Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - GEO GROUP INC | d451366dex21.htm |

| EX-99.1 - EX-99.1 - GEO GROUP INC | d451366dex991.htm |

| 8-K - 8-K - GEO GROUP INC | d451366d8k.htm |

Company Restructuring Toward

January 1, 2013 REIT Conversion

December 2012

Exhibit 99.2 |

2

This presentation contains forward-looking statements regarding future events

and future performance of the Company that involve risks and uncertainties

that could materially affect actual results, including statements regarding

estimated earnings, revenues and costs and our ability to maintain growth

and strengthen contract relationships. Factors that could cause actual

results to vary from current expectations and forward-looking statements

contained in this presentation include, but are not limited to: (1) GEO’s

ability to successfully

complete

the

conversion

to

a

real

estate

investment

trust

effective

January

1,

2013; (2) GEO’s ability to meet its financial guidance; (3) GEO’s ability

to declare future cash dividends; (4) GEO's ability to pursue further growth

and continue to enhance shareholder value; (5) GEO's ability to access the

capital markets in the future on satisfactory terms or at all; (6) risks

associated with GEO's ability to control operating costs associated with

contract start-ups; (7) GEO's ability to timely build and/or open facilities as

planned, profitably manage such facilities and successfully integrate such

facilities into GEO's

operations

without

substantial

costs;

(8)

GEO's

ability

to

win

management

contracts

for which it has submitted proposals and to retain existing management contracts;

(9) GEO's ability to obtain future financing at competitive rates; (10)

GEO's ability to sustain company-wide occupancy rates at its facilities;

and (11) other factors contained in GEO's Securities and Exchange Commission

filings, including the Forms 10-K, 10-Q and 8-K reports.

Forward-Looking Statements

Forward-Looking Statements |

3

REIT Requirements

A REIT is an entity that:

Distributes annually at least 90% of its taxable income to

shareholders in the form of a dividend

Invests at least 75% of its total assets (Asset Test) in

qualifying real estate assets

Derives at least 75% of its gross income from real estate

related sources (75% Income Test) and at least 95% of

its gross income from real estate related sources,

dividends and interest (95% Income Test)

Is substantially restricted in its ability to directly or

indirectly operate or manage health care facilities |

4

REIT Eligibility / Approval Process

July Filing with the IRS for Private Letter Ruling

Receipt of Expert Legal and Financial Advice Regarding

REIT Eligibility Requirements

Restructuring of Company Subsidiaries into Qualified REIT

Subsidiaries + Taxable REIT Subsidiaries

Divestiture of Health Care Facility Operations by

December 31, 2012: GEO Care

Historical Earnings and Profit Distribution

Final IRS Review and Approval

Receipt of final PLR from IRS not needed before

January 1, 2013 to operate in REIT compliance |

5

REIT Announcement

GEO Board has unanimously approved all necessary steps to

position GEO to operate in compliance with REIT rules

beginning January 1, 2013

2013E Adjusted EBITDA of $320 to $330 million; AFFO of

$200-210 million; and FFO of $215-225 million

Estimated annual dividend of $2.20-2.40 per share

Special dividend of $350 million, or $5.68 per share, payable

in December 2012 (80% / 20% Stock / Cash Election)

One-time REIT-related costs/charges of $15-20 million offset

by elimination of net deferred tax liabilities resulting in positive

earnings adjustment of $90-110 million

Annual tax savings estimated at $45-50 million |

6

Event Timeline

-

December 12, 2012

Record Date for Special

Dividend

-

December 31, 2012

Special Dividend Payment

Date

-

December 31, 2012

Complete Company

Reorganization; Asset

Divestiture

-

January 1, 2013

Begin Operating in

Compliance

with REIT Rules

-

First Half 2013

Shareholder Vote to

Approve REIT Ownership

Restrictions in the Charter |

7

Significant Projected Benefits from REIT

Structure for GEO and its Shareholders

Increases Shareholder Value

Lowers Cost of Capital

Attracts Larger Base of Potential

Shareholders

Provides Greater Flexibility to Pursue

Growth Opportunities

Creates More Efficient Operating Structure |

8

Diversified Government

Outsourcing Services Provider

Diversified Business Units

-

U.S. Corrections & Detention

-

Community Reentry

-

International Services

3 Federal Clients

11 State DOC Clients

6 International Clients

Presence in United States,

Australia, South Africa

and United Kingdom

73,000 beds

101 Facilities (94 U.S., 7 Int’l)

18,000 Employees

70,000 Offenders Monitored

Co-Leader in Corrections

& Detention

Largest in Community-Based

Services

Largest in Electronic Monitoring

Largest in Youth Services

REIT Structure Aligns with GEO’s

Diversified Business Segments |

9

Fundamentally, GEO is in a real

estate intensive industry

GEO has financed and developed

dozens of facilities since the mid-

1980s

GEO owns/leases significant

portion of its correctional and

detention facilities

GEO has more than $1.7 billion in

long-term assets with minimum

targeted ROIC of 13-15%

Foundation of our Business is

Long-Term Corrections Assets |

10

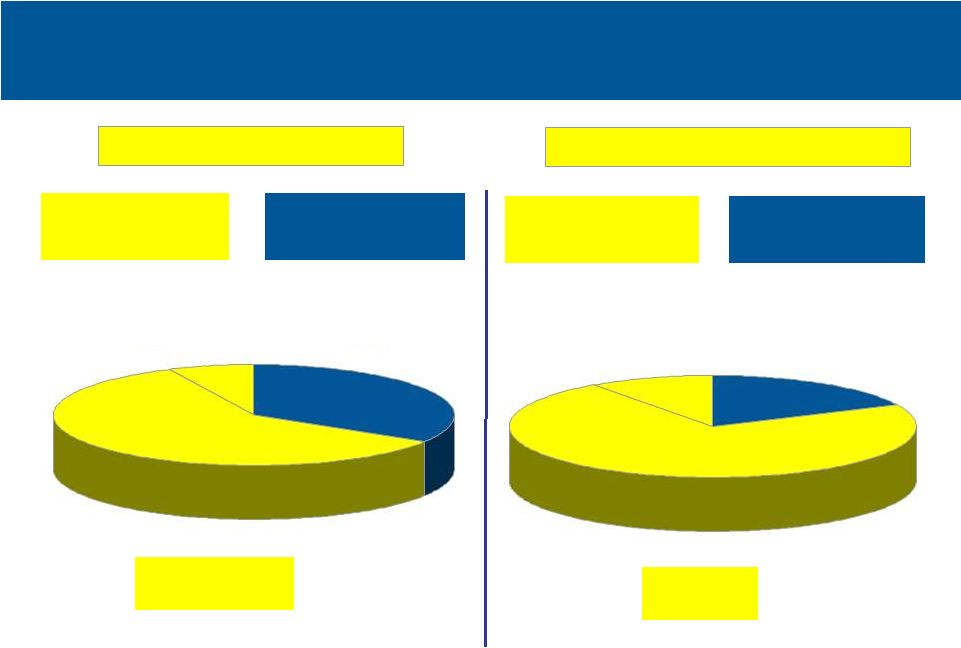

Significant Facility/Bed Ownership in U.S. Markets

GEO Controlled

66%

Gov’t Controlled

34%

GEO Controlled

82%

Gov’t Controlled

18%

Facility/Bed Ownership

Facility/Bed Ownership

Facility Level EBITDA

Facility Level EBITDA

* Charts exclude International Facilities, BI Electronic Monitoring and

Reentry Services & Health Care Operations Divestiture

Leased

10%

Managed Only

18%

Owned

72%

Leased

7%

Managed Only

34%

Owned

59% |

11

Enhanced Shareholder Value Creation

•

Increased Dividends

Special Dividend of $350 Million in 2012

(80% / 20% Stock / Cash Election)

For 2013:

For Illustrative

Purposes Only

in Millions

(except per share data)

Pre-Tax Income

$130 -

$140

Current Shares Outstanding *

61.6

Dividends per Share *

$2.20 -

$2.40

* Based on GEO’s current outstanding share count of 61.6 million

|

12

Lower Cost of Capital

•

More efficient REIT structure leads to greater access to

capital markets and lower cost of capital

•

Due to capital intensive nature of corrections/detention

business, new structure provides greater flexibility to

pursue growth opportunities

•

REIT structure allows GEO to pursue a range of

attractive ROIC opportunities |

13

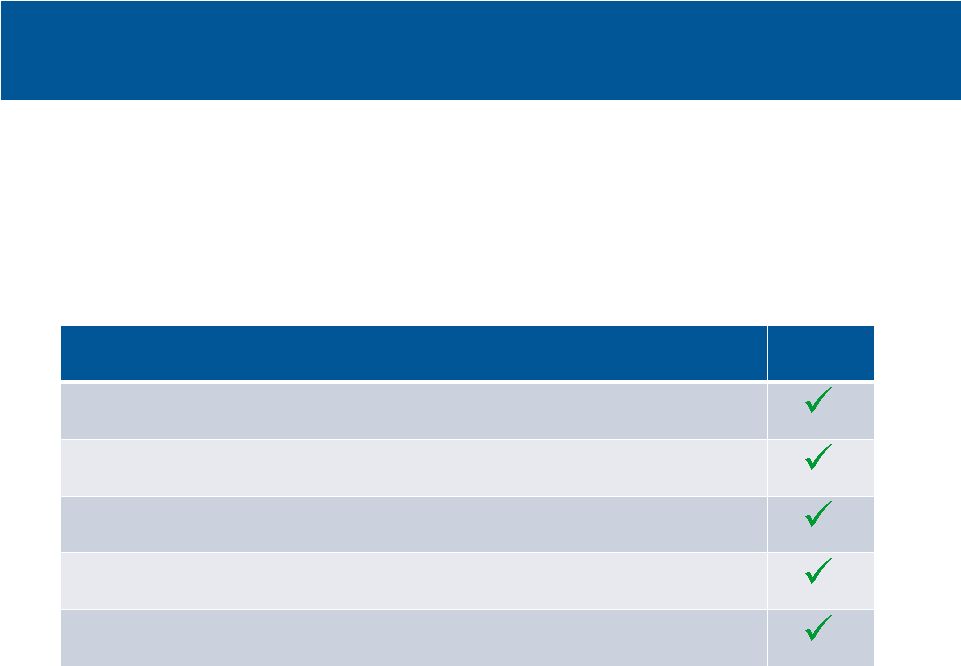

Potential to Expand Investor Base

•

REIT structure to draw a more diversified investor

base including active and passive REIT investors

•

GEO has attractive real estate characteristics and

business fundamentals

GEO

Stable, sustainable income

Diversified, investment grade government customer base

Solid occupancy rates

Strong customer retention (in excess of 90%)

Low maintenance capex requirements |

14

New Company Structure |

15

E&P Distribution in 4Q12

•

Special dividend of $350 million, $5.68 per share, to be

paid on December 31, 2012 to shareholders of record

as of December 12, 2012

80% / 20% Stock / Cash Election

Eligible for maximum individual dividend tax rate

of 15%

•

Shareholders who elect to receive all cash will be

placed in a lottery capped at approx. $7 million

•

Adequate liquidity to fund cash portion (approx. $77

million) of special dividend |

16

REIT-Related Costs

•

One-time REIT-related costs estimated at $15-20

million including costs related to modifying existing debt

agreements

•

Offset by positive earnings adjustment of $90-110

million due to the elimination of certain net deferred tax

liabilities

•

Ongoing annual compliance costs of $3-5 million |

17

Asset Divestiture

•

Due to REIT provisions in the tax code, GEO will need to divest

its health care facility operations by Dec. 31, 2012

Six managed-only hospitals (1,970 Beds) and two

Correctional Healthcare contracts

•

GEO Board has entered into agreement for Management

Buyout (MBO) of health care facility operations for $36 million,

plus up to $5 million in earn-out payments

•

MBO to pay $2.6 million in additional annual payments and

cost savings to GEO for support services and licensing for five

years

•

$13-17 million after-tax, non-cash write-off of goodwill, other

intangible assets, and intercompany debt in 4Q12

•

MBO provides certainty of closing and aligns with steps to

operate in compliance with REIT rules beginning on

January 1, 2013 |

18

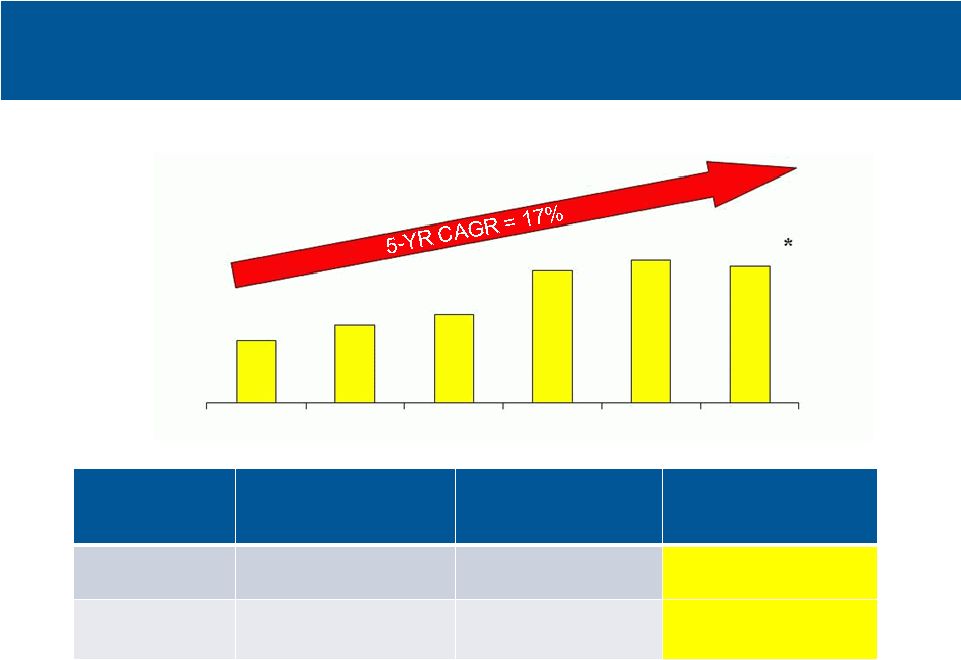

Growing Cash Flows to Support Increased Dividends

GEO AFFO has Grown at 17% CAGR since 2008

AFFO

Bridge

GEO 2012E

GEO 2013E

Status Quo

GEO 2013E *

REIT/TRS

Cash Taxes

$5-10 Million

$55-60 Million

$10-15 Million

AFFO

$210-220 Million

$160-170 Million

$200-210 Million

* Reflects Healthcare Divestiture and $3-5 Million in Compliance

Costs $93.9

$117.4

$132.2

$198.7

$215.0

$205.0

$0

$50

$100

$150

$200

$250

2008

2009

2010

2011

2012E

2013E |

19

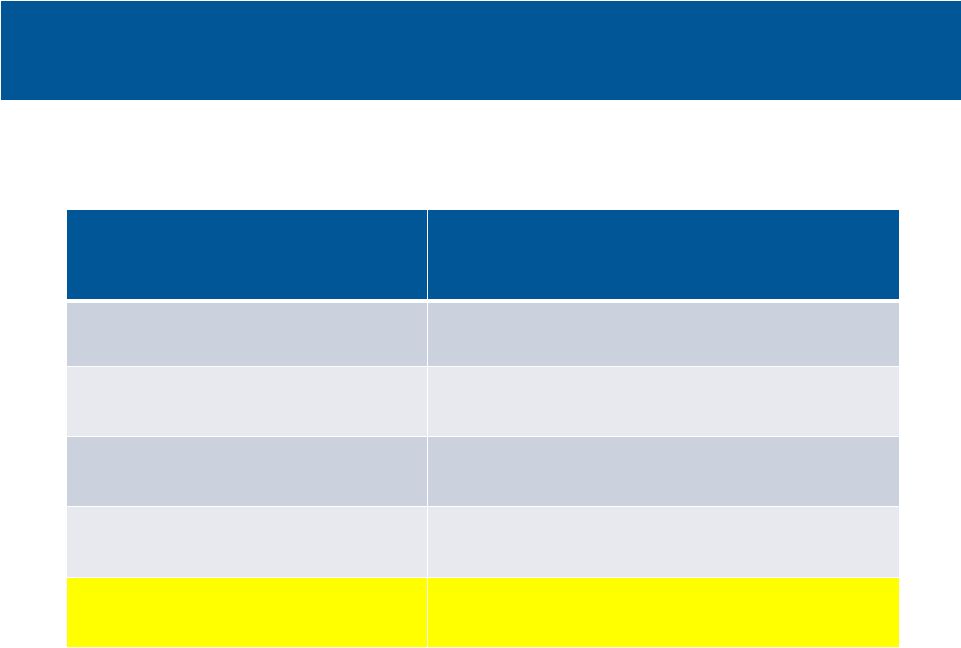

2013 REIT Guidance

Guidance

2013E

REIT/TRS

Adjusted EBITDA

$320

Million

-

$330

Million

FFO

$215

Million

-

$225

Million

AFFO

$200

Million

-

$210

Million

Pre-Tax Income

$130

Million

-

$140

Million

Dividend per Share *

$2.20

-

$2.40

•

REIT structure to drive increased dividend distribution

* Based on GEO’s current outstanding share count of 61.6 million

|

20

Beds in Inventory

Facility

State

Beds

Prospective Clients

Great Plains Correctional Facility

OK

2,048

State & Federal

North Lake Correctional Facility

MI

1,740

State & Federal

Desert View CCF

CA

650

State, Federal & Local

Central Valley CCF

CA

640

State, Federal & Local

Leo Chesney CCF

CA

318

State, Federal & Local

Mesa Verde CCF

CA

400

State, Federal & Local

McFarland CCF

CA

260

State, Federal & Local

TOTAL

6,056

-

Carrying Costs for GEO’s Idle Facilities Equal $0.14 Per

Share -

Incremental EBITDA Potential = $30-35 Million

(Based on GEO’s Avg. Per Diem of $55 and Avg. Company-Owned

Margins) |

21

Opportunity Pipeline

Faciliy

Location

Client

Ownership

Beds

Annual Ops

Revenues

Dev.

Capex

Opening

Date

Proposal

Pipeline

Beds

Riverbend CF

Ga.

GA DOC

Owned

1,500

=

$28M

$80M

Dec-11

Karnes Co. Civil Detention Facility

Tex.

ICE

Owned

600

=

$15M

$32M

Mar-12

New Castle CF Expansion

Ind.

IDOC

Managed

512

=

$8M

$23M

Mar-12

Adelanto ICE Processing Center Exp.

Calif.

ICE

Owned

650

=

$21M

$70M

Aug-12

Aurora USMS Contract

Col.

USMS

Owned

320

=

$8M

-

Oct-12

New Hampshire -

New Beds

NH

1,700

BOP CAR 14

U.S.

1,300

Florida Prison Bid

Fla.

3,854

Michigan Prison Beds

Mich.

1,750

Southwest Border Transportation

TX, AZ, NM, CA

N/A

TOTAL

3,582

=

$80M

$205M

8,604 |