. federal income tax purposes. In order to avoid possible adverse tax consequences, including deferred tax and interest charges under the U.S. Internal Revenue Code and Treasury regulations thereunder, “U.S. Holders” (as defined below under “Material Cayman Islands and United States Federal Income Tax Considerations—United States Federal Income Taxation”) may make a “qualified electing fund,” or QEF, election or a mark-to-market election with respect to their investments in our ordinary shares. U.S. Holders should consult with their tax advisors as to whether or not to make such elections and the related consequences and should carefully review the information set forth under “Material Cayman Islands and United States Federal Income Tax Considerations—United States Federal Income Taxation—Consequences to U.S. Holders—Passive Foreign Investment Company Status and Related Tax Consequences” for additional information. |

| Risk Factors |

Please read “Risk Factors” beginning on page 20 of this prospectus for a discussion of the factors that you should carefully consider before deciding to invest in our ordinary shares. |

Except as otherwise indicated, all information in this prospectus reflects or assumes no exercise by the underwriters of their option to purchase up to an additional 3,300,000 ordinary shares in this offering at the assumed public offering price of $18.37 per share, which represents the closing price of the ordinary shares on The NASDAQ Global Select Market on December 17, 2012.

16

Table of Contents

Summary Consolidated Financial Data

We were incorporated as a Cayman Islands exempted company on December 1, 2010. Prior to our initial public offering, our operations were limited to negotiating and entering into the Purchase Agreement and the Subservicing Agreement with Ocwen Loan Servicing, negotiating and entering into arrangements with lenders and other third parties to effect the transfer of our initial Mortgage Servicing Assets, associated servicing advances and the related match funded liabilities to us, negotiating and entering into professional and administrative services agreements with Ocwen Loan Servicing and Altisource Portfolio Solutions S.A., or “Altisource” and general corporate functions. We also entered into a stock purchase agreement pursuant to which William C. Erbey, the founder of our company and the Chairman of our Board of Directors, acquired $10.0 million of our ordinary shares at a purchase price of $14.00 per share concurrently with the closing of our initial public offering. Therefore, we have no historical financial statements reflecting our operations prior to our inception, and our audited balance sheet as of December 31, 2011 and the results of our operations for 2011 reflect only the activities described above.

The following table sets forth certain of our financial information. The consolidated financial information for the year ended December 31, 2011 has been derived from our audited consolidated financial statements included in this prospectus. The summary financial information for the three and nine month periods ended September 30, 2012 and 2011 has been derived from our unaudited consolidated financial statements included in this prospectus, which, in the opinion of management, include all adjustments (consisting of normal recurring adjustments) that are necessary for a fair presentation of our financial position and results of operations for such periods. The operating results for the nine months ended September 30, 2012 may not be indicative of the results that may be expected for the entire year.

The unaudited as adjusted balance sheet data below gives effect to the completion of this offering as if it had been completed at September 30, 2012.

The following information should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, including the notes thereto, appearing elsewhere in this prospectus.

Servicing Advances

We value servicing advances that we make on mortgage loans at their carrying amounts because they have no scheduled maturity, generally are realized within a relatively short period of time and do not bear interest.

Notes Receivable—Rights to MSRs

We record the Notes Receivable—Rights to MSRs at the purchase price of the related Rights to MSRs (as described in the Purchase Agreement). We amortize Notes Receivable—Rights to MSRs using the prospective interest method of accounting. At each reporting date, we calculate the present value of the net cash flows related to the underlying mortgage servicing rights and adjust the carrying value of the applicable Notes Receivable—Rights to MSRs to this amount. The change in the carrying value of the Notes Receivable—Rights to MSRs reduces the interest income associated with our Notes Receivable—Rights to MSRs.

17

Table of Contents

We estimate the fair value of our Notes Receivable—Rights to MSRs by calculating the present value of expected future cash flows of the related mortgage servicing rights utilizing assumptions that we believe are reasonable and consistent with the assumptions that are used by other market participants. The most significant assumptions used are estimates of the speed at which mortgages will prepay and the aggregate principal amount of mortgage loans that will become delinquent, both of which are based on our historical experience and available market data. Other assumptions used in our valuation are:

| • Cost of servicing |

• Compensating interest expense | |

| • Discount rate reflecting the risk of earning future income streams from the mortgage servicing rights |

• Interest rate used for computing float earnings | |

| • Interest rate used for computing the cost of servicing advances |

• Collection rate of other ancillary fees | |

The significant components of the estimated future cash inflows for the mortgage servicing rights held by us include servicing fees, late fees, prepayment penalties and float earnings. Significant cash outflows include the cost of servicing, the cost of financing servicing advances and compensating interest payments. We consider external market-based assumptions in determining the discount rate and interest rate for the cost of financing advances, the interest rate for float earnings and the cost of servicing. The more significant assumptions used in the September 30, 2012 and December 31, 2011 valuation include mortgage loan prepayment projections ranging from 12% to 25% of the related mortgage loans’ unpaid principal balance per year (depending on loan type) averaging to a long-term projected mortgage loan prepayment rate of approximately 18% of the related mortgage loans’ unpaid principal balance per year, and delinquency rates ranging from 15% to 35% of the aggregate unpaid principal balance of mortgage loans related to the mortgage servicing rights held by us (depending on loan type). The long-term prepayment projections include voluntary and involuntary mortgage loan prepayment projections. Other assumptions include an interest rate of 1-month LIBOR plus 4% for computing the cost of financing servicing advances, an interest rate of 1-month LIBOR for computing float earnings, and discount rates ranging from 14% to 22%, which reflect the risks associated with our relationship with Ocwen Loan Servicing (which currently services all of the Purchased Assets), including the risk that Ocwen Loan Servicing could become bankrupt, insolvent or otherwise be terminated as servicer.

Match Funded Liabilities

The majority of our match funded liabilities as of September 30, 2012 bear interest at a rate that is adjusted regularly based on a market index, and thus their carrying value approximates fair value. A portion of our liabilities are fixed, and their carrying value also approximates fair value as of September 30, 2012.

18

Table of Contents

Consolidated Statement of Operations

(dollars in thousands, except ordinary share data)

(unaudited)

| Three Months

Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Revenue |

||||||||||||||||

| Interest income—notes receivable—Rights to MSRs |

$ | 14,017 | $ | — | $ | 27,542 | $ | — | ||||||||

| Interest income—other |

146 | — | 283 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total interest income |

14,163 | — | 27,825 | — | ||||||||||||

| Other revenue |

669 | — | 1,664 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

14,832 | — | 29,489 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses |

||||||||||||||||

| Compensation and benefits |

1,257 | — | 2,682 | — | ||||||||||||

| General and administrative expenses |

679 | 38 | 1,625 | 82 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

1,936 | 38 | 4,307 | 82 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

12,896 | (38 | ) | 25,182 | (82 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other expense |

||||||||||||||||

| Interest expense |

6,252 | — | 12,507 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expense |

6,252 | — | 12,507 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

6,644 | (38 | ) | 12,675 | (82 | ) | ||||||||||

| Income tax expense |

72 | — | 149 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | 6,572 | $ | (38 | ) | $ | 12,526 | $ | (82 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per share |

||||||||||||||||

| Basic |

$ | 0.37 | $ | (1.90 | ) | $ | 1.04 | $ | (4.08 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | 0.37 | $ | (1.90 | ) | $ | 1.04 | $ | (4.08 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average ordinary shares outstanding |

||||||||||||||||

| Basic |

17,581,593 | 20,000 | 12,008,394 | 20,000 | ||||||||||||

| Diluted |

17,581,593 | 20,000 | 12,008,394 | 20,000 | ||||||||||||

| Dividends declared per share |

$ | 0.34 | $ | 0.00 | $ | 0.94 | $ | 0.00 | ||||||||

19

Table of Contents

Consolidated Balance Sheet

(dollars in thousands, except ordinary share data)

(unaudited)

| September 30, 2012 |

As adjusted for the offering |

|||||||

| Assets |

||||||||

| Cash |

$ | 33,750 | $ | 421,992 | ||||

| Match funded advances |

1,446,091 | 1,446,091 | ||||||

| Notes receivable—Rights to MSRs |

177,730 | 177,730 | ||||||

| Other assets |

45,334 | 45,334 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,702,905 | $ | 2,091,147 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Liabilities |

||||||||

| Match funded liabilities |

$ | 1,250,912 | $ | 1,250,912 | ||||

| Dividends payable |

3,058 | 3,058 | ||||||

| Other liabilities |