Attached files

| file | filename |

|---|---|

| 8-K - SYNERGETICS USA INC 8-K 12-13-2012 - SYNERGETICS USA INC | form8k.htm |

Exhibit 99.1

NEUROSURGERY OPHTHALMOLOGY QUALITY. PERFORMANCE. INNOVATION. Annual Shareholders’ Meeting Presentation December 13, 2012

Certain statements made in this presentation are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may include statements concerning management’s expectations of future financial results, potential business, potential acquisitions, government agency approvals, additional indications and therapeutic applications for medical devices, as well as their outcomes, clinical efficacy and potential markets and similar statements, all of which are forward looking. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from predicted results. For a discussion of such risks and uncertainties, please refer to the information set forth under “Risk Factors” included in Synergetics USA, Inc.’s Annual Report on Form 10-K for the year ended July 31, 2012, and information contained in subsequent filings with the Securities and Exchange Commission. These forward looking statements are made based upon our current expectations and we undertake no duty to update information provided in this presentation. Safe Harbor Statement *

Program *

Business Meeting *

Shareholders’ Business Meeting * Declaration of Quorum Election of Directors Approval of Amendment No. 2 to Non-Employee Directors’ Stock Option Plan Advisory Approval of Executive Compensation Advisory Vote on Frequency of Executive Compensation Approval Ratification of Independent Public Accountant Report of Inspectors of Election

Strategy Update *

Overall Strategy Drive accelerating growth in Ophthalmology Manage OEM neurosurgery business for stable growth and strong cash flows Deliver improving profitability through enterprise-wide lean initiatives Demonstrate solid financial performance *

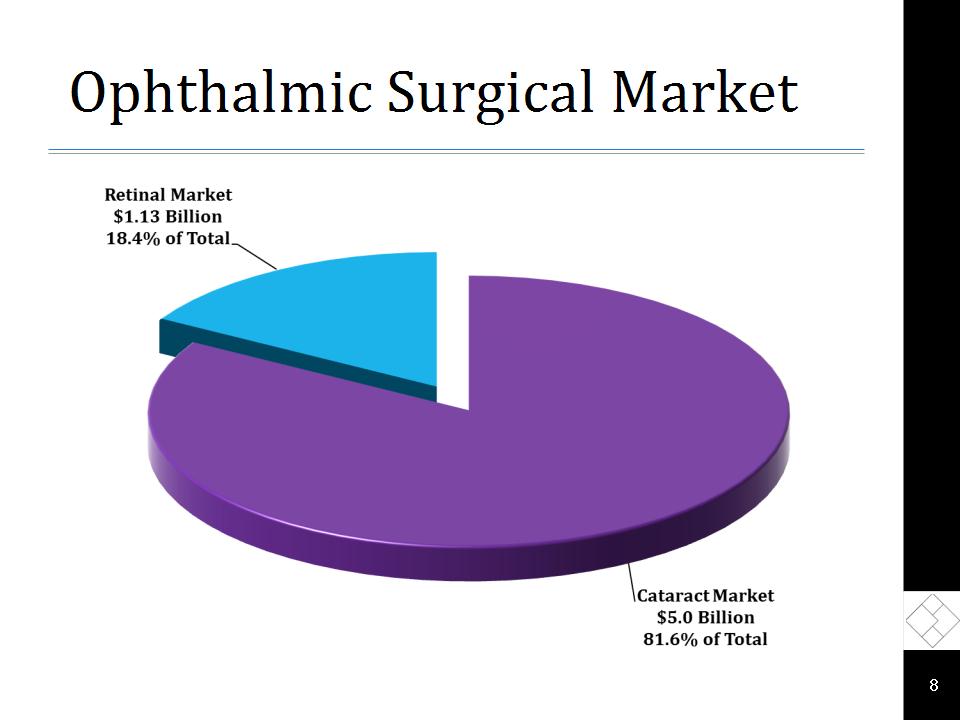

Ophthalmic Surgical Market *

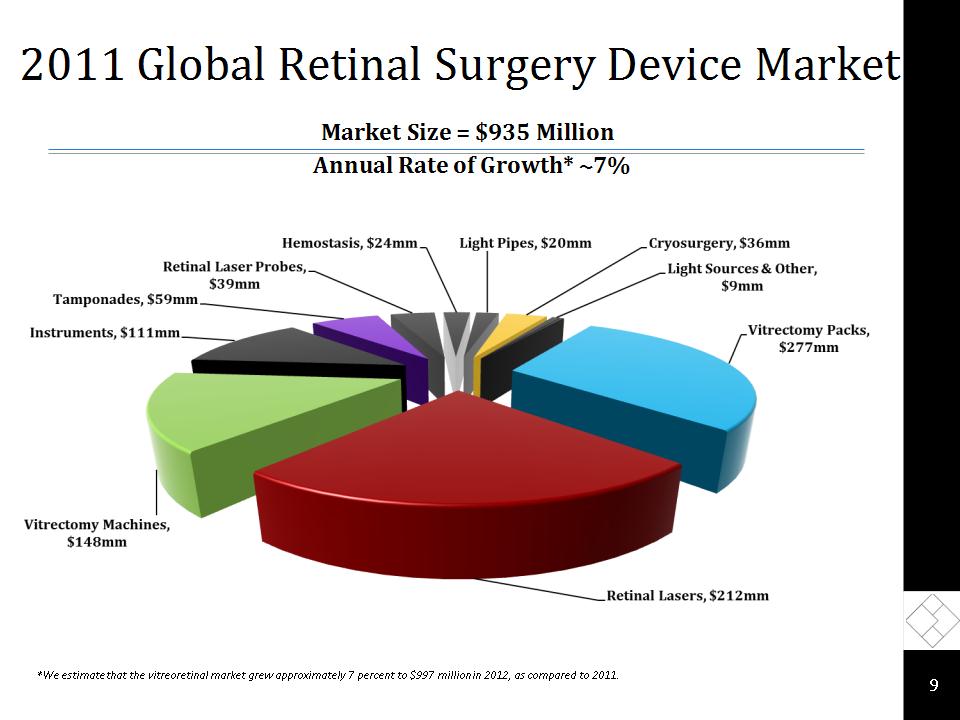

2011 Global Retinal Surgery Device Market * *We estimate that the vitreoretinal market grew approximately 7 percent to $997 million in 2012, as compared to 2011. Annual Rate of Growth* ~7% Market Size = $935 Million

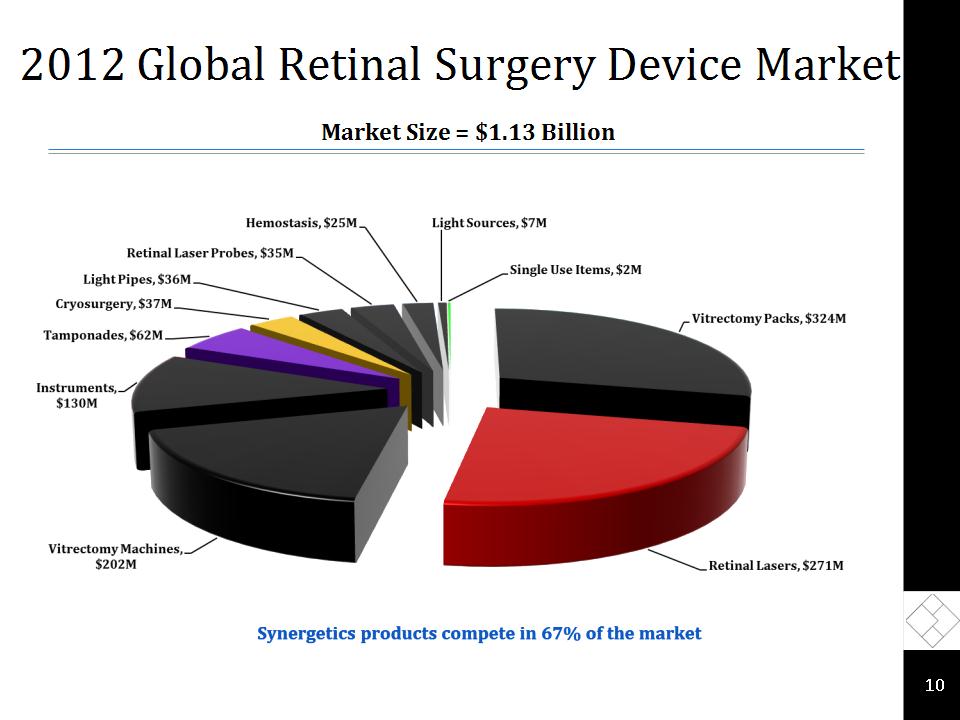

2012 Global Retinal Surgery Device Market * Market Size = $1.13 Billion

Marketing *

VersaVIT™ vs. CONSTELLATION® Vision System VersaVIT™ Small & Portable at 25lbs. Simple setup and user operation Unique fluid containment system Battery and CO² cartridge compatible for cord free use Cost efficient system Lower operating costs CONSTELLATION® Ferrari of vitrectomy machines Large footprint Many bells and whistles High acquisition cost Increases operating costs Reliability issues *

ASC vs. Hospital Ambulatory Surgery Center (ASC) Physicians control care for patients Typically surgeons own or have ownership or may be corporate owned More efficient – less time wasted Specialized (ophtho, ortho, etc.) Specialized staffed Highly focused on profitability Lower costs to patients and government (current vitrectomy reimbursement rate of $1,655) Hospital Out-Patient Department (HOPD) Challenging patient flow (pre, intra, post) Staff not specialized and are trained to handle multiple specialties. Patient frustrations – parking, long walks to OR, confusing, etc. Lack efficiencies Equipped to handle more difficult procedures Higher cost to patient and government (current vitrectomy reimbursement rate of $2,820) *

Sales *

Way back in 2010 Introduction to Synergetics Sales Organization Recognized as a core asset of the organization 18 Direct Territory Mangers Highly regulated sales environment Technical expertise requirement Forced turnover Elevated hiring standards Synergetics commitment to employee development & training Introduction to “Day in the Life” video Synergetics sales rep as a “member of the OR team” Customer intimacy Increasing productivity by: introducing new products in new categories, enabling more productive/profitable visits to our core customers *

2012 Current State Remain a core asset of the organization 23 Direct Territory Mangers Highly regulated sales environment Technical expertise requirement Forced turnover Elevated hiring standards Synergetics commitment to employee development & training Synergetics sales rep as a “member of the OR team” Customer intimacy Increasing productivity by: introducing new products in new categories, enabling more productive/profitable visits to our core customers. *

Evolution of Organization Currently compete in 67% of the $1 billion global retinal market – Compared with 33% in FY 2010 In 2 new categories since 2010 – Vitrectomy pack and Vitrectomy machine Expanded sales organization by 5 heads due to technical and service requirements Systems-based sales organization in 2012 vs. boutique “a la carte” provider in 2010 Technical & procedural knowledge grows as we aspire to be a dominant provider in OR Ongoing product and clinical training to support our increased roll in all procedures Growing reputation as core products provider to ASC and hospital environments *

Operations *

Enterprise Wide Lean Initiative Overview Create a culture of continuous improvement through all functional operational areas by driving out waste in processes Future State Improved Service Levels Reduced Costs Higher Quality Ultimate Customer Satisfaction *

Enterprise Wide Lean Initiative Methodology Utilization of Visual Management Regular Communication Daily departmental and operational standup meetings Bi-monthly enterprise deployment meeting Standardized Problem Solving Activities (Kaizen Improvement Events) Progress Continuous Improvement (you never reach the end) *

Finance *

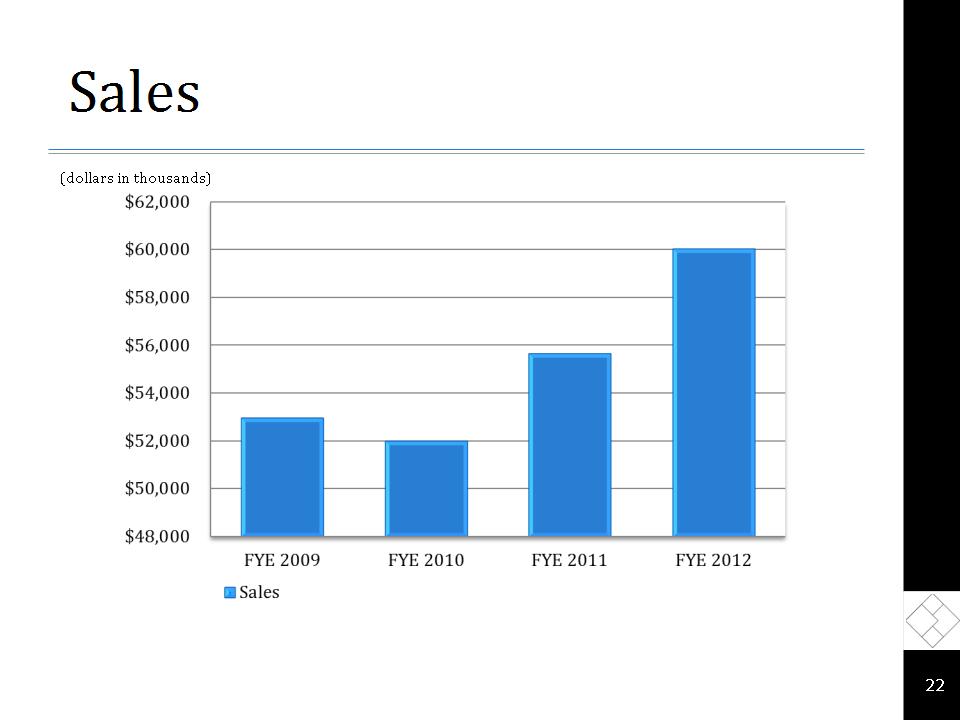

Sales * (dollars in thousands)

Net Income * * FYE 2010 net income excludes $522,000 from Income from Stryker sales and $1,533,000 from Income from Alcon settlement. (dollars in thousands)

EBITDA * * FYE 2010 net income excludes $817,000 from Pre-Tax Income from Stryker sales and $2,398,000 from Pre-Tax Income from Alcon settlement. (dollars in thousands)

This presentation contains certain non-GAAP financial information that management believes is useful to investors in evaluating the Company’s performance. More information about these non-GAAP financial measures and reconciliations to the most comparable GAAP financial measures are included in a Current Report on Form 8-K that the Company filed with the Securities and Exchange Commission immediately prior to this presentation. This Current Report on Form 8-K is available on the Company’s website at www.synergeticsusa.com by clicking on Financial Information: SEC Filings under the Investor Relations tab. Non-GAAP Financial Information *

Q & A Session *

NEUROSURGERY OPHTHALMOLOGY QUALITY. PERFORMANCE. INNOVATION. 3845 Corporate Centre Drive O’Fallon, MO 63368 (636) 939-5100 www.synergeticsusa.com