Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATHEON INC | d451798d8k.htm |

| EX-99.1 - PRESS RELEASE - PATHEON INC | d451798dex991.htm |

Patheon

Fiscal 2012 Fourth Quarter Results

December 17, 2012

Exhibit 99.2 |

1

Use of Non-GAAP Financial Measures

Forward-looking statement

This presentation contains forward-looking statements or information which reflect our

expectations regarding possible events, conditions, our future growth, results of

operations, performance, and business prospects and opportunities. All statements, other

than statements of historical fact, are forward-looking statements. Forward-looking

statements necessarily involve significant known and unknown risks, assumptions and

uncertainties that may cause our actual results in future periods to differ materially from those

expressed or implied by such forward-looking statements. These risks are described in our

2011 Form 10-K, and our other filings with the U.S. Securities and Exchange

Commission and with the Canadian Securities Administrators. Accordingly, you are cautioned not to

place undue reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof, and except as required by law, we assume no

obligation to update or revise them to reflect new events or circumstances. These

slides contain references to the following non-GAAP measures: (1) “Adjusted EBITDA” which is income (loss) before

discontinued operations before repositioning expenses, interest expense, foreign exchange

losses reclassified from other comprehensive income (loss), refinancing expenses,

acquisition and related costs, gains and losses on sale of capital assets, gain on

extinguishment of debt, income taxes, asset impairment charges, depreciation and amortization

and other income and expenses; (2) “Adjusted EBITDA Margin which is adjusted

EBITDA as a percentage of revenue; and (3) “Adjusted EBITDA Excluding Certain Items,”

which is “Adjusted EBITDA” excluding the consulting fees associated with the

strategic initiatives. Since Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted

EBITDA before certain items are non-GAAP measures that do not have a standardized meaning, they

may not be comparable to similar measures presented by other issuers. You are cautioned that

these non-GAAP measures should not be substituted for their comparable GAAP measures

as indicators of performance. We have included these measures because we believe

that this information is used by certain investors to assess our financial performance, before non-cash charges and certain

costs that we do not believe are reflective of our underlying business. In addition, Adjusted

EBITDA is used by management as an internal measure of profitability.

Reconciliations of Adjusted EBITDA and Adjusted EBITDA before certain items to the closest U.S.

GAAP measures are included in the Appendix to this presentation.

|

2

Guidance

Actual

Revenue

>$700 M

$749.1 M

Transformation

Savings

$20 M

>$40 M

Adjusted

EBITDA margin

High-teens or 20%

Q3 & Q4 Adjusted

EBITDA approx. 17%

Full fiscal 2012 highlights |

3

•

Revenue increased by $28.4 million from prior year

•

Conversion to a gross profit increase of $21.9 million from prior year

•

Operating income increase of $29.1 million from prior year

•

Adjusted EBITDA increase of $21.4 million from prior year

•

Transformation continues to yield benefits

Fourth quarter highlights |

4

•

Increases size and scale in attractive contract development and

manufacturing market

•

Adds proprietary technologies and products

•

Broadens combined company geographic footprint

–

Patheon gains greater access to Emerging Markets

–

Banner penetrates more deeply into Europe

•

Provides opportunity to cross-sell Patheon and Banner services

Banner Acquisition rationale |

5

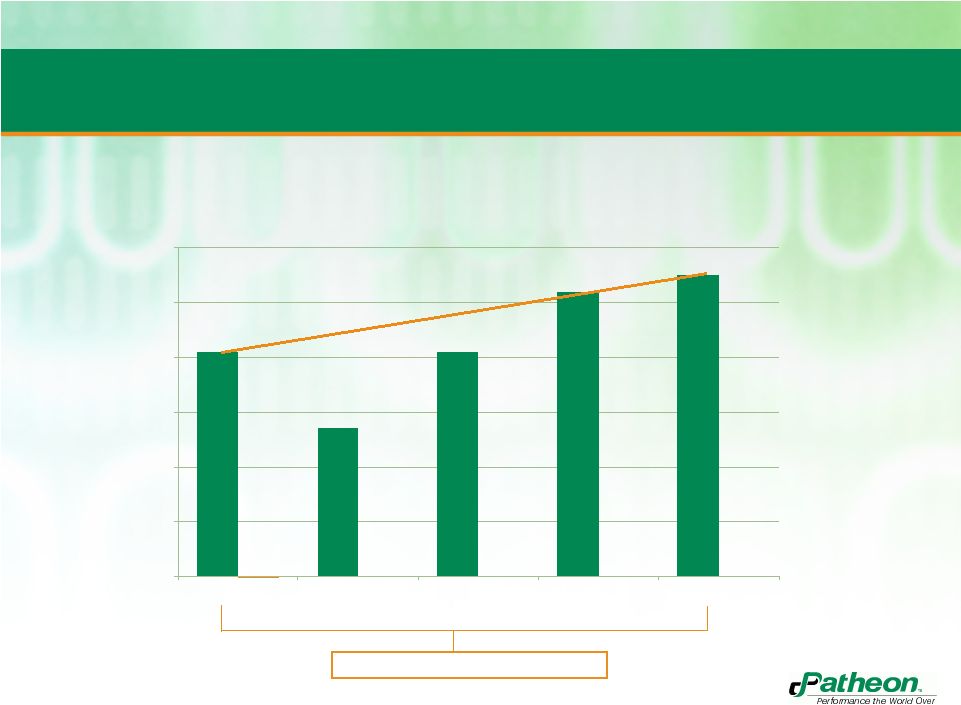

181.6

153.9

181.5

203.7

210.0

100

120

140

160

180

200

220

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Revenue increased by $28.4 million from prior year

Revenue

(U.S. $ in millions)

15.6% yr-yr revenue growth |

6

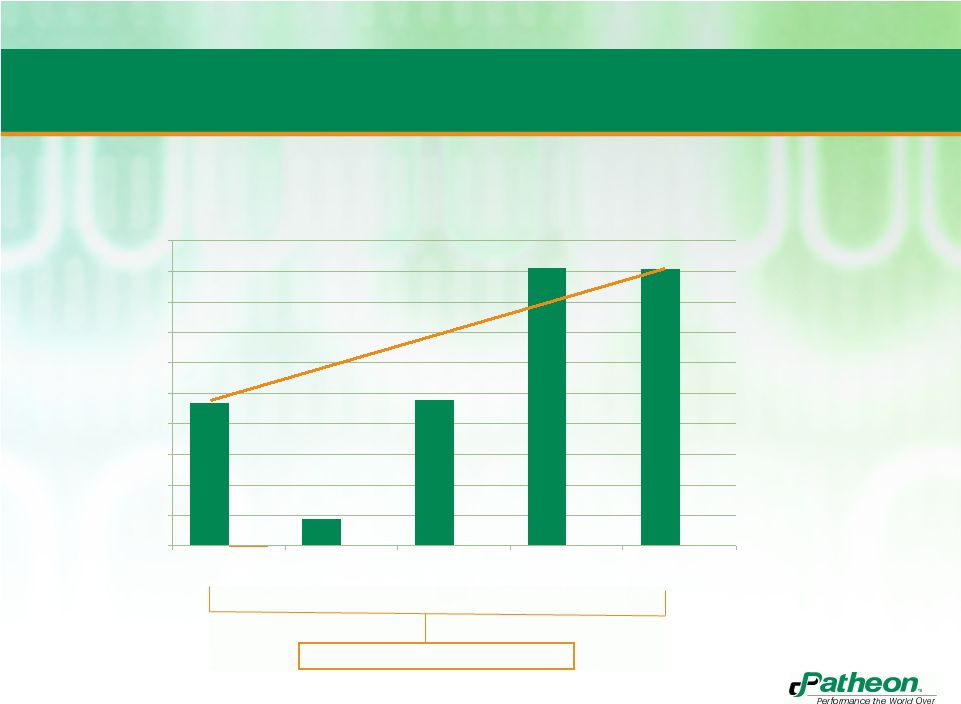

33.5

14.4

34.0

55.5

55.4

10

15

20

25

30

35

40

45

50

55

60

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Gross profit increased by $21.9 million from prior year

Gross Profit

(U.S. $ in millions)

65.4% yr-yr gross profit growth |

7

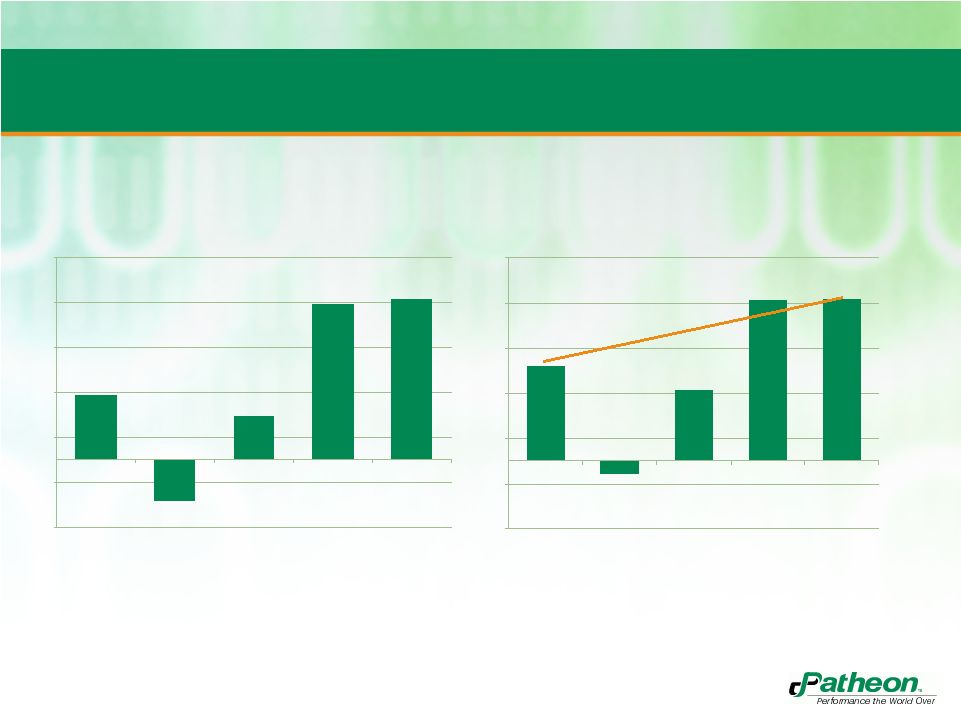

Adjusted EBITDA increase of $21.4 million from prior year

14.5

(9.2)

9.7

34.6

35.9

-15

-5

5

15

25

35

45

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Adjusted EBITDA

(U.S. $ in millions)

21.0

(2.9)

15.7

35.6

35.9

-15

-5

5

15

25

35

45

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Adjusted EBITDA Excluding Certain Items

(U.S. $ in millions) |

8

8.0 %

6.0 %

5.3 %

17.0 %

17.1 %

2

4

6

8

10

12

14

16

18

20

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Improving Adjusted EBITDA Margin

Adjusted EBITDA Margin

9.1% increase in Adjusted EBITDA Margin |

9

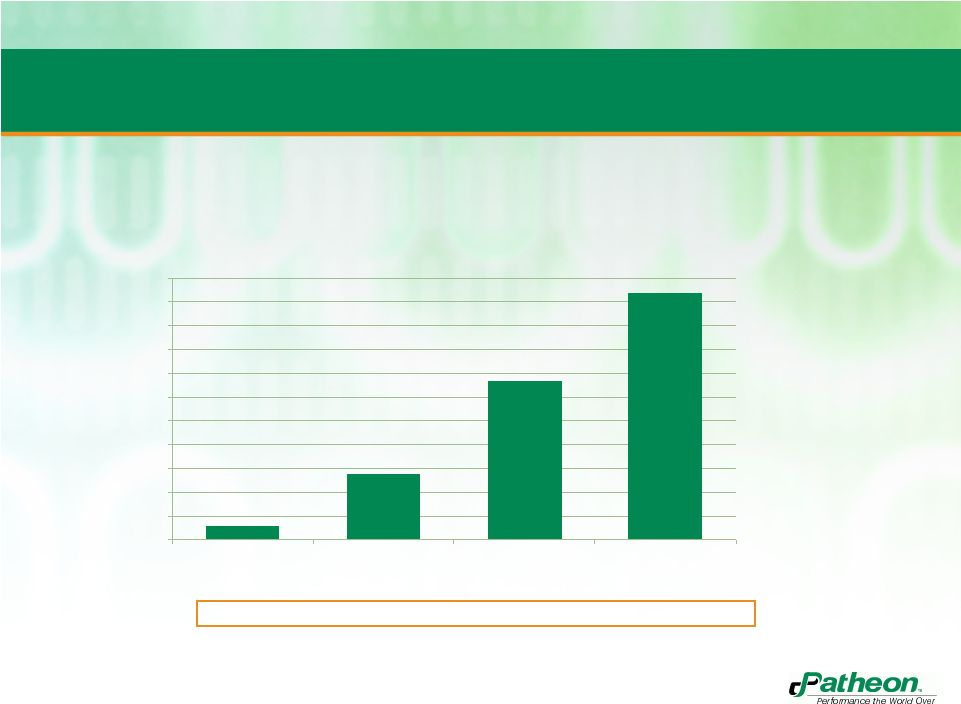

2.4

11.1

26.8

41.4

0

4

8

12

16

20

24

28

32

36

40

44

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Cumulative Transformation Impact

Transformation Impact

Transformation Impact

(U.S. $ in millions)

$19.8 million in consulting fees and $41.4 million in positive Adjusted EBITDA

impact |

10

Summary financial results

Three months ended October 31,

Statement of Operations

2012

2011

Change

(in millions of U.S. dollars)

$

$

$

Revenues

210.0

181.6

28.4

Gross Profit

55.4

33.5

21.9

Selling, general and administrative expenses

29.5

35.9

6.4

Operating income (loss)

23.1

(6.0)

29.1

Loss before discontinued operations

(23.0)

(9.8)

(13.2)

Adjusted EBITDA

35.9

14.5

21.4

Balance Sheets

Q4 2012

Q4 2011

Cash and cash equivalents

39.4

33.4

Total debt (LT & ST)

313.1

287.3

Undrawn lines of credit

64.4

94.9 |

Thank you

11 |

Appendix

Adjusted EBITDA and Adjusted EBITDA Excluding Certain Items

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Q4 2012

(in millions of U.S. dollars)

$

$

$

$

$

(Loss) income before discontinued operations

(9.8)

(19.3)

(79.6)

15.5

23.0

Depreciation and amortization

12.2

10.6

10.8

9.3

10.1

Repositioning expenses

3.5

0.8

6.0

0.1

(0.8)

Interest expense, net

6.6

6.5

6.5

6.8

6.7

Acquisition-related costs

-

-

-

-

3.2

Impairment charge

-

-

57.9

-

-

Loss on sale of capital assets

0.1

-

-

-

0.4

Provision for (benefit from) income taxes

1.0

(7.7)

8.0

3.3

39.8

Other (income) expense, net

0.9

(0.1)

0.1

(0.4)

(0.5)

Adjusted EBITDA

14.5

(9.2)

9.7

34.6

35.9

Consulting

6.5

6.3

6.0

1.0

-

Adjusted EBITDA excluding certain items

21.0

(2.9)

15.7

35.6

35.9

12 |