Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NEW AMERICA ENERGY CORP. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - NEW AMERICA ENERGY CORP. | ex311.htm |

| EX-32.1 - CERTIFICATION - NEW AMERICA ENERGY CORP. | ex321.htm |

| EX-31.2 - CERTIFICATION - NEW AMERICA ENERGY CORP. | ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

(Mark One)

|

|

|

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended August 31, 2012

|

|

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from __________ to __________

|

|

|

000-54243

|

|

|

Commission File Number

|

|

|

NEW AMERICA ENERGY CORP.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

|

N/A

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

3651 Lindell Rd., Ste D#138, Las Vegas, NV

|

89103

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(800) 508-6149

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

n/a

|

n/a

|

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

|

Common Stock, $0.001 par value

|

|

Title of class

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes

|

[ ]

|

No

|

[X]

|

|

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was approximately $7,521,121 (based on 25,934,900 shares held by non-affiliates and a February 29, 2012 closing market price of $0.29 per share) as of February 29, 2012 (the last business day of the registrant’s most recently completed second quarter), assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

|

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST 5 YEARS:

Indicate by check mark whether the issuer has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

|

Yes

|

[ ]

|

No

|

[ ]

|

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

53,312,133 shares of common stock issued and outstanding as of December 11, 2012

|

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes.

|

None

|

2

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1

|

Business

|

4 |

|

Item 1A

|

Risk Factors

|

10 |

|

Item 1B

|

Unresolved Staff Comments

|

17 |

|

Item 2

|

Properties

|

17 |

|

Item 3

|

Legal Proceedings

|

28 |

|

Item 4

|

Mine Safety Disclosures

|

28 |

|

PART II

|

||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

29 |

|

Item 6

|

Selected Financial Data

|

29 |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

30 |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

31 |

|

Item 8

|

Financial Statements and Supplementary Data

|

31 |

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

32 |

|

Item 9A

|

Controls and Procedures

|

32 |

|

Item 9B

|

Other Information

|

34 |

|

PART III

|

||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

35 |

|

Item 11

|

Executive Compensation

|

38 |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

39 |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

40 |

|

Item 14

|

Principal Accounting Fees and Services

|

41 |

|

PART IV

|

||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

42 |

|

SIGNATURES

|

43 |

3

ITEM 1. BUSINESS

Forward Looking Statements

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

These risks include, by way of example and not in limitation:

|

|

·

|

the uncertainty that we will not be able to successfully identify commercially viable resources on our exploration properties;

|

|

|

·

|

risks related to the large number of established and well-financed entities that are actively competing for limited resources within the mineral property exploration field;

|

|

|

·

|

risks related to the failure to successfully manage or achieve growth of our business if we are successful in identify a viable mineral resource, and;

|

|

|

·

|

other risks and uncertainties related to our business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," “Company,” "our" and "New America" mean New America Energy Corp., unless otherwise indicated.

4

Measurement & Currency

Conversion of metric units into imperial equivalents is as follows:

|

Metric Units

|

Multiply by

|

Imperial Units

|

|

hectares

|

2.471

|

= acres

|

|

meters

|

3.281

|

= feet

|

|

kilometers

|

0.621

|

= miles (5,280 feet)

|

|

grams

|

0.032

|

= ounces (troy)

|

|

tonnes

|

1.102

|

= tons (short) (2,000 lbs)

|

|

grams/tonne

|

0.029

|

= ounces (troy)/ton

|

Cautionary Note to United States Investors

We caution U.S. investors that the Company may have materials in the public domain that may use terms that are recognized and permitted under Canadian regulations, however the U.S. Securities and Exchange Commission (“S.E.C.”) may not recognize such terms. We have detailed below the differences in the SEC regulations as compared to the Canadian Regulations under National Instrument NI 43-101.

|

S.E.C. Industry Code

|

National Instrument 43-101 (“NI 43-101”)

|

|

Reserve: That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The United States Securities and Exchange Commission requires a final or full Feasibility Study to be completed in order to support either Proven or Probably Reserves and does not recognize other classifications of mineralized deposits. Note that for industrial mineral properties, in addition to the Feasibility Study, “sales” contracts or actual sales may be required in order to prove the project’s commerciality and reserve status.

|

Mineral Reserve: The economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

|

|

Proven Reserves: Reserves for which a quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, grade and/or quality are computed from the results of detailed sampling; the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, share, depth and mineral content of reserves are well established.

|

Proven Mineral Reserve: The economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

|

|

Probable Reserves: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

|

Probable Mineral Reserve: The economically mineable part of an indicated, and in some circumstances, a Measured Mineral Resource, demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, and economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

|

5

Corporate Information

The address of our principal executive office is 3651 Lindell Road, Ste. D#138, Las Vegas, Nevada. Our telephone number is 800-508-6149.

Our common stock is quoted on the OTCBB (“Over-the-Counter- Bulletin-Board”) under the symbol "NECA".

New America Energy Corp (formerly “Atheron, Inc.”) was incorporated in Nevada on May 8, 2006 as a development stage company, initially developing a technology for ethanol-methanol gasoline. The Company did not progress the development of this technology.

On November 5, 2010, we underwent a change of control and the Company’s newly appointed sole director and majority shareholder approved a name change to New America Energy Corp. and a twenty-five (25) new for one (1) old forward stock split of the Company’s issued and outstanding shares of common stock.

On November 16, 2010, the Nevada Secretary of State accepted for filing the Certificate of Amendment to the Company’s Articles of Incorporation to change our name from Atheron, Inc. to New America Energy Corp. The forward stock split and name change became effective with the Over-the-Counter Bulletin Board at the opening of trading on December 1, 2010.

On November 14, 2012, the Nevada Secretary of State accepted for filing an amendment to our articles of incorporation whereby we increased our authorized common shares from 75,000,000 to 800,000,000, pursuant to the approval of our board of directors and majority shareholders as of June 26, 2012.

At the report date mineral claims, with unknown reserves, have been acquired. The Company has not established the existence of a commercially mineable ore deposit and therefore has not reached the development stage and is considered to be in the exploration stage.

We do not have any subsidiaries.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

We are considered to be an exploration stage company, as we have not generated any revenues from operations.

Our common stock is traded over-the-counter on the OTCBB under the ticker symbol “NECA.”

Our Current Business

We are an exploration stage company engaged in the exploration of mineral properties. The Company is focused exclusively on the acquisition and development of mineral resource properties.

On February 3, 2011 we entered into property acquisition agreements with First Liberty Power Corp. (“FLPC”) and GeoXplor Inc. (“GeoXplor”). Pursuant to the terms of the agreements, we acquired an option, as well as exploration rights, in certain unpatented mining claims located in Southern Utah known as the “Uravan Property”. On May 31, 2011, we amended the agreement to extend the payment date for an additional 120 days. The Company did not pay the required option payments under the agreements and the property was lost on September 30, 2011.

On May 31, 2011, we entered into a property acquisition agreement with GeoXplor Corp. to acquire an option, as well as exploration rights, in certain unpatented mining claims located in Clayton Valley, Nye County, Nevada. Subsequently on October 27, 2011, we entered into an amended property acquisition agreement whereby we acquired additional claims. Further on June 20, 2012, we entered into an amended property acquisition agreement which amended and replaced the May 31, 2011 agreement and the October 27, 2011 agreement. Under the amended agreement we amended and extended the terms for payments to GeoXplor Corp. in exchange for the issuance of additional shares.

6

Our exploration programs will be exploratory in nature and there is no assurance that a commercially viable mineral deposit, a reserve, exists until further exploration, particularly drilling, is undertaken and a comprehensive evaluation concludes economic and legal feasibility. We have not yet generated or realized any revenues from our business operations.

On March 28, 2012, we entered into an investment agreement (the “Investment Agreement”) with Fairhills Capital Offshore Ltd., a Cayman Islands exempted company (“Fairhills”). Pursuant to the terms of the Investment Agreement, Fairhills has committed to purchase up to Three Million Dollars ($3,000,000) of our common stock over a period of up to thirty-six (36) months.

On May 1, 2012, we entered into an amendment to the Investment Agreement (the “Amendment”). Pursuant to the Amendment, the purchase price of the shares shall be equal to a discount of Twenty-Five percent (25%) percent from the lowest volume weighted average price during the ten (10) trading days immediately prior to receipt by Fairhills of a put notice (as defined in the Investment Agreement.)

In connection with the Investment Agreement, we also entered into a registration rights agreement (the “Registration Rights Agreement”) with Fairhills. Pursuant to the Registration Rights Agreement, we are obligated to file a registration statement with the Securities and Exchange Commission (“SEC”) covering Eighteen Million (18,000,000) shares of the common stock underlying the Investment Agreement within 21 days after the closing of the Investment Agreement. The Company was required to reduce the number of Shares registered under the registration statement to 9,500,000 because of Rule 415 of the Securities Act of 1933, as amended, and will file an additional registration statement to register the remaining 8,500,000 in the future, if necessary. We were obligated to use all commercially reasonable efforts to have the registration statement declared effective by the SEC within 120 days after the closing of the Investment Agreement and maintain the effectiveness of such registration statement until termination in accordance with the Investment Agreement. The registration statement was declared effective by the SEC on August 30, 2012.

At an assumed purchase price under the Investment Agreement of $0.04595 (equal to 75% of the closing price of our common stock of $0.0612 on May 25, 2012), we will be able to receive up to $436,525 in gross proceeds, assuming the sale of the entire 9,500,000 Shares being registered hereunder pursuant to the Investment Agreement. At an assumed purchase price of $0.04595 under the Investment Agreement, we would be required to register 55,788,357 additional shares to obtain the balance of $2,563,475 under the Investment Agreement. However, as the closing bid price of the Shares have dropped substantially since the date of the Investment Agreement, we will be required to register far more than 55,788,357 additional Shares to obtain the balance of $2,563,475 under the Investment Agreement. We are currently authorized to issue 800,000,00075,000,000 shares of our common stock. stock; however our management intends to request that our shareholders approve an increase in our authorized capital stock. Fairhills has agreed to refrain from holding an amount of shares which would result in Fairhills from owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

On November 6, 2012, Fairhills assigned all of its rights, duties, and obligations under the Investment Agreement, the Registration Rights Agreement, and other associated documents (the “Assignment”), to Deer Valley Management, LLC, a Delaware limited liability company (“Deer Valley”), and the Company consented to the Assignment. Fairhills and Deer Valley share the same ownership and management and there will not be any substantial change to our arrangement under the Investment Agreement as a result of the Assignment.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the Investment Agreement. These risks include dilution of stockholders, significant decline in our stock price and our inability to draw sufficient funds when needed.

Deer Valley will periodically purchase our common stock under the Investment Agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to Fairhills to raise the same amount of funds, as our stock price declines.

On March 28, 2012, we entered into a debt instrument with Fairhills whereby Fairhills provided us with a $200,000 loan which was due by September 28, 2012, and carries a 2% annual rate of interest. As of the date hereof, we have not repaid the balance due on this loan, so we are in default. The

7

note was not convertible into our common stock and we have agreed that we will not use the funds raised in the Fairhills/Deer Valley financing to repay this note. The note is secured by 3,333,333 shares of our restricted common stock owned by our director and officer, Rick Walchuk, which are being held in escrow by Fairhills’s counsel. As we are in default of this loan, Fairhills has the right to the shares held in escrow. However, as of the date hereof, Fairhills has not exercised its right to claim such shares held in escrow.

On October 1, 2012, the Company drew down $15,000 in funds under the Investment Agreement and issued 620,000 Shares to Fairhills.

Midsouth Capital Inc. (“Midsouth”) who brokered the agreement with Fairhills will receive certain commissions for the financings with Fairhills pursuant to an agreement whereby Midsouth is the Company’s non-exclusive financial advisor, investment banker and placement agent for the purpose of assisting the Company to raise capital. The Company agreed to: (i) issue 80,000 Shares; (ii) a success fee of 10% of the amount for any capital raised; (iii) 150,000 restricted Shares, with piggy back registration rights, per $1,000,000 of capital raised for a period of two years. Pursuant to our agreement with MidSouth we have issued Midsouth 80,000 Shares, and paid them a stock fee of 30,000 additional Shares and a cash fee of $20,000 based on 10% of the initial $200,000 funded by Fairhills and a further payment of $1,500 in relation to the Financing Agreement as commission on the drawdown of $15,000 from Fairhills under the Investment Agreement.

Market, Customers and Distribution Methods

Although there can be no assurance, large and well capitalized markets are readily available for all metals and precious metals throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for subject metals.

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Competition

The mineral exploration industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of mineral exploration properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration properties.

8

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration properties or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of energy legislation and/or regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including international political conditions, overall levels of supply and demand for mineral exploration.In the face of competition, we may not be successful in acquiring, exploring or developing profitable mineral properties or interests, and we cannot give any assurance that suitable oil and gas properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

|

|

●

|

keeping our costs low;

|

|

●

|

relying on the strength of our management’s contacts; and

|

|

●

|

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

|

Intellectual Property

We have not filed for any protection of our trademark, and we do not have any other intellectual property.

Research and Development

We did not incur any research and development expenses during the period from May 8, 2006 (inception) to our fiscal year ended August 31, 2012.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. After the effectiveness of this Registration Statement we will begin filing Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

Any operations at our mineral properties will be subject to various federal and state laws and regulations in the United States which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. There are no current orders or directions relating to us or our properties with respect to the foregoing laws and regulations.

9

Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties. We are not presently aware of any specific material environmental constraints affecting our properties that would preclude the economic development or operation of property in the United States.

The U.S. Forest Service requires that mining operations on lands subject to its regulation obtain an approved plan of operations subject to environmental impact evaluation under the National Environmental Policy Act. Any significant modifications to the plan of operations may require the completion of an environmental assessment or Environmental Impact Statement prior to approval. Mining companies must post a bond or other surety to guarantee the cost of post-mining reclamation. These requirements could add significant additional cost and delays to any mining project undertaken by us.

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Any future mining operations at our mining properties may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures for pollution control in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended ("CERCLA"), imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. Those liable groups include, among others, the current owners and operators of facilities which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. We cannot predict the potential for future CERCLA liability with respect to our mining properties or surrounding areas.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of August 31, 2012 we did not have any employees. Rick Walchuk, our Director and Chief Executive Officer spends about 20 hours per week on our operations on a consulting basis and Alexander Tsingos, our Director and Secretary, spends

time as required on a consulting basis.

ITEM 1A. RISK FACTORS

An investment in our securities should be considered highly speculative due to various factors, including the nature of our business and the present stage of our development. An investment in our securities should only be undertaken by persons who have sufficient financial resources to afford the total loss of their investment. In addition to the usual risks associated with investment in a business, the following is a general description of significant risk factors which should be considered. You should carefully consider the following material risk factors and all other information contained in this Annual Report before deciding to invest in our Common Shares. If any of the following risks occur, our business, financial condition and results of operations could be materially and adversely affected. Additional risks and uncertainties we do not presently know or that we currently deem immaterial may also impair our business, financial condition or operating results.

10

RISKS RELATING TO OUR COMPANY

We currently have no source of operating cash flow and we have a history of operating losses.

We have no revenues from operations, our mineral property interests are in the exploration stage and we have a history of operating losses. We will not receive revenues from operations at any time in the near future, and we have no prior year’s history of earnings or cash flow. We have incurred losses. There can be no assurance that our operations will ever generate sufficient revenues to fund our continuing operations or that we will ever generate positive cash flow from our operations. Further, we can give no assurance that we will attain or sustain profitability in any future period.

We are currently a mining exploration stage company. See “Item 2 Properties” of this Report for more information regarding our mining claims.

According to SEC definitions, our mining claims do not have any proven or probable reserves. A “reserve,” as defined by the SEC, is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not carried out any feasibility study with regard to our mining claims. As a result, we currently have no reserves and there are no assurances that we will be able to prove that there are reserves on our mining concessions.

Mineral exploration is highly speculative in nature and there can be no certainty of our successful development of profitable commercial mining operations.

The exploration and development of mineral properties involve significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few explored properties develop into producing mines. Substantial expenses may be incurred to locate and establish mineral reserves, develop metallurgical processes, and construct mining and processing facilities at a particular site. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; metals prices which are highly cyclical; drilling and other related costs that appear to be rising; and government regulations, including those related to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by us towards the exploration and evaluation of mineral deposits will result in discoveries of commercial quantities of ore.

The Company may be unable to obtain the funds necessary to finalize our property option agreement.

Under the terms of our amended option agreement executed June 20, 2012, the effective date, for our mining claims, we are required to expend a total of $1,000,000 within four years on exploration and make property payments of $375,000. Exploration payments of $100,000 are required to be expended prior one year of the effective date, with a further $200,000 to be expended during the second year, $300,000 to be expended during the third year and the remaining $400,000 to be expended during the fourth year. Property payments have been amended to pay $100,000 by May 31, 2012, $25,000 on March 4, 2013, $150,000 on May 31, 2012 and $100,000 on May 31, 2014. Further, we are required to make property payment of $100,000 by May 31, 2012, which has been paid, $25,000 on March 4, 2013, $150,000 on May 31, 2013 and $100,000 on May 31, 2014. While we are current in our requirements under this agreement, currently we do not have sufficient funds to expend the ongoing exploration funds and property payments required under the option agreement. We have been successful in obtaining financing for operations by way of loans and financings and we currently have a financing agreement for up to $3,800,000 but as an exploration company it is often difficult to obtain adequate financing when required, and it is not necessarily the case that the terms of such financings will be favorable. If we fail to obtain additional financing on a timely basis, we could forfeit our mineral property interests and/or reduce or terminate operations.

11

Because our business involves numerous operating hazards, we may be subject to claims of a significant size, which would cost a significant amount of funds and resources to rectify. This could force us to cease our operations.

Our operations are subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure and cratering. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs, which would adversely affect our business.

Damage to the environment could also result from our operations. If our business is involved in one or more of these hazards, we may be subject to claims of a significant size that could force us to cease our operations.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. Although we intend to substantially comply with all applicable laws and regulations, because these rules and regulations frequently are amended or interpreted, we cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulations could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the costs of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and properties are subject to extensive laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to health and safety. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences; (ii) restrict the types, quantities and concentration of various substances that can be released in the environment in connection with exploration activities; (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas; (iv) require remedial measures to mitigate pollution from former operations; and (v) impose substantial liabilities for pollution resulting from our proposed operations.

The exploration of mineral reserves are subject to all of the usual hazards and risks associated with mineral exploration, which could result in damage to life or property, environmental damage, and possible legal liability for any or all damages. Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. Even though we are at liberty to obtain insurance against certain risks in such amounts we deem adequate, the nature of those risks is such that liabilities could exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and there is no assurance that we will obtain such insurance in the future. There are also risks against that we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our financial position, future earnings, and/or competitive positions.

The prices of metals are highly volatile and a decrease in metal prices can have a material adverse effect on our business.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals market from the time exploration for a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a minerals property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metal prices have decreased. Adverse fluctuations of metals market prices may force us to curtail or cease our business operations.

12

Mining operations generally involve a high degree of risk.

Mining operations are subject to all the hazards and risks normally encountered in the exploration, development and production of base or precious metals, including unusual and unexpected geological formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Mining operations could also experience periodic interruptions due to bad or hazardous weather conditions and other acts of God. Milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailing disposal areas, which may result in environmental pollution and consequent liability.

If any of these risks and hazards adversely affect our mining operations or our exploration activities, they may: (i) increase the cost of exploration to a point where it is no longer economically feasible to continue operations; (ii) require us to write down the carrying value of one or more mines or a property; (iii) cause delays or a stoppage in the exploration of minerals; (iv) result in damage to or destruction of mineral properties or processing facilities; and (v) result in personal injury, death or legal liability. Any or all of these adverse consequences may have a material adverse effect on our financial condition, results of operations, and future cash flows.

We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We will be competing with many exploration companies that have significantly greater personnel, financial, managerial and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

We may not have access to all of the supplies and materials we need to begin exploration, which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials prior to undertaking exploration programs. If we cannot find the products, equipment and materials we need, we will have to suspend our exploration plans until we do find the products, equipment and materials.

We are an exploration stage company, and there is no assurance that a commercially viable deposit or “reserve” exists in the property in which we have claim.

We are an exploration stage company and cannot assure you that a commercially viable deposit, or “reserve,” exists on our mineral properties. Therefore, determination of the existence of a reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic and environmental factors. If we fail to find commercially viable deposits, our financial condition and results of operations will be materially adversely affected.

We depend on our officers and directors and the loss of these individuals could adversely affect our business.

Our Company is completely dependent on our two officers and directors, Rick Walchuk and Alexander Tsingos. We currently have no employees and the loss of either or both of these individuals could significantly and adversely affect our business. We do not carry any life insurance on our directors and officers.

13

RISKS RELATING TO AN INVESTMENT IN OUR SECURITIES

Our Common Stock Price May be Volatile

The trading price of our common stock may fluctuate substantially. The price of our common stock, at any given time, may be higher or lower than the price you pay for your shares, depending on many factors, some of which are beyond our control and may not be directly related to our operating performance. These factors include the following: (i) price and volume fluctuations in the overall stock market from time to time; (ii) volatility resulting from trading in derivative securities related to our common stock including puts, calls, long-term equity anticipation securities, or leaps, or short trading positions; (iii)actual or anticipated changes in our earnings or fluctuations in our operating results or changes in the expectations of securities analysts; (iv) general economic conditions and trends; (v) loss of a major funding source; or (vi) departures of key personnel.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted and feasible, developing natural resource properties. Our mining claims are in the exploration stage only and are without proven reserves of natural resources. Accordingly, we have not generated any revenues nor have we realized a profit from our -operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural resources, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

We may, in the future, issue additional common shares that would reduce investors’ percent of ownership and may dilute our share value.

The future issuance of common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the common shares held by our investors, and might have an adverse effect on any trading market for our common shares.

Market for Penny Stock has suffered in recent years from patterns of fraud and abuse.

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include: (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; (iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses.

Our common shares are subject to the “Penny Stock” Rules of the SEC, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted regulations that generally define a "penny stock" to be any equity security other than a security excluded from such definition by Rule 3a51-1 under the Securities Exchange Act of 1934, as amended. For the purposes relevant to our Company, it is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

14

Our common shares are currently regarded as a “penny stock”, since our shares are not listed on a national stock exchange or quoted on the NASDAQ Market within the United States, to the extent the market price for its shares is less than $5.00 per share. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide a customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written determination that the penny stock is a suitable investment for the purchaser, and receive the purchaser's written agreement to the transaction.

To the extent these requirements may be applicable; they will reduce the level of trading activity in the secondary market for the common shares and may severely and adversely affect the ability of broker-dealers to sell the common shares.

FINRA sales practice requirements may also limit a stockholders ability to buy and sell our stock.

In addition to the penny stock rules promulgated by the SEC, which are discussed in the immediately preceding risk factor, FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the ability to buy and sell our stock and have an adverse effect on the market value for our shares.

Our common stock may experience extreme rises or declines in price, and you may not be able to sell your shares at or above the price paid.

Our common stock may be highly volatile and could be subject to extreme fluctuations in response to various factors, many of which are beyond our control, including (but not necessarily limited to): (i) the trading volume of our shares; (ii) the number of securities analysts, market-makers and brokers following our common stock; (iii) changes in, or failure to achieve, financial estimates by securities analysts; (iv) actual or anticipated variations in quarterly operating results; (v) conditions or trends in our business industries; (vi) announcements by us of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; (vii) additions or departures of key personnel; (viii) sales of our common stock; and (ix) general stock market price and volume fluctuations of publicly-trading and particularly , microcap companies.

Investors may have difficulty reselling shares of our common stock, either at or above the price they paid for our stock, or even at fair market value. The stock markets often experience significant price and volume changes that are not related to the operating performance of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition, there is a history of securities class action litigation following periods of volatility in the market price of a company’s securities. Although there is no such shareholder litigation currently pending or threatened against the Company, such a suit against us could result in the incursion of substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business. Moreover, and as noted below, our shares are currently traded on the OTCBB and, further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to manipulation by market-makers, short-sellers and option traders.

We have not and do not intend to pay any cash dividends on our common shares and, consequently, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have not, and do not, anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

15

A decline in the price of our common stock could affect our ability to raise further working capital, it may adversely impact our ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because we may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, or convertible debt instruments, a decline in the price of our common stock could be detrimental to our liquidity and our operations because the decline may cause investors to not choose to invest in our stock. If we are unable to raise the funds we require for all our planned operations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. a result, our business may suffer, and not be successful and we may go out of business. We also might not be able to meet our financial obligations if we cannot raise enough funds through the sale of our common stock and we may be forced to go out of business.

Deer Valley will pay less than the then-prevailing market price for our common stock.

The common stock to be issued to Deer Valley pursuant to the Investment Agreement will be purchased at a 25% discount from the lowest volume weighted average price during the ten (10) trading days immediately prior to receipt by the Investor of the Put Notice. Deer Valley has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If Deer Valley sells the shares, the price of our common stock could decrease. If our stock price decreases, Deer Valley may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

Your ownership interest may be diluted and the value of our common stock may decline, if and when, we exercise our put rights pursuant to the Investment Agreement with Deer Valley.

Effective April 30 2012, and as amended May 1, 2012, we entered into a $3,000,000 Investment Agreement with Fairhills, which was assigned to Deer Valley on November 6, 2012. Pursuant to the Investment Agreement, when we deem it necessary, we may raise capital through the private sale of our common stock to Deer Valley at a price equal to a 25% discount from the lowest volume weighted average price during the ten (10) trading days immediately prior to receipt by the Investor of the Put Notice. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted.

We are registering an aggregate of 18,000,000 shares of common stock to be issued under the Investment Agreement. The sale of such shares could depress the market price of our common stock.

We are registering an aggregate of 18,000,000 Shares of common stock under a registration statement for issuance pursuant to the Investment Agreement with Deer Valley. Notwithstanding Deer Valley’s ownership limitation, the 18,000,000 Shares would represent approximately 25.7% of our shares of common stock outstanding immediately after our exercise of the put right under the Investment Agreement. The sale of these Shares into the public market by Deer Valley could depress the market price of our common stock.

At an assumed purchase price under the Investment Agreement of $0.04595 (equal to 75% of the closing price of our common stock of $0.0612 on May 25, 2012), we will be able to receive up to $436,524 in gross proceeds, assuming the sale of the entire 9,500,000 Shares being registered hereunder pursuant to the Investment Agreement. At an assumed purchase price of $0.04595 under the Investment Agreement, we would be required to register 55,788,357 additional shares to obtain the balance of $2,563,475 under the Investment Agreement. . However, as the closing bid price of the Shares have dropped substantially since the date of the Investment Agreement, we will be required to register far more than 55,788,357 additional Shares to obtain the balance of $2,563,475 under the Investment Agreement. We are currently authorized to issue 800,000,000 shares of our common stock. Deer Valley has agreed to refrain from holding an amount of shares which would result in Deer Valley from owning more than 4.99% of the then-outstanding shares of our common stock at any one time. Due to the floating offering price, we are not able to determine the exact number of shares that we will issue under the Investment Agreement.

16

We may not have access to the full amount available under the Investment Agreement.

On October 1, 2012, the Company drew down $15,000 in funds under the Investment Agreement and issued 620,000 Shares to Fairhills.

Our ability to continue to draw down funds and sell shares under the Investment Agreement requires that the registration statement continue to be effective. In addition, the registration statement of which this prospectus is a part registers 9,500,000 Shares issuable under the Investment Agreement, and our ability to access the Investment Agreement to sell any remaining shares issuable under the Investment Agreement is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares. These subsequent registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these subsequent registration statements cannot be assured. The effectiveness of these subsequent registration statements is a condition precedent to our ability to sell the shares of common stock subject to these subsequent registration statements to Deer Valley under the Investment Agreement.

Certain Restrictions on the extent of puts and the delivery of advance notices may have little, if any, effect on the adverse impact of our issuance of shares in connection with the Investment Agreement, and as such, Deer Valley may sell a large number of shares, resulting in substantial dilution to the value of the shares held by existing shareholders.

Deer Valley has agreed, subject to certain exceptions listed in the Investment Agreement, to refrain from holding an amount of shares which would result in Deer Valley or its affiliates owning more than 4.99% of the then-outstanding shares of our common stock at any one time. These restrictions, however, do not prevent Deer Valley from selling shares of common stock received in connection with a put, and then receiving additional shares of common stock in connection with a subsequent put. In this way, Deer Valley could sell more than 4.99% of the outstanding common stock in a relatively short time frame while never holding more than 4.99% at one time.

.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our executive staff offices remotely from corporate offices in Las Vegas, Nevada, which are our principal offices. These offices provide mail, and the use of office facilities as required. The fees for these offices are approximately $50 per month. Our sole director and officer, Rick Walchuk provides office space where he works in his country of residence, free of charge to the Company. Our office is located at 3651 Lindell Road, Ste. D#138, Las Vegas, Nevada. Our telephone number is 800-508-6149.

Clayton Valley Properties

Clayton Ridge and Ralston Basin (Mud Lake)

On May 31, 2011, we entered into a property acquisition agreement with GeoXplor Corp. Pursuant to the terms of the agreement; we acquired an option, as well as exploration rights, in certain unpatented mining claims located in Clayton Valley, Nye County, Nevada. Subsequently on October 27, 2011, we entered into an amended property acquisition agreement which amended and replaced the original agreement.

On June 20, 2012, we entered into an amended property acquisition agreement which amended and replaced the May 31, 2011 agreement and the October 27, 2011 agreement.

17

Under the amended agreement we amended and extended the terms for payments to GeoXplor Corp. in exchange for the issuance of additional shares

|

·

|

$75,000 on May 31, 2011 (paid);

|

|

·

|

$25,000 on June 22, 2012 (paid);

|

|

$25,000 on March 4, 2013;

|

|

|

·

|

$150,000 on May 31, 2013;

|

|

·

|

$100,000 on May 31, 2014;

|

|

·

|

2,750,000 shares to be issued as follows:

|

|

(1) 500,000 shares of our common stock on execution of the Original Agreement (issued);

|

|

|

(2) 250,000 shares of our common stock on execution of the Amended Agreement (issued);

|

|

|

(3) 750,000 shares of our common stock on or before June 22, 2012; (issued)

|

|

|

(4) 500,000 shares of our common stock on or before the date two years from the date of the Original Agreement; and

|

|

(5) 500,000 shares of our common stock on or before the date three years from the date of the Original Agreement; and

|

|

|

A 3.0% net value royalty on production of Lithium and other minerals from the Property measured by 3% of the gross proceeds less costs associated with production from the Property.

|

|

|

The Company has the right to purchase up to 2% of the Net Value Royalty for $1,000,000 for each 1%.

|

Should the Company or its assignee or a joint venture including the Company present a feasibility study recommending the mining of Lithium from the Property and authorize implementation of a mining plan or sell, option, assigns, disposes or alienates all or a portion of its interest in the Property, the Company shall pay GeoXplor an additional bonus of $500,000 in cash or shares of the Company, at the sole election of GeoXplor.

Further, we have a required to expense not less than $1,000,000 in exploration and development testing, from the Effective Date of the amended purchase agreement as follows:

$100,000 during the first year;

$200,000 during the second year;

$300,000 during the third year; and

$400,000 during the fourth year.

If we are unable to make any of the share issuances or payments under the agreements with GeoXplor, the property rights will revert to GeoXplor.

During the fiscal year ended August 31, 2012, the Company made a cash payment in the amount of $25,000 (2011-$75,000) to GeoXplor.

During the period ended August 31, 2012, the Company issued 1,000,000 (2011-500,000) shares of common stock to GeoXplor.

During the twelve month period ended August 31, 2012, the Company paid $122,848 (2011-$104,823) to GeoXplor in respect to the gravity survey on the property and recorded this amount as an exploration expense.

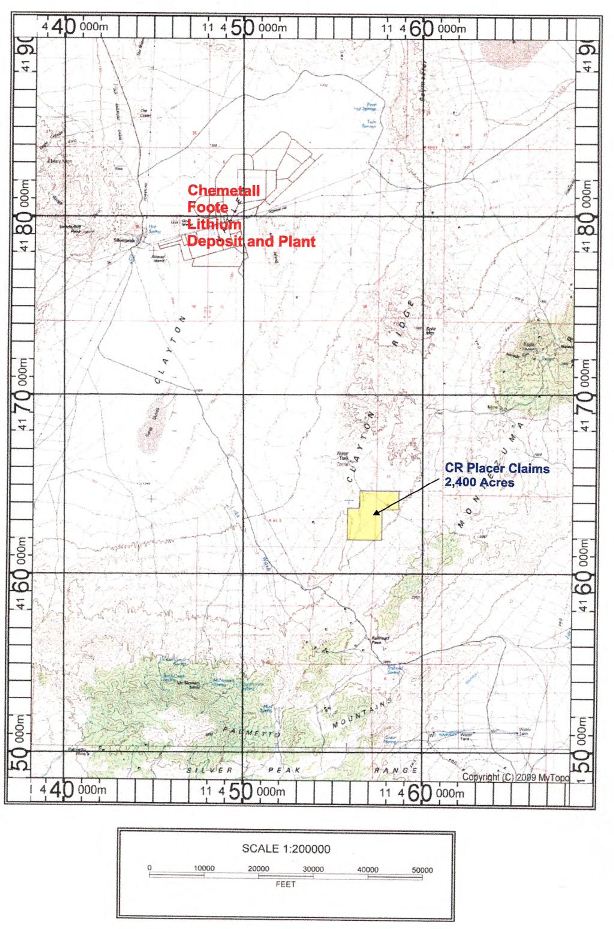

Clayton Ridge Location and Access

The Clayton Ridge CR 1 – 15 claims are association placer claims in good standing on Bureau of Land Management land in Esmeralda County, Nevada. The Clayton Ridge mineral claims are located in the western part of Esmeralda County, Nevada, 38 miles southwest of Tonopah. The nearest town is Silver Peak, which has a population of approximately 200 and is accessible via State Highway 47.

18

Access to the property is via paved roads, US highway 95 from the town of Tonopah and Goldfield and direct access to the property is via secondary gravel and dirt roads. There are a few four-wheel-drive trails and tracks which turn off from that graded road and provide established paths to various parts of the claim block. Actual four wheel drive is rarely needed on those paths. The nearest rail and commercial airline service is to Las Vegas, NV approximately 190 miles to the southeast.

Water and grid-supplied electricity are available in close proximity.

19

History of Operations

This property is currently without known reserves and the proposed property is exploratory in nature. There is insufficient information for a resource estimate of lithium brines on the property.

20

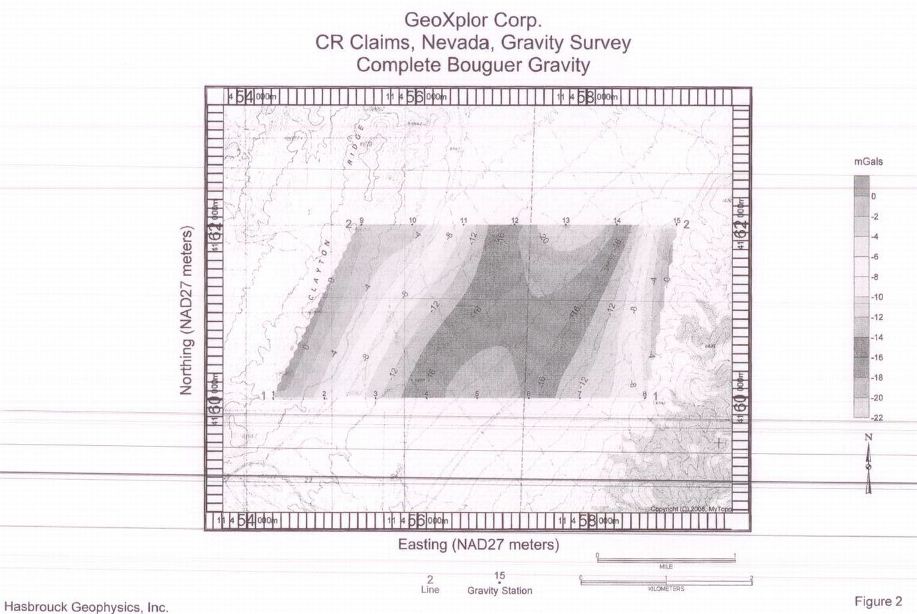

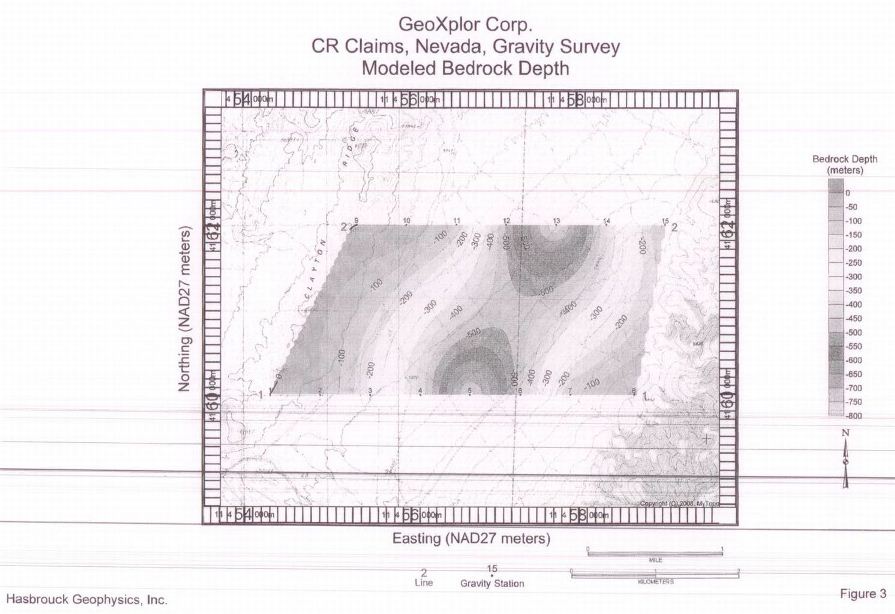

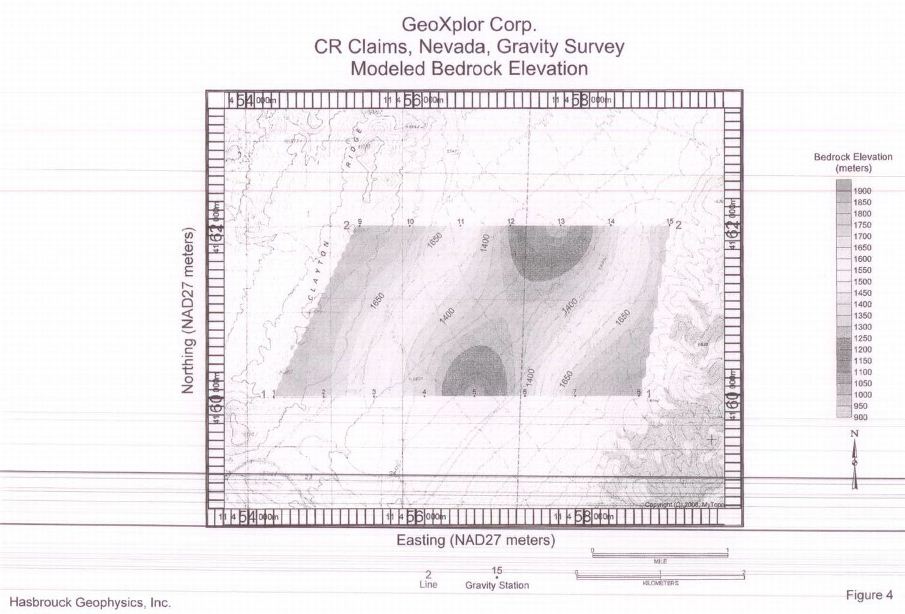

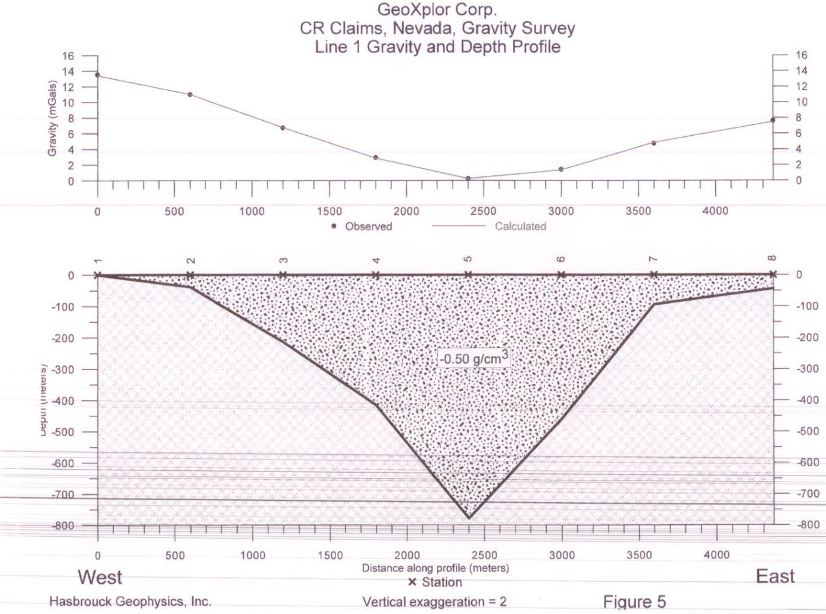

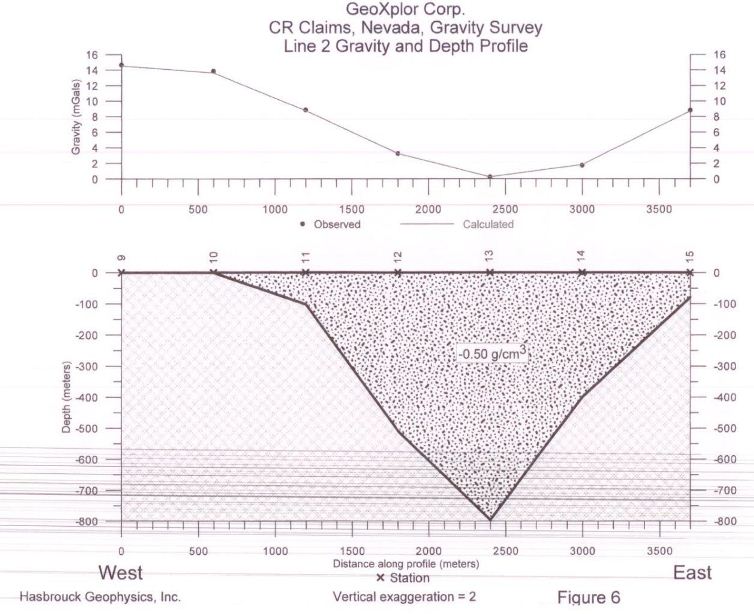

A reconnaissance gravity survey consisting of two lines was recently conducted over the Clayton Ridge claims by Hasbrouck Geophysics under the guidance of GeoXplor Corp. Jim Hasbrouck analyzed and interpreted the survey's data; the results indicated the presence of significant bedrock and elevation lows which clearly recommend further exploration of the property.

21

22

23

There is no history of lithium exploration on the property previous to GeoXplor Corp.

Present Condition and Plan of Exploration

On November 22, 2011, the Company determined to commence initial exploration on Clayton Ridge. The initial phase of the exploration program consisted of a complete gravity survey over the claim area to determine the depths of the basin and delineate troughs or traps that might contain economic values and concentrations of lithium brines. A total of about 125 gravity stations were used. The gravity data was acquired with a leased LaCoste and Romberg Model G gravity meter.

The Company is required to expend a total of $100,000 in exploration on or before May 31, 2012 and this program fulfilled the Company’s requirements for expenditures as the Company has expended a total of $122,848 to GeoXplor in respect to the gravity survey on the property and recorded this amount as an exploration expense.

The Company has a requirement to expend a total of $200,000 on exploration by June 20, 2013. It has not yet detailed any further exploration programs. A portion of the funds expended in 2012 which are in excess of the $100,000 required expenditure may be credited towards this $200,000 requirement.

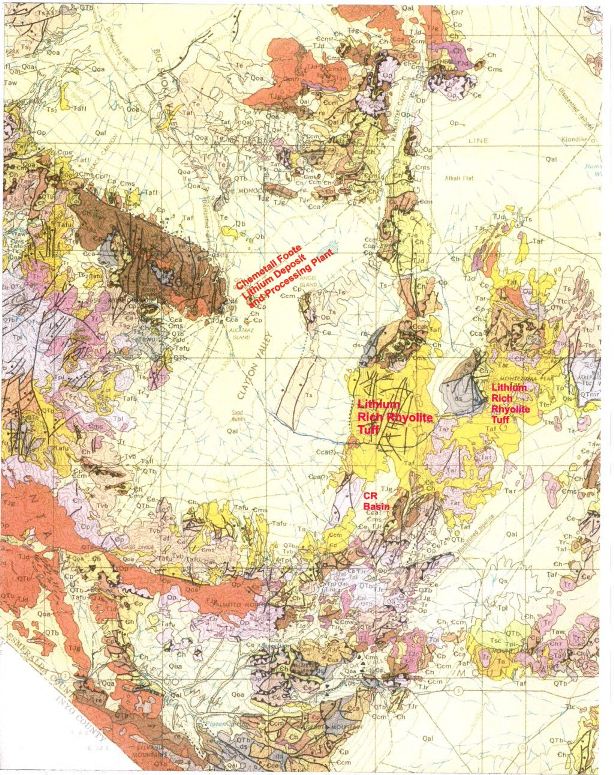

Geology

Lithium is a locatable mineral according to the Code of Federal Regulations. Lithium should be located by lode claims where it occurs in bedrock and by placer claims where it occurs in alluvium. The claims cover a conceptual target for lithium brines. The concept is consistent with generally accepted data and theories about the formation of the extensive lithium brine resources in the area.

Lithium production by Foote Minerals (now Chemetall Foote) began in 1967 from brines pumped from the Clayton Valley region, the next major valley to the west beyond Clayton Ridge and about 10 miles west of the claim group.

A preliminary reconnaissance gravity geophysical survey conducted consisting of two lines was conducted over the CR Claims in August 2011 by GeoXplor Corp. so that initial modeling of bedrock depth and elevation could be conducted.

The modeled bedrock depth and elevation results show significant bedrock and elevation lows along the two lines. These lows, are probably connected, however the bedrock depth and elevation contour maps indicate a small saddle in between the two lines which is actually an artifact of the contouring algorithm and is not real (this occurs because the stations are nominally 600 meters apart while the lines are two kilometers apart). Although the modeling of the gravity data indicates that a substantial thickness of sediments exists in the middle of the valley between Clayton Ridge to the west and the Montezuma Range to the east, additional gravity surveys will need to be conducted in the area to determine if these bedrock and elevation lows become shallower to the south and/or north such that a closed basin exists.

24

The claims are located in the Basin and Range physiographic region which stretches from southern Oregon and Idaho to Mexico. It is characterized by extreme elevation changes between linear, north to northeasterly trending mountains and flat intermountain valleys or basins. Volcanism began as early as the Oligocene geologic epoch about 30 million years ago and with tectonic extension reaching full stride during the Miocene epoch about 17 million years ago.

Clayton Valley-Montezuma Range is underlain by a thick body of tuffaceous sediments, ranging from upper Miocene to Pliocene in age. The volcanic sequence has been named the Esmeralda formation and consists of approximately 15,000 feet of lucustrine volcanic sediments which include poorly sorted conglomerates and sandstones, limestone, mudstones and tuffaceous units. Fossils suggest a relatively fresh environment of deposition. Two major volcanic events where recorded in the Tertiary sediments. An early Pliocene volcanic episode is represented by a single welded tuff unit with an age of 22 million years and is exposed on the northern end of the Silver Peak Range. The tuff was ejected prior to the block faulting that disturbed the drainage of the Silver Peak region and created several closed basins into which the lower part of the Esmeralda formation was deposited.