Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Unum Group | d456403d8k.htm |

2013 Outlook Meeting

December 17, 2012

Exhibit 99.1 |

2

Safe Harbor Statement

Certain

information

in

this

presentation

constitutes

"forward-looking

statements"

within

the

meaning

of

the

Private

Securities

Litigation

Reform Act of 1995. Forward-looking statements are those not based on historical

information, but rather relate to future operations, strategies, financial results, or

other developments and speak only as of the date made. These forward-looking statements are subject to

numerous assumptions, risks, and uncertainties, many of which are beyond our control.

The following factors, in addition to other factors mentioned from time to time, may

cause actual results to differ materially from those contemplated by the forward-looking statements: (1)

unfavorable economic or business conditions, both domestic and foreign; (2) legislative,

regulatory, or tax changes, both domestic and foreign, including the effect of

potential legislation and increased regulation in the current political environment; (3) sustained periods of low

interest rates; (4) changes in claim incidence, recovery rates, mortality rates, and offsets

due to, among other factors, the rate of unemployment and consumer confidence, the

emergence of new diseases, epidemics, or pandemics, new trends and developments in

medical treatments, the effectiveness of claims management operations, and changes in

government programs; (5) fluctuation in insurance reserve liabilities; (6) investment

results, including, but not limited to, realized investment losses resulting from defaults, contractual terms

of

derivative

contracts,

and

impairments

that

differ

from

our

assumptions

and

historical

experience;

(7)

the

lack

of

appropriate

investments

in the market which can be acquired to match our liability cash flows and duration; (8)

changes in interest rates, credit spreads, and securities prices; (9) increased

competition from other insurers and financial services companies due to industry

consolidation or other factors; (10) changes in demand for our products due to, among

other factors, changes in societal attitudes, the rate of unemployment, and consumer

confidence; (11) changes in accounting standards, practices, or policies; (12) changes in our financial strength and credit ratings;

(13) rating agency actions, state insurance department market conduct examinations and other

inquiries, other governmental investigations and

actions,

and

negative

media

attention;

(14)

effectiveness

in

managing

our

operating

risks

and

the

implementation

of

operational

improvements and strategic growth initiatives; (15) actual experience that deviates from our

assumptions used in pricing, underwriting, and reserving; (16) actual persistency

and/or sales growth that is higher or lower than projected; (17) effectiveness of our risk management

program; (18) the level and results of litigation; (19) currency

exchange rates; (20) ability of our subsidiaries to pay dividends as a result of

regulatory restrictions or changes in reserving or capital requirements; (21) ability and

willingness of reinsurers to meet their obligations; (22)

changes

in

assumptions

related

to

intangible

assets

such

as

deferred

acquisition

costs,

value

of

business

acquired,

and

goodwill;

(23)

ability to recover our systems and information in the event of a

disaster or unanticipated event and to protect our systems and information

from

unauthorized

access

and

deliberate

attacks;

and

(24)

events

or

consequences

relating

to

political

instability,

terrorism,

or

acts

of

war,

both domestic and foreign. For further information about risks and uncertainties which

could cause actual results to differ from those contained in the forward-looking

statements, see Part I, Item 1A of our annual report on Form 10-K for the year ended December 31, 2011

and

our

subsequently

filed

Forms

10-Q.

The

forward-looking

statements

in

this

presentation

are

being

made

as

of

the

date

of

this

presentation,

and

the

Company

expressly

disclaims

any

obligation

to

update

or

revise

any

forward-looking

statement

contained

herein,

even

if made available on our website or otherwise. |

3

Today’s Participants

Kevin McCarthy

Executive Vice President and Chief Operating Officer

President and Chief Executive Officer

Executive Vice President and Chief Financial Officer

Tom Watjen

Rick McKenney |

4

A Look at Our Performance

2012 Assessment

2013 Outlook

Closing Comments / Question & Answer

Agenda |

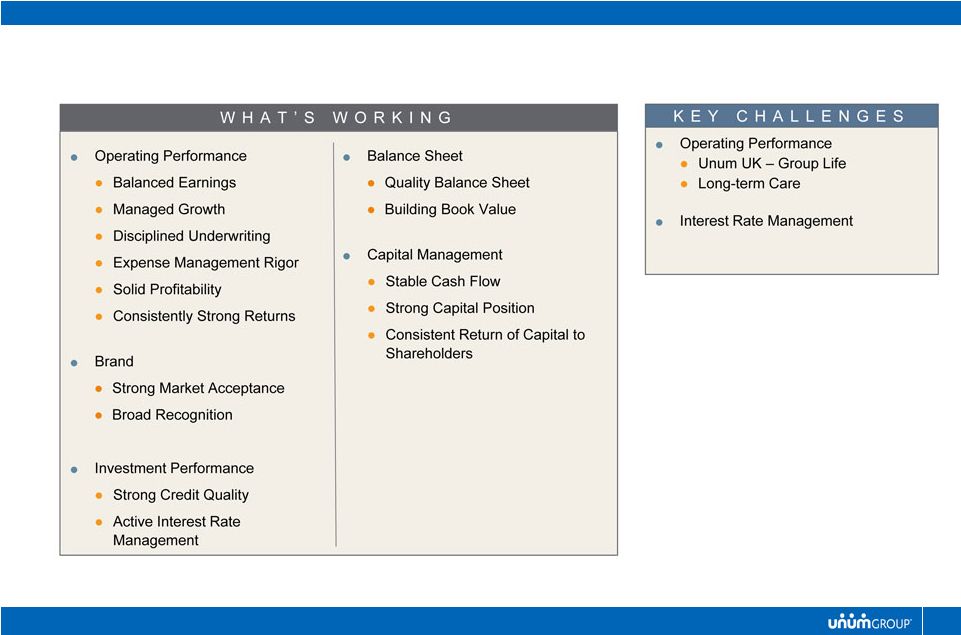

What’s Working |

6

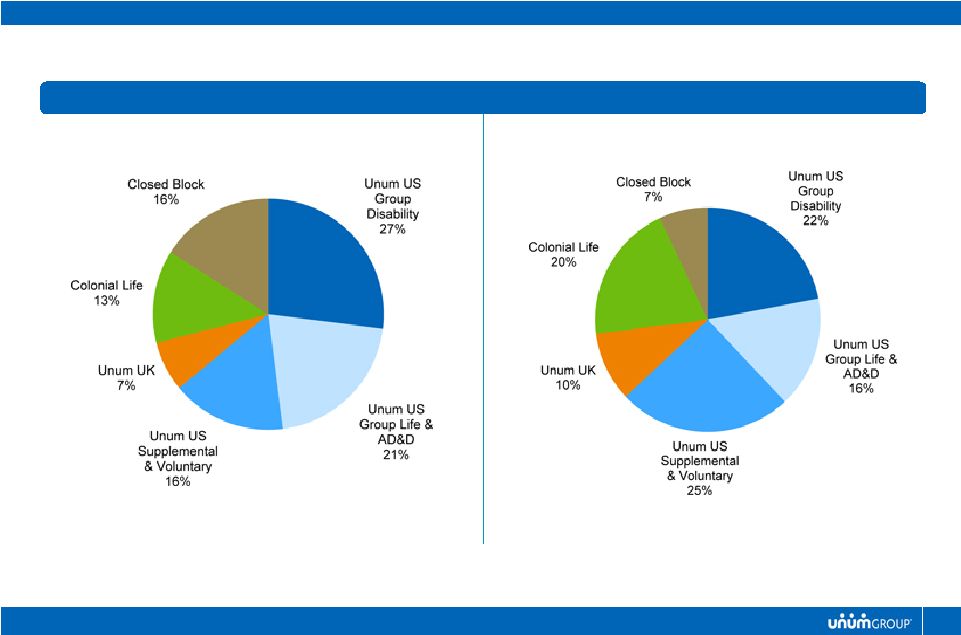

Full Year 2002

Before-tax Operating Earnings by Segment*

Operating Performance

BALANCED EARNINGS

*

Excludes Corporate Segment

9M2012

Does not reflect the impact of ASU 2010-26 or the segment reporting changes

implemented in 4Q2008 |

7

Market Segmentation

Growth Trends in Premium Income

Operating Performance

MANAGED GROWTH IN OUR CORE BUSINESS SEGMENTS

2.6%

5.0%

($ millions)

Growth Markets

Unum US –

Core Market –

Employee Benefits

Colonial Life

Unum US –

Voluntary Benefits

Unum UK –

Group LTD

Opportunistic Markets

Unum US –

Large Case –

Employee Benefits

Unum US –

ID –

Recently Issued

Unum UK –

Group Life |

8

Growth Trends in Premium Income

Operating Performance

MANAGED GROWTH IN OUR CORE BUSINESS SEGMENTS

Data –

Trailing 4 quarters |

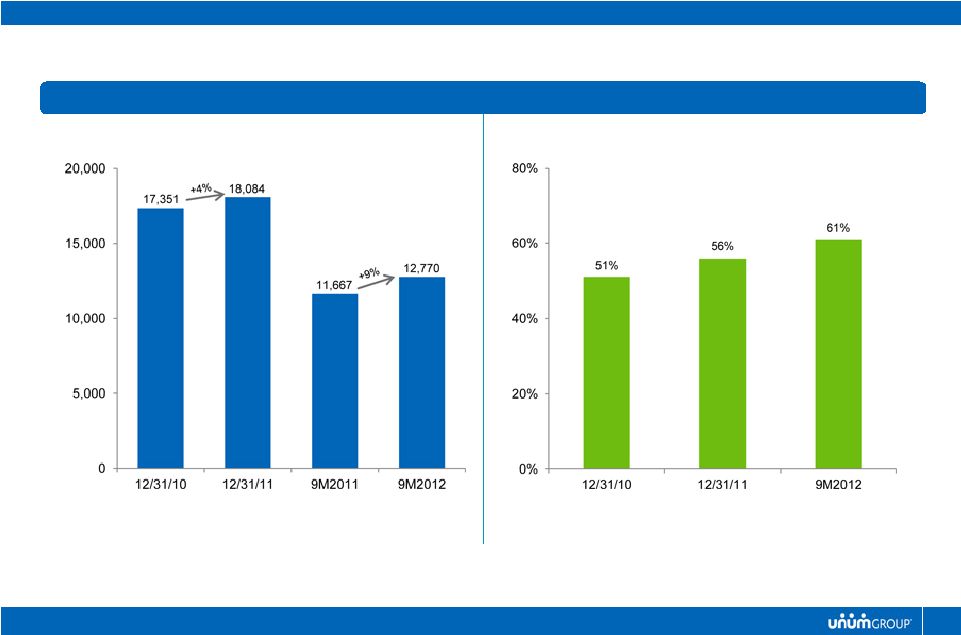

9

New Account Growth

% of Sales from Existing Relationships

Operating Performance

MANAGED GROWTH IN OUR CORE BUSINESS SEGMENTS |

10

Colonial Life

Unum US

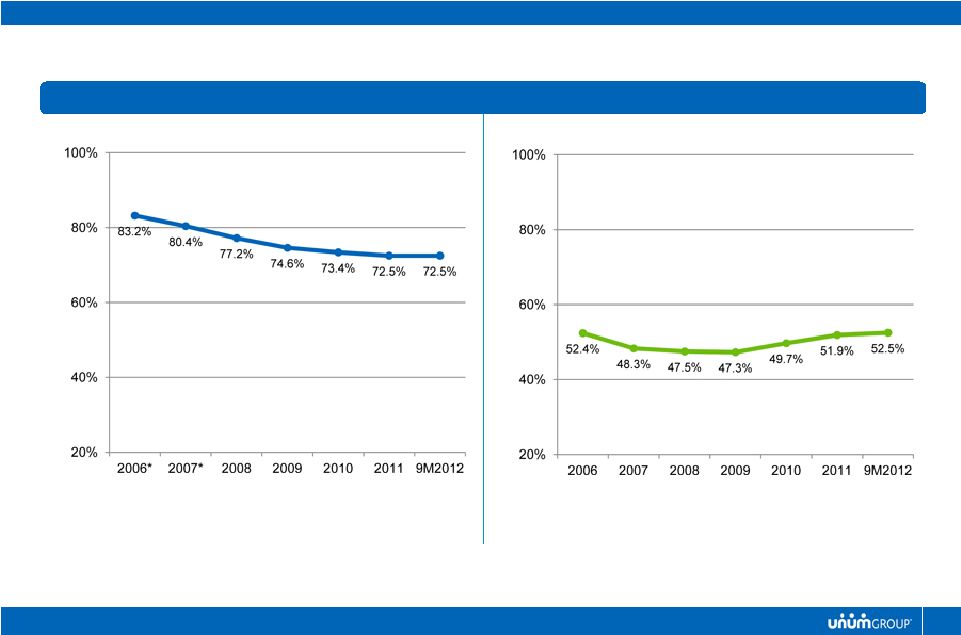

Benefit Ratios

Operating Performance

DISCIPLINED UNDERWRITING

*

Excludes special items |

11

Colonial Life

Unum US

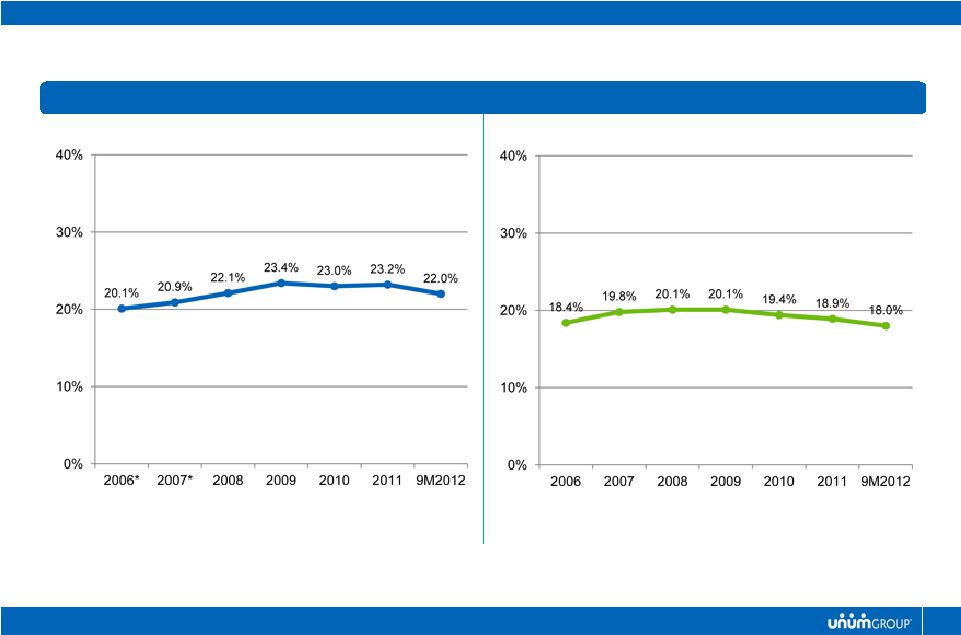

Other Expense Ratios

Operating Performance

EXPENSE MANAGEMENT RIGOR

*

Excludes special items |

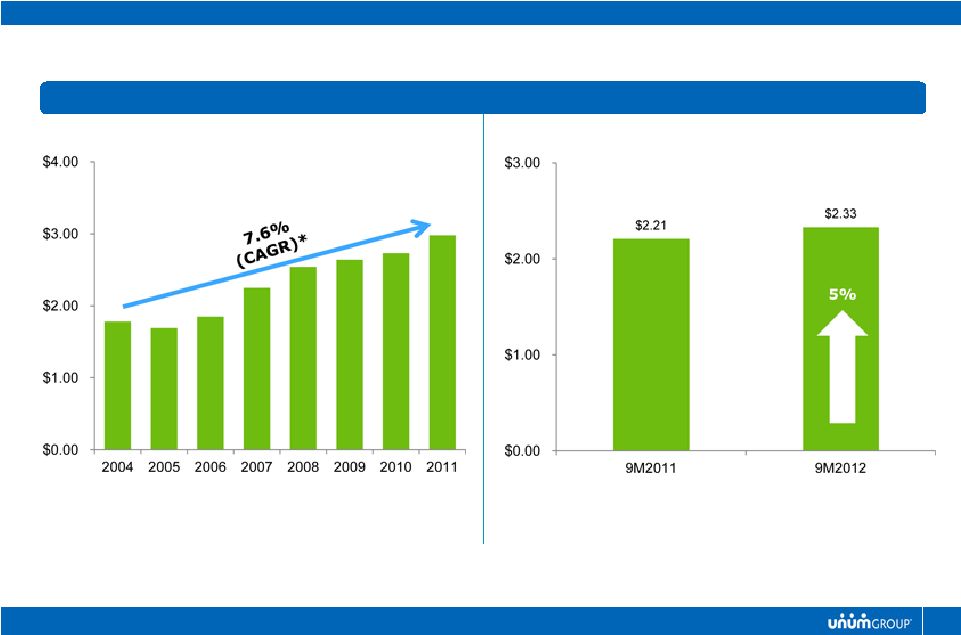

12

Operating Earnings Per Share

Operating Performance

SOLID PROFITABILITY

Years 2004-2008 do not reflect the impact of ASU 2010-26 and special

items * EPS Growth Rate |

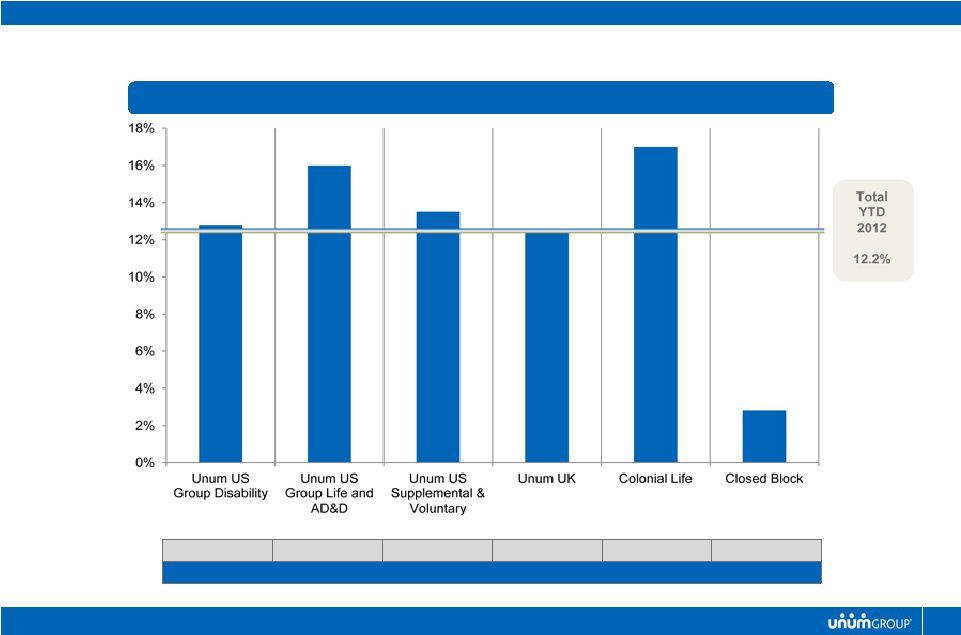

13

YTD 2012 Return on Equity

Operating Performance

19%

11%

20%

10%

13%

27%

YTD % AVERAGE CONSOLIDATED GAAP EQUITY*

CONSISTENTLY STRONG RETURNS

*

Excludes Corporate segment |

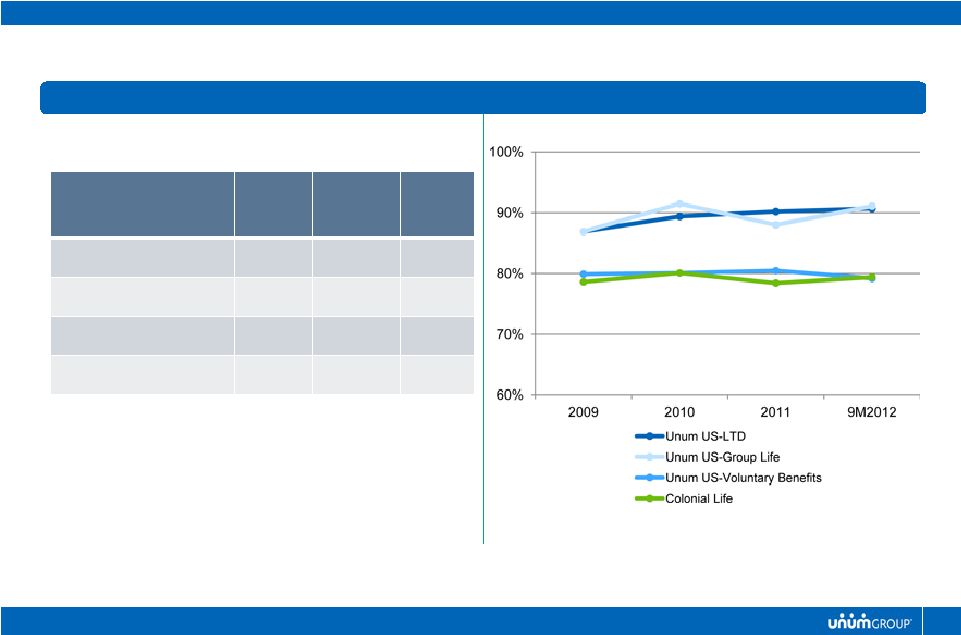

14

Claimant Research

Persistency

Brand

STRONG MARKET ACCEPTANCE

% Satisfied

Unum

Industry

Average

Unum

Rank

Overall handling

91%

87%

#1

Clear explanation

88%

83%

#1

Quality of interaction

90%

86%

#1

Likely to recommend

90%

87%

#1

LTD Claimant Satisfaction

Source: 2011 GenRe Survey of LTD Claimants |

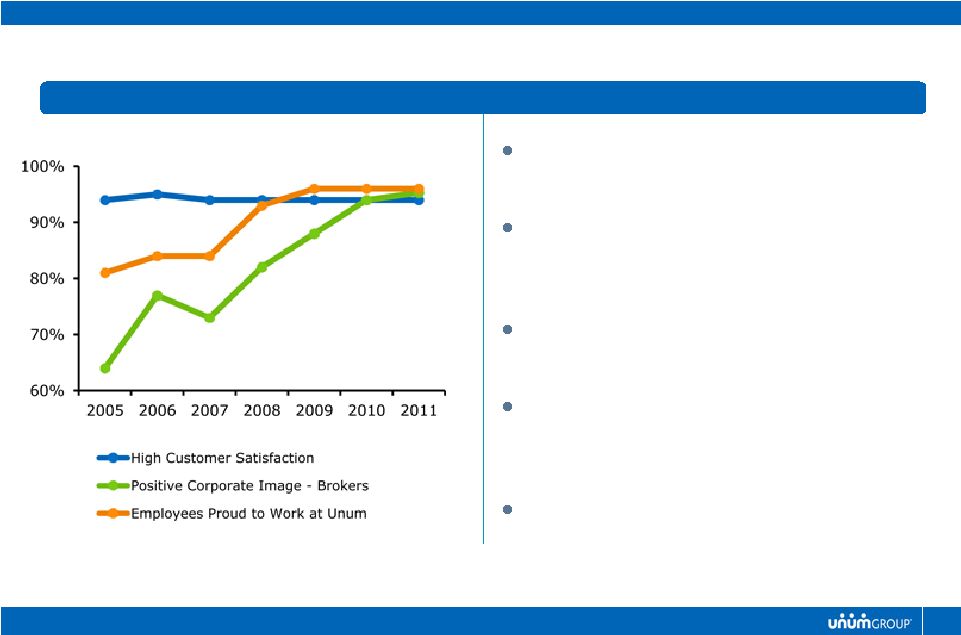

15

Image and Reputation

External Recognition

Brand

BROAD RECOGNITION

Source: Internal surveys of employees, brokers, and customers

Best Places to Work in Insurance

2009 –

2012

Best Places to Work in Maine,

Tennessee, and South Carolina

2006 –

2012

Forbes Magazine –

Top 150 Most

Reputable Companies

Center for Political Accountability –

Corporate Leader in Political Disclosure

and Accountability

Newsweek Magazine –

Green

Companies -

#34 |

16

Investment Performance

STRONG CREDIT QUALITY

Default Experience

Watch List

Watch List

1

Formerly 5.12% due to Lehman, Moody’s has subsequently removed it

Sales and Write-downs of Investments

Sales and Write-downs of Investments

* Includes Supranationals

Breakdown of UK and EuroZone Exposure |

17

2012 Results to Date:

$2.7 billion invested

New money yield of 4.88% (hedge-adjusted)

Overall portfolio yield down 13 bp to 6.54%

Current investment portfolio market value $51.8 billion

Interest Rate Impacts:

Investing new cash flows at lower rates

Decreases to reserve discount rates

Potential persistency impacts as result of price increases

Mitigating Factors:

Placement of premium rate increases

Measured reduction in interest reserve margins

Operating effectiveness (expense management and risk management)

Investment Performance

ACTIVE INTEREST RATE MANAGEMENT |

18

Balance Sheet

QUALITY BALANCE SHEET

Source: Moody’s Investor Service

Goodwill and Intangibles (% of Stockholders Equity)

* Weighted average RBC for traditional US Insurance Companies

Capital Management

Asset Quality

Low Level of Intangibles

Solid Investment Portfolio

Liabilities

Comfortable Leverage

Low Disintermediation Risk

Capital

Insurance Company Strength (RBC)

Holding Company Cash Levels |

19

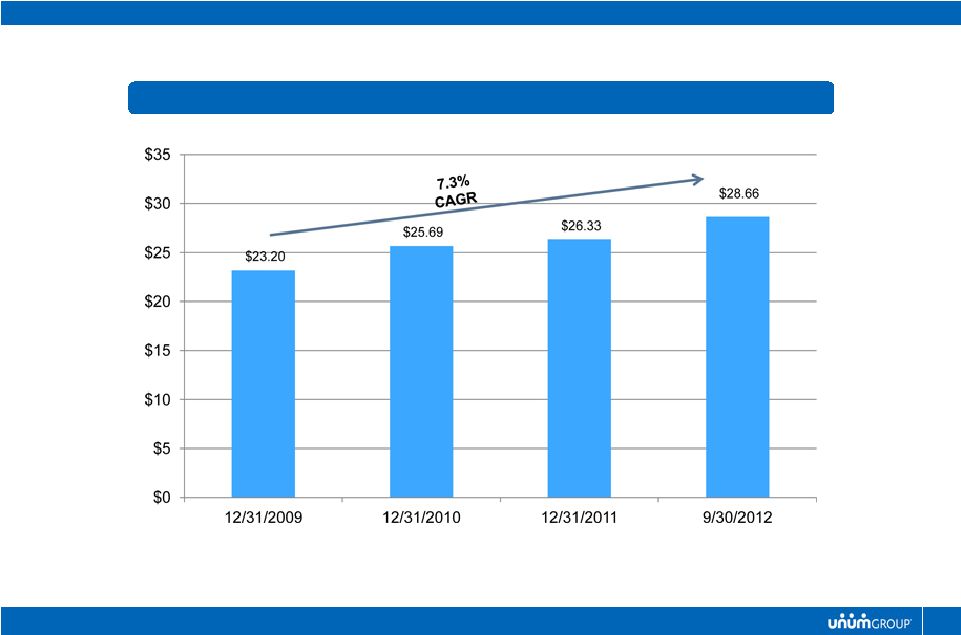

Book Value Per Share

Balance Sheet

BUILDING BOOK VALUE

(Excluding AOCI) |

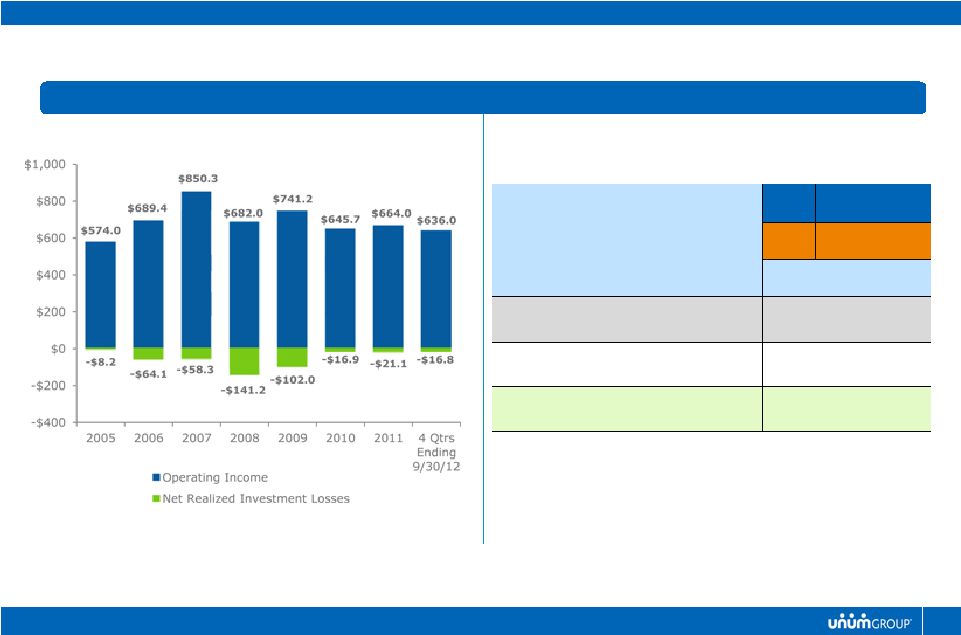

20

($ millions)

($ millions)

Combined Statutory Net Income*

Capital Generation Model

Capital Management

STABLE CASH FLOW

*

Statutory Net Income for traditional US Insurance Companies excluding special

items STATUTORY NET INCOME

U.S.

$600 -

$650

U.K.

$100 -

$150

$700 -

$800

CAPITAL REQUIRED TO

SUPPORT CURRENT GROWTH

+/-

$50

INTEREST EXPENSE

$150

EXCESS CAPITAL GENERATED

ANNUALLY BEFORE DIVIDENDS

$550 -

$650 |

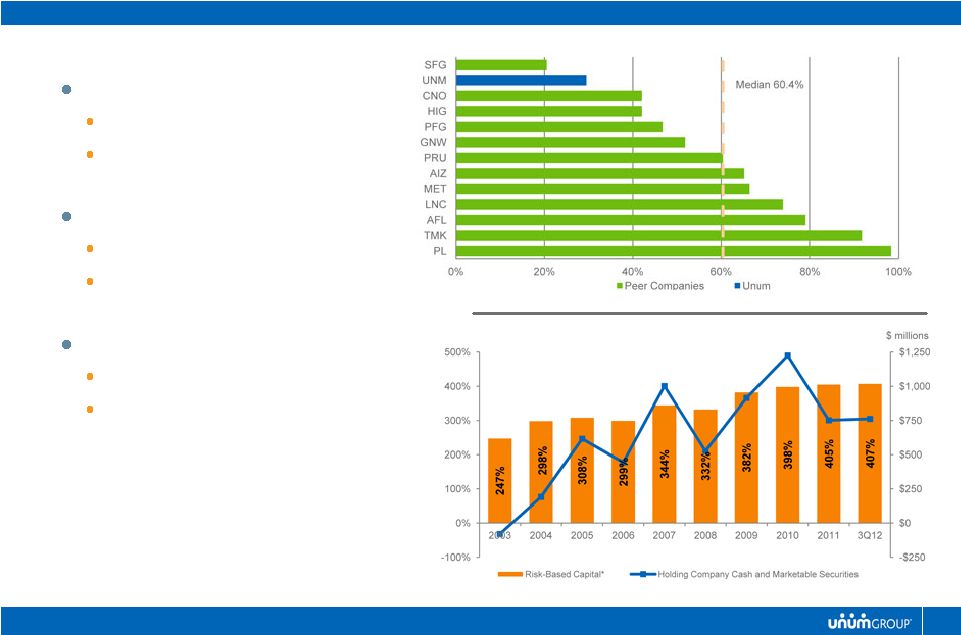

21

($ millions)

Risk-Based Capital

Holding Companies Cash and Marketable Securities

Capital Management

STRONG CAPITAL POSITION IN 2012

As of 9/30/2012 |

22

Capital Management

CONSISTENT RETURN OF CAPITAL TO SHAREHOLDERS

Rating Agency Actions

S&P Upgrade

Share Repurchases

2008

2009

$700 million

---

Moody’s Upgrade

Fitch Upgrade

A.M. Best Upgrade

2010

2011

$356 million

$620 million

TOTAL

$2,176 million

*

Projection for 2012

Dividend Increase

---

+10%

+12%

+14%

$578 million

S&P Upgrade

Moody’s Upgrade

2012

$500 million *

+24% |

Key Challenges |

24

Operating Performance

Unum UK -

Group Life

Long-term Care

Interest Rate Management

Key Challenges |

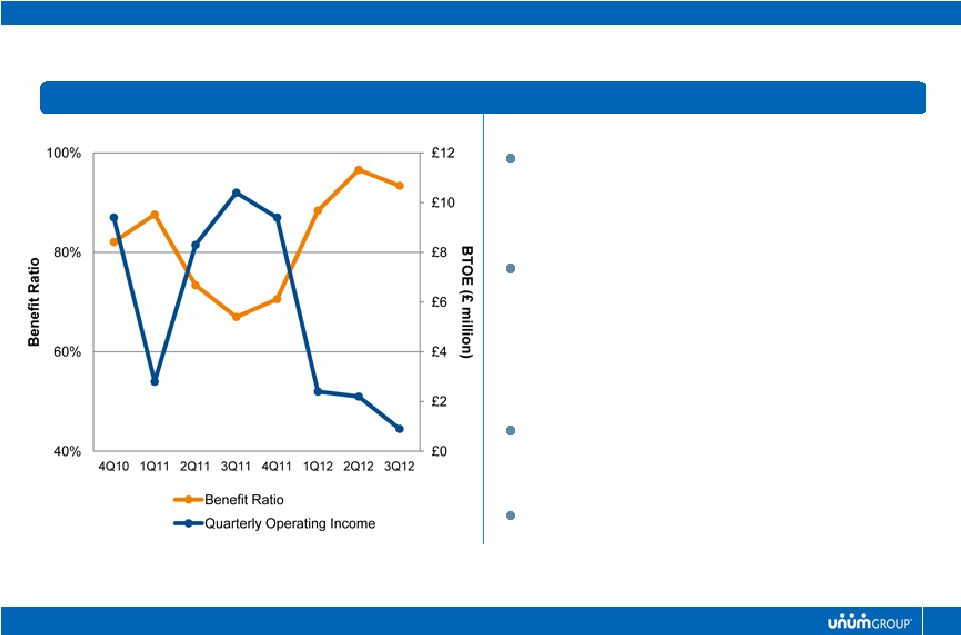

25

Key Messages

Operating Performance

UNUM UK –

GROUP LIFE

Our primary focus is to stabilize

profitability in 2013 and improve returns

and growth over the medium term.

Our segmented growth strategy and

focus on rate increases is expected to

improve profitability; however, pressure

on new sales and persistency is also

likely.

We are evaluating reinsurance

alternatives to reduce volatility.

We continue to remain focused on

operating effectiveness.

Operating Results |

26

Key Messages

Operating Performance

LONG-TERM CARE

•

Primary Risks:

•

Interest Rates –

we see 2 to 3 years of

sufficient margin for low interest rates.

•

Risk Experience –

claim volatility expected

given very young age of block; IALR

estimated

in

range

of

85%

to

90%

(+/-

5%).

•

Primary risk mitigating factor is our

ability to raise rates on in-force

business.

Interest Adjusted Loss Ratio

* Excludes $573.6 million reserve charge.

Including this charge, the IALR was 179.3%. |

27

10-Year Single-A Bond Yields

Key Messages

Interest Rate Management

Limited amount of new cash flow to

invest relative to portfolio size

Strong interest margins

Hedges cover 20% of LTC cash flows for

2013

Pricing adjustments

Source: Bloomberg

Nov 2011 |

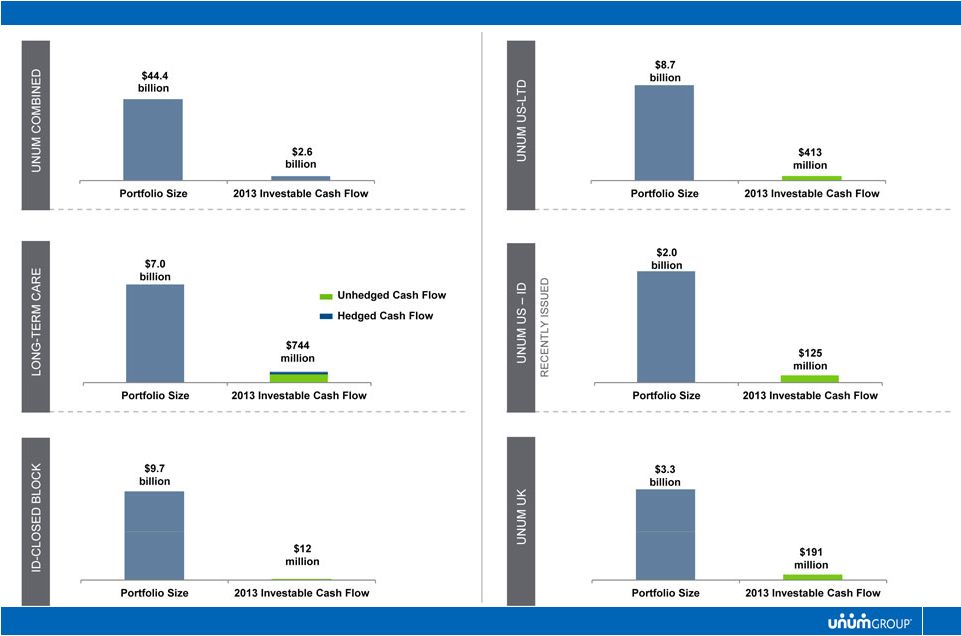

28

Interest Rate Management

2013 INVESTABLE CASH FLOW |

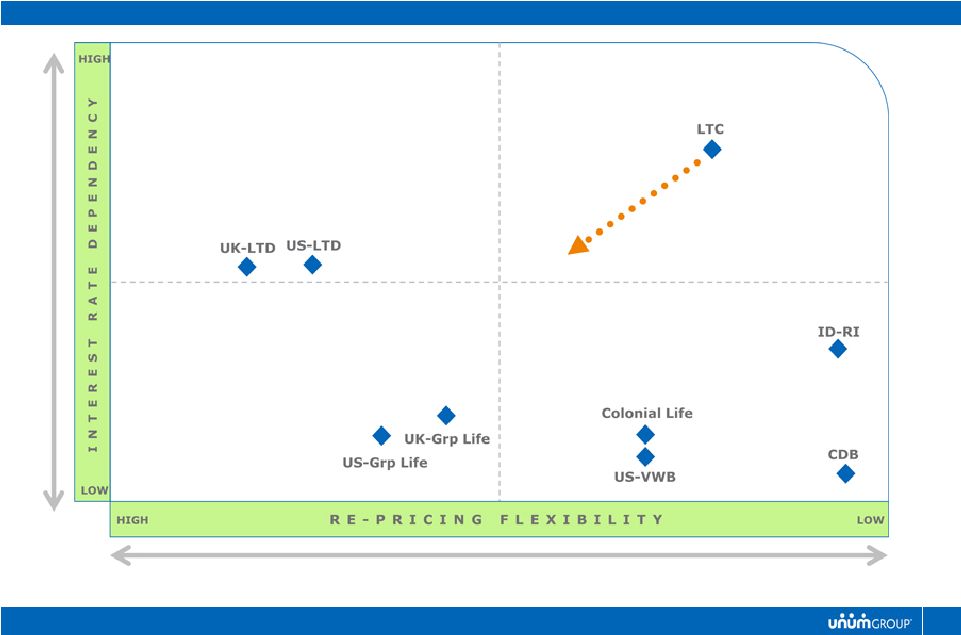

29

Interest Rate Management

PRODUCT LINE SENSITIVITIES |

2012 Assessment |

31

2012*

Annual Outlook

2012

9 Months Actual

Sales Growth

5 -

8%

6.1%

Premium Growth

0 -

2%

2.7%

Earnings Per Share Growth

6 -

12%

5.4%

Return on Equity

11 -

12%

12.2%

2012 Assessment

* Original outlook for 2012 as of November 16, 2011

|

32

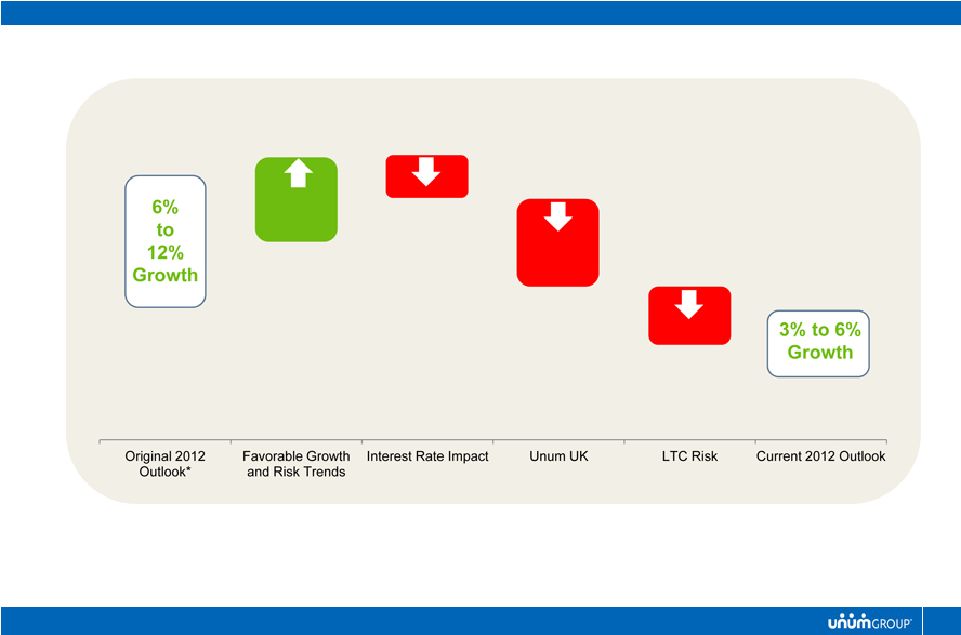

2012 Assessment

FACTORS THAT IMPACTED OUR 2012 OUTLOOK

* November 16, 2011 Annual Investor Meeting |

2013 Outlook |

34

We anticipate the general environment for 2013 to be similar to 2012.

Below average economic growth with limited employment growth

A continuation of today’s low interest rates

While the environment will remain challenging, the need for our products and

services remains strong.

We are taking the needed actions to protect our solid margins and returns.

The impact of our pricing and risk actions will build in 2014 and beyond

We expect to maintain our consistent plan of returning capital to

shareholders. $500 million of share repurchases and continued dividend

increases Maintain solid capital metrics and ratings

While we anticipate 2013 operating growth to be below our long-term targets, we

expect positive operating EPS growth in 2013.

Ninth consecutive year of operating EPS growth

2013 Outlook

KEY MESSAGES |

35

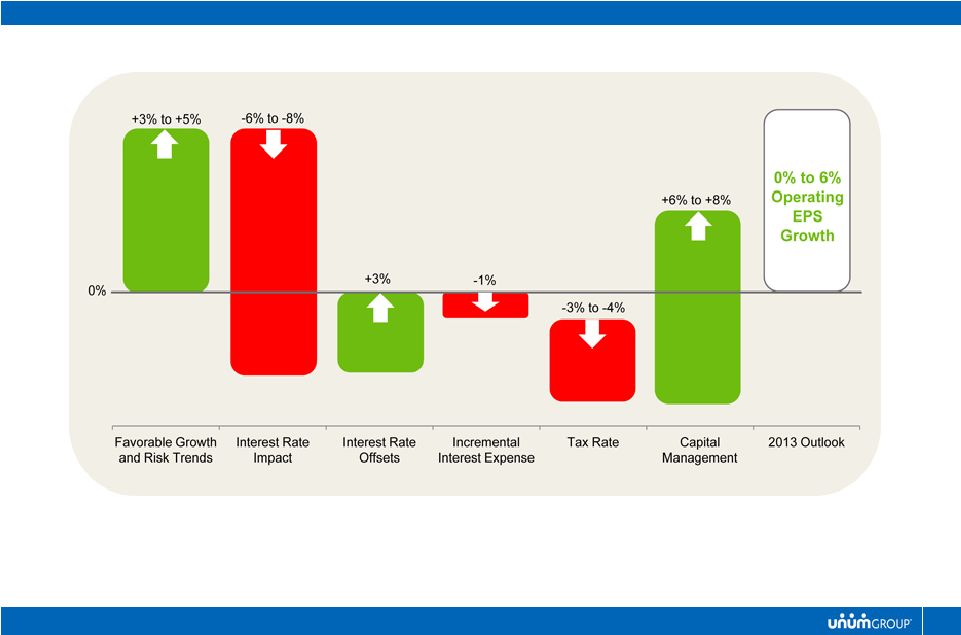

2013 Outlook

FACTORS IMPACTING OUR 2013 OUTLOOK |

36

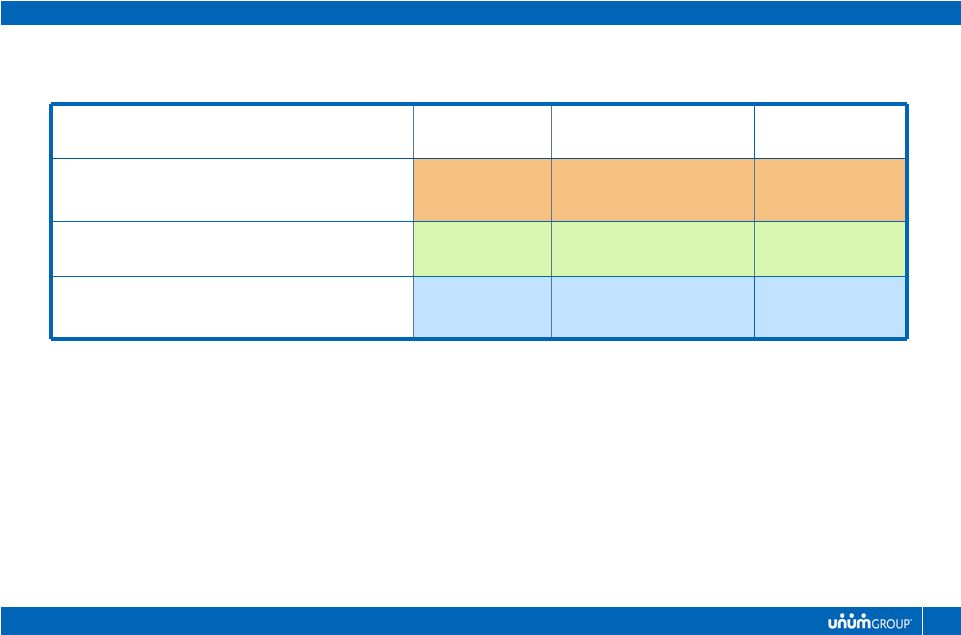

2013 Outlook

CAPITAL OUTLOOK

Capital Management Criteria

2012

Projection

September 30, 2012

Actual

2013

Projection

Risk-Based Capital Ratio for

Traditional U.S. Insurance Companies

375% -

400%

407%

375% -

400%

Leverage

22% -

23%

25%

24% -

25%

Holding Companies Cash and

Marketable Securities ($ millions)

$500 -

$800

$762

$500 -

$800 |

37

2013 Outlook

Sales

Growth

Premium

Growth

Earnings

Growth

ROE

Unum US

3 -

6%

1 -

3%

0 -

2%

12 -

14%

Unum UK ($)

(15 -

20)%

(17 -

20)%

(1) -

1%

15 -

17%

Colonial Life

3 -

6%

3 -

5%

1 -

3%

15 -

17%

Core Operations

1 -

5%

0 -

2%

0 -

2%

13 -

15%

Closed Block

15 –

20%

2 -

4%

Total Operations*

(2 -

5)%

10 -

12%

Capital Management

6 -

8%

0 -

1%

Total

0 -

6%

11 -

12%

* Consolidated After-Tax Operating Earnings including Corporate

Segment |

Closing Comments |

39

Good businesses with positive long-term trends

We remain committed to disciplined growth

Not

tempted

to

“stretch”

in

these

uncertain

times

Our solid financial foundation and predictable cash flow remain an asset

Leading to a consistent capital deployment strategy

We have a realistic but cautious outlook for the environment

Confident we are taking the actions needed to build value

Closing Comments |

40

Closing Comments

A Look At Our Performance |

Question and Answer |

Reconciliation of Non-GAAP Financial

Measures |

43

Reconciliation of Non-GAAP Financial Measures

Year Ended

December 31

2002 *

(in millions)

Unum US

Group Disability

289.9

$

Group Life and Accidental Death and Dismemberment

224.1

Supplemental and Voluntary

165.9

Total Unum US

679.9

Unum UK

69.5

Colonial Life

137.5

Closed Block

170.4

Corporate

(155.0)

Total Operating Income by Segment

902.3

Net Realized Investment Loss

(309.1)

Income Tax

(196.3)

Income from Continuing Operations Before Cumulative Effect

of Accounting Principle Change

396.9

Income from Discontinued Operations, Net of Tax

11.4

Cumulative Effect of Accounting Principle Change, Net of Tax

(7.1)

Net Income

401.2

$

* Does not reflect the impact of ASU 2010-26 or the segment reporting changes implemented in Q4

2008. 2012

2011

Unum US

Group Disability

219.6

$

225.2

$

Group Life and Accidental Death and

Dismemberment 165.8

155.9

Supplemental and Voluntary

249.5

228.4

Total Unum US

634.9

609.5

Unum UK

96.3

138.8

Colonial Life

206.0

205.1

Closed Block

66.7

93.1

Corporate

(73.9)

(59.6)

Total Operating Income by

Segment 930.0

986.9

Net Realized Investment Gain (Loss)

31.6

(12.3)

Non-operating

Retirement-related Loss (34.8)

(24.0)

Income Tax

(266.3)

(297.4)

Net Income

660.5

$

653.2

$

(in millions)

Nine Months Ended September 30 |

44

Reconciliation of Non-GAAP Financial Measures

(in millions)

benefit ratio

(in millions)

benefit ratio

Unum US

Premium Income

4,481.1

$

4,703.6

$

Benefits and Change in Reserves for Future Benefits

3,681.3

82.2%

4,263.4

90.6%

Regulatory Reassessment Charge

(76.5)

(349.2)

Benefits and Change in Reserves for Future Benefits, Excluding

Regulatory Reassessment Charge

3,604.8

80.4%

3,914.2

83.2%

2006

Year Ended December 31

2007

(in millions)

Other Expense Ratio

(in millions)

Other Expense Ratio

Unum US

Premium Income

4,481.1

$

4,703.6

$

Other Expenses

927.5

20.7%

958.5

20.4%

Regulatory Reassessment Charge

10.3

(15.0)

Other Expenses Excluding Regulatory Reassessment Charge

937.8

20.9%

943.5

20.1%

Year Ended December 31

2007

2006 |

45

Reconciliation of Non-GAAP Financial Measures

2011

2010

2009

2008

2007**

2006**

2005**

2004**

After-tax Operating Income

2.98

$

2.73

$

2.64

$

2.54

$

2.25

$

1.85

$

1.69

$

1.78

$

Net Realized Investment Gain (Loss), Net of Tax

(0.01)

0.05

-

(0.89)

(0.12)

0.01

(0.02)

0.06

Non-operating Retirement-related Loss, Net of Tax

(0.07)

(0.06)

(0.09)

(0.03)

(0.04)

(0.05)

(0.05)

(0.04)

Deferred Acquisition Costs and Reserve Charges for

Closed Block, Net of Tax

(2.04)

-

-

-

-

-

-

(2.37)

Regulatory Reassessment Charges, Net of Tax

-

-

-

-

(0.10)

(0.79)

(0.16)

(0.29)

Special Tax Items and Debt Extinguishment Costs

0.08

(0.03)

-

-

(0.10)

0.23

0.14

0.17

Other, Net of Tax

-

-

-

-

-

(0.04)

0.01

0.01

Income (Loss) from Continuing Operations

0.94

2.69

2.55

1.62

1.89

1.21

1.61

(0.68)

Income (Loss) from Discontinued Operations

-

-

-

-

0.02

0.02

0.03

(0.18)

Net Income (Loss)

0.94

$

2.69

$

2.55

$

1.62

$

1.91

$

1.23

$

1.64

$

(0.86)

$

* Amounts per diluted common share.

** Does not reflect the impact of ASU 2010-26.

Year Ended December 31*

2012

2011

(in millions)

per share *

(in millions)

per share *

After-tax Operating Income

662.5

$

2.33

$

677.2

$

2.21

$

Net Realized Investment Gain (Loss), Net

of Tax 20.7

0.07

(8.4)

(0.03)

Non-operating

Retirement-related Loss, Net of Tax (22.7)

(0.08)

(15.6)

(0.05)

Net Income

660.5

$

2.32

$

653.2

$

2.13

$

* Amounts per diluted common share.

Nine Months Ended September 30 |

46

Reconciliation of Non-GAAP Financial Measures

After-Tax

Average

Operating

Allocated

Annualized

Income (Loss)

Equity

Return

On Equity

Nine Months Ended September 30, 2012

Unum US

Group Disability

144.5

$

1,503.5

$

12.8%

Group Life and Accidental Death and Dismemberment

108.0

897.0

16.0%

Supplemental and Voluntary

163.7

1,618.5

13.5%

Total Unum US

416.2

4,019.0

13.8%

Unum UK

73.1

787.4

12.4%

Colonial Life

133.9

1,051.1

17.0%

Closed Block

43.8

2,121.5

2.8%

Corporate

(4.5)

(715.5)

Total

662.5

$

7,263.5

$

12.2%

Nine Months Ended September 30, 2011

Unum US

Group Disability

148.3

$

1,504.1

$

13.1%

Group Life and Accidental Death and Dismemberment

101.5

840.2

16.1%

Supplemental and Voluntary

149.7

1,527.2

13.1%

Total Unum US

399.5

3,871.5

13.8%

Unum UK

112.4

775.1

19.3%

Colonial Life

133.3

978.2

18.2%

Closed Block

57.7

2,388.4

3.2%

Corporate

(25.7)

(319.0)

Total

677.2

$

7,694.2

$

11.7%

(in millions) |

47

Reconciliation of Non-GAAP Financial Measures

September 30

December 31

September 30

December 31

2012

2011

2011

2010

Total Stockholders' Equity, As Reported

8,673.3

$

8,169.7

$

8,995.8

$

8,484.9

$

Net Unrealized Gain on Securities

892.2

614.8

894.0

416.1

Net Gain on Cash Flow Hedges

400.3

408.7

421.1

361.0

Total Stockholders' Equity, As Adjusted

7,380.8

$

7,146.2

$

7,680.7

$

7,707.8

$

Average Equity, As Adjusted

7,263.5

$

7,694.2

$

September 30

2012

2011

2010

2009

Total Stockholders' Equity (Book Value)

31.53

$

27.91

$

26.80

$

24.25

$

Net Unrealized Gain on

Securities 3.24

2.11

1.31

1.16

Net Gain on Cash Flow Hedges

1.46

1.39

1.14

1.12

Subtotal

26.83

24.41

24.35

21.97

Foreign Currency Translation Adjustment

(0.29)

(0.41)

(0.34)

(0.23)

Subtotal

27.12

24.82

24.69

22.20

Unrecognized Pension and Postretirement Benefit Costs

(1.54)

(1.51)

(1.00)

(1.00)

Total Stockholders' Equity, Excluding Accumulated

Other Comprehensive Income

28.66

$

26.33

$

25.69

$

23.20

$

December 31

(per share)

(in millions)

September 30

2012

(in millions)

Debt, As Reported

3,239.8

$

Exclude Non-recourse Debt and Securities Lending Agreements

1,045.2

Debt, As Adjusted

2,194.6

$

Total Stockholders' Equity, As Reported

8,673.3

$

Exclude Net Unrealized Gain on Securities and

Net Gain on Cash Flow Hedges

1,292.5

Exclude Northwind and Tailwind Capital

855.7

6,525.1

Debt, As Adjusted

2,194.6

Total Capital, As Adjusted

8,719.7

$

Debt to Capital Ratio

25.2% |