Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - ANDEAVOR LOGISTICS LP | a8-ka12x12x2012chevron.htm |

NYSE: TLLP Acquisition of Chevron’s Northwest Products System Tesoro Logistics LP Exhibit 99.2

2 This Presentation includes forward-looking statements. These statements relate to, among other things, completion of our acquisition of Chevron’s Northwest Products System; our potential acquisitions of BP Carson logistics assets, potential timing of the transactions; estimates regarding the impact to EBITDA, maintenance capital expenditures, third party revenues, revenue growth, and volumes; and potential synergies and other opportunities for growth. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,“ “potential” and similar terms and phrases to identify forward-looking statements in this Presentation. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations and the proposed acquisition involve risks and uncertainties, many of which are outside of our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. Please see our Risk Factor disclosures included in our 2011 Annual Report on Form 10-K and our quarterly reports on Form 10-Q. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. We have provided estimates for annual EBITDA, a non-GAAP financial measure. Please see the Appendix for the definition and reconciliation of these annual EBITDA estimates. Forward Looking Statements

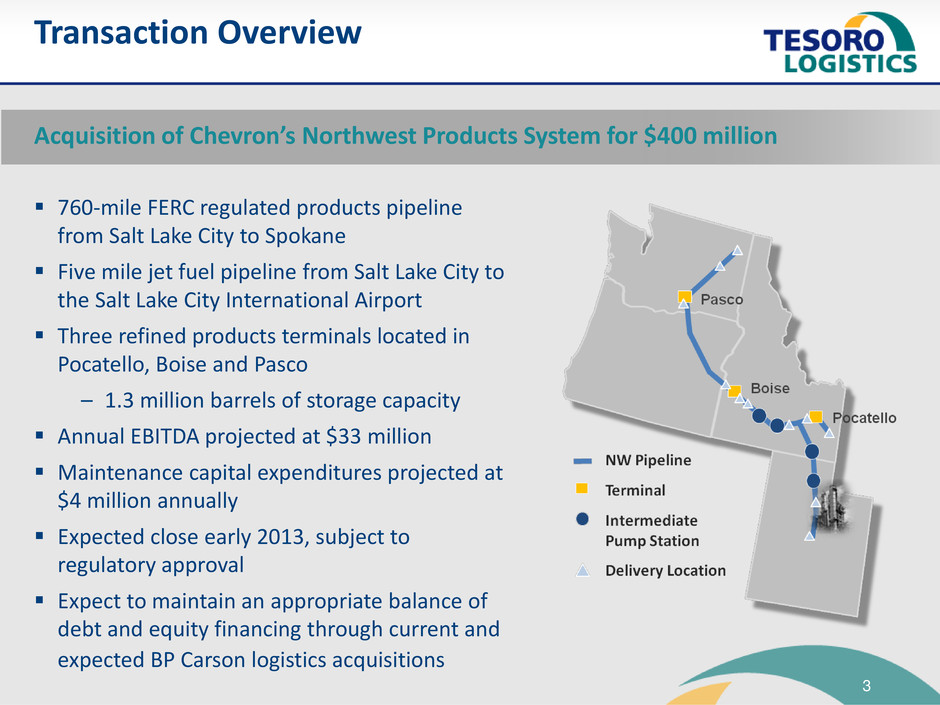

3 Transaction Overview 760-mile FERC regulated products pipeline from Salt Lake City to Spokane Five mile jet fuel pipeline from Salt Lake City to the Salt Lake City International Airport Three refined products terminals located in Pocatello, Boise and Pasco – 1.3 million barrels of storage capacity Annual EBITDA projected at $33 million Maintenance capital expenditures projected at $4 million annually Expected close early 2013, subject to regulatory approval Expect to maintain an appropriate balance of debt and equity financing through current and expected BP Carson logistics acquisitions Acquisition of Chevron’s Northwest Products System for $400 million

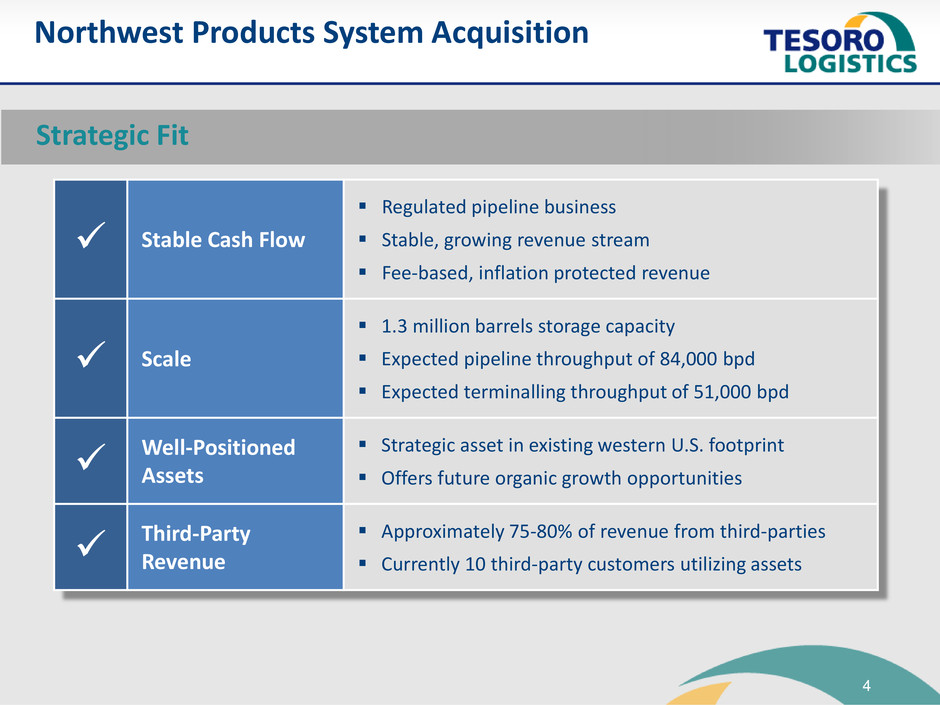

4 Stable Cash Flow Regulated pipeline business Stable, growing revenue stream Fee-based, inflation protected revenue Scale 1.3 million barrels storage capacity Expected pipeline throughput of 84,000 bpd Expected terminalling throughput of 51,000 bpd Well-Positioned Assets Strategic asset in existing western U.S. footprint Offers future organic growth opportunities Third-Party Revenue Approximately 75-80% of revenue from third-parties Currently 10 third-party customers utilizing assets Northwest Products System Acquisition Strategic Fit

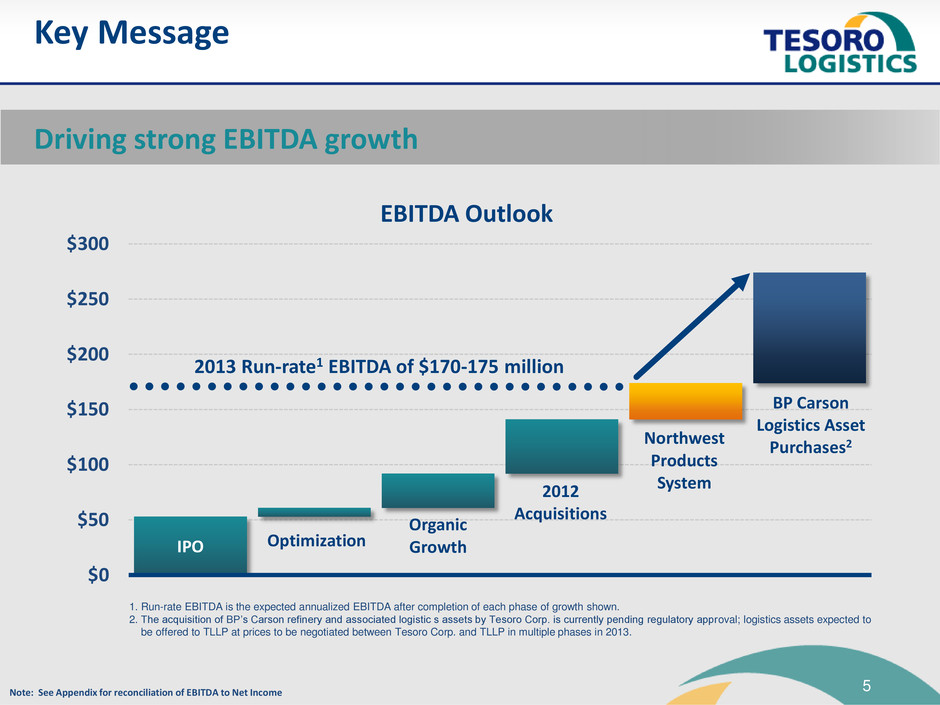

5 Key Message IPO Optimization Organic Growth 2012 Acquisitions Northwest Products System BP Carson Logistics Asset Purchases2 $0 $50 $100 $150 $200 $250 $300 EBITDA Outlook 2013 Run-rate1 EBITDA of $170-175 million Note: See Appendix for reconciliation of EBITDA to Net Income Driving strong EBITDA growth 1. Run-rate EBITDA is the expected annualized EBITDA after completion of each phase of growth shown. 2. The acquisition of BP’s Carson refinery and associated logistic s assets by Tesoro Corp. is currently pending regulatory approval; logistics assets expected to be offered to TLLP at prices to be negotiated between Tesoro Corp. and TLLP in multiple phases in 2013.

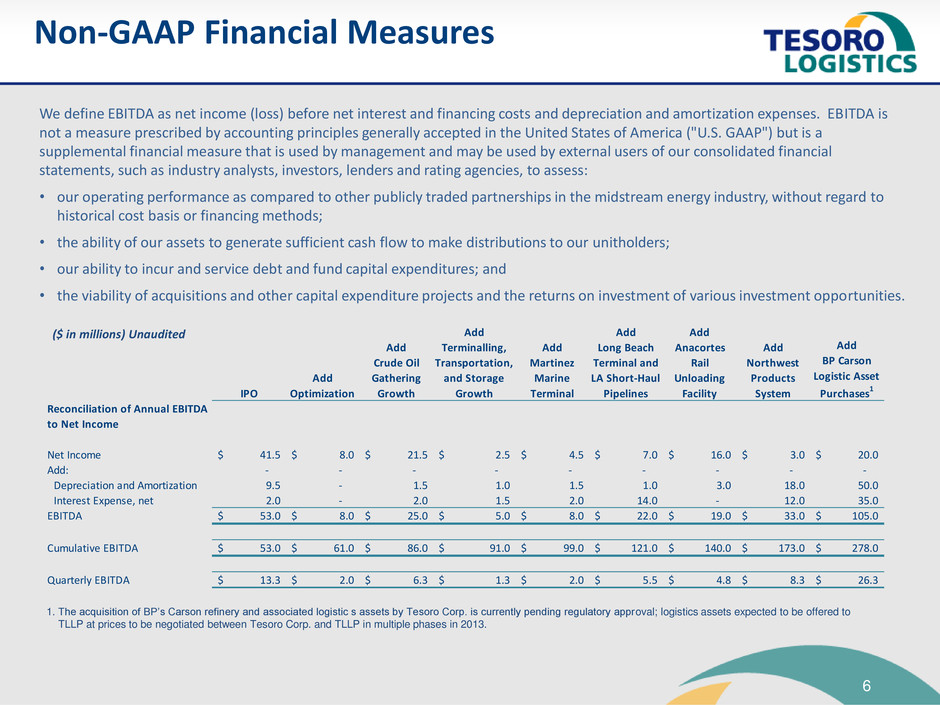

6 We define EBITDA as net income (loss) before net interest and financing costs and depreciation and amortization expenses. EBITDA is not a measure prescribed by accounting principles generally accepted in the United States of America ("U.S. GAAP") but is a supplemental financial measure that is used by management and may be used by external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, to assess: • our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; • the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; • our ability to incur and service debt and fund capital expenditures; and • the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. Non-GAAP Financial Measures 1. The acquisition of BP’s Carson refinery and associated logistic s assets by Tesoro Corp. is currently pending regulatory approval; logistics assets expected to be offered to TLLP at prices to be negotiated between Tesoro Corp. and TLLP in multiple phases in 2013. ($ in millions) Unaudited IPO Add Optimization Add Crude Oil Gathering Growth Add Terminalling, Transportation, and Storage Growth Add Martinez Marine Terminal Add Long Beach Terminal and LA Short-Haul Pipelines Add Anacortes Rail Unloading Facility Add Northwest Products System Add BP Carson Logistic Asset Purchases 1 Reconciliation of Annual EBITDA to Net Income Net Income 41.5$ 8.0$ 21.5$ 2.5$ 4.5$ 7.0$ 16.0$ 3.0$ 20.0$ Add: - - - - - - - - - D prec ation and Amortization 9.5 - 1.5 1.0 1.5 1.0 3.0 18.0 50.0 I ter st Expense, net 2.0 - 2.0 1.5 2.0 14.0 - 12.0 35.0 EBITDA 53.0$ 8.0$ 25.0$ 5.0$ 8.0$ 22.0$ 19.0$ 33.0$ 105.0$ Cumulative EBITDA 53.0$ 61.0$ 86.0$ 91.0$ 99.0$ 121.0$ 140.0$ 173.0$ 278.0$ Quarterly EBITDA 13.3$ 2.0$ 6.3$ 1.3$ 2.0$ 5.5$ 4.8$ 8.3$ 26.3$