Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOOUNTING FIRM - SOLARCITY CORP | d229977dex231.htm |

| EX-10.4 - 2012 EMPLOYEE STOCK PURCHASE PLAN AND FORM OF AGREEMENTS USED THEREUNDER - SOLARCITY CORP | d229977dex104.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 4, 2012

Registration No. 333-184317

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

SOLARCITY CORPORATION

(Exact name of Registrant as specified in its charter)

| Delaware | 4931 | 02-0781046 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3055 Clearview Way

San Mateo, California 94402

(650) 638-1028

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Lyndon R. Rive

Chief Executive Officer

SolarCity Corporation

3055 Clearview Way

San Mateo, California 94402

(650) 638-1028

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Steven V. Bernard Alexander D. Phillips Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Seth R. Weissman SolarCity Corporation 3055 Clearview Way San Mateo, California 94402 (650) 638-1028 |

Thomas J. Ivey Skadden, Arps, Slate, Meagher & Flom LLP 525 University Avenue Palo Alto, California 94301 (650) 470-4500 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer x | (Do not check if a smaller reporting company) | Smaller reporting company ¨ | ||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a) may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 4, 2012

10,065,012 Shares

This is an initial public offering of SolarCity Corporation’s shares of common stock. We are offering to sell 10,000,000 shares in this offering. The selling stockholders identified in this prospectus are offering to sell an additional 65,012 shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $13.00 and $15.00. We intend to list the common stock on the NASDAQ Global Market under the symbol “SCTY.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. See “Risk Factors” on page 13 to read about factors you should consider before buying shares of common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

To the extent that the underwriters sell more than 10,065,012 shares of common stock, the underwriters have the option to purchase up to an additional 1,509,752 shares of common stock from us at the initial public offering price less the underwriting discount, within 30 days from the date of this prospectus.

The underwriters expect to deliver the shares against payment in New York, New York on , 2012.

| Goldman, Sachs & Co. | Credit Suisse | BofA Merrill Lynch |

| Needham & Company | Roth Capital Partners |

Prospectus dated , 2012.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 13 | ||||

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA |

37 | |||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

47 | |||

| 91 | ||||

| 111 | ||||

| 120 | ||||

| 130 | ||||

| 134 | ||||

| 137 | ||||

| 142 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

145 | |||

| 149 | ||||

| 157 | ||||

| 157 | ||||

| 157 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus and in any free writing prospectus filed with the Securities and Exchange Commission. We, the underwriters and the selling stockholders have not authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. We, the underwriters and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

Neither we, the selling stockholders, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who obtain this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Through and including (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before buying shares in this offering. Therefore, you should read this entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes contained elsewhere in this prospectus. Unless the context requires otherwise, the words “we,” “us,” “our” and “SolarCity” refer to SolarCity Corporation and its wholly owned subsidiaries.

SolarCity

Our Vision for Better Energy

We sell renewable energy to our customers at prices below utility rates. Our long-term agreements generate recurring customer payments and position us to provide our growing base of customers with other energy products and services that further lower their energy costs. We call this “Better Energy.”

Overview

The demand for Better Energy is allowing us to install more solar energy systems than any other company in the United States. We believe this significant demand for our energy solutions results from the following value propositions:

| Ÿ | We lower energy costs. Our customers buy renewable energy from us for less than they currently pay for electricity from utilities with little to no up-front cost. They are also able to lock in their energy costs for the long term and insulate themselves from rising energy costs. |

| Ÿ | We build long-term customer relationships. Most of our customers agree to a 20-year contract term, positioning us to provide them with additional energy-related solutions during this relationship to further lower their energy costs. At the end of the original contract term, we intend to offer our customers renewal contracts. |

| Ÿ | We make it easy. We perform the entire process, from permitting through installation, and make it simple for customers to switch to renewable energy. |

| Ÿ | We focus on quality. Our top priority is to provide value and quality service to our customers. We have assembled a highly skilled team of in-house professionals dedicated to the highest engineering standards, overall quality and customer service. |

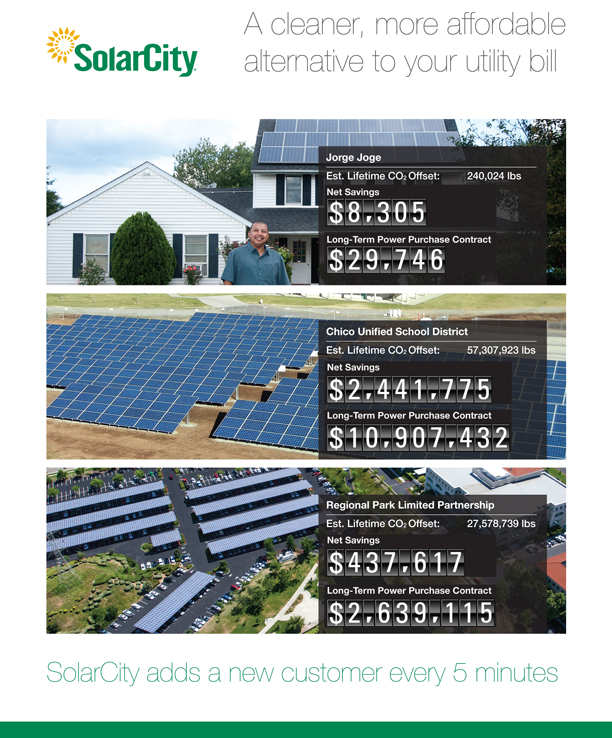

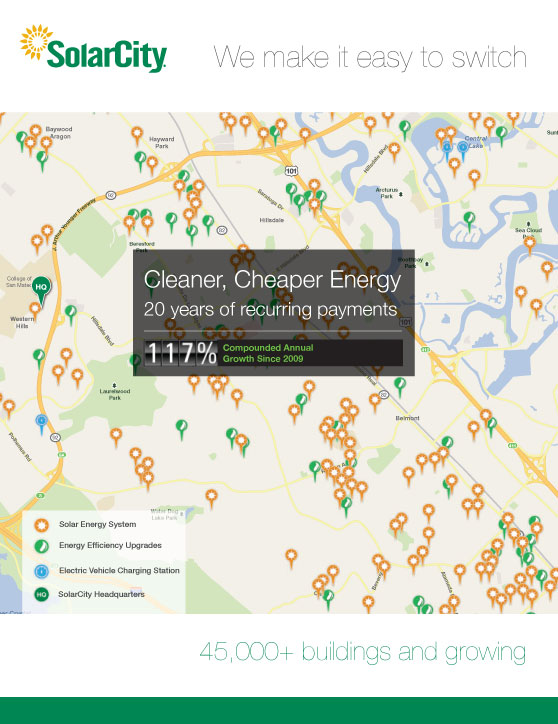

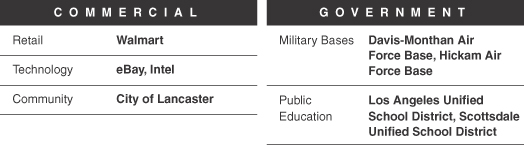

We currently serve customers in 14 states, and we intend to expand our footprint internationally, operating in every market where distributed solar energy generation is a viable economic alternative to utility generation. We generate revenue from a mix of residential customers, commercial entities such as Walmart, eBay and Intel, and government entities such as the U.S. Military. Since our founding in 2006, we have provided or contracted to provide systems or services on more than 45,000 buildings. In addition, aggregate contractual cash payments that our customers are obligated to pay over the term of our long-term customer agreements have grown at a compounded annual rate of 117% since 2009. We structure these customer agreements as either leases or power purchase agreements. Our lease customers pay a fixed monthly fee with an electricity production guarantee. Our power purchase agreement customers pay a rate based on the amount of electricity the solar energy system actually produces.

1

Table of Contents

Our long-term lease and power purchase agreements create high-quality recurring customer payments, investment tax credits, accelerated tax depreciation and other incentives. Our financial strategy is to monetize these assets at the lowest cost of capital. We share the economic benefit of this lower cost of capital with our customers by reducing the price they pay for energy. Historically, we have monetized the assets created by substantially all of our leases and power purchase agreements via investment funds we have formed with fund investors. In general, we contribute the assets to the investment fund and receive upfront cash and retain a residual interest. The allocation among us and the fund investors of the economic benefits as well as the timing of receipt of such economic benefits varies depending on the structure of the investment fund. We use a portion of the cash received from the investment fund to cover our variable and fixed costs associated with installing the related solar energy systems. We invest the excess cash in the growth of our business. In the future, in addition to or in lieu of monetizing the value through investment funds, we may use debt, equity or other financing strategies to fund our operations. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Investment Funds.”

To date, we have raised $1.57 billion through 23 investment funds and related financing facilities established with banks and other large companies such as Credit Suisse, Google, PG&E Corporation and U.S. Bancorp, and we continue to create additional investment funds. Approximately $602 million of the amount we have raised remains available for future deployments. We also have made significant investments in our business infrastructure and personnel to support our growth, and as a result we have incurred substantial net losses over the past five years.

Our long-term energy contracts serve as a gateway for us to engage our residential customers in performing energy efficiency evaluations and energy efficiency upgrades. During an energy efficiency evaluation, our proprietary software enables us to capture, catalog and analyze all of the energy loads in a home to identify the most valuable and actionable solutions to lower energy costs. We then offer to perform the appropriate upgrades to improve the home’s energy efficiency. We also offer energy-related products such as electric vehicle charging stations and proprietary advanced monitoring software, and we are expanding our product portfolio to include additional products such as on-site battery storage solutions. Approximately 21% of our new residential solar energy system customers in 2011 purchased additional energy products or services from us, and as our customers’ energy needs evolve over time, we believe we are well-positioned to be their provider of choice.

Market Opportunity

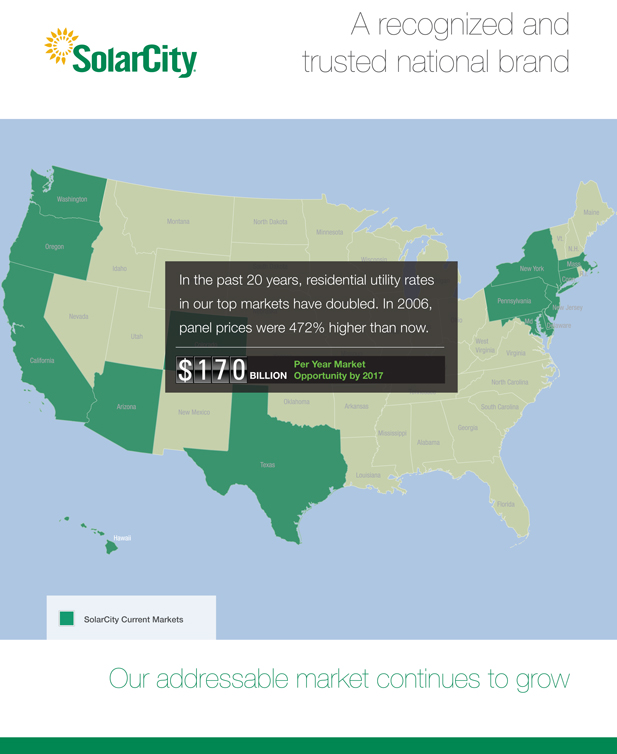

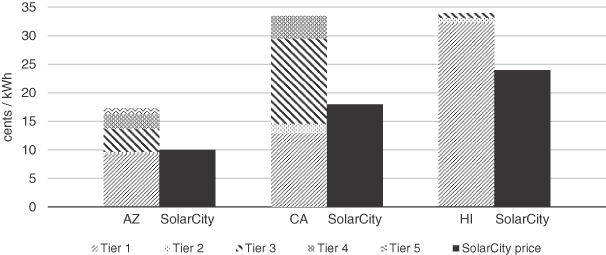

According to the Energy Information Agency, or EIA, in 2010, total sales of retail electricity in the United States were $368 billion. U.S. retail electricity prices have increased at an average annual rate of 3.4% and 3.2% from 2000 to 2010 for residential and commercial customers, respectively. The average annual rate increase in the states where we operate has been higher. For example, in Hawaii, the average annual rate increases over the past 10 years reached as high as 7.7% and 8.0% for residential and commercial customers, respectively. Despite these increasing U.S. retail electricity prices, U.S. electricity usage has continued to grow over the past 10 years.

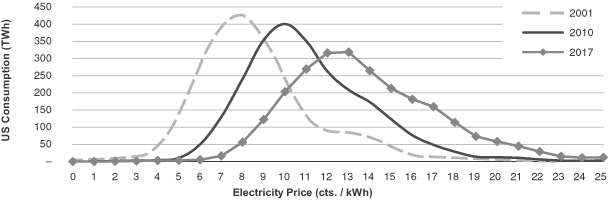

Across the United States, many utility customers are paying retail electricity prices at or above our current blended electricity price of 15 cents per kilowatt hour, or kWh. Based on EIA data, in 2010 approximately 340 terawatt hours, or TWh, of the retail electricity sold in the United States was priced, on average, at or above our current blended electricity price. The volume of sales in TWh at or above this rate increased approximately 295% from 2001 to 2010. In dollar terms, 2010 data suggests a U.S. market size of $58 billion at an electricity price at or above 15 cents per kWh. Using historical annual

2

Table of Contents

growth rates for residential and commercial retail electricity prices for 2000 to 2010 and flat electricity consumption, the implied U.S. market size at or above 15 cents per kWh increases to $170 billion, or 950 TWh, by 2017.

As a result of rising energy prices, the market for energy efficiency solutions is expected to grow significantly. Lawrence Berkeley National Laboratory estimates that energy efficiency services sector spending in the United States will increase more than four-fold from 2008 to 2020, reaching $80 billion under a high-growth scenario and approximately $37 billion under a low-growth scenario. This sector consists primarily of the installation and deployment of energy efficiency products and services, including energy efficiency-related engineering, construction, services, technical support and equipment.

Rising retail electricity prices, coupled with inelastic demand, create a significant and growing market opportunity for lower cost retail energy. SolarCity sells cleaner, cheaper energy than utilities.

Our Approach

We have developed an integrated approach that allows our customers to switch to Better Energy in a simple and cost-efficient manner. The key elements of our integrated approach are:

| Ÿ | Sales. We have structured our sales organization to efficiently engage prospective customers, from initial interest through customized proposals and, ultimately, signed contracts. |

| Ÿ | Financing. We provide multiple pricing options to our customers to help make renewable, distributed energy affordable. |

| Ÿ | Engineering. We have developed software that simplifies and expedites the custom design process and optimizes the energy production of each solar energy system. |

| Ÿ | Installation. We obtain all necessary building permits and handle the installation of our solar energy systems. By managing these logistics, we make the installation process simple for our customers. |

| Ÿ | Monitoring and Maintenance. Our proprietary monitoring software provides both SolarCity and our customers with a real-time view of their energy generation, consumption and carbon offset through an easy-to-read application available on smartphones and any device with a web browser. |

| Ÿ | Complementary Products and Services. Using our proprietary software, we analyze our customers’ energy usage and identify opportunities for energy efficiency improvements. |

Our Strengths

We believe the following strengths enable us to deliver Better Energy:

| Ÿ | Lower cost energy. We sell energy to our customers at prices below utility rates. Our customers typically achieve a lower overall electricity bill immediately upon installation. As retail utility rates rise, our customers’ savings increase. |

| Ÿ | Easy to switch. By providing the sales, financing, engineering, installation, monitoring and maintenance ourselves, we offer a simple and efficient process to our customers. |

| Ÿ | Long-term customer relationships. Most of our solar energy customers purchase energy from us under 20-year contracts, and we leverage these relationships to offer energy efficiency services tailored to our customers’ needs. In addition, because our solar energy systems have an estimated life of 30 years, we intend to offer our customers renewal contracts at the end of the original contract term. |

3

Table of Contents

| Ÿ | Significant size and scale. We believe that our size and scale provide our customers with confidence in our continuing ability to service their system and guarantee its performance over the duration of their long-term contract. |

| Ÿ | Innovative technology. We continually innovate and develop new technologies to facilitate our growth and to enhance the delivery of our products and services. |

| Ÿ | Brand recognition. Our ability to provide high-quality services, our dedication to best-in-class engineering efforts and our exceptional customer service have helped us establish a recognized and trusted national brand. |

| Ÿ | Strong leadership team. We are led by a strong management team with demonstrated execution capabilities and an ability to adapt to rapidly changing market environments. |

Our Strategy

Our goal is to become the largest provider of clean distributed energy in the world. We plan to achieve this disruptive strategy by providing every home and business an alternative to their energy bill that is cleaner and cheaper than their current energy provider. We intend to:

| Ÿ | Rapidly grow our customer base. We intend to invest significantly in additional sales, marketing and operations personnel and leverage strategic relationships with new and existing industry leaders to further expand our business and customer base. |

| Ÿ | Continue to offer lower priced energy. We plan on reducing costs by continuing to leverage our buying power with our suppliers, developing additional proprietary software to further ensure that our integrated team operates as efficiently as possible, and working with fund investors to develop innovative financing solutions to lower our cost of capital and offer lower-priced energy to our customers. |

| Ÿ | Leverage our brand and long-term customer relationships to provide complementary products. We plan to continue to invest in and develop complementary energy products, software and services, such as energy storage and energy management technologies, to offer further cost-savings to our customers. We also plan to expand our energy efficiency business to our commercial customers. |

| Ÿ | Expand into new locations. We intend to continue to expand into new locations, initially targeting those markets where climate, government regulations and incentives position solar energy as an economically compelling alternative to utilities. |

Risk Factors

Our business is subject to many risks and uncertainties, as more fully described under “Risk Factors” and elsewhere in this prospectus. For example, you should be aware of the following before investing in our common stock:

| Ÿ | Existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic barriers to the purchase and use of solar energy systems that may significantly reduce demand for our solar energy systems. |

| Ÿ | We rely on net metering and related policies to offer competitive pricing to our customers in some of our key markets. |

4

Table of Contents

| Ÿ | Our business currently depends on the availability of rebates, tax credits and other financial incentives. The expiration, elimination or reduction of these rebates, credits and incentives would adversely impact our business. |

| Ÿ | Our business depends in part on the regulatory treatment of third-party owned solar energy systems. |

| Ÿ | If the Internal Revenue Service or the U.S. Treasury Department makes additional determinations that the fair market value of our solar energy systems is materially lower than what we have claimed, we may have to pay significant amounts to our investment funds or to our fund investors and such determinations could have a material adverse effect on our business, financial condition and prospects. |

| Ÿ | Our ability to provide solar energy systems to customers on an economically viable basis depends on our ability to finance these systems through financing arrangements with fund investors. |

| Ÿ | A material drop in the retail price of utility-generated electricity or electricity from other energy sources would harm our business, financial condition and results of operations. |

Corporate Information

We were incorporated in June 2006 as a Delaware corporation. Our headquarters are located at 3055 Clearview Way, San Mateo, California 94402, and our telephone number is (650) 638-1028. You can access our website at www.solarcity.com. Information contained on our website is not a part of, and is not incorporated into, this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

“SolarCity,” “SolarGuard,” “SolarLease” and “PowerGuide” are our registered trademarks in the United States and, in some cases, in certain other countries. Our other unregistered trademarks and service marks in the United States include: “Better Energy,” “SolarBid,” “SolarStrong” and “SolarWorks.” This prospectus also contains trademarks, service marks and tradenames of other companies.

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act of 1933, as amended, or the Securities Act, and Section 3(a)(80) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Pursuant to Section 102 of the Jumpstart Our Business Startups Act, or JOBS Act, we have provided reduced executive compensation disclosure and have omitted a compensation discussion and analysis from this prospectus. Pursuant to Section 107 of the JOBS Act, we have elected to utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

5

Table of Contents

THE OFFERING

| Common stock offered by us |

10,000,000 shares |

| Common stock offered by the selling stockholders |

65,012 shares |

| Total common stock offered |

10,065,012 shares |

| Common stock outstanding after this offering |

71,708,364 shares |

| Option to purchase additional shares |

The underwriters have an option to purchase a maximum of 1,509,752 additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including working capital, capital expenditures and potential acquisitions of complementary businesses, technologies or other assets. |

| We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. See “Use of Proceeds.” |

| Reserved share program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to 704,550 shares of our common stock being offered for sale (or 7% of the shares offered by this prospectus) to certain business associates, friends and family of our executive officers and board of directors through a reserved share program. We will offer these shares to the extent permitted under applicable regulations in the United States and applicable jurisdictions. If these persons purchase reserved shares, it will reduce the number of shares available for sale to the general public. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other shares offered by this prospectus. |

| Proposed NASDAQ Global Market symbol |

SCTY |

| Risk factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

6

Table of Contents

The number of shares of our common stock to be outstanding after this offering is based on 61,708,364 shares of our common stock outstanding as of October 31, 2012, and excludes:

| Ÿ | 14,591,691 shares of our common stock issuable upon exercise of outstanding stock options at a weighted-average exercise price of $4.67 per share under our 2007 Stock Plan; |

| Ÿ | 16,991 shares of common stock issuable upon vesting of restricted stock units under our 2007 Stock Plan; |

| Ÿ | 1,485,010 shares of our common stock, on an as-converted basis, issuable upon the exercise of outstanding warrants to purchase Series E preferred stock, at a weighted average exercise price of $5.41 per share; and |

| Ÿ | 10,202,157 shares of common stock reserved for future issuance under our equity-based compensation plans, consisting of 1,902,157 shares of common stock reserved for issuance under our 2007 Stock Plan as of October 31, 2012, 7,000,000 shares of common stock reserved for issuance under our 2012 Equity Incentive Plan and 1,300,000 shares of common stock reserved for issuance under our 2012 Employee Stock Purchase Plan, and excluding shares that become available under the 2012 Equity Incentive Plan and 2012 Employee Stock Purchase Plan pursuant to provisions of these plans that automatically increase the share reserves each year, as more fully described in “Executive Compensation—Employee Benefit Plans.” The 2012 Equity Incentive Plan and the 2012 Employee Stock Purchase Plan will become available when this offering closes. |

Except as otherwise indicated, all information in this prospectus:

| Ÿ | assumes the automatic conversion of all outstanding shares of our preferred stock into an aggregate of 50,441,799 shares of common stock effective upon the closing of this offering, including the net exercise of warrants to purchase our Series F preferred stock into 63,853 shares of common stock, based upon the mid-point of the price range on the cover of this prospectus, the conversion of each share of our existing preferred stock (other than our Series G preferred stock) into one share of common stock and the conversion of all shares of our Series G preferred stock into 8,372,065 shares of common stock (or approximately 2.47 shares of common stock for each share of Series G preferred stock issued), based upon the mid-point of the price range on the cover of this prospectus and the adjustment provisions relating to our Series G preferred stock described in “Description of Capital Stock;” |

| Ÿ | assumes the conversion of outstanding, non-expiring preferred stock warrants to common stock warrants effective upon the closing of this offering; |

| Ÿ | assumes we will file our amended and restated certificate of incorporation and adopt our amended and restated bylaws immediately prior to the closing of this offering; and |

| Ÿ | assumes the underwriters will not exercise their option to purchase additional shares of common stock from us in this offering. |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read the summary consolidated financial data set forth below in conjunction with our consolidated financial statements, the notes to our consolidated financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained elsewhere in this prospectus.

We derived the summary consolidated statements of operations data for the years ended December 31, 2009, 2010 and 2011 from our audited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated statements of operations data for the nine months ended September 30, 2011 and 2012 and the unaudited consolidated balance sheet data as of September 30, 2012 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited financial information on a basis consistent with our audited consolidated financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results that may be expected in any future period, and our interim results are not necessarily indicative of the results to be expected for the full fiscal year.

8

Table of Contents

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||

| Consolidated statements of operations data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Operating leases |

$ | 3,212 | $ | 9,684 | $ | 23,145 | $ | 16,103 | $ | 33,584 | ||||||||||

| Solar energy systems sales |

29,435 | 22,744 | 36,406 | 22,706 | 69,805 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

32,647 | 32,428 | 59,551 | 38,809 | 103,389 | |||||||||||||||

| Cost of revenue: |

||||||||||||||||||||

| Operating leases |

1,911 | 3,191 | 5,718 | 3,289 | 8,615 | |||||||||||||||

| Solar energy systems |

28,971 | 26,953 | 41,418 | 31,415 | 57,924 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of revenue |

30,882 | 30,144 | 47,136 | 34,704 | 66,539 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

1,765 | 2,284 | 12,415 | 4,105 | 36,850 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Sales and marketing |

10,914 | 22,404 | 42,004 | 27,246 | 49,976 | |||||||||||||||

| General and administrative |

10,855 | 19,227 | 31,664 | 24,126 | 31,904 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

21,769 | 41,631 | 73,668 | 51,372 | 81,880 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(20,004 | ) | (39,347 | ) | (61,253 | ) | (47,267 | ) | (45,030 | ) | ||||||||||

| Interest expense, net |

334 | 4,901 | 9,272 | 7,516 | 14,922 | |||||||||||||||

| Other expenses, net |

2,360 | 2,761 | 3,097 | 1,884 | 17,895 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income taxes |

(22,698 | ) | (47,009 | ) | (73,622 | ) | (56,667 | ) | (77,847 | ) | ||||||||||

| Income tax provision |

(22 | ) | (65 | ) | (92 | ) | (62 | ) | (107 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(22,720 | ) | (47,074 | ) | (73,714 | ) | (56,729 | ) | (77,954 | ) | ||||||||||

| Net income (loss) attributable to noncontrolling interests(1) |

3,507 | (8,457 | ) | (117,230 | ) | (86,172 | ) | (16,806 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to stockholders(1) |

$ | (26,227 | ) | $ | (38,617 | ) | $ | 43,516 | $ | 29,443 | $ | (61,148 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share attributable to common stockholders: |

||||||||||||||||||||

| Basic |

$ | (3.13 | ) | $ | (4.50 | ) | $ | 0.82 | $ | 0.58 | $ | (5.63 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | (3.13 | ) | $ | (4.50 | ) | $ | 0.76 | $ | 0.53 | $ | (5.63 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

8,378,590 | 8,583,772 | 9,977,646 | 9,845,324 | 10,867,584 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

8,378,590 | 8,583,772 | 14,523,734 | 14,144,765 | 10,867,584 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net income (loss) per share attributable to common stockholders(2): |

||||||||||||||||||||

| Basic |

$ | 0.89 | $ | (0.92 | ) | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

$ | 0.82 | $ | (0.92 | ) | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Pro forma weighted average shares outstanding(3): |

||||||||||||||||||||

| Basic |

50,945,159 | 59,378,923 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

55,491,248 | 59,378,923 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (1) | Under GAAP, we are required to present the impact of a hypothetical liquidation of our joint venture investment funds on our income statement. For a more detailed discussion of this accounting treatment, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Components of Results of Operations—Net Income (Loss) Attributable to Stockholders.” |

9

Table of Contents

| (2) | Pro forma net income (loss) attributable to common stockholders assumes the distribution of a deemed dividend on Series G convertible redeemable preferred stock prior to conversion to common stock, the net exercise of the warrants to purchase Series C and F convertible redeemable preferred stock, based upon the mid-point of the price range on the cover of this prospectus, and the conversion of the Series E convertible redeemable preferred stock warrants into warrants to purchase common stock as occurring at the beginning of the fiscal period. Accordingly, the charge for the change in the fair value of the convertible redeemable preferred stock warrant liability recorded in the fiscal period is reversed because this charge would not have been recorded after the net exercise and conversion. Pro forma basic or diluted net income (loss) per share attributable to common stockholders is calculated by dividing the pro forma net income (loss) attributable to common stockholders by the weighted average basic or diluted pro forma shares of common stock. See Note 22 of the notes to our consolidated financial statements for a description of how we compute basic and diluted earnings per share attributable to common stockholders and pro forma basic and diluted earnings per share attributable to common stockholders. |

| (3) | Pro forma weighted average shares outstanding have been calculated assuming the conversion of all outstanding shares of our preferred stock upon the completion of this offering into (i) 42,060,393 shares of our common stock as of December 31, 2011, including the net exercise of warrants to purchase Series C and Series F convertible redeemable preferred stock into 167,347 shares of common stock and (ii) 50,441,799 shares of our common stock as of September 30, 2012, including the net exercise of warrants to purchase Series F convertible redeemable preferred stock into 63,853 shares of common stock, in each case based upon the mid-point of the price range on the cover of this prospectus. |

Our consolidated balance sheet as of September 30, 2012 is presented on:

| Ÿ | an actual basis; |

| Ÿ | a pro forma basis, giving effect to (i) the automatic conversion of all outstanding shares of our existing convertible preferred stock (other than our Series G convertible preferred stock) into one share of common stock and the conversion of all shares of our Series G convertible preferred stock into 8,372,065 shares of common stock, based upon the mid-point of the price range on the cover of this prospectus and the adjustment provisions relating to our Series G convertible preferred stock described in “Description of Capital Stock,” immediately prior to the closing of this offering, (ii) the net exercise of outstanding Series C and Series F convertible preferred stock warrants that would otherwise expire upon the completion of this offering, based upon the mid-point of the price range on the cover of this prospectus, and (iii) the reclassification of preferred stock warrant liabilities to additional paid-in capital effective upon the closing of this offering; and |

| Ÿ | a pro forma as adjusted basis, giving effect to the pro forma adjustments and our sale of 10,000,000 shares of common stock in this offering, based on an assumed initial public offering price of $14.00 per share, the mid-point of the price range on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses we will pay. |

10

Table of Contents

| As of September 30, 2012 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated balance sheet data: |

||||||||||||

| Cash and cash equivalents |

$ | 49,318 | $ | 49,318 | $ | 179,622 | ||||||

| Total current assets |

244,626 | 244,626 | 374,930 | |||||||||

| Solar energy systems, leased and to be leased – net |

858,746 | 858,746 | 858,746 | |||||||||

| Total assets |

1,151,171 | 1,151,171 | 1,278,121 | |||||||||

| Total current liabilities |

214,208 | 214,208 | 214,208 | |||||||||

| Deferred revenue, net of current portion |

179,584 | 179,584 | 179,584 | |||||||||

| Lease pass-through financing obligation, net of current portion |

134,988 | 134,988 | 134,988 | |||||||||

| Sale-leaseback financing obligation, net of current portion |

14,855 | 14,855 | 14,855 | |||||||||

| Other liabilities |

93,533 | 93,533 | 93,533 | |||||||||

| Convertible redeemable preferred stock |

208,420 | — | — | |||||||||

| Stockholders’ (deficit) equity |

(89,652 | ) | 139,476 | 266,426 | ||||||||

| Noncontrolling interests in subsidiaries |

34,179 | 34,179 | 34,179 | |||||||||

| (1) | The pro forma balance sheet data in the table above assumes (i) the conversion of all outstanding shares of convertible redeemable preferred stock into common stock, (ii) the net exercise of the outstanding Series F convertible redeemable preferred stock warrants, based upon the mid-point of the price range on the cover of this prospectus, and (iii) the reclassification of preferred stock warrant liabilities to additional paid-in capital, effective upon the closing of this offering. |

| (2) | The pro forma as adjusted balance sheet in the table above assumes the pro forma conversions, net exercise and reclassifications described in (1) above plus the sale of 10,000,000 shares of our common stock in this offering and the application of the net proceeds at an initial public offering price of $14.00, the mid-point range set forth in the cover page, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Each $1.00 increase or decrease in the assumed initial public offering price of $14.00 per share, the mid-point of the price range on the cover of this prospectus, would increase or decrease, as applicable, our cash, cash equivalents and short-term investments, working capital, total assets and total stockholders’ (deficit) equity by approximately $9.3 million, assuming that the number of shares we offer, as stated on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses we will pay. |

Key operating metrics:

We regularly review a number of metrics, including the following key operating metrics, to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections and make strategic decisions.

| Year Ended December 31, | Nine Months Ended September 30, 2012 |

|||||||||||||||

| 2009 | 2010 | 2011 | ||||||||||||||

| New buildings(1) |

2,907 | 4,832 | 9,034 | 23,340 | ||||||||||||

| Buildings (end of period)(1) |

5,866 | 10,698 | 19,732 | 43,072 | ||||||||||||

| Cumulative customers (end of period)(2) |

5,775 | 10,541 | 18,384 | 39,656 | ||||||||||||

| Megawatts booked(3) |

36 | 92 | 134 | 279 | ||||||||||||

| Megawatts deployed(3) |

15 | 31 | 72 | 109 | ||||||||||||

| Cumulative megawatts deployed (end of period)(3) |

27 | 58 | 129 | 239 | ||||||||||||

| Transactions for other energy products and services(4) |

67 | 400 | 3,716 | 10,433 | ||||||||||||

| (1) | Buildings includes all residential, commercial and government buildings where we have installed or contracted to install a solar energy system, or performed or contracted to perform an energy efficiency evaluation or other energy efficiency services. |

| (2) | Customers include all residential, commercial and government consumers that use or will use energy generated by a solar energy system that we have sold or contracted to sell to the consumer or that we have installed or contracted to install pursuant to a lease or power purchase agreement. For landlord-tenant structures in which we contract with the landlord or |

11

Table of Contents

| development company, we include each residence as an individual customer. For commercial customers with multiple locations, each location is deemed a customer if we maintain a separate contract for the location. |

| (3) | Megawatts booked represents the aggregate megawatt production capacity of solar energy systems pursuant to customer contracts signed during the applicable period. Megawatts deployed represents the aggregate megawatt production capacity of solar energy systems that have had all required inspections completed during the applicable period. Cumulative megawatts deployed represents the aggregate megawatt production capacity of operating solar energy systems subject to leases and power purchase agreements and solar energy systems we have sold to customers. |

| (4) | Transactions for other energy products and services includes all transactions during the period when we perform or contract to perform a service or provide, install or contract to install a product. It excludes the outright sale or installation of a solar energy system under a lease or power purchase agreement and any related monitoring. |

We also track the nominal contracted payments of our leases and power purchase agreements entered into during specific periods and as of specified dates. Nominal contracted payments equal the sum of the cash payments that the customer is obligated to pay over the term of the agreement. When calculating nominal contracted payments, we only include those leases and power purchase agreements that are signed. For a lease, we include the monthly fee and upfront fee as set forth in the lease. As an example, the nominal contracted payments for a 20-year lease with monthly payments of $200 and an upfront payment of $5,000 is $53,000. For a power purchase agreement, we multiply the contract price per kilowatt hour by the estimated annual energy output of the associated solar energy system to determine the nominal contracted payment. The nominal contracted payments of a particular lease or power purchase agreement decline as the payments are received by us or a fund investor. For a more detailed discussion, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Metrics.”

The following table sets forth, with respect to our leases and power purchase agreements, the aggregate nominal contracted payments of such agreements signed during the period presented and the aggregate nominal contracted payments remaining as of the end of each period presented as of the dates presented:

| As of December 31, | As of September 30, 2012 |

|||||||||||||||

| 2009 | 2010 | 2011 | ||||||||||||||

| (in thousands) | ||||||||||||||||

| Aggregate nominal contracted payments (agreements signed during period) |

$ | 65,234 | $ | 183,188 | $ | 252,752 | $ | 404,967 | ||||||||

| Aggregate nominal contracted payments (remaining as of period end) |

$ | 106,204 | $ | 273,166 | $ | 485,780 | $ | 831,810 | ||||||||

12

Table of Contents

Investing in our common stock involves a substantial risk of loss. You should carefully consider these risk factors, together with all of the other information included in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks occurred, it could materially adversely affect our business, financial condition or operating results. In that case, the trading price of our common stock could decline, and you may lose part or all of your investment. See the section entitled “Special Note Regarding Forward-Looking Statements and Industry Data” elsewhere in this prospectus.

Risks Related to our Business

Existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic barriers to the purchase and use of solar energy systems that may significantly reduce demand for our solar energy systems.

Federal, state and local government regulations and policies concerning the electric utility industry, and internal policies and regulations promulgated by electric utilities, heavily influence the market for electricity generation products and services. These regulations and policies often relate to electricity pricing and the interconnection of customer-owned electricity generation. In the United States, governments and utilities continuously modify these regulations and policies. These regulations and policies could deter customers from purchasing renewable energy, including solar energy systems. This could result in a significant reduction in the potential demand for our solar energy systems. For example, utilities commonly charge fees to larger, industrial customers for disconnecting from the electric grid or for having the capacity to use power from the electric grid for back-up purposes. These fees could increase our customers’ cost to use our systems and make them less desirable, thereby harming our business, prospects, financial condition and results of operations. In addition, depending on the region, electricity generated by solar energy systems competes most effectively with expensive peak-hour electricity from the electric grid, rather than the less expensive average price of electricity. Modifications to the utilities’ peak hour pricing policies or rate design, such as to a flat rate, would require us to lower the price of our solar energy systems to compete with the price of electricity from the electric grid.

In addition, any changes to government or internal utility regulations and policies that favor electric utilities could reduce our competitiveness and cause a significant reduction in demand for our products and services. For example, certain jurisdictions have proposed assessing fees on customers purchasing energy from solar energy systems and a utility in San Diego, California recently attempted to impose a new charge that would disproportionately impact solar energy system customers who utilize net metering, either of which would increase the cost of energy to those customers and could reduce demand for our solar energy systems. Any similar government or utility policies adopted in the future could reduce demand for our products and services and adversely impact our growth.

We rely on net metering and related policies to offer competitive pricing to our customers in some of our key markets.

Forty-three states have a regulatory policy known as net energy metering, or net metering. Each of the states and Washington, D.C., where we currently serve customers has adopted a net metering policy except for Texas, where certain individual utilities have adopted a policy similar to net metering. Net metering typically allows our customers to interconnect their on-site solar energy systems to the utility grid and offset their utility electricity purchases by receiving a bill credit at the utility’s retail rate for energy generated by their solar energy system in excess of electric load that is exported to the grid. At the end of the billing period, the customer simply pays for the net energy used or receives a credit at the retail rate if more energy is produced than consumed. Utilities operating in states without a net

13

Table of Contents

metering policy may receive solar electricity that is exported to the grid at times when there is no simultaneous energy demand by the customer to utilize the generation onsite without providing any compensation to the customer for this generation. Our ability to sell solar energy systems or the electricity they generate may be adversely impacted by the failure to expand existing limits on the amount of net metering in states that have implemented it, the failure to adopt a net metering policy where it currently is not in place or the imposition of new charges that only or disproportionately impact customers that utilize net metering. Our ability to sell solar energy systems or the electricity they generate also may be adversely impacted by the unavailability of expedited or simplified interconnection for grid-tied solar energy systems or any limitation on the number of customer interconnections or amount of solar energy that utilities are required to allow in their service territory or some part of the grid.

Limits on net metering, interconnection of solar energy systems and other operational policies in key markets could limit the number of solar energy systems installed there. For example, California utilities are currently required to provide net metering to their customers until the total generating capacity of net metered systems exceeds 5% of the utilities’ “aggregate customer peak demand.” This cap on net metering in California was increased to 5% in 2010 as utilities neared the prior cap of 2.5%. If the current net metering caps in California, or other jurisdictions, are reached, future customers will be unable to recognize the cost savings associated with net metering. We substantially rely on net metering when we establish competitive pricing for our prospective customers. The absence of net metering for new customers would greatly limit demand for our solar energy systems.

Our business currently depends on the availability of rebates, tax credits and other financial incentives. The expiration, elimination or reduction of these rebates, credits and incentives would adversely impact our business.

U.S. federal, state and local government bodies provide incentives to end users, distributors, system integrators and manufacturers of solar energy systems to promote solar electricity in the form of rebates, tax credits and other financial incentives such as system performance payments and payments for renewable energy credits associated with renewable energy generation. We rely on these governmental rebates, tax credits and other financial incentives to lower our cost of capital and to incent fund investors to invest in our funds. These incentives enable us to lower the price we charge customers for energy and for our solar energy systems. However, these incentives may expire on a particular date, end when the allocated funding is exhausted, or be reduced or terminated as solar energy adoption rates increase. These reductions or terminations often occur without warning.

The federal government currently offers a 30% investment tax credit under Section 48(a)(3) of the Internal Revenue Code, or the Federal ITC, for the installation of certain solar power facilities until December 31, 2016. This credit is due to adjust to 10% in 2017. Solar energy systems that began construction prior to the end of 2011 were eligible to receive a 30% federal cash grant paid by the U.S. Treasury Department under section 1603 of the “American Recovery and Reinvestment Act of 2009,” or the U.S. Treasury grant, in lieu of the Federal ITC. Pursuant to the Budget Control Act of 2011, U.S. Treasury grants apparently will be subject to sequestration beginning in 2013. The U.S. federal government’s Office of Management and Budget, in a report issued in September 2012, outlined the anticipated sequestration, which would result in a 7.6% reduction in spending for the U.S. Treasury grant program, with a resulting decrease in U.S. Treasury grants received by us. In addition, applicable authorities may adjust or decrease incentives from time to time or include provisions for minimum domestic content requirements or other requirements to qualify for these incentives.

Reductions in, or eliminations or expirations of, governmental incentives could adversely impact our results of operations and ability to compete in our industry by increasing our cost of capital, causing us to increase the prices of our energy and solar energy systems, and reducing the size of our

14

Table of Contents

addressable market. In addition, this would adversely impact our ability to attract investment partners and to form new investment funds and our ability to offer attractive financing to prospective customers. For the year ended December 31, 2011 and the nine months ended September 30, 2012, more than 90% of new customers chose to enter into financed lease or power purchase agreements rather than buying a solar energy system for cash.

Our business depends in part on the regulatory treatment of third-party owned solar energy systems.

Our leases and power purchase agreements are third-party ownership arrangements. Sales of electricity by third parties face regulatory challenges in some states and jurisdictions. Other challenges pertain to whether third-party owned systems qualify for the same levels of rebates or other non-tax incentives available for customer-owned solar energy systems, whether third-party owned systems are eligible at all for these incentives, and whether third-party owned systems are eligible for net metering and the associated significant cost savings. Reductions in, or eliminations of, this treatment of these third-party arrangements could reduce demand for our systems, adversely impact our access to capital and could cause us to increase the price we charge our customers for energy.

The Office of the Inspector General of the U.S. Department of Treasury has issued subpoenas to a number of significant participants in the rooftop solar energy installation industry, including us. The subpoena we received requires us to deliver certain documents in our possession relating to our participation in the U.S. Treasury grant program. These documents will be delivered to the Office of the Inspector General of the U.S. Department of Treasury, which is investigating the administration and implementation of the U.S. Treasury grant program.

In July 2012, we and other companies with significant market share, and other companies related to the solar industry, received subpoenas from the U.S. Department of Treasury’s Office of the Inspector General to deliver certain documents in our respective possession. In particular, our subpoena requested, among other things, documents dated, created, revised or referred to since January 1, 2007 that relate to our applications for U.S. Treasury grants or communications with certain other solar development companies or certain firms that appraise solar energy property for U.S. Treasury grant application purposes. The Inspector General is working with the Civil Division of the U.S. Department of Justice to investigate the administration and implementation of the U.S. Treasury grant program, including possible misrepresentations concerning the fair market value of the solar power systems submitted for grant under that program made in grant applications by companies in the solar industry, including us. We intend to cooperate fully with the Inspector General and the Department of Justice. We anticipate that at least six months will be required to gather all of the requested documents and provide them to the Inspector General, and at least another year following that for the Inspector General to conclude its review of the materials.

We are not aware of, and have not been made aware of, any specific allegations of misconduct or misrepresentation by us or our officers, directors or employees, and no such assertions have been made by the Inspector General or the Department of Justice. However, if at the conclusion of the investigation the Inspector General concludes that misrepresentations were made, the Department of Justice could decide to bring a civil action to recover amounts it believes were improperly paid to us. If it were successful in asserting this action, we could then be required to pay damages and penalties for any funds received based on such misrepresentations (which, in turn, could require us to make indemnity payments to certain of our fund investors). Such consequences could have a material adverse effect on our business, liquidity, financial condition and prospects. Additionally, the period of time necessary to resolve the investigation is uncertain, and this matter could require significant management and financial resources that could otherwise be devoted to the operation of our business.

15

Table of Contents

The Internal Revenue Service recently notified us that it is conducting an income tax audit of two of our investment funds.

In October of 2012, we were notified that the Internal Revenue Service was commencing income tax audits of two of our investment funds which audit will include a review of the fair market value of the solar power systems submitted for grant under the 1603 Grant Program. If, at the conclusion of the audits currently being conducted, the Internal Revenue Service determines that the valuations were incorrect and that our investment funds received U.S. Treasury grants in excess of the amounts to which they were entitled, we could be subject to tax liabilities, including interest and penalties, and we could be required to make indemnity payments to the fund investors.

If the Internal Revenue Service or the U.S. Treasury Department makes additional determinations that the fair market value of our solar energy systems is materially lower than what we have claimed, we may have to pay significant amounts to our investment funds or to our fund investors and such determinations could have a material adverse effect on our business, financial condition and prospects.

We and our fund investors claim the Federal ITC or the U.S. Treasury grant in amounts based on the fair market value of our solar energy systems. We have obtained independent appraisals to support the fair market values we report for claiming Federal ITCs and U.S. Treasury grants. The Internal Revenue Service and the U.S. Treasury Department review these fair market values. With respect to U.S. Treasury grants, the U.S. Treasury Department reviews the reported fair market value in determining the amount initially awarded, and the Internal Revenue Service and the U.S. Treasury Department may also subsequently audit the fair market value and determine that amounts previously awarded must be repaid to the U.S. Treasury Department. Such audits of a small number of our investment funds are ongoing. With respect to Federal ITCs, the Internal Revenue Service may review the fair market value on audit and determine that the tax credits previously claimed must be reduced. If the fair market value is determined in either of these circumstances to be less than we reported, we may owe the fund or our fund investors an amount equal to this difference, plus any costs and expenses associated with a challenge to that valuation. The U.S. Treasury Department has determined in a small number of instances to award us U.S. Treasury grants for our solar energy systems at a materially lower value than we had established in our appraisals and, as a result, we have been required to pay our fund investors a true-up payment or contribute additional assets to the associated investment funds. For example, in the fourth quarter of 2011, we had discussions with representatives of the U.S. Treasury Department relating to U.S. Treasury grant applications for certain commercial solar energy systems submitted in the third and fourth quarters of 2011 and the appropriate U.S. Treasury grant valuation guidelines for such systems. We were unsuccessful in our attempts to have the U.S. Treasury Department reconsider its valuation for these systems, and while we maintained the accuracy of the contracted value to the investment fund, we elected at that time to receive the lower amounts communicated by the U.S. Treasury Department. Other U.S. Treasury grant applications have been accepted and the U.S. Treasury grant paid in full on the basis of valuations comparable to those projects as to which the U.S. Treasury has determined a significantly lower valuation than that claimed in our U.S. Treasury grant applications. The U.S. Department of Treasury issued valuation guidelines on June 30, 2011, and no grant applications that we have submitted at values below those guidelines have been reduced by the U.S. Treasury Department. If the Internal Revenue Service or the U.S. Treasury Department disagrees now or in the future, as a result of any pending or future audit, the outcome of the Department of Treasury Inspector General investigation or otherwise, with the fair market value of more of our solar energy systems that we have constructed or that we construct in the future, including any systems for which grants have already been paid, and determines we have claimed too high of a fair market value, it could have a material adverse effect on our business, financial condition and prospects. For example, a hypothetical five percent downward adjustment in the fair market value in the approximately $341 million of U.S. Department of Treasury grant applications that we have submitted as of September 30, 2012 would obligate us to repay approximately $17 million to our fund investors.

16

Table of Contents

Our ability to provide solar energy systems to customers on an economically viable basis depends on our ability to finance these systems with fund investors who require particular tax and other benefits.

Our solar energy systems have been eligible for Federal ITCs or U.S. Treasury grants, as well as depreciation benefits. We have relied on, and will continue to rely on, financing structures that monetize a substantial portion of those benefits and provide financing for our solar energy systems. With the lapse of the U.S. Treasury grant program, we anticipate that our reliance on these tax-advantaged financing structures will increase substantially. If, for any reason, we were unable to continue to monetize those benefits through these arrangements, we may be unable to provide and maintain solar energy systems for new customers on an economically viable basis.

The availability of this tax-advantaged financing depends upon many factors, including:

| Ÿ | our ability to compete with other renewable energy companies for the limited number of potential fund investors, each of which has limited funds and limited appetite for the tax benefits associated with these financings; |

| Ÿ | the state of financial and credit markets; |

| Ÿ | changes in the legal or tax risks associated with these financings; and |

| Ÿ | non-renewal of these incentives or decreases in the associated benefits. |

Under current law, the Federal ITC will be reduced from approximately 30% of the cost of the solar energy systems to approximately 10% for solar energy systems placed in service after December 31, 2016. In addition, U.S. Treasury grants are no longer available for new solar energy systems. Moreover, potential fund investors must remain satisfied that the structures we offer make the tax benefits associated with solar energy systems available to these investors, which depends both on the investors’ assessment of the tax law and the absence of any unfavorable interpretations of that law. Changes in existing law and interpretations by the Internal Revenue Service and the courts could reduce the willingness of fund investors to invest in funds associated with these solar energy system investments. We cannot assure you that this type of financing will be available to us. If, for any reason, we are unable to finance solar energy systems through tax-advantaged structures or if we are unable to realize or monetize depreciation benefits, we may no longer be able to provide solar energy systems to new customers on an economically viable basis. This would have a material adverse effect on our business, financial condition and results of operations.

We need to enter into additional substantial financing arrangements to facilitate our customers’ access to our solar energy systems, and if this financing is not available to us on acceptable terms, if and when needed, our ability to continue to grow our business would be materially adversely impacted.

Our future success depends on our ability to raise capital from third-party fund investors to help finance the deployment of our residential and commercial solar energy systems. In particular, our strategy is to seek to reduce the cost of capital through these arrangements to improve our margins or to offset future reductions in government incentives and to maintain the price competitiveness of our solar energy systems. If we are unable to establish new investment funds when needed, or upon desirable terms, to enable our customers’ access to our solar energy systems with little or no upfront cost, we may be unable to finance installation of our customers’ systems, or our cost of capital could increase, either of which would have a material adverse effect on our business, financial condition and results of operations. To date we have raised capital sufficient to finance installation of our customers’ solar energy systems from a number of financial institutions and other large companies. The contract terms in certain of our investment fund documents condition our ability to draw on investment

17

Table of Contents

commitments from the fund investors, including if an event occurs that could reasonably be expected to have a material adverse effect on the fund or in one case on us. If we do not satisfy such condition due to events related to our business or a specific investment fund or developments in our industry (including related to the Department of Treasury Inspector General investigation) or otherwise, and as a result we are unable to draw on existing commitments, it could have a material adverse effect on our business, liquidity, financial condition and prospects. If any of the financial institutions or large companies that currently invest in our investment funds decide not to invest in future investment funds to finance our solar energy systems due to general market conditions, concerns about our business or prospects, the pendency of the Department of Treasury Inspector General investigation or any other reason, or materially change the terms under which they are willing to provide future financing, we will need to identify new financial institutions and companies to invest in our investment funds and negotiate new financing terms.

In the past, we encountered challenges raising new funds, which caused us to delay deployment of a substantial number of solar energy systems for which we had signed leases or power purchase agreements with customers. For example, in late 2008 and early 2009, as a result of the state of the capital markets, our ability to finance the installation of solar energy systems was limited and resulted in a significant backlog of signed sales orders for solar energy systems. Our future ability to obtain additional financing depends on banks’ and other financing sources’ continued confidence in our business model and the renewable energy industry as a whole. It could also be impacted by the liquidity needs of such financing sources themselves. For example, we have become aware that one of our financing sources is in the process of selling its tax equity portfolio, including its interest in our investment funds. If we experience higher customer default rates than we currently experience in our existing investment funds or we lower the credit rating requirement for new customers, this could make it more difficult or costly to attract future financing. Solar energy has yet to achieve broad market acceptance and depends on continued support in the form of performance-based incentives, rebates, tax credits and other incentives from federal, state and foreign governments. If this support diminishes, our ability to obtain external financing on acceptable terms, or at all, could be materially adversely affected. In addition, we face competition for these investor funds. If we are unable to continue to offer a competitive investment profile, we may lose access to these funds or they may only be available on less favorable terms than our competitors. Our current financing sources may be inadequate to support the anticipated growth in our business plans. Our inability to secure financing could lead to cancelled projects and could impair our ability to accept new projects and customers. In addition, our borrowing costs could increase, which would have a material adverse effect on our business, financial condition and results of operations.

A material drop in the retail price of utility-generated electricity or electricity from other sources would harm our business, financial condition and results of operations.

We believe that a customer’s decision to buy renewable energy from us is primarily driven by their desire to pay less for electricity. The customer’s decision may also be affected by the cost of other renewable energy sources. Decreases in the retail prices of electricity from the utilities or from other renewable energy sources would harm our ability to offer competitive pricing and could harm our business. The price of electricity from utilities could decrease as a result of:

| Ÿ | the construction of a significant number of new power generation plants, including nuclear, coal, natural gas or renewable energy technologies; |

| Ÿ | the construction of additional electric transmission and distribution lines; |

| Ÿ | a reduction in the price of natural gas as a result of new drilling techniques or a relaxation of associated regulatory standards; |

18

Table of Contents

| Ÿ | the energy conservation technologies and public initiatives to reduce electricity consumption; and |

| Ÿ | development of new renewable energy technologies that provide less expensive energy. |

A reduction in utility electricity prices would make the purchase of our solar energy systems or the purchase of energy under our lease and power purchase agreements less economically attractive. In addition, a shift in the timing of peak rates for utility-generated electricity to a time of day when solar energy generation is less efficient could make our solar energy system offerings less competitive and reduce demand for our products and services. If the retail price of energy available from utilities were to decrease due to any of these reasons, or others, we would be at a competitive disadvantage, we may be unable to attract new customers and our growth would be limited.

A material drop in the retail price of utility-generated electricity would particularly adversely impact our ability to attract commercial customers.

Commercial customers comprise a significant and growing portion of our business, and the commercial market for energy is particularly sensitive to price changes. Typically, commercial customers pay less for energy from utilities than residential customers. Because the price we are able to charge commercial customers is only slightly lower than their current retail rate, any decline in the retail rate of energy for commercial entities could have a significant impact on our ability to attract commercial customers. We may be unable to offer solar energy systems for the commercial market that produce electricity at rates that are competitive with the price of retail electricity on a non-subsidized basis. If this were to occur, we would be at a competitive disadvantage to other energy providers and may be unable to attract new commercial customers, and our business would be harmed.

Rising interest rates could adversely impact our business.

Changes in interest rates could have an adverse impact on our business by increasing our cost of capital. For example:

| Ÿ | rising interest rates would increase our cost of capital; and |

| Ÿ | rising interest rates may negatively impact our ability to secure financing on favorable terms to facilitate our customers’ purchase of our solar energy systems or energy generated by our solar energy systems. |

The majority of our cash flows to date have been from solar energy systems under lease and power purchase agreements that have been monetized under various investment fund structures. One of the components of this monetization is the present value of the payment streams from the customers who enter into these leases and power purchase agreements. If the rate of return required by the fund investor rises as a result of a rise in interest rates, it will reduce the present value of the customer payment stream and consequently reduce the total value derived from this monetization. Rising interest rates could harm our business and financial condition.

We have guaranteed a minimum return to be received by an investor in certain of our investment funds and could be adversely affected if we are required to make any payments under those guarantees.

For three of our joint venture investment funds with one investor, with total investments of approximately $86.2 million, we are contractually required to make payments to the investor to ensure the investor achieves a specified minimum internal rate of return in the event of liquidation of the funds or if we purchase the investor’s equity stake in the funds, including following the investor’s exercise of its put

19

Table of Contents