Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MATTRESS FIRM HOLDING CORP. | a12-28629_18k.htm |

Exhibit 99.1

FOR IMMEDIATE RELEASE

MATTRESS FIRM ANNOUNCES THIRD FISCAL QUARTER FINANCIAL RESULTS

— Net Sales Increased 51.1% with 6.6% Comparable-Store Sales Growth —

— Earnings per Diluted Share of $0.47 on an Adjusted Basis, $0.37 on a GAAP basis —

— Strengthens Market Leadership In North and South Carolina with Agreement to Acquire 28 Stores —

— Updates Financial Guidance for Fiscal 2012 —

HOUSTON, December 4, 2012 /BUSINESSWIRE/ — Mattress Firm Holding Corp. (NASDAQ: MFRM) today announced its financial results for the third fiscal quarter (13 weeks) ended October 30, 2012. Net sales for the third fiscal quarter increased 51.1% to $277.3 million, reflecting comparable-store sales growth of 6.6% and an increase in store units from new store openings and acquisitions. The Company reported third-quarter GAAP earnings per diluted share (“EPS”) of $0.37. Excluding acquisition-related costs and secondary offering costs, adjusted earnings per diluted share (“Adjusted EPS”) for the third fiscal quarter were $0.47. Diluted EPS on a generally accepted accounting principles (“GAAP”) basis and non-GAAP (“Adjusted”) basis are reconciled in the table below:

Third Fiscal Quarter Reconciliation of GAAP to Adjusted EPS

See “Reported to Adjusted Statements of Operations Data” for Notes

|

|

|

Thirteen Weeks |

|

Thirty-Nine Weeks |

| ||

|

|

|

Ended |

|

Ended |

| ||

|

|

|

October 30, 2012 |

|

October 30, 2012 |

| ||

|

GAAP EPS |

|

$ |

0.37 |

|

$ |

0.95 |

|

|

Acquisition-related costs (1) |

|

0.05 |

|

0.20 |

| ||

|

Secondary offering costs (2) |

|

0.04 |

|

0.04 |

| ||

|

Adjusted EPS * |

|

$ |

0.47 |

|

$ |

1.19 |

|

* Due to rounding to the nearest cent, totals may not equal the sum of the lines in the table above.

“We have continued to drive strong performance as evidenced by our 6.6% and 8.8% comparable-store sales growth in the third fiscal quarter and the first nine months of fiscal 2012, respectively, while adding more than 280 net stores through accretive acquisitions and new store openings since the beginning of this fiscal year,” stated Steve Stagner, Mattress Firm’s president and chief executive officer. “Our core strategy of further penetrating our existing and new markets continues to result in increased market share and profitability, and the acquired stores continue to generate total sales above our initial expectations. We believe we are well positioned to drive revenue and earnings in the coming years through store growth and our relative market share strategy. However, our expectations for the balance of this fiscal year are now below our previous plan in light of recent sales trends that continue to be impacted by ticket pressures and, beginning in early November, lower traffic growth. We expect that targeted initiatives being deployed internally will address many of our sales challenges. It is important to keep in context that in fiscal 2012, even after giving effect to our updated guidance, we expect to achieve impressive full year revenue and operating earnings growth in excess of 40% over the prior year. As we look to fiscal 2013, we remain confident that the execution of our growth strategy and improving operating efficiencies will drive market share and EPS gains.”

Third Quarter Financial Summary

· Net sales increased 51.1% to $277.3 million in the third fiscal quarter of 2012, reflecting comparable-store sales growth of 6.6% and growth in store units from new store openings and acquisitions.

5815 Gulf Freeway · Houston, TX · 77023 · Phone: 713-923-1090 · Fax: 713-923-1096

· Company-operated stores increased to 1,011 as of the end of the third fiscal quarter. During the quarter, the Company opened 31 new stores, closed 11, and added 34 from the acquisition of Mattress X-Press in September 2012.

· Income from operations for the third fiscal quarter was $23.0 million. Excluding $5.0 million of acquisition-related and secondary offering costs, adjusted income from operations was $28.0 million, representing an increase of $6.6 million, or 30.9%, over the prior year.

· Adjusted operating margin in the third fiscal quarter increased 112 basis-points over the second fiscal quarter of fiscal 2012, and such improvement included a 40 basis-point improvement in gross margin, a 107 basis-point decrease in selling and marketing expense, offset by a 35 basis-point increase in general and administrative expense and other items. Adjusted operating margin in the third fiscal quarter was 10.1% as compared to 11.7% in the same quarter of 2011, and such decrease included a 177 basis-point increase in selling and marketing expense, a 20 basis-point increase in other expense categories, offset by a 41 basis-point decrease in general and administrative expense.

· Acquisition-related costs included in income from operations related to the Mattress Giant and Mattress X-Press acquisitions totaled $3.0 million during the third fiscal quarter and consisted of $0.5 million classified as cost of sales attributable to duplicate warehouse facilities and costs of remerchandising the acquired stores, and $2.5 million classified as general and administrative expenses related to direct costs of the transactions, costs of retraining personnel and duplicate costs of the Mattress Giant corporate office.

· The Company completed the public offering of 5,435,684 shares of its common stock by certain of its shareholders on October 10, 2012. The Company did not sell any shares of common stock in the offering and did not receive any proceeds from the sale. The Company incurred approximately $1.9 million in costs related to the offering.

Acquisitions

In September 2012, the Company completed the acquisition of the assets and operations of Mattress XPress, Inc. and Mattress XPress of Georgia, Inc. (collectively “Mattress X-Press”), including 29 mattress specialty stores located primarily in South Florida and five stores in Georgia, for approximately $13.2 million. The Company has commenced rebranding of the Mattress X-Press stores as Mattress Firm, with completion anticipated to occur by the end of fiscal 2012.

Subsequent to the end of the third fiscal quarter, in November 2012, the Company entered into an agreement to acquire the assets and operations of Factory Mattress & Water Bed Outlet of Charlotte, Inc. (dba “Mattress Source”), including 28 mattress specialty stores in North Carolina and South Carolina, for approximately $11.2 million, subject to customary adjustments. The closing of the acquisition, which is conditioned on the prior satisfaction of customary closing conditions, is expected to occur by the end of the fourth fiscal quarter of 2012 and will be funded by cash reserves and revolver borrowings. The Company intends to rebrand the stores as Mattress Firm subsequent to the closing of the transaction.

Consistent with our core relative market share strategy, the Mattress X-Press and pending Mattress Source acquisitions will add stores in markets where Mattress Firm currently has company-operated stores. The addition of the acquired stores, once rebranded, is expected to drive advertising efficiency and improved market-level profitability in those markets.

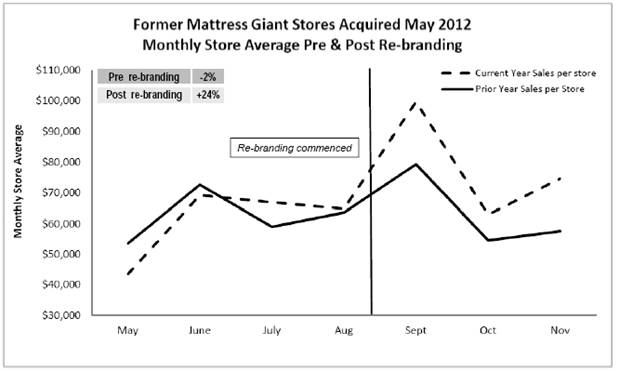

The effect of rebranding on the sales per store performance of the former Mattress Giant stores has continued to be positive, as demonstrated by the charts below:

Year-to-Date Financial Summary

Net revenues increased $233.7 million, or 45.4%, to $749.1 million, for the three fiscal quarters (thirty-nine weeks) ended October 30, 2012, from $515.4 million in the comparable prior-year period, reflecting comparable-store sales growth of 8.8% and an increase in store units from new store openings and acquisitions.

The Company opened 88 new stores and acquired 215 stores, while closing 21 stores in the first nine months of fiscal 2012, adding 282 net store units, an increase of 38.7%.

Net income was $32.3 million for the three fiscal quarters ended October 30, 2012 and GAAP EPS was $0.95. Excluding acquisition-related and secondary offering costs, and related tax effects, adjusted net income was $40.4 million for the three fiscal quarters and Adjusted EPS was $1.19. See “Reported to Adjusted Statements of Operations Data” below for a reconciliation of net income as reported to adjusted net income.

Balance Sheet

The Company had cash and cash equivalents of $10.9 million at the end of the third fiscal quarter on October 30, 2012. On November 5, 2012, the Company completed an amendment of its senior credit agreement. As a result of the amendment, the maturity of term borrowings in the aggregate amount of $200 million was extended by two years to January 18, 2016, the maturity of the revolving loan facility was extended by two years to January 18, 2015 and the revolving loan commitment was increased to $100 million from the previous commitment of $35 million. The interest rate on the extended term borrowings was revised to LIBOR plus a margin of 3.5%, representing a 1.25% increase over the previous rate. Furthermore, the annual amount of permitted capital expenditures was increased to $80 million from the previous annual amount of $40 million, beginning with fiscal 2012.

Financial Guidance

The Company expects the pending acquisition of 28 Mattress Source stores to add incremental sales during the fourth fiscal quarter of 2012 of approximately $2.0 million. Such sales estimates anticipate temporary closings of the stores while rebranding efforts are undertaken. The impact on EPS during the fourth fiscal quarter of 2012 is expected to be a reduction of $0.03 that is attributable to acquisition-related costs. The Company expects that these acquired stores will be accretive to EPS for the fiscal year (52 weeks) ending January 28, 2014 (“fiscal 2013”) by $0.05 to $0.06 as a result of expected increases in sales volumes and improvement in operational efficiencies of the rebranded stores.

The Company is updating its outlook for fiscal 2012 to include the anticipated results from the pending acquisition of 28 Mattress Source stores, actual results through the third quarter, and the Company’s expectation of future results based on information currently known. Furthermore, the Company intends to rebrand approximately 20 additional stores to Mattress Firm during the first quarter of fiscal 2013 that were acquired in December 2010 and are currently operated under the name Mattress Discounters, which will have an effect on fiscal 2012 results. The GAAP EPS guidance for fiscal 2012 includes a noncash impairment charge that will be recorded in the fiscal fourth quarter of $2.1 million, before income tax benefit, related to the Mattress Discounters intangible trade name asset.

Revised Revenue and Diluted Earnings per Share (EPS) Guidance:

|

Full Fiscal Year Ending January 29, 2013 |

|

Prior Guidance Range |

|

Updated Range |

| |

|

|

|

|

|

|

| |

|

Revenue (in billions) |

|

$1.022 to $1.039 |

|

$1.010 to $1.015 |

| |

|

New Stores |

|

100 |

|

115 to 120 |

| |

|

GAAP EPS |

|

$1.47 to $1.50 |

|

$1.18 to $1.21 |

| |

|

Acquisition-related costs |

|

$0.20 to $0.23 |

|

$0.23 |

| |

|

Secondary offering costs |

|

— |

|

$0.04 |

| |

|

Noncash impairment charge |

|

— |

|

$0.04 |

| |

|

Adjusted EPS |

|

$1.67 to $1.73 |

|

|

$1.49 to $1.52 |

|

|

Comparable-store sales increase |

|

7% to 9% |

|

|

6% to 6.5% |

|

For the fourth fiscal quarter ending January 29, 2013, the Company expects net sales in a range from $261 million to $266 million, GAAP EPS in a range from $0.23 to $0.26, and Adjusted EPS in the range of $0.30 to $0.33, excluding

acquisition-related costs, secondary offering costs and noncash impairment charge. Comparable-store sales are expected to be in the range of flat to an increase of 2.0%.

Call Information

A conference call to discuss third fiscal quarter results is scheduled for today, December 4, 2012, at 5:00 p.m. Eastern Time. The call will be hosted by Steve Stagner, president and chief executive officer, and Jim Black, chief financial officer.

The conference call will be accessible by telephone and the Internet. To access the call, participants from within the U.S. may dial (877) 407-3982, and participants from outside the U.S. may dial (201) 493-6780. Participants may also access the call via live webcast by visiting the Company’s investor relations Web site at www.mattressfirm.com.

The replay of the call will be available from approximately 8:00 p.m. Eastern Time on December 4, 2012 through midnight Eastern Time on December 18, 2012. To access the replay, the domestic dial-in number is (877) 870-5176, the international dial-in number is (858) 384-5517, and the passcode is 404236. The archive of the webcast will be available on the Company’s Web site for a limited time.

Net Sales and Store Unit Information

The components of the net sales increase were as follows (in millions):

|

|

|

Increase (decrease) in net sales |

| ||||

|

|

|

Thirteen Weeks |

|

Thirty-Nine Weeks |

| ||

|

|

|

Ended |

|

Ended |

| ||

|

|

|

October 30, 2012 |

|

October 30, 2012 |

| ||

|

Comparable-store sales |

|

$ |

12.0 |

|

$ |

44.8 |

|

|

New stores |

|

33.9 |

|

93.8 |

| ||

|

Acquired stores |

|

49.9 |

|

101.3 |

| ||

|

Closed stores |

|

(2.0 |

) |

(6.2 |

) | ||

|

|

|

$ |

93.8 |

|

$ |

233.7 |

|

The composition of net sales by major category of product and services were as follows (in millions):

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| ||||||||||||||||

|

|

|

November 1, |

|

% of |

|

October 30, |

|

% of |

|

November 1, |

|

% of |

|

October 30, |

|

% of |

| ||||

|

|

|

2011 |

|

Total |

|

2012 |

|

Total |

|

2011 |

|

Total |

|

2012 |

|

Total |

| ||||

|

Specialty mattresses |

|

$ |

86.0 |

|

46.9 |

% |

$ |

144.8 |

|

52.2 |

% |

$ |

225.1 |

|

43.7 |

% |

$ |

378.7 |

|

50.6 |

% |

|

Conventional mattresses |

|

82.0 |

|

44.7 |

% |

109.3 |

|

39.4 |

% |

245.1 |

|

47.6 |

% |

307.2 |

|

41.0 |

% | ||||

|

Furniture and accessories |

|

11.6 |

|

6.3 |

% |

17.9 |

|

6.5 |

% |

33.8 |

|

6.6 |

% |

49.2 |

|

6.6 |

% | ||||

|

Total product sales |

|

179.6 |

|

97.9 |

% |

272.0 |

|

98.1 |

% |

504.0 |

|

97.8 |

% |

735.1 |

|

98.1 |

% | ||||

|

Delivery service revenues |

|

3.9 |

|

2.1 |

% |

5.3 |

|

1.9 |

% |

11.4 |

|

2.2 |

% |

14.0 |

|

1.9 |

% | ||||

|

Total net sales |

|

$ |

183.5 |

|

100.0 |

% |

$ |

277.3 |

|

100.0 |

% |

$ |

515.4 |

|

100.0 |

% |

$ |

749.1 |

|

100.0 |

% |

Prior-year components of the Company’s net sales have been reallocated between specialty mattresses and conventional mattresses to be consistent with current-year presentation.

The activity with respect to the number of Company-operated store units was as follows:

|

|

|

Thirteen Weeks |

|

Thirty-Nine Weeks |

|

|

|

|

Ended |

|

Ended |

|

|

|

|

October 30, 2012 |

|

October 30, 2012 |

|

|

Store units, beginning of period |

|

957 |

|

729 |

|

|

New stores |

|

31 |

|

88 |

|

|

Acquired stores |

|

34 |

|

215 |

|

|

Closed stores |

|

(11 |

) |

(21 |

) |

|

Store units, end of period |

|

1,011 |

|

1,011 |

|

Forward-Looking Statements

Certain statements contained in this press release are not based on historical fact and are “forward-looking statements” within the meaning of applicable federal securities laws and regulations. In many cases, you can identify forward-looking statements by terminology such as “may,” “would,” “should,” “could,” “forecast,” “feel,” “project,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “continue” or the negative of these terms or other comparable terminology; however, not all forward-looking statements contain these identifying words. The forward-looking statements contained in this press release, such as those relating to our net sales and EPS for fiscal year 2012, the pending acquisition of Mattress Source stores, the rebranding and integration of these and other recently acquired stores and the effect of such stores on our net sales and EPS for fiscal 2012, and our EPS for fiscal 2013, are subject to various risks and uncertainties, including but not limited to downturns in the economy and a reduction in discretionary spending by consumers; our ability to execute our key business strategies and advance our market-level profitability; our ability to profitably open and operate new stores and capture additional market share; our relationship with our primary mattress suppliers; our dependence on a few key employees; the possible impairment of our goodwill or other acquired intangible assets; the effect of our planned growth and the integration of our acquisitions (including our recent acquisition of Mattress Giant and the operations of Mattress X-Press and the pending acquisition of the Mattress Source operations) on our business infrastructure; the impact of seasonality on our financial results and comparable-store sales; our ability to raise adequate capital to support our expansion strategy; our success in pursuing and completing strategic acquisitions; the effectiveness and efficiency of our advertising expenditures; our success in keeping warranty claims and comfort exchange return rates within acceptable levels; our ability to deliver our products in a timely manner; our status as a holding company with no business operations; our ability to anticipate consumer trends; risks related to our controlling stockholder, J.W. Childs Associates, L.P.; heightened competition; changes in applicable regulations; risks related to our franchises, including our lack of control over their operation and our liabilities if they default on note or lease obligations; risks related to our stock and other factors set forth under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 31, 2012 filed with the Securities and Exchange Commission (“SEC”) on April 20, 2012 (as amended on May 30, 2012) and our other SEC filings. Forward-looking statements relate to future events or our future financial performance and reflect management’s expectations or beliefs concerning future events as of the date of this press release. Actual results of operations may differ materially from those set forth in any forward-looking statements, and the inclusion of a projection or forward-looking statement in this press release should not be regarded as a representation by us that our plans or objectives will be achieved. Except as required by applicable law, we do not undertake to publicly update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

Adjusted EBITDA is defined as net income before income tax expense, interest income, interest expense, depreciation and amortization (“EBITDA”), without giving effect to non-cash goodwill and intangible asset impairment charges, gains or losses on store closings and impairment of store assets, gains or losses related to the early extinguishment of debt, financial sponsor fees and expenses, non-cash charges related to stock based awards and other items that are excluded by management in reviewing the results of operations. We have presented Adjusted EBITDA because we believe that the exclusion of these items is appropriate to provide additional information to investors about our ongoing operating performance excluding certain non-cash and other items and to provide additional information with respect to our ability to comply with various covenants in documents governing our indebtedness and as a means to evaluate our period-to-period results. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed to imply that our future results will be unaffected by any such adjustments. We have provided this information

to analysts, investors and other third parties to enable them to perform more meaningful comparisons of past, present and future operating results and as a means to evaluate the results of our ongoing operations. Management also uses Adjusted EBITDA to determine executive incentive compensation payment levels. In addition, our compliance with certain covenants under the credit agreement between our indirect wholly owned subsidiary, Mattress Holding Corp., certain lenders, and UBS Securities LLC, as sole arranger and bookrunner and a lender, are calculated based on similar measures, which differ from Adjusted EBITDA primarily by the inclusion of pro forma results for acquired businesses in those similar measures. Other companies in our industry may calculate Adjusted EBITDA differently than we do. Adjusted EBITDA is not a measure of performance under U.S. GAAP and should not be considered as a substitute for net income prepared in accordance with U.S. GAAP. Adjusted EBITDA has significant limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under U.S. GAAP.

The following table contains a reconciliation of our net income determined in accordance with U.S. GAAP to EBITDA and Adjusted EBITDA for the periods indicated (in thousands):

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| ||||||||

|

|

|

November 1, |

|

October 30, |

|

November 1, |

|

October 30 |

| ||||

|

|

|

2011 |

|

2012 |

|

2011 |

|

2012 |

| ||||

|

Net income |

|

$ |

12,314 |

|

$ |

12,456 |

|

$ |

16,979 |

|

$ |

32,277 |

|

|

Income tax expense |

|

551 |

|

8,484 |

|

870 |

|

19,972 |

| ||||

|

Interest income |

|

(1 |

) |

— |

|

(4 |

) |

(1 |

) | ||||

|

Interest expense |

|

8,530 |

|

2,097 |

|

25,479 |

|

6,386 |

| ||||

|

Depreciation and amortization |

|

4,234 |

|

6,257 |

|

12,951 |

|

16,432 |

| ||||

|

Intangible assets and other amortization |

|

439 |

|

(215 |

) |

1,254 |

|

972 |

| ||||

|

EBITDA |

|

26,067 |

|

29,079 |

|

57,529 |

|

76,038 |

| ||||

|

Loss on store closings and impairment of store assets |

|

285 |

|

196 |

|

324 |

|

267 |

| ||||

|

Loss from debt extinguishment |

|

— |

|

— |

|

1,873 |

|

— |

| ||||

|

Financial sponsor fees and expenses |

|

102 |

|

12 |

|

294 |

|

63 |

| ||||

|

Stock-based compensation |

|

19 |

|

651 |

|

58 |

|

1,653 |

| ||||

|

Secondary offering costs |

|

— |

|

1,935 |

|

— |

|

1,935 |

| ||||

|

Vendor new store funds (a) |

|

473 |

|

304 |

|

773 |

|

937 |

| ||||

|

Acquisition related expenses (b) |

|

70 |

|

3,025 |

|

178 |

|

10,074 |

| ||||

|

Other (c) |

|

242 |

|

(132 |

) |

924 |

|

(896 |

) | ||||

|

Adjusted EBITDA |

|

$ |

27,258 |

|

$ |

35,070 |

|

$ |

61,953 |

|

$ |

90,071 |

|

(a) Adjustment to recognize vendor funds received upon the opening of a new store in the period opened, rather than over 36-months as presented in our financial statements, which is consistent with how management has historically reviewed its results of operations.

(b) Noncash effect included in net income related to purchase accounting adjustments made to inventories resulting from acquisitions and other acquisition-related cash costs included in net income, such as direct acquisition costs and costs related to training and integration of acquired businesses.

(c) Consists of various items that management excludes in reviewing the results of operations.

As Adjusted EPS and the other “As Adjusted” data provided in this press release are also considered non-GAAP financial measures. For more information, please refer to “Reported to Adjusted Statements of Operations Data” below.

MATTRESS FIRM HOLDING CORP.

Consolidated Balance Sheets

(In thousands, except share amounts)

|

|

|

January 31, |

|

October 30, |

| ||

|

|

|

2012 |

|

2012 |

| ||

|

|

|

|

|

(unaudited) |

| ||

|

Assets |

|

|

|

|

| ||

|

Current assets: |

|

|

|

|

| ||

|

Cash and cash equivalents |

|

$ |

47,946 |

|

$ |

10,855 |

|

|

Accounts receivable, net |

|

18,607 |

|

28,187 |

| ||

|

Inventories |

|

40,961 |

|

62,181 |

| ||

|

Deferred income taxes |

|

12,574 |

|

6,357 |

| ||

|

Prepaid expenses and other current assets |

|

12,054 |

|

15,715 |

| ||

|

Total current assets |

|

132,142 |

|

123,295 |

| ||

|

Property and equipment, net |

|

95,674 |

|

133,905 |

| ||

|

Intangible assets, net |

|

84,795 |

|

91,206 |

| ||

|

Goodwill |

|

291,141 |

|

345,423 |

| ||

|

Debt issue costs and other, net |

|

9,729 |

|

10,839 |

| ||

|

Total assets |

|

$ |

613,481 |

|

$ |

704,668 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

| ||

|

Current liabilities: |

|

|

|

|

| ||

|

Notes payable and current maturities of long-term debt |

|

$ |

2,414 |

|

$ |

6,953 |

|

|

Accounts payable |

|

42,396 |

|

76,952 |

| ||

|

Accrued liabilities |

|

31,780 |

|

41,447 |

| ||

|

Customer deposits |

|

6,294 |

|

8,290 |

| ||

|

Total current liabilities |

|

82,884 |

|

133,642 |

| ||

|

Long-term debt, net of current maturities |

|

225,940 |

|

225,630 |

| ||

|

Deferred income taxes |

|

31,045 |

|

25,840 |

| ||

|

Other noncurrent liabilities |

|

49,353 |

|

61,367 |

| ||

|

Total liabilities |

|

389,222 |

|

446,479 |

| ||

|

|

|

|

|

|

| ||

|

Stockholders’ equity: |

|

|

|

|

| ||

|

Common stock, $0.01 par value; 120,000,000 shares authorized; 33,768,828 shares issued and outstanding at January 31, 2012 and October 30, 2012 |

|

338 |

|

338 |

| ||

|

Additional paid-in capital |

|

361,717 |

|

363,370 |

| ||

|

Accumulated deficit |

|

(137,796 |

) |

(105,519 |

) | ||

|

Total stockholders’ equity |

|

224,259 |

|

258,189 |

| ||

|

Total liabilities and stockholders’ equity |

|

$ |

613,481 |

|

$ |

704,668 |

|

MATTRESS FIRM HOLDING CORP.

Consolidated Statements of Operations

(In thousands, except share and per share amounts)

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| ||||||||||||||||

|

|

|

November 1, |

|

% of |

|

October 30, |

|

% of |

|

November 1, |

|

% of |

|

October 30, |

|

% of |

| ||||

|

|

|

2011 |

|

Sales |

|

2012 |

|

Sales |

|

2011 |

|

Sales |

|

2012 |

|

Sales |

| ||||

|

Net sales |

|

$ |

183,514 |

|

100 |

% |

$ |

277,259 |

|

100 |

% |

$ |

515,352 |

|

100 |

% |

$ |

749,091 |

|

100 |

% |

|

Cost of sales |

|

110,106 |

|

60.0 |

% |

167,173 |

|

60.3 |

% |

315,333 |

|

61.2 |

% |

454,299 |

|

60.6 |

% | ||||

|

Gross profit from retail operations |

|

73,408 |

|

40.0 |

% |

110,086 |

|

39.7 |

% |

200,019 |

|

38.8 |

% |

294,792 |

|

39.4 |

% | ||||

|

Franchise fees and royalty income |

|

1,329 |

|

0.7 |

% |

1,490 |

|

0.5 |

% |

3,401 |

|

0.7 |

% |

4,022 |

|

0.5 |

% | ||||

|

|

|

74,737 |

|

40.7 |

% |

111,576 |

|

40.2 |

% |

203,420 |

|

39.5 |

% |

298,814 |

|

39.9 |

% | ||||

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Sales and marketing expenses |

|

41,420 |

|

22.6 |

% |

67,475 |

|

24.3 |

% |

122,138 |

|

23.7 |

% |

183,167 |

|

24.5 |

% | ||||

|

General and administrative expenses |

|

11,638 |

|

6.3 |

% |

20,868 |

|

7.5 |

% |

35,761 |

|

6.9 |

% |

56,746 |

|

7.6 |

% | ||||

|

Loss on store closings and impairment of store assets |

|

285 |

|

0.2 |

% |

196 |

|

0.1 |

% |

324 |

|

0.1 |

% |

267 |

|

0.0 |

% | ||||

|

Total operating expenses |

|

53,343 |

|

29.1 |

% |

88,539 |

|

31.9 |

% |

158,223 |

|

30.7 |

% |

240,180 |

|

32.1 |

% | ||||

|

Income from operations |

|

21,394 |

|

11.7 |

% |

23,037 |

|

8.3 |

% |

45,197 |

|

8.8 |

% |

58,634 |

|

7.8 |

% | ||||

|

Other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Interest income |

|

(1 |

) |

0.0 |

% |

— |

|

0.0 |

% |

(4 |

) |

0.0 |

% |

(1 |

) |

0.0 |

% | ||||

|

Interest expense |

|

8,530 |

|

4.6 |

% |

2,097 |

|

0.8 |

% |

25,479 |

|

4.9 |

% |

6,386 |

|

0.9 |

% | ||||

|

Loss from debt extinguishment |

|

— |

|

0.0 |

% |

— |

|

0.0 |

% |

1,873 |

|

0.4 |

% |

— |

|

0.0 |

% | ||||

|

|

|

8,529 |

|

4.6 |

% |

2,097 |

|

0.8 |

% |

27,348 |

|

5.3 |

% |

6,385 |

|

0.9 |

% | ||||

|

Income before income taxes |

|

12,865 |

|

7.0 |

% |

20,940 |

|

7.6 |

% |

17,849 |

|

3.5 |

% |

52,249 |

|

7.0 |

% | ||||

|

Income tax expense |

|

551 |

|

0.3 |

% |

8,484 |

|

3.1 |

% |

870 |

|

0.2 |

% |

19,972 |

|

2.7 |

% | ||||

|

Net income |

|

$ |

12,314 |

|

6.7 |

% |

$ |

12,456 |

|

4.5 |

% |

$ |

16,979 |

|

3.3 |

% |

$ |

32,277 |

|

4.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Basic net income per common share |

|

$ |

0.55 |

|

|

|

$ |

0.37 |

|

|

|

$ |

0.76 |

|

|

|

$ |

0.96 |

|

|

|

|

Diluted net income per common share |

|

$ |

0.55 |

|

|

|

$ |

0.37 |

|

|

|

$ |

0.76 |

|

|

|

$ |

0.95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Reconciliation of weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Basic weighted average shares outstanding |

|

22,399,952 |

|

|

|

33,768,828 |

|

|

|

22,399,952 |

|

|

|

33,768,828 |

|

|

| ||||

|

Effect of dilutive securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Stock options |

|

— |

|

|

|

93,907 |

|

|

|

— |

|

|

|

113,592 |

|

|

| ||||

|

Restricted shares |

|

— |

|

|

|

4,773 |

|

|

|

— |

|

|

|

2,742 |

|

|

| ||||

|

Diluted weighted average shares outstanding |

|

22,399,952 |

|

|

|

33,867,508 |

|

|

|

22,399,952 |

|

|

|

33,885,162 |

|

|

| ||||

MATTRESS FIRM HOLDING CORP.

Consolidated Statements of Cash Flows

(In thousands)

|

|

|

Thirty-Nine Weeks Ended |

| ||||

|

|

|

November 1, |

|

October 30, |

| ||

|

Cash flows from operating activities: |

|

2011 |

|

2012 |

| ||

|

Net income |

|

$ |

16,979 |

|

$ |

32,277 |

|

|

Adjustments to reconcile net income to cash flows provided by operating activities: |

|

|

|

|

| ||

|

Depreciation and amortization |

|

12,951 |

|

16,432 |

| ||

|

Interest expense accrued and paid-in-kind |

|

18,872 |

|

— |

| ||

|

Loan fee and other amortization |

|

1,911 |

|

1,855 |

| ||

|

Loss from debt extinguishment |

|

1,873 |

|

— |

| ||

|

Deferred income tax expense |

|

— |

|

8,613 |

| ||

|

Stock-based compensation |

|

58 |

|

1,653 |

| ||

|

Loss on store closings and impairment of store assets |

|

324 |

|

267 |

| ||

|

Effects of changes in operating assets and liabilities, excluding business acquisitions: |

|

|

|

|

| ||

|

Accounts receivable |

|

(3,389 |

) |

(6,887 |

) | ||

|

Inventories |

|

(8,136 |

) |

(15,219 |

) | ||

|

Prepaid expenses and other current assets |

|

256 |

|

(647 |

) | ||

|

Other assets |

|

(2,476 |

) |

(904 |

) | ||

|

Accounts payable |

|

9,531 |

|

22,138 |

| ||

|

Accrued liabilities |

|

4,780 |

|

1,837 |

| ||

|

Customer deposits |

|

933 |

|

134 |

| ||

|

Other noncurrent liabilities |

|

3,250 |

|

4,906 |

| ||

|

Net cash provided by operating activities |

|

57,717 |

|

66,455 |

| ||

|

Cash flows from investing activities: |

|

|

|

|

| ||

|

Purchases of property and equipment |

|

(22,192 |

) |

(50,726 |

) | ||

|

Business acquisitions, net of cash acquired |

|

(100 |

) |

(51,613 |

) | ||

|

Net cash used in investing activities |

|

(22,292 |

) |

(102,339 |

) | ||

|

Cash flows from financing activities: |

|

|

|

|

| ||

|

Proceeds from issuance of debt |

|

40,198 |

|

18,000 |

| ||

|

Principal payments of debt |

|

(51,248 |

) |

(19,207 |

) | ||

|

Debt issuance costs |

|

(1,273 |

) |

— |

| ||

|

Net cash used in financing activities |

|

(12,323 |

) |

(1,207 |

) | ||

|

Net increase (decrease) in cash and cash equivalents |

|

23,102 |

|

(37,091 |

) | ||

|

Cash and cash equivalents, beginning of period |

|

4,445 |

|

47,946 |

| ||

|

Cash and cash equivalents, end of period |

|

$ |

27,547 |

|

$ |

10,855 |

|

MATTRESS FIRM HOLDING CORP.

Reported to Adjusted Statements of Operations Data

(In thousands, except share and per share amounts)

|

|

|

Thirteen Weeks Ended |

| |||||||||||||

|

|

|

November 1, 2011 |

|

October 30, 2012 |

| |||||||||||

|

|

|

|

|

|

|

Acquisition- |

|

Secondary |

|

|

| |||||

|

|

|

|

|

|

|

Related |

|

Offering |

|

|

| |||||

|

|

|

As Reported |

|

As Reported |

|

Costs (1) |

|

Costs (2) |

|

As Adjusted |

| |||||

|

Income from operations |

|

$ |

21,394 |

|

$ |

23,037 |

|

$ |

3,025 |

|

$ |

1,935 |

|

$ |

27,997 |

|

|

Other expense, net |

|

8,529 |

|

2,097 |

|

— |

|

— |

|

2,097 |

| |||||

|

Income before income taxes |

|

12,865 |

|

20,940 |

|

3,025 |

|

1,935 |

|

25,900 |

| |||||

|

Income tax expense (3) |

|

551 |

|

8,484 |

|

1,175 |

|

492 |

|

10,151 |

| |||||

|

Net income |

|

$ |

12,314 |

|

$ |

12,456 |

|

$ |

1,850 |

|

$ |

1,443 |

|

$ |

15,749 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic net income per common share * |

|

$ |

0.55 |

|

$ |

0.37 |

|

$ |

0.05 |

|

$ |

0.04 |

|

$ |

0.47 |

|

|

Diluted net income per common share * |

|

$ |

0.55 |

|

$ |

0.37 |

|

$ |

0.05 |

|

$ |

0.04 |

|

$ |

0.47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic weighted average shares outstanding |

|

22,399,952 |

|

33,768,828 |

|

33,768,828 |

|

33,768,828 |

|

33,768,828 |

| |||||

|

Diluted weighted average shares outstanding |

|

22,399,952 |

|

33,867,508 |

|

33,867,508 |

|

33,867,508 |

|

33,867,508 |

| |||||

|

|

|

Thirty-Nine Weeks Ended |

| |||||||||||||

|

|

|

November 1, 2011 |

|

October 30, 2012 |

| |||||||||||

|

|

|

|

|

|

|

Acquisition- |

|

Secondary |

|

|

| |||||

|

|

|

|

|

|

|

Related |

|

Offering |

|

|

| |||||

|

|

|

As Reported |

|

As Reported |

|

Costs (1) |

|

Costs (2) |

|

As Adjusted |

| |||||

|

Income from operations |

|

$ |

45,197 |

|

$ |

58,634 |

|

$ |

10,074 |

|

$ |

1,935 |

|

$ |

70,643 |

|

|

Other expense, net |

|

27,348 |

|

6,385 |

|

— |

|

— |

|

6,385 |

| |||||

|

Income before income taxes |

|

17,849 |

|

52,249 |

|

10,074 |

|

1,935 |

|

64,258 |

| |||||

|

Income tax expense (3) |

|

870 |

|

19,972 |

|

3,395 |

|

492 |

|

23,859 |

| |||||

|

Net income |

|

$ |

16,979 |

|

$ |

32,277 |

|

$ |

6,679 |

|

$ |

1,443 |

|

$ |

40,399 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic net income per common share * |

|

$ |

0.76 |

|

$ |

0.96 |

|

$ |

0.20 |

|

$ |

0.04 |

|

$ |

1.20 |

|

|

Diluted net income per common share * |

|

$ |

0.76 |

|

$ |

0.95 |

|

$ |

0.20 |

|

$ |

0.04 |

|

$ |

1.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic weighted average shares outstanding |

|

22,399,952 |

|

33,768,828 |

|

33,768,828 |

|

33,768,828 |

|

33,768,828 |

| |||||

|

Diluted weighted average shares outstanding |

|

22,399,952 |

|

33,885,162 |

|

33,885,162 |

|

33,885,162 |

|

33,885,162 |

| |||||

* Due to rounding to the nearest cent per diluted share, totals may not equal the sum of the line items in the table above.

(1) In April 2012, we announced the signing of an agreement for all of the equity interests of MGHC Holding Corporation (“Mattress Giant”), including 181 specialty retail stores. The acquisition closed on May 2, 2012. In September 2012, we announced the signing of an agreement for the acquisition of the leasehold interests, store assets, distribution center assets and related inventories, and assumption of certain liabilities, of Mattress XPress, Inc. and Mattress XPress of Georgia, Inc. (collectively, “Mattress X-Press”), including 34 mattress specialty retail stores. The acquisition closed on September 25, 2012. Acquisition-related costs, consisting of direct transaction costs and integration costs, are included in the results of operations as incurred. During the thirteen and thirty-nine weeks ended October 30, 2012, we incurred $3.0 million and $10.1 million of acquisition-related costs, respectively.

(2) Reflects $1.9 million of costs borne by us in connection with a secondary offering of shares of common stock by certain of our selling stockholders which was completed in October 2012.

(3) Reflects effective income tax rate of 38.9% and an additional $0.3 million in foregone tax benefits on certain acquisition-related costs considered nondeductible.

Our “As Adjusted” data is considered a non-U.S. GAAP financial measure and is not in accordance with, or preferable to, “As Reported,” or GAAP financial data. However, we are providing this information as we believe it facilitates year-over-year comparisons for investors and financial analysts.

About Mattress Firm

Houston-based Mattress Firm is one of the nation’s leading specialty bedding retailers, offering a broad selection of both traditional and specialty mattresses from leading manufacturers, including Sealy, Serta, Simmons, Stearns & Foster and Tempur-Pedic.

Investor Relations Contact: Brad Cohen, ir@mattressfirm.com, 713.343.3652

Media Contact: Sari Martin, mattressfirm@icrinc.com, 203.682.8345

###