Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Churchill Downs Inc | a8k121212.htm |

Prepared For: Investor Relations (NASDAQ: CHDN) December 12, 2012 Bill Mudd, Executive VP & CFO Mike Anderson, VP Finance & Investor Relations Wells Fargo Securities Boston Gaming Forum

Forward-Looking Statements In addition to historical facts or statements of current conditions, this document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, estimates, expectations or beliefs about future events, results or outcomes, or otherwise are not statements of historical fact. The actual performance of the Company may differ materially from what is projected in such forward- looking statements. Investors should refer to statements included in reports filed by the Company with the Securities and Exchange Commission for discussion of additional information concerning factors that could cause the Company’s actual results of operations to differ materially from the forward-looking statements made in this document and related presentation. The information being provided today is as of this date only and Churchill Downs Incorporated expressly disclaims any obligation to release publicly any updates or revisions to these forward-looking statements to reflect any changes in expectations. 2

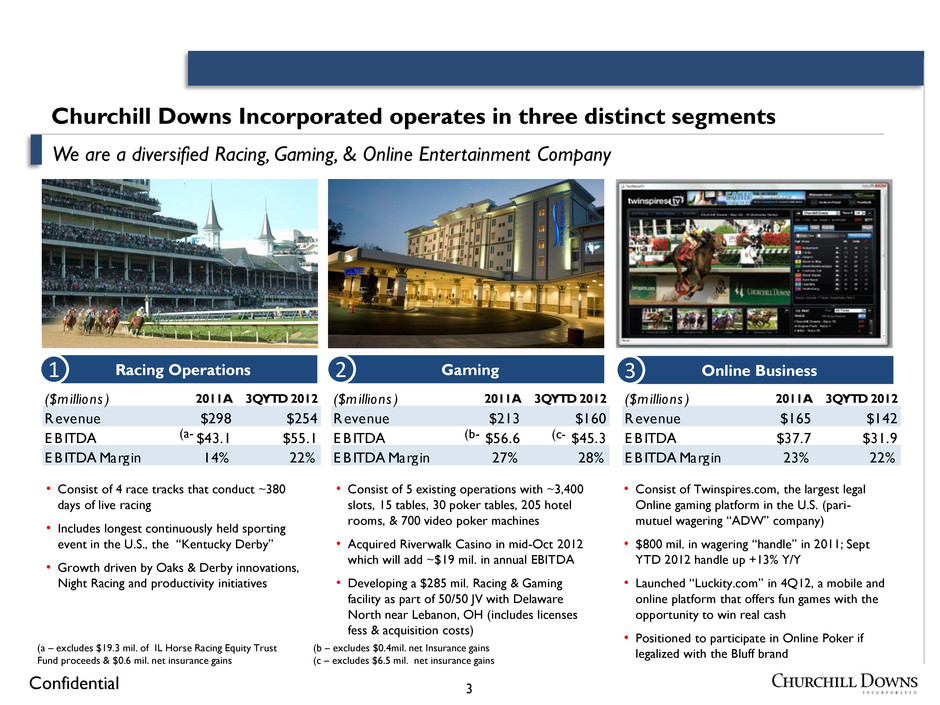

3 ($m illions ) 2011A 3QYTD 2012 Revenue $298 $254 E BITDA $43.1 $55.1 E BITDA Marg in 14% 22% Churchill Downs Incorporated operates in three distinct segments Confidential We are a diversified Racing, Gaming, & Online Entertainment Company Racing Operations 1 Gaming 2 Online Business 3 (a – excludes $19.3 mil. of IL Horse Racing Equity Trust Fund proceeds & $0.6 mil. net insurance gains (b – excludes $0.4mil. net Insurance gains (c – excludes $6.5 mil. net insurance gains • Consist of 4 race tracks that conduct ~380 days of live racing • Includes longest continuously held sporting event in the U.S., the “Kentucky Derby” • Growth driven by Oaks & Derby innovations, Night Racing and productivity initiatives • Consist of 5 existing operations with ~3,400 slots, 15 tables, 30 poker tables, 205 hotel rooms, & 700 video poker machines • Acquired Riverwalk Casino in mid-Oct 2012 which will add ~$19 mil. in annual EBITDA • Developing a $285 mil. Racing & Gaming facility as part of 50/50 JV with Delaware North near Lebanon, OH (includes licenses fess & acquisition costs) • Consist of Twinspires.com, the largest legal Online gaming platform in the U.S. (pari- mutuel wagering “ADW” company) • $800 mil. in wagering “handle” in 2011; Sept YTD 2012 handle up +13% Y/Y • Launched “Luckity.com” in 4Q12, a mobile and online platform that offers fun games with the opportunity to win real cash • Positioned to participate in Online Poker if legalized with the Bluff brand (a- (b- (c- ($m illions ) 1A 3QYTD 2012 Revenue $213 $160 E BITDA $56.6 $45.3 E BITDA Marg in 27% 28% ($m illions ) 2011A 3QYTD 2012 Revenue $165 $142 E BITDA $37.7 $31.9 E BITDA Marg in 23% 22%

4 Racing Operations: We own 4 premier Thoroughbred Racetracks Our debt and equity is back-stopped with valuable real estate • 336 acres in western Chicago suburb, Arlington Heights • Operates 11OTB’s • 20 minutes form O’Hare airport • Rich history with the “Arlington Million” Arlington International Racecourse Churchill Downs Racetrack Calder Race Course Fair Grounds Race Course • Home of the Kentucky Oaks and Kentucky Derby • National historic landmark • 138 consecutive years of international event • Night racing series beginning in 2009 • 231 acres in Miami Gardens, FL with convenient access off Florida Turnpike • Sits adjacent to Sun Life Stadium – home of the NFL’s Miami Dolphins • 145 acres in New Orleans, LA • Network of 11 OTB’s • Video poker machines in 9 of the OTB’s • Home of the “Louisiana Derby” • New Orleans Jazz Festival host since 1972

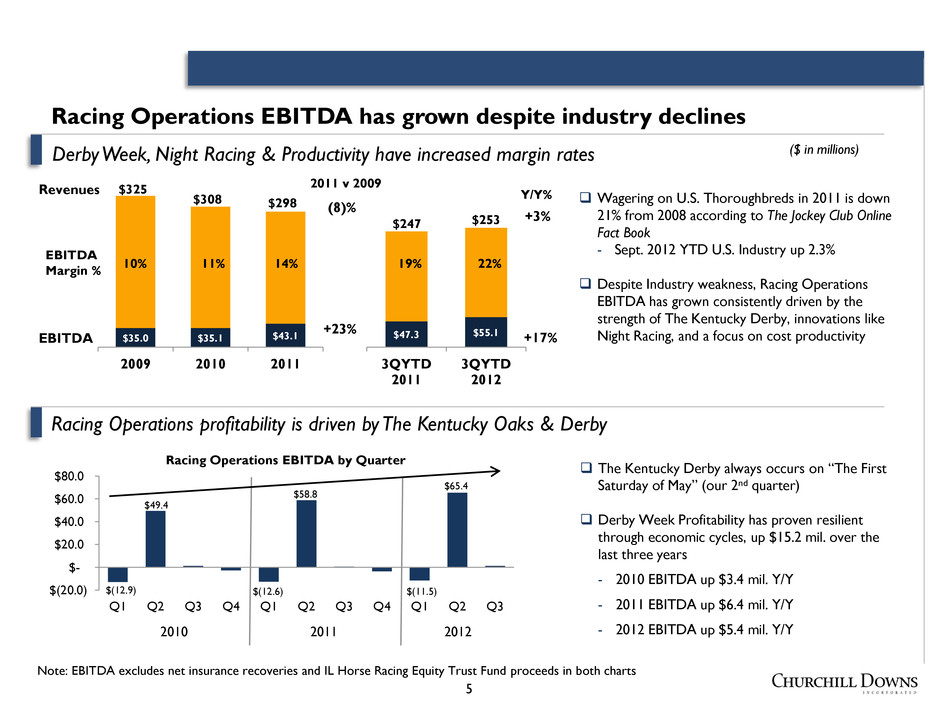

5 Racing Operations EBITDA has grown despite industry declines $35.0 $35.1 $43.1 2009 2010 2011 $325 $308 $298 $47.3 $55.1 3QYTD 2011 3QYTD 2012 $247 $253 Revenues EBITDA 2011 v 2009 (8)% +23% Y/Y% +3% +17% Wagering on U.S. Thoroughbreds in 2011 is down 21% from 2008 according to The Jockey Club Online Fact Book - Sept. 2012 YTD U.S. Industry up 2.3% Despite Industry weakness, Racing Operations EBITDA has grown consistently driven by the strength of The Kentucky Derby, innovations like Night Racing, and a focus on cost productivity Derby Week, Night Racing & Productivity have increased margin rates ($ in millions) $(20.0) $- $20.0 $40.0 $60.0 $80.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2010 2011 2012 Racing Operations profitability is driven by The Kentucky Oaks & Derby Note: EBITDA excludes net insurance recoveries and IL Horse Racing Equity Trust Fund proceeds in both charts The Kentucky Derby always occurs on “The First Saturday of May” (our 2nd quarter) Derby Week Profitability has proven resilient through economic cycles, up $15.2 mil. over the last three years - 2010 EBITDA up $3.4 mil. Y/Y - 2011 EBITDA up $6.4 mil. Y/Y - 2012 EBITDA up $5.4 mil. Y/Y $49.4 $58.8 $65.4 $(12.9) $(12.6) $(11.5) Racing Operations EBITDA by Quarter EBITDA Margin % 10% 11% 14% 19% 22%

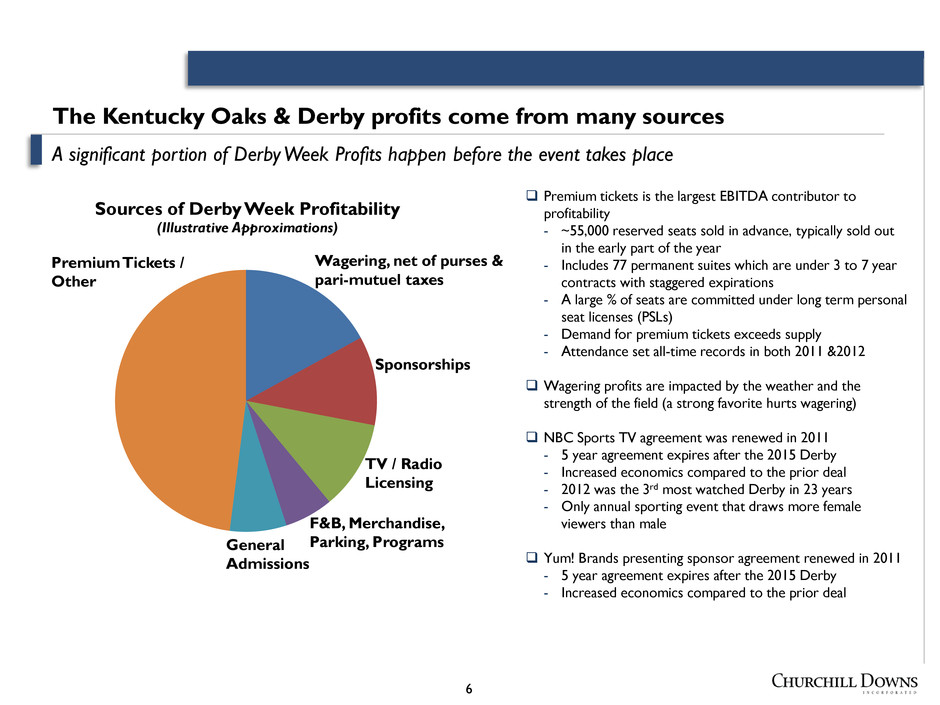

6 The Kentucky Oaks & Derby profits come from many sources Sources of Derby Week Profitability (Illustrative Approximations) Wagering, net of purses & pari-mutuel taxes Premium Tickets / Other Sponsorships TV / Radio Licensing F&B, Merchandise, Parking, Programs General Admissions Premium tickets is the largest EBITDA contributor to profitability - ~55,000 reserved seats sold in advance, typically sold out in the early part of the year - Includes 77 permanent suites which are under 3 to 7 year contracts with staggered expirations - A large % of seats are committed under long term personal seat licenses (PSLs) - Demand for premium tickets exceeds supply - Attendance set all-time records in both 2011 &2012 Wagering profits are impacted by the weather and the strength of the field (a strong favorite hurts wagering) NBC Sports TV agreement was renewed in 2011 - 5 year agreement expires after the 2015 Derby - Increased economics compared to the prior deal - 2012 was the 3rd most watched Derby in 23 years - Only annual sporting event that draws more female viewers than male Yum! Brands presenting sponsor agreement renewed in 2011 - 5 year agreement expires after the 2015 Derby - Increased economics compared to the prior deal A significant portion of Derby Week Profits happen before the event takes place

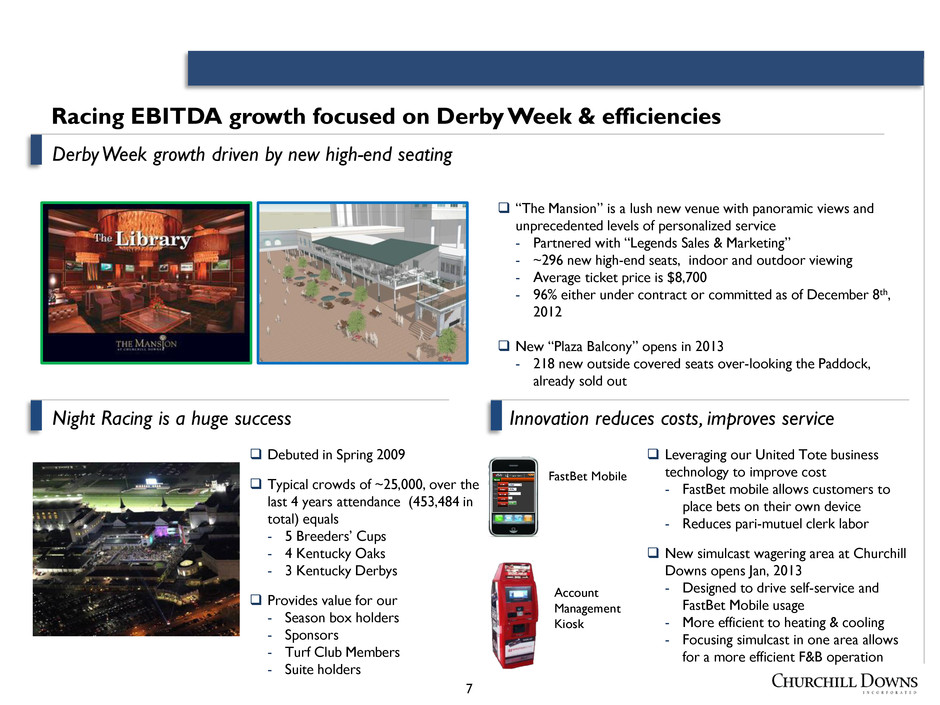

7 Racing EBITDA growth focused on Derby Week & efficiencies Derby Week growth driven by new high-end seating “The Mansion” is a lush new venue with panoramic views and unprecedented levels of personalized service - Partnered with “Legends Sales & Marketing” - ~296 new high-end seats, indoor and outdoor viewing - Average ticket price is $8,700 - 96% either under contract or committed as of December 8th, 2012 New “Plaza Balcony” opens in 2013 - 218 new outside covered seats over-looking the Paddock, already sold out Night Racing is a huge success Debuted in Spring 2009 Typical crowds of ~25,000, over the last 4 years attendance (453,484 in total) equals - 5 Breeders’ Cups - 4 Kentucky Oaks - 3 Kentucky Derbys Provides value for our - Season box holders - Sponsors - Turf Club Members - Suite holders Innovation reduces costs, improves service FastBet Mobile Account Management Kiosk Leveraging our United Tote business technology to improve cost - FastBet mobile allows customers to place bets on their own device - Reduces pari-mutuel clerk labor New simulcast wagering area at Churchill Downs opens Jan, 2013 - Designed to drive self-service and FastBet Mobile usage - More efficient to heating & cooling - Focusing simulcast in one area allows for a more efficient F&B operation

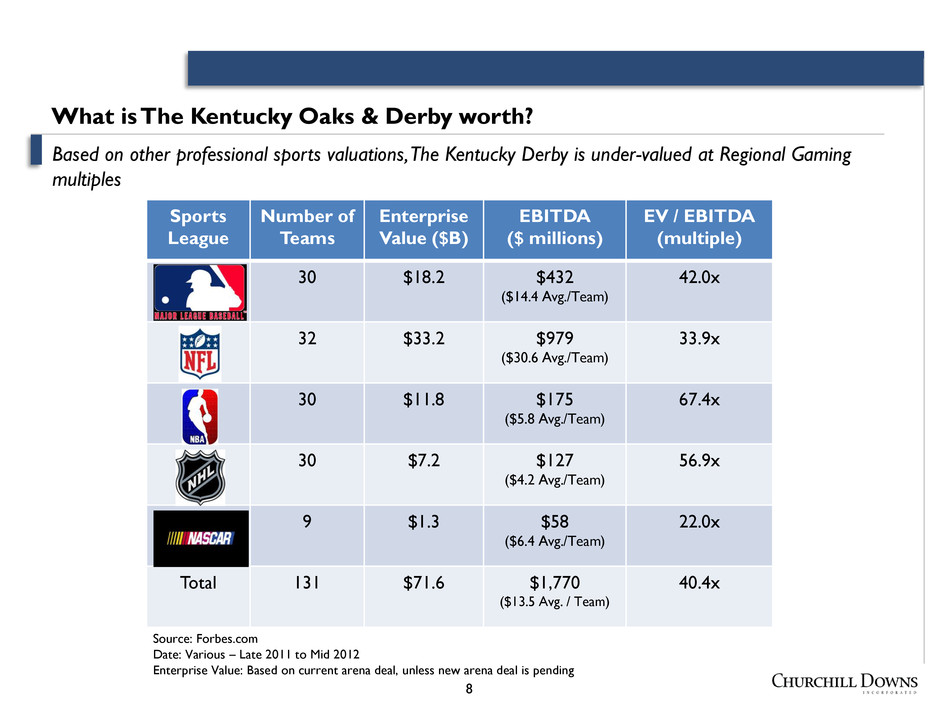

8 Sports League Number of Teams Enterprise Value ($B) EBITDA ($ millions) EV / EBITDA (multiple) 30 $18.2 $432 ($14.4 Avg./Team) 42.0x 32 $33.2 $979 ($30.6 Avg./Team) 33.9x 30 $11.8 $175 ($5.8 Avg./Team) 67.4x 30 $7.2 $127 ($4.2 Avg./Team) 56.9x 9 $1.3 $58 ($6.4 Avg./Team) 22.0x Total 131 $71.6 $1,770 ($13.5 Avg. / Team) 40.4x What is The Kentucky Oaks & Derby worth? Source: Forbes.com Date: Various – Late 2011 to Mid 2012 Enterprise Value: Based on current arena deal, unless new arena deal is pending Based on other professional sports valuations, The Kentucky Derby is under-valued at Regional Gaming multiples

9 Gaming: Our properties are relatively new and in mature markets Growing our Gaming Business thru development and acquisitions • Located in Miami Gardens Florida, near Sun Life Stadium • Greenfield construction, opened January 2010 • 1,214 Slot Machines • 29 Poker Tables Calder Casino Harlow’s Casino & Resort Fair Grounds Slots & Video Poker Riverwalk Hotel Casino • Acquired in December 2010 for $138 million • 818 Slot Machines • 15 table games & a poker room • 105-room hotel (50% rooms renovated in 2012) • $15 million in renovations grand opening in January 2013 • Greenfield construction at the racetrack, opened November 2008 • 626 slot machines • 11 Off Track Betting facilities operate ~700 Video Poker Machines • Acquired in October 2012 for $141 million • 723 slot machines • 18 table games • 80-room hotel

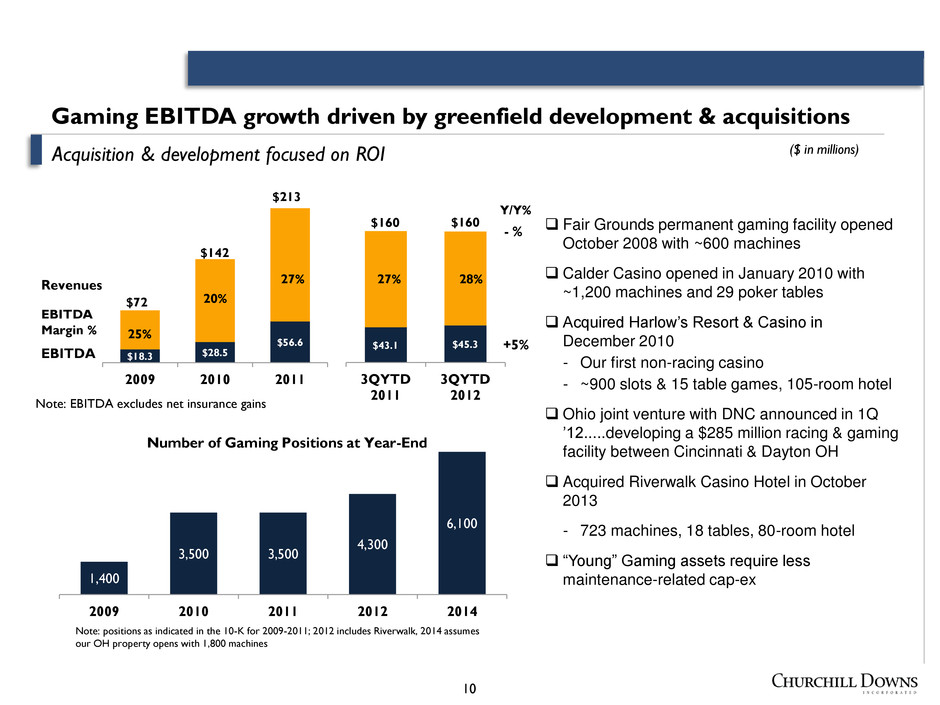

10 Gaming EBITDA growth driven by greenfield development & acquisitions Acquisition & development focused on ROI ($ in millions) Note: EBITDA excludes net insurance gains $18.3 $28.5 $56.6 2009 2010 2011 $72 $142 $213 $43.1 $45.3 3QYTD 2011 3QYTD 2012 $160 $160 Revenues EBITDA Y/Y% - % +5% EBITDA Margin % 25% 20% 27% 27% 28% 1,400 3,500 3,500 4,300 6,100 2009 2010 2011 2012 2014 Number of Gaming Positions at Year-End Note: positions as indicated in the 10-K for 2009-2011; 2012 includes Riverwalk, 2014 assumes our OH property opens with 1,800 machines Fair Grounds permanent gaming facility opened October 2008 with ~600 machines Calder Casino opened in January 2010 with ~1,200 machines and 29 poker tables Acquired Harlow’s Resort & Casino in December 2010 - Our first non-racing casino - ~900 slots & 15 table games, 105-room hotel Ohio joint venture with DNC announced in 1Q ’12.....developing a $285 million racing & gaming facility between Cincinnati & Dayton OH Acquired Riverwalk Casino Hotel in October 2013 - 723 machines, 18 tables, 80-room hotel “Young” Gaming assets require less maintenance-related cap-ex

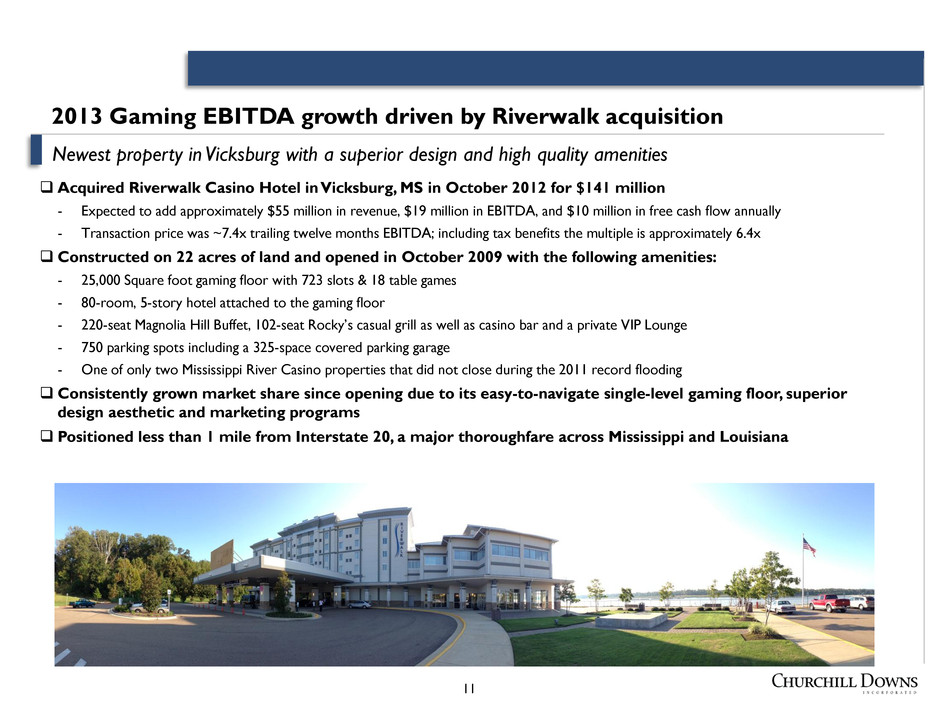

11 2013 Gaming EBITDA growth driven by Riverwalk acquisition Newest property in Vicksburg with a superior design and high quality amenities Acquired Riverwalk Casino Hotel in Vicksburg, MS in October 2012 for $141 million - Expected to add approximately $55 million in revenue, $19 million in EBITDA, and $10 million in free cash flow annually - Transaction price was ~7.4x trailing twelve months EBITDA; including tax benefits the multiple is approximately 6.4x Constructed on 22 acres of land and opened in October 2009 with the following amenities: - 25,000 Square foot gaming floor with 723 slots & 18 table games - 80-room, 5-story hotel attached to the gaming floor - 220-seat Magnolia Hill Buffet, 102-seat Rocky’s casual grill as well as casino bar and a private VIP Lounge - 750 parking spots including a 325-space covered parking garage - One of only two Mississippi River Casino properties that did not close during the 2011 record flooding Consistently grown market share since opening due to its easy-to-navigate single-level gaming floor, superior design aesthetic and marketing programs Positioned less than 1 mile from Interstate 20, a major thoroughfare across Mississippi and Louisiana

12 New event center focuses on attracting meeting groups, local VIP entertainment, family reunions, weddings and attracting new gaming guests ~ $15 million in capital spending, fully funded by our flood insurance collections Construction to be complete by late 2012, Grand Opening early 2013 Renovations include the following amenities: - Buffet area - Steakhouse - Business center - Spa facility - Fitness center - Outdoor Pool - Multi-purpose event center Updated amenities should allow Harlow’s to pull customers from a farther distance and return property to pre-flood performance levels Harlow’s will benefit from new amenities during 2013

13 On February 29 – we announced a Joint Venture (“JV”) with Delaware North Companies to purchase Lebanon Raceway license in Ohio to develop a new Video Lottery Terminal (“VLT”) facility and harness racetrack 50/50 JV will manage the development and operation of the VLT facility and racetrack – after acquisition of racing licenses and assets $60 million purchase price ($10M cash and $50M note) with $10M contingent payment to sellers based on performance $225 million project cost ($50M license fee + $175M development including VLT cost) JV’s applications to Ohio Lottery Commission and Ohio State Racing Commission were submitted in July 2012, expect approval by year-end JV hopes to begin construction of the new facility in December, with estimated completion scheduled for 1st half of 2014 2014 Gaming EBITDA growth driven by new Ohio Casino & Racetrack Partnering with Delaware North on a $285 million development in an attractive gaming market

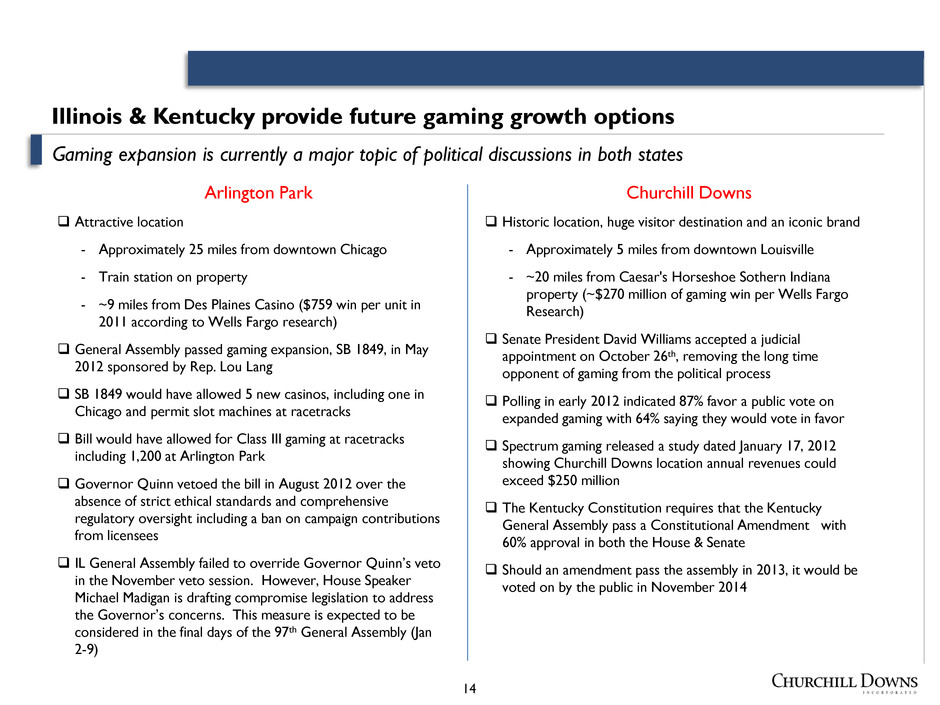

14 Illinois & Kentucky provide future gaming growth options Gaming expansion is currently a major topic of political discussions in both states Attractive location - Approximately 25 miles from downtown Chicago - Train station on property - ~9 miles from Des Plaines Casino ($759 win per unit in 2011 according to Wells Fargo research) General Assembly passed gaming expansion, SB 1849, in May 2012 sponsored by Rep. Lou Lang SB 1849 would have allowed 5 new casinos, including one in Chicago and permit slot machines at racetracks Bill would have allowed for Class III gaming at racetracks including 1,200 at Arlington Park Governor Quinn vetoed the bill in August 2012 over the absence of strict ethical standards and comprehensive regulatory oversight including a ban on campaign contributions from licensees IL General Assembly failed to override Governor Quinn’s veto in the November veto session. However, House Speaker Michael Madigan is drafting compromise legislation to address the Governor’s concerns. This measure is expected to be considered in the final days of the 97th General Assembly (Jan 2-9) Arlington Park Churchill Downs Historic location, huge visitor destination and an iconic brand - Approximately 5 miles from downtown Louisville - ~20 miles from Caesar's Horseshoe Sothern Indiana property (~$270 million of gaming win per Wells Fargo Research) Senate President David Williams accepted a judicial appointment on October 26th, removing the long time opponent of gaming from the political process Polling in early 2012 indicated 87% favor a public vote on expanded gaming with 64% saying they would vote in favor Spectrum gaming released a study dated January 17, 2012 showing Churchill Downs location annual revenues could exceed $250 million The Kentucky Constitution requires that the Kentucky General Assembly pass a Constitutional Amendment with 60% approval in both the House & Senate Should an amendment pass the assembly in 2013, it would be voted on by the public in November 2014

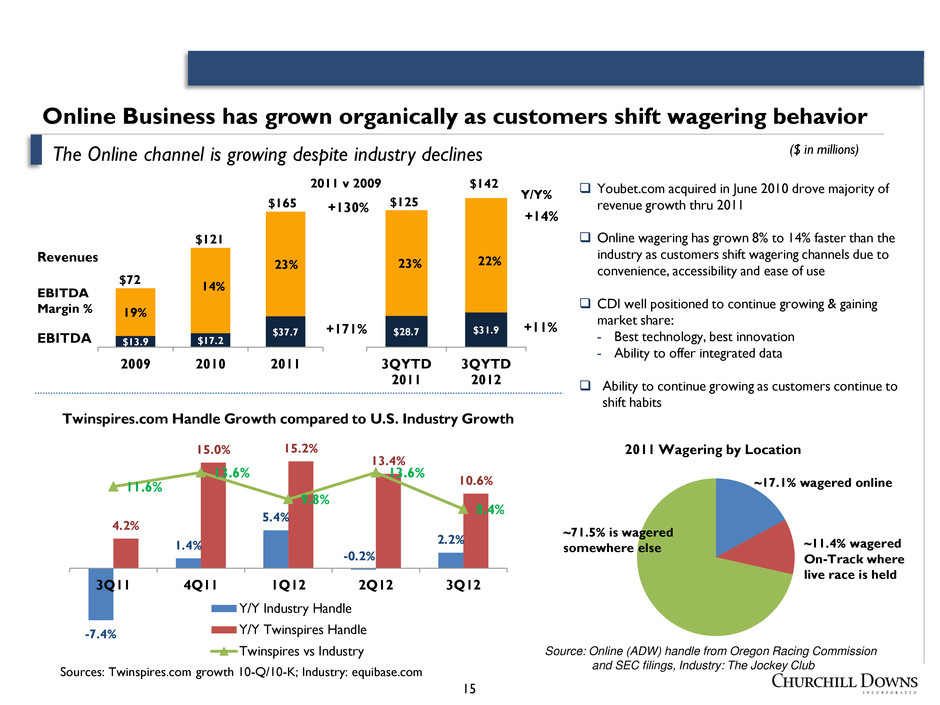

15 Online Business has grown organically as customers shift wagering behavior $13.9 $17.2 $37.7 2009 2010 2011 $72 $121 $165 $28.7 $31.9 3QYTD 2011 3QYTD 2012 $125 $142 Revenues EBITDA 2011 v 2009 +130% +171% Y/Y% +14% +11% Youbet.com acquired in June 2010 drove majority of revenue growth thru 2011 Online wagering has grown 8% to 14% faster than the industry as customers shift wagering channels due to convenience, accessibility and ease of use CDI well positioned to continue growing & gaining market share: - Best technology, best innovation - Ability to offer integrated data Ability to continue growing as customers continue to shift habits The Online channel is growing despite industry declines ($ in millions) EBITDA Margin % 19% 14% 23% 23% 22% -7.4% 1.4% 5.4% -0.2% 2.2% 4.2% 15.0% 15.2% 13.4% 10.6% 11.6% 13.6% 9.8% 13.6% 8.4% 3Q11 4Q11 1Q12 2Q12 3Q12 Y/Y Industry Handle Y/Y Twinspires Handle Twinspires vs Industry Twinspires.com Handle Growth compared to U.S. Industry Growth Sources: Twinspires.com growth 10-Q/10-K; Industry: equibase.com ~17.1% wagered online ~11.4% wagered On-Track where live race is held ~71.5% is wagered somewhere else 2011 Wagering by Location Source: Online (ADW) handle from Oregon Racing Commission and SEC filings, Industry: The Jockey Club

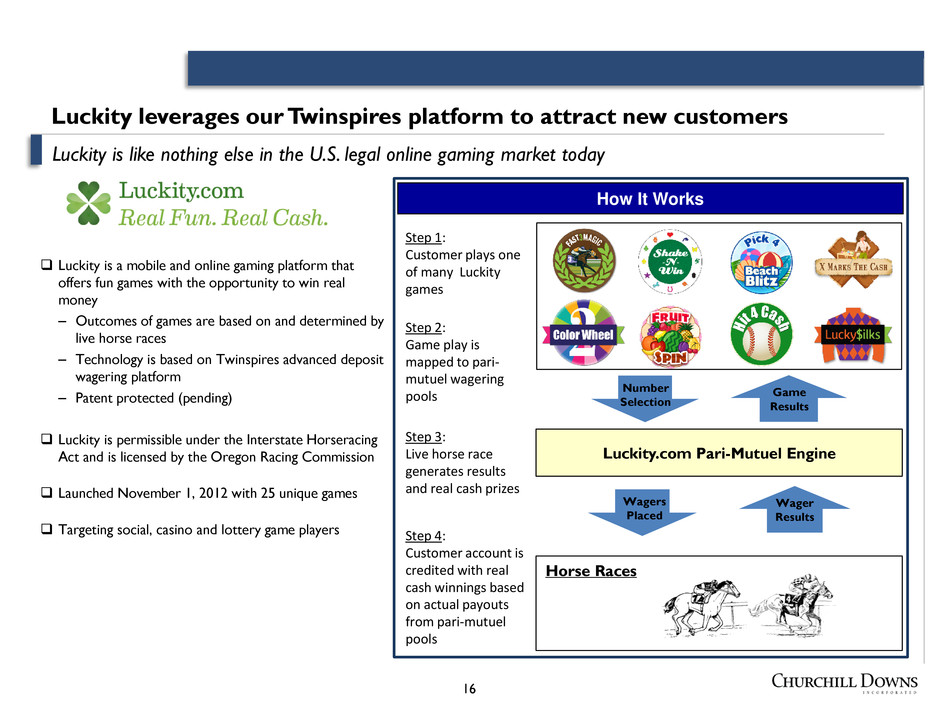

16 How It Works Step 1: Customer plays one of many Luckity games Step 2: Game play is mapped to pari- mutuel wagering pools Step 3: Live horse race generates results and real cash prizes Step 4: Customer account is credited with real cash winnings based on actual payouts from pari-mutuel pools Luckity.com Pari-Mutuel Engine Horse Races Number Selection Game Results Wagers Placed Wager Results Luckity is a mobile and online gaming platform that offers fun games with the opportunity to win real money – Outcomes of games are based on and determined by live horse races – Technology is based on Twinspires advanced deposit wagering platform – Patent protected (pending) Luckity is permissible under the Interstate Horseracing Act and is licensed by the Oregon Racing Commission Launched November 1, 2012 with 25 unique games Targeting social, casino and lottery game players Luckity leverages our Twinspires platform to attract new customers Luckity is like nothing else in the U.S. legal online gaming market today

17 Game Examples

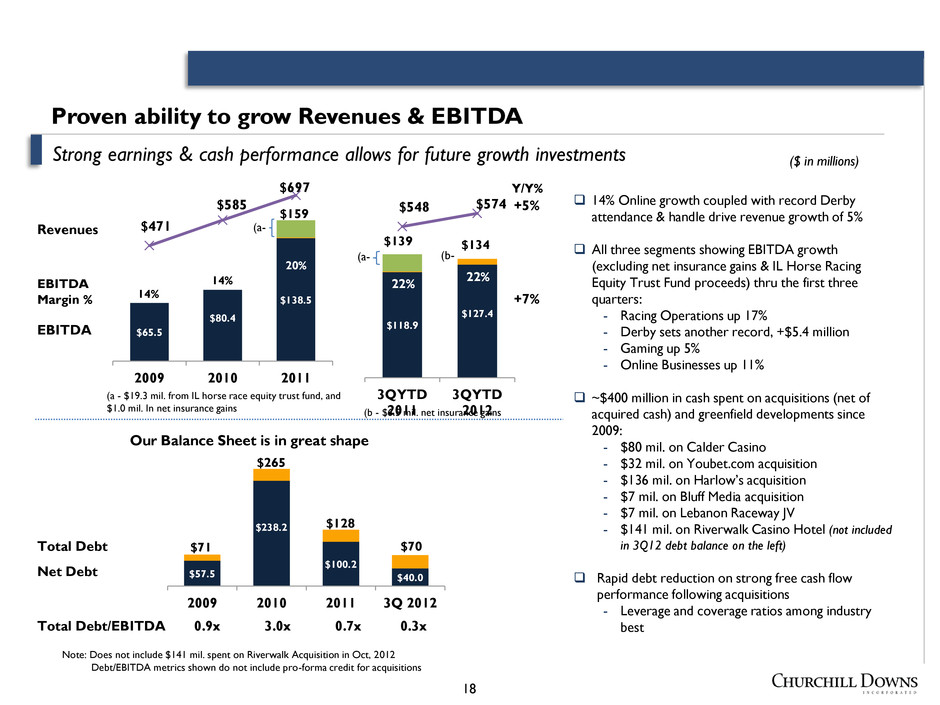

18 Proven ability to grow Revenues & EBITDA $65.5 $80.4 $138.5 $471 $585 $697 -50 50 150 250 350 450 550 650 750 0 20 40 60 80 100 120 140 160 180 200 2009 2010 2011 $159 Revenues EBITDA 14% Online growth coupled with record Derby attendance & handle drive revenue growth of 5% All three segments showing EBITDA growth (excluding net insurance gains & IL Horse Racing Equity Trust Fund proceeds) thru the first three quarters: - Racing Operations up 17% - Derby sets another record, +$5.4 million - Gaming up 5% - Online Businesses up 11% ~$400 million in cash spent on acquisitions (net of acquired cash) and greenfield developments since 2009: - $80 mil. on Calder Casino - $32 mil. on Youbet.com acquisition - $136 mil. on Harlow’s acquisition - $7 mil. on Bluff Media acquisition - $7 mil. on Lebanon Raceway JV - $141 mil. on Riverwalk Casino Hotel (not included in 3Q12 debt balance on the left) Rapid debt reduction on strong free cash flow performance following acquisitions - Leverage and coverage ratios among industry best Strong earnings & cash performance allows for future growth investments ($ in millions) EBITDA Margin % 20% 14% 14% Our Balance Sheet is in great shape (a - $19.3 mil. from IL horse race equity trust fund, and $1.0 mil. In net insurance gains (a- $118.9 $127.4 $548 $574 250 300 350 400 450 500 550 600 0 2 40 60 80 100 12 140 160 180 200 3QYTD 2011 3QYTD 2012 +5% +7% Y/Y% 22% 22% (a- (b- (b - $6.5 mil. net insurance gains $139 $134 $57.5 $238.2 $100.2 $40.0 0 50 100 150 200 250 300 2009 2010 2011 3Q 2012 $71 Total Debt Net Debt Note: Does not include $141 mil. spent on Riverwalk Acquisition in Oct, 2012 Debt/EBITDA metrics shown do not include pro-forma credit for acquisitions $265 $128 $70 Total Debt/EBITDA 0.9x 3.0x 0.7x 0.3x

19 Investment Rationale Summary Disciplined, Shareholder-Focused Management Team - Diverse backgrounds with multi-industry, technology and international experience - Proven record of capital allocation, revenue & earnings growth Diversified portfolio of Racing, Gaming, Online Entertainment Businesses - Largest legal Online gaming platform in the U.S. (Twinspires.com), showing organic growth - Iconic Kentucky Oaks & Derby Brands continue to set all-time records - Four premier Thoroughbred Race Tracks - ~4,300 gaming positions at four casinos and 9 OTBs, Ohio JV adds 1,800 more in 2014 Significant Growth Opportunities / Pipeline - Organic growth in our Online business as customers shift wagering behavior - Organic growth with the Kentucky Oaks & Derby as we develop new high-end seating - ~$285 million JV racing & gaming development near Lebanon, Ohio - Luckity.com a mobile and online social game that pays real money - Options on gaming expansion in Illinois and Kentucky - Positioned to participate in U.S. online poker upon legalization Strong Financial Position - Strong balance sheet, backstopped with valuable real estate - Disciplined maintenance capital spending - Derby and Online businesses, in particular, deliver strong free cash flow

20 Appendix

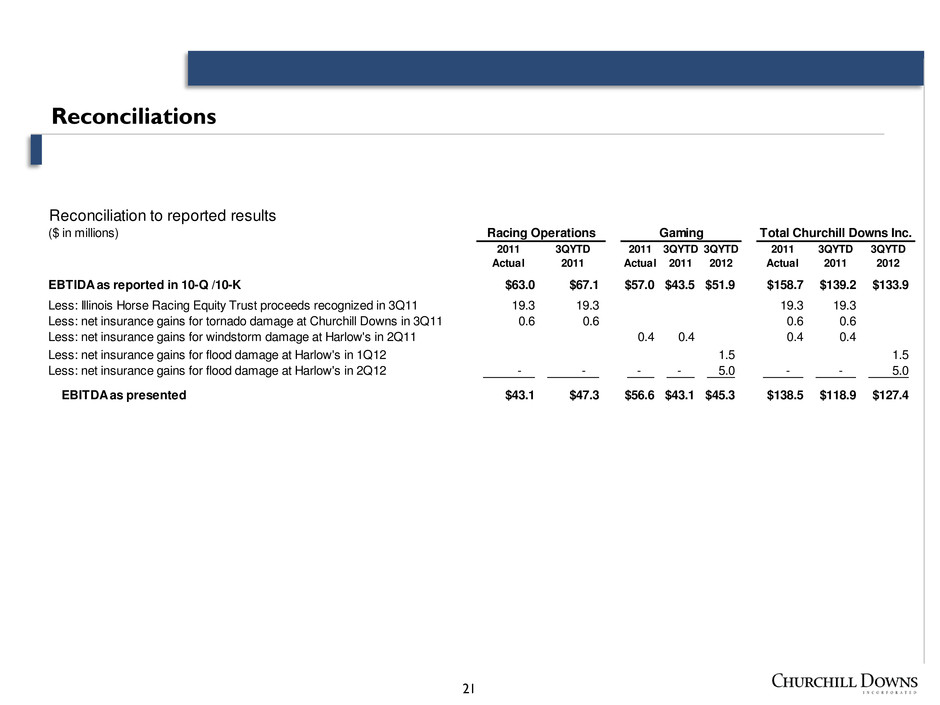

21 Reconciliations Reconciliation to reported results ($ in millions) 2011 Actual 3QYTD 2011 2011 Actual 3QYTD 2011 3QYTD 2012 2011 Actual 3QYTD 2011 3QYTD 2012 EBTIDA as reported in 10-Q /10-K $63.0 $67.1 $57.0 $43.5 $51.9 $158.7 $139.2 $133.9 Less: Illinois Horse Racing Equity Trust proceeds recognized in 3Q11 19.3 19.3 19.3 19.3 Less: net insurance gains for tornado damage at Churchill Downs in 3Q11 0.6 0.6 0.6 0.6 Less: net insurance gains for windstorm damage at Harlow's in 2Q11 0.4 0.4 0.4 0.4 Less: net insurance gains for flood damage at Harlow's in 1Q12 1.5 1.5 Less: net insurance gains for flood damage at Harlow's in 2Q12 - - - - 5.0 - - 5.0 EBITDA as presented $43.1 $47.3 $56.6 $43.1 $45.3 $138.5 $118.9 $127.4 Racing Operations Total Churchill Downs Inc.Gaming

22 Bill Carstanjen, President & COO Bob Evans, Chairman & CEO Alan Tse, EVP & General Counsel Bill Mudd, EVP & CFO CEO since 2006 Diverse background – strategy consulting, software, private equity Technology-focused Led CDI’s diversified growth strategy President and COO, 7 years with CDI M&A background with Cravath, Swaine & Moore LLP and GE Previously led legal and development teams Formerly GE Capital Columbia Law School CFO since 2007 15 year multi-industry, multi-business background with GE International experience Leads strategic, finance and development teams General Counsel since 2011 Oversees all legal, corporate governance and compliance Former GC for LG Electronics MobileComm USA Background in technology-focused industries Harvard Law School Shareholder-Focused Management Team