Attached files

| file | filename |

|---|---|

| 8-K - LMI AEROSPACE INC 8-K 12-5-2012 - LMI AEROSPACE INC | form8k.htm |

| EX-2.1 - EXHIBIT 2.1 - LMI AEROSPACE INC | ex2_1.htm |

| EX-99.1 - EXHIBIT 99.1 - LMI AEROSPACE INC | ex99_1.htm |

| EX-10.1 - EXHIBIT 10.1 - LMI AEROSPACE INC | ex10_1.htm |

EXHIBIT 99.2

LMI Aerospace Acquisition of

Valent Aerostructures

Investor Presentation

Valent Aerostructures

Investor Presentation

December 6, 2012

Forward Looking Statements and Non-GAAP Financial Measures

Cautionary Statement

This presentation includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,”

“project,” “forecast,” intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” and similar expressions are intended to identify forward-looking statements.

In addition, all statements that address operating performance, events or developments with respect to the combined company that we expect or

anticipate will occur in the future - including, without limitation, statements relating to growth and statements about future operating results - are forward-

looking statements. Our forward-looking statements are estimates and projections reflecting management’s judgment based on currently available

information and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-

looking statements, including, without limitation, risks related to the ability of the parties to complete the proposed transaction in a timely matter or at all;

our ability to integrate and achievement our intended objectives with respect to Valent; the proposed transaction resulting in unexpected costs or

liabilities, the ability of the parties to complete the proposed debt transaction on the terms anticipated or at all, our ability to comply with our new debt

covenants, and the increased leverage that will result from the proposed debt transaction. Additional factors that might cause such differences (and

could adversely impact our business and financial performance generally) include, but are not limited to, those discussed in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2011 and other reports filed with the U.S. Securities and Exchange Commission, which are

incorporated herein by reference. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not

consider any such list to be a complete set of all potential risks or uncertainties. Moreover, forward-looking statements are based on our current

expectations and speak only as of the date when made, and we undertake no obligation to publicly update or revise any forward-looking statements

except as required by law. As a result of the foregoing, you should not place undue reliance on forward-looking statements.

“project,” “forecast,” intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” and similar expressions are intended to identify forward-looking statements.

In addition, all statements that address operating performance, events or developments with respect to the combined company that we expect or

anticipate will occur in the future - including, without limitation, statements relating to growth and statements about future operating results - are forward-

looking statements. Our forward-looking statements are estimates and projections reflecting management’s judgment based on currently available

information and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-

looking statements, including, without limitation, risks related to the ability of the parties to complete the proposed transaction in a timely matter or at all;

our ability to integrate and achievement our intended objectives with respect to Valent; the proposed transaction resulting in unexpected costs or

liabilities, the ability of the parties to complete the proposed debt transaction on the terms anticipated or at all, our ability to comply with our new debt

covenants, and the increased leverage that will result from the proposed debt transaction. Additional factors that might cause such differences (and

could adversely impact our business and financial performance generally) include, but are not limited to, those discussed in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2011 and other reports filed with the U.S. Securities and Exchange Commission, which are

incorporated herein by reference. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not

consider any such list to be a complete set of all potential risks or uncertainties. Moreover, forward-looking statements are based on our current

expectations and speak only as of the date when made, and we undertake no obligation to publicly update or revise any forward-looking statements

except as required by law. As a result of the foregoing, you should not place undue reliance on forward-looking statements.

Use of Non-GAAP Financial Measures

References in these slides to “Adjusted EBITDA” are to consolidated net income from operations, excluding consolidated interest, income taxes,

depreciation, and amortization, as well as excluding the effects of any of the following to the extent otherwise included in the foregoing: (1) gains or

losses realized by Valent and its subsidiaries from the sale of assets other than in the ordinary course of business and any “extraordinary items” of gain

or loss, (2) management fees, general overhead expenses, or other intercompany charges charged by LMI to Valent and its subsidiaries, (3) but

excluding any costs related to the contemplated transactions and any charges from LMI and any of its affiliates, (4) excluding the effects of integration or

consolidation benefits and expenses, and (5) effects of purchase accounting. In determining consolidated earnings from operations, the purchase and

sales prices of goods and services sold by Valent and its subsidiaries to LMI or its affiliates, or purchased by Valent and its subsidiaries from LMI or its

affiliates, shall be adjusted to reflect the amounts that Valent and its subsidiaries would have received or paid if dealing with an independent party in an

arm’s length commercial transaction. In addition, in determining consolidated earnings from operations, program accounting will be continued in

accordance with GAAP; provided that any transaction between LMI, or any subsidiary of LMI (other than Valent and its subsidiaries), and any of Valent

and its subsidiaries, the terms of which were agreed to without input from senior-level management of LMI or Valent or its subsidiaries, will be deemed to

be an arm’s length commercial transaction. Since Adjusted EBITDA is a non-GAAP measure that does not have a standardized meaning, it may not be

comparable to similar measures presented by other issuers. You are cautioned that this non-GAAP measure is not based on any comprehensive set of

accounting rules or principles and should be considered only in conjunction with, and not as a substitute for, or superior to, consolidated net income from

operations, excluding consolidated interest, income taxes, depreciation, and amortization, as determined in accordance with GAAP, as an indicator of

performance. A reconciliation of this non-GAAP measure to its closest U.S. GAAP measure is included in the Appendix to this presentation.

depreciation, and amortization, as well as excluding the effects of any of the following to the extent otherwise included in the foregoing: (1) gains or

losses realized by Valent and its subsidiaries from the sale of assets other than in the ordinary course of business and any “extraordinary items” of gain

or loss, (2) management fees, general overhead expenses, or other intercompany charges charged by LMI to Valent and its subsidiaries, (3) but

excluding any costs related to the contemplated transactions and any charges from LMI and any of its affiliates, (4) excluding the effects of integration or

consolidation benefits and expenses, and (5) effects of purchase accounting. In determining consolidated earnings from operations, the purchase and

sales prices of goods and services sold by Valent and its subsidiaries to LMI or its affiliates, or purchased by Valent and its subsidiaries from LMI or its

affiliates, shall be adjusted to reflect the amounts that Valent and its subsidiaries would have received or paid if dealing with an independent party in an

arm’s length commercial transaction. In addition, in determining consolidated earnings from operations, program accounting will be continued in

accordance with GAAP; provided that any transaction between LMI, or any subsidiary of LMI (other than Valent and its subsidiaries), and any of Valent

and its subsidiaries, the terms of which were agreed to without input from senior-level management of LMI or Valent or its subsidiaries, will be deemed to

be an arm’s length commercial transaction. Since Adjusted EBITDA is a non-GAAP measure that does not have a standardized meaning, it may not be

comparable to similar measures presented by other issuers. You are cautioned that this non-GAAP measure is not based on any comprehensive set of

accounting rules or principles and should be considered only in conjunction with, and not as a substitute for, or superior to, consolidated net income from

operations, excluding consolidated interest, income taxes, depreciation, and amortization, as determined in accordance with GAAP, as an indicator of

performance. A reconciliation of this non-GAAP measure to its closest U.S. GAAP measure is included in the Appendix to this presentation.

2

Charlie Newell

Co-Chief Executive Officer - Valent Aerostructures

Ronald S. Saks

President & Chief Executive Officer

Ed Dickinson

Vice President & CFO

Henry Newell

Co-Chief Executive Officer - Valent Aerostructures

Participants

3

Strategically Compelling Transaction

§ Creates an industry leading aerostructures supplier with significant scale

- Over $480 mm in projected pro forma FY2013 sales and over $80 mm in projected pro forma FY2013 EBITDA,

excluding synergies

excluding synergies

- Added scale expected to improve LMI’s ability to take advantage of the anticipated strong up cycle in commercial

aerospace, growth in large-cabin business jet deliveries and stable military platforms

aerospace, growth in large-cabin business jet deliveries and stable military platforms

- Partner of choice with a majority of revenues coming from sole source, long term agreements (“LTAs”)

§ LMI acquires a leading franchise, adding substantial technical capabilities

- Critically important complex assembly and aerostructures technologies on legacy and new platforms, with existing

infrastructure to support future growth

infrastructure to support future growth

- High-end precision machining capabilities

- Named one of 16 Boeing Suppliers of the Year in 2010 and one of 13 Spirit Platinum Award Winners in 2011

§ Excellent strategic fit

- Complementary capabilities on high-demand platforms with a mix of commercial, business jet and military exposure

- Increased ability to compete for larger, more complex design build projects

- Deepens relationships with blue chip customer base and provides further diversification across major platforms

- Expected to create substantial synergy opportunities

§ Significant financial benefits

- Combined company is expected to realize growth in revenue and EBITDA at both LMI and Valent, driven by

increased platform content and expected build rate escalation

increased platform content and expected build rate escalation

- Slightly dilutive to FY2013 earnings, but projected to be highly accretive to FY2014 earnings

4

Transaction Overview

|

Purchase Price

|

§ $247 mm with potential earnout contingent upon FY2013 performance

§ Approximately 8.6x projected FY2013 EBITDA, adjusted for net present value

of tax benefits |

|

Consideration

|

§ Stock: $15 mm

§ Cash and retention of Valent indebtedness: $232 mm

|

|

Earnout

|

§ Cash earnout of up to $40 mm based on Valent’s FY2013 financial

performance |

|

Tax Benefits

|

§ Estimated $35 mm of net present value of cash benefit from tax savings

|

|

Financing

|

§ $300 mm fully committed financing provided by RBC Capital Markets

|

|

Approval

Process |

§ Hart-Scott-Rodino approval

§ Expected closing on or prior to December 31, 2012

|

5

Valent Aerostructures - The Right Partner for LMI

§ Supplier of major, complex sub-

assemblies and machined parts for

leading Tier 1 suppliers and OEMs

assemblies and machined parts for

leading Tier 1 suppliers and OEMs

§ Blue chip customer base

§ Major commercial aerospace platform

exposure

exposure

- Boeing 737, 747-8, 777, 787,

V-22 and Gulfstream G650

V-22 and Gulfstream G650

§ Proven ability to in-source current

supply chain products to enhance

profitability

supply chain products to enhance

profitability

§ Significant investment in state-of-the-

art technologies / facilities

art technologies / facilities

§ Two facilities dedicated to assembly

and integration of complex assemblies

and integration of complex assemblies

§ ~650 non-union employees

Manufacturing Site

Tulsa/Coweta

Wichita

Fredonia

Cuba

Washington

St. Louis

Lenexa

Cottonwood Falls

Assembly Site

Processing Site

737 Crew Floor Assembly

6

Valent Aerostructures - The Right Partner for LMI

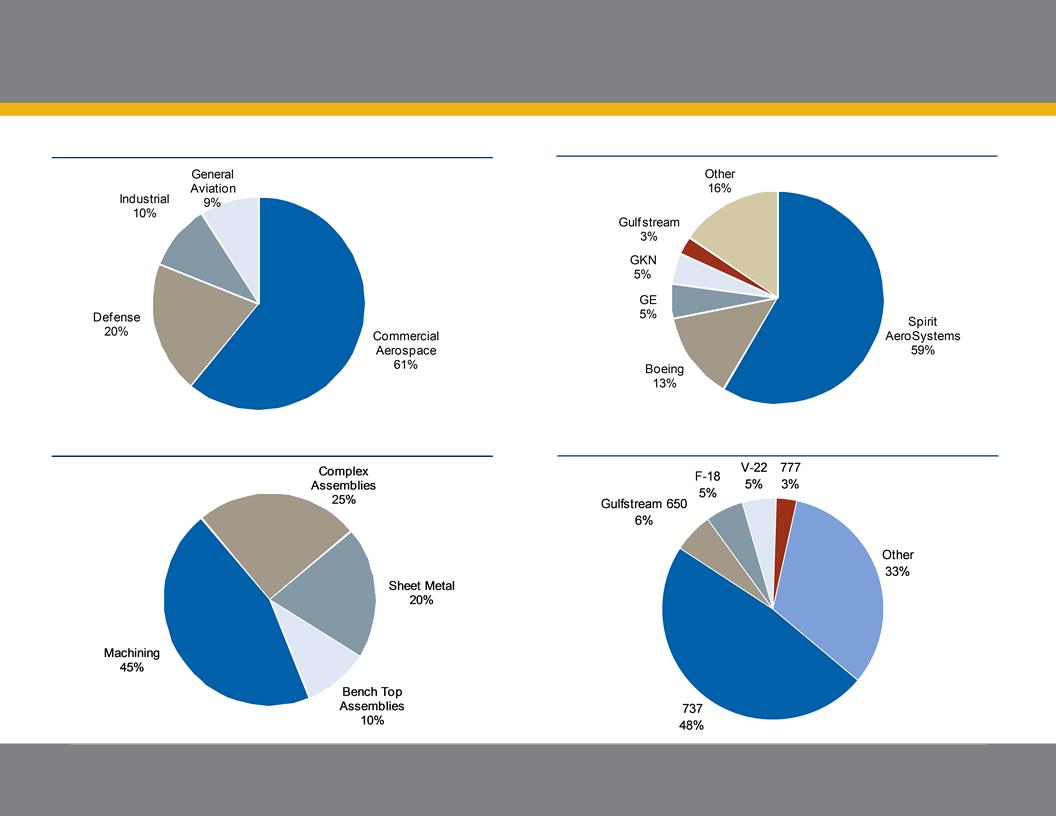

FY2012 Revenue Breakdown - by End Market

FY2012 Revenue Breakdown - by Activity

FY2012 Revenue Breakdown - by Platform

FY2012 Revenue Breakdown - by Customer

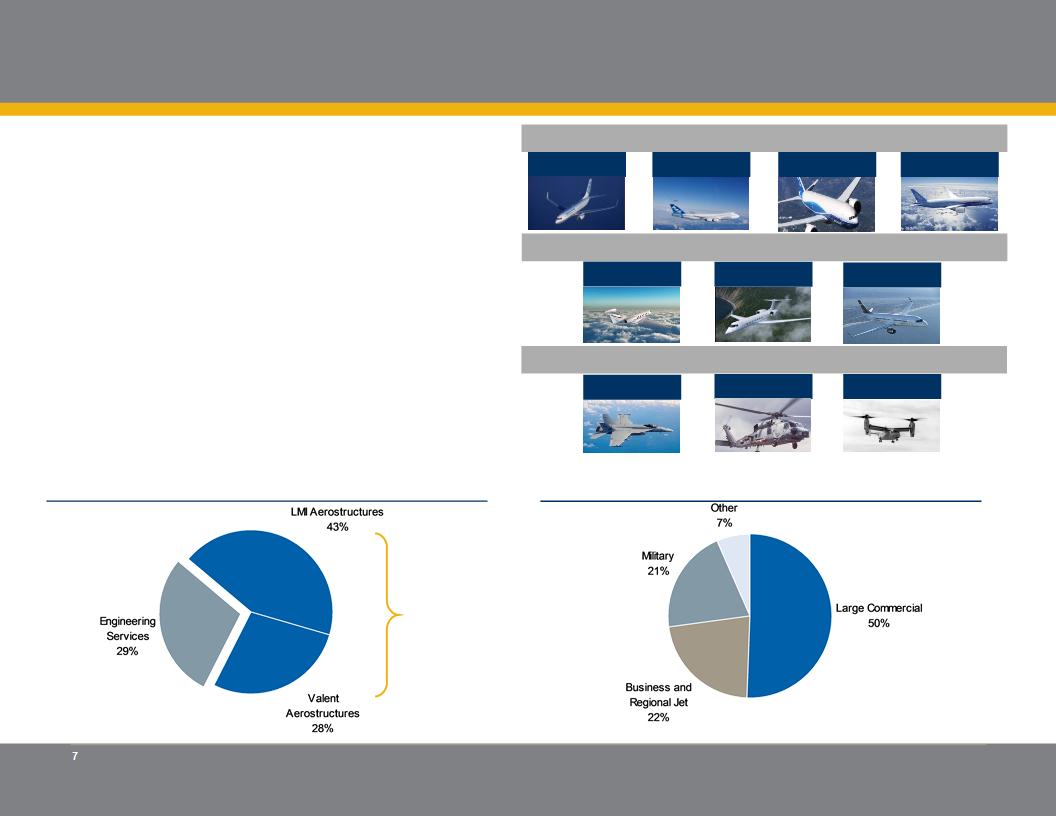

Pro Forma Combined Company Snapshot

§ 2013E PF Projected Revenue: $480+ mm

§ 2013E PF Projected EBITDA: $80+ mm

§ Over 85% of Aerostructures revenue under LTA

§ Critical supplier to OEM and Tier 1 suppliers on

legacy and new platforms

legacy and new platforms

- Boeing Supplier of the Year

- Aviation Partners Boeing Supplier of the

Year

Year

- Spirit Platinum Award Winner

737

747

777

787

Military Platforms

C- Series

G650

G450 / G550

Commercial Platforms

F-18

V-22

Blackhawk

Corporate & Regional Platforms

Est. PF FY2012 Revenue by Segment

Est. PF FY2012 Aerostructures Revenue by End Market

PF Aerostructures

71%

8

Strategic Rationale

Creates an industry leading aerostructures

supplier with significant scale

supplier with significant scale

LMI acquires a leading franchise, adding

substantial technical capabilities

substantial technical capabilities

Excellent strategic fit

Significant financial benefits