Attached files

| file | filename |

|---|---|

| 8-K - SYNERGETICS USA, INC. 8-K 12-17-2012 - SYNERGETICS USA INC | form8k.htm |

Exhibit 99.1

NEUROSURGERY OPHTHALMOLOGY QUALITY. PERFORMANCE. INNOVATION. Investor Presentation December 2012 *

Certain statements made in this presentation are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may include statements concerning management’s expectations of future financial results, potential business, potential acquisitions, government agency approvals, additional indications and therapeutic applications for medical devices, as well as their outcomes, clinical efficacy and potential markets and similar statements, all of which are forward looking. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from predicted results. For a discussion of such risks and uncertainties, please refer to the information set forth under “Risk Factors” included in Synergetics USA, Inc.’s Annual Report on Form 10-K for the year ended July 31, 2012, and information contained in subsequent filings with the Securities and Exchange Commission. These forward looking statements are made based upon our current expectations and we undertake no duty to update information provided in this presentation. Safe Harbor Statement *

Overview Corporate Information Market Information* NASDAQ: SURG Market Cap: $113.5 mm 52 Week Range: $3.30 – $7.55 Shares Outstanding: 25mm Institutional Ownership: 47% Russell Microcap Index * Synergetics USA, Inc. is a medical device company focused in the fast-growing ophthalmology and neurosurgery markets Formed through a reverse merger of Synergetics, Inc. and Valley Forge Scientific in 2005 Synergetics, Inc. was founded in 1991 and Valley Forge was founded in 1980 Corporate Headquarters: O’Fallon, MO Manufacturing Facilities: O’Fallon, MO and King of Prussia, PA *Source: Yahoo Finance, as of 12/14/12.

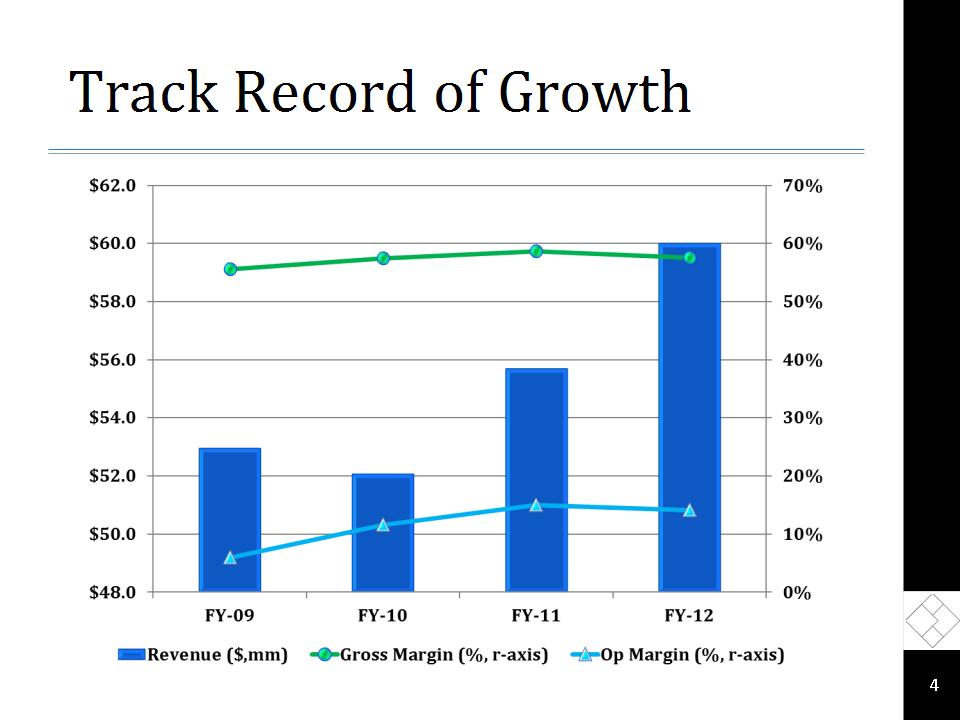

Track Record of Growth *

FY 2012 Revenue Mix Ophthalmic sales represent Synergetics’ largest and business In the U.S., Synergetics sells ophthalmic surgical products directly to end-users at hospitals, ambulatory surgery centers and surgeon offices throughout the country Internationally, Synergetics sells and distributes ophthalmic surgical products in approximately 60 countries Marketing partner and key OEM relationships with J&J’s Codman division and Stryker for neurosurgery products. *

Overall Strategy Drive accelerating growth in Ophthalmology Manage OEM neurosurgery business for stable growth and strong cash flows Deliver improving profitability through enterprise-wide lean initiatives Demonstrate solid financial performance *

Recent Events Implementation of corporate-wide lean initiatives Project Restore to improve cost structure Transition of Neurosurgery business to OEM marketing partners from direct sales Alcon settlement and discontinuation of supply agreement *

Ophthalmic Surgical Market *

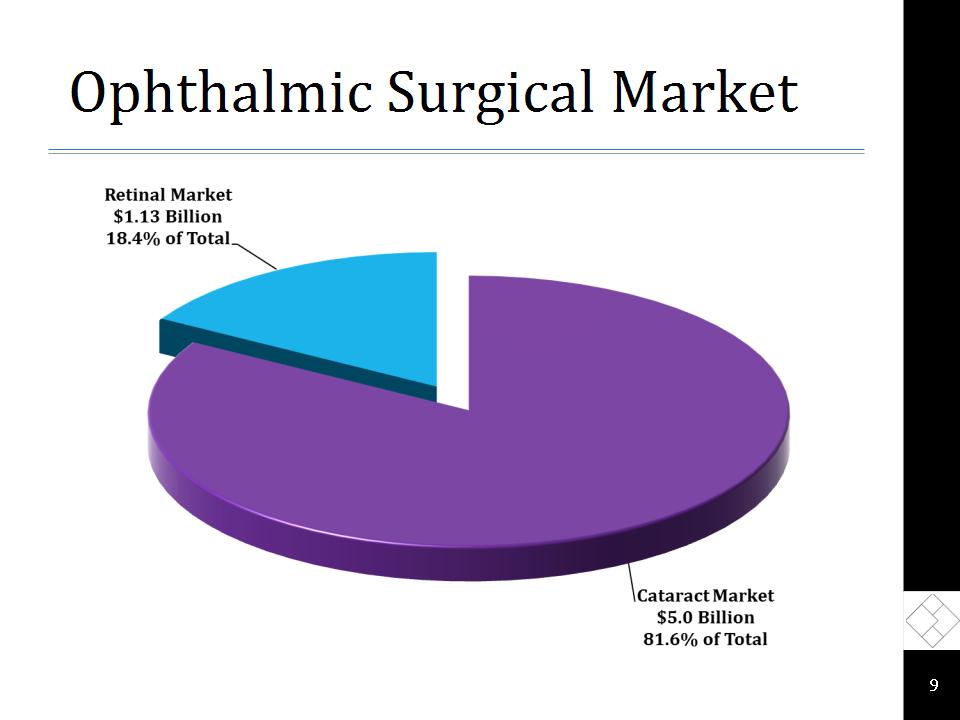

Ophthalmic Surgical Market *

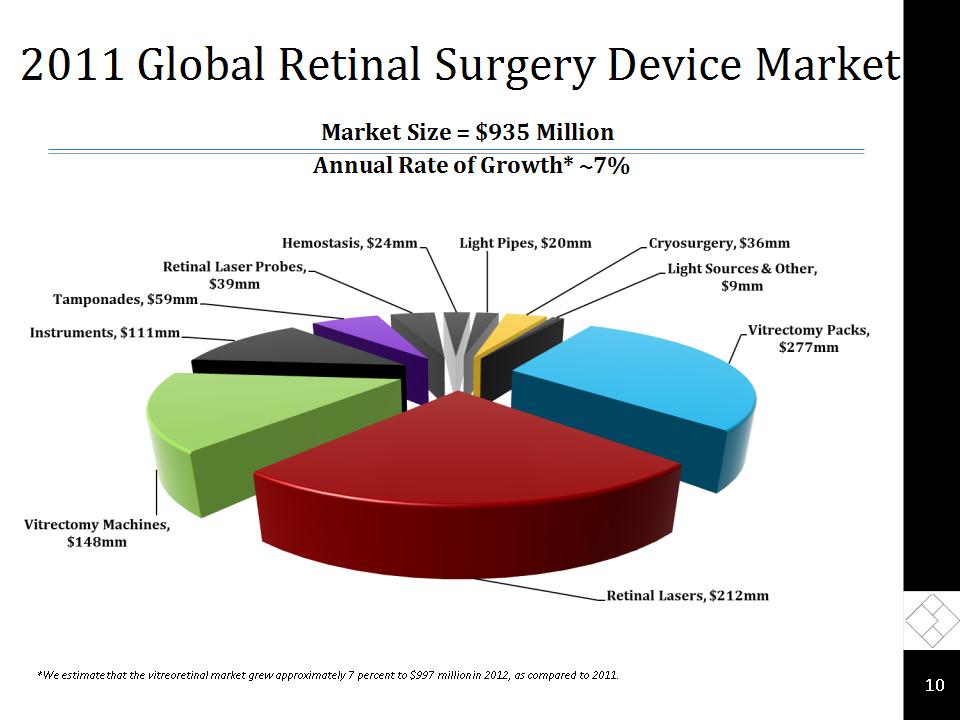

2011 Global Retinal Surgery Device Market * *We estimate that the vitreoretinal market grew approximately 7 percent to $997 million in 2012, as compared to 2011. Annual Rate of Growth* ~7% Market Size = $935 Million

2012 Global Retinal Surgery Device Market * Market Size = $1.13 Billion

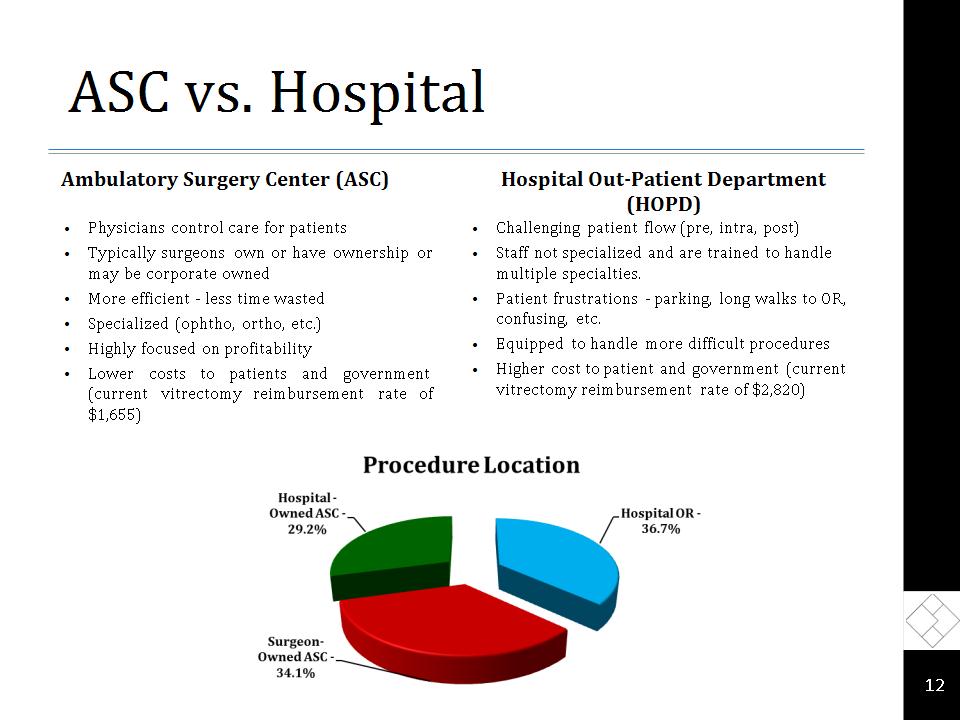

ASC vs. Hospital Ambulatory Surgery Center (ASC) Physicians control care for patients Typically surgeons own or have ownership or may be corporate owned More efficient – less time wasted Specialized (ophtho, ortho, etc.) Highly focused on profitability Lower costs to patients and government (current vitrectomy reimbursement rate of $1,655) Hospital Out-Patient Department (HOPD) Challenging patient flow (pre, intra, post) Staff not specialized and are trained to handle multiple specialties. Patient frustrations – parking, long walks to OR, confusing, etc. Equipped to handle more difficult procedures Higher cost to patient and government (current vitrectomy reimbursement rate of $2,820) *

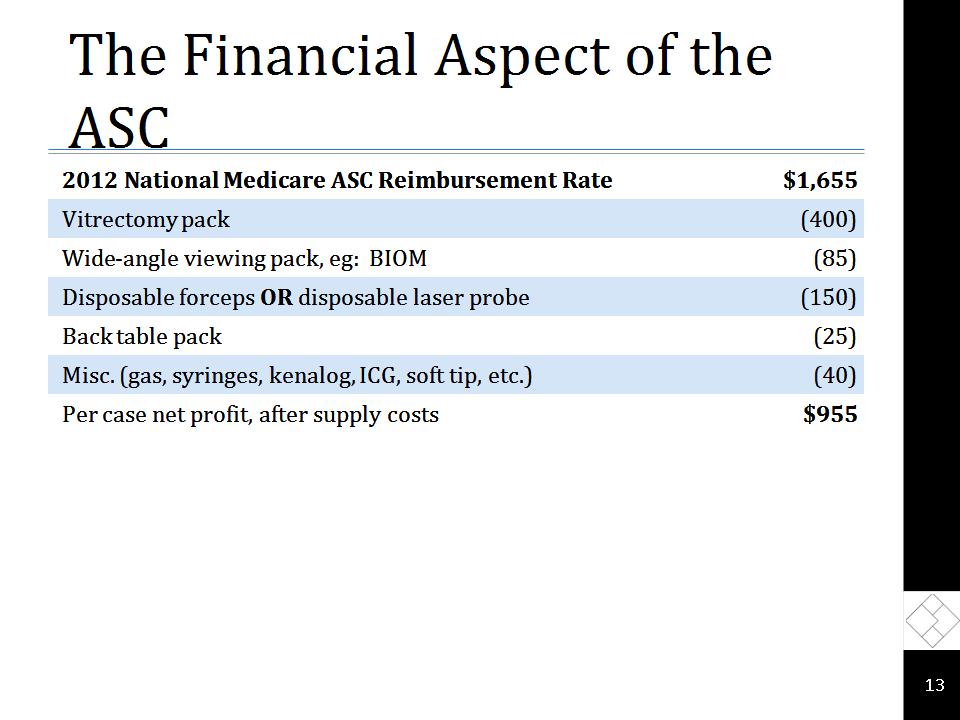

The Financial Aspect of the ASC 2012 National Medicare ASC Reimbursement Rate $1,655 Vitrectomy pack (400) Wide-angle viewing pack, eg: BIOM (85) Disposable forceps OR disposable laser probe (150) Back table pack (25) Misc. (gas, syringes, kenalog, ICG, soft tip, etc.) (40) Per case net profit, after supply costs $955 *

Ophthalmic Products * Core VersaPACK™ UVE (Ultimate Vit Enhancer) VersaVIT™ Directional Laser Probes DDMS- Diamond Duster Membrane Scraper Endoilluminator Awh Chandelier Photon II New

VersaPACK™: Compelling Value Proposition VersaPACK is our first product for the $275 million vitrectomy pack market Compelling value proposition to retinal surgeons Competitively priced vs. other packs Compatible with existing competitive vitrectomy machines Enables continued use of 1st gen machines thus avoiding large capital expenditure Estimated 200,000 vitrectomies performed yearly (U.S.) High margin, recurring disposable product *

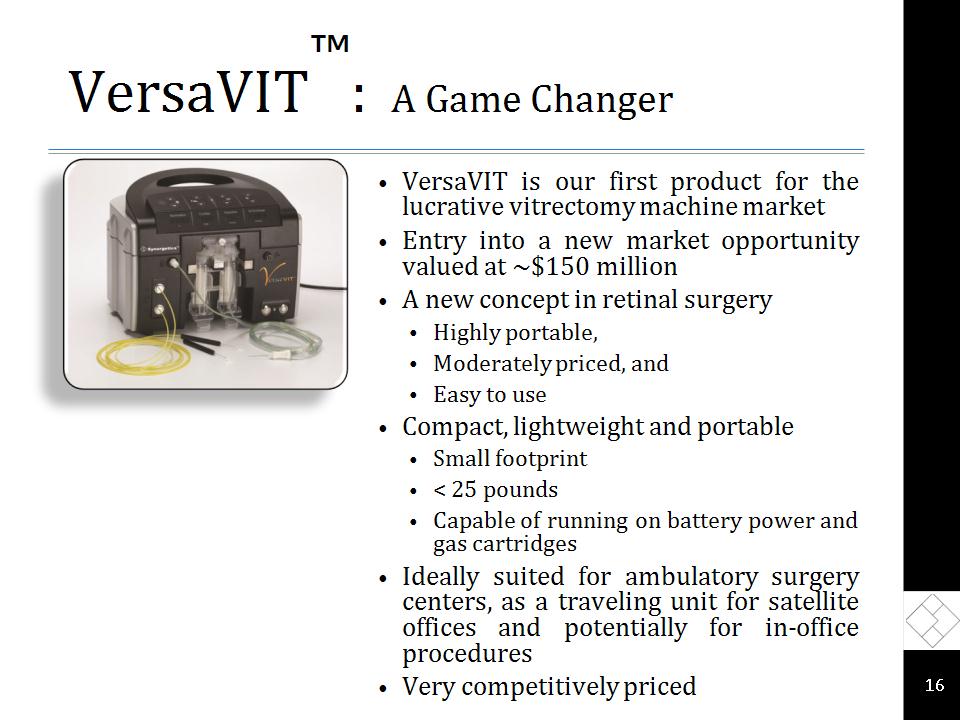

VersaVIT™: A Game Changer VersaVIT is our first product for the lucrative vitrectomy machine market Entry into a new market opportunity valued at ~$150 million A new concept in retinal surgery Highly portable, Moderately priced, and Easy to use Compact, lightweight and portable Small footprint < 25 pounds Capable of running on battery power and gas cartridges Ideally suited for ambulatory surgery centers, as a traveling unit for satellite offices and potentially for in-office procedures Very competitively priced *

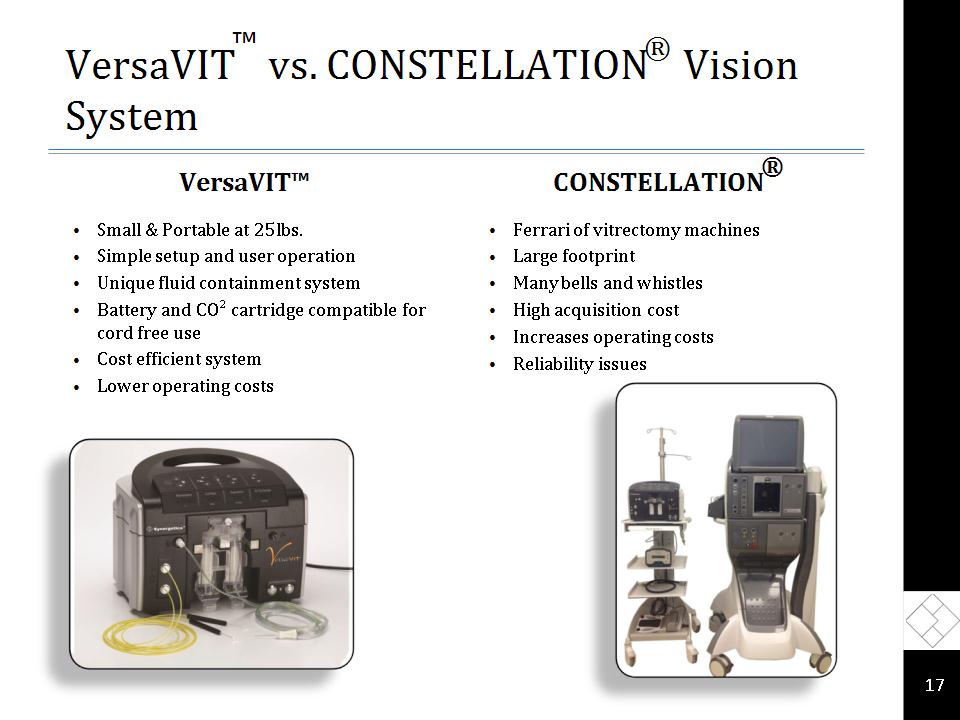

VersaVIT™ vs. CONSTELLATION® Vision System VersaVIT™ Small & Portable at 25lbs. Simple setup and user operation Unique fluid containment system Battery and CO² cartridge compatible for cord free use Cost efficient system Lower operating costs CONSTELLATION® Ferrari of vitrectomy machines Large footprint Many bells and whistles High acquisition cost Increases operating costs Reliability issues *

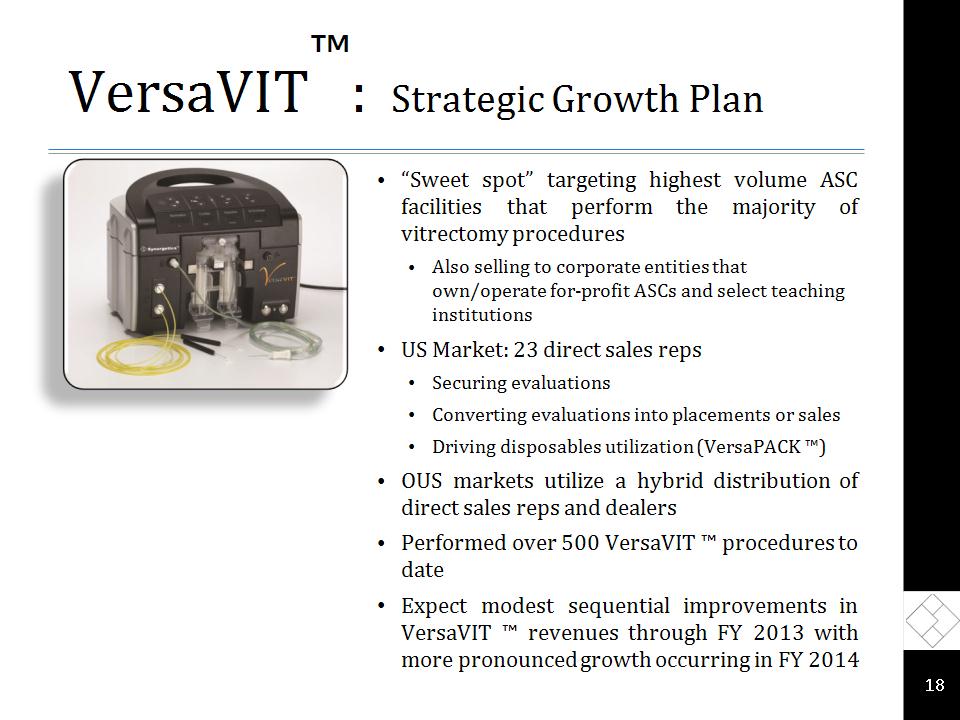

VersaVIT™: Strategic Growth Plan “Sweet spot” targeting highest volume ASC facilities that perform the majority of vitrectomy procedures Also selling to corporate entities that own/operate for-profit ASCs and select teaching institutions US Market: 23 direct sales reps Securing evaluations Converting evaluations into placements or sales Driving disposables utilization (VersaPACK ™) OUS markets utilize a hybrid distribution of direct sales reps and dealers Performed over 500 VersaVIT ™ procedures to date Expect modest sequential improvements in VersaVIT ™ revenues through FY 2013 with more pronounced growth occurring in FY 2014 *

Ophthalmology Product Video *

Neurosurgery Market *

Neurosurgery Overview Best-in-class neurosurgical technologies Ultrasonic aspirators Disposable tips and tubing Electrosurgical generators Disposable bipolar forceps Strong OEM partnerships J&J’s Codman division distributes our electrosurgical generators and bipolar forceps Stryker distributes our ultrasonic aspirator disposables Multi-year OEM contracts with Codman and Stryker provide high visibility Attractive operating margins High barriers to entry Expanding OEM platform complements our strategic focus Packaging Mitosol®, a drug used in glaucoma surgery, for Mobius Therapeutics™ *

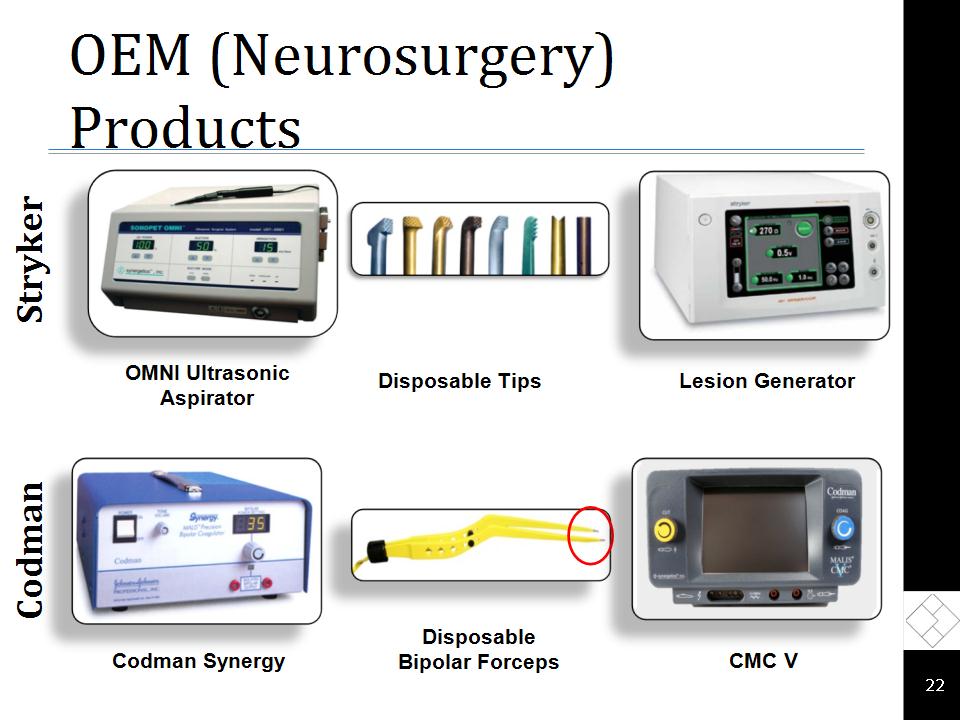

OEM (Neurosurgery) Products * Codman Stryker Lesion Generator OMNI Ultrasonic Aspirator Disposable Tips Codman Synergy Disposable Bipolar Forceps CMC V

Neurosurgery Product Video *

Financials *

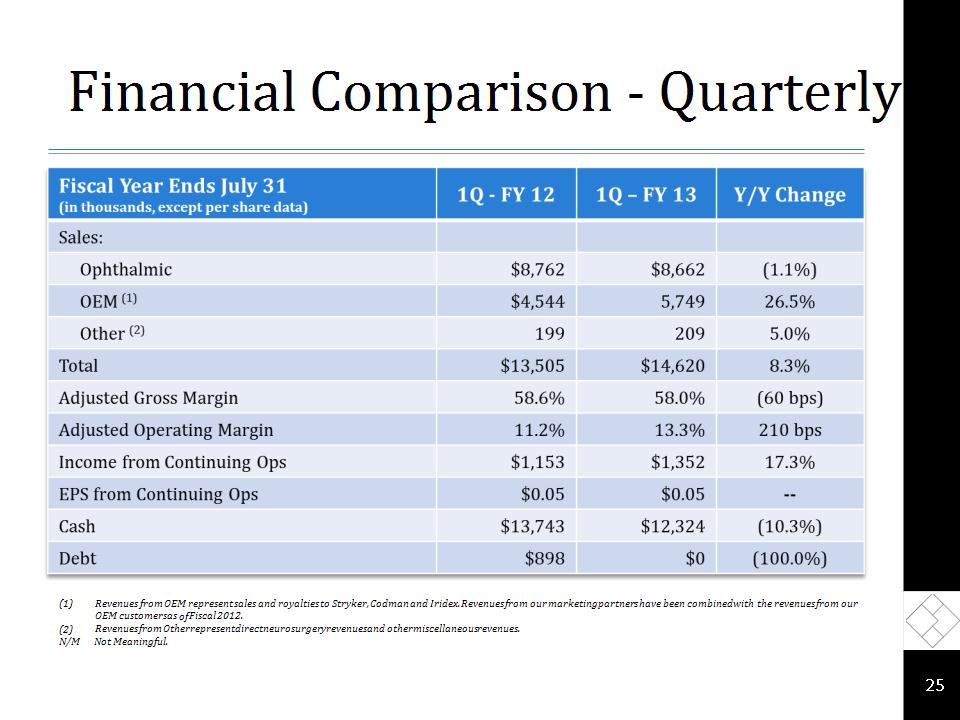

Financial Comparison - Quarterly * Revenues from OEM represent sales and royalties to Stryker, Codman and Iridex. Revenues from our marketing partners have been combined with the revenues from our OEM customers as of Fiscal 2012. Revenues from Other represent direct neurosurgery revenues and other miscellaneous revenues. N/M Not Meaningful.

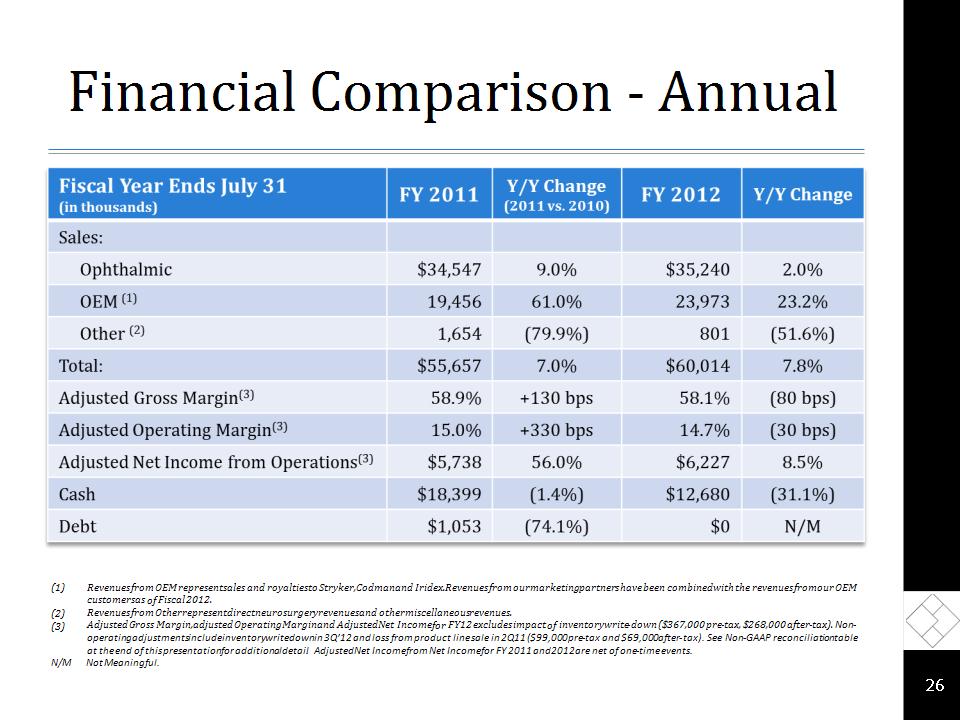

Financial Comparison - Annual * Revenues from OEM represent sales and royalties to Stryker, Codman and Iridex. Revenues from our marketing partners have been combined with the revenues from our OEM customers as of Fiscal 2012. Revenues from Other represent direct neurosurgery revenues and other miscellaneous revenues. Adjusted Gross Margin, adjusted Operating Margin and Adjusted Net Income for FY12 excludes impact of inventory write-down ($367,000 pre-tax, $268,000 after-tax). Non-operating adjustments include inventory writedown in 3Q’12 and loss from product line sale in 2Q11 ($99,000 pre-tax and $69,000 after-tax) . See Non-GAAP reconciliation table at the end of this presentation for additional detail. Adjusted Net Income from Net Income for FY 2011 and 2012 are net of one-time events. N/M Not Meaningful.

Investment Rationale Serving growing ophthalmic and neurosurgery markets with leading technologies Retinal surgery a compelling segment of ophthalmology High barriers to entry and limited competition New product introductions to help drive acceleration in revenue growth Business model favors high margin disposables and leverages off our capital equipment Lean initiatives fueling improving operating margins *

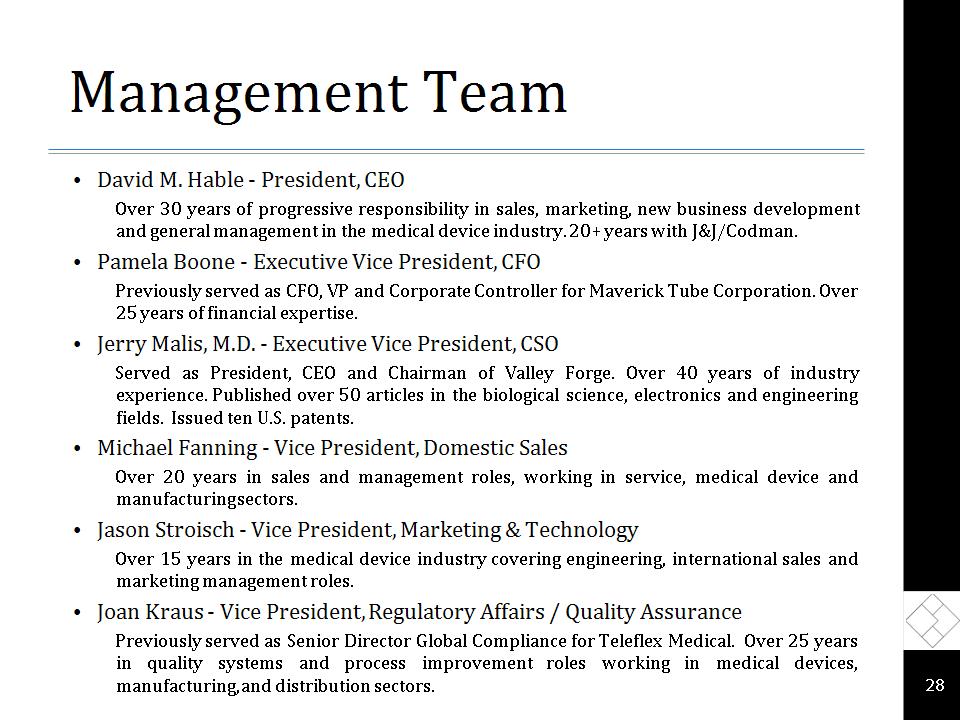

Management Team David M. Hable – President, CEO Over 30 years of progressive responsibility in sales, marketing, new business development and general management in the medical device industry. 20+ years with J&J/Codman. Pamela Boone – Executive Vice President, CFO Previously served as CFO, VP and Corporate Controller for Maverick Tube Corporation. Over 25 years of financial expertise. Jerry Malis, M.D. – Executive Vice President, CSO Served as President, CEO and Chairman of Valley Forge. Over 40 years of industry experience. Published over 50 articles in the biological science, electronics and engineering fields. Issued ten U.S. patents. Michael Fanning – Vice President, Domestic Sales Over 20 years in sales and management roles, working in service, medical device and manufacturing sectors. Jason Stroisch – Vice President, Marketing & Technology Over 15 years in the medical device industry covering engineering, international sales and marketing management roles. Joan Kraus – Vice President, Regulatory Affairs / Quality Assurance Previously served as Senior Director Global Compliance for Teleflex Medical. Over 25 years in quality systems and process improvement roles working in medical devices, manufacturing, and distribution sectors. *

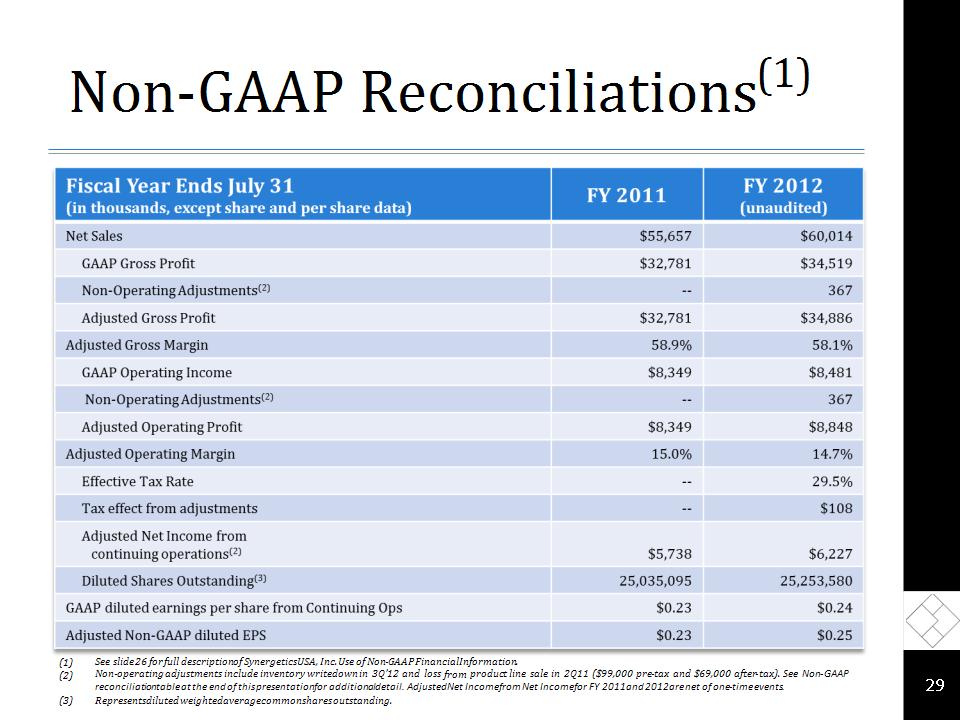

Non-GAAP Reconciliations(1) * See slide 26 for full description of Synergetics USA, Inc. Use of Non-GAAP Financial Information. Non-operating adjustments include inventory writedown in 3Q’12 and loss from product line sale in 2Q11 ($99,000 pre-tax and $69,000 after-tax). See Non-GAAP reconciliation table at the end of this presentation for additional detail. Adjusted Net Income from Net Income for FY 2011 and 2012 are net of one-time events. Represents diluted weighted average common shares outstanding.

(1)Use of Non-GAAP Financial Information In addition to results reported in accordance with GAAP, the Company occasionally provides non-GAAP financial information that management uses in evaluating the Company’s performance, such as EBITDA. These non-GAAP amounts, including EBITDA, consist of GAAP amounts excluding inventory write-down and disposition charges to the extent occurring during the period. EBITDA is defined as income from continuing operations before interest expense, income taxes, depreciation and amortization. The Company measures its performance primarily through its operating profit. In addition to its consolidated financial statements presented in accordance with GAAP, management uses certain non-GAAP measures, including EBITDA, to measure operating performance. The Company provides a definition of the components of these measurements and reconciliation to the most directly comparable GAAP financial measure. EBITDA is presented to enhance an understanding of the Company’s operating results and is not intended to represent cash flow or results of operations. The use of EBITDA provides an indication of the Company’s ability to service debt and measure operating performance. Management believes EBITDA is useful in evaluating the Company’s operating performance compared to other companies in its industry and is beneficial to investors, potential investors and other key stakeholders, including creditors, who use this measure in their evaluation of the Company’s performance. The Company’s calculation of EBITDA may be different from that used by other companies and is not based on any comprehensive set of accounting rules or principles. EBITDA does have certain material limitations primarily due to the exclusion of certain amounts that are material to the Company’s results of operations, such as interest expense, income tax expense, depreciation and amortization. Due to these limitations, EBITDA should not be considered a measure of discretionary cash available to the Company to invest in its business and should be utilized in conjunction with other information contained in the Company’s unaudited condensed consolidated financial statements prepared in accordance with GAAP. *

NEUROSURGERY OPHTHALMOLOGY QUALITY. PERFORMANCE. INNOVATION. 3845 Corporate Centre Drive O’Fallon, MO 63368 (636) 939-5100 www.synergeticsusa.com