Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMEREN CORP | d455552d8k.htm |

| EX-10.1 - 2013 AMEREN EXECUTIVE INCENTIVE PLAN - AMEREN CORP | d455552dex101.htm |

| EX-99.1 - FORMULA FOR DETERMINING 2013 TARGET PERFORMANCE SHARE UNIT AWARDS - AMEREN CORP | d455552dex991.htm |

| EX-3.1.(I) - CERTIFICATE OF AMENDMENT OF CERTIFICATE OF DESIGNATION - AMEREN CORP | d455552dex31i.htm |

| EX-3.1.(II) - BY-LAWS OF AMEREN CORPORATION - AMEREN CORP | d455552dex31ii.htm |

EXHIBIT 10.2

| Performance Share Unit Award Agreement

Ameren Corporation

2006 Omnibus Incentive Compensation Plan

January 1, 2013 |

Ameren Corporation

Performance Share Unit Award Agreement

THIS AGREEMENT, effective January 1, 2013, represents the grant of Performance Share Units by Ameren Corporation (the “Company”), to the Participant named below, pursuant to the provisions of the Ameren Corporation 2006 Omnibus Incentive Compensation Plan (as the same may be amended from time to time, the “Plan”). The number of Shares ultimately earned and paid, if any, for such Performance Share Units will be determined pursuant to Section 3 of this Agreement.

The Plan provides a description of the terms and conditions governing the Performance Share Units. If there is any inconsistency between the terms of this Agreement and the terms of the Plan, the Plan’s terms will completely supersede and replace the conflicting terms of this Agreement. All capitalized terms will have the meanings ascribed to them in the Plan, unless specifically set forth otherwise herein. The parties hereto agree as follows:

1. Grant Information. The individual named below has been selected to be a Participant in the Plan, as specified below:

(a) Participant:

(b) Target Number of Performance Share Units:

2. Performance Period. The performance period begins on January 1, 2013, and ends on December 31, 2015 (“Performance Period”).

3. Performance Grid. The number of Performance Share Units earned by the Participant under this Agreement will be determined in accordance with the following grid. If the actual performance results fall between two of the categories listed below, straight-line interpolation will be used to determine the amount earned. Payouts that otherwise would have been more than 100% of Target will be capped at Target if the Company’s total shareholder return (“TSR”) is negative over the three-year period. TSR shall be calculated in the manner set forth in Exhibit 1 hereto and compared to the peer group identified in Exhibit 1.

| Ameren’s Percentile in Total Shareholder Return vs. Utility Peers During the Performance Period |

Payout—Percent of Target Performance Share Units Granted | |||

| 90th percentile + |

200% | |||

| 70th percentile |

150% | |||

| 50th percentile |

100% | |||

| 30th percentile |

50% | |||

| <30th percentile but three-year average GAAP Earnings Per Share (“EPS”)1 reaches or exceeds the average of the Executive Incentive Plan (“EIP”) threshold levels for 2013, 2014 and 2015 |

30% | |||

| <30th percentile and three-year average GAAP EPS1 does not reach the average of the EIP threshold levels for 2013, 2014 and 2015 |

0% (no payout) |

4. Calculation of Earned Performance Share Units. The Committee, in its sole discretion, will determine the number of Performance Share Units earned by the Participant at the end of the Performance Period based on the performance of the Company, calculated using the performance grid set forth in Section 3 of this Agreement.

5. Vesting of Performance Share Units. Subject to provisions set forth in Section 9 of this Agreement related to a Change of Control (as defined in the Second Amended and Restated Ameren Corporation Change of Control Severance Plan, as amended (the “Change of Control Severance Plan”)) of the Company and Section 10 of this Agreement relating to termination for Cause (as defined in the Change of Control Severance Plan), the Performance Share Units will vest as set forth below:

| (a) | Provided the Participant has continued employment through such date, one hundred percent (100%) of the earned Performance Share Units will vest on December 31, 2015; or |

| (b) | Provided the Participant has continued employment through the date of his death and such death occurs prior to December 31, 2015, the Participant will be entitled to a prorated award based on the Target Number of Performance Share Units set forth in Section 1(b) of this Agreement plus accrued dividends as of the date of his death, with such prorated number based upon the total number of days the Participant worked during the Performance Period; or |

| (c) | Provided the Participant has continued employment through the date of his Disability (as defined in Code Section 409A), and such Disability occurs prior to December 31, 2015, one hundred percent (100%) of the Performance Share Units he would have earned had he remained employed by the Company for the entire Performance Period will vest on December 31, 2015, based on the actual performance of the Company during the entire Performance Period; or |

| 1 | GAAP EPS achievement levels could be adjusted to include or exclude specified items of an unusual or non recurring nature as determined by the Committee at its sole discretion and as permitted by the Plan. |

| (d) | Provided the Participant has continued employment through the date of retirement (as described below) and such retirement occurs before December 31, 2015, the following vesting schedule shall be applicable to the Performance Share Units: |

| (i) | If the Participant retires at an age of 55 or greater with five (5) or more years of service (as defined in the Ameren Retirement Plan, as supplemented and amended from time to time) and is not otherwise described in paragraph (ii) below— the Participant is entitled to receive a prorated portion of the Performance Share Units that would have been earned had the Participant remained employed by the Company for the entire Performance Period, based on the actual performance of the Company during the entire Performance Period, with the prorated number based upon the total number of days the Participant worked during the Performance Period; or |

| (ii) | If the Participant retires after reaching age 62 with ten (10) or more years of service (as defined in the Ameren Retirement Plan, as supplemented and amended from time to time)— the Participant is entitled to receive one hundred percent (100%) of the Performance Share Units that would have been earned had the Participant remained employed by the Company for the entire Performance Period based on the actual performance of the Company during the entire Performance Period. |

Termination of employment during the Performance Period for any reason other than death, Disability, retirement as described above, or on or after a Change of Control in accordance with Section 9 will require forfeiture of this entire award, with no payment to the Participant.

6. Form and Timing of Payment. All payments of vested Performance Share Units pursuant to this Agreement will be made in the form of Shares. Except as otherwise provided in this Agreement, payment will be made upon the earliest to occur of the following:

(a) January 1, 2016 or as soon as practicable thereafter;

(b) The Participant’s death or as soon as practicable thereafter.

Fractional Performance Share Units that constitute less than a single share may be rounded to the nearest full share or converted to cash, at the Company’s option.

7. Right as Shareholder. Except as specifically set forth in this Agreement, the Participant shall not have voting or any other rights as a shareholder of the Company with respect to Performance Share Units. The Participant will obtain full voting and other rights as a shareholder of the Company upon the payment of the Performance Share Units in Shares as provided in Section 6 or 9 of this Agreement.

8. Dividends. The Participant shall be entitled to receive dividend equivalents, which represent the right to receive Shares measured by the dividend payable with respect to the corresponding number of Performance Share Units. Dividend equivalents on Performance Share Units will accrue and be reinvested into additional Performance Share Units throughout the three-year Performance Period. The additional Shares will be paid as set forth in Section 6 or 9 of this Agreement. Participants will not be entitled to any dividend equivalent amount on Performance Share Units covered by this Agreement which are not ultimately earned.

9. Change of Control.

(a) Company No Longer Exists. Upon a Change of Control which occurs on or before December 31, 2015 in which the Company ceases to exist or is no longer publicly traded on the New York Stock Exchange or the NASDAQ Stock Market, the Target Number of Performance Share Units awarded as set forth in Section 1(b) of this Agreement plus the accrued dividends as of the date of the Change of Control shall be converted to nonqualified deferred compensation with the following features:

| (i) | The initial amount of the nonqualified deferred compensation shall equal the value of one Share based on the closing price on the New York Stock Exchange on the last trading day prior to the date of the Change of Control multiplied by the sum of the Target Number of Performance Share Units awarded as set forth in section 1(b) of this Agreement plus the additional Performance Share Units attributable to accrued dividends; |

| (ii) | Interest on the nonqualified deferred compensation shall accrue based on the prime rate (adjusted on the first day of each calendar quarter) as published in the “Money Rates” section in the Wall Street Journal from the date of the Change of Control until such nonqualified deferred compensation is distributed or forfeited; |

| (iii) | If the Participant remains employed with the Company or its successor until the last day of the Performance Period, the nonqualified deferred compensation, plus interest, shall be paid to the Participant in an immediate lump sum on January 1, 2016, or as soon as practicable thereafter; |

| (iv) | If the Participant retired (as described in Section 5(d) of this Agreement) or terminated employment due to Disability prior to the Change of Control under Section 9(a) of this Agreement, the Participant shall immediately receive the nonqualified deferred compensation, plus interest, upon such Change of Control; |

| (v) | If the Participant remains employed with the Company or its successor until his death or Disability which occurs after the Change of Control and before the last day of the Performance Period, the Participant (or his estate or designated beneficiary) shall immediately receive the nonqualified deferred compensation, plus interest, upon such death or Disability; |

| (vi) | If the Participant has a qualifying termination (as defined in Section 9(c) of this Agreement) before the last day of the Performance Period, the Participant shall immediately receive the nonqualified deferred compensation, plus interest, upon such termination; provided that such distribution shall be deferred until the date which is six (6) months following the Participant’s termination of employment to the extent required by Code Section 409A; and |

| (vii) | In the event the Participant terminates employment before the end of the Performance Period for any reason other than described in Sections (iv), (v) or (vi) above, the nonqualified deferred compensation, plus interest, will immediately be forfeited. |

(b) Company Continues to Exist. If there is a Change of Control of the Company but the Company continues in existence and remains a publicly traded company on the New York Stock Exchange or the NASDAQ Stock Market, the Performance Share Units will pay out upon the earliest to occur of the following:

| (i) | As set forth in Section 6 (“Form and Timing of Payments”) of this Agreement; or |

| (ii) | If the Participant experiences a qualifying termination (as defined in Section 9(c) of this Agreement) during the two-year period following the Change of Control and the termination occurs prior to January 1, 2016, one hundred percent (100%) of the Performance Share Units he would have earned had he remained employed by the Company for the entire Performance Period based on the actual performance of the Company during the entire Performance Period. Such Performance Share Units will vest on December 31, 2015 and the vested Performance Share Units will be paid in Shares on January 1, 2016 or as soon as practicable thereafter; provided that such distribution shall be deferred until the date which is six (6) months following the Participant’s termination of employment to the extent required by Code Section 409A. |

(c) Qualifying Termination. For purposes of Sections 9(a)(vi) and 9(b)(ii) of this Agreement, a qualifying termination means (i) an involuntary termination without Cause, (ii) for Change of Control Severance Plan participants, a voluntary termination of employment for Good Reason (as defined in the Change of Control Severance Plan) or (iii) an involuntary termination that qualifies for severance under the Ameren Corporation Severance Plan for Ameren Employees (as in effect immediately prior to the Change of Control).

(d) Termination in Anticipation of Change of Control. If a Participant qualifies for benefits as provided in the last sentence of Section 4.1 of the Change of Control Severance Plan, or if a Participant is not a Participant in the Change of Control Severance Plan but is terminated within six (6) months prior to the Change of Control and qualifies for severance benefits under the Company’s general severance plan and the Participant’s termination of employment occurs before December 31, 2015, then the Participant shall receive (i) upon a Change of Control described in Section 9(a) of this Agreement, an immediate cash payout equal to the value of one Share based on the closing price on the New York Stock Exchange on the last trading day prior to the date of the Change of Control multiplied by the sum of the Target Number of Performance Share Units awarded as set forth in Section 1(b) of this Agreement plus the additional Performance Share Units attributable to accrued dividends or (ii) upon a Change of Control described in Section 9(b) of this Agreement, the payout provided for in Section 9(b) of this Agreement; provided that any such distributions shall be deferred until the date which is six (6) months following the Participant’s termination of employment to the extent required by Code Section 409A.

10. Termination for Cause. Termination of employment for Cause at any time prior to payout of the Shares will require forfeiture of the entire Performance Share Unit Award, with no distribution of any Shares to the Participant.

11. Nontransferability. Performance Share Units awarded pursuant to this Agreement may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated (a “Transfer”) other than by will or by the laws of descent and distribution, except as provided in the Plan. If any Transfer, whether voluntary or involuntary, of Performance Share Units is made, or if any attachment, execution, garnishment, or lien will be issued against or placed upon the Performance Share Units, the Participant’s right to such Performance Share Units will be immediately forfeited to the Company, and this Agreement will lapse.

12. Requirements of Law. The granting of Performance Share Units under the Plan will be subject to all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

13. Tax Withholding. The Company will have the power and the right to deduct or withhold, or require the Participant or the Participant’s beneficiary to remit to the Company, an amount sufficient to satisfy federal, state, and local taxes, domestic or foreign, required by law or regulation to be withheld with respect to any taxable event arising as a result of this Agreement.

14. Stock Withholding. With respect to withholding required upon any taxable event arising as a result of Performance Share Units granted hereunder, the Company, unless notified otherwise by the Participant in writing within thirty (30) days prior to the taxable event, will satisfy the tax withholding requirement by withholding Shares having a Fair Market Value equal to the total minimum statutory tax required to be withheld on the transaction. The Participant agrees to pay to the Company, its Affiliates and/or its Subsidiaries any amount of tax that the Company, its Affiliates and/or its Subsidiaries may be required to withhold as a result of the Participant’s participation in the Plan that cannot be satisfied by the means previously described.

15. Administration. This Agreement and the Participant’s rights hereunder are subject to all the terms and conditions of the Plan, as the same may be amended from time to time, as well as to such rules and regulations as the Committee may adopt for administration of the Plan. It is expressly understood that the Committee is authorized to administer, construe, and make all determinations necessary or appropriate to the administration of the Plan and this Agreement, all of which will be binding upon the Participant.

16. Continuation of Employment. This Agreement will not confer upon the Participant any right to continuation of employment by the Company, its Affiliates, and/or its Subsidiaries, nor will this Agreement interfere in any way with the Company’s, its Affiliates’, and/or its Subsidiaries’ right to terminate the Participant’s employment at any time.

17. Amendment to the Plan. The Plan is discretionary in nature and the Committee may terminate, amend, or modify the Plan; provided, however, that no such termination, amendment, or modification of the Plan may in any way adversely affect the Participant’s rights under this Agreement, without the Participant’s written approval.

18. Amendment to this Agreement. The Company may amend this Agreement in any manner, provided that no such amendment may adversely affect the Participant’s rights hereunder without the Participant’s written approval.

19. Successor. All obligations of the Company under the Plan and this Agreement, with respect to the Performance Share Units, will be binding on any successor to the Company, whether the existence of such successor is the result of a direct or indirect purchase, merger, consolidation, or otherwise, of all or substantially all of the business and/or assets of the Company.

20. Severability. The provisions of this Agreement are severable and if any one or more provisions are determined to be illegal or otherwise unenforceable, in whole or in part, the remaining provisions will nevertheless be binding and enforceable.

21. Applicable Laws and Consent to Jurisdiction. The validity, construction, interpretation and enforceability of this Agreement will be determined and governed by the laws of the State of Missouri without giving effect to the principles of conflicts of law. For the purpose of litigating any dispute that arises under this Agreement, the parties hereby consent to exclusive jurisdiction and agree that such litigation will be conducted in the federal or state courts of the State of Missouri.

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed effective as of January 1, 2013.

| Ameren Corporation | ||

| By: |

| |

| Vice President, Human Resources of Ameren Services Company, on behalf of Ameren Corporation | ||

| By: |

| |

| Participant | ||

EXHIBIT 1

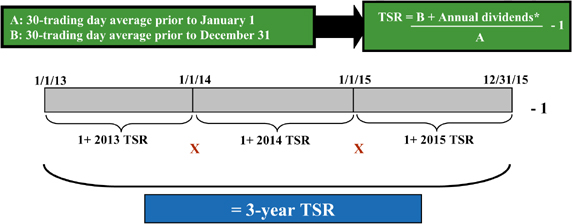

Total Shareholder Return

Total Shareholder Return shall be calculated as follows:

| * | In practice, dividends will be treated as having been reinvested quarterly. |

Peer Group

Following are the peer group companies. In order to be counted in the final calculations, a company must still have a ticker at the end of the performance period.

| Company |

Ticker |

Company |

Ticker | |||||||

| ALLIANT ENERGY CORPORATION |

LNT | NEXTERA ENERGY INC. | NEE | |||||||

| AMERICAN ELECTRIC POWER CO INC |

AEP | OGE ENERGY | OGE | |||||||

| CLECO CORPORATION |

CNL | PINNACLE WEST CAPITAL CORP | PNW | |||||||

| CMS ENERGY |

CMS | PPL CORPORATION | PPL | |||||||

| DOMINION RESOURCES INC |

D | PSEG INC. | PEG | |||||||

| DTE ENERGY CO |

DTE | SCANA | SCG | |||||||

| DUKE ENERGY |

DUK | SOUTHERN CO | SO | |||||||

| EDISON INTERNATIONAL |

EIX | XCEL ENERGY INC | XEL | |||||||

| FIRSTENERGY CORP |

FE | WESTAR ENERGY, INC. | WR | |||||||

| GREAT PLAINS ENERGY INC |

GXP | WISCONSIN ENERGY | WEC | |||||||

| INTEGRYS |

TEG |