Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SKOOKUM SAFETY SOLUTIONS CORP. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - SKOOKUM SAFETY SOLUTIONS CORP. | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - SKOOKUM SAFETY SOLUTIONS CORP. | ex32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - SKOOKUM SAFETY SOLUTIONS CORP. | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended August 31, 2012 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________ to ________ | |

| Commission file number: 333-178464 |

| Skookum Safety Solutions Corp. | |

| (Exact name of registrant as specified in its charter) | |

| Nevada | 05-0554762 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| E09 Calle Jacarandas, Urbanizacion Los Laureles, Escazu San Jose, Costa Rica |

________ |

| (Address of principal executive offices) | (Zip Code) |

|

Registrant’s telephone number: (866) 279-7880 | |

|

__________________________________________________ (Former name and former address, if changed since last Report) | |

|

Securities registered under Section 12(b) of the Exchange Act:

| |

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

|

Securities registered under Section 12(g) of the Exchange Act:

| |

| Title of class | |

| none | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| [ ] Large accelerated filer | [ ] Accelerated filer |

| [ ] Non-accelerated filer | [X] Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not Available.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 2,300,000 shares as of December 10, 2012.

| 1 |

| 2 |

PART I

Company Overview

We were incorporated as “Skookum Safety Solutions Corp.” (“Skookum”) on October 19, 2010, in the State of Nevada for the purpose of developing, manufacturing, and selling home health products specifically for the treatment of symptoms associated with Gastroesophogeal Reflux Disease (GERD) and other maladies in both children and adults.

Business of Company

We are engaged in the business of developing, manufacturing, and selling blocks designed to elevate the head of a bed or crib specifically for the treatment of symptoms associated with certain medical disorders in children and adults. These products will be marketed to the doctors who treat these disorders, as well as the patients (and the parents of minor patients) who are afflicted by them. We are currently in the process of developing our product design, seeking manufacturers, and planning marketing strategies. We have had discussions with product designers, manufacturers, and marketing consultants regarding these activities, but we have not, however, entered into any oral or written agreement concerning the designing, manufacturing, or marketing of our products as of the date of this Annual Report. When we are satisfied that our products will compete effectively in the Home Healthcare Industry, we will begin the manufacture and distribution of the products online initially, and eventually through conventional retailers. Natalie M. Rydstrom is our president and sole director. Our offices are located at E09 Calle Jacarandas, Urbanizacion Los Laureles, Escazu San Jose, Costa Rica.

Gastroesophageal Reflux Disease (GERD)

Gastroesophageal reflux disease, or GERD, is a digestive disorder that affects the lower esophageal sphincter (LES) -- the muscle connecting the esophagus with the stomach. Gastroesophageal refers to the stomach and esophagus. Reflux means to flow back or return. Therefore, gastroesophageal reflux is the return of the stomach's contents back up into the esophagus.

In normal digestion, the LES opens to allow food to pass into the stomach and closes to prevent food and acidic stomach juices from flowing back into the esophagus. Gastroesophageal reflux occurs when the LES is weak or relaxes inappropriately, allowing the stomach's contents to flow up into the esophagus. The severity of GERD depends on LES dysfunction as well as the type and amount of fluid brought up from the stomach and the neutralizing effect of saliva. For support and further information on the preceding statements/paragraphs, please see http://emedicine.medscape.com/article/176595-overview.

Doctors recommend lifestyle and dietary changes for most people needing treatment for GERD. Treatment aims at decreasing the amount of reflux or reducing damage to the lining of the esophagus from refluxed materials. Avoiding foods and beverages that can weaken the LES is recommended. These foods include chocolate, peppermint, fatty foods, coffee, and alcoholic beverages. Foods and beverages that can irritate a damaged esophageal lining, such as citrus fruits and juices, tomato products, and pepper, should also be avoided.

Decreasing the size of portions at mealtime may also help control symptoms. Eating meals at least 2 to 3 hours before bedtime may lessen reflux by allowing the acid in the stomach to decrease and the stomach to empty partially. In addition, being overweight often worsens symptoms. Many overweight people find relief when they lose weight.

Elevating the head of the bed on 6-inch blocks or sleeping on a specially designed wedge reduces heartburn by allowing gravity to minimize reflux of stomach contents into the esophagus. For support and further information on the preceding statements/paragraphs, please see http://emedicine.medscape.com/article/176595-treatment#a1156. Pillows should not be used to prop up someone suffering from GERD because this will only increase pressure on the stomach. For support and further information on the preceding statements, please see http://www.uptodate.com/contents/patient-information-acid-reflux-gastroesophageal-reflux-disease-in-adults.

| 3 |

Antacids taken regularly can neutralize acid in the esophagus and stomach and stop heartburn. Many people find that nonprescription antacids provide temporary or partial relief. An antacid combined with a foaming agent such as alginic acid helps some people. These compounds are believed to form a foam barrier on top of the stomach that prevents acid reflux from occurring. For support and further information on the preceding statements, please see http://emedicine.medscape.com/article/176595-treatment#aw2aab6b6b3.

Elevating a Baby’s Head

Most babies sleep flat on their back without any problems. Doctors and safety experts recommend keeping soft objects such as pillows and stuffed animals out of the crib to reduce the incidence of SIDS. However, there are some medical conditions for which doctors recommend elevating a baby’s head while he sleeps. Among these are GERD, ear infections, and congestion resulting from colds or respiratory disorders.

GERD

When a baby swallows milk, it glides past the back of the throat into a muscular tube (the esophagus) and, from there, into the stomach. At the junction of the esophagus and the stomach is a ring of muscles (lower esophageal sphincter) that opens to let the milk drop into the stomach and then tightens to prevent the milk (and the stomach contents) from moving back up into the esophagus. If the stomach contents should happen to re-enter the esophagus, this is called "reflux."

Infants are especially prone to reflux because their stomachs are quite small (about the size of their fists or a golf ball), so they are easily distended by the milk. Additionally, the lower esophagus valve may be immature and may not tighten up when it should.

Every baby spits up or vomits occasionally, and some do so quite often, or even with every feeding. If, despite the spitting, a baby is content, in no discomfort, growing, and experiencing no breathing problems from the vomiting, then she is what pediatricians call "a happy spitter," and no treatment is needed. Typically, the lower esophagus valve tightens up sometime in the first year, usually around 4-5 months of age, at which time the spitting up may go away.

Unlike happy spitters, babies are diagnosed with GERD if the vomiting seems to be causing significant problems, such as:

- discomfort and pain (presumably heartburn due to the acid-filled stomach contents irritating the esophagus);

- breathing problems of any kind (gagging, choking, coughing, wheezing, and, worst-case scenario, pneumonia due to inhalation of the stomach contents into the lungs, called aspiration); or

- poor growth (due to the loss of necessary nutrition from vomiting).

For support and further information on the preceding statements/paragraphs, please see http://www.webmd.com/heartburn-gerd/reflux-infants-children.

Congestion

Concerns about the safety of over-the-counter cold medicines for children have left many parents searching for alternative remedies for children's cold and cough symptoms.

Popular over-the-counter cold and cough remedies for infants have been withdrawn from the market after the FDA warned in January 2008 against giving those types of medicines to children younger than 2 because of the possibility of serious harm or death.

While the FDA is considering whether to change the guidelines for children ages 2 to 11, the Consumer Healthcare Products Association in October 2008 said they would voluntarily change the labels on cough and cold medications to say they should not be used in children younger than 4. An FDA advisory panel made a similar recommendation in October 2008, saying that nonprescription cold medicines should not be given to children ages 2 to 5.

| 4 |

Children get six to 10 colds a year on average, according to the National Institutes of Health. Parents are constantly seeking a way to ease their symptoms. The nonprescription remedies include antihistamines for runny noses, decongestants for stuffy noses, cough suppressants, and expectorants for loosening mucus to relieve congestion.

Unfortunately, no home remedies or cold medicines will make a cold go away faster; they usually run their course in seven to 10 days. At best, some medicines will relieve symptoms. But even that is in question, says Sheela R. Geraghty, MD, an assistant professor of pediatrics at Cincinnati Children’s Hospital Medical Center in Ohio. She recommends fluids, reducing fever to make a child comfortable, and keeping noses suctioned so babies can eat comfortably.

The American Academy of Pediatrics, the FDA, Johns Hopkins Children’s Center, Geraghty, Rachel Dodge, MD, MPH, a pediatrician with Johns Hopkins Children’s Center in Baltimore, and Joyce Allers, RN, clinical program manager of the School Health Program at Children’s Healthcare of Atlanta indicated the suggestions below.

Saline nasal drops can help relieve congestion, especially in an infant’s small nasal passages. Because babies breathe through their noses and not their mouths, breaking up nasal congestion can make it easier to breathe, allowing a baby to nurse or drink from a bottle more comfortably.

Resting with the head elevated may make children feel more comfortable by improving drainage. If you want to raise a baby’s head slightly, however, do not place any soft bedding or pillows in the crib itself because of the risk of sudden infant death syndrome, Dodge cautions. They recommend placing a folded towel between a mattress and box springs to elevate the head and chest. Choose a slight angle so a child doesn’t slide down the mattress.

A cool-mist humidifier or vaporizer in a child’s room can add moisture to the air, helping ease breathing through dry, congested nasal passages. Some pediatricians and children’s hospitals, as well as the AAP, recommend them. After each use, empty water from the machine. Make sure to follow manufacturer’s instructions on keeping machines clean and disinfected. Do not use hot water in a vaporizer because of the risk of burns.

Geraghty advises against using a humidifier. Most aren’t cleaned between each use, she says, resulting in mold and mildew spreading through the air in a child’s room, worsening their condition.

For support and further information on the preceding statements/paragraphs, please see www.babycenter.ca/baby/health/commoncold/; http://www.nlm.nih.gov/medlineplus/ency/article/003049.htm; http://healthy-uandme.blogspot.com/2009_01_01_archive.html

Ear Infections

Dr. Benjamin Spock notes (in his article, Easing the Pain of Ear Infections) that next to colds, middle-ear infections (called otitis media) are the most frequently cited reason for visits to the doctor. Seventy-one percent of children have at least one incident by the age of 3, and 46 percent have at least three.

Typically, a middle-ear infection sets in after a cold has been raging for at least two or three days. Normally, the middle-ear cavity produces small amounts of fluid that usually drains out through the eustachian tube, which connects the middle ear to the back of the nose. When the eustachian tube becomes swollen because of a cold, sinus infection, or allergy and stops functioning properly, fluid begins to accumulate.

| 5 |

When an infection strikes, Dr. Spock suggests several things parents can do to soothe their child until they can see a doctor.

- Give acetaminophen or ibuprofen (never aspirin) for pain, but don't bother with cold medicines.

- To ease some of the pressure, keep the child's head elevated. If she's over 2 and no longer sleeps in a crib, it's fine to use a pillow when she lies down. Babies can also be kept upright in a car seat. Once she's begun to feel better, put her to sleep in her crib again. But never use a pillow with an infant.

- A warm, moist towel applied to the child's face near the ear can also help. With an older child, you can use a heating pad, but be cautious: Put it on the lowest setting, wrap it in an additional towel or receiving blanket, and keep it away from water. Never use a heating pad on a baby.

- If there is no discharge, alleviate the pain by using a dropper to put two to three drops of room-temperature sesame or olive oil into the external ear canal. If there's pus, gently tuck a cotton ball into the external ear.

- Swallowing opens the eustachian tube and drains the fluid from the middle ear, so you can try having a child 4 or older chew sugarless gum. Have babies drink plenty of liquids. In fact, both of these may also help prevent a cold from turning into an ear infection in the first place.

For support and further information on the preceding statements/paragraphs, please see http://www.parenting.com/article/easing-the-pain-of-ear-infections?page=0,1.

Problems with Current Products

Sleep positioners are products designed to hold infants in position as they sleep, generally on a soft wedge at an angle. In the last 13 years, the federal government has received 12 reports of babies known to have died from suffocation associated with their sleep positioners. Most of the babies suffocated after rolling from the side to the stomach.

In addition to the deaths, the commission has received dozens of reports of babies who were placed on their back or side in the positioners only to be found later in hazardous positions within or next to the product.

“We urge parents and caregivers to take our warning seriously and stop using these sleep positioners so children can be assured of a safe sleep,” says Inez Tenenbaum, chairman of the Consumer Product Safety Commission.

FDA pediatric expert Susan Cummins, M.D., M.P.H, says parents and caregivers can create a safe sleep environment for babies if they leave the crib free of pillows, comforters, quilts, toys, and other items.

Some manufacturers have advertised that their products prevent SIDS, gastroesophageal reflux disease (GERD) or flat head syndrome, a deformation caused by pressure on one part of the skull. Although in the past FDA has approved a number of these products for GERD or flat head syndrome, new information suggests the positioners pose a risk of suffocation.

As a result, FDA is requiring makers of FDA-cleared sleep positioners to submit data showing the products’ benefits outweigh the risks. FDA is also requesting that these manufacturers stop marketing their devices while FDA reviews the data.

Infant sleep positioner manufacturers who are making medical claims without FDA clearance must stop marketing those products immediately, agency experts say, adding there’s no evidence the devices have benefits that outweigh the risk of suffocation.

Because of the increased risk of SIDS, the FDA has determined that the risks of using sleep positioners to elevate a baby’s head outweigh the benefits discussed above. Thus a product that elevates the head without risk to the baby is likely to find a receptive market.

For support and further information on the preceding statements/paragraphs, please see http://www.fda.gov/ForConsumers/ConsumerUpdates/ucm227575.htm.

| 6 |

Our Products

Due to the incidence of both adult and childhood GERD, as well as other childhood maladies that indicate an elevated head while sleeping, we feel that there will be significant demand for our products. Consumers seeking non-surgical, non-pharmaceutical, cost-effective solutions to treat nighttime symptoms of GERD and other disorders will find that our product meets their needs.

We are in the process of developing products for both the adult and baby markets, which will elevate the heads of cribs, toddler beds, or standard adult beds. Our products will be blocks that can stack to reach the desired height, so that consumers can raise the head of their bed a variable level to meet their specific needs.

The crib block product will be called “Upsy Daisy,” and will be 1.5 inches high, allowing parents to raise their child’s crib in increments of 1.5 inches. The adult bed products will be called “Bed Blocks,” and will be 2 inches high, allowing adults to raise their beds in increments of 2 inches.

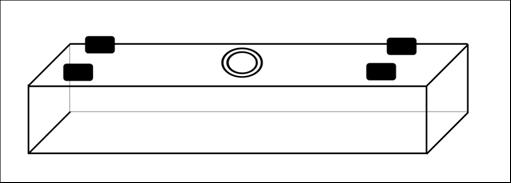

Figure 1

As shown in the diagram (Figure 1) above, our products are hard plastic blocks with raised pegs that interlock with one another. Each block has an indentation in the top where a bed post or crib leg can fit more securely than on a raised flat surface. By making the blocks 1.5 inches high for children and 2 inches high for adults, we allow consumers to experiment and determine the amount of elevation that meets their needs.

| 7 |

Competition

We compete with a number of established manufacturers who sell products designed to elevate the head of children or adults suffering from GERD and other disorders. Those who have products designed to go in the crib with a baby have been contraindicated by the United States FDA, reducing their competitive effectiveness. However, there are companies that already manufacture products designed to raise the head of a crib or bed externally. These companies enjoy brand recognition which exceeds that of our brand name. We compete with several manufacturers, importers, and distributors who have significantly greater financial, distribution, advertising, and marketing resources than we do, including:

| · | Crib Blox are a product developed and manufactured by British company Prince Lionheart, which was established in 1973. They currently have a manufacturing facility in Santa Maria, California, which improves their ability to access the North American market. They currently offer products in the United States, Canada, England, Belgium, France, Australia, Germany, Holland, Ireland, Italy, Luxembourg, South Korea, Spain, China, Mexico, Peru, Brazil, and Japan. Crib Blox are designed to rest under the legs of a crib in order to elevate a baby’s head approximately 2 inches. They are not stackable, so parents have few options if they wish to raise the head of the crib further than 2 inches. Cribblox does not make any products for adults. |

| · | Dex Products is a California company that specializes in developing and manufacturing baby products. They have been doing so since 2000, and they currently manufacture and sell the Safe Lift Universal Crib Wedge, which gently elevates baby’s head and torso. It fits all cribs and toddler beds, and positions easily and securely under the sheet. The product is easy to clean, has a waterproof cover, and non skid bottom. However, this product may fall into the category of products that received SIDS warnings by the FDA because it is soft and goes in the crib with the baby. |

| · | Sleighters Furniture and Sleep Shop has been manufacturing and selling sleep-related products since 1945. They have developed the Beds Up Insert, a metal mattress frame add-on that attaches to your standard bed frame, creating an angled wedge our of the bed frame. This physically stable solution allows consumers to safely elevate their head for sleep. They advertise the product as night time relief for a variety of ailments such as Acid Reflux, Asthma, Emphysema GERD, Heart burn, Hiatal Hernia, Snoring, Sinus problems and Vertigo. Consumers have the option to raise their mattress head by 2”, 4”, or 6”. However, Sleighters does not make a product for children or babies. The Beds Up Insert is significantly more expensive than our products. |

We compete primarily on the basis of quality, brand name recognition, and price. We believe that our success will depend upon our ability to remain competitive in our product areas. The failure to compete successfully in the future could result in a material deterioration of customer loyalty and our image and could have a material adverse effect on our business.

Intellectual Property

Once we determine the final design for our products, we intend to file for a patent on their unique designs. We will file for patent pending status as we design and develop designs for our products. We will apply for patent protection and/or copyright protection in the United States, Canada, and other jurisdictions.

We intend to aggressively assert our rights under trade secret, unfair competition, trademark and copyright laws to protect our intellectual property, including product design, proprietary manufacturing processes and technologies, product research and concepts and recognized trademarks. These rights are protected through the acquisition of patents and trademark registrations, the maintenance of trade secrets, the development of trade dress, and, where appropriate, litigation against those who are, in our opinion, infringing these rights.

While there can be no assurance that registered trademarks and patents will protect our proprietary information, we intend to assert our intellectual property rights against any infringer. Although any assertion of our rights can result in a substantial cost to, and diversion of effort by, our company, management believes that the protection of our intellectual property rights is a key component of our operating strategy.

| 8 |

Regulatory Matters

We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations of the home medical products industry. We are subject to the laws and regulations of those jurisdictions in which we plan to sell our product, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development, manufacture, and sale of our Product in the United States, Canada, and other jurisdictions are not subject to special regulatory and/or supervisory requirements.

Employees

We have no employees other than our President and directorNatalie M. Rydstrom. She currently oversees all responsibilities in the areas of corporate administration, business development, and research. We intend to expand our current management to retain skilled directors, officers, and employees with experience relevant to our business focus. Our current management team is highly skilled in technical areas such as researching and developing our product, but not skilled in areas such as marketing our product and business management. Obtaining the assistance of individuals with an in-depth knowledge of operations and marketing will allow us to build market share more effectively. We intend on employing sales representatives in the United States and Canada when our product is ready for production and shipping and in various countries when we are ready to expand internationally.

Environmental Laws

We have not incurred and do not anticipate incurring any expenses associated with environmental laws.

Our principal executive offices are located at E09 Calle Jacarandas, Urbanizacion Los Laureles, Escazu San Jose, Costa Rica. Our offices are adequate for our current needs.

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. Mine Safety Disclosures

Not applicable.

| 9 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate making an application for trading of our common stock on the over the counter bulletin board in the near future. We can provide no assurance that our shares will be traded on the bulletin board, or if traded, that a public market will materialize.

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;(b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;(d) contains a toll-free telephone number for inquiries on disciplinary actions;(e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and;(f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with; (a) bid and offer quotations for the penny stock;(b) the compensation of the broker-dealer and its salesperson in the transaction;(c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, because our common stock is subject to the penny stock rules, stockholders may have difficulty selling those securities.

Holders of Our Common Stock

As of August 31, 2012, we had 2,300,000 shares of our common stock issued and outstanding held by 40 shareholders of record.

| 10 |

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. we would not be able to pay our debts as they become due in the usual course of business, or;

2. our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Recent Sales of Unregistered Securities

On August 31, 2011, our former president, CEO, CFO, and sole director Rebecca Kyllo acquired 1,500,000 common shares, at a price of $0.02 per share for total consideration of $30,000 in cash. These shares were issued pursuant to Section 4(2) of the Securities Act of 1933 and are restricted shares as defined in the Securities Act. We did not engage in any general solicitation or advertising.

On June 1, 2011, we issued 500,000 shares of our common stock to 39 investors at a price of $0.08 per share for total consideration of $40,000 in cash. Each purchaser represented their intention to acquire the securities for investment only and not with a view toward distribution. All purchasers were given adequate access to sufficient information about us to make an informed investment decision. None of the securities were sold through an underwriter and accordingly, there were no underwriting discounts or commissions involved. The investors purchased shares pursuant to Regulation S under the United States Securities Act of 1933, as amended. No general solicitation or advertising was used in connection with our Regulation S offering.

Furthermore, we complied with the conditions of Rule 903 as promulgated under the Securities Act including, but not limited to, the following: (i) each recipient of the shares is a non-U.S. resident and has not offered or sold their shares in accordance with the provisions of Regulation S; (ii) an appropriate legend was affixed to the securities issued in accordance with Regulation S; (iii) each recipient of the shares has represented that it was not acquiring the securities for the account or benefit of a U.S. person; and (iv) each recipient of the shares agreed to resell the securities only in accordance with the provisions of Regulation S, pursuant to a registration statement under the Securities Act, or pursuant to an available exemption from registration. We will refuse to register any transfer of the shares not made in accordance with Regulation S, after registration, or under an exemption.

Securities Authorized for Issuance under Equity Compensation Plans

We have not adopted an equity compensation plan.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

| 11 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Results of Operations for the Year Ended August 31, 2012, the Period from Inception (October 19, 2010) to August 31, 2012

Revenues

We are a development stage company and have generated no revenues since inception (October 19, 2010) to August 31, 2012. We do not anticipate significant revenues until we have completed and successfully sold our products and services in the market.

Operating Expenses

Operating expenses were $52,469 for the year ended August 31, 2012 and $69,077 from inception (October 19, 2010) to August 31, 2012. Our operating expenses for the year ended August 31, 2012 consisted mainly of professional fees of $36,329, officer compensation of $8,125, and general and administrative of $8,015. Our operating expenses for the period from inception (October 19, 2010) to August 31, 2012 consisted mainly of professional fees of $48,329, officer compensation of $8,125, and general and administrative of $12,623.

Net Loss

Our net loss for the year ended August 31, 2012 was $52,469 and $69,077 for the period from inception (October 19, 2010) to August 31, 2012.

| 12 |

Liquidity and Capital Resources

As of August 31, 2012, we had total current assets of $40,948. Our total current liabilities as of August 31, 2012 were $6,900. We had a deficit accumulated during the development stage of $69,077 and working capital of $34,048 as of August 31, 2012.

Cash used in operating activities was $43,947 for the year ended August 31, 2012, mostly as a result of our net loss.

Cash flows provided by financing activities during the year ended August 31, 2012 was $30,000 as a result of the sale of our common stock.

Based upon our current financial condition, we do not have sufficient cash to operate our business at the current level for the next twelve months. We intend to fund operations through increased sales and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements. We plan to seek additional financing in a private equity offering to secure funding for operations. There can be no assurance that we will be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our business plan will be impaired. There can be no assurance that such additional financing will be available to us on acceptable terms or at all.

Going Concern

We have a deficit accumulated during the development stage of $69,077 as of August 31, 2012. Our financial statements are prepared using the generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, we have no current source of revenue and a limited amount of working capital. Without realization of additional capital, it would be unlikely for us to continue as a going concern. Our management plans on raising cash from public or private debt or equity financing, on an as needed basis and in the longer term, and, ultimately, upon achieving profitable operations through the development of business activities.

Off-Balance Sheet Arrangements

We did not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. We do not believe that any accounting policies currently fit this definition.

Recently Issued Accounting Pronouncements

The Company has evaluated recent pronouncements through Accounting Standards Updates “ASU” 2012-03 and believes that none of them will have a material impact on the Company’s financial position, results of operations or cash flows.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

| 13 |

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

| 14 |

Silberstein Ungar, PLLC CPAs and Business Advisors

Phone (248) 203-0080

Fax (248) 281-0940

30600 Telegraph Road, Suite 2175

Bingham Farms, MI 48025-4586

www.sucpas.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Boards of Directors

Skookum Safety Solutions Corp.

San Jose, Costa Rica

We have audited the accompanying balance sheets of Skookum Safety Solutions Corp., as of August 31, 2012 and 2011, and the related statements of operations, stockholders’ equity, and cash flows for the periods then ended and the period from October 19, 2010 (date of inception) to August 31, 2012. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company has determined that it is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Skookum Safety Solutions Corp., as of August 31, 2012 and 2011 and the results of their operations and cash flows for the periods then ended and the period from October 19, 2010 (date of inception) to August 31, 2012, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Skookum Safety Solutions Corp. will continue as a going concern. As discussed in Note 9 to the financial statements, the Company has incurred losses from operations, has limited working capital and is in need of additional capital to grow its operations so that it can become profitable. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 9. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Silberstein Ungar, PLLC

Silberstein Ungar, PLLC

Bingham Farms, Michigan

December 8, 2012

| F-1 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

AS OF AUGUST 31, 2012 AND 2011

| 2012 | 2011 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and equivalents | $ | 40,948 | $ | 54,895 | ||||

| Prepaid expenses | 0 | 5,000 | ||||||

| Total Current Assets | 40,948 | 59,895 | ||||||

| TOTAL ASSETS | $ | 40,948 | $ | 59,895 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Liabilities | ||||||||

| Current Liabilities | ||||||||

| Accrued expenses | $ | 6,900 | $ | 6,000 | ||||

| Due to officer | 0 | 503 | ||||||

| Total Liabilities | 6,900 | 6,503 | ||||||

| Stockholders’ Equity | ||||||||

| Common Stock, $.001 par value, 30,000,000 shares authorized, 2,300,000 shares issued and outstanding (2,000,000 - 2011) | 2,300 | 2,000 | ||||||

| Additional paid-in capital | 100,825 | 68,000 | ||||||

| Deficit accumulated during the development stage | (69,077 | ) | (16,608 | ) | ||||

| Total Stockholders’ Equity | 34,048 | 53,392 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 40,948 | $ | 59,895 | ||||

See accompanying notes to financial statements.

| F-2 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

FOR THE PERIODS ENDED AUGUST 31, 2012 AND 2011

FOR THE PERIOD FROM OCTOBER 19, 2010 (INCEPTION) TO AUGUST 31, 2012

| Year ended August 31, 2012 | Period from October 19, 2010 (Inception) to August 31, 2011 | Period from October 19, 2010 (Inception) to August 31, 2012 | ||||||||||

| REVENUES | $ | 0 | $ | 0 | $ | 0 | ||||||

| EXPENSES | ||||||||||||

| Professional fees | 36,329 | 12,000 | 48,329 | |||||||||

| Officer compensation | 8,125 | 0 | 8,125 | |||||||||

| General and administrative | 8,015 | 4,608 | 12,623 | |||||||||

| TOTAL EXPENSES | 52,469 | 16,608 | 69,077 | |||||||||

| LOSS FROM OPERATIONS | (52,469 | ) | (16,608 | ) | (69,077 | ) | ||||||

| PROVISION FOR INCOME TAXES | 0 | 0 | 0 | |||||||||

| NET LOSS | $ | (52,469 | ) | $ | (16,608 | ) | $ | (69,077 | ) | |||

| NET LOSS PER SHARE: BASIC AND DILUTED | $ | (0.02 | ) | $ | (0.01 | ) | ||||||

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING: BASIC AND DILUTED | 2,045,860 | 1,351,735 | ||||||||||

See accompanying notes to financial statements.

| F-3 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF STOCKHOLDERS’ EQUITY

PERIOD FROM OCTOBER 19, 2010 (INCEPTION) TO AUGUST 31, 2012

| Common Stock | Additional paid-in | Deficit accumulated during the development | ||||||||||||||||||

| Shares | Amount | Capital | stage | Total | ||||||||||||||||

| Inception, October 19, 2010 | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||

| Founder shares issued for cash at $0.02 per share | 1,500,000 | 1,500 | 28,500 | — | 30,000 | |||||||||||||||

| Shares issued for cash at $0.08 per share | 500,000 | 500 | 39,500 | — | 40,000 | |||||||||||||||

| Net loss for the period ended August 31, 2011 | — | — | — | (16,608 | ) | (16,608 | ) | |||||||||||||

| Balance, August 31, 2011 | 2,000,000 | 2,000 | 68,000 | (16,608 | ) | 53,392 | ||||||||||||||

| Shares issued for cash at $0.10 per share | 300,000 | 300 | 29,700 | — | 30,000 | |||||||||||||||

| Forgiveness of accrued officer compensation | — | — | 3,125 | — | 3,125 | |||||||||||||||

| Net loss for the year ended August 31, 2012 | — | — | — | (52,469 | ) | (52,469 | ) | |||||||||||||

| Balance, August 31, 2012 | 2,300,000 | $ | 2,300 | $ | 100,825 | $ | (69,077 | ) | $ | 34,048 | ||||||||||

See accompanying notes to financial statements.

| F-4 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

FOR THE PERIODS ENDED AUGUST 31, 2012 AND 2011

FOR THE PERIOD FROM OCTOBER 19, 2010 (INCEPTION) TO AUGUST 31, 2012

| Year ended August 31, 2012 | Period from October 19, 2010 (Inception) to August 31, 2011 | Period from October 19, 2010 (Inception) to August 31, 2012 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

| Net loss for the period | $ | (52,469 | ) | $ | (16,608 | ) | $ | (69,077 | ) | |||

| Adjustments to reconciled net loss to net cash used in operating activities: | ||||||||||||

| Changes in assets and liabilities: | ||||||||||||

| (Increase) decrease in prepaid expenses | 5,000 | (5,000 | ) | 0 | ||||||||

| Increase in accrued expenses | 900 | 6,000 | 6,900 | |||||||||

| Increase in accrued officer compensation | 3,125 | 0 | 3,125 | |||||||||

| Increase (decrease) in due to officer | (503 | ) | 503 | 0 | ||||||||

| Net Cash Used in Operating Activities | (43,947 | ) | (15,105 | ) | (59,052 | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

| Proceeds from issuance of common stock | 30,000 | 70,000 | 100,000 | |||||||||

| Net Cash Provided by Financing Activities | 30,000 | 70,000 | 100,000 | |||||||||

| NET INCREASE (DECREASE) IN CASH | (13,947 | ) | 54,895 | 40,948 | ||||||||

| Cash, beginning of period | 54,895 | 0 | 0 | |||||||||

| Cash, end of period | $ | 40,948 | $ | 54,895 | $ | 40,948 | ||||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||||||

| Cash paid for interest | $ | 0 | $ | 0 | $ | 0 | ||||||

| Cash paid for income taxes | $ | 0 | $ | 0 | $ | 0 | ||||||

| SUPPLEMENTAL NON-CASH INVESTING AND FINANCING INFORMATION: | ||||||||||||

| Forgiveness of accrued officer compensation | $ | 3,125 | $ | 0 | $ | 3,125 | ||||||

See accompanying notes to financial statements.

| F-5 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

AUGUST 31, 2012

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Skookum Safety Solutions Corp. (‘Skookum” or “the Company”) was incorporated under the laws of the State of Nevada, U.S. on October 19, 2010. Skookum is developing a line of baby products. Skookum is a development stage company and has not yet realized any revenues from its planned operations.

Development Stage Company

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles related to development-stage companies. A development-stage company is one in which planned principal operations have not commenced or if its operations have commenced, there has been no significant revenues there from.

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

Accounting Basis

The Company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America (“GAAP” accounting). The Company has adopted an August 31 fiscal year end.

Cash and Cash Equivalents

Skookum considers all highly liquid investments with maturities of three months or less to be cash equivalents. At August 31, 2012 and 2011, respectively, the Company had $40,948 and $54,895 of cash.

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, prepaid expenses, accrued expenses and an amount due to an officer. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these financial statements.

Income Taxes

Income taxes are computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| F-6 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

AUGUST 31, 2012

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition

The Company recognizes revenue when products are fully delivered or services have been provided and collection is reasonably assured.

Foreign Currency

The operations of the Company are located in Canada. Skookum maintains both U.S. Dollar and Canadian Dollar bank accounts. The functional currency is the U.S. Dollar. Transactions in foreign currencies other than the functional currency, if any, are re-measured into the functional currency at the rate in effect at the time of the transaction. Re-measurement gains and losses that arise from exchange rate fluctuations are included in income or loss from operations due to materiality. Monetary assets and liabilities denominated in Canadian Dollars are translated into U.S. Dollars at the rate in effect at the balance sheet date. Revenue and expenses denominated in Canadian Dollars are translated at the average exchange rate.

Basic Income (Loss) Per Share

Basic income (loss) per share is calculated by dividing the Company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company’s net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. There are no such common stock equivalents outstanding as of August 31, 2012.

Stock-Based Compensation

Stock-based compensation is accounted for at fair value in accordance with ASC Topic 718. To date, the Company has not adopted a stock option plan and has not granted any stock options.

Recent Accounting Pronouncements

Skookum does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow.

NOTE 2 – PREPAID EXPENSES

Prepaid expenses at August 31, 2011 consisted of an amount paid to the Company’s attorneys as a retainer for future legal services. The prepaid amount was applied to legal services used during the year ended August 31, 2012. Prepaid expenses were $0 as of August 31, 2012.

NOTE 3 – ACCRUED EXPENSES

Accrued expenses at August 31, 2012 and 2011 consisted of amounts due to the Company’s accountant and outside independent auditors.

NOTE 4 – DUE TO OFFICER

An officer and shareholder of the Company paid certain expenses on behalf of the Company. The amount due to the officer is unsecured, non-interest bearing and due on demand. The balance due to the officer is $0 and $503 as of August 31, 2012 and 2011, respectively.

| F-7 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

AUGUST 31, 2012

NOTE 5 – COMMON STOCK

The Company has 30,000,000 shares of $0.001 par value common stock authorized.

During the period ended August 31, 2011, the Company issued 1,500,000 shares of common stock at $0.02 per share to its founder for total cash proceeds of $30,000.

Additionally, the Company issued 500,000 shares of common stock at $0.08 per share for total cash proceeds of $40,000.

During the year ended August 31, 2012, the Company issued 300,000 shares of common stock at $0.10 per share for total cash proceeds of $30,000.

On July 19, 2012, a shareholder forgave a balance due of $3,125. The amount was recorded as contributed capital.

As of August 31, 2012 there were 2,300,000 shares of common stock issued and outstanding.

NOTE 6 – INCOME TAXES

As of August 31, 2012, the Company had net operating loss carry forwards of approximately $69,077 that may be available to reduce future years’ taxable income through 2032. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization is determined not likely to occur and accordingly, the Company has recorded a valuation allowance for the deferred tax asset relating to these tax loss carry-forwards.

The provision for Federal income tax consists of the following for the periods ended August 31, 2012 and 2011:

| 2012 | 2011 | |||||||

| Federal income tax benefit attributable to: | ||||||||

| Current Operations | $ | 17,839 | $ | 5,647 | ||||

| Less: valuation allowance | (17,839 | ) | (5,647 | ) | ||||

| Net provision for Federal income taxes | $ | 0 | $ | 0 | ||||

The cumulative tax effect at the expected rate of 34% of significant items comprising our net deferred tax amount is as follows as of August 31, 2012 and 2011:

| 2012 | 2011 | |||||||

| Deferred tax asset attributable to: | ||||||||

| Net operating loss carryover | $ | 23,486 | $ | 5,647 | ||||

| Less: valuation allowance | (23,486 | ) | (5,647 | ) | ||||

| Net deferred tax asset | $ | 0 | $ | 0 | ||||

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards of $69,077 for Federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur net operating loss carry forwards may be limited as to use in future years.

| F-8 |

SKOOKUM SAFETY SOLUTIONS CORP.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

AUGUST 31, 2012

NOTE 7 – COMMITMENTS AND CONTINGENCIES

The Company neither owns nor leases any real or personal property. An officer has provided office services without charge. There is no obligation for the officer to continue this arrangement. Such costs are immaterial to the financial statements and accordingly are not reflected herein. The officers and directors are involved in other business activities and most likely will become involved in other business activities in the future.

NOTE 8 – RELATED PARTY TRANSACTIONS

During the year ended August 31, 2012, the Company entered into an agreement with an officer and shareholder for compensation in the amount of $10,000. The agreement was for the period from January 1, 2012 through August 31, 2012. The officer and shareholder was paid $5,000 on this agreement as of August 31, 2012. On July 19, 2012, the officer resigned and forgave the prorated balance due on the agreement of $3,125. The amount was recorded as contributed capital.

NOTE 9 – GOING CONCERN

Skookum has a deficit accumulated during the development stage of $69,077 as of August 31, 2012. Skookum's financial statements are prepared using the generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, Skookum has no current source of revenue and a limited amount of working capital. Without realization of additional capital, it would be unlikely for Skookum to continue as a going concern. Skookum's management plans on raising cash from public or private debt or equity financing, on an as needed basis and in the longer term, and, ultimately, upon achieving profitable operations through the development of business activities.

NOTE 10 – SUBSEQUENT EVENTS

In accordance with ASC Topic 855-10, the Company has analyzed its operations subsequent to August 31, 2012 to the date these financial statements were issued, and has determined that it does not have any material subsequent events to disclose in these financial statements.

| F-9 |

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

No events occurred requiring disclosure under Item 304 of Regulation S-K during the fiscal year ending August 31, 2012.

Item 9A. Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, we have carried out an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this annual report, being August 31, 2012. This evaluation was carried out under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Based upon that evaluation, including our Chief Executive Officer and Chief Financial Officer, we have concluded that our disclosure controls and procedures were ineffective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934). Management has assessed the effectiveness of our internal control over financial reporting as of August 31, 2012 based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of this assessment, management concluded that, as of August 31, 2012, our internal control over financial reporting was not effective. Our management identified the following material weaknesses in our internal control over financial reporting, which are indicative of many small companies with small staff: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines.

We plan to take steps to enhance and improve the design of our internal control over financial reporting. During the period covered by this annual report on Form 10-K, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we hope to implement the following changes during our fiscal year ending August 31, 2013: (i) appoint additional qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies and procedures for accounting and financial reporting. The remediation efforts set out in (i) and (ii) are largely dependent upon our securing additional financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be adversely affected in a material manner.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

None

| 15 |

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The following information sets forth the names, ages, and positions of our current directors and executive officers as of August 31, 2012.

| Name | Age | Principal Positions With Us |

| Natalie M. Rydstrom | 30 | President, Chief Executive Officer, Chief Financial Officer and Director |

Set forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Natalie M. Rydstrom - President, CEO, CFO and Director

Natalie M. Rydstrom has been President, CEO, CFO and Director of our company since July 26, 2012.

Natalie M. Rydstrom has been in marketing and public relations for the past 7 years. From 2008 to 2010 she was the owner and director of operations for Simply Events which is a Spanish based bespoke public relations and events company. She then accepted a short term contract to work for CNIS as their event director and public relations coordinator. From May 2011 to January 2012 she was the director of client services for the internet marketing agency called Obsidian Edge. Currently, Mrs. Ryndstrom is a journalist and the head news anchor for SportsBook Review Costa Rica. We believe her experience qualifies her to service as our officer and director.

Term of Office

Our Directors are appointed for a one year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten years, none of the following occurred with respect to a present or former director, executive officer, or employee: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

| 16 |

Committees of the Board

Our company currently does not have nominating, compensation or audit committees or committees performing similar functions nor does our company have a written nominating, compensation or audit committee charter. Our directors believe that it is not necessary to have such committees, at this time, because the functions of such committees can be adequately performed by the board of directors.

Our company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for directors. The board of directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our company does not currently have any specific or minimum criteria for the election of nominees to the board of directors and we do not have any specific process or procedure for evaluating such nominees. The board of directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our board of directors may do so by directing a written request addressed to our Chief Executive Officer, Natalie M. Rydstrom, at the address appearing on the first page of this annual report.

Code of Ethics

As of August 31, 2012, we had not adopted a Code of Ethics for Financial Executives, which would include our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 11. Executive Compensation

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to our former or current executive officers for the fiscal years ended August 31, 2012 and 2011.

| SUMMARY COMPENSATION TABLE | |||||||||

|

Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

| Natalie M. Rydstrom, President, CEO, CFO and Director |

2012 2011 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

| Former Rebecca Kyllo, President, CEO, CFO and Director |

2012 2011 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

0 0 |

Narrative Disclosure to the Summary Compensation Table

Although we do not currently compensate our officers, we reserve the right to provide compensation at some time in the future. Our decision to compensate officers depends on the availability of our cash resources with respect to the need for cash to further our business purposes.

| 17 |

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of August 31, 2012.

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |||||||||

| OPTION AWARDS | STOCK AWARDS | ||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

| Natalie M. Rydstrom | - | - | - | - | - | - | - | - | - |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of August 31, 2012, the beneficial ownership of our common stock by each executive officer and director, by each person known by us to beneficially own more than 5% of the our common stock and by the executive officers and directors as a group:

| Title of class | Name and address of beneficial owner (1) | Amount of beneficial ownership | Percent of class (2) |

| Common |

Natalie M. Rydstrom E09 Calle Jacarandas, Urbanizacion Los Laureles, Escazu San Jose, Costa Rica |

1,500,000 | 65% |

| Total of All Directors and Executive Officers: | |||

|

More Than 5% Beneficial Owners: |

|||

| None | |||

| (1) | As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of, a security). In addition, for purposes of this table, a person is deemed, as of any date, to have "beneficial ownership" of any security that such person has the right to acquire within 60 days after such date. |

| (2) | The percent of class is based on 2,300,000 shares of the Company’s common stock issued and outstanding as of December 10, 2012. |

| 18 |

Item 13. Certain Relationships and Related Transactions, and Director Independence

None of our directors or executive officers, nor any proposed nominee for election as a director, nor any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to all of our outstanding shares, nor any members of the immediate family (including spouse, parents, children, siblings, and in-laws) of any of the foregoing persons has any material interest, direct or indirect, in any transaction since our incorporation or in any presently proposed transaction.

Item 14. Principal Accounting Fees and Services

Below is the table of Audit Fees (amounts in US$) billed by our auditor in connection with the audit of the Company’s annual financial statements:

|

Year Ended August 31, |

Audit Services $ |

Audit Related Fees $ |

Tax Fees $ |

Other Fees $ |

| 2012 | $10,600 | - | - | - |

| 2011 | $6,000 | - | - | - |

PART IV

Item 15. Exhibits, Financial Statements Schedules

| (a) | Financial Statements and Schedules |

The following financial statements and schedules listed below are included in this Form 10-K.

Financial Statements (See Item 8)

| (b) | Exhibits |

| Exhibit Number | Description |

| 3.1 | Articles of Incorporation (1) |

| 3.2 | Bylaws(1) |

| 3.3 | Amendment to Bylaws |

| 31.1 | Certification of Chief Executive Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of Chief Financial Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101** | The following materials from the Company’s Annual Report on Form 10-K for the year ended August 31, 2012 formatted in Extensible Business Reporting Language (XBRL). |

| (1) | Incorporated by reference to Registration Statement on Form S-1 filed on December 13, 2011 |

| ** | Provided herewith |

| 19 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Skookum Safety Solutions Corp.

/s/ Natalie M. Rydstrom

Natalie M. Rydstrom

President, Chief Executive Officer and Director

December 14, 2012

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

/s/ Natalie M. Rydstrom

Natalie M. Rydstrom

President, Chief Executive Officer and Director

December 14, 2012

| 20 |